DIpil Das

What’s the Story?

Coresight Research’s analysts provide directional outlooks and themes to watch in their sectors in 2021. This report focuses on the US market but includes some discussion of China e-commerce. Moreover, two of our markets—luxury and technology—are truly global. For the US-specific outlooks offered in this report, our assumption is that the early months of 2021 will remain similar to the last months of 2020—with very high Covid-19 infection rates severely hampering a return to normal operations for many retail and food-service businesses. We assume that the health crisis will moderate through 2021, not least due to the introduction of vaccines, and that any return to more regular ways of living, working and spending will occur predominantly in the second half of the year. We emphasize that this does not represent an expectation of a full return to pre-crisis normality during 2021.Why It Matters

2021 is perhaps the most difficult year in recent memory for which to offer start-of-the-year predictions. However, to offer directional guidance, our analysts discuss the trends and data points that they expect to see during the year.Macro Context and Outlook

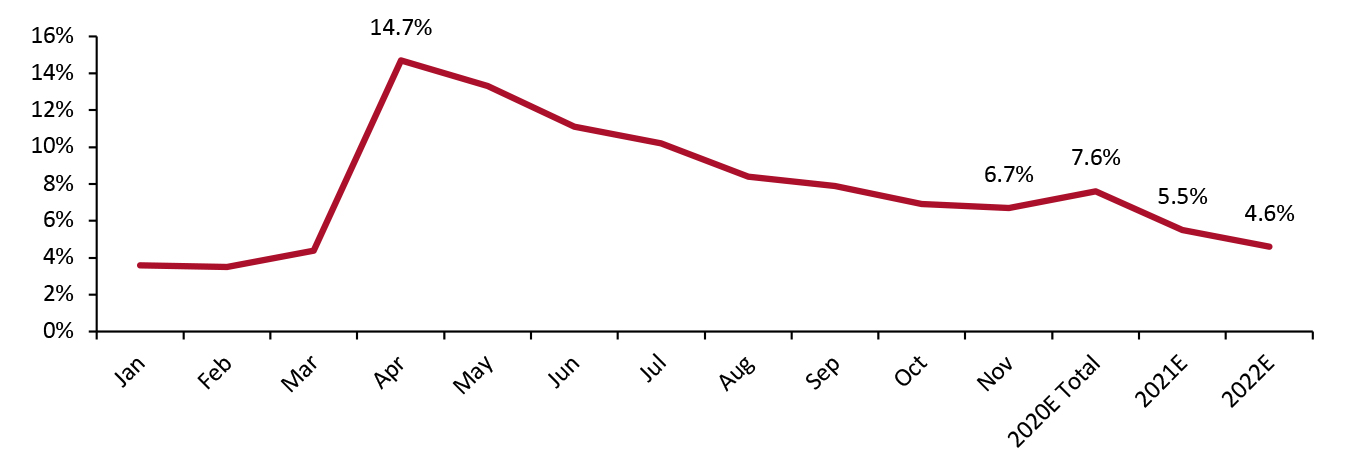

Before we turn to our sector analysis, we discuss selected major macro indicators for the US, including consumer sentiment and interest rates, GDP, the housing market, unemployment and a new round of stimulus checks. Approved by US Congress on December 22, 2020, and signed off by President Trump on December 27, a $900 billion coronavirus relief bill will see eligible Americans receive direct stimulus payments of up to $600. Congress also approved a new round of subsidies for jobless people and hard-hit businesses. We saw basic needs and financial obligations take priority among consumer spending in the first round of stimulus checks, according to a Coresight Research survey conducted on August 5. We expect the second round of stimulus payments to also drive consumer spending in basic financial obligations versus discretionary retail in early 2021: With case numbers climbing in parts of the US, many consumers are likely to stay at home and prioritize shopping for basic needs. After reaching a high of 14.7% in April, the US unemployment rate declined every month since, dropping to 6.7% in November and signaling economic recovery from the pandemic. The labor force participation rate was 60.2% in April and had increased to 61.5% in November, although it had stagnated since June. As shown in Figure 1, the annual US unemployment rate is estimated to be 5.5% in 2021 overall, compared to 7.6% in 2020, according to Federal Reserve Economic Data (FRED), indicating overall long-term employment recovery.Figure 1. US Unemployment Rate [caption id="attachment_121332" align="aligncenter" width="725"]

Source: US Bureau of Labor Statistics/Federal Reserve Bank of St. Louis[/caption]

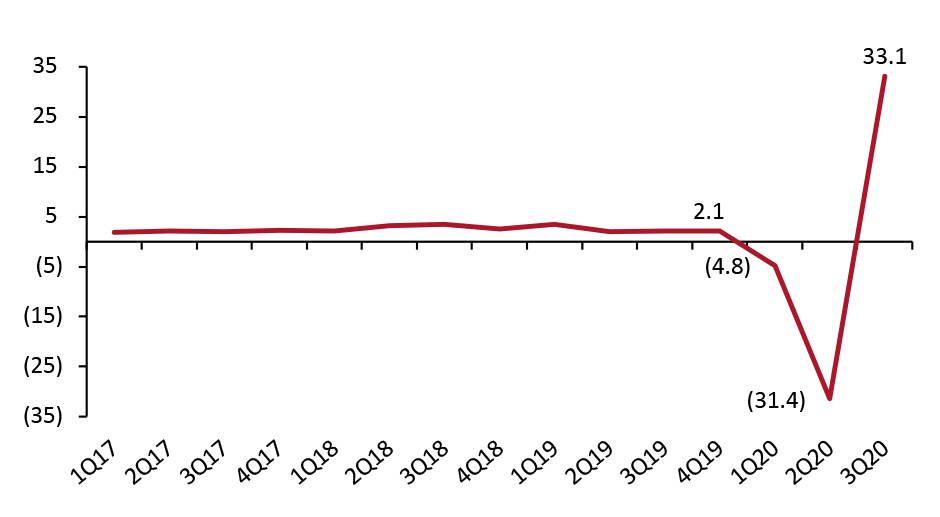

According to the most recent estimates from the US Bureau of Economic Analysis (BEA), the US economy grew at an accelerated rate of 33.1% (annualized and seasonally adjusted) in the third quarter of 2020, following a steep fall of 31.4% in the second quarter—the deepest decline ever recorded. The increase in GDP reflects increases in personal consumer expenditures, private inventory investment, exports, nonresidential fixed investment and residential fixed investment that were partly offset by decreases in federal government spending and state and local government spending.

Source: US Bureau of Labor Statistics/Federal Reserve Bank of St. Louis[/caption]

According to the most recent estimates from the US Bureau of Economic Analysis (BEA), the US economy grew at an accelerated rate of 33.1% (annualized and seasonally adjusted) in the third quarter of 2020, following a steep fall of 31.4% in the second quarter—the deepest decline ever recorded. The increase in GDP reflects increases in personal consumer expenditures, private inventory investment, exports, nonresidential fixed investment and residential fixed investment that were partly offset by decreases in federal government spending and state and local government spending.

Figure 2. US GDP: Change from Preceding Quarter (Annualized; %) [caption id="attachment_121333" align="aligncenter" width="725"]

Source: BEA[/caption]

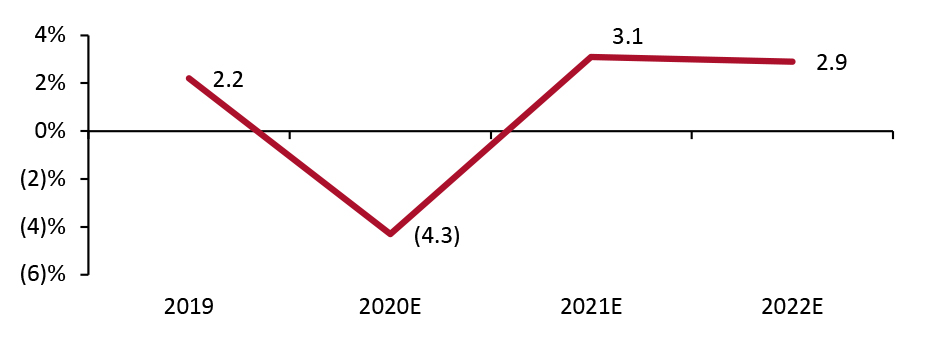

As shown in Figure 3, the International Monetary Fund (IMF) expects US GDP to have declined by 4.3% in 2020 and grow by 3.1% in 2021. The IMF then expects US GDP to increase by 2.9% in 2022.

Source: BEA[/caption]

As shown in Figure 3, the International Monetary Fund (IMF) expects US GDP to have declined by 4.3% in 2020 and grow by 3.1% in 2021. The IMF then expects US GDP to increase by 2.9% in 2022.

Figure 3. US GDP: Change from Preceding Year (Annualized; %) [caption id="attachment_121334" align="aligncenter" width="725"]

Source: IMF[/caption]

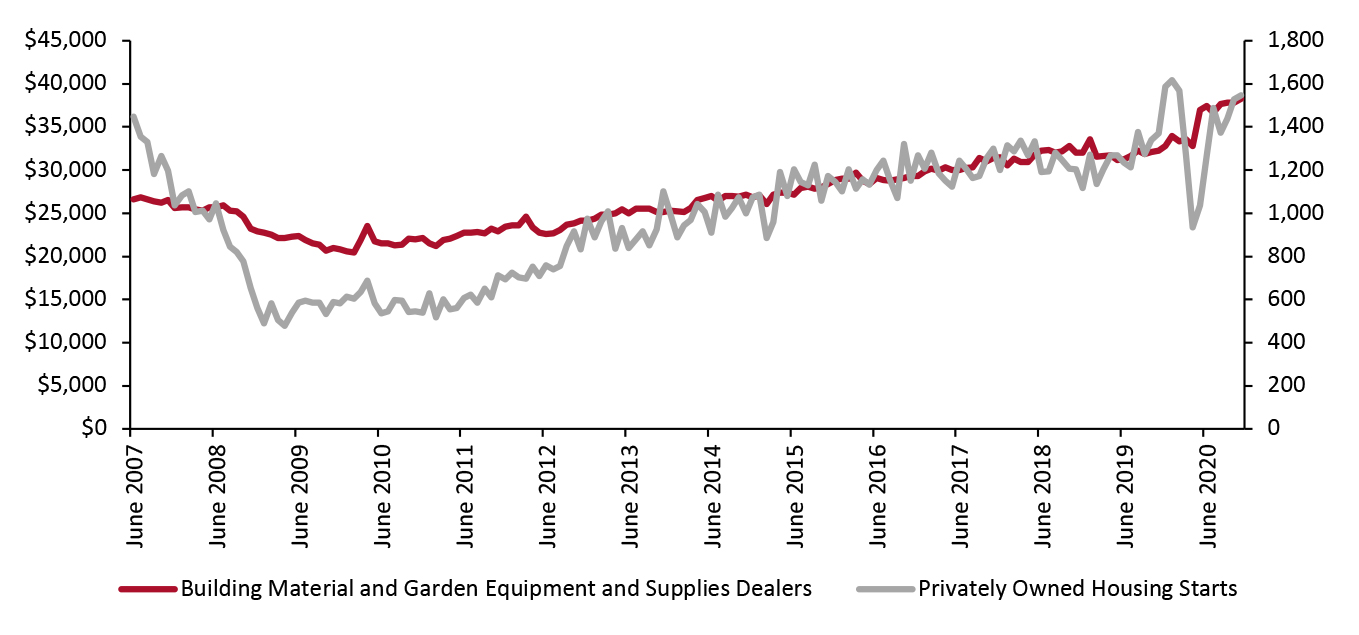

House prices in the US rose substantially since the outbreak of the pandemic, with the average sales price up by 8.3% from April to November 2020. The rise in house prices correlates with strong growth in housing starts, particularly for privately owned housing units. Housing starts for privately owned housing units saw a 65.6% growth from April to November 2020.

House sales were partly driven by people relocating to non-urban locations amid the pandemic, along with home buyers looking to take advantage of record-low mortgage rates. The effective 30-year fixed mortgage rate averaged 3.01% in the third quarter of 2020, down from 3.29% in the prior quarter and 3.71% in the year-ago quarter.

We expect the homebuying surge to remain strong until at least early 2021, driving increases in retail sales, particularly in the home-improvement sector (“Building Material and Garden Equipment and Supplies Dealers” as termed by the US Census Bureau). Increases in housing starts correlate strongly with an increase in retail sales in this sector, as shown in Figure 4.

Source: IMF[/caption]

House prices in the US rose substantially since the outbreak of the pandemic, with the average sales price up by 8.3% from April to November 2020. The rise in house prices correlates with strong growth in housing starts, particularly for privately owned housing units. Housing starts for privately owned housing units saw a 65.6% growth from April to November 2020.

House sales were partly driven by people relocating to non-urban locations amid the pandemic, along with home buyers looking to take advantage of record-low mortgage rates. The effective 30-year fixed mortgage rate averaged 3.01% in the third quarter of 2020, down from 3.29% in the prior quarter and 3.71% in the year-ago quarter.

We expect the homebuying surge to remain strong until at least early 2021, driving increases in retail sales, particularly in the home-improvement sector (“Building Material and Garden Equipment and Supplies Dealers” as termed by the US Census Bureau). Increases in housing starts correlate strongly with an increase in retail sales in this sector, as shown in Figure 4.

Figure 4. Building Material and Garden Equipment and Supplies Dealers’ Retail Sales (Left Axis, USD Bil.) and Privately Owned Housing Starts (Right Axis, Thousands of Units) [caption id="attachment_121335" align="aligncenter" width="700"]

Source: US Census Bureau[/caption]

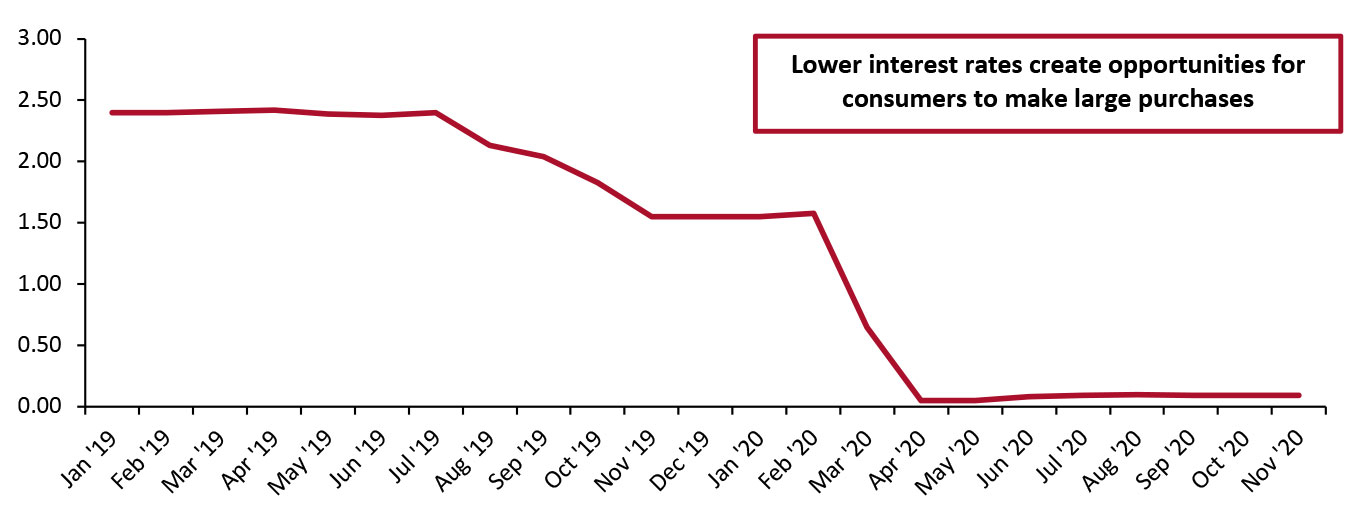

The effective federal funds rate declined to below 0.5% in April and has since remained consistent at this level. The US Federal Reserve has embarked on a plan to keep interest rates at very low levels for at least two more years. Lower interest rates translate to lower borrowing and financing costs for things purchased on credit, creating opportunities for the consumer market.

In 2021, we expect to see consumers continue to make large purchases, driving retail sales in sectors such as automobiles, home improvement and gardening, and furniture and home furnishing.

Source: US Census Bureau[/caption]

The effective federal funds rate declined to below 0.5% in April and has since remained consistent at this level. The US Federal Reserve has embarked on a plan to keep interest rates at very low levels for at least two more years. Lower interest rates translate to lower borrowing and financing costs for things purchased on credit, creating opportunities for the consumer market.

In 2021, we expect to see consumers continue to make large purchases, driving retail sales in sectors such as automobiles, home improvement and gardening, and furniture and home furnishing.

Figure 5. Effective Federal Funds Rate, January 2019–November 2020 (%) [caption id="attachment_121348" align="aligncenter" width="725"]

Source: Board of Governors of the Federal Reserve Systems [/caption]

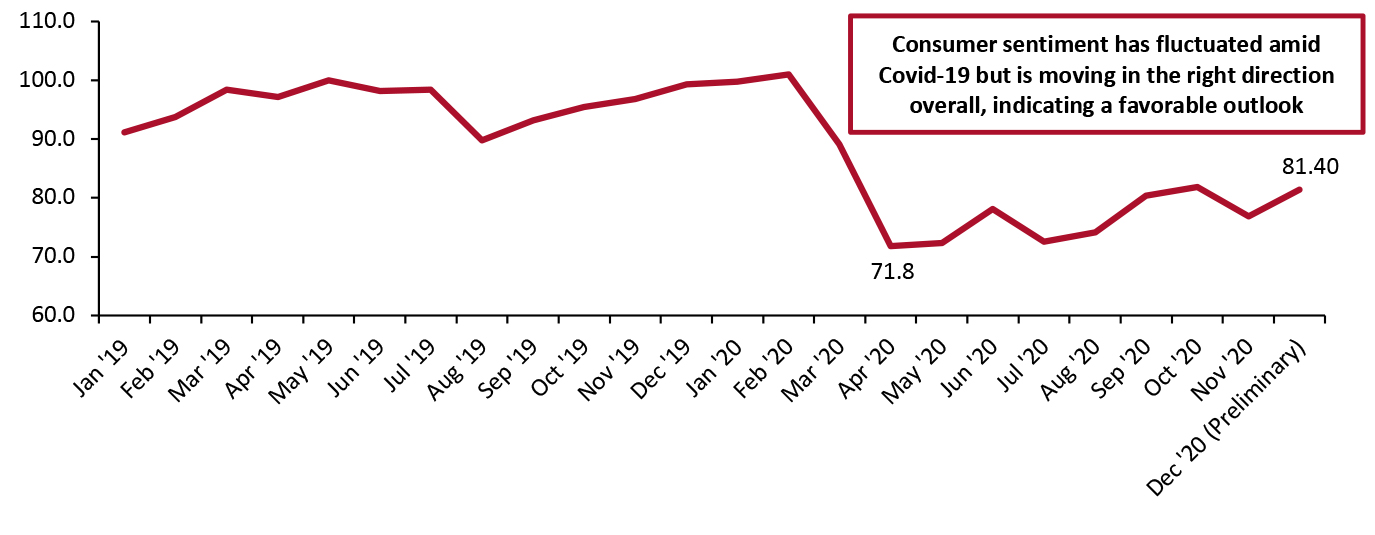

The US consumer sentiment index tumbled to 71.8 at the beginning of the pandemic in the US in April—the lowest level in nearly six years—down from 89.1 in March. Since then, consumer sentiment has fluctuated but is moving in the right direction overall, indicating a favorable outlook. The University of Michigan reported on December 11 that its preliminary result saw the consumer sentiment index climb to 81.4 in the two weeks ended December 9, from 76.9 in November.

Source: Board of Governors of the Federal Reserve Systems [/caption]

The US consumer sentiment index tumbled to 71.8 at the beginning of the pandemic in the US in April—the lowest level in nearly six years—down from 89.1 in March. Since then, consumer sentiment has fluctuated but is moving in the right direction overall, indicating a favorable outlook. The University of Michigan reported on December 11 that its preliminary result saw the consumer sentiment index climb to 81.4 in the two weeks ended December 9, from 76.9 in November.

Figure 6. University of Michigan: Consumer Sentiment Index, January 2019–December 2020 (Preliminary) [caption id="attachment_121337" align="aligncenter" width="725"]

Source: University of Michigan[/caption]

Source: University of Michigan[/caption]

US and China E-Commerce

Directional Outlook- We estimate that US e-commerce sales surged by around 34.7% in 2020 but that total online sales growth will moderate to mid- to high single digits in 2021. We model slow growth in online nonfood sales as shoppers return to stores—which is likely to be incremental and more obvious in the second half of the year, given the current health crisis. As we note in the next section on US food retail, we expect online grocery sales growth to slow sharply in 2021 as it laps very high rates of growth in 2020 and may be depressed by consumers returning to workplaces and food-service businesses.

- Boosted by a strong performance during the Covid-19 pandemic, which pushed more brands and retailers to go digital, we estimate that e-commerce in China will reached ¥9.6 trillion ($1.46 trillion) in 2020, increasing by 12.9% from 2019. We expect this to climb to ¥10.6 trillion ($1.62 trillion) in 2021, representing more modest year-over-year growth of 9.9% as consumers return to physical stores once the effects of the pandemic ease.

- Coresight Research’s weekly US consumer surveys regularly confirm that a substantial share of US consumers (i.e., over one-quarter) expect to retain the habit of shopping more online and less in stores after the crisis ends—although the incremental recovery of store-based sales indicates that we will ultimately see only a partial retention of sales in the online channel.

- We expect experiential e-commerce to continue to gain traction, including livestreaming, video consultations and augmented reality (AR)-enhanced shopping experiences. A growing number of companies are likely to create 3D shopping environments and experiences to establish highly immersive virtual retail spaces.

- Driven by booming e-commerce, the global e-commerce logistics market— which includes spending on transportation services, warehousing and distribution services by businesses—is estimated to grow at a CAGR of 20.5% during the period 2020–2027, according to research firm Global Industry Analysts. We expect almost all companies that sell online to need to consider investing in and upgrading their logistics capabilities.

- We anticipate seeing continued expansion of physical footprints among e-commerce platforms, with fierce offline competition. For example, in 2020 Amazon opened four new grocery stores under the banner “Amazon Fresh,” which combines aspects of online and traditional shopping. Amazon currently has almost 600 retail locations in the US—made up of a combination of pop-ups, convenience stores, bookstores, grocery stores (including Whole Foods) and general merchandise stores. We expect that e-commerce platforms will continue to invest in physical stores to supplement their online business. We also anticipate that brands and retailers will continue to invest in integrating online and offline operations to provide consumers with seamless shopping experiences.

- Amid a still tough economic context, we see e-commerce platforms rolling out discount formats to meet the demands of price-sensitive shoppers. In China, Alibaba and JD.com have developed their discount businesses to compete with low-price retailer Pinduoduo and capture sales in a post-crisis world.

- Expected partial retention of consumer behavior of buying more online, less in-store

- Omnichannel approaches to reaching consumers both online and offline

- Brands and third-party merchants increasing their online presence

- The development of efficient and extensive logistics networks

- Highly competitive environment—competition for traditional e-commerce platforms from multichannel retailers, direct-to-consumer (DTC) brands and social platforms that incorporate e-commerce functions

- Continued investments in fulfillment and logistics networks weighing on margins

- Increased costs of acquiring new consumers online

- Rules and regulations on e-commerce platforms imposed by local governments—for example, China’s issuing of draft rules to prevent monopolistic behavior by Chinese Internet giants including Alibaba, JD.com and Pinduoduo

- Faster and more efficient delivery: E-commerce platforms are gearing up to offer consumers improved delivery services. Key investments include upgrading infrastructure, such as warehouses, fulfillment centers and sorting centers; providing different order fulfillment options, such as collection points and pickup lockers; and leveraging autonomous delivery technology.

- Livestreaming e-commerce: Following explosive growth over the past two years, livestreaming e-commerce is well established in China, under the new regulations from the Chinese government. In the US, we expect livestreaming to gain momentum, with more brands and retailers turning to this channel to engage with consumers remotely. We estimate that the US livestreaming e-commerce market will reach $25 billion in 2023.

- Social commerce:With improved in-app shopping features, social commerce is becoming the driving force of the e-commerce sector. Social media platforms in the US, including Facebook, Instagram and Pinterest, have been improving their integrated shopping functionality to make the process completely seamless. In China, more diverse social platforms are adding e-commerce features, posing threats to traditional e-commerce platforms.

US Food Retailers, Mass Merchandisers, Warehouse Clubs and Discount Stores

Directional Outlook- Major US food retailers, mass merchandisers, warehouse clubs and other grocery-heavy retailers enjoyed exceptionally strong demand in 2020, making the comparatives challenging for 2021. In particular, they are unlikely to see the gains in food sales that we saw in 2020, when US food retail spending (across all types of retailers) was up by around 11%, we estimate from BEA data.

- The market context of early 2021 looks to be similar to that of late 2020, amid the Covid-19 crisis. However, across 2021 overall, we expect that there will be an incremental return to visiting food-service businesses and more regular working practices (i.e., a partial return to offices). On the assumption that these shifts are meaningful in scale (although likely weighted to the second half of the year), we expect year-over-year growth in total food retail sales to be slightly negative in 2021 overall.

- In the first 11 months of 2020, the US food-service industry saw a year-over-year reduction in sales of $136 billion, according to Census Bureau data—equating to a 19.4% decline versus the same period the prior year. Any sizeable shift in this spending back to restaurants, cafés and bars in 2021 will put a dent in food retail sales, which amounted to $1.1 trillion in 2020.

- Some pandemic-related habits are likely to be retained—for example, flexibility in working from home is probably here to stay, and online shopping habits look likely to be retained by many consumers. Moreover, even with a vaccine, some consumers may not be confident enough to return to pre-crisis behaviors for a substantial period of time. These factors will likely mitigate the shift in food spending from retail to food service.

- The near-term growth outlook for grocery e-commerce remains uncertain, given the exceptionally strong performance in 2020. As we begin to lap the peaks of that growth—such as the 125.7% year-over-year increase our US CPG Sales Tracker recorded for the four weeks ended May 17, 2020—we expect to see the year-over-year change turn negative. We envisage online retail sales of food to be possibly down a few percent in the context of a total food retail market that may also be slightly negative. Even our more optimistic models indicate just a small potential increase in online food sales in 2021, given the very demanding comparatives.

- Gains at mass merchandisers and warehouse clubs in 2020 were supported by their status as “essential” stores, but the strong performances at Target and Walmart has continued beyond temporary store closures and lockdowns—and has encompassed more than essentials. This strength is likely supported by in-store shoppers seeking to consolidate their visits to stores—a tailwind that may fade during 2021. However, expanded digital capabilities and capacity at Target and Walmart have contributed strongly, and that should provide support for medium-term growth.

- Amid a still tough economic context, discount formats are likely to remain structural winners. Dollar stores, such as Dollar General and Family Dollar, and expanding formats such as Aldi and Grocery Outlet are well positioned to capture share among a price-conscious consumer base feeling the effects of the Covid-19 pandemic.

- In early 2021, the stay-at-home behaviors of 2020—such as working from home—are likely to be sustained, driving retail food sales and consolidated visits to stores.

- The economic impacts of the crisis, such as reduced disposable income for many, may encourage shoppers to continue spending in food retail rather than switching back to food service.

- Heightened demand for online shopping and omnichannel fulfillment services (such as curbside pickup) supports retailers that have sophisticated and diverse e-commerce capabilities, such as Target and Walmart.

- A vaccine rollout and/or otherwise reduced case numbers could prompt a shift from retail food spending back to food service.

- Elevated e-commerce penetration piles costs onto food retailers, which erodes margins.

- There is likely to be a reversal of consolidated shopping behaviors in the medium term as consumers return to shopping from a range of stores—which is disadvantageous to “one-stop” retailers.

- Digital strength: Both Target and Walmart have ramped up their omnichannel capabilities and now have substantial competitive advantages in omnichannel services. Warehouse clubs are somewhat behind Target and Walmart in the omnichannel journey, but investments in recent years proved worthwhile in 2020 and are likely to support growth in 2021 too.

- E-commerce adoption: The pandemic is accelerating e-commerce adoption among dollar stores and discount retailers such as Big Lots. Dollar General announced plans to roll out BOPIS (buy online, pick up in store) services to its stores by the end of 2020. In 2020, Big Lots added curbside-pickup options and partnered with Instacart and on-demand logistics provider Pickup to launch a delivery service. Digital channels provide an avenue for growth—albeit one that comes with extra costs and more challenging economics for low-price players.

- Store openings: In a retail landscape marked by store closures, discount retailers and warehouse clubs are standing out with their increasing physical store footprints. Dollar General has announced plans to open 1,050 stores in the fiscal year ending January 2022. In its fiscal year 2021, Costco plans to open 20–22 warehouse units, with five to six units scheduled to open in the third quarter and seven to eight in the fourth quarter. In 2021, BJ’s expects to open around six new clubs.

US Drugstores

Directional Outlook- After seeing an uptick of around 5% in 2020, we expect drugstore retail channel growth to moderate to low single digits in 2021. Consumers reacted to the coronavirus by filling 90-day prescriptions to stock-up and limit their trips to stores. In 2021, this trend will largely level out, and we expect people to stick to monthly prescription filings.

- As opposed to some other specialist retail sectors, online growth at health and beauty specialist retailers outperformed the overall online growth of the health and beauty market in 2020. From IRI data, we calculate that total online sales of health and beauty products (excluding prescription drugs) grew by an average of 47% in the first three quarters of 2020. Health and beauty specialist retailers’ online sales grew by an average 71% in the same period, we calculate from Census Bureau data. With consumers returning to more normalized spending patterns, we expect online growth at health and beauty specialist retailers to sustain momentum in 2021.

- In 2020, drugstore chains experienced strong sales for front-end products, including home hygiene, personal hygiene and wellness products. Additionally, they have capitalized on strong food retail demand through their expanded grocery offerings. The pandemic-induced stickiness is likely to help contribute to the growth of front-store sales in 2021.

- The competition in retail health care will heat up in 2021, as CVS opens 1,300 HealthHUBS, the Walgreens-VillageMD partnership opens 40 co-branded clinics, and Walmart Health opens 22 new clinics in 2021. The drugstore chains’ expansion into the primary health-care space has been largely welcomed by consumers, driving higher satisfaction and increased spending.

- Administering vaccines has become a lucrative way for pharmacies to generate additional sales. In September, the Department of Health and Human Services authorized state-licensed pharmacists nationwide to administer Covid-19 vaccines when they become available. This development should help contribute to the growth of prescription drugs and front-store sales in pharmacy chains in 2021.

- Some crisis habits, such as online filing for prescription drugs, will likely become deeply embedded in consumer buying behavior, enabling Amazon and e-pharmacy startups to gain ground in 2021. Online-only pharmacies have been making inroads with key value propositions, including faster delivery, convenience and cost savings. Pharmacy incumbents may see their market share dwindle if they fail to significantly step up their omnichannel capabilities and provide competitive e-commerce offerings.

- Personal health-care expenditure is projected to rise by 6% to reach $3.56 trillion in 2021, according to Centers for Medicare & Medicaid Services.

- Administering Covid-19 vaccines may result in additional foot traffic and sales.

- Expected retention of crisis-related habits, including spending more time at home, which will continue to drive front-end and grocery sales at drugstores.

- Ongoing reimbursement pressure will continue to negatively impact drugstore retailers’ profitability.

- Amazon Pharmacy and e-pharmacy startups are stepping up their competition with drug retailers.

- Telehealth: Covid-19 boosted telehealth adoption as consumers stayed at home and avoided pharmacies and hospitals. In 2021, drugstore retailers will likely continue to leverage telehealth to drive customer engagement, so the technology will take on a more significant role in the health-care system, ,especially primary care.

- Health-care market entry: Amazon and e-pharmacy startups will seriously challenge the dominance of established drug retailers by attracting younger demographics through value propositions such as discounts, convenience and free home delivery. We expect online startups to grow their geographical reach and raise new rounds of capital from investors in 2021.

- Competition in retail health care: Consumer demand for value-based care closer to home has fueled a race between drug retailers as they aim to capture a greater share of this demand. In 2021, drug retailers will maintain their push into health-care services, positioning themselves as hubs of consumer health care.

US Apparel and Footwear Retailing

Directional Outlook- By category, apparel and footwear have been among the biggest losers of 2020: We estimate from BEA data that total US clothing spending declined by 12.0% and footwear spending by 12.3%. We will still see a challenging apparel and footwear market in early 2021 as infection rates remain high and restrictions remain in place in parts of the US ahead of vaccine rollouts. We expect to see a more sustained recovery in the category in the second half of 2021.

- We estimate that the total US clothing and footwear market will grow by around 7% in 2021 overall—a more moderate increase than we previously estimated, given the ongoing severity of the pandemic and the ensuing implications for apparel and footwear demand and on in-store traffic at apparel retailers. This estimate implies that clothing and footwear spending in 2021 will still be approximately 6% below 2019 levels, reflecting the challenging economic and social backdrop that is likely to last into 2021. However, we note considerable uncertainty around the pace of improvement in the Covid-19 pandemic, thus there is potential for a stronger bounce back.

- The store-focused apparel and footwear specialty sector has consistently underpaced total clothing spending since the onset of the coronavirus crisis, as consumers have switched to e-commerce and rival sectors such as mass merchants, which remained open amid lockdowns (for instance, Target has reported a bounce in apparel sales). Clothing-store sales decreased by 19.2% year over year in November 2020, according to the Census Bureau, and we estimate that sector sales decreased by around 27.2% for the whole year, as benchmarked to Census Bureau data. On the basis of a return to greater in-store shopping during 2021, we assume that the store-based specialty sector will claw back some of the share of clothing and footwear spending that it lost in 2020—but far from all of it, as consumers are likely to retain certain habits, especially that of buying more online.

- Following an estimated 27% increase in US online clothing and footwear sales in 2020 (amid a declining total apparel market), we expect much more modest e-commerce growth in 2021. On the basis that shoppers return to in-store shopping, particularly in the second half of 2021, we model a slight unwinding of the record 37.4% e-commerce penetration estimated for 2020. We therefore expect US clothing and footwear online sales growth to slow to mid-single digits for 2021 overall.

- As consumers are increasingly opting for more casual and comfortable daily wear, existing apparel retailers and brands are expanding their product offerings. In 2021, we expect to see strong growth opportunities in categories including athleisure, denim, lingerie, sneakers and sportswear.

- Many US consumers are likely to retain the habit of purchasing more online even when the crisis ends. As we stated earlier, Coresight Research’s US consumer surveys have found that more than one-quarter of respondents expect to buy more online and less in stores once the crisis ends.

- Consumers value convenience in the shopping journey. To meet this need and ensure safety during the pandemic, apparel retailers and brands have increased investments in omnichannel capabilities and fulfillment, which will support apparel sales growth going forward—especially online sales.

- US consumers will still be living under some sort of lockdown—whether official or by opting to stay at home—in early 2021 (at least), which will continue to hit apparel demand, especially in physical retail.

- Amid channel shifts to e-commerce, distribution costs, including delivery costs, will present a challenge for apparel and footwear retailers. In addition, retailers have reported that the cost pressure of moving products from warehouses to distribution centers is rising due to increased digital shipment volume and higher cost per shipment.

- There will be higher customer acquisition costs associated with online retailing, as retailers increase digital ad spending, add loyalty programs and offer virtual services and promotions. Companies such as NIKE have reported lowering these customer acquisition costs by focusing on retaining a high proportion of engaged, frequent shoppers, so that the company can increase returns on advertising spend and overall digital operating margin. We expect to see more retailers looking to grow their digital engagement strategically and deepen connections with shoppers, in order to develop a more sustainable customer acquisition approach.

- Collaborations: We expect to see apparel retailers and brands embracing collaborations on special collections to be sold alongside their regular offerings. Collaborations and product partnerships can help to further customer reach and create interesting and iconic products by sharing resources and ideas.

- Social media and influencers: Partnership with influencers to launch livestreaming events is another big theme we are watching. We have seen retailers including and American Eagle Outfitters, Levi’s and VF Corporation leveraging social media and influencers to attract customers to boost sales. We expect this trend to continue in 2021.

- Direct to consumer (DTC): We expect more apparel and footwear brands to shift from wholesale to DTC sales, as already indicated by moves from Adidas and Levi’s, with the aim of enhancing connections with consumers.

US Department Store Retailers

Directional Outlook- Given their expansive real estate portfolios, US department stores were deeply affected by Covid-19 and the ensuing extended store closures. For 2021, Coresight Research expects total department store sector sales to be up by around 4–7%, following an estimated 16.1% decline in 2020 (benchmarked to Census Bureau data). However, this will not recoup all of 2020’s decline—at the 5.5% midpoint increase, 2021 sales would still be 11.5% below those of 2019. Moreover, sector sales have been supported by what the Census Bureau categorizes as discount department stores, which is likely to include some general merchandise retailers that stretch the definition of a department store; traditional, nondiscount formats recorded a much steeper decline in 2020.

- As department stores reopened after the US lockdown in early summer, store traffic was challenged; some consumers were not comfortable going to public places such as malls, where many department stores are located. Shifting consumer category demand potentially affected traffic too, as consumers no longer needed to shop for dressier apparel—categories that department stores are traditionally known for. However, department stores have reported incremental improvements as they shifted categories to meet consumer demand and consumers’ shopping behaviors have become somewhat more normalized. However digital businesses are thriving, and we expect department stores to lean further into digital in 2021, particularly as unpredictability around Covid-19 restrictions persist in the US. Nordstrom is the standout, with 54% of its third-quarter sales being digital, compared to 33% in the third quarter in 2019. Macy’s digital sales accounted for 38% of total sales, growing 27% year over year. Kohl’s digital sales represented 32% of total sales in the third quarter, increasing by 25% year over year.

- We expect continued contraction of the department store fleet in fiscal 2021; 90 store closures at Macy’s and JCPenney are already in the pipeline, which will take the department store fleet across the four major retailers (JCPenney, Kohl’s, Macy’s and Nordstrom) from 2,778 stores to 2,668 stores. We expect further store optimization in 2021, with department stores announcing more closures as e-commerce accelerates and physical store traffic remains challenging.

- As the pandemic persists, department stores will likely continue to shift category demand to meet consumer demand. In 2020, department stores shifted to athleticwear, beauty, casualwear, home and jewelry. The luxury categories at Bloomingdale’s outperformed, accounting for 30% of overall business in the second quarter of 2020 compared to 20% in the second quarter of 2019. In the near term, we expect these categories to be a focus for department stores. As the country emerges from Covid-19 through vaccinations, hopefully in the second half of 2021, we expect a gradual return to spending in fashion categories as consumers return to events, parties and weddings.

- Department stores are investing in new growth opportunities spanning payment methods, channels and categories, in order to reach new customers. Macy’s invested in flexible payment solution Klarna and reported that its younger consumers sought this service. Nordstrom is investing in Nordstrom Rack and digitalizing its products to differentiate itself as the “first off-price online retailer,” and Kohl’s entered a partnership with Sephora on December 1, 2020 to bring 200 shop-in-shops to its physical stores and online from 2021—bringing prestige beauty to its customers.

- In 2021, we expect department stores to continue to focus on efficiency in supply chains, including leveraging physical stores as fulfillment centers to offer ship from store, BOPIS and curbside pickup, as well as owning last-mile delivery through same-day partnerships. Kohl’s fulfilled 40% of its digital business from its stores in the third quarter of 2020; Macy’s fulfilled 50% of its digital business from stores; and Nordstrom fulfilled 20% of its full-price orders and 25% of Nordstrom Rack orders in stores. Macy’s launched a partnership across Macy’s and Bloomingdale’s with DoorDash in 2020—we expect that this will become an industry standard in 2021, as traditional carriers are under increasing pressure and retailers are increasingly looking to own the last-mile delivery process to build consumer trust.

- Department stores’ extensive physical store formats can be leveraged as an asset, acting as micro-fulfillment centers to both fulfill digital orders and promote curbside and BOPIS services, which will help to reduce shipping costs.

- In the era of Covid-19, “one-stop” department stores are advantageous to consumers looking for an efficient way to shop for the entire family in one go and minimize store visits.

- We expect that consumers will still be working remotely and living under semi-restrictive scenarios in 2021—resumption of a semblance of pre-crisis normality is not likely to occur until at least the second half of the year. This will impact demand for apparel in particular, furthering the delay of consumer demand for formal and business apparel.

- The degree to which consumers will adopt the habit of not shopping in stores in the long term is not certain. The potential decrease in store traffic could impact revenue recovery and the department store footprint.

- The long-term impact of category preferences and lower average order value may affect the department store, due to a shift to low-value categories—such as from dress apparel to casual apparel. The high-value Home category has been trending upward throughout 2020, which has been positive for department stores. However, its growth trajectory is unlikely to continue at elevated double-digit growth levels, which will also impact department stores.

- Investment in beauty: As we noted earlier, Kohl’s announced a partnership with major beauty retailer Sephora on December 1, 2020 to bring 200 shop-in-shops to its stores and online beginning in 2021—reaching a total of 850 stores by 2023. This announcement came on the heels of a Target announcement in November 2020 to bring 100 Ulta Beauty shop-in-shops into its stores in 2021. We expect that these two major announcements will help to generate beauty competition among department stores, and we anticipate further announcements of collaborations and innovations in 2021 from Nordstrom and Macy’s to stay relevant in the competitive beauty space.

- Leveraging store spaces within the supply chain: Department stores will focus on supply chain efficiencies in 2021, further leveraging physical store fleets as micro-fulfillment centers to fulfill digital orders. As shipping costs mount, store spaces have renewed significance—particularly for BOPIS and curbside-pickup services, as these reduce shipping costs. The year 2020 is evidence that same-day delivery and owning last-mile delivery is a necessity due to digital demand and overloaded traditional carriers. We expect department stores, and all retailers, to invest in owning this capability.

- Innovation to reach new consumers: We expect department store chains to look to innovative services and offerings to expand their consumer base and keep up with the latest demands. For instance, Macy’s introduced flexible payment service provider Klarna, which the company reported appeals to its customers aged under 40. Moreover, Kohl’s plans to expand its activewear sales from 20% to at least 30% of its business to appeal to the health and wellness-focused consumer. Nordstrom is expanding its Nordstrom Rack business to expand its online footprint, making it the biggest off-price online retailer. The company reported that the majority of its new customers come from Nordstrom Rack, with one-third becoming full-price customers within one year.

US Beauty Retail

Directional Outlook- After an almost flat 2020, with total US spending on core beauty categories up by 0.6%, we expect US beauty retail to see a substantial bounce in 2021, with projected year-over-year spending growth of 4.0%. While the first half of 2021 will continue to present a challenge for the overall beauty sector, as coronavirus cases remain high in some parts of the country and consumers face restrictions ahead of any vaccine rollout, we expect to see a more sustained recovery in the beauty category in the second half of 2021. This includes spending on cosmetics, fragrances, bath products and nail products—the beauty category as defined by the US Bureau of Economic Analysis. This represents sales through all channels, including the lockdown-resilient, high-growth e-commerce channel. Our estimates assume that a large number of consumers will continue to avoid public places and large social events in the first half of the year.

- In 2021, the specialist sector will face exceptionally weak comparatives, due to the 15.4% decline in 2020. Online sales will likely be a large contributor in the sector regaining share, as some consumers retain crisis-induced shopping habits, such as channel shifts. We estimate a high-single-digit increase for the specialist sector in 2021, which would see these retailers regain some of the share ceded in 2020. This sector includes sales by specialist retailers of cosmetics, beauty products and perfume as well as optical goods and other health and personal care products, as outlined by the US Census Bureau.

- In 2021, we expect the online share of US beauty retail sales to continue to increase but at a significantly lower rate than the estimated nine-percentage-point increase to 28% e-commerce penetration in 2020. This market size includes sales of personal care categories—such as bath products, hair care and shaving products—as well as the core beauty categories of cosmetics, fragrances and skin care.

- By beauty category, we expect that the demand for makeup will continue to be weak in 2021 due to the realities of wearing masks, working from home, self-isolation and social distancing requirements. However, we expect demand for specific categories within makeup—particularly products that are visible while wearing a mask, such as eyeliner, eyeshadow and mascara—to continue to rise in 2021. On the other hand, the share of total beauty sales from skincare products is likely to increase in 2021, given the ongoing shift in demand for skin care from older consumers to an increasingly younger consumer base and the impact of the crisis on accelerating self-care and pampering trends.

- In 2021, some crisis-induced shopping behaviors are likely to be retained, such as online beauty shopping and buying beauty products for home use. The near-term visibility for the beauty sector remains challenging owing to recent spikes in coronavirus cases in some parts of the US. Even with a vaccine, we do not see all beauty consumers as being confident enough to return to pre-crisis shopping behaviors in the near term. Furthermore, any vaccine rollout will take time and the impact of vaccine launch will be gradual.

- Amid still tough economic circumstances, we are seeing beauty brands and retailers, such as Coty, Estée Lauder and Ulta Beauty, experiencing a solid sales rebound in their most recent reported quarter—emphasizing strong recovery in the beauty category.

- Adoption of new beauty retail models, such as shoppable livestreaming

- Growing online traffic at DTC beauty brands

- Strong demand for certain beauty categories, such as skin care, eye makeup and eye-grooming tools

- Demand for contact-free retail to drive the adoption of technology in the beauty industry, such as touchless testers for skincare products and fragrances

- Weakening demand for the overall makeup products (except eye makeup)

- Ongoing requirement for face masks in public places and growing work-from-home norms

- A likely difficult start to the year, as consumers continue to avoid public places and social events are canceled following the late-2020 rise in the coronavirus cases in some parts of the US

- CBD: We expect to see growing demand for CBD and clean beauty products driven by wellness and sustainability trends as more consumers seek functional benefits in beauty, mental health, skin care and sleep care. Similarly, clean beauty remains a growing trend as more consumers emphasize sustainability, product traceability and mindful living.

- DIY and at-home beauty products and services: In 2021, we expect DIY and home-use beauty products and services to continue to witness strong demand as consumers spend more time at home than pre-crisis, with many displaying reduced willingness to visit beauty salons. Furthermore, digital advances such as virtual try-on services and beauty tutorials will help consumers to feel more at ease with DIY and at-home beauty products.

- Contactless in-store beauty shopping: We believe that many beauty brands and retailers will adopt touchless technologies in 2021 to provide an enhanced but contact-light in-store shopping experience. Furthermore, more beauty stores around the world will likely make enhancements to minimize physical contact, from automatic doors to touchless checkout.

US Home and Home-Improvement Retailers

Directional Outlook- We anticipate that overall growth in spending on furniture will soften in 2021, against robust comparatives for 2020. In terms of macro trends, we expect the positive effect of a solid outlook for house sales activity in 2021 to be offset partly by the fact that some furniture retail spending will have been drawn forward to 2020. We estimate a lower-single-digit increase in total furniture spending in 2021, versus the estimated 5.9% increase in spending in 2020. However, growth is likely to prove volatile as we lap the lockdown period and post-lockdown boom. In year-over-year terms, growth is therefore likely to be strongest in the first half of the year.

- Despite a vaccine rollout, the coronavirus crisis is likely to keep consumers at home more in 2021 than pre-crisis. Demand for furniture will be supported by the factor that the vaccination program is likely to take many months, by which time already established working-at-home and learning-at-home practices will have become even more entrenched. The notable caveat that may temper growth in the category is that a substantial part of the demand will likely have already been fulfilled in 2020. Assuming this exceptional demand eases off, performance in the furniture category is likely to be more closely tied to cyclical economic forces than it has been in 2020.

- With the strong performance in 2020, home-improvement retail sales in 2021 will be weighed against demanding comparatives, and we estimate a single-digit increase in total home-improvement retailers’ sales in 2021 versus an estimated increase of 13.0% in 2020 (benchmarked to Census Bureau data), under an assumption of a moderate recovery in the US economy. As with furniture, growth is likely to prove variable through the course of 2021: In year-over-year terms, growth is likely to be more robust earlier in the year, when the sector will be annualizing more moderate growth rates from 2020. We expect housing sales in 2021 to stay high, buoyed by historically low mortgage rates, but sales could taper off toward the end of 2021. We expect home-improvement sales trends to follow a somewhat similar trajectory.

- We also attribute the forecast of eased sales growth in 2021 to some homeowners having brought forward planned home-improvement projects to this year. Assuming this exceptional, crisis-prompted demand falls away, the sector’s performance is likely to become more closely tied to traditional underlying economic forces.

- We expect that retailers will continue to invest in enhancing their e-commerce fulfillment capabilities and becoming efficient omnichannel operators in areas such as ship from store, curbside pickup and BOPIS.

- We expect that some home and home-improvement retailers focused on brick-and-mortar sales will consider rationalizing their store footprint, with Williams-Sonoma, for example, having already announced that it anticipates a future with “fewer, better, more profitable stores.”

- Consumers increasingly moving from cities to larger suburban homes

- Real estate activity thriving in second-home markets

- The upsurge in homebuilding activity

- Consumer spending continuing to shift away from travel and experiences, leaving increased disposable income for home and home improvement

- The uncertain economic environment

- High unemployment levels in the US, coupled with low consumer confidence

- Uncertainty regarding further government stimulus decisions

- Supply chain investments: With the accelerated shift to e-commerce, managing logistics and last-mile delivery in the face of increased demand will continue to represent a significant challenge for retailers. We expect retailers to invest in e-commerce and efficient fulfillment that matches consumer expectations, such as ship from store, curbside pickup and BOPIS.

- Shifts away from experience-based spending: Home and home improvement will continue to gain from the experience economy’s loss. While the introduction of vaccines may gradually shore up the outlook for the experience economy, we expect that this will take many months, which augurs well for the home and home-improvement sector overall in 2021.

- Furniture-as-a-service: Startups focused on furniture-as-a-service are likely to continue to enjoy a favorable environment in 2021, particularly as work-from-home trends are likely to permeate and remain relevant in 2021.

Global Luxury Market

Directional Outlook- Coresight Research expects Covid-19 to continue to heavily impact the global personal luxury goods market in 2021. We expect the market to approach a return to pre-pandemic levels in late 2021 or early 2022 as the Covid-19 vaccine rollout becomes more widespread. We estimate that the global personal luxury goods market declined by 20–25% at constant exchange rates in 2020, to $257—275 billion, based on data from Euromonitor International. This is largely due to the widespread global impact of the coronavirus, which caused disruption in travel and decreased consumer discretionary spending.

- Among personal luxury product segments, we expect designer ready-to-wear (RTW) apparel and footwear to have been hit the hardest by Covid-19 as consumers are working from home as well as going out, socializing and traveling less—instances where people are most likely to flaunt new clothing. We expect designer RTW to outperform the post-pandemic recovery in 2021, benefiting from pent-up demand and consumers trading up with a “less but better” strategy.

- Luxury brands were slow to embrace e-commerce, with the fear that wider access and a less experiential selling environment would undermine a brand’s exclusivity. The Covid-19 pandemic has not just prompted brands to make the shift but has also accelerated brands’ digital strategies. For example, Moncler connected with its customers via livestreaming and offering digital appointments. Pent-up demand could drive luxury shoppers to increasingly seek such convenient ways of accessing their favorite brands.

- Travel and tourism are important drivers of spending in the luxury sector, but international travel is currently almost at a standstill and domestic travel has reduced significantly. Even though vaccinations against the coronavirus have been rolled out in some regions, we believe that people will remain reluctant to travel internationally for some time until vaccines are more widespread and infection rates have dropped significantly. While visits to international luxury flagship locations have dropped, some spending has been reallocated to online luxury shopping.

- Chinese luxury shoppers have been instrumental to growth in the global luxury sector for the last twenty years and will remain a key driver of the market based on their number and economic motivation. Until Covid-19, most luxury spending by Chinese consumers has taken place abroad—70% of total luxury spending by Chinese consumers, some €68 billion ($75 billion), was outside of China in 2019, according to Coresight Research estimates based on Bain & Company data.

- For our Chinese outbound tourist survey, in late September and early October 2020, we surveyed 770 Chinese Internet users who had spent at least one night on a trip outside of Mainland China (referred to as “travelers”), with a focus on the implications of Covid-19 for respondents’ plans for their next overseas trips. Some 72.2% of travelers said that the pandemic will change how they travel after 2020. Among travelers that expect to change how they travel, 84.7% said they will travel less to international destinations, and 79.5% will avoid crowded destinations.

- Some 68.8% of tourists who have traveled in the last 12 months and plan to travel overseas after September 2020 expect to buy luxury goods on their next trip, especially in the beauty and handbags categories.

- As China embraces signs of recovery from the pandemic, we are seeing consumers begin to return to stores. A number of luxury brands, such as Ralph Lauren and Tapestry, reported business in China being further on the path to recovery compared to European and North American markets based on performance in the quarters ended in September 2020. Beyond 2021, we believe that Chinese consumers will continue to be a key driver of global luxury growth, fueled by the expanding middle class and increasing spending power among younger generations.

- Recovery in the US and Europe is likely to be slower than the recovery momentum we see in China due to higher infection rates and lockdowns closing nonessential businesses for a second time in some regions, muting store traffic. Retailers in the US and Europe will also be dependent on domestic demand amid reduced international travel, and domestic consumers are typically not as disposed to luxury spending as Chinese luxury shoppers are.

- Pent-up demand will likely drive consumers to seek out luxury brands.

- “Revenge shopping” may lead consumers to splurge and overcompensate for the shopping time “lost” due to pandemic-related restrictions and closures.

- Consumers are trading up to buy better products as a result of unspent disposable income.

- Reduced travel and tourism will continue to impact luxury sales.

- A weak global macroeconomic backdrop, spanning high unemployment and resulting reduced disposable incomes, will continue to impact consumers’ ability to spend.

- Digital expansion: E-commerce will command center stage in brands’ strategies. As consumers adopt new habits during the pandemic, we believe that many of these behaviors will persist even after the pandemic ends. Luxury brands will continue to accelerate digital and e-commerce strategies to serve this new consumer so as not to be left behind.

- Innovative consumer engagement: Brands will likely increasingly adopt technology— such as gamification, livestreaming and AR/virtual reality (VR)—to engage with customers. Several luxury brands, such as Balenciaga and Burberry, have been early adopters of emerging technologies, and the natural curve for a new technology is for it to gain wider acceptance after it has crossed the early adoption phase. We think that more brands will implement new technologies that help consumers to shop safely, as well as for launching new collections, as in-person fashion shows may take considerable time to return.

- Sustainability: We expect sustainability to gain greater focus as consumers increasingly reflect on responsible shopping. The pandemic has largely made shoppers more conscious about their decisions—regarding spending and otherwise. Shoppers are likely to research more about a brand and its sustainability policies and actions before they decide to make a significant purchase. We think brands will also accelerate their sustainability initiatives to meet the concerns of the new, conscious shopper.

Global Retail Technology Market

Directional Outlook- Vendors of retail technology experienced a solid 2020, with revenues increasing by mid-single digits, driven by strength in e-commerce, Internet and the cloud. We expect 2021 to be at least as robust, with other sectors of retail and the broader economy able to invest again.

- Supply chains, along with their agility and robustness, became the central focus of retailers in 2020 in the context of enormous swings in demand. Until enough of the population has been vaccinated, swings in demand are still likely in hotspots. Supply chains will also have to adapt again once consumer buying behavior reverts to pre-crisis normalized patterns.

- Enterprises are continuing to digitalize and move their IT operations to the cloud, which makes them more nimble and offers substantial scale to accommodate seasonal or one-time surges in computing needs. Operating in the cloud also enables retailers to innovate at a higher level, due to more frequent software updates and the ability to develop in the cloud.

- The steady increase in the competitiveness of retail—fueled by data-powered e-commerce companies and international competitors—is making use of tools such as artificial intelligence (AI) and machine learning (ML) essential to find relationships among data and steadily look for hidden revenues and areas for efficiency improvement.

- Many retailers and other enterprises were caught unprepared by the outbreak and upgraded their technology infrastructure to be more resilient and accommodate remote work and collaboration. Companies are likely to maintain and upgrade these capabilities to be better prepared for future unforeseen developments, with many having benefited from conducting business in a more decentralized way.

- Continued growth in retail sales gives retailers a stronger foundation for investing in technology in 2021.

- The increase in e-commerce penetration requires retailers to continue to invest in infrastructure and capacity to catch up with large retailers and meet growing demand.

- Retailers that suspended or postponed technology investments in 2020 are likely to resume programs with improving visibility on the economic outlook.

- Retailer liquidations and store closures equates to fewer retailers and locations that are capable of and require investment, particularly in physical retail.

- Retailers are still likely to continue to prioritize essential technology investments, which have a quick and calculable return, rather than broad spending without a quantifiable return on investment.

- Supply-chain modernization and enhancement: Maintaining and improving supply chains is a never-ending process, and the combination of future unpredictable swings and an increasingly competitive environment makes a flexible, automated supply chain a necessity.

- Urgency of AI/ML: Beyond supply chain automation and efficiency improvement, Al/ML technology helps retailers compete more effectively in intelligently engaging customers, communicating with them and removing friction online and offline.

- Enterprise collaboration and remote work: Enterprises and employees rapidly took advantage of collaboration and communication tools during lockdowns, and the success of these tools has opened the door to new ways of working, which we expect to remain into 2021.

US REITs Sector

Directional Outlook- It is hard to be optimistic for US shopper demand for physical store formats into early 2021, given the current health crisis. However, it is also difficult to imagine that 2021 overall will be worse than 2020 for discretionary brick-and-mortar retail demand. We expect further substantial improvements in in-store demand to be weighted toward the second half of the year—one consideration for REITs is whether all of their tenants can survive a further-delayed return to near-normal demand.

- Although store closures were not as bad as feared in 2020, we remain concerned that many closures have been shifted into 2021. What closures we saw in 2020 were weight toward sectors with a strong mall presence: As of December 18, 36.8% of all 8,688 store closures were by apparel and footwear retailers with a further 15.5% by department stores—and those department stores will account for a hugely disproportionate share of closed square footage and shopping-center anchors (see the department store section earlier in this report for information on planned 2021 closures).

- Both in 2021 and over the medium term, we expect demand for space from traditional mall tenants, such as department stores, to decline further as many shutter stores and scale back their brick-and-mortar expansion plans. As a result, malls will continue to turn toward more resilient, non-traditional tenants—including health care, grocery, residential-use, and online and digitally native brands—to arrest declining occupancy rates and foot traffic. We also expect to see former retail space being repurposed as fulfillment centers for online operations—although the opportunities here are highly dependent on localized demand and the suitability for conversion.

- We expect sustained relative resilience for outdoor shopping center formats versus enclosed malls, due to perceived safety versus enclosed centers and due to the tenant mix in some open-air formats.

- Coresight Research’s surveys have consistently recorded shopping centers/malls as the most-avoided types of places by US consumers: As of December 15, 58% were avoiding shopping centers/malls; and 26% expect to retain the habit of buying more online, less in-store once the crisis eases or ends. These data all point toward challenges for retail spaces and property owners.

- The continued disruption in retail put tension on the relationship between tenants and landlords, most notably in cases where retailers made sometimes-aggressive, pre-emptive declarations on their willingness to pay rent. Many retailers and REITs are likely to see a frayed tenant-landlord relationship as a result of the crisis.

- The traditional, enclosed mall format was struggling pre-crisis. The Covid-19 pandemic has amplified difficulties through reduced rents, tenant bankruptcies and an apparently sustained reluctance among consumers to return to covered malls. Malls that will be most affected by closures will be the Class B, C and D malls, which have higher vacancy rates and are struggling the most with waning consumer appeal. Higher-end Class A malls are less likely to be impacted as severely, given that they generate higher sales per square foot at superior locations and have a mixed-use value proposition. REITs with greater degrees of exposure to non-mall centers, such as open-air centers also look more resilient.

- Reflecting the challenges facing the REITs sector, two companies—CBL & Associates and Pennsylvania Real Estate Investment Trust—filed for bankruptcy in November. While we have seen many retail bankruptcy filings, REIT bankruptcy filings remain rare.

- Near-zero interest rates and stimulus packages can help the retail economy to recover. Pent-up demand in the post-coronavirus era may lead consumers to miss physical shopping experiences and increase outings to shopping centers.

- The potential easing of infection rates amid vaccination will likely result in an improvement in shopper demand for brick-and-mortar retail during 2021.

- The US pandemic crisis continuing into early 2021

- The ever-growing expansion of e-commerce as a structural headwind for the physical retail industry—even more so during the Covid-19 crisis

- High unemployment rates and low levels of business activity, resulting in reduced demand for commercial real estate, putting pressure on retail REITs

- As uncertainty related to the health situation looks set to remain into 2021, the probability of additional lease cancelations in the upcoming months due to retailers’ bankruptcies and store closures is high. Retail rents likely face downward pressure as stores continue to close.

- Nontraditional tenants: In malls, we expect to see an incrementally greater proportion of nontraditional tenants such as grocery and health care backfill the vacant space created by department stores and apparel stores. Other new types of tenants include digitally native brands and CBD stores.

- Safety innovations: Many consumers are still worried about returning to indoor malls as the pandemic drags on, implying further relative resilience for open-air formats. Meanwhile, mall operators can continue to offer safe and innovative ways to serve retailers and customers, including by extending retailers’ offerings outdoors through open-air pop-ups or curbside pickup points in parking lots that serve all participating tenants.

- Digital programs: Under pressure due to rising e-commerce and a large number of consumers staying away from malls for an extended period, mall operators are launching their own digital programs, underpinning collaboration with retail tenants to extend their customer reach. This includes livestreaming—an opportunity to generate shopper excitement in 2021.

Source for all Euromonitor data: Euromonitor International Limited 2020 © All rights reserved IRI Disclaimer: The information contained herein is based in part on data reported by the IRI E-Market Insights™ solution and as interpreted solely by Coresight Research. The information is believed to be reliable at the time supplied by IRI but is neither all-inclusive nor guaranteed by IRI or Coresight Research, Inc. Without limiting the generality of the foregoing, specific data points may vary considerably from other information sources. Any opinion expressed herein reflect the judgement of Coresight Research, Inc. and are subject to change. IRI disclaims liability of any kind arising from the use of this information.