DIpil Das

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting at the end of January until the April 15 deadline. In this report, we look at what happened in the second week of the 2020 tax filing season.

As of February 7, 2020:

Source: IRS [/caption]

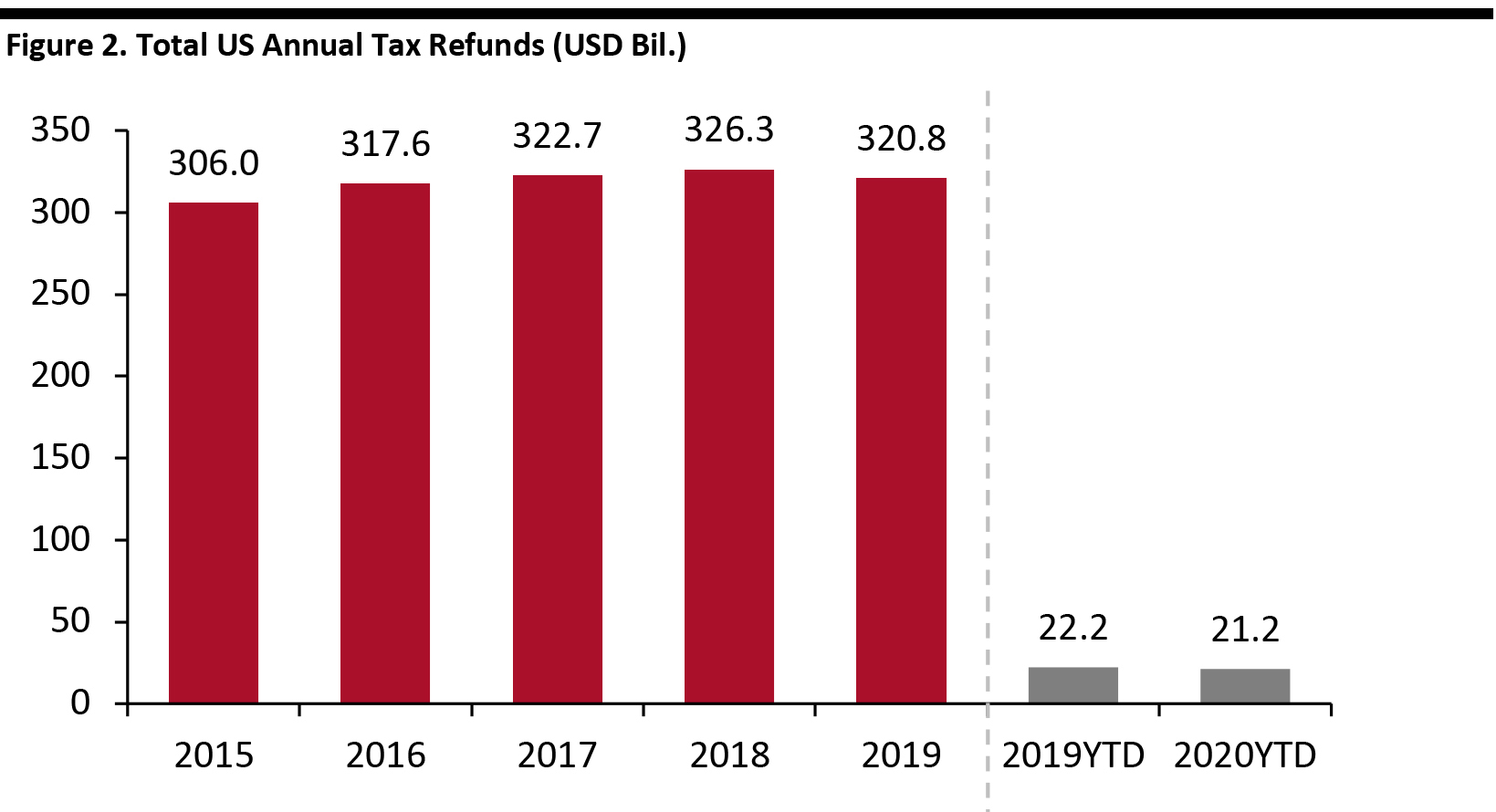

The graph below shows total annual refunds disbursed, which increased at a 1.2% CAGR during 2015–2019.

[caption id="attachment_103865" align="aligncenter" width="700"]

Source: IRS [/caption]

The graph below shows total annual refunds disbursed, which increased at a 1.2% CAGR during 2015–2019.

[caption id="attachment_103865" align="aligncenter" width="700"] Source: IRS [/caption]

Tax Returns: Consumer Plans for 2020

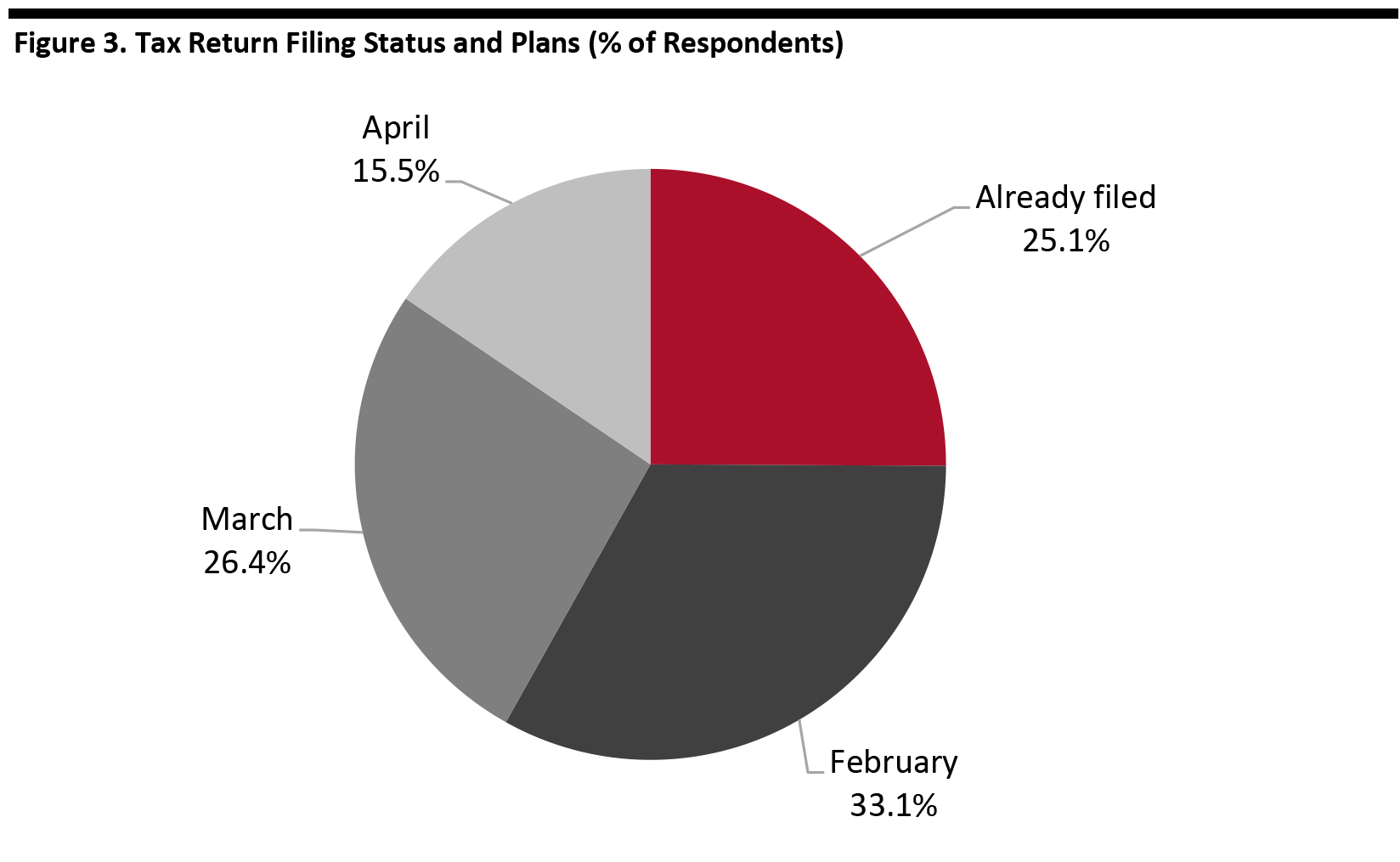

According to a Prosper Insights & Analytics survey in February 2020, of 7,671 adults aged 18 and older, 25.1% said they had already filed tax returns, while 33.1% expect to do so by the end of February. And, 26.4% said they plan to file in March, while 15.5% will take their time and file in April.

[caption id="attachment_103866" align="aligncenter" width="700"]

Source: IRS [/caption]

Tax Returns: Consumer Plans for 2020

According to a Prosper Insights & Analytics survey in February 2020, of 7,671 adults aged 18 and older, 25.1% said they had already filed tax returns, while 33.1% expect to do so by the end of February. And, 26.4% said they plan to file in March, while 15.5% will take their time and file in April.

[caption id="attachment_103866" align="aligncenter" width="700"] Source: Prosper Insights & Analytics [/caption]

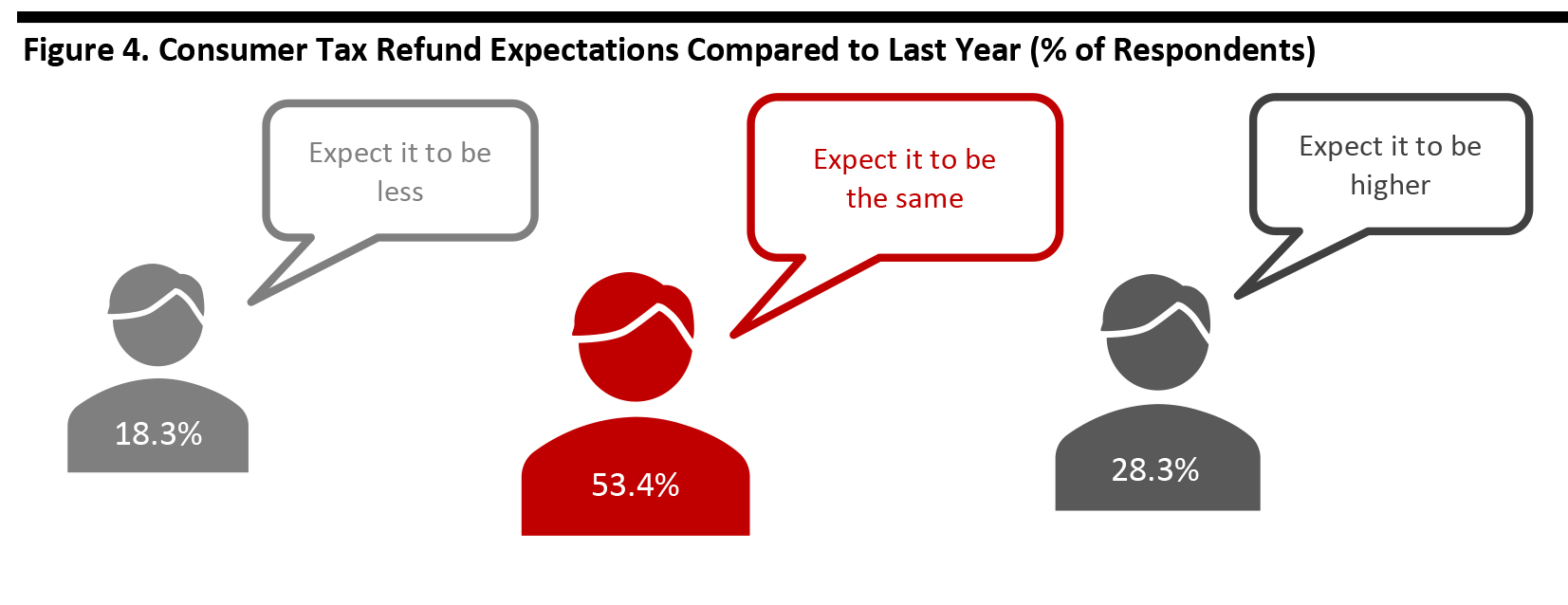

The survey also found that nearly two-thirds (64.8%) of those surveyed expect to receive a refund. Among those expecting a refund:

Source: Prosper Insights & Analytics [/caption]

The survey also found that nearly two-thirds (64.8%) of those surveyed expect to receive a refund. Among those expecting a refund:

Source: Prosper Insights & Analytics [/caption]

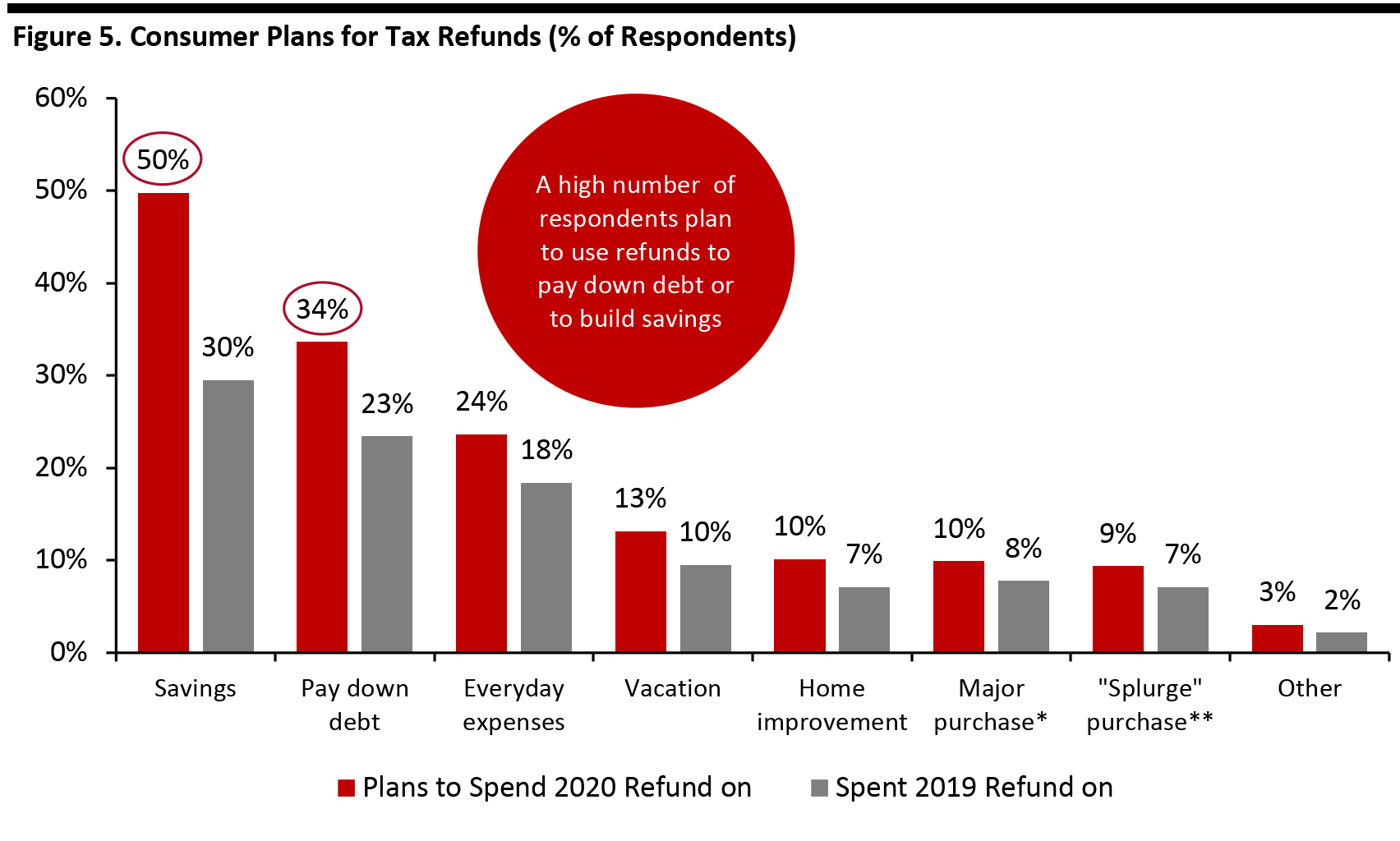

The survey also found almost half of respondents plan to save their tax refunds, with 50% of respondents expecting refunds said they would save the money. Of those planning to spend their refunds, the top expected uses include paying down debt (at 34%) and spend on everyday expenses (at 24%).

[caption id="attachment_103868" align="aligncenter" width="700"]

Source: Prosper Insights & Analytics [/caption]

The survey also found almost half of respondents plan to save their tax refunds, with 50% of respondents expecting refunds said they would save the money. Of those planning to spend their refunds, the top expected uses include paying down debt (at 34%) and spend on everyday expenses (at 24%).

[caption id="attachment_103868" align="aligncenter" width="700"] *Includes TVs, furniture, cars, etc.

*Includes TVs, furniture, cars, etc.

**Includes dining out, apparel, trips to a salon/spa, etc.

Source: Prosper Insights & Analytics [/caption]

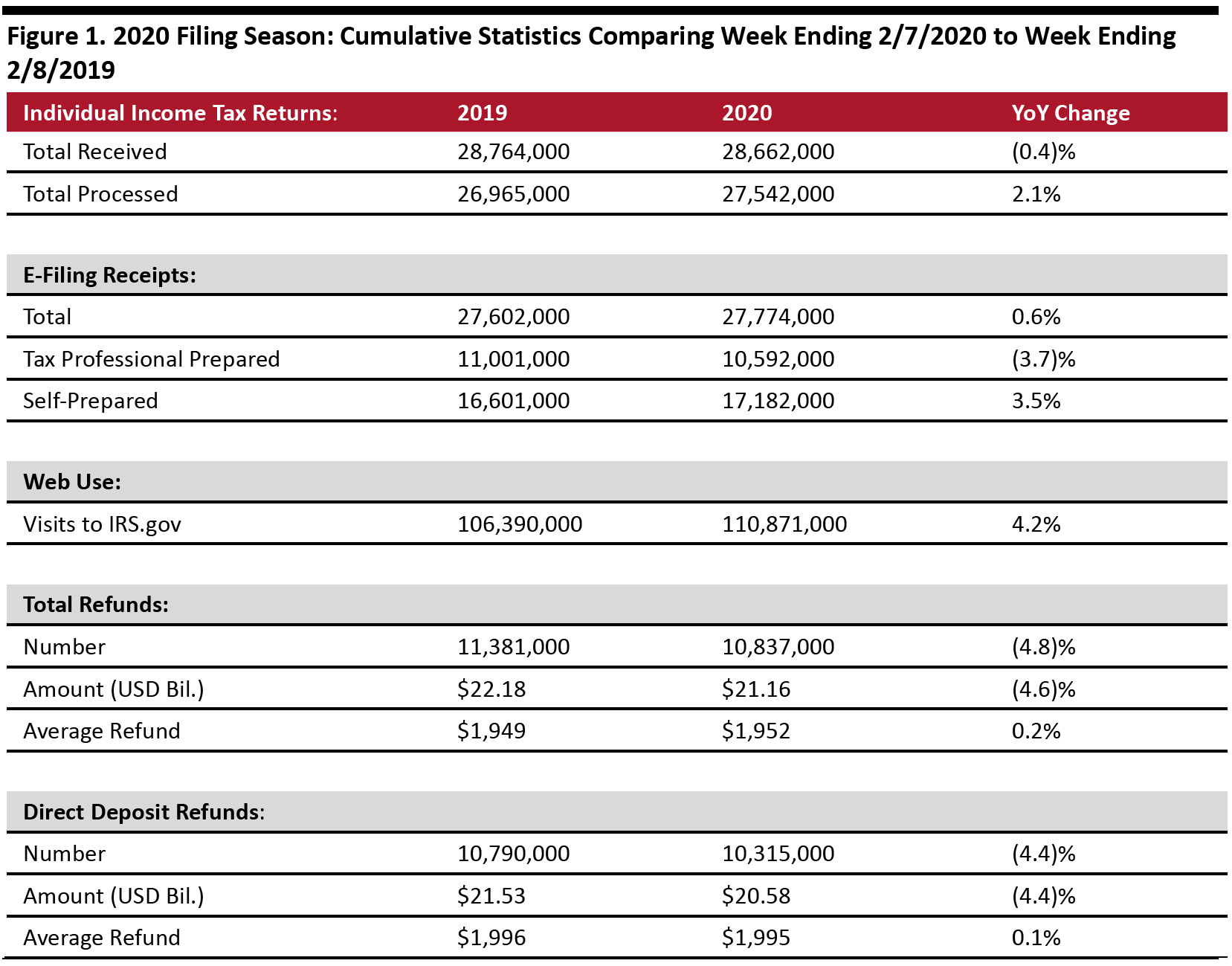

- The IRS had received 28.7 million tax returns and processed 27.5 million. The number of returns processed was up 2.1% year over year.

- Of the returns filed, 96.9% were filed electronically. Of those, 38.1% were prepared by tax professionals, the remaining 61.9% were self-prepared.

- The number of taxpayers using the IRS website to access information is increasing: The site logged 110.9 million visits, up 4.2% year over year.

- A total of 10.8 million refunds had been issued as of February 7, totaling $21.16 billion and averaging $1,952 each. The number of refunds issued was down 4.8% and the total amount refunded was down 4.6% year-over-year. However, the average refund grew marginally by 0.2% year over year.

- Of those refunds issued, 95.2% were paid using direct deposit. The average direct deposit refund was $1,995, slightly down 0.1% year over year.

- The IRS expects a surge in tax return filings for the two weeks following the Presidents Day holiday.

- 18.3% expect their refund to be less than last year.

- 53.4% expect it to be the same.

- 28.3% expect it to be higher.

**Includes dining out, apparel, trips to a salon/spa, etc.

Source: Prosper Insights & Analytics [/caption]