Nitheesh NH

Each year, tax refunds return billions of dollars to the US consumer economy. The IRS reports tax return filings and refunds on a weekly basis until the extended deadline of May 17, 2021. Our US Tax Tracker reports provided coverage of tax return filings at four-week intervals, and this report presents a wrap-up of this year’s tax season.

We note that last year’s filing deadline was extended to July 15, so the end-of-season figures from 2021 are not directly comparable to a year ago, since the tax season was still under way.

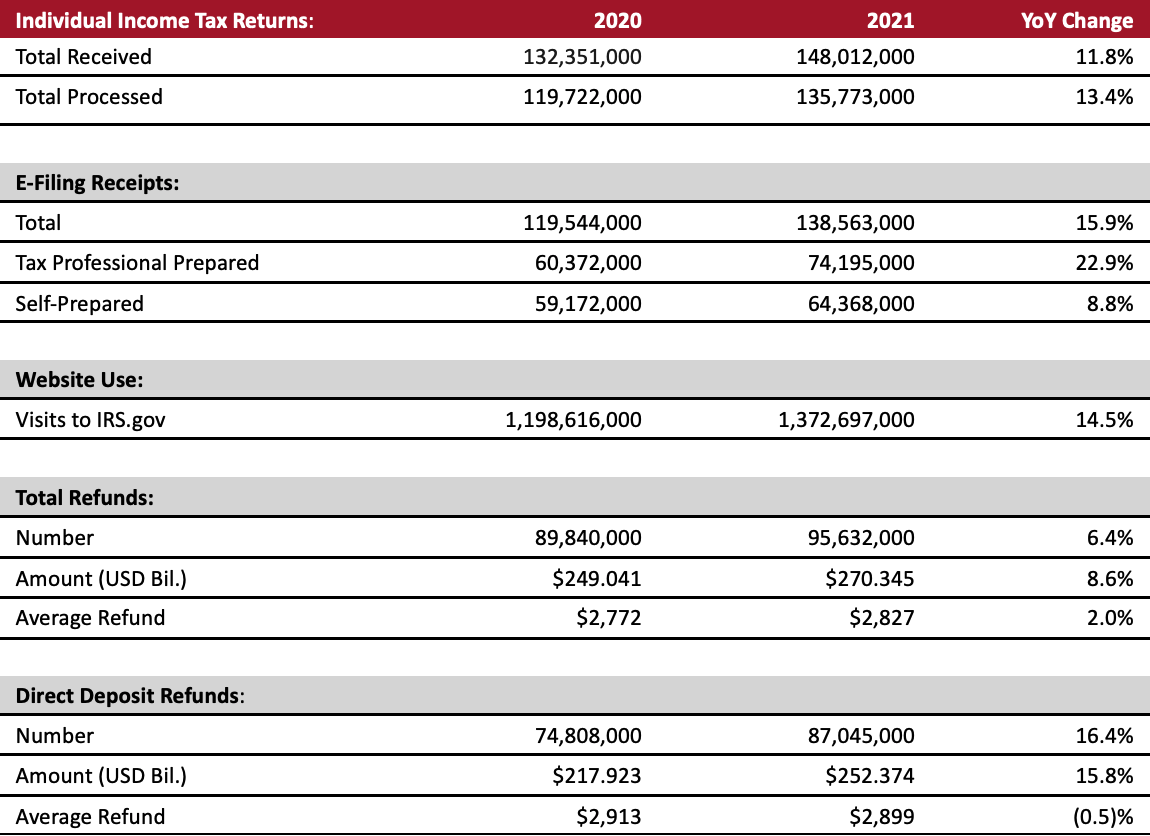

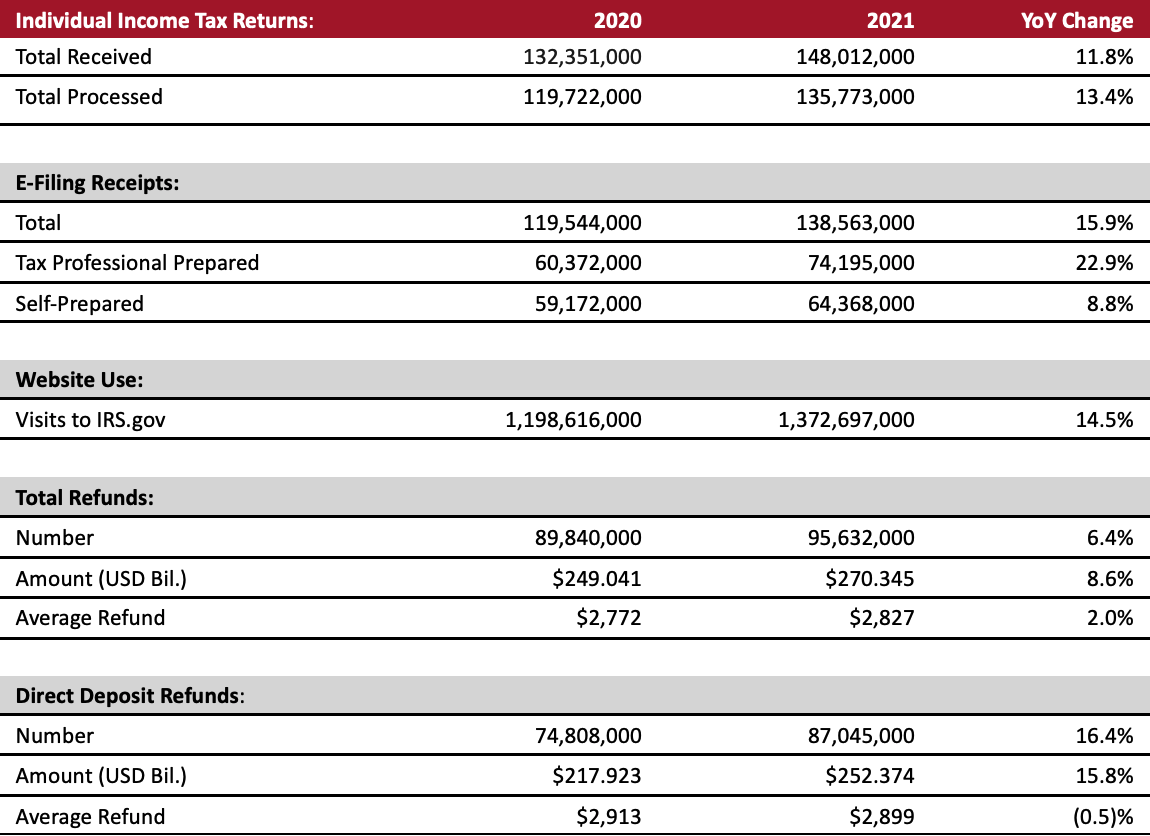

As of May 21, 2021:

*The IRS delayed the start of its filing season this year; last year’s deadline was extended to July 15.

*The IRS delayed the start of its filing season this year; last year’s deadline was extended to July 15.

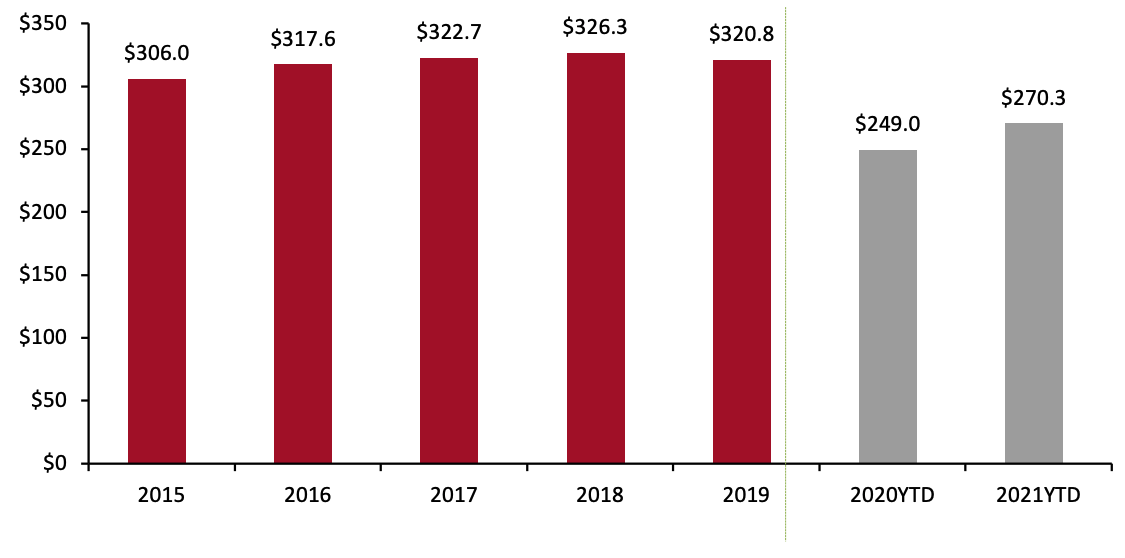

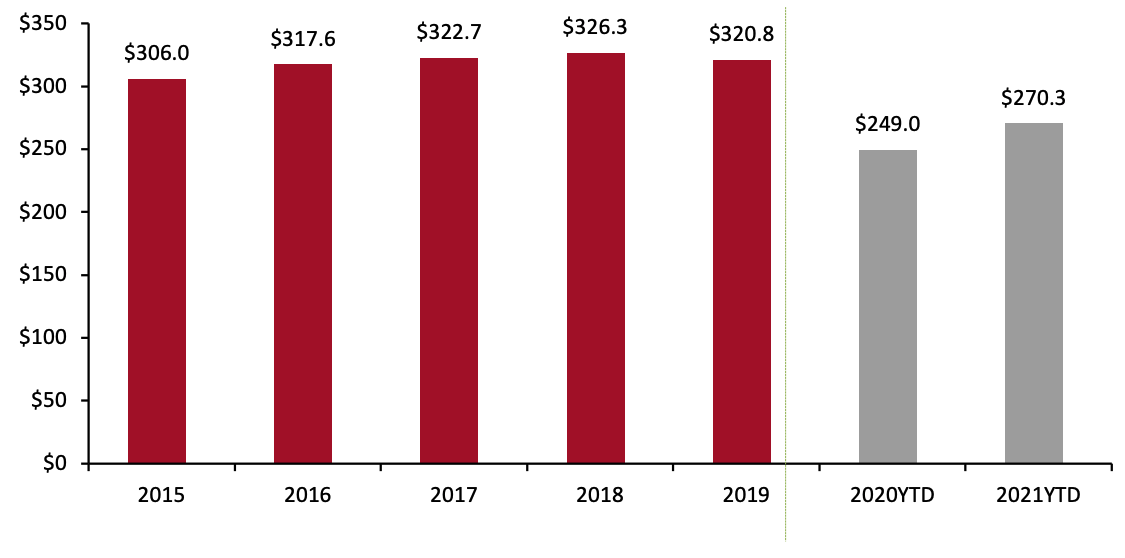

Source: IRS[/caption] The graph below shows the total annual refunds disbursed, which increased at a 0.2% CAGR from 2016 to 2020. Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_128067" align="aligncenter" width="720"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS had issued 95.6 million refunds, totaling $270.3 billion. The number of refunds issued was up 6.4% year over year. The total amount refunded was up 8.6% year over year.

- The average refund amounted to $2,827—up 2.0% year over year.

- Of the refunds issued, 93.3% were paid using direct deposit. The average direct deposit refund was $2,899—down 0.5% year over year.

- The IRS had received 148 million tax returns and processed 135 million. The number of returns processed was up 13.4% year over year.

- Of the returns filed, 93.6% were filed electronically. Of those, 53.6% were prepared by tax professionals and the remaining 46.4% were self-prepared.

- The number of taxpayers using the IRS website to access information increased sharply: The site logged nearly 1.4 billion visits, up 14.5% year over year.

*The IRS delayed the start of its filing season this year; last year’s deadline was extended to July 15.

*The IRS delayed the start of its filing season this year; last year’s deadline was extended to July 15.Source: IRS[/caption] The graph below shows the total annual refunds disbursed, which increased at a 0.2% CAGR from 2016 to 2020. Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_128067" align="aligncenter" width="720"]

Source: IRS[/caption]

Source: IRS[/caption]