Introduction

Our quarterly

US Retail Inventory Tracker reviews inventories held by US retailers in the

Coresight 100, our global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past nine quarters.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the quantity of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported results for the first quarter of fiscal 2022 (1Q22), ended April 30, 2022.

Retail’s Performance This Quarter

In January 2022, US retail sales increased by a revised 9.4% year over year, suggesting that the economy is continuing to grow despite inflation and concerns of a looming recession. In February 2022, US retail sales increased by a revised 13.1% year over year, boosted by another strong month of job creation, as average hourly wages continue to rise within the still-tight labor market. In March 2022, US retail sales increased by a revised 3.8% year over year, against strong 2021 comparatives. However, 3.8% growth amidst a backdrop of high inflation points to a slowdown in consumer spending. In April 2022, US retail sales grew 6.4% year over year, against strong 2021 comparatives, indicating that retail sales are healthy.

In May 2022, US retail sales increased by 6.5% year over year, against very strong May 2021 retail sales data (when pandemic-driven stimulus checks boosted retail spending).

US retail traffic increased by 8.1% year over year in May 2022—decelerating from April’s growth of 20.9% year over year. Likewise, average transaction volume (ATV) increased by 2.5%, lower than April’s growth of 4.5%.

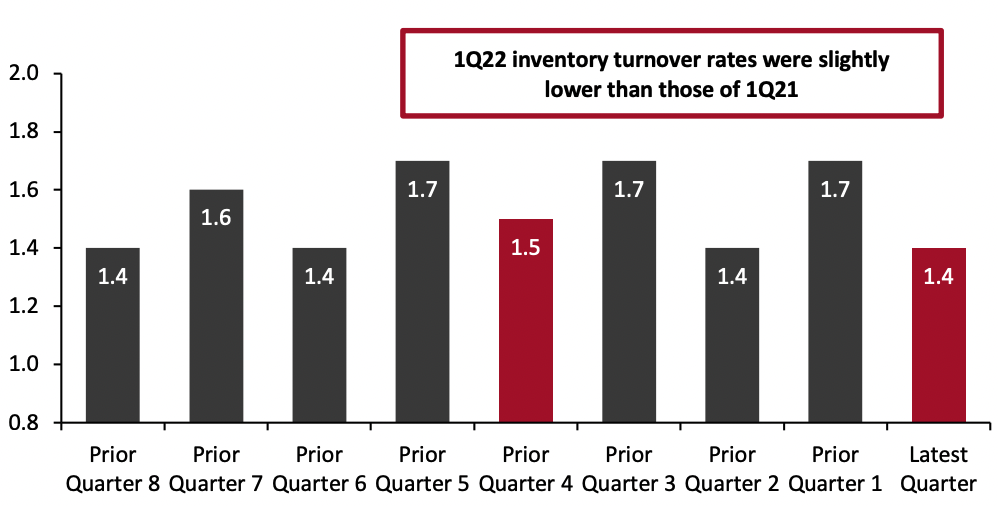

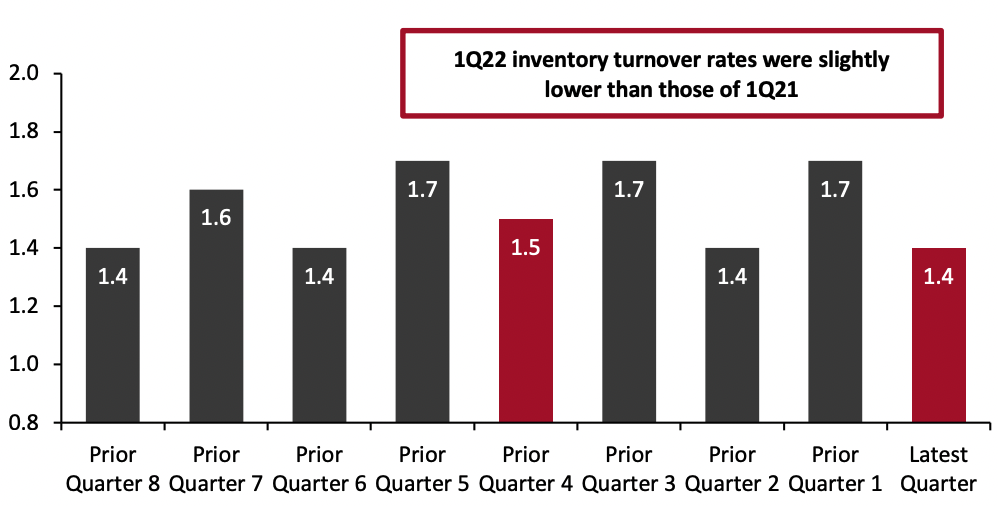

Overview: Inventory Turnover Rates Down Slightly Year over Year

Most retailers covered saw their inventory turnover rates below those of the previous year (1Q21).

Figure 1. Inventory Turnover Ratios by Quarter: All Retailers

[caption id="attachment_150759" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

The latest quarter saw negative growth in inventory turnover, mainly due to high inflationary pressures and supply chain constraints.

Apparel specialty retailers: Apparel specialists saw their inventory turnover ratios decline by 22.6% year over year due to inflationary commodity price increases and lower-than-expected demand during the first quarter.

Off-price retailers: Off-pricers saw a decline of 32.6% in their inventory turnover ratios year over year as cost pressures persist.

Beauty retailers: Beauty retailers were an exception in the discretionary category and saw their inventory turnover ratio increase by 42.5% year over year. The retailers covered saw strong demand for fragrance, haircare, skincare and makeup products.

Department stores: Department stores’ inventory turnover ratios declined by 14.3% year over year. As consumer shopping behaviors shifted during the quarter to more occasion-based apparel, men’s and women’s apparel and shoes outperformed other categories in terms of sales.

Discount stores: Discount retailers reported a 26.0% year-over-year decline in inventory turnover ratios.

Drugstores: Drugstore retailers’ inventory turnover ratios increased by 2.2% year over year.

Electronics retailer: The one covered electronics retailer, Best Buy, saw a 15.1% year-over-year decline in its inventory turnover ratio, due to cost inflation and supply chain constraints.

Food and grocery retailers: Food and grocery retailers’ inventory turnover ratios increased by 5.2% year over year.

Home-improvement retailers: Home-improvement retailers witnessed a 20.6% year-over-year decline in inventory turnover ratios.

Jewelry retailers: The one covered jewelry retailer, Signet Jewelers, saw a 0.5% year-over-year decline in its inventory turnover ratio.

Luxury retailers: The luxury retailers covered saw a decline of 12.9% year over year in their inventory turnover ratios.

Mass merchandisers: Mass merchandisers reported a 22.2% year-over-year decline in their inventory turnover ratios.

Warehouse clubs: Wholesale clubs’ inventory turnover ratio declined by 8.2% year over year.

Figure 2. Inventory Turnover Ratios by Quarter

[wpdatatable id=2098]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

*Excludes Wayfair, an outlier

The absolute inventory turnover ratios have been rounded off to one decimal

Source: Company reports/Coresight Research

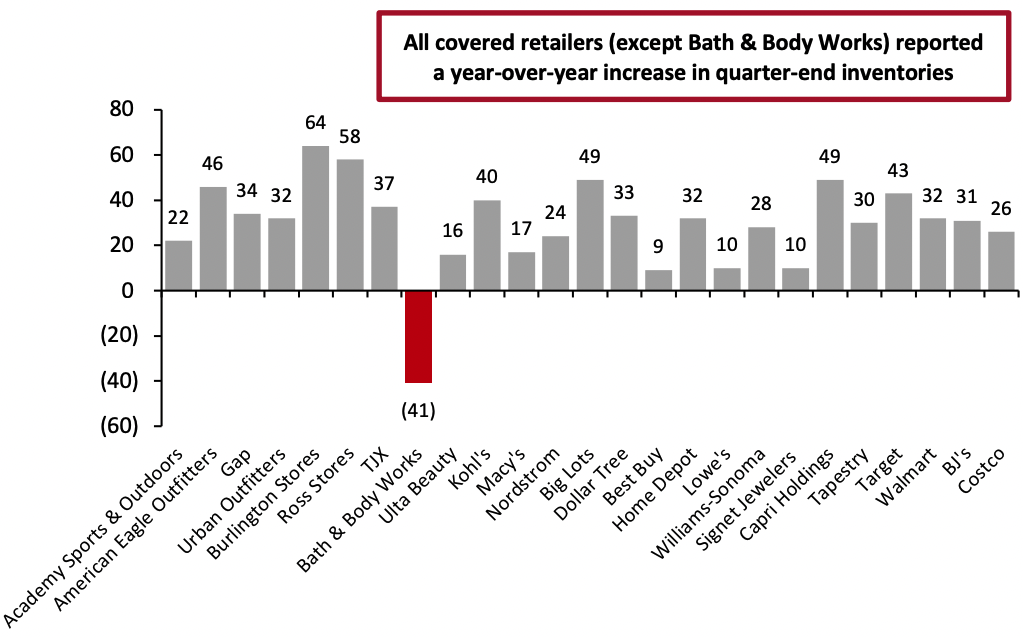

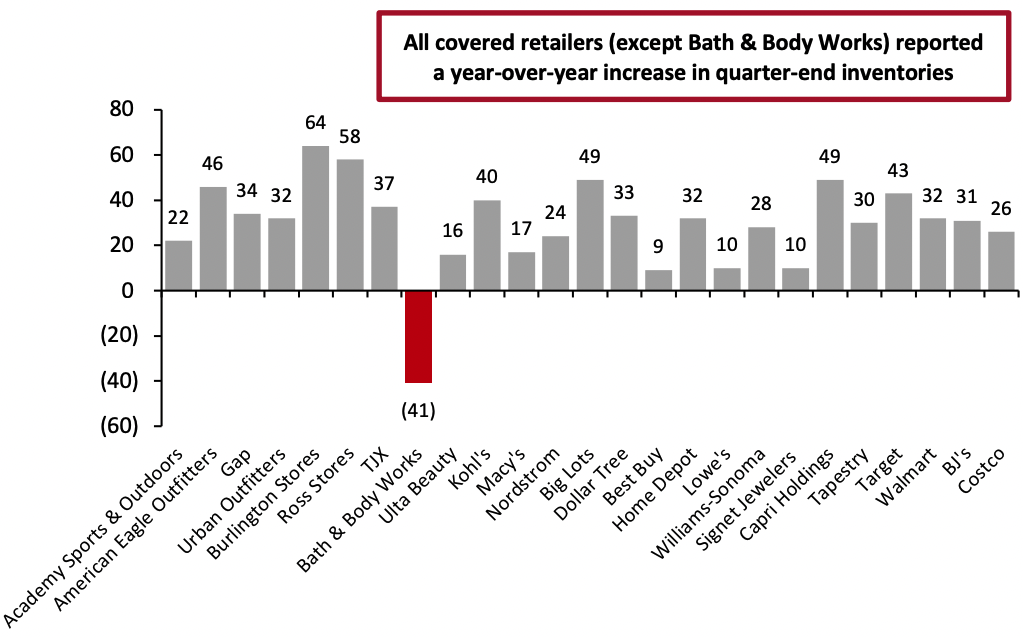

Sector and Company Overview

We look at the inventory levels of selected retailers across sectors and assess why inventory levels changed from the year-ago period. Amid softer discretionary demand, all but one of our covered companies saw inventories rise compared to one year earlier, and all but one of those saw double-digit percentage increases.

Figure 3. Latest-Quarter Inventory Values of Covered US Retailers: YoY % Change

[caption id="attachment_150760" align="aligncenter" width="700"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

All covered apparel specialists witnessed an increase in quarter-end inventories year over year, amid high-cost inflation and high in-transit inventory due to supply chain constraints.

|

Commentary |

| Academy Sports & Outdoors |

The company ended 1Q22 with inventory up 22.0% year over year, in line with the company’s expectations, as it annualized diminished inventory levels resulting from the 39.0% sales comp last year.

The company noted that the best-performing division in the quarter was footwear, due to improved inventory levels that helped drive in-stocks back to historical levels. However, the company said that it is still chasing receipts in the cleated business, which continues to experience shortages due to shutdowns that occurred in Vietnam in 3Q21.

Management stated that the company has a strong inventory position for the summer and back-to-school season in the next quarter. |

| American Eagle Outfitters |

The company ended 1Q22 with inventory up 46.2% year over year, due to higher in-transit inventory and on-hand inventory.

Management stated that consolidated ending inventory costs were up double-digits compared to last year, with higher costs driving roughly half of the increase. From a brand standpoint, Aerie and American Eagle also drove half of the increase in inventory cost.

CFO Michael Mathias said, “For the second quarter, we will be entirely focused on clearing out excess spring inventory. We expect higher markdowns as we clear through excess inventory, combined with continued freight inflation and the impact of our supply chain acquisitions to result in a gross margin rate of approximately 33%.” |

| Gap

|

At quarter-end, the company’s inventory was up 33.7% year over year, largely stemming from longer in-transit times, elevated long-life basics as a result of receipt delays, pack-and-hold strategies and higher input costs.

CEO Sonia Syngal said, “Reverting to a longer inventory push model not only diluted economic value but meant we were defining customer trends too early in the process and we're unable to chase into the right fashion choices closer in. This resulted in excess inventory and less relevant styles that will pressure sales in the short term while we rebalance the assortment going forward.”

Management stated that the company over-planned for larger sizes with customer demand under-pacing supply, leading to an excessive inventory across stores. This issue was exacerbated by out-of-stocks in core sizes due to continued supply chain disruption and inventory delays. |

| Urban Outfitters

|

The company’s inventory was up 31.9% year over year.

CFO Melanie Marein-Efron said, “Our inventory is elevated in the first quarter due to several factors. First, inventory costs have increased as a result of higher freight and raw material costs; second, last year's inventory was significantly constrained due to supply chain disruptions; third, as supply chain disruptions have persisted, we have extended our inventory lead times and are holding more inventory earlier than normal to ensure that we have adequate inventory to protect sales; lastly, Urban Outfitters brand sales came in lower than planned in 1Q22, resulting in higher inventory than we wanted. And hence, we believe that overall inventory levels in the second quarter will continue to be elevated.”

Management said that the company’s current inventory levels, mostly at the Urban Outfitters brand in North America, are higher than it would like and could lead to higher markdowns versus last year's low levels. Also, as supply chain challenges continue to drive higher freight costs, its initial product margins will be negatively impacted. |

Off-Price Retailers

All covered off-price retailers reported a significant increase in inventory compared to the year-ago period, reflecting companies’ plans to rebuild and store inventory to flow to stores later in the year.

| |

Commentary |

| Burlington Stores |

The company’s total inventory was up 63.8% year over year.

At the end of 1Q22, the company’s in-store inventory increased by approximately 2.0% on a comp store basis, reflecting the aggressive actions taken by its merchandising team to rebuild its comp store inventory. Its reserve inventory, which includes stock that is being stored for later release (either later in the season or in a subsequent season), represented 50.0% of inventory versus 35.0% last year. In dollar terms, this is almost double last year's levels, according to the company.

Management stated that the company achieved 20.0% comp store sales growth last year and, as a resulte in its first quarter. However, it missed due to low and unbalanced inventories in February and March. The company deliberately planned for inventories to be down in the first quarter, but this backfired, as late deliveries created significant gaps in its assortment, impacting its sales. However, the company has raised its inventory plans for the rest of the year so that in-store inventories will be in line with or slightly higher than last year. |

| Ross Stores

|

The company’s total inventories were up 57.5% year over year, mainly due to higher packaway inventory.

Packaway merchandise represented 43.0% of total inventory versus 34.0% last year when the company used a substantial amount of packaway inventory to meet robust consumer demand.

Management said that supply chain congestion eased somewhat during the first quarter, resulting in early receipt of merchandise that the company stored in packaway and will flow to stores later in the year.

Average store inventories were up, although the company still operated with significantly less inventory in store than its pre-pandemic levels. |

| The TJX Companies

|

The company ended the quarter with inventory up 36.7% year over year. On a per-store basis, inventory was up 37.0% on a constant currency basis.

Management said that the company remains well positioned to take advantage of the excellent deals it is seeing in the marketplace and flow fresh merchandise to its stores and online throughout the year. |

Beauty Retailers

Bath & Body Works saw a double-digit decline in inventory levels year over year, while Ulta Beauty reported a double-digit increase in inventories year over year.

| |

Commentary |

| Bath & Body Works |

Bath and Body Work’s total inventory declined by 41.3% year over year.

EO Sarah Elizabeth Nash said, “Our vertically integrated supply chain is 85% North America-based, which has been a key differentiator for us. It has enabled Bath & Body Works to successfully navigate a dynamic environment and present full and abundant product assortments to our customers with speed and agility.” |

| Ulta Beauty |

The company’s total inventory increased by 16.0% year over year, reflecting the impact of 28 new store openings as well as proactive efforts by the company, such as maintaining strong in-stock of key items to mitigate sales risk due to anticipated supply chain disruptions.

CFO Scott Settersten said, “Our team is working really hard with our vendor partners, the merchants, the inventory planning teams, the supply chain teams to make sure we get the right product in the right place.” |

Department Stores

On a year-over-year basis, all the covered department stores witnessed double-digit growth in inventory levels at the end of the quarter.

| |

Commentary |

| Kohl’s

|

The company’s inventory level was up 40.1% year over year, driven by investment in beauty inventory to support and heightened in-transit inventory due to ongoing supply chain disruptions. The company continues to leverage pack and hold inventory for late holiday receipts, such as sleepwear and fleece items.

The company expects inventory to end the year up high-single-digit as compared to 2021. |

| Macy’s

|

The company ended the quarter with inventory up 17.2% year over year.

CEO Jeffrey Gennette said, “We saw a rise in consumer demand in occasion-based merchandise categories, while at the same time, we experienced a deceleration in casual active and soft home categories, both at a faster pace than we anticipated. Simultaneously, supply chain constraints relaxed, resulting in a higher percentage of receipts than we expected. The combination of these factors created an imbalance in our overall inventory levels as well as by channel. However, we were able to navigate these demand and supply trends and as a result, we delivered a strong improvement in both inventory turn and gross margin compared to 2021.”

Management said that the shift in consumer demand for more occasion-based categories such as dresses and tailored clothing is a benefit for sales growth at Macy's. With the company’s broad assortment base, it is pivoting to those categories and building replenishment stock in its bestsellers. |

| Nordstrom

|

The company’s inventory increased by 23.7% year over year, with approximately one-fourth of the inventory increase due to pull forward of anniversary sale receipts.

CEO Erik Nordstrom said, “As we move through the year, we expect to see continued benefits from our multi-layered plan to both expand our offerings of the most coveted brands we carry, as well as source from new vendors and increase our use of pack and hold inventory, to ensure we have the right selection that our customers want.”

Management said it is using analytics and consumer insights as part of its category work to provide the most relevant curated assortment for its customers and improve decision making around its inventory assortment and allocation. |

Discount Stores

All covered discount stores witnessed an increase in inventory levels year over year, due to high capitalized freight costs and average unit cost, as well as a softening of sales trends in discretionary categories.

| |

Commentary |

| Big Lots

|

The company’s total inventory was up 48.5% year over year, driven both by inflationary increases and product mix effects.

Management said that the company over-inventoried in some discretionary categories in its first quarter as demand softened.

For its second quarter of fiscal 2022, the company expects inventory to be up in the low 20s in percentage terms, year over year, but down significantly from the end of the first quarter. Big Lots plans to get inventory back in a cleaner position by the end of the second quarter of fiscal 2022. |

| Dollar Tree |

The company’s total inventory increased by 33.2% year over year.

At its Dollar Tree banner, inventory increased by 39.0% year over year, due to increased capitalized freight costs and a catch-up on past due inventories. At Family Dollar, inventory increased by 27.0% year over year, due to increased capitalized freight cost and an increase in the average unit cost. Both banners had fewer average inventory units in store than during the same period in 2019, prior to the pandemic. |

Electronics Retailer

| |

Commentary |

| Best Buy |

The company ended the quarter with inventory up 9.4% year over year. Management said that pockets of inventory constraints still exist but are currently isolated to certain products and vendors.

CEO Corie Barry said, “Overall, our inventory remains healthy. Even though inventory availability in consumer electronics is much better than it has been for much of the pandemic, the supply chain continues to be challenging with ongoing transportation disruptions and higher costs including containers, labor and fuel.” |

Home and Home-Improvement Retailers

All covered home and home-improvement retailers reported an increase in inventory levels year over year.

| |

Commentary |

| Home Depot |

The company’s inventories increased by 31.9% year over year and inventory turns were up 4.4X, down from 5.5X last year. According to the company, this level of inventory reflects outsized demand for home-improvement projects, actions taken to improve in-stocks and the impact of the delayed start to spring.

Management said that the company is working to bring goods in early to make sure that it is ready for the spring season. |

| Lowe’s

|

The company’s inventory was up 10.1% year over year, reflecting an approximately 13.0% increase in both product and commodity inflation.

CEO Marvin Ellison said, “We're ready to capitalize on the increased demand with our enhanced assortment, strong inventory position, improved supply chain capabilities and seasonal staffing in place to serve our customers.”

Management said that the company continues to strategically invest in inventory and made in-stock improvements in constrained categories including paint and appliances. |

| Williams-Sonoma |

The company’s inventories were up 28.4% year over year.

Merchandise inventories increased by 28.4% year over year, which includes inventory in transit. Inventory on hand increased by 17.7% year over year.

Management said that the company expects to see sequential improvement in its in-stock inventory levels, enabling it to fill significant back orders and recognize net revenue even if demand wanes over the rest of the year.

CEO Laura Alber said, “We are pleased that our customer satisfaction scores remain high and that we are beginning to see some improvement with in-stock inventory across our brands.” |

Jewelry Retailers

| |

Commentary |

| Signet Jewelers Limited |

The company’s inventory increased by 9.8% year over year, driven substantially by the addition of Diamond's Direct to its base.

Signet’s inventory efficiency remains healthy, with turns above ar over year. Moreover, its clearance and sell-down penetration was 9.0 percentage points lower than in its first quarter of last year. |

Luxury Retailers

Both luxury retailers reported an increase in inventories year over year due to high in-transit inventory amid industry-wide supply chain and logistics challenges.

| |

Commentary |

| Capri Holdings |

The company’s inventory increased by 48.9% year over year, compared to a historically low level of inventory last year.

Management stated that sales revenue would have been even greater if there were no inventory constraints. The company estimated that inventory constraints had a mid-single-digit impact on Michael Kors' fourth-quarter growth rate.

CFO Thomas Edwards said, “Given the ongoing extended transportation delays we have implemented new programs to receive seasonal merchandise earlier as well as hold more core inventory. As a result, we expect inventory to increase by a similar amount in the first quarter versus the prior year. We expect levels will moderate sequentially and be back in balance by the end of the year.” |

| Tapestry |

Tapestry’s inventory increased by 30.4% year over year due to in-transit inventory, which remained elevated in light of continuing industry-wide supply chain and logistics challenges. On-hand inventory was up by a low-single-digit year over year.

Management stated that the company has adjusted the timing of its buys and recognition of elongated lead times supported by investments in core styles. Overall, the company is pleased with the makeup of its current inventory, which supports its future growth expectations. |

Mass Merchandisers

Both Target and Walmart reported an increase in inventory year over year, due to higher product costs and a shift in consumer demand from discretionary categories to essentials.

| |

Commentary |

| Target

|

The company ended the quarter with inventory up 43.1% year over year.

CEO Brian Cornell said, “We saw much higher-than-expected transportation costs and a more dramatic change in our sales mix than we anticipated. This resulted in excess inventory, much of it in bulky categories, which put additional strain on an already stretched supply chain.”

Management stated that the company ended up carrying too much inventory in several categories where the slowdown in sales was more pronounced than expected, including home, electronics, sporting goods and apparel. |

| Walmart

|

Total inventory increased by 32.0% year over year, due to inflation and aggressive inventory buys over the past few quarters.

Management stated that the company’s general merchandise inventory level, primarily in Walmart US, was a lower percentage of total sales in 1Q22, resulting in an unfavorable gross margin mix.

Walmart expects the inventory position to improve as it moves through its second quarter of fiscal 2023. |

Warehouse Clubs

Both covered warehouse clubs reported an increase in inventory compared to the year-ago period, due to higher inventory costs. These retailers continue to accumulate inventory to combat inflation heading into the second quarter.

| |

Commentary |

| BJ’s Wholesale Club |

The company ended the quarter with inventory up 30.5% year over year, due to higher inventory costs.

CFO Laura Felice said, “With respect to our inventory levels, our teams have proactively worked to stay ahead of supply chain challenges that have hampered our business last year. We have also opportunistically made the decision to buy an inventory earlier than usual partially to combat inflation heading into the second quarter.”

Management stated that the company’s general merchandise inventory was up compared to last year’s first quarter and a little bit heavy. However, the company does not see significant markdowns coming through its general merchandise business. |

| Costco

|

Total inventory increased by 26.1% year over year, driven by high inflation.

Non-food inventories were up year over year in certain categories. The company stated that it was heavy in terms of inventory in small appliances and domestics, primarily due to merchandise arriving late this year.

In addition, the company has several hundred million dollars of extra inventory in both late-arriving holiday merchandise from last season, which it is storing until this fall, and some buy-in merchandise to ensure proper inventory levels in the face of these ongoing supply chain issues.

Management stated that it continued its transition from vendor drop ship to direct ship from its own inventory, particularly for big and bulky items. Overall, this lowers the cost of merchandise and improves delivery times and service levels for members. |

Looking Forward

In 1Q22, most retailers reported a decrease in their inventory turnover ratios compared to the same quarter last year. Many US retailers that scrambled to restock shelves in the latest quarter amid product shortages disclosed that their stores are now packed with too much merchandise.

In the next quarter, we expect to see further deterioration in the inventory turnover ratios for most covered retailers amid soaring inflation and higher gas prices. With shoppers' tastes quickly shifting, many retailers now find themselves with surplus inventory.

Most of the retailers covered saw significant increases in inventory levels and mixed sales performance in the latest quarter, which led to lower inventory turnover ratios compared to the year-ago quarter. Many will need to mark down products, especially seasonal items, to clear out inventory.

Walmart referenced a trade down to private label from some consumers and a mix of sales more skewed to food (versus general merchandise) while Target referred to discounting related to slower discretionary sales. Retailers including American Eagle Outfitters, Ross Stores, TJX, Kohl’s, Big Lots and Lowe’s are focusing on cleaning out excess spring inventory and expect to be well positioned in terms of inventory in the next quarter. Nordstrom is using analytics and consumer insights to improve decision making around its inventory assortment and allocation to provide the most relevant curated assortment for its customers. Retailers must consider predictive systems to access better insights into inventory requirements—from demand at the consumer level through to sourcing.

The crisis-related US port congestion and impacts on shipping lanes continue to contribute to higher in-transit inventory levels. To reduce the risk of supply chain disruptions, retailers should strategically use air and ocean freight, diversify sourcing options, and work with a variety of suppliers and manufacturers.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

All covered apparel specialists witnessed an increase in quarter-end inventories year over year, amid high-cost inflation and high in-transit inventory due to supply chain constraints.

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

All covered apparel specialists witnessed an increase in quarter-end inventories year over year, amid high-cost inflation and high in-transit inventory due to supply chain constraints.