Web Developers

Strong US Retail Sales Buoyed by Higher Consumer Spending

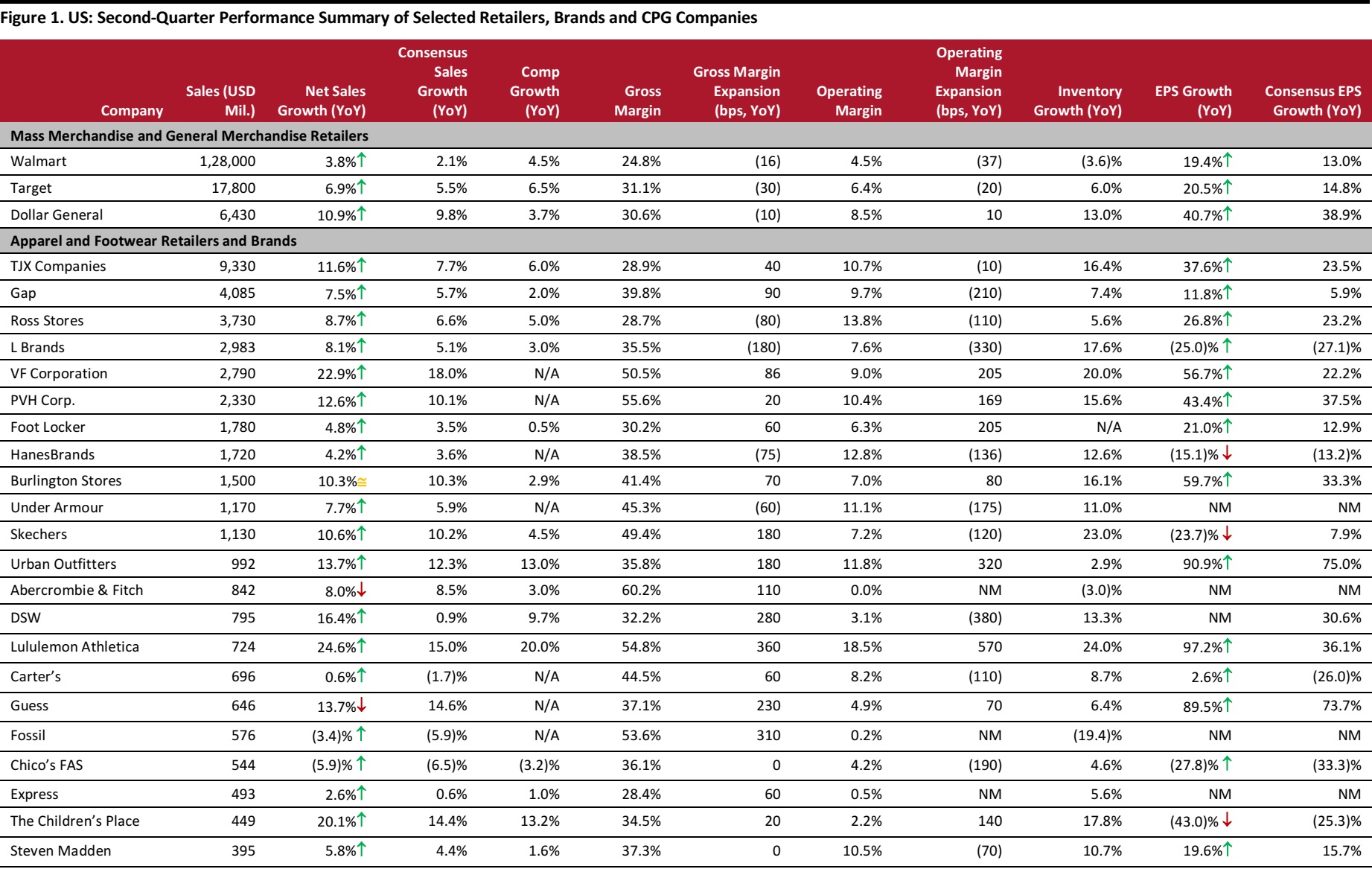

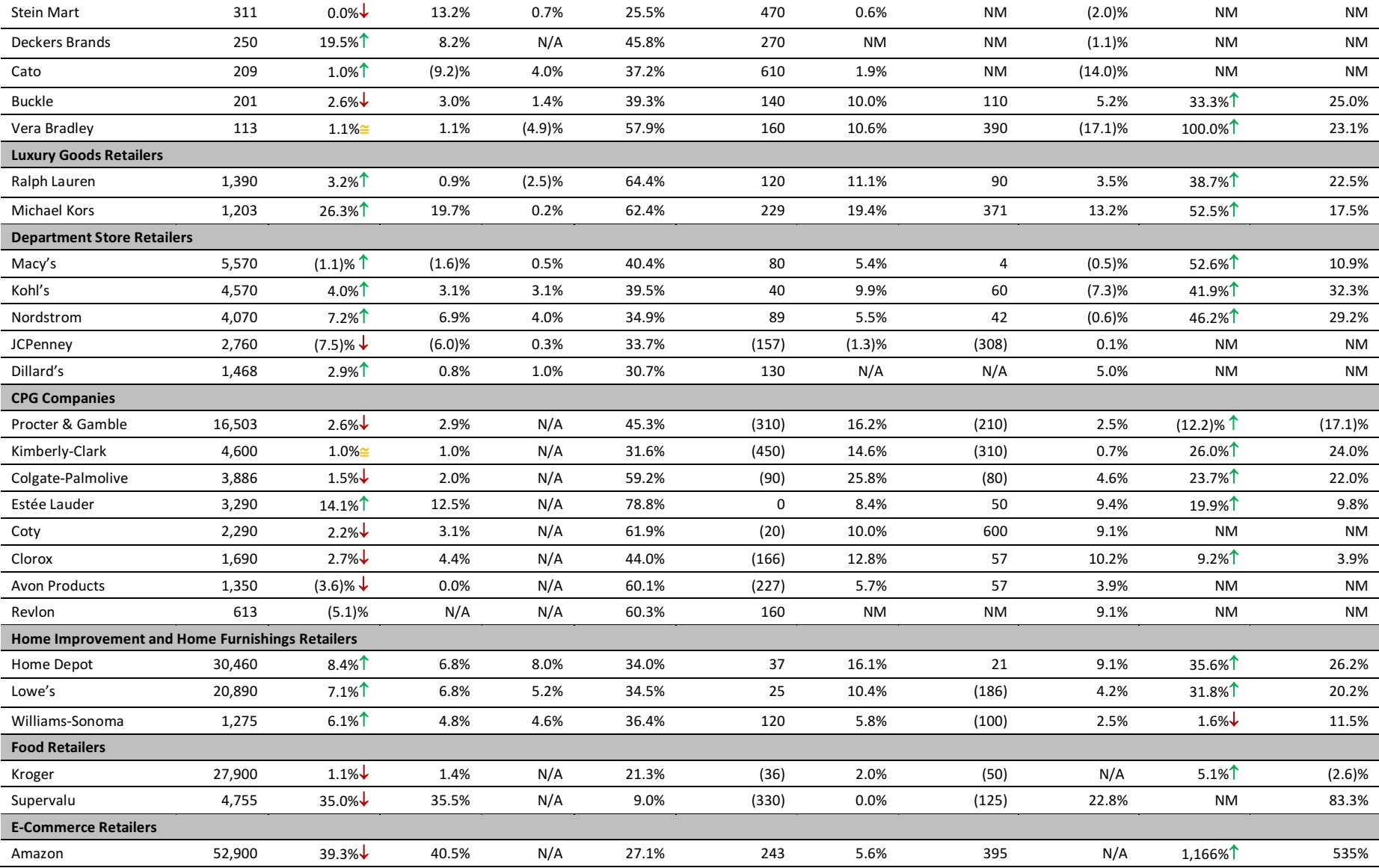

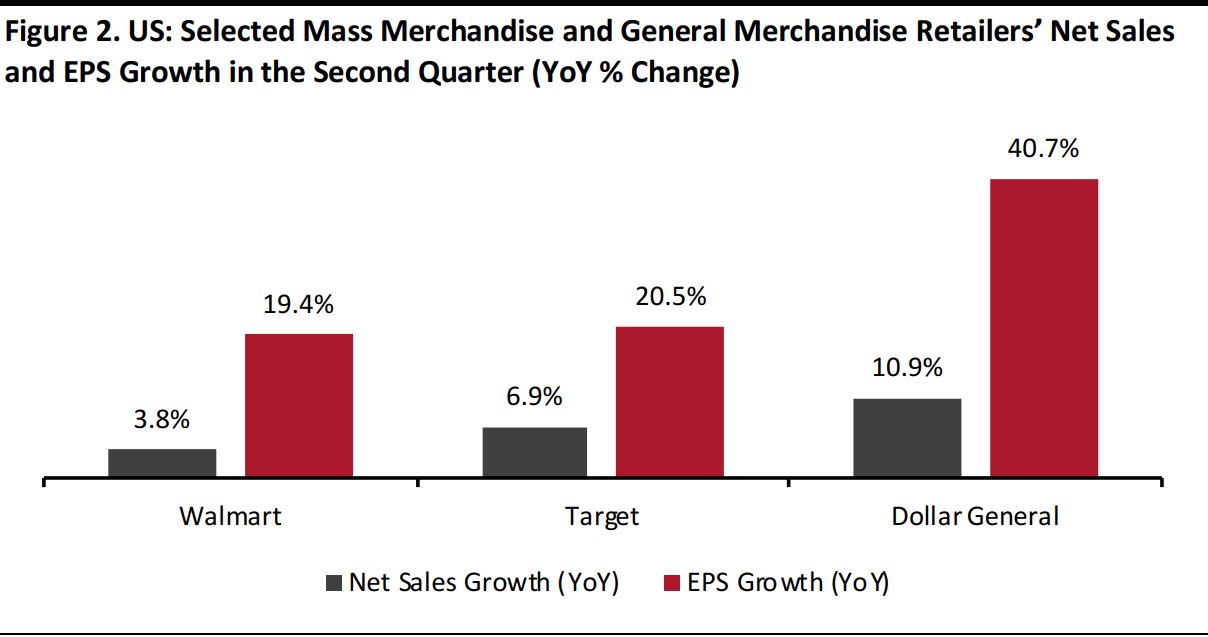

US consumers continued to spend freely in the second quarter of 2018 as tax cuts and a near-record-low unemployment rate boosted consumer confidence. After growing by a strong, 4.7% year over year in the first quarter, US retail sales continued their momentum in the second quarter, increasing by 5.7% year over year. In this report, we review the most recent quarterly earnings of selected large US retailers and consumer packaged goods (CPG) companies.The quarter under review ended in June, July or mid-August, depending on the individual company’s fiscal calendar.Some of the companies we discuss are currently in their fiscal 2018 year and others their fiscal 2019 year, but we will generally refer to the quarter under discussion as the “second quarter” for simplicity’s sake. We also consider performance by retail sector in this report and analyze the factors that influenced each sector’s results.Apparel, Footwear and Luxury Shine, While Other Sectors Post Mediocre Performance

Performance by sector was mixed in the second quarter.- The apparel, footwear, luxury and specialty sectors were clear winners,with robust growth in sales. Buoyant consumer sentiment and new fashion trends have boosted growth of the formerly lackluster apparel market.

- Furniture, general merchandise, and food and beverage players tended to report modest increases in revenues in the second quarter. Companies such as Walmart and Target posted their best comps in a decade and generated performances that exceeded Wall Street estimates.

- Home improvement retailers sustained their trend of strong revenue growth as consumers continued to invest in their homes.

- Among the department stores on our focus list, Kohl’s and Nordstrom posted healthy sales growth that beat consensus estimates.

- Consumers’ increasing enthusiasm for online shopping was reflected in strong online sales for many businesses.

Source: Company reports

In the sections below, we look at second-quarter performance by retail sector and highlight notable companies within each sector.Mass Merchandise and General Merchandise Retailers

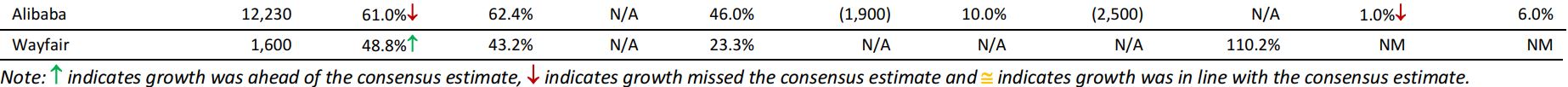

The companies on our mass merchandise and general merchandise focus list performed strongly in the second quarter.On average, the companies we analyzed in this segment grew revenues by 7.2% year over year, beating the consensus estimate of 5.8%, while their EPS growth of 27.4% beat the consensus estimate of 22.2%. These averages and those mentioned in subsequent sections are unweighted.Walmart

Walmart posted its strongest same-store sales growth in more than a decade in the second quarter (the company is in its fiscal 2019 year). Walmart’s revenues, EPS and comp growth were all ahead of consensus estimates.- Revenues grew by 3.8% year over year, beating Wall Street estimates of 2.1%.

- Adjusted EPS grew by 19.4% year over year, ahead of the consensus estimate of 13%.

- E-commerce sales surged by40%, led by a revamp of the Walmart website, which attracted more brands:the company added 1,100 new brands to Walmart.com between January and June 2018.

- Walmart’s grocery segment posted its best comp in nine years, led by strong fresh food sales. The company highlighted that it now offers grocery pickupat more than 1,800 locations and that it will have installed 700 pickup towers by the end of this year.

- The company raised its full-year EPS guidance to $4.90–$5.05 from $4.75–$5.00 previously.

- The acquisition of Indian retail giant Flipkart for $16 billion.

- The Asda-Sainsbury combination in the UK.

- The sale of 80% of the company’s Brazil business.

Target

Target has been investing in store remodels with the aim of making shopping“easier” and “inspiring.”In the second quarter, Target remodeled 113 stores, after having remodeled 56 in the first quarter. The company is on track to remodel more than 1,000 stores across the US by 2020. These store remodels drove traffic in the second quarter and helped the company generate strong results.- Revenues increased by 6.9% year over year,beating the consensus estimate of 5.5% growth.

- Target posted same-store sales growth of 6.5%, its strongest comp since 2005, driven by a 6% increase in traffic.

- The company reported EPS of $1.47, which beat the consensus estimate of $1.40.

- Target increased its full-year adjusted EPS guidance to $5.30–$5.50 from $5.15–$5.45 previously.

Source: Company reports

Apparel and Footwear Retailers and Brands

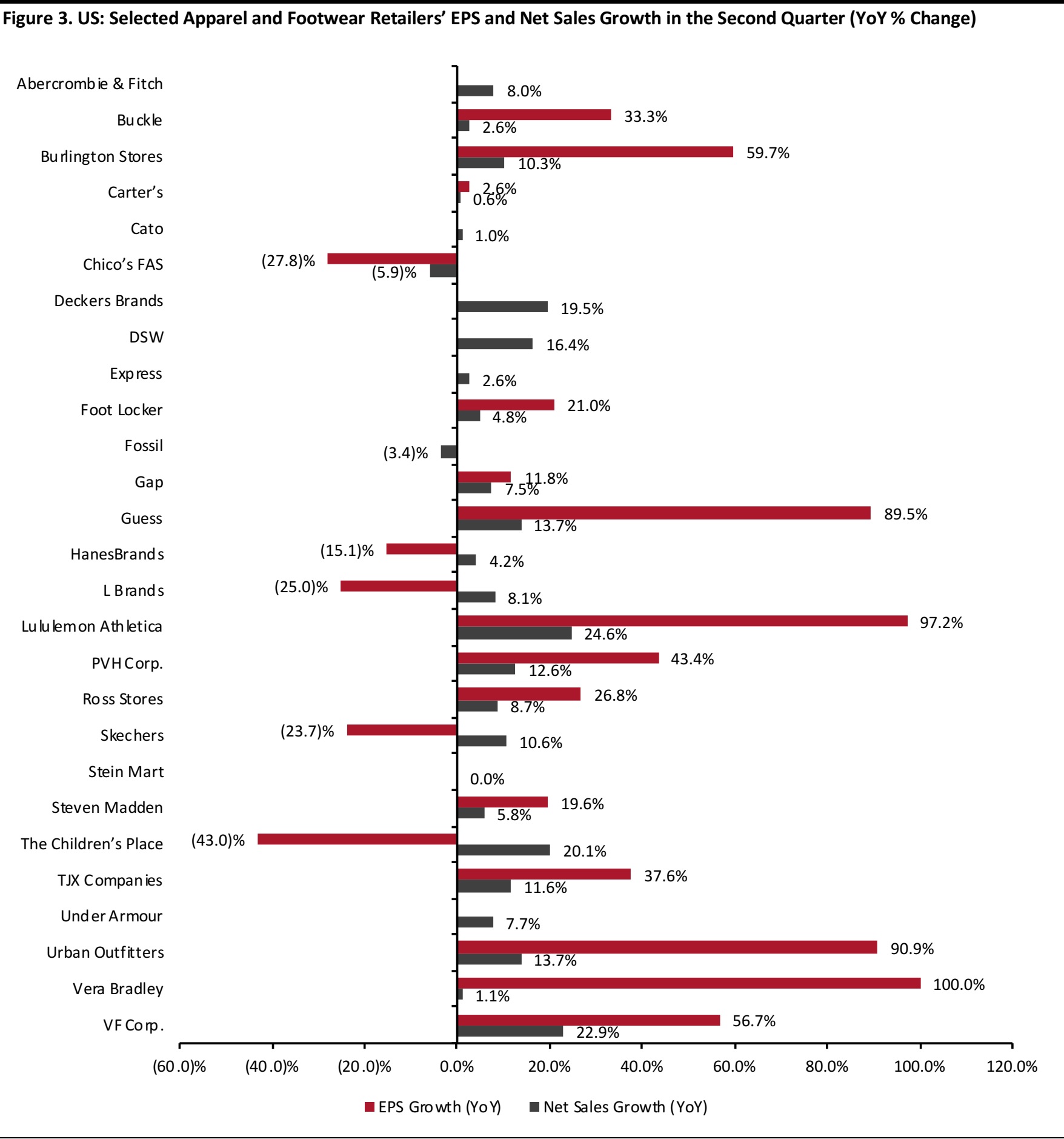

After years of sluggish performance, the US apparel market has seen an upturn in demand and this was reflected in much stronger top-line figures in the second quarter among the apparel and footwear retailers and brands on our focus list (we include off-price retailers in this segment). Among the companies on our list,21of the 27in this sector posted sales figures that beat consensus estimates, while 16 reported EPS that beat consensus estimates. The apparel and footwear companies on our list grew sales by 8.5% in the quarter, beating the consensus estimate of 5.9%. These companies’ EPS also topped consensus, growing by 29.2% year over year versus analysts’ estimate of 16.0%. Some of the big winners in this retail sector were TJX Companies, VF Corporation, Burlington Stores,Foot Locker, Guess and Urban Outfitters.TJX Companies

- TJX Companies reported strong second-quarter results for its fiscal 2019 year, with year-over-year sales growth of 11.6% beating the consensus estimate of 7.7%, driven by comp growth of 6%.

- EPS growth of 37.6% was well ahead of the consensus growth estimate of 23.5%.

- The most notable aspect of the company’s second-quarter performance was a 16.4% year-over-year increase in inventory. TJX Companies also reported that this was the 16th consecutive quarter of customer traffic increases for both the group and the Marmaxx division.The company has historically been able to maintain its quarterly days inventory outstanding (DIO) at around 60 days. DIO is a metric that indicates how many days, on average, it takes a company to turn its inventory into sales. As TJX Companies’ DIO has been mostly stable over time, the increase in inventory in the second quarter can be attributed to growing demand, as evidenced by the rise in traffic across its store estate.

VF Corporation

- VF Corporation posted strong results in the most recent quarter, the first quarter of its fiscal 2019 year,as it witnessed double-digit growth across all regions, channels and product families.

- Adjusted EPS was $0.43, above the consensus estimate of $0.33.

- Revenues came in at $2.79 billion, beating the consensus estimate of $2.68 billion.

- The company raised its full-year EPS guidance to $3.52–$3.57 from $3.48–$3.53 previously and its full-year revenue guidance to $13.60–$13.70 billion from $13.50–$13.60 billion previously.

- VF Corporation also announced that it will split into two different companies, one comprising power brands such as Vans, The North Face and Timberland and the other its more sluggish jeans business.

HanesBrands

- HanesBrands grew its second-quarter revenues by 4.2% year over year, to $1.72 billion, beating the $1.71 billion consensus estimate.

- Adjusted EPS of $0.45 was down from $0.53 in the year-ago quarter, missing the $0.46 consensus.

- By segment, the company’s international business performed well, with sales up 14.9% year over year. Global activewear and global innerwear sales were up 12% and 1%, respectively.

- HanesBrands maintained its full-year net sales guidance of $6.72–$6.82 billion, in line with the consensus estimate of $6.77 billion. The company expects full-year adjusted EPS of $1.72–$1.80, in line with the consensus estimate of $1.76.

Urban Outfitters

- Urban Outfitters posted stellar second-quarter results (the company is in its fiscal 2019 year),with robust sales growth of 13.7% topping the consensus estimate of 12.3%, driven by impressive, 13% comparable sales growth.

- The company’s operating margin expanded by 320 basis points, to 11.8%. The company attributed the strong performance to robust,double-digit growth in digital sales.

- Inventories increased by 2.9% year over year.

- All three of the company’s main brands—Free People, Anthropologie and Urban Outfitters—posted double-digit retail segment comp sales, driven by strength in apparel and accessories. Free People comps were up 17.0%, ahead of the 14.2% consensus estimate. Anthropologie comps grew by 11.0%, beating the 10.0% consensus estimate, and Urban Outfitters brand comps were up 15.0%, versus the 11.2% consensus estimate.

- The company’s EPS growth of 91% beat the consensus growth estimate of 75%.

- Urban Outfitters continues to grow through expansion and plans to open 17 new stores in its current fiscal year.

Foot Locker

- Foot Locker reported second-quarter revenues of $1.78 billion, up 4.8% year over year and above the $1.76 billion consensus estimate. The company’s adjusted EPS grew by 21% year over year, to $0.75, and was ahead of the $0.70 consensus estimate.

- Foot Locker’s comps increased by 0.5%, which was below the 0.7% consensus estimate.

- Growth was mainly driven by Foot Locker’s apparel segment, which posted double-digit comp growth.

- Management highlighted that comps are expected to turn positive in the current fiscal year, in comparison with negative comps reported in fiscal 2017.

EPS growth is not shown for some companies because their year-over-year EPS change was not meaningful

Source: Company reports

EPS growth is not shown for some companies because their year-over-year EPS change was not meaningful

Source: Company reports

Luxury Goods Retailers

In the luxury segment, both Ralph Lauren and Michael Kors beat consensus revenue and EPS estimates in the most recent quarter, but Michael Kors outperformed Ralph Lauren on both top-line and bottom-line growth.Michael Kors

- Michael Kors reported stellar performance in the most recent quarter (the first quarter of its fiscal 2019 year), with revenues up 26.3% year over year, to $1.20 billion, beating the consensus estimate of $1.14 billion. Revenue growth was driven by strong performances from the Michael Kors and Jimmy Choo brands.

- Diluted EPS was $1.22, up 52.5% year over year and above the consensus estimate of $0.94.

- Comparable sales increased by 0.2%. Positive comp performances in the Americas and Asia were partially offset by declines in Europe.

- Michael Kors raised its full-year EPS guidance to $4.90–$5.00. For the full year, the company expects revenues to reach $5.13 billion.

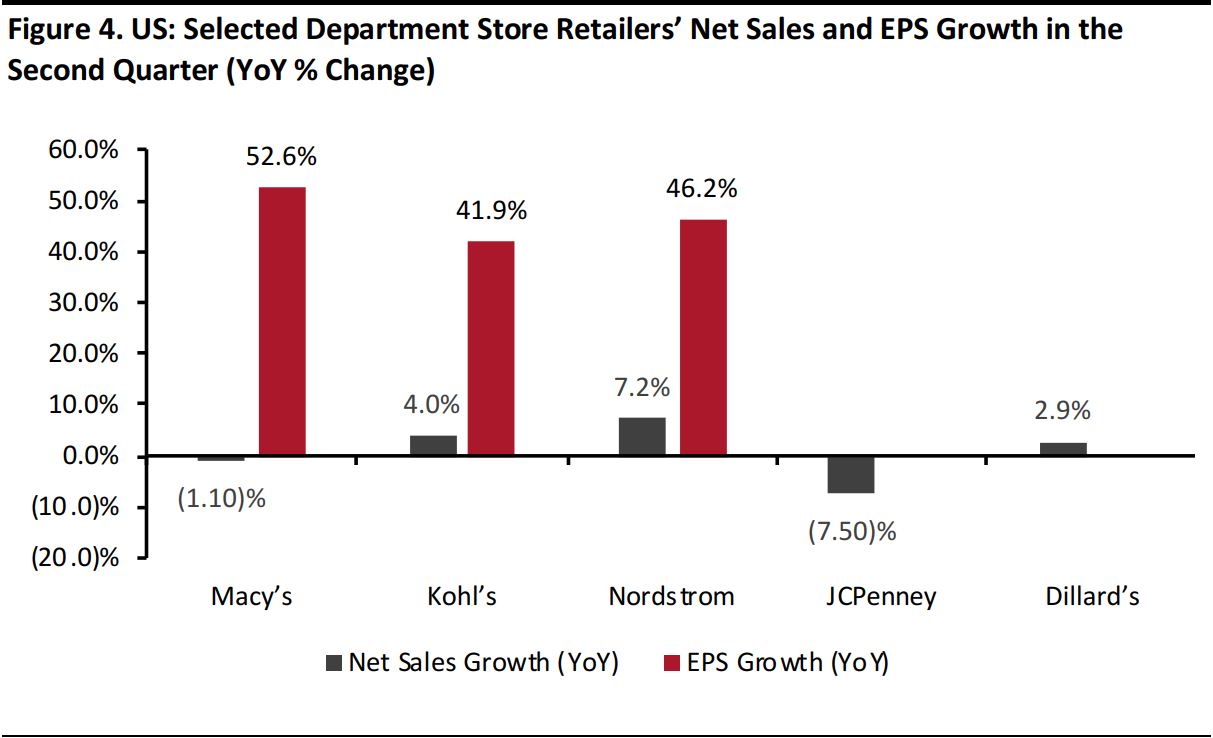

Department Store Retailers

Four out of the five department store retailers on our focus list were able to beat Wall Street expectations and post healthy sales figures in the second quarter. JCPenney was the exception.Macy’s

- Macy’s reported second-quarter revenues of $5.57 billion, down 1.1% year over year but beating the consensus estimate of $5.55 billion.

- The company grew comparable sales by 0.5%.

- Macy’s reported adjusted EPS of $0.70, beating the consensus estimate of $0.51. The company raised its full-year EPS guidance to $3.95–$4.15 from $3.75–$3.95 previously.

- The company’s loyalty program, which was launched last year, now has more than 1 million new members at the bronze level.

- Macy’s opened 65 Backstage stores in the first half of the year and is well on track to complete 120 Backstage store openings this year.

Kohl’s

- Kohl’s surpassed analysts’ expectations on both the top and bottom lines in the second quarter.

- The company reported year-over-year sales growth of 4%, which was well above the consensus estimate of 3.1%.

- The company’s EPS grew by 41.9% year over year, well ahead of the consensus estimate of 32.3%.

- Kohl’s is in the process of streamlining its business, and its efforts to downsize its stores have been paying off. The company’s inventory fell by 7.3% year over year in the second quarter.

- The company plans to lease out excess space to other businesses such as Aldi.

Nordstrom

- Nordstrom reported strong performance in the second quarter. The company grew revenues by 7.2% year over year, to $4.07 billion, surpassing the consensus estimate of $3.90 billion.

- Comps came in at 4.0%.

- The company’s diluted EPS increased by 46.2% year over year, to $0.95.

- Nordstrom raised its full-year EPS guidance to $3.50–$3.65 and its net sales guidance to $15.40–$15.50 billion.The company is making steady progress in its online business, too, with digital sales growing by 23% in the second quarter and accounting for 34% of total sales.

- In September, the company launched a customer loyalty program called The Nordy Club, which incorporates point systems coupled with offerings that provide enhanced and personalized services such as access to new product launches, off-price clearance events and “Clear the Rack” sales.

JCPenney

- JCPenney reported second-quarter net sales of $2.76 billion, down 7.5% year over year and below the $2.81 billion consensus estimate.

- Comparable sales were up 0.3% for the period.

- The company’s adjusted EPS was $(0.32), down from $(0.15) in the year-ago quarter and below the consensus estimate of $(0.05).

- Children’s, jewelry, Sephora, women’s apparel and salon were the top-performing divisions and categories during the quarter.

- The company lowered its full-year adjusted EPS guidance to $(1.00)–$(0.80), from $(0.07)–$0.13 previously, versus the $0.04 consensus estimate.

- JCPenney closed 141 stores in 2017 and has more than 800 stores left with lease terms that prevent the company from shutting them down.

EPS growth is not shown for some companies because their year-over-year EPS change was not meaningful

Source: Company reports

EPS growth is not shown for some companies because their year-over-year EPS change was not meaningful

Source: Company reports

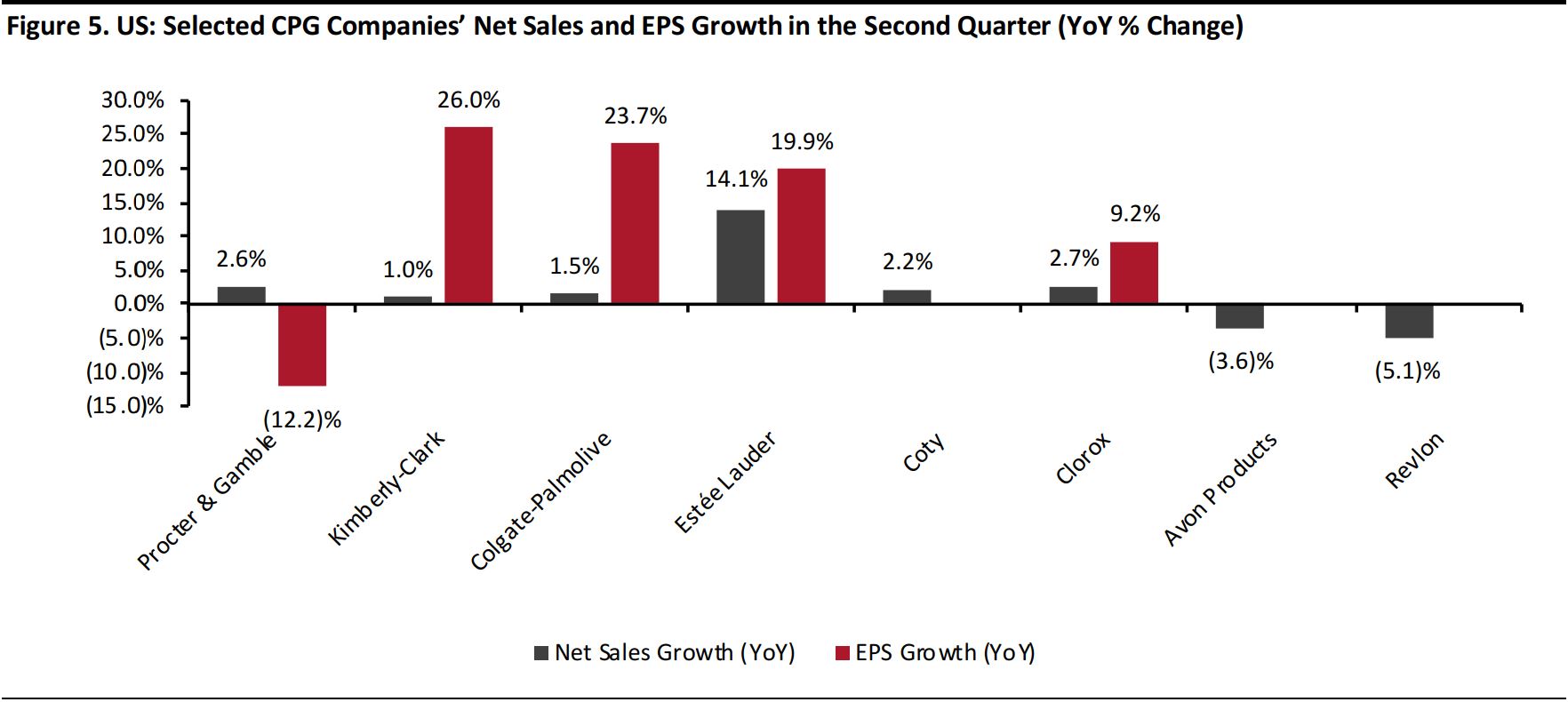

CPG Companies

Big players in the CPG sector are struggling to maintain growth due to increased competition from newer rivals, price wars and a lack of innovation.The CPG companies on our focus list grew sales by 1.93% year over year, below the consensus estimate of 3.7%.Estée Lauder

- Estée Lauder outperformed its peers by posting a stellar performance in the most recent quarter, the fourth quarter of its fiscal 2018 year.

- The company reported adjusted EPS of $0.61, up 19.9% year over year. Revenues were $3.29 billion, up 14.1% year over year and beating the consensus estimate of $3.25 billion.

- Skincare was the fastest-growing segment, with sales growing at a rate of 29% in the quarter. For the next fiscal year, the company guided for sales growth of 7%–8%, ahead of the 5%–6% growth expected for the global prestige beauty market. The company expects to generate full-year adjusted EPS of $4.62–$4.71.

- Estée Lauder–owned Origins is venturing into the cannabis skincare market with the launch of its new Hello, Calm mask in collaboration with Sephora.

Clorox

- Clorox reported mixed results for the most recent quarter, the fourth quarter of its fiscal 2018 year(ended June 30). Revenues of $1.69 billion were up 2.7% year over year but below the consensus estimate of $1.72 billion.

- Diluted EPS was $1.66, up 9.2% year over year and above the consensus estimate of $1.58.

- Clorox provided fiscal year 2019 sales guidance of 2%–4% growth and raised its EPS guidance to $6.32–$6.52 from $6.15–$6.30 previously.

EPS growth is not shown for some companies because their year-over-year EPS change was not meaningful

Source: Company reports

EPS growth is not shown for some companies because their year-over-year EPS change was not meaningful

Source: Company reports

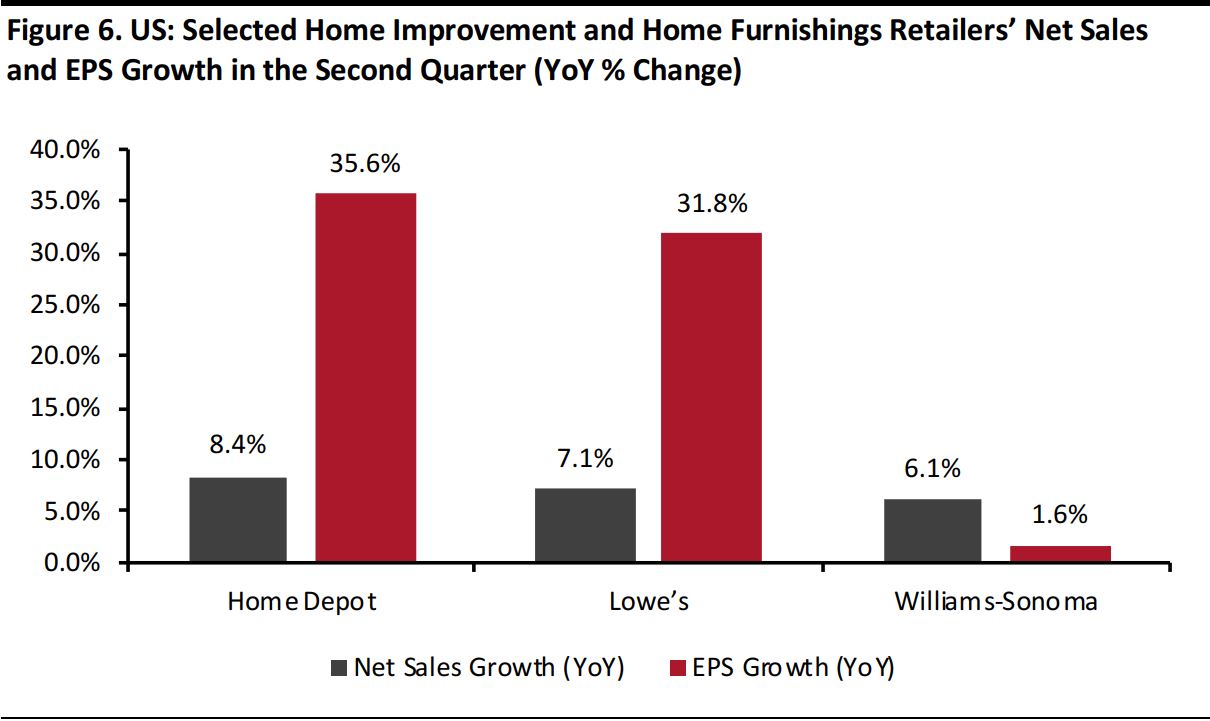

Home Improvement and Home Furnishings Retailers

The home improvement and home furnishings market is trending upward as consumers continue to spend on their homes.The companies on our focus list in this sector posted healthy sales growth that beat consensus estimates in the second quarter.Home Depot

- Home Depot reported EPS of $3.05 in the second quarter, up from $2.25 in the year-ago quarter and ahead of the $2.84 consensus estimate.

- The company’s total revenues increased by 8.4% year over year, to $30.46 billion, ahead of the $30.03 billion consensus estimate.

- Comps rose by 8.0%, beating the 6.6% consensus estimate. Comps for US stores were up 8.1% in the quarter.

- Categories that performed well included lumber, indoor garden, outdoor garden and electrical.

- Home Depot raised its full-year revenue guidance from a 6.5% increase to a 7.0% increase, reflecting expected comp growth of 5.3%. The company raised its EPS guidance from$9.31 to $9.42, versus consensus of $9.43.

Lowe’s

- Lowe’s reported net sales of $20.89 billion for the second quarter, up 7.1% year over year and beating the $20.79 billion consensus estimate.

- Adjusted EPS increased by 31.8% year over year, to $2.07, beating the consensus estimate of $2.02.

- Comps increased by 5.2%, driven by a 4.5% increase in average ticket, a 0.6% increase in total transactions, and positive in-store and online traffic numbers. Comp sales for the US were up 5.3%.

- Lowe’s lowered its full-year guidance, owing to the negative impact of closing 99 Orchard Supply Hardware stores. The company guided for full-year EPS of $4.50–$4.60, with comps expected to increase by 3.0%.

Source: Company reports

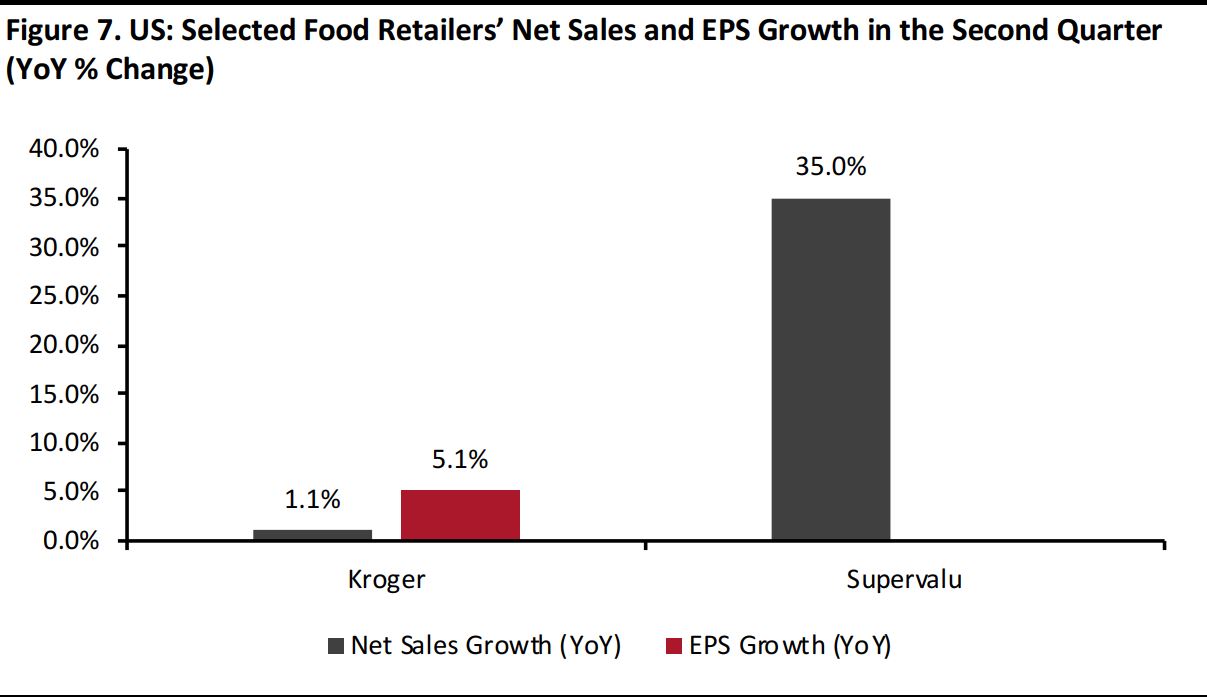

Food Retailers

Food retail is largely influenced by food-price inflation, changing lifestyles and food choices. The mature US food retail sector has tended to grow only modestly.Kroger

- Kroger reported second-quarter net sales of $27.9 billion, up 1.1% year over year but slightly below the $28.0 billion consensus estimate.

- The company’s adjusted EPS increased by 5.1% year over year,to $0.41, beating the consensus estimate of $0.38.

- Kroger guided for 2.0%–2.5% full-year sales growth, excluding fuel, and for adjusted EPS of $2.00–$2.15.

- Kroger has increasingly focused on enhancing the shopping experience for its customers. As part of its Restock Kroger drive, the company launched the Kroger Ship program in four cities: Cincinnati, Houston, Louisville and Nashville. Through this program, customers can choose to shop online for items exclusively available in these regions and receive free doorstep delivery on orders of more than $35 or pay a fee of $4.99 per order for smaller orders.

- Kroger expanded its partnership with Instacart to increase its delivery coverage area to an additional 75 markets throughout the US by late October. It also started a pilot delivery service in Arizona that uses autonomous vehicles in partnership with startup Nuro to speed deliveries.

Supervalu EPS growth is not shown because its year-over-year EPS change was not meaningful.

Source: Company reports

Supervalu EPS growth is not shown because its year-over-year EPS change was not meaningful.

Source: Company reports

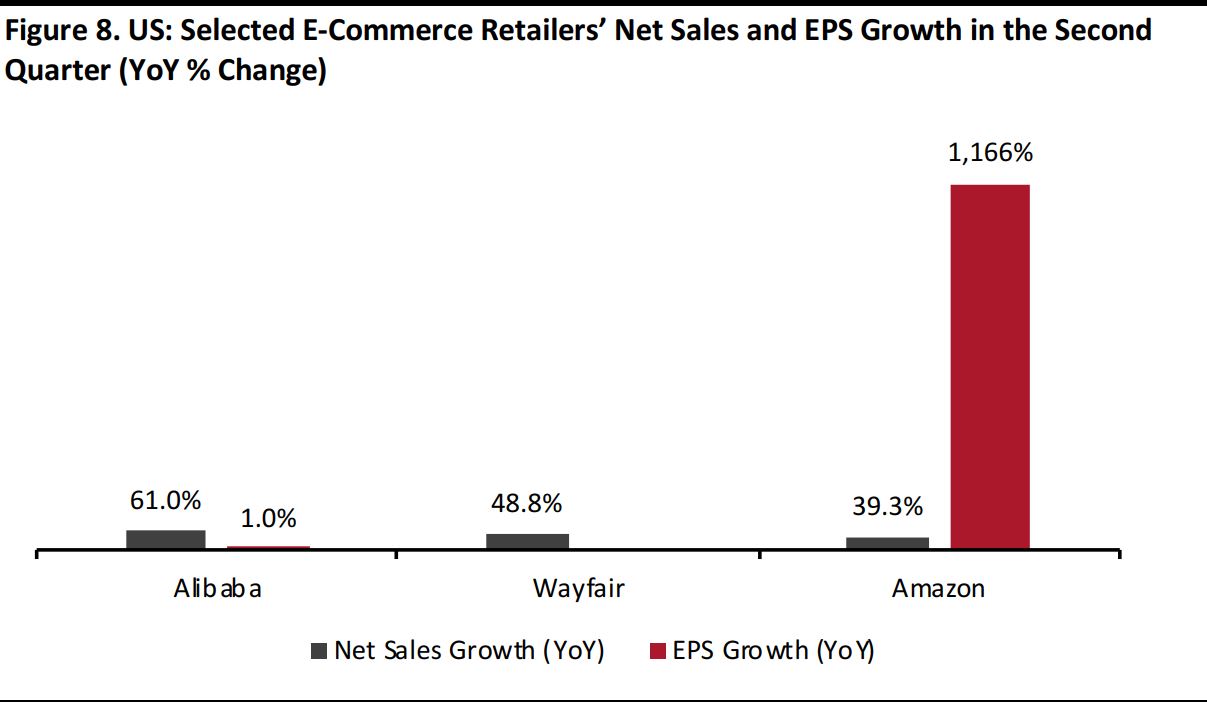

E-Commerce Retailers

Amazon continues to dominate the US retail e-commerce space,and the company posted stellar top-line and bottom-line figures for the second quarter. Alibaba missed on bottom-line growth due to one-off expenses reported in the quarter.Amazon

- In the second quarter, Amazon continued to post strong numbers, aided by an increase in Prime memberships, growth in Echo device sales and increasing subscription revenues.

- The company reported second-quarter net sales of $52.9 billion, up 39.3% year over year but slightly below the $53.5 billion consensus estimate. Amazon Web Services, which accounts for more than 50% of the company’s operating profits, posted revenue growth of 48.9% year over year.

- The company’s adjusted EPS increased by 1,166% year over year, to $5.07, and beat the consensus estimate of $2.49.

- For the third quarter, Amazon guided for revenues of $54.0–$57.5 billion, up 23%–31%. The midpoint of the guidance range is above the consensus estimate of $54.24 billion.

- Amazon is investing in its Prime membership offerings internationally, launching free Prime same-day delivery in a few cities in Italy and Spain. The company launched Prime in Australia during the quarter, offering members unlimited free delivery on millions of local and international items, Prime Video and other offerings.

- Citigroup estimates that more than 275 million people will be Prime members by 2029, up from 101 million in 2017.

Alibaba

- Alibaba is the only company included here that does not have meaningful US operations. We include it in this report because it is listed on the New York Stock Exchange.

- Alibaba missed consensus growth estimates in the most recent quarter, the first quarter of its fiscal 2019 year, with revenues surging 61% year over year, to $12.23 billion, while consensus called for growth of 62.4%.

- The company’s EPS grew by only 1% year over year in the quarter, to $1.22, missing the consensus estimate of $1.24.

- Alibaba’s robust top-line performance was driven by revenue growth from its China retail business, the consolidation of the Cainiao Network and Ele.me, and a near doubling of revenues in the Alibaba Cloud business.

- The bottom line was impacted by an increase of $1.6 billion in share-based compensation expenses related to share-based awards granted to Ant Financial employees.

Alibaba EPS growth bar is too small to be visible; Wayfair EPS growth is not shown because its year-over-year EPS change was not meaningful.

Source: Company reports

Alibaba EPS growth bar is too small to be visible; Wayfair EPS growth is not shown because its year-over-year EPS change was not meaningful.

Source: Company reports