Nitheesh NH

Each year, tax refunds pump billions of dollars back into the US consumer economy. The IRS reports tax return filings and refunds on a weekly basis, until the usual April 15 deadline. This year, on March 17, the IRS extended the tax-filing deadline to May 17, providing consumers with additional time to manage their tax returns amid the pandemic. Our US Tax Tracker reports provide coverage on tax return filings at four-week intervals. In this report, we look at what happened in the fifth week of the 2021 tax filing season.

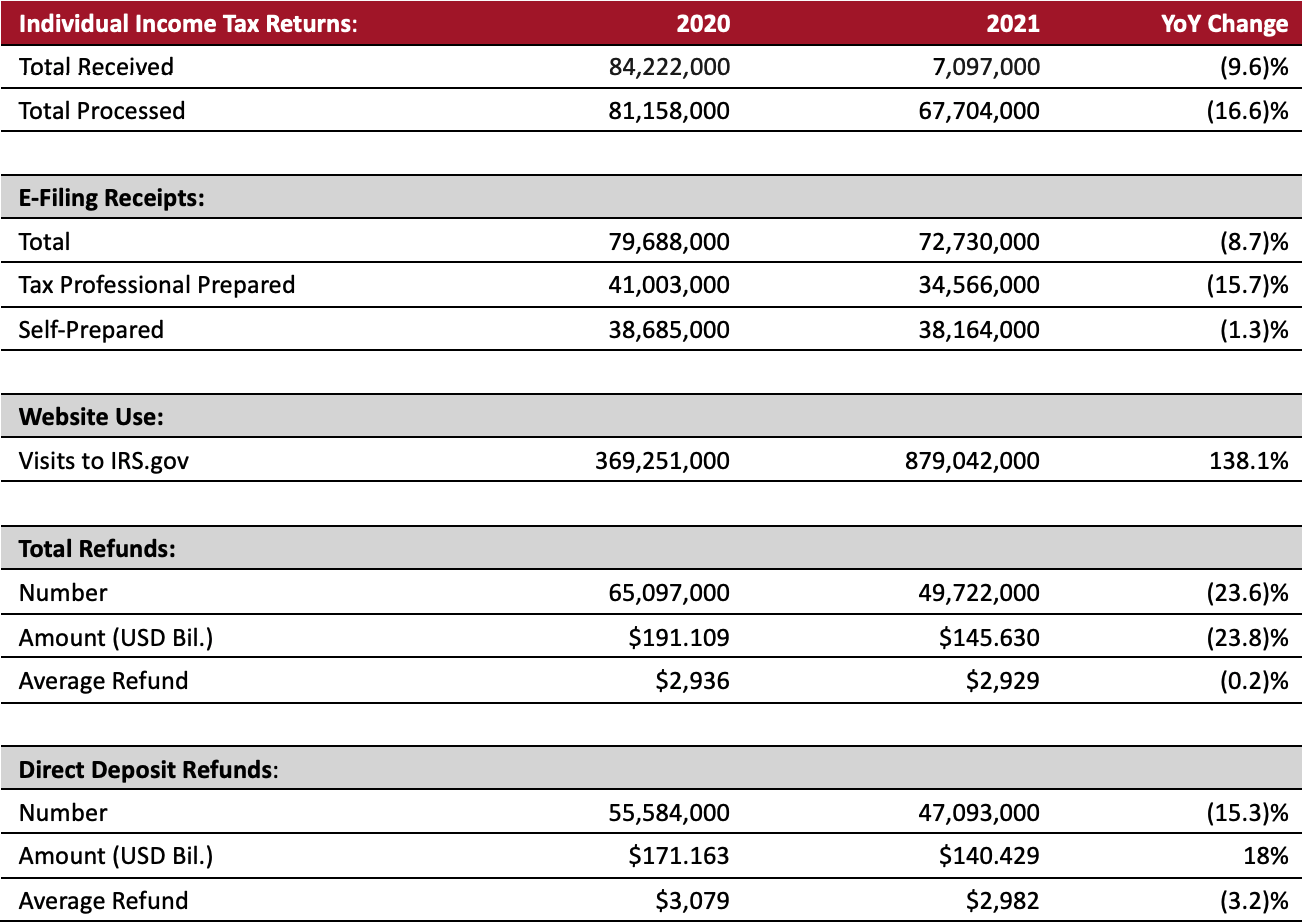

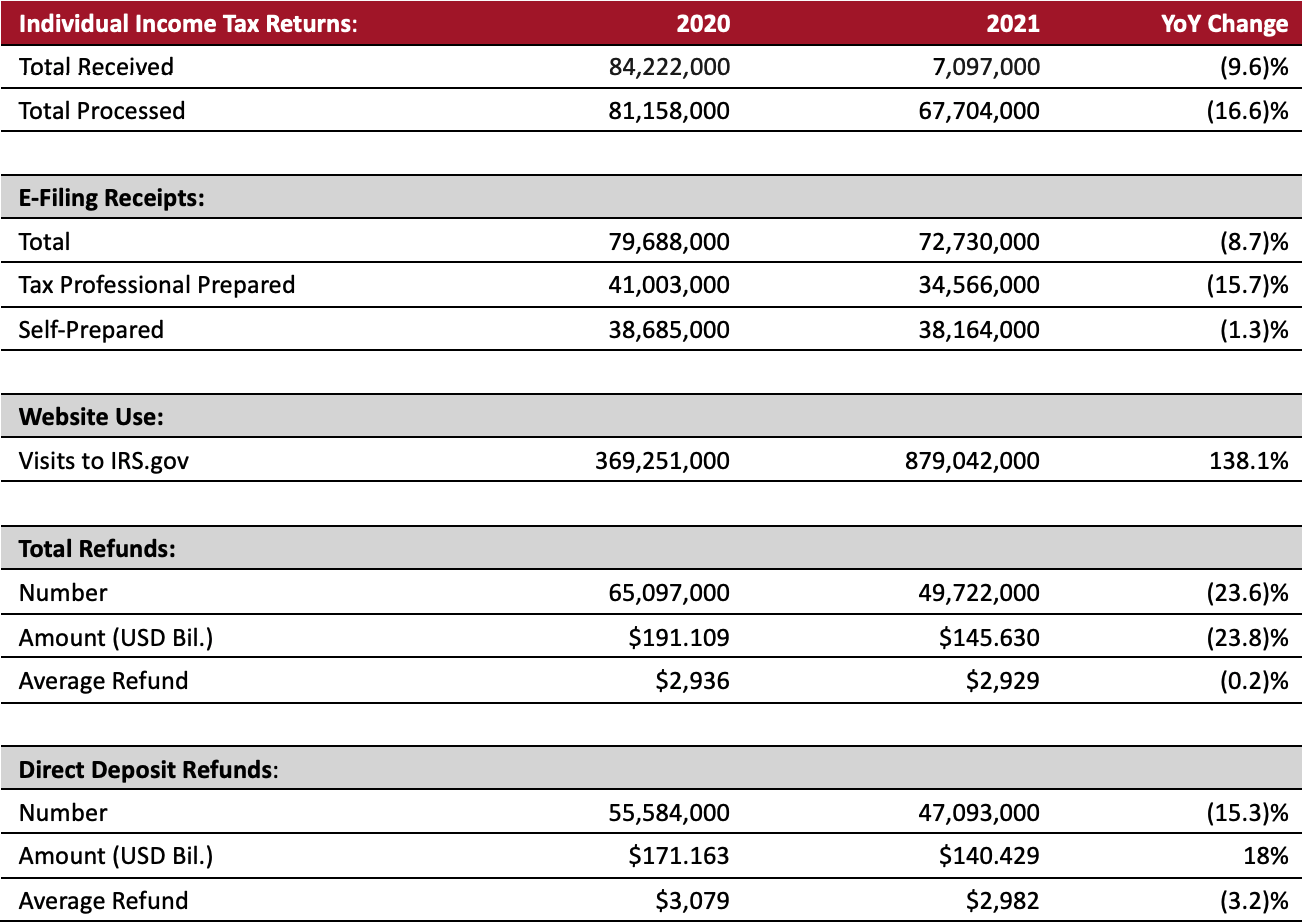

As of March 19, 2021:

*Note: The IRS delayed the start of its filing season this year.

*Note: The IRS delayed the start of its filing season this year.

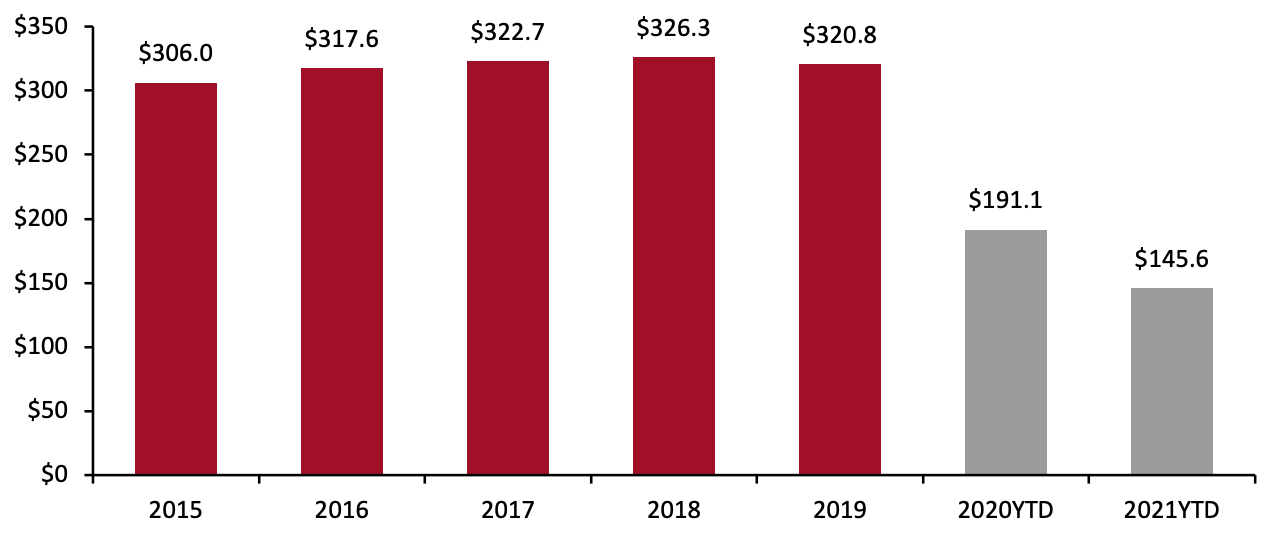

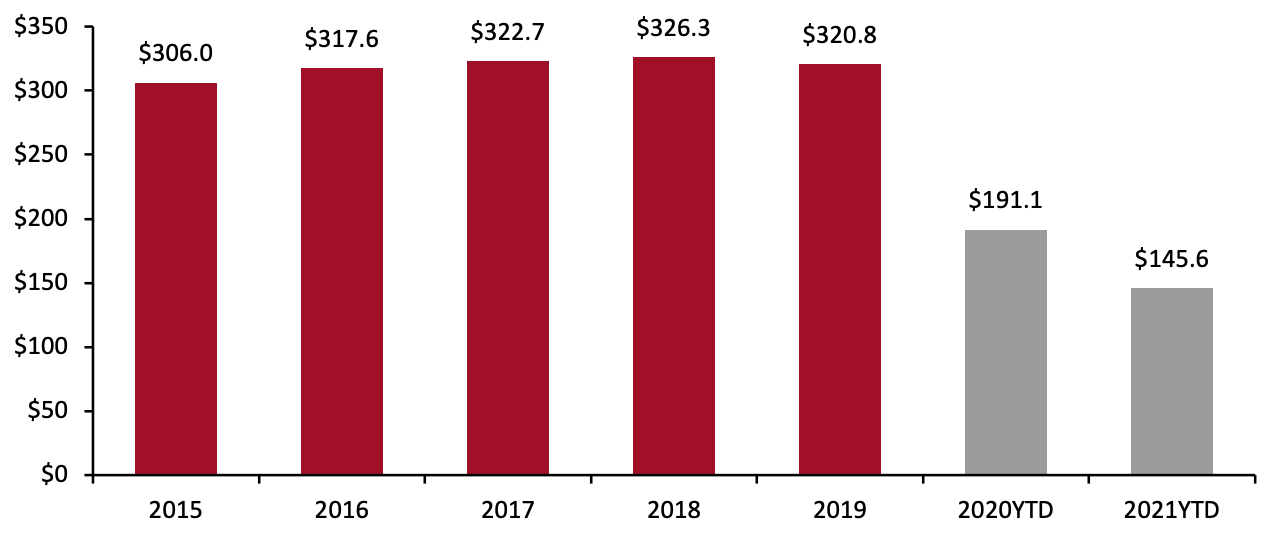

Source: IRS[/caption] The graph below shows the total annual refunds disbursed, which increased at a 0.2% CAGR from 2016 to 2020. Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_125157" align="aligncenter" width="720"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS had issued 49.7 million refunds, totaling $145.63 billion. The number of refunds issued was down 23.6% year over year. The total amount refunded was down 23.8% year over year.

- The average refund amounted to $2,929—down 0.2% year over year.

- The average direct deposit refund was $2,982, down 3.2% year over year.

- The IRS had received 76.1 million tax returns and processed 67.7 million. The number of returns processed was down 16.6% year over year.

- Of the returns filed, 95.6% were filed electronically. Of those, 47.6% were prepared by tax professionals and the remaining 52.4% were self-prepared.

- Taxpayers using the IRS website to access information increased dramatically: The site logged 879 million visits, up 138.1% year over year.

- According to the IRS, consumers that require additional time to file their tax returns beyond the already-extended May 17 deadline can request an extension until October 15 by filing Form 4868. While the IRS is providing additional time for taxpayers to finalize their filing paperwork, it requires taxpayers to pay the taxes owed by the May deadline.

*Note: The IRS delayed the start of its filing season this year.

*Note: The IRS delayed the start of its filing season this year.Source: IRS[/caption] The graph below shows the total annual refunds disbursed, which increased at a 0.2% CAGR from 2016 to 2020. Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_125157" align="aligncenter" width="720"]

Source: IRS[/caption]

Source: IRS[/caption]