albert Chan

Each year, the US Internal Revenue Service (IRS) reports tax return filings and refunds on a weekly basis, starting in February and going until the April 15 filing deadline. It is still early in the filing season, so there will likely be more variability to the data. Filings have likely been delayed due to confusion over the new tax rates and the government shutdown, which made it difficult for accountants to get answers to help people prepare income tax returns. After the second week of returns data, the year-over-year decline in the number of filings has moderated, indicating that tax filings are catching up.

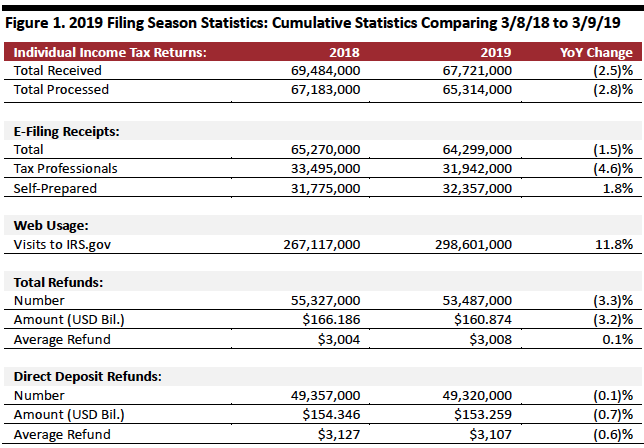

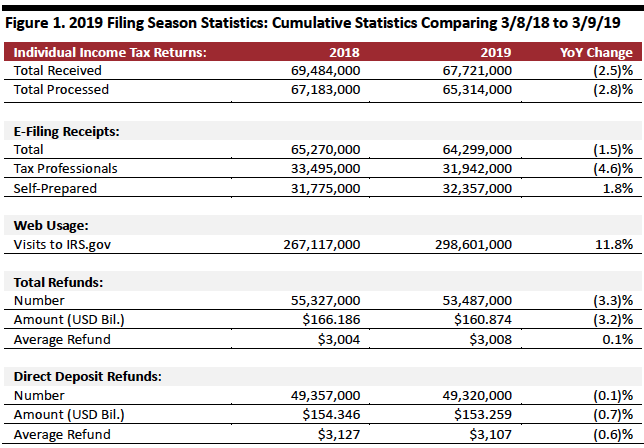

As of March 8, 2019:

Source: IRS[/caption]

Given a solid US economy, higher wages and employment rates, total refunds are likely to be higher in 2019, once the disruption from the government shutdown is resolved.

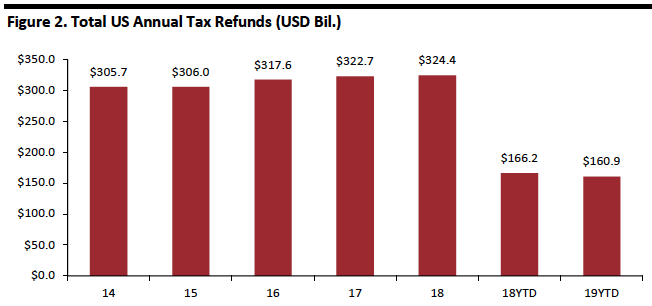

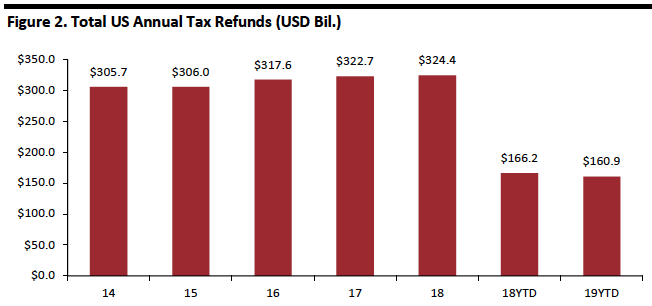

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_81093" align="aligncenter" width="652"]

Source: IRS[/caption]

Given a solid US economy, higher wages and employment rates, total refunds are likely to be higher in 2019, once the disruption from the government shutdown is resolved.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_81093" align="aligncenter" width="652"] Source: IRS[/caption]

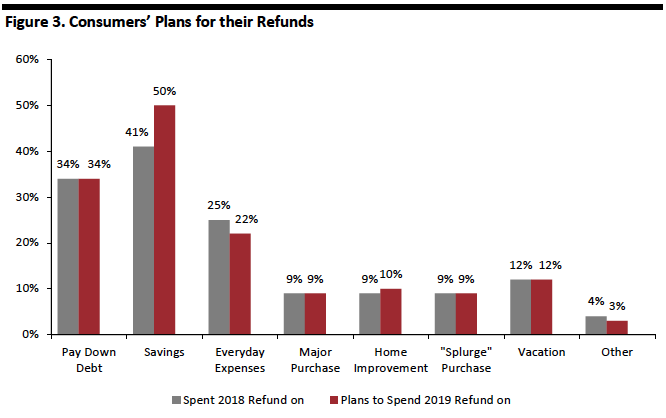

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

The National Retail Federation (NRF) has been conducing its annual Tax Returns Survey since 2007 and recently released its survey conducted by the NRF and Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Among those expecting a refund:

Source: IRS[/caption]

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

The National Retail Federation (NRF) has been conducing its annual Tax Returns Survey since 2007 and recently released its survey conducted by the NRF and Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Among those expecting a refund:

Source: IRS[/caption]

Source: IRS[/caption]

- The IRS had received 67.7 million tax returns and processed 65.3 million of them. The number of returns received was down 2.5% from the corresponding date a year ago.

- Of the returns filed, 94.9% were electronically filed. Of those, 49.7% were prepared by tax professionals, the remaining 50.3% were self-prepared.

- More people are now using the IRS website to get information: the site logged about 298.6 million visits, up 11.8% from the year-ago period.

- A total of 53.5 million refunds had been issued as of March 8, totaling $160.9 billion and averaging $3,008 each, up $4 from a year ago. The number of refunds issued was down 3.3% and the total amount refunded is down 3.2% year-over-year, and the average refund is up 0.1%.

- Of those refunds issued, 92.2% were paid using direct deposit. The average direct deposit refund was $3,008, up 0.1% from the corresponding date last year.

Source: IRS[/caption]

Given a solid US economy, higher wages and employment rates, total refunds are likely to be higher in 2019, once the disruption from the government shutdown is resolved.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_81093" align="aligncenter" width="652"]

Source: IRS[/caption]

Given a solid US economy, higher wages and employment rates, total refunds are likely to be higher in 2019, once the disruption from the government shutdown is resolved.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_81093" align="aligncenter" width="652"] Source: IRS[/caption]

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

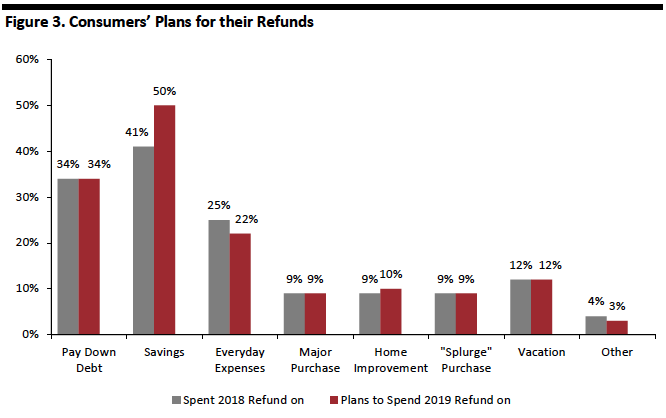

The National Retail Federation (NRF) has been conducing its annual Tax Returns Survey since 2007 and recently released its survey conducted by the NRF and Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Among those expecting a refund:

Source: IRS[/caption]

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

The National Retail Federation (NRF) has been conducing its annual Tax Returns Survey since 2007 and recently released its survey conducted by the NRF and Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Among those expecting a refund:

- 22% expect their refund to be less than last year

- 48% expect it to be the same

- 29% expect it to be higher

Source: IRS[/caption]

Source: IRS[/caption]