Nitheesh NH

Each year, the IRS reports tax return filings and refunds on a weekly basis, until the April 15 deadline. Our US Tax Tracker reports will provide coverage on tax return filings at four-week intervals. In this report, we look at what happened in the first week of the 2021 tax filing season.

The IRS kicked off the 2021 tax filing season on February 12 this year when it began accepting tax returns for 2020—a delay compared to the normal start in early January. The delays this year allowed the IRS more time to prepare for the Covid-19 Relief Bill, which took effect in the US in late December. The IRS expects to receive over 160 million individual tax returns in 2020, and that most will be filed before the April 15 deadline.

The IRS made several interesting changes this year:

*Note: The IRS delayed the start of its filing season this year.

*Note: The IRS delayed the start of its filing season this year.

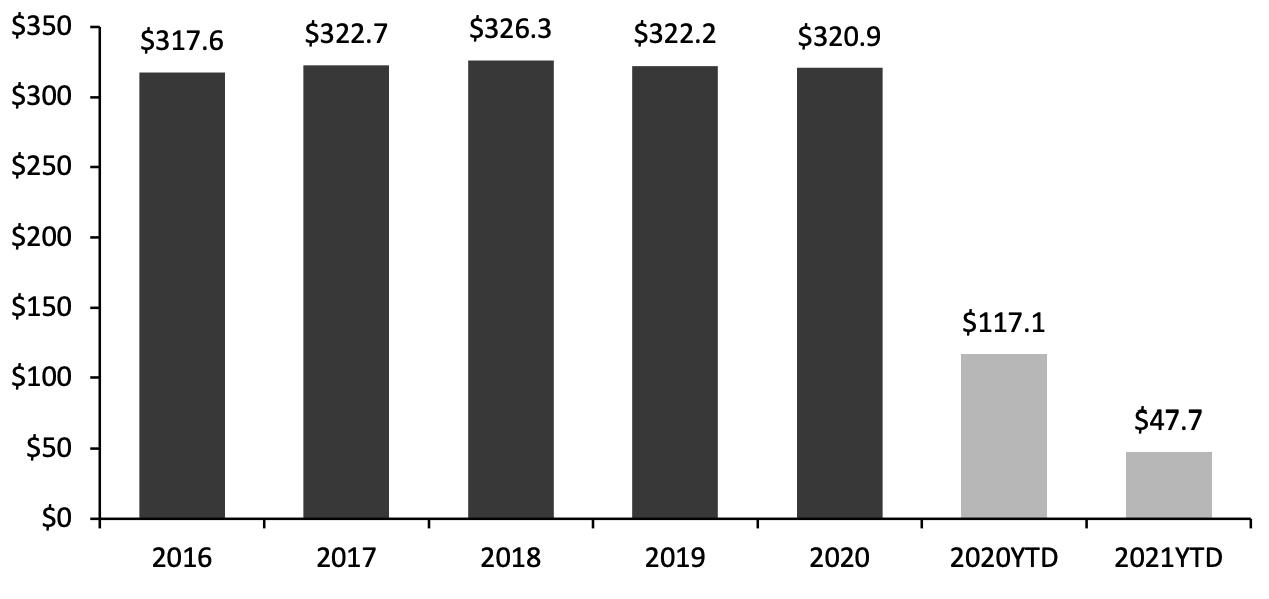

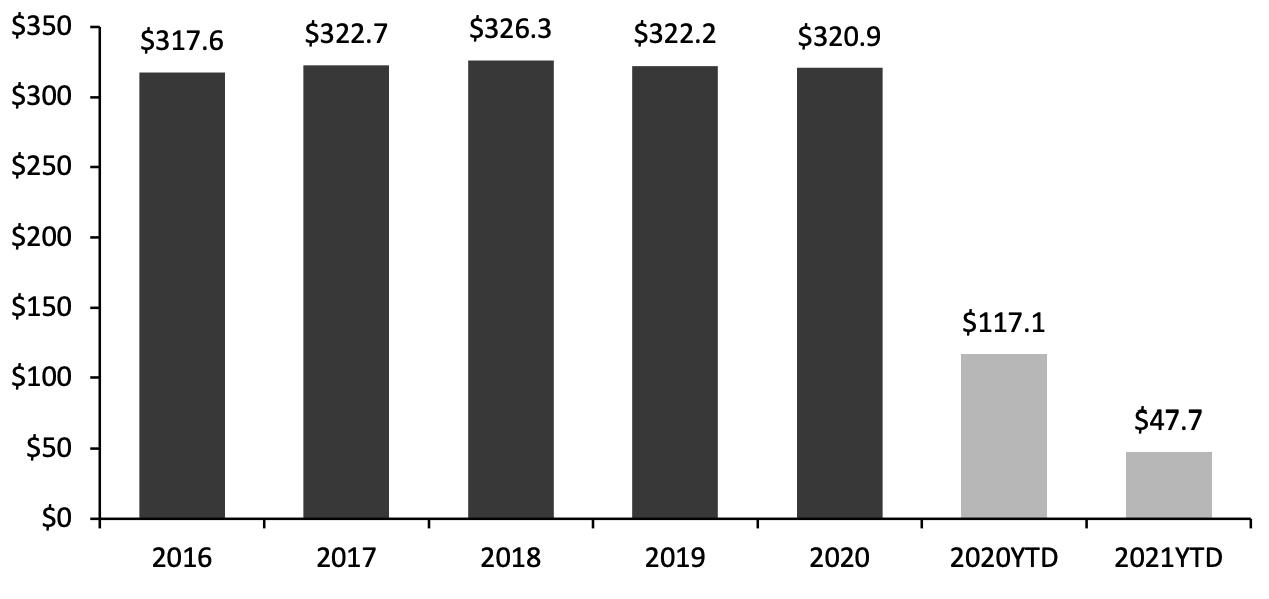

Source: IRS[/caption] The graph below shows the total annual refunds disbursed, which increased at a 0.2% CAGR from 2016 to 2020. Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_124098" align="aligncenter" width="720"] Source: IRS[/caption]

Tax Season Survey: Consumer Plans for 2021

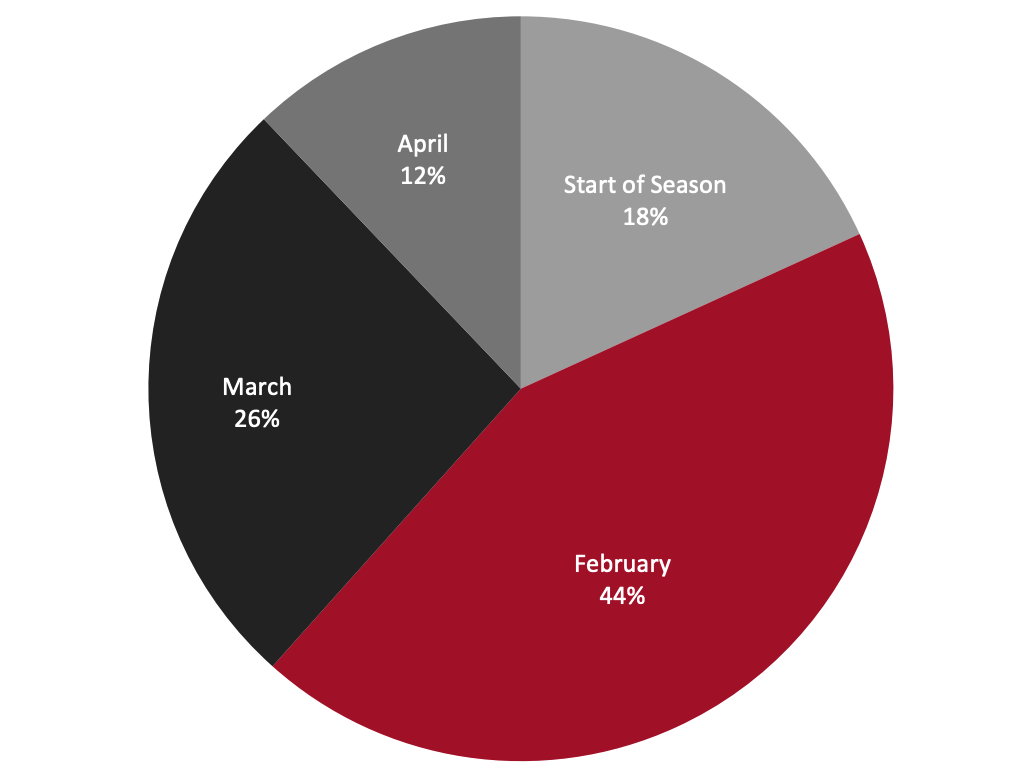

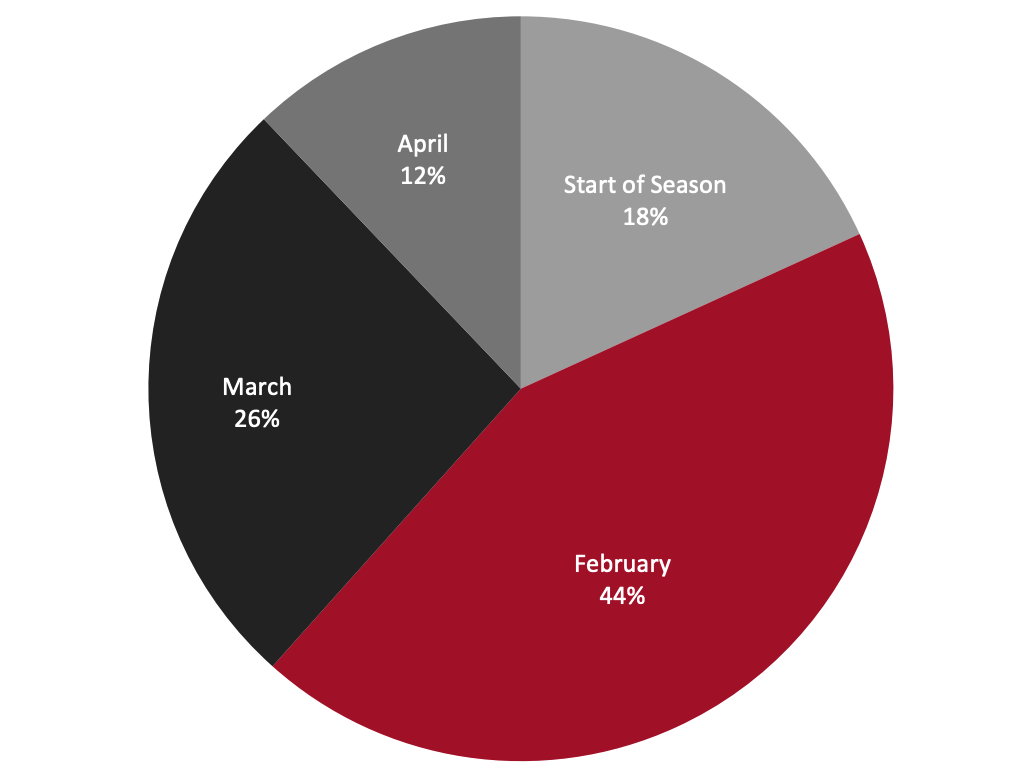

In a survey of US consumers conducted by online marketplace Offers.com in early February 2021, of the 1,075 respondents who plan to file taxes this year, 18% plan to do so at the start of the tax season, while 43% expect to do so by the end of February. Some 26% of the surveyed respondents said that they plan to file their taxes in March and 12% expect to take their time and file in April.

Figure 3. When Consumers Plan to File Taxes

[caption id="attachment_124099" align="aligncenter" width="480"]

Source: IRS[/caption]

Tax Season Survey: Consumer Plans for 2021

In a survey of US consumers conducted by online marketplace Offers.com in early February 2021, of the 1,075 respondents who plan to file taxes this year, 18% plan to do so at the start of the tax season, while 43% expect to do so by the end of February. Some 26% of the surveyed respondents said that they plan to file their taxes in March and 12% expect to take their time and file in April.

Figure 3. When Consumers Plan to File Taxes

[caption id="attachment_124099" align="aligncenter" width="480"] Source: Offers.com[/caption]

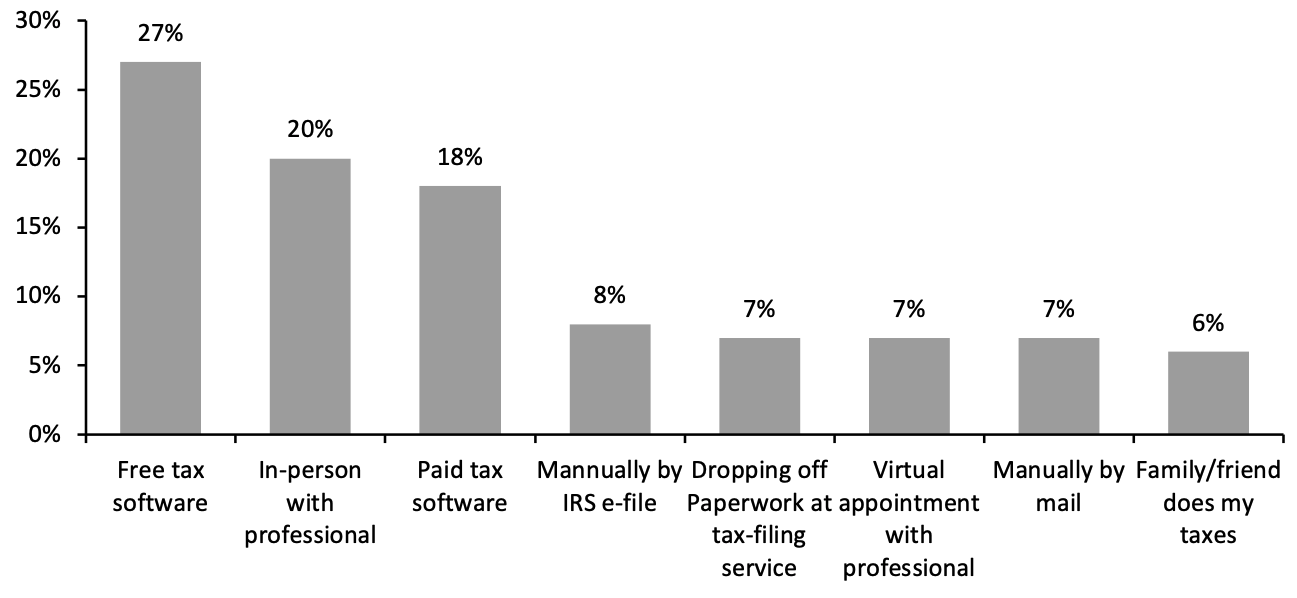

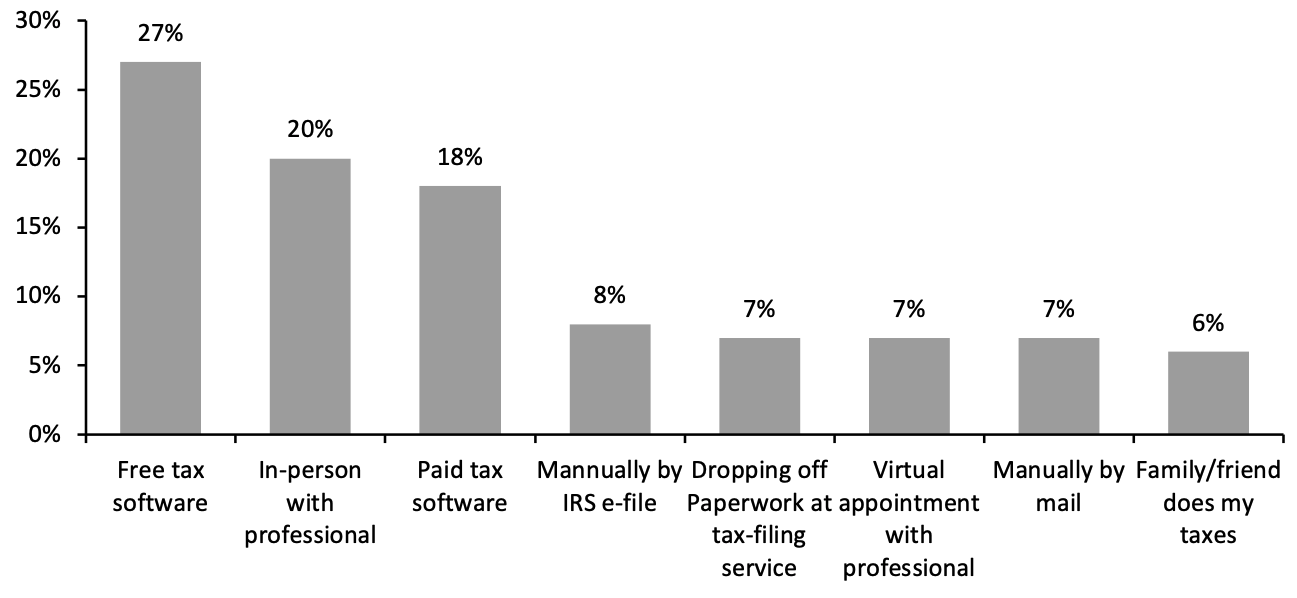

The survey also asked participants how they plan to file their taxes. Figure 4 shows that most respondents plan to use free tax software, with an in-person appointment the second-most-popular response.

Figure 4. Consumers’ Expected Methods for Tax Filing

[caption id="attachment_124100" align="aligncenter" width="720"]

Source: Offers.com[/caption]

The survey also asked participants how they plan to file their taxes. Figure 4 shows that most respondents plan to use free tax software, with an in-person appointment the second-most-popular response.

Figure 4. Consumers’ Expected Methods for Tax Filing

[caption id="attachment_124100" align="aligncenter" width="720"] Source: Offers.com[/caption]

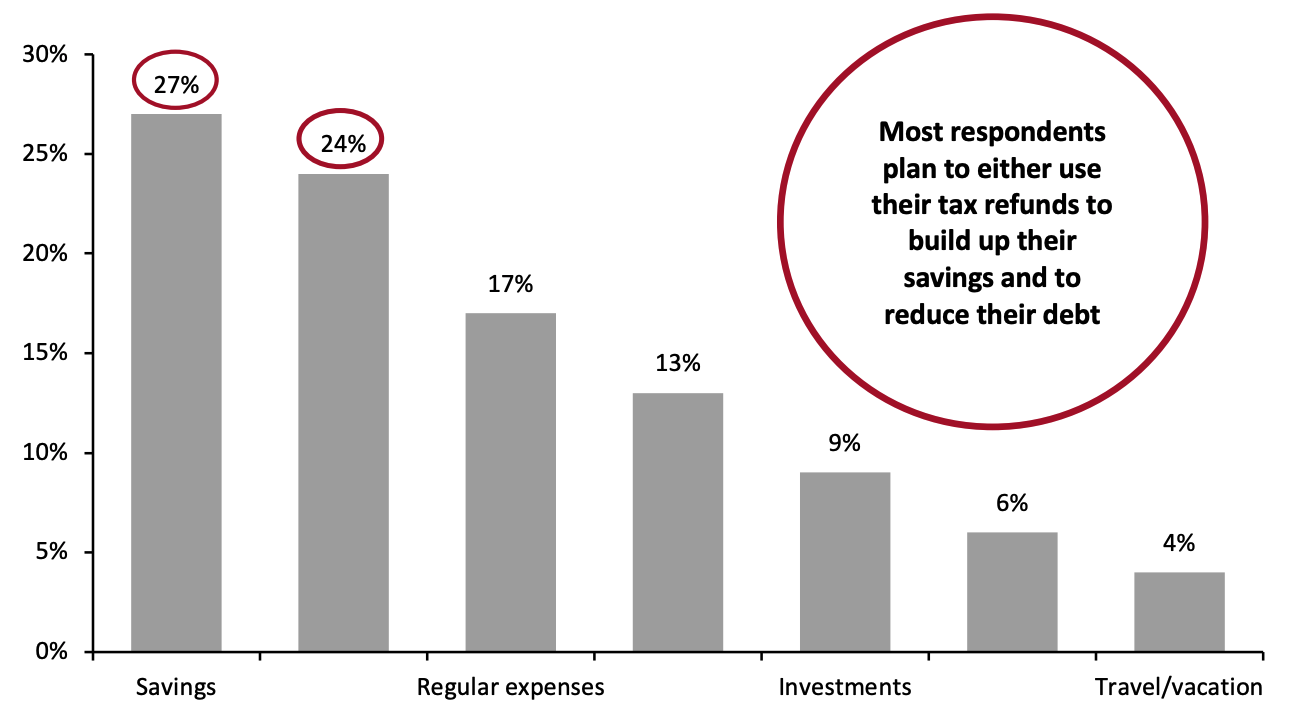

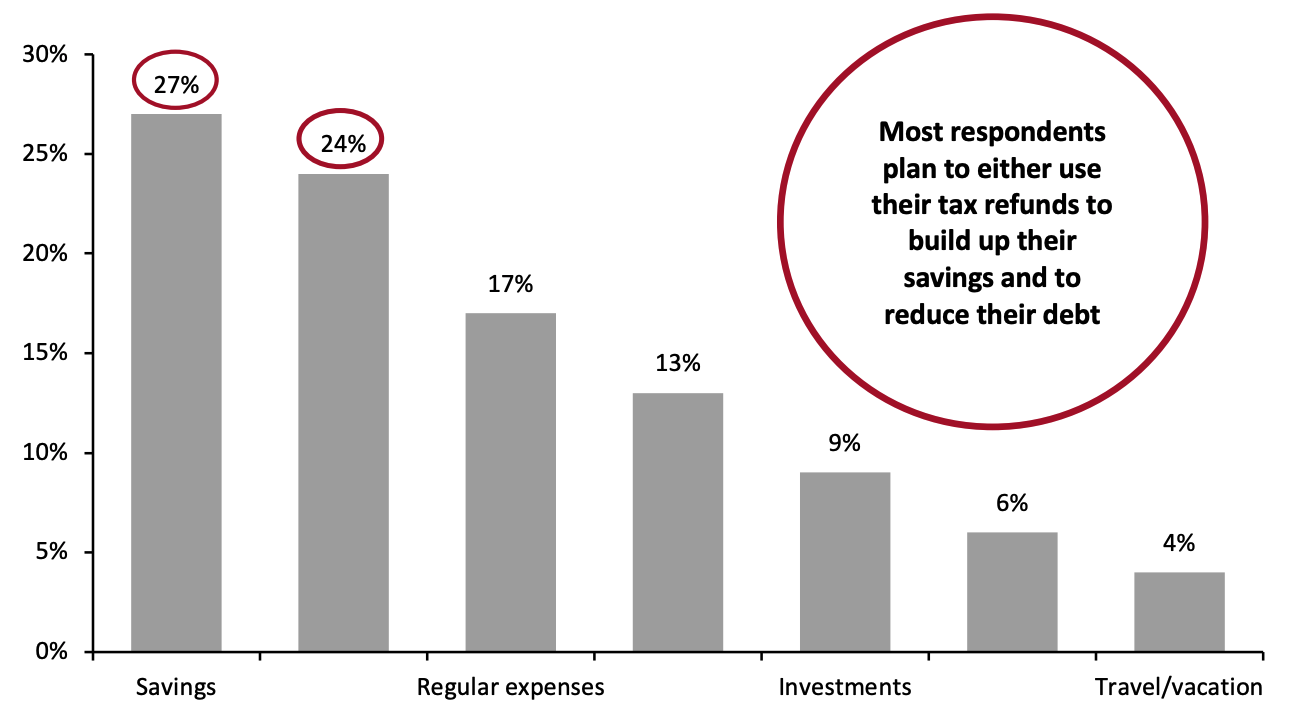

The survey found that the top expected use for tax refunds among participants was using it to increase their savings. Not far behind, some 24% reported that they plan to use it to reduce their debt and 17% expect to spend it on regular expenses.

Figure 5. Consumers’ Spending Plans for Tax Refunds

[caption id="attachment_124101" align="aligncenter" width="720"]

Source: Offers.com[/caption]

The survey found that the top expected use for tax refunds among participants was using it to increase their savings. Not far behind, some 24% reported that they plan to use it to reduce their debt and 17% expect to spend it on regular expenses.

Figure 5. Consumers’ Spending Plans for Tax Refunds

[caption id="attachment_124101" align="aligncenter" width="720"] Source: Offers.com[/caption]

Source: Offers.com[/caption]

- Forms 1040 and 1040-SR will now be available in Spanish. The IRS now also has a new form allowing taxpayers to request that they receive information from the IRS in one of 20 different languages besides English.

- The Coronavirus Aid, Relief, and Economic Security Act (CARES) Act now allows taxpayers who did not itemize deductions to take a charitable deduction of up to $300 for cash contributions made in 2020 to qualifying organizations.

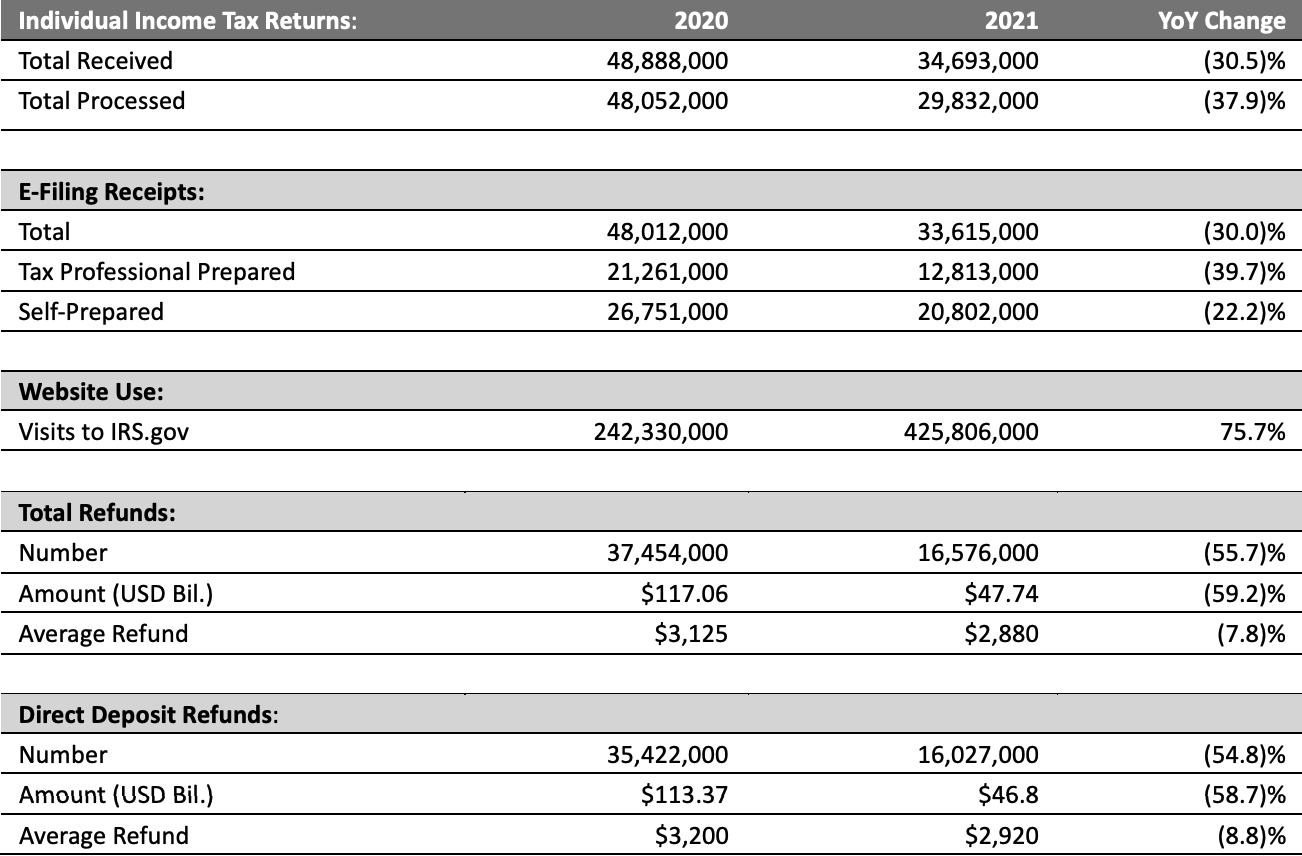

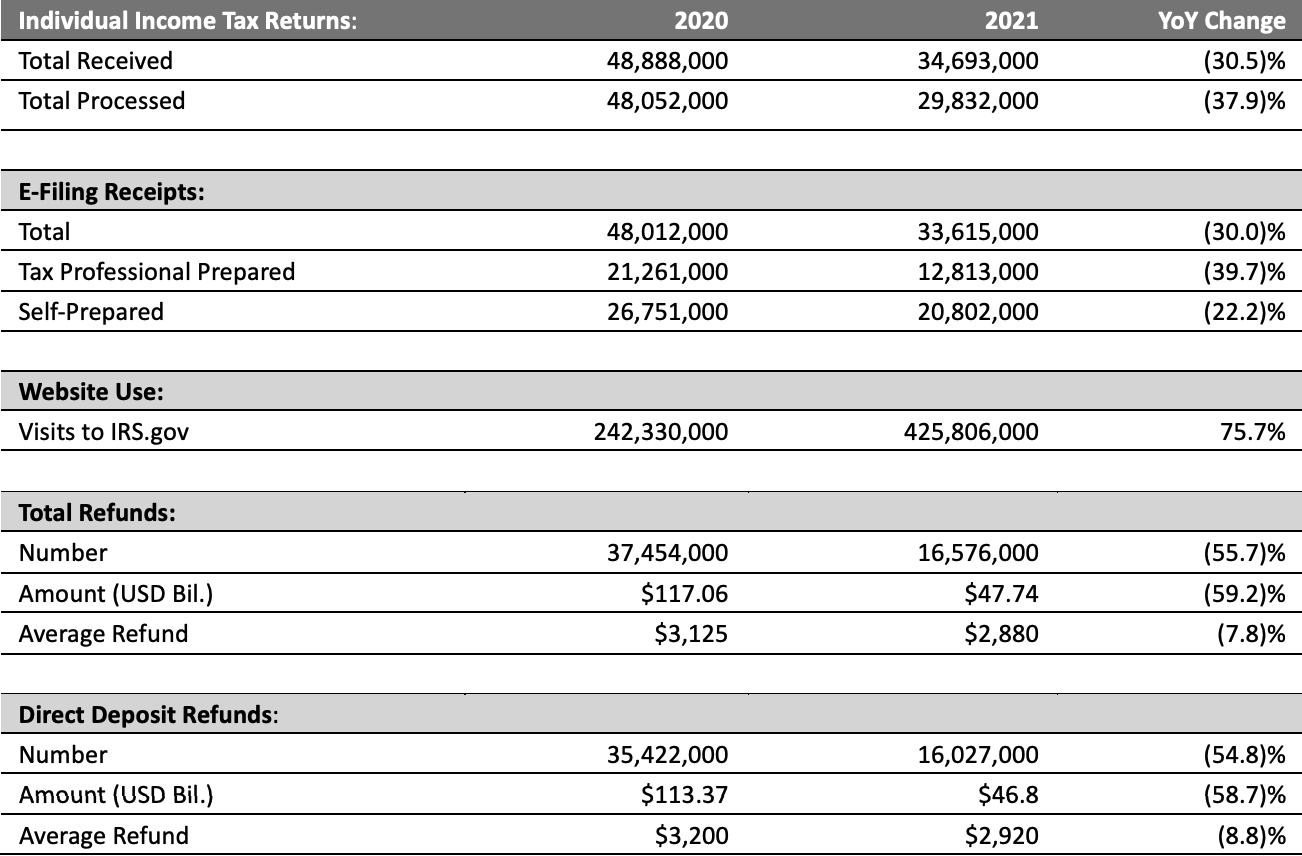

- The IRS had issued 16.6 million refunds, totaling $47.74 billion. The number of refunds issued was down 55.7% year over year and was up 286% compared to the first week of the 2020 filing season. The total amount refunded was down 59.2% year over year and up 494% compared to the first week of the 2020 filing season.

- The average refund amounted to $2,880—down 7.8% year over year and up 54% compared to the first week of the 2020 filing season.

- Out of the refunds issued, 96.7% were paid by the IRS using direct deposit. The average direct deposit refund was $2,920, down 8.8% year over year and up 52% compared to the first week of the 2020 filing season.

- The IRS had received 34.7 million tax returns and processed 29.8 million. The number of returns processed was down 37.9% year over year and up 130% compared to the first week of the 2020 filing season.

- Of the returns filed, 96.8% were filed electronically. Of those, 38.1% were prepared by tax professionals and the remaining 61.9% were self-prepared.

- Taxpayers using the IRS website to access information increased dramatically: The site logged 425.8 million visits, up 75.7% year over year.

*Note: The IRS delayed the start of its filing season this year.

*Note: The IRS delayed the start of its filing season this year.Source: IRS[/caption] The graph below shows the total annual refunds disbursed, which increased at a 0.2% CAGR from 2016 to 2020. Figure 2. Total US Annual Tax Refunds (USD Bil.) [caption id="attachment_124098" align="aligncenter" width="720"]

Source: IRS[/caption]

Tax Season Survey: Consumer Plans for 2021

In a survey of US consumers conducted by online marketplace Offers.com in early February 2021, of the 1,075 respondents who plan to file taxes this year, 18% plan to do so at the start of the tax season, while 43% expect to do so by the end of February. Some 26% of the surveyed respondents said that they plan to file their taxes in March and 12% expect to take their time and file in April.

Figure 3. When Consumers Plan to File Taxes

[caption id="attachment_124099" align="aligncenter" width="480"]

Source: IRS[/caption]

Tax Season Survey: Consumer Plans for 2021

In a survey of US consumers conducted by online marketplace Offers.com in early February 2021, of the 1,075 respondents who plan to file taxes this year, 18% plan to do so at the start of the tax season, while 43% expect to do so by the end of February. Some 26% of the surveyed respondents said that they plan to file their taxes in March and 12% expect to take their time and file in April.

Figure 3. When Consumers Plan to File Taxes

[caption id="attachment_124099" align="aligncenter" width="480"] Source: Offers.com[/caption]

The survey also asked participants how they plan to file their taxes. Figure 4 shows that most respondents plan to use free tax software, with an in-person appointment the second-most-popular response.

Figure 4. Consumers’ Expected Methods for Tax Filing

[caption id="attachment_124100" align="aligncenter" width="720"]

Source: Offers.com[/caption]

The survey also asked participants how they plan to file their taxes. Figure 4 shows that most respondents plan to use free tax software, with an in-person appointment the second-most-popular response.

Figure 4. Consumers’ Expected Methods for Tax Filing

[caption id="attachment_124100" align="aligncenter" width="720"] Source: Offers.com[/caption]

The survey found that the top expected use for tax refunds among participants was using it to increase their savings. Not far behind, some 24% reported that they plan to use it to reduce their debt and 17% expect to spend it on regular expenses.

Figure 5. Consumers’ Spending Plans for Tax Refunds

[caption id="attachment_124101" align="aligncenter" width="720"]

Source: Offers.com[/caption]

The survey found that the top expected use for tax refunds among participants was using it to increase their savings. Not far behind, some 24% reported that they plan to use it to reduce their debt and 17% expect to spend it on regular expenses.

Figure 5. Consumers’ Spending Plans for Tax Refunds

[caption id="attachment_124101" align="aligncenter" width="720"] Source: Offers.com[/caption]

Source: Offers.com[/caption]