albert Chan

What’s the Story?

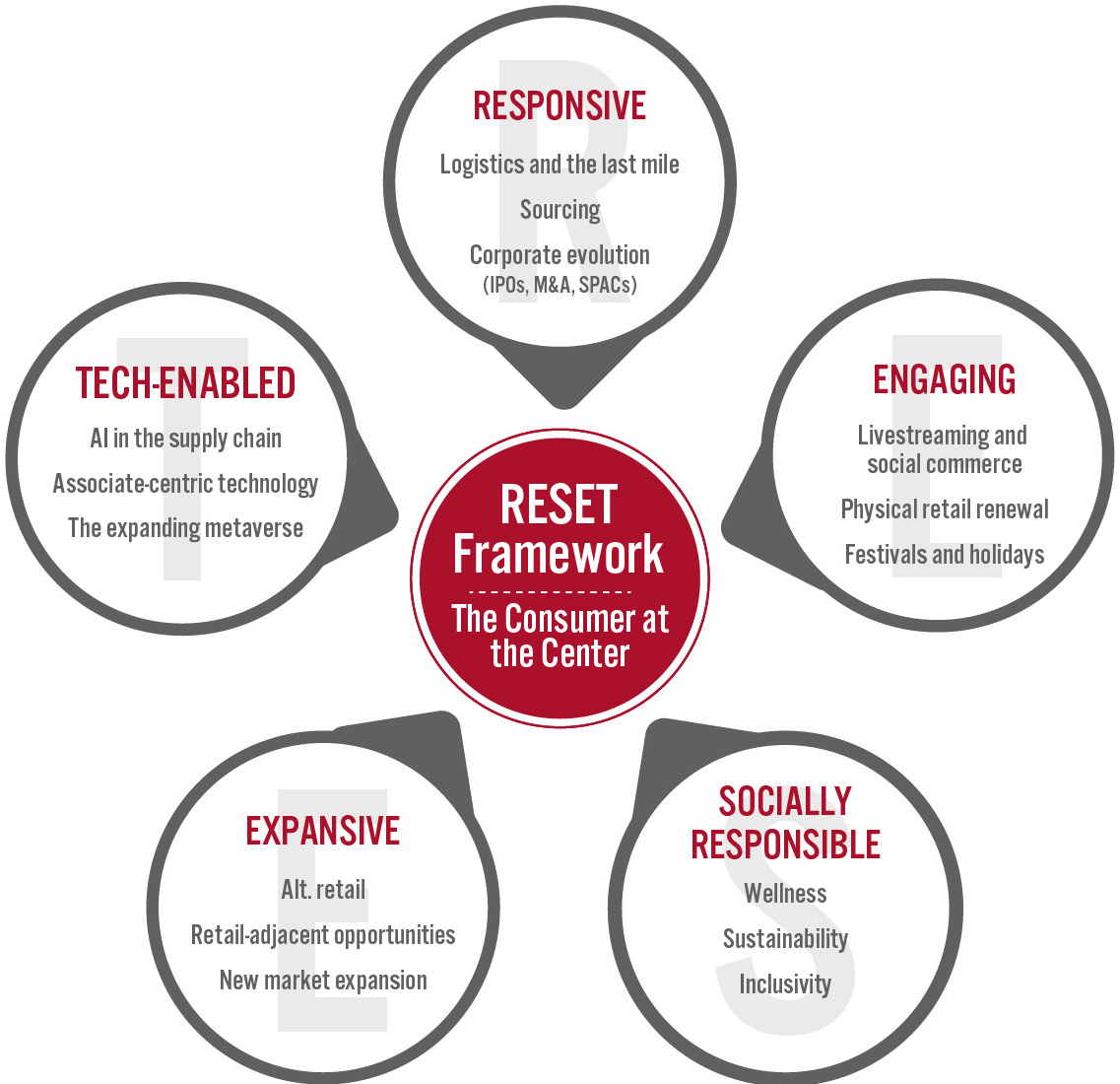

We present our flagship annual report on global retail and consumer trends. This year, we focus on recommendations around five themes, which make up our RESET framework for change in retail. Why a framework for change? We expect 2022 to be a transitional year for consumers and retailers, with an incrementally more normal environment, such as in how consumers live and work, for instance, and more normalized retail sector momentum. This follows two years of upheaval, scrambled reactions and, in the case of 2021, very strong retail demand. Even in 2022, we look highly unlikely to return to something very similar to pre-crisis normalcy in everyday life and behaviors, yet we expect to be closer to that point in 12 months than we are now. At the same time, retailers will need to discern what changes will stick—and they will need to continue to respond to structural, multiyear shifts. Read on for our analysts’ views on the prospects for 2022.Global Retail Trends in 2022

Our RESET framework for change in retail groups our trends, and our recommendations to capitalize on those trends, around five areas of evolution. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.Figure 1. RESET Framework [caption id="attachment_138094" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

1. Responsive

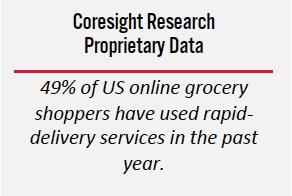

Logistics and the Last MileAnalyst Prediction: After streamlining much of their last-mile logistics in 2021, facilitating rapid order fulfillment such as one-hour to same-day delivery will be a key focus area for many retailers in 2022.

Recommendation: Retailers should leverage their existing store networks, warehouses or fulfillment facilities to optimally forward-position inventory and roll out automated micro-fulfillment centers that increase delivery capacity while speeding up delivery times. Retailers can focus their efforts on urban customers, who are more willing to pay for rapid delivery services.

Why It Matters: Driven by the retention of online shopping behaviors and a rise in expectations for convenience and fast delivery, the last mile has become a crucial component of the supply chain. In a May 2021 survey conducted by Coresight Research in collaboration with media firm January Digital, “fast, free delivery for online orders” ranked as the top feature that was “very important” to US consumers when choosing a retailer or brand. While rapid delivery has traditionally been concentrated in the grocery and convenience sectors, we expect a greater encroachment into nonfoods as delivery platforms partner with discretionary retailers and as vertically integrated rapid-delivery players expand their offerings.

Recommendation: Retailers should leverage their existing store networks, warehouses or fulfillment facilities to optimally forward-position inventory and roll out automated micro-fulfillment centers that increase delivery capacity while speeding up delivery times. Retailers can focus their efforts on urban customers, who are more willing to pay for rapid delivery services.

Why It Matters: Driven by the retention of online shopping behaviors and a rise in expectations for convenience and fast delivery, the last mile has become a crucial component of the supply chain. In a May 2021 survey conducted by Coresight Research in collaboration with media firm January Digital, “fast, free delivery for online orders” ranked as the top feature that was “very important” to US consumers when choosing a retailer or brand. While rapid delivery has traditionally been concentrated in the grocery and convenience sectors, we expect a greater encroachment into nonfoods as delivery platforms partner with discretionary retailers and as vertically integrated rapid-delivery players expand their offerings.

Product Sourcing

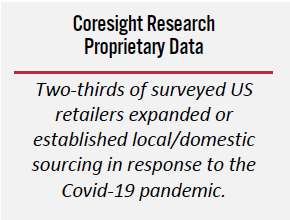

Analyst Prediction: The ongoing supply chain difficulties will continue at least into mid-2022, making sourcing activities a focal point of strategic planning by retailers in the year.

Recommendation: Retailers should use this opportunity to implement multiyear resilience to their sourcing strategies, including the diversification of their supplier mix and shortening of inventory lead times. Proximity sourcing can reduce shipping times and prices, new vendors could offer lucrative deals to secure longer-term commitments, and shorter lead times can reduce risk exposure.

Recommendation: Retailers should use this opportunity to implement multiyear resilience to their sourcing strategies, including the diversification of their supplier mix and shortening of inventory lead times. Proximity sourcing can reduce shipping times and prices, new vendors could offer lucrative deals to secure longer-term commitments, and shorter lead times can reduce risk exposure.

Why It Matters: Supply chain complexities tend to compound across the sourcing and production stages through to delivery, increasing brands’ or retailers’ vulnerability to risks. As retailers have long relied on single-source competition, the pandemic-led upheaval has more than underscored the risks of such a strategy and highlighted the criticality of sourcing processes. We expect global shipping challenges to persist in 2022, with the underlying cause of pandemic-driven disruption including lockdowns remaining a material threat—driving brands and retailers to turn toward structural sourcing changes.

M&A, IPOs and SPACs

Analyst Prediction: US retail M&A (mergers and acquisitions) will maintain strong momentum through 2022, fueled by core business portfolio redefinitions and the continued focus of larger companies on value-creation strategies.

Recommendation: Retailers and brand owners should remain cognizant of the current trends in the global retail and retail-tech landscapes when devising their M&A strategies. Companies must also establish a well-defined and comprehensive M&A tax strategy for each function and geography to identify a deal’s cash and non-cash values, and empower a dedicated M&A integration leader to manage all stakeholders and their competing priorities.

Recommendation: Retailers and brand owners should remain cognizant of the current trends in the global retail and retail-tech landscapes when devising their M&A strategies. Companies must also establish a well-defined and comprehensive M&A tax strategy for each function and geography to identify a deal’s cash and non-cash values, and empower a dedicated M&A integration leader to manage all stakeholders and their competing priorities.

Why It Matters: M&A is one component of our broader identified trend of M&A, IPOs (initial public offerings) and SPACs (special purpose acquisition companies). As many brand owners and retailers are rethinking their strategies and business models to fully recover from the crisis and thrive in 2022 and beyond, M&A provides a strong option for value creation. Trends such as digitalization, the convergence of technology with in-store experiences and contactless delivery options are also creating opportunities for M&A deal activity, as businesses will look to acquire disruptors. Aside from M&A, we believe that private equity firms are likely to be a significant catalyst for retail-focused SPACs in future, with access to expansive networks and financial resources. A run of retail-focused IPOs looks set to continue, fueled by expansionary monetary policies, a strong equity market, pricing volatility and the market being more receptive to growth IPOs.

2. Engaging

Livestreaming and Social Commerce

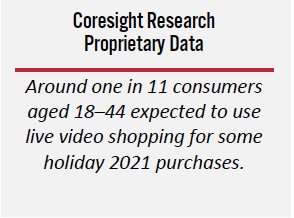

Analyst Prediction: Blending entertainment and social engagement with instant purchasing, livestream shopping will continue to offer brands, retailers and digital platforms an innovative channel with immense space for creating value for consumers.

Recommendation: Retailers and brands must pivot to catering to young consumers’ growing interests with social networking and livestream shopping by working with influencers. Added to this, the use of social media for shopping peaks among 25–34-year-olds, and 78% of social media shoppers in this age group make a purchase at least once a month via social media, according to Coresight Research’s 2021 US social commerce survey. Furthermore, 37% of social media shoppers who follow celebrities/influencers reported that their shopping behaviors are “often/always” affected by influencers/celebrities.

Recommendation: Retailers and brands must pivot to catering to young consumers’ growing interests with social networking and livestream shopping by working with influencers. Added to this, the use of social media for shopping peaks among 25–34-year-olds, and 78% of social media shoppers in this age group make a purchase at least once a month via social media, according to Coresight Research’s 2021 US social commerce survey. Furthermore, 37% of social media shoppers who follow celebrities/influencers reported that their shopping behaviors are “often/always” affected by influencers/celebrities.

Why It Matters: 2021 saw the accelerated adoption of livestream shopping and shoppable content on social media channels. With the blend of entertainment and instant shopping, livestreaming and social e-commerce enable consumers to discover and purchase products through real-time shoppable videos on social media, marketplaces and self-owned e-commerce websites. While shoppable live videos are still nascent in the US, a full livestream-shopping tech landscape are emerging, and best practices from brands and retailers are proving to be applicable. A plethora of specialist tech innovators have emerged, including Buywith (whose “shop with me” solution enables viewers to browse a website alongside the host and see the creator’s screen to keep on top of the products being discussed) and NTWRK (a video-shopping app that specializes in selling exclusive streetwear collections). Livestreaming and social commerce is supporting brand growth in a wide range of product categories, from beauty to apparel to electronics. Retailers and brands should continue experimenting and growing in the livestreaming and social commerce space in 2022, with the goal of staying ahead of shopper expectations.

Physical Retail Renewal

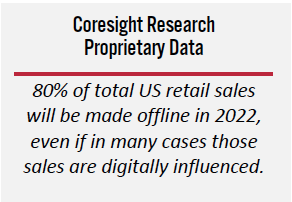

Analyst Prediction: E-commerce will again gain share of total retail sales in 2022, while stores will be annualizing their strong 2021 bounceback, adding urgency to brick-and-mortar renewal.

Recommendation: Retailers must renew their investment in stores as high-value touchpoints. We renew our BEST framework for physical retail—stores must build brands (B), offer experiential retail (E), provide differentiated services (S) and integrate technology to reduce the in-store data deficit (T).

Recommendation: Retailers must renew their investment in stores as high-value touchpoints. We renew our BEST framework for physical retail—stores must build brands (B), offer experiential retail (E), provide differentiated services (S) and integrate technology to reduce the in-store data deficit (T).

Why It Matters: We remain bullish on the role of physical stores (and, so, multichannel retailers) in the retail ecosystem, reflected in our expectation for multichannel retailers to again outperform in the online channel in 2022 (see our 2022 Retail and Tech Outlook for more). Yet, long-term survival requires adaptation, with better stores and—yes—fewer of them in some cases. We point to four purposes or shopper missions that will be key planks of brick-and-mortar demand in the coming year, and around which retailers can serve demand: convenience, such as urgent purchases; collection of online orders; discount, where shoppers appear happy (for now) to trade omnichannel services for low prices; and destination, where stores serve as the template to the brand and offer experience-rich shopping.

Festivals and Holidays

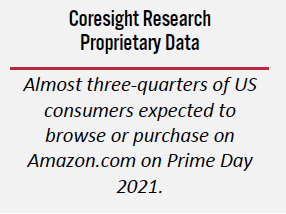

Analyst Prediction: The festivalization of retail will continue apace in 2022, as existing shopping events grow in scale and entertainment value, and as new events are added to the calendar.

Recommendation: In a likely lower-growth retail market (in the US), and with channel share partly up for grabs among consumers still adjusting their behaviors, retailers must leverage shopping holidays and festivals as well as calendar events to excite customers, amplify loyalty, drive impulse purchasing and capture share.

Recommendation: In a likely lower-growth retail market (in the US), and with channel share partly up for grabs among consumers still adjusting their behaviors, retailers must leverage shopping holidays and festivals as well as calendar events to excite customers, amplify loyalty, drive impulse purchasing and capture share.

Why It Matters: Shopping festivals are big business, and are getting bigger, from the 10.10 Shopping Festival to Amazon Prime Day and Target Deal Days in the US to Singles’ Day in China (and increasingly elsewhere), and Flipkart’s Big Billion Days and Amazon’s Great Indian Festival in India. Added to those are calendar events that provide opportunities for brand building and rewarding loyalty (such as through early-access deals) as well as the more obvious potential of driving incremental purchases. Increasingly, festival engagement will be online, with livestreaming offering an accessible means of engaging shoppers; Walmart going all in on livestreaming for the 2021 holiday season is one template for enhanced engagement during peak shopping seasons.

3. Socially Responsible

Wellness

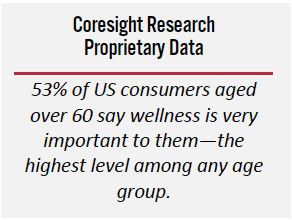

Analyst Prediction: The pursuit of wellness that has long been claimed to characterize the millennial and Gen Z generations will “trickle up” the generations, with 2022 kickstarting a multiyear, billion-dollar expansion in spending on wellness products by older shoppers.

Recommendation: Retailers must put inclusivity into action within their wellbeing offerings by catering to older consumers. An aging society—where 21% of the US population will be aged 65+ by 2030, up from 17% in 2020—only adds pressure to address these needs. The aging of the millennial cohort adds renewed urgency for retailers to offer wellness solutions that reach beyond the youngest adults.

Recommendation: Retailers must put inclusivity into action within their wellbeing offerings by catering to older consumers. An aging society—where 21% of the US population will be aged 65+ by 2030, up from 17% in 2020—only adds pressure to address these needs. The aging of the millennial cohort adds renewed urgency for retailers to offer wellness solutions that reach beyond the youngest adults.

Why It Matters: We expect concern with wellness to remain the pre-eminent multiyear trend driving discretionary spending shifts; the importance attached to physical and mental wellbeing has only been amplified by the pandemic. This secular trend will direct the flow of hundreds of billions of dollars worldwide, including within apparel (to the benefit of athleisure), beauty (to “clean” and wellbeing-centered products), supplements, sleep-economy products, home fitness categories and mental wellbeing services. Underscoring the significance of senior spenders, Coresight Research’s US surveys consistently find that older consumers are more concerned with their wellness than their younger counterparts. Amplifying the opportunity, we also find those aged 60 and over tend to be more discerning shoppers, such as being more willing to pay more for healthier food or sustainable clothing.

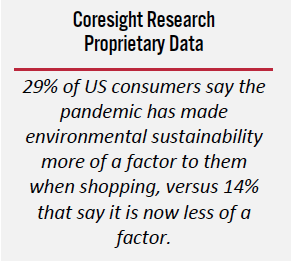

Sustainability

Analyst Prediction: Customers, employees and governments will increasingly demand sustainability efforts from businesses, seeking transparency in sources, and progress and reporting of goals.

Recommendation: Brands and retailers can look to Coresight Research’s EnCORE framework to internalize a sustainability strategy. The final component of that framework—excellence in communication and reporting—will become more essential as consumers look for quantifiable reassurance on sustainability.

Recommendation: Brands and retailers can look to Coresight Research’s EnCORE framework to internalize a sustainability strategy. The final component of that framework—excellence in communication and reporting—will become more essential as consumers look for quantifiable reassurance on sustainability.

Why It Matters: Sustainability will remain one of the foremost multiyear trends to watch in retail, with the pandemic further accelerating environmental concerns and sustainability up the list of demands among consumers, employees and investors alike. As stakeholders become better informed of the impacts of unsustainable production practices and consumption habits due to the ubiquity of information, they are demanding action with greater urgency from businesses. Businesses need to make sustainability a focal point of strategy planning, set definite targets and communicate progress periodically to all stakeholders, including consumers, who are becoming more conscious of their consumption habits. Retailers must leverage relevant technologies, such as blockchain, and platforms that can help improve traceability and visibility across the supply chain—and they must improve communication to stakeholders.

Inclusivity

Analyst Prediction: Retailers and brands will expand inclusive product offerings into their portfolios, becoming mainstream offerings. They will also incorporate inclusive corporate strategies to ensure more diverse internal and external representation across the supply chain, covering people, brands and suppliers.

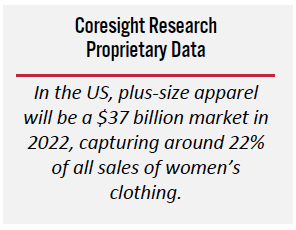

Recommendation: Retailers and brands should leverage consumer demand for inclusive categories to grow their portfolios. As one example of this, extended sizing has been a consistently outperforming category. In 2022, there will be even more opportunities, as 61% of Americans reported that they have gained weight since the start of the pandemic, according to The Harris Poll for the American Psychological Association conducted in February 2021.

Recommendation: Retailers and brands should leverage consumer demand for inclusive categories to grow their portfolios. As one example of this, extended sizing has been a consistently outperforming category. In 2022, there will be even more opportunities, as 61% of Americans reported that they have gained weight since the start of the pandemic, according to The Harris Poll for the American Psychological Association conducted in February 2021.

Why It Matters: Inclusivity, providing equal access for people who might otherwise be excluded or marginalized, is permeating every aspect of retail organizations, including internal corporate structures, brand portfolios, suppliers, the consumers that retailers serve, and the content on social media. Inclusivity encompasses a range of identity characteristics, from ability, age and gender to race and social background. 2021 was a watershed year for inclusivity, accelerated by the racial justice movements in the US, which inspired a global conversation on diversity and representation. Increased consumer demand for transparency propelled retailers and brands to take action and update their corporate strategies to include their internal organizations, the products on their shelves and their suppliers. Social media continues to advance body positivity and improve representation of gender identity and persons with disabilities. Retailers and brands are beginning to expand their offerings to include more products to serve consumers, but demand still exceeds supply. Inclusivity is driving billion-dollar growth for unmet needs across adaptive apparel, gender-neutral designs, extended sizes, and beauty for all ages, races, and genders. Inclusive products and corporate practices are no longer a consideration, but a necessity for retailers and brands to be competitive.

4. Expansive

Alt. Retail—DTC, DNVBs, Rental, Resale, Subscriptions

Analyst Prediction: Illustrating the growth of the wider “alt. retail” space, we expect sales by digitally native vertical brands (DNVBs) to see further growth in 2022, driven by consumers’ sustained shift to e-commerce, the expansion of DNVBs offline and their partnerships with large retailers.

Recommendation: We recommend traditional retailers seek out partnerships with, or acquisitions of, strong DNVBs, which can help retailers expand their brand portfolios. For example, Amazon, Sephora, Target, Urban Outfitters, Ulta Beauty and Walmart are already carrying apparel or beauty DNVBs in their portfolio.

Recommendation: We recommend traditional retailers seek out partnerships with, or acquisitions of, strong DNVBs, which can help retailers expand their brand portfolios. For example, Amazon, Sephora, Target, Urban Outfitters, Ulta Beauty and Walmart are already carrying apparel or beauty DNVBs in their portfolio.

Why It Matters: “Alt. retail” encompasses a number of new retail models, from DNVBs and DTC (direct to consumer) to rental, resale and subscription. Within the DNVB space, many companies have seen success in recent years, especially in 2021, with the boom in online retail expanding the opportunities to build strong customer relationships through a DTC model.

Retail-Adjacent Opportunities

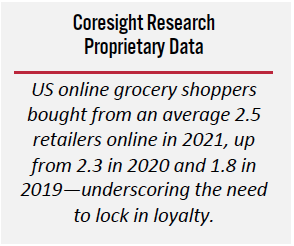

Analyst Prediction: More larger retailers will expand beyond retailing with a bidirectional view that is unified by data. Companies will grow and develop more sophisticated loyalty and paid-membership services for their customers. Meanwhile, they will use their shoppers’ data to cultivate new revenue streams.

Recommendation: On the B2C (business-to-consumer) side, brands and retailers need to step up their loyalty offerings with premium tiers or programs. On the B2B (business-to-business) side, they must leverage the data-driven insights these opportunities can generate to drive further revenue, such as through retail media.

Recommendation: On the B2C (business-to-consumer) side, brands and retailers need to step up their loyalty offerings with premium tiers or programs. On the B2B (business-to-business) side, they must leverage the data-driven insights these opportunities can generate to drive further revenue, such as through retail media.

Why It Matters: This two-pronged strategy brings dual gains. Implemented well, premium loyalty programs and subscription memberships lock in loyalty and drive cross-category purchasing. We have seen ample evidence of this at Amazon with its Prime program, where members are much more likely to buy nontraditional categories (such as grocery) on Amazon.com. In addition, Coresight Research survey data confirm that grocery retailers see net gains of wallet share with paid memberships. Such programs add incremental data and, by capturing greater share, increase transactional data—the springboard for retailers to offer services such as online advertising and data services to consumer goods firms and others.

New Market Expansion

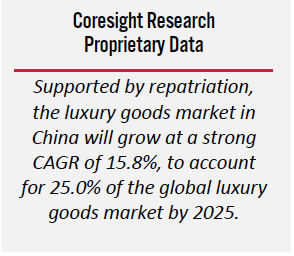

Analyst Prediction: More global brands and retailers will seek growth in higher-growth markets by tapping local expertise—such as that offered by e-commerce marketplaces.

Recommendation: Retailers should continue to consider their presence in markets such as China and India, including through asset-light means such global marketplaces (using shopping festivals as a springboard), joint ventures and partnerships with local companies.

Recommendation: Retailers should continue to consider their presence in markets such as China and India, including through asset-light means such global marketplaces (using shopping festivals as a springboard), joint ventures and partnerships with local companies.

Why It Matters: The repeated hindrances to global travel underscore the need for brands and retailers to bring their offerings to consumers, online and (in some cases) in-store. In categories such as luxury, we expect the repatriation of spend to be (partially) retained even when international travel finally recovers. In India, liberalization of foreign direct investment restrictions (to 100% of single-brand retail and 51% of multibrand retail) increase the appeal of this market. The opportunity to piggyback on the consolidation of retail, which remains largely non-organized in India, adds to the underlying opportunity.

5. Tech-Enabled

AI in the Supply Chain

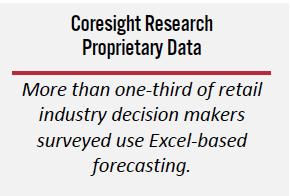

Analyst Prediction: Retailers will need to adopt or increase their usage of AI in the supply chain to keep pace with continuing swings in demand and data-centric competitors.

Recommendation: Retailers should embrace leveraging AI/ML (artificial intelligence/machine learning) into supply chain planning, particularly in demand forecasting, whose accuracy increases markedly when using ML and incorporating external data such as weather and local events.

Recommendation: Retailers should embrace leveraging AI/ML (artificial intelligence/machine learning) into supply chain planning, particularly in demand forecasting, whose accuracy increases markedly when using ML and incorporating external data such as weather and local events.

Why It Matters: Having inventory on the shelf remains essential in general and particularly in the current environment, when consumers continue to make fewer, targeted shopping trips. Not having desired and essential items in stock remains one of the main reasons that a customer will leave a store without making a purchase, possibly never to return and telling friends and acquaintances in person and on social media. ML-based tools such as prescriptive analytics constantly scour real-time data to find anomalies, such as a shortfall in expected sales despite inventory availability in the backroom, which can be remedied by sending a message to a sales associate. In addition, optimal inventory management increases revenues, improves margins and reduces working capital.

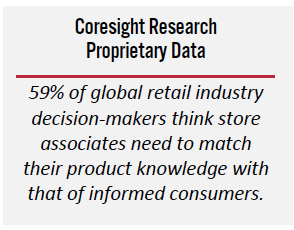

Associate-Centric Technology

Analyst Prediction: Retailers will equip associates with intelligent mobile tools that enable them to raise the level of service, offering more personalized communication and recommendations to customers.

Recommendation: Retailers should arm associates with tablets or other technology that assist them in offering intelligent, personalized experiences to consumers that enhance the experience of visiting physical stores and maximize upselling opportunities.

Recommendation: Retailers should arm associates with tablets or other technology that assist them in offering intelligent, personalized experiences to consumers that enhance the experience of visiting physical stores and maximize upselling opportunities.

Why It Matters: In-person customer service remains the one edge that physical retailers have over the point-and-click convenience of e-commerce. Moreover, consumers have repeatedly stated that they enjoy visiting physical stores. Retailers need to offset challenges such as high turnover and labor shortages with technology that empower the existing associates to leverage and add intelligence to the wealth of data they already have on consumers to access product information and make intelligent recommendations to consumers. AI/ML can find relationships between past purchases, current inventory and external data such as social media postings to understand the customer’s wants and needs and upsell products and services that they may not yet have considered.

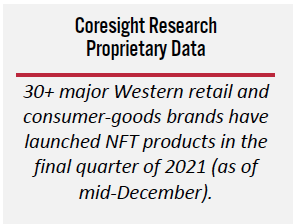

The Expanding Metaverse

Analyst Prediction: The world’s biggest consumer-goods brand owners will lead the charge to mass-appeal metaverse-related transactional offerings, including non-fungible tokens (NFTs), in 2022.

Recommendation: Retailers should take stock of the digital content they already possess with the goal of repurposing it in the “metaverse,” a digital reality that can include elements from virtual and augmented reality, media such as NFTs and payment via cryptocurrencies. Retailers should also monitor the evolution of the metaverse and consider using it for virtual gatherings and creating virtual places (such as stores) for consumers to visit.

Recommendation: Retailers should take stock of the digital content they already possess with the goal of repurposing it in the “metaverse,” a digital reality that can include elements from virtual and augmented reality, media such as NFTs and payment via cryptocurrencies. Retailers should also monitor the evolution of the metaverse and consider using it for virtual gatherings and creating virtual places (such as stores) for consumers to visit.

Why It Matters: While it is still in its early stages, the development of the metaverse appears to be the next step in the technology progression of the Internet, which has been supported by the proliferation of smartphones and the explosion of social media. A recent major event was Facebook changing its name to Meta, indicating an inflection point in the company’s development—and Meta is currently developing the essential technology infrastructure for providers to present their content and for consumers to experience and enjoy it.