EXECUTIVE SUMMARY

Chinese New Year, or Spring Festival as it is known locally, illustrates the unique spending patterns of Chinese shoppers, whether domestically or abroad. In Part 1 of our 2017 Spring Festival Report, we forecast that Chinese retail sales will hold up during this year’s Spring Festival, helped by demand for quality products, and increasing competition from e-commerce players for Spring Festival shopping, traditionally a stronghold of physical retailers.

In Part 2, we focus on two main themes: 1) the continued rise in Chinese outbound travel; and 2) the growing preference for spending on experiences and entertainment.

Forecasts For 2017 Spring Festival Spending On Experiences

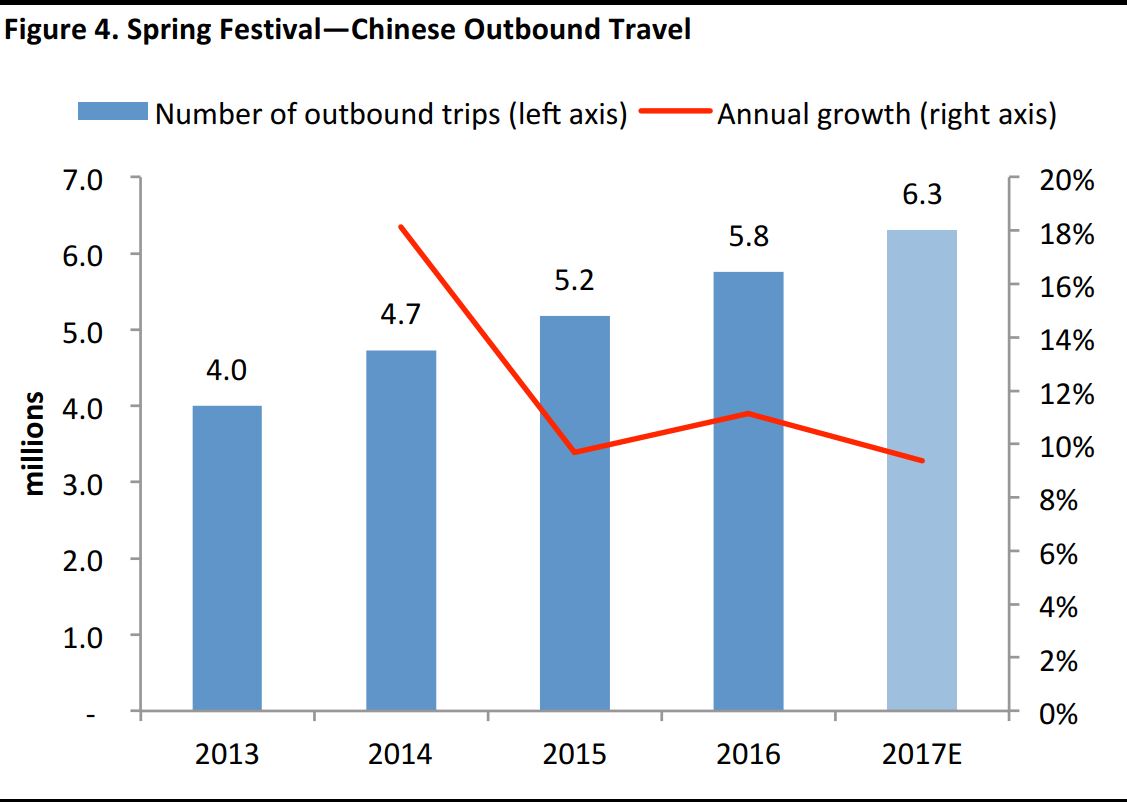

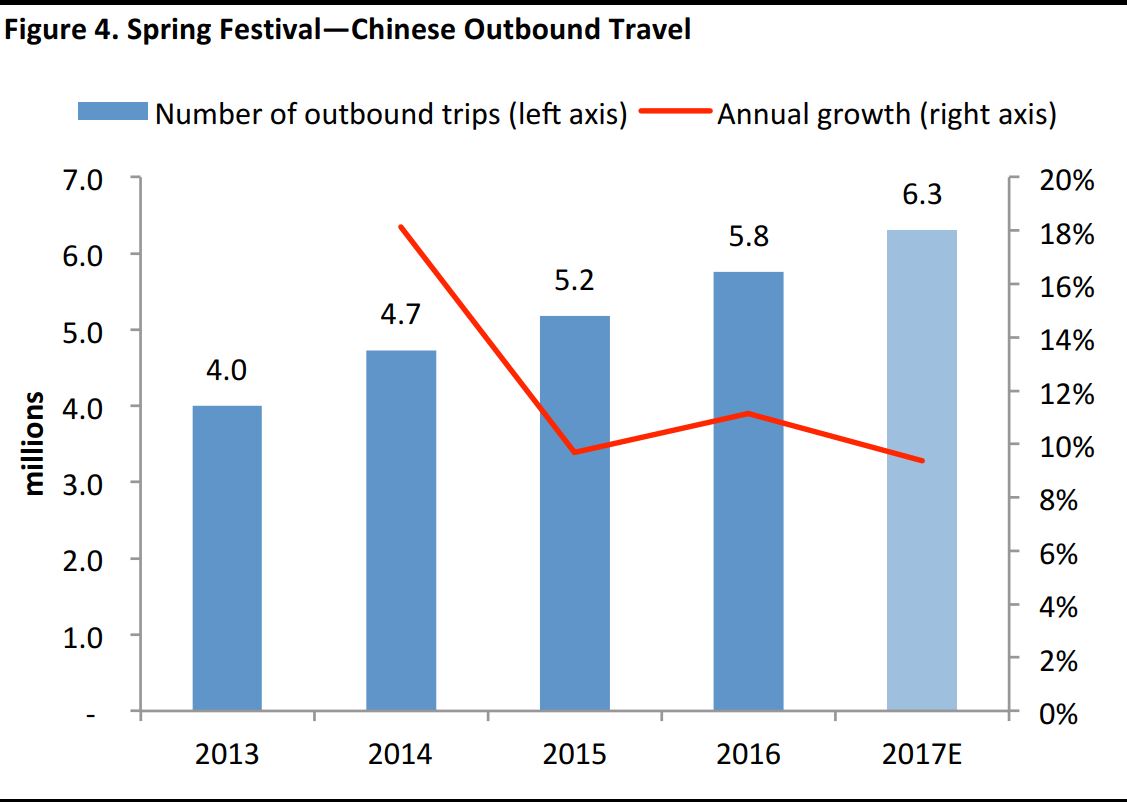

- We expect the number of overseas trips taken by Chinese to increase 9% year over year to reach 6.3 million during this year’s Spring Festival.

- We expect Chinese retail sales to increase 12% year over year, slightly above the growth seen last year.

Structural Trends Underpinning Our Expectations

We see three key trends for Chinese consumption patterns for the holiday:

- The continued upgrade of Chinese consumption, as consumers allocate more spending to experiences and entertainment.

- Strong demand for outbound travel and overseas spending, as relaxed visa policies and the expanding network of international direct flights from China will lead to a broader choice of destinations.

- The gamification of Spring Festival customs, as the added augmented reality (AR) function will likely spur the sharing of virtual red envelopes.

Fung Global Retail Technology team covers Chinese outbound tourism trends extensively and performs a survey on tourists every year. Our past survey results were featured in our 2016 report,

Global Chinese Shoppers Carry Spending Momentum Into 2016, and our 2015 report,

Global Chinese Shoppers: The $200 Billion Opportunity.

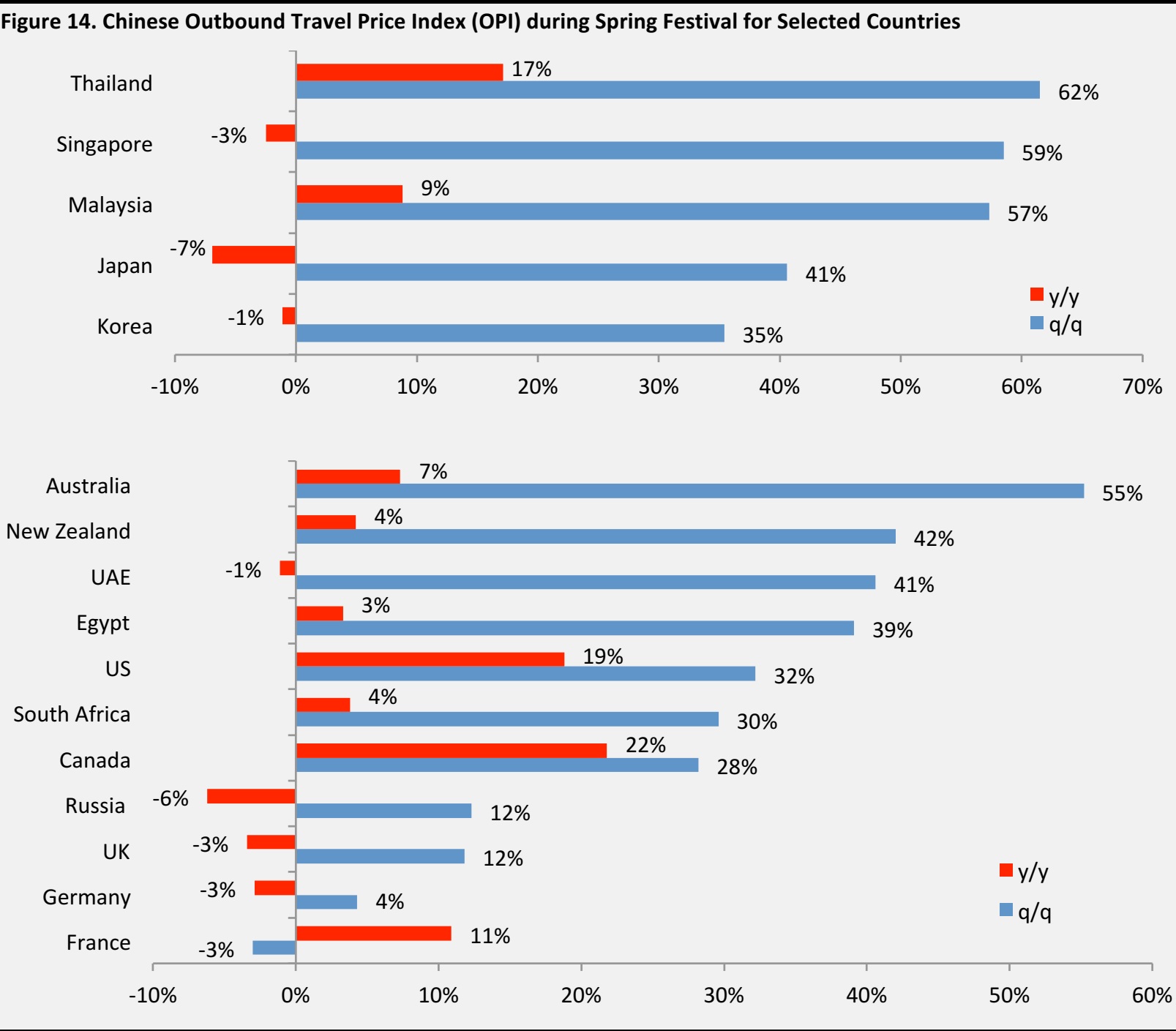

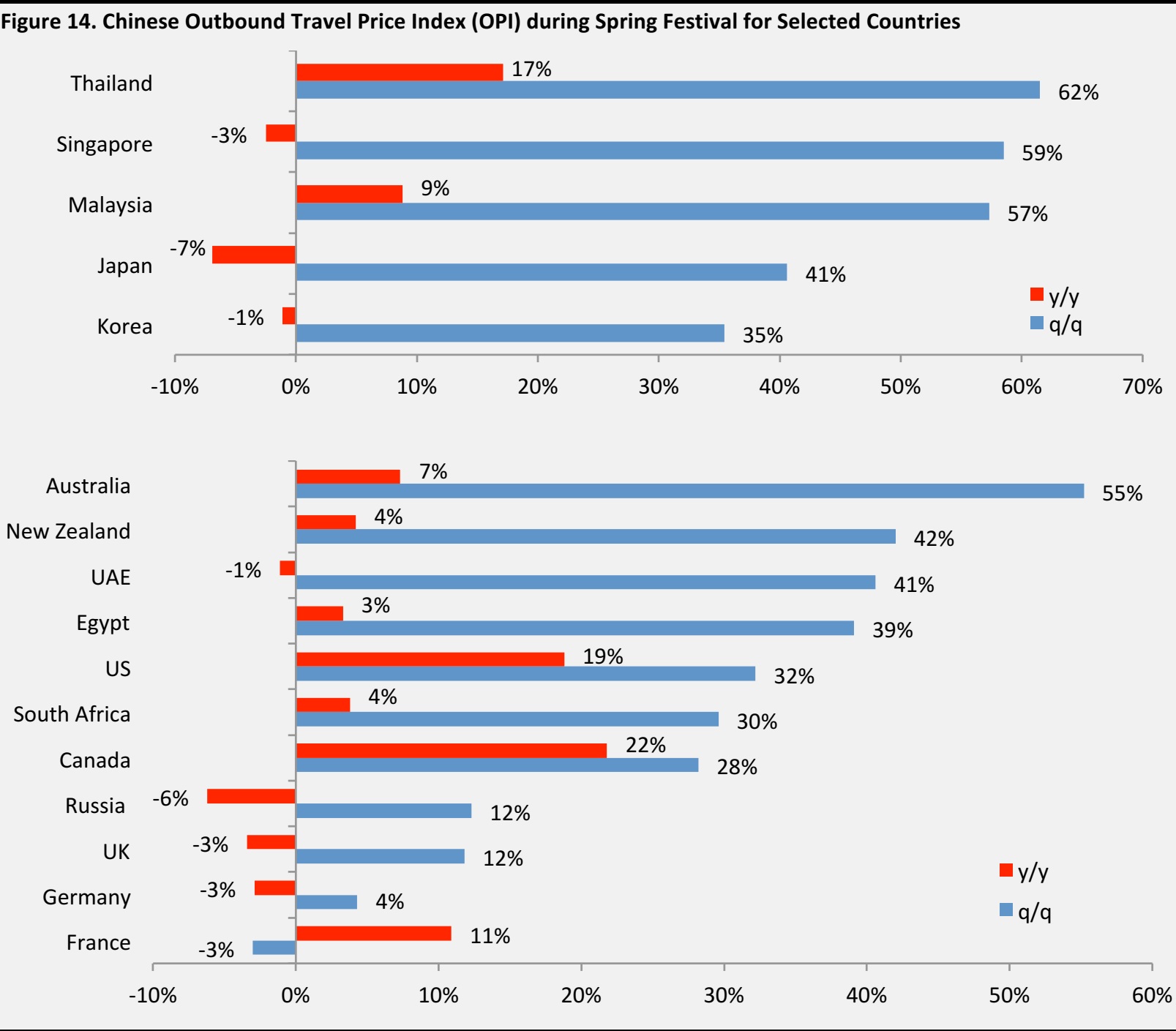

WINNERS AND LOSERS—OUR VIEW

In our view, China’s consumption upgrade is largely spurred by rising incomes and Chinese consumers’ pursuit of a better quality of life. We highlight our expectations for the winners and losers of this year’s Spring Festival below.

Winners: Within China, we expect the

movie industry and

payment providers to benefit, as Chinese consumers increasingly spend on entertainment, such as going to the movies, and sending virtual red envelopes and playing AR games on their mobile phones.

From an outbound travel standpoint, we expect

Australia, Thailand and

Japan to see the largest increase in Chinese tourists’ visitations, due to relaxed visa policies and more direct flights from China. We also expect the

UK to benefit as sterling depreciation should increase the number of visiting Chinese tourists and is positive for UK tourism receipts.

Losers: We expect domestic

mom-and-pop stores to lose out to large retailers and e-commerce players. Most small stores will be closed during Spring Festival.

Elsewhere, we expect

Taiwan to be negatively impacted by tensions in the cross-straits relationship, and that Chinese tourists will choose to visit countries that offer unique experiences over

Hong Kong.

Source: Shutterstock

Source: Fung Global Retail & Technology

Source: Fung Global Retail & Technology

WINNERS AND LOSERS – OUR VIEW

In the following section, we highlight those industries and countries that will likely be better off on the back of the themes of China’s consumption upgrade and outbound Chinese tourists during Spring Festival.

PAYMENT PROVIDERS (POSITIVE)

Those payment providers that are best able to attract Chinese consumers and to increase their presence during Spring Festival will be better off. China’s leading payment providers—Tencent’s Wechat Pay and Alibaba’s Alipay —have introduced new functions to virtual red envelopes, expanded their geographical coverage and launched promotions with partnering retailers to capture the opportunity.

Adding Augmented Reality (AR) and Location-Based Service (LBS) Functionalities to Virtual Red Packets

Tencent and Alibaba unveiled their respective location-based (LBS) + augmented reality (AR) games that allow users to collect virtual red envelopes. Users can hide virtual red envelopes by scanning physical objects and send clues to their friends to find. Starting January 28, the games are available on Alipay, Alibaba’s payment app, and QQ, Tencent’s messaging service, in China and abroad.

To up the ante, Tencent and Alibaba are both offering cash gifts to attract users to their AR games. Alibaba announced that it will offer ¥200 million (US$29 million) in cash for players to find in its AR game, while Tencent will offer ¥300 million (US$43 million). In order to attract shoppers to their physical stores, foreign brands, including Coca Cola, Procter & Gamble and Uniqlo, will offer a total of ¥30 million (US$4.3 million) in virtual red envelopes for shoppers to find in their stores.

Expanding their Geographical Coverage and Launching Promotions

China’s leading payment providers are expanding their geographical coverage and launching promotions with partnering retailers to increase their presence during Spring Festival 2017. The expansion of Chinese payment providers overseas enables Chinese consumers shopping at overseas retailers to use their mobile wallets to pay.

Alipay has reached a partnership with DFS Group, a leading luxury travel retailer, for its in-store mobile payment service to be made available in selected DFS stores. China Unionpay International is partnering with Qatar Duty Free (QDF) to offer travelers the opportunity to earn prizes as part of the Spring Festival promotion. QDF staff will be dressed in traditional Chinese costumes during the period.

CASE STUDY

THE DIGITIZATION OF TRADITION—VIRTUAL RED ENVELOPES AS AN EFFECTIVE USER-ACQUISITION TOOL

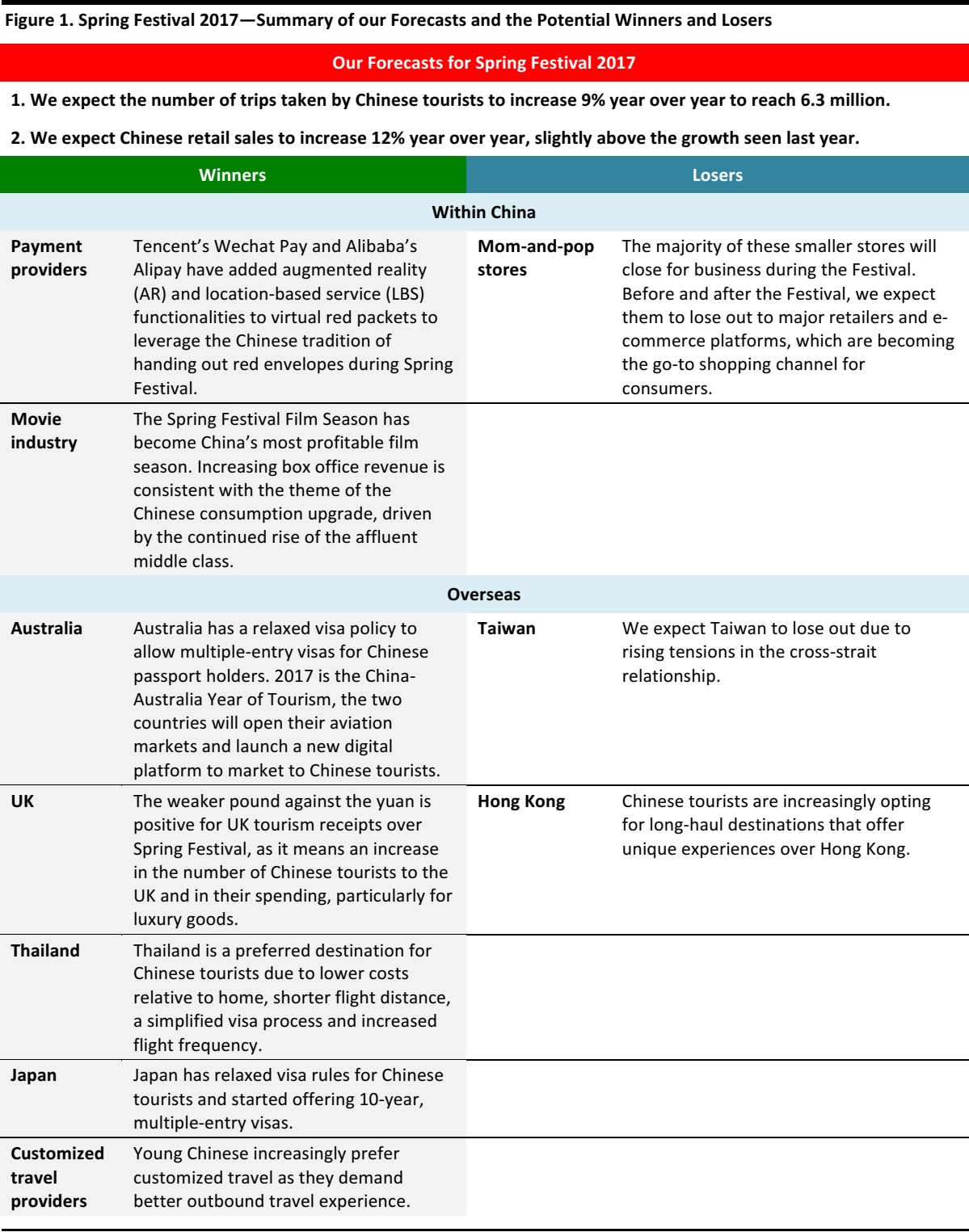

The virtual red envelope is an example of how China’s tech companies have taken advantage of a cultural tradition to further entrench their presence in the mobile payment industry.

The Challenge

Tech companies often face the challenge of gaining traction with users and merchants simultaneously. They need to incentivize users to bind their payment credentials to their accounts, and at the same time, convince merchants to devote resources to building their platform.

WeChat’s Solution

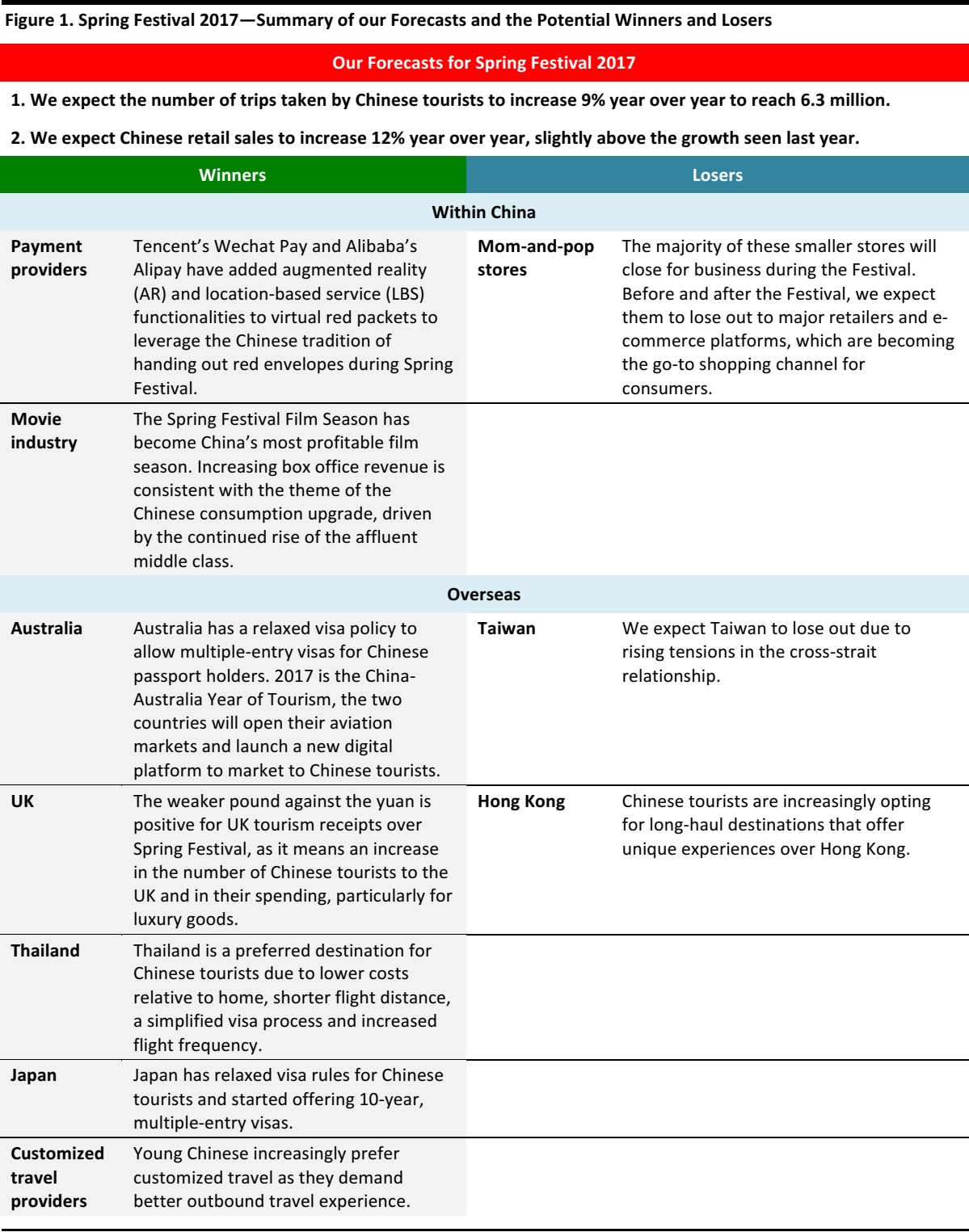

WeChat launched a peer-to-peer payment feature called Red Envelopes prior to Spring Festival in 2014. Giving out red envelopes with cash to relatives and friends is a time-honored tradition during Spring Festival. WeChat deftly used this tradition to get users to adopt mobile payments on its messaging platform.

Source: Shutterstock

The results have been staggering. In 2016 (the third year since launch), WeChat delivered 8.08 billion digital red envelopes on Chinese New Year’s Eve (10.6 red envelopes per user). The number of red envelopes that were shared, which has developed into a popular peer-to-peer transfer method from merely a Spring Festival tradition, grew from 1 billion for the full-year 2015, up from 16 million in 2014. WeChat has enjoyed some significant benefits by launching its virtual red envelope feature:

- Unlocking subsequent transaction activity across WeChat ecosystem: A prerequisite for successful expansion into mobile finance is winning over Chinese users’ digital wallets. As users top up their WeChat accounts to give away red envelopes, they bind their credit card to their accounts, and open themselves up to other payment services on WeChat’s one-stop platform.

- Gamification of Chinese New Year: WeChat users can allocate a sum of money to be distributed among a specified group of friends on a “first-come, first-served” basis. This feature has proven very popular, as users like to compete to get the most red envelopes; the thrill of competition leads to more and more envelopes being sent.

Reaction from Competitors

WeChat is by far the most popular platform for exchanging virtual red envelopes, but some competitors have introduced their own version of virtual red envelopes in order to increase the profile of their mobile payment platforms. In 2016, Alipay saw 324.5 billion red envelopes exchanged and Baidu Wallet saw 11.2 billion red envelopes being exchanged, which contained a total of ¥300 million (about US$45.6 million) between January 28 and February 8.

Source: Tencent

Source: Tencent

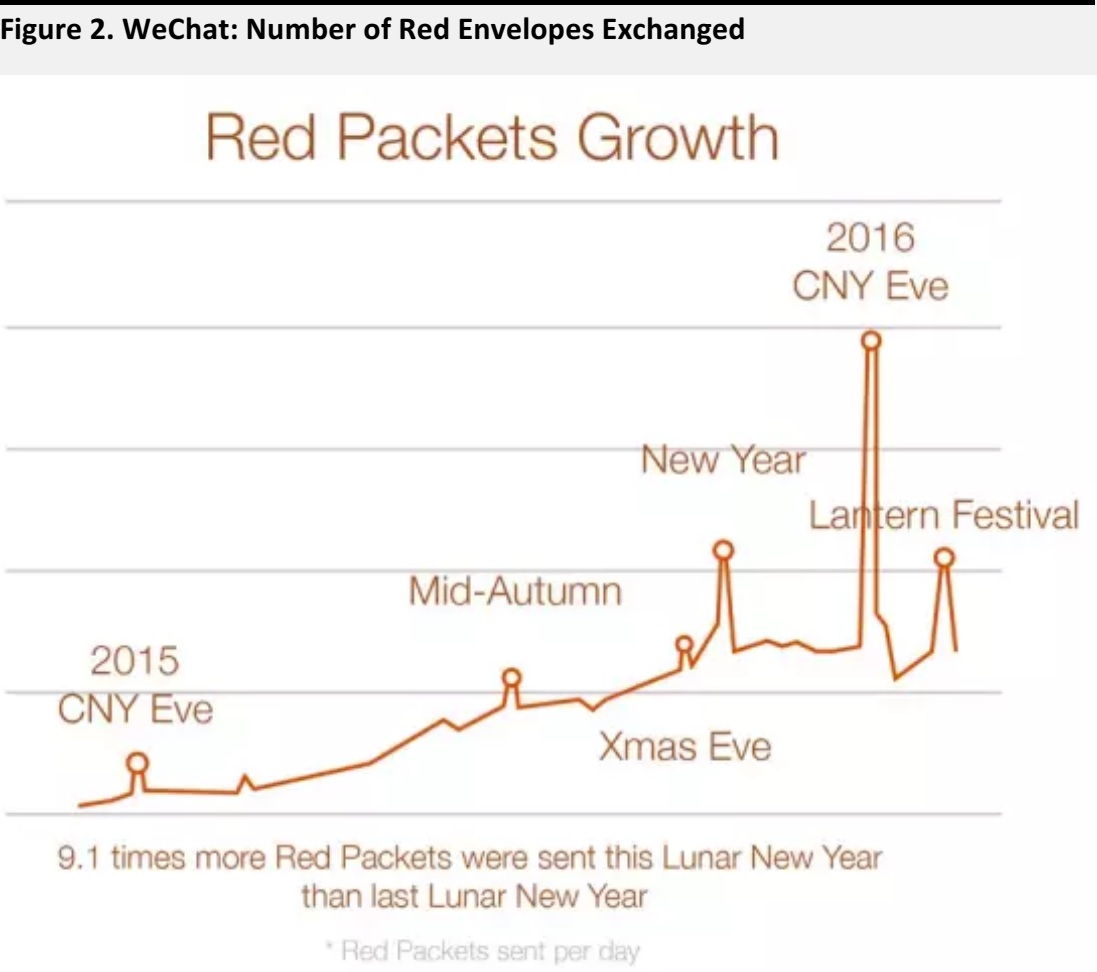

MOVIE AND ENTERTAINMENT INDUSTRY (POSITIVE)

We believe Chinese consumers’ spending on leisure and entertainment will increase, as they allocate more spending and upgrade to experiences and entertainment.

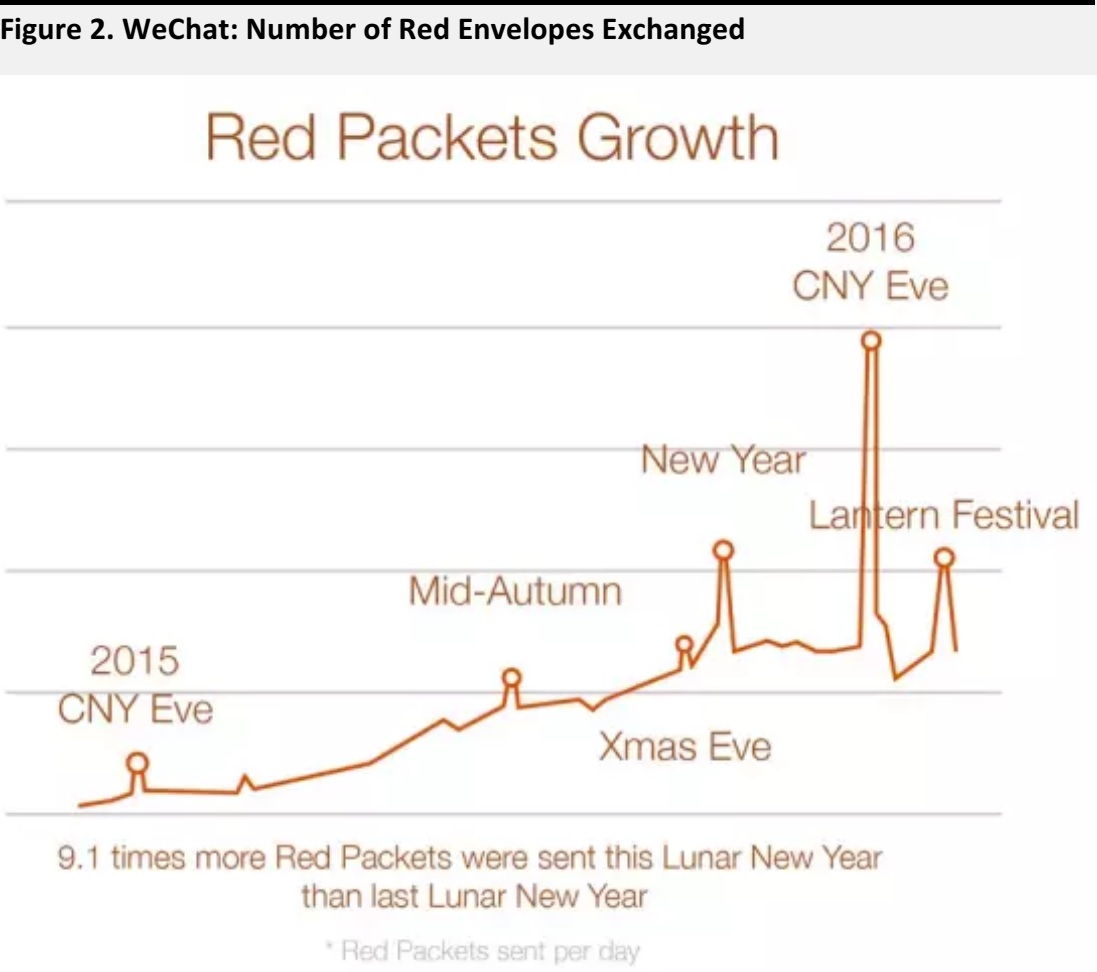

The Spring Festival Film Season has become China’s most profitable film season, as cinema operators and entertainment companies compete to attract Chinese consumers. Increasing box office revenue is consistent with the theme of the Chinese consumption upgrade, driven by the continued rise of the affluent middle class.

Since 2016, China’s box office revenues during Spring Festival have been picking up significantly. Total box office revenue during Spring Festival 2016 increased 65% year over year to ¥3 billion, exceeding the record set in North America for Christmas 2015, and representing a 7% share of fiscal year 2016 total box office revenue.

Source: State Administration of Press, Publication, Radio, Film and Television

Source: State Administration of Press, Publication, Radio, Film and Television

TRAVEL INDUSTRY (POSITIVE)

We expect the number of overseas trips taken by Chinese during Spring Festival 2017 to increase 9% year over year to reach 6.3 million. An increase in Chinese outbound tourism is positive for the travel industry, in our view. In particular, we expect those countries with higher Chinese tourists’ visitations and customized travel providers to benefit disproportionately.

Source: Civil Aviation Resource Net Of China/Fung Global Retail & Technology

Winners

- Australia

- UK

- Thailand

- Japan

- Customized travel providers

Losers

Source: National Tourism Organizations

Australia (Positive)

Australia will be one of the most popular destinations for Chinese tourists during this year’s Spring Festival and the rest of the year, in our view.

Australia has taken a number of measures to boost Chinese tourists’ visitations, which include:

- The recent rollout of a relaxed visa policy for Chinese passport holders that allows multiple entries.

- Declaration of 2017 as the “China-Australia Year of Tourism” (CAYOT). Initiatives include the launch of a new digital platform in China to enable Chinese travelers to visualize the wonders of Australia.

- China and Australia will open the aviation market between the two countries, which includes the removal of all capacity restrictions for each country’s airline. Six leading Chinese airlines will launch direct flights connecting lower-tier Chinese cities with Australian cities.

China has become the most important tourism market by revenue for Australia, and is poised to overtake New Zealand by visitor numbers as early as 2017. Tourism Australia targets to increase Chinese tourists’ spending in the country to A$13 billion (US$ 9.8 billion) by 2020, from A$9 billion (US$ 6.8 billion) in 2016.

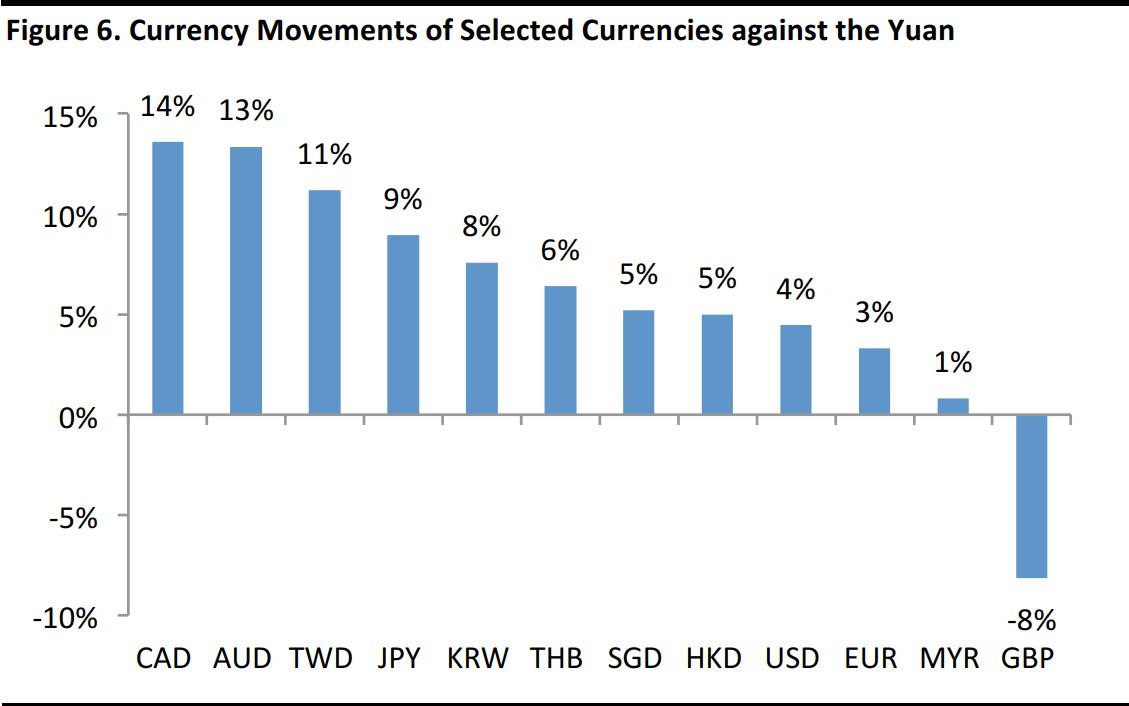

UK (Positive)

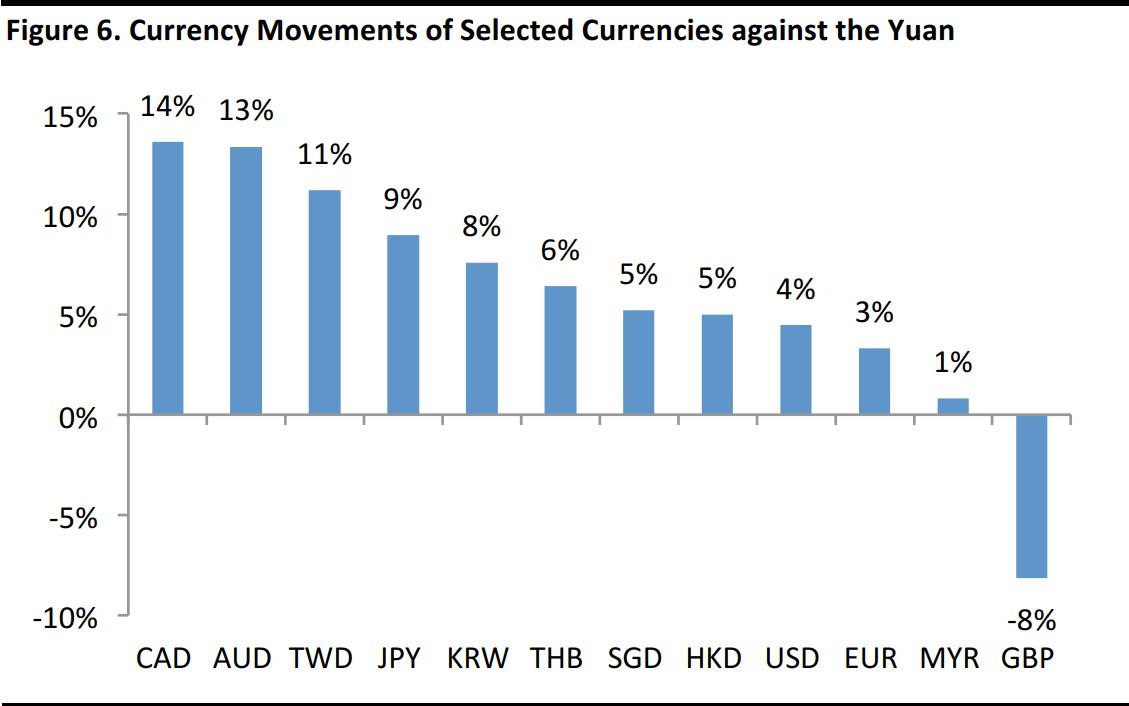

The weaker pound against the yuan is positive for UK tourism receipts over Spring Festival, as it increases: 1) the number of Chinese tourists to the UK; and 2) their spending, particularly for luxury goods.

According to Ctrip, after the announcement of Brexit, the number of searches for UK-bound trips increased 200%, and bookings for the UK increased 150% quarter over quarter. We expect the UK to benefit from some Chinese tourist traffic that has been diverted from continental Europe due to security concerns over terrorist attacks.

Note: Priced as of January 26, 2017. Relative to January 25, 2016.

Source: Barchart

Thailand (Positive)

We expect Thailand to be Chinese tourists’ top destination for this Spring Festival, and for Thai retail operators to benefit. Thailand is a preferred destination for Chinese tourists due to lower costs relative to home, shorter flight distance, a simplified visa process and increased flight frequency. Thailand reduced visa fees for Chinese passport holders visiting in December 2016 to February 2017.

The Thai Chamber of Commerce forecasts spending during Spring Festival will reach at least THB50 billion (US$1.4 billion) this year, on par with the same period last year. Thai retail operators such as Robinson Department Store and Big C Supercenter are competing for the spending of Chinese tourists by offering prizes and discounts.

Source: National Tourism Organizations

Japan (Positive)

Japan has relaxed visa rules for Chinese tourists, which we expect to attract Chinese tourists to Japan. Under the relaxed visa rules announced by Japan’s Ministry of Foreign Affairs, Japan will offer 10-year, multiple-entry visas for Chinese tourists and lower the visa requirements, as part of a plan to increase the number of tourists to 40 million per year by 2020.

Chinese visitors to Japan have increased 28% to 6.4 million in 2016 and total spending amounted to JPY1.47 trillion (US$12.8 billion), according to the Japan National Tourism Organization. Among Chinese, Japanese goods are perceived to be of higher quality, with consumer electronics, luxury and skin-care products the most popular.

Source: Shutterstock

Customized Travel Providers (Positive)

In general, young Chinese prefer customized travel and China’s travel industry has launched high-end customized tour packages in order to fulfil this demand for a better outbound travel experience.

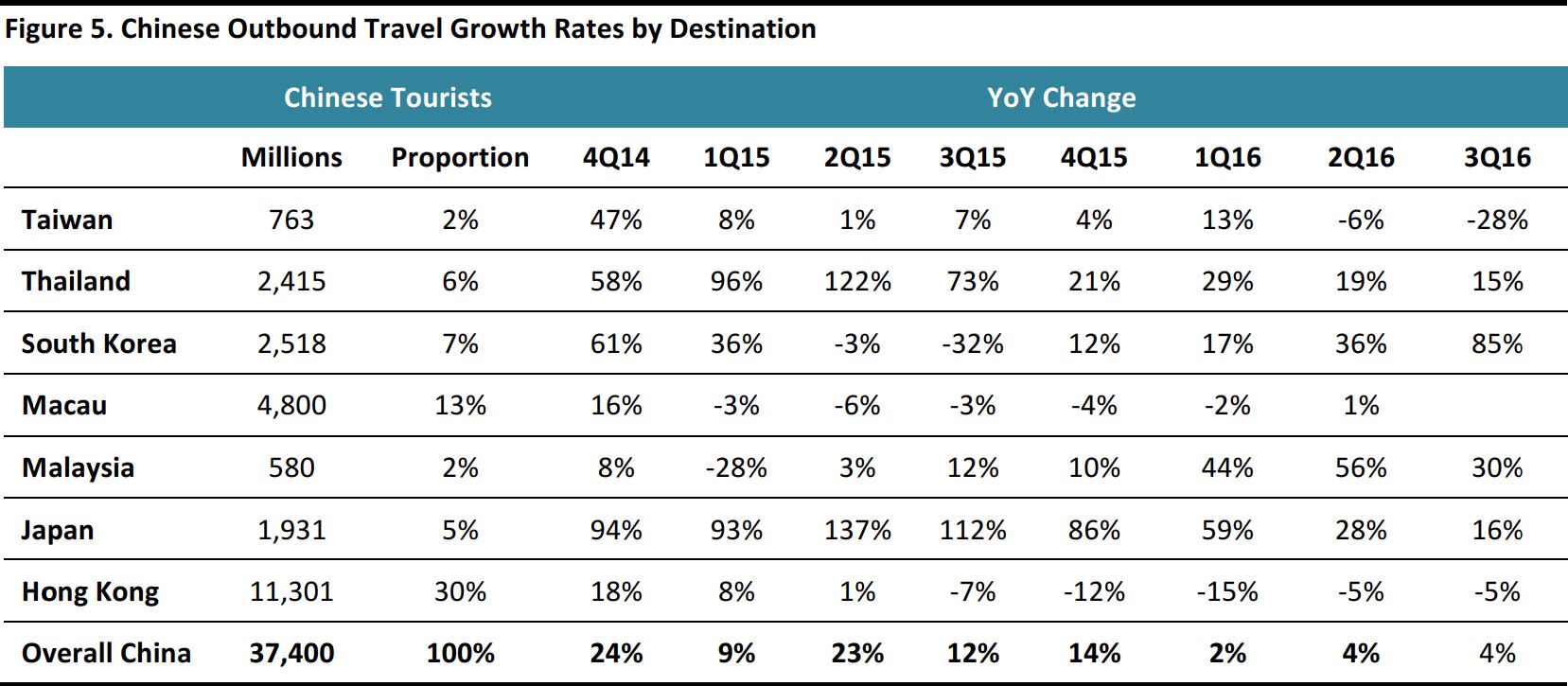

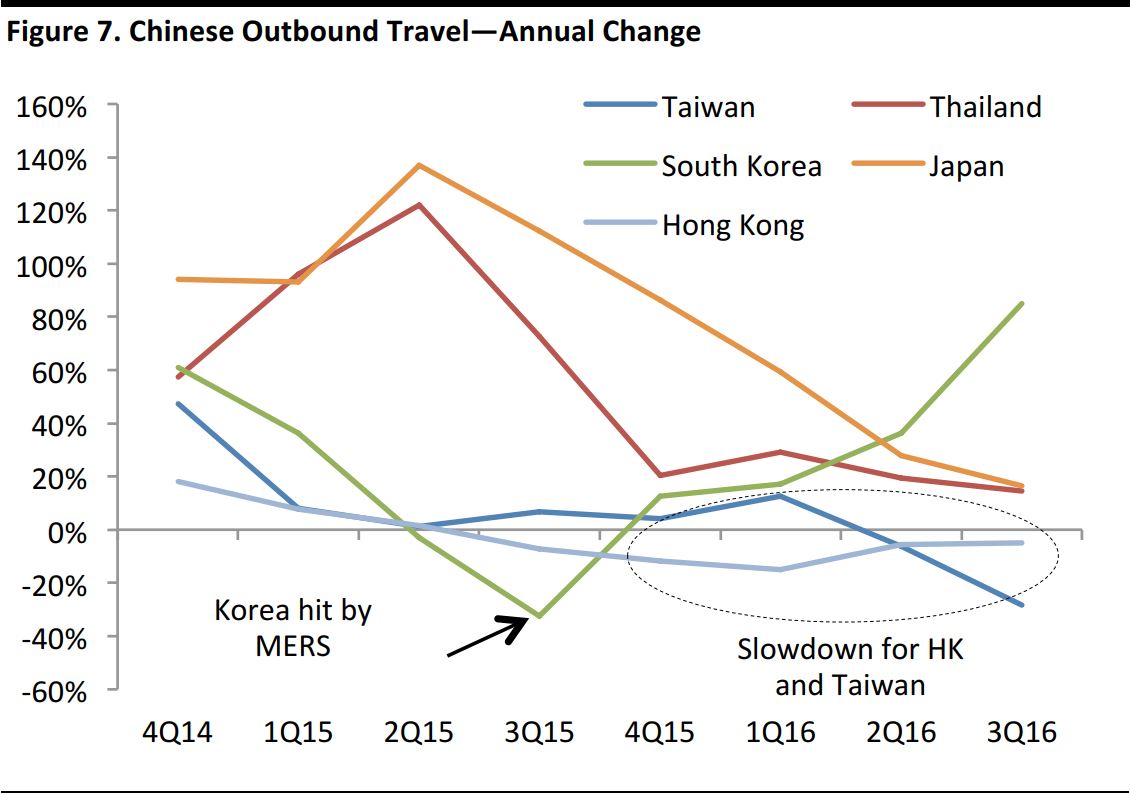

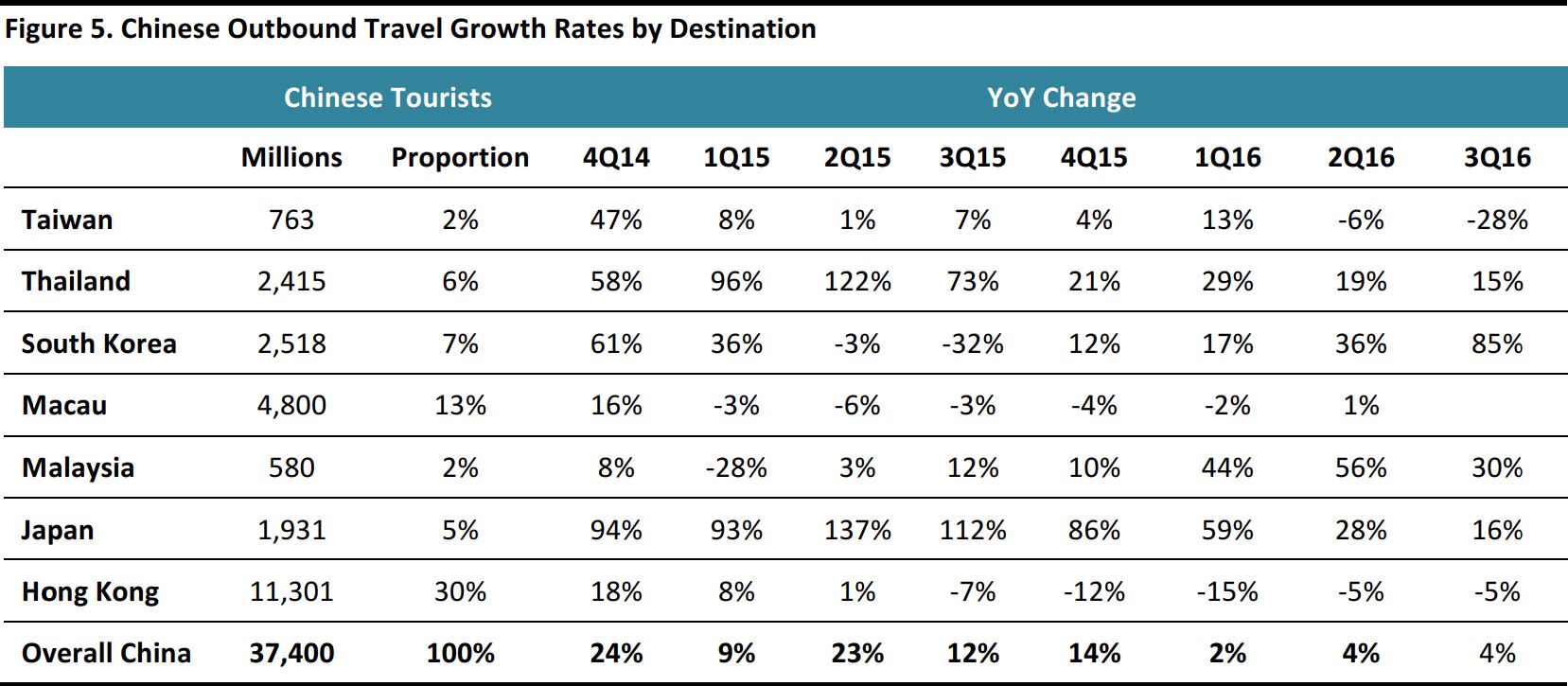

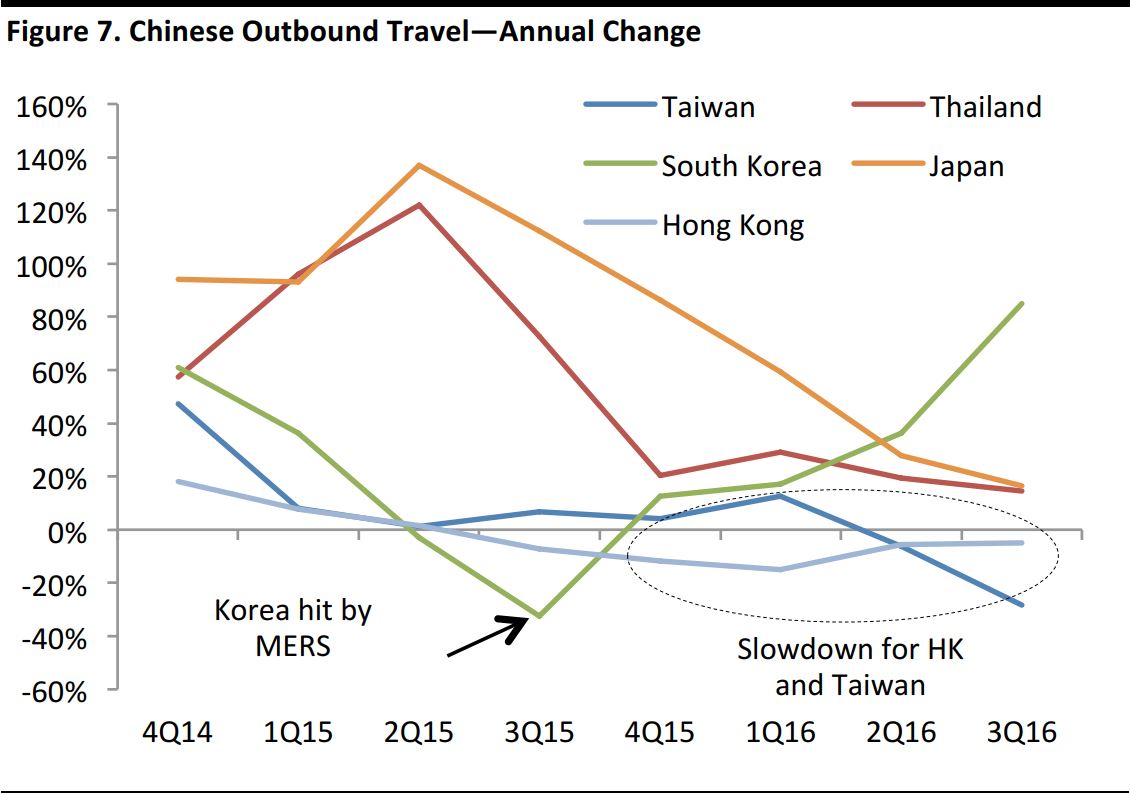

Taiwan (Negative)

We expect Taiwan to lose out to other travel destinations during this year’s Spring Festival. ForwardKeys, a consultancy that analyzes big data of advance travel bookings for Spring Festival, found that bookings for Taiwan-bound trips have fallen 12.4% year over year. The decline was mainly attributable to rising cross-strait tensions. Between January and October 2016, the number of mainland Chinese tourists headed to Taiwan fell 11.7% year over year to 3.1 million tourists. For October 2016 (the month of National Day Golden Week), the number of Chinese tourists to Taiwan fell 44.3% year over year.

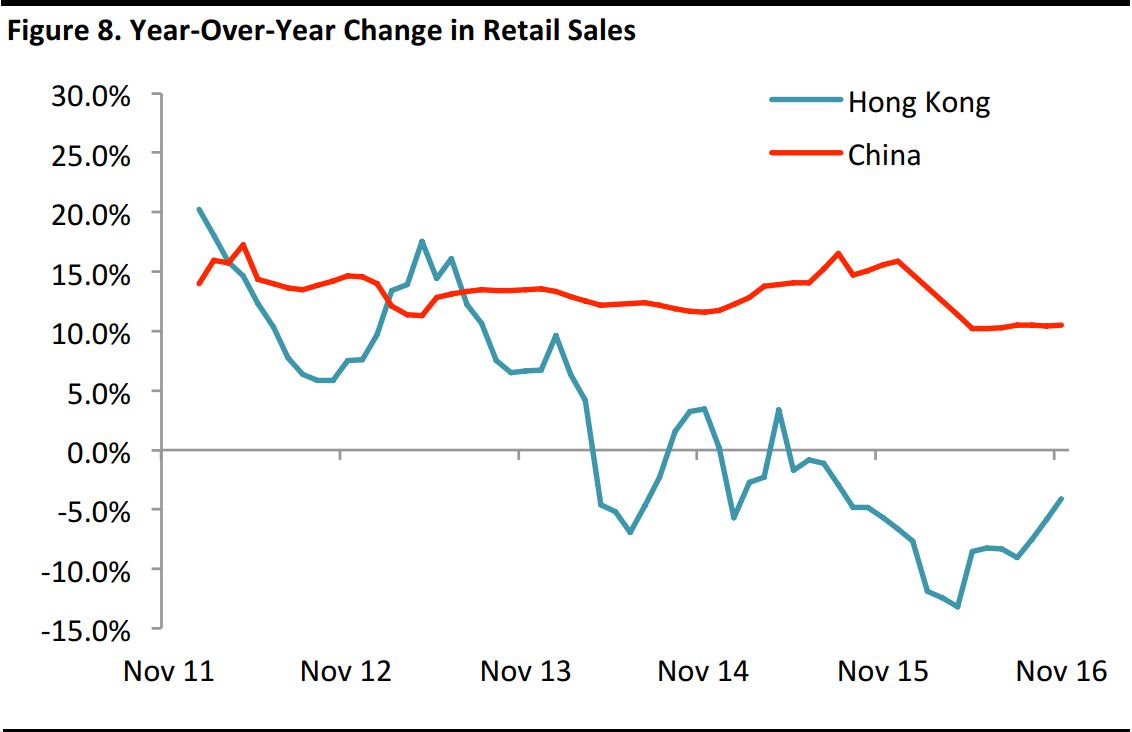

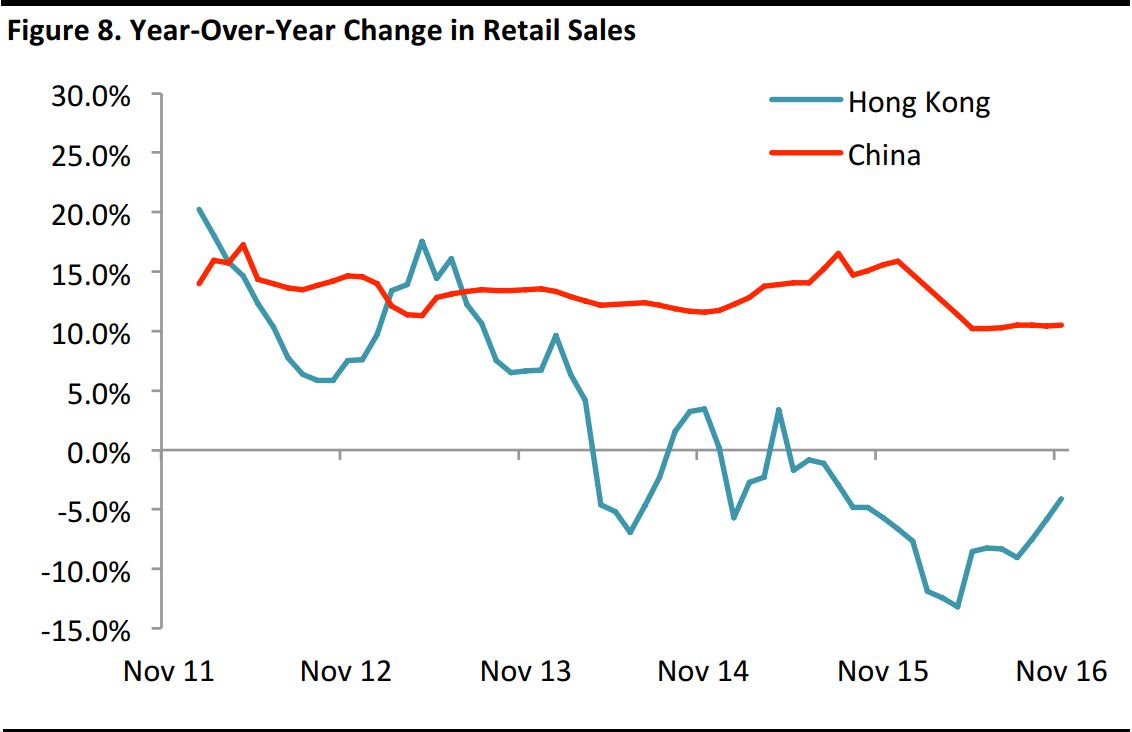

Hong Kong (Negative)

The structural trend of a decelerating number of Chinese tourists visiting Hong Kong will continue into 2017, driven by Chinese tourists opting for longer-haul destinations offering unique experiences over Hong Kong. Also, Chinese tourists bound for Hong Kong appear to prioritize sightseeing experiences over shopping, which is a negative for Hong Kong retailers.

Nonetheless, we expect a year-over-year rebound in Hong Kong retail sales and Chinese tourists’ visitation to Hong Kong in 1Q17, due to a low base effect.

Source: Census and Statistics Department

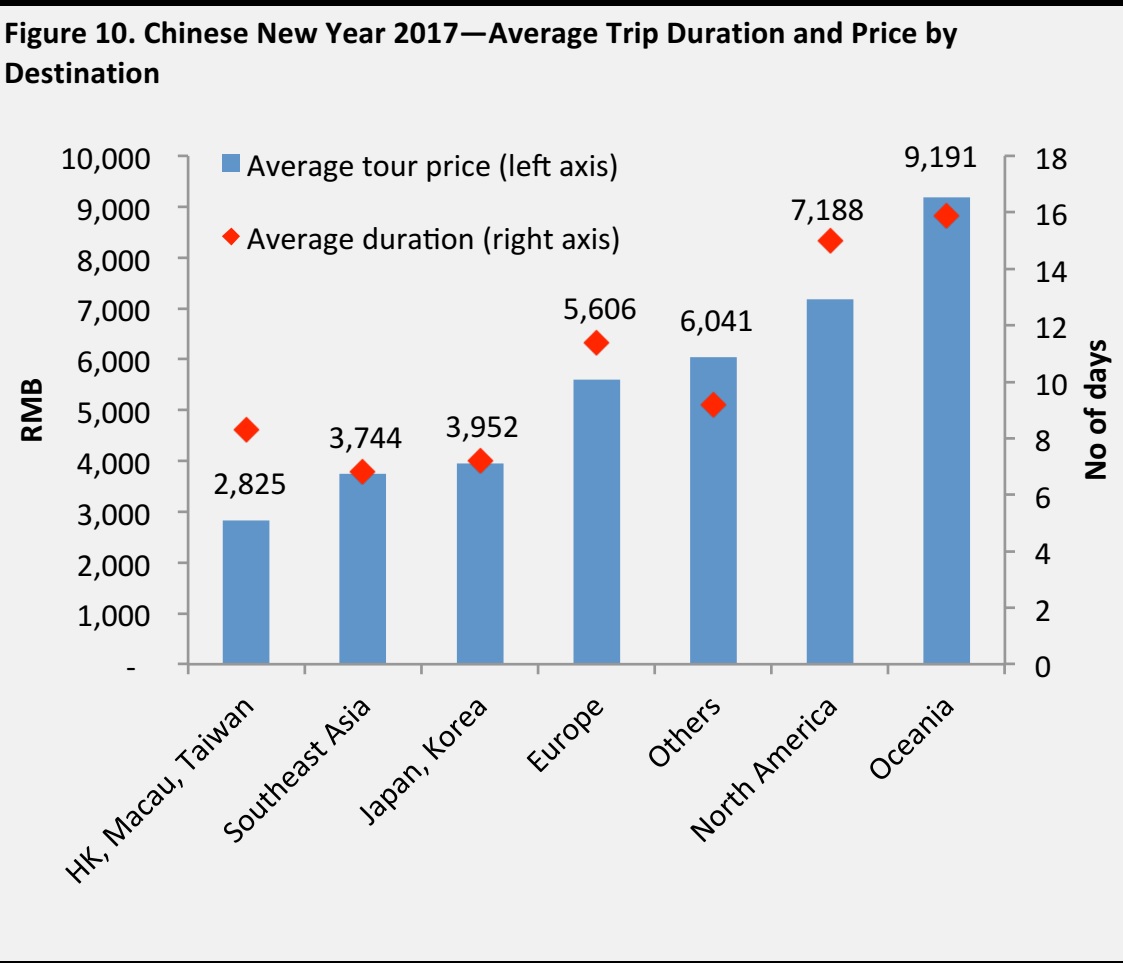

CHINESE OUTBOUND TRAVEL DURING SPRING FESTIVAL 2017

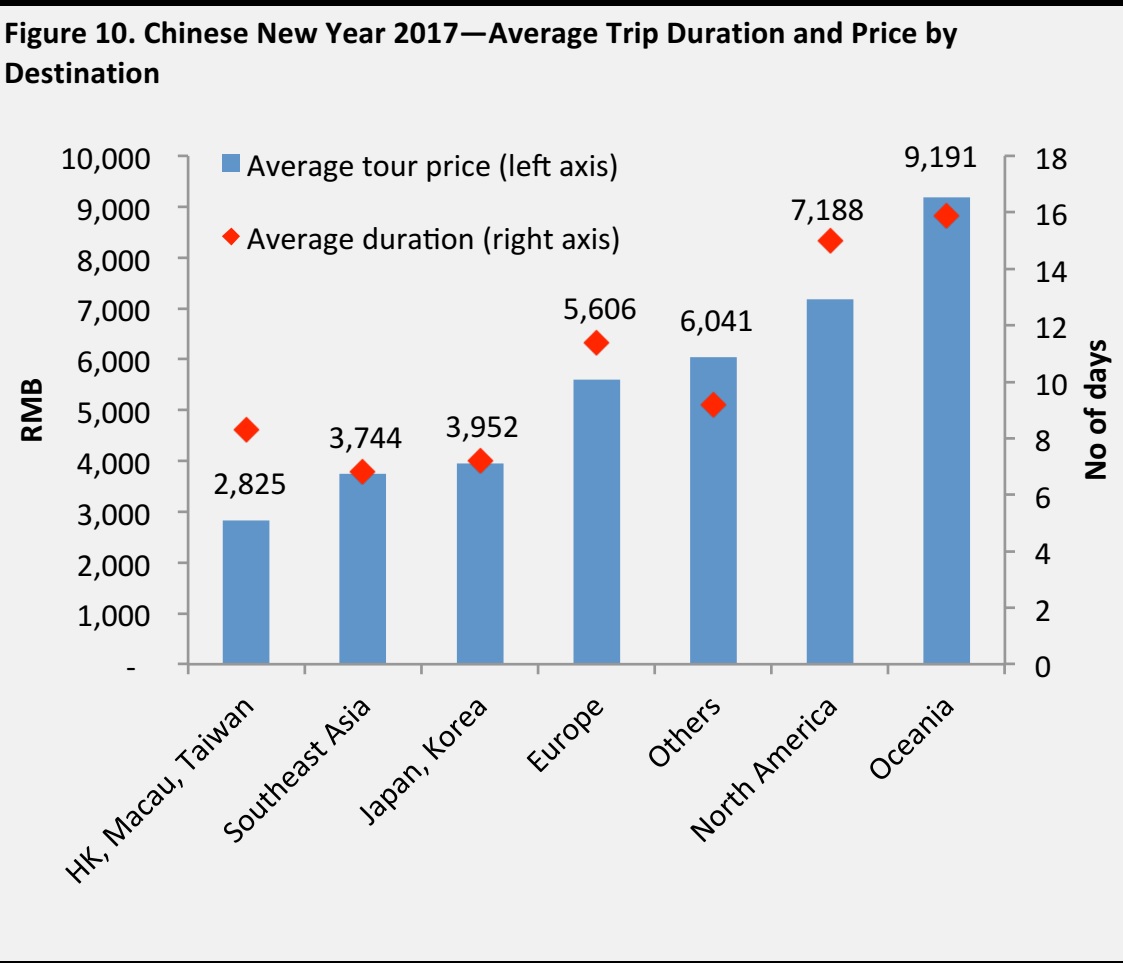

We expect the number of overseas trips taken by Chinese during Spring Festival 2017 to increase 9% year over year to reach 6.3 million. The most popular destinations will likely be Thailand and Japan for short haul, and the UK and Australia for long haul, in our view.

Our Expectations for Outbound Travel

We summarize our expectations for outbound travel during this year’s Spring Festival below:

- Thailand and Japan are the most popular destinations for Chinese tourists, due to geographical proximity and relaxed visa policies.

- The average price of a tour group has increased year over year, with the sharpest increase seen for Thailand and Australia-bound tours.

In our view, the growth in Chinese outbound tourism is mainly due to:

- Currency fluctuations, such as sterling depreciation, which has increased the attractiveness of the UK as a travel destination

- Relaxation of visa policies for Chinese passport holders

- Expansion in airlines’ route networks, further connecting lower-tier cities in China with overseas destinations

- Chinese tourists’ increasing appetite for outbound travel, as the average household disposable income increases

Introducing Spring Festival Golden Week—Why it Matters for Overseas and Domestic Retailers

Chinese New Year, or Spring Festival as it is known locally, is an annual festival when Chinese people celebrate the arrival of the New Year. During the seven-day festival, which this year spans January 27 to February 2, the Chinese tradition is for people to return to their hometowns/home for a family reunion to celebrate the New Year.

Spring Festival is important for overseas retailers and service providers, as many Chinese people are choosing to travel overseas with their families. For those who opt to stay in the country, they will be sending virtual red envelopes to family and friends, and spending at restaurants and cinemas during the week-long festival.

Source: Shutterstock

Recap of Outbound Travel During Spring Festival 2016

During last year’s Spring Festival (which fell on February 7–13, 2016), Chinese outbound travel increased 11.2% year over year to 5.76 million, according to the Ministry of Commerce.

We compare Spring Festival with the Chinese National Day Golden Week to put the numbers into perspective.

- Chinese tourists took 5.76 million overseas trips during Spring Festival 2016, broadly similar to the approximate 6 million who travelled overseas for National Day.

- Retail sales during Spring Festival 2016 were 63% of that of National Day Golden Week.

DRIVERS OF CHINESE OUTBOUND TRAVEL

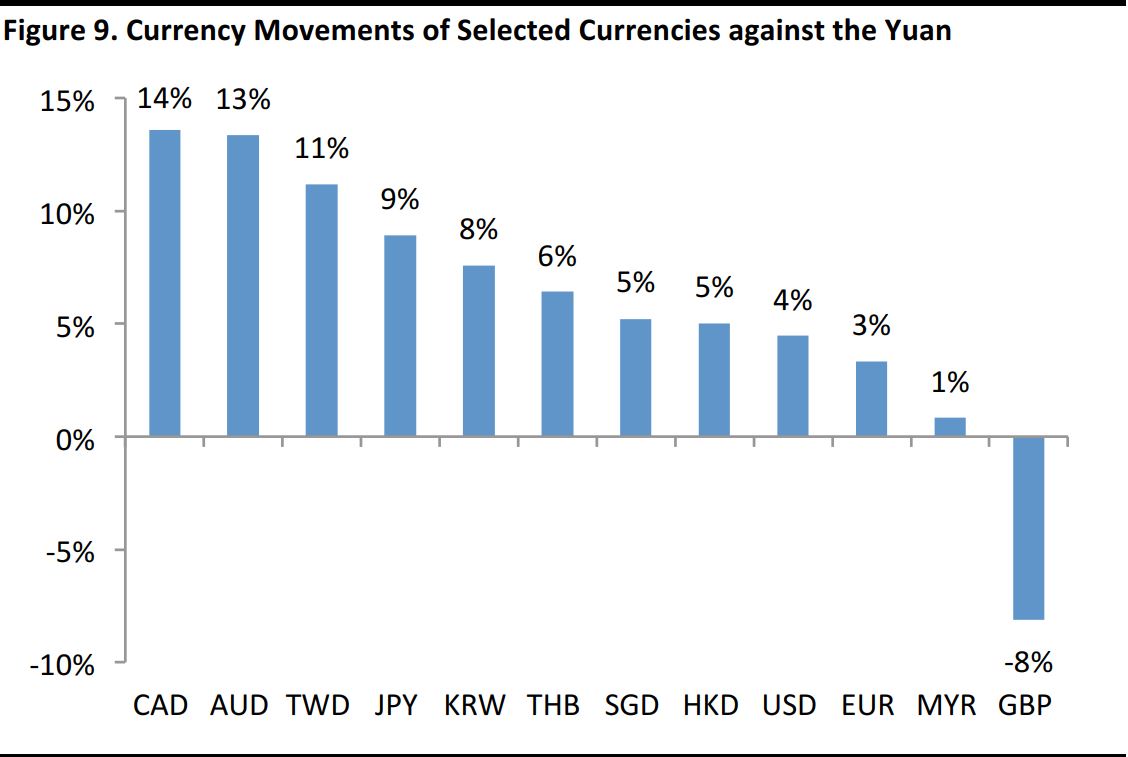

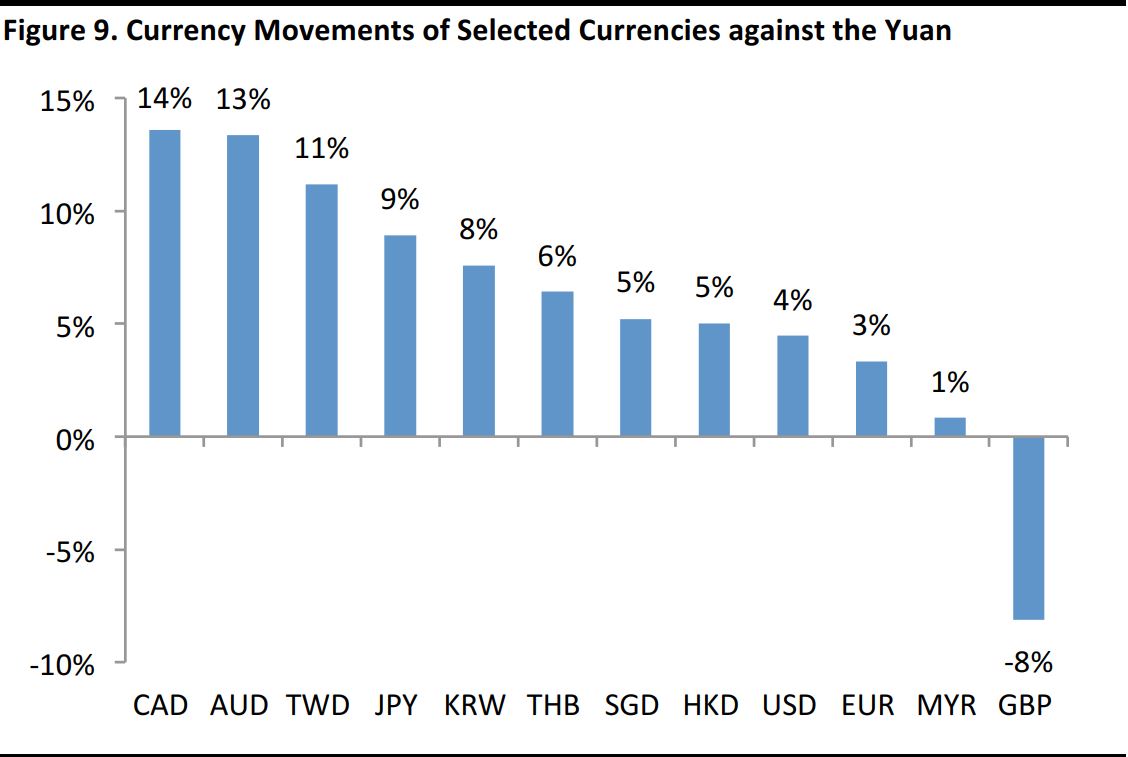

In our view, higher Chinese outbound travel during Spring Festival and their choice of destination are primarily driven by: 1) currency fluctuations; 2) relaxation of visa policies; and 3) more direct flights, as airlines expand their networks to connect lower-tier Chinese cities with more overseas destinations.

Currency fluctuations

The trend of yuan depreciation reduces the buying power of Chinese traveling overseas and the attractiveness of overseas destinations to Chinese tourists. Compared to a year ago, the Chinese yuan has depreciated by 9% against the yen, 4% against the US dollar and 3% against the euro. A stronger yen and US dollar makes trips to Japan and the US for Chinese citizens more expensive.

Nonetheless, we believe the relative depreciation of the yuan will likely have little impact on Chinese consumer demand for luxury goods overseas. Even after factoring in exchange-rate fluctuations, luxury goods overseas, at outlets in particular, are still priced at a discount to those sold within China.

In contrast, the yuan has appreciated against the British pound by over 8% over the past year, which will likely increase the appeal of the UK as a destination to Chinese tourists, in our view.

Note: Priced as of January 26, 2017. Relative to January 25, 2016

Source: Barchart

Relaxation of Visa Policies

A country’s relaxation of visa policies for Chinese passport holders will drive Chinese tourists’ visitations higher, in our view.

The

changes, rather than the

state of visa policies for Chinese passport holders is more important in driving incremental tourist volumes to a destination, in our opinion. For example:

- Australia saw its ranking jump to the 6th-most-popular destination for Chinese tourists in 2017, from outside the top 10 in 2016, largely due to a more relaxed visa policy. Under the new visa scheme that came into effect on December 12, 2016, Chinese passport holders can apply for a ten-year visa, which will attract repeat visitors to Australia.

- Morocco will likely see an acceleration of Chinese tourists, due to its relaxed visa policy for Chinese passport holders—since June 1, 2016, it has implemented a visa-free policy for Chinese passport holders.

We also take note of countries that have simplified their visa processes, or made it easier for Chinese tourists:

- Destinations with a simplified visa process: Fiji, Bali, Mauritius, Maldives, Taiwan, Malaysia, Vietnam

- Destinations with as visa-free process: Morocco, Thailand

- Destinations with multiple-year, multiple-entry visas: Japan, Australia, Israel, US, Canada, Australia

- Destinations with visa on arrival: UAE

Japan and Korea are moving towards 10-year visas for the general Chinese public, although this is unlikely to be launched before Spring Festival 2017. EU countries appear to be falling behind.

According to the Global Passport Power Rank 2017, Chinese passport holders have visa-free or visa-on-arrival access to 57 countries.

MORE DIRECT FLIGHTS CONNECTING CHINESE CITIES WITH OVERSEAS DESTINATIONS

The expansion of airlines’ routes connecting more Chinese cities with international destinations with direct flights and with increasing frequency will likely drive Chinese air travel demand higher

Source: Shutterstock

CASE STUDY

BIG DATA ANALYSIS OF SPRING FESTIVAL ADVANCE BOOKINGS

We review big data reports published by major Chinese Online Travel Agencies (OTA) to glean Chinese outbound travel trends during Spring Festival 2017. We acknowledge that the findings of these reports will unlikely be entirely consistent. However, they provide more color on the general trends for Chinese outbound travel during Spring Festival 2017.

Ctrip 2017 Spring Festival Tourism Big Data Report

Ctrip expects outbound travel during Spring Festival 2017 to be “the hottest ever” and to surpass last year’s 6 million trips. The report, published on December 12, 2016, is based on big data analysis of advance Spring Festival 2017 overseas travel bookings made on Ctrip up to December 10, 2016. We outline the highlights of the report below.

- Average duration for an overseas trip is 9.2 days. The peak departure period for Chinese tourists falls on January 25 and 26.

- Most popular destinations are Southeast Asia (chosen by over 30% of Chinese tourists) and Japan and Korea (chosen by over 20%).

- Average travel product pricing during Spring Festival is higher than during off season, according to Ctrip’s ticket pricing index. Thailand saw the largest increase in pricing, up by 15%, as the authorities cracked down on Thailand-bound “zero cost tours”. Ticket pricing to the US increased 10%, largely due to the appreciation of the US dollar. In contrast, pricing for certain European and Middle Eastern countries such as Turkey and Egypt has declined as much as 30%, due to their fall in popularity with Chinese tourists, dampened by recent violent incidents.

Source: Ctrip/Fung Global Retail & Technology

Tuniu 2017 Spring Festival Travel Trends Report

Tuniu expects the top-three destinations during Spring Festival to be Thailand, Japan and France. Korea, which was ranked in the top three in the same period last year, was not included in this year’s top 10. The report, published on January 16, 2017, analyzed advance traveling bookings and tourism demand for Spring Festival 2017.

Source: Ctrip/Tuniu/Fung Global Retail & Technology

ForwardKeys 2017 Chinese New Year International Travel Outlook Report

ForwardKeys, an Applied Traveller Intelligence firm, forecasts the number of Chinese outbound travelers will increase 9.8% year over year, with Thailand and Japan as the most popular destinations. The report analyzed advance travel booking data for Spring Festival.

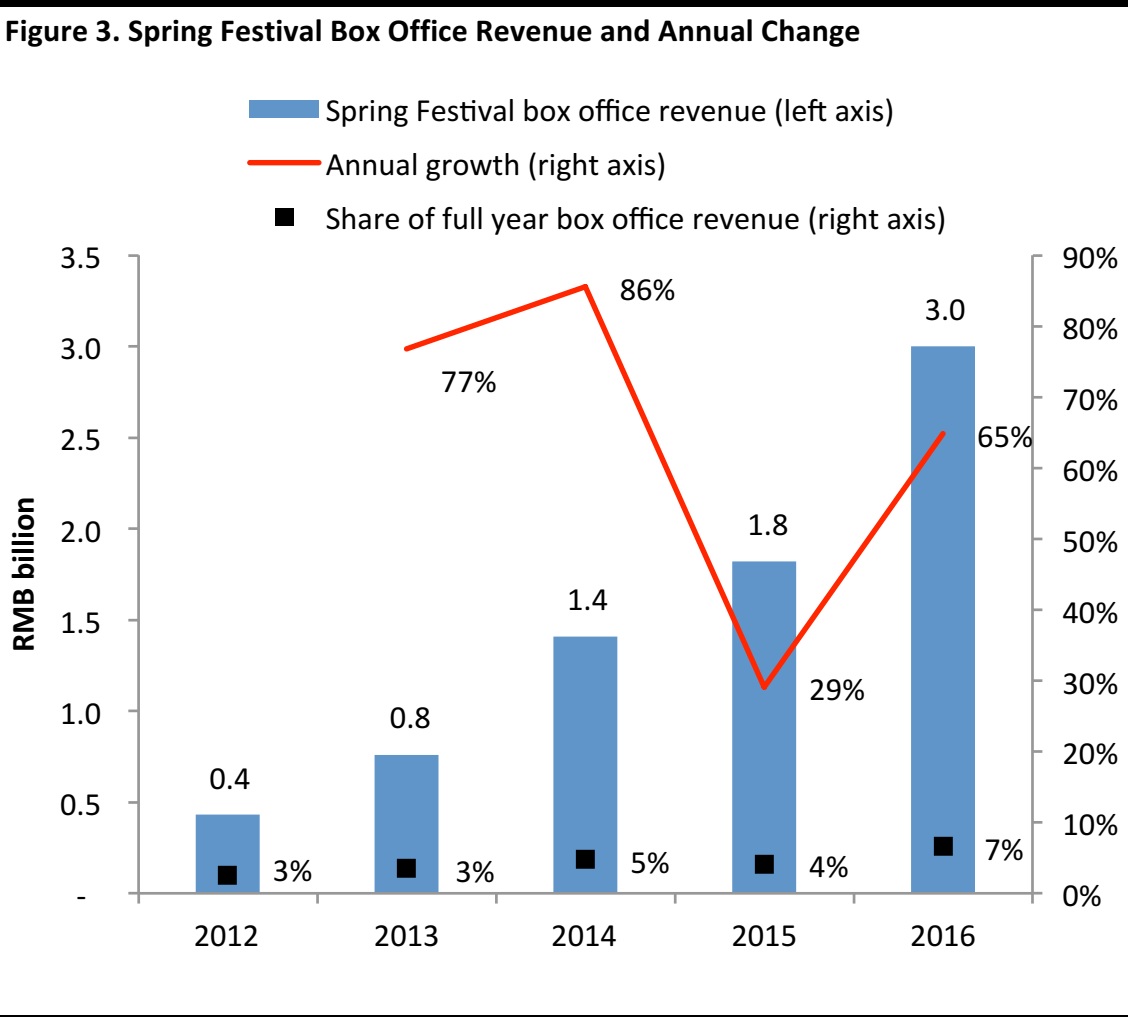

CHINESE SPRING FESTIVAL OUTBOUND TRAVEL—PRICING

We expect overseas travel pricing during Spring Festival 2017 to increase year over year, reflecting the high seasonal travel demand among Chinese this year.

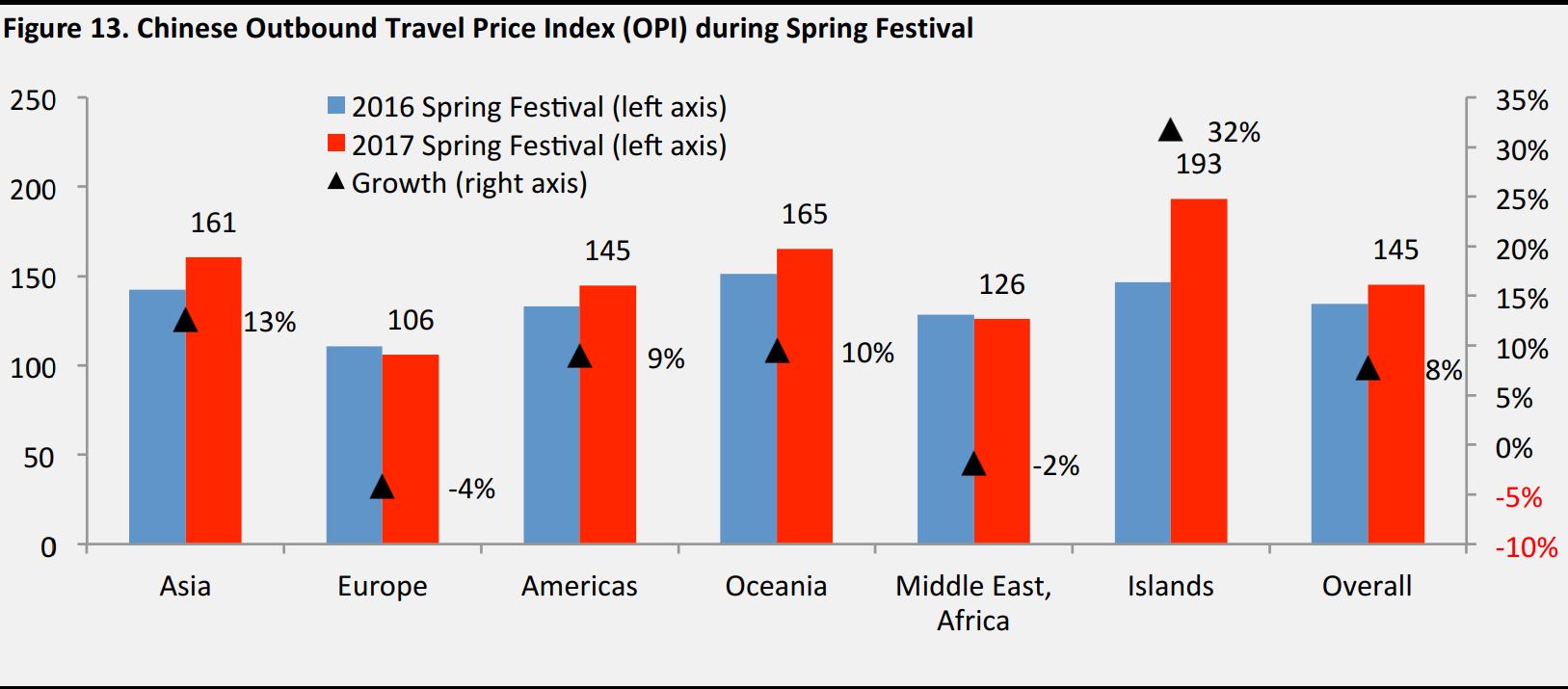

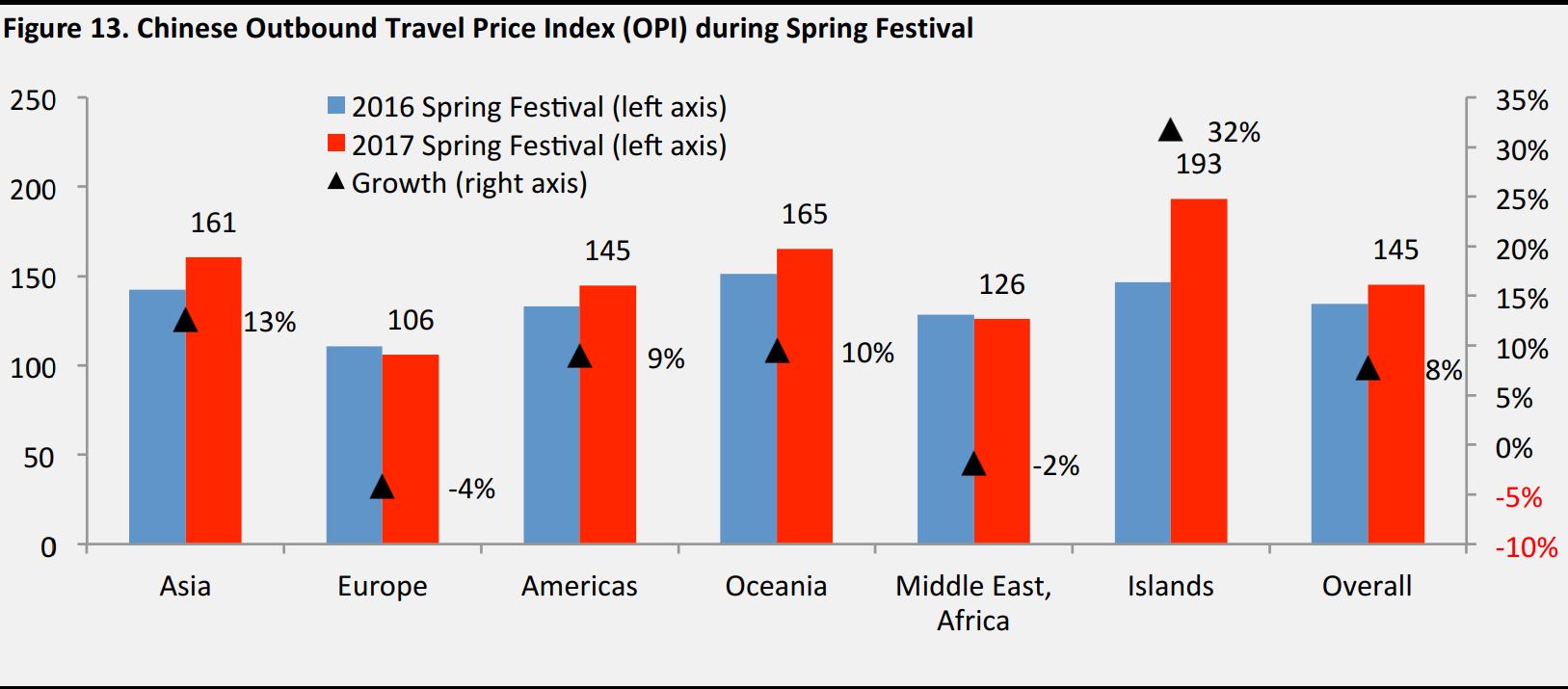

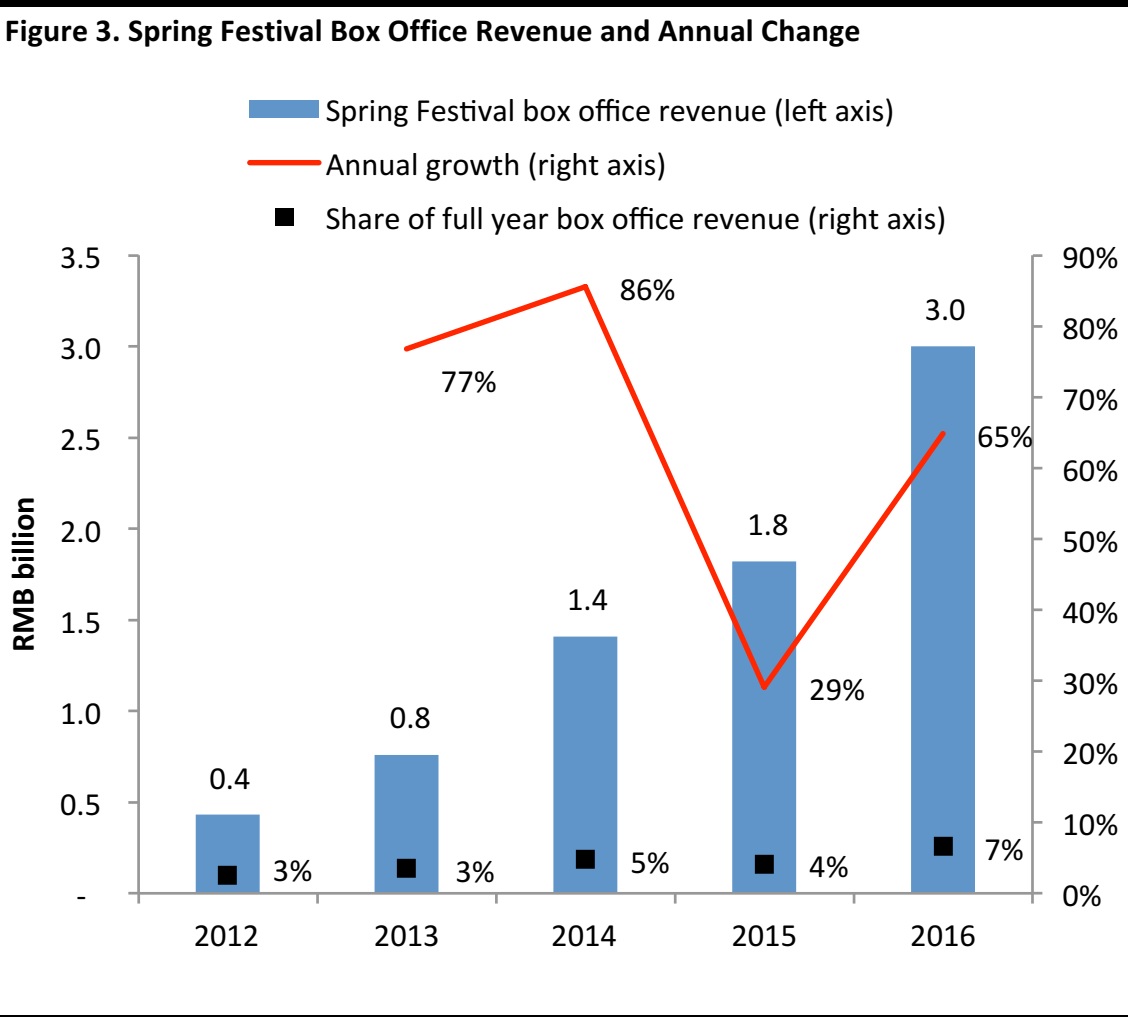

2017 Spring Festival Outbound Travel Price Index

The Outbound Travel Price Index (OPI) tracks the changes in pricing for outbound tourism products for Chinese travelers. The composite price index indicates a sharp rise in travel prices during Spring Festival, reflecting high seasonal travel demand and Chinese tourists’ preferences for higher-quality travel experience.

Tuniu 2017 Spring Festival Travel Trends Report

Tuniu expects the top-three destinations during Spring Festival to be Thailand, Japan and France. Korea, which was ranked in the top three in the same period last year, was not included in this year’s top 10. The report, published on January 16, 2017, analyzed advance traveling bookings and tourism demand for Spring Festival

- Outbound travel prices: The global composite index for Spring Festival 2017 was 145.1, higher than that during the summer and Golden Week 2016, and up by 7.8% year over year. The global composite index, which monitors 17 global cities, reflects the changes of consumer prices in outbound travel to worldwide destinations for Chinese citizens.

- Pricing by regions: The regions which saw the sharpest increase in prices are the Pacific Islands (up 32% year over year) and Asia (up 13% year over year). Europe saw the largest decline in prices, falling by 4% year over year. By country, Thailand and Australia saw the largest increase in prices.

- Short-haul destinations: Within Asia, travel prices for Thailand increased the most, largely due to the authorities’ crackdown on “zero costs tours”. The price index of guided tours in Thailand increased 61.5% quarter over quarter and 17.1% year over year.

- Long-haul destinations: Prices for all long-haul destinations (except France) rose month-over-month in January 2017. On a monthly basis, travel prices to Australia increased the most, up 55%, followed by New Zealand, which was up 42%.

Source: Utour/Ivy Alliance Tourism Consulting/ Fung Global Retail & Technology

Source: Utour/Ivy Alliance Tourism Consulting/ Fung Global Retail & Technology

Source: Utour/Ivy Alliance Tourism Consulting/ Fung Global Retail & Technology

Source: Fung Global Retail & Technology

Source: Fung Global Retail & Technology

Source: Tencent

Source: Tencent Source: State Administration of Press, Publication, Radio, Film and Television

Source: State Administration of Press, Publication, Radio, Film and Television