DIpil Das

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting at the end of January until the April 15 deadline. This year, in response to the ongoing coronavirus outbreak, the US Department of the Treasury (of which the IRS is a division) announced the deadline to file (and more importantly, to pay) has been extended to July 15. In this report, we look at what happened in the eighth week of the 2020 tax filing season.

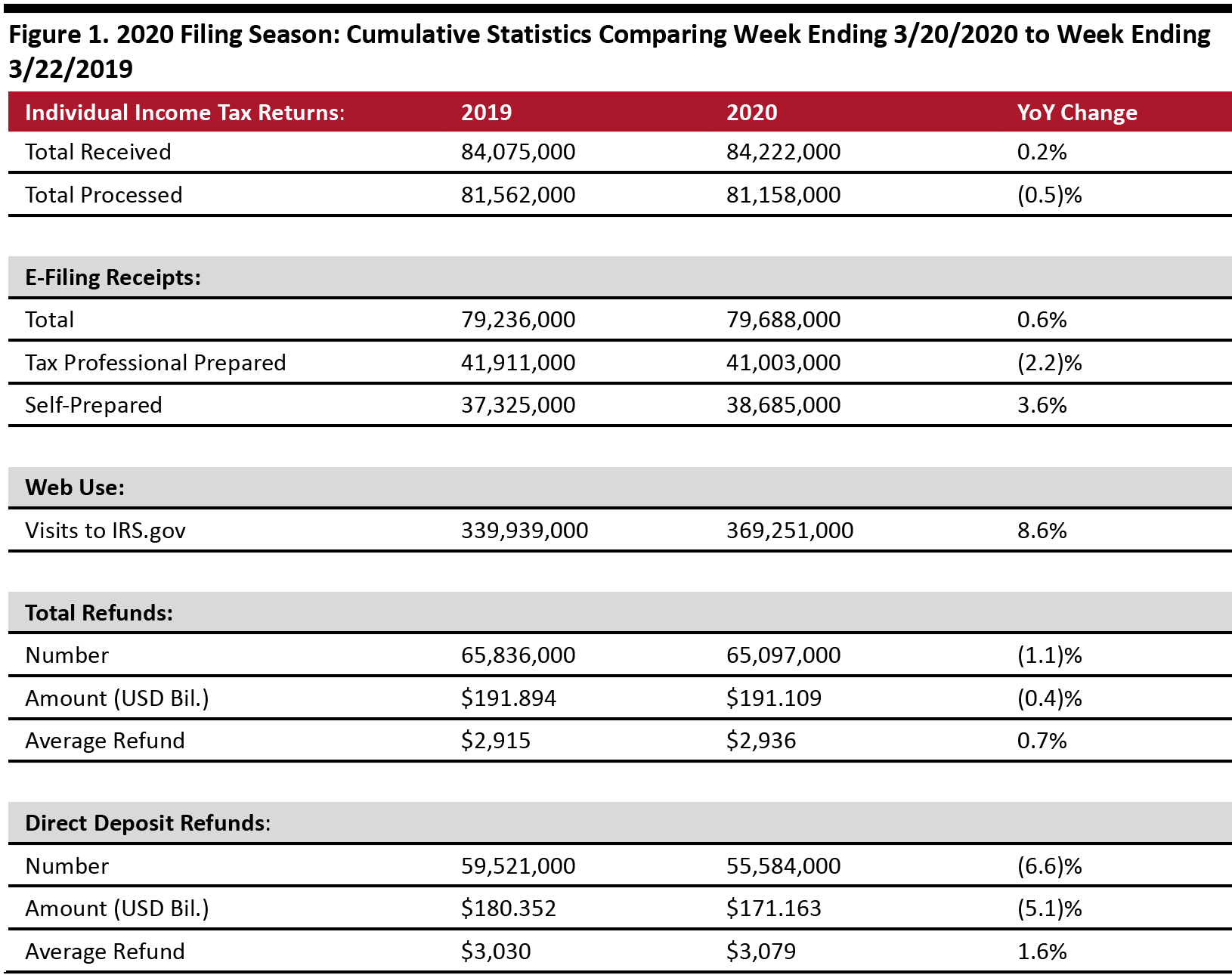

As of March 20, 2020:

Source: IRS [/caption]

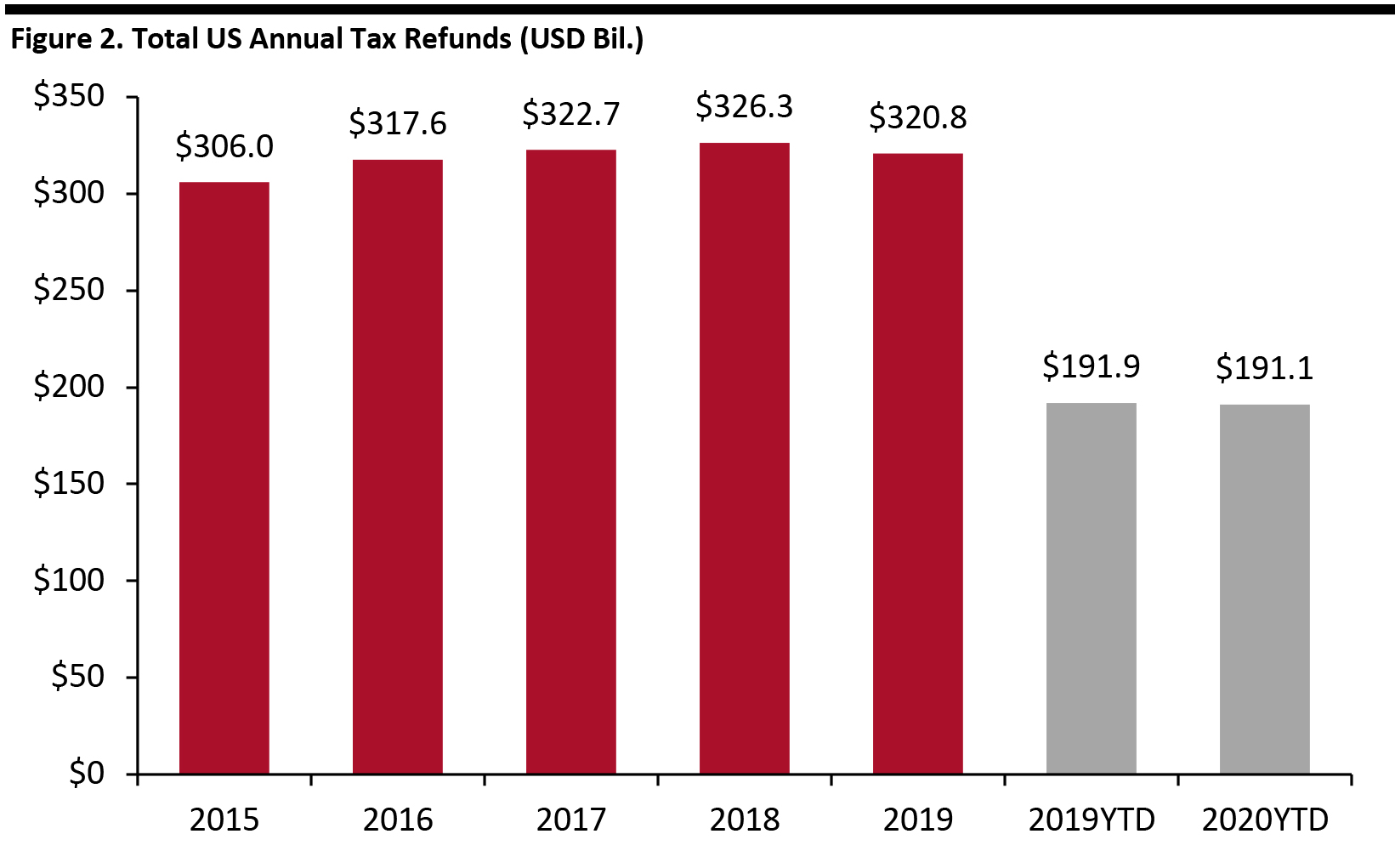

The graph below shows total refunds increasing at a 1.2% CAGR during 2015-2019.

[caption id="attachment_106847" align="aligncenter" width="700"]

Source: IRS [/caption]

The graph below shows total refunds increasing at a 1.2% CAGR during 2015-2019.

[caption id="attachment_106847" align="aligncenter" width="700"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS had received 84.2 million tax returns and processed 81.2 million. The number of returns processed was down 0.5% year over year.

- Of the returns filed already, 94.6% were filed electronically. Of those, 51.5% were prepared by tax professionals, the remaining 48.5% were self-prepared.

- With IRS temporarily closing down all Taxpayer Assistance Centers and suspending all in-person customer service nationwide, more taxpayers are going online for information: The IRS website logged about 369.3 million visits, up 8.6% year over year.

- A total of 65.1 million refunds had been issued as of March 20, totaling $191.1 billion and averaging $2,936. The number of refunds was down 1.1% and the total amount refunded was down 0.4% year over year. However, the average refund grew 0.7% year over year.

- Of those refunds issued, 85.4% were paid using direct deposit. The average direct deposit refund was $3,079, up 1.6% year over year.