DIpil Das

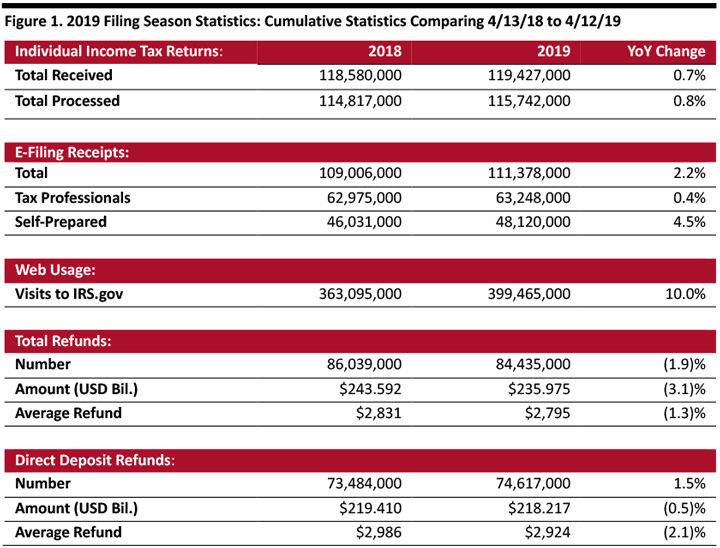

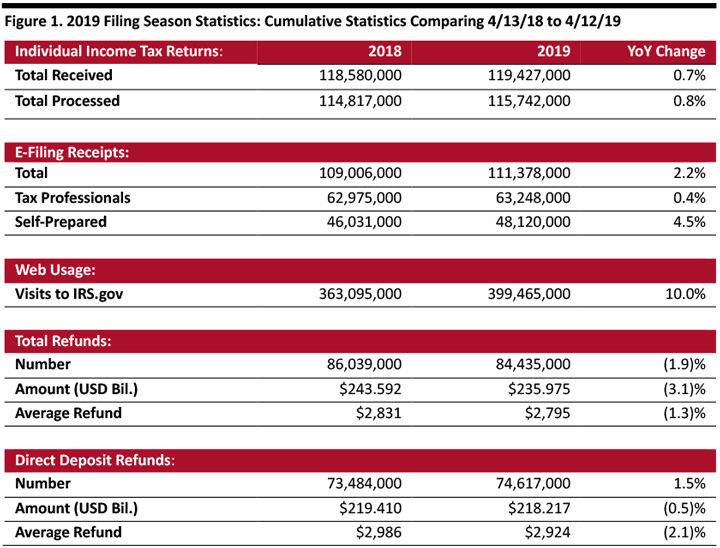

Each year, the IRS reports tax return filings and refunds on a weekly basis, starting in February and going until well after the April 15 filing deadline. Filings turned positive year over year just three data days before the April 15 tax return filing deadline, yet the number, total amount and average amount of refunds trails the year-ago figures.

As of April 12, 2019:

Source: IRS[/caption]

While growth in filings has now turned positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

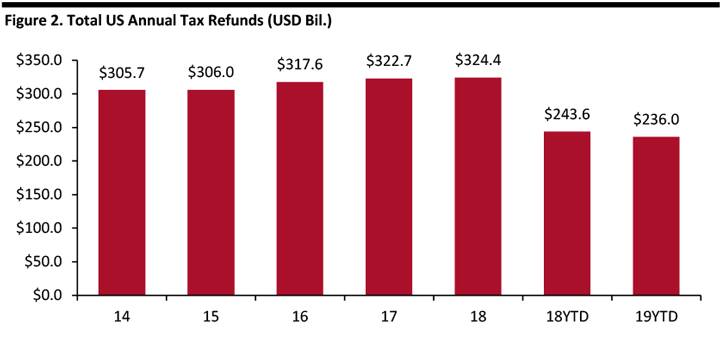

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_84765" align="aligncenter" width="720"]

Source: IRS[/caption]

While growth in filings has now turned positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_84765" align="aligncenter" width="720"] Source: IRS[/caption]

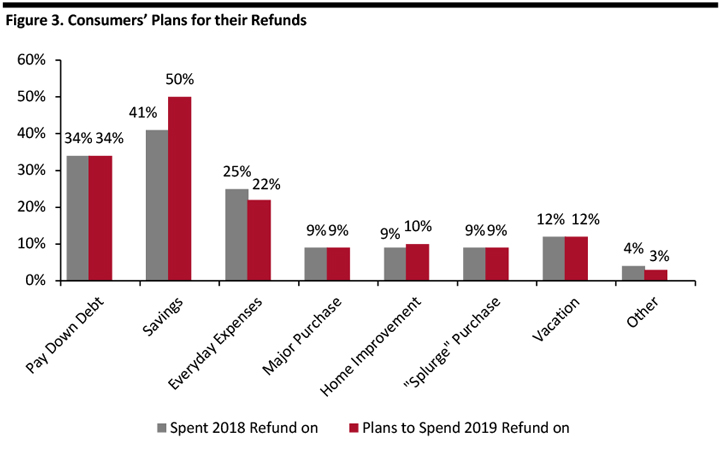

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

The NRF has been conducting its annual Tax Returns Survey since 2007 and recently released its survey conducted in partnership with Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Of those expecting a refund:

Source: IRS[/caption]

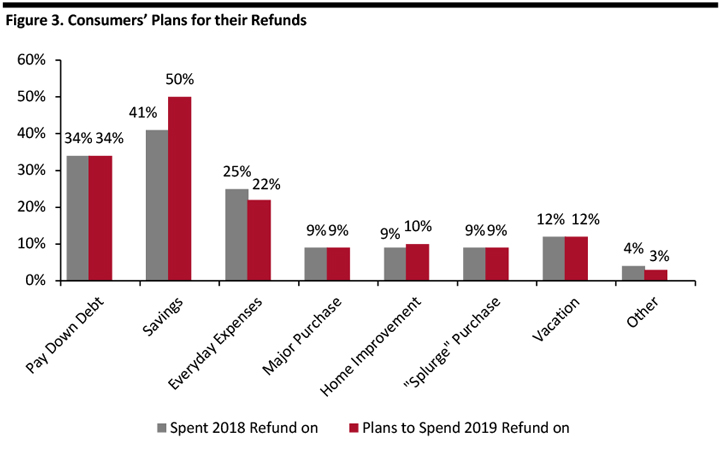

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

The NRF has been conducting its annual Tax Returns Survey since 2007 and recently released its survey conducted in partnership with Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Of those expecting a refund:

Source: NRF/Prosper Insights & Analytics[/caption]

Source: NRF/Prosper Insights & Analytics[/caption]

- The IRS had received 119.4 million tax returns and processed 115.7 million. The number of returns received was up 0.7% from the corresponding date a year ago.

- Of the returns filed, 93.3% were electronically filed. Of those, 56.8% were prepared by tax professionals, the remaining 43.2% were self-prepared.

- More people are now using the IRS website to get information: The site logged about 399.5 million visits, up 10.0% from the year-ago period.

- A total of 84.4 million refunds had been issued as of April 12, totaling $236.0 billion and averaging $2,795 each, down $36 from a year ago. The number of refunds issued was down 1.9% and the total amount refunded is down 3.1% year over year, and the average refund is down 1.3%.

- Of those refunds issued, 88.4% were paid using direct deposit. The average direct deposit refund was $2,924, down 2.1% from the corresponding date last year.

Source: IRS[/caption]

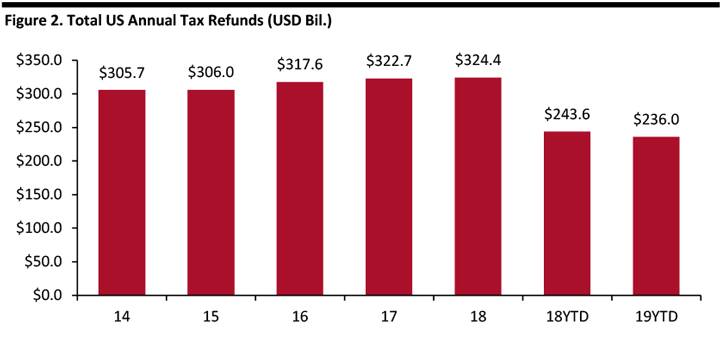

While growth in filings has now turned positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_84765" align="aligncenter" width="720"]

Source: IRS[/caption]

While growth in filings has now turned positive, total refunds and the average refund are still down versus last year, implying a mismatch between withholding and the updated tax rates.

The graph below shows total annual refunds disbursed to consumers, which increased at a 1.5% CAGR during 2014-2018.

[caption id="attachment_84765" align="aligncenter" width="720"] Source: IRS[/caption]

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

The NRF has been conducting its annual Tax Returns Survey since 2007 and recently released its survey conducted in partnership with Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Of those expecting a refund:

Source: IRS[/caption]

NRF Taxpayer Survey Highlights Savings, Debt Repayment and Everyday Expenses

The NRF has been conducting its annual Tax Returns Survey since 2007 and recently released its survey conducted in partnership with Prosper Insights & Analytics. In the survey, of 7,729 adults aged 18 and older, nearly two-thirds (65%) of those surveyed expect to receive a refund. Of those expecting a refund:

- 22% expect the refund to be less than last year.

- 48% expect it to be the same.

- 29% expect it to be higher.

Source: NRF/Prosper Insights & Analytics[/caption]

Source: NRF/Prosper Insights & Analytics[/caption]