DIpil Das

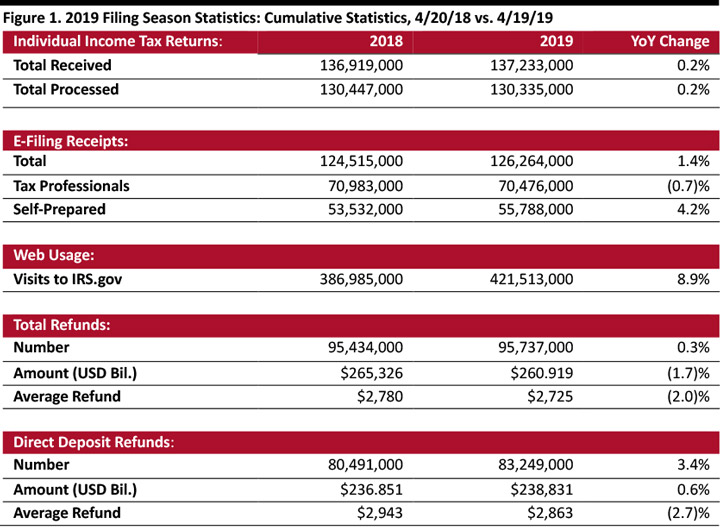

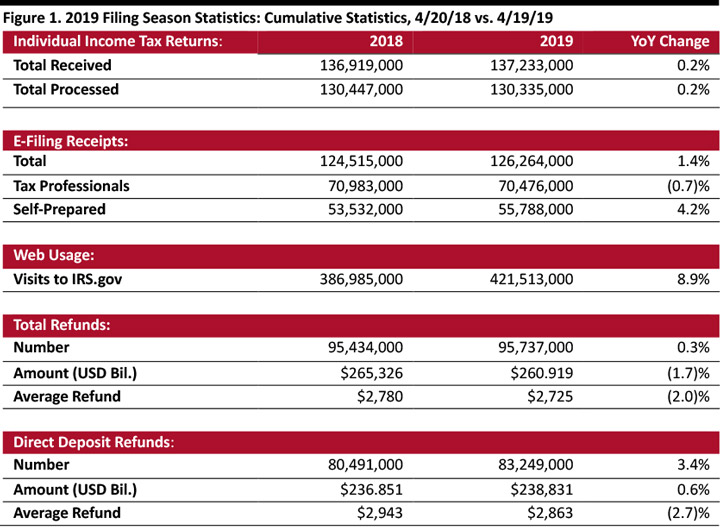

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting in February and going until well after the April 15 filing deadline. As of April 19, the number of returns filed was slightly above the same time last year and the average refund was down slightly.

As of April 19, 2019:

Source: IRS[/caption]

While the growth in filings is positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

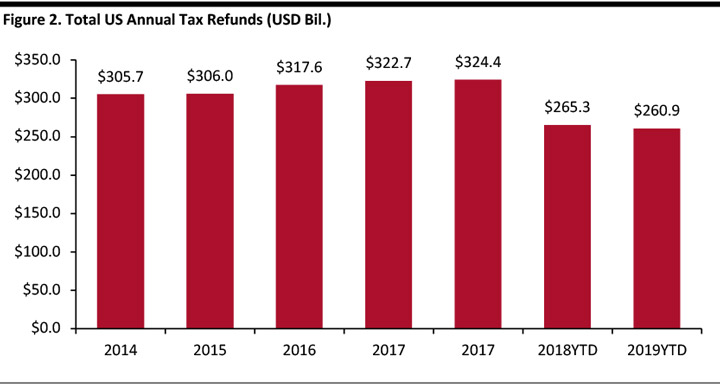

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014–2018.

[caption id="attachment_85549" align="aligncenter" width="720"]

Source: IRS[/caption]

While the growth in filings is positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014–2018.

[caption id="attachment_85549" align="aligncenter" width="720"] Source: IRS[/caption]

What Comes Next

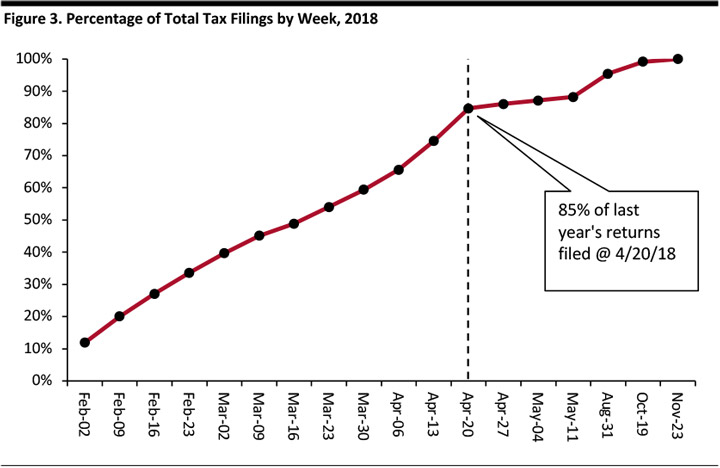

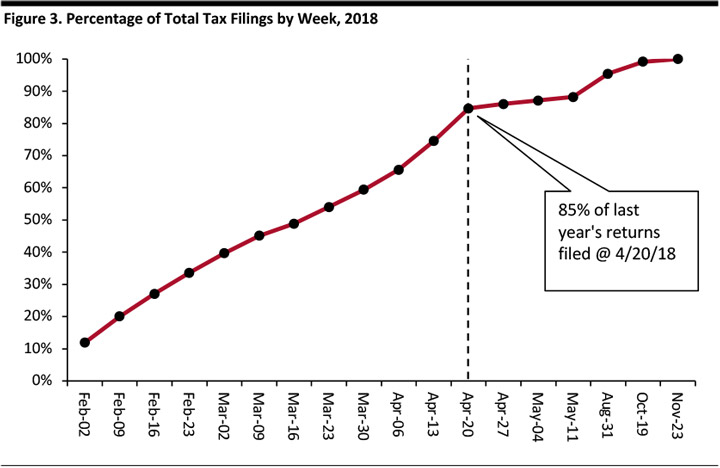

Although the April 15 tax filing deadline is now behind us, some additional returns will still be filed, due to late filers and various tax adjustments. The graph on the next page shows that, last year, 85% of last year’s tax returns had been filed by April 20.

[caption id="attachment_85550" align="aligncenter" width="720"]

Source: IRS[/caption]

What Comes Next

Although the April 15 tax filing deadline is now behind us, some additional returns will still be filed, due to late filers and various tax adjustments. The graph on the next page shows that, last year, 85% of last year’s tax returns had been filed by April 20.

[caption id="attachment_85550" align="aligncenter" width="720"] Source: IRS[/caption]

Source: IRS[/caption]

- The IRS had received 137.2 million tax returns and processed 130.8 million. The number of returns received was up 0.2% from the corresponding date a year ago.

- Of the returns filed, 92.3% were filed electronically. Of those, 55.8% were prepared by tax professionals; the remaining 44.1% were prepared by taxpayers themselves.

- More people are now using the IRS website to get information: The site logged about 5 million visits, up 8.9% from the year-ago period.

- A total of 95.7 million refunds had been issued as of April 19, totaling $260.9 billion and averaging $2,725 each, down $55 from a year ago. The number of refunds issued was up 0.3% and the total amount refunded is down 1.7% year over year, while the average refund is down 2.0%.

- Of those refunds issued, 87.0% were paid using direct deposit. The average direct deposit refund was $2,863, down 2.7% from the corresponding date last year.

Source: IRS[/caption]

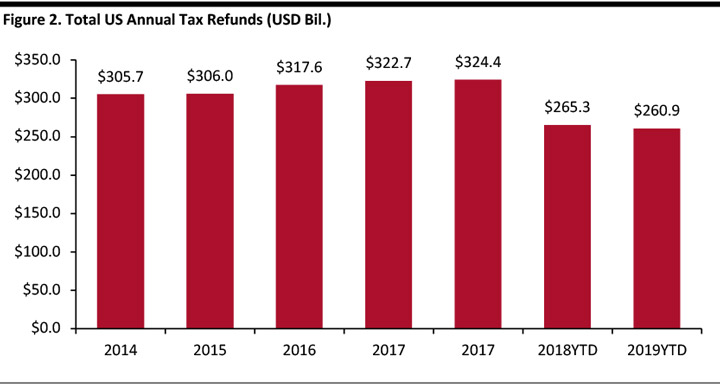

While the growth in filings is positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014–2018.

[caption id="attachment_85549" align="aligncenter" width="720"]

Source: IRS[/caption]

While the growth in filings is positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014–2018.

[caption id="attachment_85549" align="aligncenter" width="720"] Source: IRS[/caption]

What Comes Next

Although the April 15 tax filing deadline is now behind us, some additional returns will still be filed, due to late filers and various tax adjustments. The graph on the next page shows that, last year, 85% of last year’s tax returns had been filed by April 20.

[caption id="attachment_85550" align="aligncenter" width="720"]

Source: IRS[/caption]

What Comes Next

Although the April 15 tax filing deadline is now behind us, some additional returns will still be filed, due to late filers and various tax adjustments. The graph on the next page shows that, last year, 85% of last year’s tax returns had been filed by April 20.

[caption id="attachment_85550" align="aligncenter" width="720"] Source: IRS[/caption]

Source: IRS[/caption]