Introduction

Our quarterly

US Retail Inventory Tracker reviews inventories held by US retailers in the

Coresight 100, our global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past nine quarters.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported results for the second quarter of fiscal 2021 (2Q21), ended July 31, 2021.

In May 2021, US retail sales grew 17.0% year over year and 19.3% compared to 2019 values. June 2021 saw year-over-year retail sales growth decelerate to a still-strong 13.2%—with sales up 25.0% on a two-year basis, the second-strongest sales growth of any month in the past year. In July 2021, retail sales growth slowed to 8.9% year over year but was up 20.8% on a two-year basis, the fourth-strongest sales growth rate in the past year.

In August 2021, retail sales growth strengthened to 12.0%. This may be partly attributed to historically high levels of savings, supported by previous

stimulus payments, and continued wage growth. Overall demand for goods remains strong, even as the rise in Covid-19 cases redirects some consumer spending away from services (such as dining out and traveling) and toward retail categories.

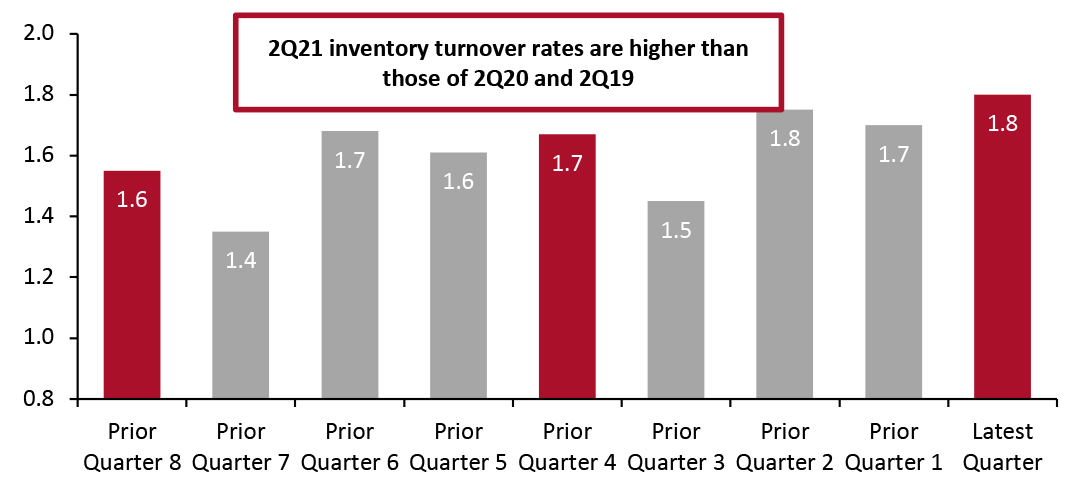

Overview: Inventory Turnover Rates Increase Year over Year and on a Two-Year Basis

Most retailers covered here saw their inventory turnover rates increase compared to the same quarter in the previous year (2Q20) as well as on a two-year basis (pre-pandemic 2Q19).

Figure 1. Inventory Turnover Ratios by Quarter: All Retailers

[caption id="attachment_133967" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

The latest quarter continued to see a strong rebound in inventory turnover, led mainly by soaring digital sales.

Apparel specialty retailers: Apparel specialists saw their inventory turnover ratios increase by 2% year over year and by 12% on a two-year basis. While athleisure, casualwear and intimates remained catalysts for these retailers, they are also witnessing a strong rebound in demand for dresswear, as consumers are returning to socializing.

Off-price retailers: Off-pricers maintained their growth momentum from the previous quarter, with inventory turnover ratios increasing by 25% year over year or by 26% on a two-year basis.

Beauty retailers: Beauty retailers saw their inventory turnover ratio increase by 23% year over year, but decline by 9% on a two-year basis. Increased demand for bath, fragrance, haircare and skincare products was partially offset by continued weak demand in the overall makeup category.

Department stores: Department stores’ inventory turnover ratios increased by 9% year over year and by 3% on a two-year basis. These retailers are seeing solid trends in various accessories, apparel and footwear categories, including activewear, denim, dresses, fine jewelry and sneakers, and see these categories as a key part of their strategy going forward.

Discount stores: Discount retailers reported a 14% year-over-year decline in inventory turnover ratios; however, on a two-year basis, inventory turnover ratios grew 9%.

Drugstores: Drugstore retailers’ inventory turnover ratios increased by 18% year over year or by 10% on a two-year basis.

Electronics retailer: The one covered electronics retailer, Best Buy, saw a 24% year-over-year decline in its inventory turnover ratio. However, compared to 2Q19, Best Buy’s inventory turnover ratio grew 1%. The company saw a demand spike in appliances, computing, home theater and mobile categories.

Food and grocery retailers: Food and grocery retailers’ inventory turnover ratios declined by 2% year over year but increased by 7% compared to 2Q19.

Home-improvement retailers: Home-improvement retailers witnessed an 11% year-over-year decline in inventory turnover ratios, but 10% growth on a two-year basis.

Luxury retailers: Luxury retailers reported an inventory turnover ratio of 161% year over year. However, on a two-year basis, growth remained flat.

Mass merchandisers: Mass merchandisers’ inventory turnover ratios increased by 3% year over year and by 33% on a two-year basis.

Warehouse clubs: Wholesale Club’s inventory turnover rates increased by 12% year over year and by 24% on a two-year basis.

Figure 2. Inventory Turnover Ratios by Quarter

[wpdatatable id=1329 table_view=regular]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

*Excludes Wayfair, an outlier

The absolute inventory turnover ratios have been rounded off to one decimal place

Source: Company reports/Coresight Research

Sector and Company Overview

We look at the inventory levels of selected retailers across sectors and assess why inventory levels changed from the year-ago period and on a two-year basis.

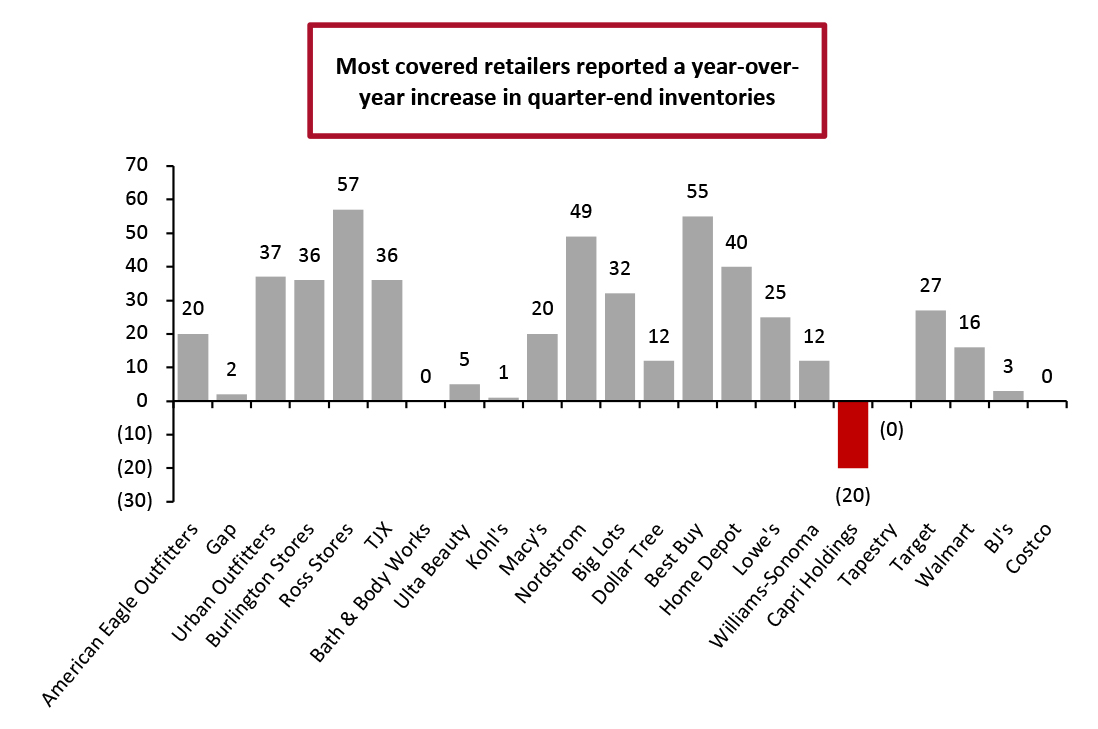

Figure 3. Latest-Quarter Inventory Values of Covered US Retailers: YoY % Change

[caption id="attachment_133968" align="aligncenter" width="724"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

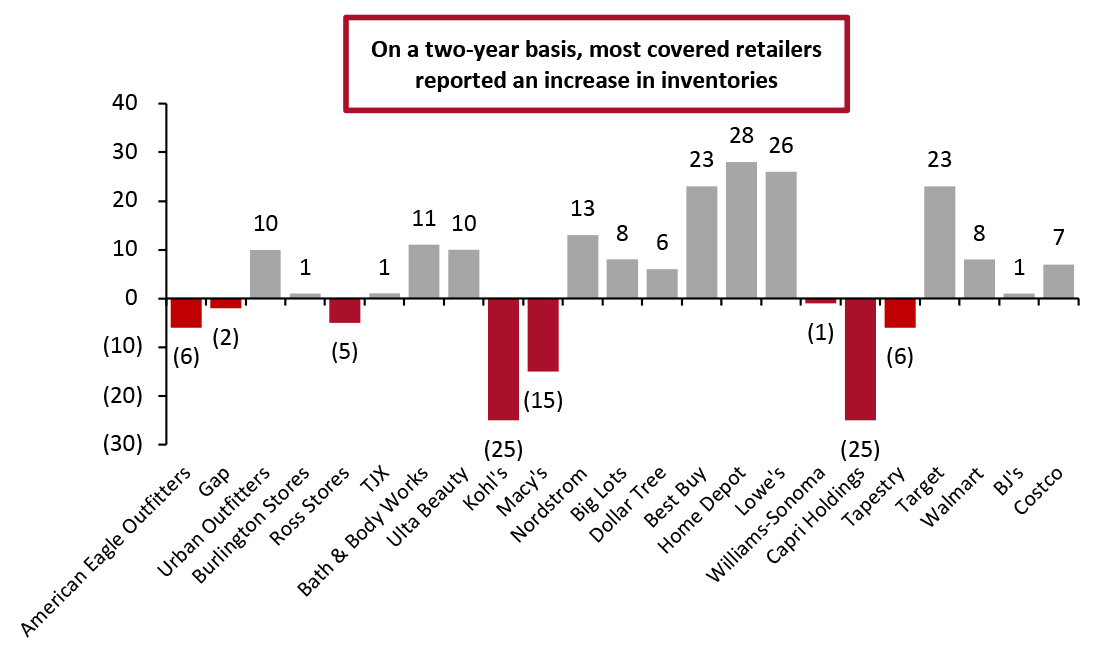

Figure 4. Latest-Quarter Inventory Values of Covered US Retailers: % Change from Two Years Prior

[caption id="attachment_133969" align="aligncenter" width="724"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

On a year-over-year basis, all covered apparel specialists witnessed an increase in quarter-end inventories. However, on a two-year basis, American Eagle Outfitters and Gap saw single-digit declines in inventories as they continued to ramp up their sourcing optimization efforts.

|

Commentary |

| American Eagle Outfitters |

The company ended 2Q21 with inventory up 20% year over year but down 6% on a two-year basis.

COO Michael Rempell said, “During the second quarter, our product arrived without major delays, and we were able to chase into high demand items. From a logistics standpoint, our hub-and-spoke model with regional inventory positioning and regional fulfillment is working. It’s part of what is fueling efficiencies, allowing us to drive substantially greater sales and margin on far less inventory. We are delivering products to customers faster. And despite industry-wide cost increases, our delivery expense is leveraged as 50% of sales.”

Management stated that inventory optimization and refreshed product assortments are supporting promotional discipline and higher full-price selling. For the American Eagle (AE) brand, the company noted that sales trends improved as tighter inventory controls enable higher full-price sales and greater emphasis on the best-selling stock-keeping units (SKUs). Aerie’s inventory was up 16% year over year, even as the company positioned inventory below current demand levels as part of its ongoing efforts to optimize inventory buys. |

| Gap

|

At quarter-end, the company’s inventory was up 2% year over year but down 2% on a two-year basis. Gap continued to ramp up its sourcing optimization efforts to reduce its costs per package. Management stated that pandemic-related US port congestion and impacts to shipping lanes have contributed to higher in-transit inventory levels.

For the next quarter, Gap expects year-over-year inventory growth to be in the range of mid-single-digits in percentage terms, anticipating volatility caused by pandemic-driven supply chain disruptions. Furthermore, management stated that they are leveraging scale advantages to ensure appropriate inventory for the upcoming holiday season. |

| Urban Outfitters

|

The company’s inventory was up 37% year over year and up 10% on a two-year basis.

Management stated that the company is chasing inventory aggressively. It Is ordering inventory several weeks earlier than it usually does, due to significant challenges in its supply chain, which is increasing inventory in transit.

For the next quarter, the company expects to bring inventory in earlier than normal to protect holiday sales. As such, Urban Outfitters expects 3Q21 inventory to be elevated compared to 3Q19. |

Off-Price Retailers

All covered off-price retailers reported higher inventory turnover ratios than in the year-ago period. Most of these retailers used reserve or packaway inventory to chase high demand during the quarter.

| |

Commentary |

| Burlington Stores |

The company’s total inventory increased by 36% year over year at the end of the quarter and by 1% on a two-year basis (compared to 2Q19).

On a comparable store basis, the company’s in-store inventory turnover fell by 7%. Reserve inventory, which includes stock that is being stored for later release (either later in the season or in a subsequent season), comprised 31% of total inventory, versus 33% in the 2019 period.

The company expects comp-store inventories to see double-digit decreases in the future, as part of management’s “Burlington 2.0” plan to operate stores with bulkier inventories to provide an increased assortment for its customers. For 3Q21, the company will continue to use reserve inventory to chase high sales trends. |

| Ross Stores

|

The company’s total inventories were up 57% year over year but down 5% on a two-year basis. Average store inventories increased by 3% relative to 2Q19.

Packaway inventory levels were 30% of total inventory versus 2Q19’s 43%, as the company uses packaway inventory to support ahead-of-plan sales. |

| The TJX Companies

|

The company ended the quarter with inventory up 36% year over year and up 1% on a two-year basis.

The company noted that inventories were lower in its stores and distribution centers as it has less packaway inventory and more goods on order and in transit. Management stated that the flexibility of the company’s distribution network, procurement strategy and store format allows it to capitalize on trends and growing categories as consumer demand changes. |

Beauty Retailers

| |

Commentary |

| Bath & Body Works |

The company’s total inventory remained flat year over year but increased by 11% on a two-year basis.

Management stated that it is building its inventory for 4Q21, as it is extremely important for the company in terms of cash flow generation. |

| Ulta Beauty |

The company’s total inventory increased by 5% year over year and by 10% on a two-year basis, reflecting its opening of 32 new stores and its Jacksonville fast-fulfillment center, which increased inventory purchases to support higher demand.

CFO Scott Settersten said, “The improvement in merchandise margin was primarily the result of anniversary-ing higher inventory reserves in the second quarter last year as well as higher sales, lower promotional activity and ongoing benefits from our cost optimization efforts. We are proactively working with our brand partners to prioritize receipts to ensure we have adequate inventory for the holiday season. As a result, we expect that our inventory levels at the end of the third quarter will likely be elevated above expected sales growth.” |

Department Stores

On a two-year basis, most covered department stores witnessed a decline in inventory levels at the end of the quarter. These retailers plan to rebuild inventory for the holiday shopping season.

| |

Commentary |

| Kohl’s

|

The company’s inventory level slightly increased 1% year over year but remained down 25% on a two-year basis, with the company reporting a 10-year high in inventory turnover for the second consecutive quarter due to tighter inventory management.

Management stated that the company is well-positioned for the holiday season in terms of inventory and that it expects a more normal season this year compared to pandemic-impacted 2020.

The company stated that it is navigating many supply chain challenges by leveraging its diverse global supply chain and maintaining a high frequency of pickups at ports and deliveries to stores. |

| Macy’s

|

The company ended the quarter with inventory up 20% year over year but down 15% on a two-year basis.

Management reported that the company has healthy sales-to-stock parity and that the inventory turnover rate has improved by 15% in the trailing 12-month period compared to the same period in 2019. The company noted that it is relatively lean on inventory for the next quarter so as to maximize its full-price sell-through.

Management stated that global supply chain disruptions have led to reduced supply, as the company offers customers a more limited selection. The company expects inventory levels to become healthier than they were before the pandemic in mid-2022 in order to sustain margin benefits.

Management expects a solid holiday season, anticipating that shoppers will return to healthy levels for the first time since the pandemic. |

| Nordstrom

|

The company’s inventory increased by 49% year over year. On a two-year basis, inventory increased by 13% versus a 6% decline in sales.

CFO Anne Bramman said, “Inventory levels were impacted by the timing shift of the Anniversary Sale and our efforts to pull forward receipts to address continuing supply chain backlog and support improving sales trends. New deliveries and in-transit product represented the majority of our inventory increase in the quarter. Our inventory is current and well-positioned in key categories as we move into the back half of the year. Looking ahead, we are anticipating continued global supply chain backlog for the balance of the year, and we are proactively managing our receipt flows to mitigate potential disruption and continue to meet customer demand.” |

Discount Stores

Most discount stores are witnessing an increase in inventory levels, both year over year and on a two-year basis.

| |

Commentary |

| Big Lots

|

The company’s total inventory was up 32% year over year and by 8% on a two-year basis.

CFO Jonathan Ramsden said, “we are seeing strong early sales for our late fall and early holiday assortment, supported by higher inventory levels. We expect inventory at the end of the third quarter to be up around 10% versus 2019, continuing to reflect healthy turn improvement. We expect a similar two-year inventory increase at the end of the fourth quarter, which will include some accelerated lawn and garden receipts to support first-quarter sales and minimize the risk of further supply chain disruption.”

The company anticipates that supply chain pressures related to Asian ports and manufacturing disruptions will continue to create challenges. However, management stated that it feels poised to take advantage of the upcoming holiday season, as evident from promising preliminary Halloween sales figures. |

| Dollar Tree |

The company’s total inventory increased by 12% year over year or by 6% on a two-year basis.

At Dollar Tree, inventory increased by 14% year over year, while inventory per selling square foot grew 9%. At Family Dollar, inventory increased by 11% year over year, while inventory per selling square foot grew 9%. |

Electronics Retailer

| |

Commentary |

| Best Buy |

The company ended the quarter with inventory up 55% year over year and up 23% compared to the corresponding period in 2019.

Management stated that product availability improved throughout the quarter as the company worked strategically to bring in as much inventory as possible, acquiring additional transportation, pulling up product flow and adjusting store assortment based on availability.

Management feels confident in the company’s ability to serve its customers during the holiday season despite supply chain uncertainty as strong demand persists. |

Home and Home-Improvement Retailers

Most of the covered home and home-improvement retailers reported lower inventory turnover ratios compared to the year-ago period, but higher levels compared to 2019.

| |

Commentary |

| Home Depot |

The company’s inventories increased by 40% year over year and by 28% on a two-year basis.

COO Edward Decker stated, “While our in-stock levels are still not where we want them to be, we are maintaining the improvements we made over the last few quarters in building depth in key categories as evidenced by inventory growing faster than sales compared to the same period last year.” |

| Lowe’s

|

The company’s inventory was up 25% year over year and up 26% on a two-year basis.

Lowe’s current inventory includes a year-over-year increase of $665 million related to inflation, the majority of which is attributable to lumber. |

| Williams-Sonoma |

The company’s inventories were up 12% year over year but down 1% on a two-year basis. Management stated that the company’s inventory levels continue to be impacted by stronger-than-expected customer demand across all brands, along with industry-wide container disruptions in Asia, delays due to Covid-19 Delta surges in Vietnam and Indonesia, and a recent port closure in China. The company noted that these challenges will cause backorder levels to remain elevated throughout 3Q21. |

Luxury Retailers

Both covered luxury retailers reported declines in inventories on a two-year basis, which they attributed to their actions to better align stocks with expected demand. However, these luxury retailers are rebuilding inventories to support expected strong sales growth over the remainder of the year.

| |

Commentary |

| Capri Holdings |

The company’s inventory declined by 20% year over year and by 25% on a two-year basis, reflecting the aggressive inventory-reduction program that it implemented at the beginning of the pandemic. Management stated that the company is building inventory to support sales growth for the remainder of the year. |

| Tapestry |

Tapestry’s inventory remained flat year over year and declined by 6% on a two-year basis, which the company attributed to its actions to lower its SKU count and prioritize inventory turns.

Looking ahead to the holiday period, Tapestry intends to protect inventory by securing significantly expedited deliveries at an additional cost, which it expects will hedge against the impact of supply chain disruptions. |

Mass Merchandisers

Both Target and Walmart reported higher inventory turnover ratios compared to the year-ago period and on a two-year basis. Both retailers reported an increase in inventory year over year as well as on a two-year basis.

| |

Commentary |

| Target

|

The company ended the quarter with inventory up 27% year over year and up 23% on a two-year basis.

By the end of 2022, Target plans to open four new regional distribution centers, with the first two slated to open in the second half of 2021. Management stated that once these distribution centers are operational, they will substantially shorten lead times to nearby stores, enhancing in-stock levels while simultaneously lowering the need for safety inventory in those stores.

Target expects a strong holiday season and stated that it is in a much better position compared to last year in terms of inventory to capitalize on the opportunities during the holiday season. |

| Walmart

|

The company’s total inventory increased by 16.2% year over year or by 8.2% on a two-year basis, reflecting higher purchases to support strong sales growth and the continued recovery of in-stock levels from the second half of 2020.

Management plans to address global supply chain disruptions by adding extra lead time to orders and chartering vessels specifically for Walmart goods.

Walmart is focusing on building automated systems that optimize inventory in real time across the supply chain, including how it obtains inventory from suppliers and how it ensures products are kept stock to fulfill demand in the fastest and most economical way possible. |

Warehouse Clubs

Our covered retailers reported an increase in inventory turnover ratios on a two-year basis.

| |

Commentary |

| BJ’s Wholesale Club |

The company ended the quarter with inventory up 3% year over year and up roughly 1% on a two-year basis.

CEO Robert Eddy stated that “Inventory availability has been a challenge.” He described issues across various segments: “Some of them are continuing problems, like consumer electronics and apparel, things coming out of China. Some of them are new. We’re not receiving all the inventory that we are ordering in some of those categories [consumer electronics]. Or we have reduced visibility, meaning the supplier doesn’t commit to shipping us on the timeframe that we normally get notice of shipments.” |

| Costco

|

Total inventory remained flat compared to the year-ago period, but increased by 7% on a two-year basis.

Management stated that the company plans to capitalize on its scale advantages to ensure an appropriate inventory for the upcoming holiday season. |

Looking Forward

In 2Q21, most retailers reported an increase in their inventory turnover ratios, both year over year and compared to the corresponding quarter in 2019, before the pandemic. Next quarter, we expect to see further improvement in inventory turnover ratios for most covered retailers, driven by the holiday season. For the holiday season, between October and December 2021, Coresight Research expects that

total US retail sales will increase by 9–10% year over year and the midpoint of our estimate would take two-year growth to 19.6%. Similar to last year, we expect

e-commerce to continue to drive a greater share of holiday sales this year.

Some retailers, such as Best Buy, Big Lots, Target and Ulta Beauty, noted that they are well-positioned for the season in terms of inventory. Costco, Gap and Urban Outfitters are planning to capitalize on scale advantages and bring inventory earlier than normal, aiming to protect holiday sales. Similarly, Tapestry intends to secure significantly expedited deliveries at an additional cost, hedging against the impact of supply chain disruptions to protect its holiday inventory. In the department store sector, Kohl’s and Macy’s head toward the holiday season with inventories down meaningfully versus two years prior.

For the holiday season, retailers should be prepared to quickly adjust inventory levels at stores. This requires ensuring that the ability to scale to customer demand is in place—for instance, through expanding ship-from-store capabilities or partnering with logistics firms that can help brands and retailers with transportation of inventory into stores.

Pandemic-driven US port congestion and impacts on shipping lanes continue to contribute to higher in-transit inventory levels. To reduce the risk of supply chain disruptions during the holidays, retailers could strategically use air freight, diversify sourcing options and work with a variety of suppliers and manufacturers.

As consumer demand remains volatile across the globe and consumers continue to engage with retailers through a wide variety of channels, real-time knowledge of the location of all inventory has become essential for most retailers. An efficient and flexible inventory management system could reroute in-store stock in areas with low demand to locations where demand is high.