albert Chan

What’s the Story?

E-commerce has continued to accelerate since the Covid-19 outbreak as shoppers shift their spending online. However, consumer preferences are fast changing, so it is essential for brands and retailers to take a preemptive approach to their e-commerce strategies for 2022 and beyond.

In this report, we identify 10 tech trends for the US e-commerce market that we expect to continue to reshape the retail industry moving forward.

This report is sponsored by headless-commerce platform provider fabric.

US E-Commerce Tech Trends in 2022

Figure 1. 10 US E-Commerce Tech Trends in 2022

[caption id="attachment_139884" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Process Automation Will Be Paramount to E-Commerce Success

The surge in online order volume has added pressure on order management. Retailers should focus on automating stages of order fulfillment, which can translate to agility in operations on a day-to-day basis, while reducing redundant tasks. During Target’s fourth-quarter 2021 earnings call, John Mulligan, COO at the company, confirmed its plans to continue expanding the rollout of its predictive inventory positioning capability across its assortment.We expect the automation of e-commerce processes to maintain strong momentum through 2022, largely due to the recent unprecedented acceleration in e-commerce sales that will see its ripple effect continue in the medium term.

What it means for brands and retailers: Retailers should focus on outsourcing automation requirements to a single technology platform provider in order to improve their return on investment versus having multiple technology providers, especially for small to mid-size retailers that are competing against the likes of Amazon to grab a greater market share.

2. Process Simplification Will Be Among Retailers’ Top Priorities

Due to the increasing need for agility in operations, we expect process simplification to be among retailers’ top priorities in 2022. We define process simplification as a retailer’s ability to break down complex issues—such as achieving inventory visibility across channels, or website personalization based on omnichannel persona—into smaller, goal-oriented matters.

The Covid-19 pandemic has emphasized the importance of simplifying processes for brands and retailers, and leading retailers have already started taking steps in this direction. For example, Walmart combined its in-store and online buying teams in early 2020. Walmart’s Senior Director of Global Communications, Kevin Gardner, said, “Our customers see one Walmart, and they expect the same low prices and seamless experience no matter how they choose to shop with us.” In 2022, we expect heightened focus on the simplification of e-commerce operations and processes, across operations such as product procurement, inventory management and promotions management.

What it means for brands and retailers: While process simplification may seem like the obvious answer to solving complex e-commerce problems, some enterprises may face difficulties in accessing and adopting appropriate technologies. Brands and retailers should look to customize their end-to-end e-commerce process flow by focusing on decoupling back-end e-commerce processes (such as customer login and order management) from front-end tasks (such as chat integration and product descriptions). Custom-built front-end processes can help retailers make changes to individual tasks and processes across channels in real time.

3. A Return to Normalcy Will Render New Meaning to E-Commerce

We expect retailers to focus on providing innovative shopper experiences across online channels, particularly as brick-and-mortar retail bounces back and presents renewed competition for digital retail. We remain bullish on the role of physical stores in 2022 (and, so, multichannel retailers), reflected in our expectation for multichannel retailers to again outperform in the online channel this year (see our 2022 Retail and Technology Outlook for more).

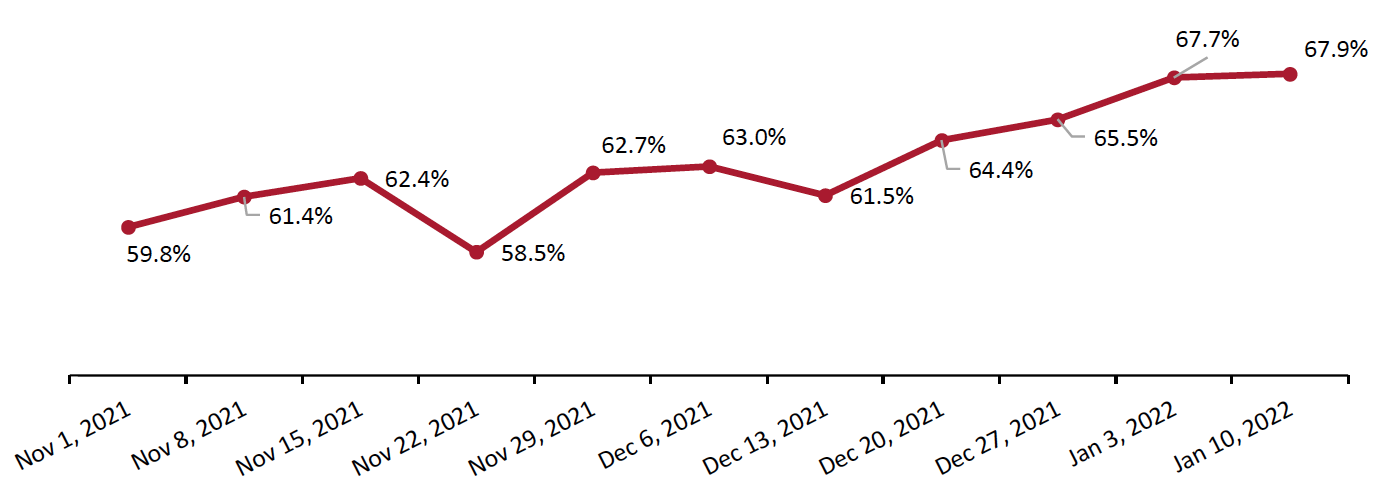

Many US consumers are still avoiding public places amid the threat of Covid-19 and the Omicron variant—67.9% cited avoiding any public place in Coresight Research’s US Consumer Tracker survey on January 10, 2022 (see Figure 3). However, we expect this number to recede as the world gradually moves toward normalcy, meaning that more consumers will return to shops and malls.

Figure 2. US Consumers’ Avoidance of Any Public Place (% of Respondents)

[caption id="attachment_139885" align="aligncenter" width="700"] Base: US respondents aged 18+

Base: US respondents aged 18+Source: Coresight Research[/caption]

As shoppers gradually begin to shop more in-store and, in fact, shop both in-store and online, we expect optimization of the online experience to be a key priority for retailers. Ensuring an enjoyable, convenient and seamless omnichannel experience enables retailers to increase the potential value of each shopper.

- According to Rodney McMullen, Chairman and CEO at Kroger, the company sees most of its customers shop online and in stores. During Kroger’s earnings call for the first quarter of fiscal 2021, he said, “When they shop both [channels], our retention rate is incredibly high and our ability to gain share within that household is very high.”

- Sportswear retailer NIKE believes that digital innovation and data and analytics capabilities are important in its direct business for inventory management, pricing (based on inventory flow) and demand-supply management, CFO Matthew Friend highlighted during the company’s earnings call for the fourth quarter of fiscal 2021.

What it means for brands and retailers: As omnichannel shopping becomes increasingly prominent, brands and retailers must ensure that they provide a seamless digital experience to online shoppers. Brands and retailers can leverage advanced analytics capabilities to offer relevant and personalized online experiences that translate to higher conversion and better retention.

4. Winning with Loyalty Programs Will Require a Multifaceted Approach

Receding shopper loyalty will continue in 2022 as shoppers try out cheaper and easily available alternatives to products. Brands and retailers should therefore develop innovation in their loyalty programs to retain customers.

Consumers have been abandoning brand loyalty when making purchases, driven by out-of-stock caused by supply chain constraints. Near the start of the Covid-19 pandemic, 46% of US consumers cited switching brands/retailers when shopping for a specific category, according to a mid-June 2020 survey conducted by McKinsey.

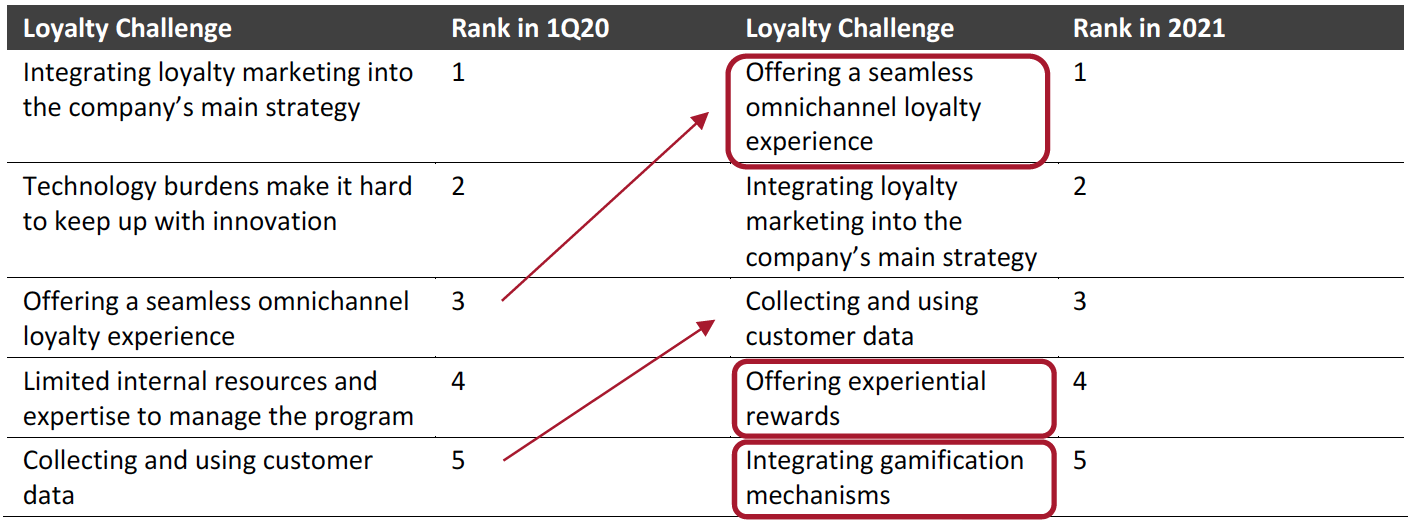

Loyalty programs have multiple underlying benefits for brands and retailers, including boosting customer engagement—which translates to increased revenues, improved shopper retention and access to customer data. Loyalty programs have increasingly become an important tool for attracting and retaining shoppers, but managing loyalty amid changing shopper preferences and channel proliferation can be challenging. In fact, offering a seamless omnichannel loyalty experience emerged as the topmost challenge in loyalty program marketing, according to a November 2021 survey of global retailers conducted by loyalty technology provider Antavo.

In Figure 5, we present the top five challenges in managing loyalty programs in 2021 versus pre-pandemic (the first quarter of 2020), as per Antavo’s survey. Based on these findings, we see two important themes in loyalty:

- A shift in how retailers are leveraging loyalty programs—The challenges in 2021 indicate a pivot toward ensuring an engaging customer experience, one that is seamless, omnichannel, experiential and incorporates gamification.

- Rising concerns around data collection and its usage—“Collecting and using customer data” climbed two ranks in 2021 versus early 2020, which is unsurprising given recent attention on the use of cookies online; for example, Google had aimed to phase out third-party cookies on its Chrome browser by 2022. Effectively using first-party data becomes more important than ever in this context.

Figure 3. Top Challenges in Loyalty Programs (% of Respondents)

[caption id="attachment_139886" align="aligncenter" width="700"] Base: 116 global retailers that offer a loyalty program, surveyed between October and November 2021

Base: 116 global retailers that offer a loyalty program, surveyed between October and November 2021Source: Antavo[/caption]

What it means for brands and retailers: It is essential for brands and retailers to create a rewarding experience for online and omnichannel shoppers. In order to win with loyalty programs, we expect retailers to focus on being proactive—revamping their existing loyalty programs. Walmart partnered with cashback company Ibotta in June 2021 to create a cash rebate program for online shoppers on its website and app. The agreement includes Walmart joining the Ibotta Performance Network—a digital network which enables delivery of cash rebates across third-party sites including social media networks.

In addition, we expect data integration, discussed as a trend above, to play a key role in determining success in loyalty programs.

5. The Need for Speed Will Increase Across E-Commerce Operations

We expect online retailers to focus on speed in operations such as order picking, fulfillment and inventory replenishment in 2022. To get goods into the hands of consumers faster, speed will be important in all stages of the end-to-end operational journey, from receiving an order to last-mile delivery.

Advances in artificial intelligence (AI) and machine learning (ML) are supporting improvements in the speed and scalability of e-commerce operations. Walmart’s first Tennessee e-commerce hub, which is set to open in fall 2022, will store millions of products that the company will ship to customers as fast as the day after an order is placed. In its 2021 investment community meeting in February 2021, Walmart’s global Chief Technology Officer, Suresh Kumar, said, “Last year, we talked of our approach to moving faster and taking advantage of the developments in AI, ML and other new technologies. Now, these modern technology elements will enable Walmart to move with speed, be innovative and become more productive.”

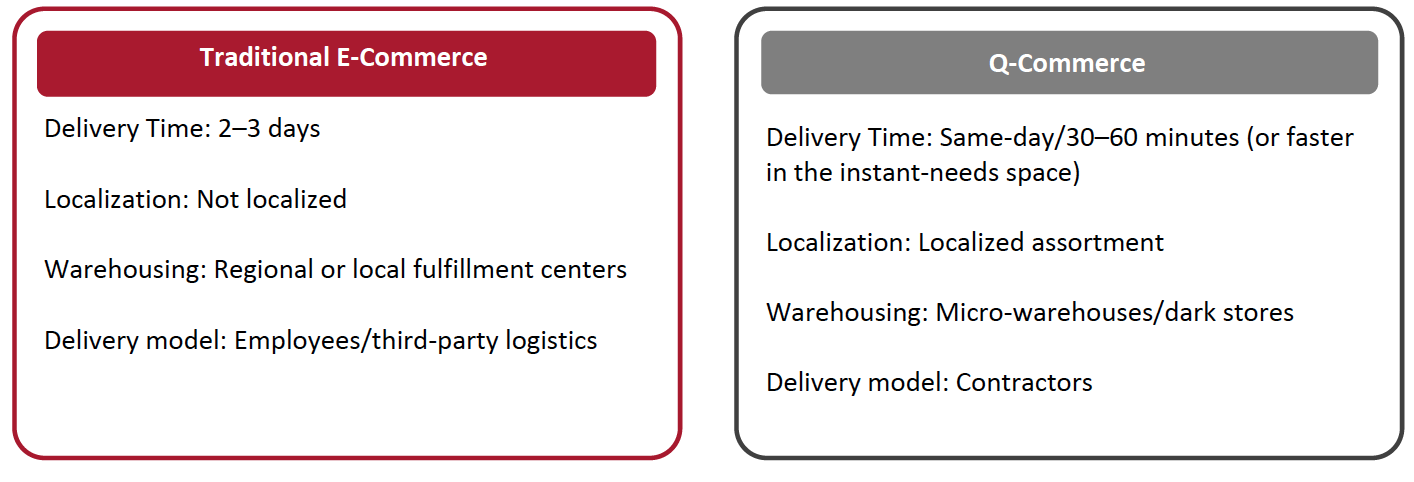

This trend has also led to substantial growth in the Q-commerce (quick-commerce)/hyperlocal delivery model. The model is built on working with third-party retailers (or restaurants) for the product itself. These quick-commerce firms are fulfillment intermediaries, traditionally promising “same-day” delivery, although the lower ranges of this (offered at a premium) have been pushed down to 30–45 minutes. We are now also seeing the emergence of the vertically integrated instant-needs space, borrowing the vertically integrated model to promise delivery in as little as 10–15 minutes.

Coresight Research estimates that retail sales (predominantly grocery/essentials) by major players in the Q-commerce market totaled $20–25 billion in the US in 2021—equating to a 10%–13% share of US online CPG (consumer packaged goods) sales, which we totaled around $191 billion in 2021, we estimate (see our coverage of rapid delivery business models for more).

Figure 4. Key Differences Between Traditional E-Commerce and Q-Commerce

[caption id="attachment_139904" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

What it means for brands and retailers: We expect some of the current volatility in shopper behavior to continue through the year, which makes speed in optimizing the digital shopping experience more important than ever. Focusing on making real-time changes across all digital touchpoints will be key to succeeding in e-commerce moving forward.

6. The Effective Use of Data and Analytics Will Determine E-Commerce Winners

In 2022, we expect greater implementation of prescriptive analytics to reveal shopper patterns and market trends before they happen. Prescriptive analytics leverages five core capabilities to identify enhancement opportunities within a retailers’ operations: anomaly detection, hidden demand assessment, sentiment analysis, clustering and shrink prediction.

Retailers must focus on effectively leveraging advanced technologies such as AI and ML to unify data, as the widespread adoption of multichannel commerce has led to multiple data streams from which it is increasingly difficult for retailers to extract actionable insights. In essence, making sense of data is more difficult than ever, yet more important than ever to ensure shopper-centricity, which helps in attracting new shoppers and retaining existing customers.

What it means for brands and retailers: Difficulties in data unification and in deriving actionable insights have compounded over the past year. With the phasing out of third-party cookies, we expect data monetization to be a key theme in 2022. One example is from Walmart’s new data arm, Walmart Data Ventures, which is set to deliver shopper-centric insights to CPG brands and suppliers upon its—currently undisclosed—launch. Although this trend is not new, the surging importance of data and analytics, along with increasing appetite for market share, will see more retailers look to monetize their data as the use of first-party data becomes prevalent.

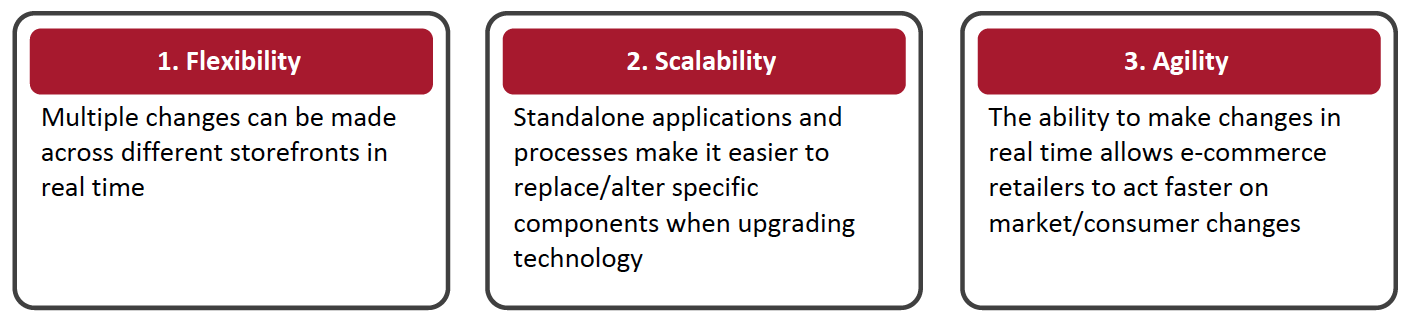

7. Headless Commerce Will Be Key to Unifying Shopper Experiences

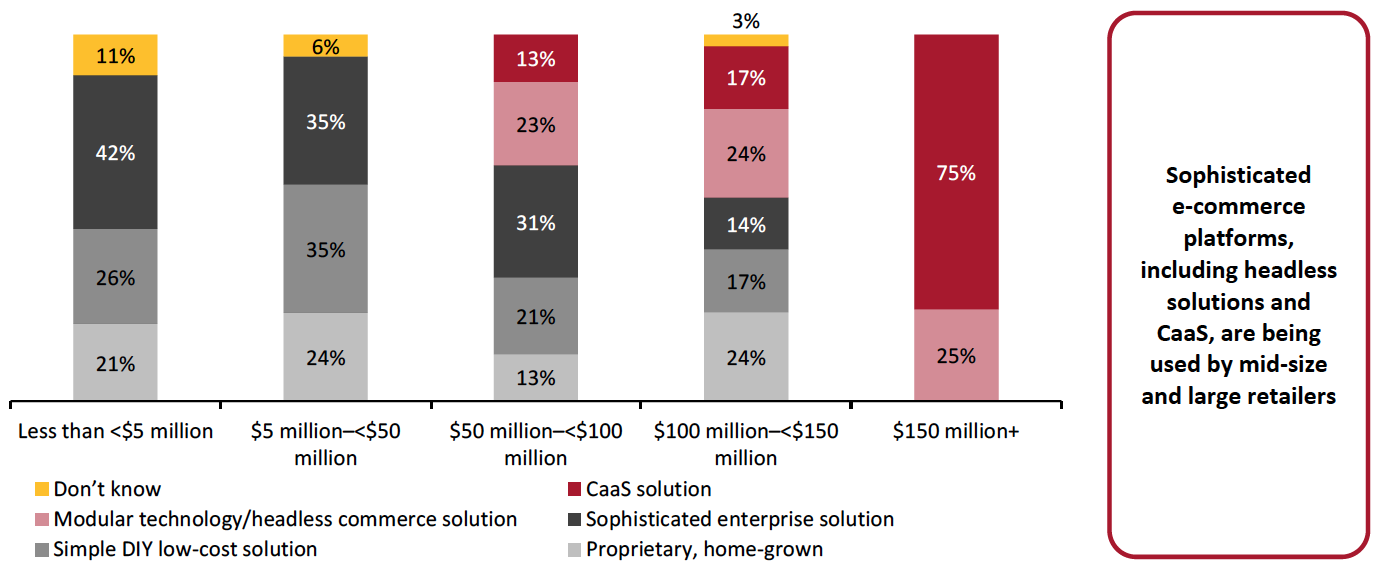

We expect smaller retailers to adopt headless commerce solutions as they look to compete with the likes of bigger e-commerce players.

Modular/headless technology separates the back end of an e-commerce platform from the front end but allows for integration/flexibility through APIs (application programming interfaces). Headless solutions are built through numerous third-party vendor offerings. Mid-size and large e-commerce retailers are already using this technology, as well as sophisticated commerce-as-a-service (CaaS) solutions, according to a Coresight Research survey of US e-commerce leaders conducted in October 2021 (see Figure 8).

Figure 5. Retailer E-Commerce Platform Types by Company Size (% of Respondents) [caption id="attachment_139888" align="aligncenter" width="700"]

Base: 153 e-commerce leaders in US retail, surveyed in October 2021

Base: 153 e-commerce leaders in US retail, surveyed in October 2021Source: Coresight Research[/caption]

Over the years, retail has gradually evolved from offline to unified omnichannel commerce, and retailers are now exploring newer ways to streamline their omnichannel operations. Advances in technology present an opportunity in moving e-commerce to a more decentralized model. We believe that as retailers look to build on e-commerce sales, decentralized and distributed headless commerce will offer improved ways to innovate and compete.

Figure 6. Key Benefits of Headless Commerce [caption id="attachment_139889" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

What it means for brands and retailers: Decoupling the front and back ends can provide much-needed flexibility to retailers, as they can customize new experiences for shoppers, for example: Headless commerce enables developers to build a front end for a new digital sales channel. In addition, the API architecture allows e-commerce players to focus on consistency in their brand story across channels and enables real-time changes to be made across all channels.

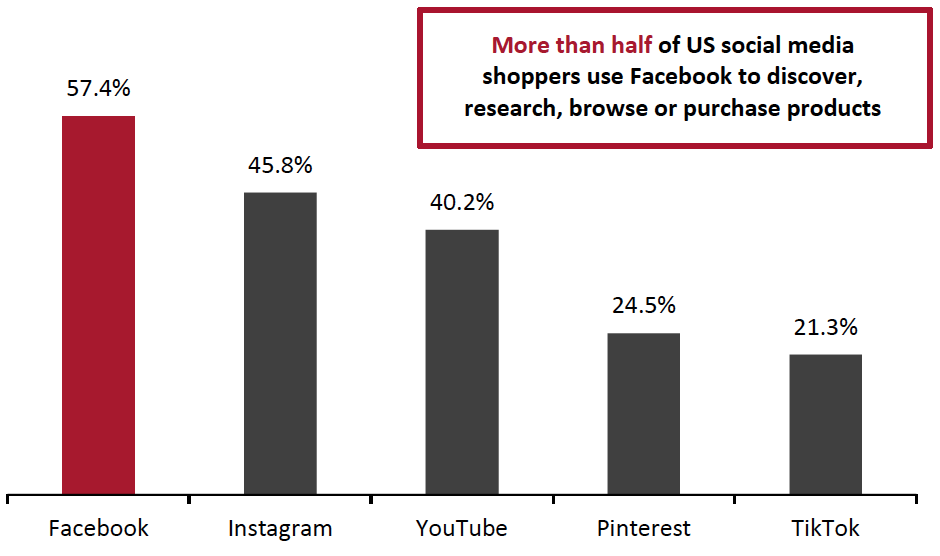

8. The Changing E-Commerce Landscape Will Offer New Social Commerce Opportunities

We expect brands and retailers to focus on revamping the social shopping experience.

Social media continues to grow as an important channel in retail. According to a Coresight Research survey of US consumers conducted in March 2021, 48% of US consumers use social media as part of the shopping process (defined as discovering, researching and browsing products, or making purchases). Among the respondents using social media as part of the shopping process, Facebook is used by more than half, making it the most popular platform—and representing a significant lead of 11.6 percentage points over Instagram (see Figure 10).

We believe there will be an increased penetration of relatively smaller, but popular platforms such as Pinterest in the coming year. Pinterest continues to make Idea Pins—Pinterest’s multipage video format—more shoppable by integrating products with its augmented-reality beauty try-on feature, “AR Try on,” and enabling visual search on video content (which the platform launched in October 2021).

Figure 7. Top Five Social Media Platforms Used for Shopping (% of Respondents) [caption id="attachment_139890" align="aligncenter" width="700"]

Base: 784 US respondents aged 18+ who use social media as a part of the shopping process, surveyed in March 2021

Base: 784 US respondents aged 18+ who use social media as a part of the shopping process, surveyed in March 2021Source: Coresight Research[/caption]

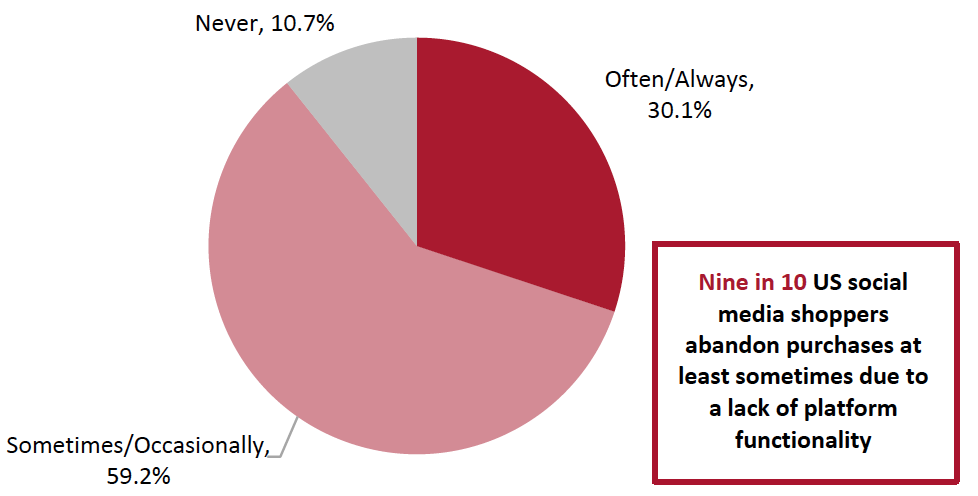

However, boosting conversion is key: Around 90% of US social media shoppers give up on making a purchase at least sometimes due to a platform’s lack of in-built functionality, according to the Coresight Research survey (see Figure 11). Brands and retailers can work with technology providers and dedicated livestreaming platforms with in-built checkout functionality to ensure an engaging and seamless experience for shoppers, as well as gathering first-party data to generate meaningful insights into customers.

Figure 8. Proportion of US Social Media Shoppers Who Give Up Purchases Due to a Lack of Platform Functionality (% of Respondents) [caption id="attachment_139891" align="aligncenter" width="700"]

Base: 770 US respondents aged 18+ who use social media as a part of the shopping process, surveyed in March 2021

Base: 770 US respondents aged 18+ who use social media as a part of the shopping process, surveyed in March 2021Source: Coresight Research[/caption]

Walmart partnered with social media platforms including TikTok and YouTube in 2021 to host live shopping events. Its partnership with Twitter saw the retailer host “Cyber Deals Sunday” on November 28, 2021, allowing users to shop products via Twitter and join the conversation around the event by posting on the platform.

[caption id="attachment_139892" align="aligncenter" width="700"] Singer and songwriter Jason Derulo hosts Walmart’s Cyber Deals Sunday on November 28, 2021

Singer and songwriter Jason Derulo hosts Walmart’s Cyber Deals Sunday on November 28, 2021Source: Walmart[/caption]

What it means for brands and retailers: Retailers will increasingly foray into innovative channels such as social media shopping and livestreaming e-commerce, as shoppers are interested in engaging with influencers and using social media to discover products and deals. Brands and retailers can achieve higher conversion rates by improving in-platform checkout functionality, which makes the journey quicker and more seamless for shoppers. We estimate that the US livestreaming e-commerce market totaled $11 billion in 2021 and will rise to $17 billion in 2022.

9. Subscription Models Will Regain Lost Ground

We expect the subscription-based e-commerce market to grow strongly in 2022 as retailers look to meet consumers’ increasing need for convenience. We believe that many consumers will at least partially retain online shopping habits following the surge in e-commerce adoption across discretionary categories amid the pandemic, leading to great potential for the subscription model. In addition, retailers are increasingly realizing that recurring sales models can lead to higher revenues and strong customer relationship. We estimate that the US subscription e-commerce market totaled $11.5 billion in 2020 and registered a high-teens growth rate in percentage terms in 2021.

What it means for brands and retailers: The market outlook is promising— around 24% of US consumers have a retail subscription, according to a June 2021 survey conducted by Pymnts.com. This figure compares to just 9.9% in June 2020. Consumer satisfaction will be paramount in succeeding with a subscription model, as customer retention is crucial.

10. Cross-Border E-Commerce Will Gather Steam

With Covid-19 (and the Omicron variant) still impacting the global retail landscape, we expect an uptick in cross-border (and direct-to-consumer) e-commerce in 2022.

This will build on the growth in popularity of the channel since the Covid-19 outbreak. Restrictions on travel and a consumer reluctance to do so has seen an increase in disposable income and reduced access to both domestic and international stores, fueling cross-border e-commerce: 46% of global shoppers said that reduced access to stores prompted them to make purchase from an international brand, according to a July 2020 survey conducted by eShopWorld. The survey found that the highest proportions of shoppers that reported as such were in China and India (61% for each).

What it means for brands and retailers: We expect cross-border commerce to be an opportunity for retailers to expand their customer base in international markets—but this will require retailers to re-evaluate major business operations, including marketing, order fulfillment and payments. Allowing consumers to shop in local currency and offering financing options can position retailers favorably to compete against both domestic and global competitors. Legacy retailers in Western countries can take advantage of shoppers in fast-growing markets such as China and India.

How Headless-Commerce Tech Platform fabric Can Assist Brands/Retailers

fabric’s digital commerce platform can help e-commerce retailers simplify their technology by decoupling the front end from the back end, which helps in making e-commerce operations more agile and so enables retailers to take a proactive approach in today’s fast-changing environment.

According to the company, its suite of solutions simplifies retailers’ e-commerce operations and provides flexibility to deliver shopper-centric experiences across all channels—and capitalize on many of the trends discussed in this report. We explore some of these solutions below:

- fabric’s Order Management System (OMS) allows online merchants to add custom attributes and improve common delivery and fulfillment workflows such as returns, order cancellation, order tracking and fraud detection. Its open API supports integration with payment gateways and shipping services. OMS is set up on a serverless environment, enabling scalability without requiring additional server capacity. fabric’s OMS can help retailers with their process automation initiatives.

- fabric’s Product Information Manager (PIM) software enables retailers to import or organize product information across all selling channels, including social media. The information is managed centrally through connected workflow capabilities. This helps in organizing product categories or even branching bundles and kits of different products.

- fabric’s Marketplace allows retailers to launch and curate product assortments from multiple dropshipping suppliers, which can help in supplementing the core offering. Some of its advantages include control on pricing and invoicing management across suppliers.

- fabric’s cloud-based Loyalty Management System enables retailers to make online shopping more experiential and less transactional. It can assist with incentivizing first-time shoppers by creating a free membership program, offering benefits such as loyalty points or gifts. The customizable suite includes services such as the creation of referral codes, membership programs and rewards, and plus-one invitations to private events. fabric allows online retailers to run multiple programs simultaneously and stack multiple cashback offers through its customizable loyalty program with drag-and-drop functionality. Through the Loyalty Management System, retailers gain access to shopper data, and a built-in analytics feature provides actionable data around the success of the loyalty program.

- fabric’s Storefront enables retailers to make real-time changes to their digital store—including homepages, category pages and product description pages—in order to act quickly on changing market trends. The solution can be integrated with any back-end or third-party services, according to the company. Storefront can help retailers in moving ahead faster and increasing agility across their e-commerce operations.

- fabric’s e-commerce APIs can plug with an open-source tool to consume data and offer actionable data analytics. The APIs are built on an open and serverless architecture that enables the unification of data from across sales channels, meaning that retailers can improve their responsiveness to changing market trends or shopper preferences.

- fabric’s Experience Manager (XM) empowers marketers and merchandisers to design their website in a highly customizable manner—add out-of-the-box components, swap images and text or add/edit product categories. The headless CMS (content management system) separates the presentation layer from the commerce back end for faster design and deployment. The XM leverages advanced ML technology to rapidly iterate designs that drive an optimal consumer experience, fabric states. fabric’s XM can help retailers in simplification of e-commerce processes.

- fabric’s subscription billing software creates a frictionless replenishment experience across sales channels, allowing retailers to create recurring payment options with customizable cadence. In addition, it allows retailers to automate failed payments through self-serve dunning management, improving the experience for shoppers. This software can help retailers capitalize on the growing and fast-evolving subscription-based retail model.fabric’s Experience Manager (XM) empowers marketers and merchandisers to design their website in a highly customizable manner—add out-of-the-box components, swap images and text or add/edit product categories. The headless CMS (content management system) separates the presentation layer from the commerce back end for faster design and deployment. The XM leverages advanced ML technology to rapidly iterate designs that drive an optimal consumer experience, fabric states. fabric’s XM can help retailers in simplification of e-commerce processes.

What We Think

E-commerce presents huge opportunities to brands and retailers in the current retail landscape. We believe that retailers must focus on simplifying their e-commerce operations. A headless platform can assist online players in decoupling the front and back ends of their operations to increase flexibility and enable them to better take advantage of the continued surge in e-commerce.

Implications for Brands and Retailers

- Having a data-driven approach can help brands and retailers understand the shopper journey and optimize experiences across all digital touchpoints, which can ensure better customer retention.

- Focusing on agility can help brands and retailers adapt quickly in the fast-changing environment—shoppers continue to expect a unified and personalized experience when they shop online. Brands and retailers must focus on adding speed to their e-commerce operations and ensuring they have the right technology tools and partners in place.