Nitheesh NH

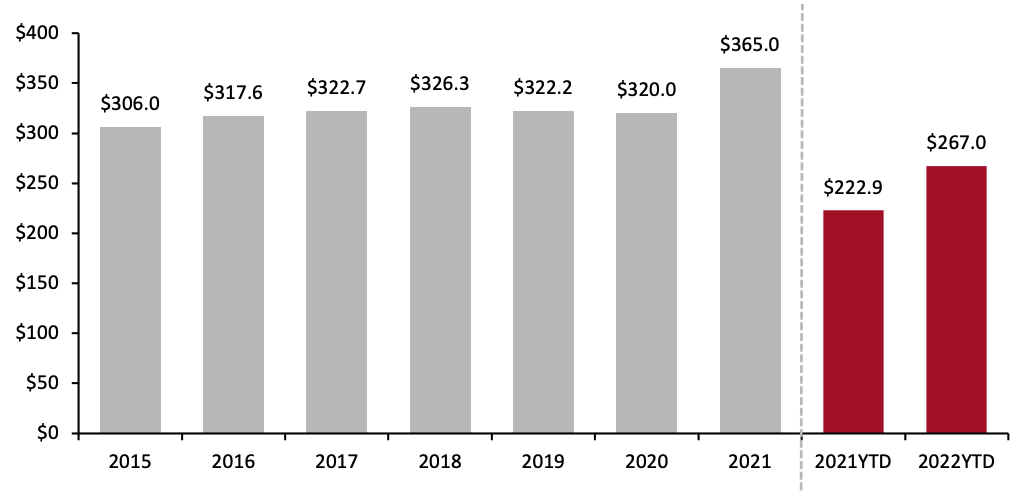

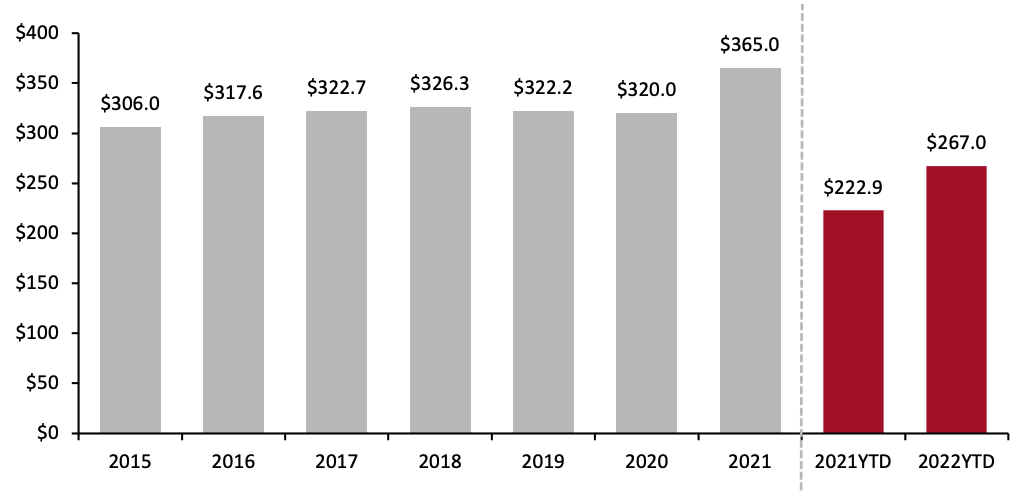

Our US Tax Tracker reports cover tax return filings at four-week intervals. This report summarizes the tax season this year, the filing deadline of which was April 18, 2022. Each year, the US consumer economy receives billions of dollars in tax refunds. Last year, the IRS reported $365 billion in total returns to taxpayers (see Figure 2), with $270 billion refunded after the tax season finished on May 17, 2021.

Because the filing deadline was extended last year to May 17, 2021, end-of-season results for 2022 are not directly comparable to those from the same time last year, as the tax season was still ongoing.

As of April 22, 2022:

• The IRS issued a total of 88.7 million refunds totaling $267 billion. The number of refunds issued was up 14.6% year over year, while the total amount refunded was up 19.8%.

• The average refund amounted to $3,012—up 4.9% year over year.

• Direct deposit was used to pay $260 billion of refunds issued, up 23.4% year over year. The average refund sent via direct deposit was $3,099, up 5.5% year over year.

• The IRS received 138.9 million tax returns (up 19.6% year over year) and processed 133.8 million (up 27.0% year over year).

• Of the returns filed, 96.0% were filed electronically. Of those, 52.9% were prepared by tax professionals, while 47.1% were self-prepared.

• The number of taxpayers who used the IRS website declined—the site saw 609 million visitors, a decline of 50.0% year over year.

IRS data are shown in the table below.

Figure 1. 2022 Filing Season: Cumulative Statistics Comparing Week Ending April 22, 2022 (Day 88 of 2022 Tax Season) to April 23, 2021 (Day 70 of 2021 Tax Season)* [wpdatatable id=1945]

Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_146758" align="aligncenter" width="700"] Source: IRS[/caption]

Source: IRS[/caption]

Figure 1. 2022 Filing Season: Cumulative Statistics Comparing Week Ending April 22, 2022 (Day 88 of 2022 Tax Season) to April 23, 2021 (Day 70 of 2021 Tax Season)* [wpdatatable id=1945]

*The IRS filing season began on January 24, 2022, two weeks earlier than in 2021. Source: IRS

The graph below shows total refunds increasing at a 3.0% CAGR during 2015–2021.Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_146758" align="aligncenter" width="700"]

Source: IRS[/caption]

Source: IRS[/caption]