Introduction

Our second-quarter 2020 (2Q20) wrap-up covers the quarterly earnings of 62 (mostly) US-based retailers, brands, e-commerce platforms and REITs in the Coresight 100.

- Over three-quarters (76% or 47 companies) beat revenue consensus estimates, 22.6% (14 companies) missed revenue consensus estimates, and one company reported revenues in line with consensus.

- Home and home-improvement retailers, e-commerce companies, mass merchandisers and CPGs enjoyed a stronger quarter, with all these companies beating revenue and earnings estimates.

- Beauty brands and retailers comprised the worst-performing sector (versus expectations) in the quarter, with all companies covered here missing the consensus revenue estimates.

- The REITs sector saw 80% (four companies) missing the consensus revenue estimates.

However, beating or meeting consensus does not mean the results were “good” in the context of retailers navigating through the

Covid-19 crisis and after emerging from coronavirus-induced lockdowns. Sales productivity rates and the pace of recovery are much more indicative of the health of retailers than benchmarking versus consensus.

Company results in 2Q20, which ended July 31 for most companies in our coverage, include recovery from the crisis. Many retailers initially saw strong sales in reopened stores, driven by pent-up demand, but this tended to moderate as the quarter progressed. The trend of a higher average basket size coupled with fewer transactions was prevalent in the last quarter as consumers continued to consolidate their shopping trips to stores—and many retailers saw this trend persisting into their next quarters. Many retailers piggybacked on growing e-commerce trends by ramping up their digital shopping channels, including the expansion of ship-from-store capabilities and the implementation of several omnichannel options, such as BOPIS (buy online, pick up in store) and curbside pickup. This pivot led to unprecedented growth in these companies’ digital sales in their last quarters.

Although we term the period under review 2Q20, some companies in this report describe their latest quarter differently; some have different quarter-end dates too.

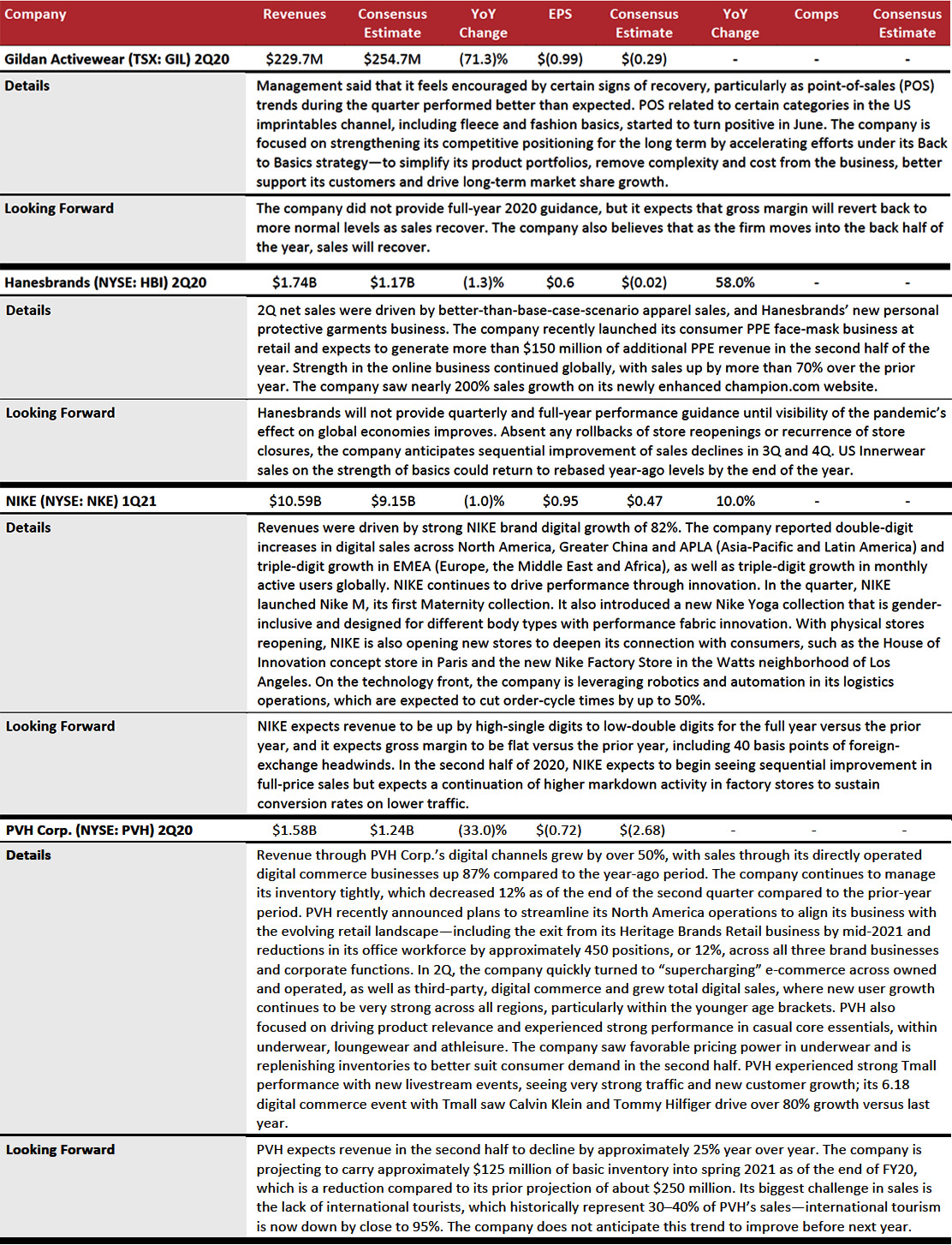

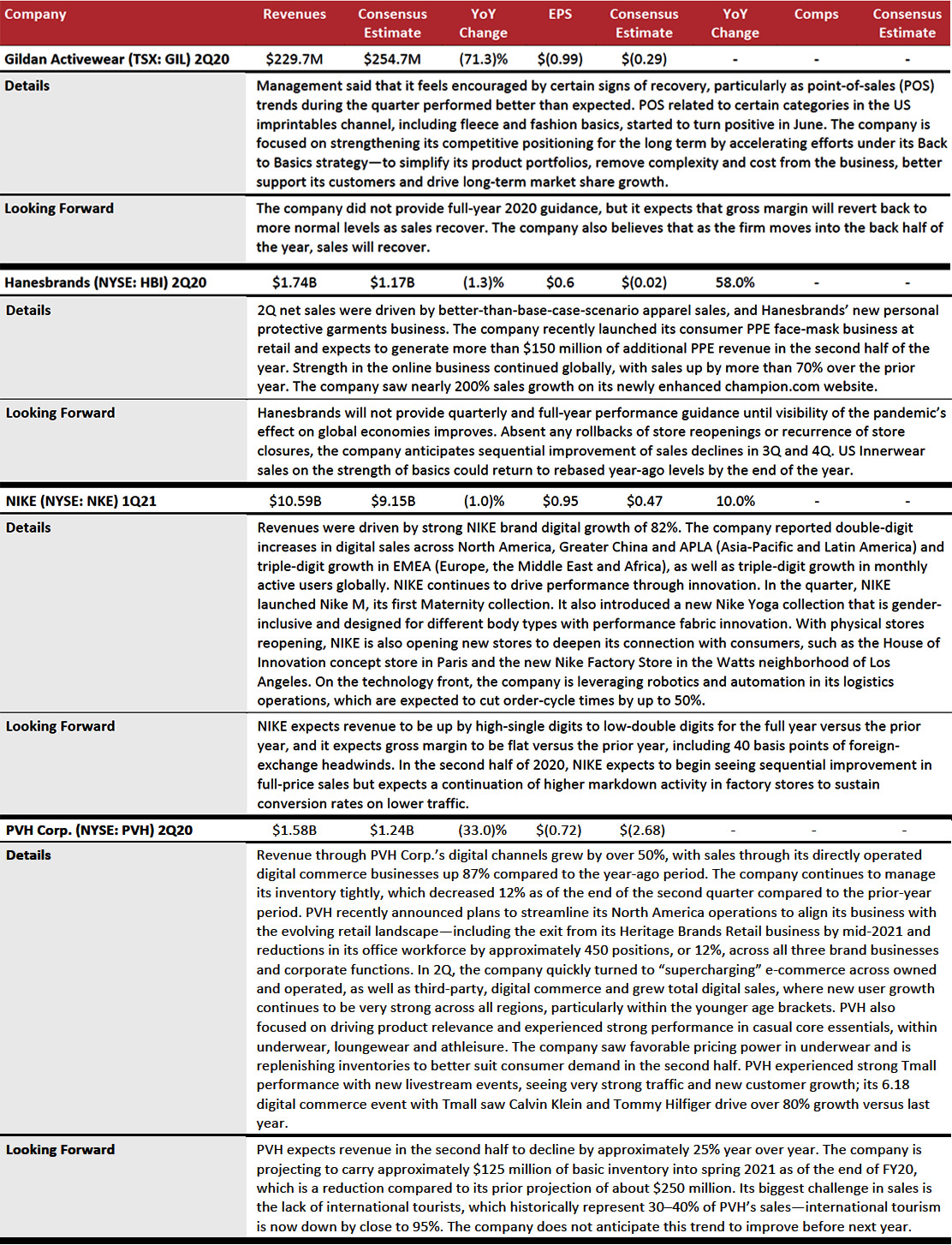

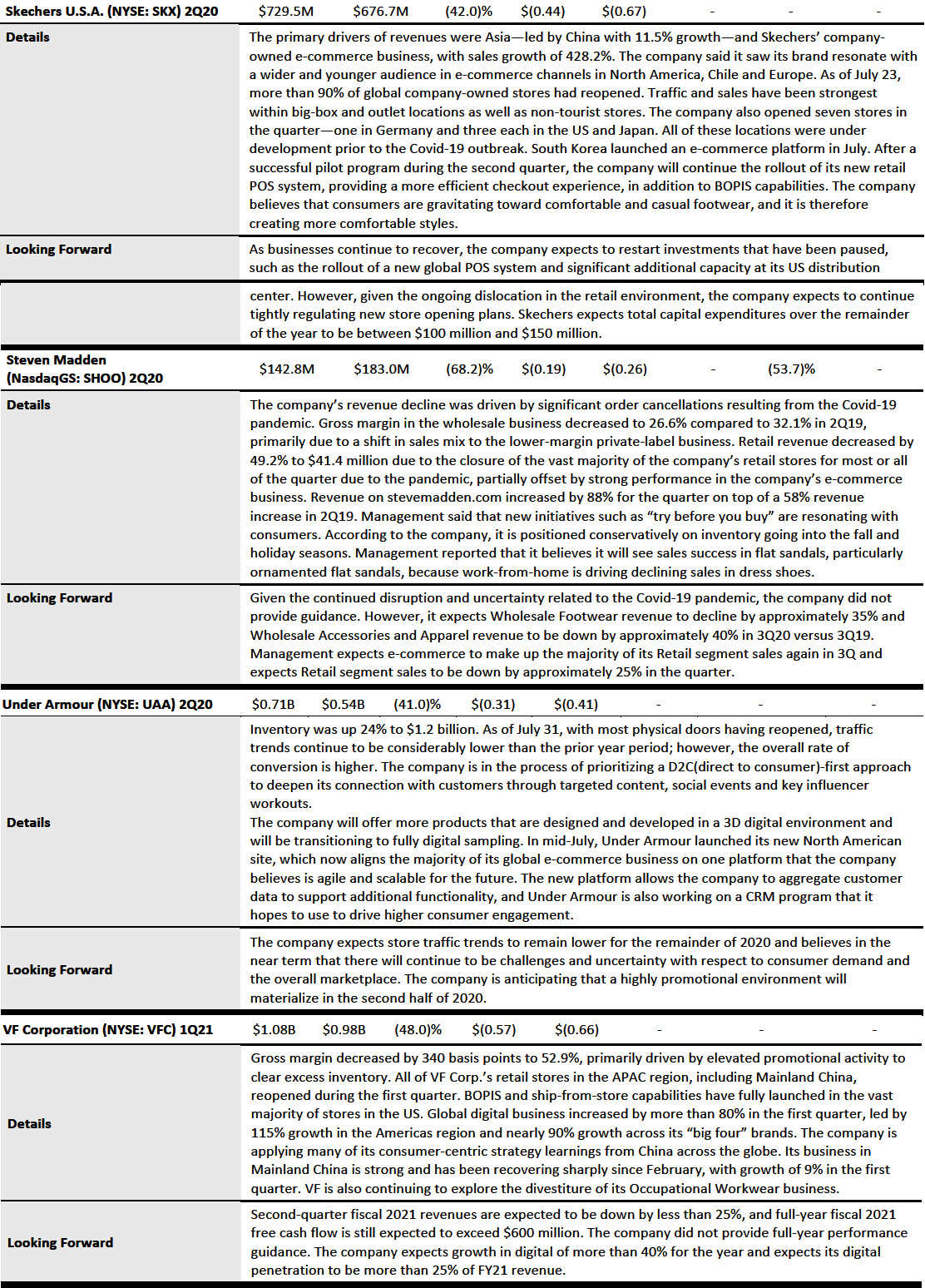

Apparel and Footwear Brand Owners

US apparel and footwear firms continued to have a weak quarter, mainly led by store closures, with average revenue growth ranging between (33)% and (71)%. One exception was Hanesbrands, which saw revenues down by only 1.3%. The company launched its consumer PPE (personal protective equipment) face-mask business at retail and expects to generate more than $150 million of additional PPE revenue in the second half of the year.

Revenue declines across selected retailers were partially offset by e-commerce growth: Revenue on stevemadden.com increased by 88% for the quarter; PVH Corp.’s revenues through digital channels grew over 50%; and VF Corporation‘s global digital business increased by more than 80% through its digital channels. Most companies expect to see declining traffic year over year—VF Corporation expects revenue declines of less than 25% in the second half, and PVH Corp. expects a decline of approximately 25% year over year.

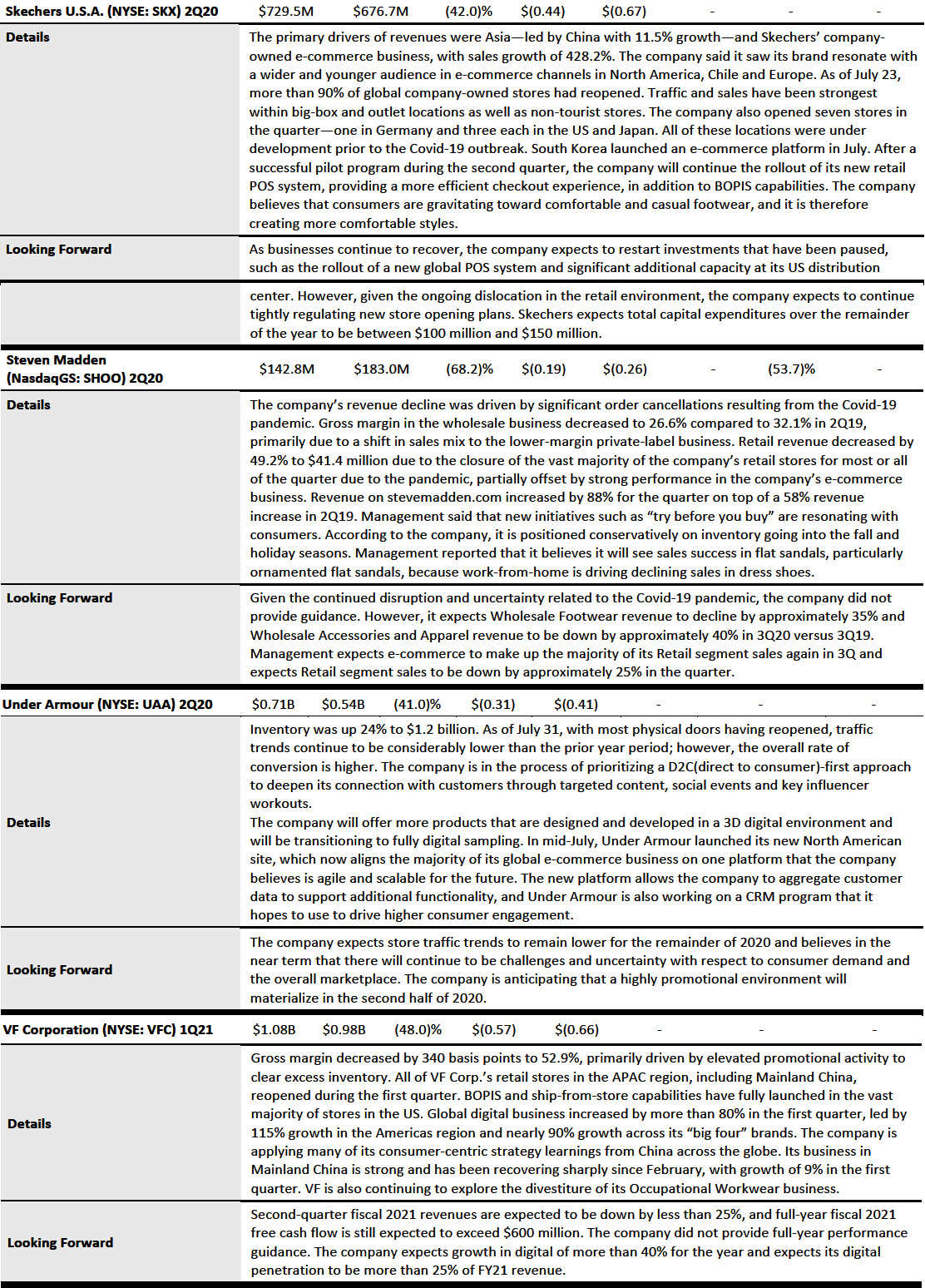

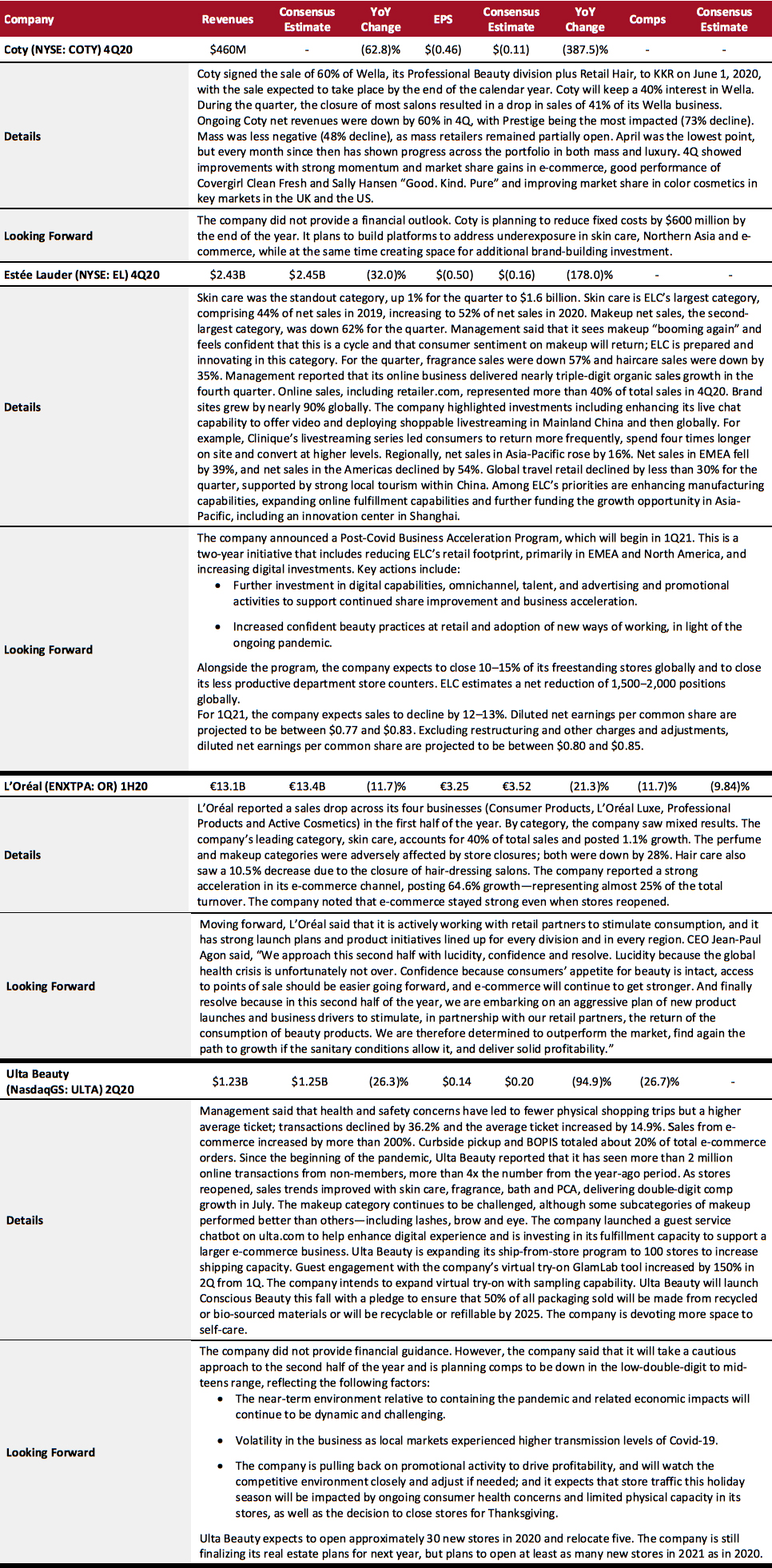

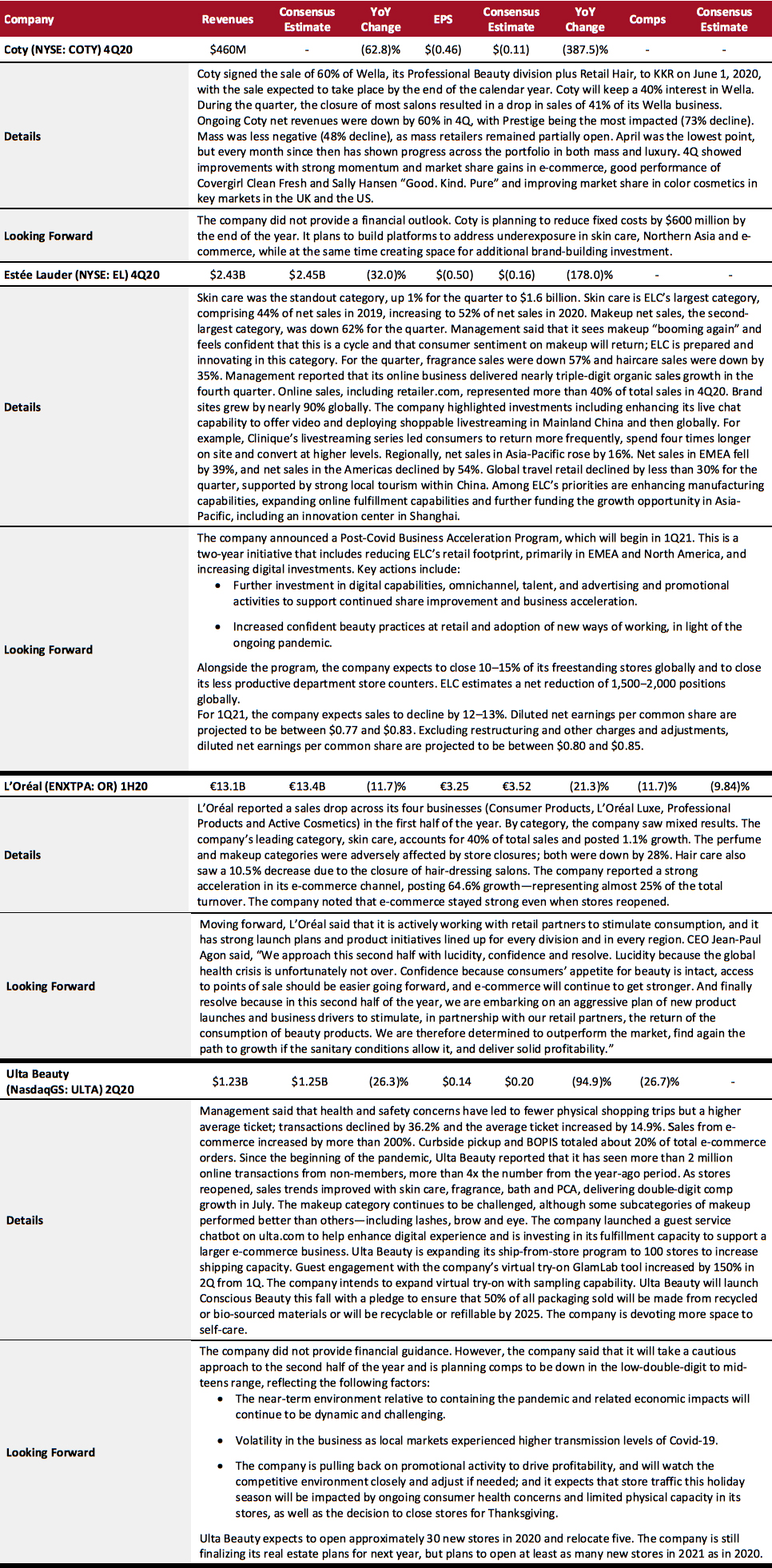

Beauty Brands and Retailers

Beauty Brands and Retailers

Our beauty sector coverage is a combination of brand owners and one retailer (Ulta Beauty). All beauty brands reported that skin care was a top category for consumers last quarter compared to color cosmetics. Estee Lauder Companies (ELC) reported that skin care, its largest category, was up 1% for the quarter to $1.6 billion; makeup sales, the second-largest category, was down 62% for the quarter. Ulta Beauty reported double-digit growth in skin care and challenges in makeup. Coty reported plans to focus on skin care due to its underexposure in this category.

Digital business was strong for beauty over the quarter, with ELC reporting that its online business delivered nearly triple-digit organic sales growth. Online sales represented more than 40% of ELC’s total sales, and the company is investing in its online business. Ulta Beauty reported that sales from e-commerce increased by more than 200%. It is increasing its digital engagement through virtual try-on initiatives to include sampling.

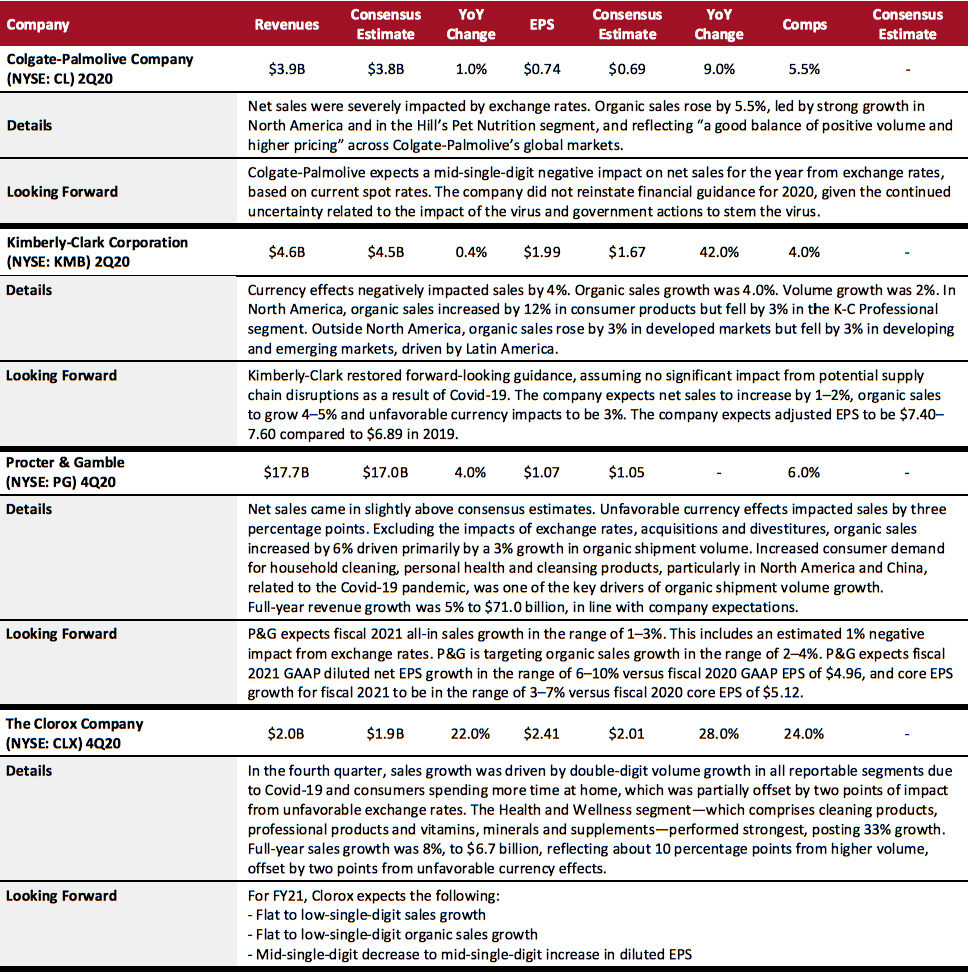

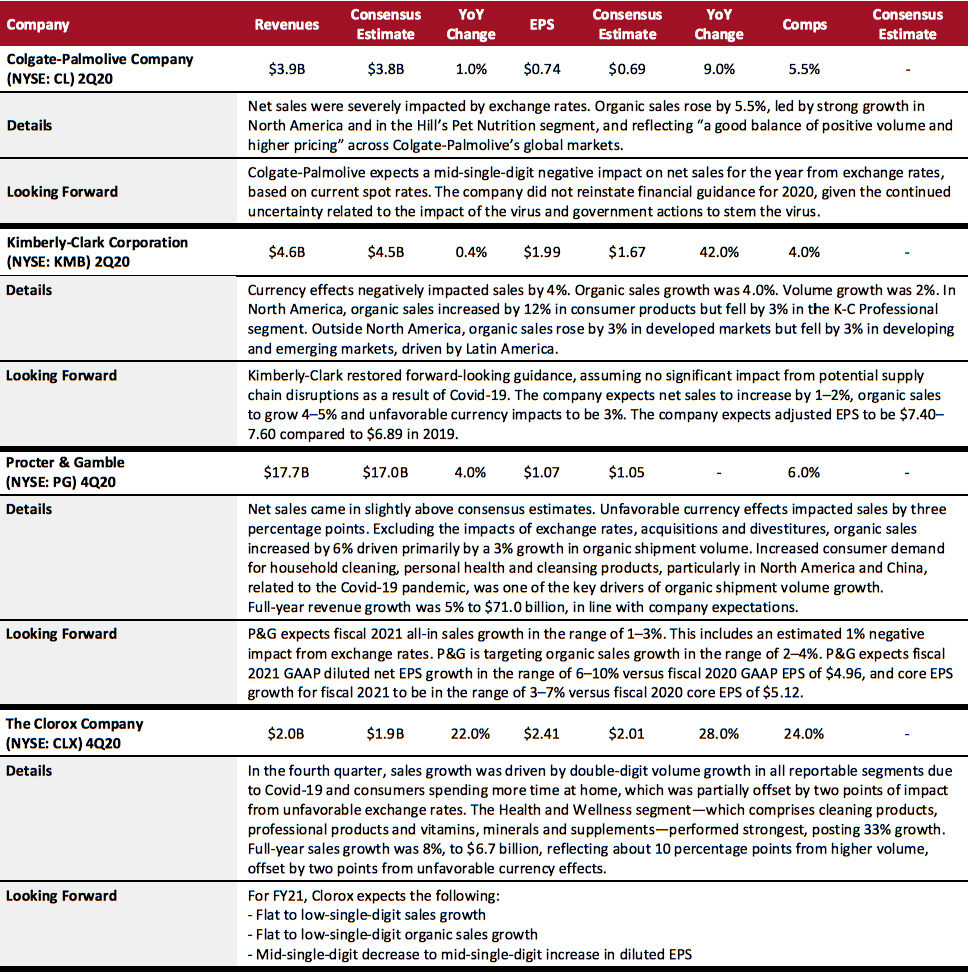

Consumer Packaged Goods (CPG)

This was a stronger quarter for P&G and Clorox than for Colgate-Palmolive and Kimberly-Clark, which were slightly more affected by negative foreign-currency impacts. As the pandemic continues to determine changes in consumer behavior and force people to spend more time at home/indoors, CPG companies experienced strong demand for household cleaning and hygiene products.

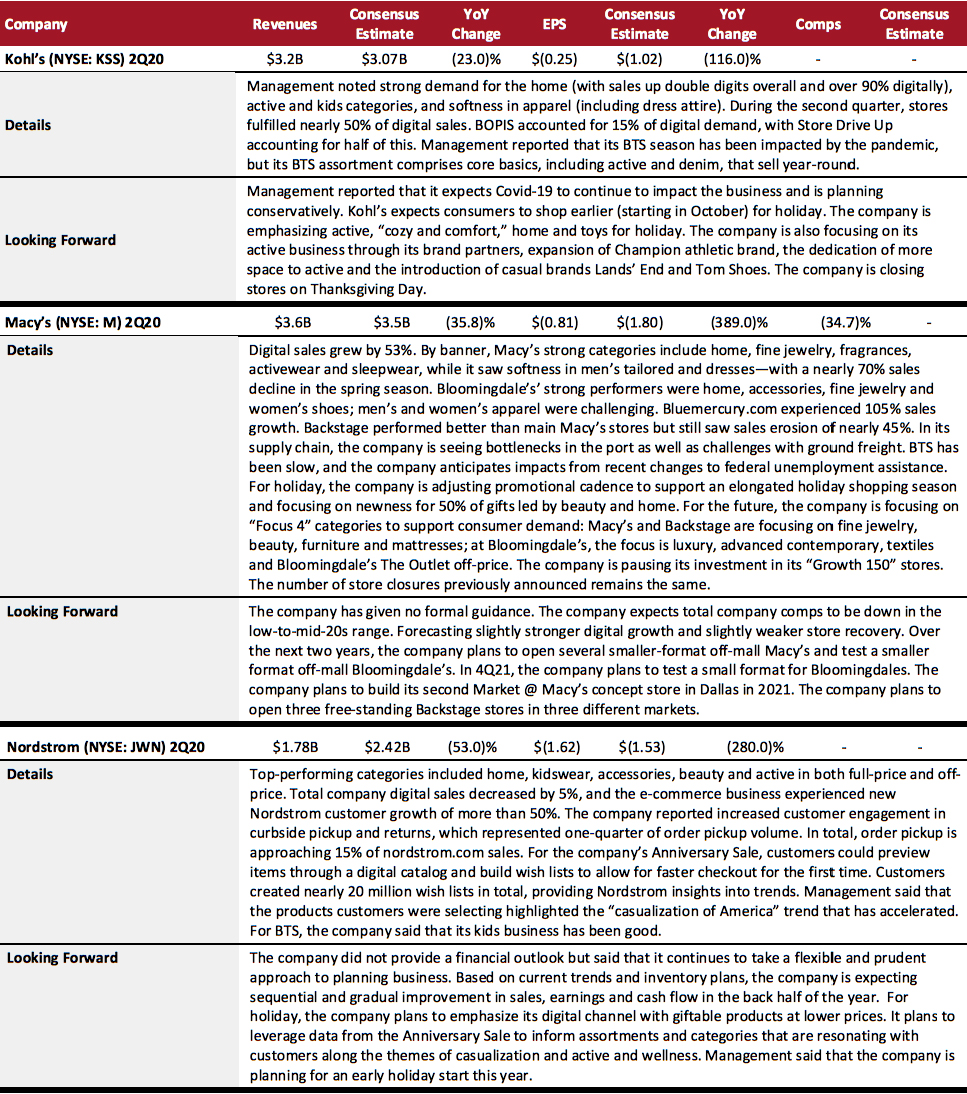

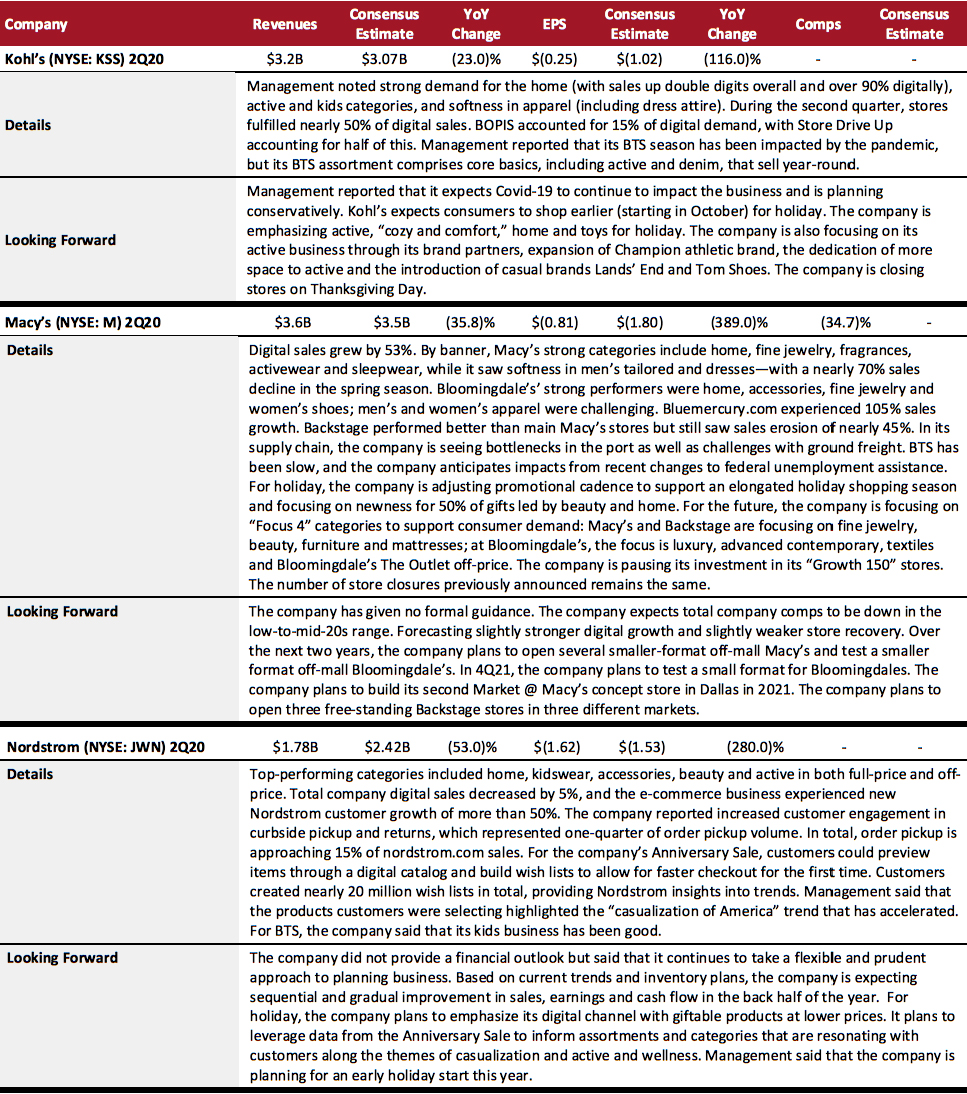

Department Stores

Kohl’s and Macy’s both reported softness in apparel and strength in home categories over the quarter. Both reported that the back-to-school (BTS) season has been negatively impacted by the pandemic. Digital grew 53% for Macy’s while Kohl’s reported that its stores fulfilled nearly 50% of digital sales. BOPIS accounted for 15% of Kohl’s digital demand, with Store Drive Up accounting for half of this. Macy’s reported it will focus on home, mattress, beauty and fine jewelry, while Kohl’s will focus on the active, “cozy and comfort,” toys and home categories. Each is expecting an early holiday season.

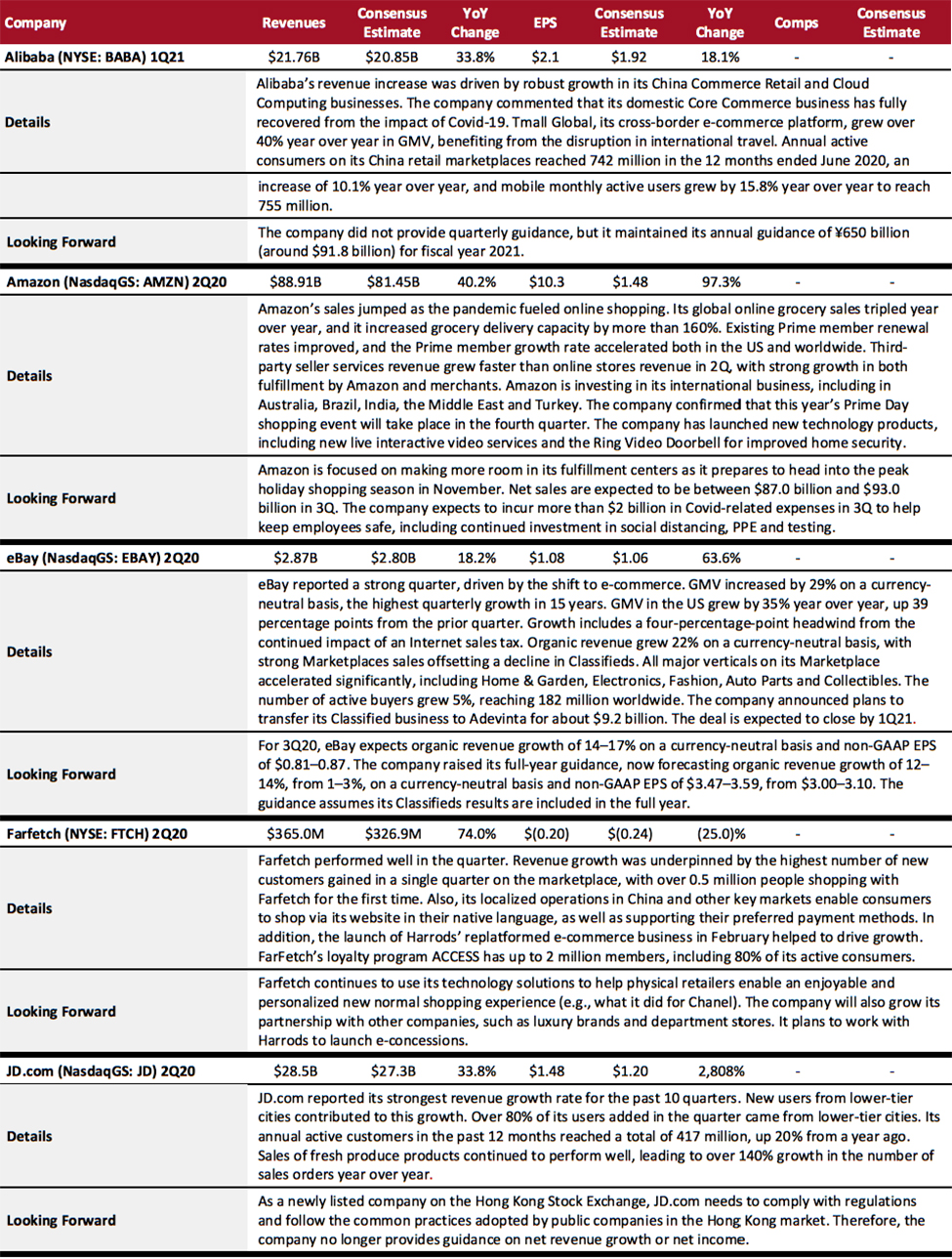

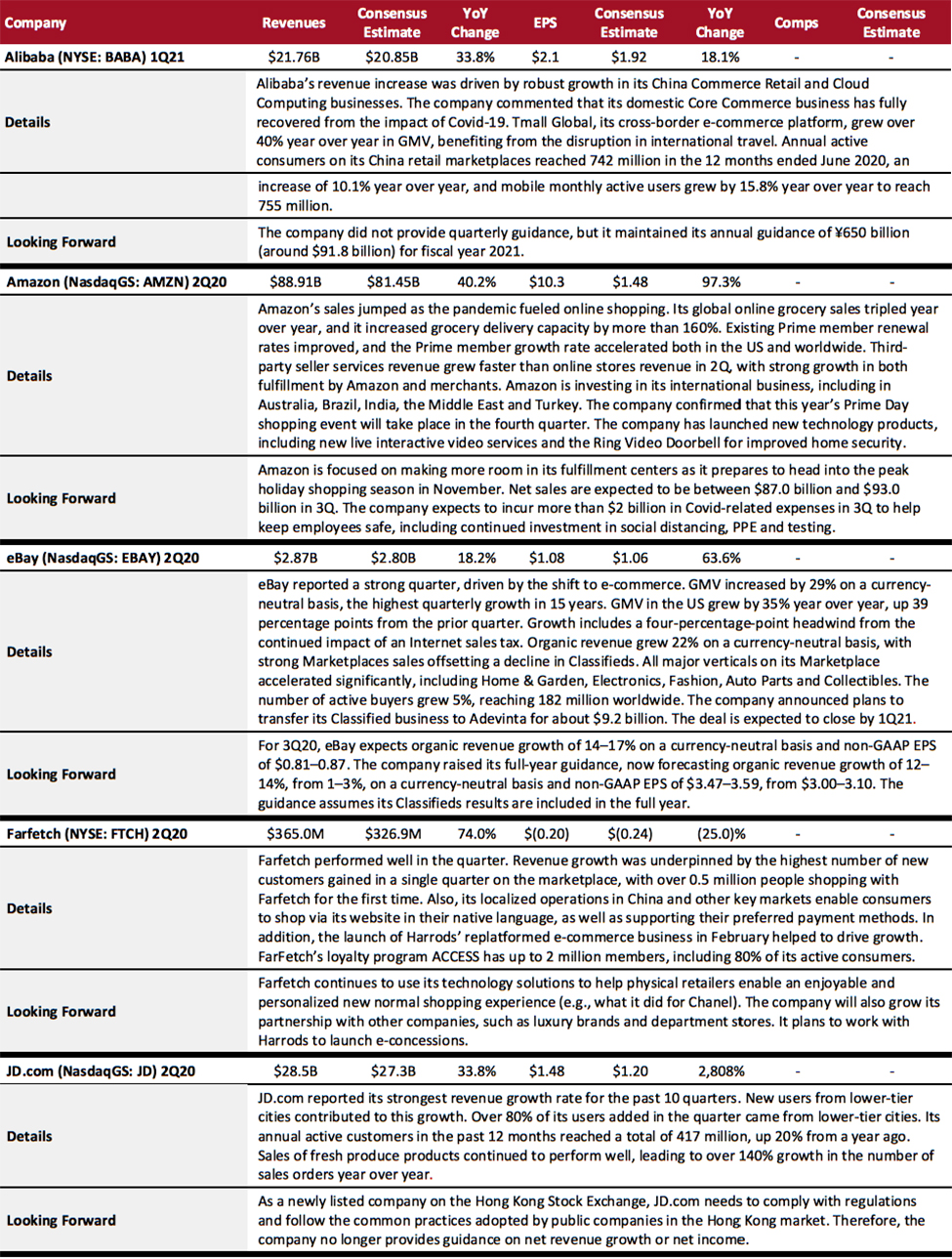

E-Commerce

eBay reported solid performance of its Marketplace platform across all major markets, with its highest quarterly GMV growth in 15 years and strong new-user acquisition. Amazon saw strong early demand in groceries and consumable products continue into 2Q, while demand increased during the quarter in its other major product categories, such as hardlines and softlines. However, both eBay’s and Amazon’s growth underpaced the digital growth reported by many US multichannel retailers (mentioned throughout this report).

In China, e-commerce giants continued to maintain momentum in sales growth, benefiting from the shift to e-commerce and travel restriction orders, as well as new users gained from lower-tier markets. Alibaba’s domestic Core Commerce business has fully recovered from the negative impact of the pandemic. JD.com reported a strong quarter, with the highest growth rate for the past 10 quarters. Farfetch benefited from its localized operations in China and other key markets that enable consumers to shop via its website in their native language, as well as supporting their preferred payment methods.

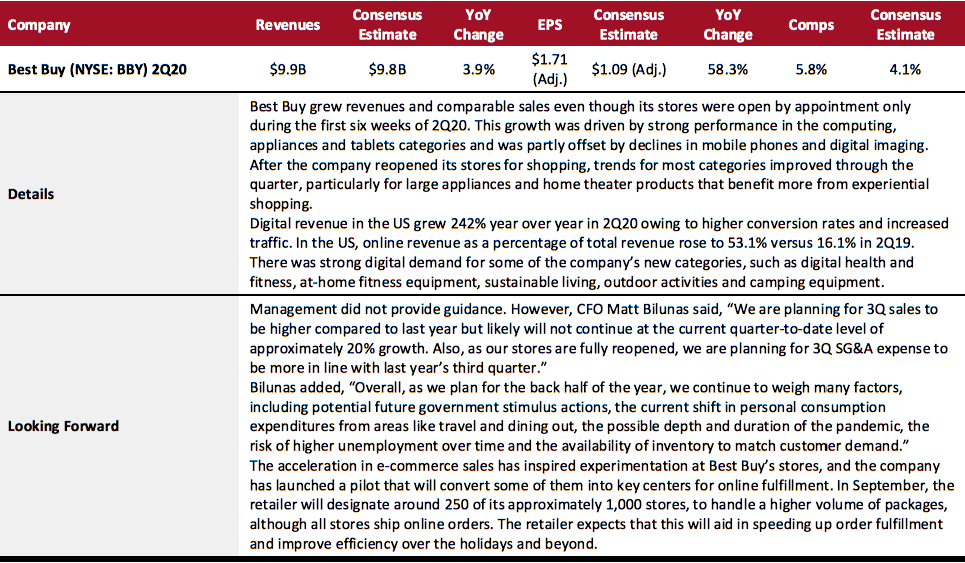

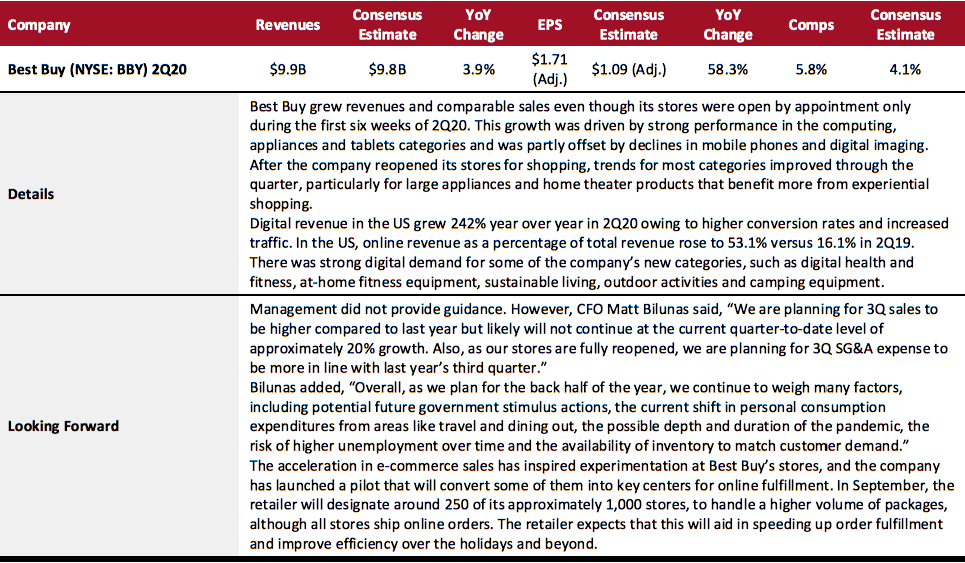

Electronics Retail

Best Buy experienced a notable improvement in trends for most categories after its stores were reopened. E-commerce sales grew significantly during the quarter and rose considerably as a percentage of sales, and on the back of a strong performance in the channel over the first two quarters, Best Buy has initiated measures to convert some of its stores into key centers for online fulfillment. The company expects this to improve fulfillment efficiency during the holiday season and beyond, and this may well be an interesting longer-term shift to note.

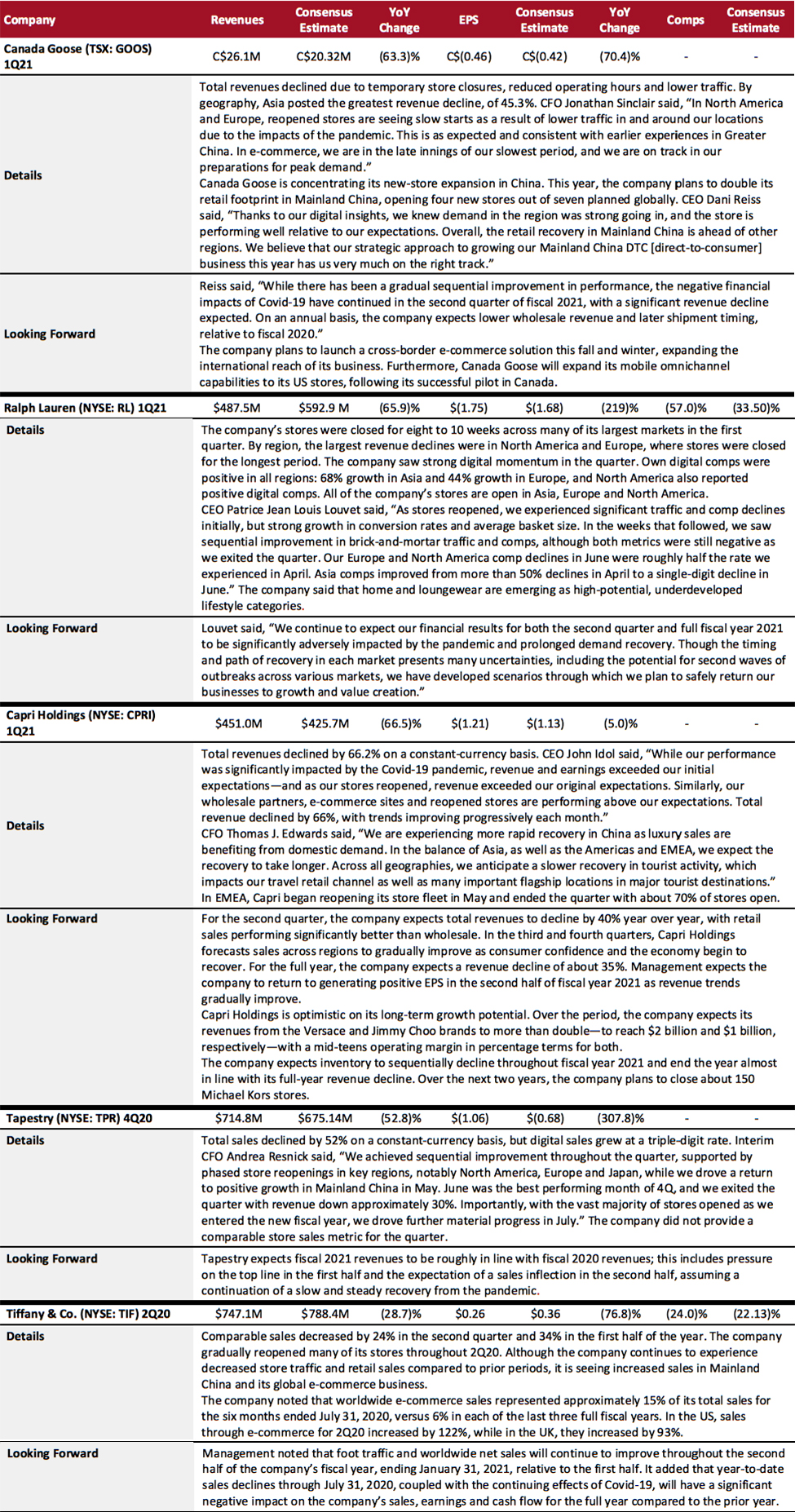

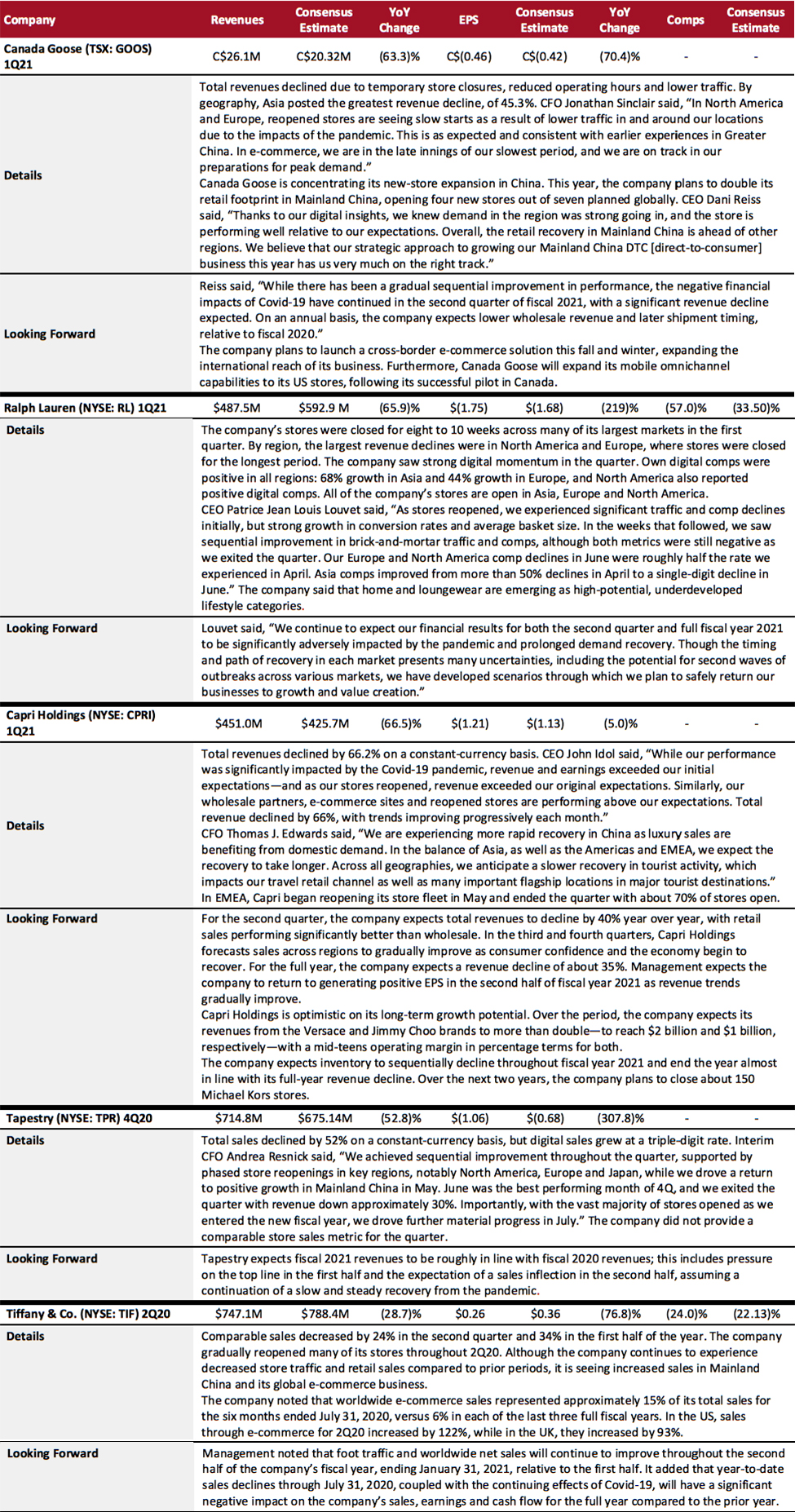

Luxury

The luxury sector appeared to regain its strength after witnessing a disastrous prior quarter. Although all the companies covered here experienced significant double-digit revenue declines in the latest quarter, some bright spots include sales rebounds in China and strong e-commerce sales in each market. Management at all companies noted that the adverse impacts of Covid-19 will continue into the next quarter and that they are enhancing their digital capabilities/increasing digital penetration to capitalize on strong global e-commerce trends.

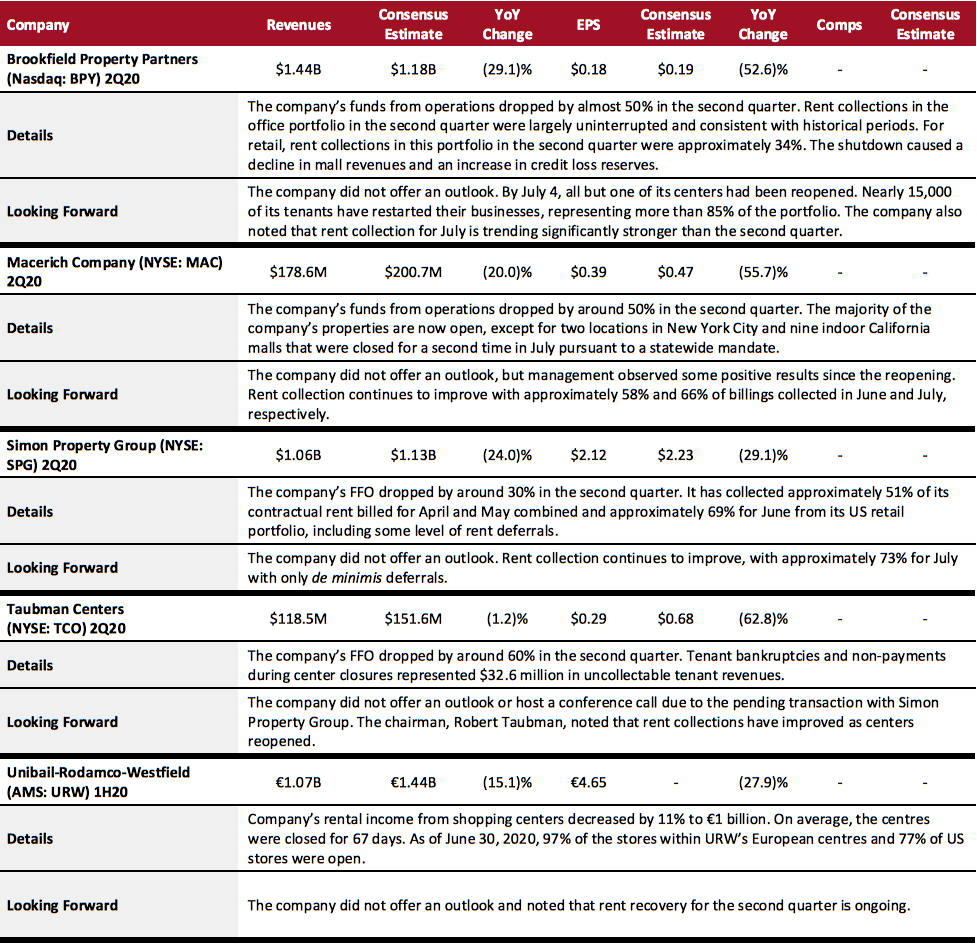

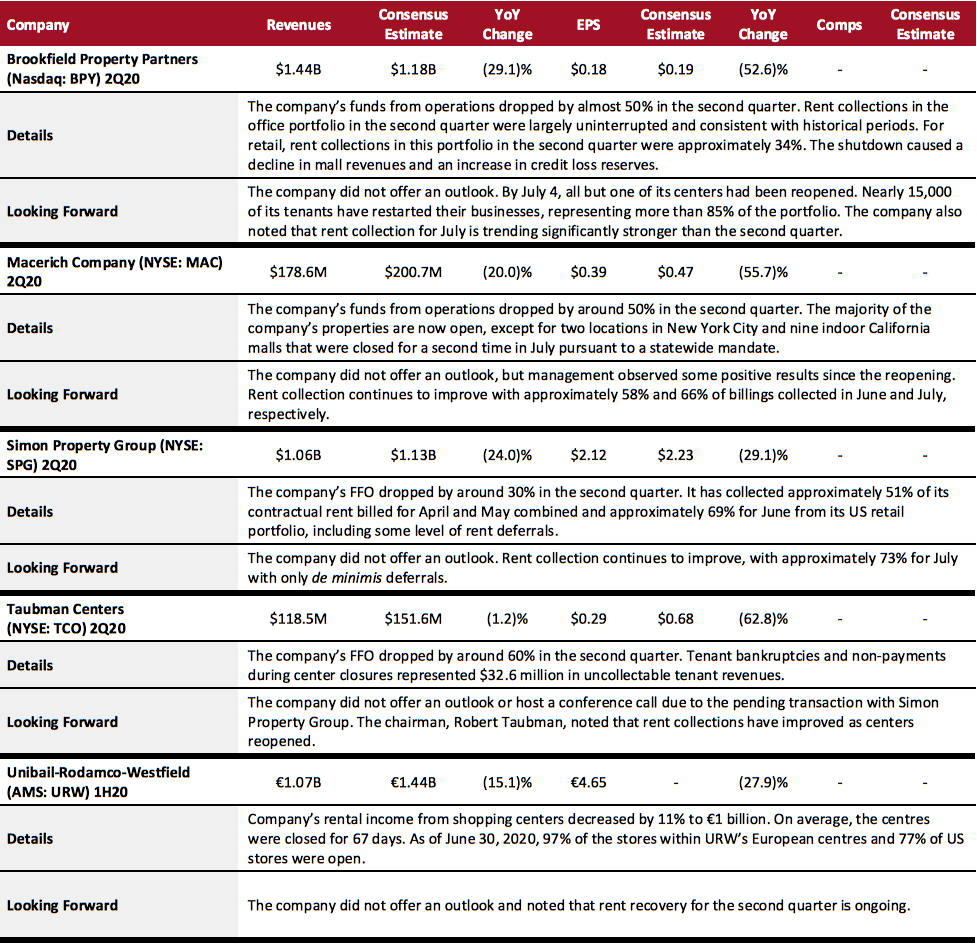

REITs

The sector continues to suffer from the outbreak of the coronavirus as many reopened centers face closures again. With uncertainty ahead, none provided an updated outlook for fiscal 2020. The sector saw improvement in traffic as centers reopened, and in rent collection going into July. The third quarter is likely to see better results in revenue and FFO than the second quarter.

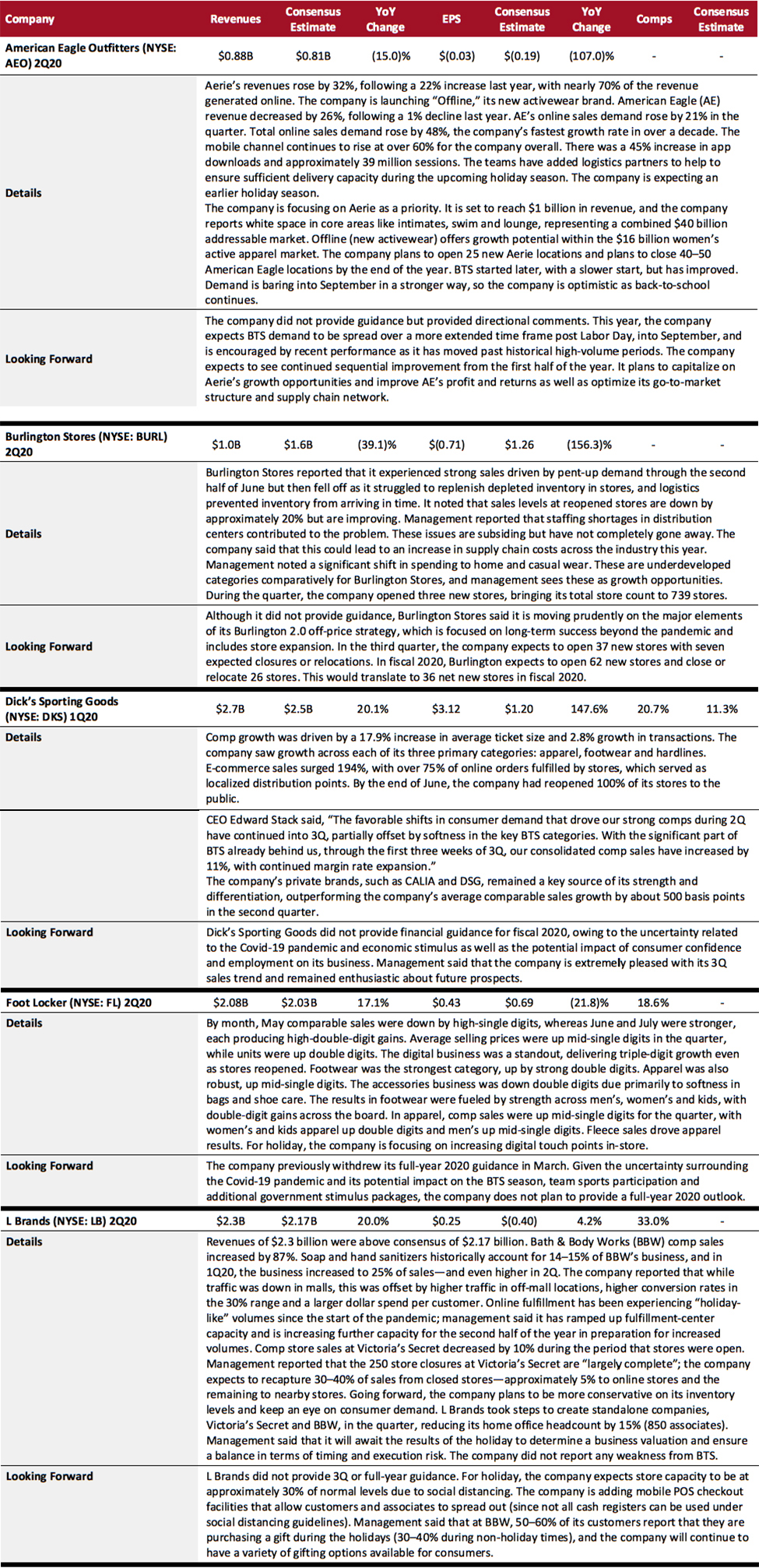

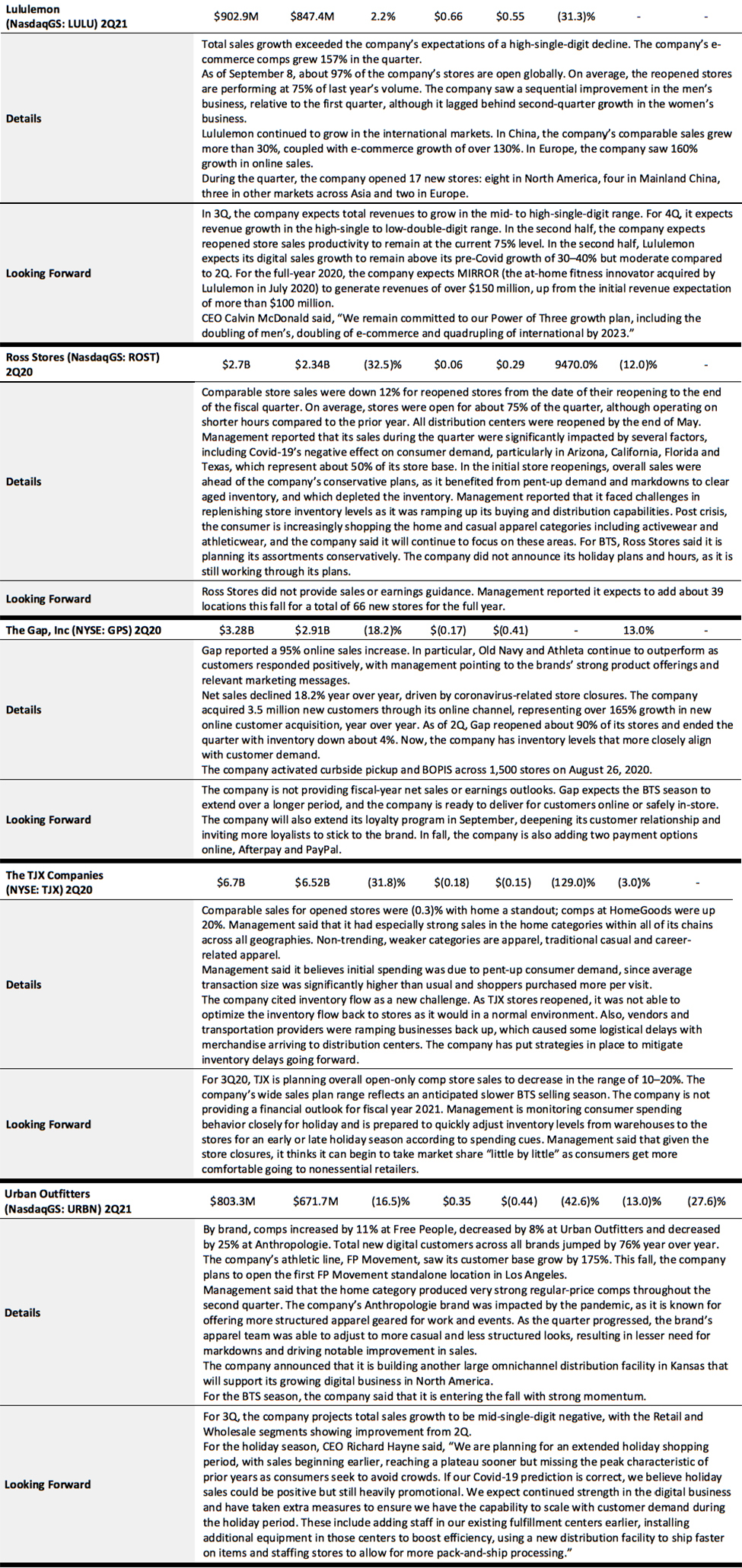

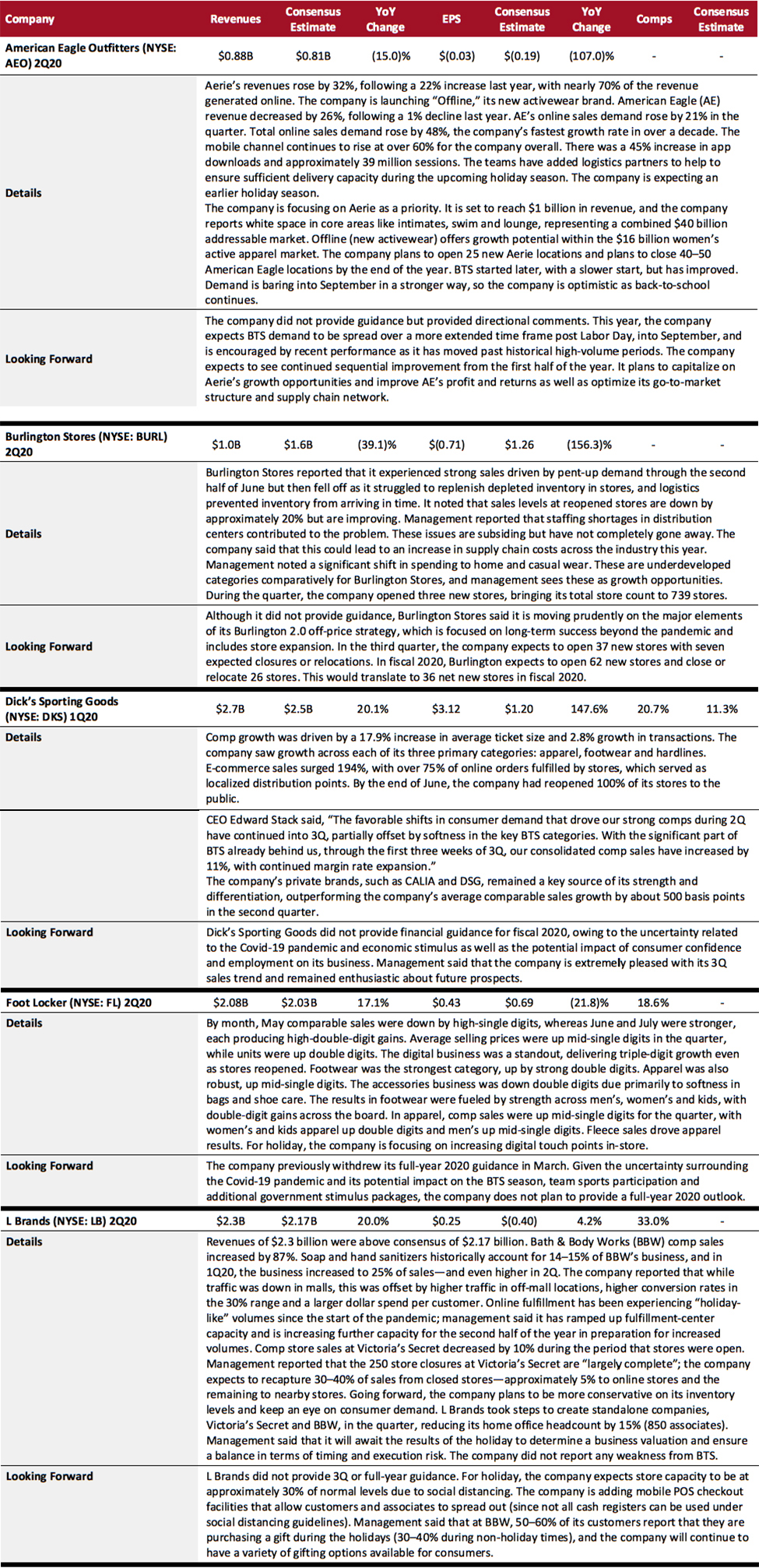

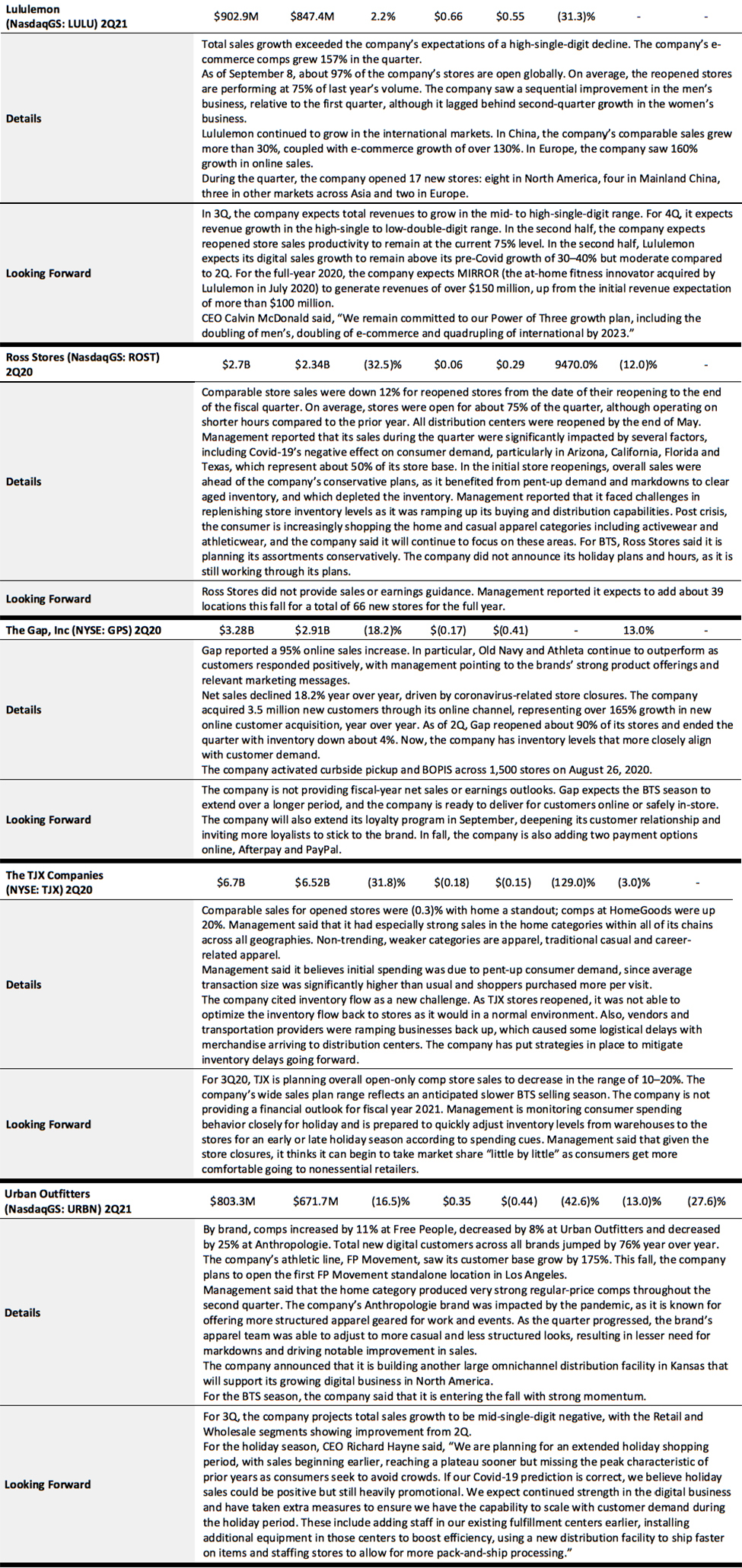

Apparel Specialty Retail

In the apparel specialty retail sector, off-pricers including Burlington Stores, Ross Stores and TJX had a rough quarter again, witnessing significant double-digit sales declines, partly due to the lack of fully fledged e-commerce businesses—or, in some cases, any e-commerce businesses—to fall back on. Management of the three companies highlighted that they experienced strong sales in reopened stores initially, driven by pent-up demand, but then struggled to replenish the inventory levels fast enough due to logistics delays.

Some retailers, such as Dick’s Sporting Goods, Foot Locker and L Brands, regained momentum, reporting double-digit revenue growth, boosted by their digital businesses. L Brands noted that it is ramping up its online capacity for the second half of the year in preparation for increased volumes.

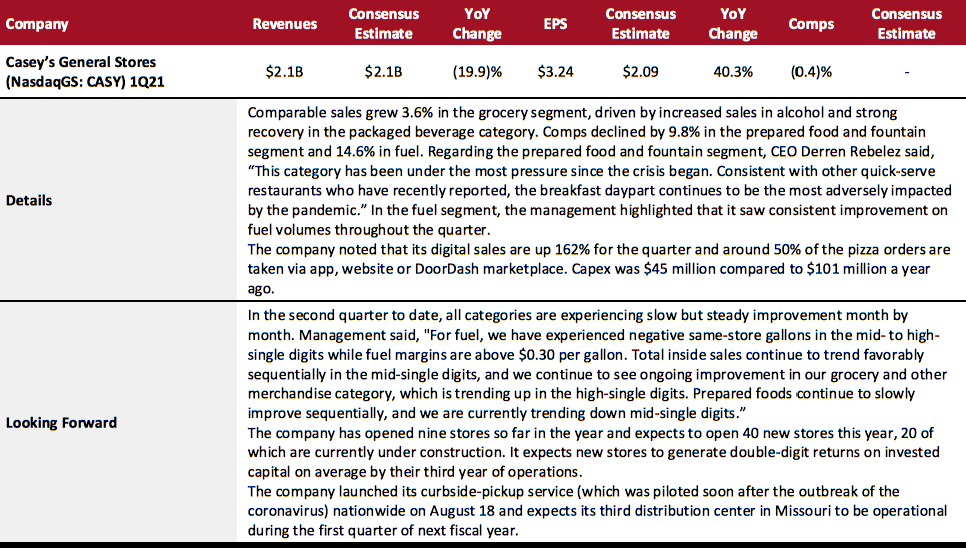

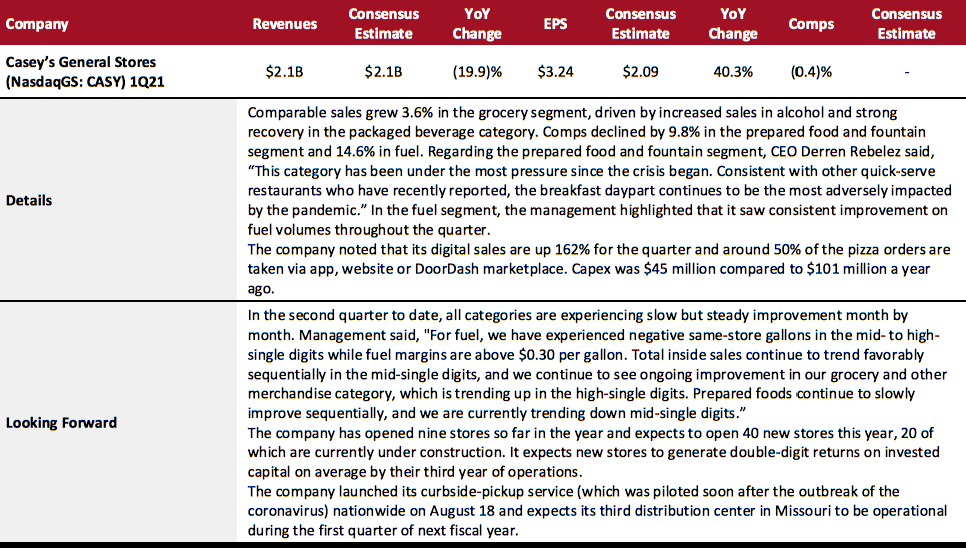

Food, Drug and Mass Retailers: Convenience Stores

Despite a challenging business environment, Casey’s saw sequential improvement in sales volume throughout the last quarter and is experiencing slow but steady improvement across all areas into its second quarter. Casey’s plans to capitalize on digital initiatives that the company added in the light of the pandemic, including its recent partnership with DoorDash and the launch of curbside pickup options.

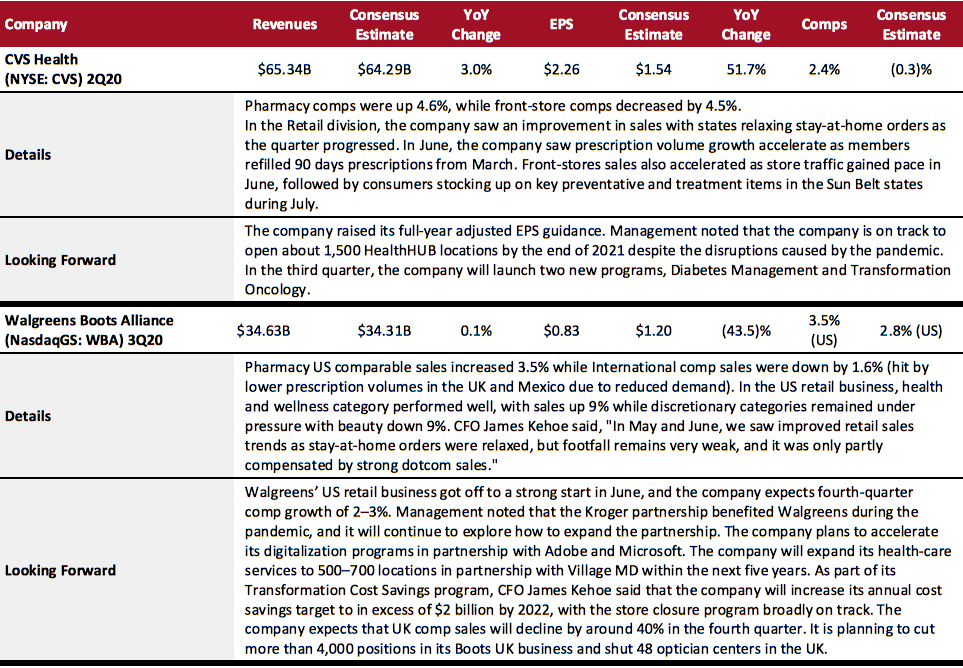

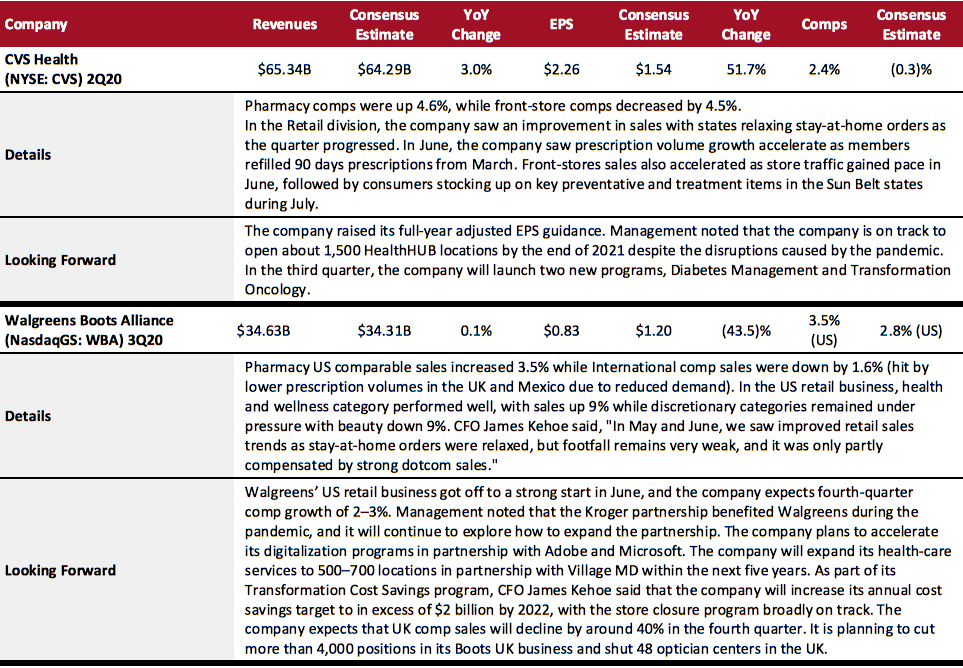

Food, Drug and Mass Retailers: Drugstores

CVS experienced a strong quarter, beating consensus on all metrics. The retailer saw an acceleration in its retail sales as stay-at-home orders were relaxed with both prescription and front-store sales seeing an uptick in June. Walgreens’ US pharmacy retail business saw consistent improvement in sales as the quarter progressed and expects to have stronger sales in the next quarter. However, the company’s international retail business, particularly in the UK, took a hit due to strict lockdowns, which negatively impacted store traffic. Walgreens expects its UK retail comps to remain weak even in the next quarter.

Both CVS and Walgreens remain committed to developing their health-care offerings by converting their stores to major health destinations.

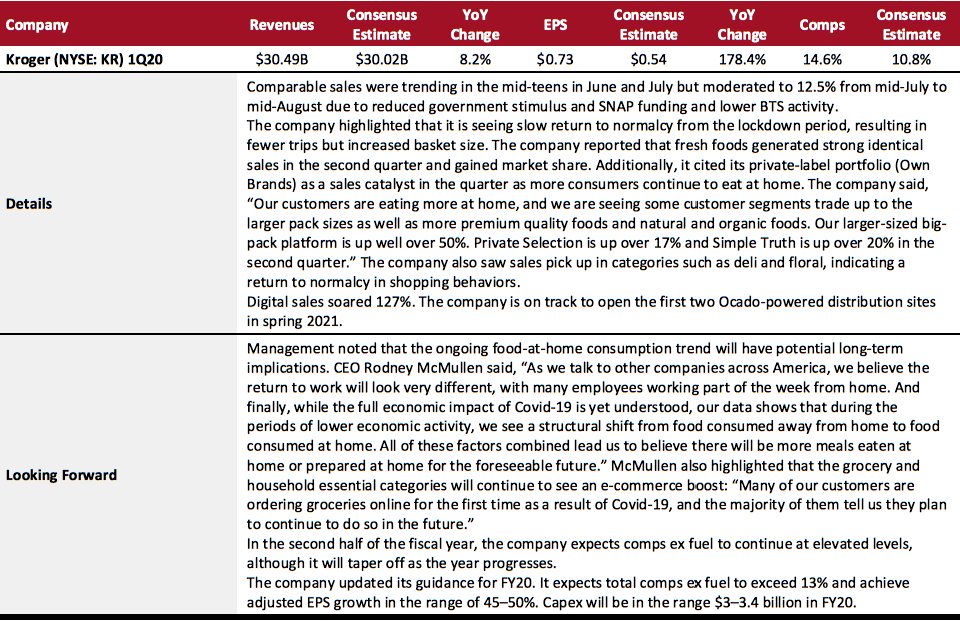

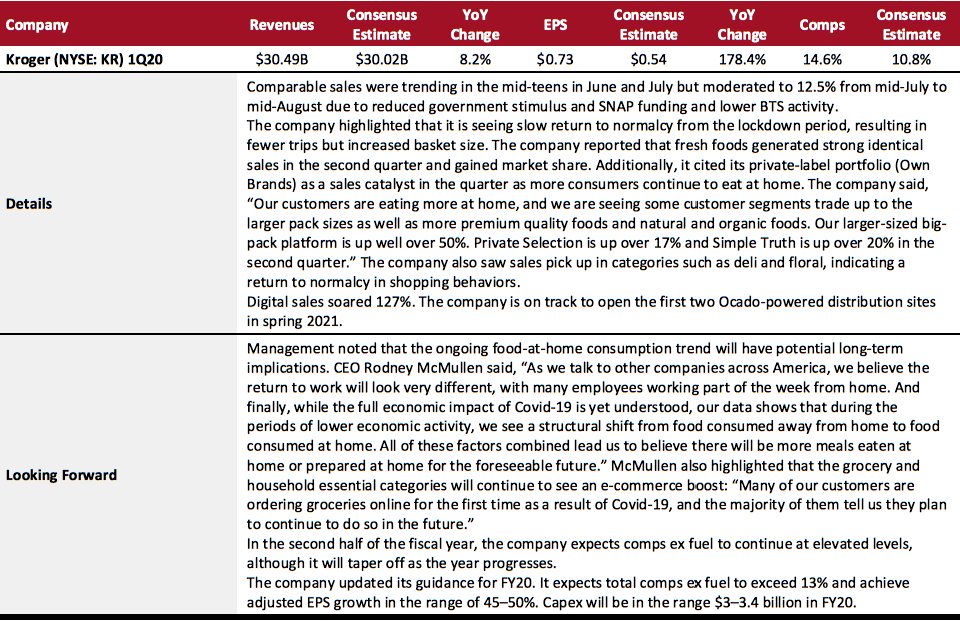

Food, Drug and Mass Retailers: Food Retailers

Kroger delivered robust second-quarter results. The company saw strong comps continuing from the first quarter into the second quarter, as growth excluding fuel trended in mid-teens in June and July, but it tapered off as the quarter progressed. The company cited fresh foods and private labels as growth catalysts in the second quarter as consumers continue to eat more at home. The same trend is also fueling the growth of Home Chef, Kroger’s meal-kit brand. Kroger benefited from the strong grocery e-commerce trend during the quarter, which it expects to sustain even after the pandemic subsides. Buoyed by a strong at-home consumption trend and showing confidence in its “Restock” growth strategy, the company expects its performance in 2020 and 2021 to be even stronger than previously anticipated.

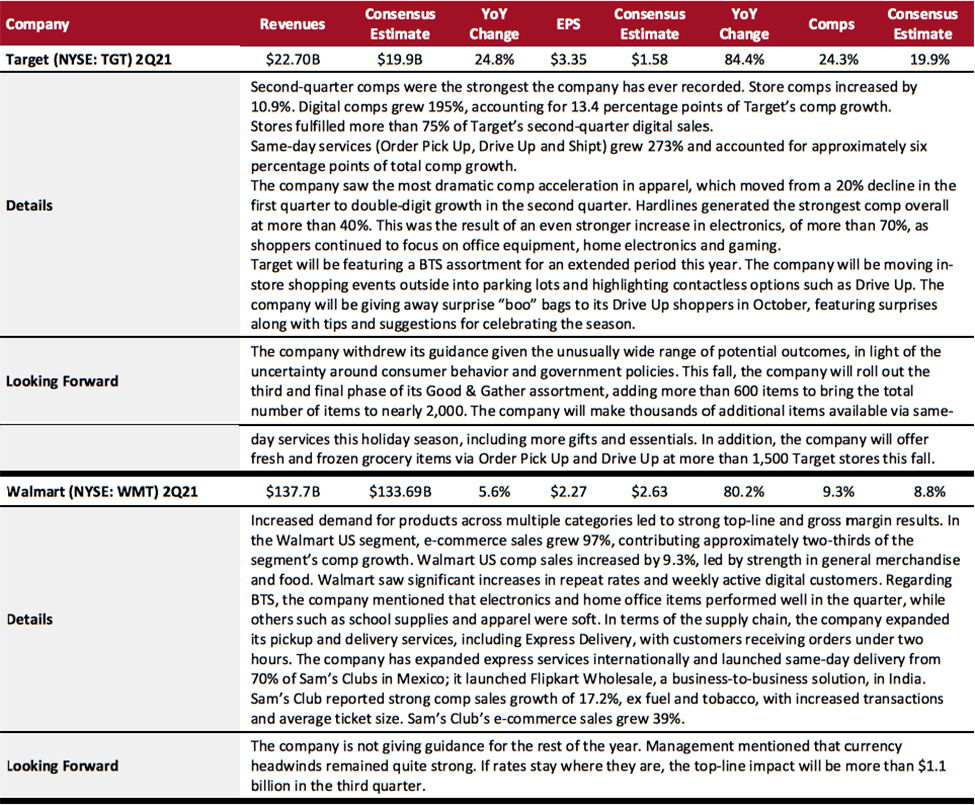

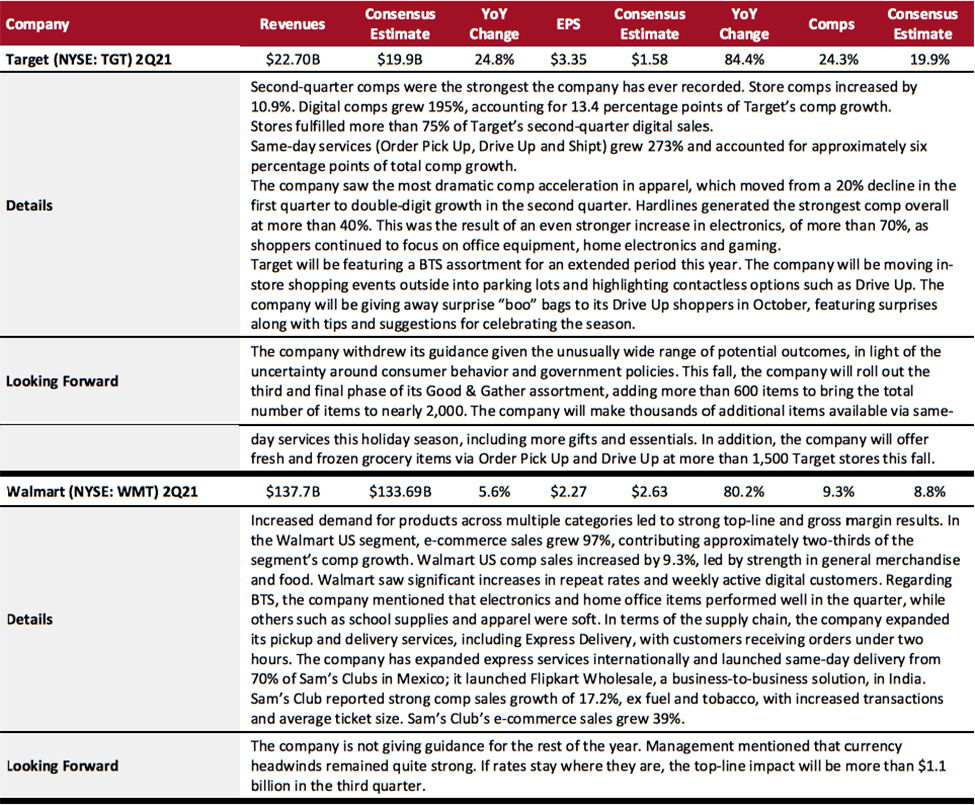

Food, Drug and Mass Retailers: Mass Merchandisers

Increased demand for general merchandise led to strong sales and margins at mass merchants such as Target and Walmart, and digital sales continued to contribute significantly to sales. Consumer focus on shopping categories such as home improvement, office equipment, electronics and gaming has risen, due to staying at home amid the pandemic. We also continue to see these two big retailers expanding their omnichannel capabilities: Walmart expanded pickup and delivery services, including Express Delivery, with customers receiving orders under two hours; Target will be moving in-store shopping events outside into parking lots and highlighted contactless options such as Drive Up. Both companies will not open stores on Thanksgiving this fall due to the coronavirus pandemic.

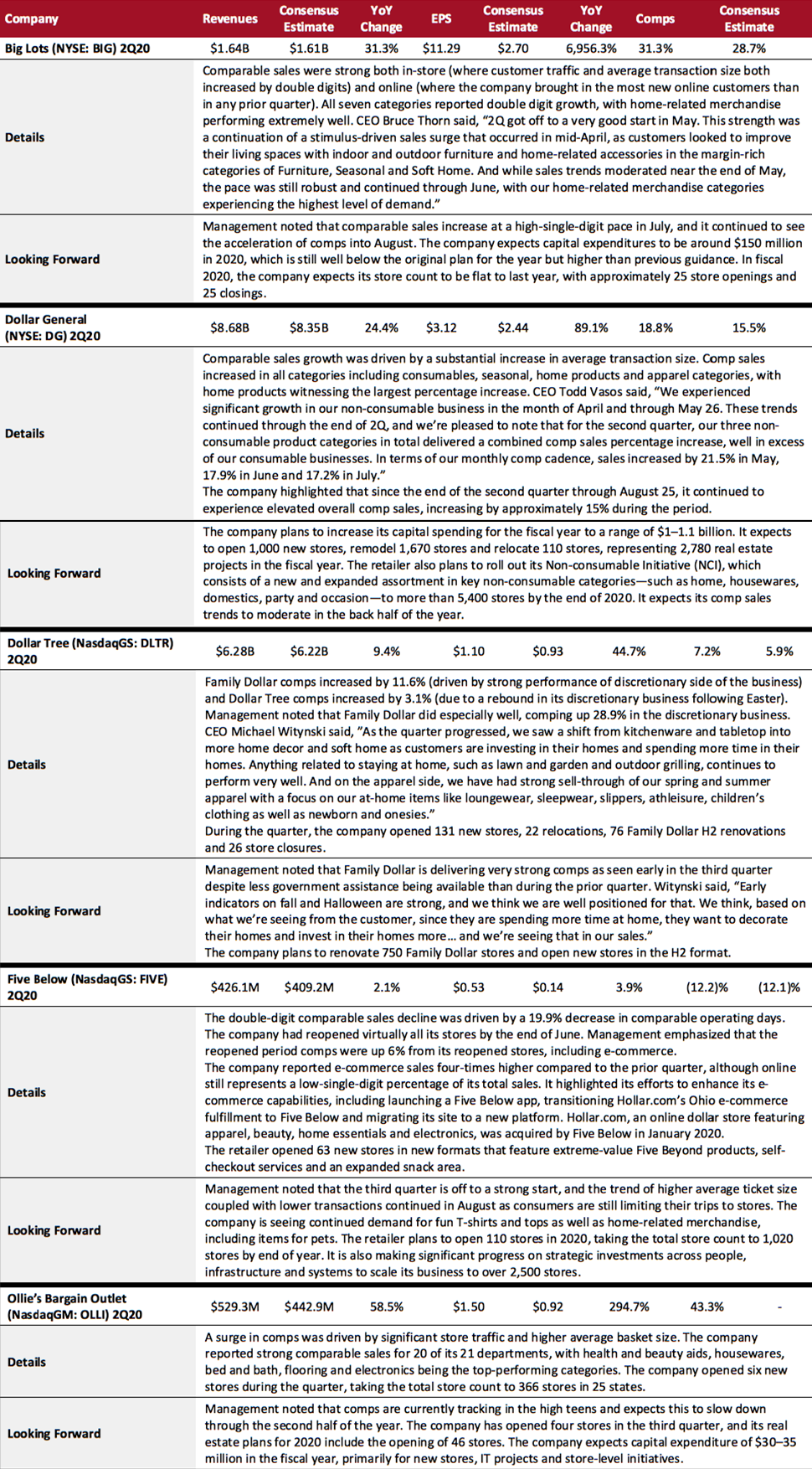

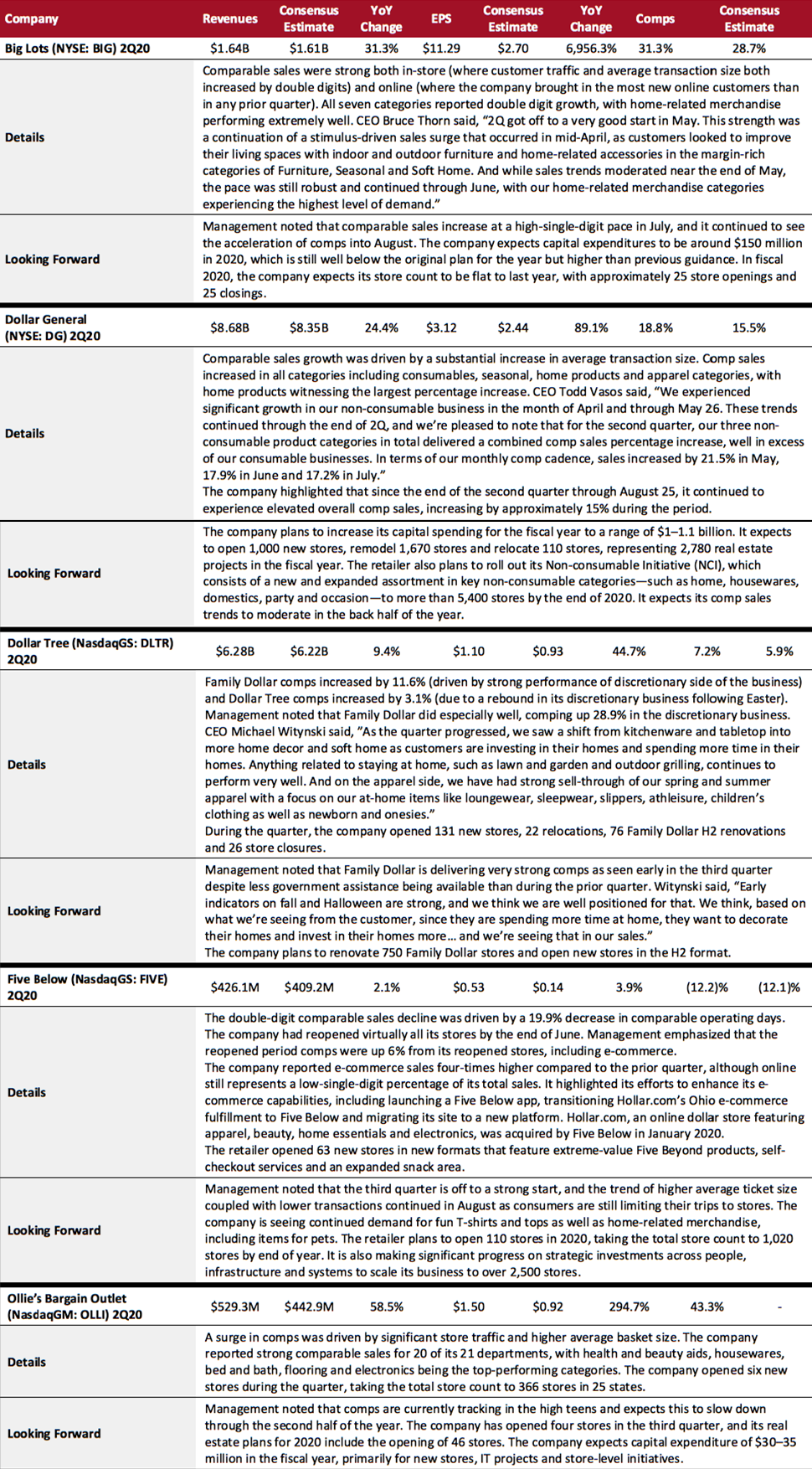

Food, Drug and Mass Retailers: Discount Stores

Discount mixed-goods retailers maintained their winning streak, as consumers continued to trade down to retail formats that emphasize value amid the economic uncertainty. Although Five Below missed expectations on comparable sales, the company witnessed strong early performance of its stores as they reopened. Management of all companies noted strong discretionary momentum in their second quarters, with home-related merchandise categories experiencing the highest demand. The companies noted strong comp sales continuing into their third quarters and emphasized that their real estate plans for 2020, including new store expansions, are broadly on track.

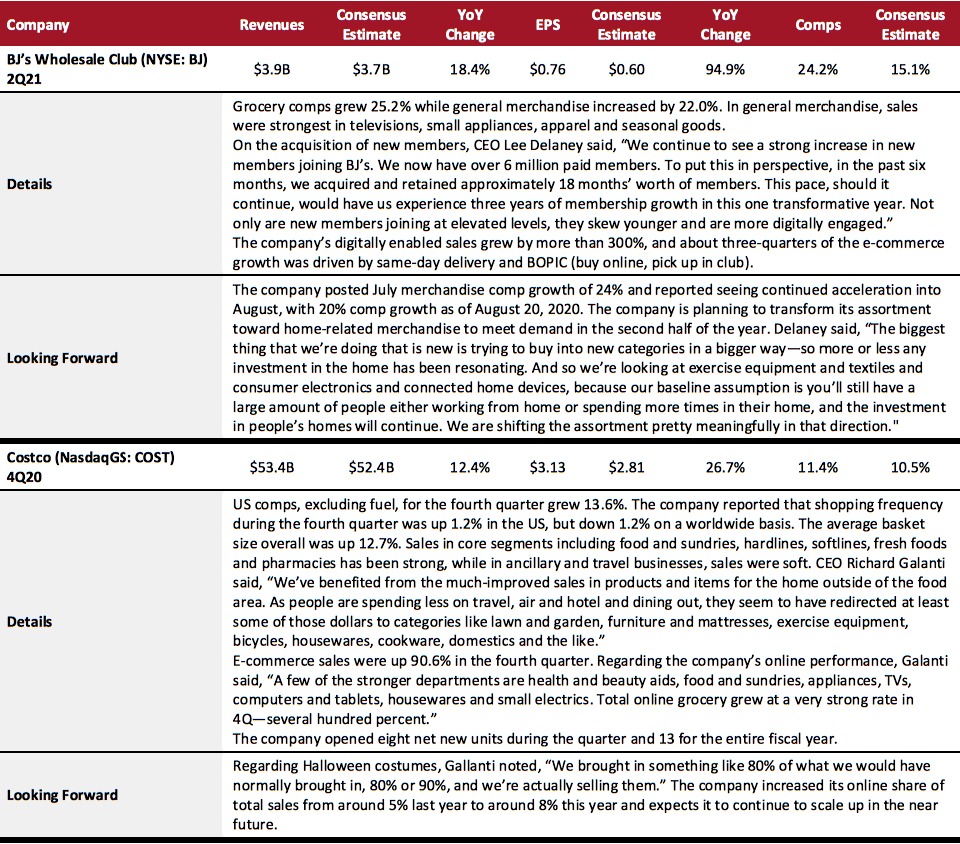

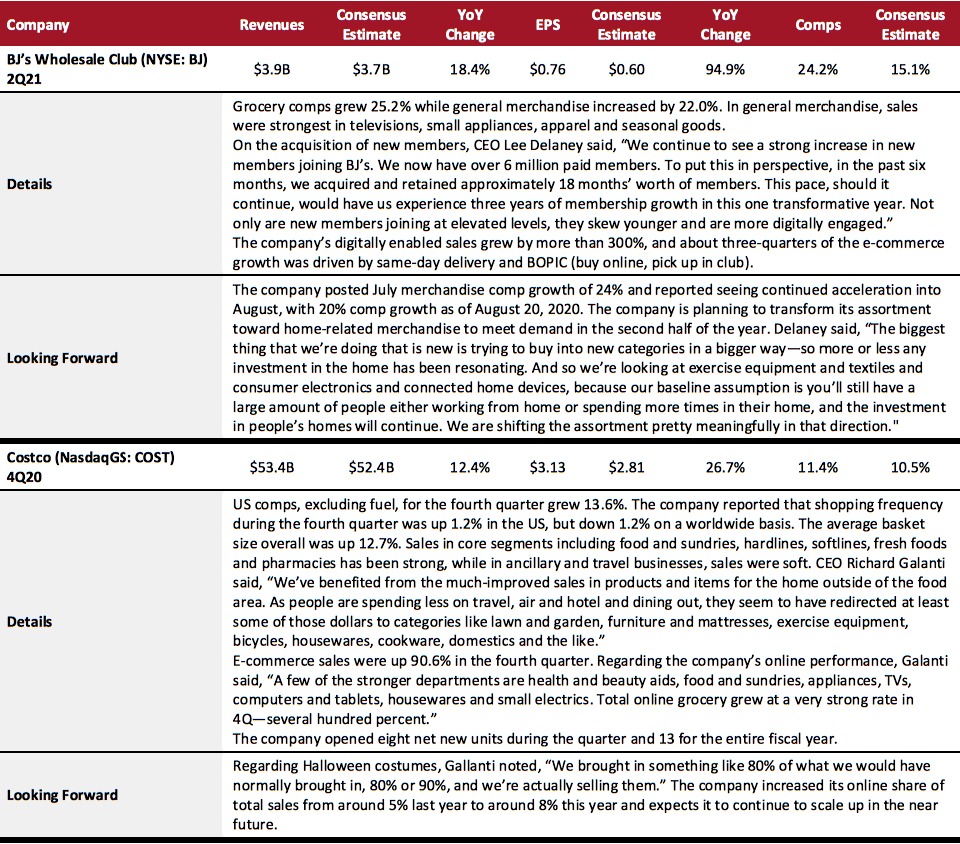

Food, Drug and Mass Retailers: Warehouse Clubs

Warehouse clubs continues to be a major beneficiary of the pandemic. The wholesale retailers’ grocery goods were in high demand while the home-related merchandise category also saw strong momentum in their last quarters. Importantly, the companies’ continued emphasis on e-commerce and omnichannel capabilities is driving customer engagement from both their core base as well as new members in the current environment.

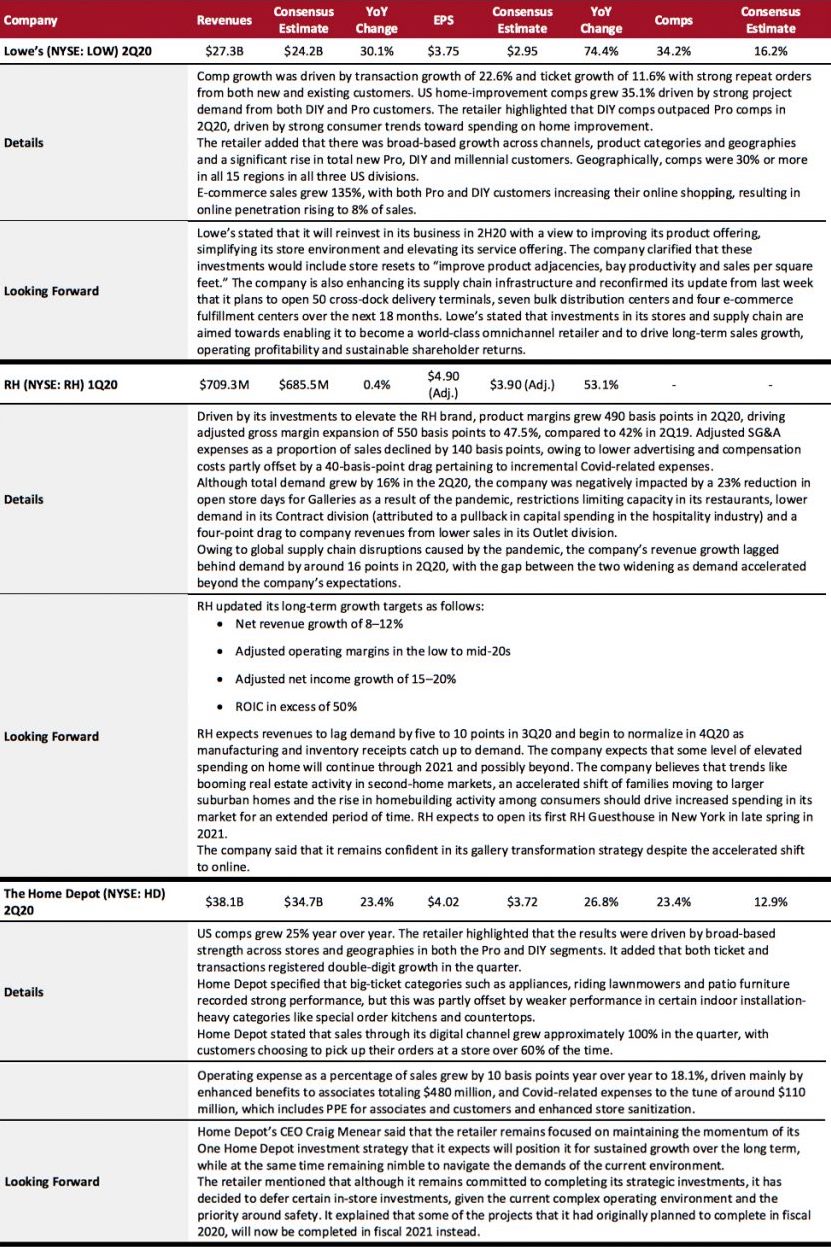

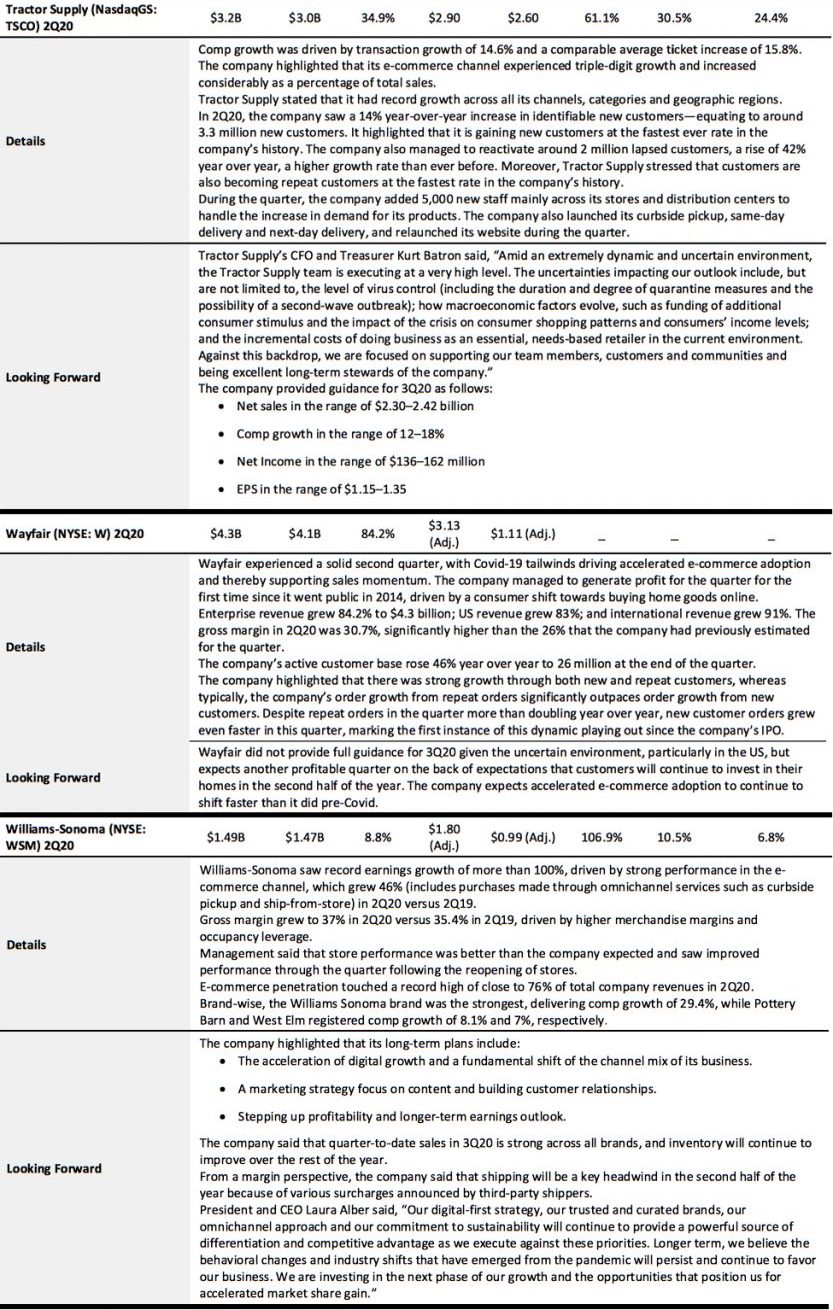

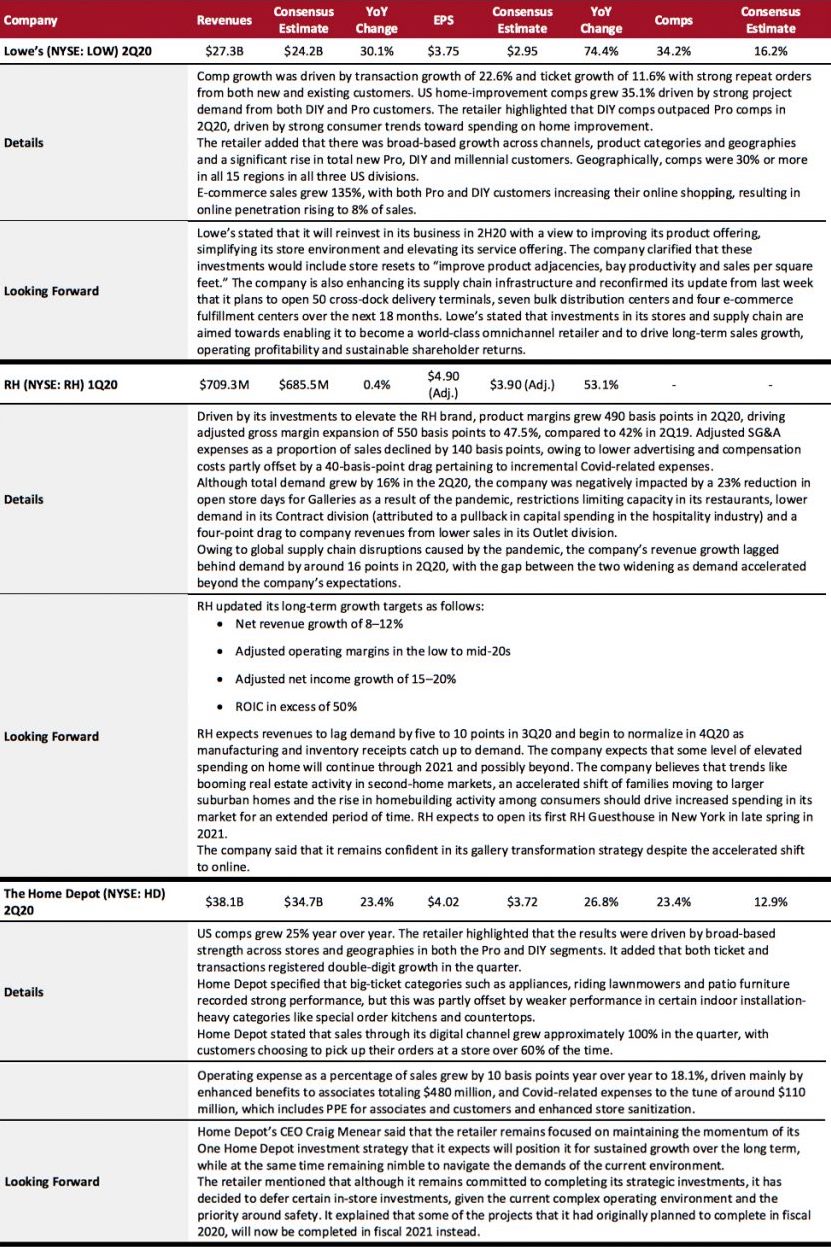

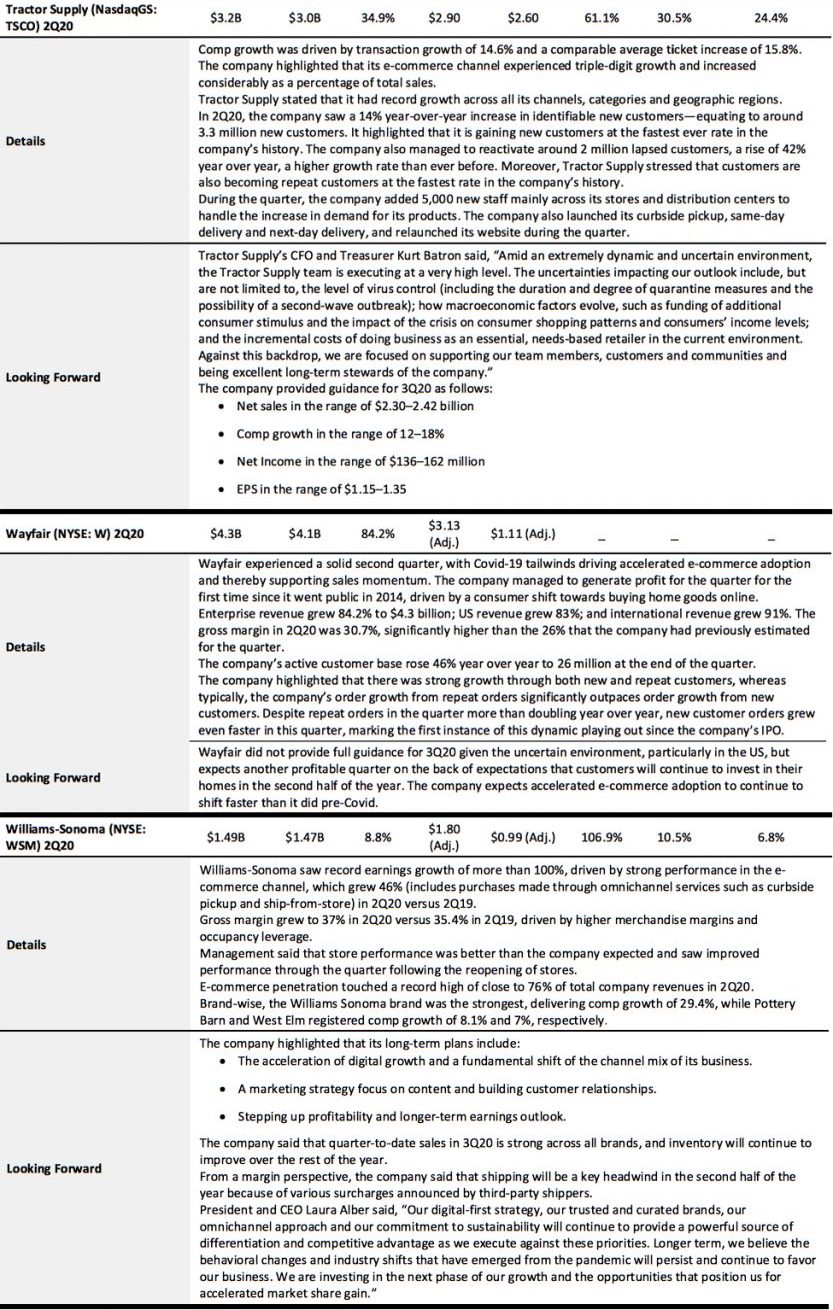

Home and Home-Improvement Retailers

The home and home-improvement sector had a strong quarter, with all five of the companies under the Coresight 100 coverage list beating consensus on revenues, EPS and comps. This strong performance was driven by continued demand and consumer spending on home improvement and home decor products as consumers spent most of their time indoors.

The acceleration in e-commerce adoption among consumers has further boosted the revenues of all five covered companies, and digitally focused retailers such as Wayfair and Williams-Sonoma have benefited significantly from the changed environment, with Wayfair reporting a profit for the first time ever during the quarter. As e-commerce penetration continued to grow during the quarter, e-commerce sales as a percentage of total sales has grown considerably for all covered companies that have reported.

Looking Forward

Looking Forward

Most of the discretionary sectors regained their momentum after witnessing a disastrous first quarter. With consumers continuing to stay indoors, we are seeing strength in home-related merchandise. This is benefiting more than home and home-improvement retailers: Burlington Stores (off-pricer), Dollar General (discounter), Nordstrom (department store) and Urban Outfitters (specialty retail) each called out home categories as outperformers. We believe the home category will continue to see outsized growth through the rest of the year, and many retailers will adjust their assortment to focus in that direction.

The holiday season is likely to start as early as October, providing for an extended shopping period. E-commerce will drive a significantly greater share of holiday sales than last year. To gear up for the holiday season, retailers should continue doubling down on their omnichannel strategy. Additionally, where possible, retailers should be prepared to quickly adjust inventory levels at stores by ensuring the capability to scale up with customer demand—such as by expanding ship-from-store capabilities or partnering with logistics firms that understand delivery needs and can help brands and retailers with transportation of inventory into stores during the holidays.

Beauty Brands and Retailers

Beauty Brands and Retailers

Looking Forward

Looking Forward