Introduction

Our second-quarter 2021 (2Q21) wrap-up covers the quarterly earnings of 57 (mostly) US-based retailers, brands, e-commerce platforms and REITs in the

Coresight 100.

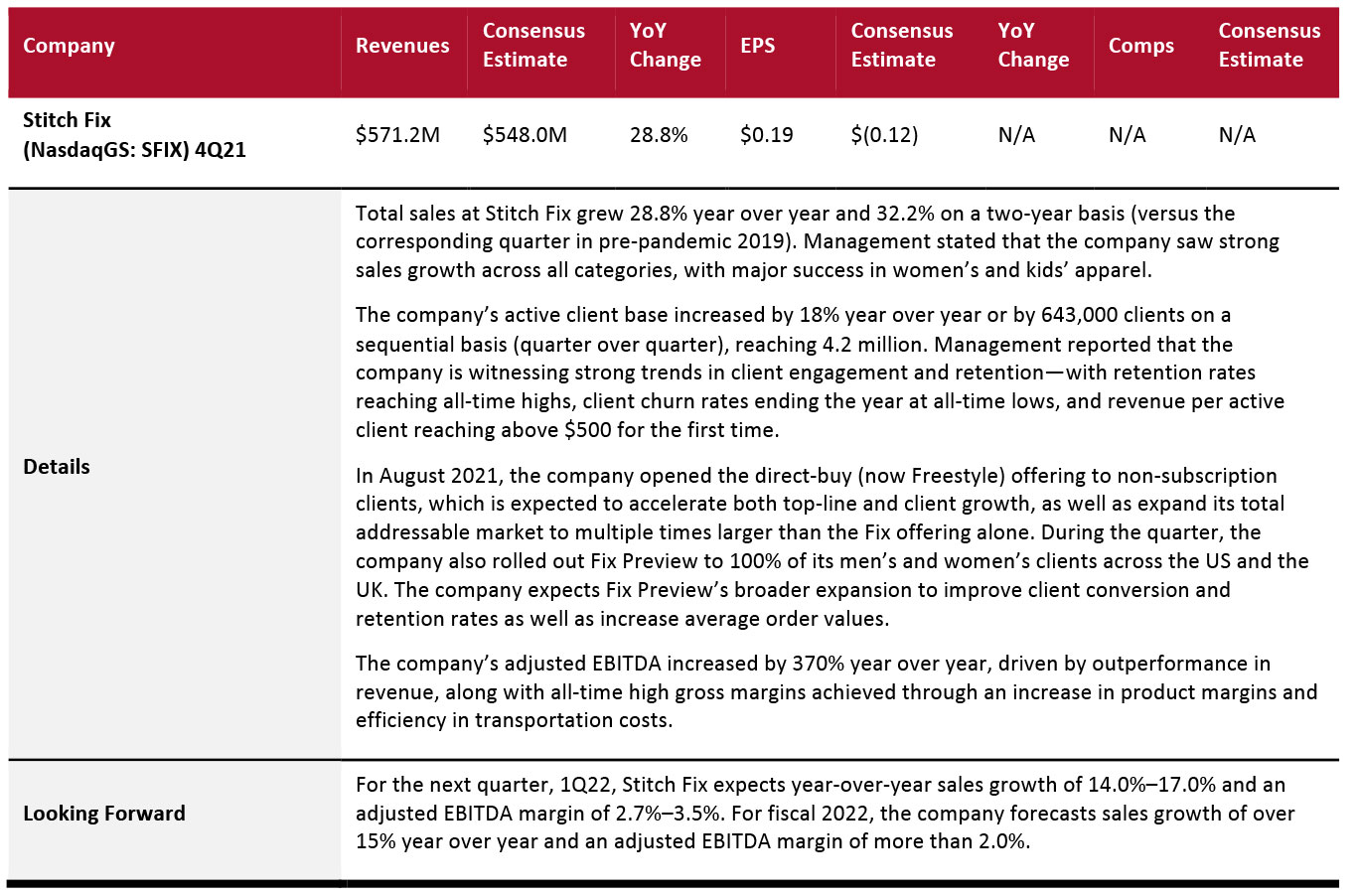

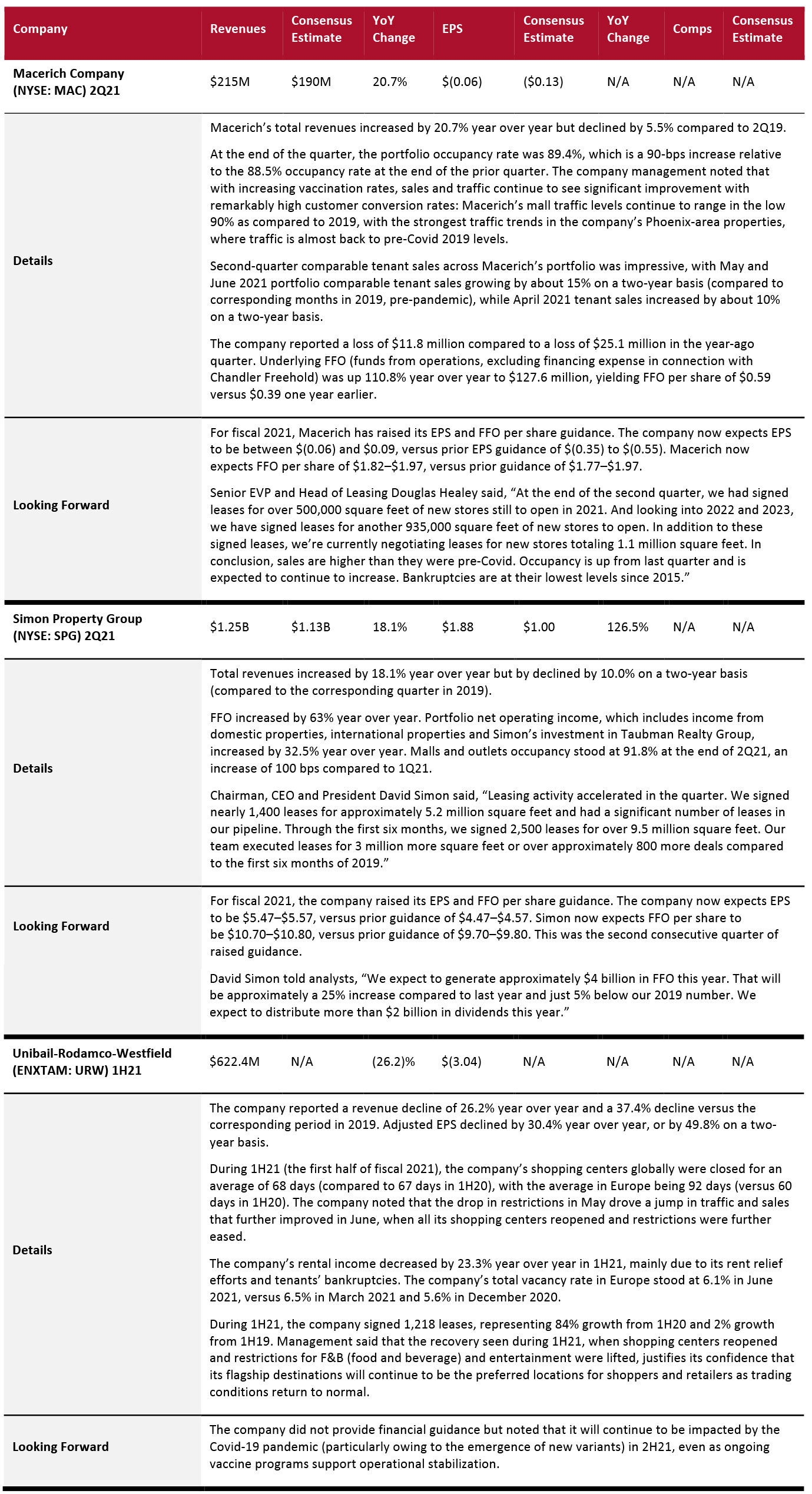

- About 86% of companies beat revenue consensus estimates, while 14% missed revenue consensus estimates. In terms of earnings, 78% of companies beat consensus estimates, while 22% missed consensus expectations.

- Apparel and footwear brand owners, apparel specialists, online apparel retailers, beauty brands and retailers, department stores, discount stores, drugstores, electronics retailers, food and grocery retailers, luxury companies, mass merchandisers and off-pricers enjoyed a stronger quarter (versus expectations): More than 90% of covered companies beat consensus revenue estimates. Furthermore, 100% of covered apparel specialists, department stores, discount stores, drugstores, electronics retailers, food and grocery retailers, mass merchandisers and off-pricers beat consensus EPS estimates.

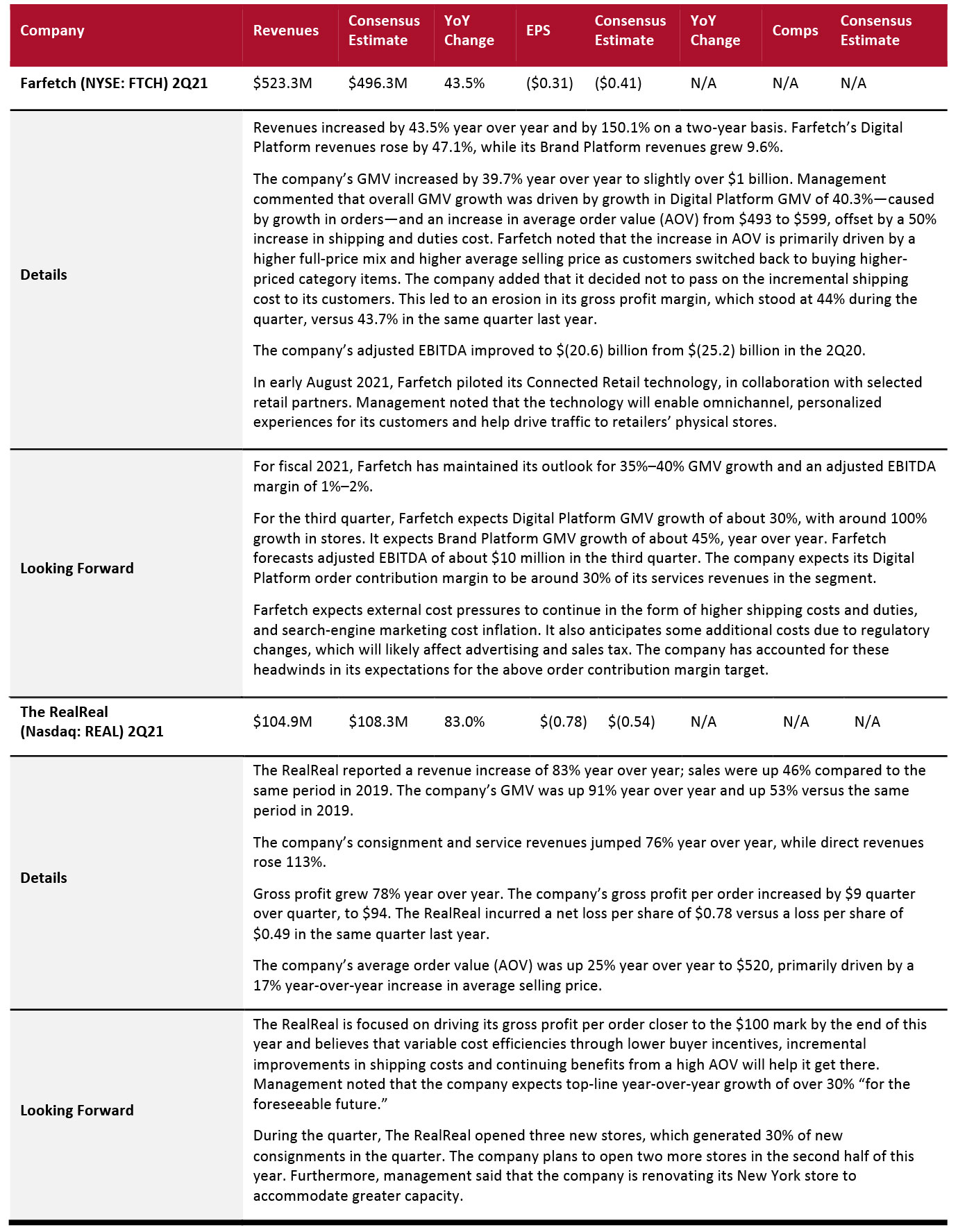

- E-commerce platforms, luxury e-commerce players and REITs were the worst-performing sector (versus expectations) in the quarter, with 50% of covered companies missing consensus revenue estimates.

However, beating or meeting consensus does not necessarily indicate positive results, as retailers navigate the Covid-19 crisis. The pace of sales recovery is a much better indicator of the health of retailers than benchmarking versus consensus.

Company results in 2Q21, which ended July 31 for most companies in our coverage, include key commentary and qualitative insights from major US retailers and brand owners on their recent performance, in terms of revenues and comps, and the impact of the coronavirus pandemic. Although we term the period under review 2Q21, some companies in this report describe their latest quarter differently; some also have different quarter-end dates.

In May 2021, US retail sales grew by 17.0% year over year and by 19.3% when compared to 2019 values. June 2021 saw year-over-year retail sales growth decelerate to a still strong 13.2% but was up 25.0% on a two-year basis, the second-strongest sales growth of any month in the past year. In July 2021, retail sales growth slowed to a still strong 8.9% year over year and was up 20.8% on a two-year basis, the fourth-strongest two-year sales growth in the past year. Slowdown in July’s growth may be partly attributed to consumer concern over the spread of the Covid-19 Delta variant, impacting spending behaviors. However, overall demand for goods continues to remain strong, even as consumer spending shifted back to services (such as dining out and traveling)—July saw traffic trends strengthen despite a surge in new cases.

In August 2021, retail sales growth strengthened to 12.0%, demonstrating consumers’ continued willingness to spend amid rising Covid-19 Delta cases. This may be partly attributed to historically high levels of savings, supported by previous

stimulus payments, and continued wage growth. Demand for goods remains strong, as the rise in Covid-19 cases redirects some consumer spending away from services again and back toward retail categories.

Below, we assess the recent performance of retailers, brand owners, e-commerce platforms and REITS in detail.

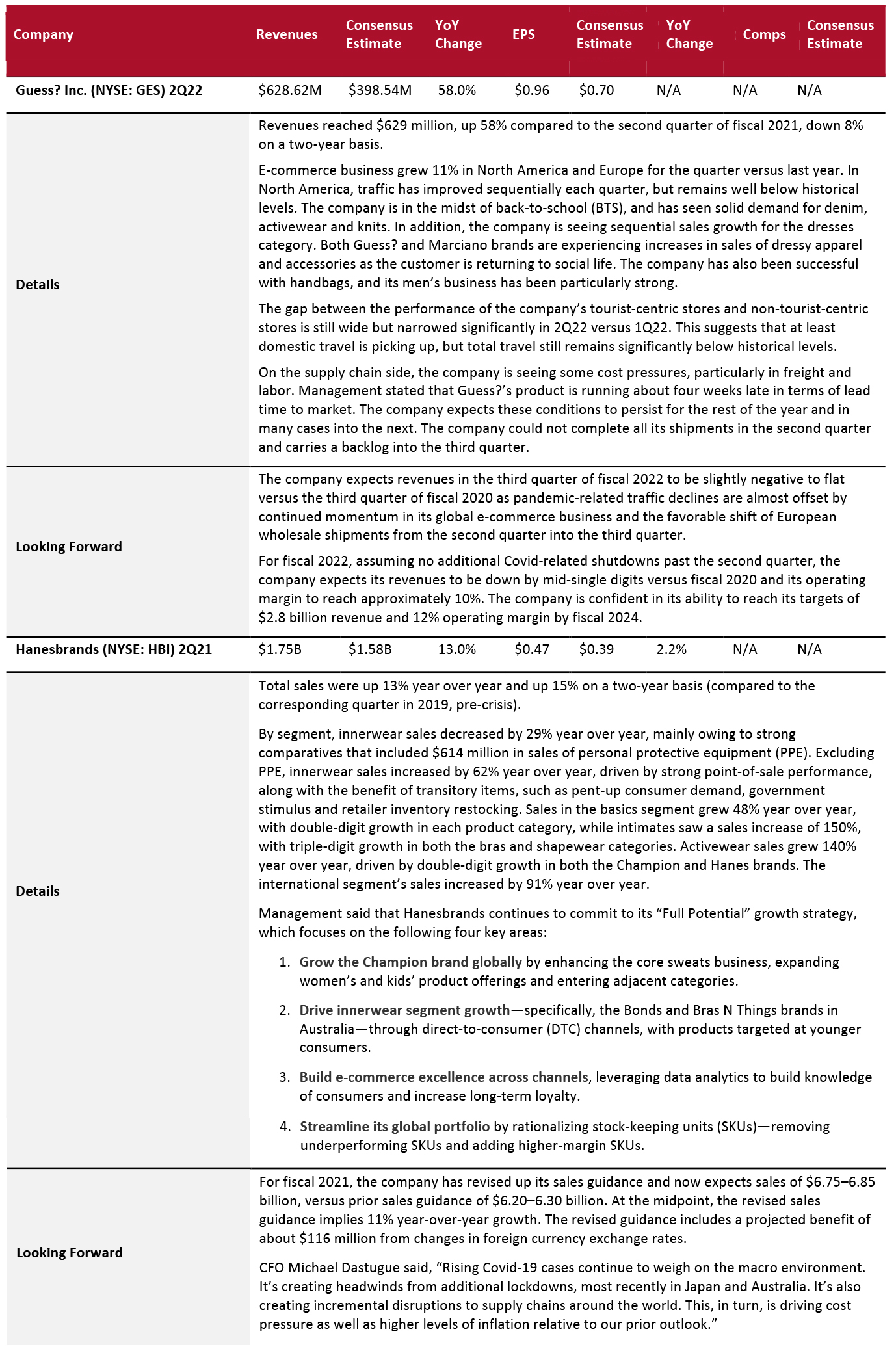

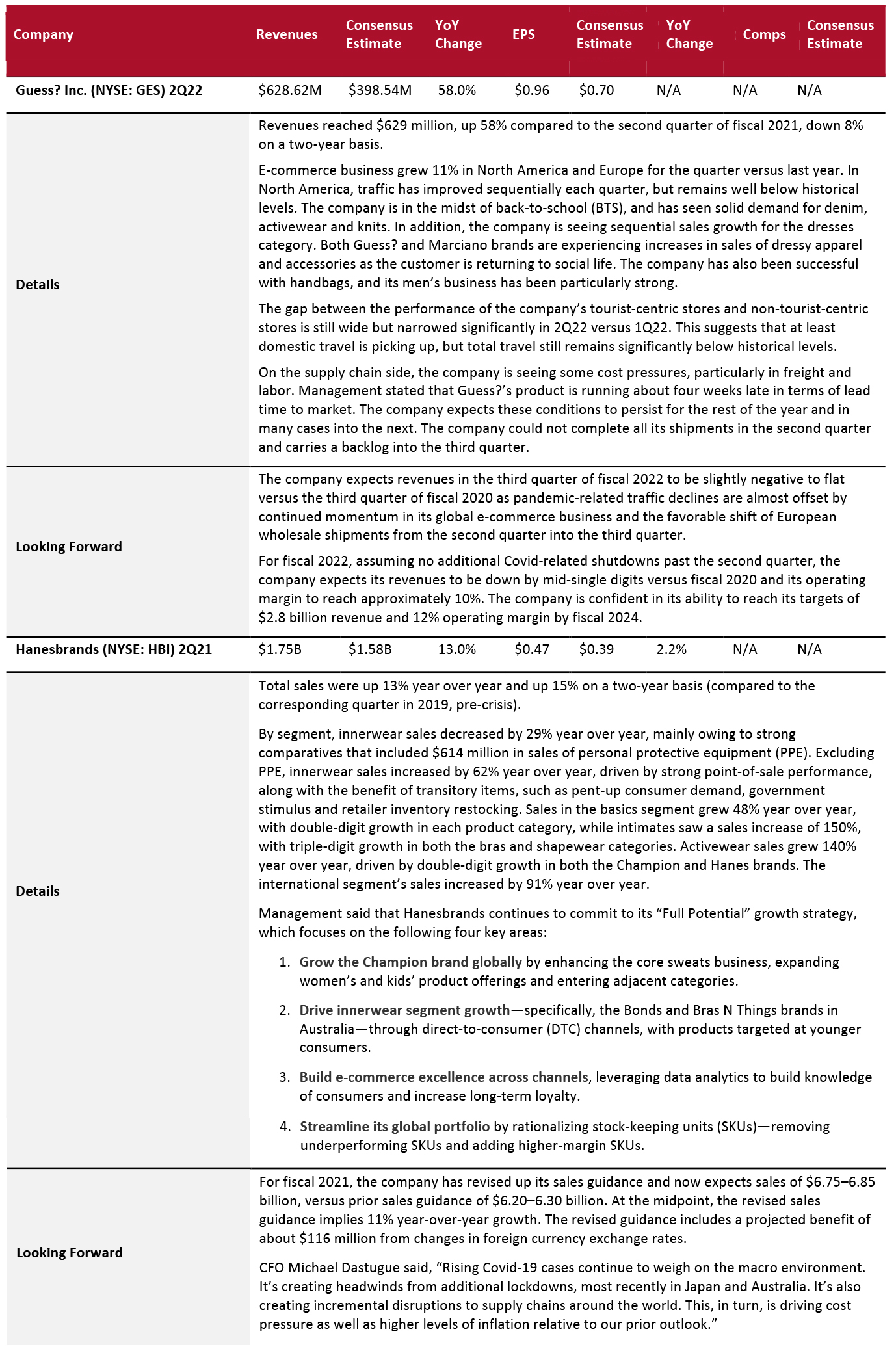

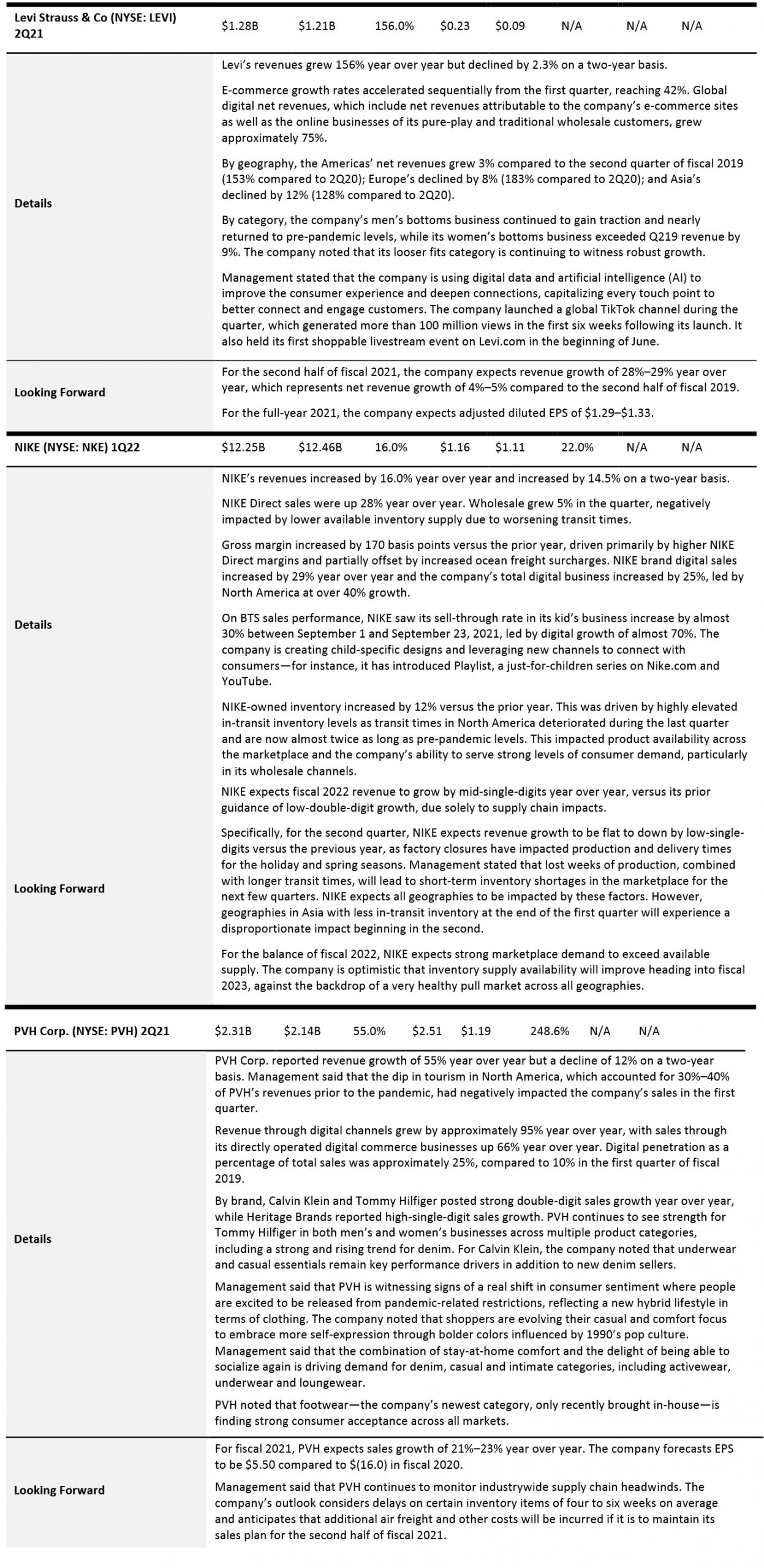

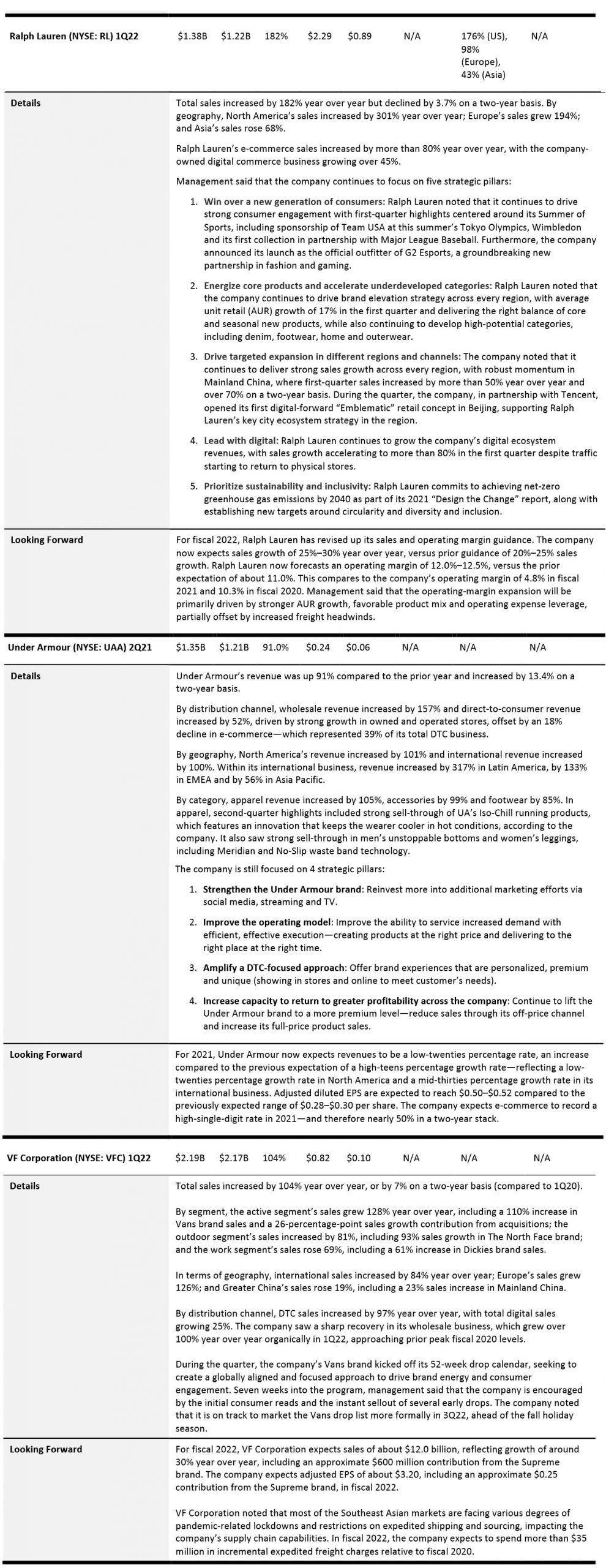

Apparel and Footwear Brand Owners

Overall, apparel and footwear brand owners are witnessing a substantial recovery, although pockets of weakness remain. On a two-year basis (versus the corresponding quarter in 2019), Hanesbrands, NIKE, Under Armour and VF Corporation reported positive sales growth, while Guess?, Levi Strauss, PVH Corp. and Ralph Lauren witnessed declines.

Going forward, these brand owners will continue to expand their digital channels and drive category expansion—the combination of stay-at-home comfort and the impact of being able to socialize again is driving demand for casual, denim, intimate categories, including activewear, loungewear and underwear.

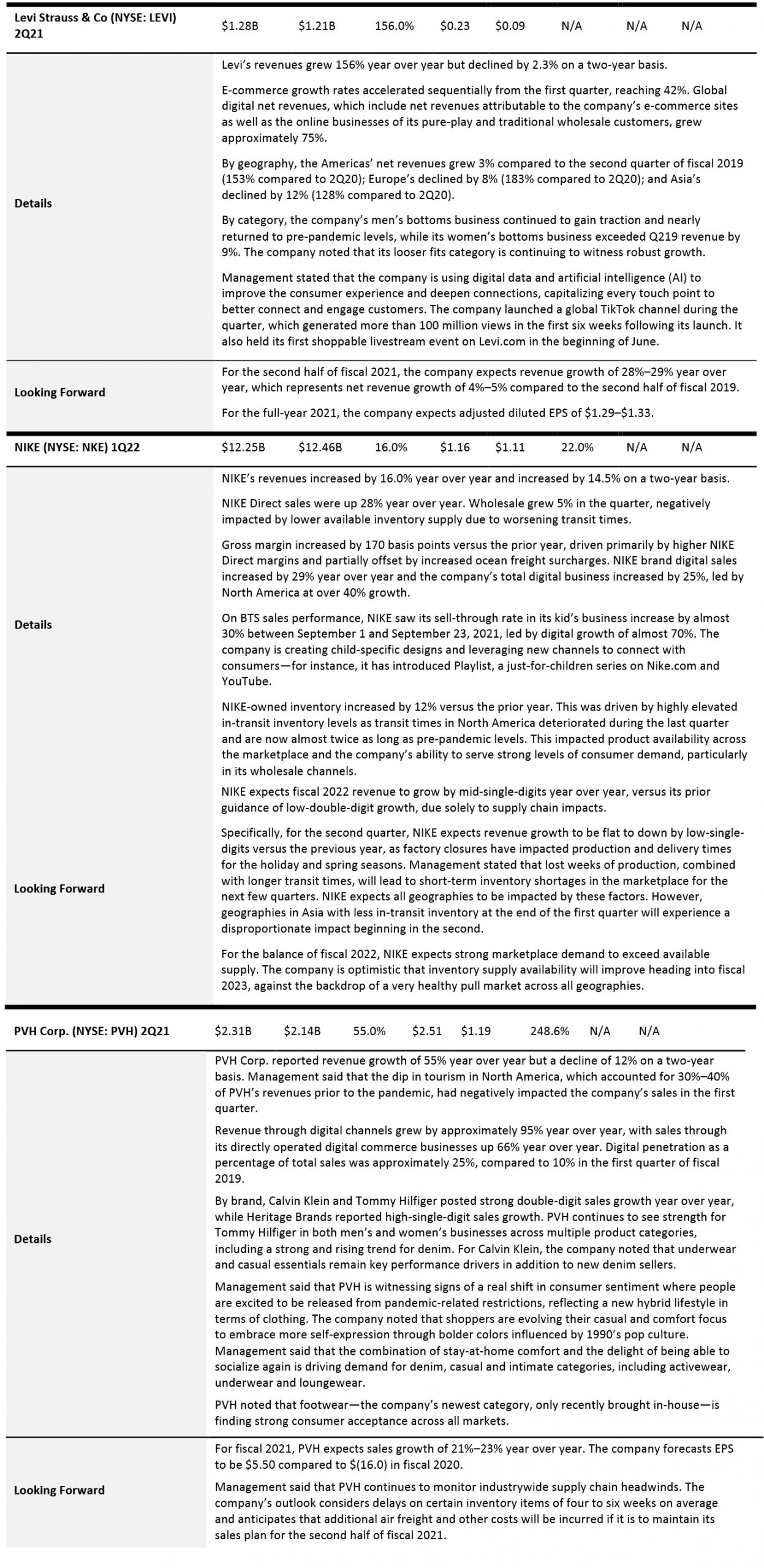

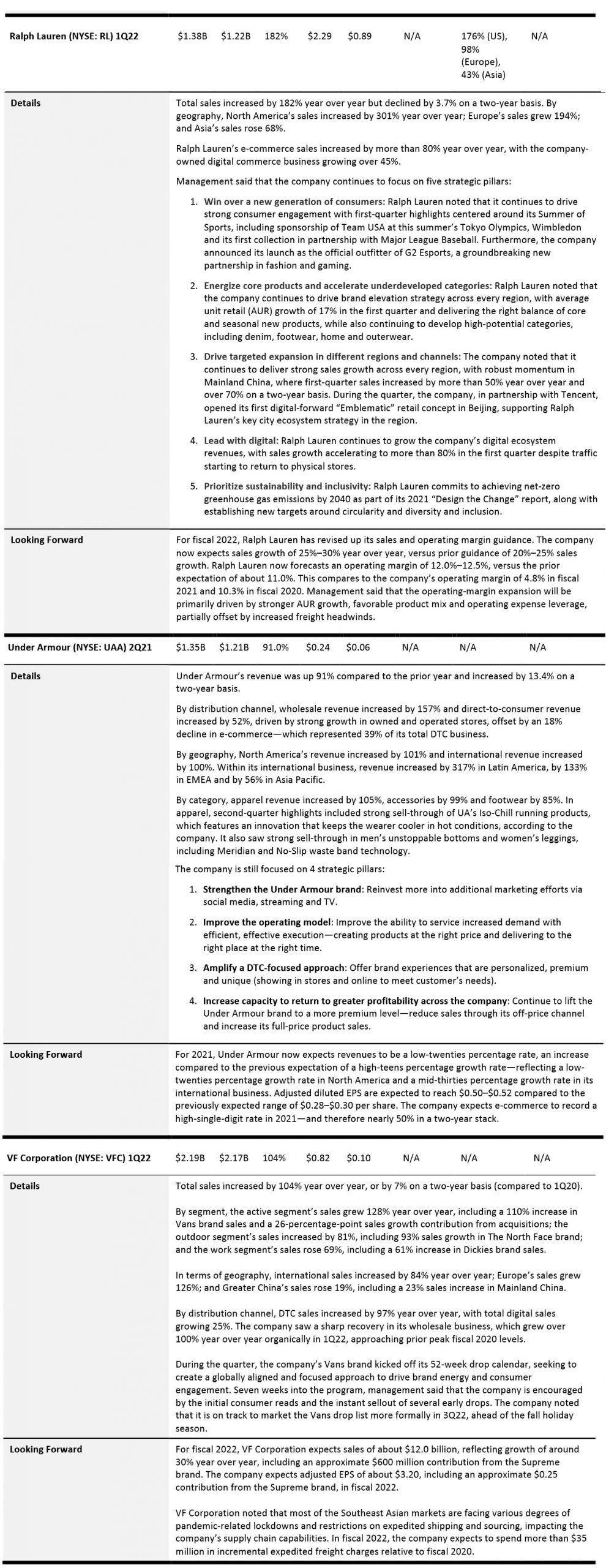

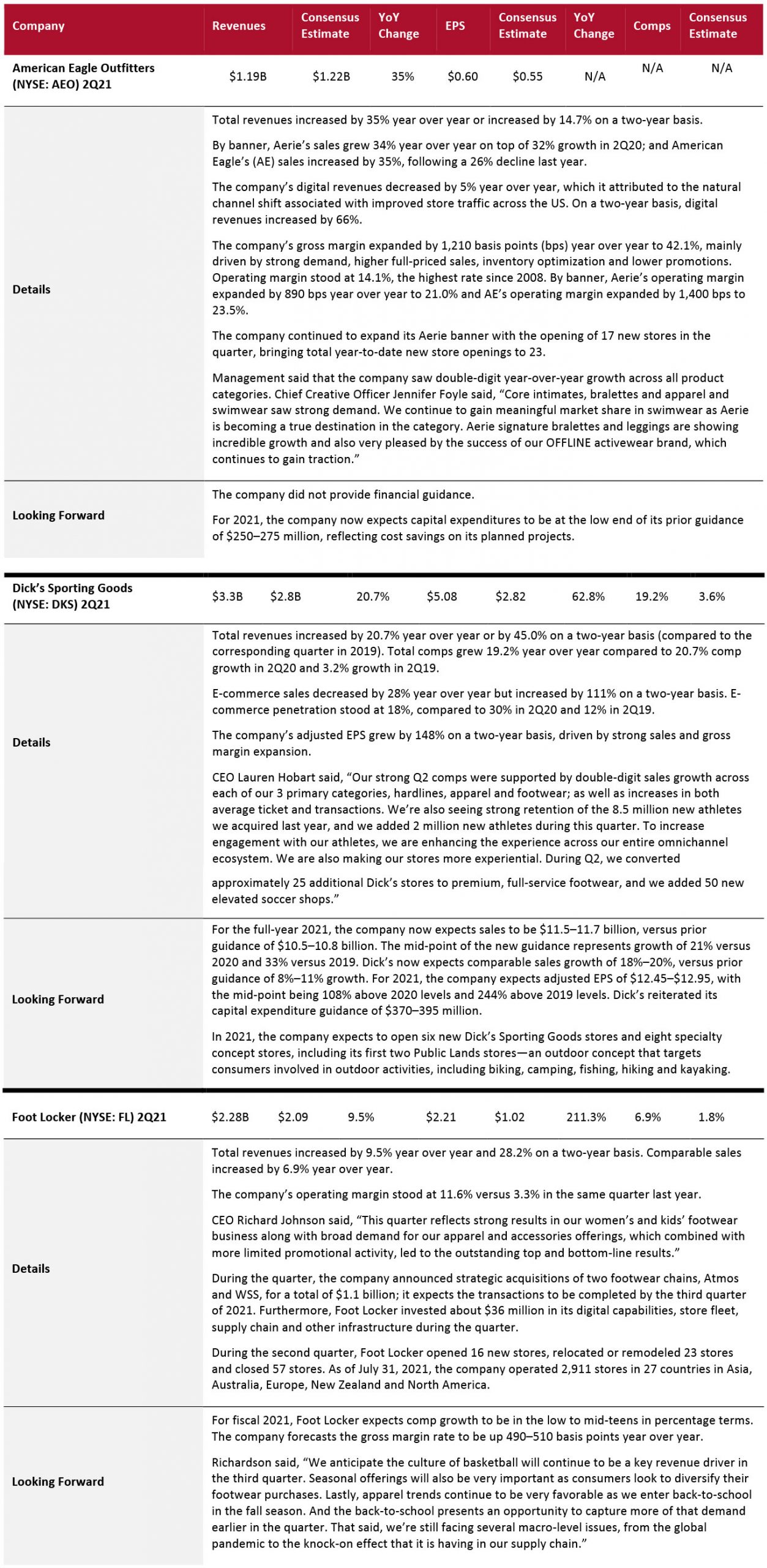

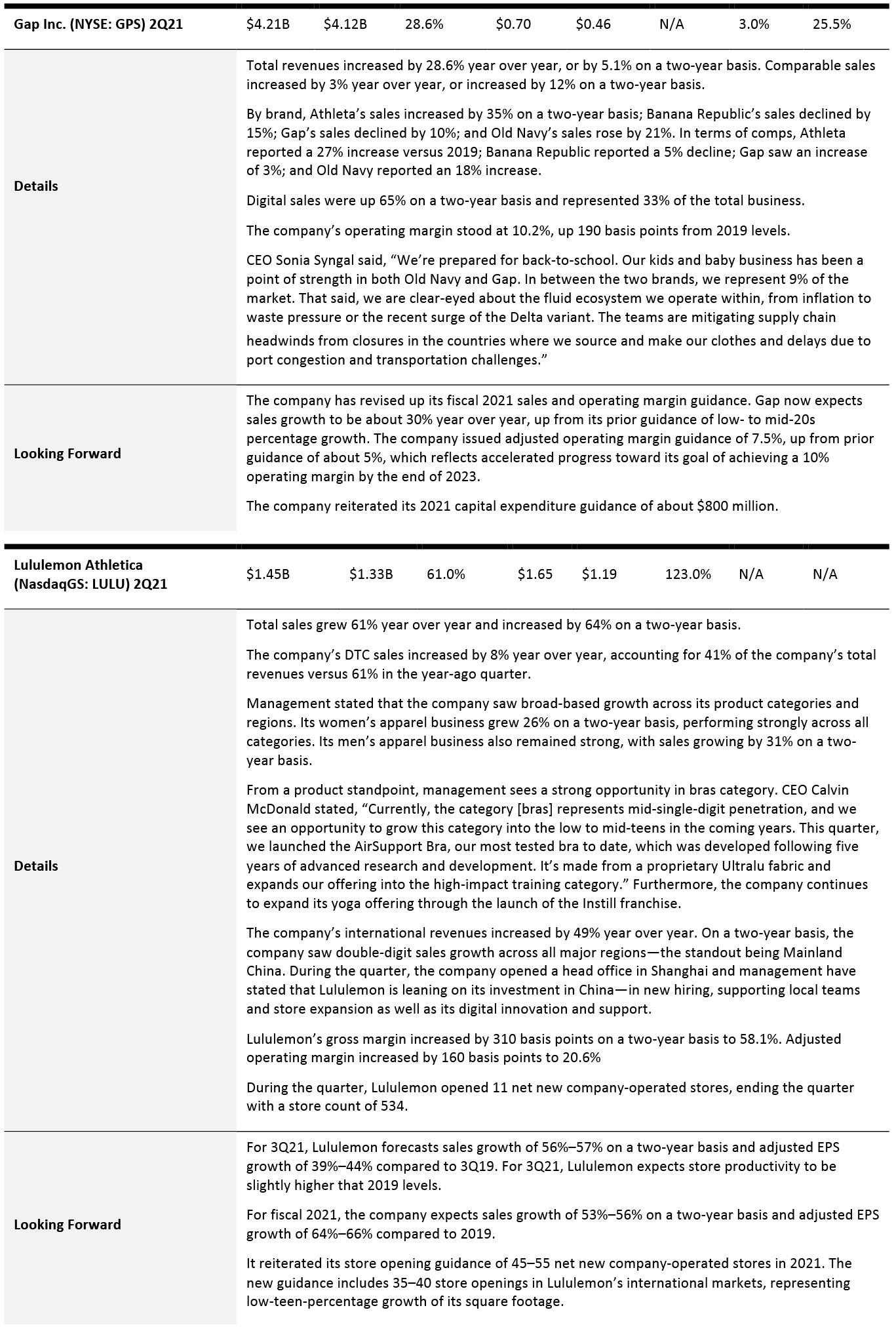

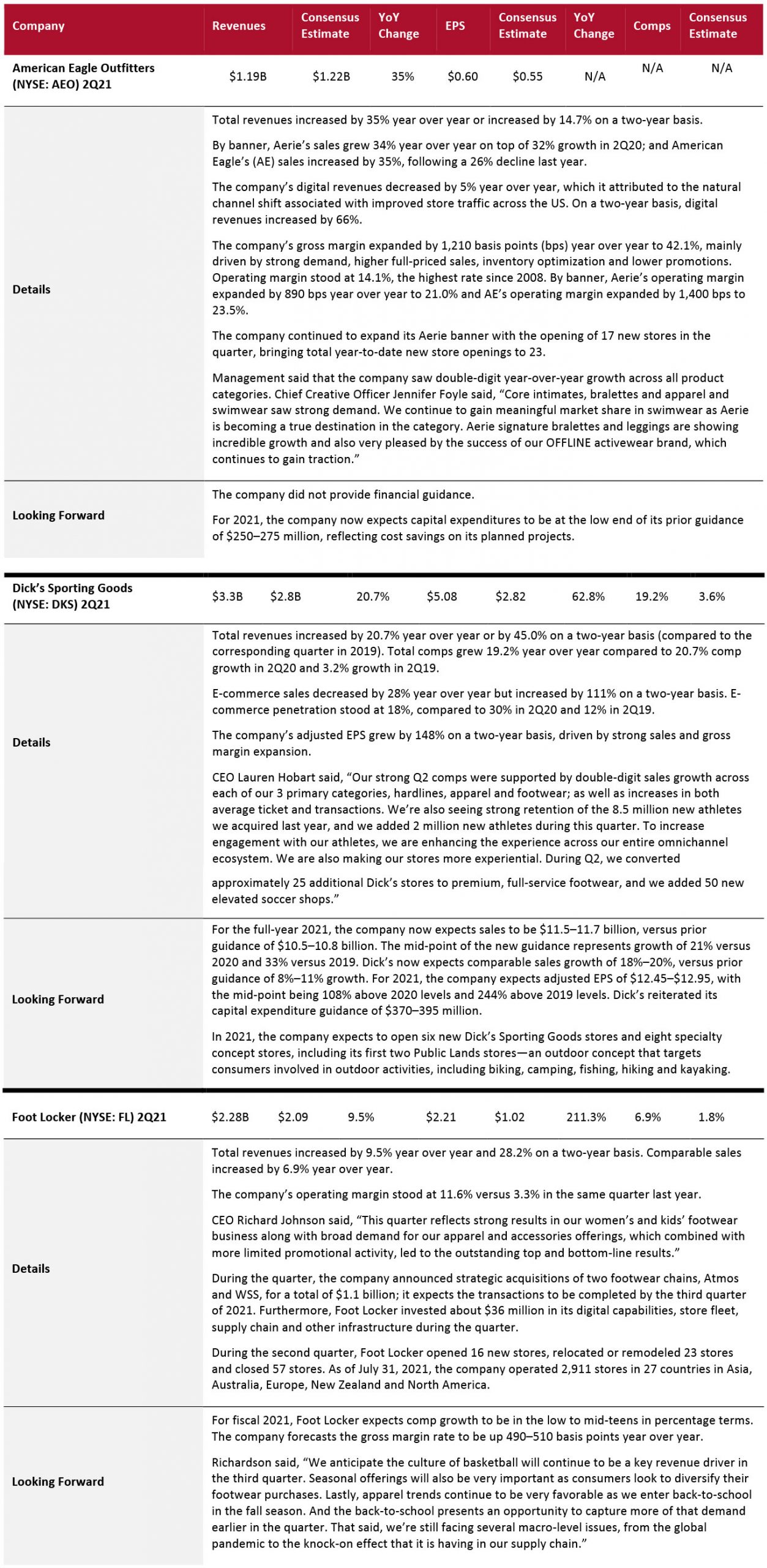

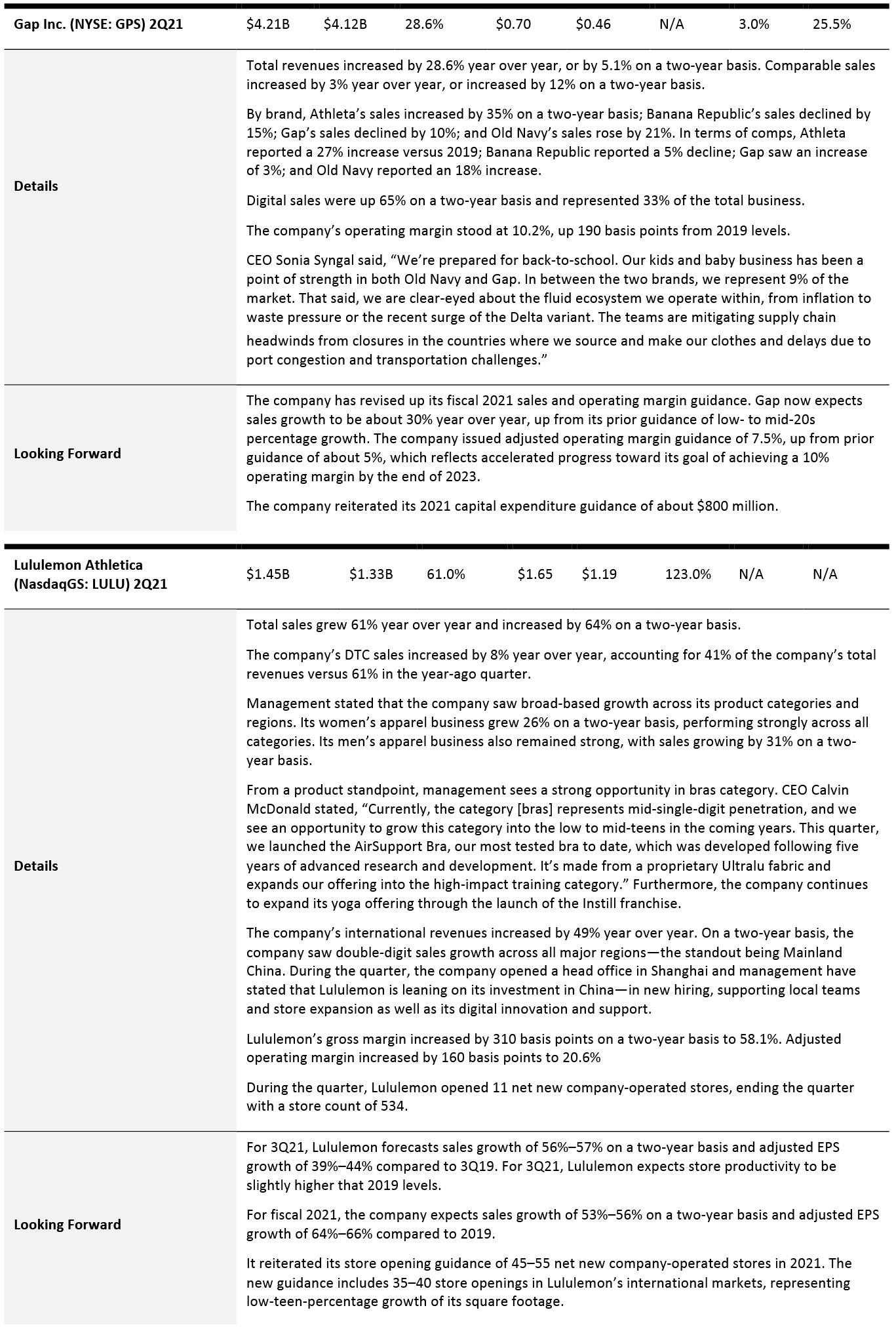

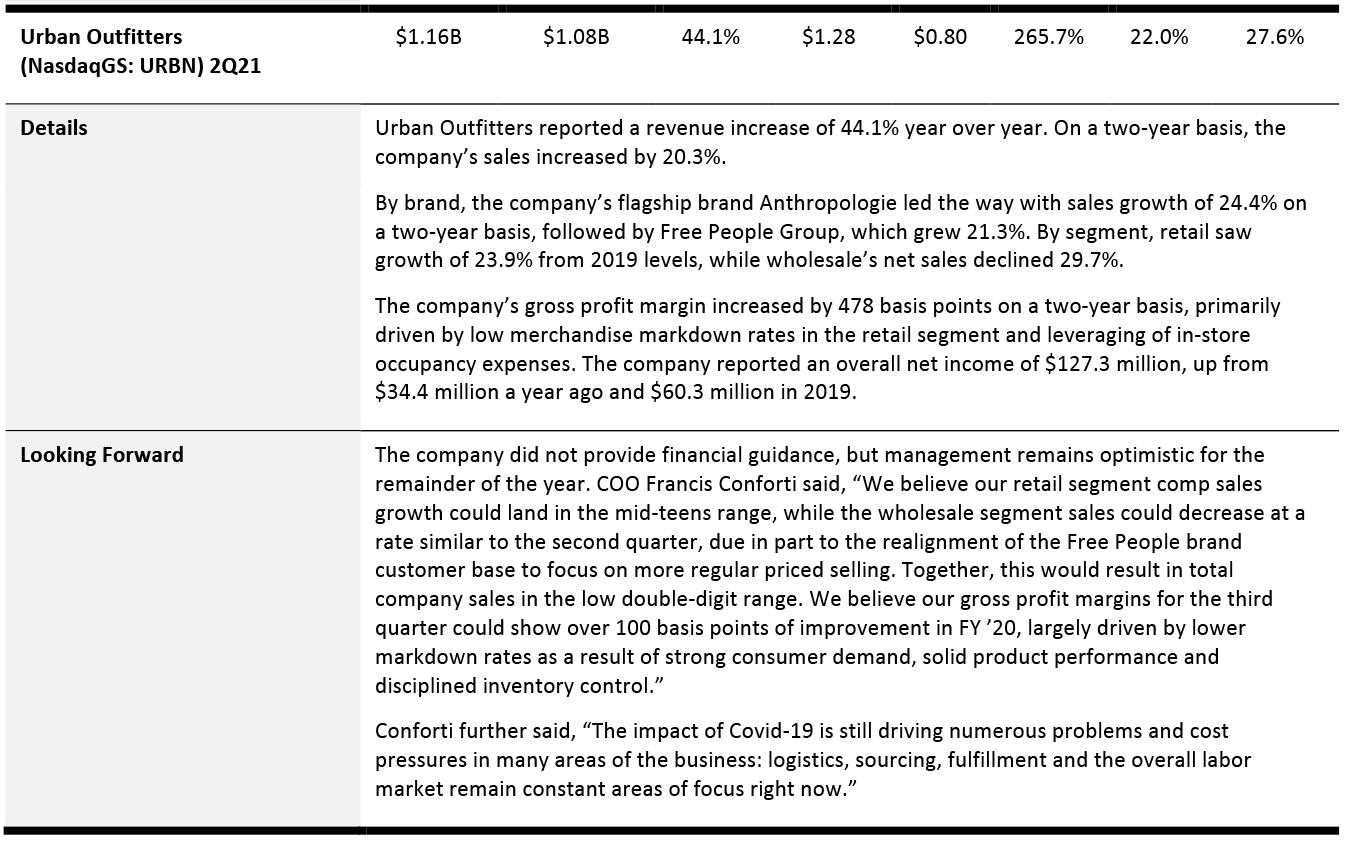

Apparel Specialty Retailers

Apparel specialists reported another strong quarter: American Eagle Outfitters, Dick’s Sporting Goods, Foot Locker, Gap, Lululemon and Urban Outfitters witnessed strong positive sales growth on a two-year basis.

While athleisure, casualwear and intimates remained strong catalysts, apparel specialty retailers are also witnessing a rebound in demand for dresswear, as consumers are returning to socializing.

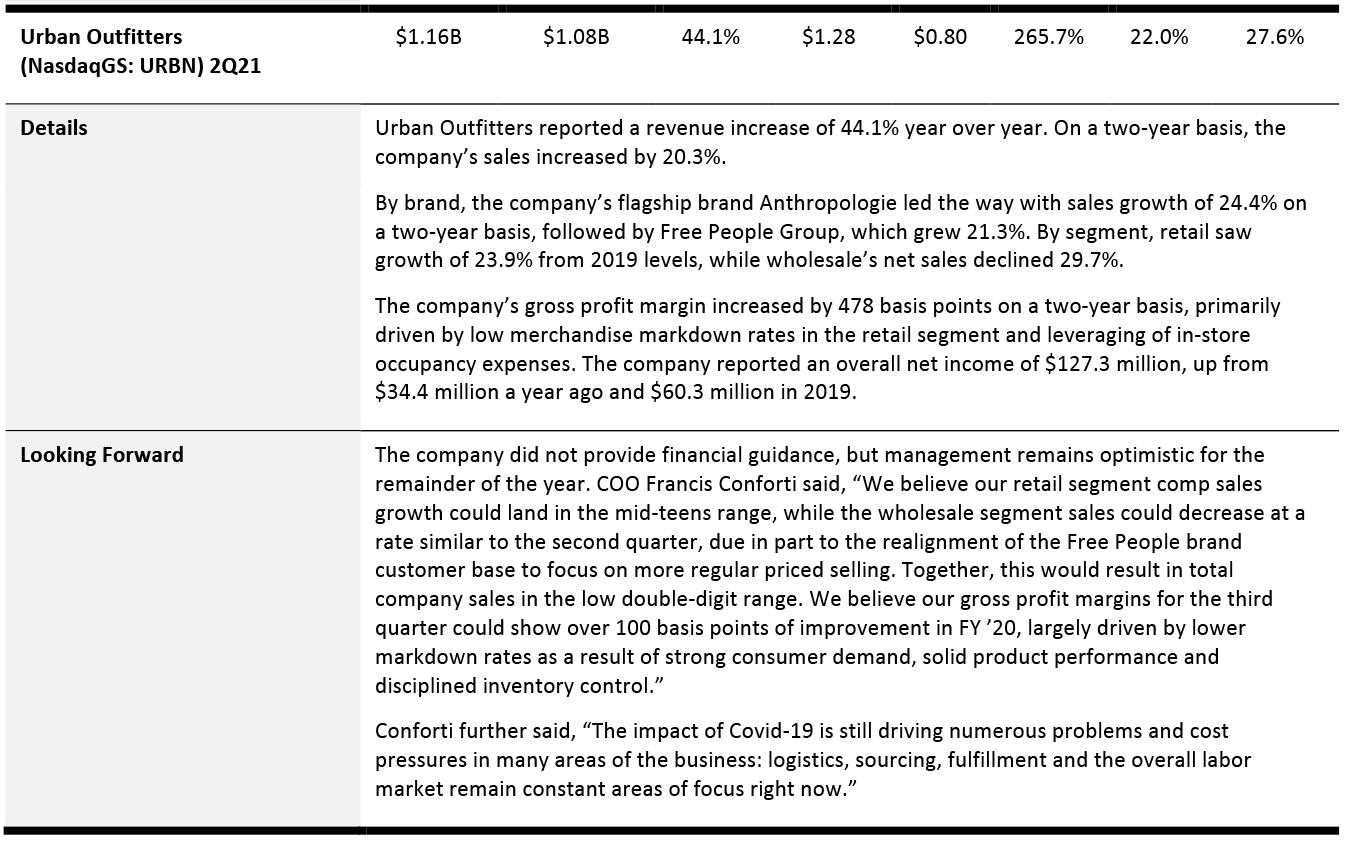

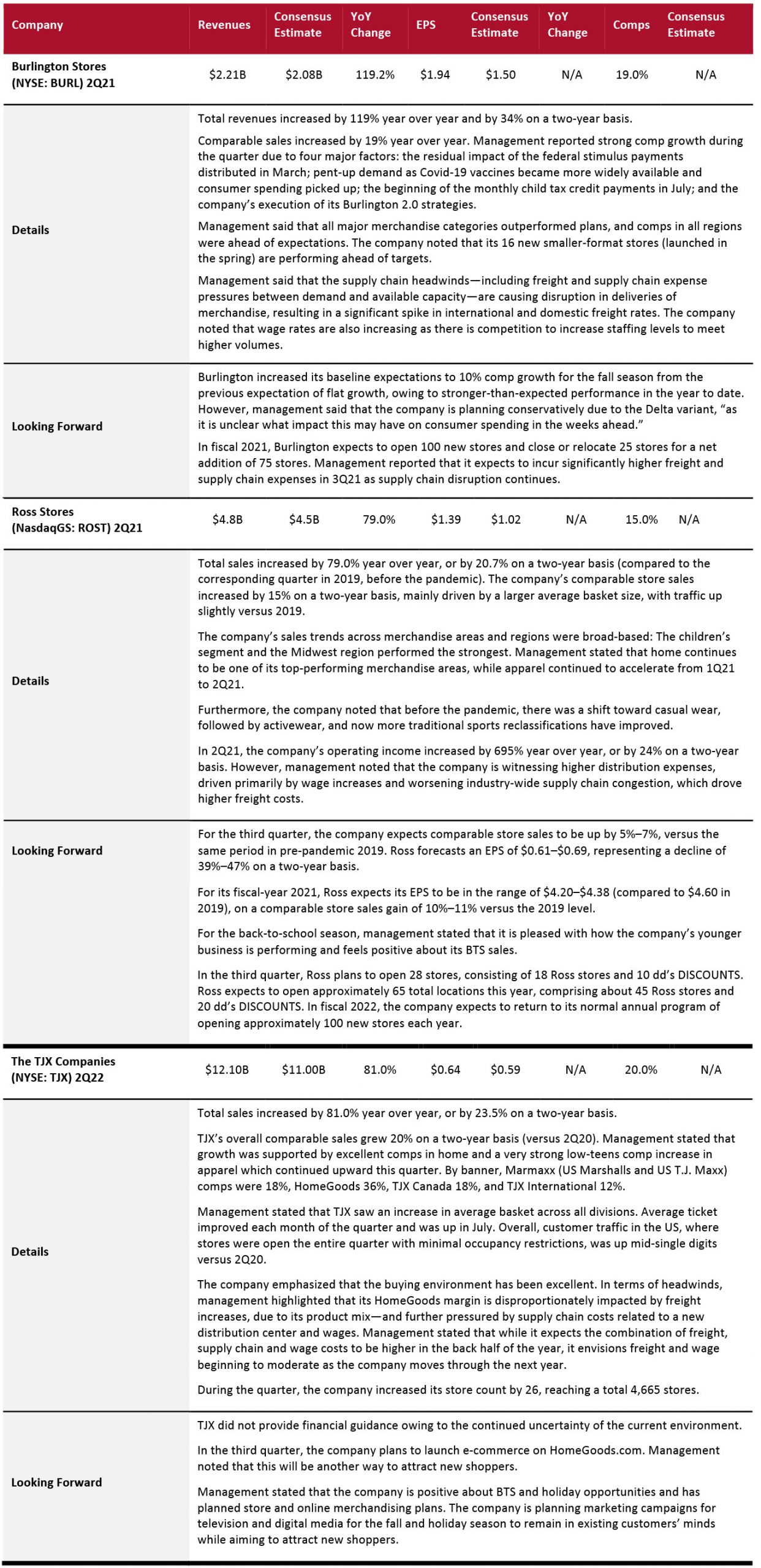

Off-Price Retailers

Off-price retailers witnessed a strong quarter, with all covered companies posting double-digit sales growth on a two-year basis. While the home category continues to outperform for these retailers, apparel is also recording strong results, as consumers resume social activities and refresh their wardrobes.

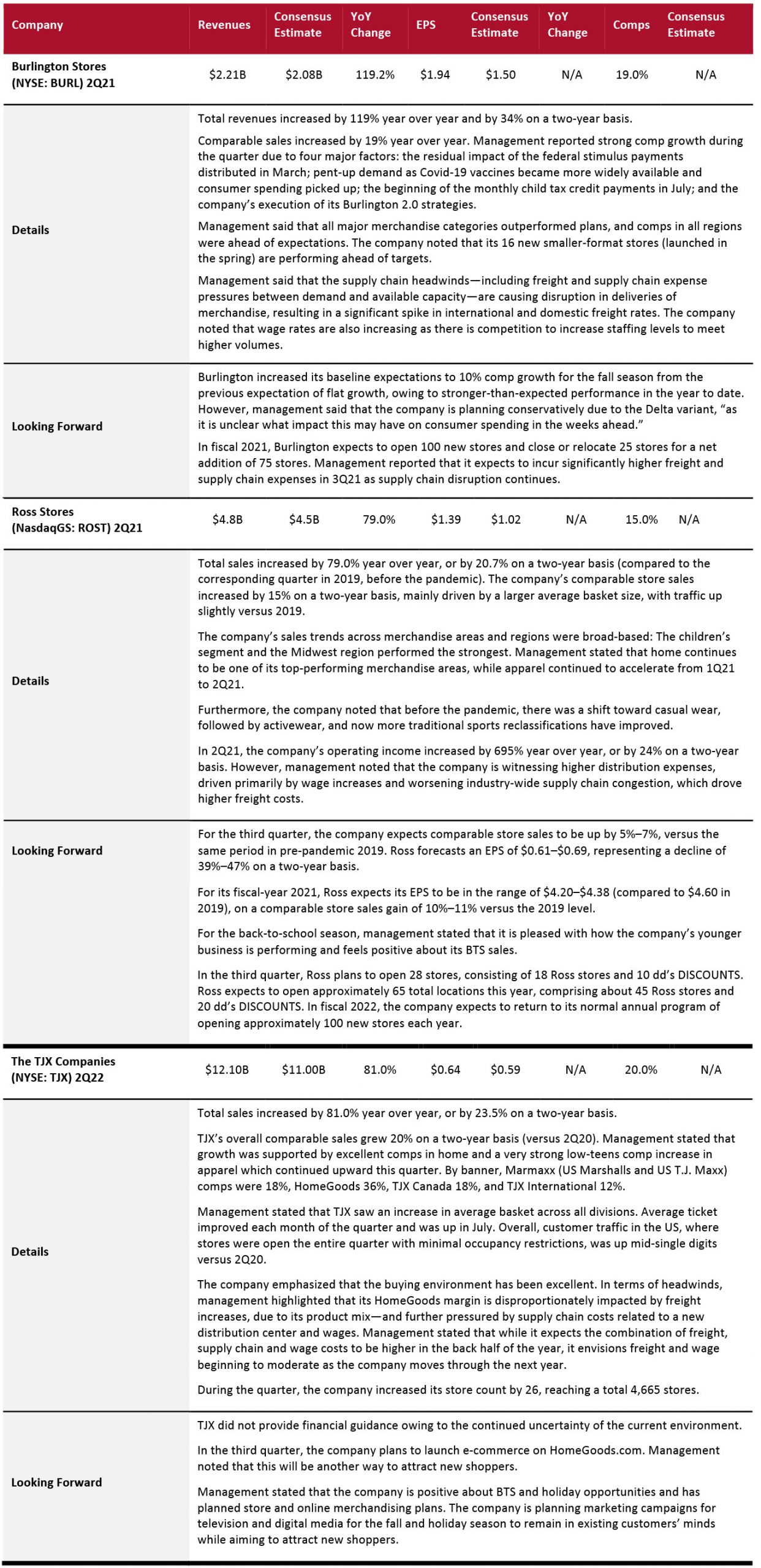

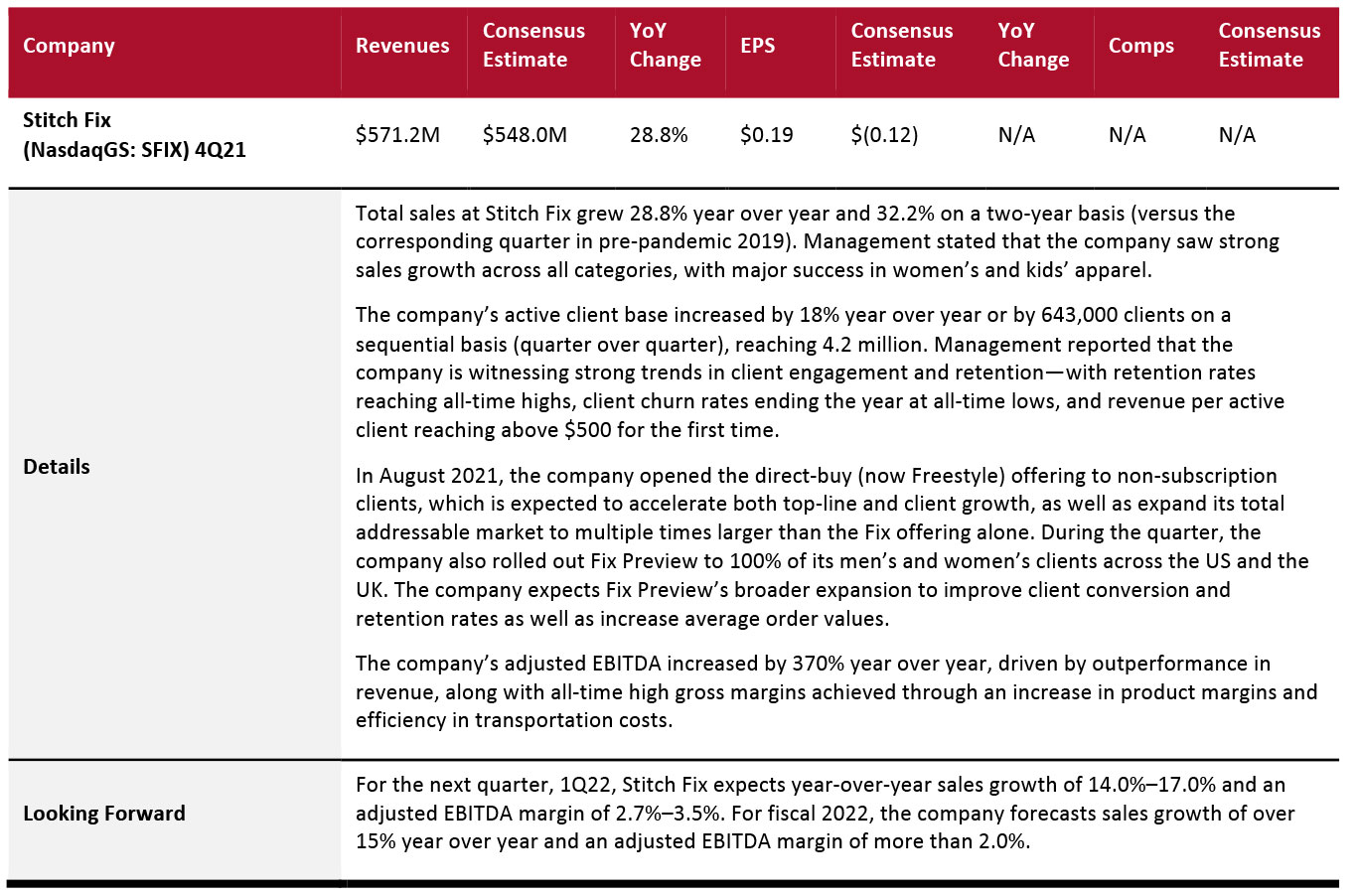

Online Apparel Retailers

Stitch Fix reported over 30% growth on a two-year basis this quarter, driven by a very strong increase in its active client base. For fiscal 2022, Stitch Fix forecasts sales growth of more than 15% year over year and adjusted operating margin expansion.

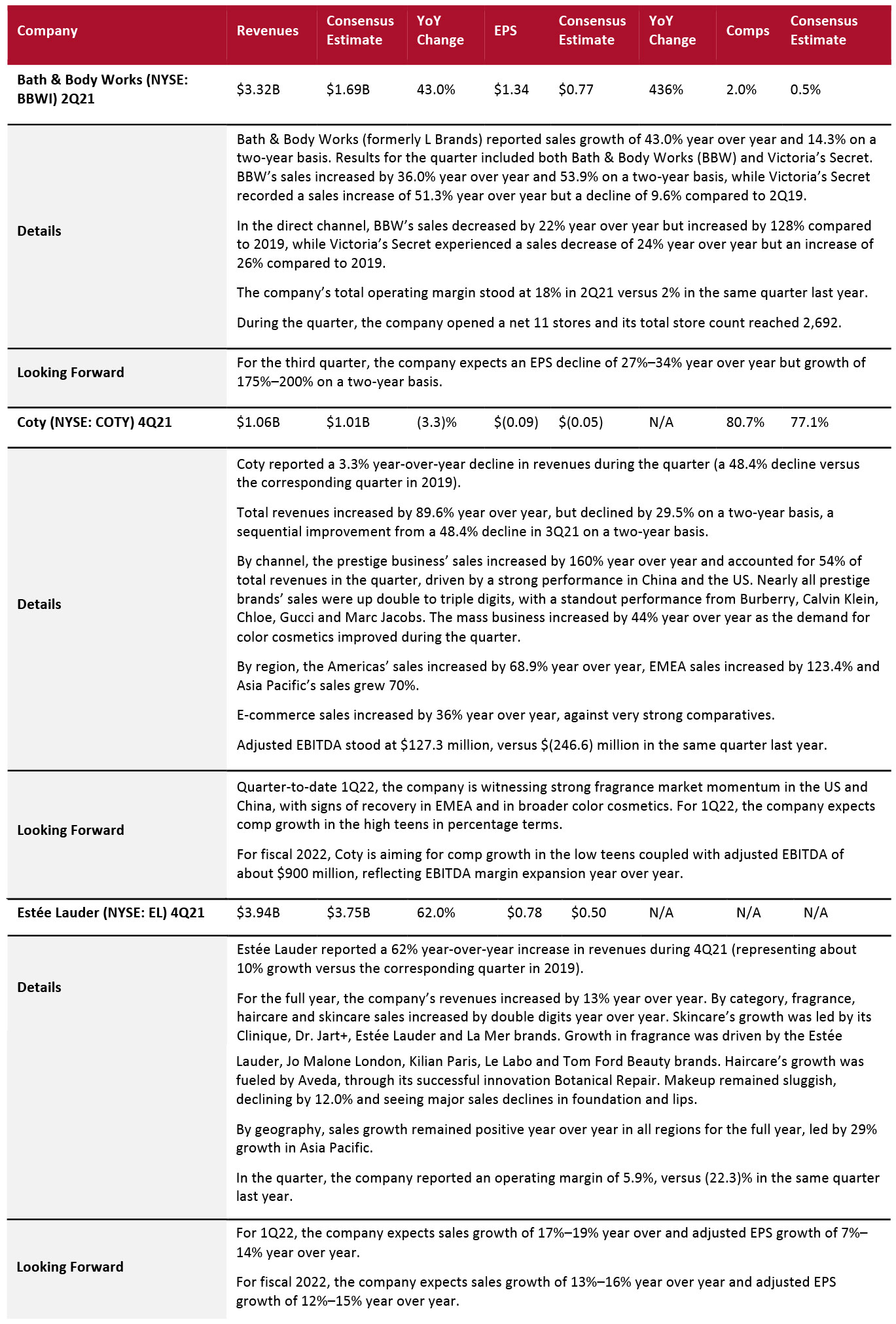

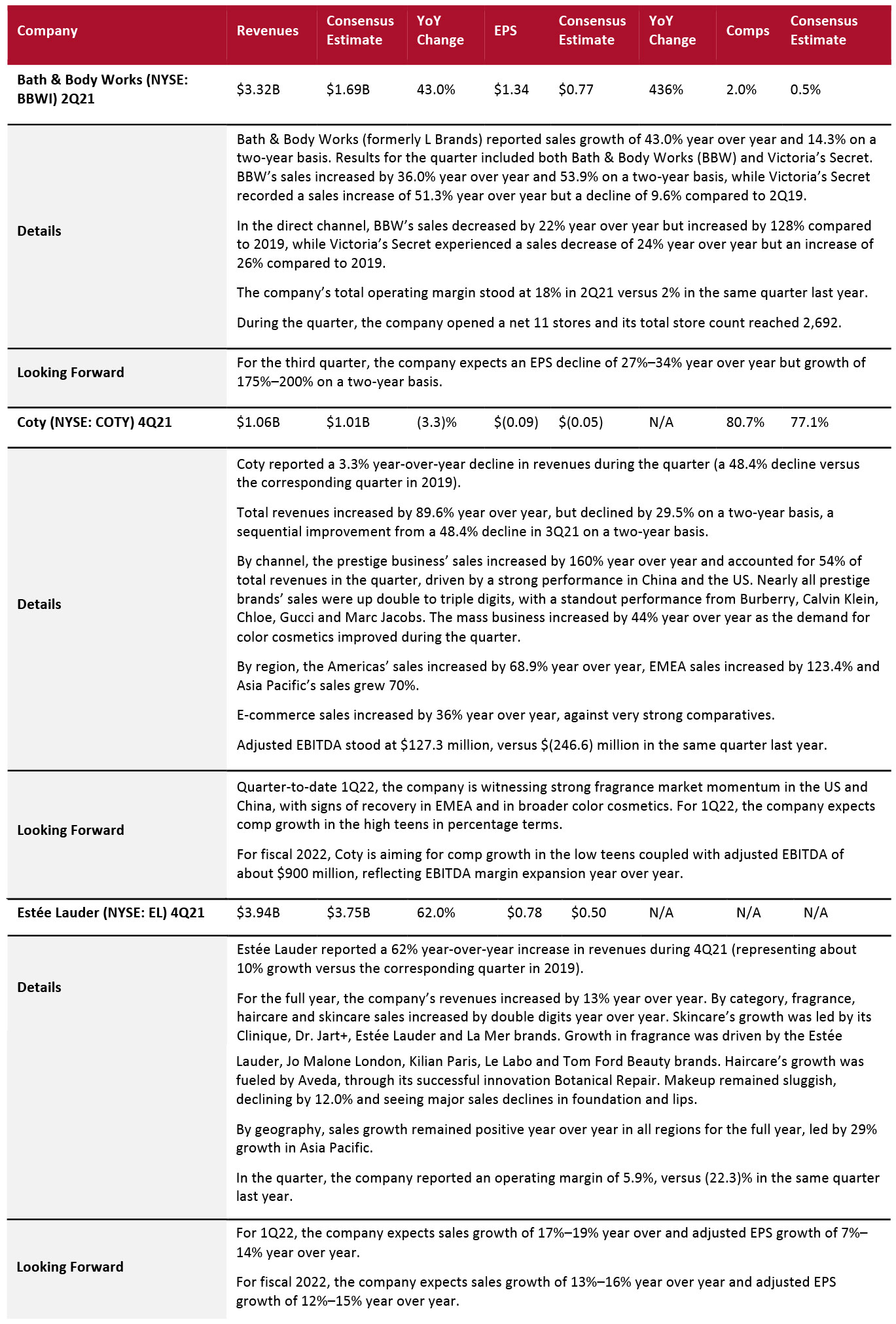

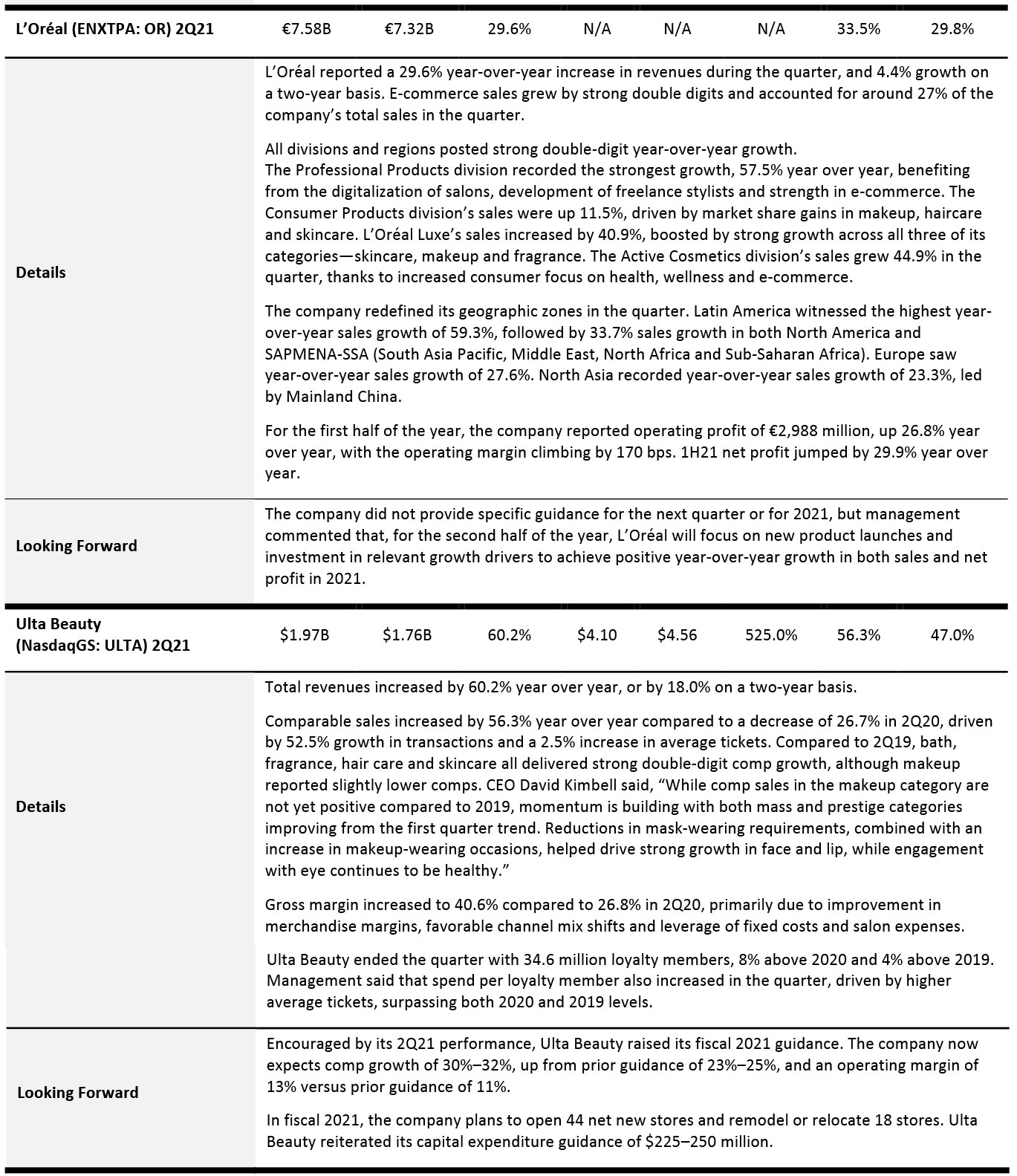

Beauty Brands and Retailers

The beauty category continues to recovery strongly, with Bath & Body Works, Estée Lauder, L’Oréal and Ulta Beauty posting positive sales growth on a two-year basis. However, Coty reported a sales decline on a two-year basis.

Within the category, bath, fragrance, haircare and skincare are trending, while demand for makeup remains weak.

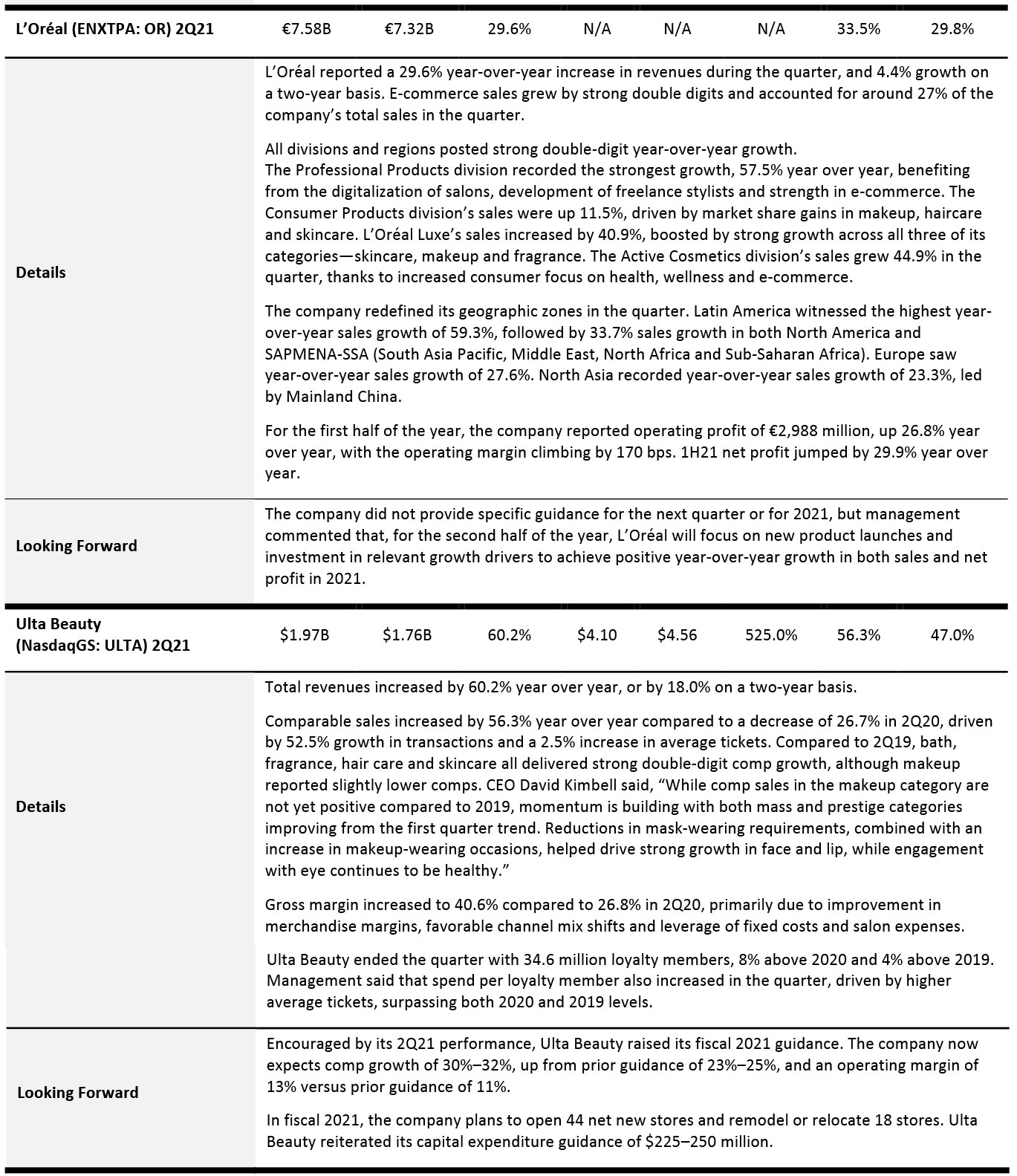

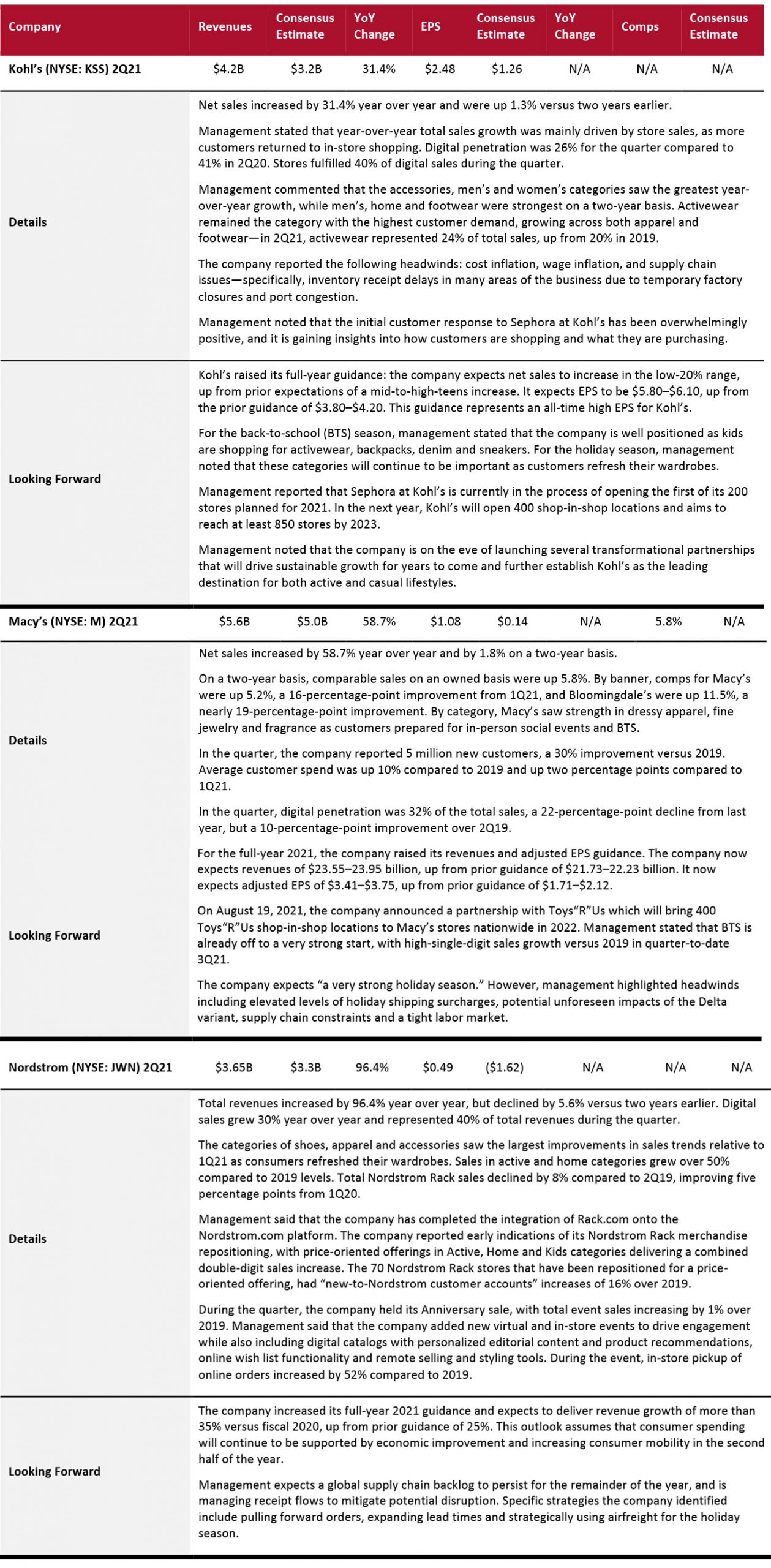

Department Stores

Major department stores are recovering solidly from the crisis. Macy’s and Kohl’s reported low-single-digit sales growth on a two-year basis; however, Nordstrom posted a mid-single-digit sales decline on a two-year basis.

The department stores covered here are seeing strong trends in various accessories, apparel and footwear categories, such as activewear, denim, dresses, fine jewelry and sneakers.

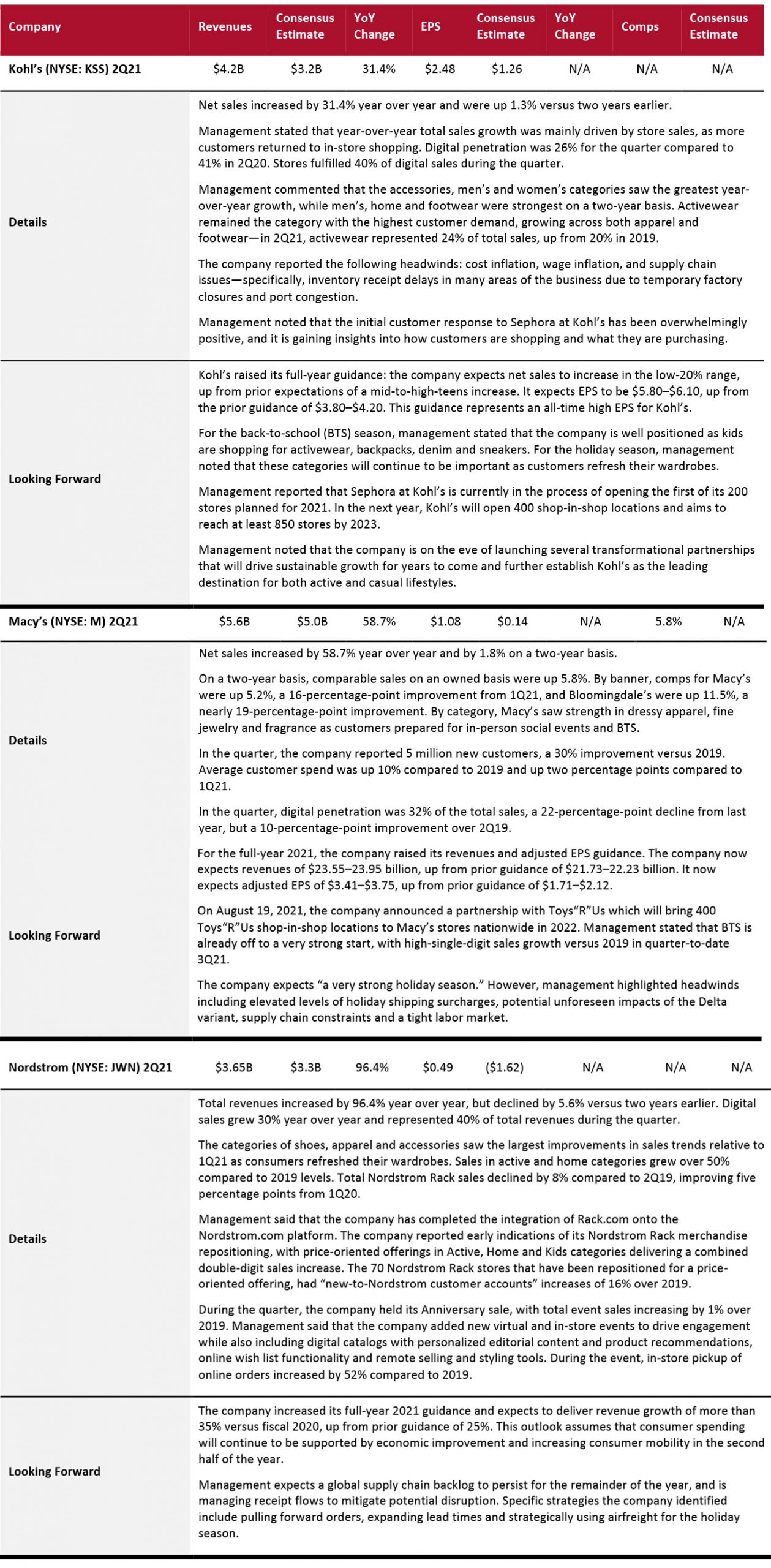

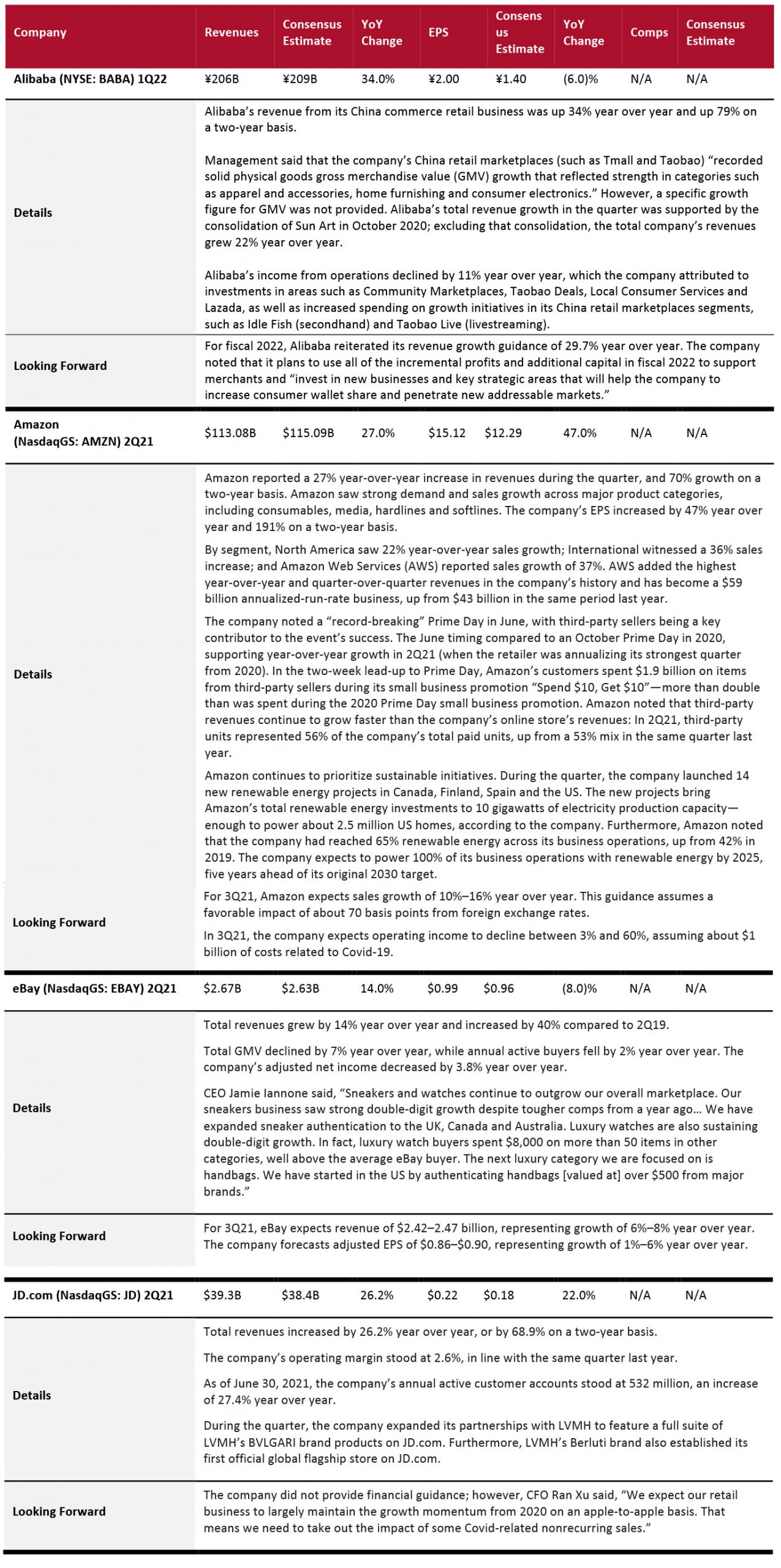

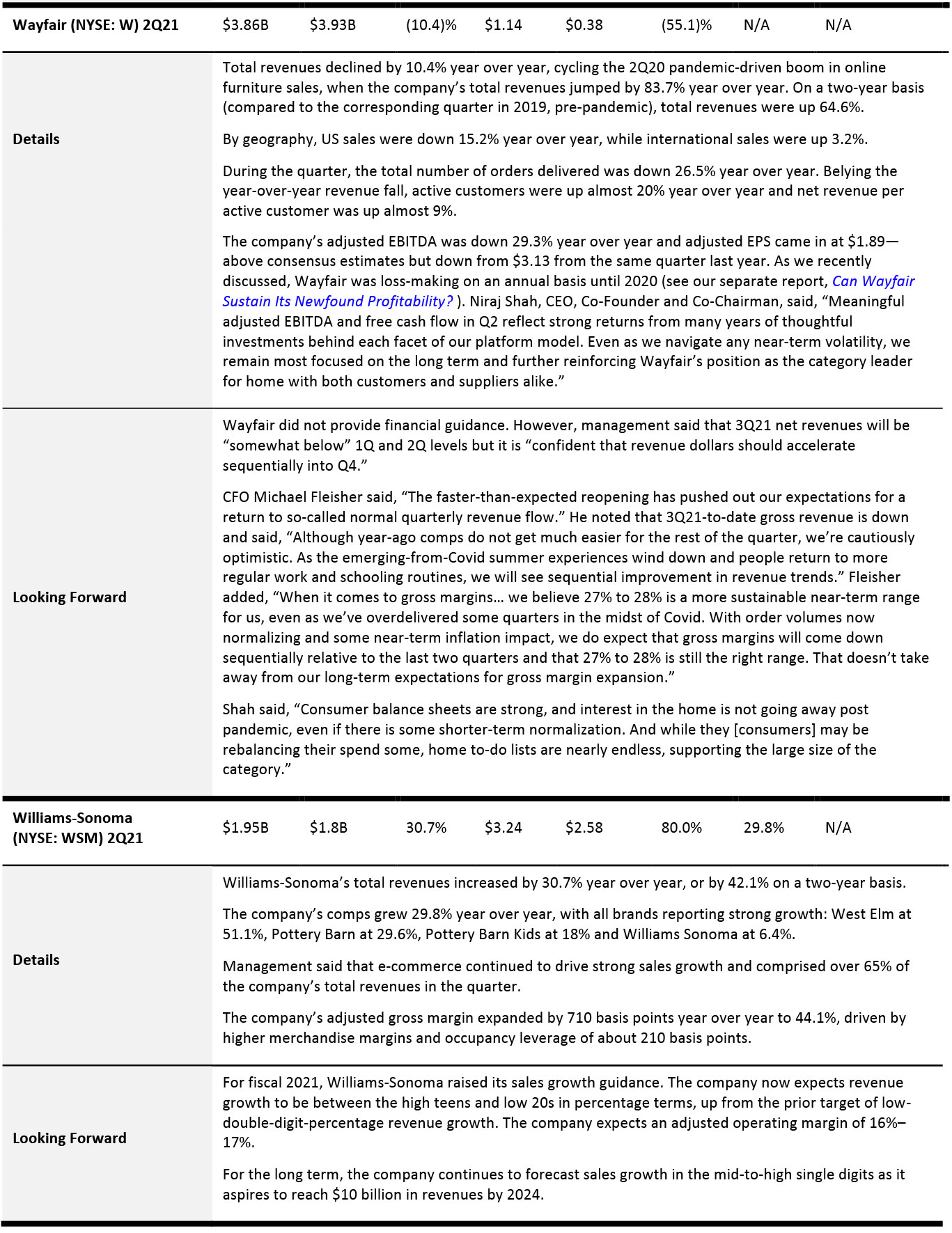

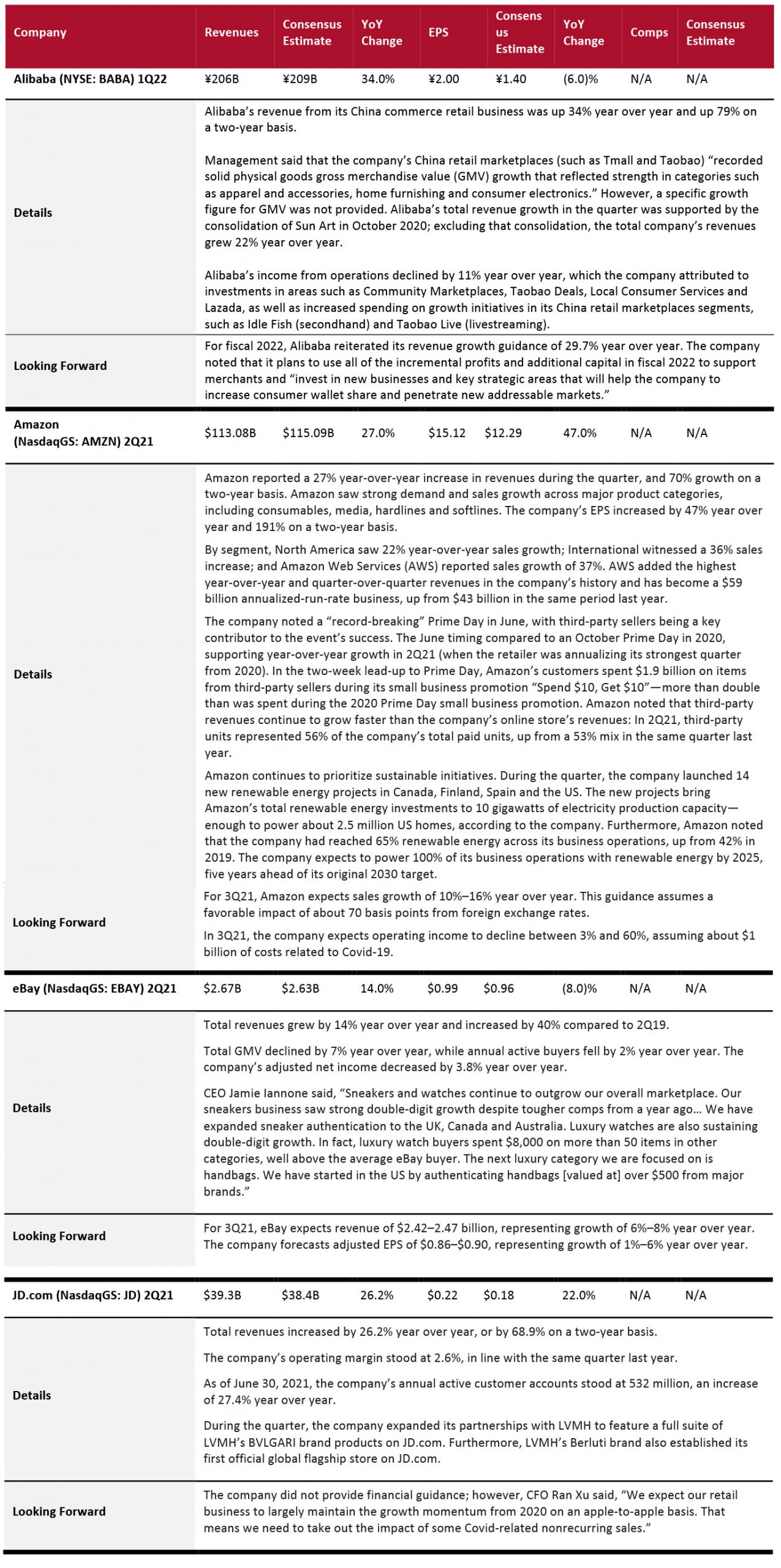

E-Commerce Platforms

E-commerce players continue to report strong top-line expansion: Alibaba, Amazon, eBay and JD.com all reported double-digit year-over-year sales growth. For the next quarter, Amazon expects double-digit year-over-year sales growth, while eBay expects high-single-digit growth. For the full fiscal year, Alibaba expects double-digit sales growth.

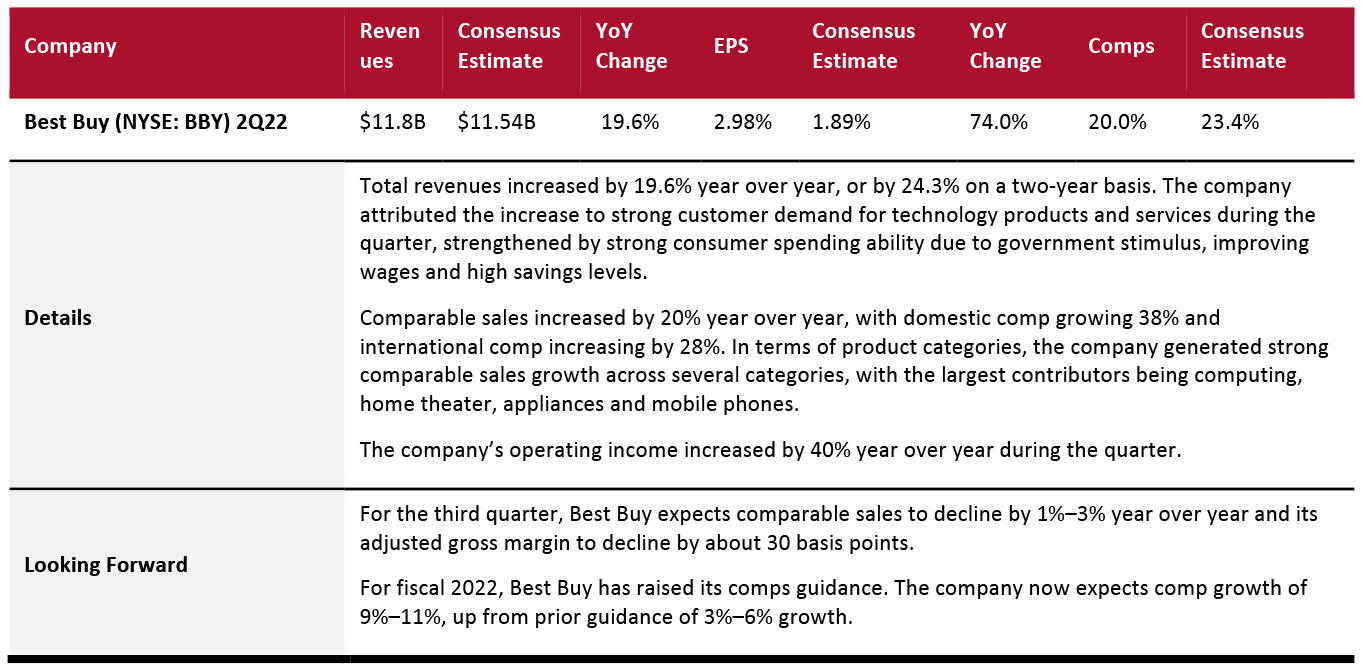

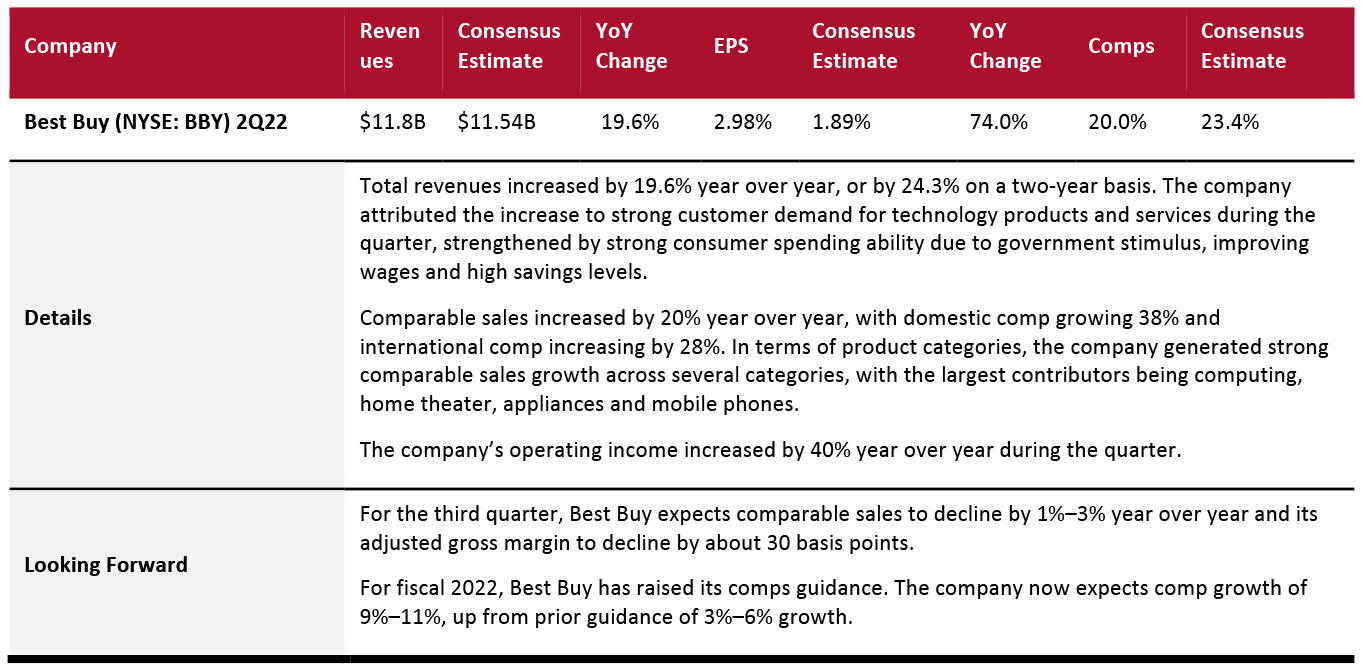

Electronics Retailers

Best Buy reported comp growth of 20% year over year, mainly driven by strong contributions from appliances, computing, home theater and mobile phones categories.

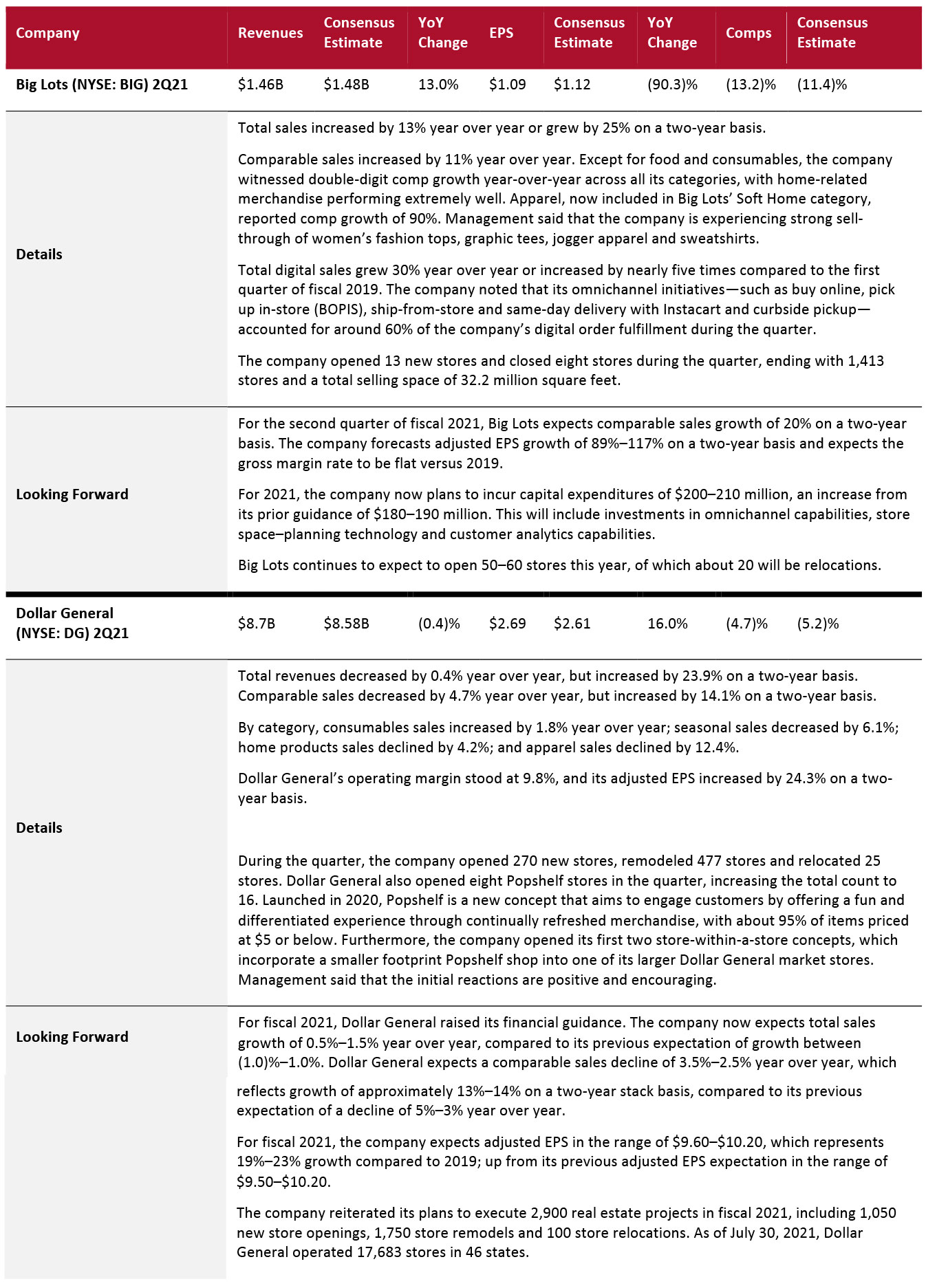

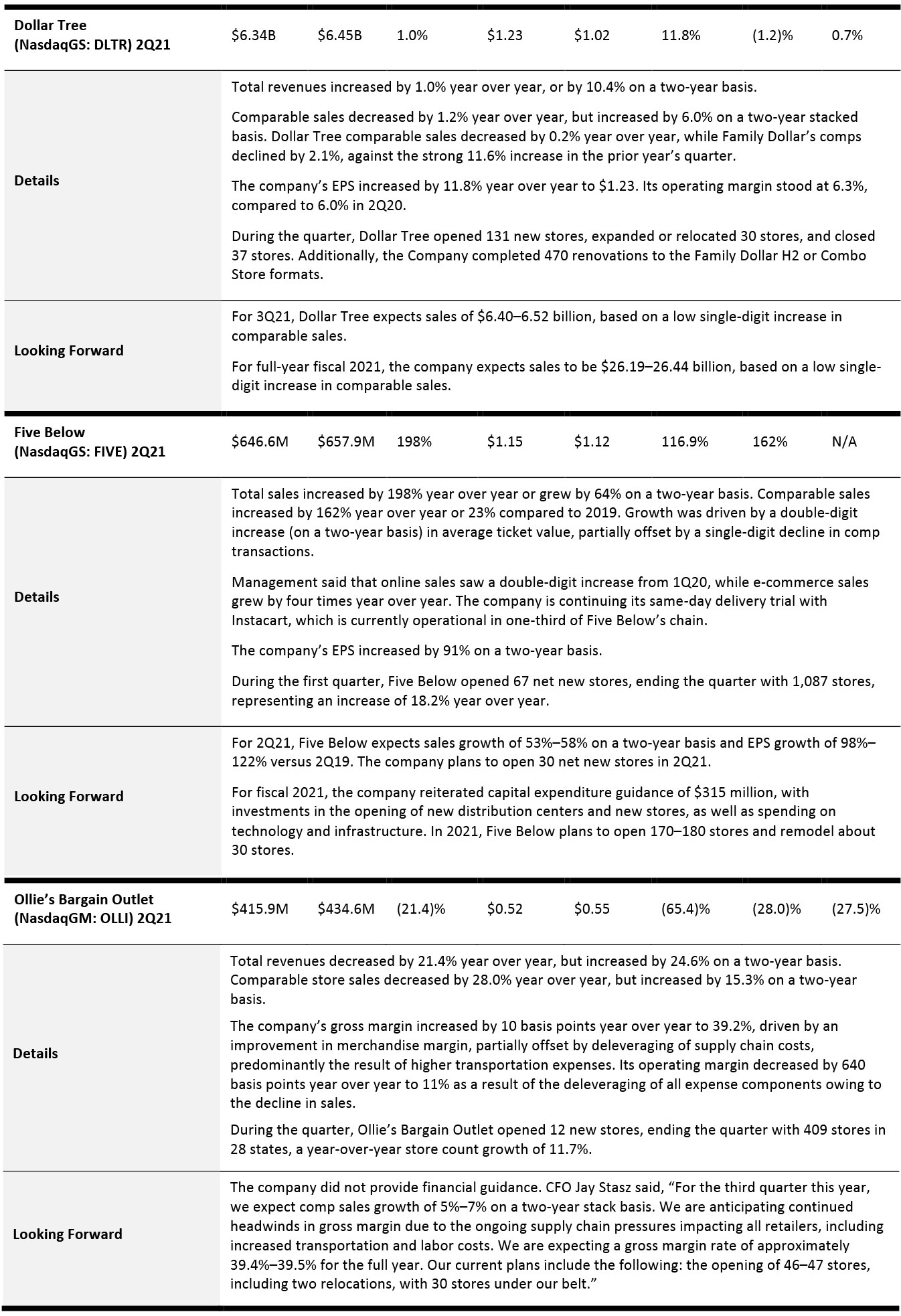

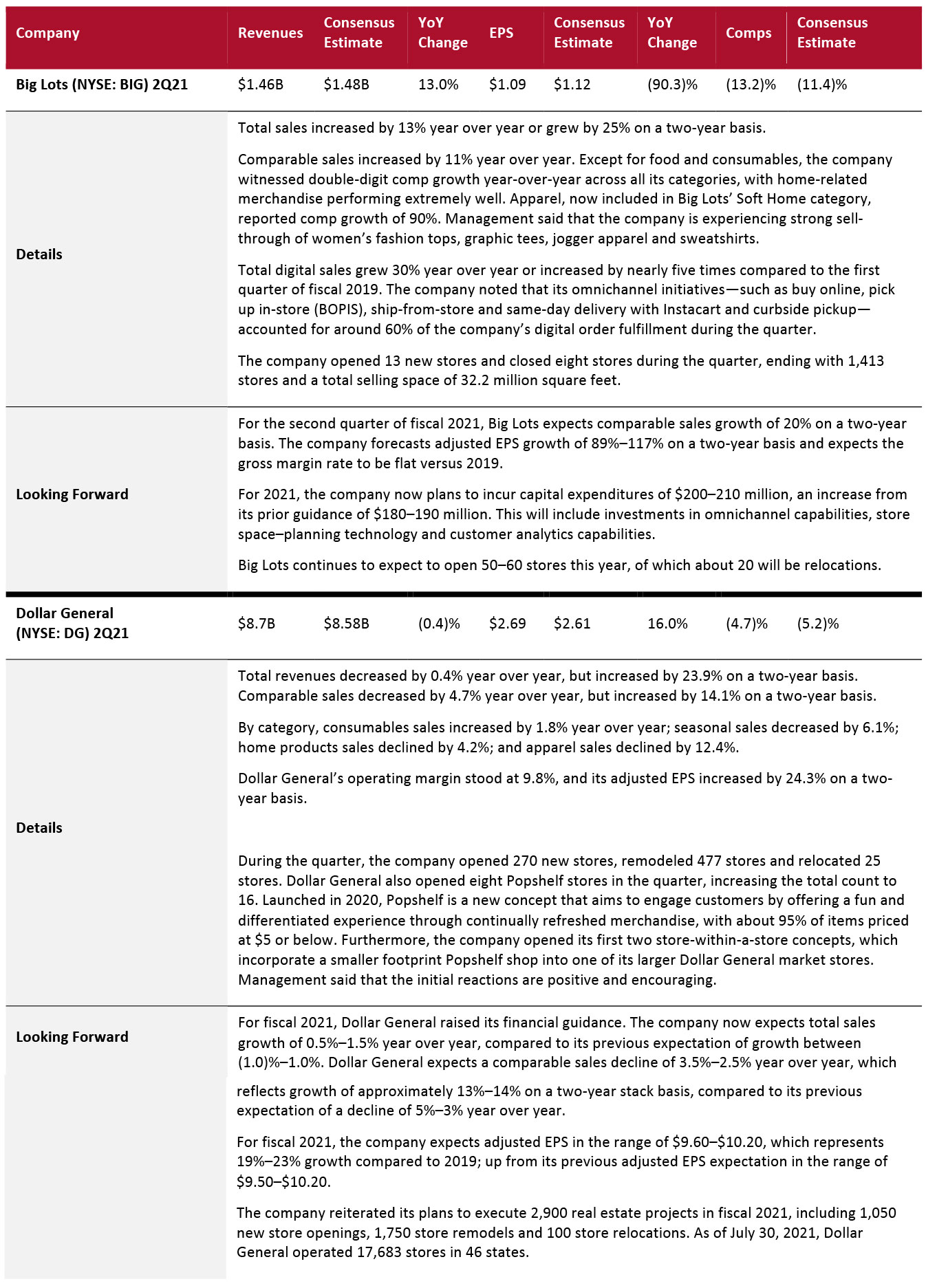

Food, Drug and Mass Retailers: Discount Stores

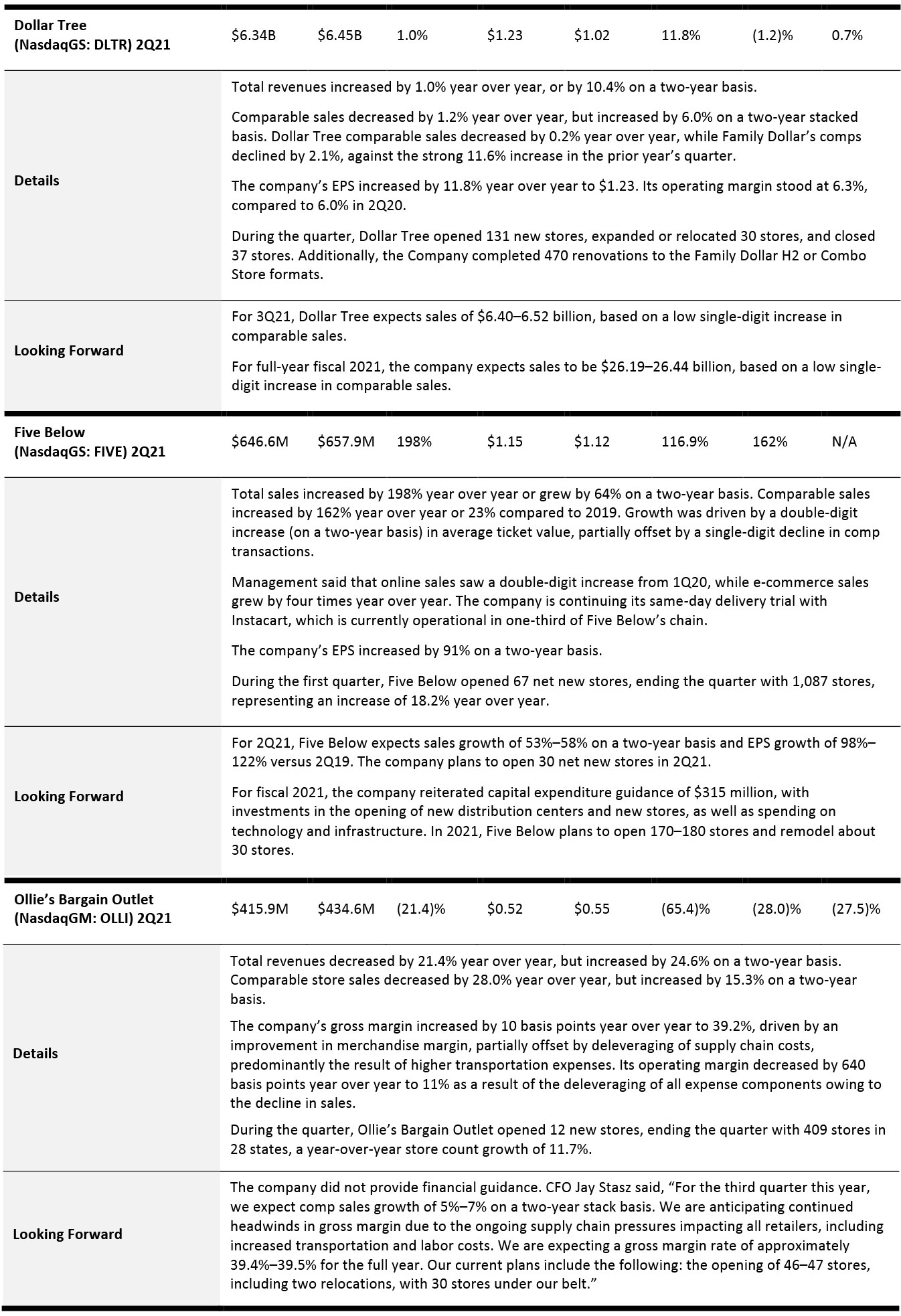

Discount stores continued their solid run this quarter, with Big Lots, Dollar General, Dollar Tree, Five Below and Ollie’s Bargain Outlets reporting double-digit revenue growth on a two-year basis. Unlike most retailers, which are shrinking their physical footprints, discounter’s real estate plans remain firmly in place—including new store expansions.

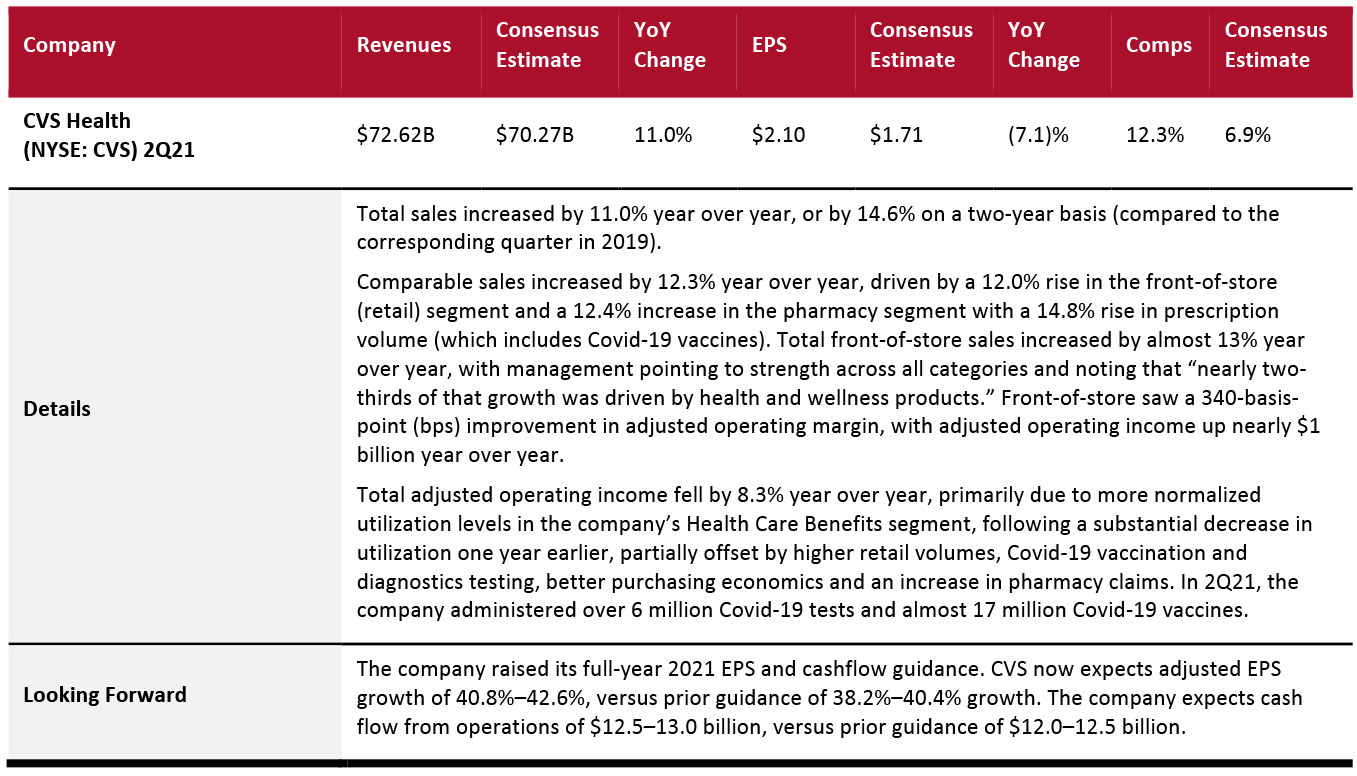

Food, Drug and Mass Retailers: Drugstores

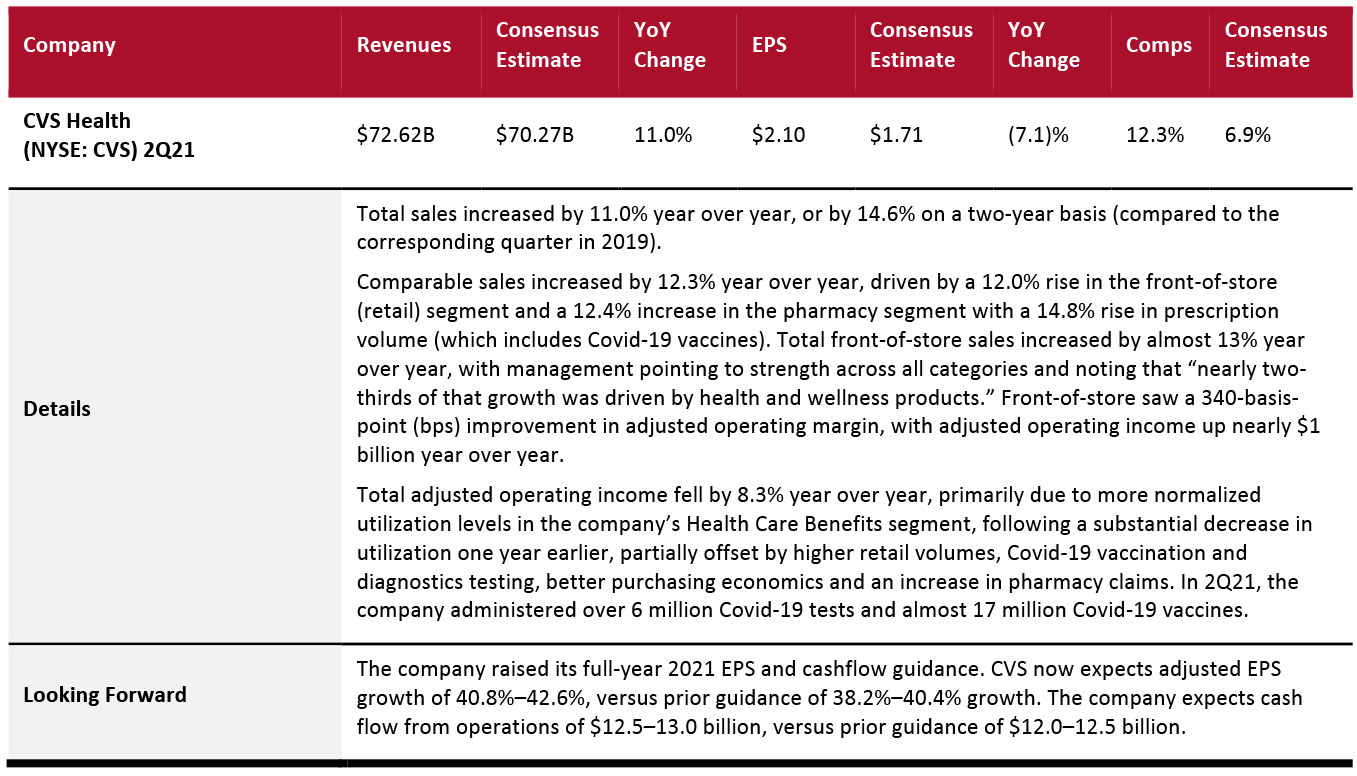

CVS Health’s sales growth accelerated in its latest quarter, driven by increased prescription volumes, and higher pharmacy and front-of-store sales—led by a rise in demand for health and wellness products

Food, Drug and Mass Retailers: Food and Grocery Retailers

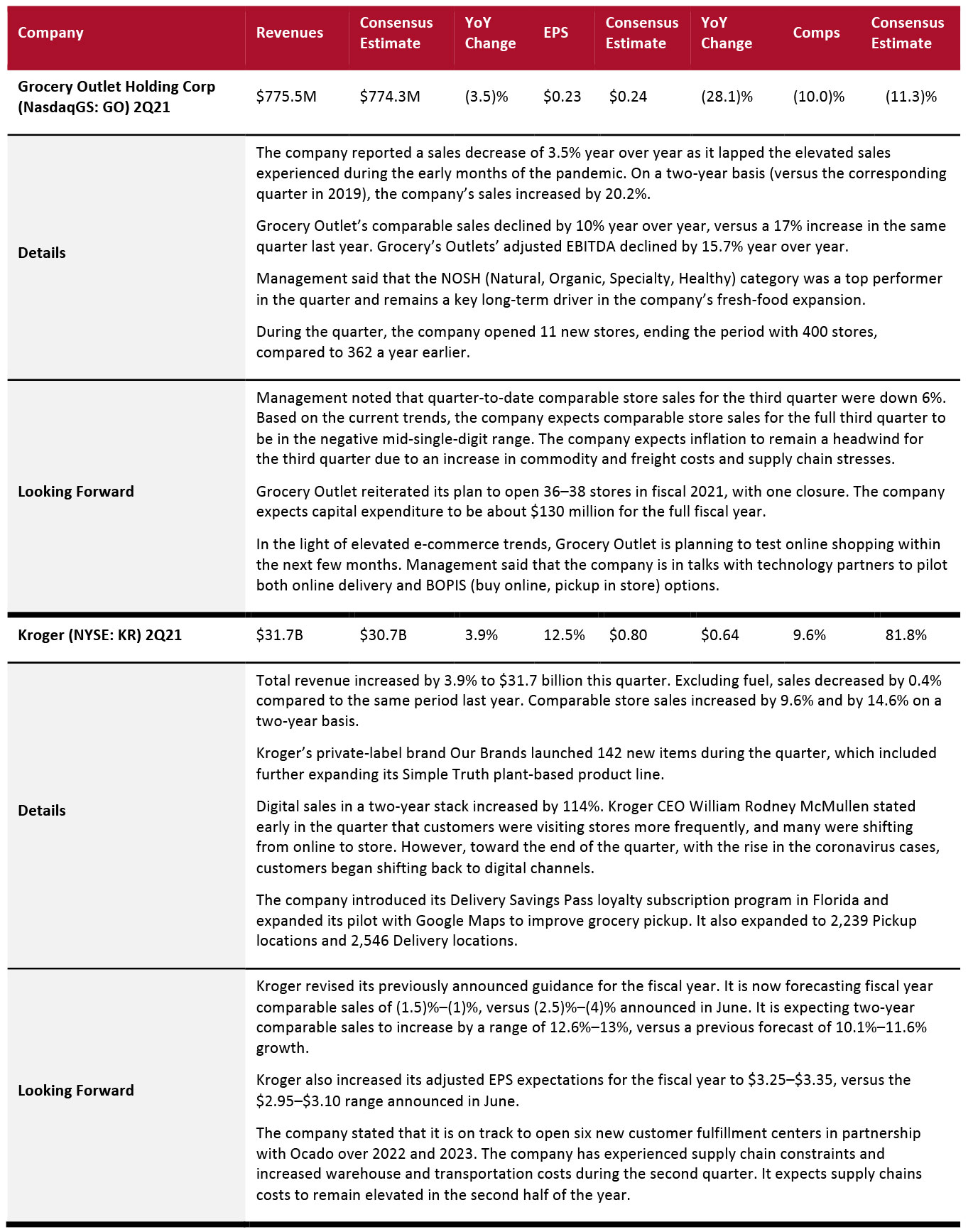

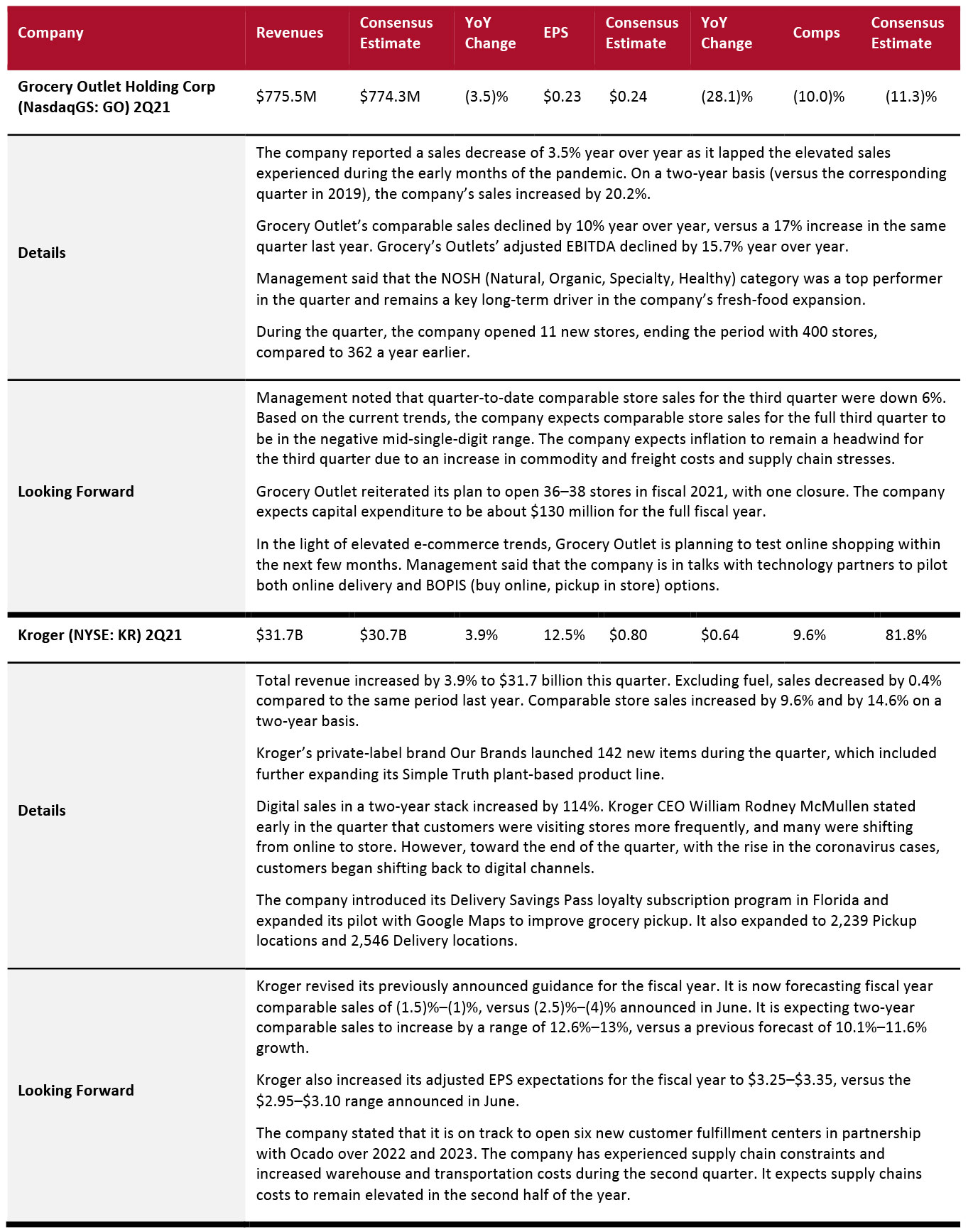

Kroger reported a high-single-digit year-over-year increase in comps, while Grocery Outlet reported a double-digit year-over-year decline. For the next quarter, both Kroger and Grocery Outlet expect comps to be in the negative single digits.

Food, Drug and Mass Retailers: Mass Merchandisers

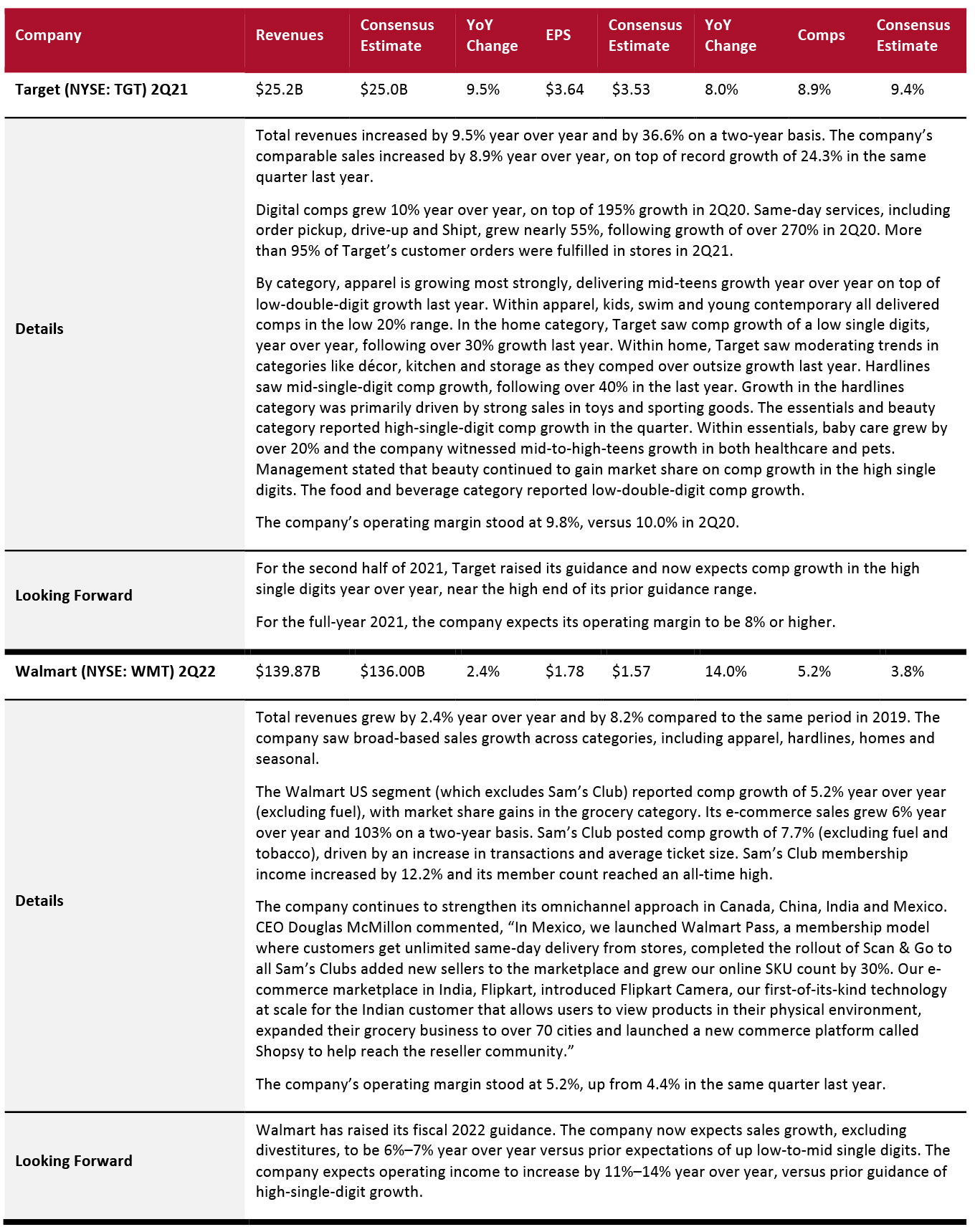

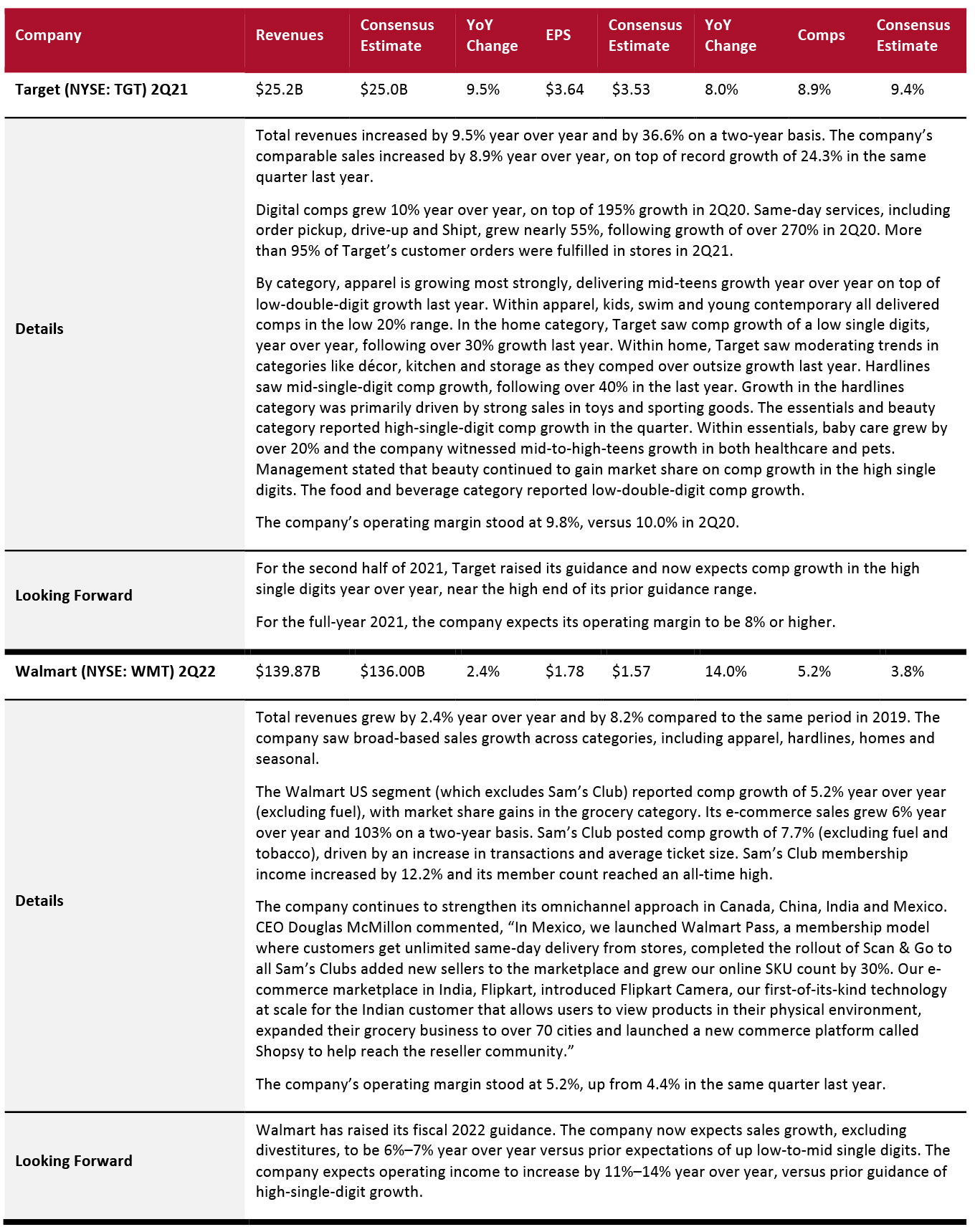

Mass merchandisers sustained their growth momentum in the latest quarter. On a two-year basis, Target reported double-digit sales growth, while Walmart posted high single-digit sales growth.

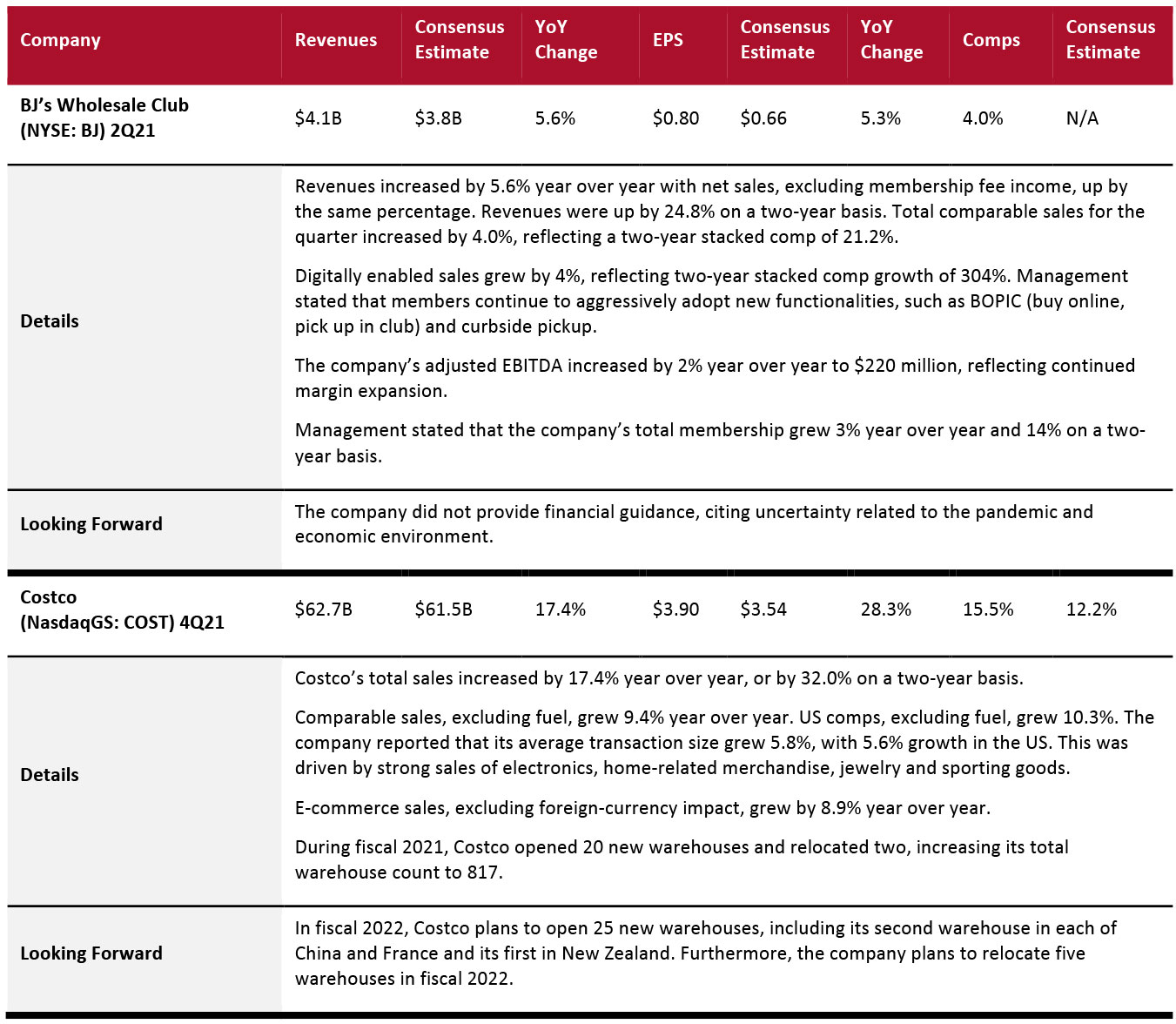

Food, Drug and Mass Retailers: Warehouse Clubs

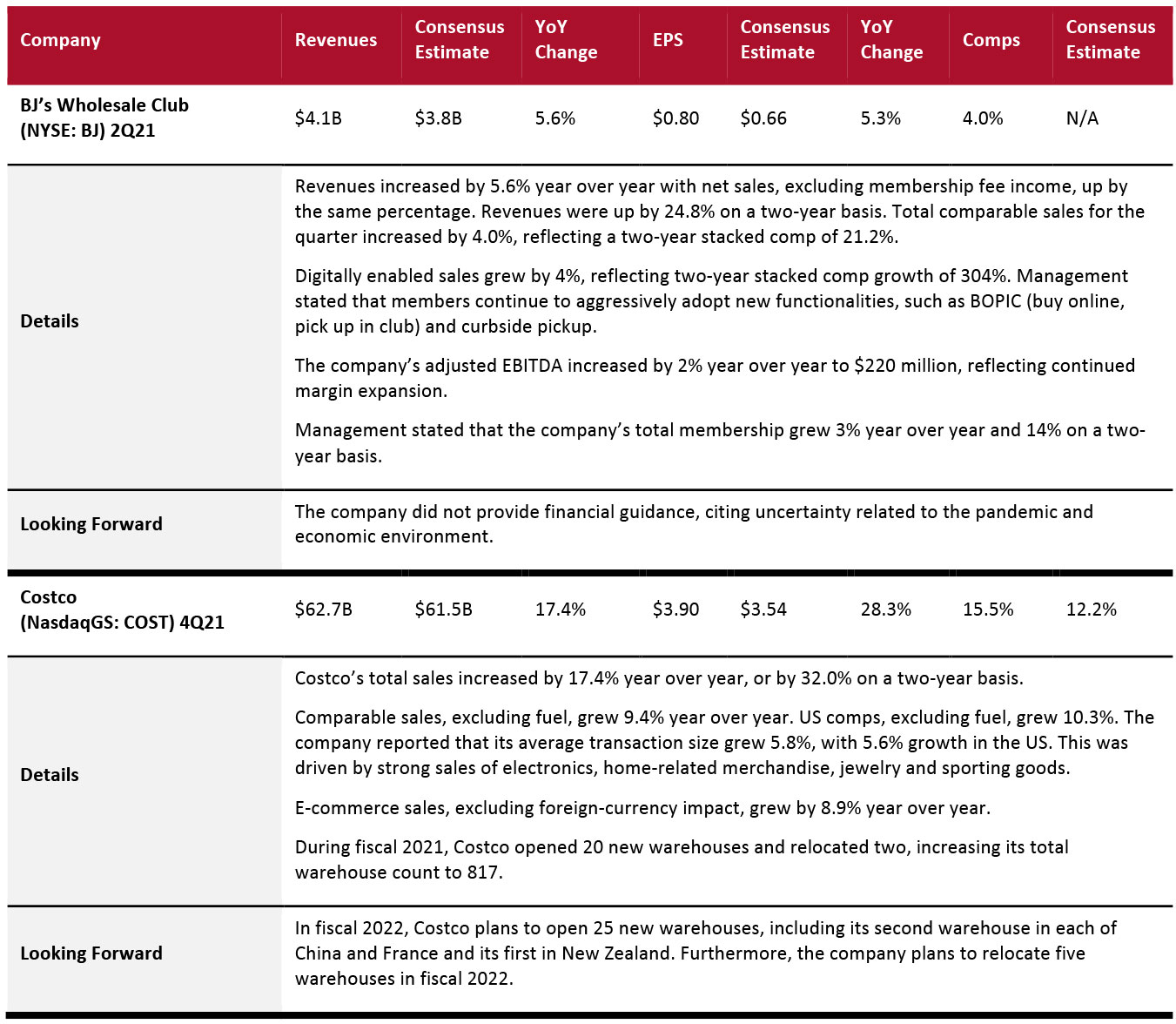

Warehouse clubs continue to perform strongly amid the pandemic. Electronics, household goods, jewelry and sporting goods saw strong sales in the quarter.

Warehouse clubs are well-positioned for sustainable growth, witnessing new club openings, positive core member trends, new member opportunities and growing e-commerce businesses.

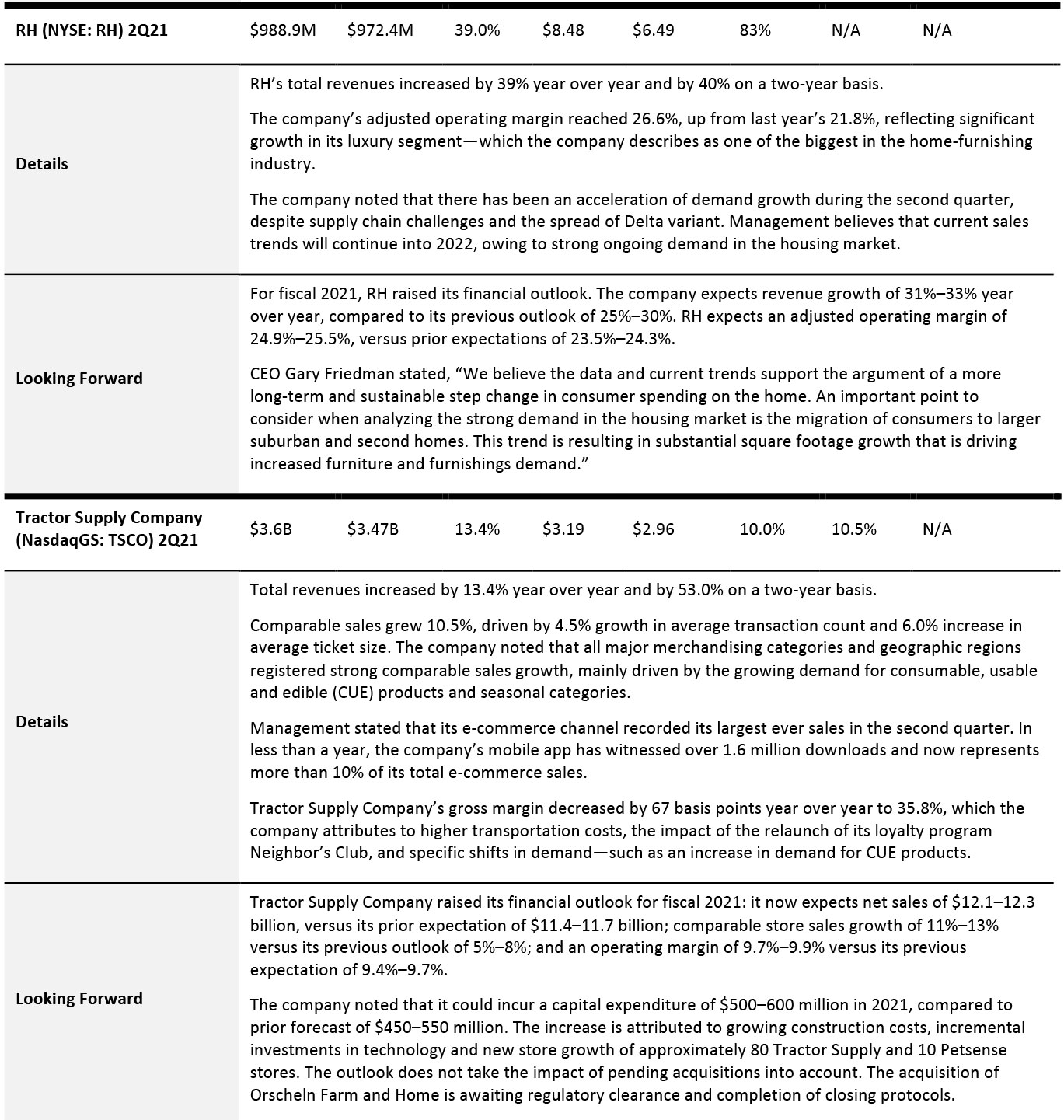

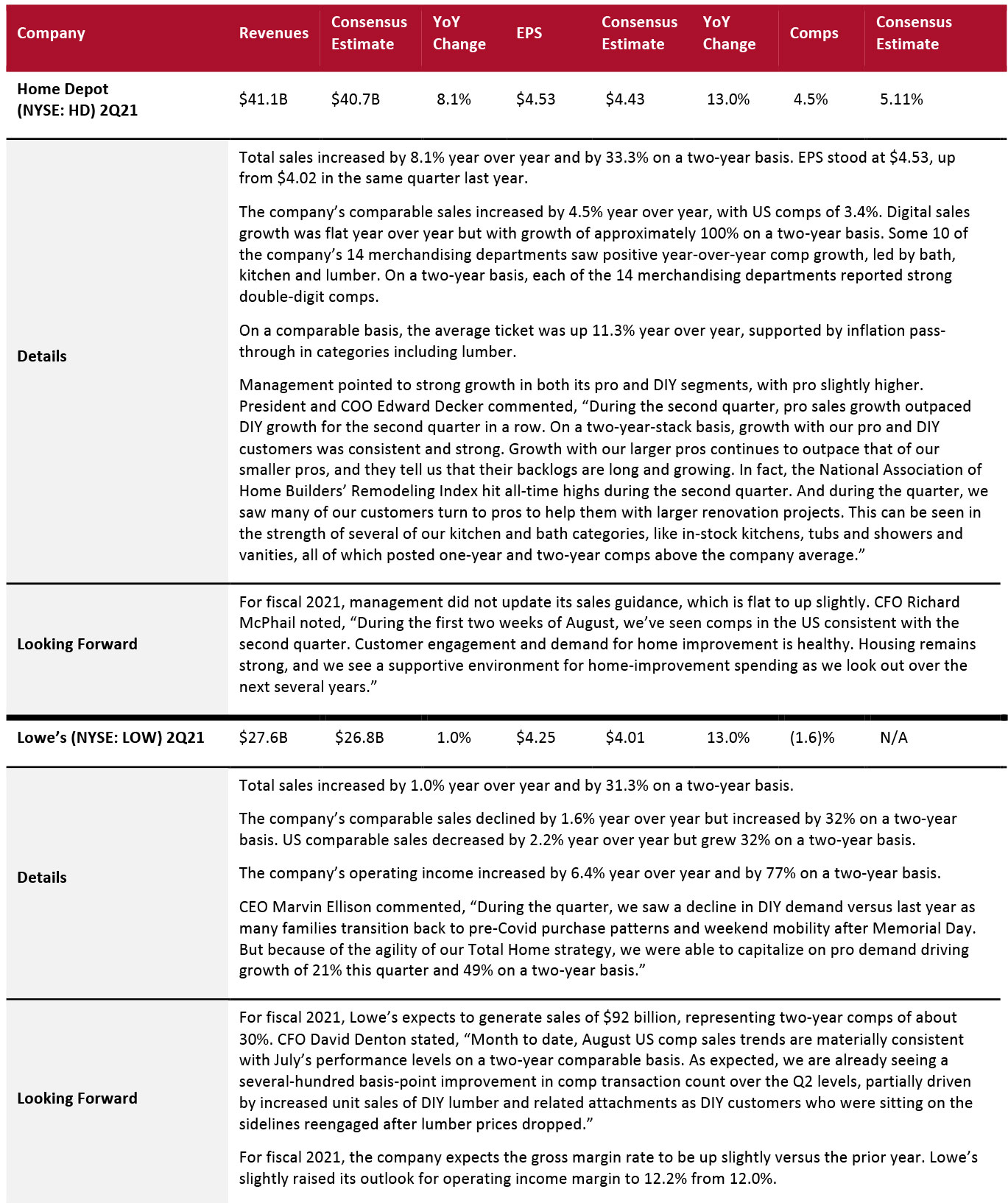

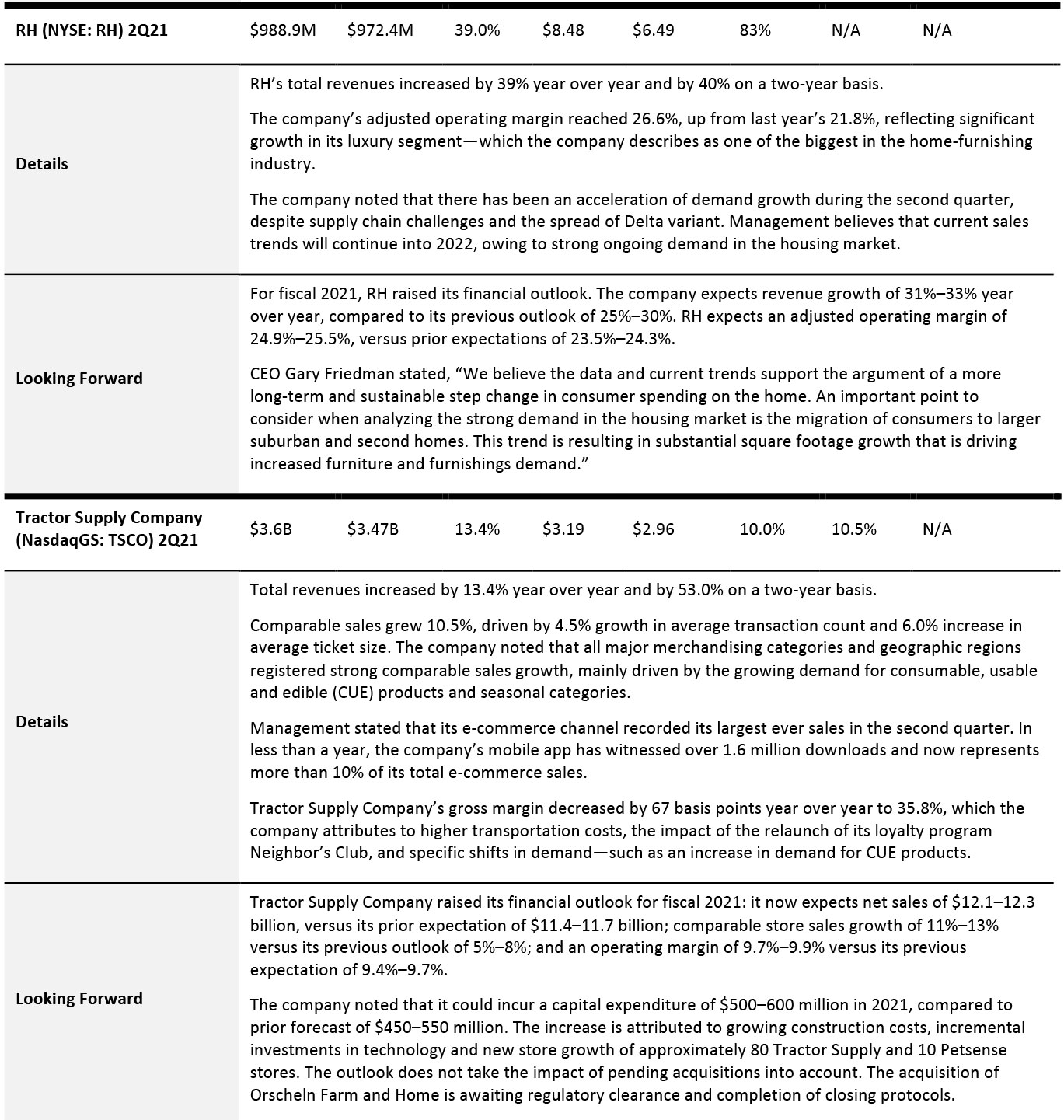

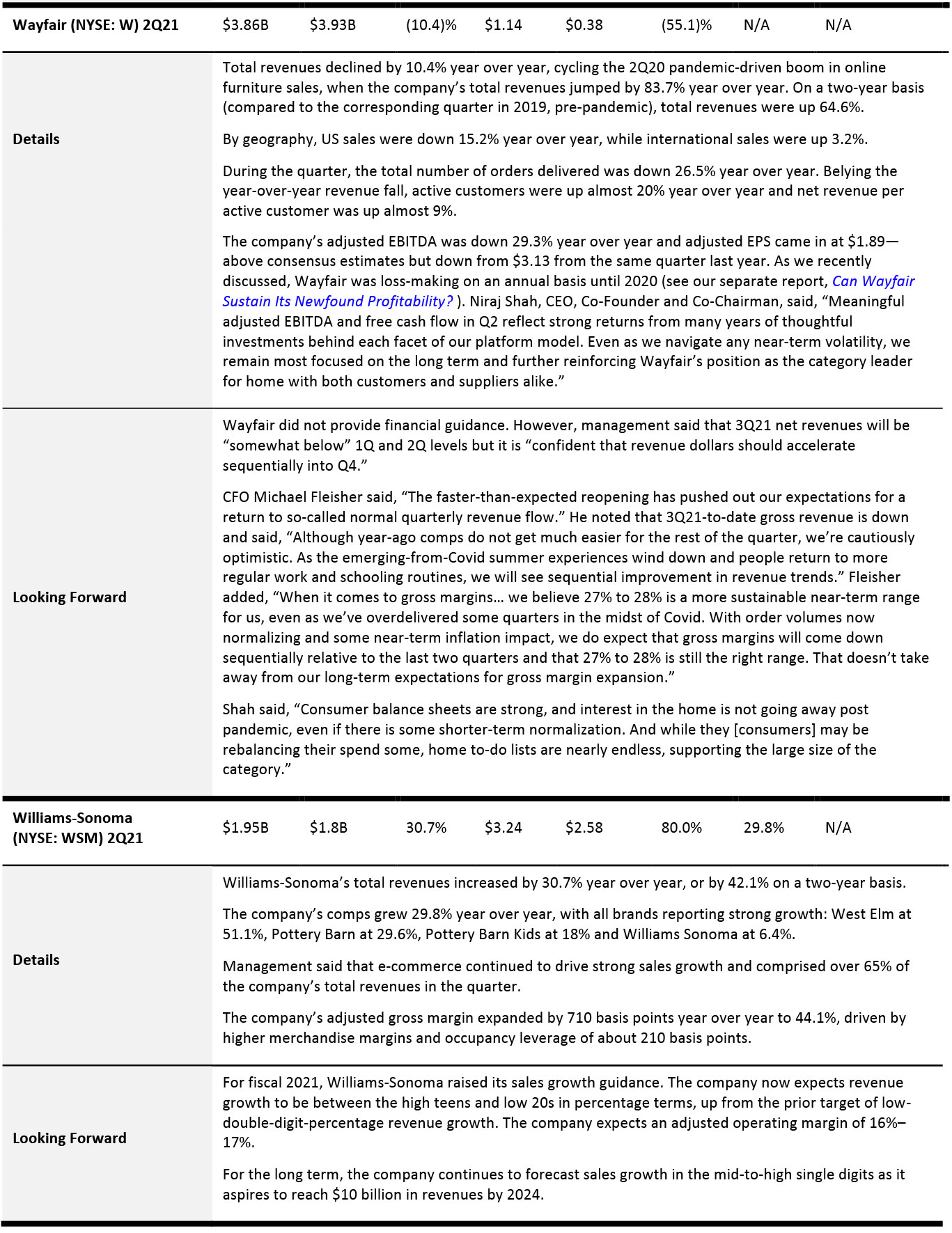

Home and Home-Improvement Retailers

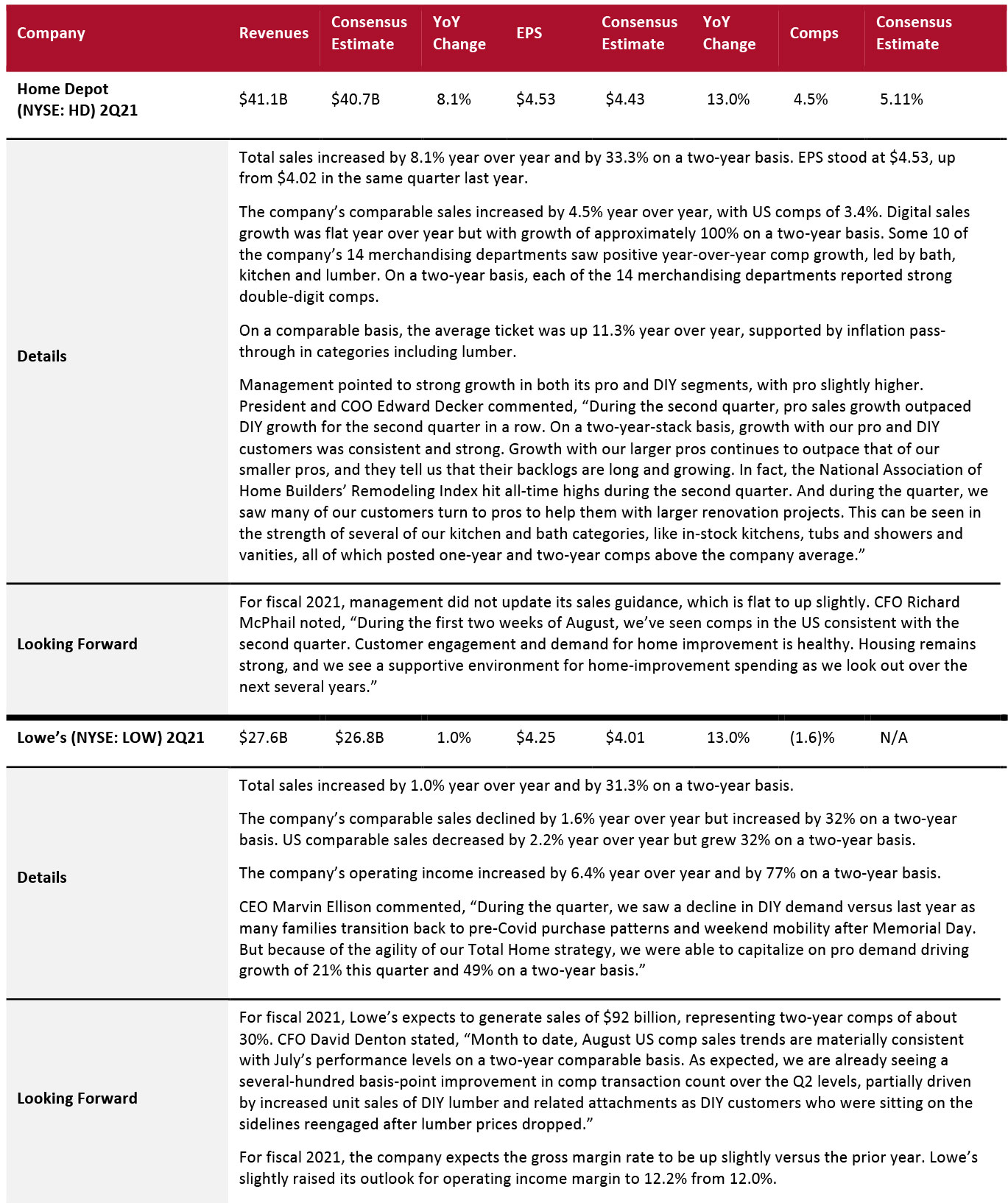

Home and home-improvement retailers sustained their growth momentum, with all covered retailers reporting sales growth of more than 30% on a two-year basis.

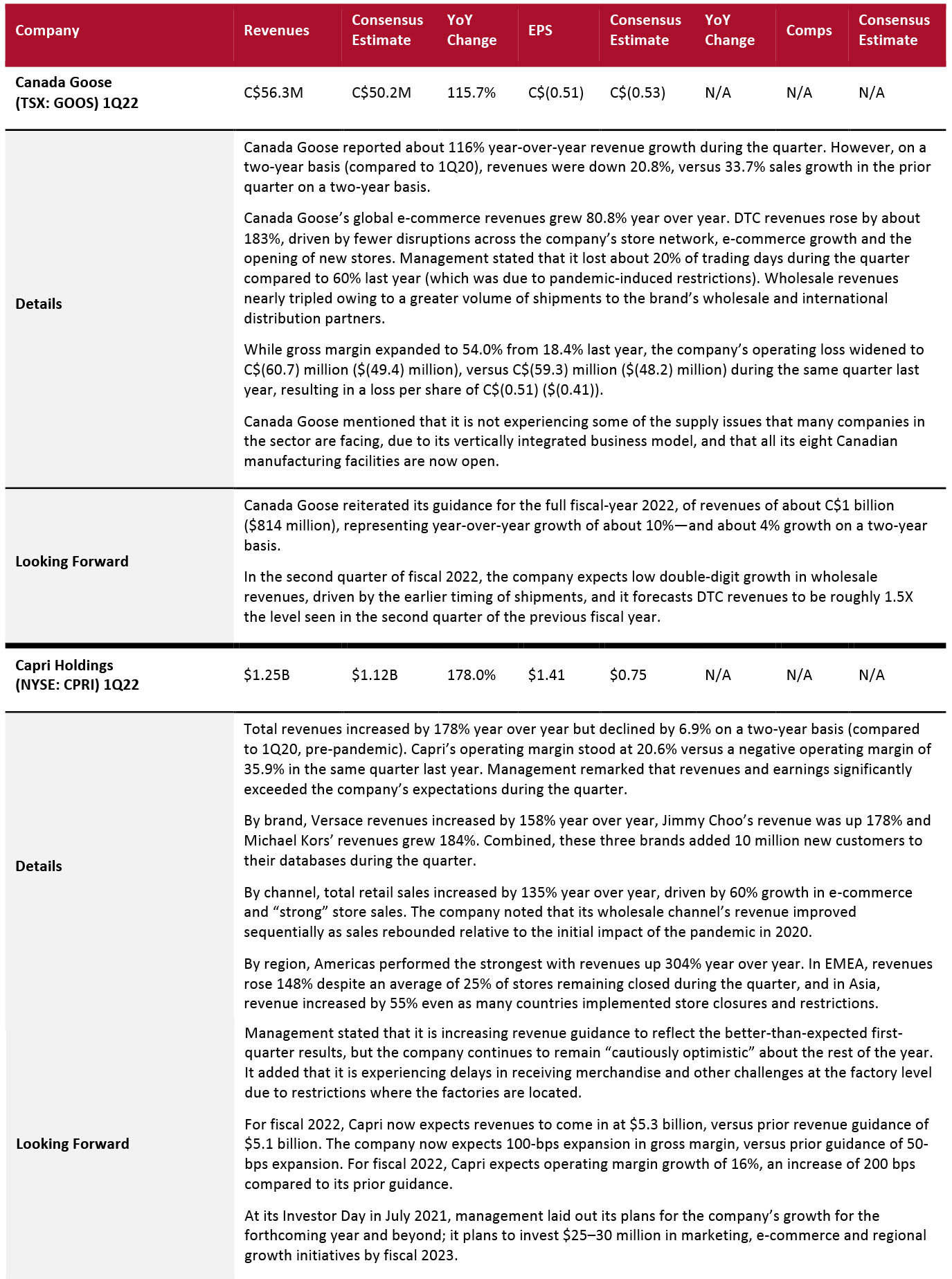

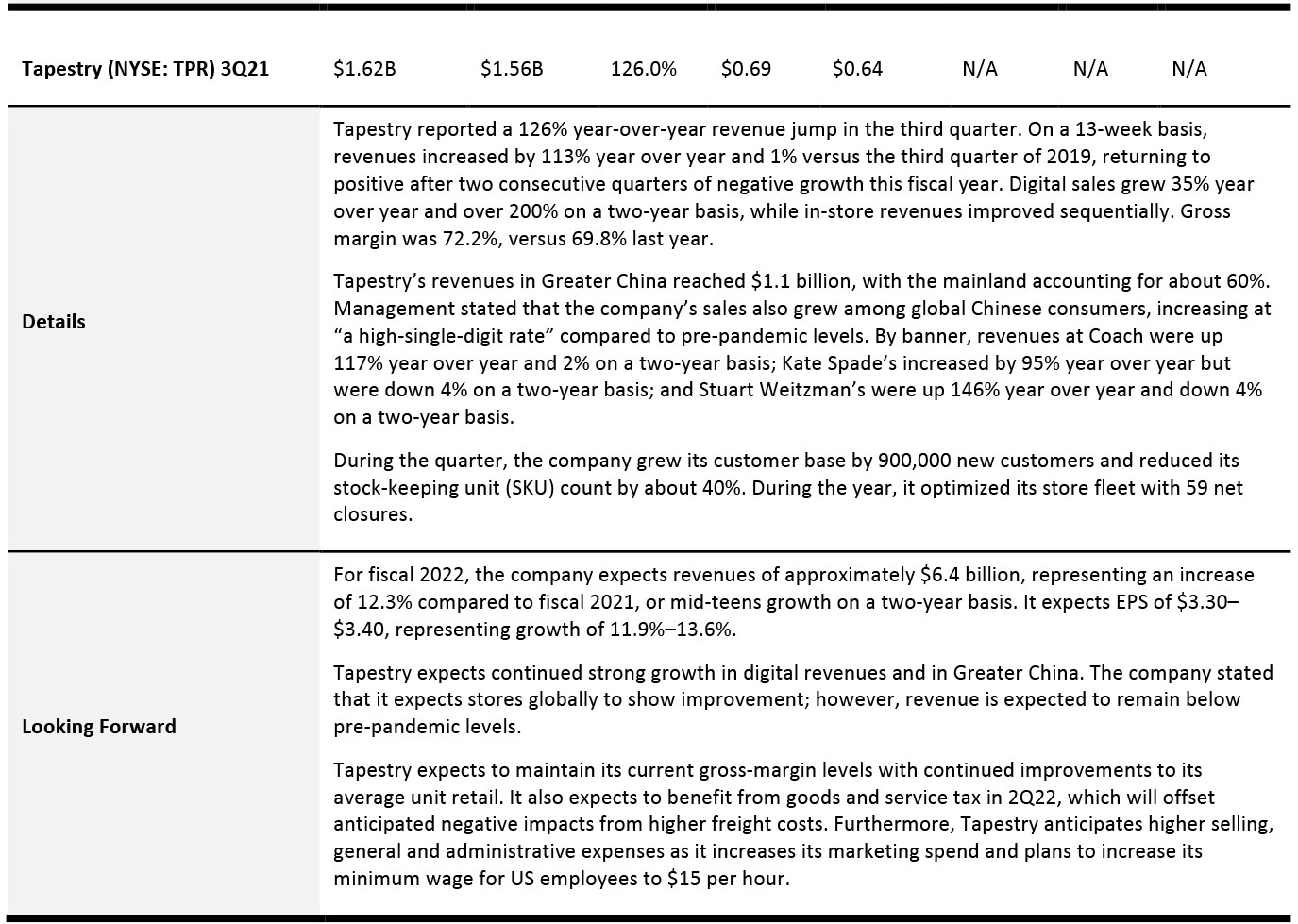

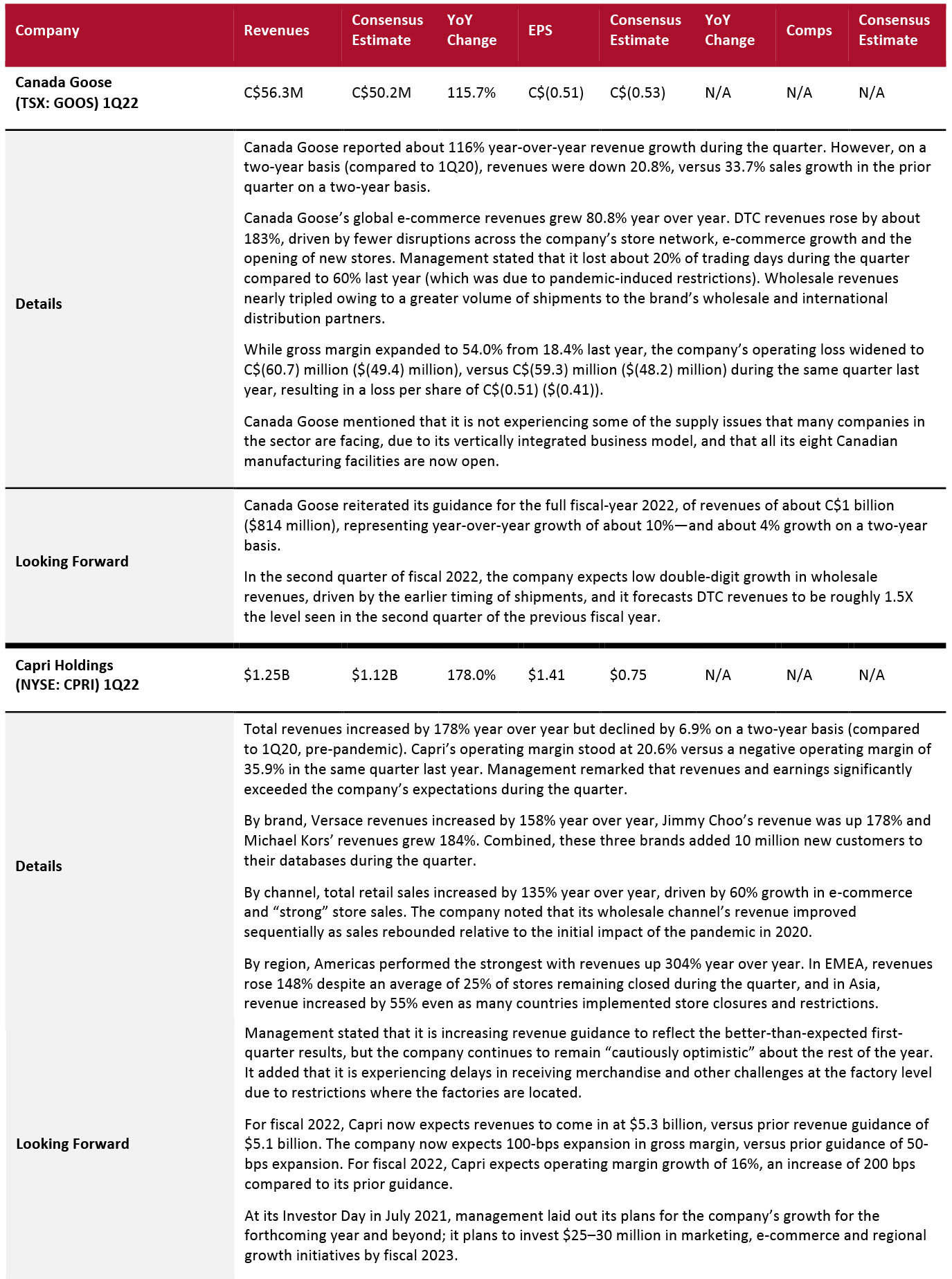

Luxury Companies

US-based luxury companies are reporting slow sales recoveries from pre-pandemic levels (slower than European firms, such as LVMH). On a two-year basis, Canada Goose reported a double-digit sales decline, Capri Holdings posted a high-single-digit sales decline, and Tapestry posted just 1% sales growth.

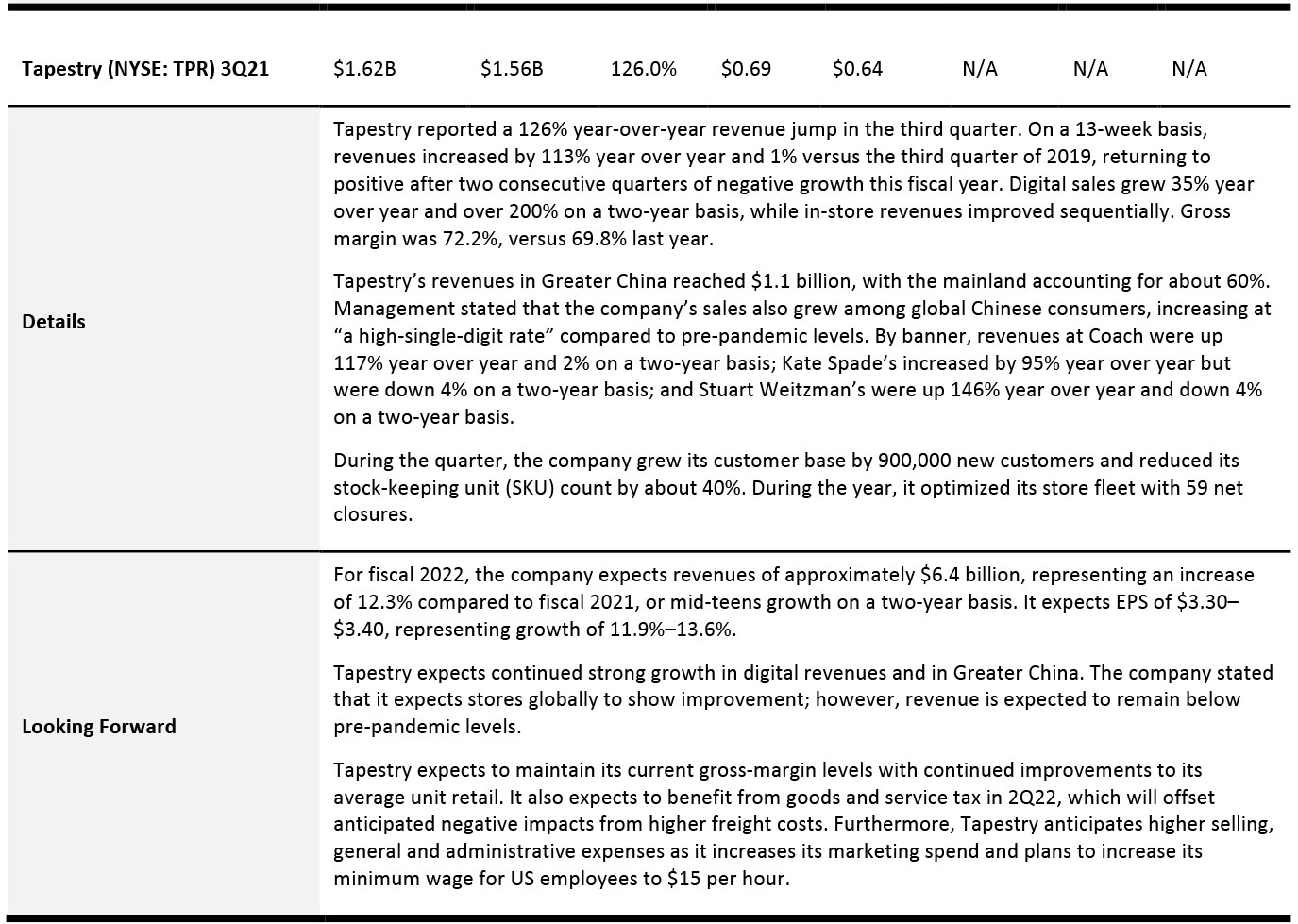

Luxury E-commerce

Luxury e-commerce platforms are recovering robustly. On a two-year basis (compared to the corresponding quarter in 2019), Farfetch posted triple-digit sales growth in its latest quarter and The RealReal reported double-digit sales growth.

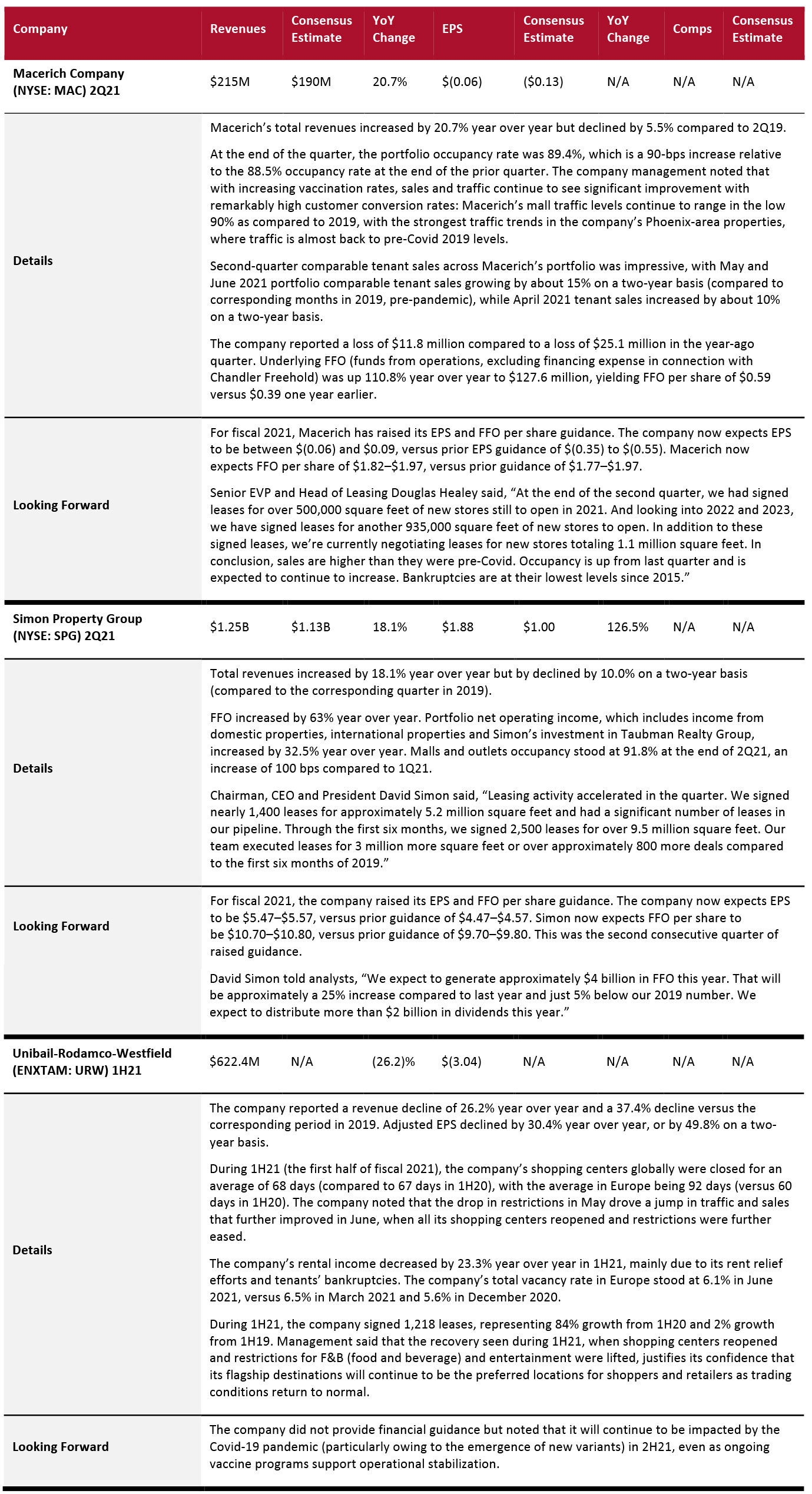

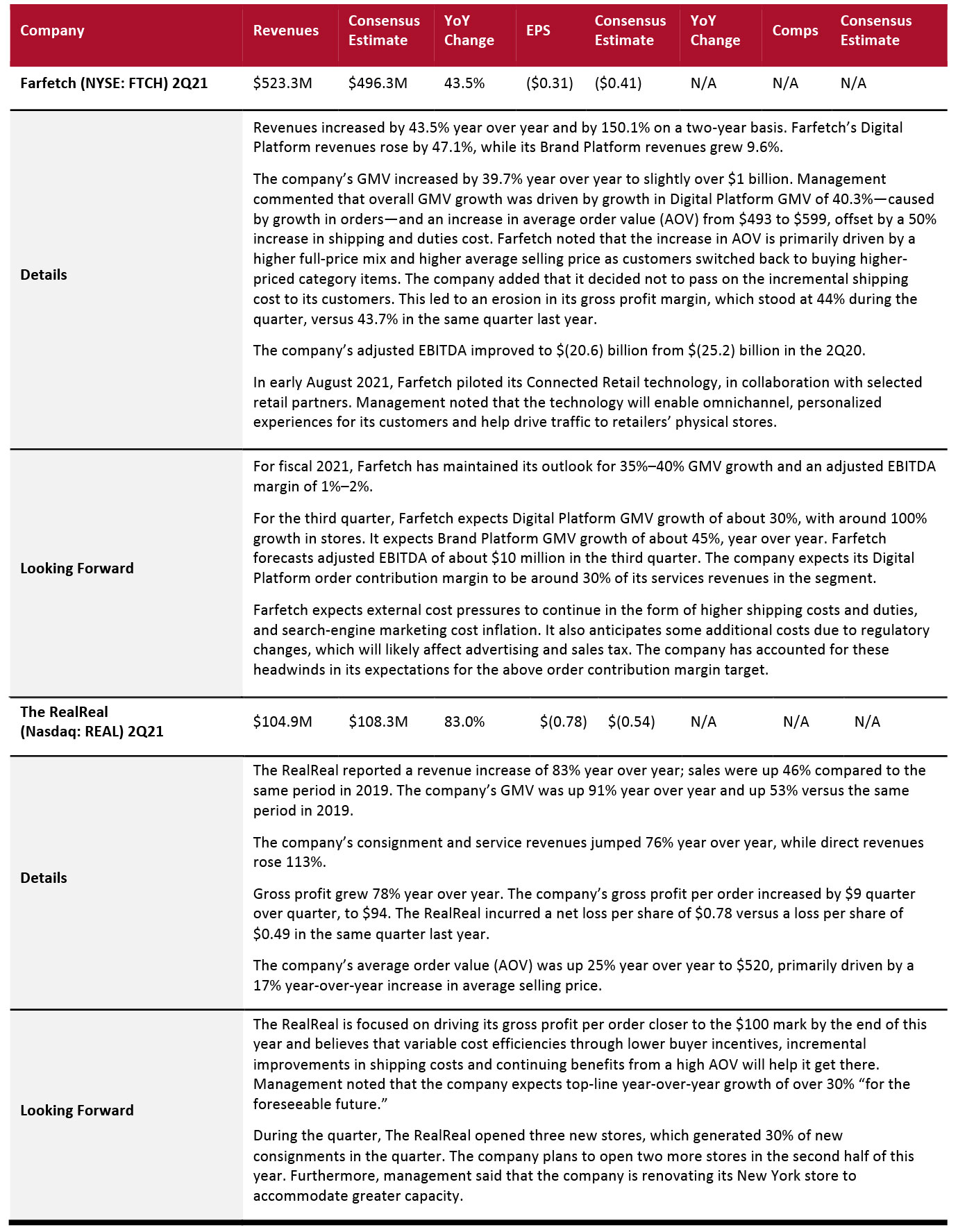

REITs

The REITs sector continues to suffer amid the Covid-19 crisis. All companies under our coverage reported a decline in revenues on a two-year basis.

However, the covered REITs remain optimistic about recovery through the remainder of 2021 and all raised their full-year earnings guidance. Macerich noted that it is observing encouraging trends in retail demand, sales and traffic.

Looking Forward

Retailers and brand owners saw a strong second quarter. Overall, apparel and footwear brand owners are witnessing a strong recovery, although pockets of weakness remain. Apparel specialty retailers reported another robust quarter, with all covered retailers posting strong positive sales growth on a two-year basis. While athleisure, casualwear and intimates remained catalysts for these retailers, they are also witnessing a strong rebound in demand for dresswear as consumers return to socializing.

Beauty retailers and brand owners continue to see a strong recovery. Within the category, bath, fragrance, haircare and skincare are recovering strongly, while demand for makeup is recovering gradually.

Off-price retailers reported another solid quarter. While the home category continues to outperform for these retailers, apparel is also performing well. These retailers remain optimistic for the holiday season and Ross Stores continued to expand its store estate. However, supply chain pressures and higher freight costs remain headwinds.

Major department stores are seeing solid recoveries from the crisis and they remain optimistic about the rest of 2021: All the covered retailers have raised their full-year 2021 guidance. They are seeing strong trends in various accessories, apparel and footwear categories, such as activewear, denim, dresses, fine jewelry and sneakers. They expect a strong holiday season, but also anticipate substantial headwinds—including elevated levels of holiday shipping surcharges, potential unforeseen impacts of the Delta variant, supply chain constraints and a tight labor market.

While consumers are increasingly returning to public places and social activities, home-related merchandise continued to perform well: All covered home-improvement retailers reported double-digit sales growth on a two-year basis. They see a continued supportive environment for home-furnishing and home-improvement spending in the near future.

Even as pandemic-related travel restrictions have eased, US-based luxury companies are witnessing slow sales recoveries from pre-pandemic levels (slower than European firms). On the other hand, US-based luxury e-commerce platforms are recovering strongly.

For the holiday season (October–December 2021), Coresight Research expects the

total US retail sales to increase by a 9%–10% year over year—the midpoint of our estimate would take two-year growth to 19.6%. Like last year,

e-commerce will likely continue to drive a greater share of holiday sales this year. To gear up for the holiday season, retailers should continue expanding their omnichannel offerings. Additionally, where possible, retailers should be prepared to quickly adjust inventory levels at stores by ensuring the capability to scale with customer demand—such as by expanding ship-from-store capabilities, or partnering with logistics firms that understand delivery needs and can help with inventory transportation into stores during the holidays.