albert Chan

What’s the Story?

3D design can help brands, manufacturers and retailers in the apparel and footwear sector to better meet fast-changing consumer demand, while also improving product quality and cutting costs.

The technology is already helping companies including NIKE, PVH Corp. and Under Armour to create new product designs more quickly and with higher precision. With 3D design software companies making steady improvements in what their technologies can do, the benefits are likely to continue to expand in the coming years.

We discuss the state of 3D design in the global apparel and footwear space and provide insights on adoption rate, pain points, key technology players and future developments.

Our definition of 3D design covers the following:

- 3D drawing—creating a sketch or garment pattern with 3D software tools that automatically render a sample (3D style on an avatar)

- 3D graphic interface—software used to communicate with other design and graphics software programs

- 3D pattern-making tool—integrated technical tools used to alter and create garment patterns

- 3D rendering—the creative process of producing an image based on three-dimensional data stored within a computer

- 3D showcase tools—used to deliver digital style assets in different settings and positions and against different backgrounds—for example, folded, layered, on hangers, etc.

- 3D visualization—software used to render multiple items or styles on an avatar

Why It Matters

3D design can create digital models of objects through the help of computer-aided design (CAD) software such as Adobe Illustrator. Brands, manufacturers and retailers in the apparel and footwear sector are increasingly using 3D CAD software to design new products with increased efficiency and accuracy.

According to market intelligence company Reports and Data, the software market for 3D rendering and visualization (the most important two functions in 3D design) is set to grow from $1 billion in 2018 to $3.7 billion by 2026.

Between $6 billion and $8 billion is spent on physical sampling (or drawing) in the apparel industry, according to Optoro, a logistics technology company that works with retailers and manufacturers to manage and then resell their returned and excess merchandise. These two data points show that the fast-growing 3D rendering and visualization software market could be more cost-efficient and bring long-term sustainability to the apparel and footwear market.

3D Design in Apparel and Footwear: Coresight Research Analysis

We have identified the following benefits of 3D design:

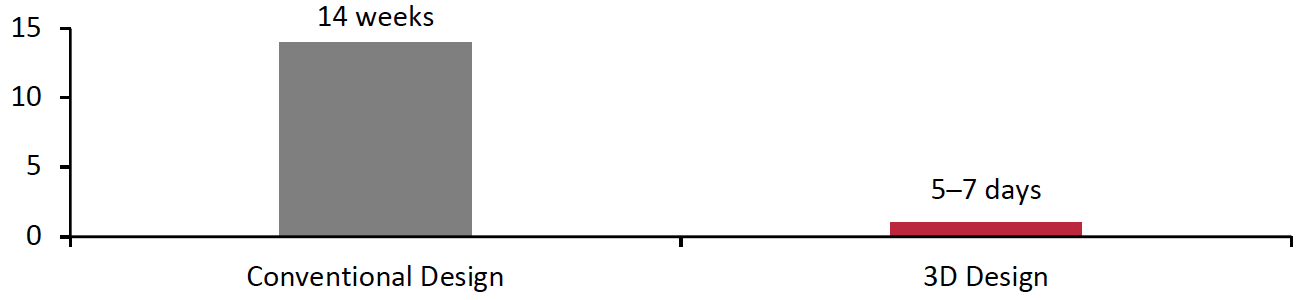

- Shorter product development times: Compared with traditional rendering techniques, 3D rendering shaves weeks off the design and sampling process, as shown in Figure 1.

- Reduced labor requirements: Much design work that usually requires four people can be completed by one person via 3D rendering.

- Reduced costs and wastage: Digital prototypes can be shared instead of physical ones using 3D design technology.

- Higher precision and reduced production time: More design details are available through 3D design, increasing production speed and making the design process more accurate.

- Streamlined communication: Sharing 3D renderings through cloud-based platforms enables designers, suppliers and retailers to collaborate and communicate more easily.

Figure 1. Typical Apparel Product Design Time

[caption id="attachment_135566" align="aligncenter" width="550"] Source: Li & Fung[/caption]

Source: Li & Fung[/caption]

We discuss four key areas of 3D design to elucidate the use of the technology in apparel and footwear on a global level.

1. Adoption RateAmong the 16 selected major apparel brands and retailers in the Coresight 100 (our focus list of the largest and most influential companies in the global retail ecosystem), 62.5% have already adopted 3D design, indicating that 3D design technologies are gaining significant traction among major players.

Figure 2. Selected Apparel Brands and Retailers, by 3D Design Adoption Status

[caption id="attachment_135567" align="aligncenter" width="550"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Looking beyond major apparel and footwear companies, the adoption rate of 3D design in the overall fashion market is still relatively low.

Nevertheless, we expect more companies to scale 3D design technology over the next two to three years. The 3D design adoption rate is set to reach 25% within the next three years, according to Sean Coxall, President of Supply Chain Solutions at Li & Fung. Most companies at enterprise level take an average of 24–36 months to put 3D design into practice. Smaller companies will likely be able to adapt faster since they have fewer organizational obstacles and infrastructure concerns.

The global apparel and footwear market has seen growth in 2021 and is poised to see continued growth in 2022.

- We estimate that US apparel and footwear sales will see 19.5% year-over-year growth in 2021 and will increase by a stabilized low-single-digit percentage rate in 2022 and beyond.

- We expect the UK apparel and footwear market to recover, with around 8.1% growth in 2021, to a total of $93 billion, and grow at a more stabilized rate of around 2%–4% in 2023 and beyond.

- In China, we expect the apparel and footwear market to fully recover to its pre-crisis level in 2021, with 11.8% year-over-year growth. We estimate that the market will grow at a more moderate 5.5% in 2022 to reach $401 billion.

In addition, the global pandemic has made apparel and footwear companies rethink how their product design processes could be upgraded to meet fast-changing demands. Apparel and footwear companies will seek to develop faster, less expensive methods of designing products and getting them to market faster in 2021 and beyond, which will create opportunities for growth in the 3D design market.

2. 3D Design Pain PointsWe discuss four pain points of 3D design adoption and implementation in the apparel and footwear sector.

Scaling Up

Although the adoption rate of 3D design among major apparel and footwear retailers is fairly high at 62.5%, the technology has typically not been widely implemented across their businesses or by smaller market players. This is largely due to the difficulty of leveraging 3D design technology for large amounts of stock-keeping units (SKUs), which can be attributed to two key issues.

Firstly, there are high labor and technology costs associated with producing large volumes of products using 3D design technology. Typical 3D rendering software would require up to four computer screens and take a designer between two and three hours to design an item. Applying 3D technology to large product volumes will require a significant increase in trained designers capable of using 3D rendering software.

Secondly, it is hard to use 3D to design products consistently from season to season. A consistent 3D design process requires an efficient workflow, a high level of automation and comprehensive standardization processes. Applying 3D design to products individually is time consuming and costly. Apparel and footwear companies should invest in developing internal 3D design workflow and automation capabilities or partner with technology firms to overcome this pain point.

Inefficient Communication of 3D Design Results with Factories, Partners and Vendors

Manufacturing processes in the apparel and footwear market involve many different players—from designers to factories, partners and vendors. Unless all stakeholders have invested in 3D design capabilities or platforms, communication of 3D design results is inefficient. For instance, a designer may create a 3D prototype but if the factory or partner they work with does not have 3D design capabilities then they will still need to send all measurements, descriptions and samples to be approved, which takes up to seven weeks on average. Ensuring connected communication between all players in the 3D design process will be key to leveraging its benefits in the apparel and footwear market.

Lack of Expertise

Skills are still one of the key roadblocks in the race to adopt 3D design. In the short term, 3D design skills such as setting up software and data architecture are in demand, while there will be need for more 3D CAD design experts in the long term.

Another challenge in gaining 3D design expertise in the apparel and footwear market is due to a reluctance to move away from traditional sketching and drawing practices among designers who are used to and prefer these physical processes.

Apparel and footwear players should consider external talent resources for 3D design in the short term as they begin their transformations, but engaging and upskilling internal talent will be preferable in the long run.

Programming Language Inconsistencies

A major issue in adopting 3D design tools in the apparel and footwear industry is inconsistencies in programming languages. In some instances, the communication links between 3D design programs and manufacturing programs are missing, requiring manufacturers to convert designs into their own technical machine languages. In other cases, design tools are purely visual and do not create any transferable manufacturing program data—making it very challenging for manufacturers to turn design ideas into a reality.

Apparel and footwear companies should seek out appropriate 3D software partners that embed the technical languages accepted by their manufacturers. For example, Ralph Lauren uses Shima Seiki’s SDS-ONE Apex Design System because of the use of using manufacturing-understood configurations in the fashion industry.

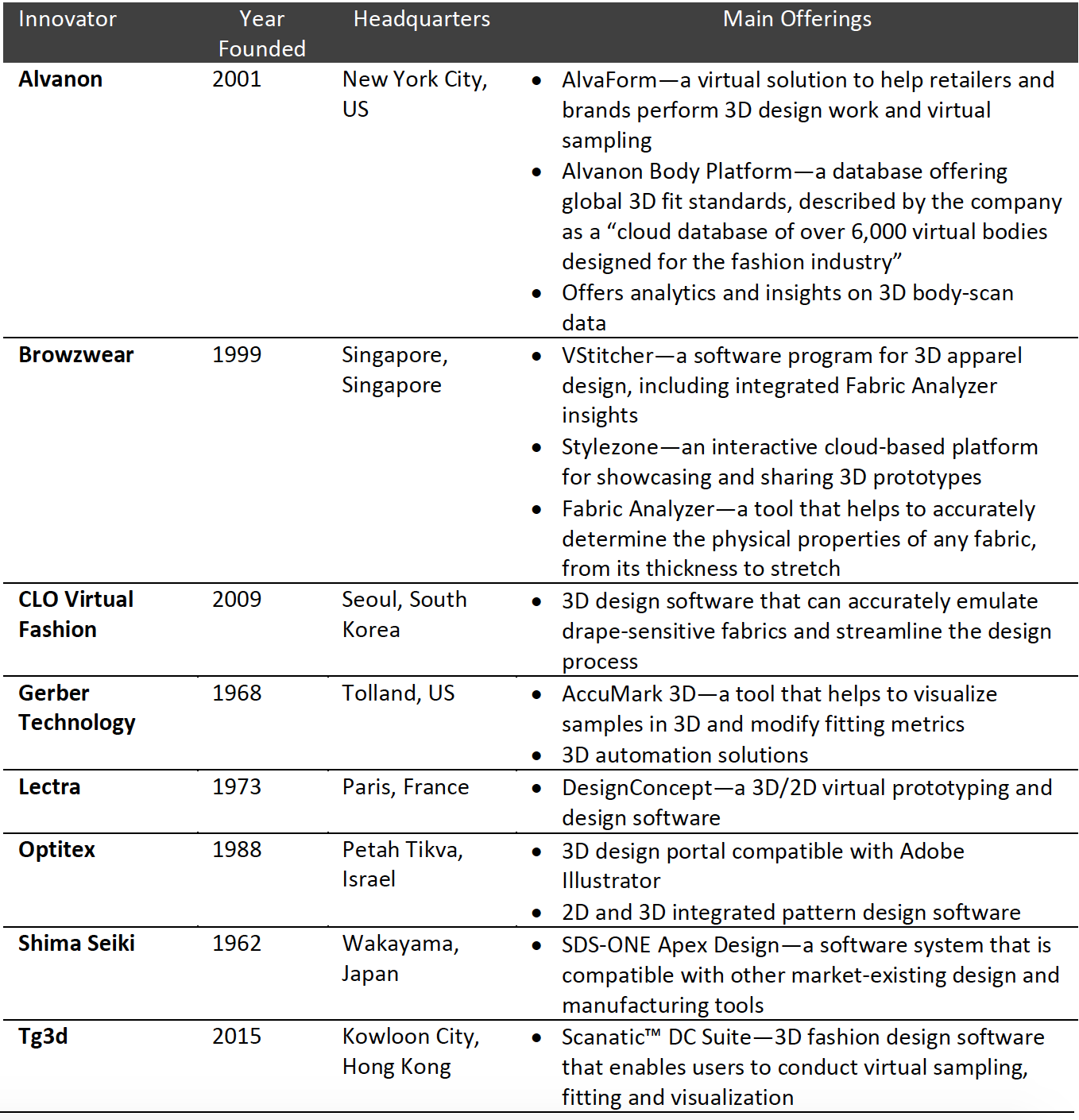

3. 3D Design Technology InnovatorsFigure 3 presents an overview of key 3D design technology innovators in the global apparel and footwear market.

Figure 3. Selected List of 3D Design Technology Innovators in Apparel and Footwear [caption id="attachment_135569" align="aligncenter" width="550"]

Source: Company reports[/caption]

4. The Future of 3D Design

Source: Company reports[/caption]

4. The Future of 3D Design

We expect the future of 3D design to be increasingly collaborative, with a focus on inclusivity. We also anticipate that there will be an increase in integrated 3D design solutions that are applicable across different product categories.

Increased Collaboration

The future of 3D design will be more collaborative—to best leverage the benefits of 3D design, we will see closer work processes between key players, such as designers and pattern makers, instead of dividing their skillsets.

Companies will also need to partner with players with advanced 3D design technology or digital infrastructure to learn and adapt. We expect to see increased collaboration in 3D design training and education, with a focus on partnering with technology advisors. Self-taught 3D design educational materials currently have limitations given that the lack of access to open-source content online, which is required for specialist fashion solutions such as Lectra, Gerber Technologies and Optitex. 3D design training companies such as Clo3D are relatively accessible and affordable, allowing designers to gain expertise in the field.

Promotion of Inclusivity

3D design has been gradually adopted to extend sizes of products to cater to plus-size or petite needs in the apparel and footwear market. For example, Alvanon, an apparel technology and consulting company, has leveraged 3D design to create a men’s standard-size series that divides sizing ranges into three groupings: “athletic” body shape from 36/S to 52/XXL; “classic” body shape from 35/XS to 52/XXL; and “classic big” sizing from 46 to 68/6XL. Beyond technical fit tools for garment design, 3D design tools allow brands and retailers to improve inclusivity in sizing.

Integration into a Comprehensive Value Chain

We expect the design process to become increasingly integrated into a more comprehensive value chain including manufacturing, sales and marketing.

For instance, 3D design tools can be developed to include sales functions, functioning as a two-way, order-taking tool whereby multiple stakeholders (mostly sales and merchandising teams) can receive quantitative and qualitative feedback automatically from the platform. In this way, 3D-designed digital samples could be used as the official product samples on e-commerce websites. In the long term, we expect businesses to aim to use 3D design as part of their digital assets, moving beyond virtual garment creation to the development of virtual resource libraries.

Product Category Expansion

Current applications of 3D design in the apparel and footwear market are largely focused on clothing and shoes. However, we are seeing 3D design emerge in new categories, such as handbags. For example, Ralph Lauren is leveraging 3D design tools in manufacturing its leather bags, to mitigate the high costs of making physical samples. Ralph Lauren is also testing 3D design in its home goods and decorations categories.

What We Think

Implications for Apparel and Footwear Brands/Retailers

- Product design plays a critical role in the supply chain, yet it remains a slow and manual process for many companies. Driven by growing need for more agile design processes, retailers should look to integrate 3D design to improve efficiency and eventually cut costs.

- Brands and retailers must ensure that they have a well-prepared project pipeline ahead of implementing 3D design tools, including steps such as choosing the right technology partners, setting up 3D design infrastructure and training employees.

Implications for Technology Companies

- Apparel and footwear brands and retailers will increasingly seek advanced 3D technologies—3D design software companies should make steady improvements in their technology offerings and expand the benefits offered to gain share of the market in the coming years.