Introduction

Our quarterly

US Retail Inventory Tracker reports review inventories held by US retailers in the

Coresight 100, our global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past eight quarters.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported 2Q20 results, which ended July 31. From May, sales declines at US brands and retailers began to ease as stores reopened and coronavirus lockdowns were lifted. Retail sales climbed 10.1% year-over-year in June, 9.7% in July and 5.6% in August.

Overview: Inventory Turnover Rates Increase Year over Year

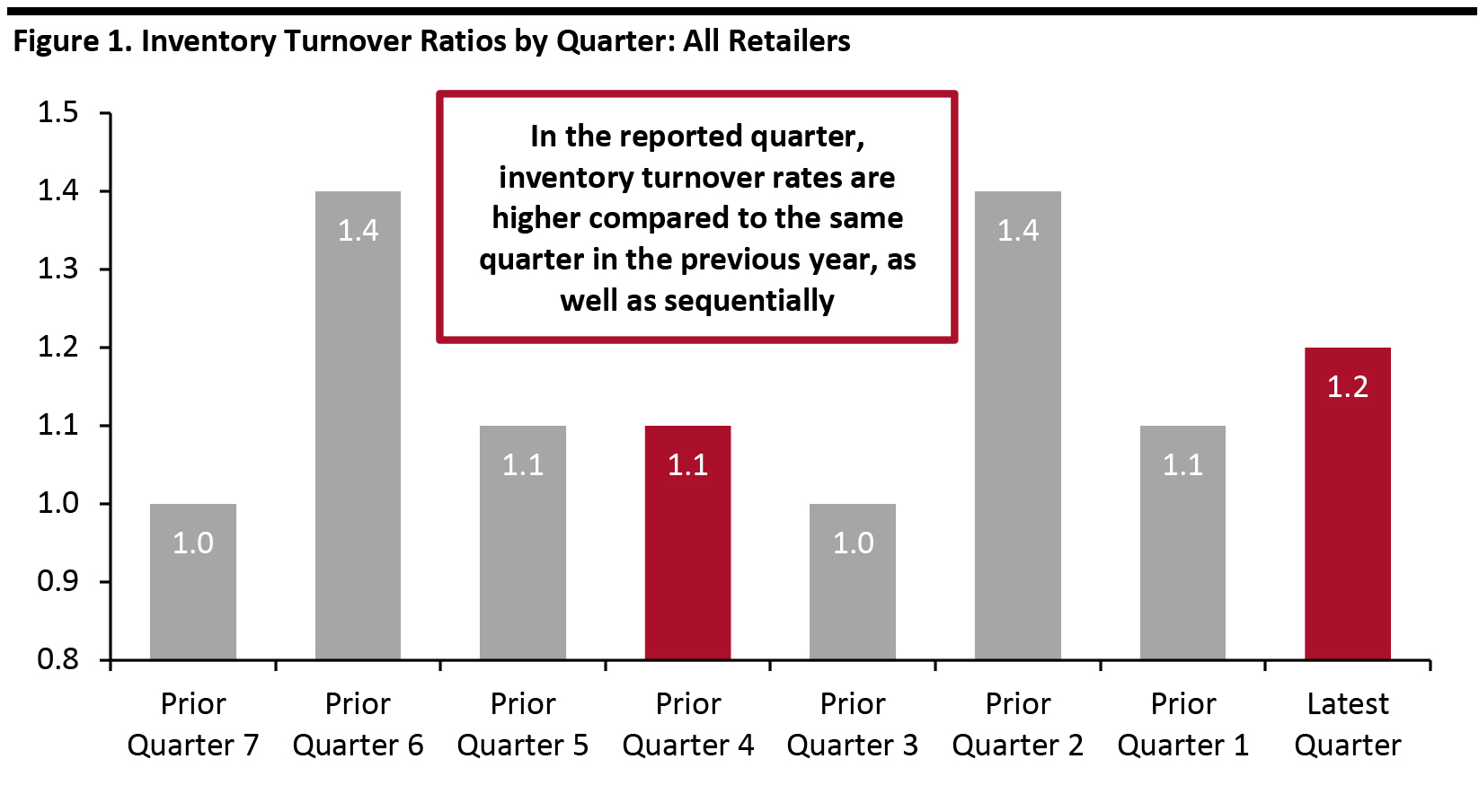

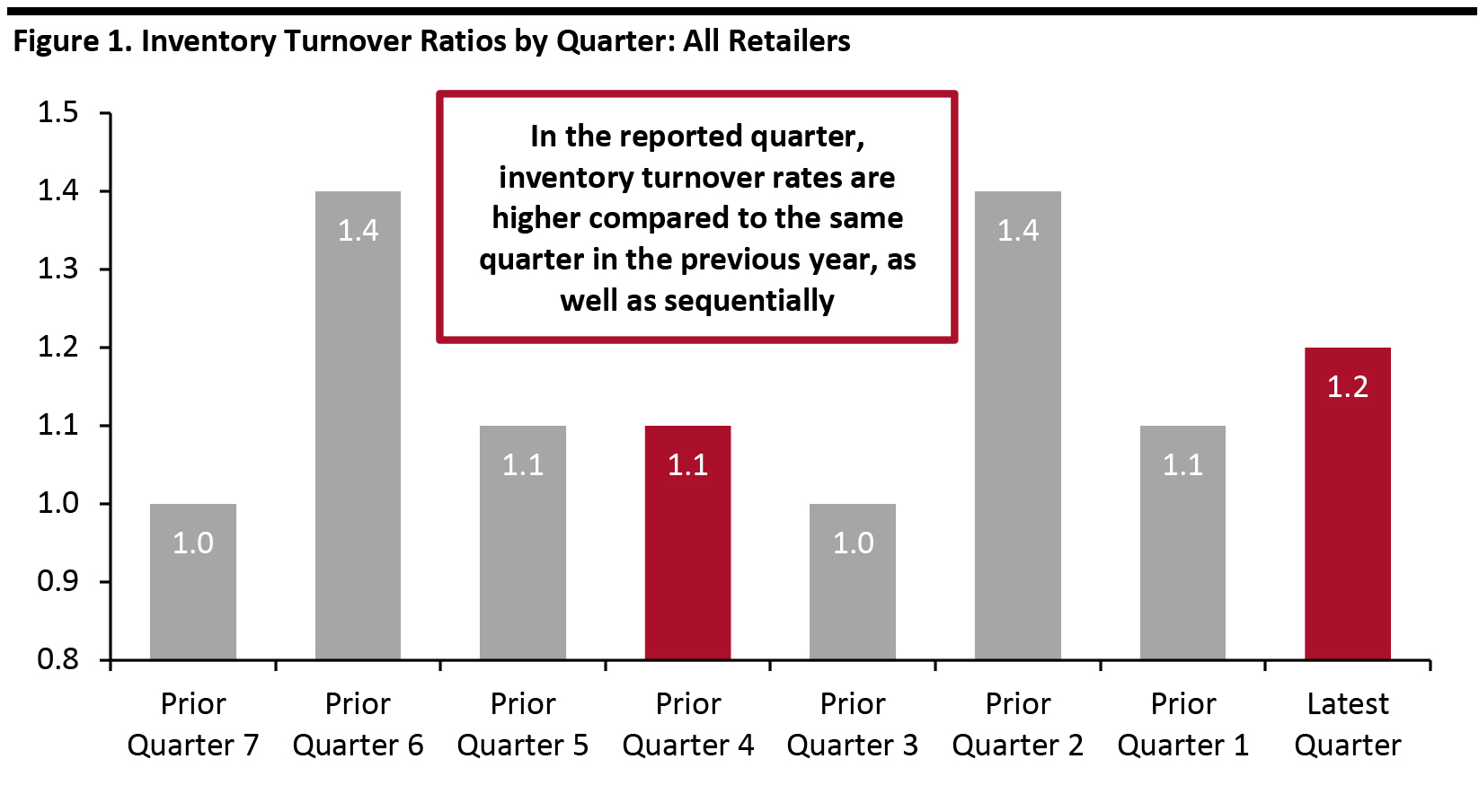

Most retailers covered here saw their inventory turnover rates increase compared to the same quarter in the previous year, as well as sequentially (quarter over quarter). The same quarter last year saw many retailers accumulate inventory to offset the impact of potential tariffs and support their expansion plans.

[caption id="attachment_116610" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

2Q20 saw a rebound from the point of inventory turnovers, mainly led by soaring digital sales. Home remains an outperforming category at most department stores, discount stores, mass merchandisers and off-price retailers. Further reflecting demand for home categories, home-improvement retailers witnessed a 30% growth in inventory turnover ratios.

Apparel specialty retailers saw their inventory turnover ratios increase 5% year over year in the second quarter versus a 15% decline in the first quarter, supported by strong pent-up demand. Essential retailers such as food, drug and mass retailers, maintained their growth momentum from the last quarter, with inventory turnover ratios increasing 6% year over year, in line with first quarter growth.

Luxury retailers posted a massive 60% year-over-year decline in inventory turnover ratios as demand for luxury goods remained subdued. Department stores saw their inventory turnover ratio decline 9% year over year in the second quarter. Our one covered beauty retailer (Ulta Beauty) saw a double-digit year-over-year decline in its inventory turnover ratio as demand for makeup was sharply curtailed by Covid-19, due to the realities of wearing masks, working from home, self-quarantine and social distancing requirements.

Our covered electronics retailer (Best Buy) saw growth in its inventory turnover ratio, accelerating to 33% in the second quarter from 23% in the first quarter. The company saw demand spike in certain categories including computing, appliances and tablets.

In the second quarter, some retailers recognized inventory reserves to account for a rise in inventory obsolescence or spoilage due to store closures. This reserve uses the money taken out of earnings to pay cash or noncash future costs associated with inventory—in accounting terms, an inventory reserve is a contra asset account that writes down the value of the inventory in the balance sheet.

On a sequential (quarter-over-quarter) basis, all retailers, except luxury retailers, witnessed positive growth in their inventory turnover ratios.

Figure 2. Inventory Turnover Ratios by Quarter

[wpdatatable id=465 table_view=regular]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

*Excludes Wayfair, an outlier

Source: Company reports/Coresight Research

Sector and Company Overview

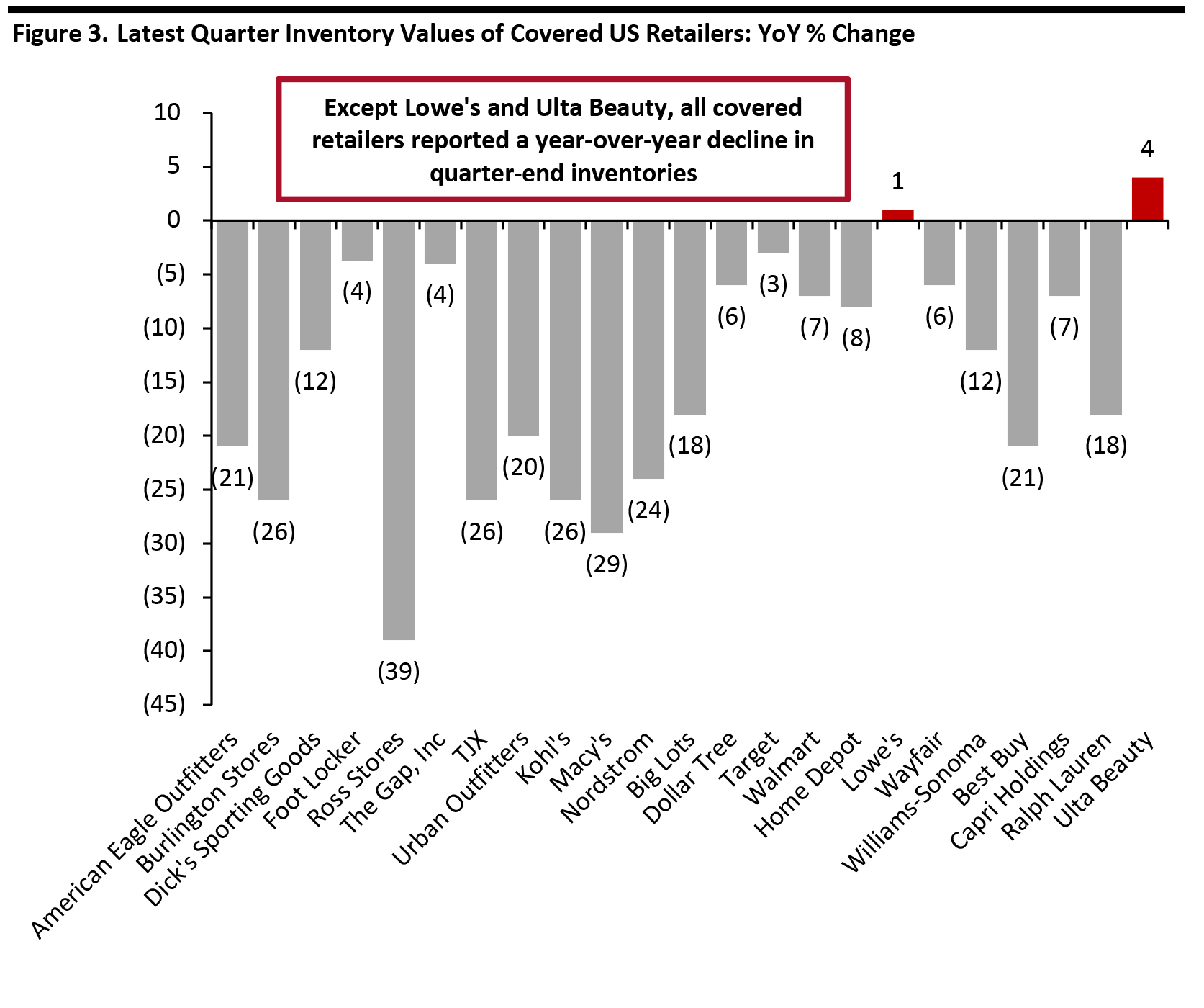

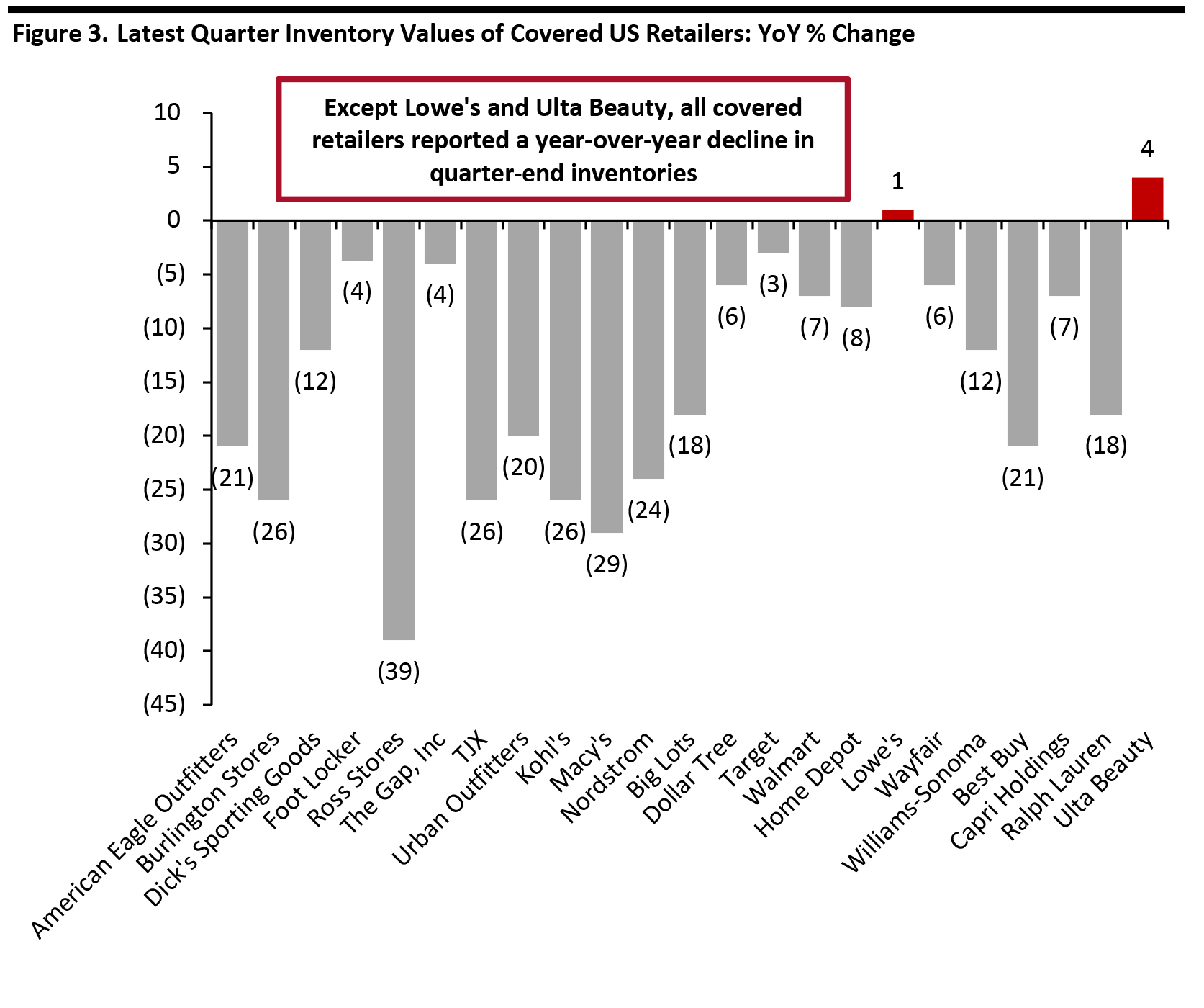

We look at the inventory levels of selected retailers across sectors and assess why inventory levels changed from the year-ago period.

[caption id="attachment_116611" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes or simply making misjudgments about the selection and design of products.

Most apparel specialty retailers saw growing preference for casual and athletic wear, while the demand for structured apparel—such as for the office and events—remains weak. The majority of apparel companies reported higher inventory turnover ratios, both compared to the year-ago period and sequentially.

Off-price retailers, such as Burlington Stores, Ross Stores and TJX, saw major year-over-year declines in their inventories as they aggressively cleared aged merchandise through markdowns. This was compounded by challenges in replenishing depleted inventory levels in their stores due to delays in getting through receipt backlogs and owing to their conservative approaches to planning in the current coronavirus-impacted environment. Furthermore, staffing shortages at distribution centers hindered their abilities to get their facilities up to full capacity.

|

Commentary |

| American Eagle Outfitters |

The company ended the second quarter with inventory down 21% year over year, mainly driven by reductions in American Eagle (AE) stocks. The company cut receipts due to store closures as well as its inventory optimization initiatives, which focus on choice and SKU count reductions. In Aerie, the company continued to invest in inventory to support its growth momentum. |

| Burlington Stores |

The company’s total inventory was down 26% at the end of the quarter. Pack and hold inventory comprised 26% of total inventory, down from 29% in the same quarter last year.

CFO John Crimmins said, “We are planning in-store inventories to remain well below last year's levels. We would expect them to be down about 20% to 25% on a comp store basis by the end of the third quarter. But we anticipate at the end of the quarter, total inventories may be closer to flat versus last year, driven by increased reserve inventory [to account for a rise in inventory obsolescence due to store closures and in anticipation of a very promotional environment in the coming months], specifically spring and summer pack and hold, which may grow significantly.” |

| Dick’s Sporting Goods

|

The company’s quarter-end inventory levels were down 12% year over year.

CEO Edward Stack said, “There are inventory constraints across a number of categories. With those constraints, we don't think it's going to get very promotional. I think vendors are being very cautious and to make sure that the market doesn't get flooded with products that needs to be cleaned up going into next year.” |

| Foot Locker

|

The company ended the second quarter with inventory down 3.7% year over year on a constant-currency basis, compared to a 17.1% growth in sales. |

| Ross Stores

|

The company’s total inventories were down 39% year over year. Packaway levels were 25% of the total inventory, down from last year’s 43% as the company used packaway to replenish store inventory throughout the quarter.

CEO Barbara Rentler said, “During the initial reopenings, overall sales were ahead of our conservative plans as we benefited from pent-up demand and aggressive markdowns to clear aged inventory. In the weeks thereafter, trends were negatively impacted from depleted store inventory levels, while we were ramping up our buying and distribution capabilities.” |

| The Gap, Inc

|

The company’s inventory was down 4% year over year at quarter end. Excluding pack and hold inventory, total inventory declined 10%.

For the remainder of the year, the company expects inventory, excluding pack and hold, to be down mid-single digits. The company said that its inventory is now better aligned to the elevated demand in its online channel and anticipates shipping expense to moderate in the second half of the year. |

| The TJX Companies

|

The company ended the quarter with inventory down 26% year over year. TJX management said that the overall inventory was lighter than expected but the company is happy with productivity of its store inventory and turnover was very healthy. |

| Urban Outfitters

|

The company’s inventory was down 20% year over year. Both Free People and Urban brands registered a record low in their quarterly markdown rate. Urban brands ended the quarter with its comp inventory down 18%. The company said that it entered the fall shopping season with clean inventories at all brands. |

Department Stores

All department stores that reported second-quarter results witnessed a year-over-year decline in inventory levels at the end of the quarter.

| |

Commentary |

| Kohl’s

|

The company’s inventory was down 26% year over year, driven by lower inventory receipts during the quarter and the company working through existing inventory as stores reopened.

For the second half of the year, management said that the company would continue to plan its inventory position conservatively but would be working closely with its vendors to meet any upside demand. |

| Macy’s

|

The company ended the second quarter with inventory down 29% year over year and entered the third quarter with a clean inventory position. The Macy’s management team reported that the company has very good sales-to-stock parity going into the fall season. |

| Nordstrom

|

The company increased receipts in July as it geared up for its Anniversary Sale that began on August 4. In off-price sales, traffic remains consistent and the company started to see steady improvement in conversion as it began to flow in inventory receipts. The company exited the second quarter in a clean position, with inventory decline in line with sales, excluding the Anniversary shift.

For the second half of the year, the company is expecting increased inventory receipts in full-rice and a steady flow of inventory receipts in off-price. |

Food, Drug and Mass Retailers

Most food retailers, drug retailers and mass merchants witnessed higher than anticipated demand, leading to out-of-stocks in certain categories. However, retailers expect inventory levels to move to a more normal position in the second half of the year.

| |

Commentary |

| Big Lots

|

The company ended the quarter with inventory down 18%, driven by strong sales in most merchandise categories. The company expects inventory decline to moderate over the course of the third quarter. |

| Dollar Tree |

The company’s total inventory declined 4.2%, while inventory per selling square foot decreased 7.6%. Family Dollar inventory reflects higher-than-normal out-of-stocks in certain categories. |

| Target

|

The company ended the quarter with inventory down 3%, versus a year-to-date sales increase of over 18%.

In the second half of the year, Target plans to heavily invest in inventory in categories such as food and general merchandise. Management said that the company’s import inventory will reach last year’s levels by the end of the third quarter and should exceed well beyond last year’s levels in the fourth quarter. |

| Walmart

|

The company’s inventory declined 7%, primarily due to heightened demand.

CEO of Walmart US John Furner said, “Early in the quarter [second quarter], coming out of the first quarter, we dealt with a number of issues in with out-of-stocks. Those had a disproportionate effect on our business. We will just work through different categories and issues we have with the supply chain not being able to fill at the right time. But in general, the inventory levels are coming back into a more normalized position.” |

Home and Home-Improvement Retailers

Most of the home and home-improvement retailers reported a strong improvement in their inventory turnover ratio compared to the year-ago period.

| |

Commentary |

| Home Depot |

The company’s merchandise inventories declined 8%, driven by strong demand during the quarter. Inventory turns were 6.1x, up from 5.1x in the same quarter last year. |

| Lowe’s

|

The company’s inventory was about flat compared to the previous year levels. The company said that it managed its supply chain well to meet elevated customer demand throughout the quarter. |

| Wayfair |

Cofounder Steven Conine said, “We and the industry operated with higher-than-usual out-of-stocks across a narrow set of categories in the second quarter. The out-of-stocks were most acute in late spring and early summer. As we worked with suppliers to circumvent these issues, we increased visibility into our partner supply chains and built more flexibility and connectivity between CastleGate [logistics platform provider] and its respective networks.” |

| Williams-Sonoma |

The company’s merchandise inventories were down 12% year over year, which the Williams-Sonoma attributed to its efforts to cut and push its inventory purchases to preserve its liquidity at the beginning of the pandemic, and the impact of its e-commerce channel outperformance in the first and second quarters. |

Electronics Retailer

| |

Commentary |

| Best Buy |

The company ended the quarter with inventory down 21% compared to the same period last year. Best Buy management said that the company experienced inventory constraints in a number of categories such as gaming consoles, which did moderate its sales growth. |

Luxury Retailers

Most luxury retailers expect inventory to sequentially decline in the second half of the year to align stocks with expected demand and revenue decline.

| |

Commentary |

| Capri Holdings |

The company’s inventory declined 7% year over year. The company expects inventory to sequentially decline throughout fiscal year 2021 and end the year about in line with its full year revenue decline. |

| Ralph Lauren |

The company’s total inventory declined 18%, while net inventory, which excludes inventory reserve and allocated goods and materials, was down 22% year over year. The company expects this inventory trend to continue in the next quarter.

CEO Patrice Jean Louis Louvet said, “We stopped shipping Spring/Summer products to nearly all wholesale accounts in March, which prevented buildup of excess inventories. We also proactively reduced our Fall/Holiday orders by two-thirds at the start of the Covid-19 pandemic in order to reintegrate existing product into upcoming collections. While these reductions are driving significant declines in our first half sell-in to wholesale, they are a critical step to realign our inventories to expected demand.” |

Beauty Retailer

| |

Commentary |

| Ulta Beauty |

The company’s total inventory grew 4% as the company needed inventory to support its 51 net new stores. However, inventory per store decreased slightly.

During the quarter, the company increased inventory reserves by $16.5 million to adjust for discontinued and slow-turning makeup SKUs and permanently closed stores. Furthermore, the company wrote off $1.4 million for inventory related to the previously announced 19 store closures expected in the third quarter. |

Looking Forward

In the second quarter of 2020, most retailers experienced positive impacts on their inventory turnover ratios due to stores reopening and the easing of some restrictions. During the initial reopenings in May, we saw a significant return to in-store shopping, as reflected in the higher-than-anticipated sales productivity of reopened stores (especially for apparel and department stores) as compared to last year’s levels. Retailers also turned to aggressive markdowns to clear aged inventory. However in the weeks thereafter, retailers witnessed depleting store inventory levels that impacted their sales.

Some retailers, such as Ulta Beauty and Burlington Stores, have invested substantially in inventory reserves to keep their inventories aligned with consumer demand and protect against a future need to make additional markdowns. On the other hand, mass merchandisers, such as Target and Walmart, are investing to offset out-of-stocks in multiple categories, such as food and general merchandise.

The holiday shopping season is likely to start as early as October, providing for an extended shopping period. We expect the e-commerce channel to drive a significantly greater share of sales compared to last year. For the holiday season, retailers should be prepared to quickly adjust inventory levels at stores. This requires ensuring that capabilities to scale to customer demand are in place—for instance, through expanding ship-from-store capabilities or partnering with logistics firms that understand delivery needs and can help brands and retailers with transportation of inventory into stores during the holiday season.

Retailers may need to reassess their usual assortment and accumulate more stock in some categories and less in others, given fluctuating consumer demand. An efficient inventory management system could reroute in-store stock that has low demand in some areas to locations where demand is high. Similarly, data-driven insights can facilitate more efficient inventory planning and in-store innovation—which have proved key for retailers amid the Covid-19 crisis. Furthermore, retailers should be prepared for potential inventory shortages in case there is a resurgence of the virus. To reduce the risk of supply chain disruptions during the holidays, retailers could diversify sourcing options and work with a variety of suppliers and manufacturers.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes or simply making misjudgments about the selection and design of products.

Most apparel specialty retailers saw growing preference for casual and athletic wear, while the demand for structured apparel—such as for the office and events—remains weak. The majority of apparel companies reported higher inventory turnover ratios, both compared to the year-ago period and sequentially.

Off-price retailers, such as Burlington Stores, Ross Stores and TJX, saw major year-over-year declines in their inventories as they aggressively cleared aged merchandise through markdowns. This was compounded by challenges in replenishing depleted inventory levels in their stores due to delays in getting through receipt backlogs and owing to their conservative approaches to planning in the current coronavirus-impacted environment. Furthermore, staffing shortages at distribution centers hindered their abilities to get their facilities up to full capacity.

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes or simply making misjudgments about the selection and design of products.

Most apparel specialty retailers saw growing preference for casual and athletic wear, while the demand for structured apparel—such as for the office and events—remains weak. The majority of apparel companies reported higher inventory turnover ratios, both compared to the year-ago period and sequentially.

Off-price retailers, such as Burlington Stores, Ross Stores and TJX, saw major year-over-year declines in their inventories as they aggressively cleared aged merchandise through markdowns. This was compounded by challenges in replenishing depleted inventory levels in their stores due to delays in getting through receipt backlogs and owing to their conservative approaches to planning in the current coronavirus-impacted environment. Furthermore, staffing shortages at distribution centers hindered their abilities to get their facilities up to full capacity.