Nitheesh NH

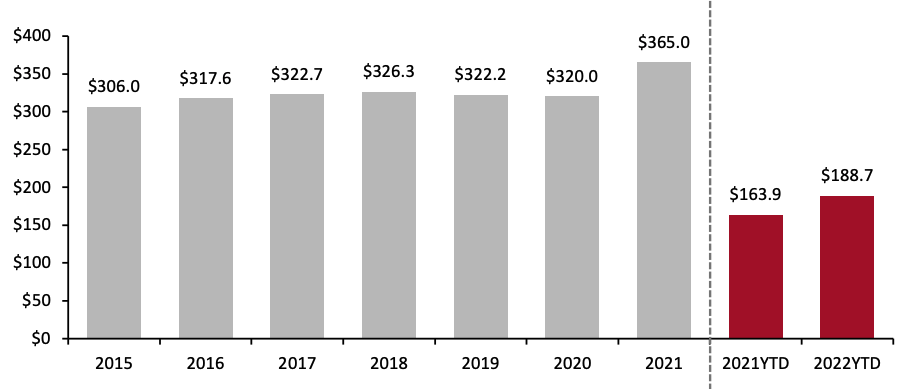

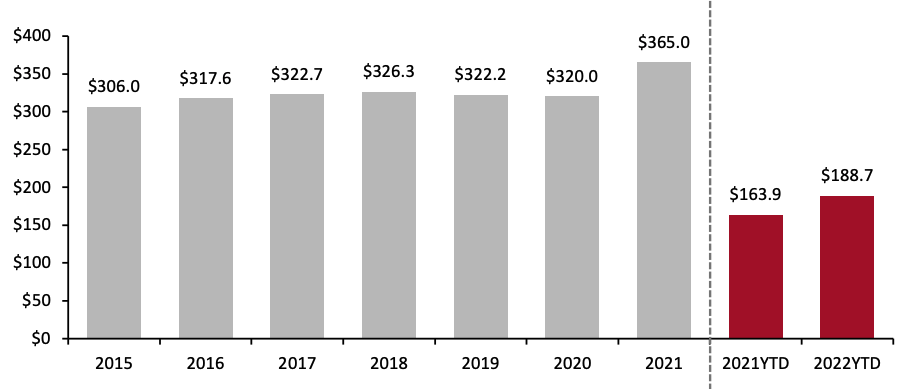

Each year, billions of dollars in tax refunds are returned to the US consumer economy: Last year, the IRS reported $365 billion in total returns to taxpayers (see Figure 2), $270 billion of which was refunded shortly after the tax season ended on May 17, 2021. The IRS reports tax return filings and refunds weekly, beginning at the end of January and continuing until the end of the year. This year, the filing deadline—April 18—was pushed back from the standard deadline of April 15 due to Emancipation Day, a holiday that falls on April 15 in 2022. Taxpayers in Maine and Massachusetts have until April 19, 2022, due to a regional holiday—Patriots’ Day—in those states.

As of March 25, 2022, the eighth week of the 2022 tax filing season:

Figure 1. 2022 Filing Season: Cumulative Statistics Comparing Week Ending March 25, 2022 (Day 61 of 2022 Filing Season) to March 26, 2021 (Day 43 of 2021 Filing Season)* [wpdatatable id=1876]

Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_145187" align="aligncenter" width="700"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS has issued a total of 57.8 million refunds totaling $188.7 billion. The number of refunds issued was up 2.4% year over year. The total amount refunded was up 15.1%.

- The average refund amounted to $3,263, up 12.4% year over year.

- Direct deposit was used to pay $185.4 billion of the refunds issued. The average refund paid via direct deposit was $3,337, up 12.8% year over year.

- The IRS has received 81.4 million tax returns (down 4.3% year over year) and processed 78.9 million (up 3.8% year over year).

- Of the returns filed, 96.4% were filed electronically. Of those, 50.9% were prepared by tax experts, while 49.1% were self-prepared.

- The number of taxpayers who used the IRS website declined—the site has seen 468 million visitors, a 52.8% year-over-year decrease.

Figure 1. 2022 Filing Season: Cumulative Statistics Comparing Week Ending March 25, 2022 (Day 61 of 2022 Filing Season) to March 26, 2021 (Day 43 of 2021 Filing Season)* [wpdatatable id=1876]

*The IRS 2022 filing season began on January 24, 2022, two weeks earlier than the 2021 season. Source: IRS

The graph below shows total refunds increasing at a 3.0% CAGR during 2015–2021.Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_145187" align="aligncenter" width="700"]

Source: IRS[/caption]

Source: IRS[/caption]