DIpil Das

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting at the end of January until the April 15 deadline. This year, in response to the ongoing coronavirus outbreak, the US Department of the Treasury (of which the IRS is a division) announced the deadline to file (and more importantly, to pay) has been extended to July 15.

In this report, we look at what happened in the 12th week of the 2020 tax filing season.

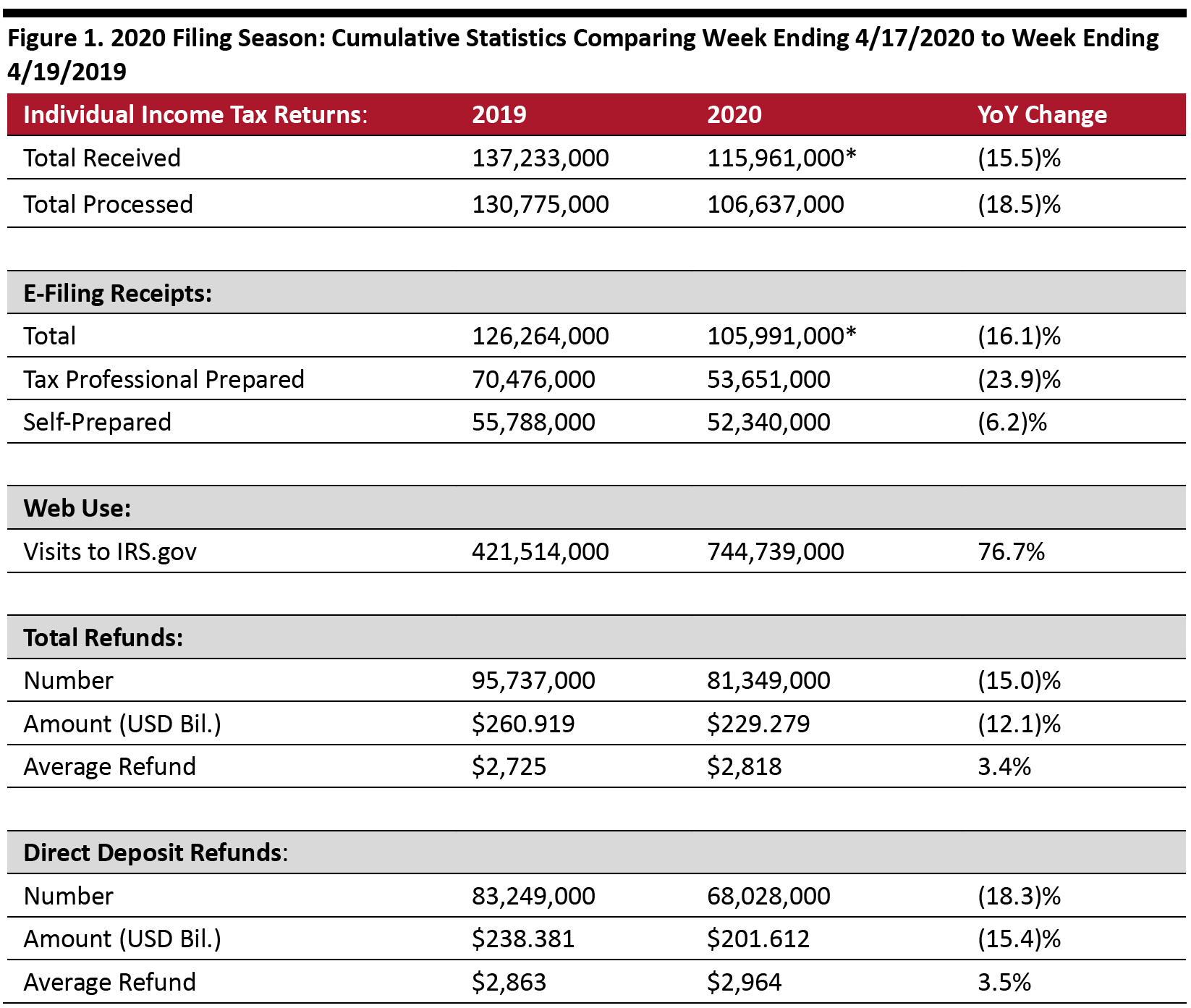

As of April 17, 2020:

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

*Includes returns filed to obtain Economic Impact Payments by those who would not usually file income tax returns

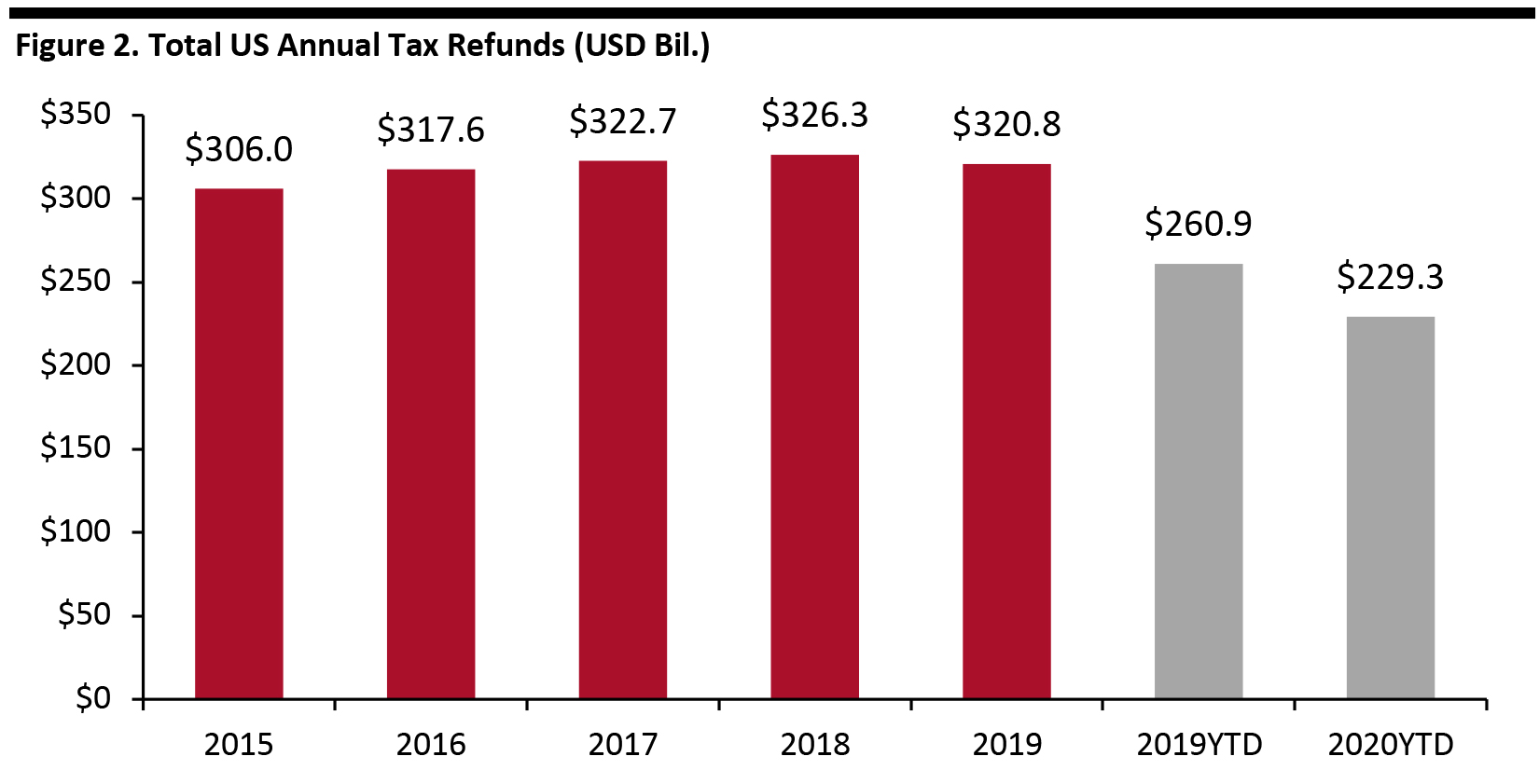

Source: IRS [/caption] The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019. [caption id="attachment_108507" align="aligncenter" width="700"] Source: IRS [/caption]

Economic Impact Payments

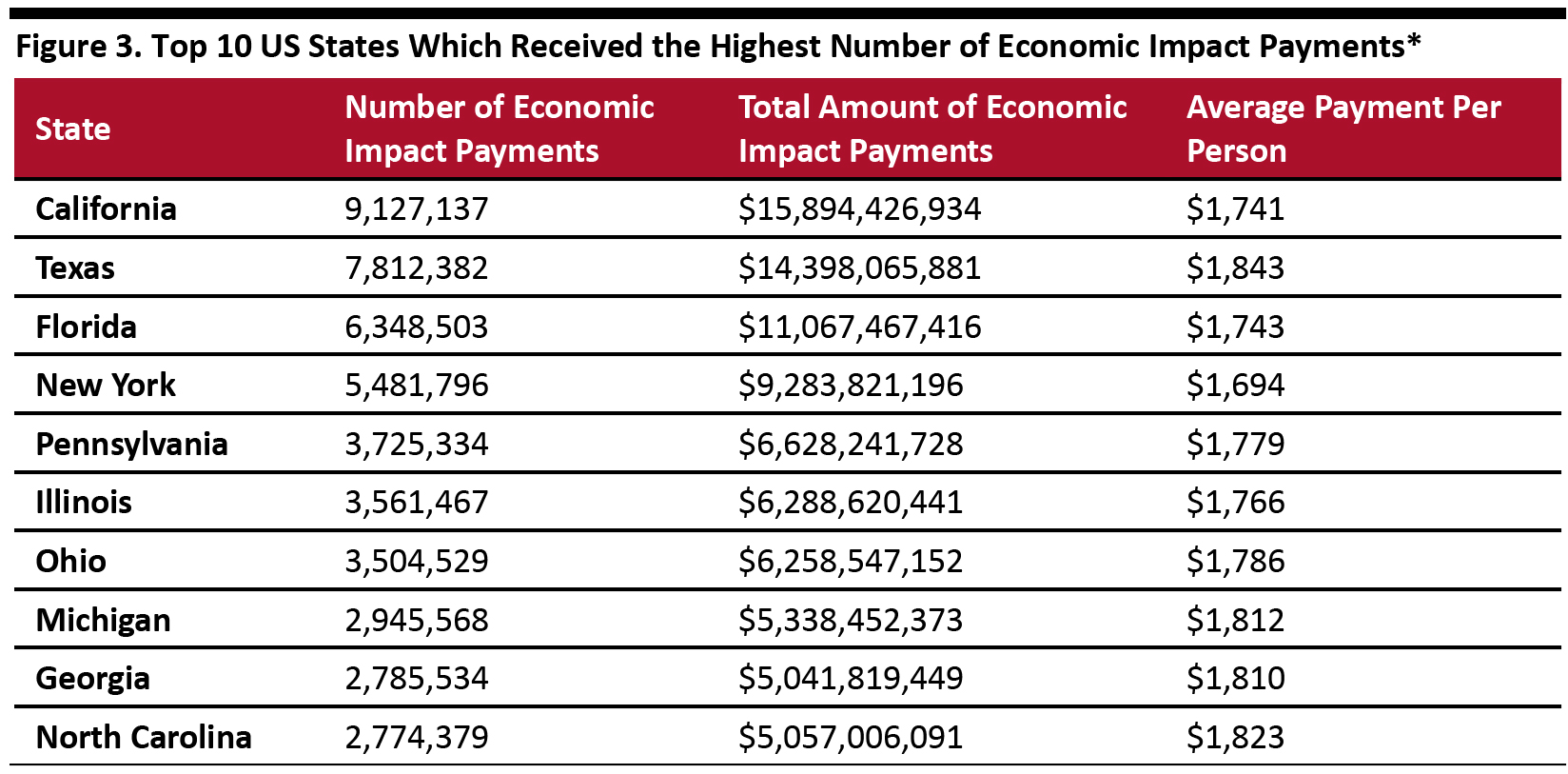

The US Department of the Treasury and the IRS jointly announced that 88.1 million Americans had received Economic Impact Payments, totaling nearly $158 billion, in the program’s first three weeks (as of April 17, 2020). The federal agencies added that they will continue to disburse payments in the coming weeks to over 62 million people still waiting for the payments.

The stimulus checks are part of $2.2 trillion CARES Act signed into law by President Trump, which is aimed at providing economic relief in response to the coronavirus crisis. Eligible taxpayers who filed a tax return for either 2018 or 2019 will receive a stimulus payment of up to $1,200 for individuals—or $2,400 for married couples—and up to $500 for each qualifying child under the age of 17. The CARES Act earmarked $300 billion in payments to individuals plus another $250 in supplemental unemployment benefits.

The IRS has released state-by-state figures for Economic Impact Payments. The statistics showed that, as of April 17, California had received the highest number of payments, with more than 9.1 million Californians receiving around $15.9 billion in total. Texas received the second-highest number of payments, with more than 7.81 million individuals receiving a total of almost $14.4 billion, followed by Florida, New York and Pennsylvania (shown in Figure 3).

[caption id="attachment_108508" align="aligncenter" width="700"]

Source: IRS [/caption]

Economic Impact Payments

The US Department of the Treasury and the IRS jointly announced that 88.1 million Americans had received Economic Impact Payments, totaling nearly $158 billion, in the program’s first three weeks (as of April 17, 2020). The federal agencies added that they will continue to disburse payments in the coming weeks to over 62 million people still waiting for the payments.

The stimulus checks are part of $2.2 trillion CARES Act signed into law by President Trump, which is aimed at providing economic relief in response to the coronavirus crisis. Eligible taxpayers who filed a tax return for either 2018 or 2019 will receive a stimulus payment of up to $1,200 for individuals—or $2,400 for married couples—and up to $500 for each qualifying child under the age of 17. The CARES Act earmarked $300 billion in payments to individuals plus another $250 in supplemental unemployment benefits.

The IRS has released state-by-state figures for Economic Impact Payments. The statistics showed that, as of April 17, California had received the highest number of payments, with more than 9.1 million Californians receiving around $15.9 billion in total. Texas received the second-highest number of payments, with more than 7.81 million individuals receiving a total of almost $14.4 billion, followed by Florida, New York and Pennsylvania (shown in Figure 3).

[caption id="attachment_108508" align="aligncenter" width="700"] *As of April 17, 2020

*As of April 17, 2020

Source: IRS [/caption]

- The IRS had received nearly 116 million tax returns and processed 106.6 million. The number of returns received and processed was down 15.5% and 18.5% year over year, respectively. The number of tax filings has dropped year over year as taxpayers take advantage of the 90-day filing extension granted by the IRS in the wake of the coronavirus crisis.

- Of the returns filed already, 91.4% were filed electronically. Of those, 50.6% were prepared by tax professionals, and the remaining 49.4% were self-prepared.

- With IRS temporarily closing all Taxpayer Assistance Centers and suspending all in-person customer services nationwide, a high number of taxpayers used the IRS website for information: The site logged about 744.7 million visits, up 76.7% year over year.

- A total of 81.3 million refunds had been issued as of April 17, totaling $229.28 billion and averaging $2,818 each. The number of refunds issued was down 15.0% and the total amount refunded was down 12.1% year over year. However, the average refund grew by 3.4% year over year.

- Of those refunds issued, 83.6% were paid using direct deposit. The average direct deposit refund was $2,964, up 3.5% year over year.

Source: IRS [/caption] The graph below shows total refunds increasing at a 1.2% CAGR during 2015–2019. [caption id="attachment_108507" align="aligncenter" width="700"]

Source: IRS [/caption]