DIpil Das

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting at the end of January until the April 15 deadline. In this report, we look at what happened in the third week of the 2020 tax filing season.

The IRS kicked off the 2020 tax filing season on January 27 when it began accepting tax returns for 2019. The IRS expects to process over 150 million individual tax returns in 2020, and that most will be filed before the April 15 deadline.

As of February 14, 2020:

Source: IRS [/caption]

The IRS noted that the PATH Act, Section 201 requires the agency to hold the tax refunds of any individual who claims the EITC or the ACTC until February 15, and so it did not include tax refunds held due to the PATH Act in this week’s report, but data from the same period last year would have included those returns. Therefore, the IRS expects cumulative tax refund numbers for week ending February 21, 2020 to be significantly higher and closer to the figures reported for the same period in 2019.

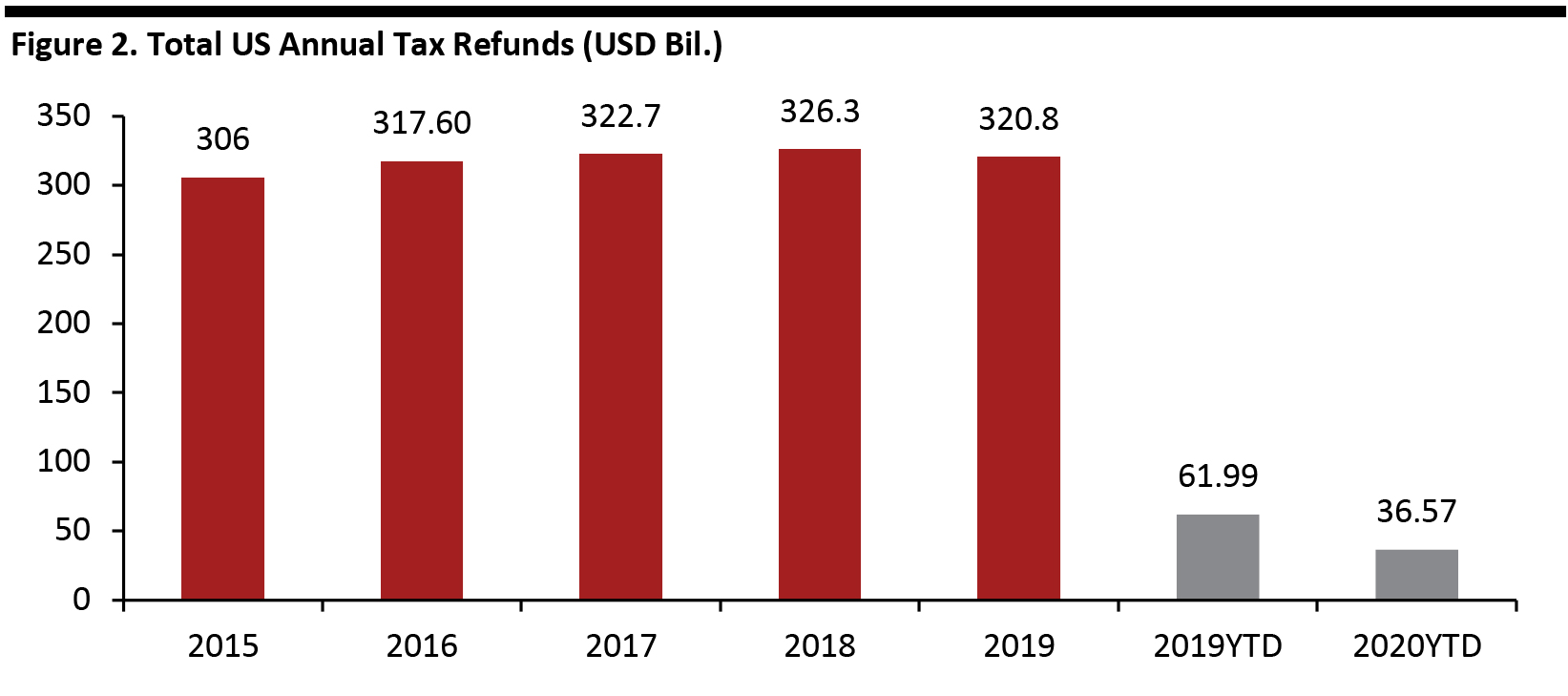

The graph below shows total annual refunds increasing at a 1.2% CAGR during 2015-2019.

[caption id="attachment_104723" align="aligncenter" width="700"]

Source: IRS [/caption]

The IRS noted that the PATH Act, Section 201 requires the agency to hold the tax refunds of any individual who claims the EITC or the ACTC until February 15, and so it did not include tax refunds held due to the PATH Act in this week’s report, but data from the same period last year would have included those returns. Therefore, the IRS expects cumulative tax refund numbers for week ending February 21, 2020 to be significantly higher and closer to the figures reported for the same period in 2019.

The graph below shows total annual refunds increasing at a 1.2% CAGR during 2015-2019.

[caption id="attachment_104723" align="aligncenter" width="700"] Source: IRS [/caption]

Tax Returns: Consumer Perceptions for 2020

According to a recent survey conducted by personal finance company Credit Karma, more than half of respondents (55%) indicated they would prefer to get a tax refund rather than have more money in their paychecks, while only 34% said they would prefer to pay exactly the right amount of withholding tax and not get a refund. The survey also found almost 44% are enthusiastic about tax refunds, saying they are the biggest “paycheck” of the year.

The survey also uncovered a number of public misconceptions about how the tax refunds work. Although 46% said they are aware tax refunds come from the money they paid to the government, the same number of respondents thought that the money comes from the government. Almost 4% of the respondents said they don’t know the source of their refund at all.

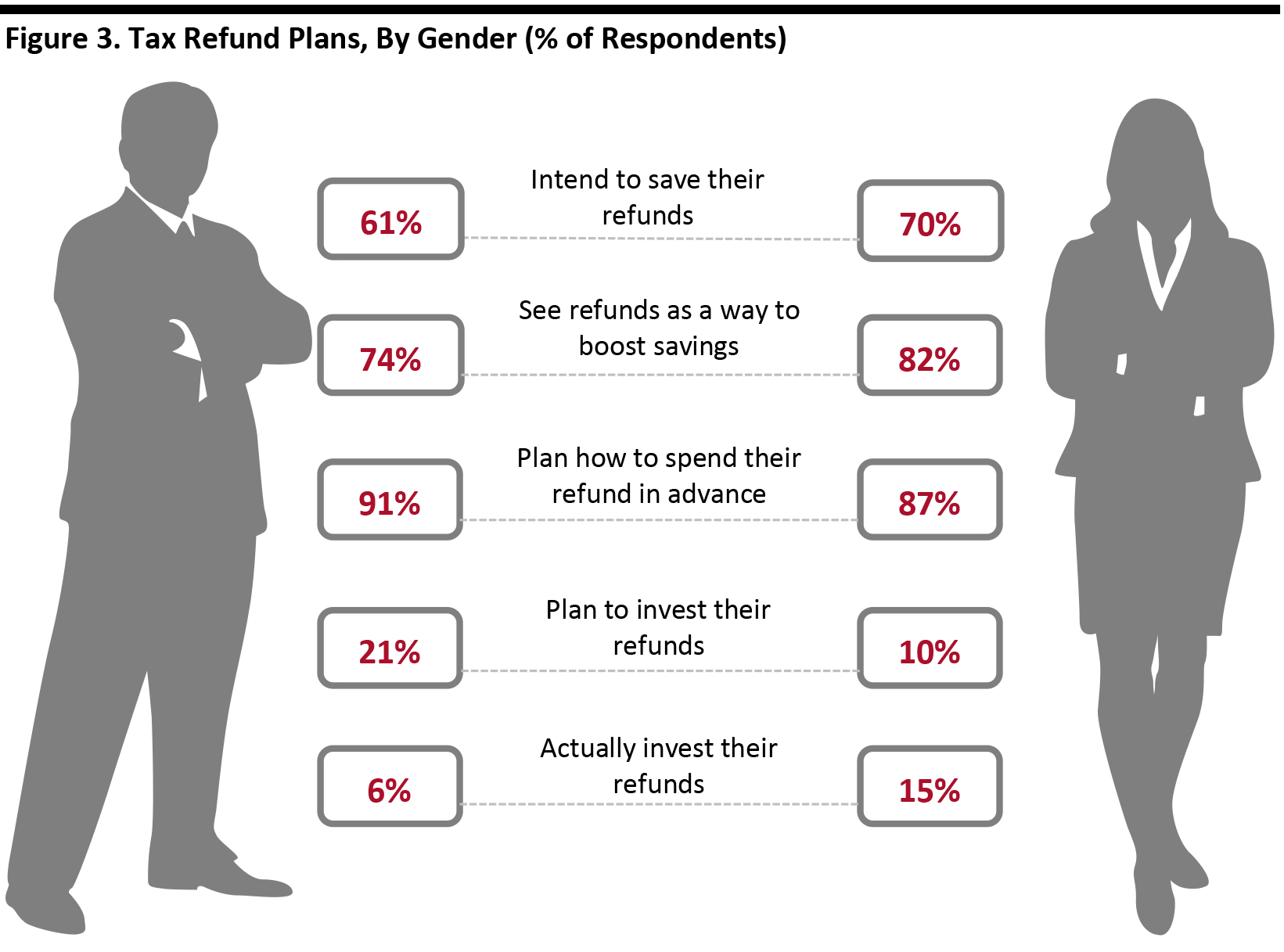

A separate survey conducted by tax preparation software company Turbo Tax pointed out that young consumers are more mindful about money, with 14% of those aged 18–35 likely to invest money for the future, compared to 7% of those aged 45 years and over. The survey also found women are more likely than men to use tax refunds to boost savings, while men are more likely to plan in advance how to spend their tax refunds.

[caption id="attachment_104724" align="aligncenter" width="700"]

Source: IRS [/caption]

Tax Returns: Consumer Perceptions for 2020

According to a recent survey conducted by personal finance company Credit Karma, more than half of respondents (55%) indicated they would prefer to get a tax refund rather than have more money in their paychecks, while only 34% said they would prefer to pay exactly the right amount of withholding tax and not get a refund. The survey also found almost 44% are enthusiastic about tax refunds, saying they are the biggest “paycheck” of the year.

The survey also uncovered a number of public misconceptions about how the tax refunds work. Although 46% said they are aware tax refunds come from the money they paid to the government, the same number of respondents thought that the money comes from the government. Almost 4% of the respondents said they don’t know the source of their refund at all.

A separate survey conducted by tax preparation software company Turbo Tax pointed out that young consumers are more mindful about money, with 14% of those aged 18–35 likely to invest money for the future, compared to 7% of those aged 45 years and over. The survey also found women are more likely than men to use tax refunds to boost savings, while men are more likely to plan in advance how to spend their tax refunds.

[caption id="attachment_104724" align="aligncenter" width="700"] Source: Turbo Tax[/caption]

Source: Turbo Tax[/caption]

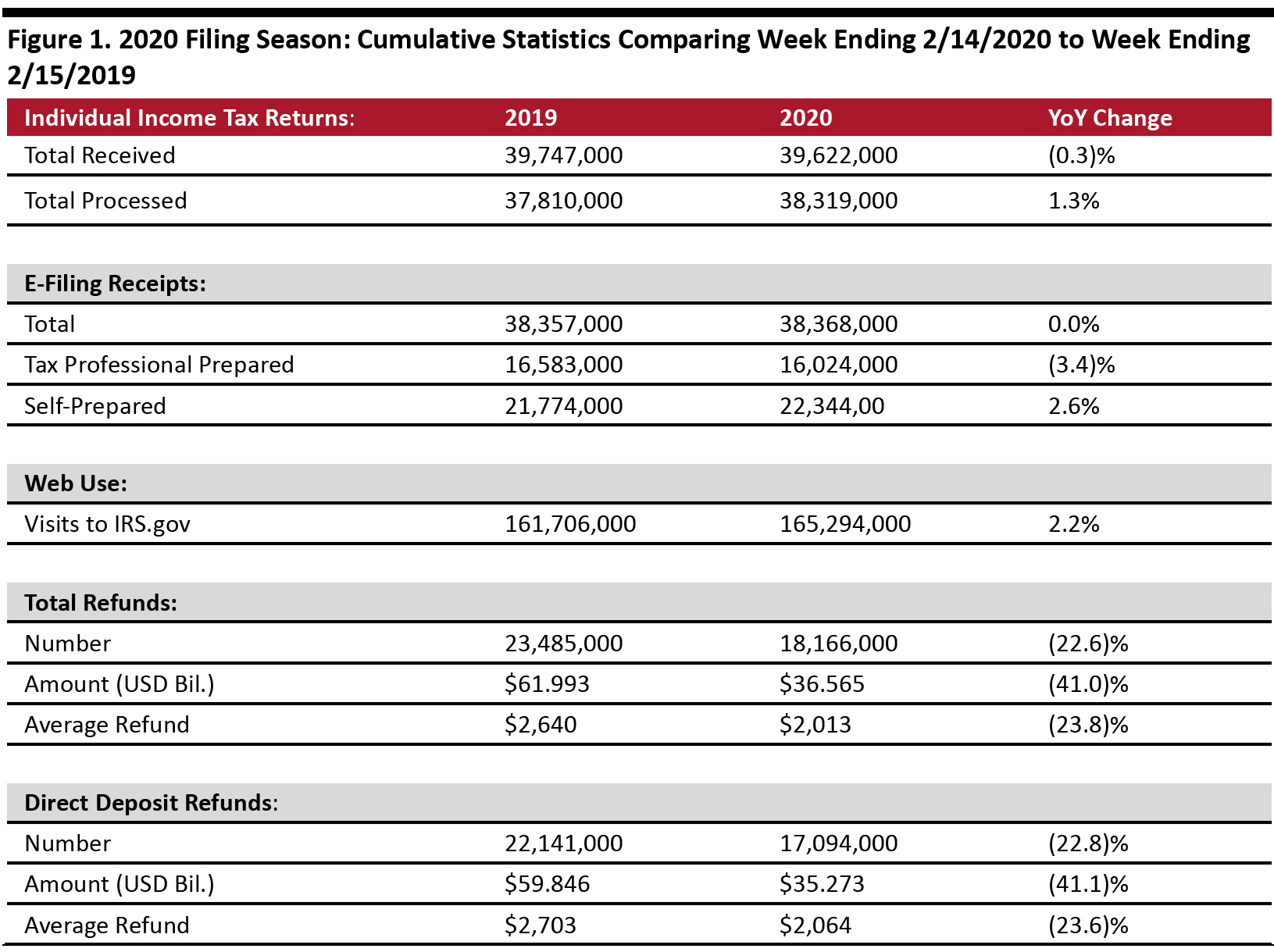

- As of February 14, the IRS had received 39.6 million tax returns, down 0.3% year over year, and had processed 38.3 million, up 1.3% year over year.

- Of the returns filed, 96.8% were filed electronically, higher than the same period last year. Of those, 41.8% were prepared by tax professionals, the remaining self-prepared.

- The number of taxpayers using the IRS website to access information is increasing: The site logged about 165.3 million visits, up 2.2% from last year.

- A total of 18.2 million refunds had been issued as of February 14, totaling $36.57 billion and averaging $2,013 each. The number of refunds issued was down 22.6% and the total amount refunded was down 41% year-over-year. The average refund was also lagging 23.8% year over year.

- Of those refunds issued, 94.1% were paid using direct deposit. The average direct deposit refund was $2,064, down 23.6% year over year.