Nitheesh NH

Introduction

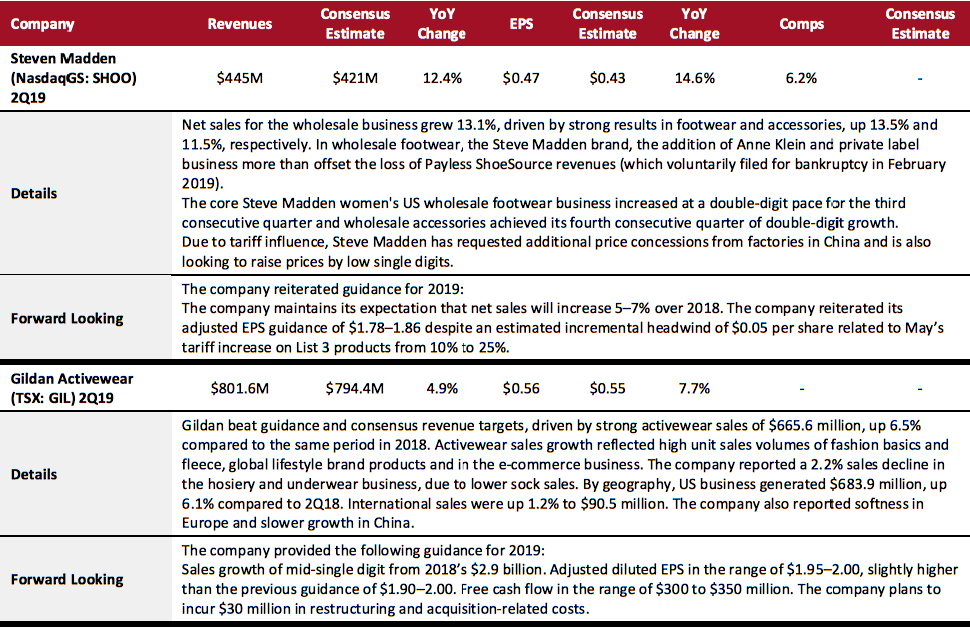

Our 2Q19 wrap-up covers quarterly earnings of 67 retailers, brands, e-commerce platforms and REITs—the (mostly) US-based companies in our Coresight 100 company coverage list.- More than half (51% or 34 companies) beat consensus estimates on the revenue line, 43% (29 companies) missed revenue consensus estimates and 6% (four companies) reported revenues in line with consensus.

- Apparel and footwear brands, e-commerce companies, REITs, and home and home-improvement retailers saw most companies (over 80%) beat consensus revenue estimates.

- The worst-performing retail sector was apparel specialty, in which 73% (eight companies) missed consensus revenue estimates. On the earnings line, specialty retail, department stores and CPG led the group.

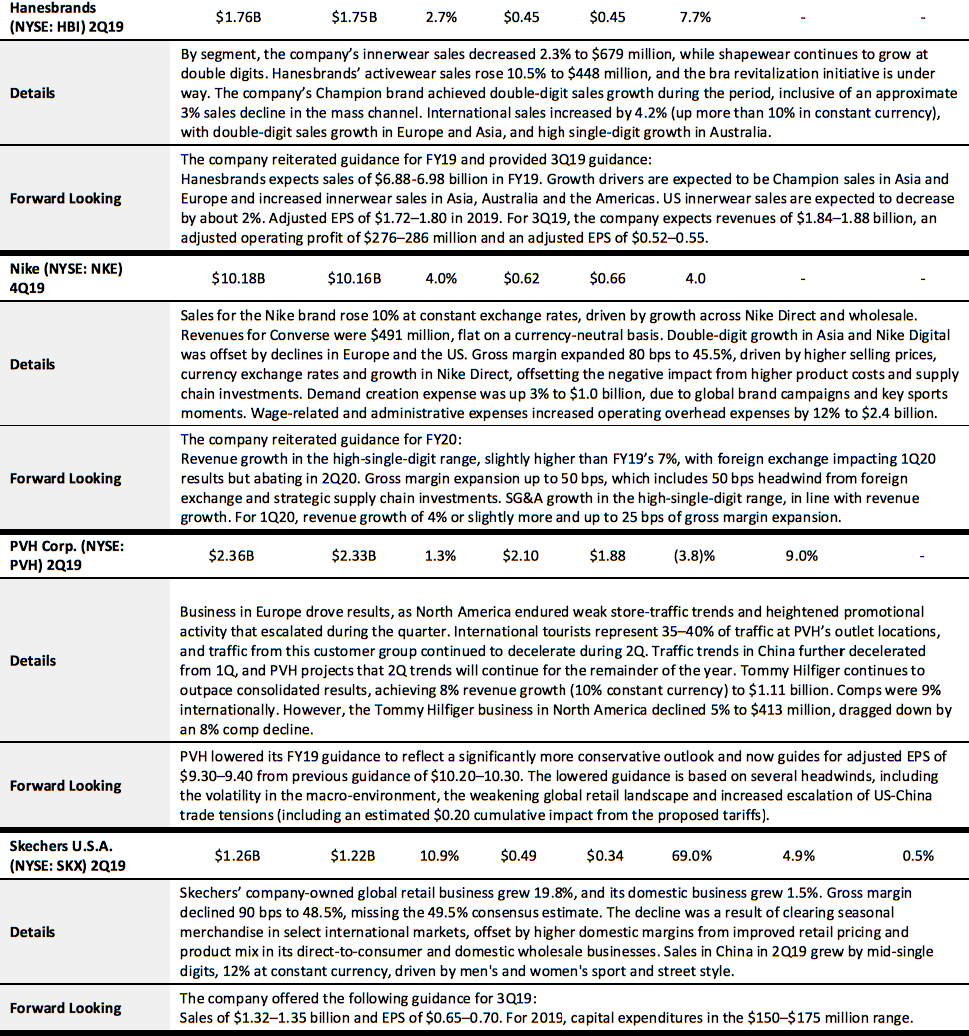

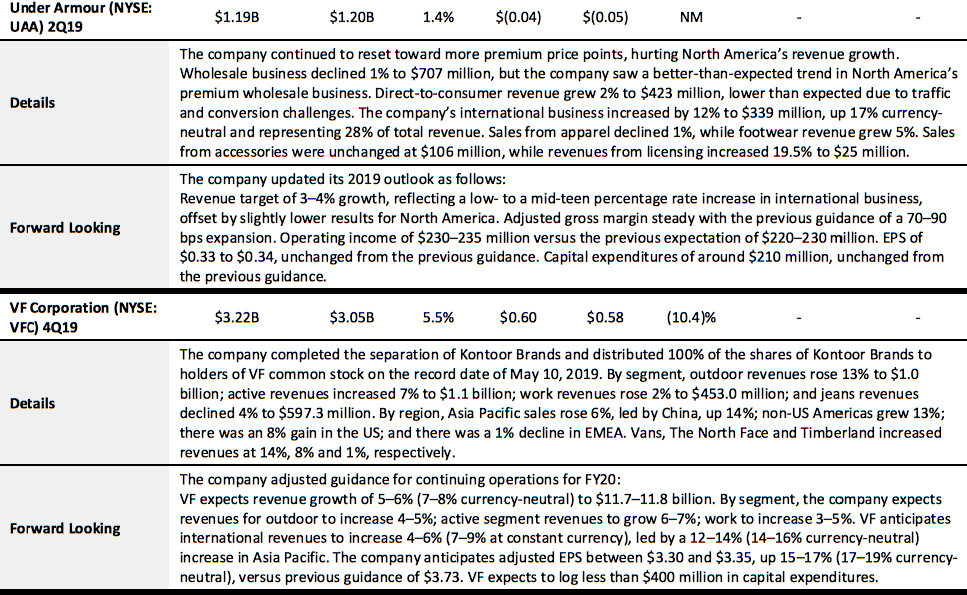

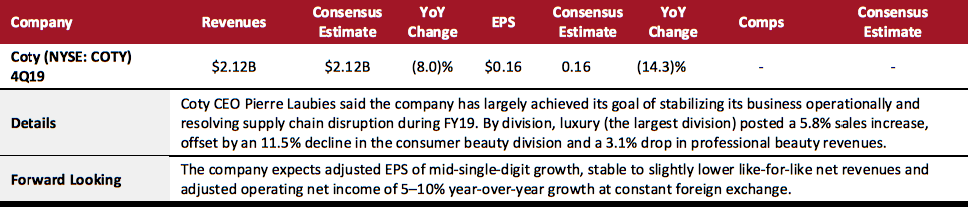

Apparel and Footwear

Overall, apparel and footwear brands experienced a solid quarter, with seven out of eight companies covered reporting revenues that beat consensus estimates and only Under Armour falling marginally short of consensus. PVH lowered its guidance based on several headwinds, including volatility in the macro-environment, the weakening global retail landscape and increased escalation of US-China trade tensions. Other retailers reiterated guidance and remained optimistic.

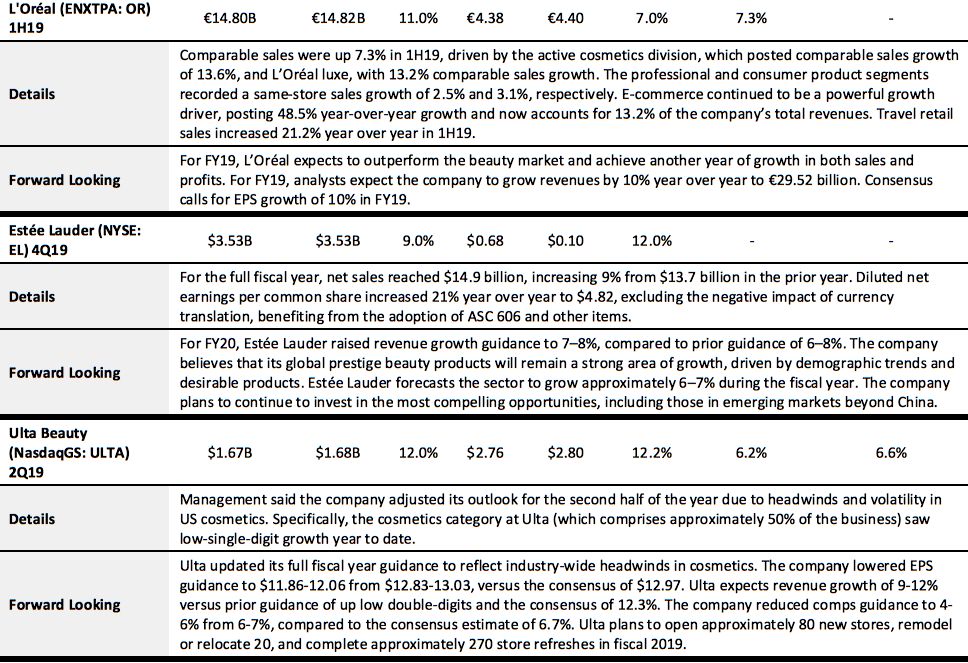

Beauty Brands and Retailers

Nearly 75% of the beauty brands and retailers had strong year-over-year revenue growth, ranging from 9% to 12%. L’Oréal’s growth was driven by its Active Cosmetics division (products sold in healthcare outlets and pharmacies, and designed to solve problems), with comparable sales growth of 13.6%, and L’Oréal Luxe, with 13.2% comparable sales growth. Despite 12% year-over-year revenue growth at Ulta, the company lowered its outlook for the second half of the year due to headwinds and volatility in US cosmetics, which experienced mid-single-digit declines through the first six months of 2019. CEO Mary Dillon explained that after several years of very strong performance, growth in the makeup category has been decelerating over the past two years and recently turned negative, and said that the company expects the trend of softness within the cosmetic category to continue through the remainder of the year.

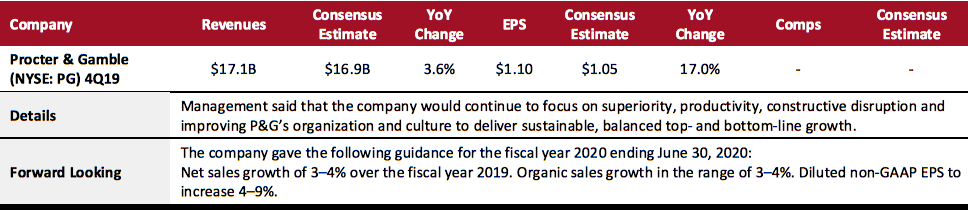

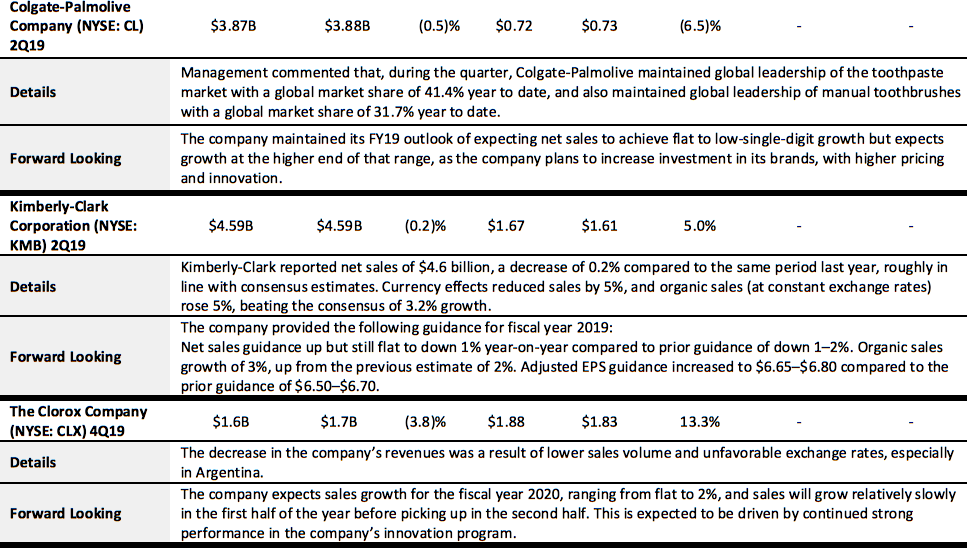

Consumer Packaged Goods (CPG)

In the quarter, the CPG sector faced various headwinds, including currency fluctuations and rise in commodities, transportation cost and tariffs. Major currencies—such as the British pound, Chinese yuan, Brazilian real and Turkish lira—weakened in the quarter. Trucking costs were up significantly in the US, with increases in many additional markets. Lower shaving frequency has reduced the size of the developed blades and razors market. More recently, and having much less of an impact, new competitors have entered at prices below the category average. Companies such as Procter & Gamble and Colgate-Palmolive are making use of product innovations and premiumization strategy to obtain organic sales growth. In addition, demand for natural products is also growing, as cited by Unilever.

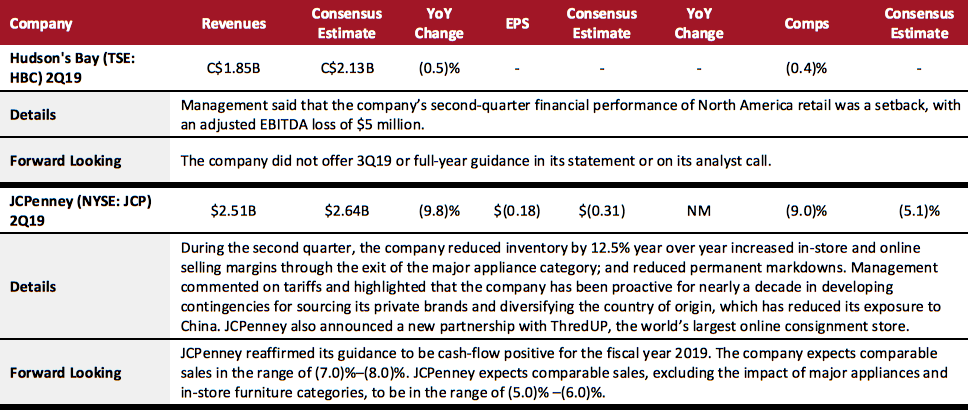

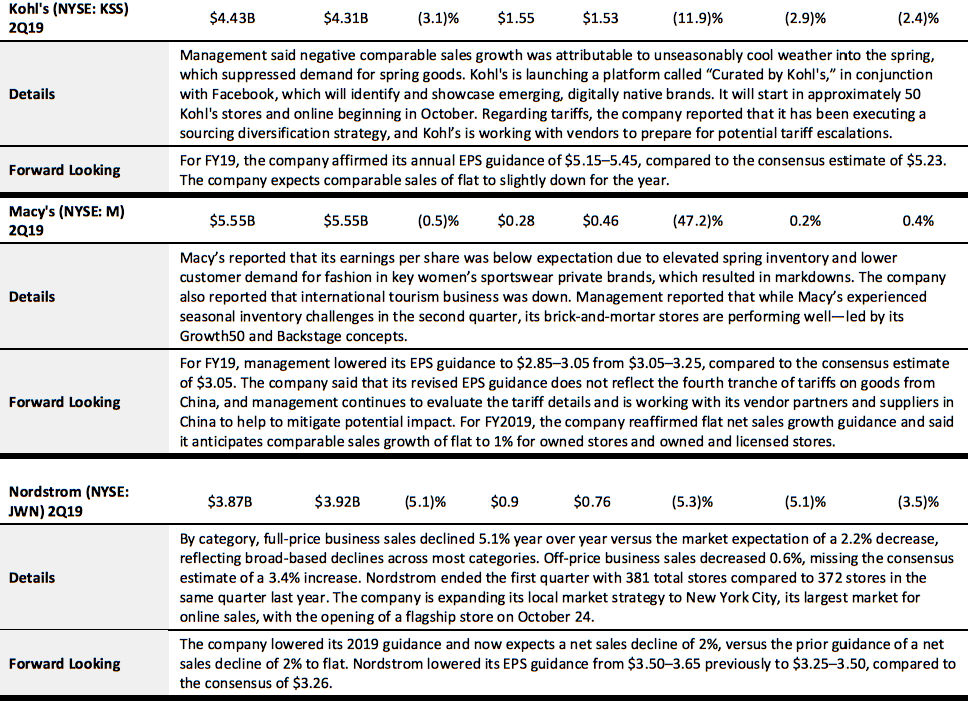

Department Stores

The department store sector struggled in the second quarter, with four out of five stores reporting negative comps; Macy's was the only retailer with positive comps, but those were just 0.2%. Most of the retailers attributed the decline to unseasonably cold weather, which suppressed demand for spring goods. Nordstrom highlighted that its annual anniversary sale was softer than expected, and its off-price sales fell short of expectations.

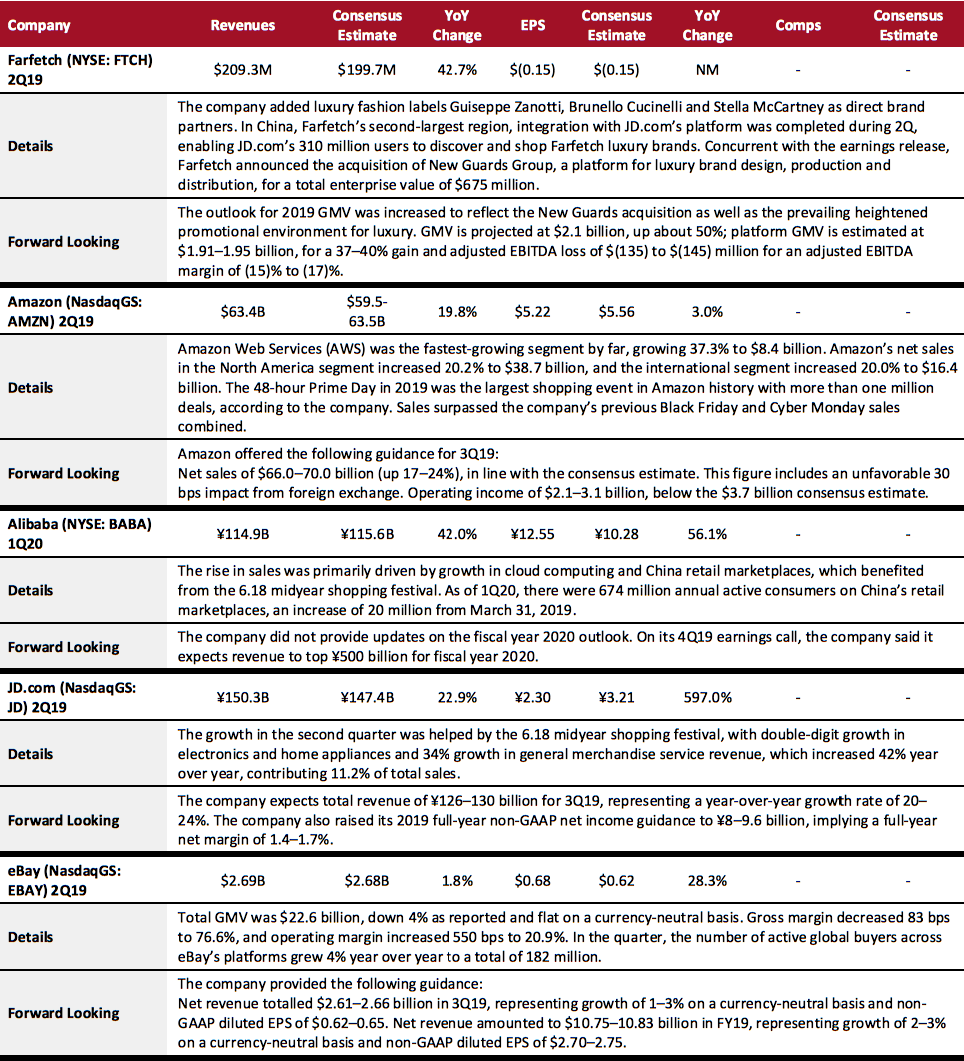

E-Commerce

The sector continued to witness strong growth. Amazon's 48-hour Prime Day in 2019 was the largest shopping event in Amazon history with more than one million deals, according to the company. Sales surpassed the company’s previous Black Friday and Cyber Monday sales combined. In the US, the landscape for Internet sales tax is evolving. At the start of 2019, only limited states had active legislation requiring marketplaces to collect sales tax., but by the end of the year, this will total more than 30 states. That said, more consumers are embracing one-day shipments and are using machine learning services from e-commerce platforms. In China, e-commerce players are continuously investing in artificial intelligence, big data and cloud technologies, with JD.com also expanding logistics networks into lower-tier cities. Alibaba cited three trends in China: an emerging affluent middle-class population, rising urbanization of lower-tier cities and the quickening pace of digitalization.

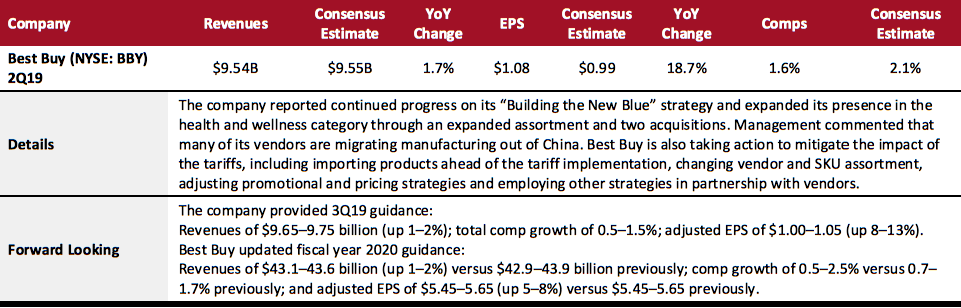

Electronics Retail

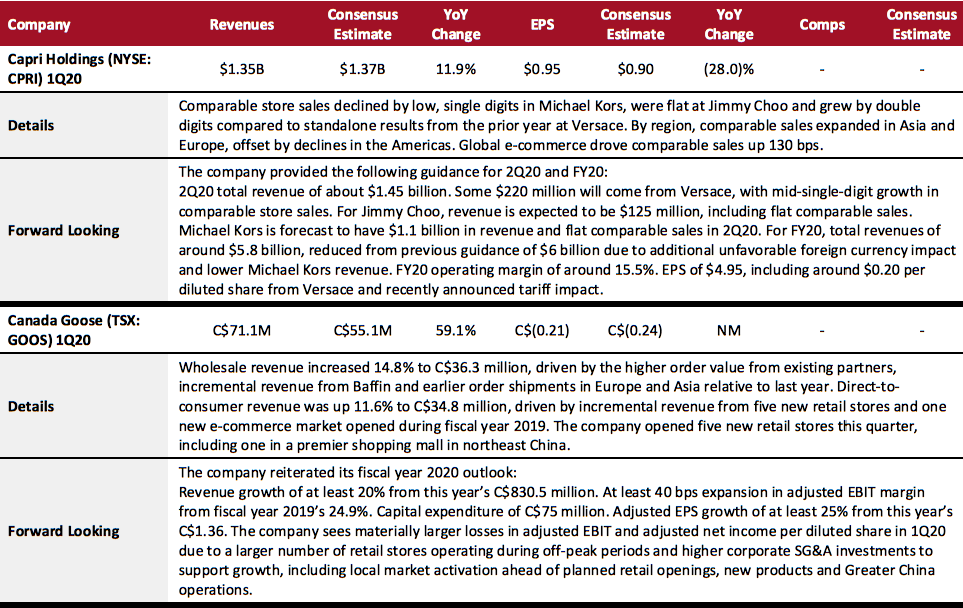

Luxury

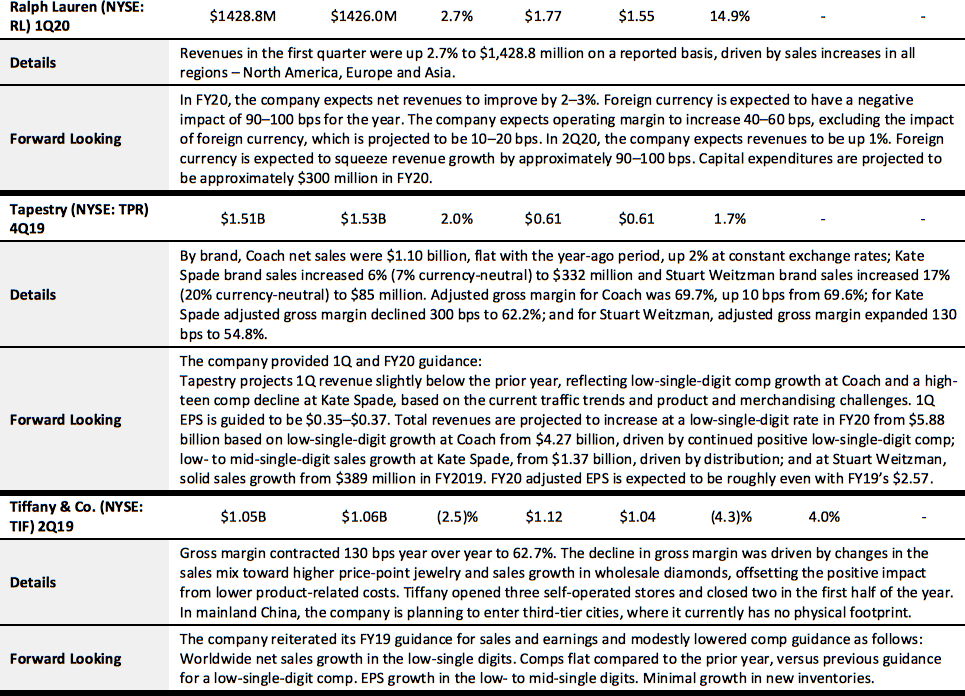

The luxury sector experienced a soft quarter, with two out of five companies under the Coresight 100 coverage list reporting revenue growth that beat consensus estimates—Capri, Tapestry and Tiffany fell only marginally short of consensus. Performances in the Asia market continue to be positive. All companies except Canada Goose lowered its guidance or kept a conservative outlook. Ralph Lauren lowered its guidance mostly because of foreign currency influences.

REITs

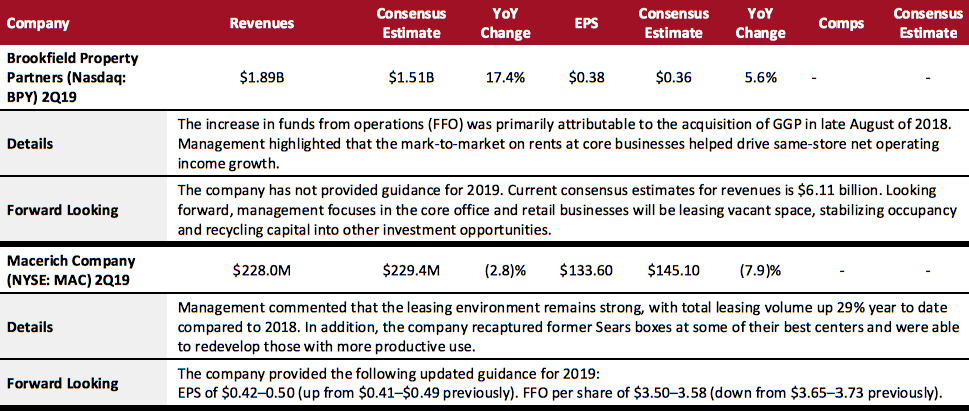

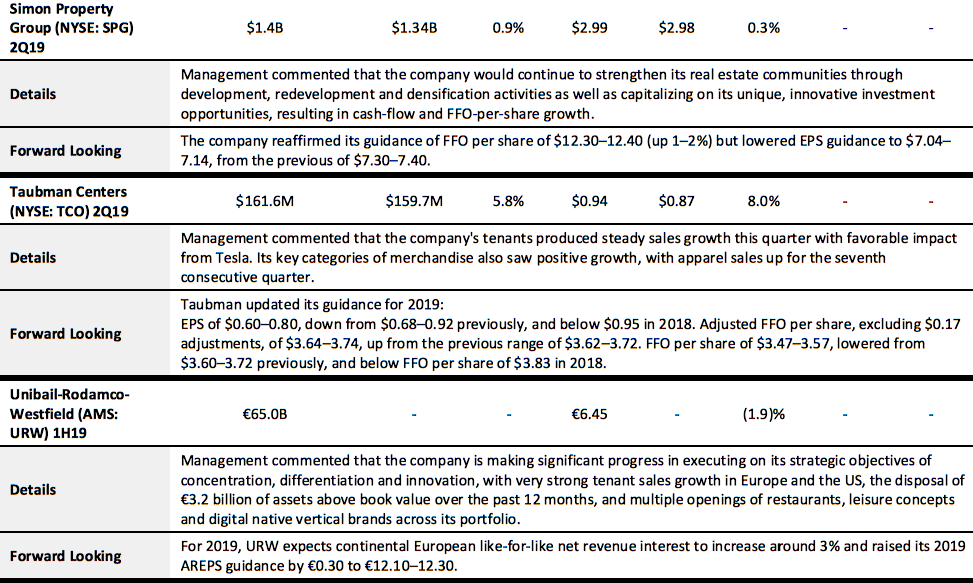

Overall, the sector delivered a solid result. Companies continue to renovate their properties and expand their portfolio through acquisition and new development. Macerich recaptured some Sears locations for redevelopment.

Specialty Retail

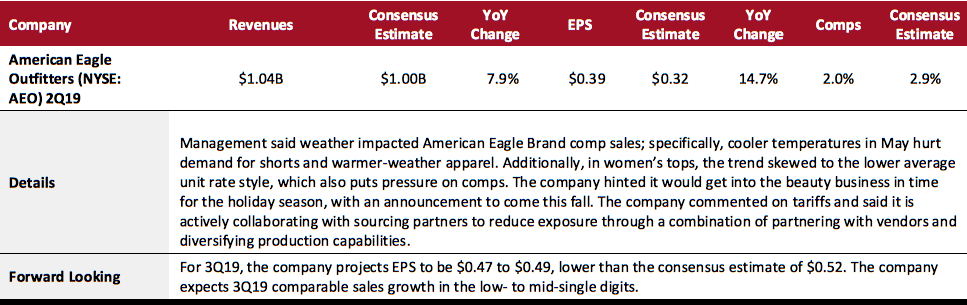

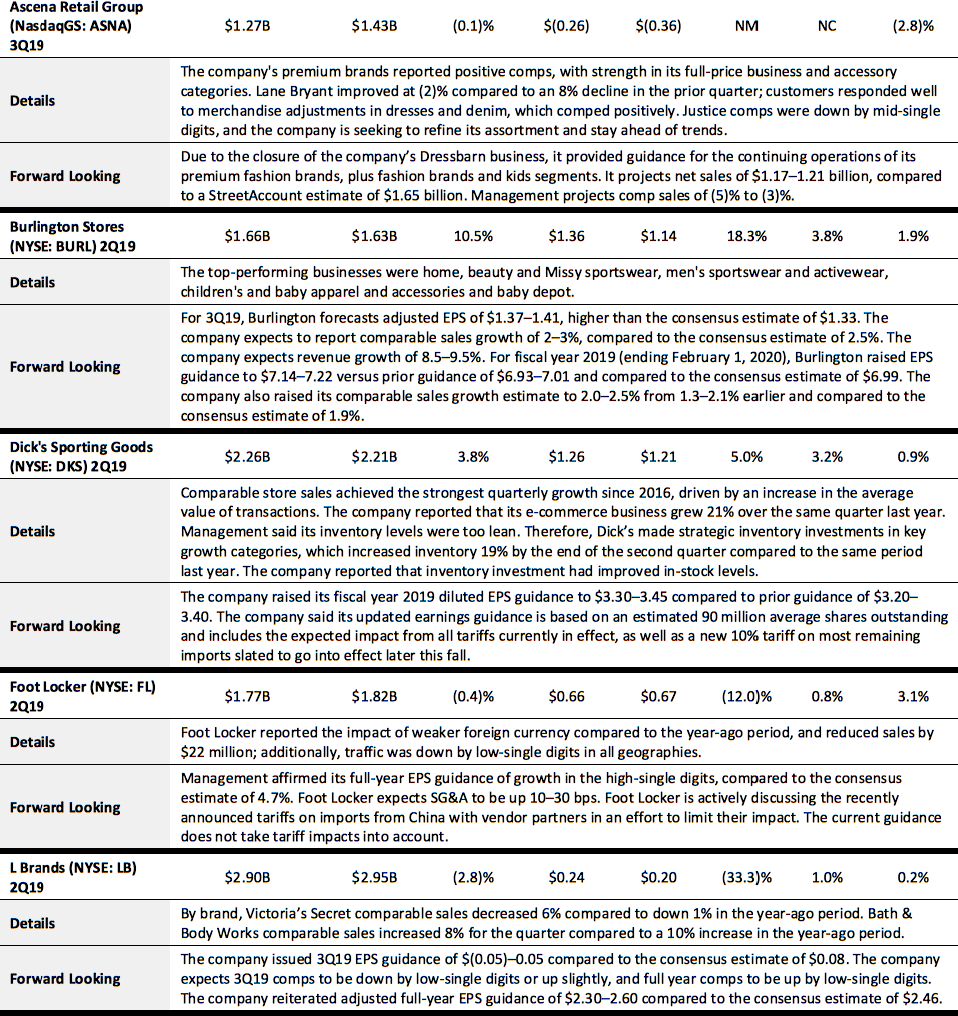

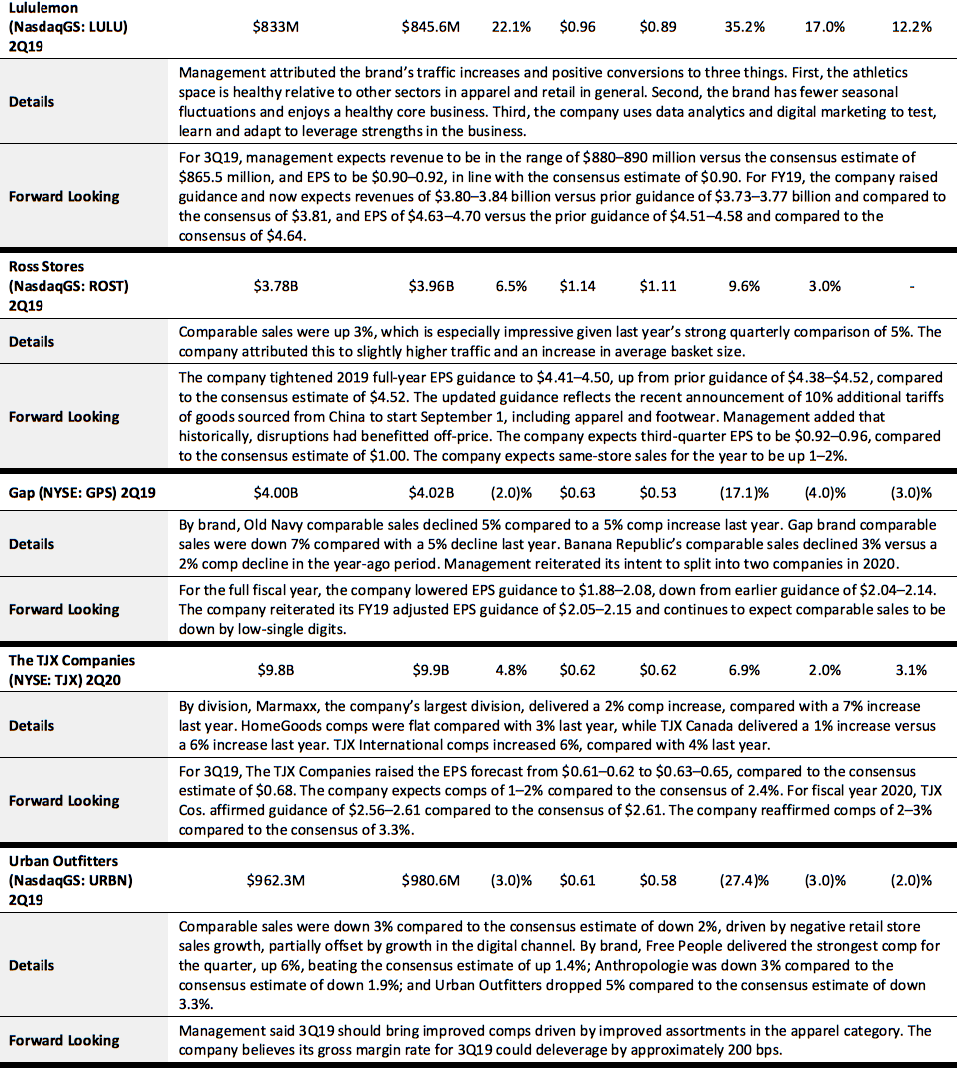

Specialty retail had a mixed quarter. Off-price retailers Burlington, Ross and TJX all reported strong results. In the athletic space, Dick's Sporting Goods and Lululemon reported comps of 3.2% and 17%, while Foot Locker had a weaker quarter with 0.4% comps; management cited the impact of weaker foreign currency. L Brands, Gap and Urban Outfitters were all down in revenue from the year-ago period and also missed consensus estimates: Urban Outfitters cited a softer women's apparel assortment; Gap cited traffic as a challenge during the quarter which resulted in an elevated promotional activity; and L Brands reported that in its portfolio, Victoria’s Secret North America operating profit declined 86%, which was offset by a Bath & Body Works increase of 7%, so improving merchandise assortment at Victoria's Secret was the company’s number one priority.

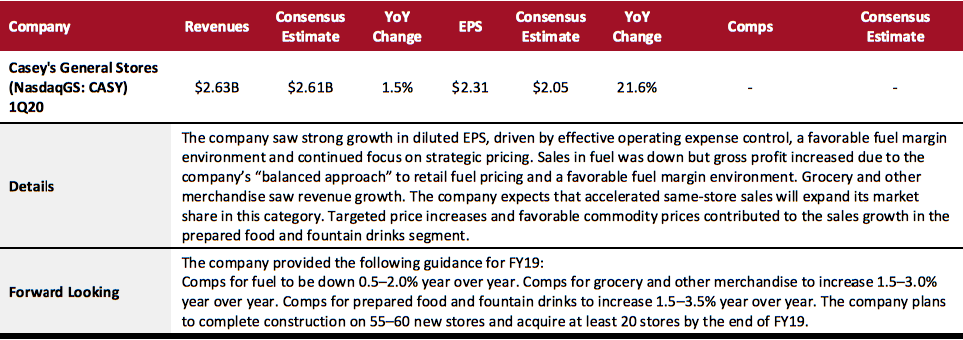

Food, Drug and Mass: Convenience Stores

Casey’s General Stores is implementing digital and loyalty initiatives to engage customers—the company implemented PriceAdvantage to all its stores to assist in fuel price optimization and continued to progress with its digital engagement program to streamline the ordering and checkout process and allow customers to pay online.

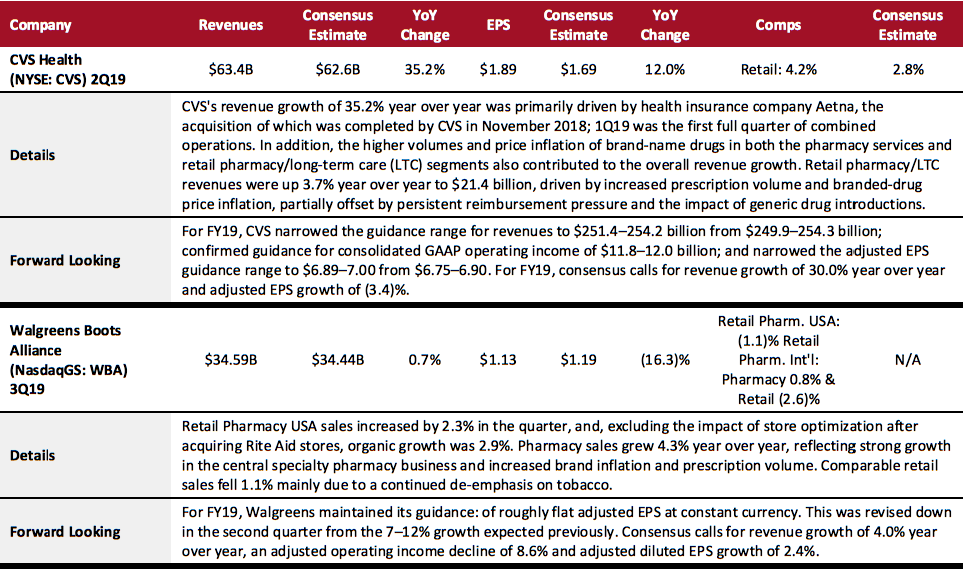

Food, Drug and Mass: Drug Stores

While CVS revised down guidance, Walgreens Boots Alliance maintained EPS guidance. Both retailers are working on revamping store estates. CVS has slowed store expansions as compared to last year. Walgreen launched a store optimization program that will affect around 200 locations over the next 18 months. The company added that several of these stores are loss-making, and approximately two-thirds of them are within walking distance of another Boots store.

Food, Drug and Mass: Food Retailers

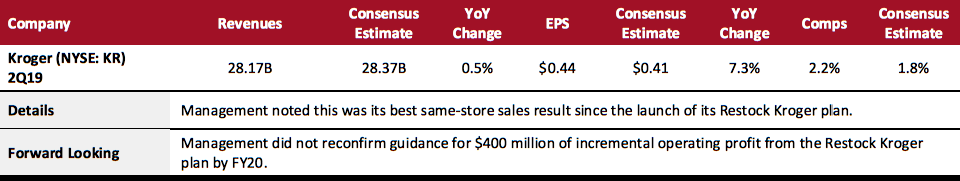

Kroger reported its strongest comparable sales growth since launching its Restock Kroger program, with the rate of comp growth jumping by 70 basis points from the prior quarter. However, Kroger's total revenue increase of 0.5% in the quarter ended August 17 compared to total grocery sector growth of 4.2% in the three months through August (from Census Bureau data)—implying an erosion of market share.

Food, Drug and Mass: Mass Merchandisers

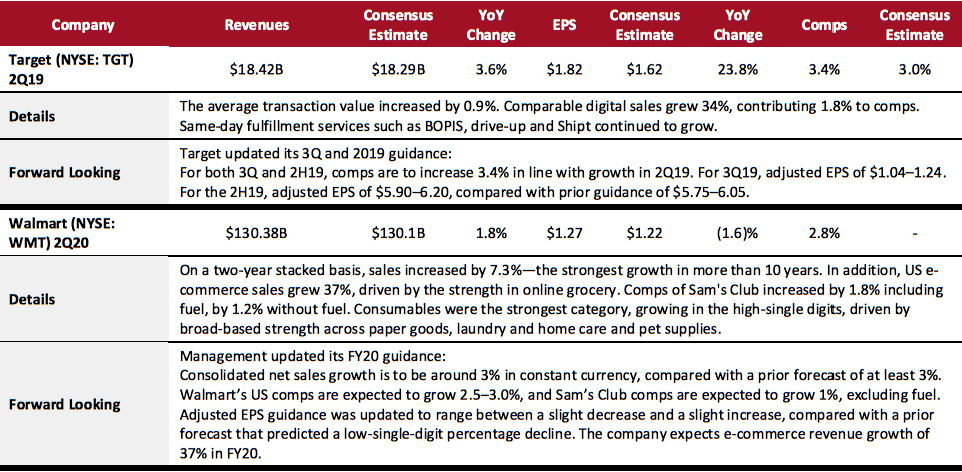

Target and Walmart continued to grow its ecommerce. Target grew on traffic growth and increased average transaction value; comparable digital sales grew 34%, contributing 1.8% to comps; same-day fulfillment services such as buy online, pick-up in store (BOPIS), drive-up and Shipt continued to grow. Walmart's strength in online grocery also drove its ecommerce business to a new level.

Food, Drug and Mass: Discount Stores

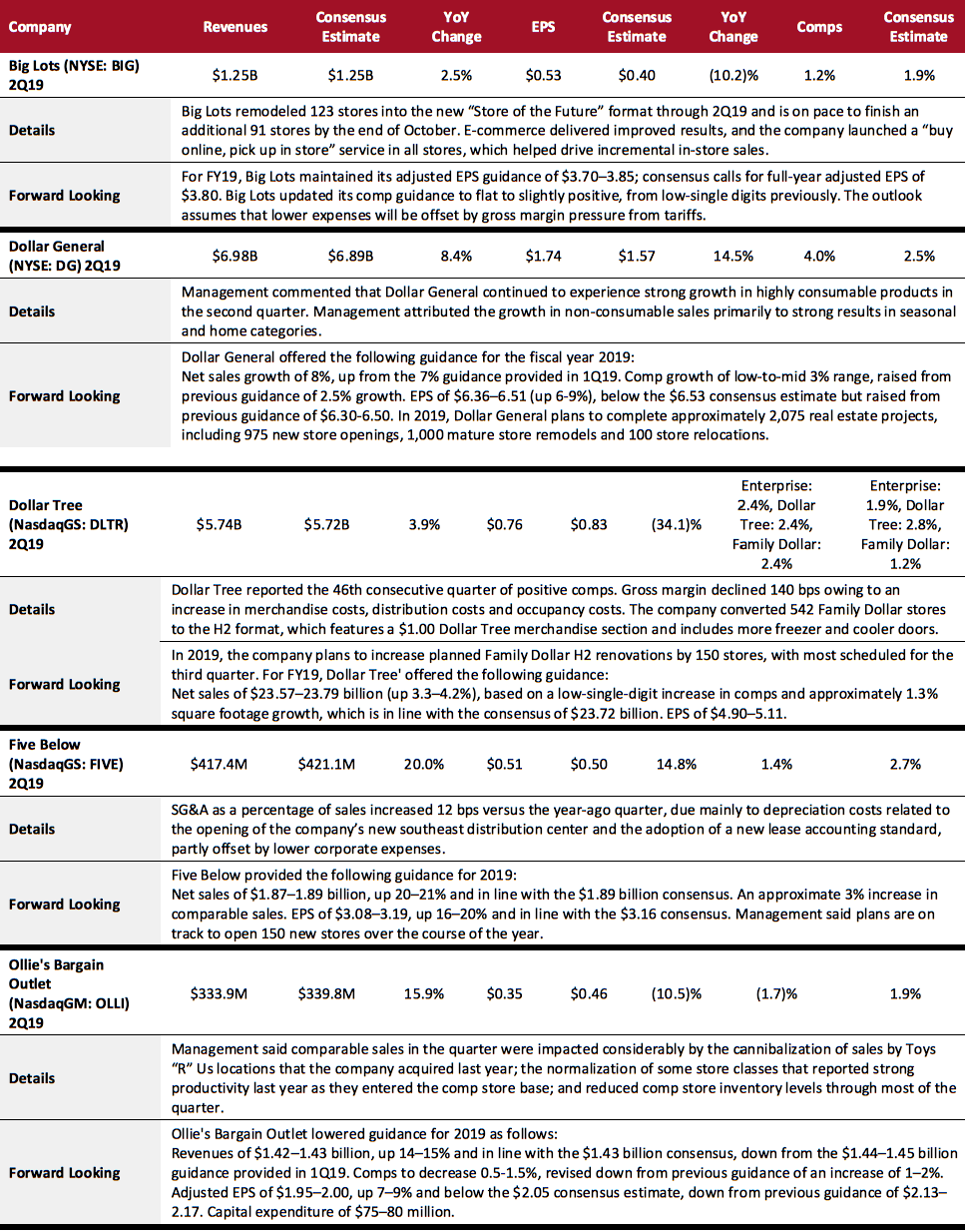

Dollar stores Dollar General and Dollar Tree continued to report strong revenue growth that beat consensus estimates. Five Below and Ollie’s Bargain Outlet, however, missed the consensus in terms of revenue growth, while Big Lots matched the consensus. Despite the ongoing narrative of retail store closures, discount stores are continuing to open stores to drive growth. While Dollar General raised guidance for the full year on the back of strong results, Big Lots lowered guidance for comps. Ollie’s experienced a tough quarter and lowered revenue guidance.

Food, Drug and Mass: Warehouse Clubs

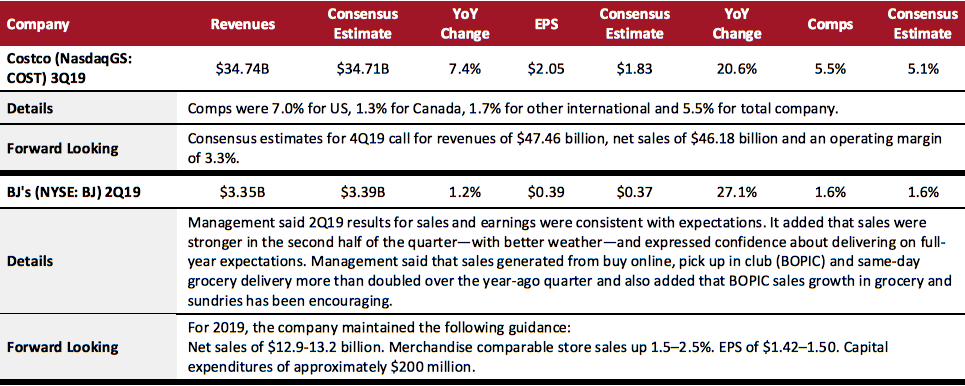

Comps growth for BJ's was in line, but revenues missed the consensus estimate. Margins improved in the quarter, driven by benefits from procurement initiatives, and the company maintained its outlook for the full year. Company management said that its 2Q19 results were in line with expectations and expressed confidence on delivering in its fullyear expectations. Costco’s revenues and EPS beat the consensus estimate, and the company is set to report its 4Q19 earnings on October 3, 2019.

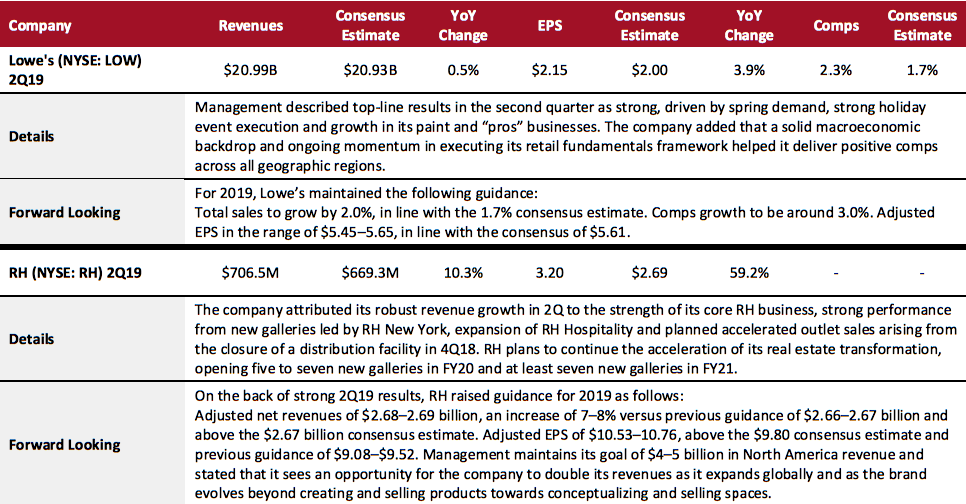

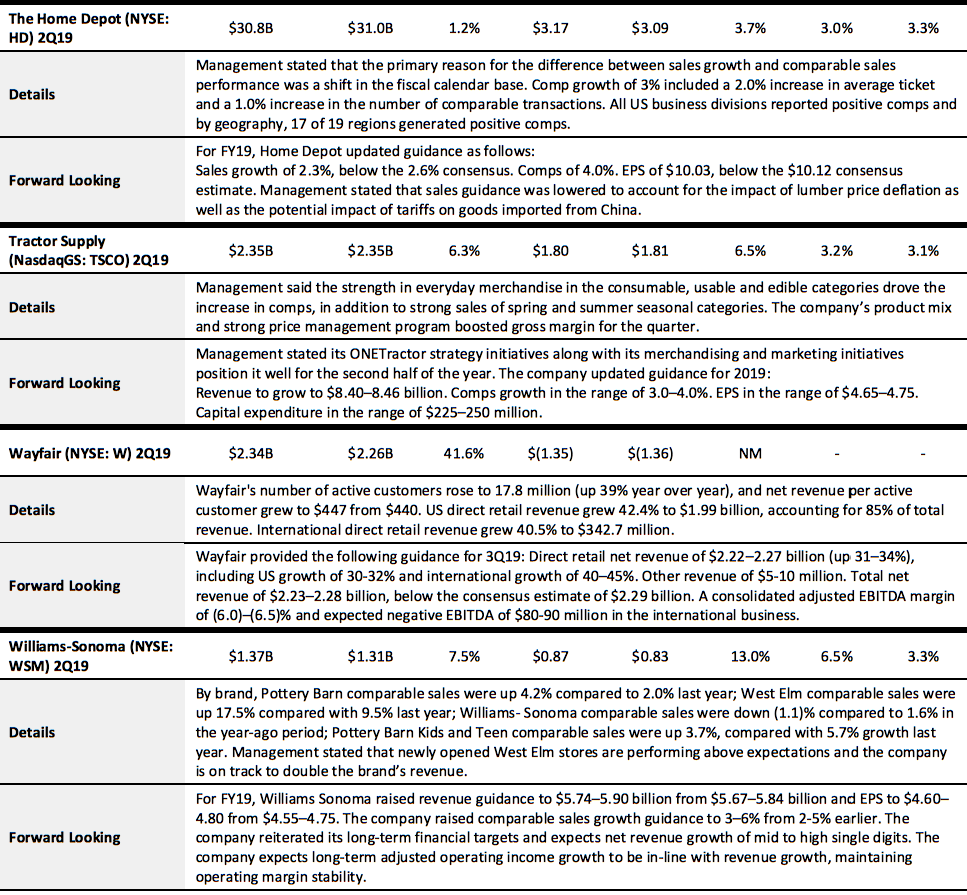

Home and Home Improvement

Overall, the home and home-improvement sector experienced a solid quarter, with four out of six companies under the Coresight 100 coverage list reporting revenue growth that beat consensus estimates, one (Tractor Supply) matching the consensus estimate and only Home Depot falling marginally short of consensus. RH, Tractor Supply and Williams- Sonoma raised guidance for the full year on the back of strong results, while Lowe's maintained its previous guidance. Home Depot, however, lowered its guidance to account for the impact of lumber price deflation as well as the potential impact of tariffs on goods imported from China.

Key Insights

Exchange rate fluctuations and volatility in the macroeconomic environment are impacting companies across sectors. Most brands and retailers are preparing themselves for potential tariff escalations. Major e-commerce players are continuing to invest in artificial intelligence and cloud technologies.