Nitheesh NH

Overview of the Privatization Deal

HBC is a department-store retailer founded in 1670, which, in the US, owns Saks Fifth Avenue. Based on the unanimous recommendation of an independent special committee of its board of directors, HBC has agreed to take the company private.

A group of shareholders that collectively owns 57% of HBC shares raised a previous offer of C$9.45 (US$7.21) per share by 9% to C$10.30 (US$7.84) per share in cash for all the shares the group does not own. The group is headed by Richard Baker, executive chairman of HBC, and includes Rhone Capital LLC, WeWork Property Advisors, Hanover Investments and Abrams Capital Management.

The price represents a premium of approximately 62% to HBC’s closing price on the Toronto Stock Exchange on June 7, 2019, the last trading day prior to the announcement of the initial privatization proposal.

The announcement came on the heels of a bid for department store chain Barneys New York by brand developer Authentic Brands Group and investment bank B. Riley Financial for an estimated price of $274 million in cash. According to insiders close to the deal and reported by the The Wall Street Journal, if the deal closes and Authentic Brands Group closes the deal, Barneys department stores could launch inside of Saks Fifth Avenue stores.

Rightsizing the HBC Portfolio

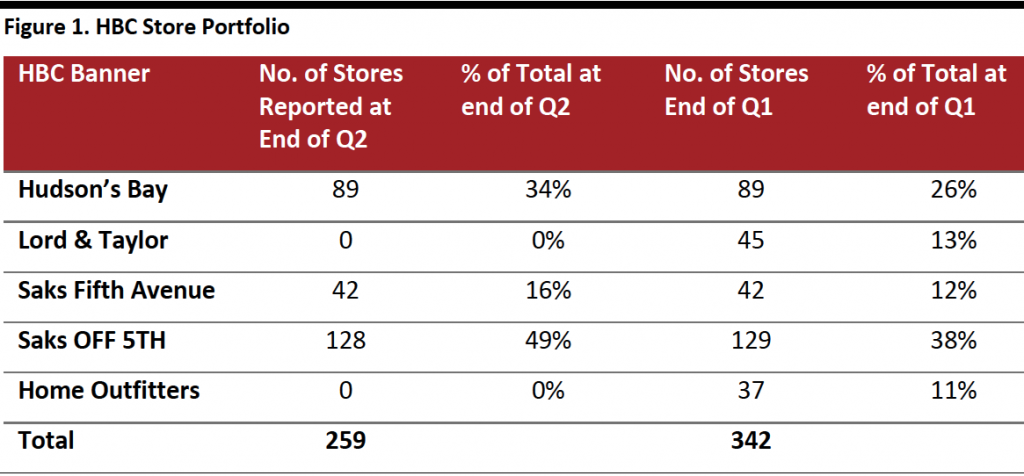

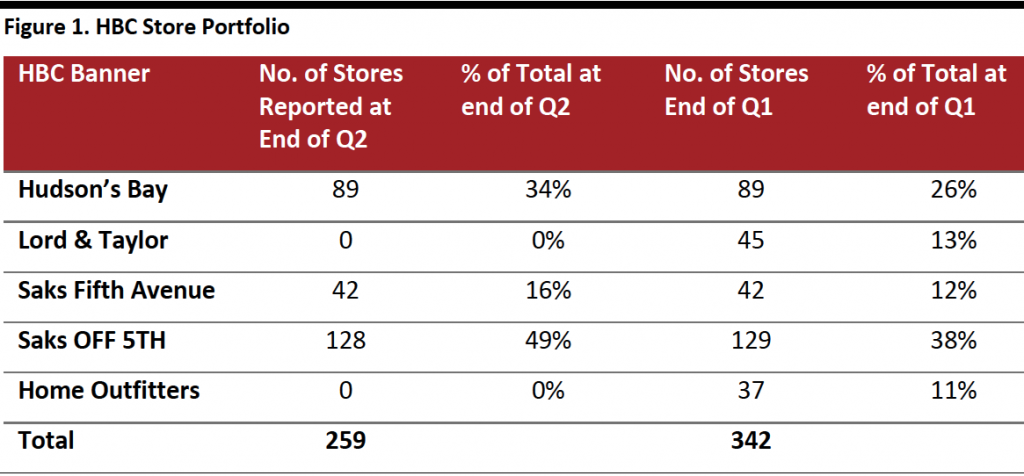

Over the past year, HBC has been working to rightsize its store portfolio, closing underperforming businesses and locations.

Source: Company reports[/caption]

Coresight Research Insight: Why Go Private?

On HBC’s last earnings call on September 12, 2019, Helena B. Foulkes, CEO & Director, said the company’s top priorities were focused on three distinct areas: Luxury, which accounts for nearly half of its sales; Canada, which accounts for more than one-third of sales; and, off-price, at 15% of sales. Foulkes said the company’s top priorities were to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Coresight Research believes going private will enable HBC management to operate more independently, and we can expect it to try edgier and riskier collaborations, and enter into more partnerships and new ventures across its three remaining banners. Retailers are realizing they have to take greater risks than in the past to better compete, but shareholders do not always support such moves. We may see innovative concepts such as CBD shops and cafés, designer studios, hosted apparel or sneaker drops, events such as retail panel discussions, fashion shows and book signings or even industry podcasts.

Source: Company reports[/caption]

Coresight Research Insight: Why Go Private?

On HBC’s last earnings call on September 12, 2019, Helena B. Foulkes, CEO & Director, said the company’s top priorities were focused on three distinct areas: Luxury, which accounts for nearly half of its sales; Canada, which accounts for more than one-third of sales; and, off-price, at 15% of sales. Foulkes said the company’s top priorities were to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Coresight Research believes going private will enable HBC management to operate more independently, and we can expect it to try edgier and riskier collaborations, and enter into more partnerships and new ventures across its three remaining banners. Retailers are realizing they have to take greater risks than in the past to better compete, but shareholders do not always support such moves. We may see innovative concepts such as CBD shops and cafés, designer studios, hosted apparel or sneaker drops, events such as retail panel discussions, fashion shows and book signings or even industry podcasts.

- On February 11, 2019, HBC sold its New York City Lord & Taylor flagship store on Fifth Avenue for a $850 million (C$1.1 billion).

- On June 10, 2019, HBC announced it had entered into an agreement to sell its real estate in Germany for US$1.5 billion (€1 billion); the company exited its German retail joint venture and divested its real estate to its retail partner SIGNA.

- On August 28, 2019, HBC and fashion rental subscription service Le Tote announced a US$100 million agreement for Le Tote to acquire Lord & Taylor.

- In September 2019, HBC announced that it was exiting the Netherlands, and planned to close 15 HBC stores in the country by December 31, 2019.

Source: Company reports[/caption]

Coresight Research Insight: Why Go Private?

On HBC’s last earnings call on September 12, 2019, Helena B. Foulkes, CEO & Director, said the company’s top priorities were focused on three distinct areas: Luxury, which accounts for nearly half of its sales; Canada, which accounts for more than one-third of sales; and, off-price, at 15% of sales. Foulkes said the company’s top priorities were to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Coresight Research believes going private will enable HBC management to operate more independently, and we can expect it to try edgier and riskier collaborations, and enter into more partnerships and new ventures across its three remaining banners. Retailers are realizing they have to take greater risks than in the past to better compete, but shareholders do not always support such moves. We may see innovative concepts such as CBD shops and cafés, designer studios, hosted apparel or sneaker drops, events such as retail panel discussions, fashion shows and book signings or even industry podcasts.

Source: Company reports[/caption]

Coresight Research Insight: Why Go Private?

On HBC’s last earnings call on September 12, 2019, Helena B. Foulkes, CEO & Director, said the company’s top priorities were focused on three distinct areas: Luxury, which accounts for nearly half of its sales; Canada, which accounts for more than one-third of sales; and, off-price, at 15% of sales. Foulkes said the company’s top priorities were to drive growth at Saks and Hudson’s Bay while enhancing the customer experience across all channels.

Coresight Research believes going private will enable HBC management to operate more independently, and we can expect it to try edgier and riskier collaborations, and enter into more partnerships and new ventures across its three remaining banners. Retailers are realizing they have to take greater risks than in the past to better compete, but shareholders do not always support such moves. We may see innovative concepts such as CBD shops and cafés, designer studios, hosted apparel or sneaker drops, events such as retail panel discussions, fashion shows and book signings or even industry podcasts.