Nitheesh NH

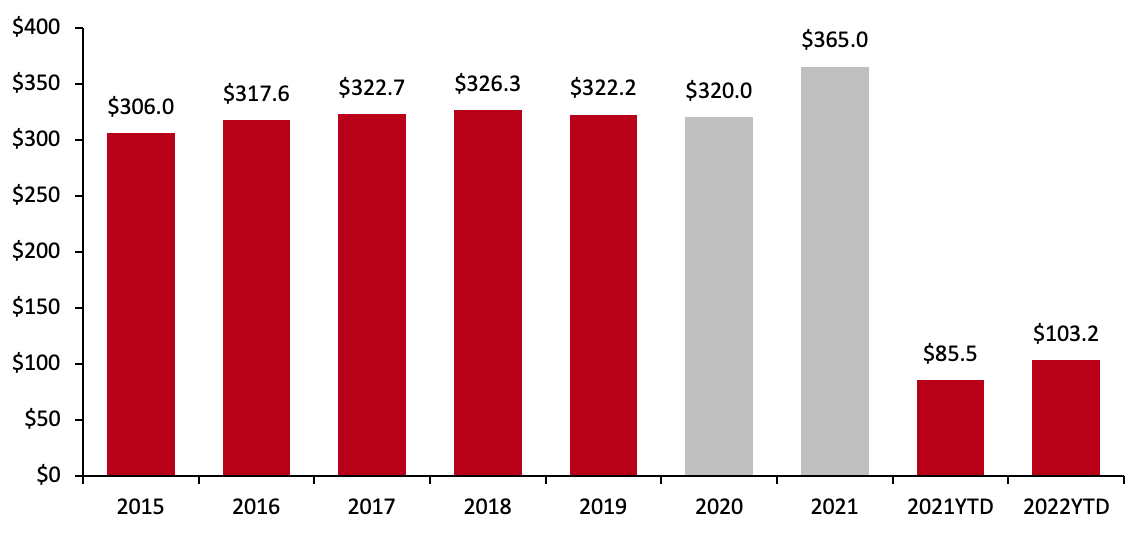

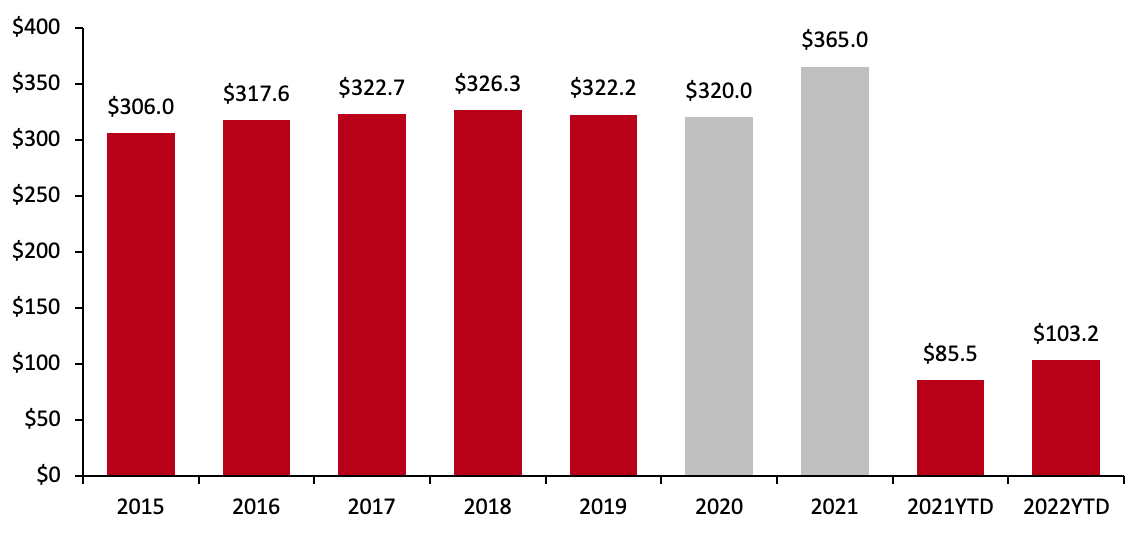

Each year, tax refunds return billions of dollars to the US consumer economy: Last year, the IRS reported $365 billion in total returns to taxpayers (see Figure 2), $270 billion of which was returned shortly after the tax season ended on May 17, 2021. The IRS reports tax return filings and refunds on a weekly basis, beginning at the end of January and continuing through the end of the year. The filing deadline—April 18 this year—was pushed back from the normal deadline of April 15, due to the Emancipation Day holiday on April 15. Taxpayers in Maine and Massachusetts have until April 19, 2022, due to the Patriots’ Day holiday there.

Figure 1. 2022 Filing Season: Cumulative Statistics Comparing Week Ending Feb 25, 2022 (Day 32 of 2022 Filing Season) to Feb 26, 2021 (Day 15 of 2021 Filing Season)* [wpdatatable id=1802]

Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_142890" align="aligncenter" width="700"] Source: IRS[/caption]

Source: IRS[/caption]

Some 40% of Americans expect tax refunds this year, 67% of which believe will help them financially, according to a January 2022 survey of 2,469 US adults conducted by US-based consumer financial services company Bankrate. The study also found that younger people consider tax returns more important than those in older generations: 75% of millennials stated that the anticipated tax refund will be important to their overall financial situation compared to 54% of baby boomers. Furthermore, a tax return was important to 77% for women in terms of their financial wellbeing, compared to 59% of men, according to the survey.

Among those anticipating tax refunds, most plan to use refunds to improve their overall financial health, according to Bankrate’s survey:- 32% intend to save the majority or all their refund

- 23% plan to pay off debt

- 12% intend to pay for day-to-day expenses

- 10% intend to fund house improvements

- 7% intend to invest their refund

- The IRS issued a total of 29.7 million refunds totaling $103.2 billion. The number of refunds issued was up 5.0% year over year. The total amount refunded was up 20.8%.

- The average refund amounted to $3,473—growing 15.0% year over year.

- Direct deposit was used to pay $103.0 billion of the refunds issued. The average refund from direct deposit was $3,529, up 15.2% year over year.

- The IRS received 45.4 million tax returns (up 0.3% year over year) and processed 43.8 million (up 11.2% year over year).

- Of the returns filed, 97.5% were filed electronically. Of those, 43.1% were prepared by tax experts, while 56.9% were self-prepared.

- The number of taxpayers who used the IRS website declined—the site saw 308 million visitors, a 37.7% year-over-year decrease.

Figure 1. 2022 Filing Season: Cumulative Statistics Comparing Week Ending Feb 25, 2022 (Day 32 of 2022 Filing Season) to Feb 26, 2021 (Day 15 of 2021 Filing Season)* [wpdatatable id=1802]

*The IRS filing season began on January 24, 2022, two weeks earlier than 2021. Source: IRS

The graph below shows total refunds increasing at a 3.0% CAGR during 2015–2021.Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_142890" align="aligncenter" width="700"]

Source: IRS[/caption]

Source: IRS[/caption]