Introduction

Our third-quarter 2020 (3Q20) wrap-up covers the quarterly earnings of 58 (mostly) US-based retailers, brands, e-commerce platforms and REITs in the

Coresight 100.

- About 87% of companies beat revenue consensus estimates; 9% missed revenue consensus estimates; and 4% reported revenues in line with consensus.

- Home and home-improvement retailers, discount retailers, warehouse clubs, e-commerce companies and mass merchandisers enjoyed a stronger quarter, with all these companies beating revenue and earnings estimates.

- REITs and beauty brands and retailers comprised the worst-performing sector (versus expectations) in the quarter, with 50% of covered companies missing consensus revenue estimates.

However, beating or meeting consensus does not mean the results were “good” in the context of retailers navigating through

the Covid-19 crisisafter emerging from coronavirus-induced lockdowns. The pace of sales recovery is much more indicative of the health of retailers than benchmarking versus consensus.

Company results in 3Q20, which ended October 31 for most companies in our coverage, include key commentary and qualitative insights from major US retailers and brand owners on their recent performance, in terms of revenues and comps, and the impact of the coronavirus pandemic. Although we term the period under review 3Q20, some companies in this report describe their latest quarter differently; some have different quarter-end dates too.

In August, US retail sales continued to rebound strongly as the reopening of stores improved, compared to the previous month. In September, US retail sales saw an extraordinary 12.9% year-over-year jump, with the growth rate almost doubling compared to August. September saw further store reopenings, with many states resuming the reopening of indoor malls as the number of coronavirus cases reduced month over month. In October, US retail sales continued to witness a double-digit year-over-year increase, fueled by strong growth in several sectors. However, in October, many states reported a spike in Covid-19 cases; as a result, the US retail traffic decline steepened, mostly toward the end of the month.

In November, US retail sales increased by a strong 9.0%; however, the

total traffic decline steepened to 37%, as several states reinstituted more restrictive mandates owing to the surge in new coronavirus cases.

Below, we assess the recent performance of retailers, brand owners, e-commerce platforms and REITS in detail.

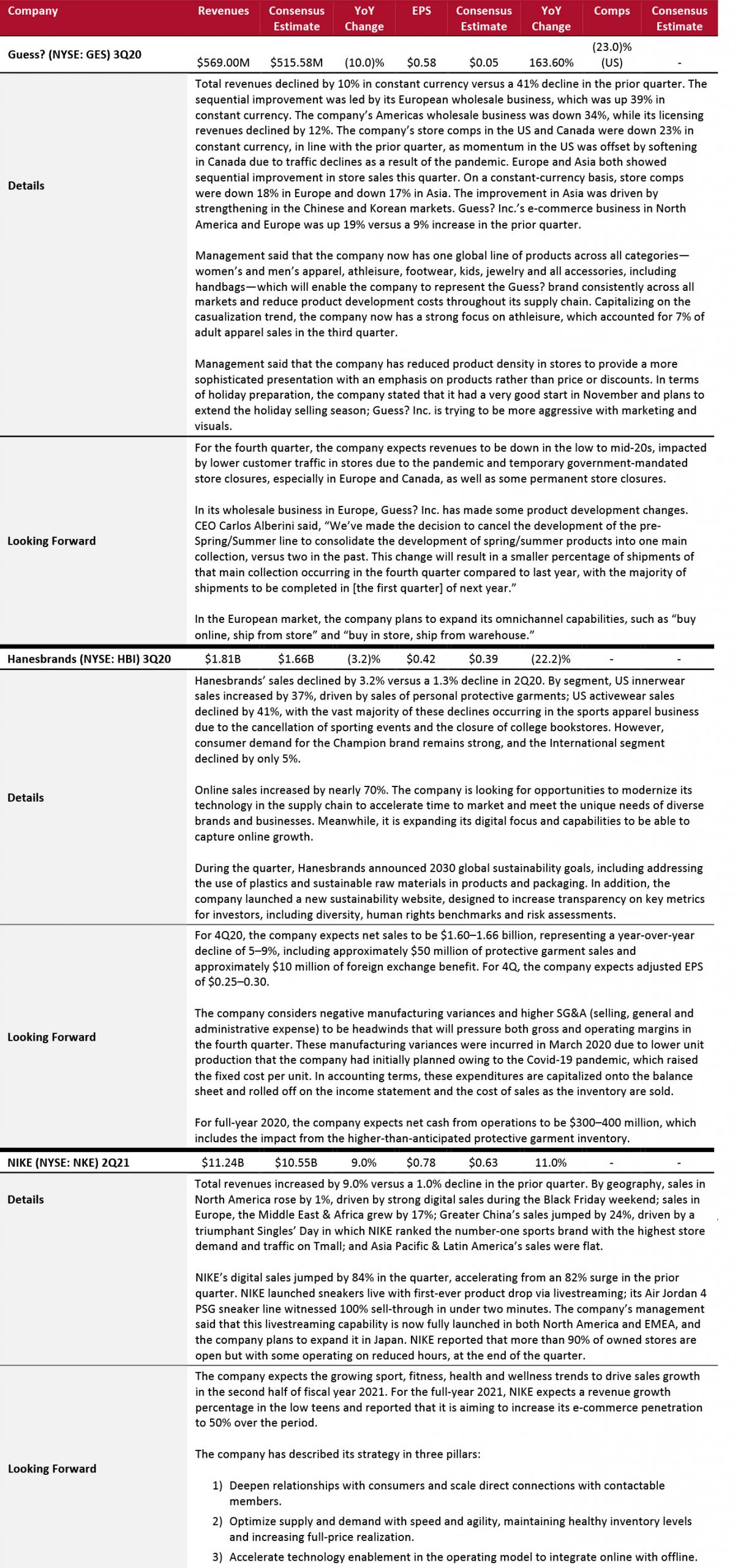

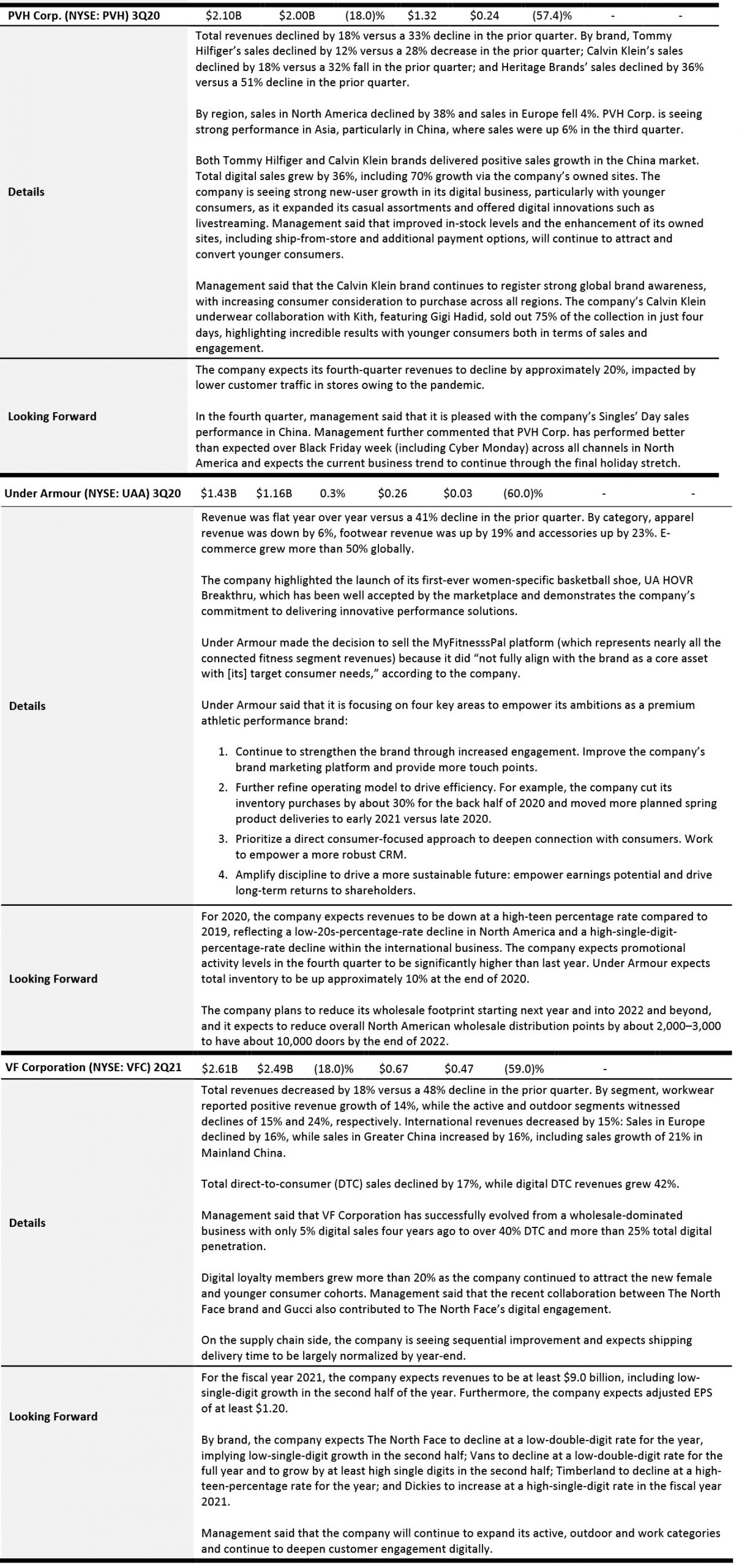

Apparel and Footwear Brand Owners

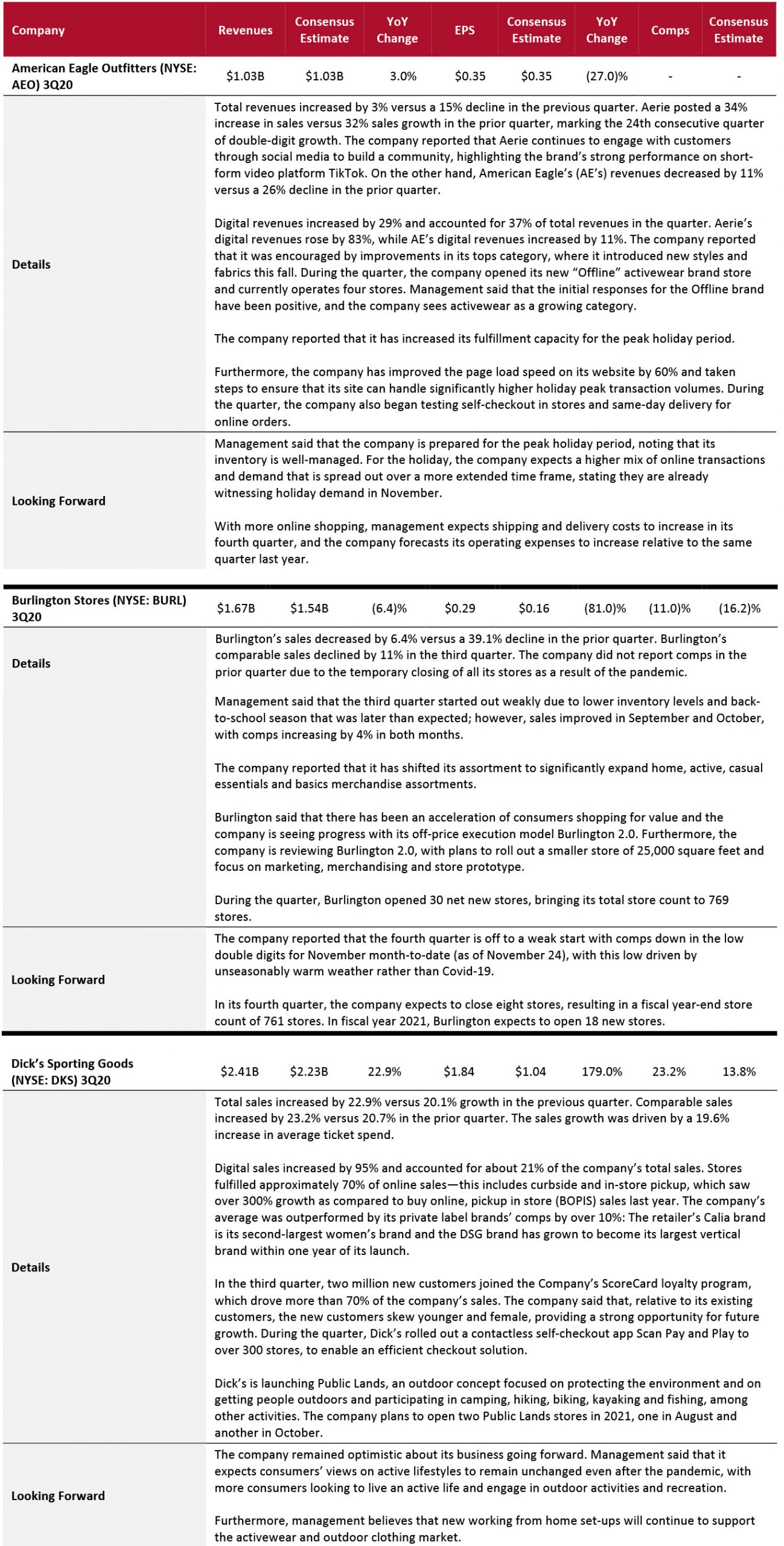

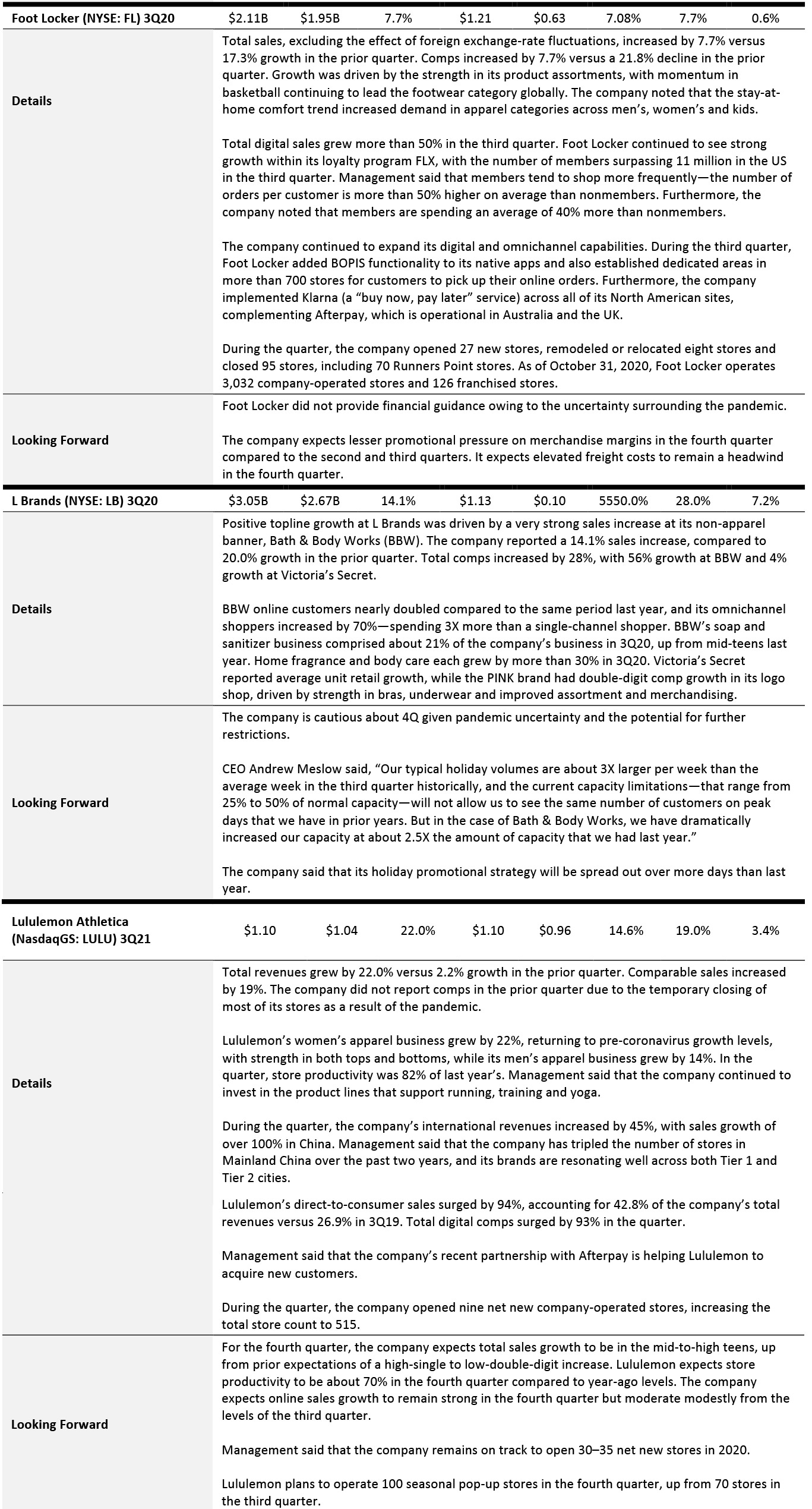

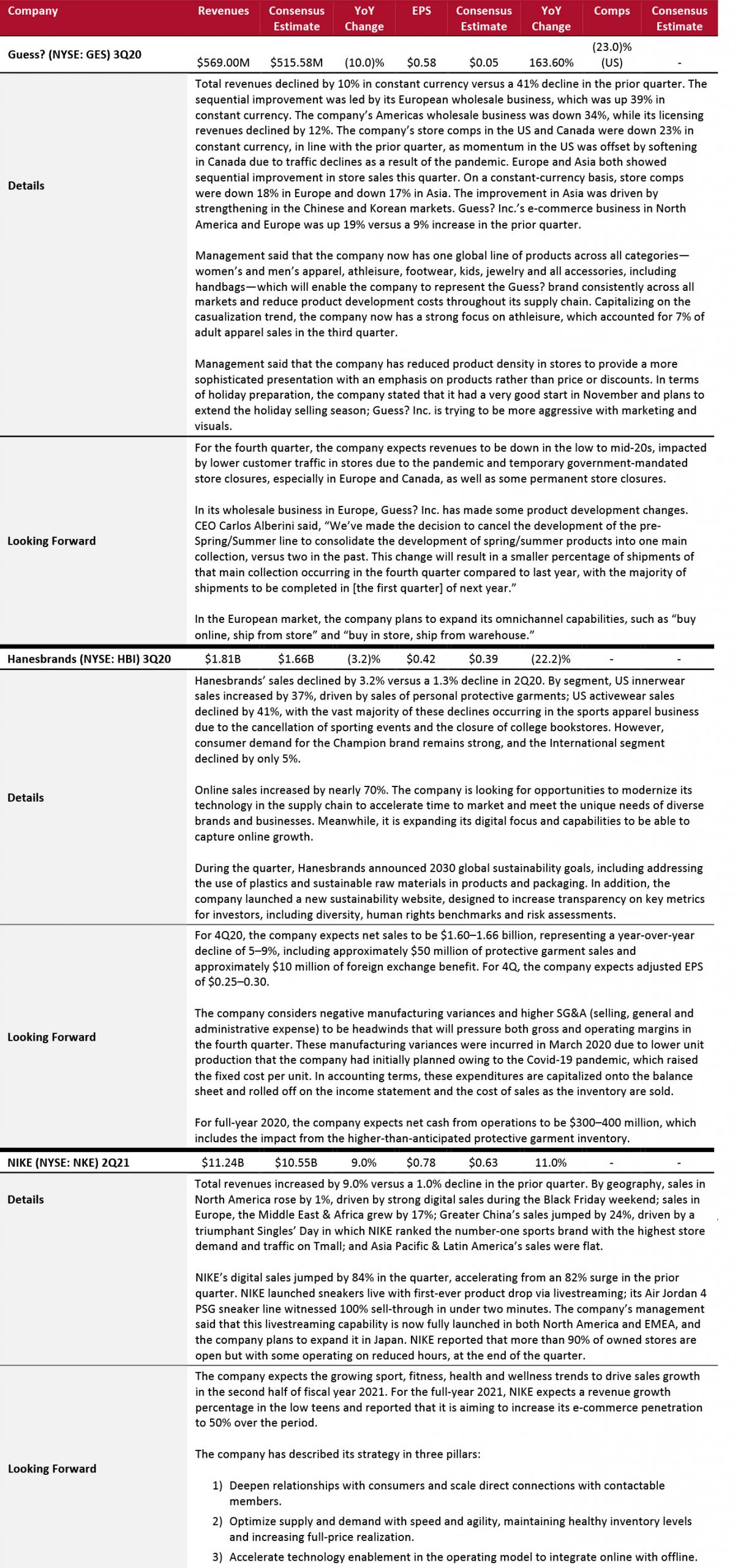

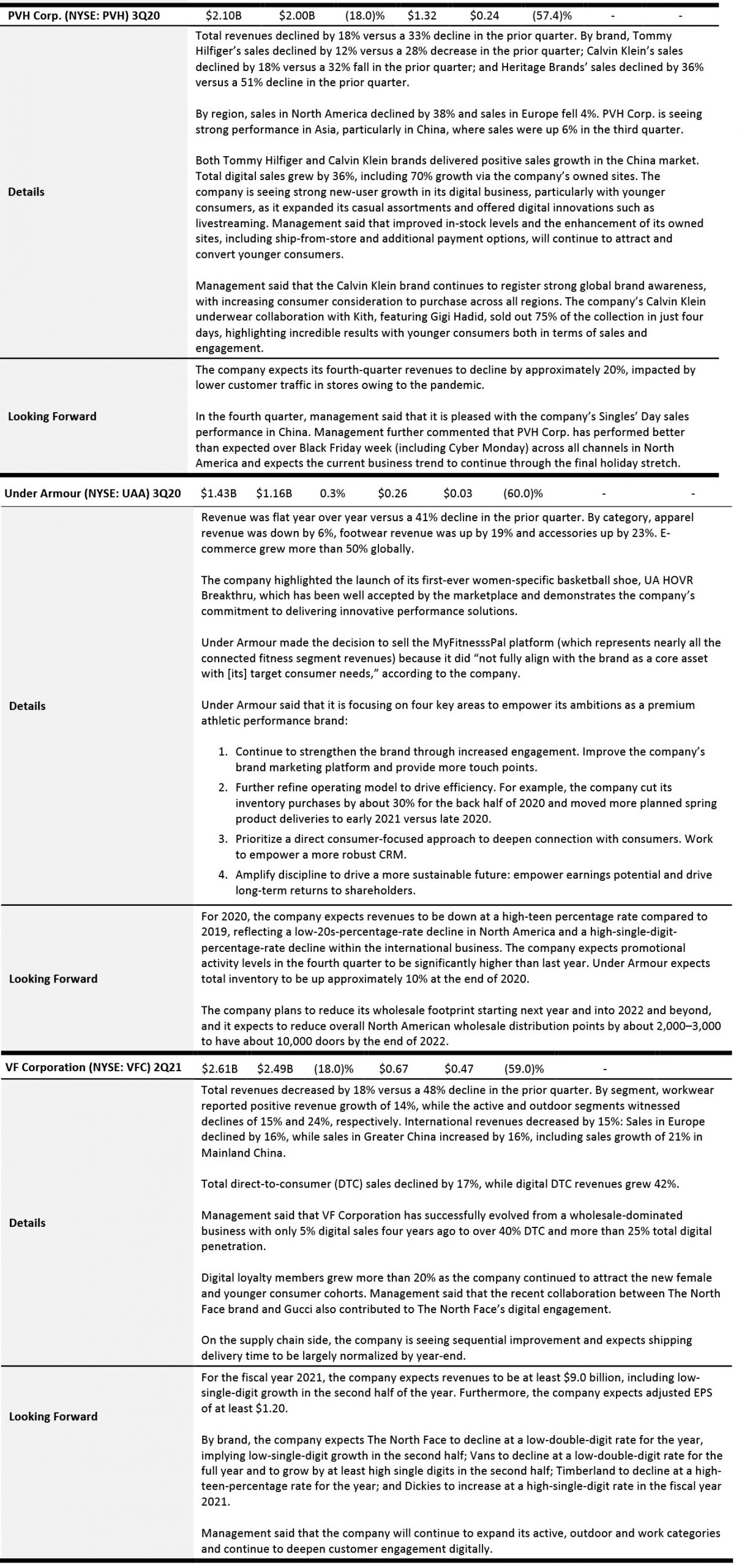

In the apparel and footwear categories, the demand for casual wear and athleisure remained strong, while tailored clothing saw weaknesses. Although the overall apparel category is recovering strongly, some brand owners, such as Guess? Inc., PVH Corp. and VF Corp, are continuing to witness double-digit declines in sales. For the fourth quarter, PVH expects its revenues to decline by about 20% and Guess? expects its sales to be down in the low to mid-20s. By contrast, we saw Hanesbrands reporting a single-digit sales decline and Under Armour posting flat sales growth.

Apparel Specialty Retailers

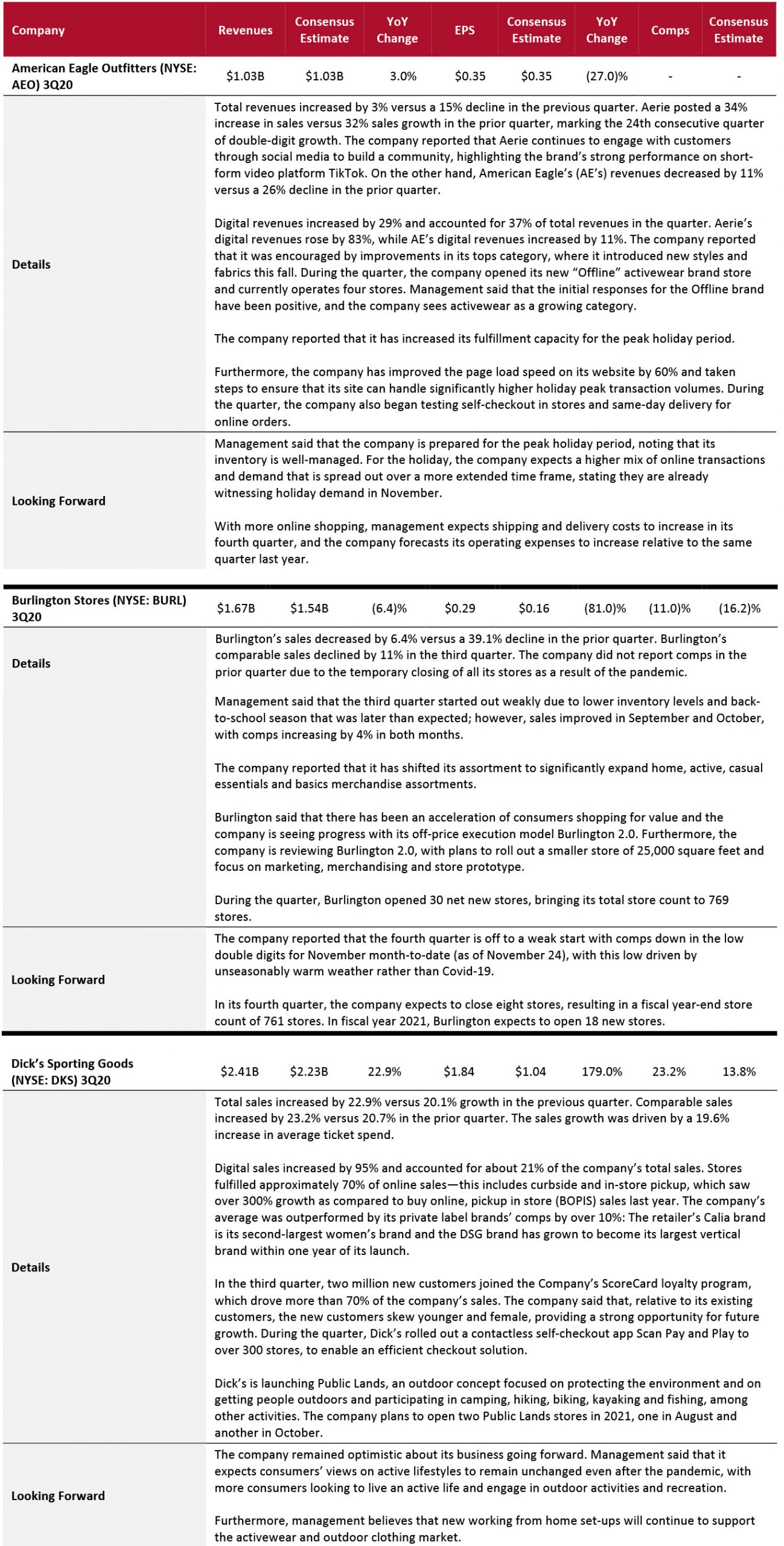

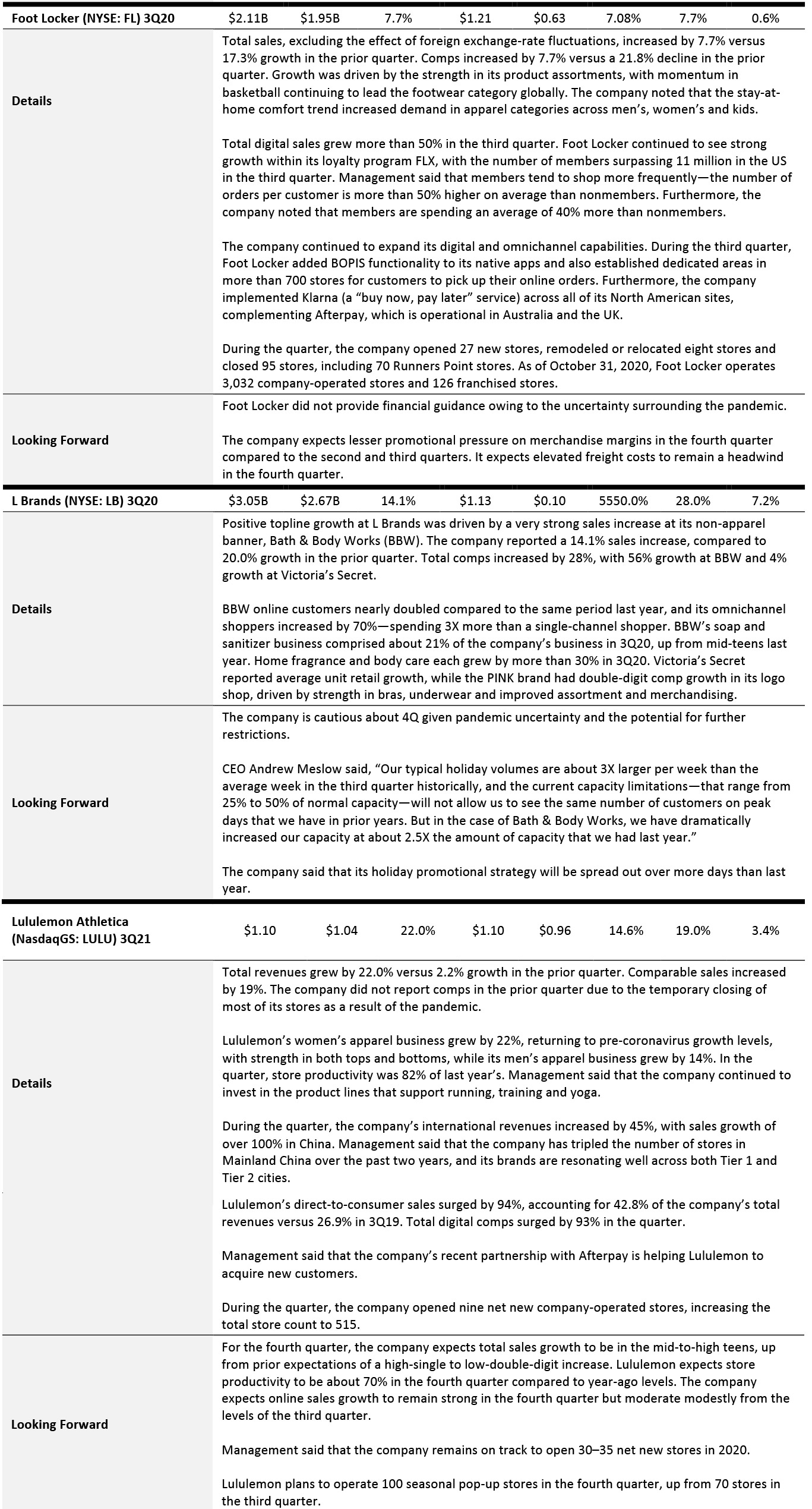

American Eagle Outfitters, Gap Inc. and Urban Outfitters are witnessing strong sequential increases in their toplines, particularly in the athleisure and casualwear categories. Athletic apparel retailer Lululemon posted double-digit comp growth in the quarter. For the fourth quarter, Lululemon expects revenue growth to be in mid-to-high teens. Similarly, Dick’s Sporting Goods posted outstanding comp growth during the quarter.

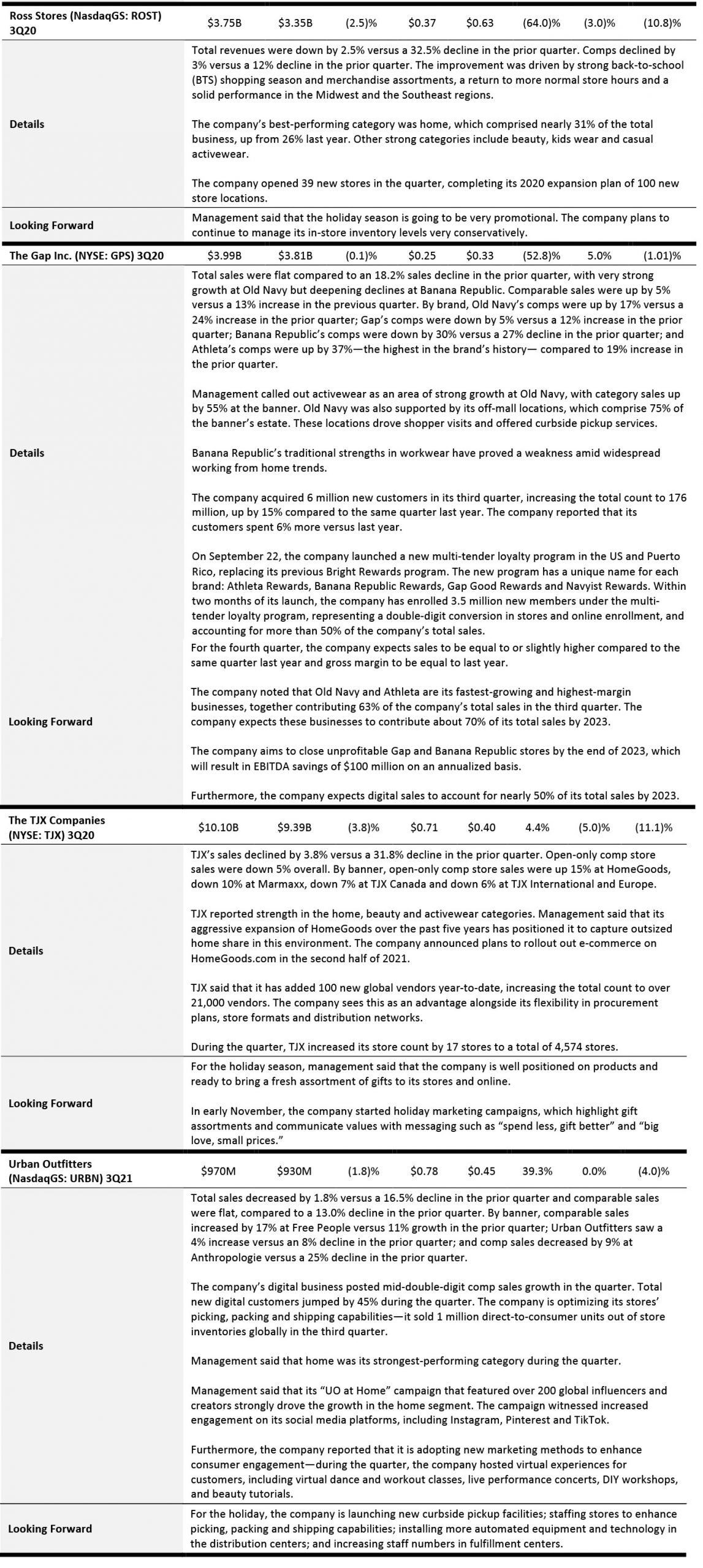

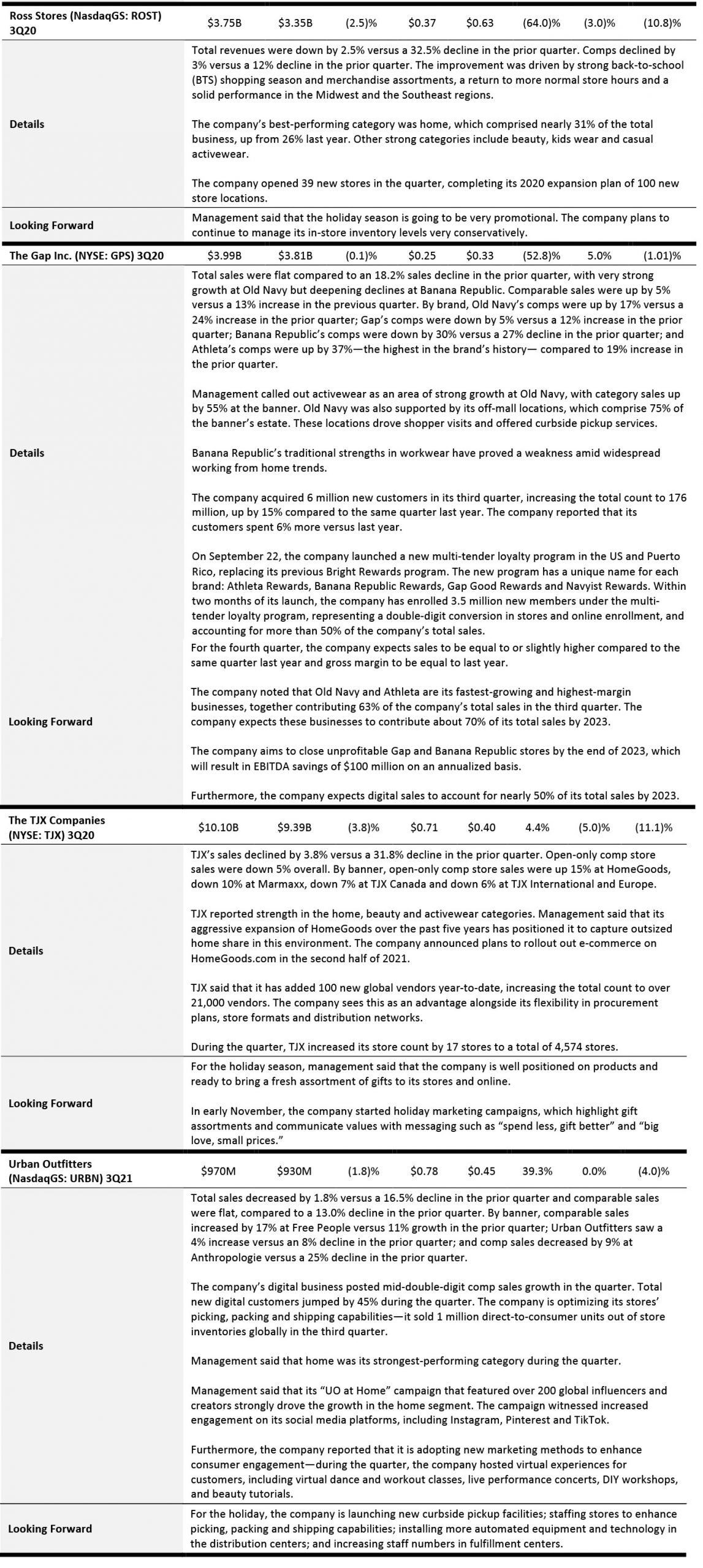

Off-pricers, such as Burlington Stores, Ross Stores and TJX, do not have substantial—or in some cases, any—e-commerce business to fall back on, yet are seeing very strong sequential topline improvements. These retailers are seeing strength in home goods, and casual and athletic apparel categories.

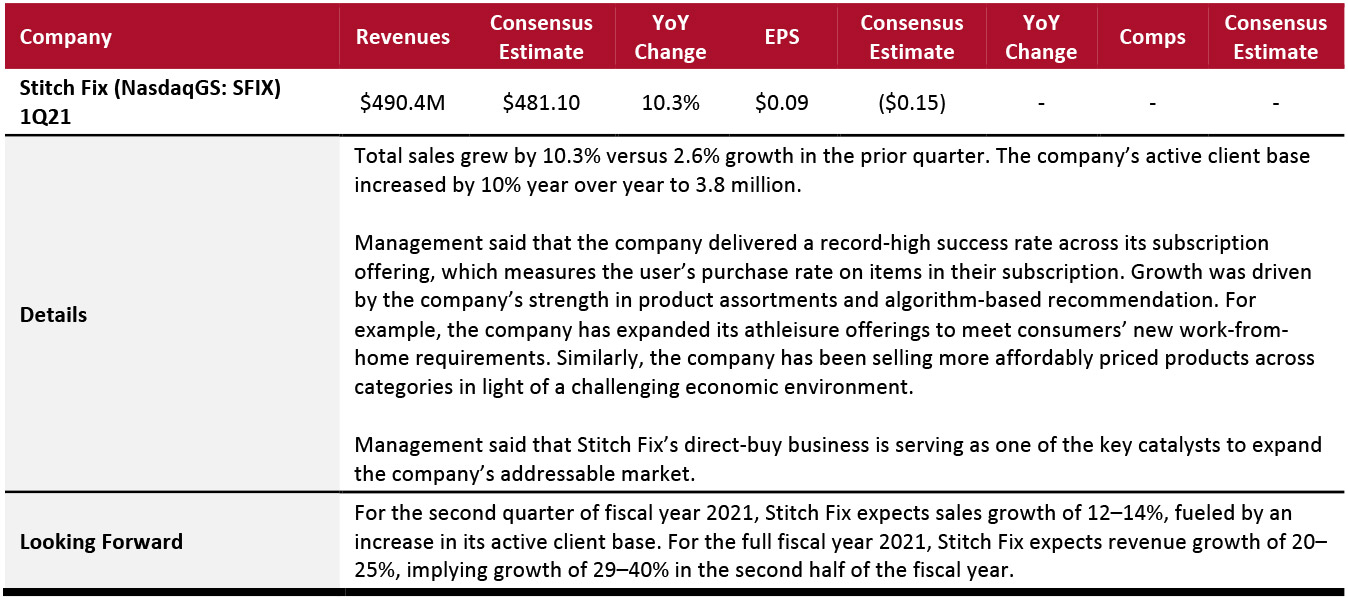

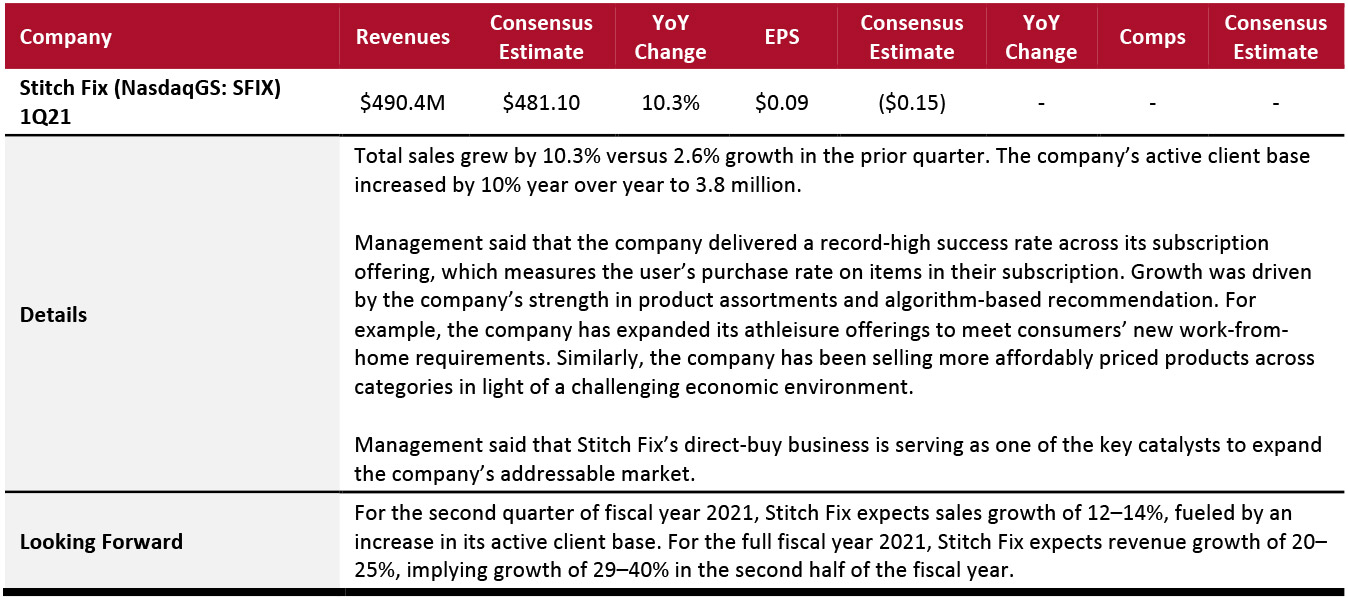

Online Apparel Retailers

Stitch Fix reported double-digit sales growth, driven by 10% growth in its active client base. Management said that the company delivered a record-high success rate across its subscription offering, which measures the user’s purchase rate on items in their subscription, driven by the company’s strength in product assortments and algorithm-based recommendation.

The company expects sales growth of 12–14% in the next quarter.

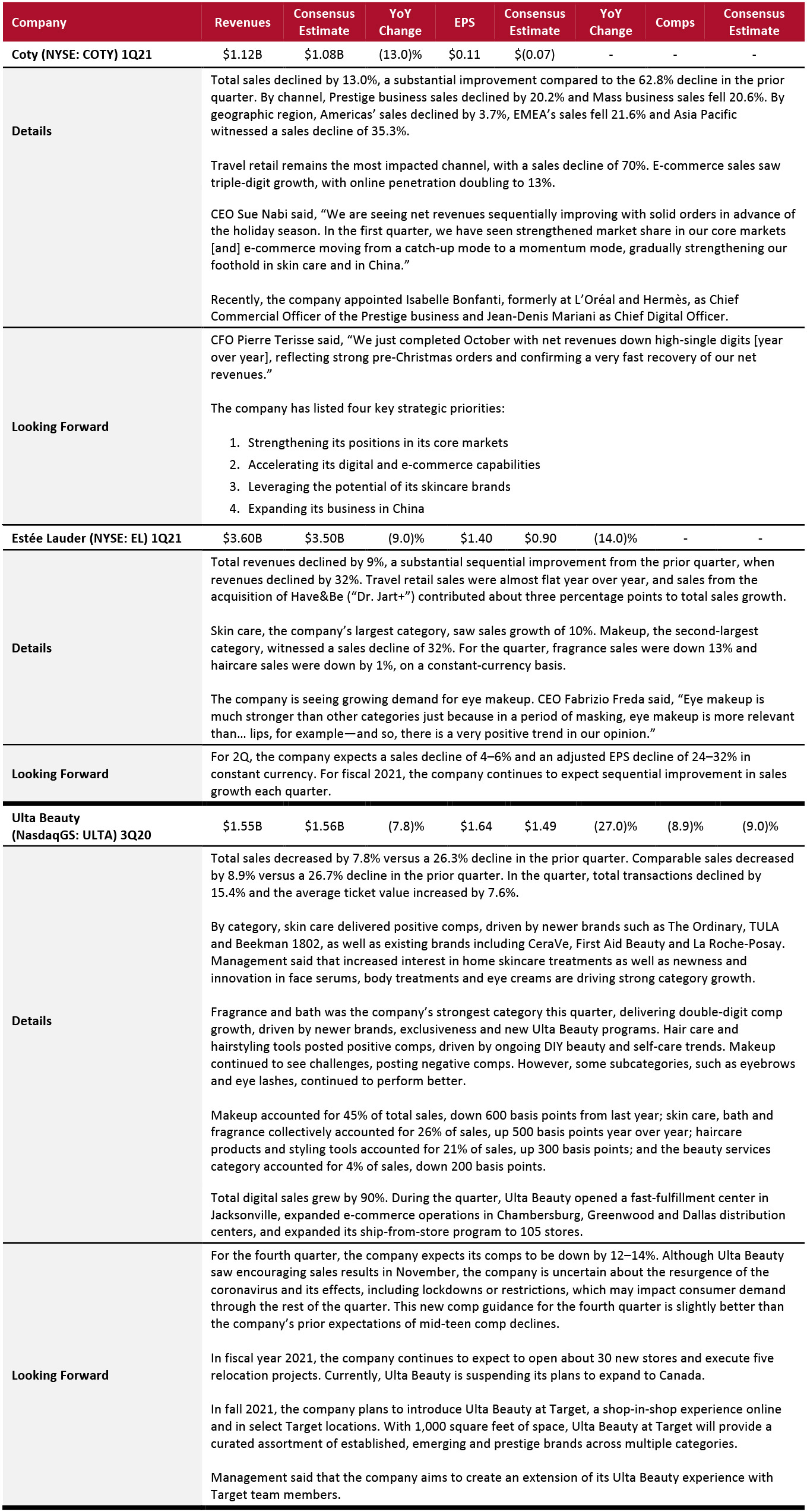

Beauty Brands and Retailers

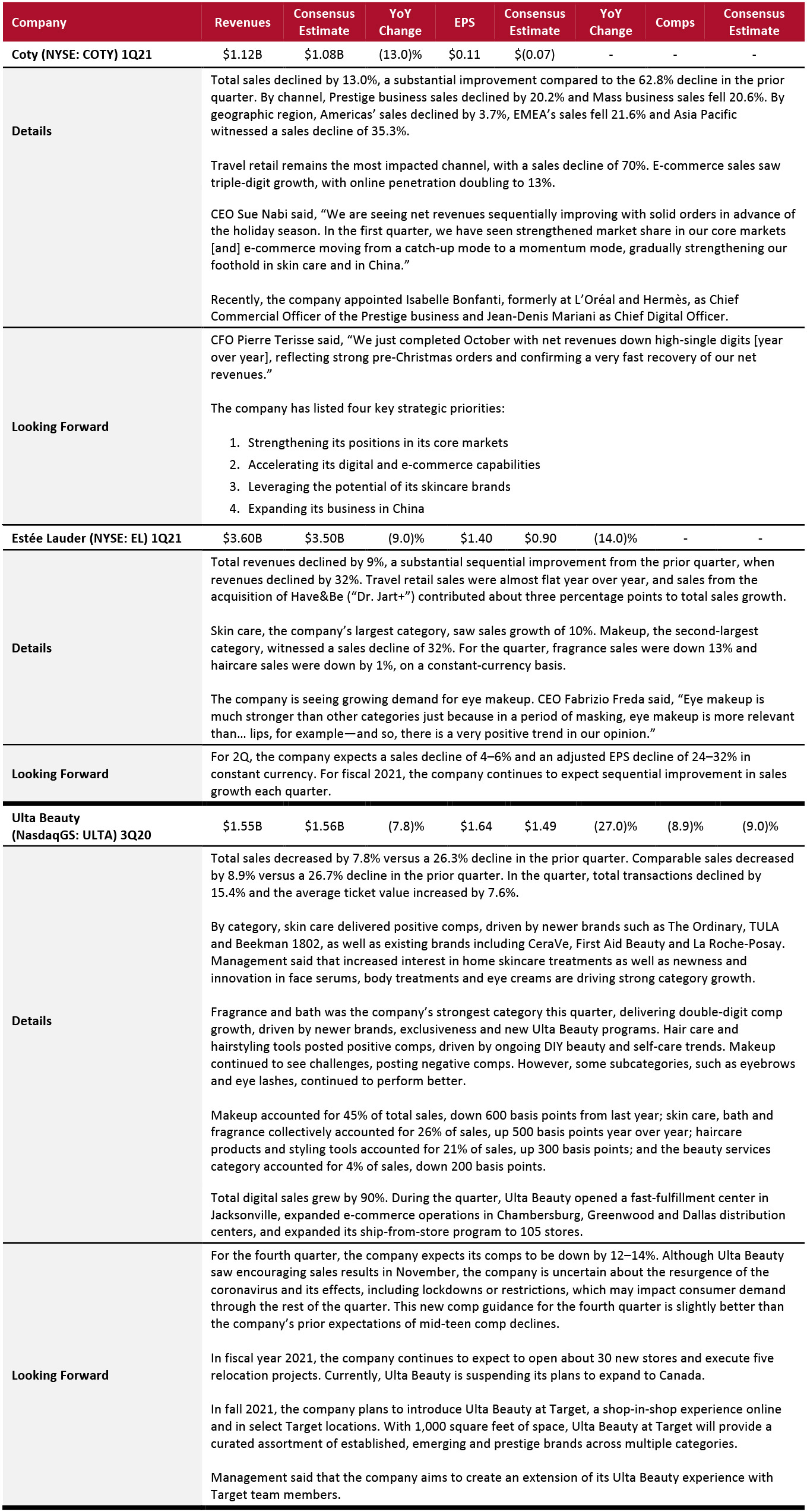

The beauty category continues to see a strong recovery, with Coty, Estée Lauder and Ulta Beauty posting a strong sequential increase in topline growth. In beauty categories, skin care is trending, but demand for makeup remains weak—except eye makeup, which is seeing a strong positive trend.

For the fourth quarter, Ulta Beauty expects its comps to be down by 12–14%. Although Ulta Beauty saw encouraging sales results in November, the company is uncertain about the resurgence of the coronavirus and its effects, including lockdowns or restrictions, which may impact consumer demand through the rest of the quarter. This new comp guidance for the fourth quarter is slightly better than the company’s prior expectations of mid-teen comp declines.

Coty witnessed strong orders in the advance of the holiday season. During the quarter, Coty has doubled its e-commerce penetration and has strengthened its foothold in the skincare category and in the China market.

Estée Lauder expects sequential improvement in sales growth each quarter in fiscal year 2021.

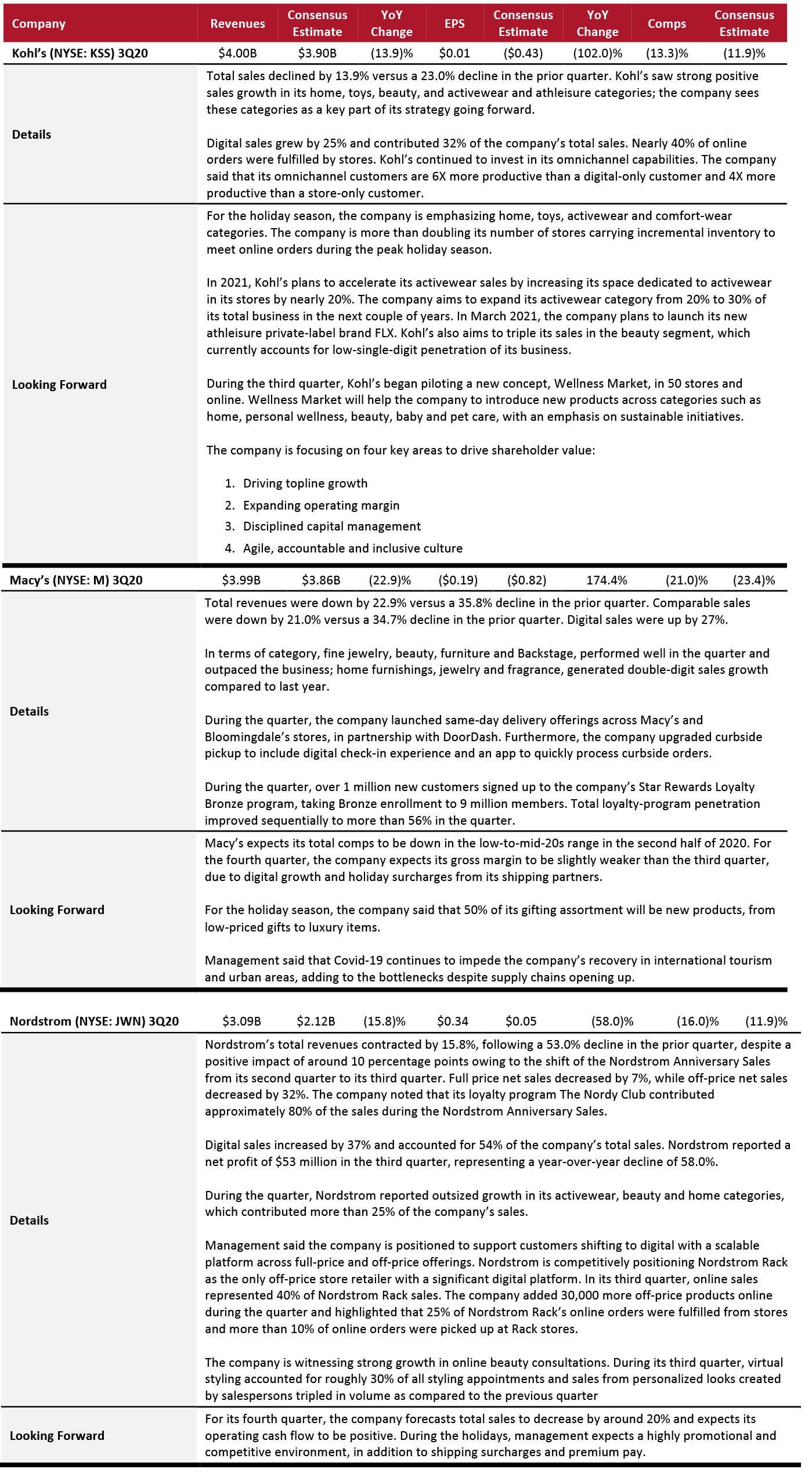

Department Stores

Department Stores

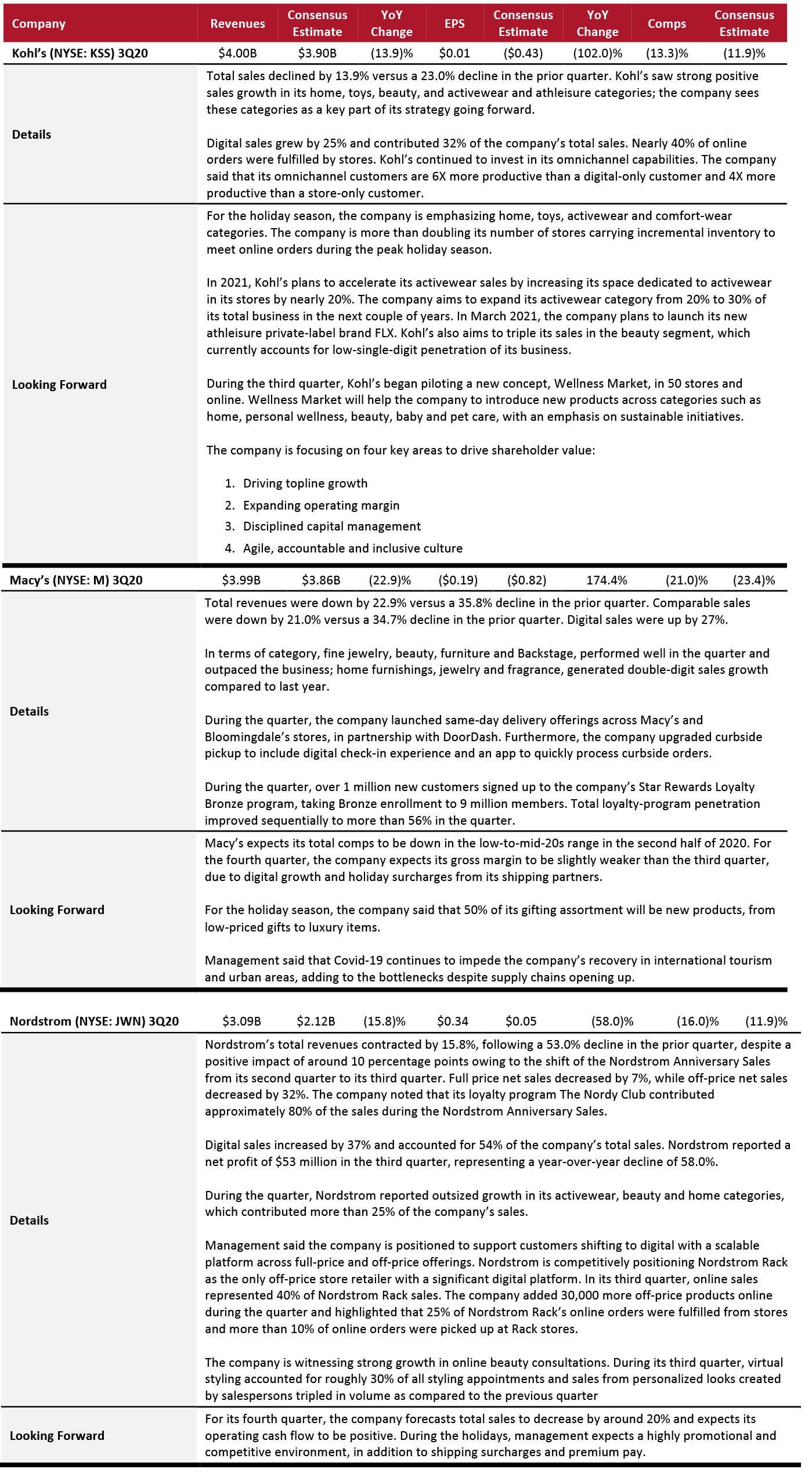

Department stores are seeing very weak recoveries from the crisis, with Kohl’s, Macy’s and Nordstrom reporting double-digit decline in sales.

Sales are likely to remain weak in the next quarter: Nordstrom expects its total sales to be down by around 20% in its fourth quarter, Macy’s expects its total comps to be down in the range of 20% in the second half of 2020.

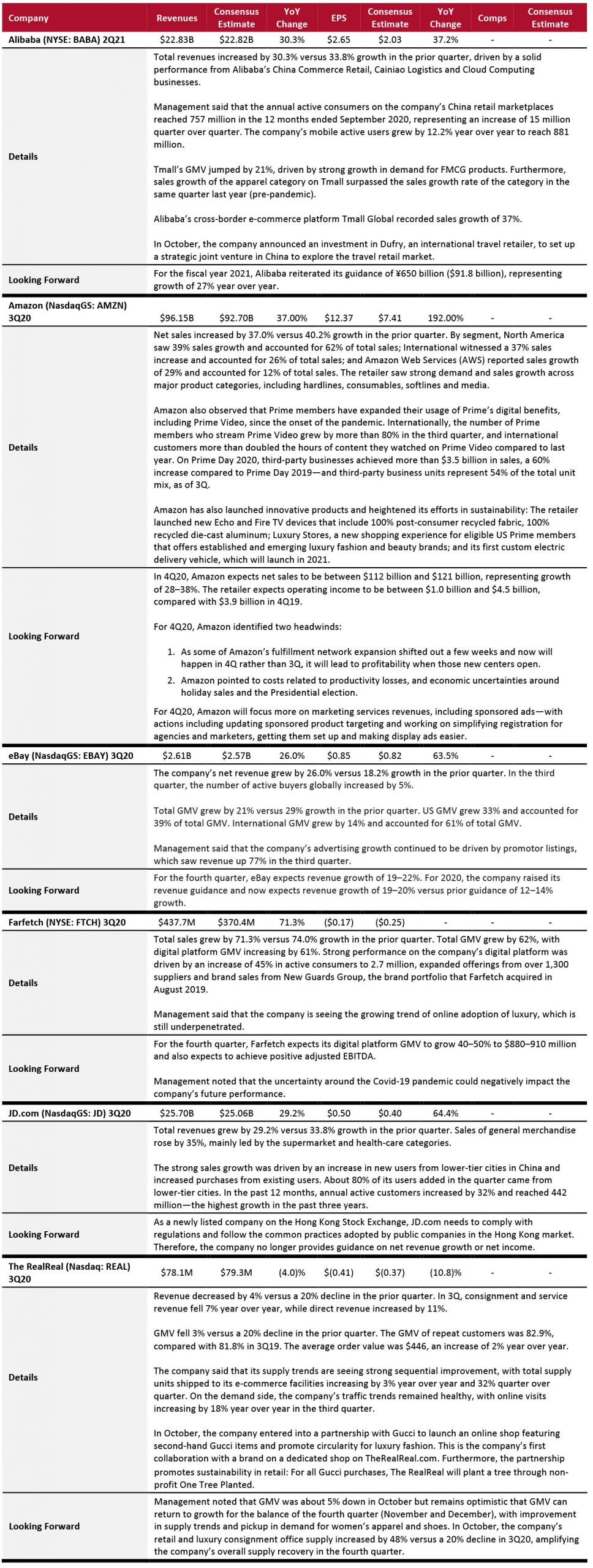

E-Commerce Platforms

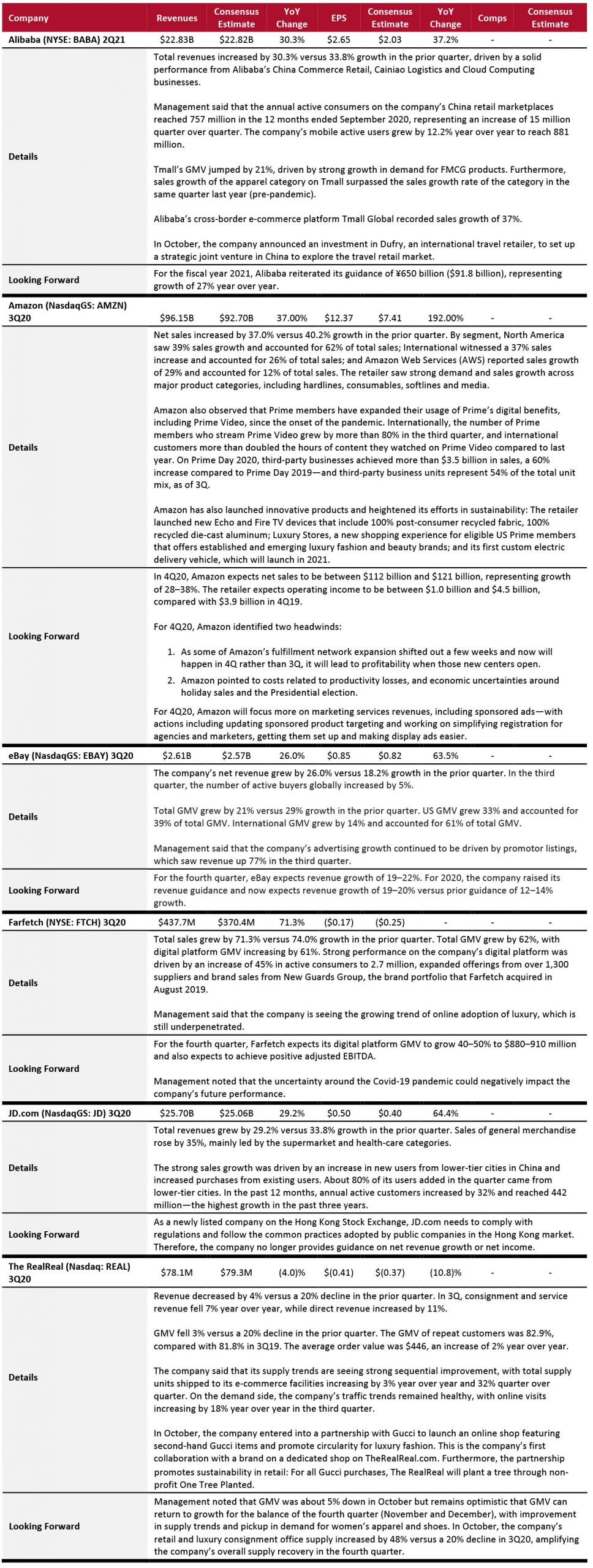

E-commerce platforms continued to post solid results, with Amazon, Alibaba, eBay, Farfetch and JD.com reporting double-digit sales growth. Amazon observed that Prime members have expanded their use of Prime’s digital benefits, including Prime Video, since the onset of the pandemic. On

Amazon’s Prime Day 2020, third-party businesses achieved more than $3.5 billion in sales, according to Amazon, a 60% increase compared to Prime Day 2019.

The RealReal, an online marketplace for secondhand luxury consignment, saw its traffic trends improve substantially in its latest quarter, with online visits increasing by double digits. On the supply side, the company is seeing strong sequential improvement and expects positive GMV growth for November and December.

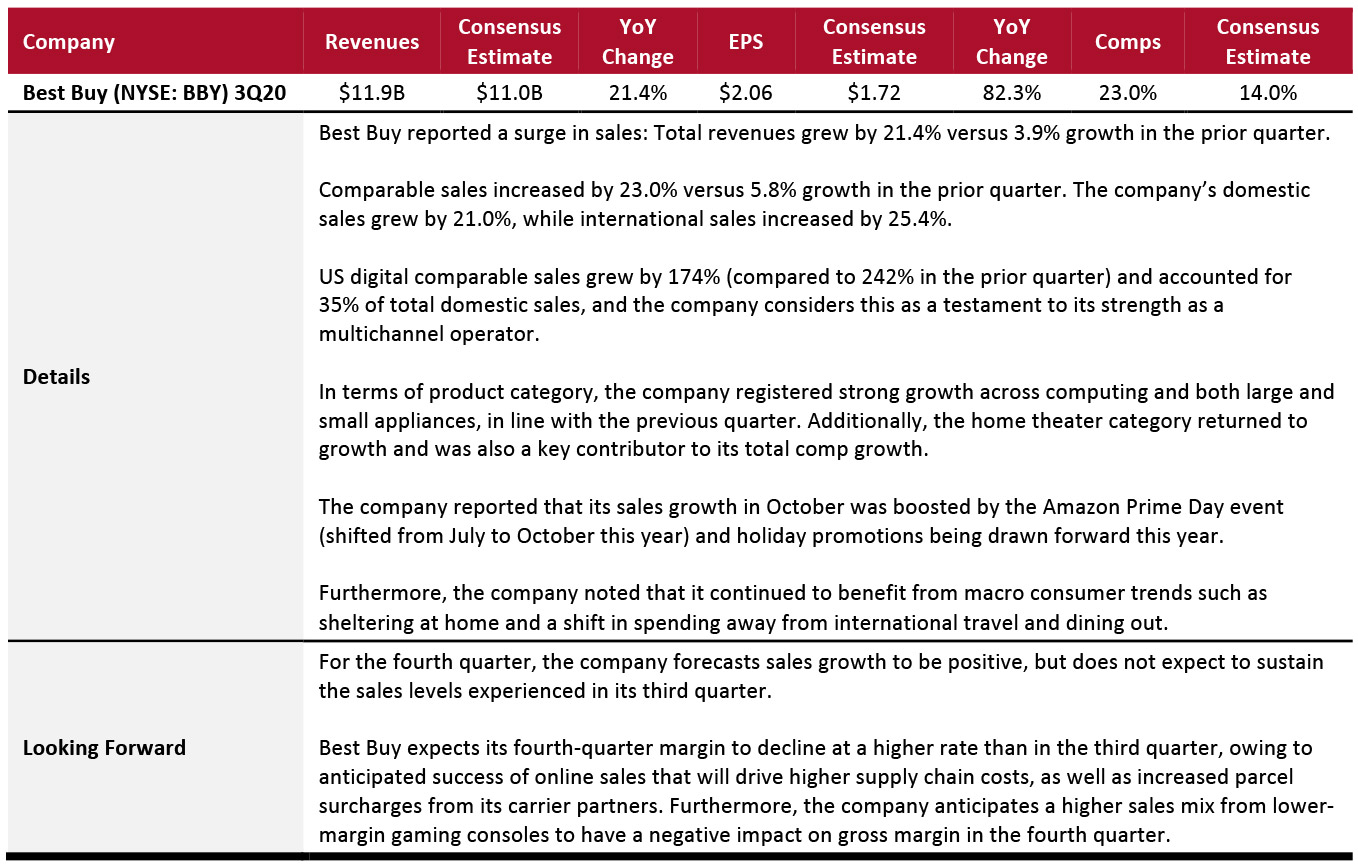

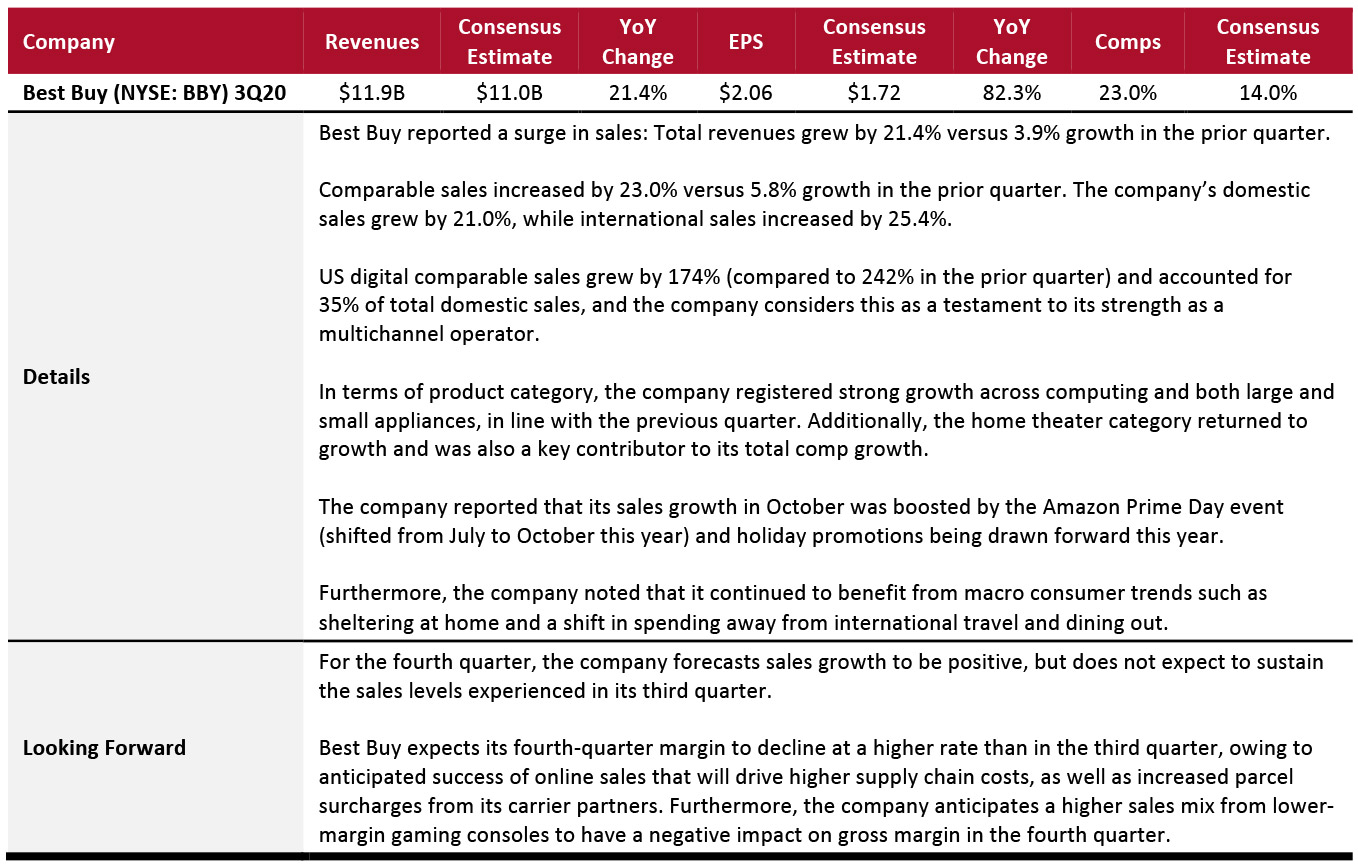

Electronics Retailers

Best Buy reported extraordinary comp growth in the quarter. In terms of product category, the company registered strong growth across computing and both large and small appliances, in line with the previous quarter. Additionally, the home theater category returned to growth and was also a key contributor to its total comp growth. For the fourth quarter, the company expects sales growth to be positive, but does not expect to sustain the sales levels experienced in the third quarter.

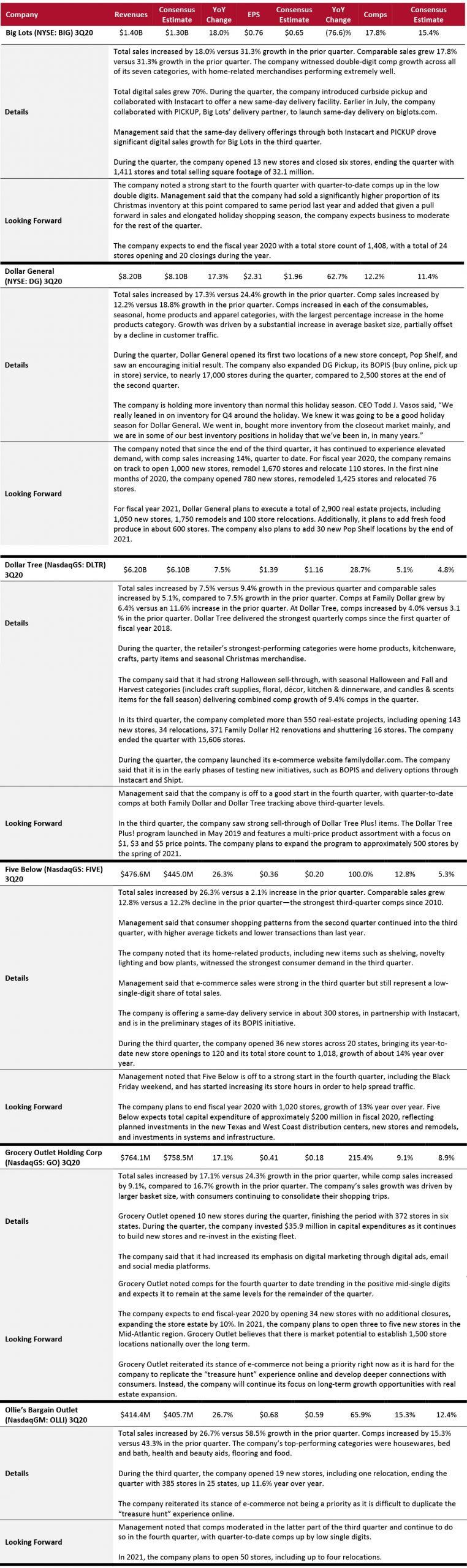

Food, Drug and Mass Retailers: Discount Stores

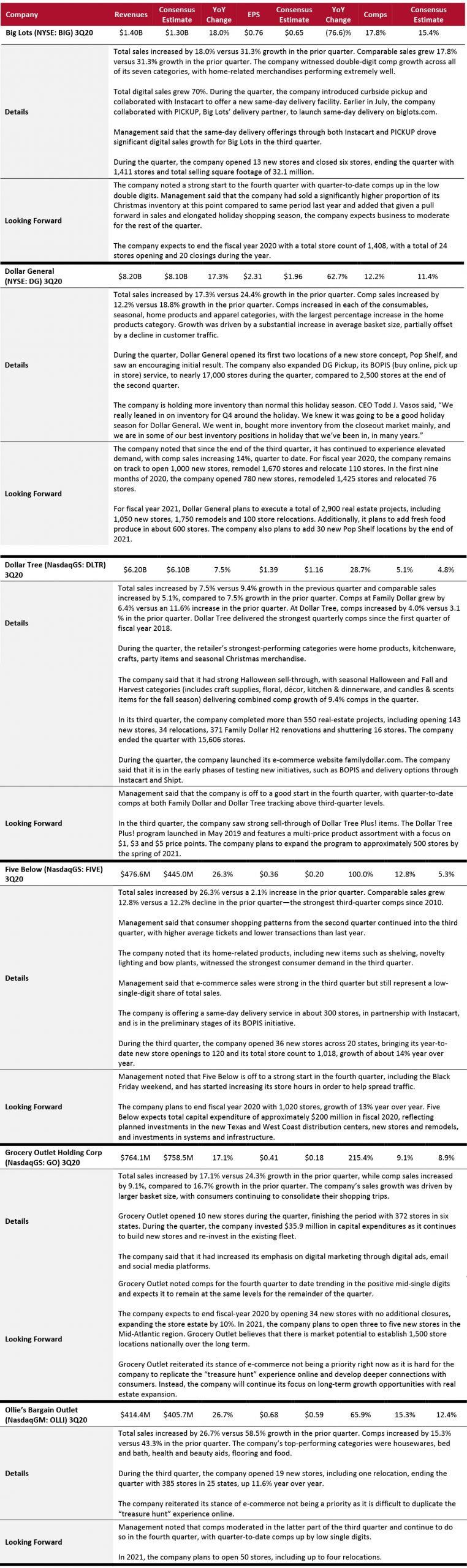

Discount stores continued their solid run in the quarter, attracting a broad base of budget-conscious customers. All the covered companies noted strong discretionary momentum driven by seasonal and home products. The discounters, except for Grocery Outlet, are embracing omnichannel retailing and are testing new e-commerce initiatives. Unlike most retailers, which are shrinking their physical footprints, discounters’ real estate plans remain firmly in place, including new store expansions.

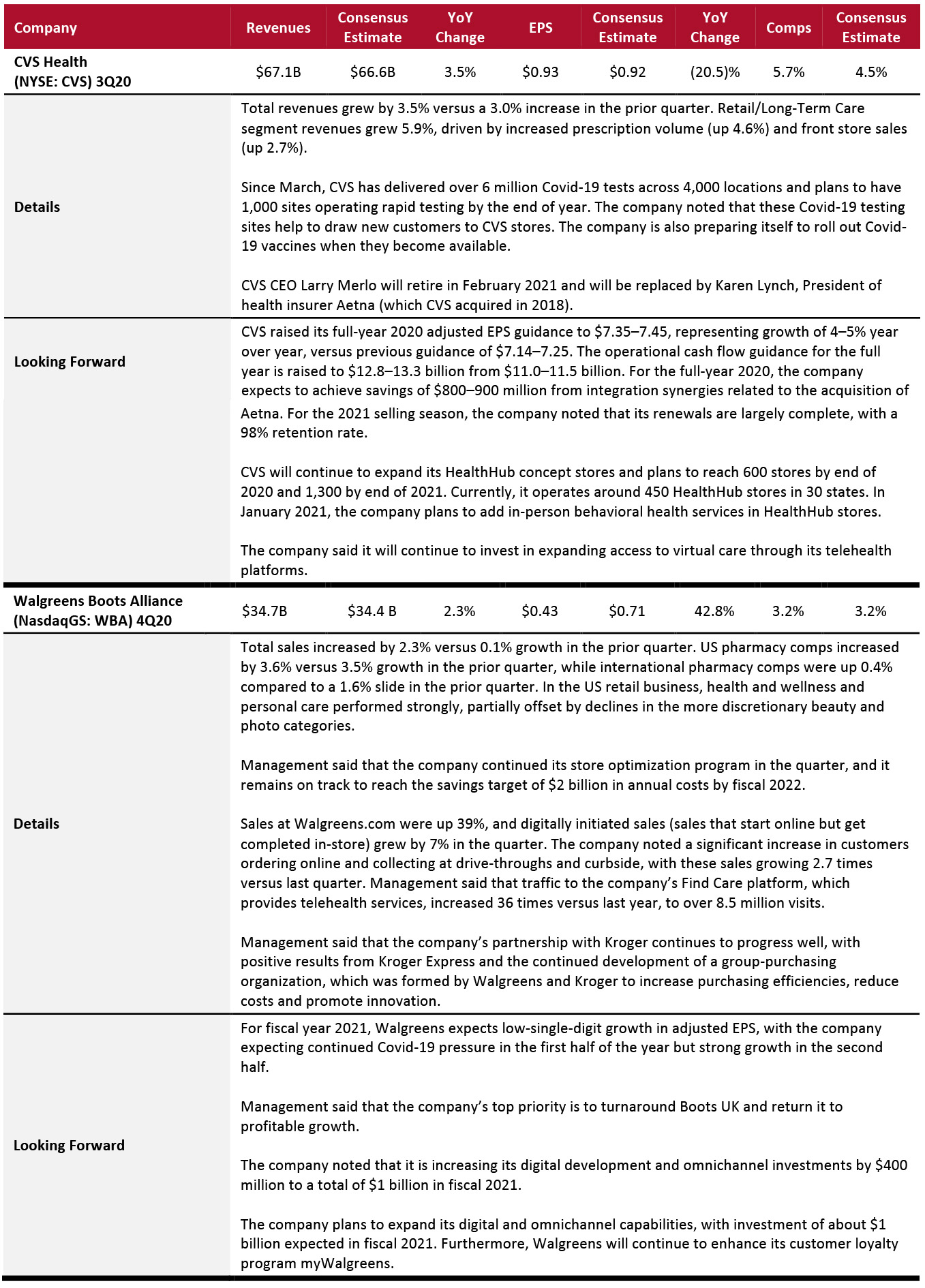

Food, Drug and Mass Retailers: Drugstores

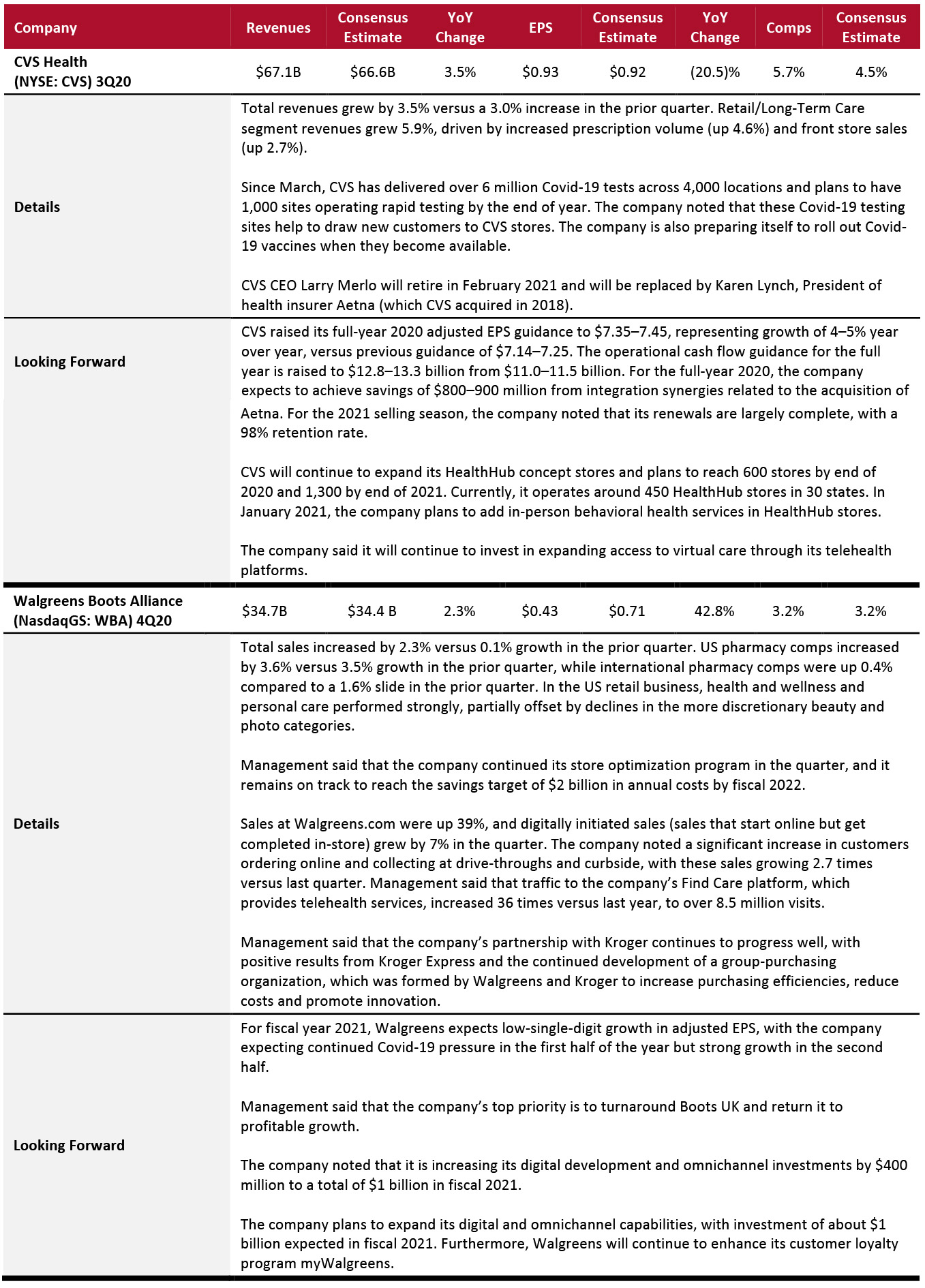

CVS had a strong quarter driven by increased prescription volume and front-store sales. Walgreens’ US business performed well during the quarter, but its international business continues to suffer as the pandemic causes notable disruption across many of the international markets and particularly in the UK. Footfall at Boots UK remained well below last year, particularly in the major high street and travel locations where Boots has a prominent store presence.

Both CVS and Walgreens maintained their aggressive push in health-care offerings by converting their store to health-care destinations and expanding their virtual care services through telehealth platforms.

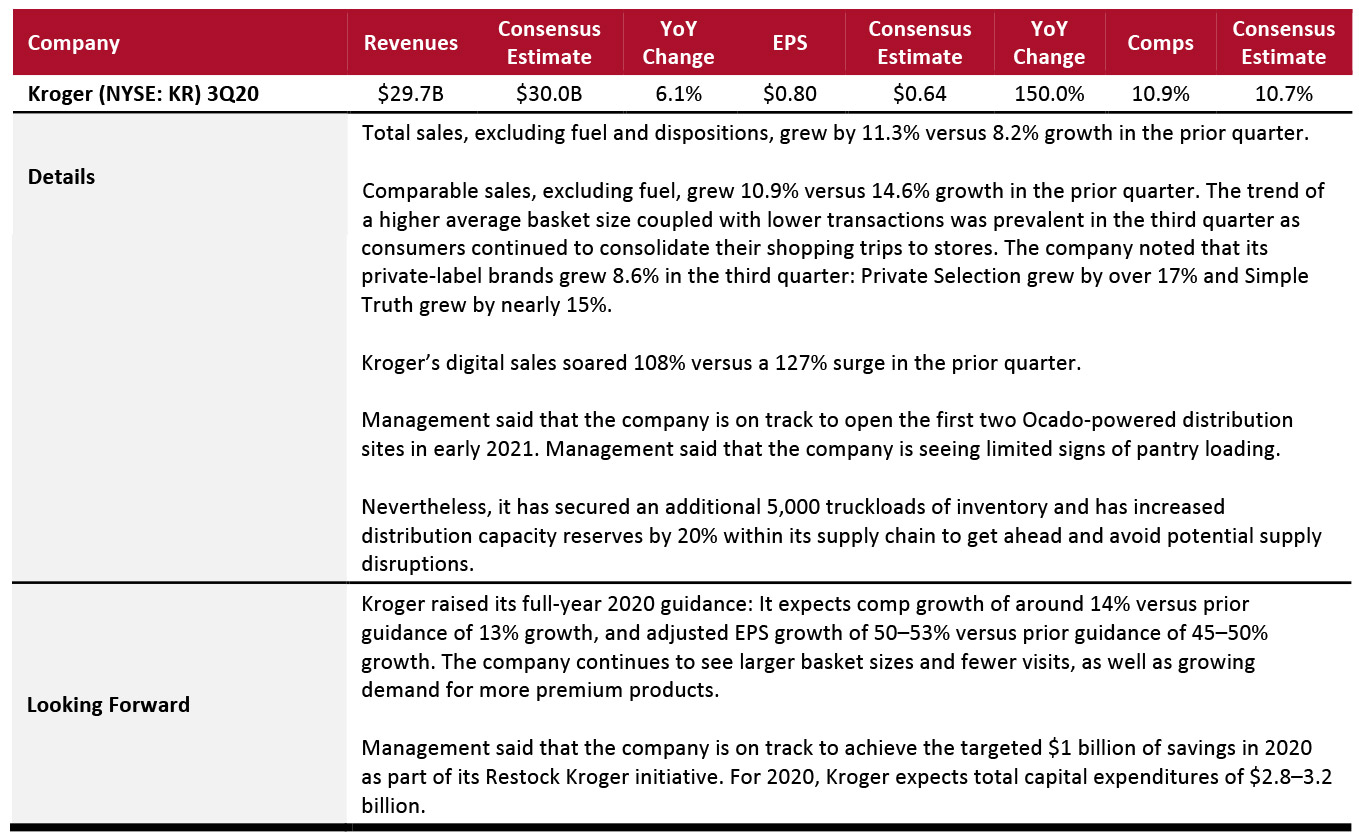

Food, Drug and Mass Retailers: Food Retailers

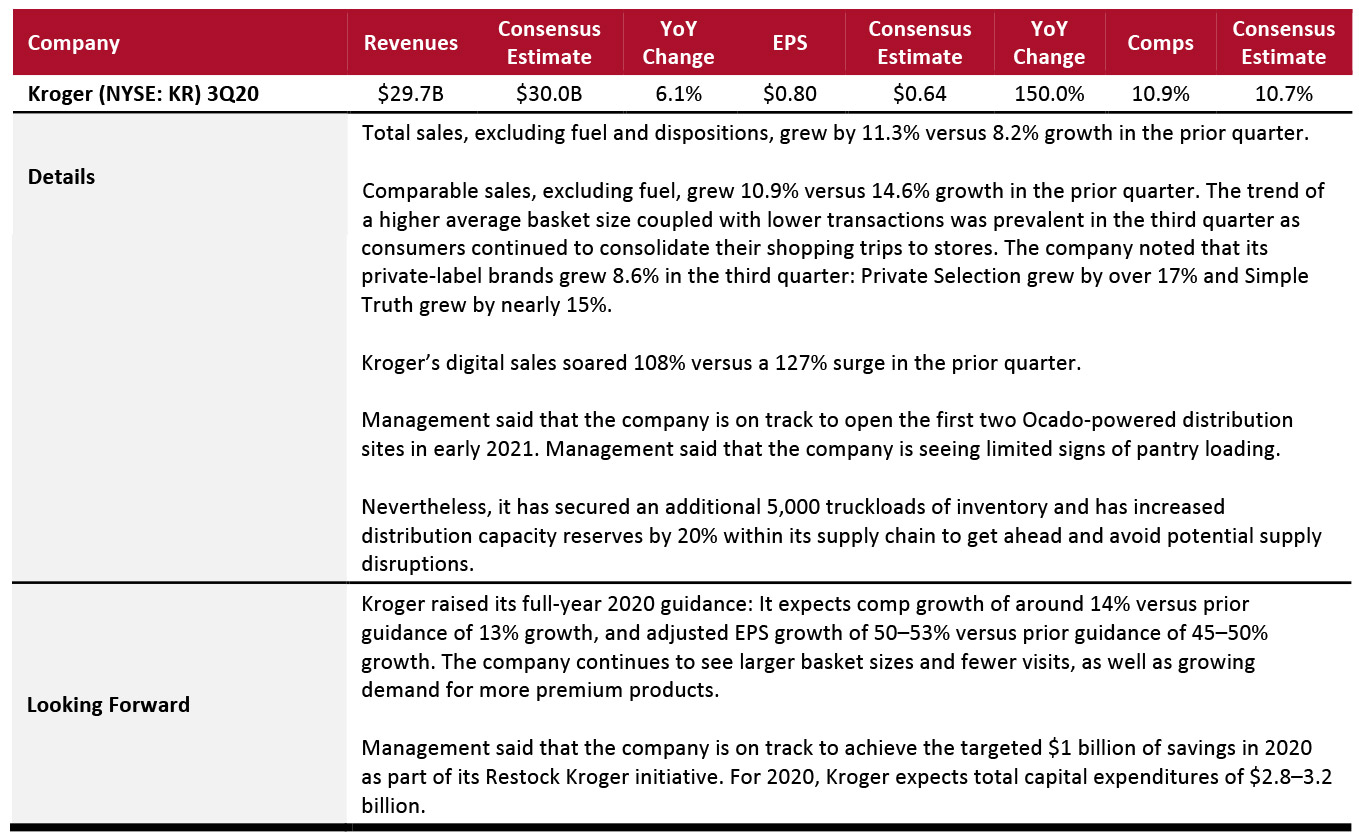

Kroger’s performance stayed strong during the quarter, driven by sustained in-home consumption. Its digital channel saw 108% growth, contributing 4.6% growth to comparable sales excluding fuel. Kroger’s strong omnichannel capabilities of 2,200 pickup locations and around 2,450 delivery locations allowed it to capture the increased demand for e-commerce offerings. Management said that the company has secured additional inventory and increased flexibility across its facilities to meet elevated demand during the peak holiday season.

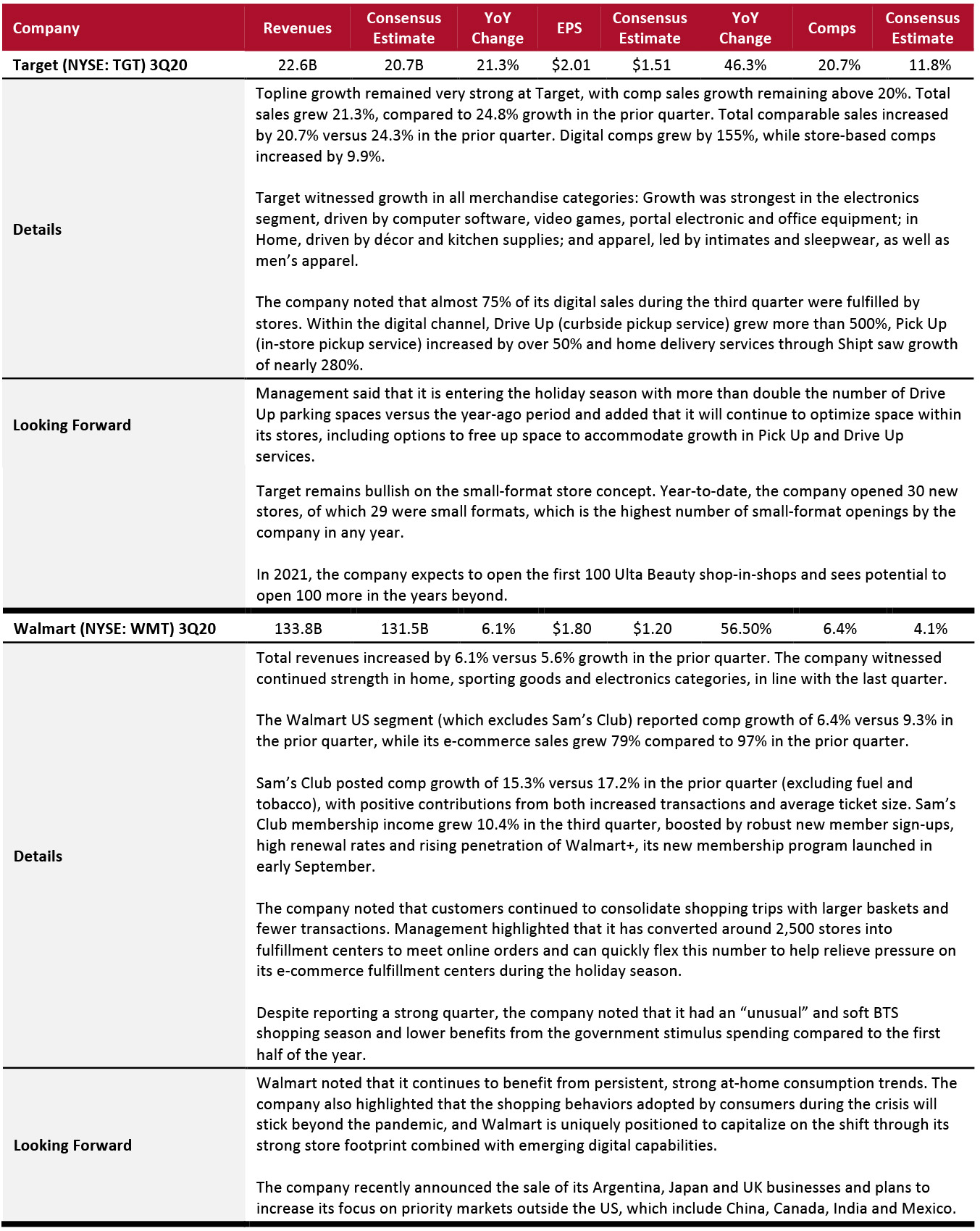

Food, Drug and Mass Retailers: Mass Merchandisers

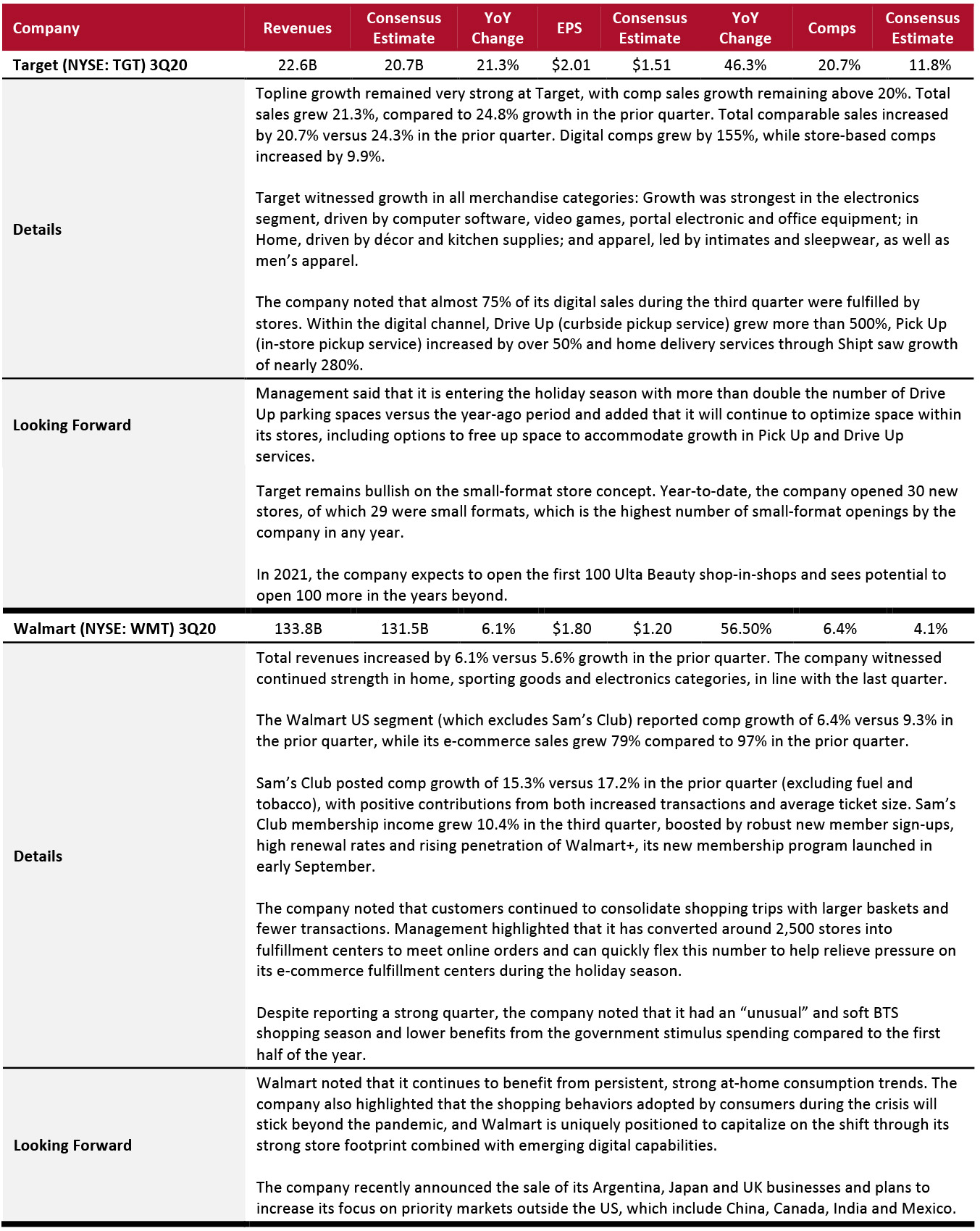

Mass merchandisers sustained their strong growth momentum in the third quarter, led by increased demand for merchandise categories including food and consumables, home-related merchandise, and health and wellness.

Target’s topline growth remained exceptionally strong, with comp sales growth remaining above 20%, supported by very strong digital growth. Target noted that home goods, apparel and electronics are performing well.

Walmart noted that it continues to benefit from persistent, strong at-home consumption trends and witnessed strength in the home, sporting goods and electronics categories. The company also highlighted that the shopping behaviors adopted by consumers during the crisis will stick beyond the pandemic, and Walmart is uniquely positioned to capitalize on the shift through its strong store footprint combined with emerging digital capabilities.

Both Walmart and Target have ramped up their omnichannel capabilities to capitalize on the e-commerce boom during the holiday season. Target has almost doubled the number of curbside locations compared to last year, while Walmart has turned on over 2,500 stores—with the capacity to add more—to fulfill online orders.

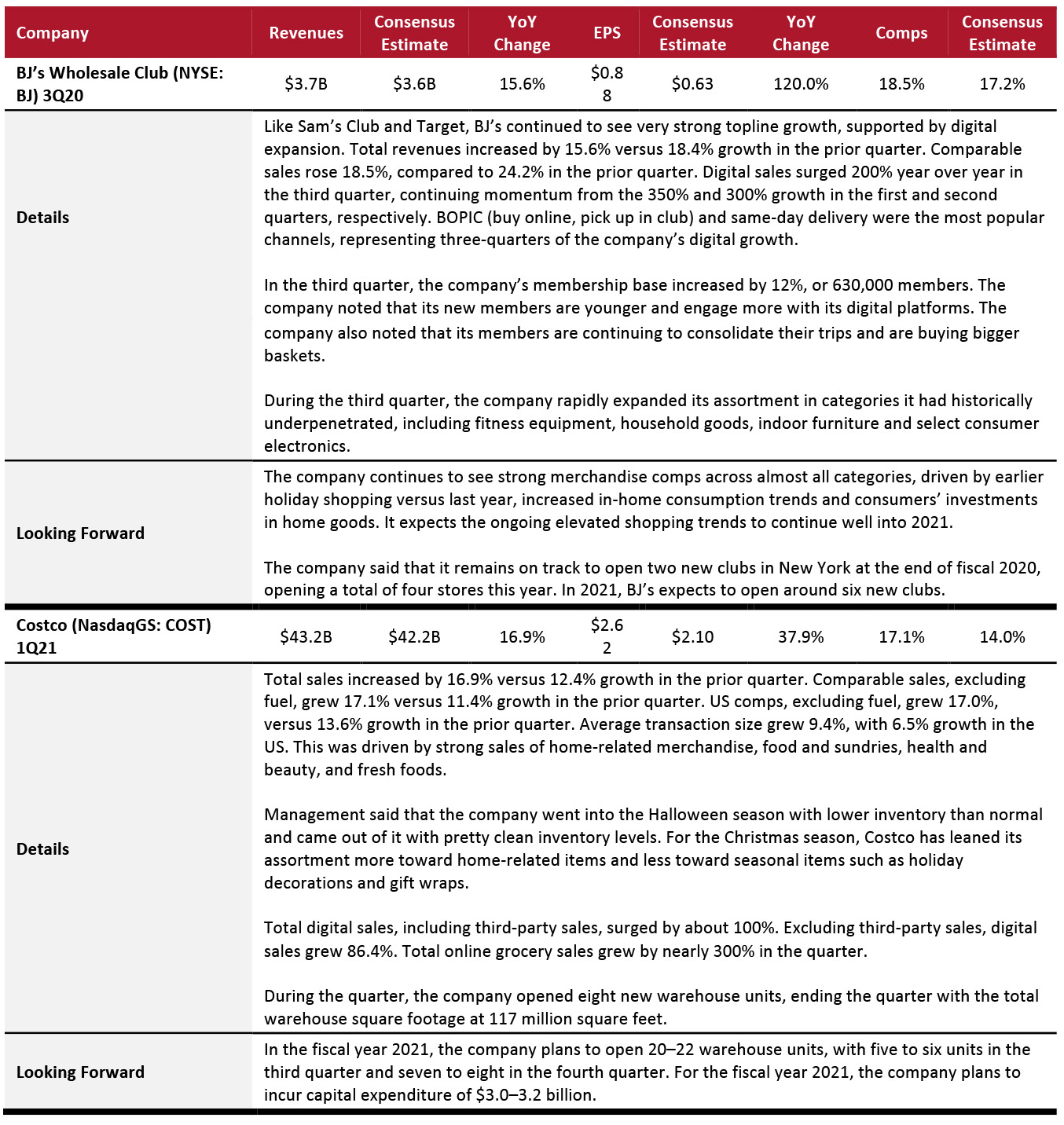

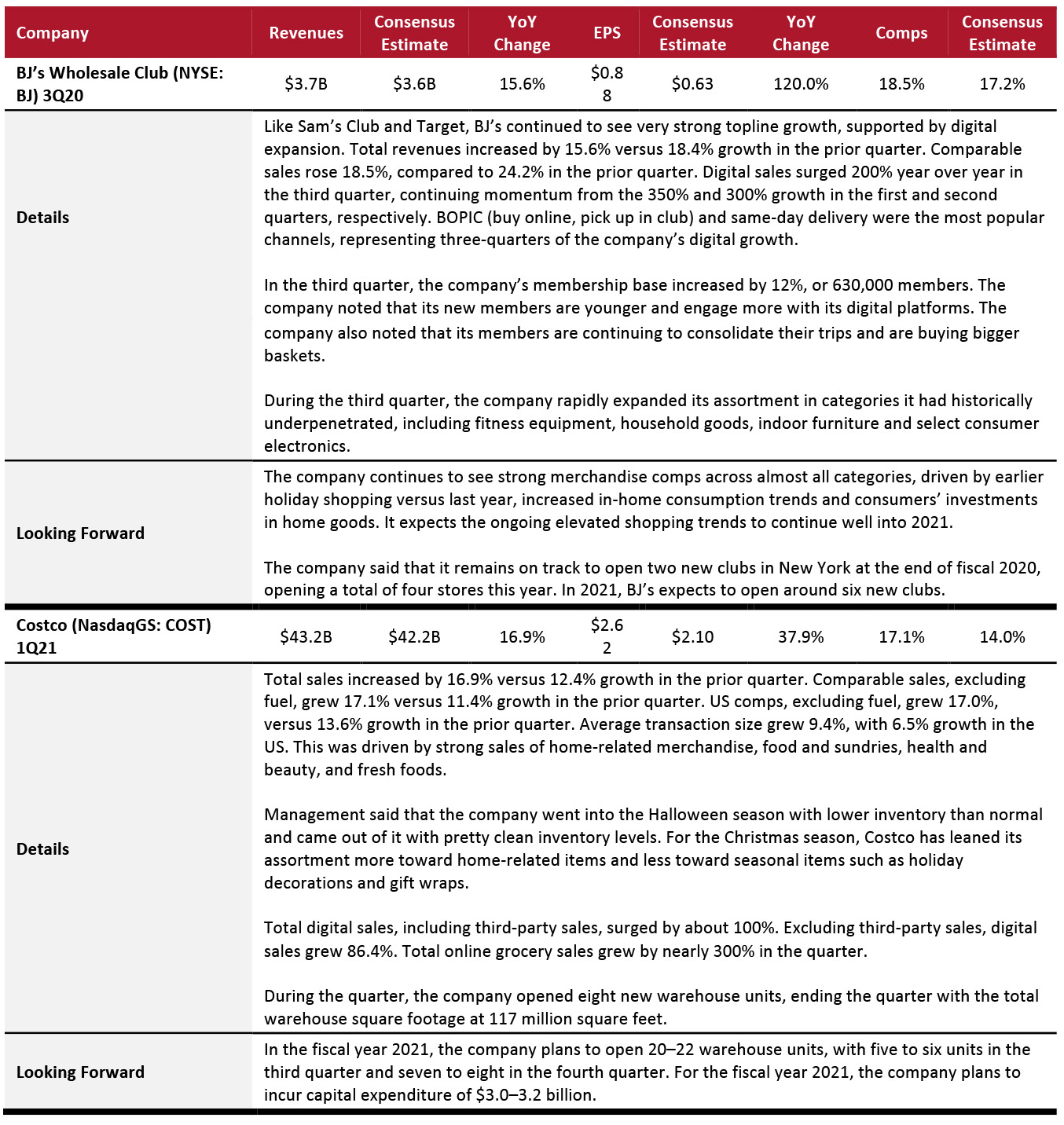

Food, Drug and Mass Retailers: Warehouse Clubs

Warehouse clubs continues to be a major beneficiary of the pandemic. The wholesale retailers’ grocery goods were in high demand while the home-related merchandise category also saw strong momentum in their last quarters. Importantly, the companies’ continued emphasis on e-commerce and omnichannel capabilities is driving customer engagement from both their core base as well as new members in the current environment.

Warehouse clubs are well-positioned for sustainable growth with new club openings, strong core member trends, new member opportunities and a growing ecommerce business.

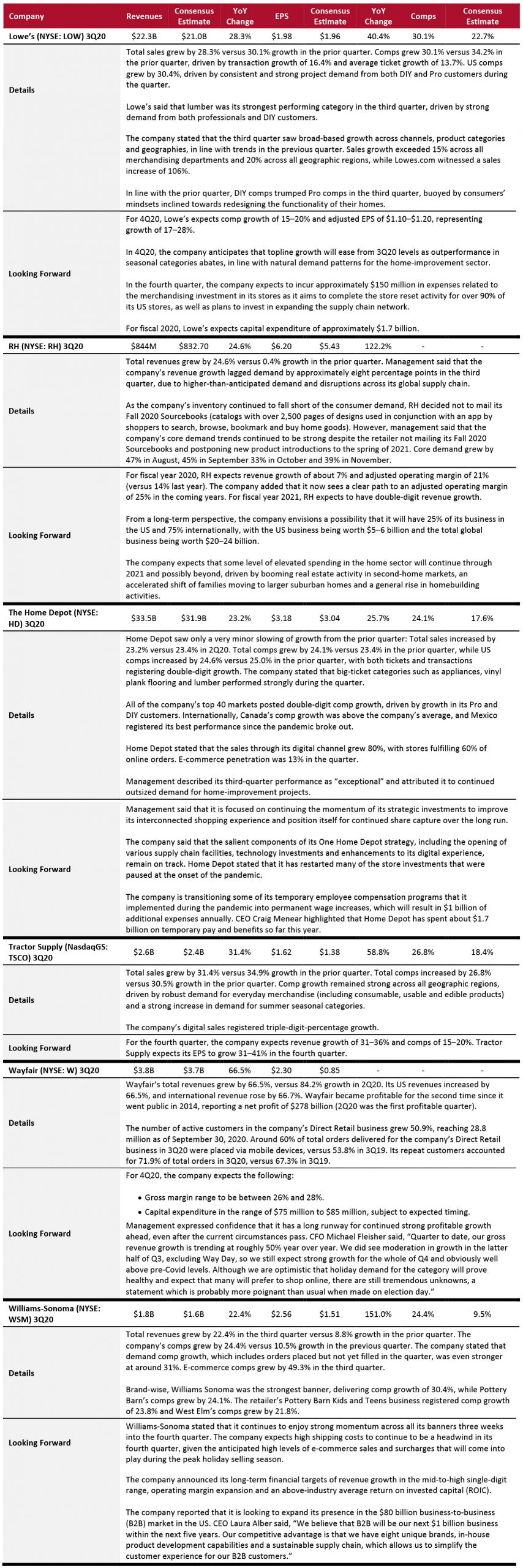

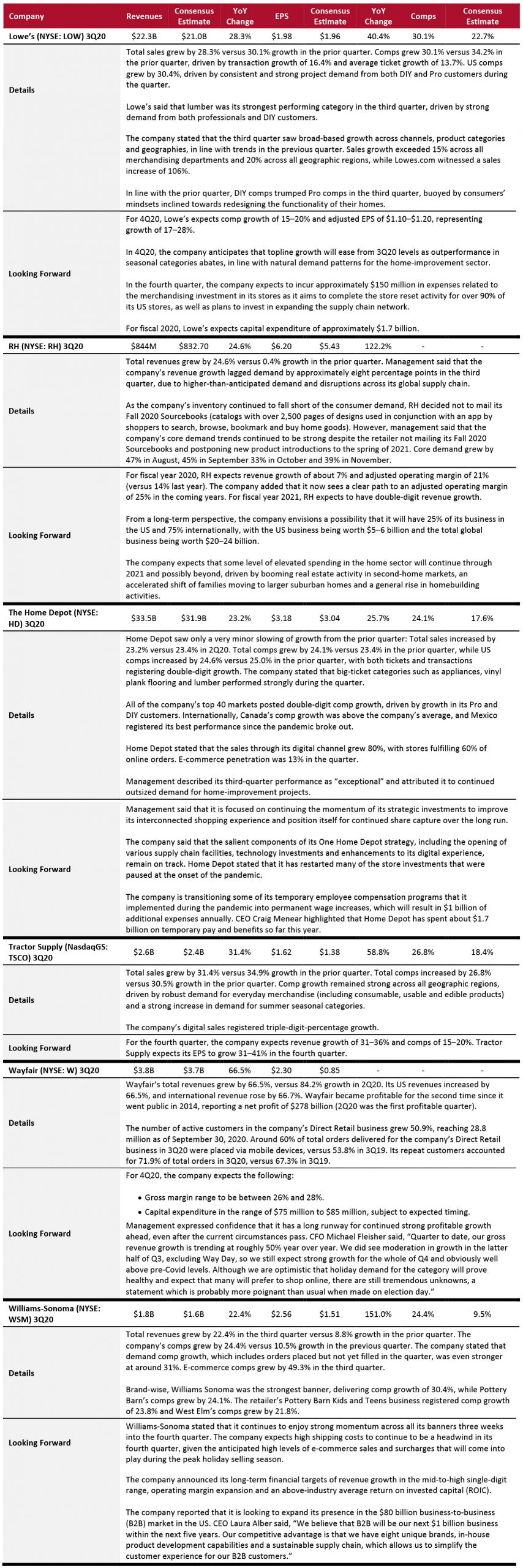

Home and Home-Improvement Retailers

The home and home-improvement sector had another strong quarter, with all six of the companies under our coverage beating consensus on revenues, EPS and comps. The strong performance in the sector was unsurprising, considering the continued demand and consumer spending on home improvement and home decor products as consumers largely stayed indoors.

For home-improvement retailers Home Depot and Lowe’s, there was continued outsized demand both from Pro and DIY customers. Similarly, e-commerce-focused retailers such as Wayfair and Williams-Sonoma continued to capitalize on accelerated e-commerce adoption among consumers, with Wayfair reporting a profit for the second time since it went public in 2014.

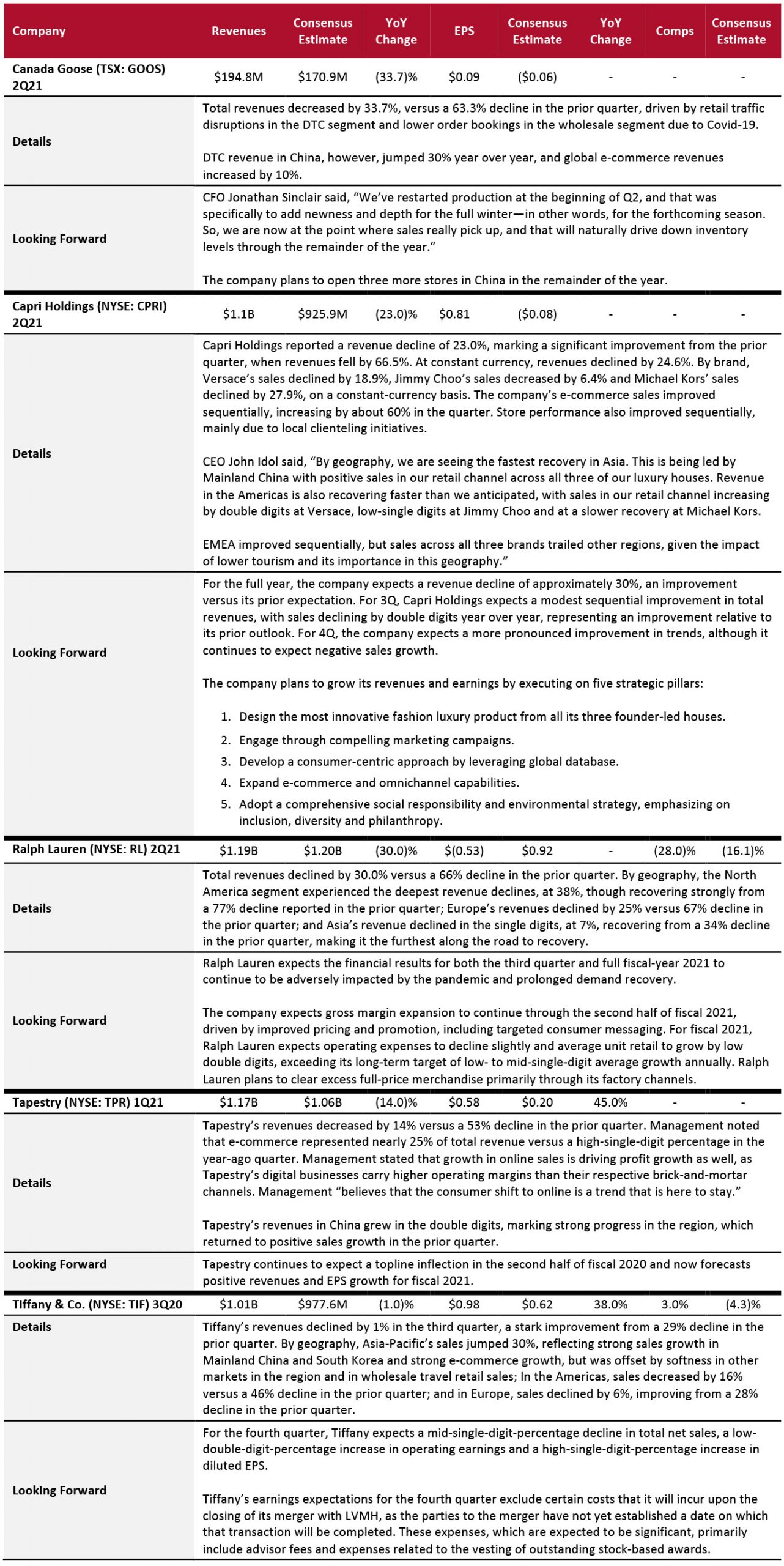

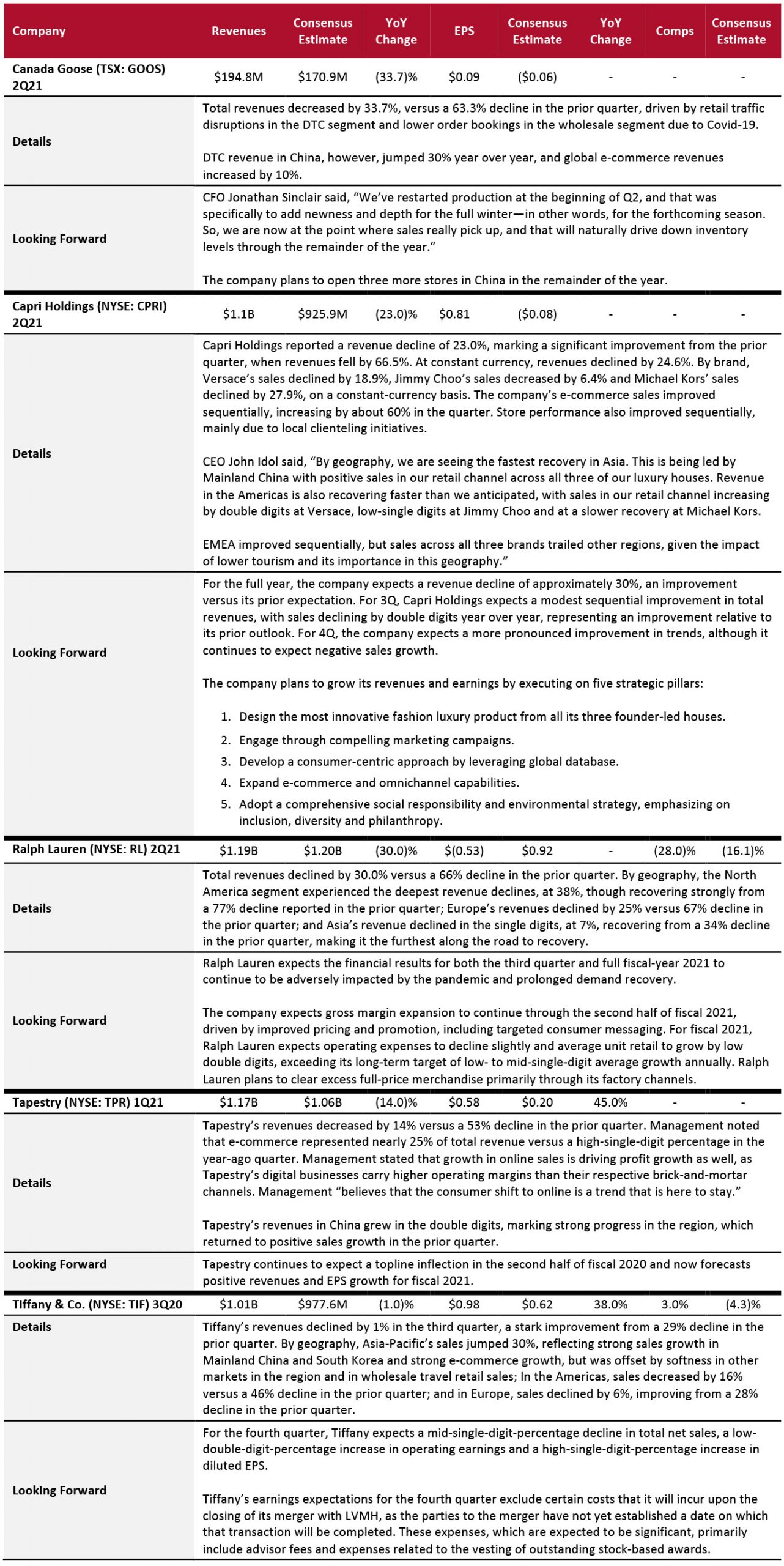

Luxury Companies

The luxury sector has been one of the most affected by the pandemic as travel and tourism, two important drivers of spending in the luxury sector, are virtually at a standstill. As lockdowns varied around the world, the latest quarter has seen a quick recovery compared to the previous quarter, but revenue growth still largely remains in the negative. Luxury shoppers from China have historically been instrumental to growth in the luxury sector, and the China segments across the covered companies seem further ahead on the path to recovery.

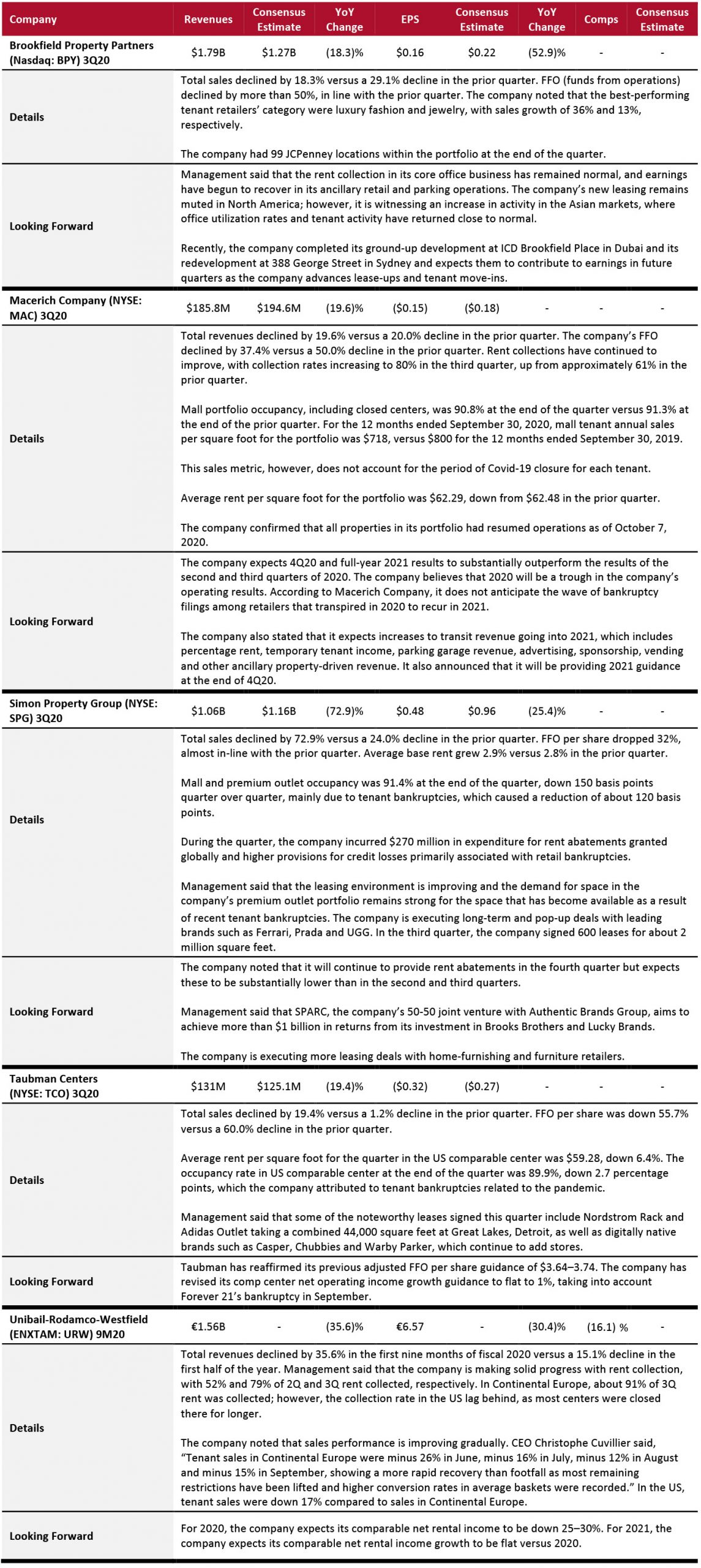

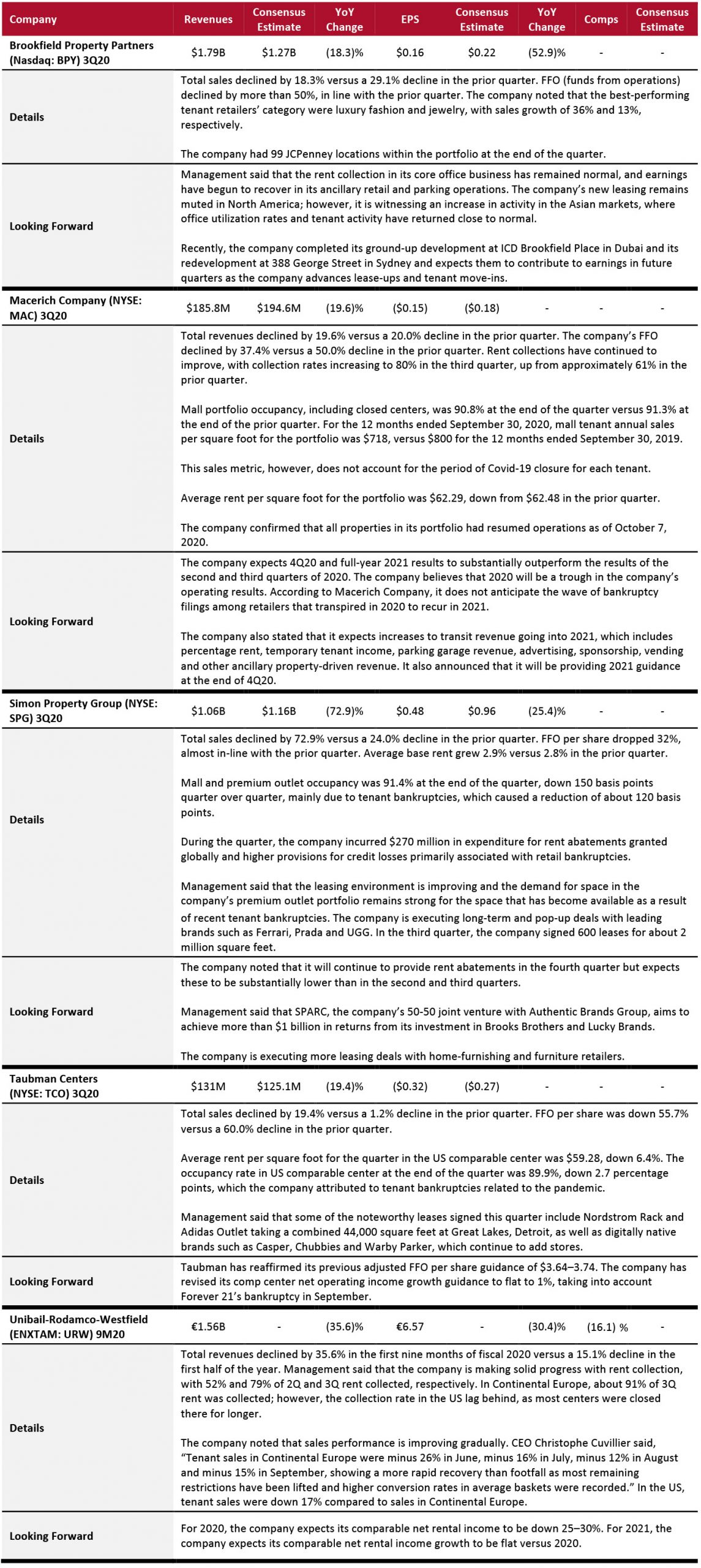

REITs

The sector continues to suffer from the outbreak of the coronavirus, as many reopened centers face closures again. All companies under our coverage reported a double-digit decline in revenues. With uncertainty ahead, most companies did not provide an outlook for fiscal 2020.

The sector saw improvement in traffic as centers reopened, and in rent collection going into the fourth quarter. However, with the recent surge in coronavirus cases and a decline in store traffic, the fourth quarter and early 2021 will remain challenging for this sector.

Looking Forward

Looking Forward

Most of the discretionary sectors regained their momentum during the quarter. With consumers continuing to stay indoors, we continue to see strength in home-related merchandise. This is benefiting more than home and home-improvement retailers, with a number of companies across sectors each calling out home categories as outperformers: Burlington Stores, TJX and Ross Stores (off-pricers); Big Lots, Dollar Tree and Dollar General (discounters); Costco (warehouse club); Kohl’s, Macy’s and Nordstrom (department stores); Target and Walmart (mass merchandisers); and Urban Outfitters (specialty retailer). We believe that the home category will continue to see outsized growth through the fourth quarter of 2020 and early 2021, and many retailers will adjust their assortment to focus in that direction.

In the apparel and footwear categories, demand for casual wear and athleisure remained strong, while tailored clothing saw weaknesses. In beauty categories, skin care is trending, but demand for makeup remains weak—except eye makeup, which is seeing a strong positive trend.

This quarter, we continued to see evidence that the crisis will support, and likely accelerate, structural changes in US retail, such as store expansion among discount retailers – all discounters reported outstanding topline growth. We expect discount stores to maintain their winning streak in the next quarter, as consumers continue to trade down to retail formats that emphasize value amid the economic uncertainty. Like discounters, warehouse clubs continued to benefit from the crisis, with Costco and BJ’s reporting strong double-digit comps. These retailers are continuing to expand their store estates.

Department stores are seeing very weak recoveries from the crisis, with sales continuing to decline by double digits. Sales are likely to remain weak in the next quarter: Nordstrom expects its total sales to be down by around 20% in its fourth quarter, while Macy’s expects its total comps to be down in the range of 20% in the second half of 2020. On the other hand, off-pricers that do not have substantial—or in some cases, any—e-commerce business to fall back on, yet are seeing much stronger sequential topline improvements than the department stores.

As the e-commerce channel continues to help retailers offset lost sales from brick-and-mortar store closures and reduce their in-store inventory, some retailers, such as American Eagle Outfitters, Urban Outfitters, Kohl’s, Macy’s, Capri Holding and Hanesbrands, are looking to strengthen their digital model. This involves looking to expand curbside pickup and ship-from-store capabilities, and implement automated fulfillment technology at stores and distribution centers.

However, online sales tend to come with higher costs and, in the new year, retailers are likely to report negative margin impacts from strong online sales during the holiday peak. Many retailers, such as American Eagle Outfitters, Best Buy, Nordstrom and Williams-Sonoma, expect high levels of e-commerce sales and high shipping

surcharges that will come into play during the peak holiday selling season to present a significant headwind in the fourth quarter.

Department Stores

Department stores are seeing very weak recoveries from the crisis, with Kohl’s, Macy’s and Nordstrom reporting double-digit decline in sales.

Sales are likely to remain weak in the next quarter: Nordstrom expects its total sales to be down by around 20% in its fourth quarter, Macy’s expects its total comps to be down in the range of 20% in the second half of 2020.

Department Stores

Department stores are seeing very weak recoveries from the crisis, with Kohl’s, Macy’s and Nordstrom reporting double-digit decline in sales.

Sales are likely to remain weak in the next quarter: Nordstrom expects its total sales to be down by around 20% in its fourth quarter, Macy’s expects its total comps to be down in the range of 20% in the second half of 2020.

Looking Forward

Most of the discretionary sectors regained their momentum during the quarter. With consumers continuing to stay indoors, we continue to see strength in home-related merchandise. This is benefiting more than home and home-improvement retailers, with a number of companies across sectors each calling out home categories as outperformers: Burlington Stores, TJX and Ross Stores (off-pricers); Big Lots, Dollar Tree and Dollar General (discounters); Costco (warehouse club); Kohl’s, Macy’s and Nordstrom (department stores); Target and Walmart (mass merchandisers); and Urban Outfitters (specialty retailer). We believe that the home category will continue to see outsized growth through the fourth quarter of 2020 and early 2021, and many retailers will adjust their assortment to focus in that direction.

In the apparel and footwear categories, demand for casual wear and athleisure remained strong, while tailored clothing saw weaknesses. In beauty categories, skin care is trending, but demand for makeup remains weak—except eye makeup, which is seeing a strong positive trend.

This quarter, we continued to see evidence that the crisis will support, and likely accelerate, structural changes in US retail, such as store expansion among discount retailers – all discounters reported outstanding topline growth. We expect discount stores to maintain their winning streak in the next quarter, as consumers continue to trade down to retail formats that emphasize value amid the economic uncertainty. Like discounters, warehouse clubs continued to benefit from the crisis, with Costco and BJ’s reporting strong double-digit comps. These retailers are continuing to expand their store estates.

Department stores are seeing very weak recoveries from the crisis, with sales continuing to decline by double digits. Sales are likely to remain weak in the next quarter: Nordstrom expects its total sales to be down by around 20% in its fourth quarter, while Macy’s expects its total comps to be down in the range of 20% in the second half of 2020. On the other hand, off-pricers that do not have substantial—or in some cases, any—e-commerce business to fall back on, yet are seeing much stronger sequential topline improvements than the department stores.

As the e-commerce channel continues to help retailers offset lost sales from brick-and-mortar store closures and reduce their in-store inventory, some retailers, such as American Eagle Outfitters, Urban Outfitters, Kohl’s, Macy’s, Capri Holding and Hanesbrands, are looking to strengthen their digital model. This involves looking to expand curbside pickup and ship-from-store capabilities, and implement automated fulfillment technology at stores and distribution centers.

However, online sales tend to come with higher costs and, in the new year, retailers are likely to report negative margin impacts from strong online sales during the holiday peak. Many retailers, such as American Eagle Outfitters, Best Buy, Nordstrom and Williams-Sonoma, expect high levels of e-commerce sales and high shipping surcharges that will come into play during the peak holiday selling season to present a significant headwind in the fourth quarter.

Looking Forward

Most of the discretionary sectors regained their momentum during the quarter. With consumers continuing to stay indoors, we continue to see strength in home-related merchandise. This is benefiting more than home and home-improvement retailers, with a number of companies across sectors each calling out home categories as outperformers: Burlington Stores, TJX and Ross Stores (off-pricers); Big Lots, Dollar Tree and Dollar General (discounters); Costco (warehouse club); Kohl’s, Macy’s and Nordstrom (department stores); Target and Walmart (mass merchandisers); and Urban Outfitters (specialty retailer). We believe that the home category will continue to see outsized growth through the fourth quarter of 2020 and early 2021, and many retailers will adjust their assortment to focus in that direction.

In the apparel and footwear categories, demand for casual wear and athleisure remained strong, while tailored clothing saw weaknesses. In beauty categories, skin care is trending, but demand for makeup remains weak—except eye makeup, which is seeing a strong positive trend.

This quarter, we continued to see evidence that the crisis will support, and likely accelerate, structural changes in US retail, such as store expansion among discount retailers – all discounters reported outstanding topline growth. We expect discount stores to maintain their winning streak in the next quarter, as consumers continue to trade down to retail formats that emphasize value amid the economic uncertainty. Like discounters, warehouse clubs continued to benefit from the crisis, with Costco and BJ’s reporting strong double-digit comps. These retailers are continuing to expand their store estates.

Department stores are seeing very weak recoveries from the crisis, with sales continuing to decline by double digits. Sales are likely to remain weak in the next quarter: Nordstrom expects its total sales to be down by around 20% in its fourth quarter, while Macy’s expects its total comps to be down in the range of 20% in the second half of 2020. On the other hand, off-pricers that do not have substantial—or in some cases, any—e-commerce business to fall back on, yet are seeing much stronger sequential topline improvements than the department stores.

As the e-commerce channel continues to help retailers offset lost sales from brick-and-mortar store closures and reduce their in-store inventory, some retailers, such as American Eagle Outfitters, Urban Outfitters, Kohl’s, Macy’s, Capri Holding and Hanesbrands, are looking to strengthen their digital model. This involves looking to expand curbside pickup and ship-from-store capabilities, and implement automated fulfillment technology at stores and distribution centers.

However, online sales tend to come with higher costs and, in the new year, retailers are likely to report negative margin impacts from strong online sales during the holiday peak. Many retailers, such as American Eagle Outfitters, Best Buy, Nordstrom and Williams-Sonoma, expect high levels of e-commerce sales and high shipping surcharges that will come into play during the peak holiday selling season to present a significant headwind in the fourth quarter.