Nitheesh NH

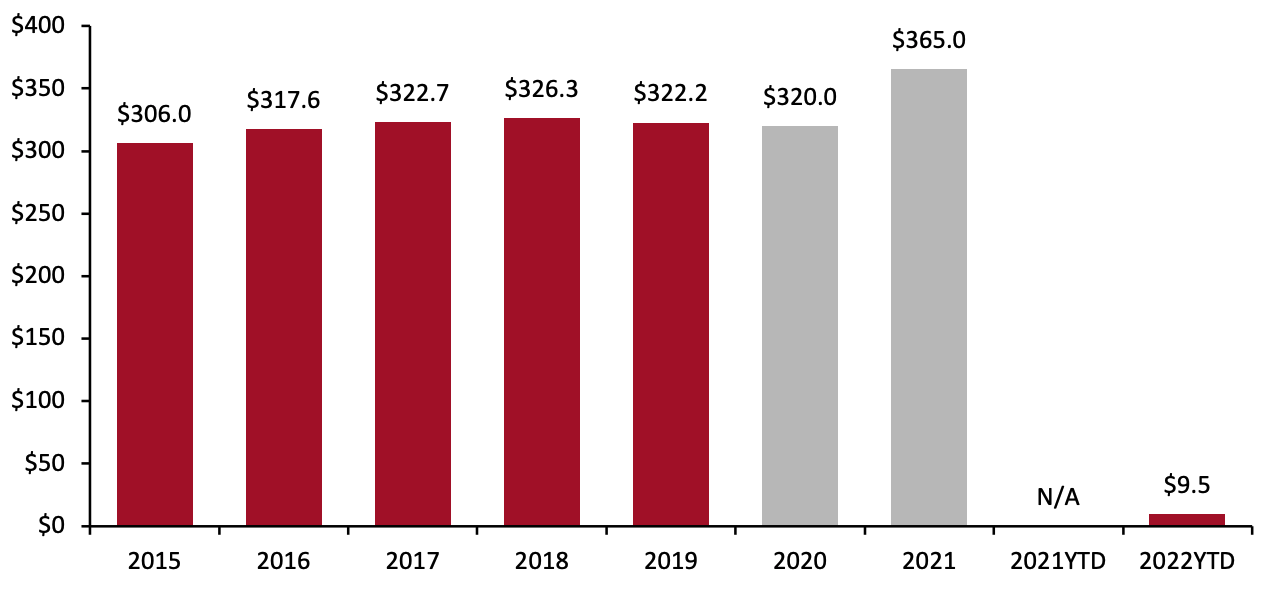

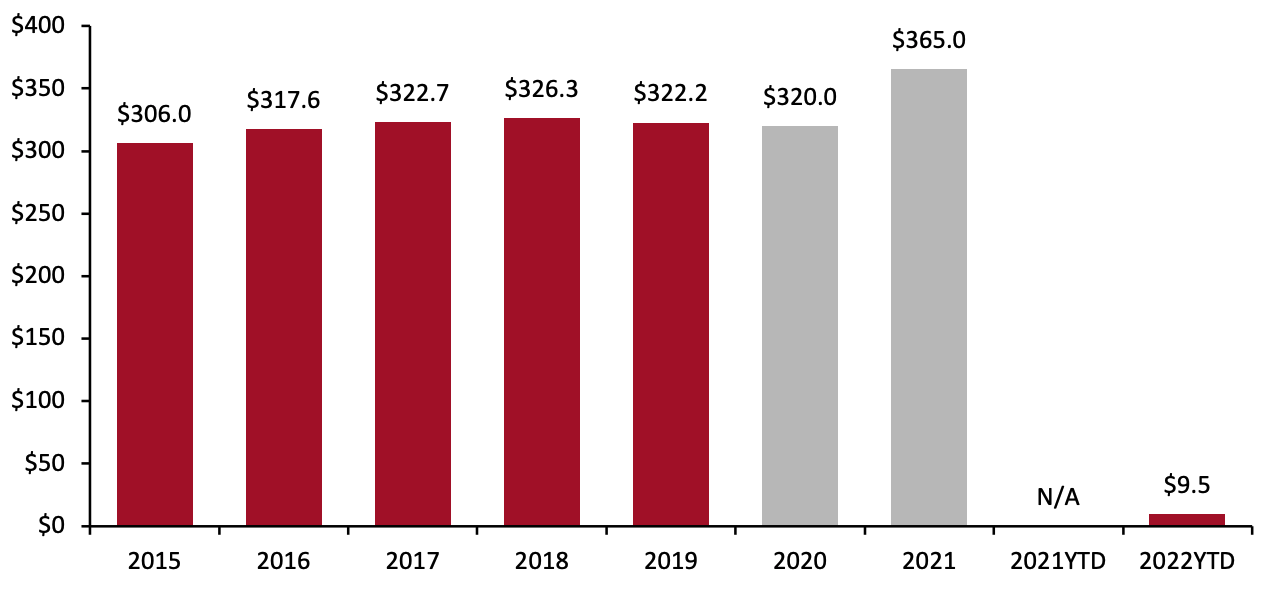

Each year, tax refunds return billions of dollars to the US consumer economy: Last year, the IRS reported returning $365 billion in total to taxpayers (see Figure 2), of which $270 billion had been returned shortly after the tax season ended on May 17, 2021.

The IRS reports tax return filings and refunds on a weekly basis annually, beginning at the end of January and continuing until the due date to file and pay, which is April 18 this year—pushed back from the normal deadline of April 15, due to the Emancipation Day holiday on April 15. Taxpayers in Maine and Massachusetts have until April 19, 2022, due to Patriots’ Day holiday.

As of February 4, 2022:

Figure 1. 2022 Filing Season: Week Ending Feb 4, 2022 [wpdatatable id=1724]

Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_141702" align="aligncenter" width="700"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS received 16.7 million tax returns and processed 13.0 million.

- The IRS issued a total of 4.3 million refunds totaling $9.5 billion, with each return averaging $2,201.

- Direct deposit was used to pay $10.3 billion of the refunds issued. The average refund from direct deposit was $2,306.

- Of the returns filed, 95.8% were filed electronically. Of those, 32.8% were prepared by tax experts, while 67.2% were self-prepared.

- The proportion of taxpayers who file electronically is continuously increasing. Nearly 120 million people visited the IRS website.

Figure 1. 2022 Filing Season: Week Ending Feb 4, 2022 [wpdatatable id=1724]

Source: IRS

The graph below shows total refunds increasing at a 3.0% CAGR during 2015–2021.Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_141702" align="aligncenter" width="700"]

Source: IRS[/caption]

Source: IRS[/caption]