Nitheesh NH

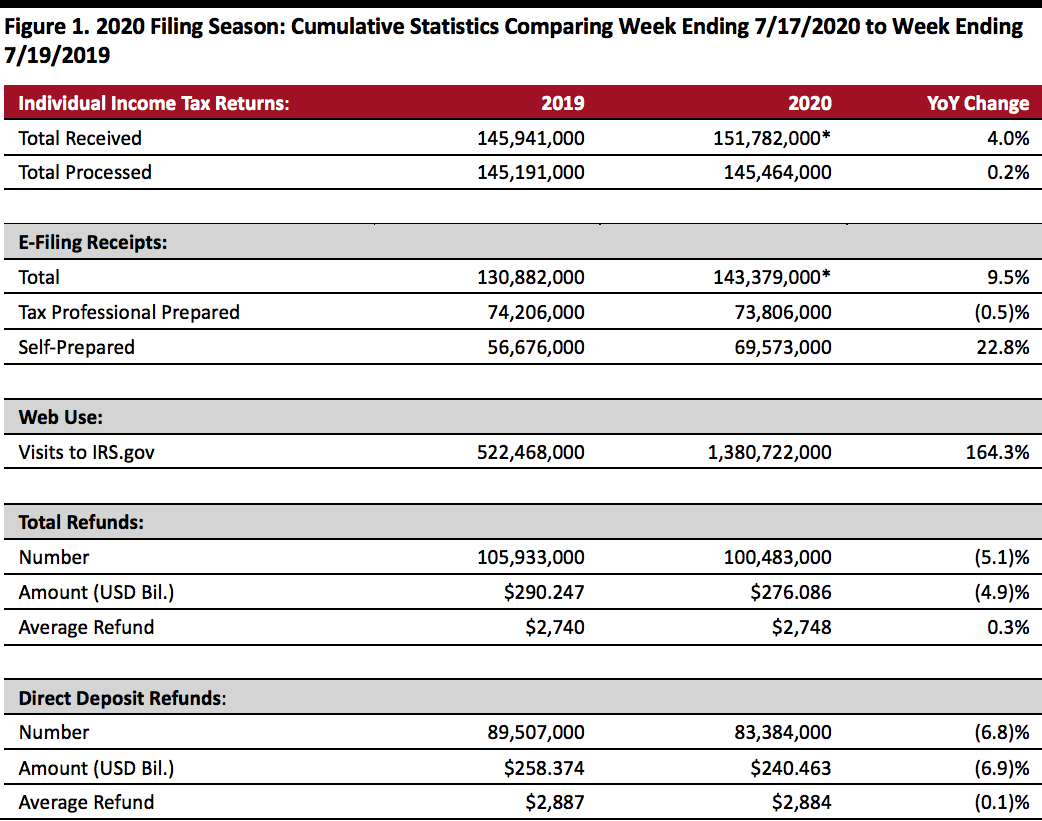

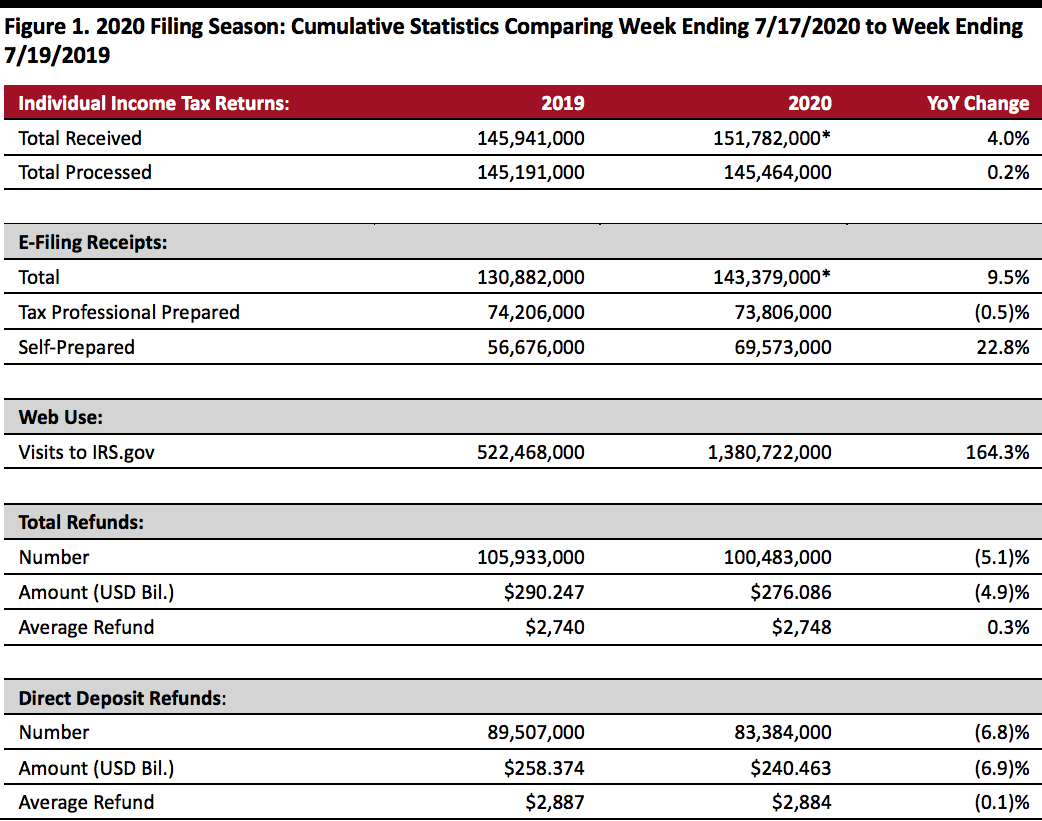

The 2020 tax season—which kicked off on January 27 and was extended to July 15 in response to the coronavirus outbreak—has wrapped up, although late returns will trickle in throughout the remainder of the year. This season, the total refund value trailed last year’s total by 4.9%, while the average refund size was flat, up by just $8. The IRS noted that it is experiencing delays in processing paper tax returns due to staff shortages, leading to refund delays.

This report represents the final tax tracker for this year’s tax season.

As of July 17, 2020:

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

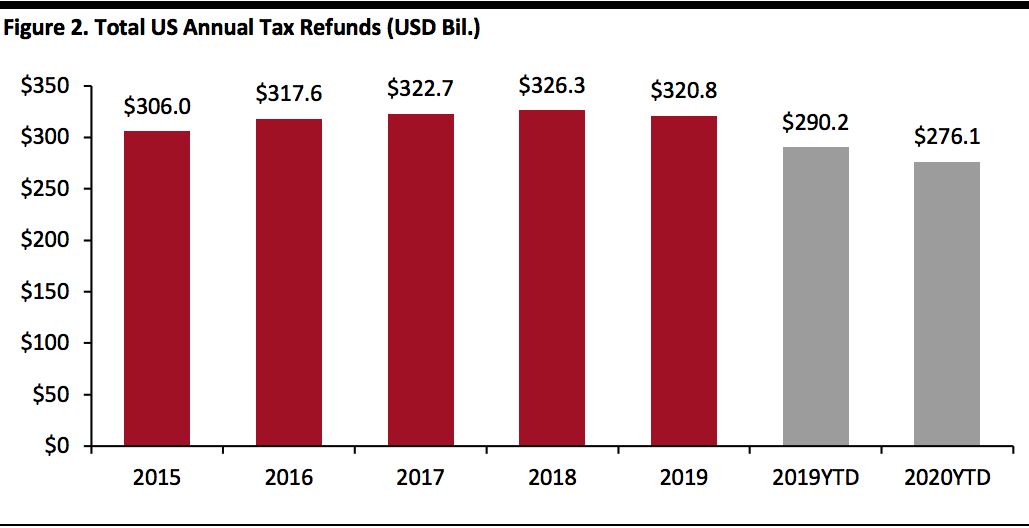

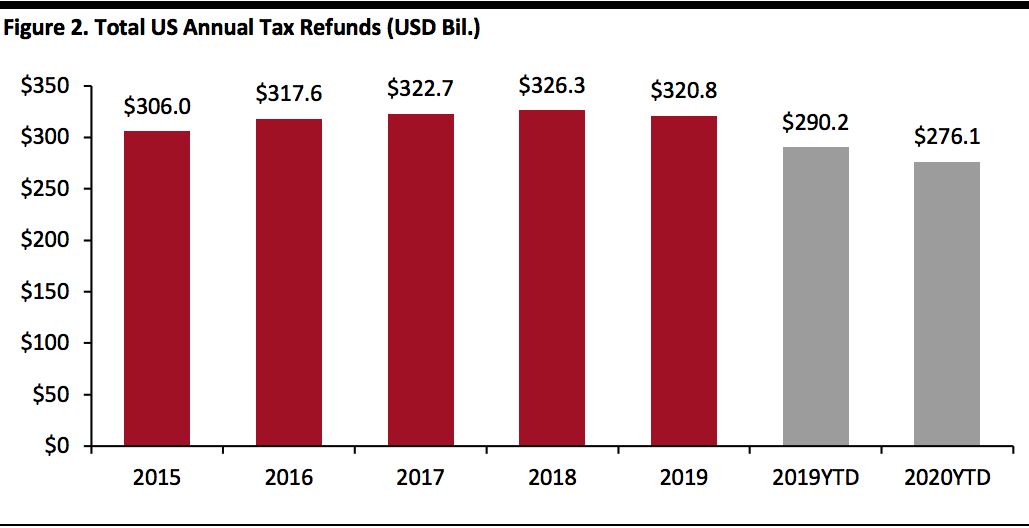

Source: IRS[/caption] The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019. [caption id="attachment_113579" align="aligncenter" width="700"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS had received 151.8 million tax returns and processed 145.5 million. The number of returns received was up 4.0% year over year, while those processed increased by 0.2%.

- Of the returns already filed, 94.5% were filed electronically. Of those, 51.5% were prepared by tax professionals, and the remaining 48.5% were self-prepared.

- The IRS temporarily closed all Taxpayer Assistance Centers and suspended in-person customer services nationwide—although some centers offered service by appointment. A high number of taxpayers therefore used the IRS website for information. The site logged 1.38 billion visits, up 164.3% year over year.

- A total of 100.5 million refunds had been issued as of July 17, totaling $276.1 billion and averaging $2,748 each. The number of refunds issued was down 5.1%, and the total amount refunded was down 4.9%, year over year. However, the average refund was roughly flat, up by only 0.3% year over year.

- Of those refunds issued, 83.0% were paid using direct deposit. The average direct deposit refund was $2,884, down 0.1% year over year.

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returnsSource: IRS[/caption] The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019. [caption id="attachment_113579" align="aligncenter" width="700"]

Source: IRS[/caption]

Source: IRS[/caption]