DIpil Das

Our 10 Trends for 2019

At midyear, we take stock of how major trends have played out in e-commerce in China. In this report, we review the first half of 2019 and identify two additional trends we think will be significant in the second half of the year. This report updates our 10 Trends for China E-Commerce 2019 report. These are our 10 China e-commerce trends for 2019 that we identified in January:- Demand for quality imported e-commerce goods will increase.

- Daigou will decline in the face of the new e-commerce law.

- Non-tier-1 cities will drive e-commerce growth.

- Shopping on mobile will continue to prevail.

- Short video apps will push content e-commerce.

- WeChat mini programs will become more popular as a cost-efficient tool for social commerce.

- New Retail will increase with greater online/offline integration.

- Parcel delivery will be faster: brands need to adapt.

- Fresh-food e-commerce will gain traction.

- Alibaba and JD.com will compete more intensely in luxury e-commerce.

Our Top Five Trends as of Midyear 2019

1. Daigou Continues to Decline, with Duty-Free Sales Falling PrecipitouslyIn January, we predicted that daigou, or people buying overseas on behalf of others, could decline due to increased restrictions in the e-commerce law that took effect on January 1, 2019, as well as to the growing easiness of buying imported goods online. The new law compels daigou merchants to obtain licenses and formally register as businesses. Otherwise, they will be subject to fines as high as ¥2 million (US$291,620) for operating an illegal business and tax evasion.

Since implementation of the law, we have seen Chinese customs increase inspections of daigou merchants at airports. Daigou merchants have also become less active in putting product updates online, deleted their content on WeChat Moments pages, and some even closed their daigou businesses.

Possibly owing to a decline in daigou, duty-free sales at Japanese department stores dropped 7.7% in January compared with the previous year, the first decrease seen in more than two years, according to the Japan Department Stores Association. Takashimaya and Daimaru Matsuzakaya saw year-over-year duty-free sales declines of 15% and 7%, respectively, in January.

One Chinese tourist interviewed by Nikkei Asian Review also mentioned that customs in China have become more strict for luxury items in particular, causing her to reduce her purchases and hide some items.

[caption id="attachment_93267" align="aligncenter" width="751"] Duty-free shop in the departures floor of Kansai International airport in Osaka, Japan

Duty-free shop in the departures floor of Kansai International airport in Osaka, Japan Source: iStock [/caption] 2. Short Video Apps Add E-Commerce Functions to Monetize Traffic

In January, we predicted that short video apps would continue to drive content e-commerce, the combination of user-generated content and online purchasing, monetizing high traffic from popular posts, articles or videos.

In June, Tencent-backed short video platform Kuaishou said its short video and live streaming app had integrated with JD.com and Pinduoduo to boost e-commerce capabilities, after a similar integration with Tmall and Taobao. The feature allows users to sell goods and demonstrate products through a channel called Kuaishou Small Store.

TikTok announced in May that users can now search specifically for products inside the app, according to Chinese media 36Kr. Search results will be directed to shops in Douyin’s mini-app network and show basic product information, including an image, description, price and a link that takes users to the retailer’s Douyin mini-app.

By giving users a more direct way to search for and buy products, TikTok and Kuaishou are placing themselves in closer competition with e-commerce platforms such as Tmall, JD.com and Pinduoduo.

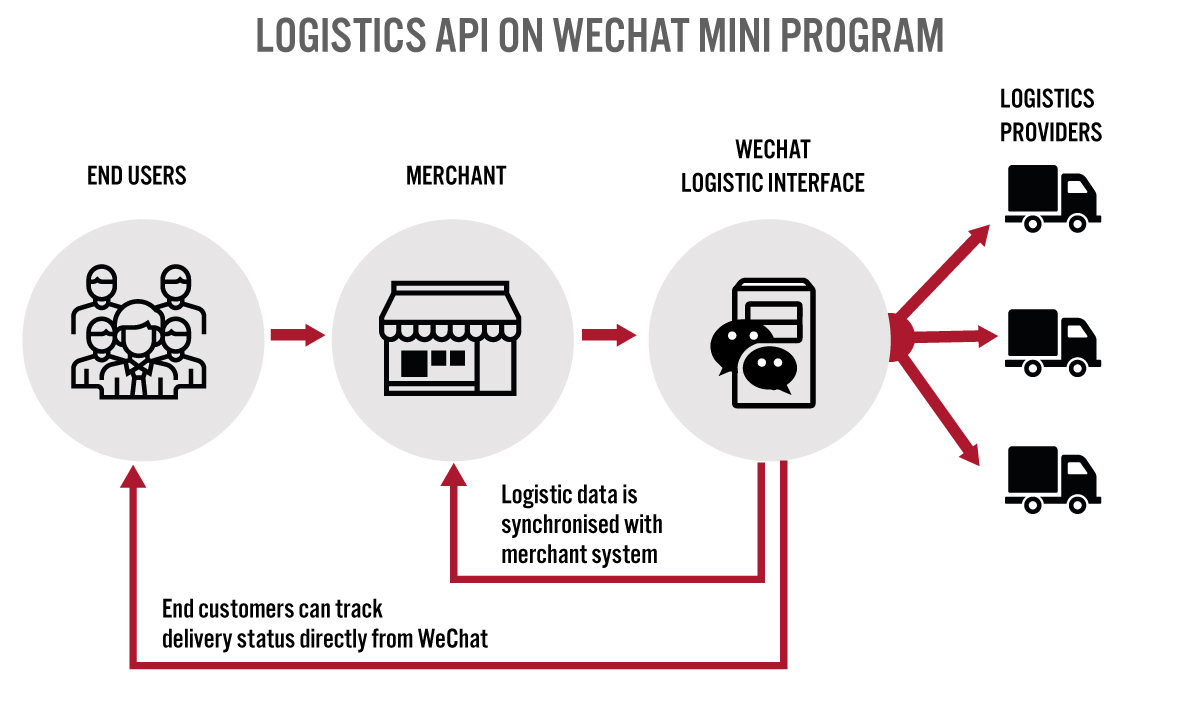

3. WeChat Mini Programs Add Logistics APIIn January, we predicted that WeChat mini programs would become more popular for brands as a way to interact with customers and sell products, since they are less expensive and come packed with a variety of social media features a standalone app would struggle to offer.

We have seen WeChat host more than 2.3 million mini programs, and the number of active users reached 250 million as of June 2019, according to Questmobile and Tencent. In April, WeChat announced the release of a new logistics application programming interface (API), enabling merchants to connect WeChat mini programs with third-party logistics providers.

This new function will let merchants create new service orders for product delivery as soon as orders are placed. Customers receive orders more quickly and cheaply than ususal, as merchants can choose the logistics provider offering the lowest price and fastest delivery time.

The API logistics function will also integrate merchants’ systems with logistics providers, synchronizing logistics data between two parties. This will create a centralized platform that lets both selllers and users track shipping and delivery. This will make things easier for merchants, who previously may have had to track shipments through a separate platform, such as a logistics provider’s page, or lacked a way to automatically give customers tracking information.

[caption id="attachment_93308" align="aligncenter" width="700"] Logistics API on WeChat mini program

Logistics API on WeChat mini program Source: Walkthechat/Coresight Research[/caption]

For small businesses in China that rely entirely on WeChat mini programs, the new functionality will likely increase the speed of order processing and improve the user experience.

Parcel Delivery Will Be Even Faster: Brands Need to Adapt

In January, we predicted that parcel delivery would become faster in China with upgraded logistics infrastructure and increasing capacity at bonded warehouses. Same-day delivery would be possible for a broader range of products.

We have seen logistics providers upping their game to provide even faster delivery. JD.com launched a 30-minute delivery service within a three-kilometer range in Beijing, Shanghai, Guangzhou and Changsha in mid-April.

In late April, JD.com rolled out one-day intra-city logistics services in partnership with Dada-JD Daojia, the company’s grocery delivery joint venture in which it holds a 47% stake. The express logistics service will focus on one-day delivery for food, medicine, consumer electronics and apparel, and will operate in Beijing, Shanghai, Guangzhou, Shenzhen and Tianjin.

In a similar move to improve the efficiency of its logistics capabilities, Alibaba-backed Ele.me rebranded its logistics arm Fengniao Logistics (from Fengniao Delivery) and added a number of new services in June 2019, including express deliveries for groceries, flowers and medication. It will establish more than 20,000 digital “instant delivery” warehousing and delivery centers across China in three years, according to Wang Lei, president of Ele.me.

We have also seen e-commerce companies acquire logistics companies to expand their delivery networks for faster service. In March, Alibaba spent around $700 million to buy a nearly 15% stake in Shenzhen-listed logistics company STO Express. Alibaba and its logistics arm, Cainiao, bought a 10% stake in market leader ZTO Express for almost $1.4 billion in May, and the retail giant also owns stakes in YTO Express and Best.

This move will give Alibaba heavy influence over the evolution of logistics networks and the future introduction of advanced technology, such as big data and intelligent and autonomous equipment, to revolutionize the labor-intensive logistics sector for faster delivery.

4. New Retail Will Continue to Prevail in Online/Offline Integration

In January, we predicted that New Retail will increase, with greater online/offline integration, and that e-commerce platforms will continue to accelerate the online/offline integration process.

In May 2019, Alibaba’s e-commerce platform Taobao launched a multi-label brick-and-mortar store called Taostyle in the Hangzhou Kerry Centre shopping mall to bring the independent clothing brands it sells to the offline retail space. The store rotates inventory and refreshes the brands it sells at least twice a month. Currently, Taostyle offers about 350 items from a rotating batch of more than 20 brands. Using consumer insights from Alibaba’s e-commerce platforms, the Taostyle team can determine which brands and products to feature regularly in the store.

Taostyle also features in-store technology to assist customers. For example, scanning a QR code on the clothing tag gives shoppers detailed product information and customer reviews. There is also a booth inside the store offering live streaming functionality so anyone can get online and promote the products they find there in real time.

[caption id="attachment_93269" align="aligncenter" width="745"] Interior of Taostyle store

Interior of Taostyle store Source: Alizila [/caption]

In January, health and beauty retailer A.S. Watson opened a lifestyle store, Watsons + NetEase Yanxuan, in Guangzhou, in collaboration with NetEase Yanxuan, which sells private label products through its e-commerce website and offline stores. The 250-square-feet store features a variety of products, including skincare and health products, travel accessories and household supplies.

Watsons and NetEase Yanxuan hope to explore online and offline integration. For Yanxuan, the physical store will help it give consumers a more concrete experience of its products, and it complement its retail channels both online and offline. For Watsons, the venture lets it leverage Yanxuan’s consumer data for product development.

[caption id="attachment_93270" align="aligncenter" width="700"] Watsons + NetEase Yanxuan store in Guangzhou

Watsons + NetEase Yanxuan store in Guangzhou Source: Watsons China [/caption]

Two Trends We Expect to Play Out in the Second Half

1. Live Streaming: The Winning Tool to Sell Plus-Size Apparel Online in ChinaChina is a promising market for plus-size clothing. A recent Coresight Research report estimates the women’s plus-size market in China is worth around $4.8 billion in 2019 and the addressable market is worth more than $10 billion.

Currently, there are too few physical stores selling plus-size clothing, and much of the opportunity in plus-size clothing is online.

Within online commerce, we see live streaming gaining more ground in selling plus-size clothing. Around 90% of plus-size retailers on Taobao participate in live streaming, according to data from plus-size live-stream incubator Dama Wenchuang, a platform of Taobao plus-size live-streamers based in Hangzhou.

Muzi Li Xiang, a three-year-old plus-size clothing retailer targeting women aged 30-40 and weighing 150-200 pounds, hosted a Frozen-themed winter wear fashion show on Taobao that attracted 50,000 live viewers and near half a million likes during last year’s 12.12 Taobao Shopping Festival.

[caption id="attachment_93271" align="aligncenter" width="720"] Muzi Lixiang’s Logo and the retailer’s founder, Xiang Li

Muzi Lixiang’s Logo and the retailer’s founder, Xiang Li Source: Muzi Lixiang’s Tmall flagship store [/caption]

Live streaming works well for plus-size clothing because it serves not only as a tool to showcase and deliver information about this category of apparel, but also as a customer engagement channel in which shoppers can interact with the host.

Implications for brands: Brands can leverage live streaming to sell plus-size clothing. Collaborating with plus-size models, who ususally have strong numbers of followers and interact with their fans on a frequent basis, would be a good way to start. For instance, Yuan Yuan, an ambassador for plus-size customers, has more than 100,000 fans on TikTok, the most popular short video app in China, according to Dama Wenchuang.

2. Shoppers in Lower-Tier Cities Will Drive Group BuyingMedia and businesses classify China’s cities into tiers based on population, gross domestic product and infrastructure. The major metropolises of Beijing, Shanghai, Guangzhou and Shenzhen are traditionally seen as tier 1 cities, with the lower tiers made up of smaller cities.

China’s lower-tier cities are growing fast, with total consumption reaching $3.3 trillion in 2017 and expected to hit $8.4 trillion in 2030, according to Morgan Stanley. The number of mobile Internet users in tier 3 and lower cities is also growing: It hit 618 million in March 2019, up 18.2% from last year, according to QuestMobile, a mobile data platform.

E-commerce players are tapping into tier-3 cities and below via the group buying model. Group buying offers products and services at significantly reduced prices but consumers have to join together to buy minimum amounts.

Alibaba’s group buying platform Juhuasuan reported the number of customers and purchasing volume from tier-3 to tier-5 cities grew 100% year over year during 2019’s midyear 6.18 shopping festival. Similarly, Pinduoduo said 70% of its orders from the same shopping festival came from cities in tier 3 and below.

One reason the group buying model works well in lower-tier cities is that it offers relatively lower prices: Consumers in these areas tend to be more price-sensitive and look for bargains.

Implications for brands: Growing consumption in lower-tier cities means potential for brands. Companies that want to expand into small and medium-sized cities can leverage the group buying model, which caters well to price-conscious lower-tier city dwellers.

Key Insights

Several major trends have solidified in the first half of 2019. The new e-commerce law has driven customers to buy though official, regulated channels, putting daigou on a downward trajectory. New forms of e-commerce such as live streaming continue to grow. Investment in and upgrades to new technology will continue to give consumers a more seamless shopping experince.

We also identified two additional trends we think will be significant in the second half of the year. Live streaming will become a major tool for merchants and brands to sell plus-size clothing online, providing information and building an inclusive community that lets these overlooked consumers be more visible. We also see lower-tier cities driving the growth in group buying.