Nitheesh NH

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting at the end of January until the April 15 deadline. This year, in response to the ongoing coronavirus outbreak, the US Department of the Treasury (of which the IRS is a division) announced the deadline to file (and more importantly, to pay) has been extended to July 15.

In this report, we look at what happened in the 13th week of the 2020 tax filing season.

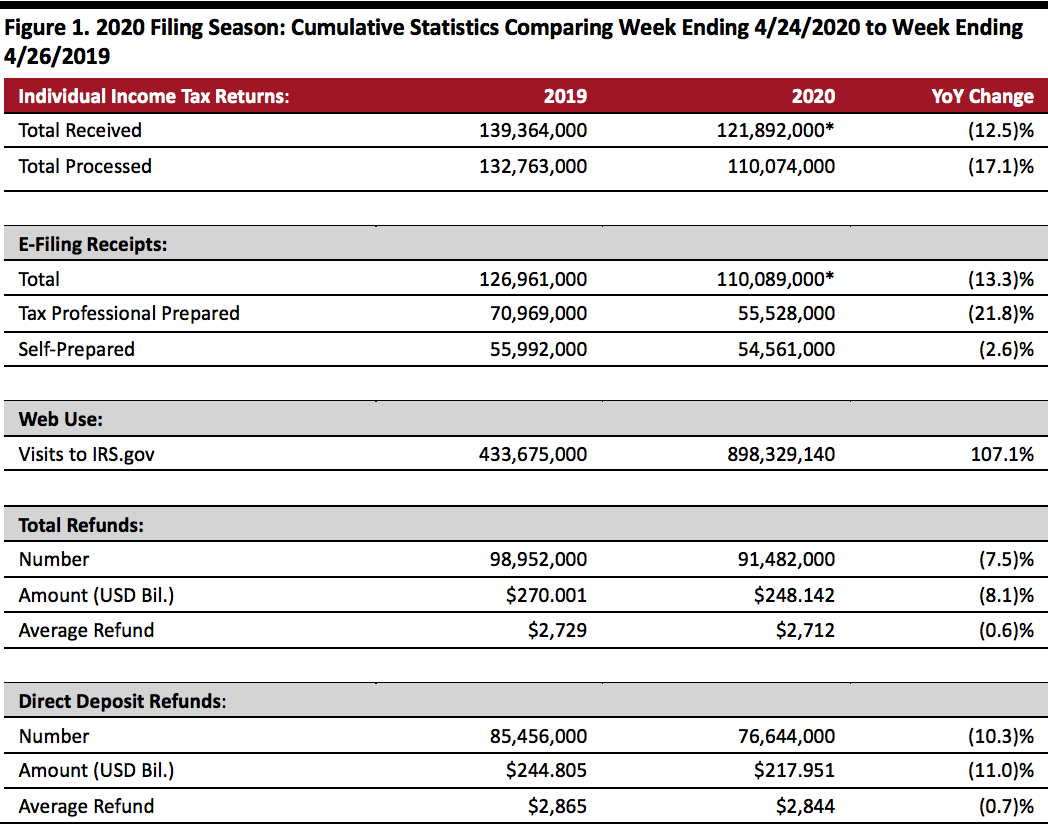

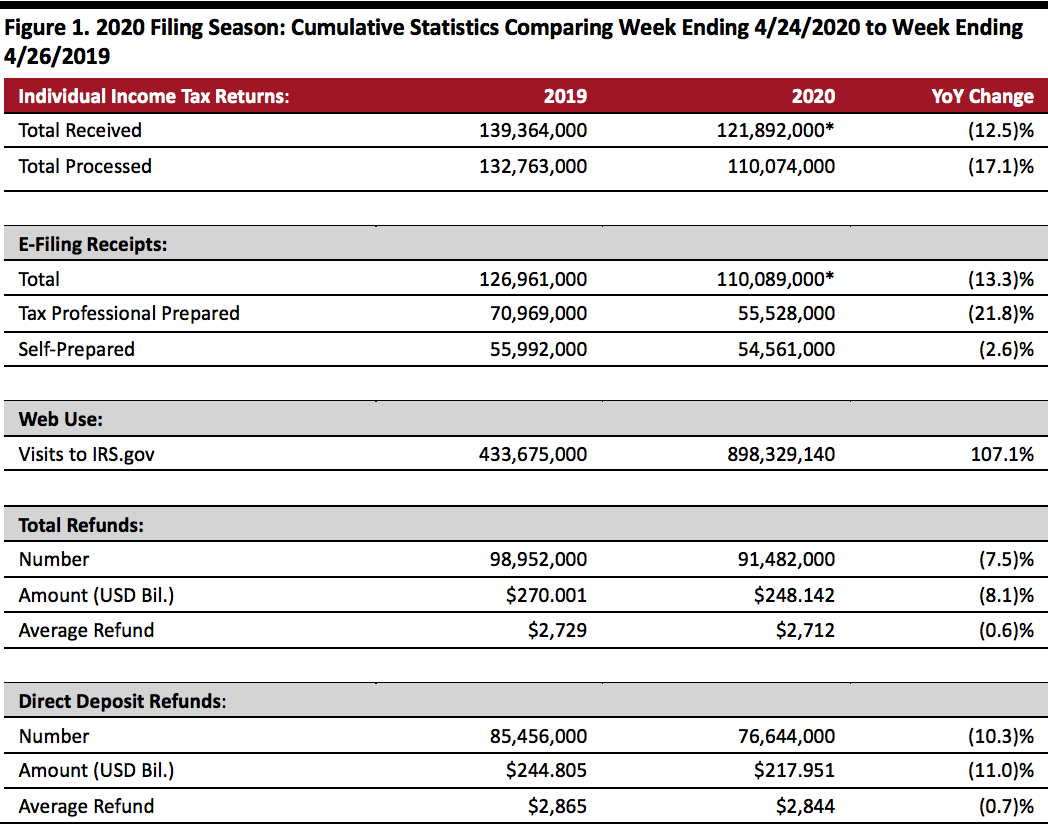

As of April 24, 2020:

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

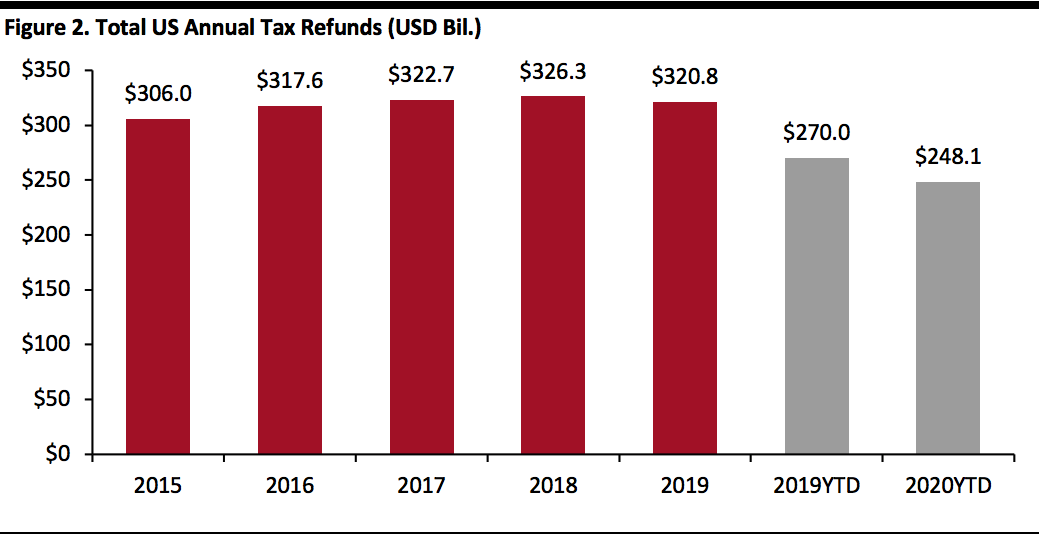

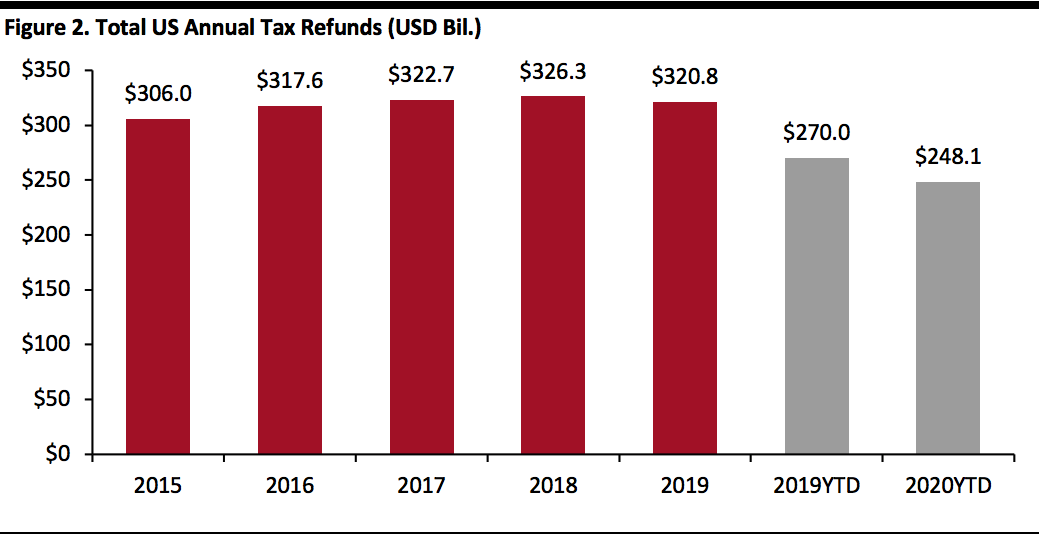

Source: IRS[/caption] The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019. [caption id="attachment_109014" align="aligncenter" width="700"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS had received 121.9 million tax returns and processed 110.1 million. The number of returns received and processed was down 12.5% and 17.5% year over year, respectively. The number of tax filing numbers has dropped year over year as taxpayers take advantage of a 90-day filing extension granted by the IRS in the wake of the coronavirus crisis.

- Of the returns filed already, 90.3% were filed electronically. Of those, 50.4% were prepared by tax professionals, and the remaining 49.6% were self-prepared.

- With IRS temporarily closing down all Taxpayer Assistance Centers and suspending all in-person customer service nationwide, a high number of taxpayers used the IRS website for information: The site logged about 898.3 million visits, up 107.1% year over year.

- A total of 91.5 million refunds had been issued as of April 24, totaling $248.14 billion and averaging $2,712 each. The number of refunds issued was down 7.5% and the total amount refunded was down 8.1% year over year. The average refund also lagged by 0.6% year over year.

- Of those refunds issued, 83.8% were paid using direct deposit. The average direct deposit refund was $2,844, down 0.7% year over year.

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returnsSource: IRS[/caption] The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019. [caption id="attachment_109014" align="aligncenter" width="700"]

Source: IRS[/caption]

Source: IRS[/caption]