DIpil Das

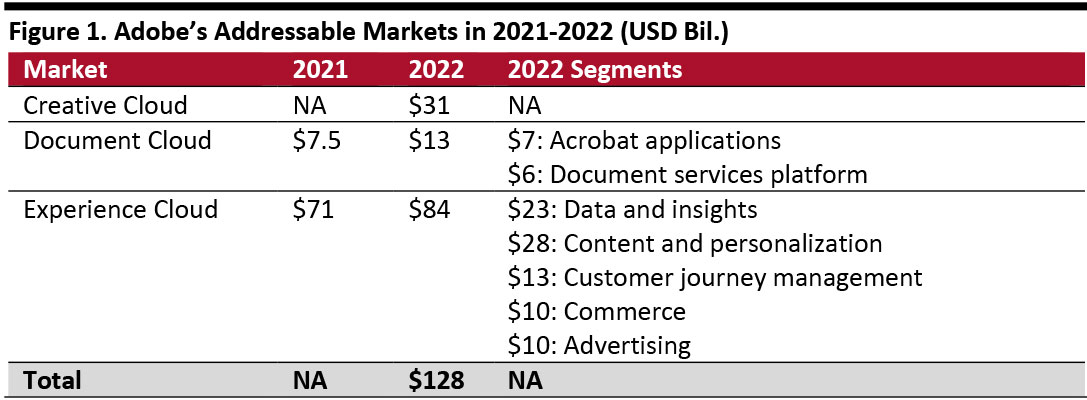

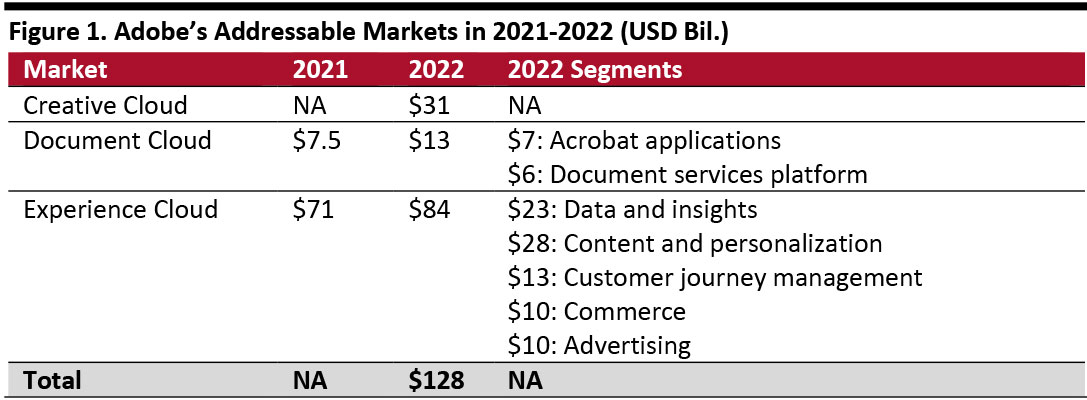

Meeting Overview: Targeting a $128 Billion Addressable Market in 2022

The objective of the meeting was to articulate the company’s strategy to expand its leadership in the creative, digital documents and customer experience management categories to drive sustainable, long-term revenue and earnings growth in 2020 and beyond.

Adobe kicked off the meeting sizing its 2022 addressable market at $128 billion, up from $108 billion in 2018 (a 4.3% CAGR), with the market expansion driven by the following factors:

Source: Company reports [/caption]

Implications for Retail

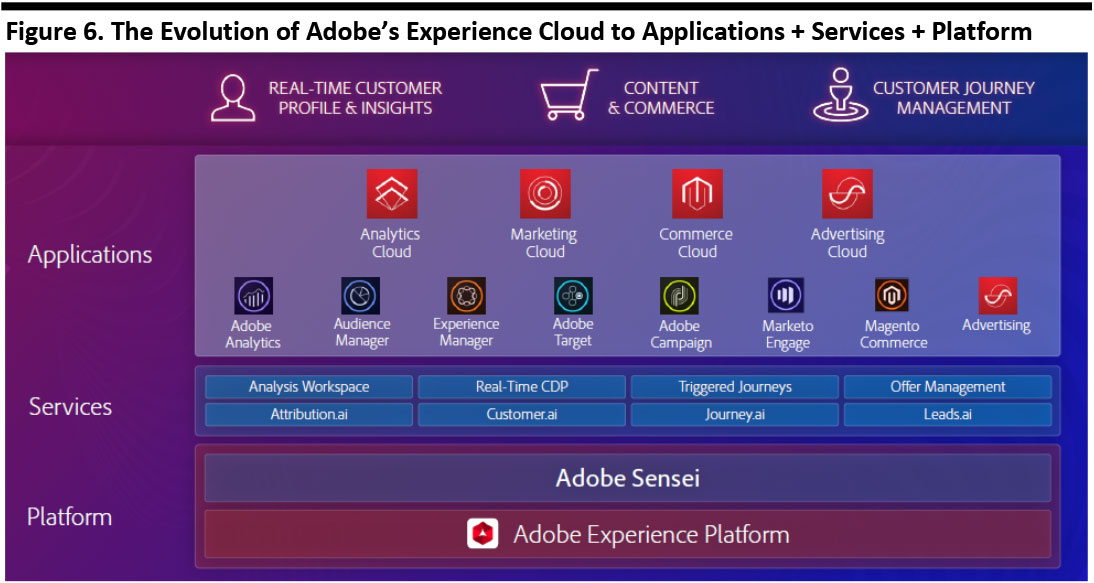

Adobe’s Experience Cloud provides the software tools that enable e-commerce, including analytics, customer data analysis, experience management, managing transactions and managing and automating advertising campaigns.

These platforms include:

· Adobe Analytics: Offers intelligence on cross-channel data, insights and activation.

· Adobe Audience Manager and Real-Time Customer Data Platform (CDP): Offers insights and activation for known and unknown audiences.

· Adobe Experience Manager (AEM) and Target: Offers a “single source of truth” to offer multichannel personalization at scale.

· Magento Commerce: Makes experiences shoppable for B2C and B2B, as well as for physical and digital goods.

· Adobe Campaign: Offers multichannel campaign orchestration and automation for B2C journeys.

· Marketo Engage: Offers omnichannel marketing automation and account-based marketing for B2B journeys.

· Unified Advertising Platform: Supports brands and agencies.

The figure below illustrates Adobe’s Experience Cloud customers in retail.

[caption id="attachment_99029" align="aligncenter" width="700"]

Source: Company reports [/caption]

Implications for Retail

Adobe’s Experience Cloud provides the software tools that enable e-commerce, including analytics, customer data analysis, experience management, managing transactions and managing and automating advertising campaigns.

These platforms include:

· Adobe Analytics: Offers intelligence on cross-channel data, insights and activation.

· Adobe Audience Manager and Real-Time Customer Data Platform (CDP): Offers insights and activation for known and unknown audiences.

· Adobe Experience Manager (AEM) and Target: Offers a “single source of truth” to offer multichannel personalization at scale.

· Magento Commerce: Makes experiences shoppable for B2C and B2B, as well as for physical and digital goods.

· Adobe Campaign: Offers multichannel campaign orchestration and automation for B2C journeys.

· Marketo Engage: Offers omnichannel marketing automation and account-based marketing for B2B journeys.

· Unified Advertising Platform: Supports brands and agencies.

The figure below illustrates Adobe’s Experience Cloud customers in retail.

[caption id="attachment_99029" align="aligncenter" width="700"] Source: Company reports[/caption]

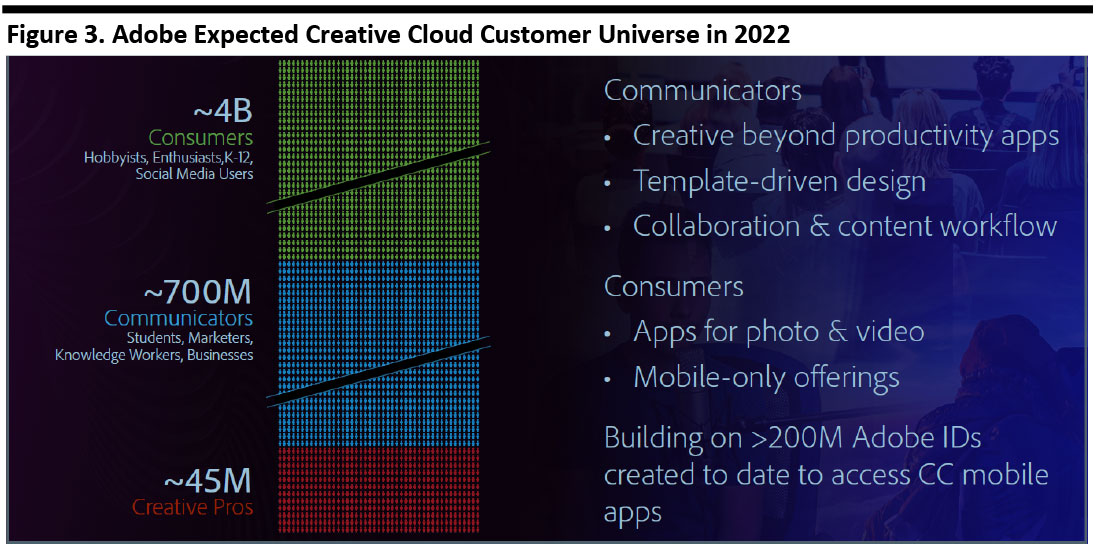

Creative Cloud: Unleashing Creativity for All

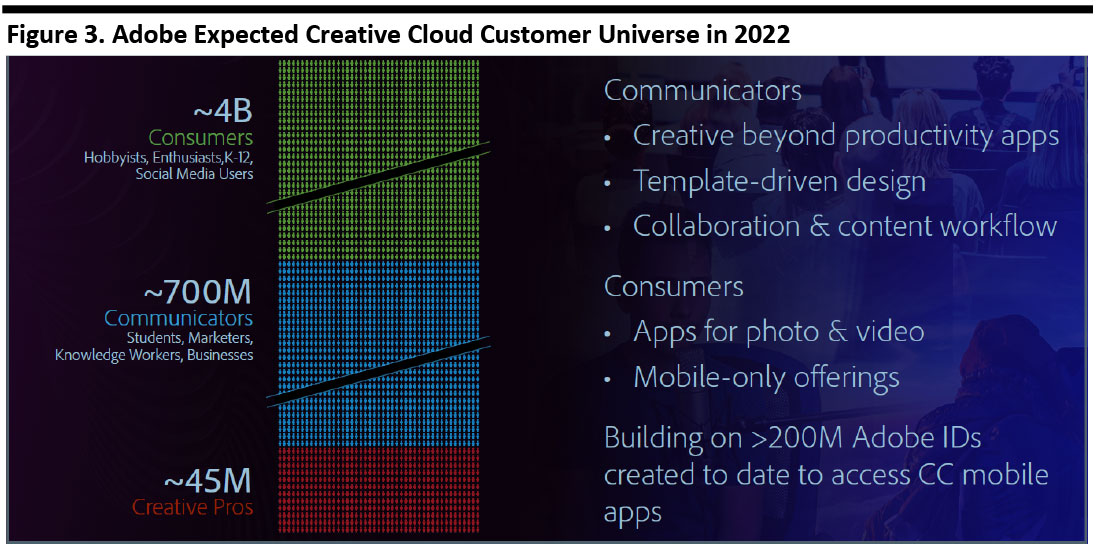

Adobe hopes to grow its Creative Cloud TAM to $31 billion in 2022 among creative professionals, communicators and consumers through the following actions:

Source: Company reports[/caption]

Creative Cloud: Unleashing Creativity for All

Adobe hopes to grow its Creative Cloud TAM to $31 billion in 2022 among creative professionals, communicators and consumers through the following actions:

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

Document Cloud: Unleashing Creativity for All

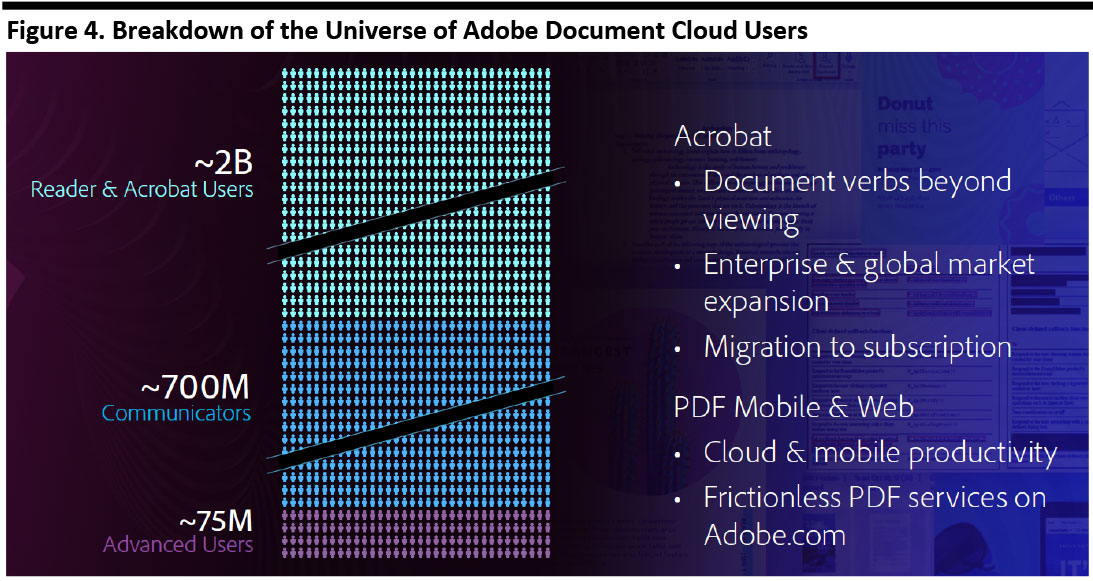

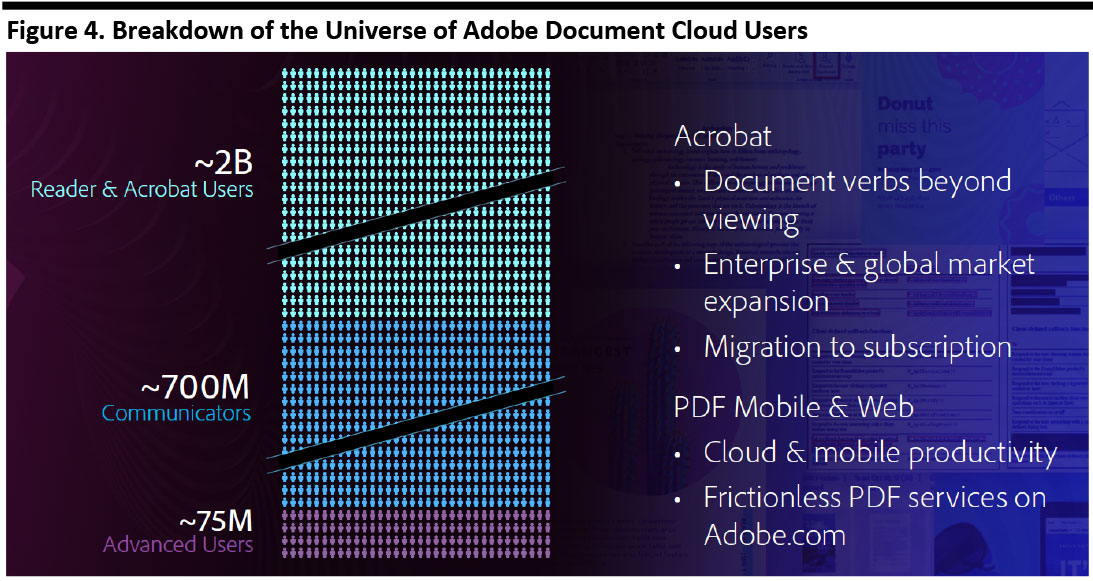

Adobe hopes to grow its Document Cloud TAM to $13 billion by 2022, which is benefitting from the paper-to-digital transformation and two billion Adobe mobile and reader users, through the following actions:

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

Document Cloud: Unleashing Creativity for All

Adobe hopes to grow its Document Cloud TAM to $13 billion by 2022, which is benefitting from the paper-to-digital transformation and two billion Adobe mobile and reader users, through the following actions:

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

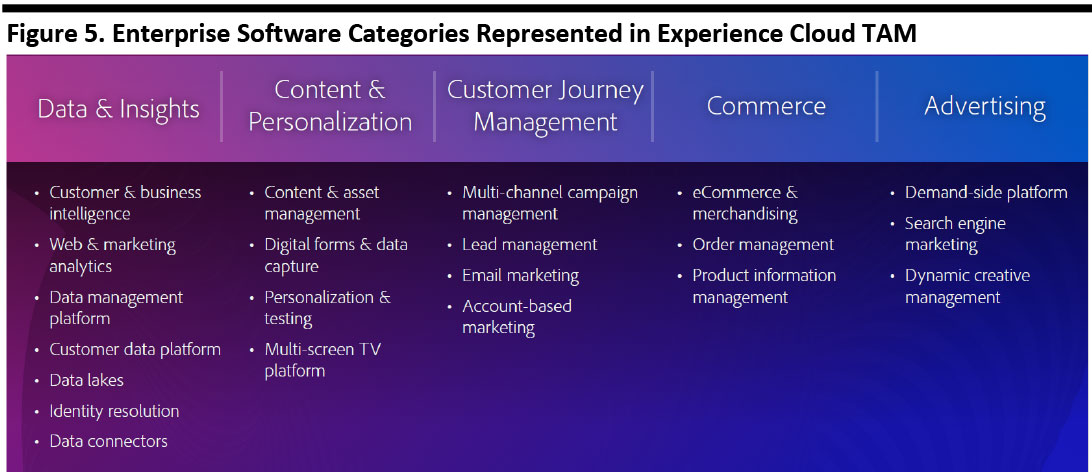

Experience Cloud: Growing Markets by Focusing on C-Level Professionals and Everyone

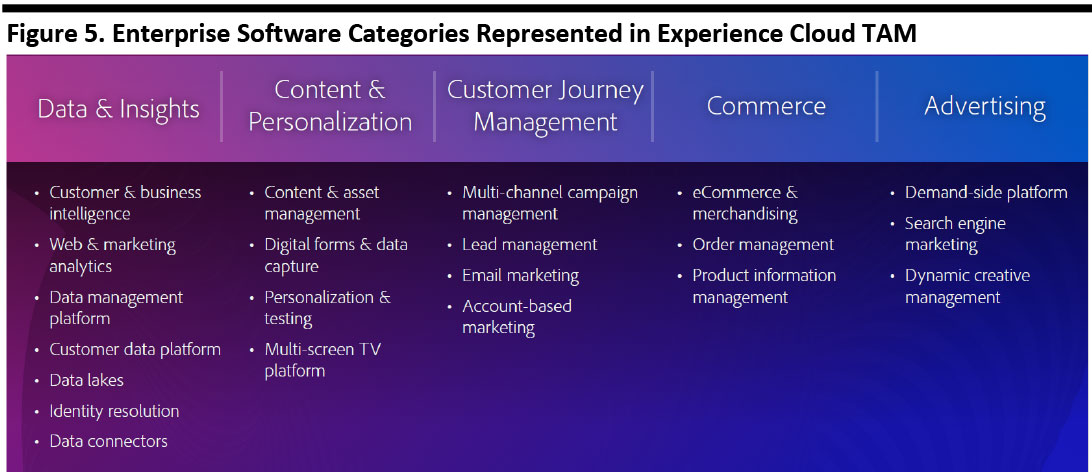

Adobe hopes to grow its Document Cloud TAM to $84 billion by 2022 from $71 million in 2021, driven by higher demand for data and insights, content and personalization, commerce, customer journey management and advertising, through the following actions:

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

Experience Cloud: Growing Markets by Focusing on C-Level Professionals and Everyone

Adobe hopes to grow its Document Cloud TAM to $84 billion by 2022 from $71 million in 2021, driven by higher demand for data and insights, content and personalization, commerce, customer journey management and advertising, through the following actions:

Source: Company reports[/caption]

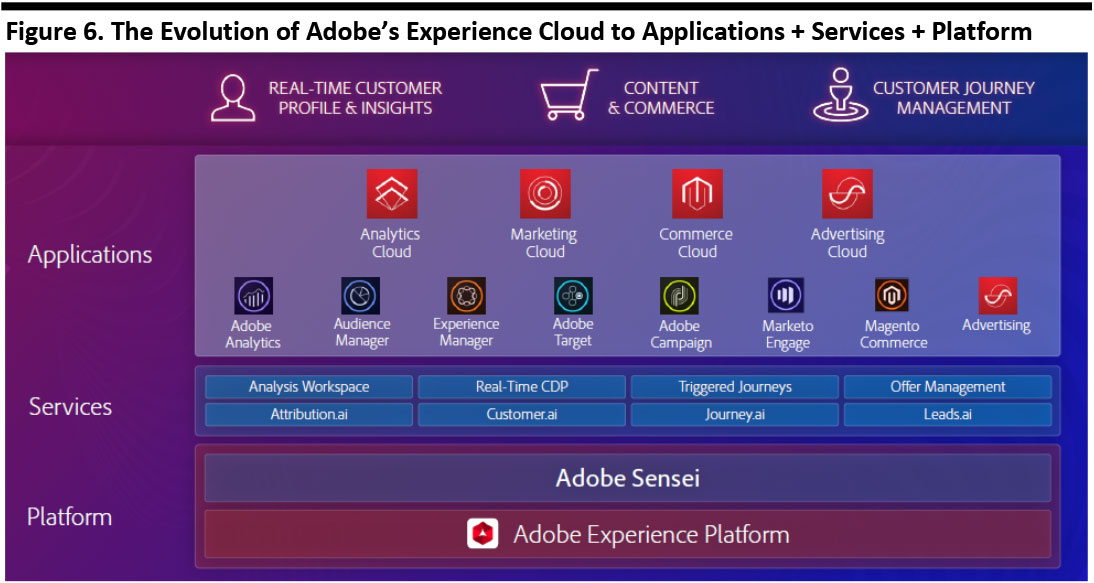

The figure below illustrates Adobe’s major cloud categories, related applications, underlying services and technology platforms.

[caption id="attachment_99033" align="aligncenter" width="700"]

Source: Company reports[/caption]

The figure below illustrates Adobe’s major cloud categories, related applications, underlying services and technology platforms.

[caption id="attachment_99033" align="aligncenter" width="700"] Source: Company reports[/caption]

Financials: Reaffirming Fiscal 2019 Guidance and Establishing FY2020 Targets

Adobe reaffirmed the following FY2019 financial targets:

Source: Company reports[/caption]

Financials: Reaffirming Fiscal 2019 Guidance and Establishing FY2020 Targets

Adobe reaffirmed the following FY2019 financial targets:

- Category Creation and Expansion: creativity for all; a platform for digital documents; and, reimagining CRM.

- Customer Expansion: creative professionals, office workers, consumers and students; marketers data scientists and developers; CMOs, CDOs, CROs and CIOs; and, vertical and global markets.

- Technology Drivers: new media, devices and modalities; intelligence everywhere; and, investments in platforms.

Source: Company reports [/caption]

Implications for Retail

Adobe’s Experience Cloud provides the software tools that enable e-commerce, including analytics, customer data analysis, experience management, managing transactions and managing and automating advertising campaigns.

These platforms include:

· Adobe Analytics: Offers intelligence on cross-channel data, insights and activation.

· Adobe Audience Manager and Real-Time Customer Data Platform (CDP): Offers insights and activation for known and unknown audiences.

· Adobe Experience Manager (AEM) and Target: Offers a “single source of truth” to offer multichannel personalization at scale.

· Magento Commerce: Makes experiences shoppable for B2C and B2B, as well as for physical and digital goods.

· Adobe Campaign: Offers multichannel campaign orchestration and automation for B2C journeys.

· Marketo Engage: Offers omnichannel marketing automation and account-based marketing for B2B journeys.

· Unified Advertising Platform: Supports brands and agencies.

The figure below illustrates Adobe’s Experience Cloud customers in retail.

[caption id="attachment_99029" align="aligncenter" width="700"]

Source: Company reports [/caption]

Implications for Retail

Adobe’s Experience Cloud provides the software tools that enable e-commerce, including analytics, customer data analysis, experience management, managing transactions and managing and automating advertising campaigns.

These platforms include:

· Adobe Analytics: Offers intelligence on cross-channel data, insights and activation.

· Adobe Audience Manager and Real-Time Customer Data Platform (CDP): Offers insights and activation for known and unknown audiences.

· Adobe Experience Manager (AEM) and Target: Offers a “single source of truth” to offer multichannel personalization at scale.

· Magento Commerce: Makes experiences shoppable for B2C and B2B, as well as for physical and digital goods.

· Adobe Campaign: Offers multichannel campaign orchestration and automation for B2C journeys.

· Marketo Engage: Offers omnichannel marketing automation and account-based marketing for B2B journeys.

· Unified Advertising Platform: Supports brands and agencies.

The figure below illustrates Adobe’s Experience Cloud customers in retail.

[caption id="attachment_99029" align="aligncenter" width="700"] Source: Company reports[/caption]

Creative Cloud: Unleashing Creativity for All

Adobe hopes to grow its Creative Cloud TAM to $31 billion in 2022 among creative professionals, communicators and consumers through the following actions:

Source: Company reports[/caption]

Creative Cloud: Unleashing Creativity for All

Adobe hopes to grow its Creative Cloud TAM to $31 billion in 2022 among creative professionals, communicators and consumers through the following actions:

- Continuing to release new innovative applications that increase productivity and collaboration for individuals, small businesses and enterprises.

- Offering products to new audiences, for example, the recent release of Photoshop for iPad, Fresco and Photoshop Camera.

- Growing customer loyalty and retention through events such as the Adobe MAX conference and Behance, an online social media platform that aims to display and enable the discovery of creative work, which has 18 million members.

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

Document Cloud: Unleashing Creativity for All

Adobe hopes to grow its Document Cloud TAM to $13 billion by 2022, which is benefitting from the paper-to-digital transformation and two billion Adobe mobile and reader users, through the following actions:

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

Document Cloud: Unleashing Creativity for All

Adobe hopes to grow its Document Cloud TAM to $13 billion by 2022, which is benefitting from the paper-to-digital transformation and two billion Adobe mobile and reader users, through the following actions:

- Delivering a superior PDF viewing experience by enhancing the mobile and online reader experience.

- Expanding the document-management capabilities of Acrobat – including editing, collaborating, scanning and signing — to help enhance business productivity.

- Making PDF handling frictionless for mobile and web by providing simple, one-click experiences to access Adobe’s PDF tools online.

- Creating a PDF ecosystem to embed services through a set of APIs, which enables new models of delivery and monetization.

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

Experience Cloud: Growing Markets by Focusing on C-Level Professionals and Everyone

Adobe hopes to grow its Document Cloud TAM to $84 billion by 2022 from $71 million in 2021, driven by higher demand for data and insights, content and personalization, commerce, customer journey management and advertising, through the following actions:

Source: Company reports/International Labor Organization/US Bureau of Labor Statistics/Business Software Alliance[/caption]

Experience Cloud: Growing Markets by Focusing on C-Level Professionals and Everyone

Adobe hopes to grow its Document Cloud TAM to $84 billion by 2022 from $71 million in 2021, driven by higher demand for data and insights, content and personalization, commerce, customer journey management and advertising, through the following actions:

- Building on established relationships with chief marketing officers and chief digital officers to drive customer-experience adoption across the enterprise.

- Educating chief information officers of the importance of the Adobe Experience Platform.

- Extending offerings and go-to-market from B2C to B2B and B2E (business to everyone), as all customers now expect the same high-quality experiences as professionals.

- Building scale in the mid-market segment through the acquisitions of Magento and Marketo.

- Evangelizing Adobe’s Data-Driven Operating Model (DDOM) to customers.

Source: Company reports[/caption]

The figure below illustrates Adobe’s major cloud categories, related applications, underlying services and technology platforms.

[caption id="attachment_99033" align="aligncenter" width="700"]

Source: Company reports[/caption]

The figure below illustrates Adobe’s major cloud categories, related applications, underlying services and technology platforms.

[caption id="attachment_99033" align="aligncenter" width="700"] Source: Company reports[/caption]

Financials: Reaffirming Fiscal 2019 Guidance and Establishing FY2020 Targets

Adobe reaffirmed the following FY2019 financial targets:

Source: Company reports[/caption]

Financials: Reaffirming Fiscal 2019 Guidance and Establishing FY2020 Targets

Adobe reaffirmed the following FY2019 financial targets:

- Q4 revenue of $2.97 billion (up 20.5% year over year).

- Adjusted EPS of $2.25 (up 23.0% year over year).

- Meeting other financial targets.

- Revenue of $13.15 billion (up 17.9%).

- Adjusted EPS of $9.75 (up 24.4%).