DIpil Das

What’s the Story?

Coresight Research’s analysts provide directional outlooks and themes to watch in their sectors in 2022, which we expect to be a transitional year for consumers and retailers. We expect to see an incrementally more normal environment—reflected in how consumers live and work, for instance—and more normalized retail sector momentum, following a very strong overall performance in 2021. Most sections of this report focus on the US market, but we include discussion of China e-commerce. Moreover, two of our markets—luxury and technology—are truly global.US Outlook

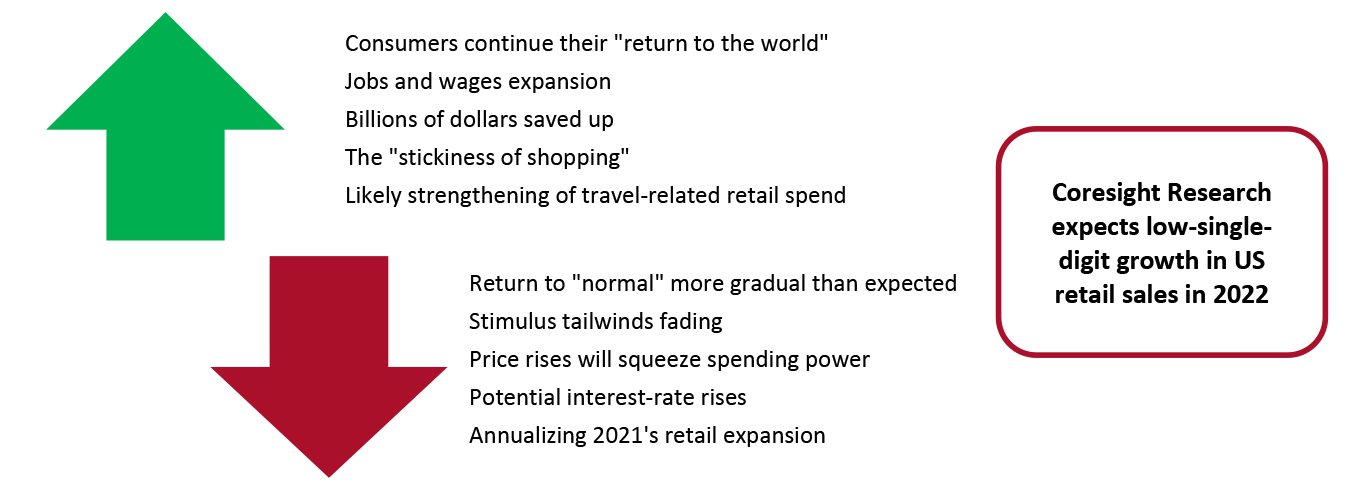

The positives for US consumer spending in 2022 include the ongoing return to more normal ways of living and working coupled with the ability to spend, which is fueled by savings and an expansion in jobs and wages. The outsized 2021 expansion in total US retail sales, which took sales for many discretionary categories way above the pre-crisis levels of 2019, looks unsustainable—and even zero growth in 2022 assumes that consumers have retained that elevated level of spending rather than reverting to normalized levels. Balancing these factors, Coresight Research’s analysts assume a low-single-digit increase in total US retail sales in 2022—the midpoint of a range that could span flattish to stronger single-digit growth. Although much more moderate than we have seen in 2021, that estimate reflects a rise on top of a jump and, so, a consolidation of gains. Raised inflation, at least in the first half of the year, will support value growth.Figure 1. US Consumer Economy Context [caption id="attachment_137399" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

The return to more normal living is taking longer than many expected, and there seems little chance that the context for 2022 will be meaningfully different from that for mid-to-late 2021: Once the majority of people are double-vaccinated, there seems little more to do to reduce Covid-19 case numbers to a point that enables a full return to pre-crisis patterns, although post-infection treatments continue to evolve. The direction will be driven in large part by the extent to which consumers and companies are willing to revert to prior behaviors on the acceptance of increased risk.

While it is a net negative to the consumer economy, a slow return to normalcy is a net benefit to retail, as billions of dollars that would otherwise get spent on services such as travel, dining out and entertainment flow to retailers instead.

We also point to the “stickiness of shopping”—once consumers start spending freely, it can be tough to turn off those taps. 2021 initially looked like it may be a year of “either/or” in regard to services versus goods, but stimulus measures ensured it was “both” for many consumers. Given the still-strong spending power enjoyed by consumers, we could see that attitude carry into 2022.

Source: Coresight Research[/caption]

The return to more normal living is taking longer than many expected, and there seems little chance that the context for 2022 will be meaningfully different from that for mid-to-late 2021: Once the majority of people are double-vaccinated, there seems little more to do to reduce Covid-19 case numbers to a point that enables a full return to pre-crisis patterns, although post-infection treatments continue to evolve. The direction will be driven in large part by the extent to which consumers and companies are willing to revert to prior behaviors on the acceptance of increased risk.

While it is a net negative to the consumer economy, a slow return to normalcy is a net benefit to retail, as billions of dollars that would otherwise get spent on services such as travel, dining out and entertainment flow to retailers instead.

We also point to the “stickiness of shopping”—once consumers start spending freely, it can be tough to turn off those taps. 2021 initially looked like it may be a year of “either/or” in regard to services versus goods, but stimulus measures ensured it was “both” for many consumers. Given the still-strong spending power enjoyed by consumers, we could see that attitude carry into 2022.

US Context

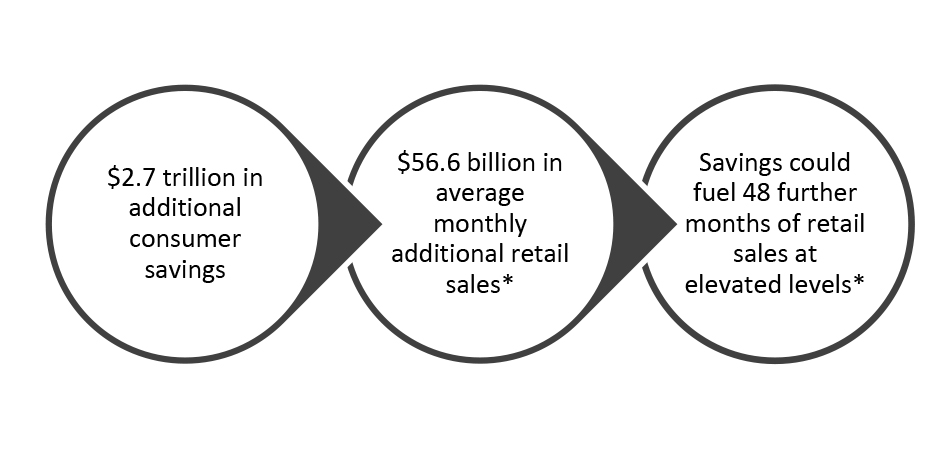

Spending Power First, the good news: We calculate that US consumers have sufficient funds to power 2021-style levels of retail spending for several more years. Consumers have accrued an additional $2.7 trillion in savings between the start of 2020 and September 2021, we estimate from US Bureau of Economic Analysis data. That is over and above typical pre-crisis net savings, based on averages for 2017–19. It represents extra funds poured into savings accounts, the stock market and pension plans since the pandemic started; the liquidity of those savings will therefore vary. That $2.7 trillion equates to a further 48 months (or four years) of elevated retail spending of the kind seen in 2021, we calculate. This is based on comparing average monthly retail sales in the first nine months of 2021 to the average of the comparable numbers for each of 2017–19.Figure 2. US Consumers’ Spending Power [caption id="attachment_137400" align="aligncenter" width="700"]

*Based on January–September 2021

*Based on January–September 2021 Source: Coresight Research [/caption]

- The 48-month estimate does not factor in any acceleration in services spending, which would provide competition to retail for those discretionary dollars.

- It does not factor in consumer willingness to spend those additional savings (or the liquidity of those savings). Nor does it factor in the squeeze effect of recently higher inflation (more on that later).

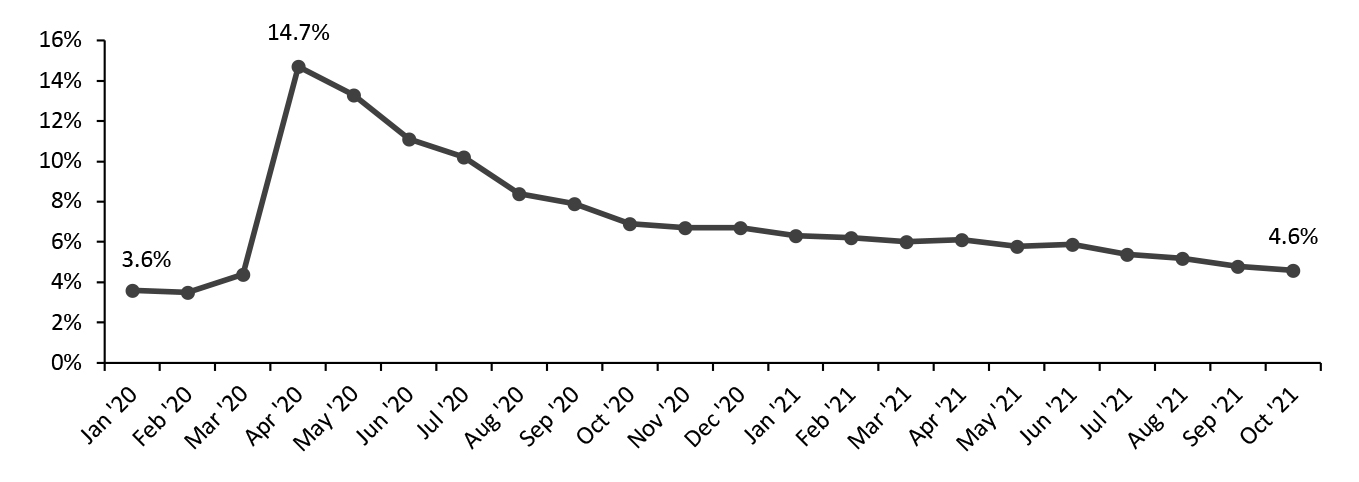

Figure 3. US Unemployment Rate [caption id="attachment_137401" align="aligncenter" width="699"]

Source: US Bureau of Labor Statistics/Federal Reserve Bank of St. Louis[/caption]

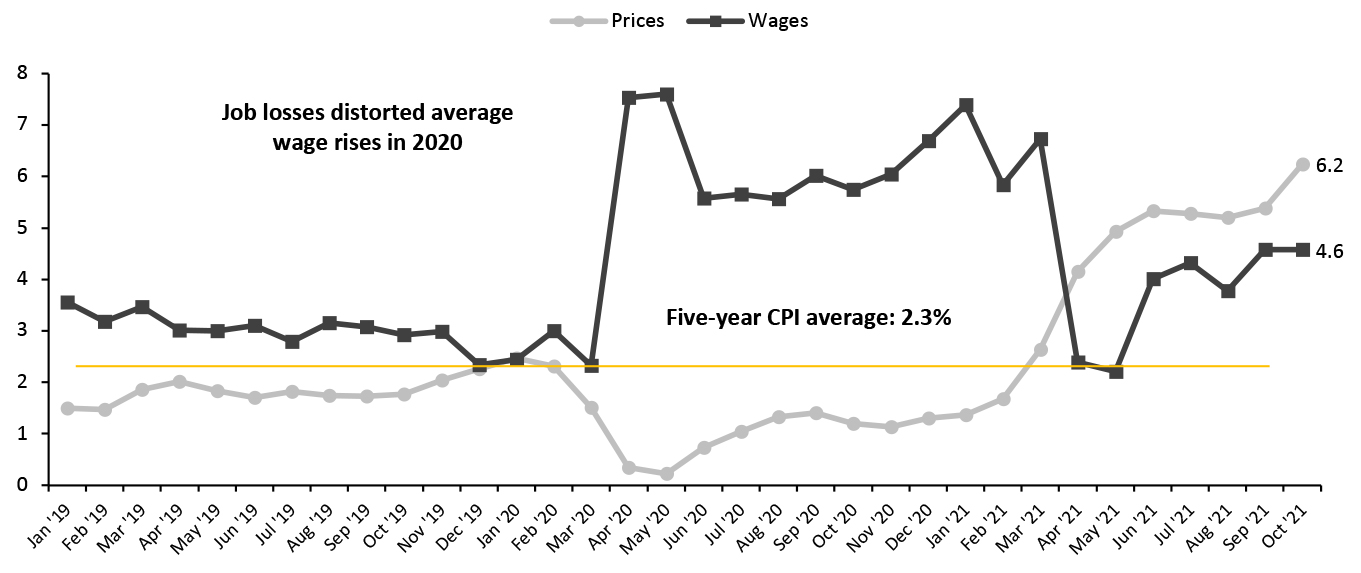

Inflation and, in turn, the threat of interest-rate rises represent the biggest headwind to consumer discretionary spending. The consumer price index (CPI) has been above the five-year average of 2.3% since March 2021 and has been considerably stronger in the second half of the year. Price increases have tended to be greatest in energy, including gasoline, and this will squeeze availability of funds for discretionary spending.

Weekly wages grew at a 4.6% year-over-year pace in October 2021, the same pace as in September. Average weekly earnings growth has underpaced the CPI since April 2021 (see Figure 4).

Source: US Bureau of Labor Statistics/Federal Reserve Bank of St. Louis[/caption]

Inflation and, in turn, the threat of interest-rate rises represent the biggest headwind to consumer discretionary spending. The consumer price index (CPI) has been above the five-year average of 2.3% since March 2021 and has been considerably stronger in the second half of the year. Price increases have tended to be greatest in energy, including gasoline, and this will squeeze availability of funds for discretionary spending.

Weekly wages grew at a 4.6% year-over-year pace in October 2021, the same pace as in September. Average weekly earnings growth has underpaced the CPI since April 2021 (see Figure 4).

Figure 4. US CPI vs. Average Weekly Wages: YoY % Change [caption id="attachment_137585" align="aligncenter" width="700"]

Source: US Bureau of Labor Statistics[/caption]

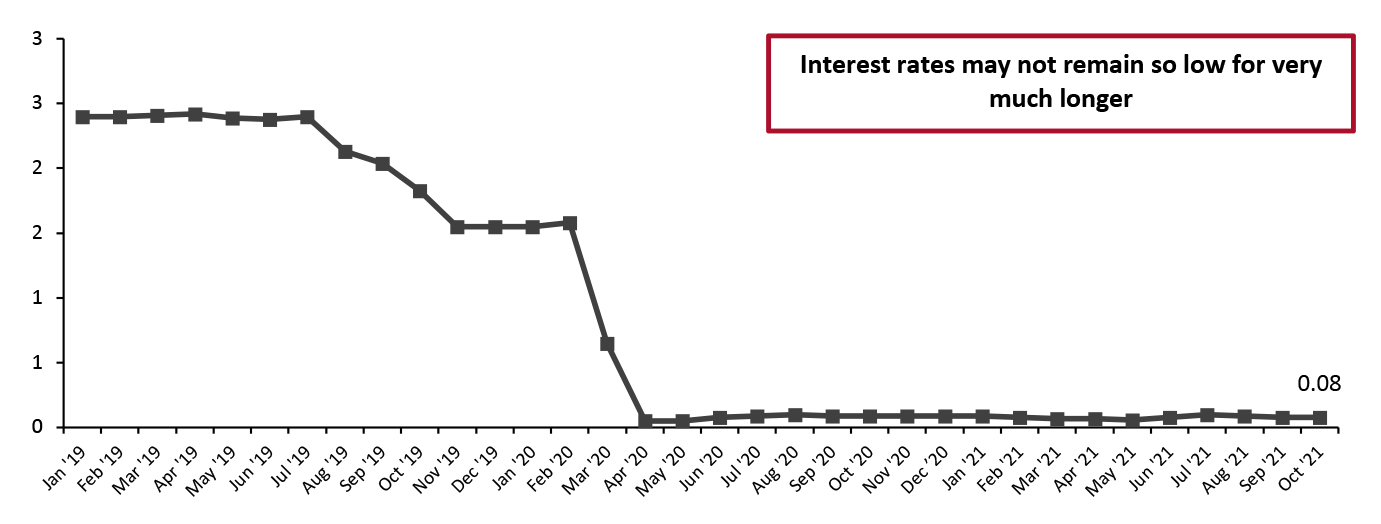

Further price rises add pressure for the Federal Reserve to raise interest rates. In an October 2021 poll of economists, Reuters found that most expected no rate rises before 2023—although that could be optimistic. In November 2021, the Federal Reserve’s Vice Chair Richard Clarida said the economic criteria for the Federal Reserve to increase interest rates could be met in 2022, although it was still “a ways away from considering interest-rate rises,” according to The Financial Times. Also in November, JP Morgan economists stated that they expect a rate rise in fall 2022, according to Reuters.

The effective federal funds rate has remained at an ultra-low level as the US Federal Reserve has embarked on a plan to keep interest rates at very low levels. Those lower interest rates have fueled retail spending by translating into lower borrowing and financing costs.

Source: US Bureau of Labor Statistics[/caption]

Further price rises add pressure for the Federal Reserve to raise interest rates. In an October 2021 poll of economists, Reuters found that most expected no rate rises before 2023—although that could be optimistic. In November 2021, the Federal Reserve’s Vice Chair Richard Clarida said the economic criteria for the Federal Reserve to increase interest rates could be met in 2022, although it was still “a ways away from considering interest-rate rises,” according to The Financial Times. Also in November, JP Morgan economists stated that they expect a rate rise in fall 2022, according to Reuters.

The effective federal funds rate has remained at an ultra-low level as the US Federal Reserve has embarked on a plan to keep interest rates at very low levels. Those lower interest rates have fueled retail spending by translating into lower borrowing and financing costs.

Figure 5. Effective Federal Funds Rate (%) [caption id="attachment_137403" align="aligncenter" width="701"]

Source: Board of Governors of the Federal Reserve Systems [/caption]

Consumer Sentiment

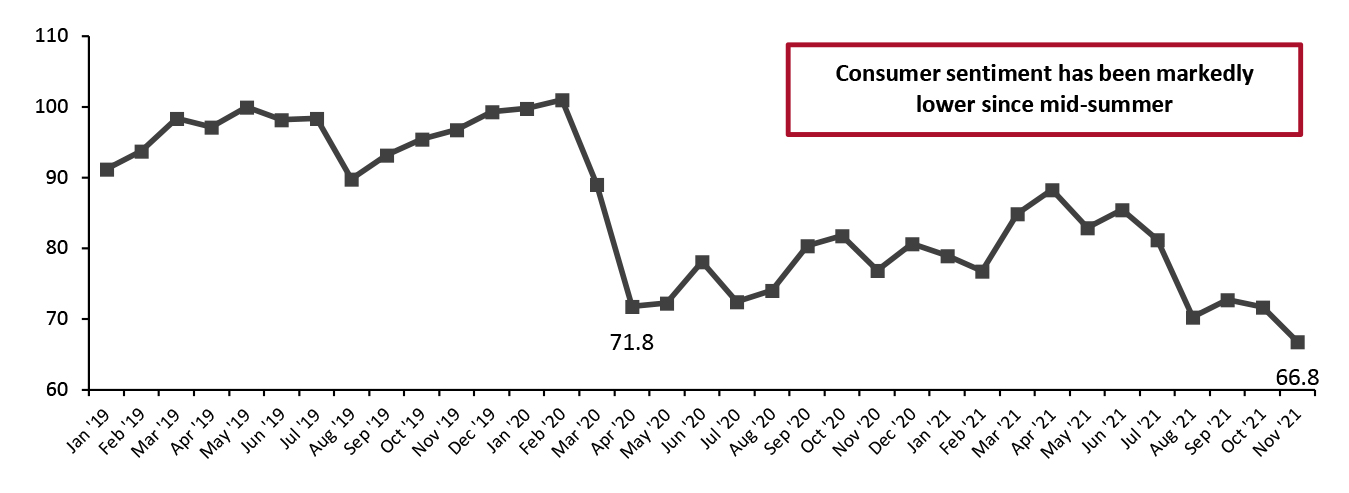

Since mid-summer 2021, US consumer sentiment has been notably lower and tending to trend downward. The most recent reading of 66.8 on the University of Michigan’s index in November 2021 was lower even than in the first waves of the pandemic, when jobs were being slashed and people instructed to remain at home. Economic concerns, such as rising inflation, appear to be the main drag.

Source: Board of Governors of the Federal Reserve Systems [/caption]

Consumer Sentiment

Since mid-summer 2021, US consumer sentiment has been notably lower and tending to trend downward. The most recent reading of 66.8 on the University of Michigan’s index in November 2021 was lower even than in the first waves of the pandemic, when jobs were being slashed and people instructed to remain at home. Economic concerns, such as rising inflation, appear to be the main drag.

Figure 6. University of Michigan: Consumer Sentiment Index [caption id="attachment_137404" align="aligncenter" width="700"]

Source: University of Michigan[/caption]

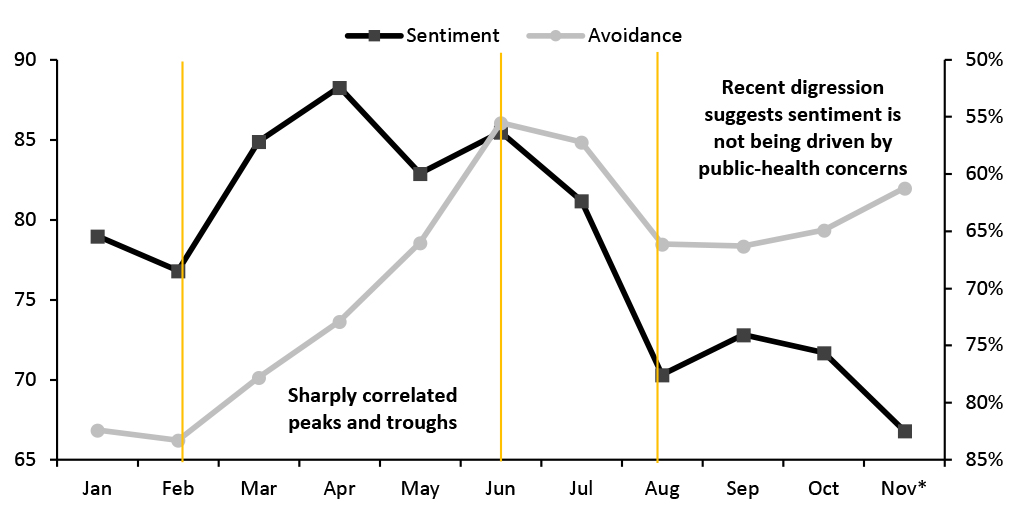

For much of 2021, shifts in consumer sentiment have roughly echoed changes in the public-health context. As charted in Figure 7, our own surveys of US consumers have found that their avoidance of public places or travel has been closely linked to consumer confidence—greater avoidance of public places has tended to correlate to more negative sentiment, and vice versa.

However, in October and November 2021, the trends for these two metrics diverged, as consumer confidence became less tied to public-health concerns and impacted more by economic concerns and, we assume, more significantly by inflationary worries. We move into 2022 with economic concerns weighing on the minds of American consumers but with public-health worries likely in the background and ready to resurface.

In Figure 7, the avoidance metric is inverted to more clearly show the correlation.

Source: University of Michigan[/caption]

For much of 2021, shifts in consumer sentiment have roughly echoed changes in the public-health context. As charted in Figure 7, our own surveys of US consumers have found that their avoidance of public places or travel has been closely linked to consumer confidence—greater avoidance of public places has tended to correlate to more negative sentiment, and vice versa.

However, in October and November 2021, the trends for these two metrics diverged, as consumer confidence became less tied to public-health concerns and impacted more by economic concerns and, we assume, more significantly by inflationary worries. We move into 2022 with economic concerns weighing on the minds of American consumers but with public-health worries likely in the background and ready to resurface.

In Figure 7, the avoidance metric is inverted to more clearly show the correlation.

Figure 7. US Consumer Sentiment (Index; Left Axis) vs. Avoidance of Any Public Place (% of Respondents; Right Axis, Inverted) [caption id="attachment_137405" align="aligncenter" width="699"]

*As of November 15, 2021, survey for avoidance

*As of November 15, 2021, survey for avoidance Base for avoidance: US respondents aged 18+

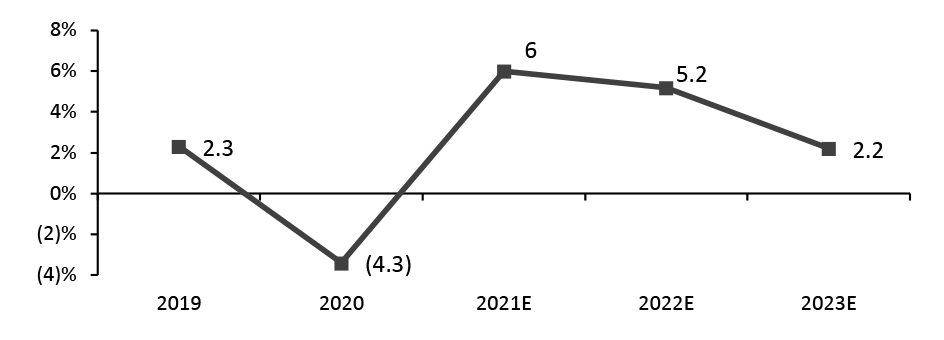

Source: University of Michigan/Coresight Research [/caption] Economic Growth As shown in Figure 8, the International Monetary Fund (IMF) expects the strong economic gains seen in 2021 to be consolidated in 2022 with a further 5.2% rise in economic output.

Figure 8. US GDP: Real-Terms YoY % Change [caption id="attachment_137406" align="aligncenter" width="700"]

Source: IMF[/caption]

Source: IMF[/caption]

US Food Retailers, Mass Merchandisers, Warehouse Clubs and Discount Stores

Directional Outlook- We estimate that US grocery sales grew by 2.1% year over year in 2021, partly due to demanding comparatives from 2020 and the partial recovery of the foodservice sector. In 2022, we expect the market to grow modestly by 1–2% as it will likely be impacted by on-premise consumption regaining its full strength offset by some retention of food-at-home spending. Should inflation trend upward, we see upside potential to our sector estimate.

- As the pandemic wore on in 2021, major US mass merchandisers and warehouse clubs that sell a diverse mix of merchandise have capitalized on the sticky behaviors of “one-stop” shopping, which partially sustained their growth momentum in 2021. We anticipate a reversal of this trend over the course of 2022 as consumers return to shopping from a range of stores, benefiting grocers with specialty and niche value propositions. However, a greater mix of e-commerce options and extended online capacity will continue to supplement mass merchandisers’ and warehouse clubs’ offline growth.

- Coresight Research estimates from Census Bureau data that almost 48% of food-away-from-home dollars were captured by US food retailers in 2020. For the first three quarters of 2021, the US food-service industry saw a year-over-year increase in sales of $134 billion—equating to a 25% increase versus the same period the prior year. A shift in the flow of food dollars back to restaurants, cafés and bars will prove a headwind for food retail sales in 2022 (although the sector maintained growth amid a partial return to food service in 2021).

- The crisis has reinforced online buying behaviors in a high proportion of shoppers. Our weekly consumer surveys have consistently found that around one-quarter of respondents are buying food online, reflecting the retention of pandemic-driven behaviors in the channel. Concerns over the pandemic could play a role in keeping consumers shopping online, further strengthening the already resilient e-commerce channel. Retailers that have invested in initiatives to expand digital capabilities are well positioned to capture expanded online grocery demand.

- Discount formats are well positioned to capture share among a price-conscious consumer base feeling the effects of inflation and the expiration of government stimulus programs. Variety discount stores (such as Dollar General and Family Dollar) and grocery discounters (such as Aldi and Grocery Outlet) will likely capitalize on price-driven consumer spending decisions.

- Mass merchandisers and warehouse clubs built on pandemic-driven grocery gains in 2021. We anticipate the grocery segment will continue to be a key driver to their topline performance in 2022 on the back of expanded product offerings and revamped loyalty programs.

- The expected partial retention of consumer behavior of cooking more meals at home will continue to fuel food-at-home demand.

- Rising food prices in tandem with the broader inflationary trends may encourage low-income consumers to continue spending in food retail rather than switching back to food service.

- Digital retail media opportunities will aid retailers in harnessing advertising revenue and offset the higher operating expenses associated with increased online fulfillment.

- We expect a flow of food dollars from retail to food services as on-premise consumption regains its full potency.

- We expect a reversal in the trend to consolidate shopping as consumers shop more frequently from a range of stores—which is disadvantageous to one-stop retailers.

US Apparel and Footwear Retailing

Directional Outlook- After a strong clothing and footwear market recovery in 2021—with total US apparel and footwear spending up by fully 30%, Coresight Research estimates—we expect US apparel and footwear sales to see flattish sales growth in 2022. Our estimates assume that a large number of consumers were able to return to normal behaviors and needed to update their wardrobes in 2021 with the vaccine rollouts.

- We assume consumers will continue to update their wardrobes in 2022 as they return to work, increase spending on travel and at restaurants, and attend more leisure activities. The 2021 jump took total category spending to well above 2019 levels—we calculate about 18% above, in fact. Given the scale of those increases, even flat category spending in 2022 reflects a retention of those gains. 2021 growth was supported by increased vaccinations, economic recovery, stimulus checks and consumers’ return to more normal ways of living and spending.

- US apparel and footwear e-commerce sales saw strong growth in 2021 even amid a consumer return to stores. We estimate that e-commerce sales will have grown by 16% in 2021—although that is lower than the estimated 30% increase in total category spending. We estimate that online apparel and footwear sales will decline at a low-single-digit percentage pace in 2022. We estimate that the e-commerce share of total US apparel and footwear sales will decline by approximately 1.0 percentage point in 2022 following a 4.0-percentage-point decline in 2021, as we expect more consumers to return to in-store shopping. However, we anticipate that many consumers will still retain online shopping habits, leaving the total e-commerce penetration rate at around 31%.

- The store-based US apparel and footwear specialty sector will go into 2022 having recovered much of the aggregate share lost amid store closures in 2020. However, pockets of the sector will face the structural challenges that confronted them pre-2020, including a longstanding link to traffic-challenged lower-tier malls. In 2021, the store-focused apparel and footwear specialty sector saw substantially higher estimated growth than total apparel and footwear spending growth as shoppers returned to stores and specialty retailers recovered ground lost to rival channels in 2020, such as online retailers and mass merchants. Clothing-store sales increased by 22.7% year over year in October 2021, according to the Census Bureau, and we estimate that sector sales increased by around 39.0% for the whole year, as benchmarked to Census Bureau data.

- In 2022, we expect more consumers to still opt for more casual and comfortable apparel categories such as athleisure and sportswear even when they return to offices. We expect the casualwear market to continue to dominate total US apparel spending in 2022 but may cede a small portion of demand to the dresswear market.

- We expect experiential e-commerce to continue to gain traction, such as livestreaming and augmented reality (AR)-enhanced shopping experiences, including virtual try-on. A growing number of apparel retailers and brands such as Amazon, Adidas, NIKE and Ralph Lauren are adopting livestreaming and virtual try-on technology to enrich consumers’ experiences and establish highly immersive virtual retail spaces.

- We anticipate continued physical store innovations among apparel retailers and brands. For example, in September 2021, Dick’s Sporting Goods opened its first outdoor concept store, Public Lands, in Pittsburgh, US. The store features a 30-foot rock wall, an in-store gear repair and rental department, and specialized shops dedicated to various outdoor activities. Levi’s is also planning more “NextGen” stores to bring tailor shops, digitalized shopping guides and customized recommendations into stores. We expect that apparel and footwear retailers and brands will continue to invest in their brick-and-mortar stores to reinvent physical retail and supplement their online businesses. We also anticipate that brands and retailers will continue to invest in integrating online and offline operations to provide consumers with seamless shopping experiences.

- Many US consumers will continue to update their wardrobes in 2022 as they increasingly return to normal ways of living and spending.

- Consumers value convenience in the shopping journey. To meet this need and ensure safety during the pandemic, apparel retailers and brands have increased their investments into omnichannel capabilities and fulfillment, which will support apparel sales growth going forward.

- Supply chain costs, including sourcing, inventory shipping and last-mile delivery, will present challenges for apparel and footwear retailers and brands. In addition, retailers have reported that the cost pressure of moving products from warehouses to distribution centers is rising due to increased digital shipment volume and higher cost per shipment amid the pandemic and port congestion.

- There will be higher marketing and customer-acquisition costs associated with online retailing as retailers increase their digital capabilities, such as working with livestreamers to launch sales events, offering virtual consulting services and leveraging social media to engage consumers (see also our later discussion on anticipated higher marketing costs for digital-first retailers, in our e-commerce section). We expect to see more retailers look to grow their digital engagement strategically and deepen connections with shoppers, in order to develop a more sustainable customer-acquisition approach.

- We expect a highly competitive environment for specialty apparel specifically—with competition from mass merchandisers such as Target and Walmart, e-commerce giant Amazon, traditional retailers, and rising digitally native brands that feature strong differentiators such as an excellent digital presence, sustainable product offerings and subscription models (featuring curation services to help consumers design their apparel styles).

US Department Store Retailers

Directional Outlook- We envisage a return to more challenging times for US department stores in 2022, following a strong rebound in 2021 due to stimulus payments and consumers returning to stores; we estimate that revenues totaled approximately $80.9 billion in 2021, up by 26.6% on 2021. Coresight Research expects total department store sector sales to be down slightly in 2022, by low-single digits, circa (0.5)%–(1.5)%. This factors in the continued structural challenges and less favorable momentum in the markets in which the sector competes (see our discussion of apparel, above)—we do not consider 2021’s recovery to have been the start of a permanent upswing for this sector. At a midpoint range of (1.0)%, 2022 revenue is set to be $80.1 billion, 16.2% below pre-pandemic revenues of $95.6 billion.

- Coresight Research assumes that e-commerce sales penetration will continue to grow back to peak levels at the major department stores during 2022 and 2023, accounting for 40%–50+% of total sales at the major retailers. In 2022, we expect e-commerce penetration to account for 39.6% of department store sales, with total online sales growing by 10.3% from 2021. In 2021, e-commerce’s share of sales moderated to 35.7% from 43.7% in 2020, when stores were closed for some periods. For example, during the first half of 2021, online sales pentetration averaged 28% at Kohl’s, down from 40% in 2020; 34.5% at Macy’s, down from 44% in fiscal 2020; and 43% at Nordstrom, down from 55% in fiscal 2020. However, each retailer reported that they expect e-commerce penetration to grow again in 2022.

- Department stores are diversifying their portfolios and investing in new categories to meet consumer demand and become less reliant on apparel as a main revenue driver. Department stores were severely impacted by apparel category losses due to Covid-19, as consumer behavior and corresponding preferences changed. Department stores are becoming more innovative and creative in their partnerships and entering less traditional categories. For example, Macy’s announced in August 2021 that it would open 400 Toys“R”Us shop-in-shop locations in its stores. Management reported that the company aims to be a one-stop-shopfor the millennial mom and to grow its toy category. The department store is also expanding into “emerging categories”—including toys, pet, food and wine, and health and fitness. In September 2021, Nordstrom introduced Nordstrom Home, a two-story retail concept store in its New York City location. Nordstrom Home includes furnishings and other home-related products from brands of all price points, including local brands and businesses and the Museum of Modern Art (MoMA) Design Store. Nordstrom reported that it sees opportunities to grow its home business by 5X within the next three to five years, tripling its selections in bedding, office and even pet products. We expect department stores to continue category expansion into less-traditional categories and to continue to be creative and innovative in order to drive demand.

- In 2022, we expect department stores to implement virtual selling capabilities, including virtual chat, virtual consultations and livestreaming, to increase e-commerce sales and engage with consumers. In 2021, Nordstrom and Saks Fifth Avenue each launched their own virtual events and livestreaming sessions on their websites, allowing consumers to watch and shop live content from a variety of hosts across all product categories. The livestream events are also viewable and shoppable after the event is over. Macy’s also hosts livestream events and is using virtual personalization tools, including a fragrance finder, to personalize the consumer’s online experience.

- We expect department stores to continue to focus on efficiency in every aspect of the supply chain in 2022, including providing the consumer with more self-sufficiency in pickups and returns. As the supply chain has been under tremendous pressure in 2021, we expect department stores to look for opportunities to increase efficiency, including leveraging physical stores as fulfillment centers to offer ship-from-store fulfillment, upgrading BOPIS (buy online, pick up in store) and curbside pickup services, and owning last-mile delivery through same-day partnerships. For example, Kohl’s will be testing self-pickup and self-returns in about 100 stores in the 2021 holiday season; in 2020, store fulfillment accounted for 40% of the company’s online orders. We expect that technology advancements such as self-checkout and returns that add autonomy in the consumer experience will help shoppers feel more in control and will improve the efficiency of retail operations.

- Department stores' extensive physical store formats can be used as an asset in omnichannel retail, acting as micro-fulfillment centers to both fulfill digital orders and promote curbside and BOPIS services, which will help to reduce shipping costs.

- In a context where some consumers are still seeking to consolidate in-person shopping trips and so limit their exposure to public places, “one-stop” department stores are advantageous to consumers looking for an efficient way to shop for the entire family in one go and minimize store visits (although department stores should be mindful of consolidation trends abating in the medium term).

- Due to the typically large size of department stores, retailers in this sector are able to explore, pursue and test new category opportunities based on consumer demands, as well as retailer shop-in-shop partnership opportunities.

- We expect that working remotely will be a permanent reality for many consumers in 2022, impacting demand for business and work apparel.

- The long-term impact of category preferences and lower average order value may affect the department store sector, due to a shift to low-value categories—such as from dress apparel to casual apparel.

- The high-value home category has been trending upward throughout 2021, which has been positive for department stores. However, its growth trajectory is unlikely to continue at elevated growth levels, which will also impact department stores.

- The structural challenges that department stores faced before 2020 have not been resolved. These include (variously and applicable to different degrees across the sector) being tied to underperforming malls, the secular decline of the “middle ground” amid a flight to budget retailers, and over-spaced, capital-intensive stores (sometimes underinvested in) in a multichannel age.

US Beauty Retailing

Directional Outlook- We expect total US spending on core beauty categories to increase at a faster pace in 2022 than our mid-single-digit-percentage estimate for 2021, driven by a resurgence in color cosmetics and a resumption of premiumization across color cosmetics, fragrance and skin care. As the US opened up amid Covid-19 vaccine rollouts, sales of beauty products migrated back to physical retail from online—and as 2022 progresses, we expect the omnichannel beauty shopper to traverse both channels, driven by convenience and efficiency.

- We expect a continued recovery in color cosmetics in 2022 as people dress up, socialize, go to work and resume a modicum of normality. The fragrance category should also experience a demand lift for this reason, along with new product launches and niche brands driving category excitement. During Covid-19, skin care experienced growth as consumers sought wellness solutions that the skincare category offers. The beauty category includes spending on cosmetics, fragrances, bath products and nail products—as defined by the US BEA—and represents sales through all channels, including the lockdown-resilient e-commerce channel.

- US beauty retail saw a substantial bounce in the first half of 2021, in part benefiting from easy pandemic-impacted 2020 comparisons but also exhibiting growth on a two-year basis (versus pre-pandemic 2019), reflecting pent-up demand. We expect the final quarter of 2021 to see steady momentum in beauty, with increased usage (and purchases) of color cosmetics and gifting opportunities for fragrance. Our estimates assume that the number of consumers avoiding public places and large social events diminishes in the second half of 2021 and continues to diminish in 2022.

- In 2022, we expect the beauty specialist retail sector—which includes sales by specialist retailers of cosmetics, beauty products and perfume as well as optical goods and other health and personal care products (but excluding drugstores and pharmacies), as outlined by the US Census Bureau—to stabilize to high-single-digit growth versus a 15.4% drop in 2020 and an estimated 10% lift in 2021. Online sales will likely moderate as consumers return to physical retail.

- In 2021 and 2022, we expect the online share of US beauty retail sales to continue to increase but at a significantly slower pace than the estimated 9.0-percentage-point year-over-year growth in e-commerce penetration in 2020 (totaling 28%). This market size includes sales of personal care categories—such as bath products, hair care and shaving products—as well as the core beauty categories of cosmetics, fragrances and skin care.

- In 2022, some crisis-induced shopping behaviors are likely to be retained by consumers, such as online beauty shopping and buying beauty products for at-home use. Beauty brands and retailers are investing in digital strategies that facilitate this shopping behavior. We expect the rollout of Sephora at Kohl’s and Ulta at Target to drive store visits and increase excitement in the beauty category in 2022. New products, continued premiumization of the beauty category, niche brands and a growing male consumer base round out the positives driving a high-single-digit growth rate in 2022.

- Beauty brands and retailers such as Coty, Estée Lauder and Ulta Beauty are reporting solid sales gains, reflecting consumer interest in this modestly priced, slightly indulgent, feel-good category. We anticipate a strong recovery in the beauty category in 2022.

- We expect the partial retention of the consumer behavior to buy more online and less in-store.

- Brands and retailers are adopting omnichannel approaches to reaching consumers both online and offline.

- Brands and third-party merchants are increasing their online presence.

- The development of efficient and extensive logistics networks will be a key tailwind for the sector.

- The sector is highly competitive, with competition for traditional e-commerce platforms from multichannel retailers, DTC brands and social platforms that incorporate e-commerce functions.

- Continued investments in fulfillment and logistics networks weigh on margins.

- Acquiring new consumers online presents additional costs to retailers.

- Rules and regulations on e-commerce platforms imposed by local governments—for example, China’s issuing of draft rules to prevent monopolistic behavior by Chinese Internet giants including Alibaba, JD.com and Pinduoduo—will impact the competitive landscape.

US and China E-Commerce

Directional Outlook US E-Commerce- We expect a further increase in US online retail sales in 2022, although there will be a meaningful easing in the online trajectory amid a deceleration in overall retail sales. We are currently penciling in a high-single-digit year-over-year increase in total US online retail sales versus an estimated 14.0% in 2021 and 33.2% in 2020 (per Census Bureau data), taking online sales to $886 billion. This would represent a more severe attenuation in the two-year pace of expansion, from the low-50s in percentage terms in 2020 and 2021, to the lower-20s in 2022. Yet, versus estimated low-single-digit growth for total retail sales, it represents a further gain in share by the online channel. The consumer habit is there and online has not yet ceded spending to stores: Coresight Research’s weekly US consumer surveys have shown a sustained pattern of online shopping across 2021, including in grocery.

- Amid an anticipated slowing in discretionary categories in 2022, we expect food to again outperform the US online average with strong, double-digit-percentage expansion representing a gain in share of total online retail sales—this category accounted for only around 8% of all US e-commerce in 2021, versus food retail spending equating to around 29% of total retail sales, which suggests a long runway for online outperformance. 2021 proved that food e-commerce can hold onto the remarkable gains seen in 2020; we expect that the year was a springboard for multiyear channel gains in groceries. Increasingly, those sales will be channeled through quick-commerce players; we estimate that rapid delivery platforms and vertically integrated players will have captured a 10%–13% share of US online CPG sales in 2021.

- We expect online-only retailers, in aggregate, to see underperformance versus total channel sales in 2022, continuing a trend we have observed in 2021: Most recently (for the third quarter of 2021), eBay reported declining GMV, Wayfair registered a sales slump and Amazon reported soft growth in its Online Stores segment. As shoppers continue to return to stores in 2022, we expect them to seek out the omnichannel services that complement those visits—specifically BOPIS, curbside pickup and in-store returns. Return visits amplify stores’ position as marketing channels for the websites of cross-channel retailers (and it is a win-win for omnichannel retailers even if those increased store visits equate to reduced online shopping).

- Nonstore retailers could be further challenged by a probable softening in discretionary/nonfood online growth—the pure-play sector is predominantly nonfood-focused. We therefore expect nonstore rivals to be compelled to invest a greater share of revenues in advertising, to capture share in a softer market. A tight labor market is likely to continue to push up fulfillment costs, too, providing an unwelcome second pinch on online-only retailers’ margins. Meanwhile, omnichannel retailers must use the contact point of stores as a lever to solidify their gains in e-commerce.

- Weaker total retail growth and slowing economic expansion are likely to be challenges for the totality of China retail into 2022, and that includes e-commerce in China. Yet, so far, total online demand has been surprisingly resilient against these negative forces, and the demand side has been positive for China e-commerce. The year-over-year pace of expansion in e-commerce increased in 2021, apparently reversing the medium-term trend of incrementally slowing growth each year. The annual growth rate reached a low of 14.5% in 2020; We estimate that 2021 will close with total e-commerce up by around 18.5%, taking online sales to ¥11.57 trillion ($1.81 trillion, as of November 18)—and this is in the context of a general slowdown in China retail sales. The e-commerce data from the National Bureau of Statistics includes food service in its figures, which adds an extra element of unpredictability (this is unlike the US, where the data represent pure retail).

- The supply side in China is a different story, with large tech firms under pressure to be seen to be doing good and keen to downplay their scale—hence, Alibaba’s push for sustainability and demotion of GMV as a key metric for the Singles’ Day 2021 shopping festival. Given the political context, we expect such forced humility to continue through 2022, stymying the growth rate at some major platforms (recently evidenced by Alibaba’s cut to full-year revenue guidance).

- Despite this content, consumer demand for shopping with platform giants appears to still be there (as of late 2021), as evidenced by JD.com’s strong 28.6% rise in Singles’ Day sales—compared to Alibaba’s 8.5% increase. The challenge for giants in being seen to voraciously pursue this demand represents an opportunity for alternative players, including specialized e-commerce verticals that cater to a specific niche or demand: China could end 2022 with a (slightly) more fragmented e-commerce sector.

- We will cover China e-commerce in greater depth in our forthcoming report 10 China E-Commerce Trends for 2022.

- There is evidence of sustained high levels of online shopping, which equates to increased total spend—in the US, this is even after the online sales jump of 2020.

- There are renewed opportunities for omnichannel players to leverage stores as marketing channels for cross-channel shopping—and to ease fulfillment costs through the use of stores.

- Rapid delivery platforms present an opportunity for retailers to serve demand for quick commerce with limited commitment and minimal investment.

- 2021’s boom for retail in the US presents demanding comparatives.

- Inflationary trends will impact fulfillment costs.

- In the US, digital-first retailers (i.e., those without stores) are likely to face pressure to up their advertising spend as shoppers continue to return to stores.

- Economic growth is slowing in China.

- There are political pressures on “big tech” in China.

The Global Luxury-Goods Market

Directional Outlook- In 2022, we expect the global personal luxury goods market to increase by 10.2% to $380.2 billion; this follows a double-digit percentage increase in 2021. We think growth will remain elevated initially and moderate to single digits in the following years. The return to a semblance of normalcy in terms of social events and travel will drive some recovery. In addition, companies’ aggressive digital strategies, growth in local purchasing and China’s rise to being the largest luxury consumption market will support sustained growth. The US has historically been the single largest market for luxury, but China looks poised to displace the US and usurp the position of the top market for luxury by 2025, growing from its current share of nearly 20% to 25%.

- Coresight Research estimates that the global personal luxury market grew 17.0% to $345.2 billion in 2021, surpassing 2019 levels. The luxury sector is heavily dependent on travel/tourism and in-person shopping, both of which were at a virtual standstill across the globe, albeit at different times, for a substantial part of 2020 through to early 2021, and only began to pick up in the second half of 2021. Apart from the further easing of travel restrictions, we think pent-up demand, increased uptake of vaccinations, declining local infection rates and improved consumer sentiment will drive growth in this sector.

- Sales in the clothing and footwear segments are likely to see a stronger resurgence through 2022 as vaccination rates become more widespread, and travel and social events return. The accessories and jewelry segments enjoyed strong sales growth through the first half of 2021, while sales growth in the other segments were subdued. In the latter quarters, however, luxury brands reported recovery in the clothing and footwear segments, which we believe will gain momentum into early 2022. Although some spending on goods will be reallocated to services, consumers will want to shop for new collections to wear when they travel or eat out; we think part of the current spend on jewelry and accessories will be redistributed to apparel and footwear.

- Coresight Research estimates that online sales in the global personal luxury goods market will grow 20.7% to $87.5 billion in 2022 and account for about 23% of the total luxury market. Our analysis indicates that the online luxury goods market totals $72.5 billion in 2021, having grown 21.2% from 2020. Even as social outings return, we think that crisis habits such as shopping for luxury online (more so than pre-pandemic times) and digital initiatives that make online luxury shopping convenient and engaging will drive this growth. Luxury companies have highlighted on recent earnings calls that they are furthering omnichannel initiatives, supporting our expectations for continued strong e-commerce growth in 2022.

- Luxury is one sector that is heavily dependent on tourism. Even as tourism returns, we think luxury brands will rethink their store portfolios in 2022, given heightened online shopping and with luxury consumers choosing to shop locally where they are based.

- As major global markets open up to tourism, we think this will bolster luxury sales in 2022.

- China has been ahead of other markets in terms of pandemic recovery and is poised to be the largest market for luxury spending, driving the global luxury market in the years to come.

- In the near term, online buying behavior developed since the onset of the pandemic is likely to continue and thus drive e-commerce growth in the sector.

- While much of the luxury market is dependent on consumers’ existing wealth, the market could miss out on new luxury shoppers and aspirational shoppers that are spending conservatively in view of a harsh inflationary macroeconomic environment. A Coresight Research surveyconducted on August 30, 2021 found that over one-quarter of US consumers that observed recent price rises plan to cut back on discretionary spending.

- As industry-wide supply chain disruptions persevere, sourcing and shipping costs are likely to increase, and we will see impacts on margins over 2022.

Global Retail Technology

Directional Outlook- We estimate that global retail technology spending will increase to $265 billion in 2022, a 12.6% increase from pre-pandemic 2019, driven by the combination of a greater ability to invest in new technology (owing to rebound in global retail sales) and a greater need to do so (owing to continuing swings in consumer demand, demographics and intensifying competition across multiple online and offline channels).

- Supply chains continue to dominate retailers’ mindshare. Their efficiency and resilience drive a retailer’s revenues and margins, as well as customer sentiment, which drives future revenues and margins. Inventory availability is of utmost importance, since consumers largely continue to avoid public places and seek to consolidate their shopping into a few targeted trips; if a retailer disappoints on inventory availability, then the consumer could leave the store and never return, telling friends of the experience on social media. Moreover, running supply chains efficiently can locate hidden revenue opportunities and raise margins through a reduction in discounting, beyond the obvious efficiency gains.

- The rationale and urgency of cloud computing is as great as ever. Moving to the cloud frees retailers and brands of the upfront expense of acquiring IT hardware and hiring IT teams, and it also enables them to innovate faster and benefit from the faster innovation rate of cloud computing. Cloud software is modular, and the modules are updated more frequently, as compared to traditional software that must be tested as a whole platform and therefore updated less frequently. This modular software approach enables the best module to be selected for any given function.

- Retailers must invest in their capabilities to meet their customers on multiple channels and platforms. The pandemic loosened the bonds and relationships that consumers maintained with retailers, through their physical and online stores. Working at home, consumers have been disconnected from these traditional channels and free to explore new channels such as livestreaming and social shopping; retailers need to understand the diverse channels their customers are using and communicate with them there.

- Hybrid work is here to stay. Employees and employers learned during the sheltering-at-home phase of the pandemic that working from home is effective, and hybrid home-office work schemes are likely to continue. Employees spending more time at home is a trend that has driven sales of PCs, routers and webcams, as well as consumer electronic devices for enjoying entertainment and exercising at home; this is set to continue. Software company Salesforce’s acquisition of business communication platform Slack underscored its view on the importance of enabling workers to communicate and collaborate on a decentralized basis, working from anywhere.

- Building on the general trend of consumer demand for increasingly personalized and customized goods are rising consumer expectations for speed of delivery. Commonplace two-day shipping has become one-day shipping, and the grocery sector has gravitated to quick commerce, whose current manual approach will likely evolve to a need for automated facilities, such as micro-factories.

- Retail sales have rebounded from pandemic levels globally and in the US, which provides a broader revenue base that retailers and brands can leverage to fund technology investments.

- The step-up in e-commerce penetration in 2021 requires retailers to step up the level of investment in e-commerce sales and fulfillment capacity in order to maintain customer satisfaction amid higher levels of demand.

- Hybrid work will generate demand for IT hardware and software tools, from enterprise upgrades as some workers return to the office and from the replacement cycle of workers from home upgrading and improving existing equipment.

- The fragmentation of consumer attention across multiple channels means that retailers and brands have to address consumers in all of these channels, requiring greater investment or selecting those channels with the maximum potential impact.

- Global transportation bottlenecks and the ongoing chip shortage is lengthening lead times for IT hardware, which could reduce retailers’ ability to execute on technology projects, as well as the availability of appliances and electronics products for consumers.