DIpil Das

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting at the end of January until the April 15 deadline. In this report, we look at the fifth week of the 2020 tax filing season.

The IRS kicked off the 2020 tax filing season on January 27 when it began accepting tax returns for 2019. The IRS expects to process over 150 million individual tax returns in 2020, and that most will be filed before the April 15 deadline.

As of February 28, 2020:

Source: IRS [/caption]

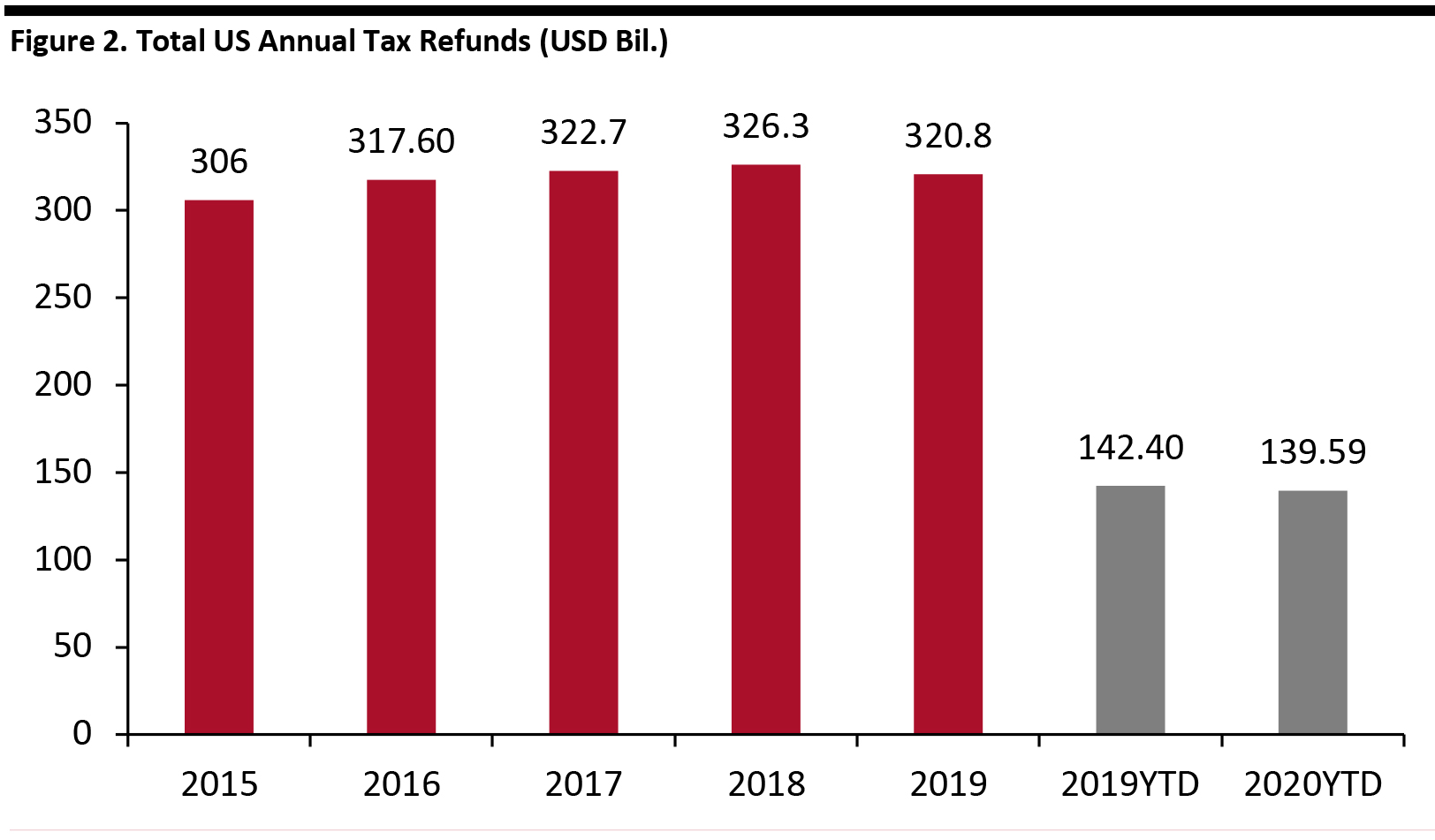

The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019.

[caption id="attachment_105022" align="aligncenter" width="700"]

Source: IRS [/caption]

The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019.

[caption id="attachment_105022" align="aligncenter" width="700"] Source: IRS[/caption]

Tax Filings: Consumer Outlook

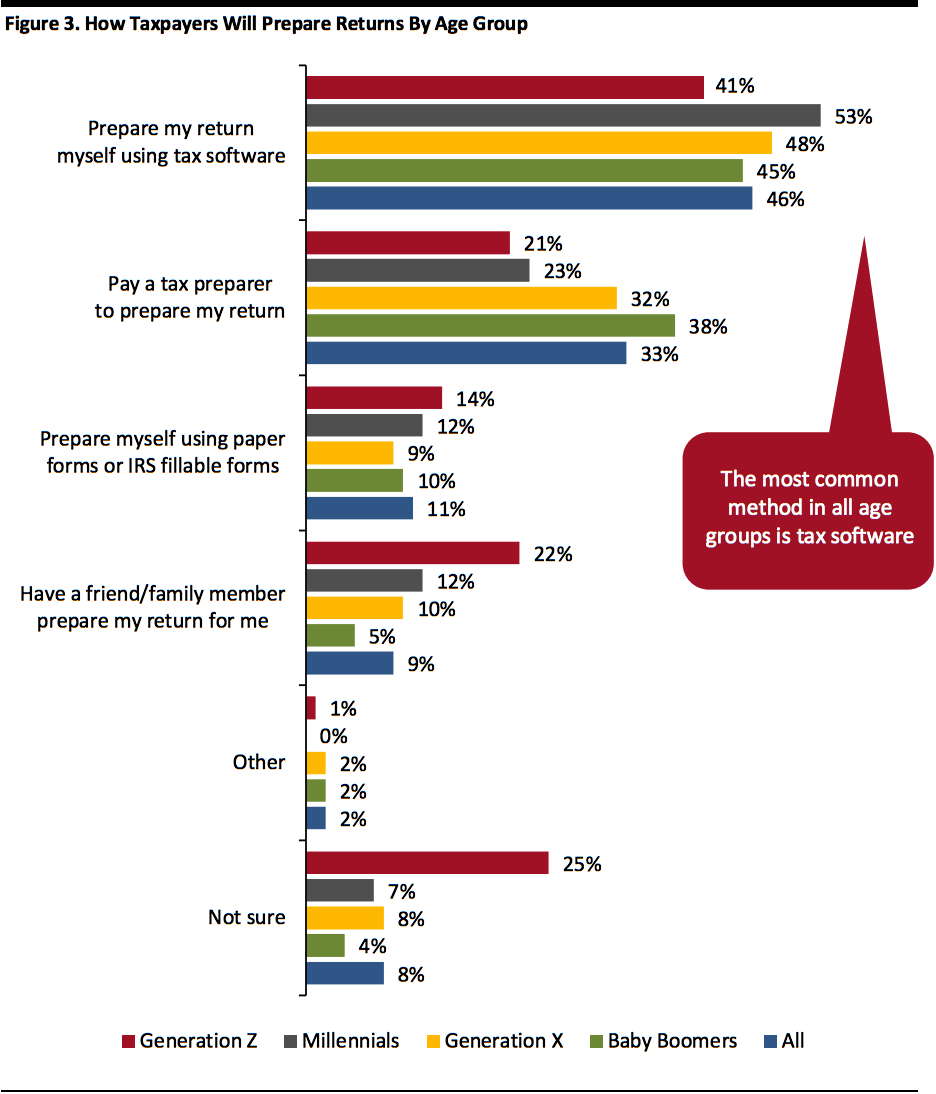

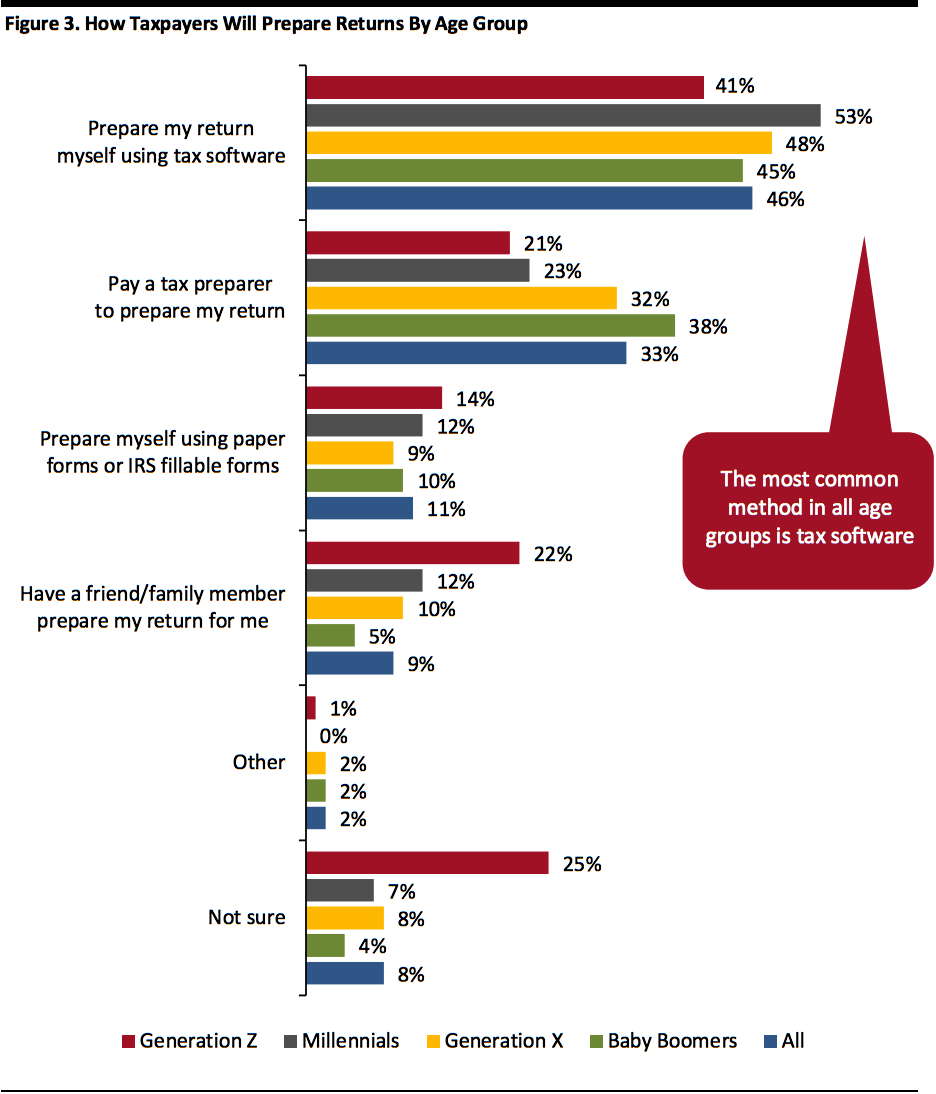

According to a survey conducted by personal finance service provider NerdWallet, nearly half of those who will file a tax return in 2020 (46%) will use a tax software, while one-third (33%) will pay a third-party tax preparer. The survey also revealed that, strangely, millennials and Gen Zers are more likely than any other age group to file a paper return (14% and 12% respectively) than an electronic one.

[caption id="attachment_105037" align="aligncenter" width="700"]

Source: IRS[/caption]

Tax Filings: Consumer Outlook

According to a survey conducted by personal finance service provider NerdWallet, nearly half of those who will file a tax return in 2020 (46%) will use a tax software, while one-third (33%) will pay a third-party tax preparer. The survey also revealed that, strangely, millennials and Gen Zers are more likely than any other age group to file a paper return (14% and 12% respectively) than an electronic one.

[caption id="attachment_105037" align="aligncenter" width="700"] NerdWallet defines generations as follows: Baby Boomers, born 1946-1964; Generation X, born 1965-1980; Millennials, born 1981-1996; Generation Z, born in 1997 and later

NerdWallet defines generations as follows: Baby Boomers, born 1946-1964; Generation X, born 1965-1980; Millennials, born 1981-1996; Generation Z, born in 1997 and later

Source: NerdWallet[/caption] The survey revealed that many taxpayers have extremely high trust in their tax preparers: Nearly 45% of those who hire a tax preparer in the past five years said they only “glance” through their return before signing and filing, while 16% sign without reviewing at all. The survey also found over half (54%) of taxpayers who have hired a tax preparer in the past five years incorrectly believe tax preparer is responsible for defending the tax return to IRS in the event of an audit. Additionally, almost 36% of Americans incorrectly believe tax preparers are responsible for additional payments owed to the IRS in case an audit exposes errors in a return they filed.

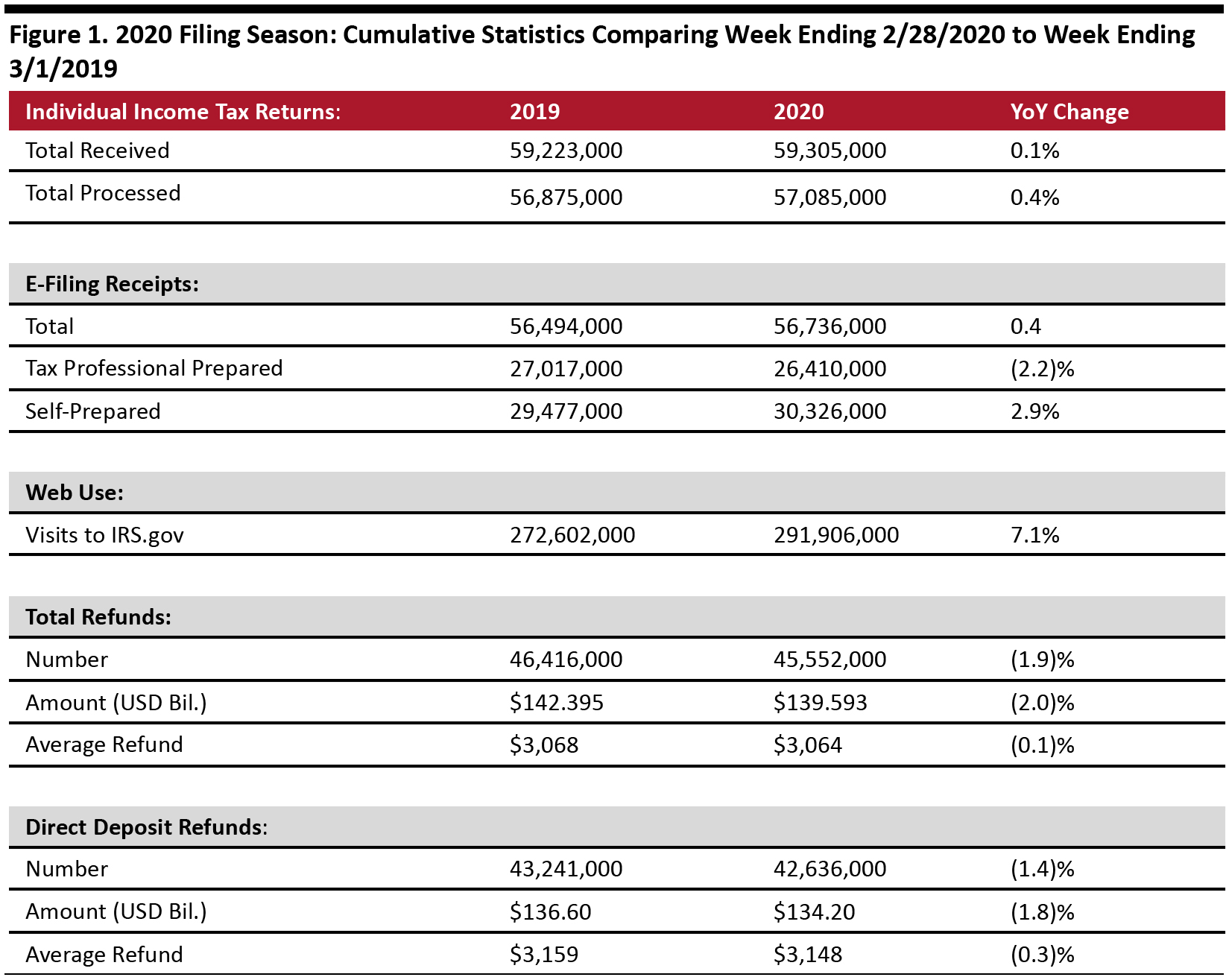

- The IRS had received 59.3 million tax returns and processed 57.1 million. The number of returns processed was up 0.4% year over year.

- The share of taxpayers filing electronically continues to increase steadily. Of the returns filed already, 95.7% were filed electronically. Of those, 46.5% were prepared by tax professionals, the remaining 53.5% were self-prepared.

- A higher number of taxpayers used the IRS website for information: The site logged about 291.9 million visits, up 7.1% year over year.

- A total of 45.6 million refunds had been issued as of February 28, totaling $139.6 billion and averaging $3,064 each. The number of refunds issued was down 1.9% and the total amount refunded was down 2% year-over-year. The average refund was also lagging 0.1% year over year.

- Of those refunds issued, 93.6% were paid using direct deposit. The average direct deposit refund was $3,148 down 0.8% year over year.

NerdWallet defines generations as follows: Baby Boomers, born 1946-1964; Generation X, born 1965-1980; Millennials, born 1981-1996; Generation Z, born in 1997 and later

NerdWallet defines generations as follows: Baby Boomers, born 1946-1964; Generation X, born 1965-1980; Millennials, born 1981-1996; Generation Z, born in 1997 and laterSource: NerdWallet[/caption] The survey revealed that many taxpayers have extremely high trust in their tax preparers: Nearly 45% of those who hire a tax preparer in the past five years said they only “glance” through their return before signing and filing, while 16% sign without reviewing at all. The survey also found over half (54%) of taxpayers who have hired a tax preparer in the past five years incorrectly believe tax preparer is responsible for defending the tax return to IRS in the event of an audit. Additionally, almost 36% of Americans incorrectly believe tax preparers are responsible for additional payments owed to the IRS in case an audit exposes errors in a return they filed.