Nitheesh NH

What’s the Story?

In this report, we outline our 10 key trends for Chinese e-commerce in 2022 and discuss how brands and retailers that are targeting the China market could capitalize on the changes we expect to see over the course of the year. In 2022, China online retail and foodservice sales will grow by a high-teens percentage to ¥13.8 trillion ($2.2 trillion as of December 7, 2021), Coresight Research estimates. 2021 was a weakened year for Chinese retail, with total growth slowing significantly (even versus regular pre-crisis years). However, online retail and food demand proved highly resilient, having increased by around 18.5% to ¥11.6 trillion ($1.8 trillion). China’s e-commerce sector is highly platformized—the country is the home of giants such as Alibaba, JD.com and Tencent. Yet, those giants are under new pressure: Oligopolies are out of fashion politically, and the pressures for large firms to be seen to be doing good have increased. We expect regulatory pressures to be the pre-eminent force in e-commerce in China, exerting downward pressure on sales growth at the very biggest e-commerce players while opening up new opportunities for alternative players and channels. This is set to enable smaller platforms, private traffic channels, short-video and livestreaming platforms, and “alt. retail” to gain greater share—and it should spur renewed attention on sustainability, resale and lower-tier markets.2022 China E-Commerce Trends

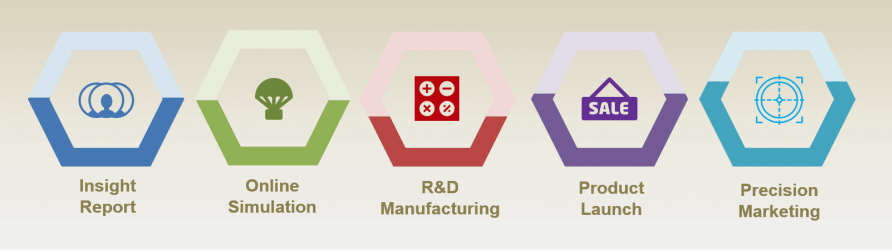

Figure 1. 2022 China E-Commerce Trends [caption id="attachment_138113" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. A Tighter Regulatory Environment Is Set To Spur Shifts in Focus and Create Pockets of Opportunity

The crackdown on tech giants and any hints of monopoly (or, more accurately, oligopoly) will continue to yield a change in tone and focus from some of the biggest e-commerce companies in 2022. We expect tech giants to remain under pressure to be seen to be doing good and keen to downplay their influence or scale.

Singles’ Day 2021 saw a perceptible shift from the pace of GMV growth to a more positive message on sustainability and inclusion from Alibaba and JD.com. Alibaba’s Chief Marketing Officer, Chris Tung, attempted to explain this as a “coming-of-age” moment for the 11.11 Global Shopping Festival: “In the early stages of 11.11, we focused on growth… but as a child becomes a teenager, the parents shift their focus to nurturing the child’s sense of responsibility: the role he or she plays in society. That is what we are doing now,” Tung told Alizila, Alibaba’s news site.

Sustainability, inclusion and the social good are likely to be beneficiaries, as we expect the e-commerce sector to display an apparently enforced humility through 2022—and those efforts to refocus and downplay their dominance are likely to stifle the pace of top-line growth at certain companies. Recent evidence of this includes a sharp slowdown in Singles’ Day sales growth at Alibaba (to a single-digit percentage) and Alibaba’s subsequent cut to full-year revenue guidance, in November 2021.

We expect this overarching trend to support a number of our subsequent trends, discussed over the following pages.

2. “Alt. Retail” Will Gain Traction

Any ceding of momentum in overall e-commerce by platform giants will provide new opportunities for alternative retail models (or “alt. retail” as we collectively call them) to garner share of online spend in 2022. We point to opportunities in two alt. retail segments:

Source: Coresight Research[/caption]

1. A Tighter Regulatory Environment Is Set To Spur Shifts in Focus and Create Pockets of Opportunity

The crackdown on tech giants and any hints of monopoly (or, more accurately, oligopoly) will continue to yield a change in tone and focus from some of the biggest e-commerce companies in 2022. We expect tech giants to remain under pressure to be seen to be doing good and keen to downplay their influence or scale.

Singles’ Day 2021 saw a perceptible shift from the pace of GMV growth to a more positive message on sustainability and inclusion from Alibaba and JD.com. Alibaba’s Chief Marketing Officer, Chris Tung, attempted to explain this as a “coming-of-age” moment for the 11.11 Global Shopping Festival: “In the early stages of 11.11, we focused on growth… but as a child becomes a teenager, the parents shift their focus to nurturing the child’s sense of responsibility: the role he or she plays in society. That is what we are doing now,” Tung told Alizila, Alibaba’s news site.

Sustainability, inclusion and the social good are likely to be beneficiaries, as we expect the e-commerce sector to display an apparently enforced humility through 2022—and those efforts to refocus and downplay their dominance are likely to stifle the pace of top-line growth at certain companies. Recent evidence of this includes a sharp slowdown in Singles’ Day sales growth at Alibaba (to a single-digit percentage) and Alibaba’s subsequent cut to full-year revenue guidance, in November 2021.

We expect this overarching trend to support a number of our subsequent trends, discussed over the following pages.

2. “Alt. Retail” Will Gain Traction

Any ceding of momentum in overall e-commerce by platform giants will provide new opportunities for alternative retail models (or “alt. retail” as we collectively call them) to garner share of online spend in 2022. We point to opportunities in two alt. retail segments:

- Community group buying is a location-based approach of selling in bulk to people living in close proximity to each other. This model enjoyed a kick-start from pandemic lockdowns but has remained a popular channel, and we expect it to grow apace in 2022. Consumers appreciate the greater value that this bulk-purchase model provides. Apparently reflecting demand for the model, Alibaba consolidated and rebranded its group-buying services under the new Taocaicai brand in September 2021, with the promise of over 1 million items on offer.

- Recommerce, or resale, is gaining traction, too. Alibaba’s resale platform, Idle Fish, anticipated generating over ¥500 billion ($78 billion as of December 2021) in GMV in fiscal 2021—more than double the ¥200 billion ($31 billion) it reported in the prior year. Alibaba’s push on sustainability, discussed above, is likely only to add impetus to this banner’s momentum in 2022.

- WeChat owner Tencent announced in November 2021 that it will soon begin allowing WeChat group-chat participants to share links to third-party e-commerce platforms such as Alibaba’s Tmall and Taobao. China’s technology regulators had warned tech firms to stop blocking links to rival platforms.

- Meanwhile, Alibaba submitted mini program applications for certain platforms (such as Idle Fish) and enabled payment through WeChat Pay on some of its digital platforms.

- Already massive, livestreaming e-commerce is likely to continue to gain share of online sales in 2022: We expect the livestreaming e-commerce market in China to total $478 billion—up by around 59% from 2021.

- Key opinion consumers (KOCs) are likely to continue to take share of video time from key opinion leaders (KOLs), their professional counterparts. We expect brands to increasingly incorporate KOCs into their livestreaming campaigns to add authenticity.

- Livestreaming remains an essential asset for brands and retailers to grow online. Reflecting this, during the 2021 Singles’ Day shopping festival, more than 100,000 brands held livestream sessions to interact with shoppers, and 43 merchants topped ¥100 million ($15.7 million) in sales volumes on live-selling platform Taobao Live, according to Alibaba.

- Douyin (the Chinese version of TikTok) moved its “Mall” features to center stage in November 2021, integrating shopping functionality in livestreaming and short-video content. Live shoppers are now able to browse items in the app, making purchasing more convenient than being redirected to third-party channels.

- As of December 2021, Douyin is reportedly ready to launch a fashion-driven e-commerce platform called Douyin Box.

- Video-sharing app Kwai/Kuaishou launched extensive initiatives in 2021 to integrate products from other e-commerce platforms (such as its partnership with JD.com in April 2021) and help sellers/creators target consumers through “Xiaodiantong”—a tool designed to help merchants target relevant followers and direct them to their livestreaming sessions.

- Estée Lauder used its WeChat mini program as a channel to communicate with deal-seeking consumers, offering exclusive promotions within the group as well as product information and reviews. Consumers could also watch livestreams directly through the group.

- Cosmetics brands Little Ondine and Zeesea shared their sales and deals within WeChat groups, which they created prior to the launch of Singles’ Day to drive excitement. Consumers within the group could shop for the products directly by clicking the links provided.

- In March 2021, JD.com invested $800 million in a 51% stake in on-demand delivery platform Dada Group. Subsequently, these two companies launched the “Nearby” service on JD.com’s app, which connects shoppers to local offline food and nonfood stores, from which Dada provides delivery.

- Ride-hailing provider Didi Chuxing is trialing a new food-delivery service via WeChat, called Aoao Chifan, in Tianjin, similar to moves we have seen with firms such as Uber (via Uber Eats) in other markets.

Source: JD.com[/caption]

9. Luxury E-Commerce Will Be Supported by a Permanent Repatriation of Spend

The pandemic and resulting restrictions on travel put a rocket under the luxury e-commerce market, and we expect a retention of online shopping behaviors to boost China’s online luxury market further in 2022. Globally, we estimate that online luxury sales will have grown by a further 21% in 2021 and will increase at a similar pace in 2022.

The path to full, pre-crisis-style travel arrangements looks as far away as ever (and as we write, the emergence of the Covid-19 Omicron variant adds further uncertainty to this recovery). When global travel returns to near-full levels, we expect online shopping to have become ingrained for many of China’s luxury consumers.

The shift of of luxury shopping from overseas to within China was reflected in Singles’ Day 2021 activities at Alibaba and JD.com.

Source: JD.com[/caption]

9. Luxury E-Commerce Will Be Supported by a Permanent Repatriation of Spend

The pandemic and resulting restrictions on travel put a rocket under the luxury e-commerce market, and we expect a retention of online shopping behaviors to boost China’s online luxury market further in 2022. Globally, we estimate that online luxury sales will have grown by a further 21% in 2021 and will increase at a similar pace in 2022.

The path to full, pre-crisis-style travel arrangements looks as far away as ever (and as we write, the emergence of the Covid-19 Omicron variant adds further uncertainty to this recovery). When global travel returns to near-full levels, we expect online shopping to have become ingrained for many of China’s luxury consumers.

The shift of of luxury shopping from overseas to within China was reflected in Singles’ Day 2021 activities at Alibaba and JD.com.

- At Alibaba’s 11.11 Global Shopping Festival virtual press conference in October 2021, Anita Lyu, General Manager at Tmall, confirmed that many Chinese consumers that turned to cross-border e-commerce platforms since the beginning of the pandemic have stuck to this new behavior, stating, “An average of 400 global brands have joined Tmall Global each month. There has been a shift in demand from well-known brands to more niche brands that offer innovative products.”

- JD.com reported seeing strong luxury demand: For example, sales volumes for Tod’s, a luxury shoes and leather goods brand, in the first minute of the event were greater than that of the entire day last year. In anticipation of strong demand, JD.com said that it doubled down on new fashion items across the flagship stores of over 300 luxury brands.

- In the third quarter of 2021, Pinduoduo reported revenue growth of 51%, versus “single-digit” GMV growth in Alibaba’s China Retail Marketplaces segment and 25.5% revenue growth at JD.com. Pinduoduo has traditionally has a higher percentage of users from lower-tier cities than either Alibaba or JD.com.

- At Alibaba, Taobao Deals, which targets lower-tier cities, appeared to see outperformance in its latest reported quarter, given the company’s comments on its “robust user growth” and 240 million annual active customers (this metric was not provided one year earlier and year-over-year growth was not provided).