Introduction

Our 3Q19 wrap-up covers the quarterly earnings of 67 retailers, brands, e-commerce platforms and REITs—the (mostly) US-based companies in our

Coresight 100.

- More than half (60% or 40 companies) beat revenue consensus estimates, 33% (22 companies) missed revenue consensus estimates and 7% (five companies) reported revenues in line with the consensus.

- Apparel specialty retailers, apparel and footwear brands, e-commerce companies and REITs saw the most companies (over 70%) beat consensus revenue estimates. In earnings, CPG; home improvement; e-commerce; apparel and footwear; and, beauty brands and retail led.

- Despite bouncing back, the luxury sector was the worst-performing sector (versus ) in the quarter, with 60% (three companies) missing the consensus earnings estimates and 40% (two companies) missing consensus revenue estimates.

We assess the recent performance of retailers in more detail below.

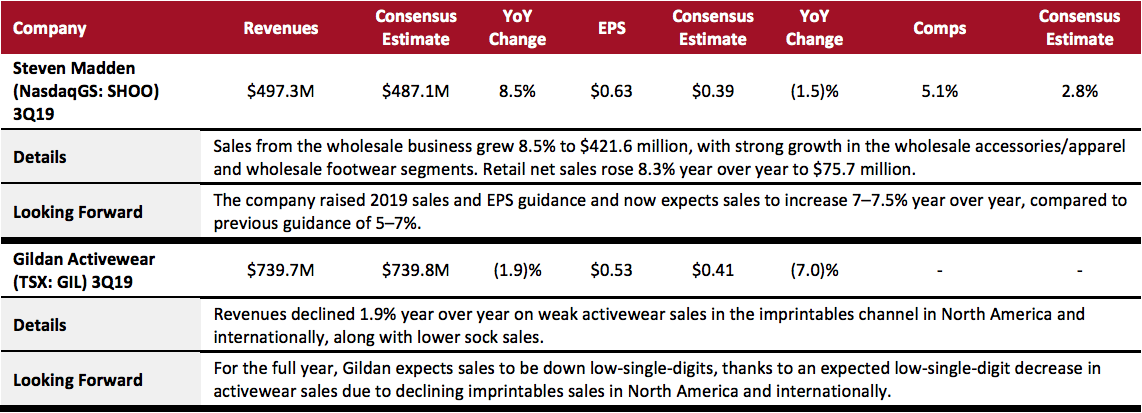

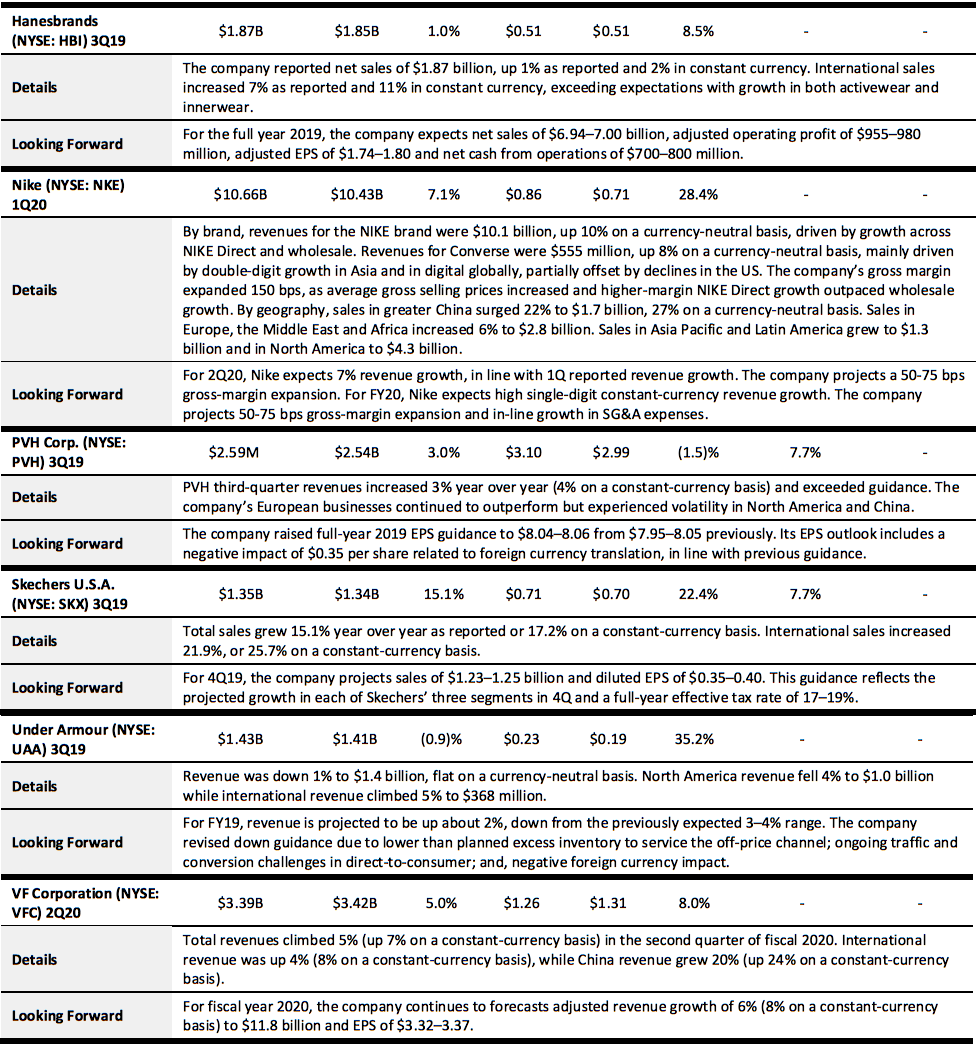

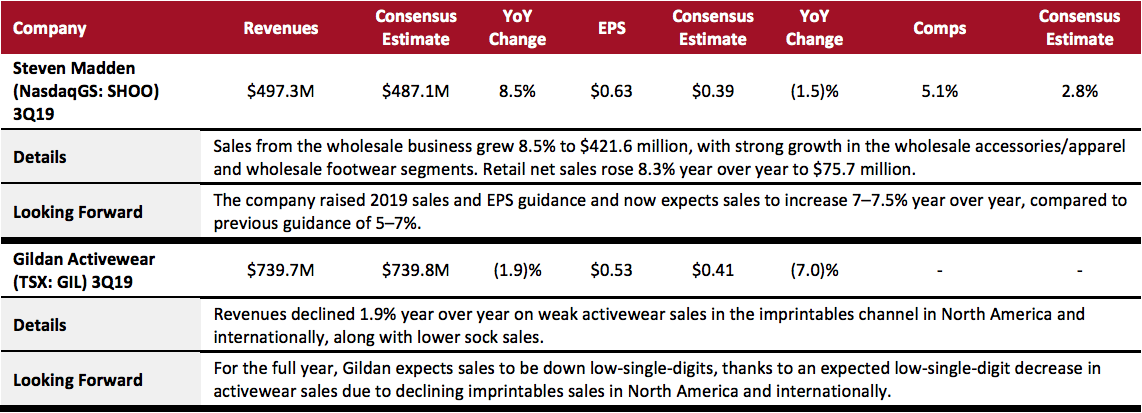

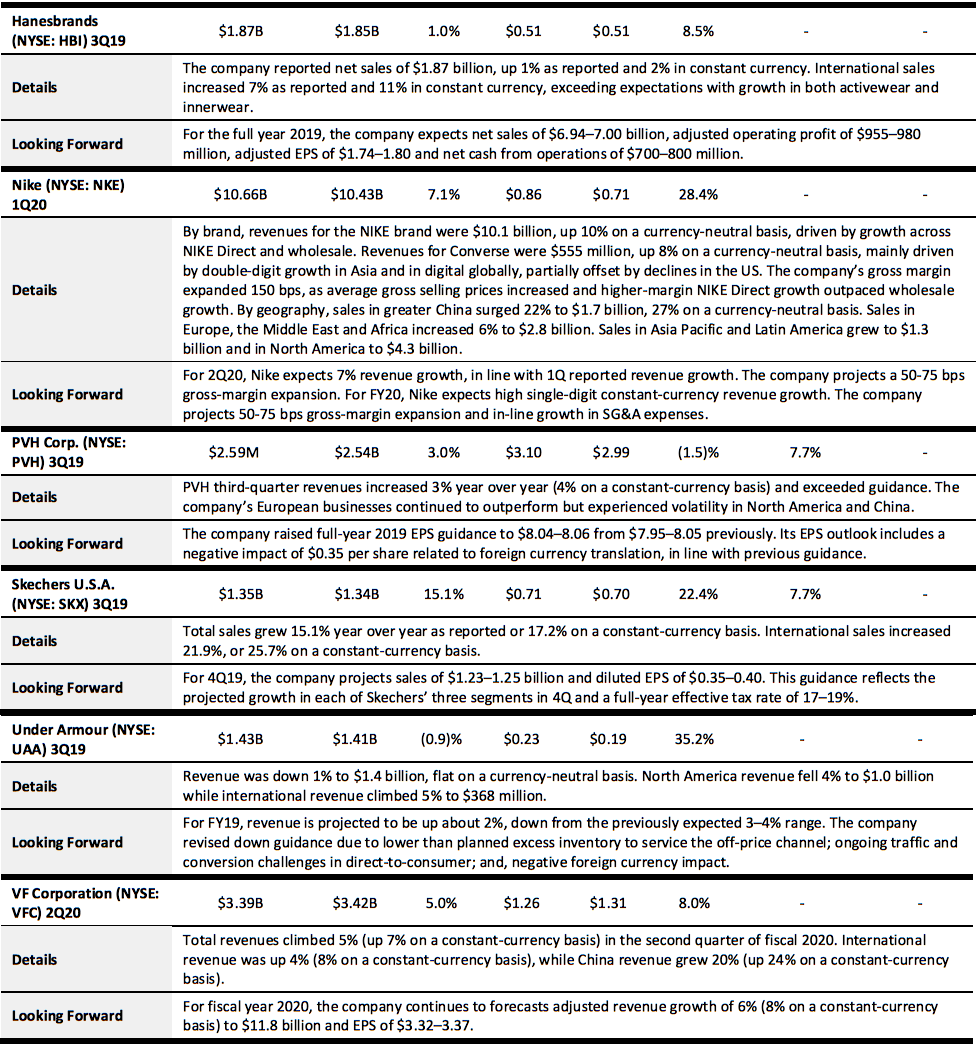

Apparel and Footwear

More than half the companies we track in the apparel and footwear sector enjoyed strong revenue growth, and most companies had guided for positive sales results. Skechers posted a record high growth rate in revenues, driven by the company’s international business. Under Armour and Gildan Activewear posted negative revenue growth, primarily due to declining sales in the US.

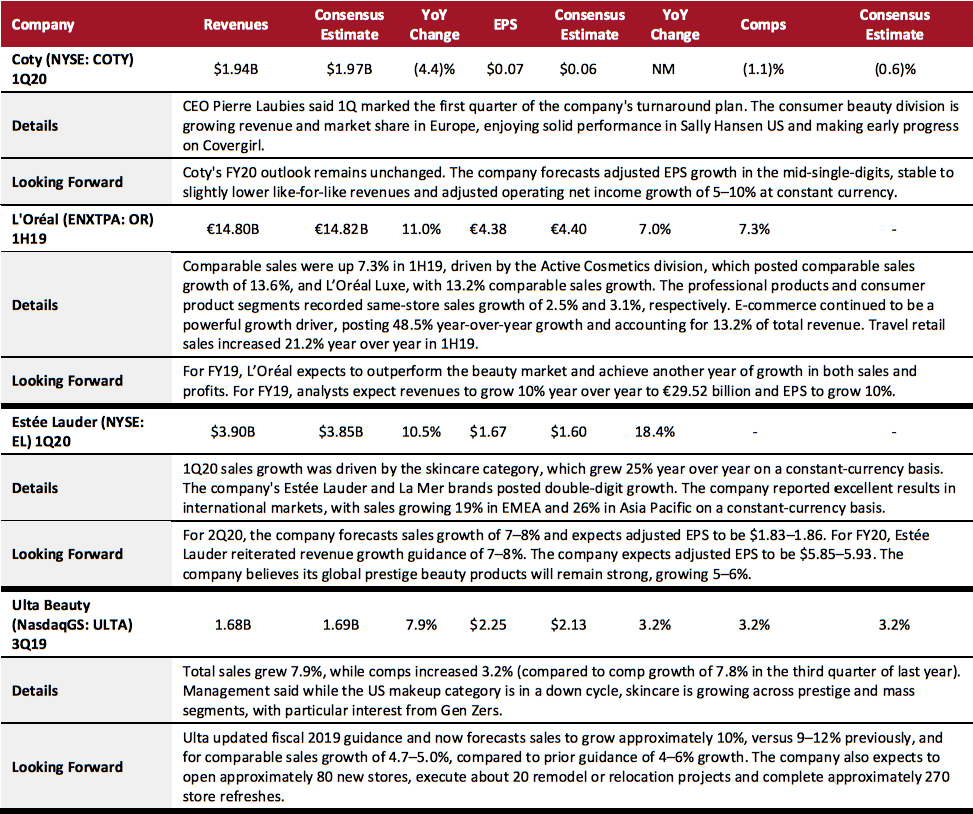

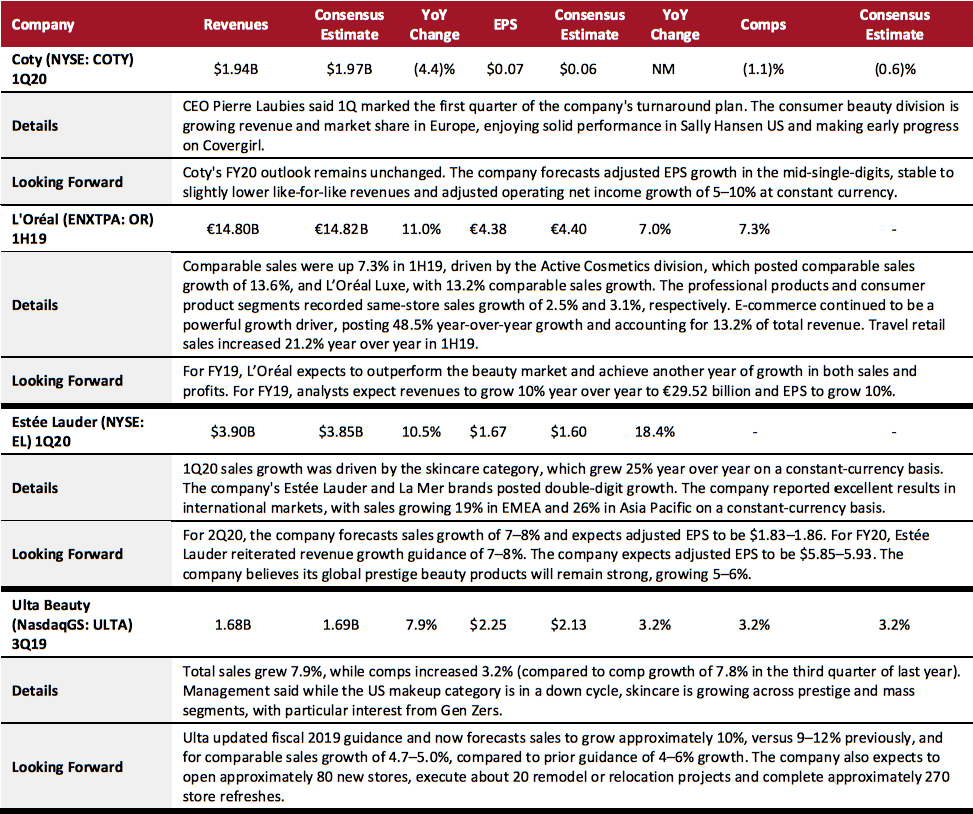

Beauty Brands and Retailers

Nearly 75% of the beauty sector enjoyed strong revenue growth, ranging from 8% to 11% year over year. L'Oréal's double-digit revenue growth was driven by its Active Cosmetics division (products sold in healthcare outlets and pharmacies, designed to solve some type of cosmetic problem) while Estée Lauder and Ulta attributed their growth to skincare. Ulta management said that while the US makeup category is experiencing a down cycle, skincare is growing across prestige and mass segments, with particular interest from the Gen Zer demographic. Coty's revenue and comps were down, missing consensus on both. Coty CEO Pierre Laubies said 1Q marked the first quarter of the company’s turnaround plan.

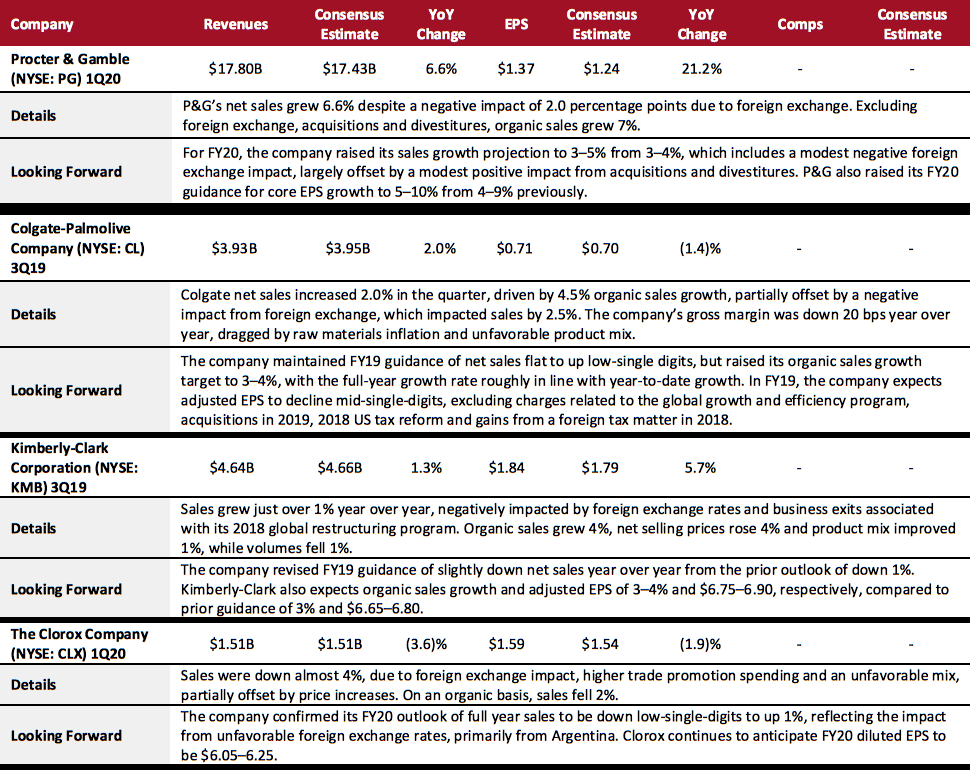

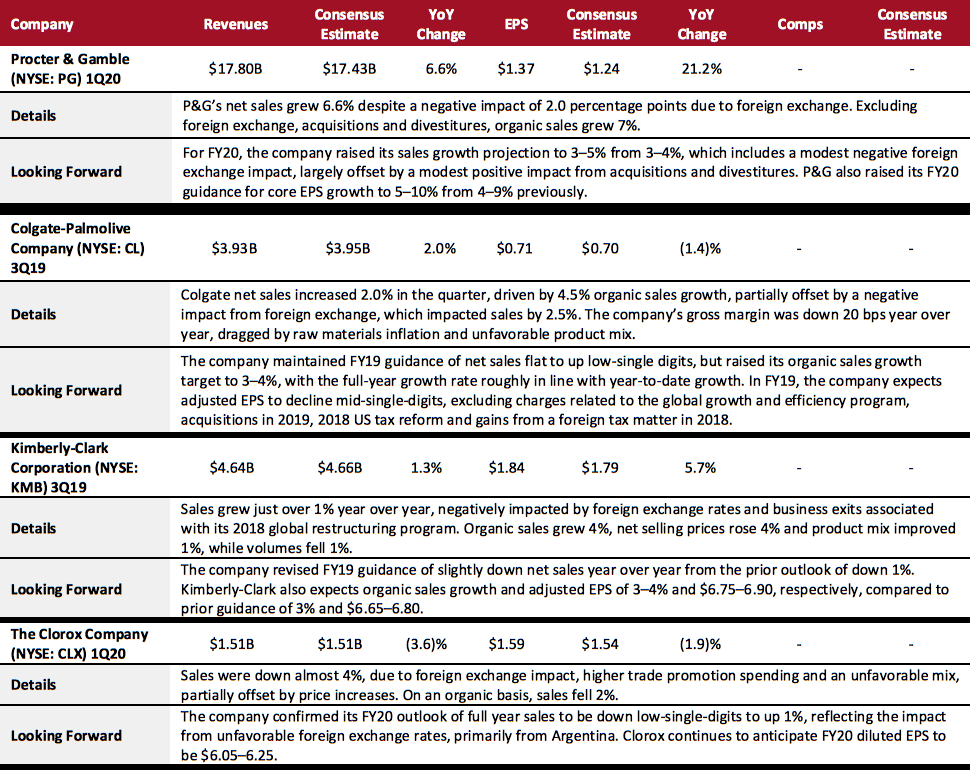

Consumer Packaged Goods (CPG)

The CPG sector posted mixed results, with sales at Procter & Gamble beating consensus estimates, while sales at Colgate-Palmolive and Kimberly-Clark fell short of market expectations. Clorox revenues were in line with the consensus estimate. The sector continued to face headwinds from foreign exchange rate fluctuations and global economic volatility. Despite that, the CPG sector experienced strong organic growth in product prices and volume. Favorable commodities also acted as a tailwind. CPG companies are focusing on product innovation to drive organic sales growth and expect cost savings to be supported by productivity improvements.

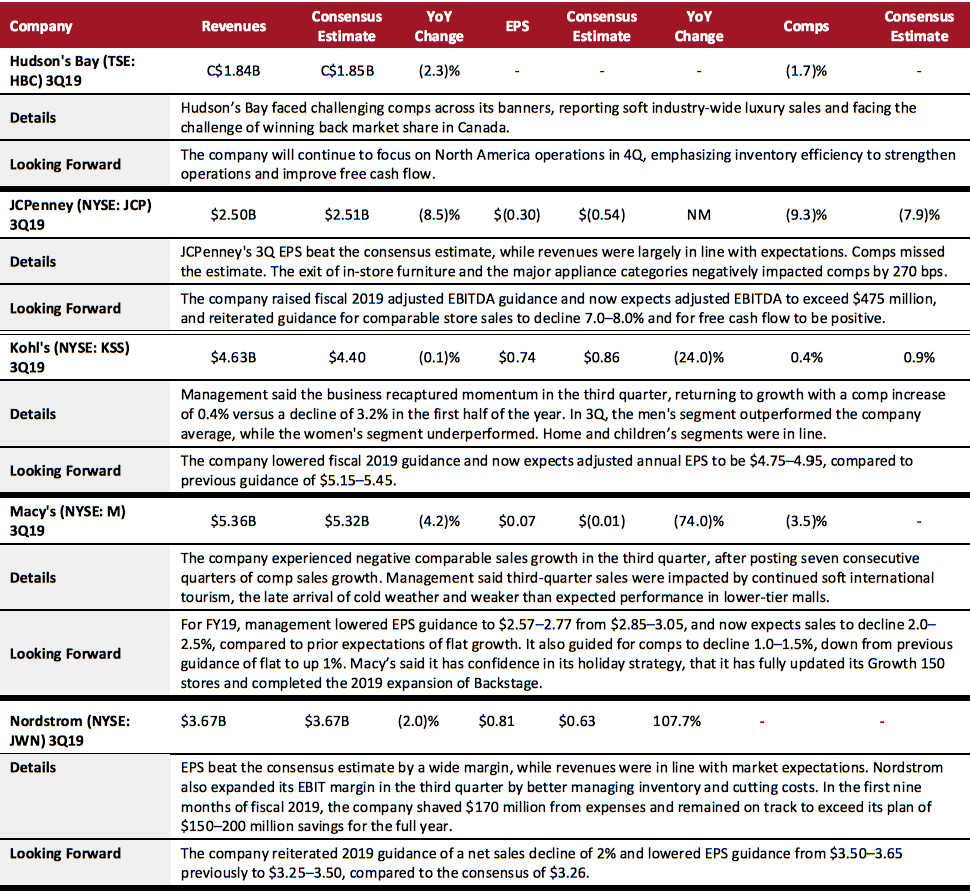

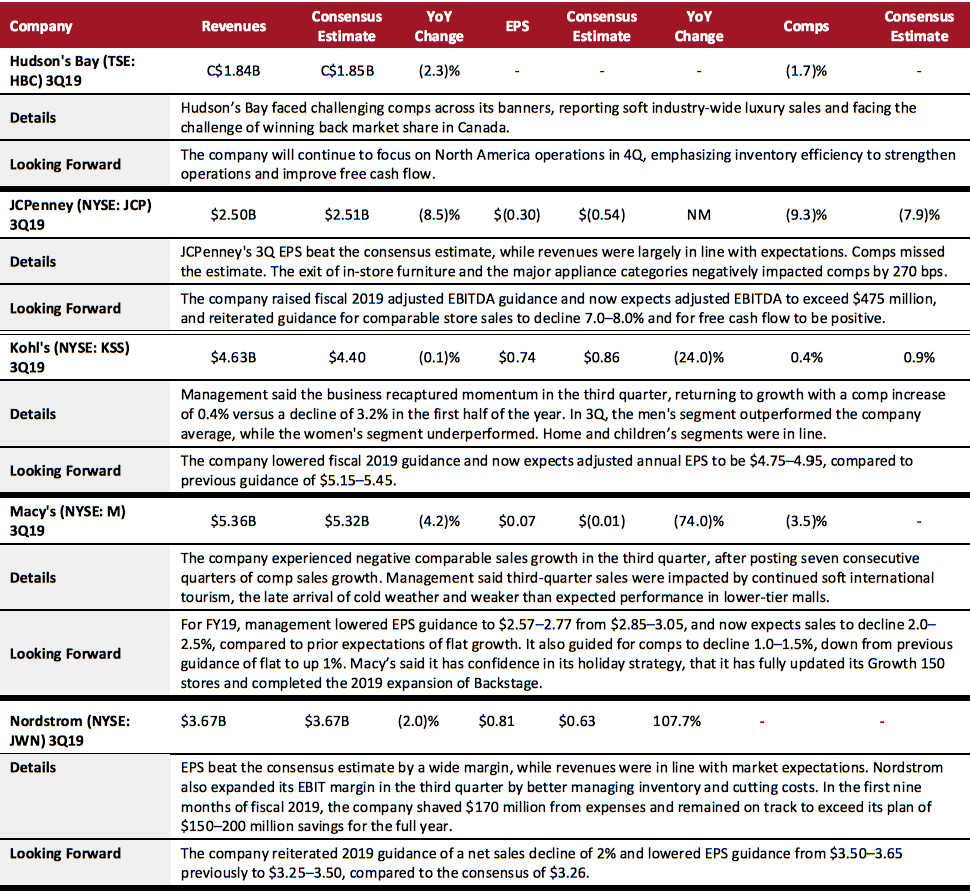

Department Stores

The department store sector continued to struggle in the third quarter, with all five of the retailers reporting revenue declines from the year-ago period. Two were above revenue consensus, two were below and one even. Half of the retailers that reported during the quarter had negative comps, except Kohl's with a slim 0.4% increase. JCPenney attributed its 3Q weakness to the exit of in-store furniture and major appliance categories; Kohl's reported its women's segment underperformed; and Macy's says it was impacted by soft international tourism, the late arrival of cold weather and weaker than expected performance in lower-tier malls.

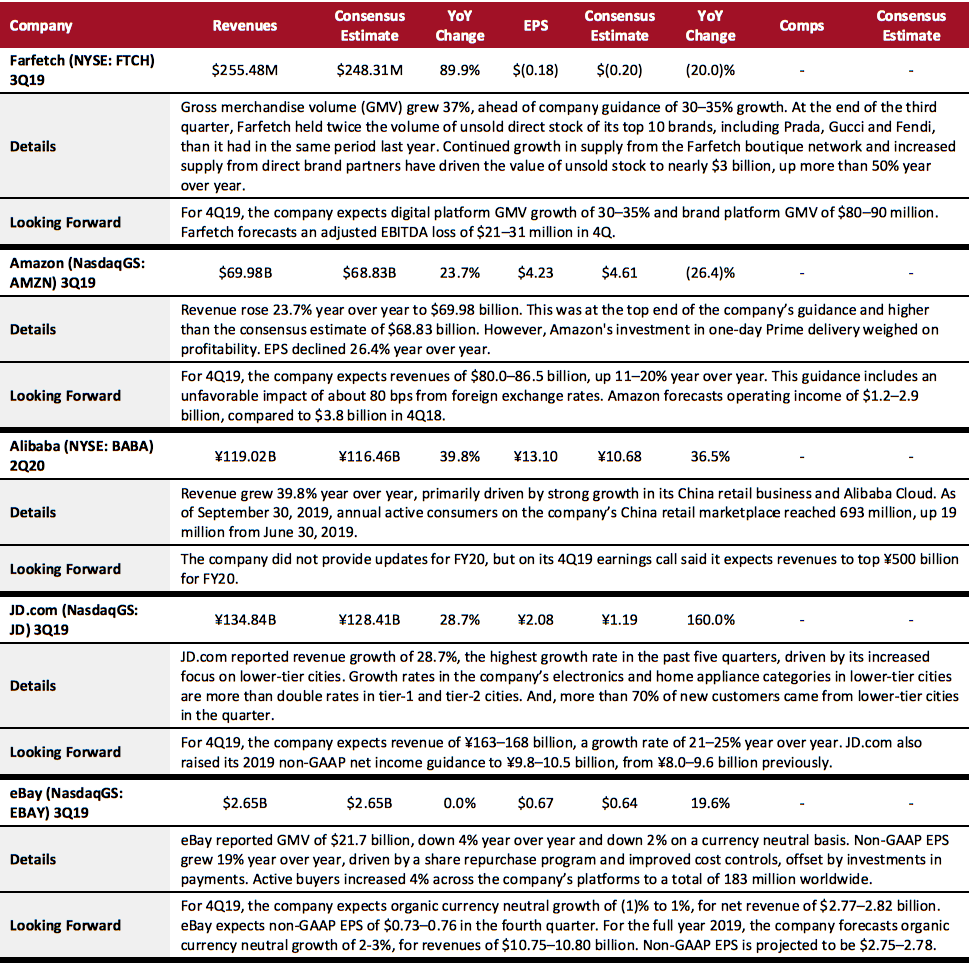

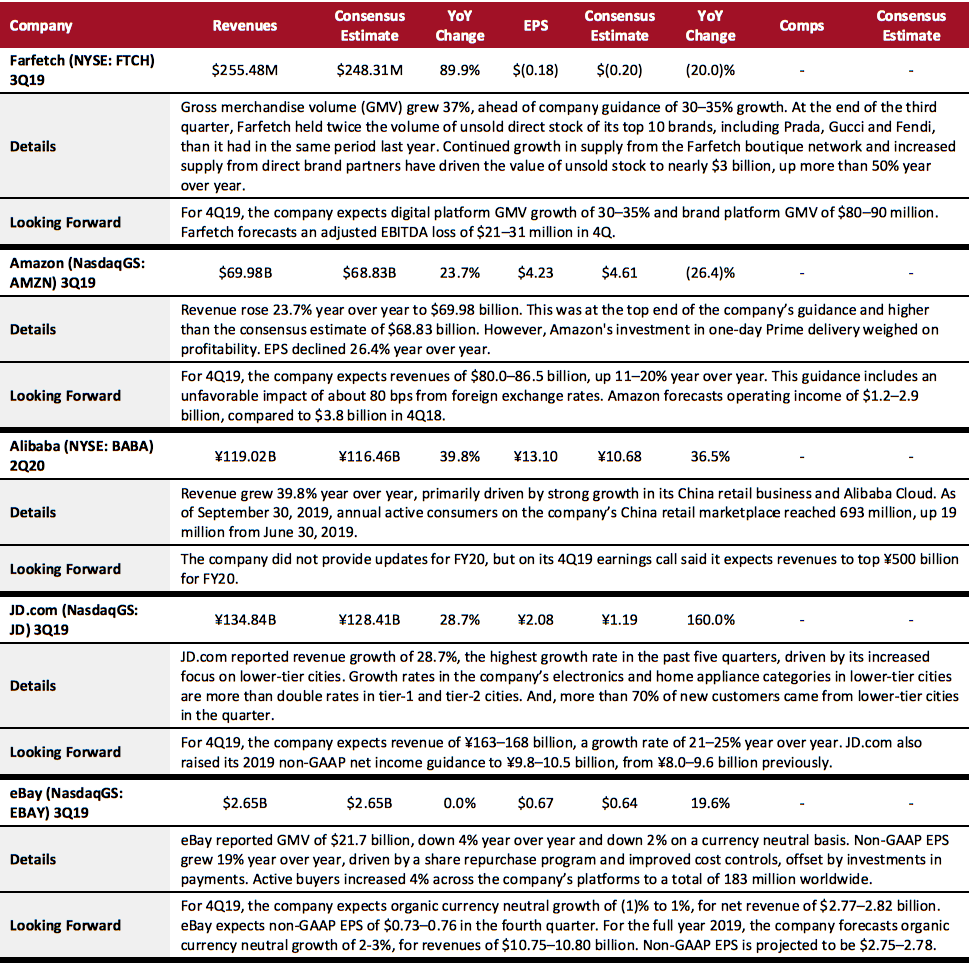

E-Commerce

Amazon reported solid sales growth in the quarter, which it attributed to Prime one-day shipping, and expects the one-day shipping offering to boost holiday shopping season sales in 4Q19. eBay sales, however, were lower than the consensus estimate due to its weakening US export business.

Chinese e-commerce giants continued to witness strong growth in their domestic market. Alibaba said its China retail sales grew 8.2% year over year in the first nine months of 2019, with e-commerce growing faster, at 17%. Both JD.com and Alibaba have been expanding their presence in China’s lower-tier markets and diversifying their offerings to cater to these markets.

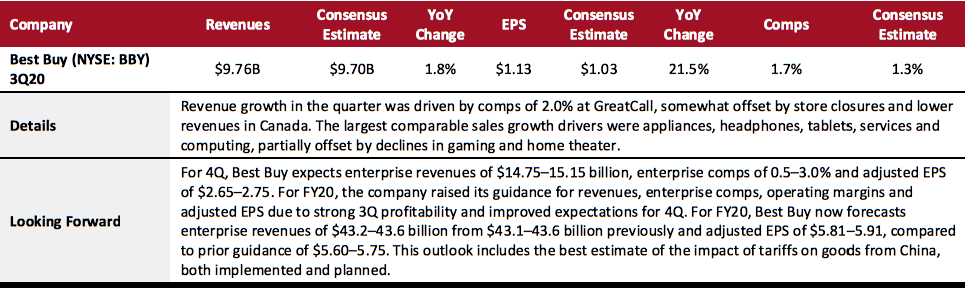

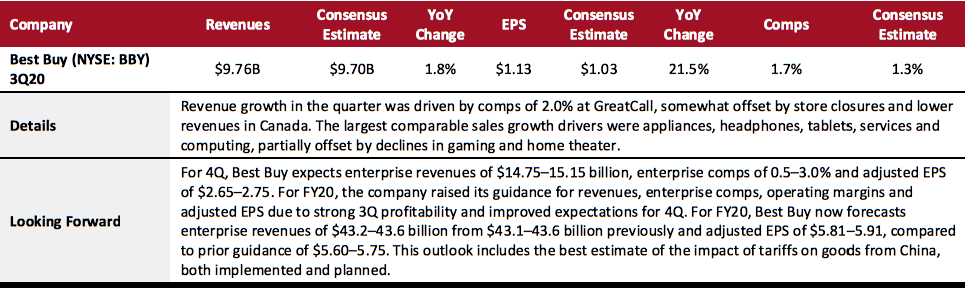

Electronics Retail

Best Buy posted a strong quarter, with revenues growth, EPS growth and comps all beating consensus estimates. The company raised fiscal 2020 revenues and earnings guidance. Management said the company is making significant progress in its “Building the New Blue” strategy that aims to enhance customer engagement by leveraging technology.

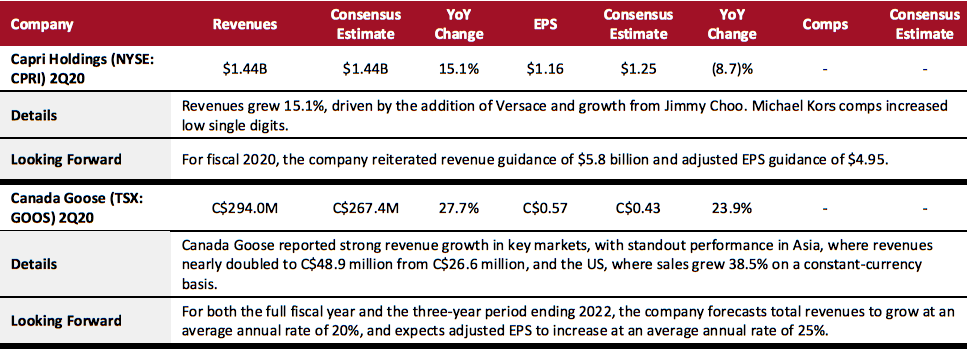

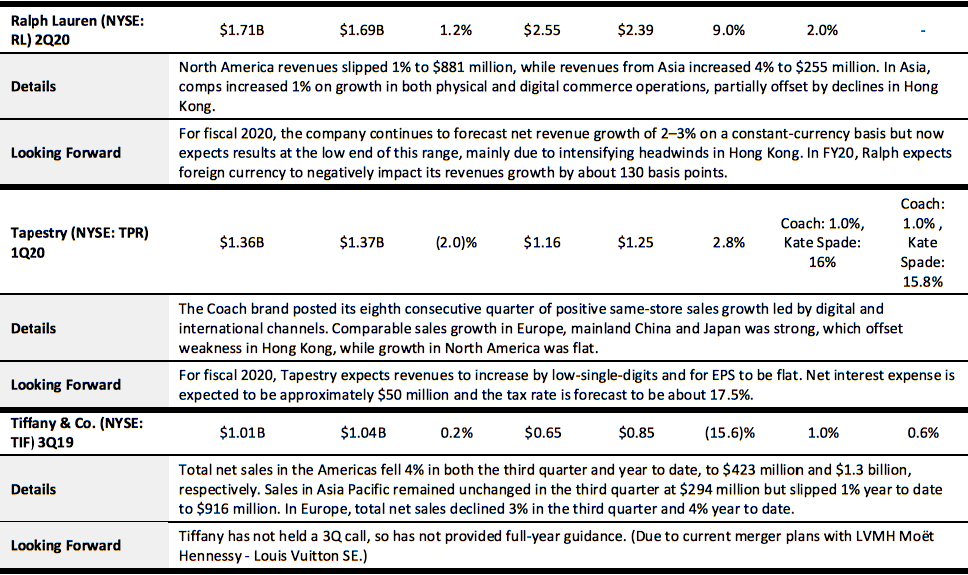

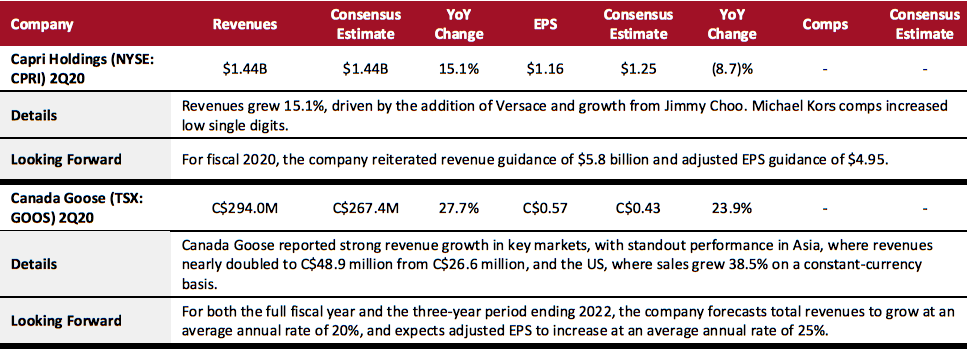

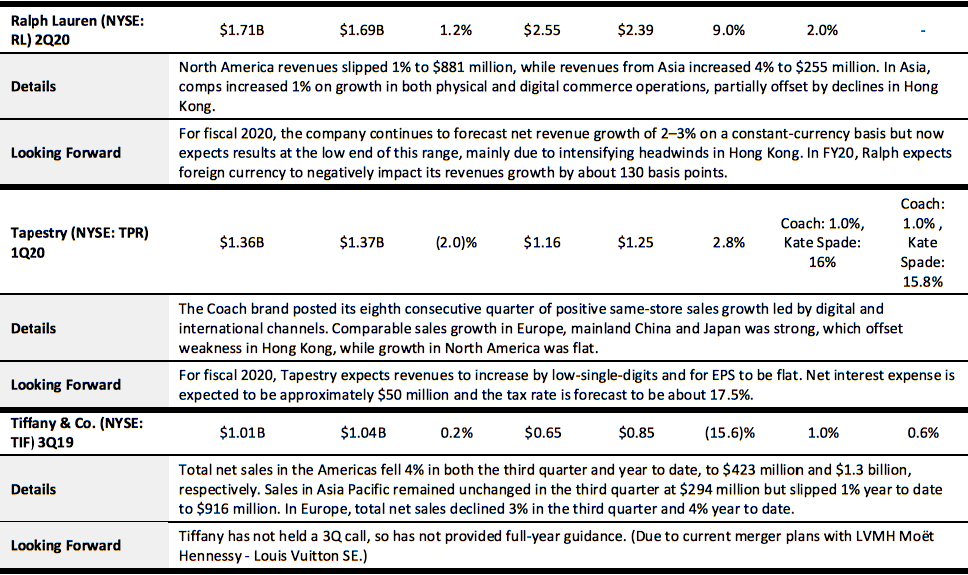

Luxury

The companies we track in the luxury sector improved performance, but most still fell short of market expectations, with three out of five companies in the Coresight 100 reporting earnings growth below consensus. Only two met expectations. Performance in Asia continued to be positive. In the next quarter and FY2020, all five companies in the sector expect positive sales growth.

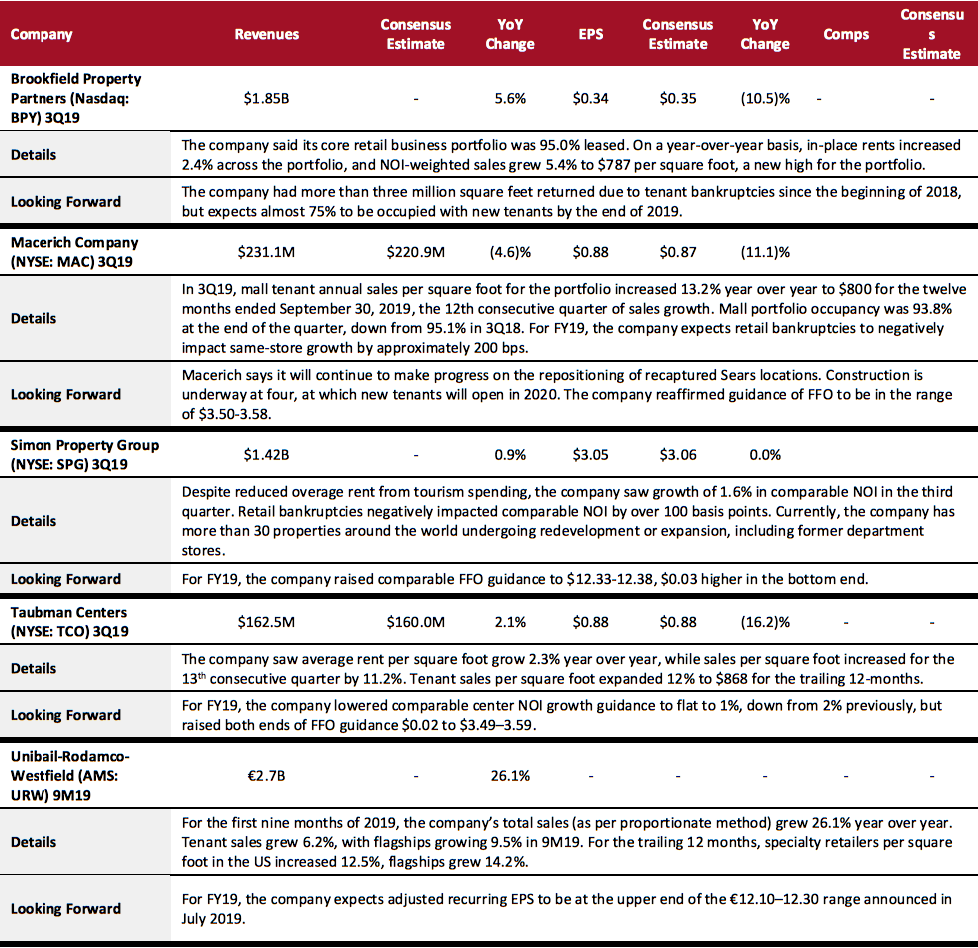

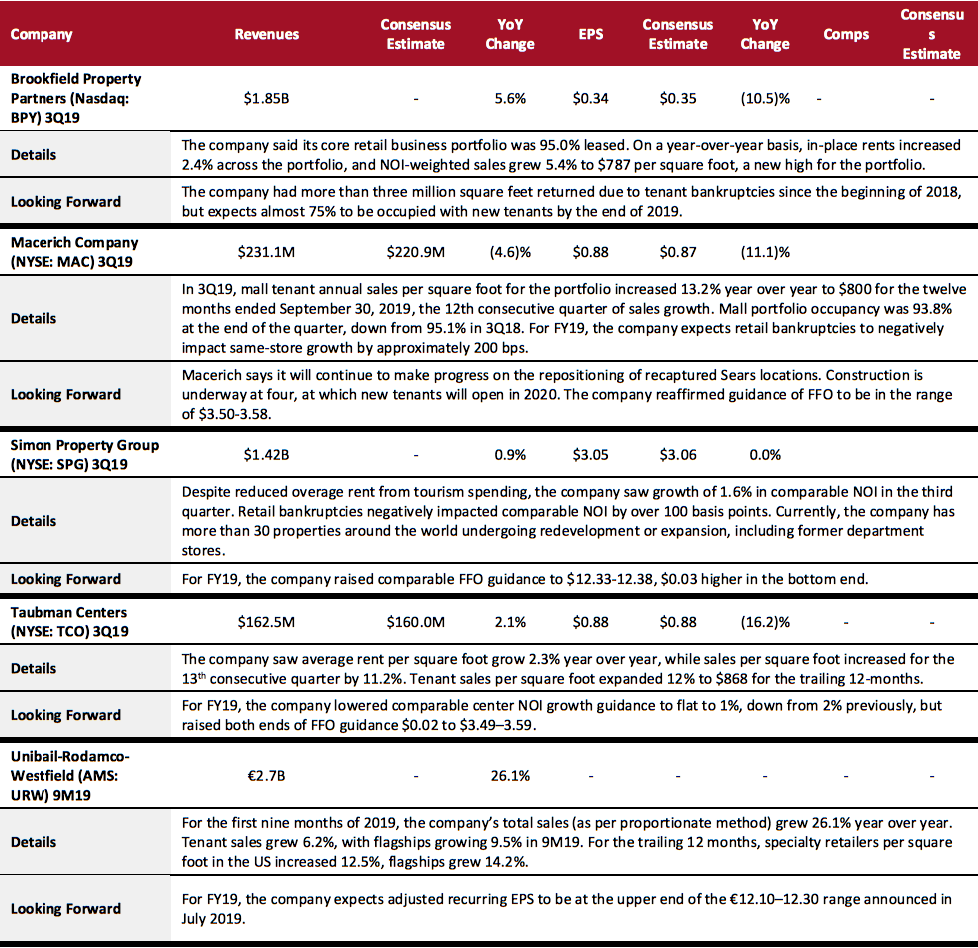

REITs

Over half of the companies in the sector reported positive results and saw tenant sales per square foot continue to grow. However, some REITs noted that retail bankruptcies caused a negative impact of 100-200 bps on comparable-store sales growth and NOI.

Specialty Retail

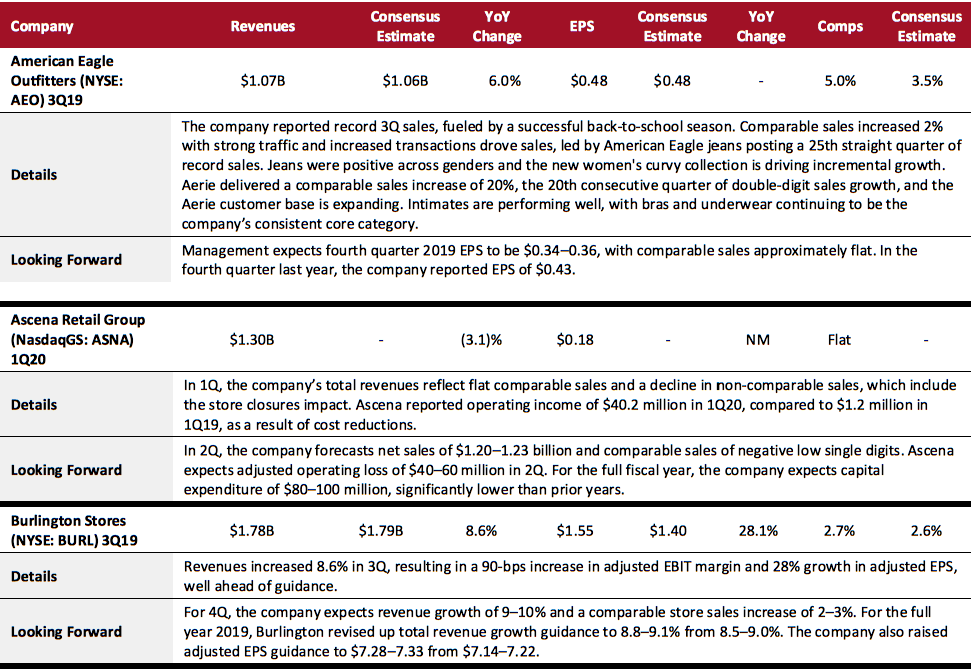

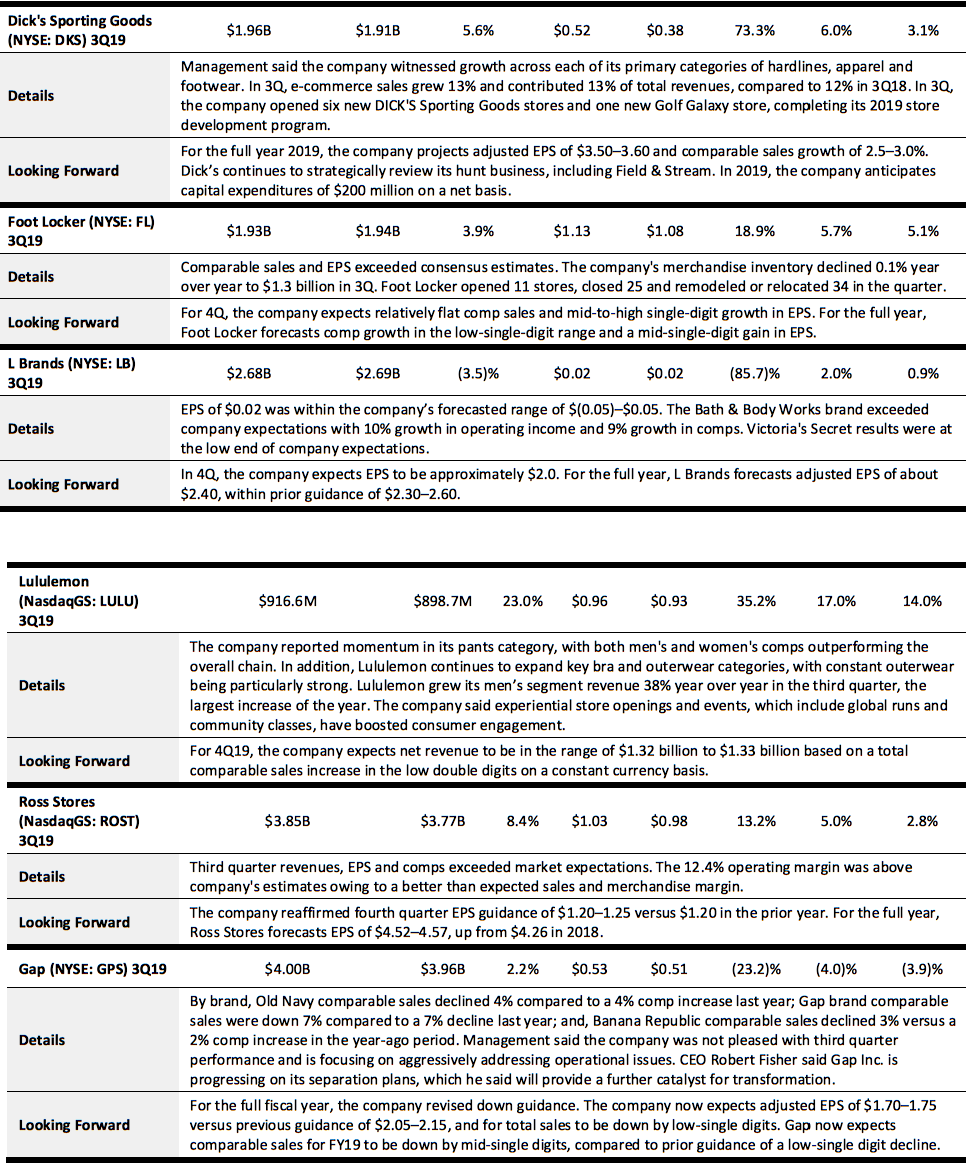

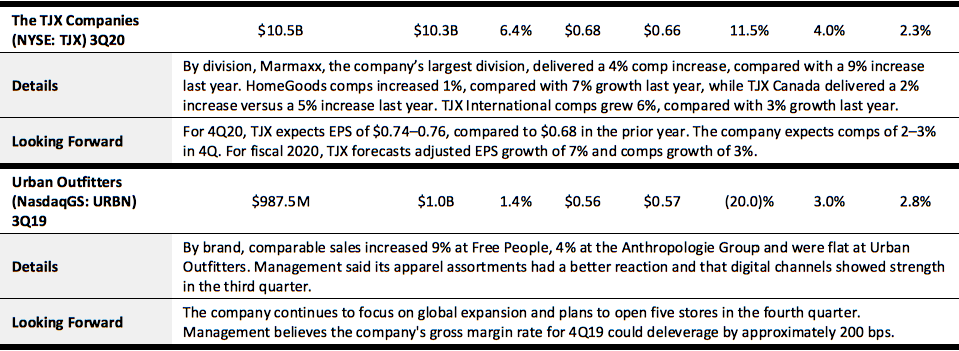

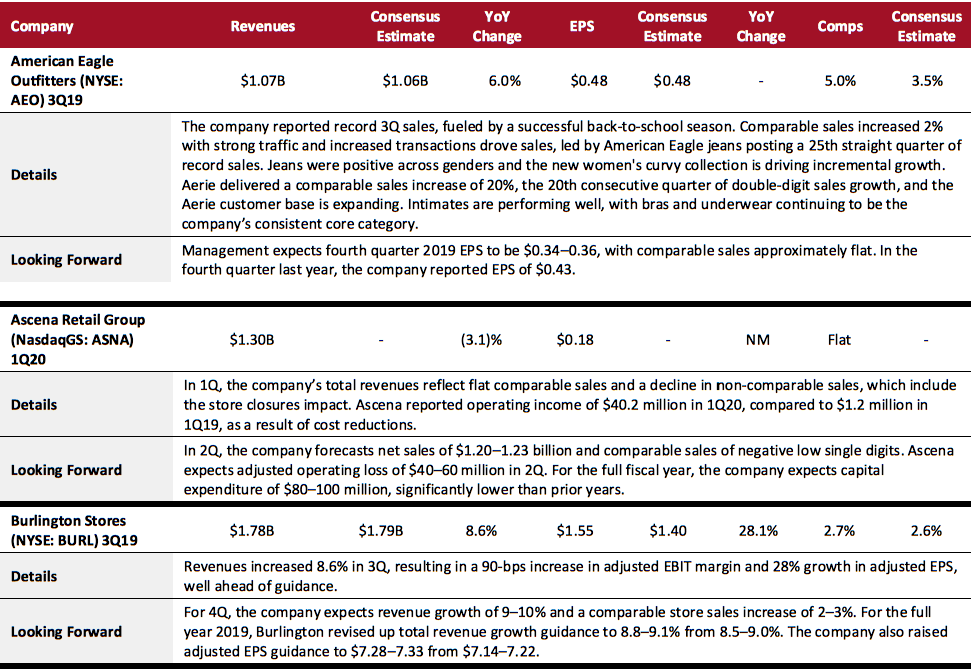

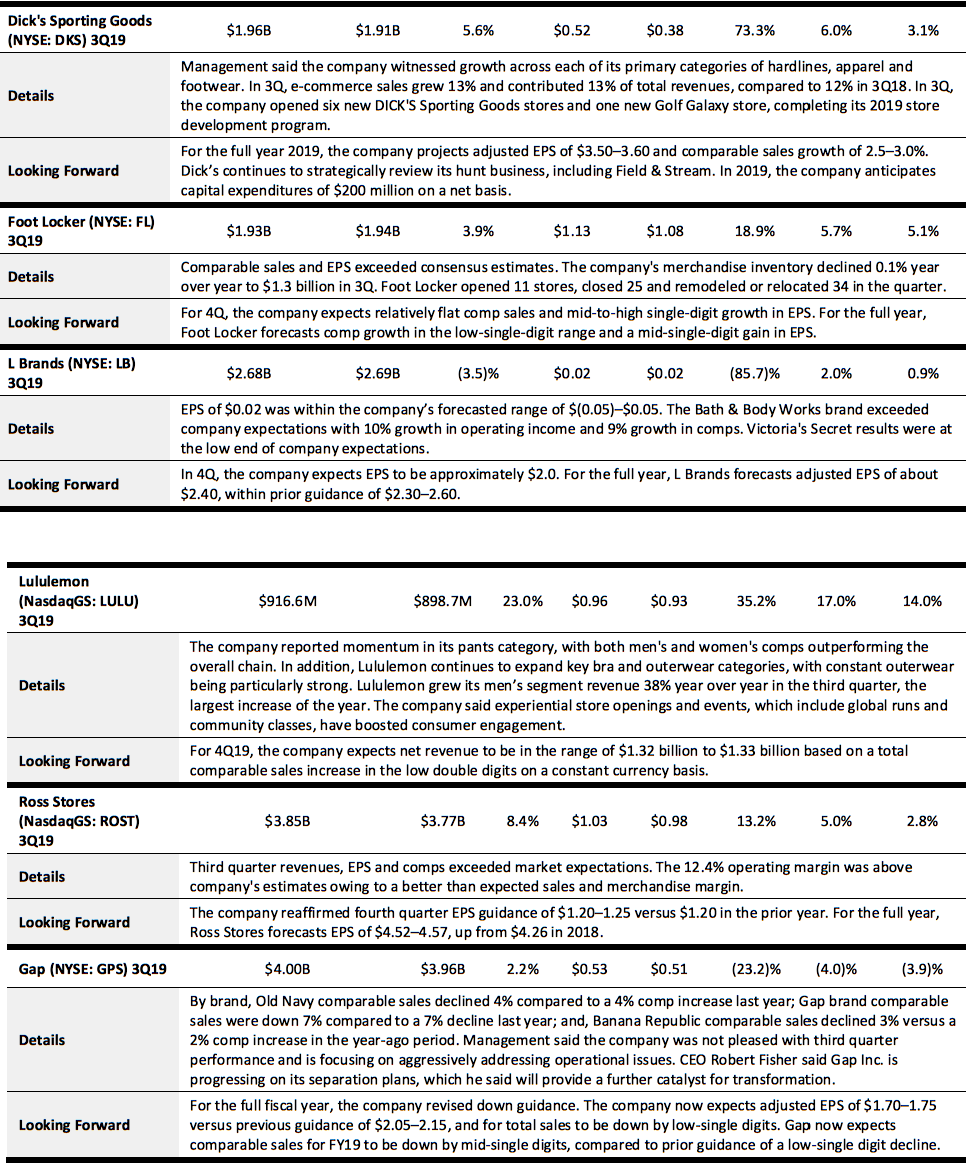

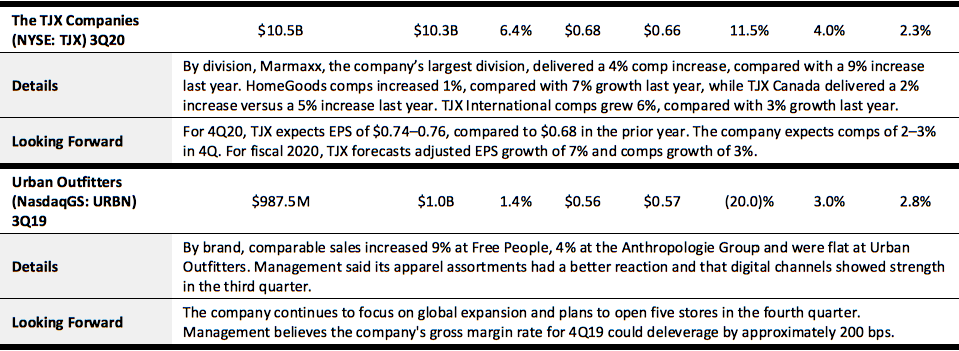

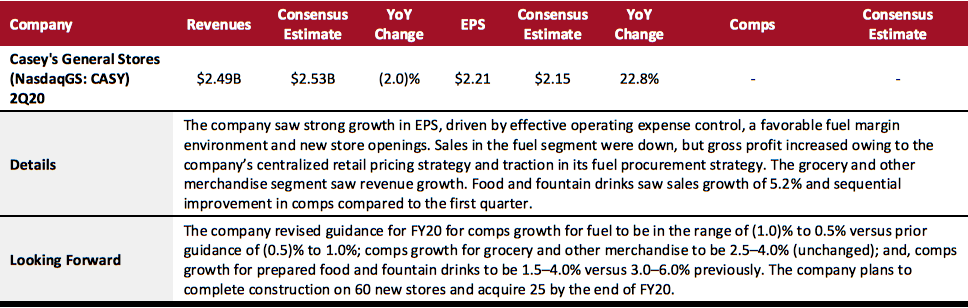

Specialty retail had a stronger quarter, with 80% of retailers reporting revenues and comps up from the year-ago period. Off-price retailers Burlington, Ross and TJX all reported revenues and comps beating consensus and revenues up steadily year over year. Revenue growth averaged 7.4% year over year across the three retailers. In the athletic space, Dick's Sporting Goods and Foot Locker reported comps of 6.0% and 5.7%, respectively. Dicks said the company saw growth across each of its primary categories of hardlines, apparel and footwear, while Foot Locker just missed its consensus revenue estimate. Lululemon posted revenue growth of 23% in the quarter, beating consensus estimates.

American Eagle Outfitters posted a strong quarter, with revenues and comps beating consensus estimates. Ascena, L Brands, Gap and Urban Outfitters had mixed quarters. Gap revenues were up and beat consensus, but comps were down 4% overall (and down across all Gap banners), with management citing operational issues. Urban Outfitters reported revenue below the consensus estimate, but comps were up (particularly at Free People) and management said its apparel assortments captured better reactions from consumers. L Brands revenues were down and missed consensus, but Bath & Body Works exceeded company expectations with 9% growth in comps, while Victoria's Secret comps were at the low end of company expectations. Ascena revenues were down sharply and below consensus, and comps were flat. Management said the company exited its value fashion segment in 2H to focus on brands with the highest profitability potential.

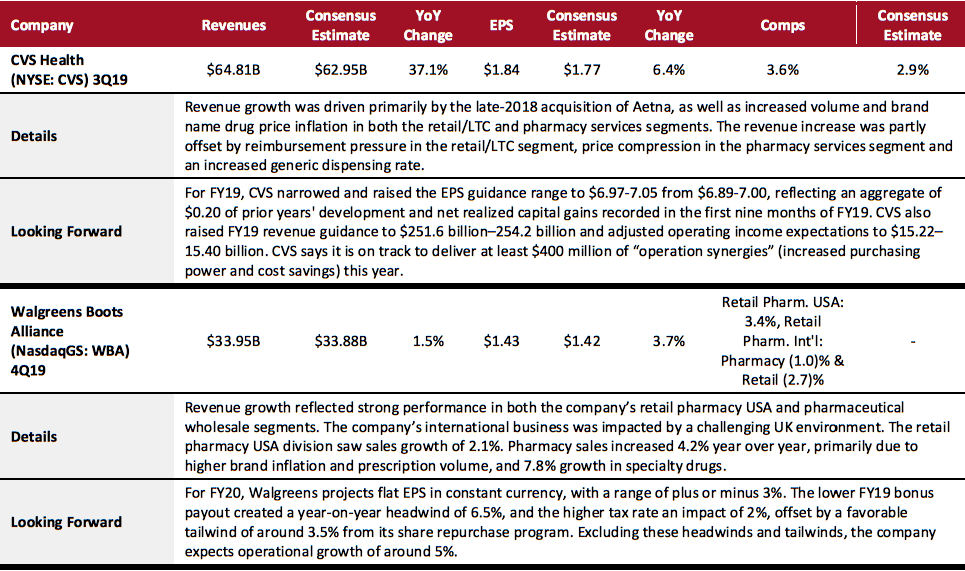

Food, Drug and Mass: Convenience Stores

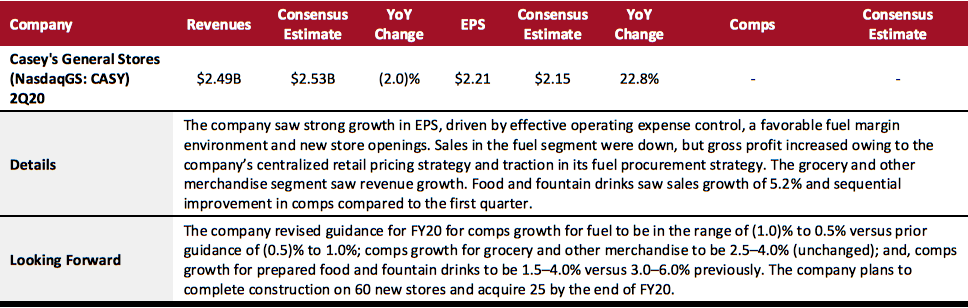

Casey’s General Stores is implementing digital and loyalty initiatives to engage customers, and continued to progress with its digital engagement program to streamline the ordering and checkout process and allow customers to pay online. It also completed an employee pilot program and rolled out a soft launch of its loyalty program at the beginning of December. The company plans to launch its loyalty program globally in early 2020.

Food, Drug and Mass: Drugstores

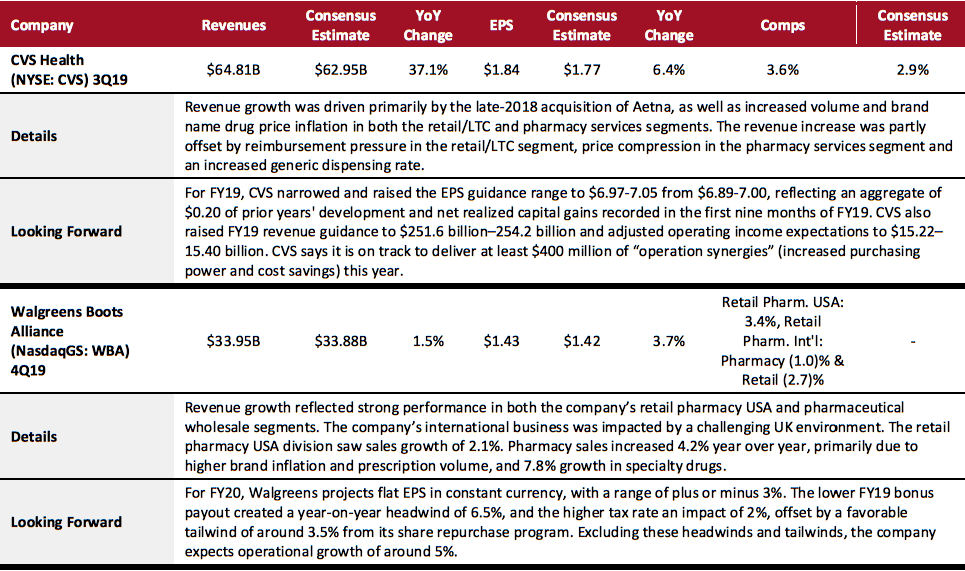

Walgreens provided FY20 guidance of flat adjusted EPS growth on a constant-currency basis, consistent with FY19 results. CVS raised FY19 adjusted EPS guidance and expects to deliver $400 million in synergies after the acquisition of Aetna. Both companies are focusing on store optimization through remodeling and store closures.

Walgreens is on track to close 200 locations and to exit 150 of its wholly-owned health clinics. The company will continue to operate clinics run by local health system partners. CVS also announced it will close 75 stores in 2020 and transform 1,500 stores into HealthHUB locations by the end of 2021.

Food, Drug and Mass: Food Retailers

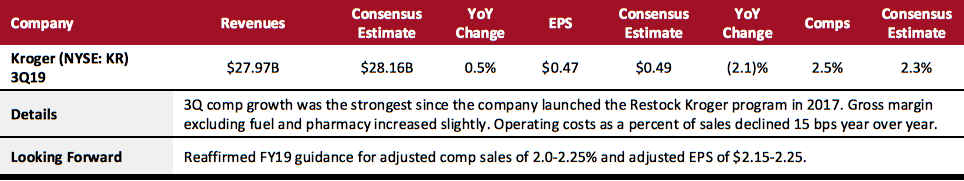

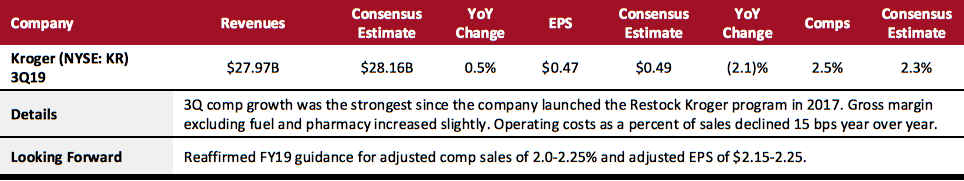

Excluding fuel and dispositions, Kroger booked a 2.7% rise in total revenues. Comp growth accelerated again, to a very solid 2.5%. Digital sales were up 21%. Management said the company continues to be "strong on people trading up" in the early holiday season and that they "expect the business to continue where it is through Christmas." However, management guided that reported comp sales in 4Q19 will be toward the lower end of the FY19 guidance range due to an expected 50-bps impact from changes to the SNAP program, impacting in January.

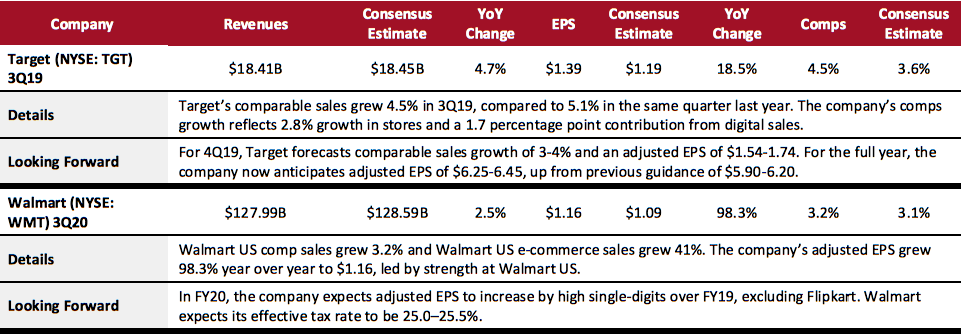

Food, Drug and Mass: Mass Merchandisers

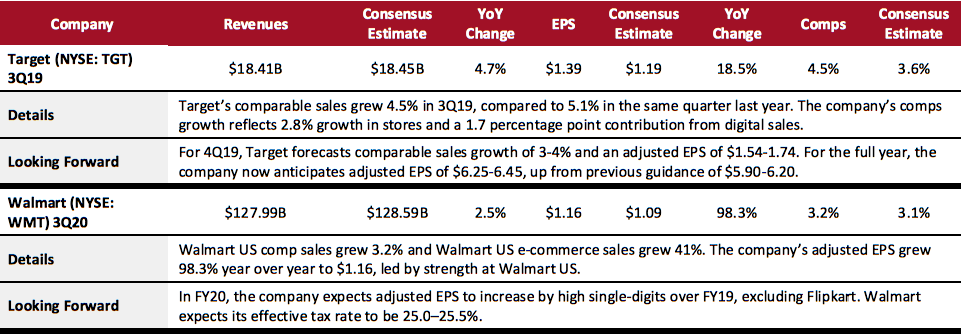

Both Target and Walmart saw organic sales growth in physical retail and online sales. For Target, higher marketing and compensation costs drove up SG&A expenses. Walmart is also spending on advertisements and expects a solid holiday season.

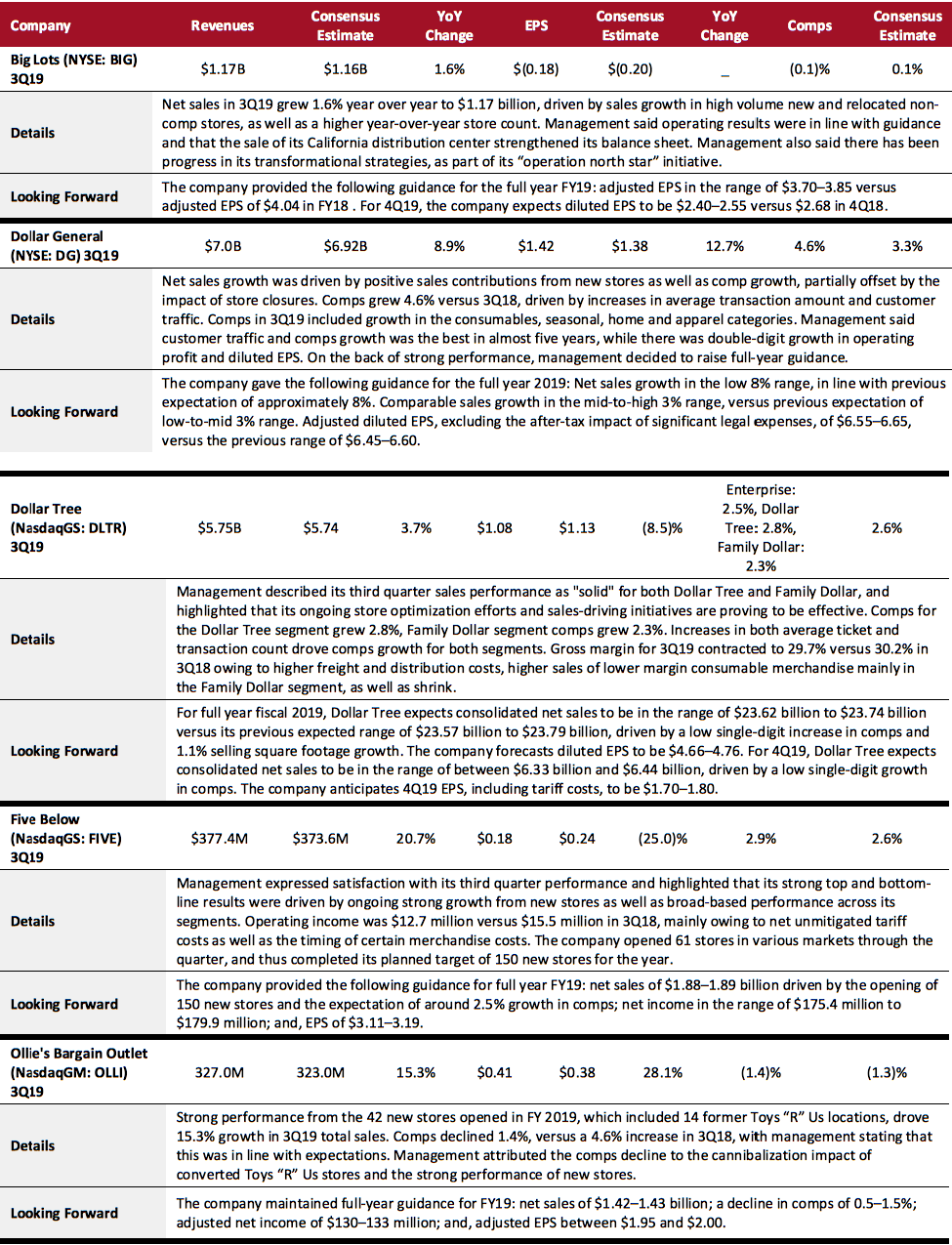

Food, Drug and Mass: Discount Stores

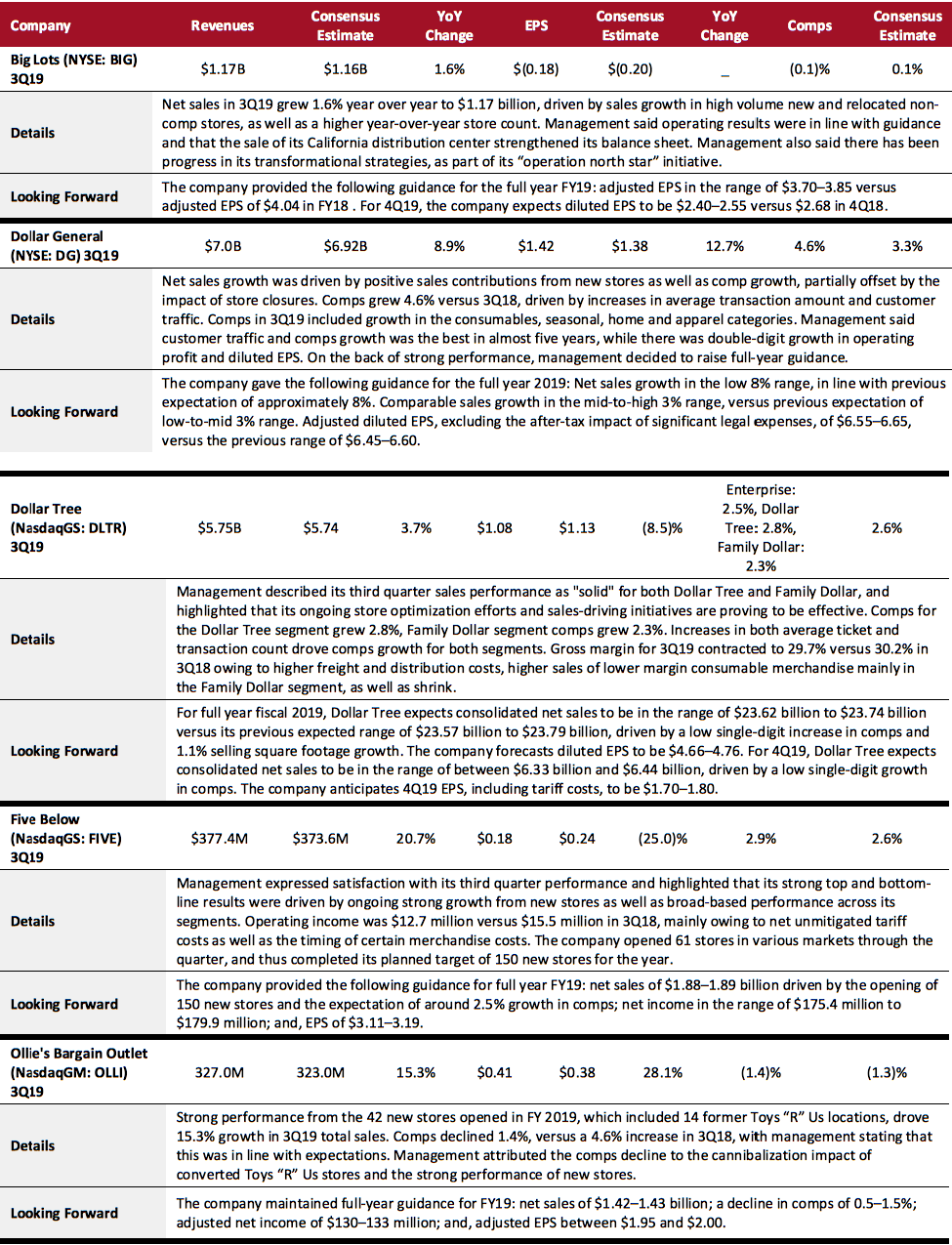

Discount stores had a strong quarter overall, with all five Coresight 100 companies in this sector beating consensus on revenues. Dollar General unsurprisingly continued to be the star performer and raised its full-year guidance. Ollie’s reported robust revenues growth and reiterated its full-year guidance. Five Below also reported strong revenue growth but lowered guidance for comps. Dollar Tree had a promising quarter, which saw improved performance from its subsidiary Family Dollar on the back of initiatives being undertaken by its parent that includes store optimization.

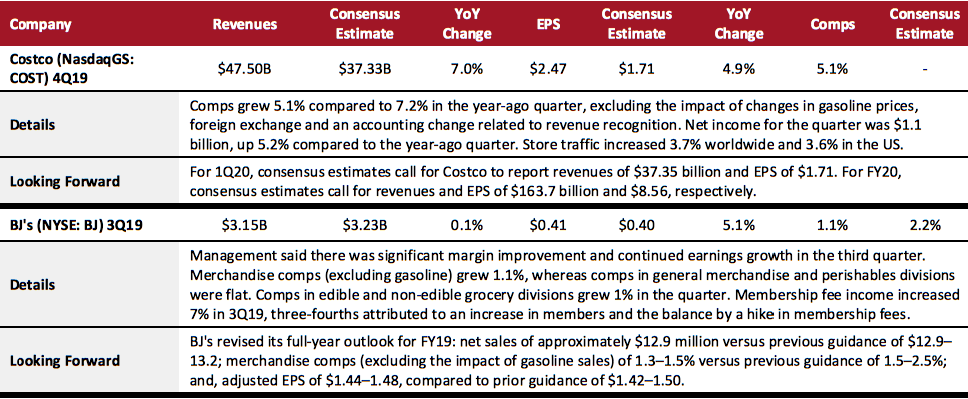

Food, Drug and Mass: Warehouse Clubs

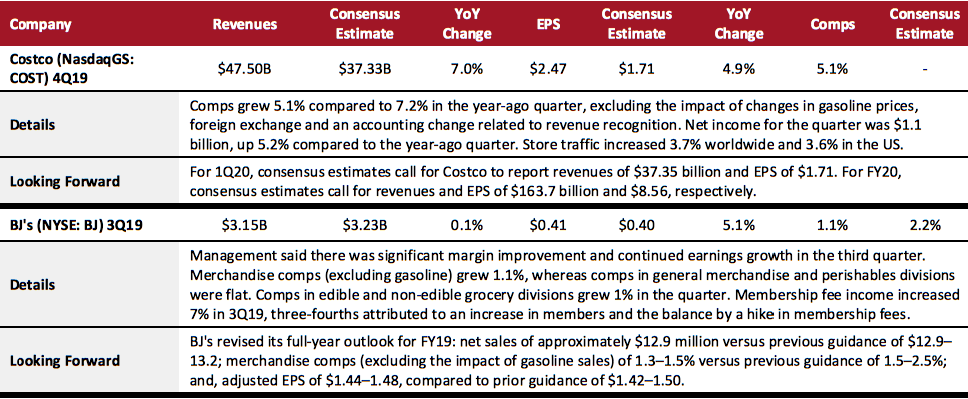

Costco's performance continued to be strong, with revenue and EPS beating consensus comfortably. BJ's, however, registered only negligible 0.1% revenue growth in 3Q19 and missed the consensus estimate. BJ's also lowered its comps guidance for full-year FY19.

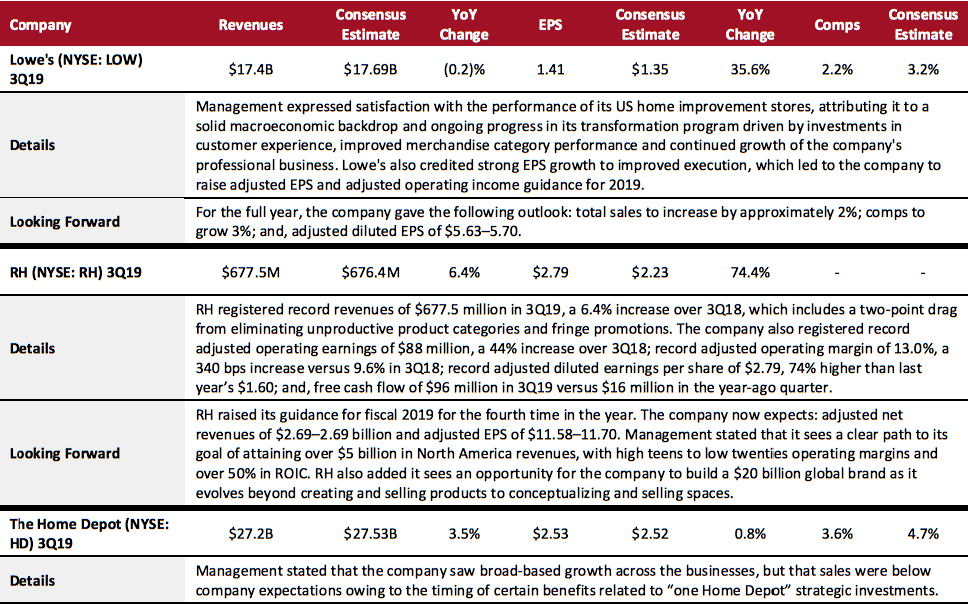

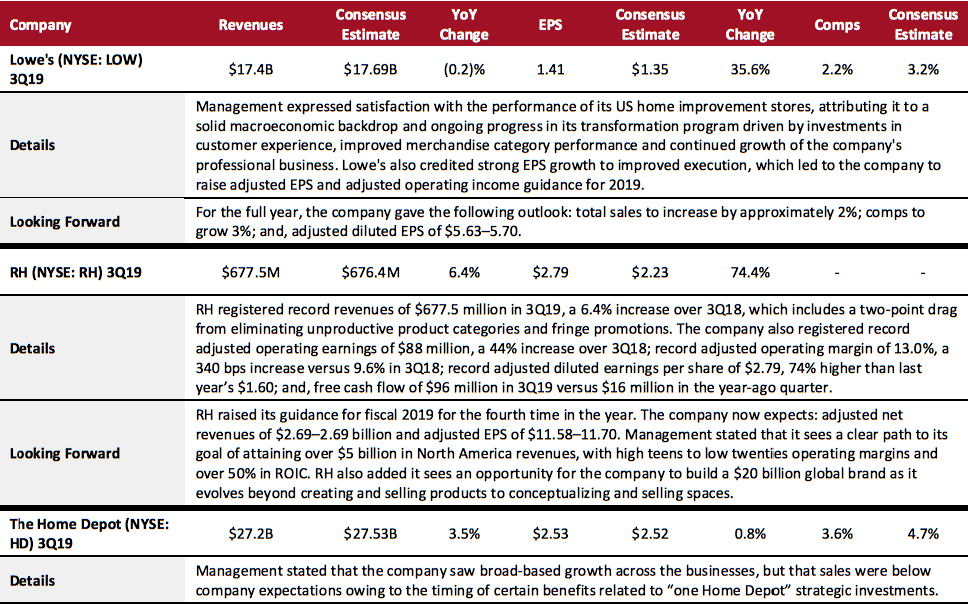

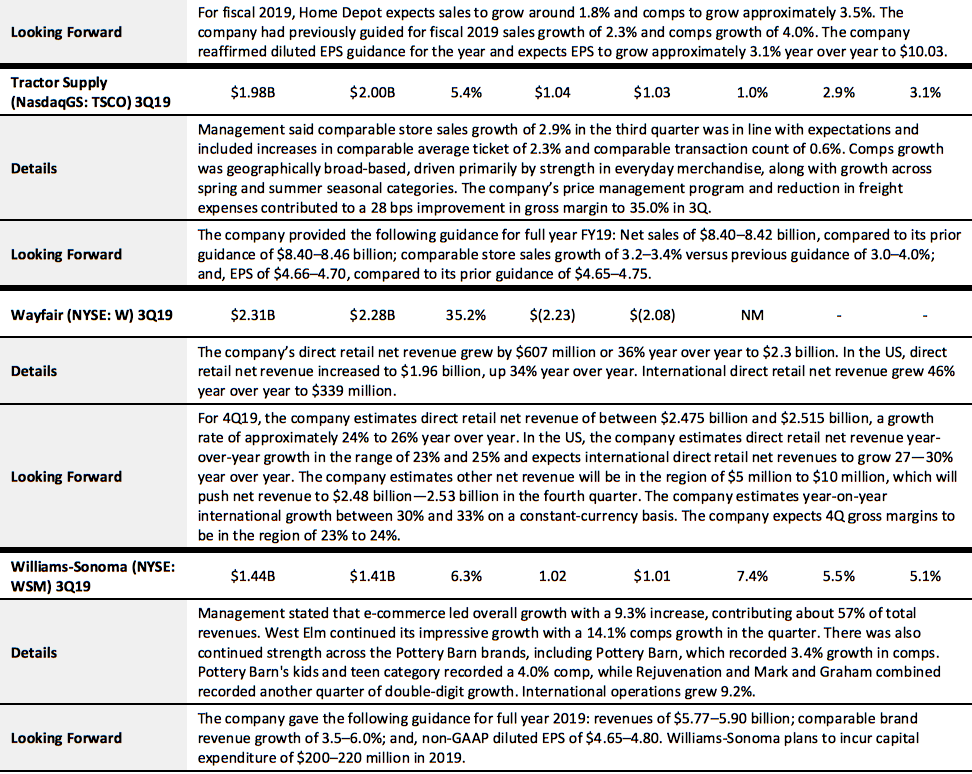

Home and Home-Improvement

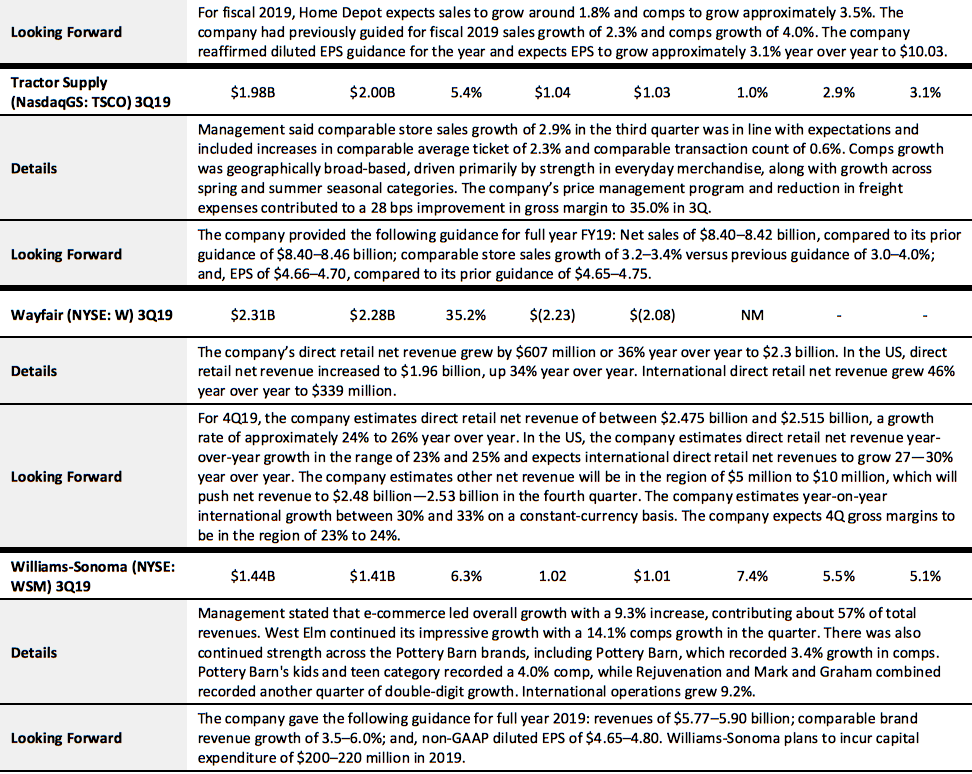

The home and home-improvement sector experienced a mixed quarter overall with three out of six companies in the Coresight 100 beating consensus on revenues, Tractor Supply being in line and two companies missing consensus. RH raised its guidance for the full year on the back of strong performance, whereas Lowe's, Tractor Supply and Williams-Sonoma more or less maintained their full-year outlooks. Home Depot lowered its full-year outlook.

Key Insights

Most of the retail sectors posted strong results in the third quarter. Brands and retailers have positive expectations for the holiday shopping season. Some companies are focusing on product innovation to drive organic sales growth and are also implementing digital and loyalty initiatives to engage customers.

Exchange rate fluctuations and volatility in the macroeconomic environment continued to impact companies across sectors.