albert Chan

Introduction

Our first-quarter 2022 (1Q22) wrap-up covers the quarterly earnings of 65 (mostly) US-based retailers, brands and e-commerce platforms in the Coresight 100. This quarter, many retailers catering to consumers on modest incomes reported soft demand, with some noting unit declines. The overall beat/miss performance perhaps conceals these pressures.

- About 74.0% of companies beat revenue consensus estimates, while 26.0% missed revenue consensus estimates. In terms of earnings, 71.0% of companies beat consensus estimates, while 28.0% missed consensus expectations, with 1.0% in line with expectations.

- Apparel and footwear brand owners, beauty brands and retailers, CPG companies, drugstores, e-commerce players, electronics retailers, jewelry retailers, luxury companies and pet care retailers enjoyed a stronger quarter (versus expectations): More than 80% of covered companies beat consensus revenue estimates. Furthermore, 100% of covered drugstores, electronics retailers, food retailers, jewelry retailers, pet care retailers and warehouse clubs beat consensus EPS estimates.

- Apparel and footwear specialty retailers, department stores, mass merchandisers and off-price retailers were the worst-performing sectors (versus expectations) in the quarter, with 50% or more of covered companies missing consensus revenue estimates.

Beating or meeting consensus does not necessarily indicate positive results, especially as retailers navigate inflationary pressures and supply chain headwinds. The pace of sales recovery is a much better indicator of retailers’ (and consumers’) health than benchmarking versus consensus.

Company results in 1Q22, which ended April 30 for most companies in our coverage, include key commentary and qualitative insights from major US retailers and brand owners on their recent performance, in terms of revenues and comps, and the impact of inflationary pressures. Although we term the period under review 1Q22, some companies in this report describe their latest quarter differently; some also have different quarter-end dates.

In each section of this report, we assess the recent performance of retailers, brand owners and e-commerce platforms by sector.

Retail’s Trajectory Over the Quarter

In January 2022, US retail sales increased by a revised 9.4% year over year, suggesting that the economy is continuing to grow despite inflation and concerns of a looming recession. In February 2022, US retail sales increased by a revised 13.1% year over year, boosted by another strong month of job creation, as average hourly wages continue to rise within the still-tight labor market. In March 2022, US retail sales increased by revised 3.8% year over year, against strong 2021 comparatives. However, 3.8% growth amidst a backdrop of high inflation points to a slowdown in consumer spending. In April 2022, US retail sales grew revised 5.5% year over year, against strong 2021 comparatives, indicating that retail sales are healthy. US retail traffic increased by 20.9% year over year in April 2022—higher than March’s growth of 16.5% year over year, however, the average ticket size continues to be impacted by inflation. In May 2022, US retail sales increased by 6.5% year over year, against very strong May 2021 retail sales data (when pandemic-driven stimulus checks proved a boost to retail spending).

Apparel and Footwear Brand Owners

All covered apparel and footwear brand owners, except for Carter’s, posted positive sales growth year over year. However, negative gross margin trends amid high inflation and supply chain constraints remain key concerns for apparel and footwear brands.

|

|

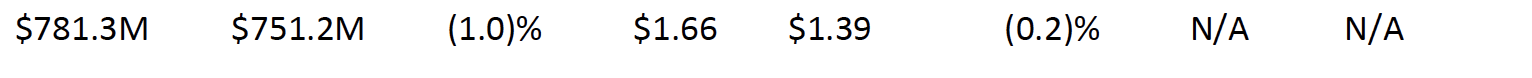

| Carter’s, Inc. (NYSE: CRI) 1Q22 |  |

| Details | Carter’s reported a 1.0% year-over-year revenue decline in its first quarter, versus 7.3% growth in the prior quarter. Diluted EPS was flat compared to the same quarter of fiscal 2021. The company’s gross margin was down 440 basis points (bps) year over year to 45.4% due to the higher inbound transportation costs, which increased nearly 60.0% over last year. By segment, US retail revenue declined by 10.0% year over year, reflecting the tougher comparison to last year's stimulus-led spending and the later Easter holiday this year; US wholesale revenue increased by 8.0% year over year and international revenue increased by 11.0%. In the US Wholesale segment, Carter’s continues to see good product demand in retailers such as Walmart, Target and Amazon because these retailers became one-stop shopping for essential products during the pandemic. The company’s toughest comps were in the Midwest and Northeast, where cold weather has not yet prompted consumers to shop for warm-weather apparel. Overall, the company is seeing consumers refreshing their children’s outfits in anticipation of summer vacation and reconnecting with families and friends. On the supply chain side, the company is now routing over 60.0% of its imports through the East Coast with good results. The East Coast ports are less congested than the West Coast, resulting in quicker receipt processing for the company. |

| Looking Forward | For fiscal 2022, the company has estimated product costs to be up 7.0%. The company expects freight costs will be up over 10.0% this year, as ocean freight rates have more than doubled since last year and the company has ocean freight rate contracts for about 90.0% of its unit volume through the first half of 2023. The rates under those contracts are less than half the current spot market rates. The company reaffirmed its fiscal 2022 guidance of net sales growth of 2.0%– 3.0% year over year and adjusted EPS growth of 12.0%–14.0% year over year. Over the next five years, the company plans to open more than 100 stores in the US. In 2022, the company plans to open 30 stores and close 20. The company’s store-opening focus will be on high-traffic, open-air centers that provide convenience for online shoppers, including curbside pickup. Nearly 30.0% of the company’s online orders in the first quarter were fulfilled by stores, and it expects stores to fulfill 40.0% or more of its online orders within the next five years. |

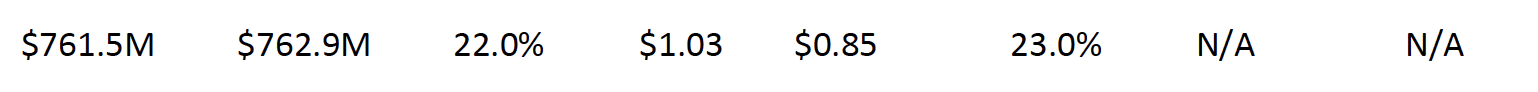

| Columbia Sportswear Company (NYSE: COLM) 1Q22 |  |

| Details | Columbia Sportswear’s first-quarter net sales increased by 22.0% year over year, compared to 23.0% growth in the prior quarter. Diluted EPS increased by 23.0% year over year. Gross margin declined by 170 basis points (bps) year over year to 49.7% due to high inbound freight costs, unfavorable year-over-year changes in inventory provisions, unfavorable regional sales mix and lower wholesale product margins, despite high direct-to-consumer (DTC) product margins. Both DTC and wholesale sales increased by 22.0% year over year. Within the DTC business, brick-and-mortar sales also increased by 22.0% and e-commerce sales increased by 21.0% year over year. By region, US sales increased by 23.0% year over year. Latin America and Asia Pacific region sales increased by 14.0% year over year. China’s sales were flat in the quarter as favorable cold weather sales conditions were offset by recent mandatory quarantines amid the region’s ongoing Covid-19 outbreak. Japan’s sales increased by mid-teens percentage, reflecting favorable weather in early 2022. The Europe, Middle East and Africa (EMEA) region’s sales increased by 42.0% year over year, driven by robust sales growth in both the Europe DTC and EMEA distributor businesses. Growth was broad-based across the outerwear, footwear and sportswear categories. According to the company, SOREL was its fastest-growing brand in the 1Q22, with sales increasing by 37.0% year over year, followed by Columbia, which reported a sales increase of 22.0%. The company’s emerging brand, Prana’s, sales increased by just 4.0% year over year, constrained by the late delivery of its spring 2022 inventory. On the innovation front, Columbia Sportswear’s spring 2022 product line includes the launch of several new technologies and products. It introduced its OutDry Extreme mesh fabric, which features more breathability and waterproofness, and no added perfluorinated chemicals (PFCs). In footwear, it launched Tech live Plush, a cushioning foam that improves heel-to-toe transition and comfort over uneven terrain. It has also combined two warm weather technologies in the new Ice Hoodie— Omni-Shade Sun Deflector and Omni-Freeze ZERO Ice—to deflect light, cool the body and wick moisture away. |

| Looking Forward | Columbia Sportswear still expects full-year 2022 net sales growth of 16.0%–18.0% year over year, even after removing any future sales to its Russian-based distributor from its outlook (a 2.0% headwind to full-year 2022 consolidated net sales). Meanwhile, the company raised its EPS guidance and now expects diluted EPS of $5.70–6.00, compared to $5.50–5.80 in the prior guidance, representing 6.9%–12.6% growth from last year. The company expects its gross margin to decline 130 bps year over year to 50.3% and its operating margin to be 13.2%–13.6%, compared to 14.4% in 2021. For the second quarter of fiscal 2022, Columbia Sportswear anticipates mid-single-digit sales growth and near breakeven earnings year over year due to the removal of fall 2022 shipments from the company’s Russia-based distributor and the impact of China’s rise in Covid-19 cases. |

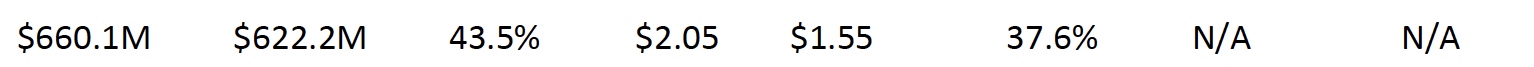

| Crocs, Inc. (NasdaqGS: CROX) 1Q22 |  |

| Details | Crocs posted sales growth of 43.5% year over year, versus 42.6% growth in the previous quarter. Adjusted EPS increased by 37.6% year over year. The company’s gross margin decreased by 580 bps year over year to 49.2% due to incremental air freight costs. Crocs brand digital sales grew 20.3%, representing 32.8% of Crocs Brand revenues, versus 32.3% in the prior year. HEYDUDE brand’s (acquired by the company on February 17, 2022) digital penetration was 25.9% of HEYDUDE brand revenues. By distribution channel, the direct-to-consumer (DTC) business, which includes retail and e-commerce, grew 34.6% year over year, and wholesale revenues grew 48.7%. By geography, the Crocs brand’s Americas’ revenue increased by 19.5% versus the first quarter of 2021 (1Q21), wherein DTC revenue increased by 18.5% on top of 131.3% growth last year. EMEA’s (Europe, Middle East and Africa) and Latin America’s combined revenue increased by 26.8% year over year, wherein DTC revenue increased by double-digits. Meanwhile, Asia’s revenue increased by 22.1% year over year. Within Asia, India, Singapore and South Korea all posted strong double-digit revenue growth versus last year. |

| Looking Forward | For fiscal 2022, the company expects revenue growth of between 52.0% and 55.0% compared to 2021. It expects revenue growth for the Crocs Brand to exceed 20.0% compared to 2021 and revenue for the HEYDUDE Brand to be approximately $750–800 million. The company expects its gross margin to include an incremental $75 million in air freight costs in the first half of 2022. It expects its adjusted operating margin to be 26.0%–27.0% and adjusted EPS growth of 20.8%-28.0% year over year. Crocs expects the macro environment to remain challenging with the backdrop of high inflation, rising interest rates and supply chain disruptions, but the company has tremendous confidence in both the Crocs and HEYDUDE brands. For the second quarter of fiscal 2022, the company expects revenue growth of 43.0%–49.0% year over year. It expects revenue growth for the Crocs brand to be 12.0%–15.0% compared to 2021 and revenue for the HEYDUDE brand to be approximately $200–220 million. |

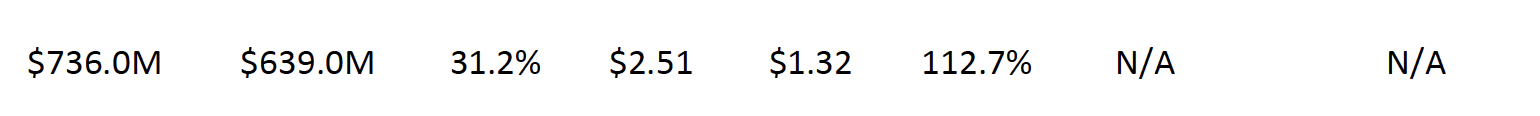

| Deckers Outdoor Corporation (NYSE: DECK) 4Q22 |  |

| Details | Deckers Outdoor Corporation reported net sales growth of 31.2% year over year, versus 10.2% growth in the prior quarter. EPS increased by 112.7% year over year, while the company’s gross margin was down 450 basis points (bps) year over year to 48.7% due to elevated freight costs. By brand, UGG brand net sales increased by 24.7%, HOKA brand net sales increased by 59.7%, Teva brand net sales decreased by 8.8% and Sanuk brand net sales decreased by 1.7%. By channel, wholesale net sales increased by 37.6%, and direct-to-consumer (DTC) net sales increased by 22.2% year over year. By geography, domestic net sales increased by 37.4% year over year, and international net sales increased by 18.2%. On the factory production front, Deckers has successfully secured additional production lines with existing partners and onboarded new partners. The company believes this will support its plan to continue fueling brand growth and allow it to expand capabilities and capacities in fiscal 2023 and beyond. Meanwhile, Deckers continued to see higher prices across most of its supply chain, with some moderation. Specifically, the company expects ocean freight costs to remain a headwind. However, it believes that impacts from ocean freight and material cost inflation can be mitigated by planned price increases for the HOKA and UGG brands later in calendar 2022. |

| Looking Forward | For fiscal 2023, Deckers expects its net sales to be in the range of $3.4–3.5 billion, representing 10%–11% growth year over year, with HOKA growing in the mid-to-high 30.0% range and UGG growing by a low-single-digit. It expects EPS to be $17.40–$18.30, representing growth of 6.4%–12.5% year over year. The company expects its gross margin to be 51.5%, 50 bps higher than last year. |

| Gildan Activewear Inc. (TSX: GIL) 1Q22 |  |

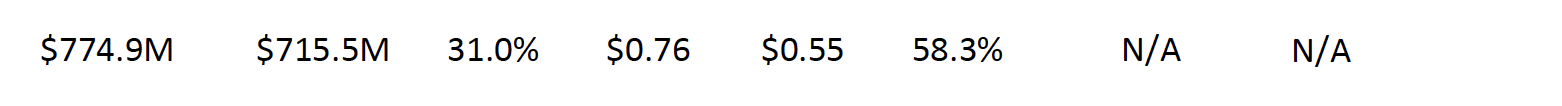

| Details | Gildan’s sales increased by 31.0% year over year, versus 14.0% growth in the prior quarter, driven by volume growth and net selling price increases. Adjusted EPS increased by 58.3% year over year. Adjusted gross margin was down 20 bps year over year to 30.9%, as the company received a one-time cotton subsidy last year, which benefited gross margins in 1Q21 by 300 bps. Excluding this benefit, the company’s adjusted gross margin expanded by 280 bps in 1Q22. By category, activewear sales were up 38.0% year over year, driven by volume growth, net selling price increases and a favorable product mix. Activewear volume growth reflected strong demand in North American markets, particularly in the distributor channel, partly offset by lower international shipments due to ongoing demand weakness in Europe and Asia. Hosiery and underwear sales increased by 3.0% over last year, driven by higher selling prices. By geography, US sales increased by 34.5% year over year, and Canada sales increased by 33.6% year over year. Meanwhile, international sales increased by 4.5% year over year. Recently, although the company has seen some deceleration in sell-through over the last few weeks tied to broader economic considerations, the overall demand for activewear remains healthy. The company has started to see some sell through slowing for specific products in the hosiery and underwear category that could be related to broader economic factors, including the lack of stimulus checks and other support payments which consumers received in 2021. |

| Looking Forward | The company feels pleased with the start to the year and the progress it can make in 2022 as it moves forward with the Gildan's Sustainable Growth (GSG) strategy, which is focused on driving growth, margin performance and its previously communicated outlook for sales and margin performance from 2022–2024. The GSG strategy outlook reflects three-year net sales CAGR in the 7.0%–10.0% range and annual operating margins in the 18.0%–20.0% range. |

| Guess?, Inc. (NYSE: GES) 1Q23 |  |

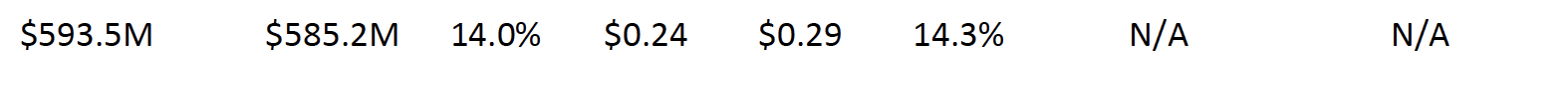

| Details | Guess reported revenue growth of 14.0% year over year, versus 23.4% growth in the prior quarter. Its adjusted EPS increased by 14.3% year over year, while its e-commerce business was flat year over year. The company’s adjusted operating margin increased by 200 bps year over year to 7.0%, driven primarily by leveraging of expenses and partially offset by higher store labor costs in the Americas’ region and unfavorable currency impact. Guess saw strength in both the women’s and men’s apparel categories. According to management, dresses, pants, sweaters, and woven tops registered strong sales growth in the women’s segment. The company also stated that demand for handbags remained solid. In the men’s segment, blazers, pants, outerwear and woven shirts categories registered strong sales growth. By geography, the Americas’ retail revenues increased by 7.0% year over year, with retail comp sales, including e-commerce, increasing by 3.0%. Americas’ wholesale revenues increased by 50.0% year over year. The company experienced expense pressure in the Americas region due to increased wages and inflation. Altogether, this resulted in almost five percentage points of deleveraging in the quarter. Europe’s total revenues increased by 14.0% year over year, as the company enjoyed a full period with open stores compared to significant closures in the same year-ago quarter. Asia’s total revenues increased by 1.0%, impacted by Covid-19 related shutdowns in China. The company’s Marciano brand registered double-digit sales growth in every region. |

| Looking Forward | For fiscal 2023, assuming no meaningful Covid-19 related shutdowns in the US, the company expects revenues to be up around 4.0% in US dollars (10.0% in constant currency) versus fiscal 2022 and adjusted operating margins to reach approximately 10.3%. The company plans to open 60 new stores in North America and Europe and remodel 370 additional locations between the two regions by the end of calendar 2022. For 2Q23, Guess expects revenues to be up 1.0% in US dollars (8.0% in constant currency) versus 2Q22 and its operating margin to reach approximately 7.5%. |

| Hanesbrands (NYSE: HBI) 1Q22 |  |

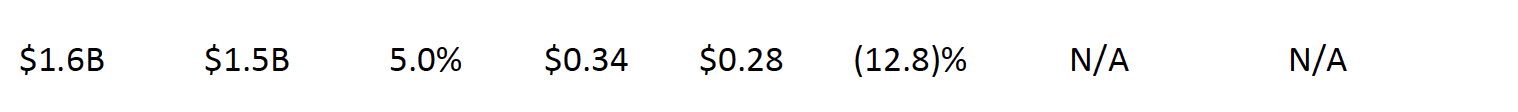

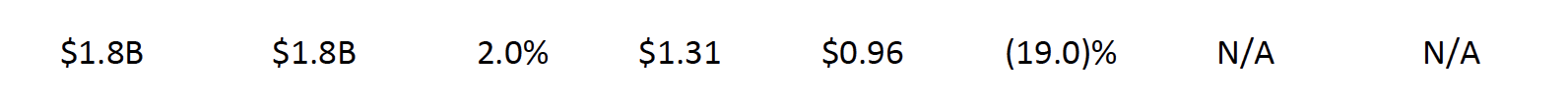

| Details | Hanesbrands reported a 5.0% year-over-year increase in sales versus 4.0% growth in the prior quarter, driven by continued strong consumer demand. Adjusted EPS declined by 12.8% year over year. The company’s adjusted gross margin declined by 305 bps year over year to 37.1% due to the expected impact of higher inflation and “the higher-than planned strategic investment in expedited freight to service new retail space gains and new product innovation.” By segment, innerwear sales increased by 1.5% year over year, on top of 35.0% growth last year, driven by retail space gains, a positive mix benefit and the partial-quarter benefit of price increases. Activewear sales grew 6.3% year over year, wherein Champion brand’s sales were consistent with the prior year. Champion was able to comp last year’s strong growth in the segment due to strong consumer demand. However, product delays resulted in around $40 million of in-hand orders going unfulfilled in the quarter. Had the product arrived on time, Champion sales in the US would have increased at a high-teens rate. Sales of other activewear brands increased by mid-teens year over year. In the quarter, Champion launched its “Win with Women” campaign, continuing to expand product offerings for younger female consumers. The campaign celebrates women in sports and aims to fuel women’s confidence. US innerwear sales increased by 1.5% over the prior year, driven by retail space gains, price increases and product mix. Inventory at the end of the first quarter of 2022 was $1.8 billion, a 22.0% increase year over year, due to the combination of higher levels of in-transits, the impact of inflation on input and transportation costs, and the strategic decision to invest in inventory in the quarter to rebuild safety stock. |

| Looking Forward | The company is experiencing incremental costs to move materials within its network, while the latest Covid-19-related challenges are putting additional pressure on demand and supply chain costs. These increased challenges have created an additional $140 million of cost headwinds in the company's 2022 business. For fiscal year 2022, Hanesbrands expects net sales of $7.0–7.2 billion, which includes a projected headwind of approximately $125 million from changes in foreign currency exchange rates. At the midpoint, this represents 4.0% growth year over year. It expects adjusted EPS to be in the range of $1.64–$1.81, representing growth of 10.8%–22.3% year over year. For its second quarter of 2022, the company expects net sales between $1.68 billion and $1.73 billion. At the midpoint, this represents around 3.0% sales decline year over year. It expects adjusted EPS to be $0.32–$0.36, representing a decline of 23.4%–31.9% year over year. |

| Levi Strauss & Co (NYSE: LEVI) 1Q22 |  |

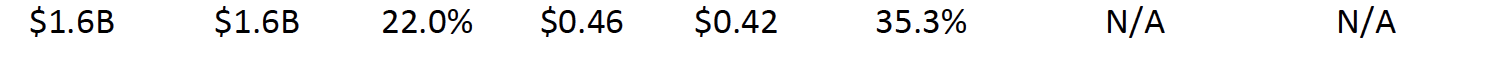

| Details | Levi’s reported revenue growth of 22.0% year over year—in line with its 22.0% growth in the prior quarter—driven by strong growth across all geographical segments. Adjusted EPS increased by 35.3% year over year. The company’s adjusted gross margin increased by 170 bps year over year to 59.4%, driven by a higher mix of sales from DTC, price increases and lower promotions. DTC net revenues increased by 35.0% year over year, driven by growth in company-operated stores and e-commerce, which grew by 48.0% and 10.0%, respectively. As a percentage of total revenues, sales from DTC stores and e-commerce comprised 30.0% and 9.0%, respectively. By geography, the Americas’ net revenue increased by 26.0% year over year, driven by growth across DTC and wholesale channels. Europe’s net revenue increased by 13.0% year over year, driven by company-operated stores as pandemic-led restrictions loosened, allowing consumers to return to stores. Asia’s net revenue increased by 11.0% year over year, driven by growth across DTC and wholesale channels. Levi’s is experiencing exceptional growth in men’s bottoms, with sales growth of 24.0%, the category’s highest first-quarter revenue in over a decade. Levi’s women’s bottoms sales also continue to grow, with sales up 21.0% year over year, and Levi’s 501 series sales were up 50.0% in the quarter, demonstrating consumers’ love for the brand’s most iconic product. |

| Looking Forward | Levi’s reaffirmed its fiscal 2022 expectations of net revenue growth of 11.0%–13.0% year over year, reaching $6.4–6.5 billion. The company expects an adjusted EPS of $1.50–1.56 in fiscal 2022, representing 2.0%–6.1% growth year over year. To drive e-commerce growth, the company plans to expand the availability of its Levi’s app, which provides customers with early access to product launches, exclusive content and offers. The app will debut in India and several European countries in the second quarter of 2022, with further global expansion later in the year. |

| PVH Corp. (NYSE: PVH) 2Q22 |  |

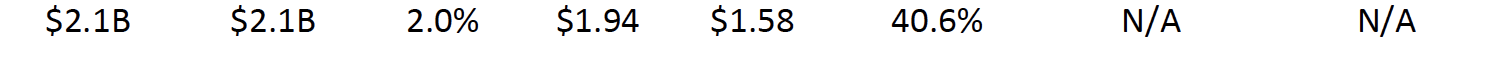

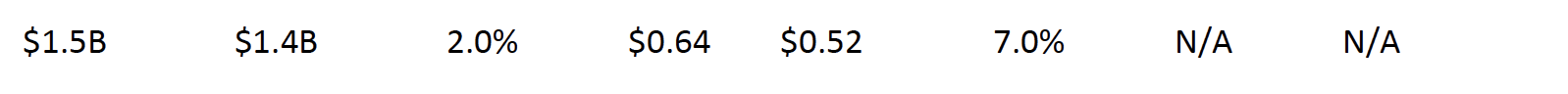

| Details | PVH Corp.’s first-quarter revenue increased by 2.0% year over year, versus 16.0% growth in the prior quarter. Its EPS increased by 40.6% year over year, while its gross margin declined by 70 basis points (bps) year over year to 58.4% due to higher freight costs.

The company stated that it continues to experience supply chain and logistics disruptions globally, as well as the impact of Covid-19 lockdowns in China. Revenue in the most recent quarter reflected a 5.0% reduction due to the sale of its Heritage Brands business and a 1.0% reduction from the Russia-Ukraine war, specifically the company’s closure of its stores in Russia and Belarus and a decline in wholesale shipments to Ukraine.

By brand, Tommy Hilfiger reported a 2.0% year-over-year sales increase, Calvin Klein reported a 13.0% sales increase and Heritage Brands reported a 31.0% sales decrease.

In April 2022, PVH introduced the PVH+ Plan, its multi-year strategic plan to drive brand, digital and direct-to-consumer (DTC) growth. The PVH+ Plan builds on the core strengths of PVH and connects its brands Calvin Klein and Tommy Hilfiger to the consumer through five key growth drivers:

|

| Looking Forward | For fiscal 2022, PVH Corp. expects revenue growth of 1.0%–2.0% year over year, reflecting a 2.0% reduction from the Heritage Brands transaction and a 2.0% reduction from the Russia-Ukraine war. It expects an operating margin of around 10.0% and an EPS of $9.00, an 11.3% decline year over year. The company expects supply chain and logistics disruptions to continue to impact its business, primarily in North America, through the rest of the year, with the first half being the most severely affected. This includes wholesale shipments initially planned for the end of the second quarter shifting into the beginning of the third quarter. For the second quarter of fiscal 2022 (2Q22), PVH projects a revenue decline of 3.0%–4.0% year over year, reflecting a 4.0% reduction from the Heritage Brands transaction and a 2.0% reduction from the Russia-Ukraine war. It expects its adjusted EPS to decline by 26.5% year over year. |

| Ralph Lauren (NYSE: RL) 4Q22 |  |

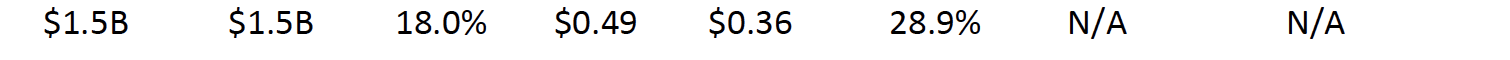

| Details | In the fourth quarter of fiscal 2022, Ralph Lauren’s revenue increased by 18.0% year over year versus 27.0% growth in the prior quarter. Its adjusted EPS increased by 28.9% year over year.

The company’s adjusted gross margin was up 40 bps year over year to 63.3%, driven by average unit retail (AUR) growth across all regions as well as favorable channel and geographic mix shifts, which more than offset increased freight, raw materials and labor input costs.

By geography, North American total revenues increased by 19.0% year over year, and comparable store sales were up 21.0%, with a 19.0% increase in brick-and-mortar stores and a 27.0% increase in digital commerce. European revenues increased by 26.0%, and comps grew 77.0%, with a 145.0% increase in brick-and-mortar stores. The brick-and-mortar increase offset a 2.0% decrease in digital commerce compared to 79% growth in the prior year’s same quarter, when a significant portion of the stores were closed due to Covid-19. In Asia, revenues grew 20.0% while comps increased by 12.0%, with 10.0% growth in brick-and-mortar stores and a 46.0% increase in digital commerce.

The company saw consumers gravitate back to more sophisticated luxury and formal wear looks. It continued to drive a mix of elevated but comfortable casual styles.

Ralph Lauren continues to leverage the following strategies:

|

| Looking Forward | For fiscal 2023, Ralph Lauren expects its revenues to increase by a high-single-digit on a constant-currency basis, with its current outlook at around 8%. The company expects operating margin growth to increase by 90–140 bps year over year and its gross margin to increase by 30–50 bps year over year, with stronger AUR and favorable product and channel mix offsetting freight and product cost inflation. For 1Q23, the company expects revenue growth of around 8% in constant currency. It expects its operating margin to be approximately 13.5% in constant currency, reflecting increased headwinds from higher freight and marketing expenses, which are expected to normalize in the second half of the year. The first quarter outlook reflects confirmed government-mandated lockdowns and other Covid-19 related restrictions, notably in China. |

| Skechers U.S.A., Inc. (NYSE: SKX) 1Q22 |  |

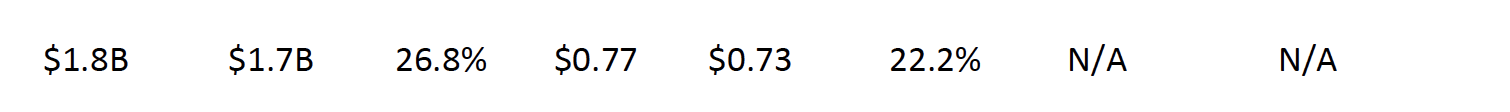

| Details | Skechers’ sales increased by 26.8% year over year, versus 24.4% growth in the prior quarter. The company saw a 28.7% increase in domestic sales and a 25.5% increase in international sales year over year, driven by wholesale sales. Both the wholesale and DTC segments experienced growth, at 32.7% and 15.7% year over year, respectively. Diluted EPS increased by 22.2% year over year, while gross margin declined by 250 bps year over year to 45.3% due to high per-unit freight costs. By region, the Americas sales increased by 31.0% year over year, driven by significant improvement in the pace of the company’s inbound receipts and outbound shipments to wholesale customers. EMEA sales increased by 49.0% year over year, reflecting a recovery in many markets that were heavily impacted by the pandemic. In the Asia Pacific region, sales increased by 4.0% year over year, led by 9.0% growth in China, though partially offset by Covid 19-induced weakness in several adjacent markets. The rollout of Skechers’ new e-commerce platform continued in the 1Q22 with the launch of new websites in France and Spain. According to the company, more markets are planned for 2022, including several in Europe. The company also continues to invest in its DTC capabilities, upgrading its point of sale (POS) systems in Japan and Belgium, with the rest of Europe to be upgraded by the end of the third quarter of fiscal 2022. Skechers opened 31 company-owned stores, including 13 in the US and seven in China, in the 1Q22. It closed 41 locations in the quarter, including 12 in the US and seven in China. |

| Looking Forward | For the second quarter of 2022, the company believes it will achieve sales of $1.7–1.8 billion, representing growth of 5.4%–8.4% year over year, and diluted EPS of $0.50–$0.55, a decline of 37.5%–43.2% year over year. For the full year 2022, the company expects sales of $7.2–7.4 billion, representing growth of 14.3%–17.5% year over year. Diluted EPS is expected to be between $2.75 and $2.95, a decline of 37.6%–41.9% year over year. Skechers anticipates that its gross margins will be down compared to last year, both in the second quarter and the full year, as freight costs will offset improved pricing. However, it expects its gross margins to improve over the year as its previously-introduced wholesale pricing takes effect. |

| Under Armour (NYSE: UAA) 1Q22 |  |

| Details | Per a February 2021 announcement, Under Armour changed its fiscal year-end from December 31 to March 31. Following a three-month transition period (January 1, 2022–March 31, 2022), Under Armour’s fiscal year 2023 will run from April 1, 2022, through March 31, 2023. Consequently, there will be no fiscal year 2022. In its transition quarter ended March 31, 2022, Under Armour reported a 3.0% year-over-year increase in revenue versus 9.0% growth in the prior quarter. Due to elevated freight expenses, the company’s gross margin decreased by 350 basis points (bps) year over year to 46.5%. By distribution channel, wholesale revenue increased by 4.0% year over year, driven by an increase in the company’s distributor business and off-price sales growth. Direct-to-consumer (DTC) revenue increased by 1.0% year over year, driven by 2.0% year-over-year growth in e-commerce, with online sales representing 45.0% of the total DTC business during the quarter. By category, apparel revenue increased by 8.0%, year over year, driven by strong sales growth in the training and team sports categories. Footwear revenue decreased by 4.0% due to Covid-19 related supply constraints, and accessories revenue decreased by 18.0% due to lower sales of sports masks compared to last year. By geography, North America witnessed revenue growth of 4.0% year over year, driven by growth in the wholesale and DTC businesses. International revenue increased by 1.0% year over year. Within the international business, Europe, the Middle East and Africa’s (EMEA) revenue increased by 18.0% year over year, while the Asia-Pacific region (APAC) saw a 14.0% decline in revenue due to Covid-19-related inbound shipping delays and challenging market conditions amplified by retail store closures and restrictions in China. Latin America’s revenue declined by 6.0%, owing to changes in the company’s business model as the company transitioned certain countries in the region to a strategic distributor model. |

| Looking Forward | For fiscal 2023, Under Armour expects a revenue increase of 5.0%–7.0% year over year, reflecting a mid-single-digit sales growth rate in North America and a low-teens growth rate in its international business. It expects gross margin to be down 150–200 bps due to expected inflationary pressures on freight and product costs. The company expects adjusted EPS to be between $0.63 and $0.68. For the first quarter of fiscal 2023, the company expects revenue to be flat to down slightly versus the prior-year quarter. Due to higher freight costs, the company expects its first-quarter gross margin to be down 250 bps compared to the prior year. |

| V.F. Corporation (NYSE: VFC) 4Q22 |  |

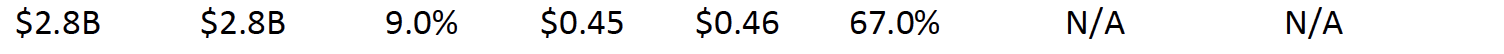

| Details | VF Corporation’s revenue from continuing operations increased by 9.0% year over year, versus 22.0% in the prior quarter. At the same time, adjusted EPS increased by 67.0% year over year, and the company’s adjusted gross margin was down 50 bps year over year to 52.2% due to incremental freight costs. By segment, active’s revenue increased by 1.0% year over year, and outdoors’ revenue increased by 20.0%, including a 24.0% increase in The North Face brand. Meanwhile, work’s revenue increased by 6.0%, including an 8.0% increase in the company’s Dickies brand. VF Corporation continued to see strong growth across channels and categories. The company launched several innovation initiatives for the Timberland brand in the quarter, including Timber Loop, an end-to-end circular design e-commerce platform. It is also transforming how the company goes to market, increasing digitization across product creation, merchandising and supply, further elevating the output while becoming quicker, more agile and more efficient. The company’s use of 3D design across product creation has led to a significant increase in new apparel and footwear styles developed with these technologies. According to the company, nearly 40.0% of Vans’ global footwear line is now designed and developed on an automated 3D configurator. VF Corporation has taken pricing actions across its brands to offset inflationary pressures. It is procuring supplies earlier, anticipating order book collection and investing in technology to create efficiencies and reduce lead times. The company is also expanding its local-for-local sourcing strategy, servicing an increasing regional demand with locally manufactured products. At the same time, the company secured additional capacity by doubling the number of ports of entry and ocean carriers used relative to pre-pandemic levels instead of using alternate origin routings and other methods. |

| Looking Forward | For fiscal 2023, the company expects its total revenues to grow at least 7.0% in constant dollars, including low double-digit percentage growth in its North Face brand and mid-single-digit percentage growth in Vans. The company expects its gross margin to be up 50 bps year over year and EPS growth of 11.0%–14.0% year over year. VF Corporation mentioned that the environment in China continues to be challenging as 12.0% of the company’s stores were closed at the end of the fourth quarter, 20.0% are currently closed (as of May 19, 2022), and the company does not anticipate they will reopen before early June. Digital traffic also continues to be impacted in the area, according to the company. As a result, the company expects its business in China to be down approximately 35.0% in 1Q23, with a gradual recovery over the rest of the year. Overall in China, the company expects mid-single-digit revenue growth year over year and remains confident in the region’s long-term growth opportunity. |

Apparel Specialty Retailers

Apparel specialists reported mixed results amid elevated supply chain and production costs: American Eagle Outfitters, Foot Locker, Lululemon Athletica and Urban Outfitters posted positive sales growth year over year, whereas Academy Sports and Outdoor, Dick’s Sporting Goods and Gap reported sales declines. In regards to categories, apparel, accessories, beauty, intimates and leggings performed strongly in the quarter.

|

|

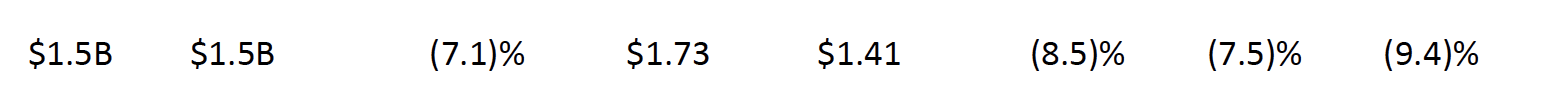

| Academy Sports and Outdoors, Inc. (NasdaqGS: ASO) 1Q22 |  |

| Details |

Total sales for Academy Sports and Outdoors declined by 7.1% year over year versus 13.2% growth in the prior quarter, while its comparable sales declined by 7.5% year over year versus 13.1% growth in the previous quarter. The company’s online sales grew 18.8% year over year, accounting for 9.5% of its total merchandise sales in the quarter. E-commerce sales have surged 375% since the first quarter of fiscal 2019. By category, footwear sales declined by 2.0% year over year, outdoor sales declined by 6.0%, apparel sales were down 9.0% and sports and recreation sales fell by 12.0%. Steven Lawrence, Executive Vice President and Chief Merchandising Officer of the company, said, “categories such as fitness, fishing and bikes saw an outsized benefit from the shutdown associated with the COVID pandemic. As we expected, these businesses are not sustaining the same level of demand as they did in 2020 and 2021.” The company’s gross margin decreased by 20 basis points (bps) year over year to 35.5% due to increased inventory and e-commerce shipping costs, while adjusted EPS declined by 8.5%. |

| Looking Forward |

The company revised down its sales and comp sales guidance for fiscal 2022 and now expects sales of $6.4–6.6 billion, compared to prior guidance of $6.6–6.8 billion and comp sales of (3.0)%–(6.0)% year over year, compared to its previous guidance of (1.0)%–(3.0)%. The company also revised down its EPS and now expects it to be $6.60–$7.30, down from $6.70–$7.30, a decline of 3.9%–13.2% year over year. In fiscal 2022, the company aims to open eight new stores as part of its plan to open 80—100 stores between fiscal 2021 and fiscal 2026. |

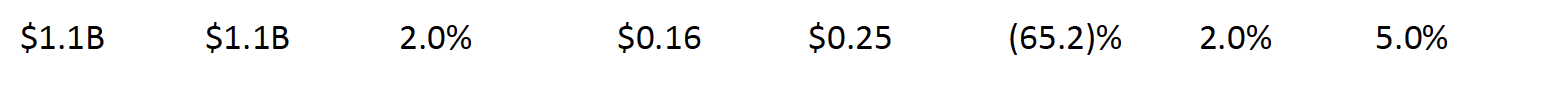

| American Eagle Outfitters (NYSE: AEO) 1Q22 |  |

| Details | American Eagle Outfitters’ total revenues increased by 2.0% year over year, missing the company’s estimates and decelerating from 14.7% growth in the prior quarter. Comparable sales increased by 2.0%, versus 14.8% growth in the prior quarter. The company’s digital revenues declined by 6% year over year against strong comparatives. By banner, Aerie’s sales grew by 8.0% year over year versus 27.0% growth in the prior quarter, and American Eagle’s sales declined by 6.0% versus 11.0% growth in the prior quarter. The company’s gross margin contracted by 540 bps year over year to 36.8%, mainly caused by high freight costs, which impacted its gross margin by 340 bps, and disruption in its supply chain business, which impacted its gross margin by 120 bps. Its operating margin was 4.0%, down 890 bps year over year, and its adjusted EPS declined by 65.2% year over year. Management stated that accessories, apparel, beauty, intimates and leggings categories saw strong momentum in the quarter, but the demand for swimwear was weak due to cold weather. The company also stated it will continue to expand its Aerie banner, opening 12 new stores in the quarter, including a mix of stand-alone and side-by-side formats with its brand OFFLINE. |

| Looking Forward | The company revised down its revenue and operating income outlook for fiscal 2022 due to shifts in the macro-economic environment. For 2022, the company expects year-over-year revenue growth to be in the low single digits versus its prior expectations of growth in mid-teen percentages. It now expects its operating income to be above $314 million, versus its previous guidance of $550–600 million, a 47.9% decline year over year. For 2Q22, the company expects revenue growth to be in-line with 1Q22 and gross margin to be about 33%, reflecting elevated freight costs, higher markdowns to clear spring inventory and the impact of supply chain acquisitions. Management said that the company will enter the second half of the year with a more balanced inventory position and leaner expense base, driving improved operating margins and net income relative to the first half. |

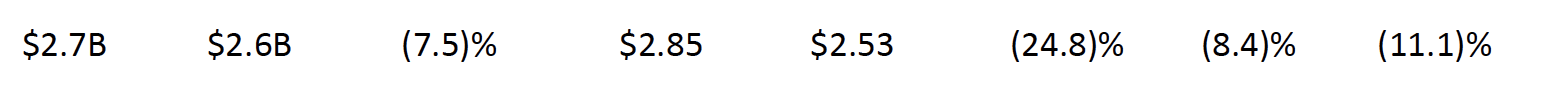

| Dick’s Sporting Goods (NYSE: DKS) 1Q22 |  |

| Details | Dick’s Sporting Goods’ total revenues declined by 7.5% year over year versus 7.3% growth in the prior quarter. Total comparable sales declined by 8.4% year over year versus 5.9% growth in the prior quarter. Management said that the negative comps reflect the “anniversary” (cycling) of notable stimulus payments in the same quarter last year, along with sales normalization in certain categories that surged amid the pandemic, such as fitness and outdoor equipment. The company witnessed a 2.0% decline in average ticket price and a 6.4% decrease in transactions. Management stated that its private-label brands, including CALIA, DSG and VRST, continued to perform well. These private labels represent the company’s largest brands in the fitness, golf, team sports and outdoor equipment categories. The company’s gross profit margin declined by 83 bps to 36.7% due to a 103 bps increase in supply chain-related costs and a “leverage on fixed occupancy cost of approximately 1,000 basis points from the significant sales increase,” partially offset by continued merchandise margin rate expansion. Adjusted EPS declined by 24.8% year over year versus 49.8% growth in the prior quarter. CEO Lauren Hobart said, “Our new concepts, including DICK’S House of Sport, Golf Galaxy Performance Center, Public Lands and Going, Going, Gone!, are delivering promising early results. Today, we are really excited to open our third House of Sport store in Minnetonka, Minnesota. House of Sport has exceeded our expectations and has been a great example of the power of elevated service, community engagement and merchandise presentations. We look forward to continuing to refine and grow these concepts.” |

| Looking Forward | For fiscal 2022, Dick’s has revised down its comp and adjusted EPS guidance. The company now expects its adjusted EPS to be down by 25.5%–41.7% year over year versus its prior guidance of 16.6%–25.5% decline, and it forecasts comps to be (2.0)%–(8.0)% versus prior guidance of flat to (4.0)%. It reiterated its plans to spend $400–425 million on capital expenditure on a gross basis in 2022, compared to $308 million on capital expenditure in 2021. |

| Foot Locker (NYSE: FL) 1Q22 |  |

| Details | Foot Locker’s total revenues increased by 1.0% year over year, decelerating from 6.9% growth in the prior quarter. Comparable sales decreased by 1.9% versus an 0.8% increase in the prior quarter. The company’s digital penetration stood at 18.3% at the end of 1Q22, compared to 24.8% in 1Q21. While overall comps were down 1.9%, comp growth from non-NIKE vendors was in the high teens as the company continues its efforts to rebalance its assortment to promote vendor diversity. Management stated that the strong momentum of brands including Adidas, Converse Crocs, New Balance and PUMA during the first quarter showcased the expanding breadth of its consumer sneaker offerings, which now cover athletic, outdoor and seasonal categories. The company’s gross margin declined by 80 bps year over year to 34.0% due to elevated supply chain costs and slightly higher markdowns, while its adjusted EPS declined by 18.4% year over year. Foot Locker continued to expand its apparel category in the quarter. CEO Richard Johnson stated, “Our efforts to grow our apparel and accessories business continue to yield results with the categories well outpacing footwear once again, comping up over 10% despite difficult year-over-year comparisons. Private label continues to be an important driver of our apparel business with Locker and Cozi continuing to gain traction in their early days and co-created brands like All City and Melody Ehsani performing well with new drops in March and April.” During the first quarter, Foot Locker opened 24 new stores, remodeled or relocated 23 stores and closed 67 stores. |

| Looking Forward | Foot Locker updated its financial guidance for fiscal 2022. The company now expects total sales change to be at the “upper end of down 4%–6%” and comparable sales growth to be at the “upper end of down 8%–10%.” The company now forecasts a gross margin of 30.6%–30.8% versus its prior guidance of 30.1%–30.3%, and adjusted EPS at the upper end of $4.25–$4.60 versus its previous guidance of $4.30–$4.60. In fiscal 2022, the company plans to open about 100 new stores, including 40 power and community stores, 27 WSS (a US-based apparel and footwear company acquired by Foot Locker in 2021) stores and nine Atmos (a Japan-based apparel and footwear company acquired in 2021) stores, while also closing a total of 190 stores. Foot Locker stated that it expects to increase WSS’s sales to $1 billion by 2024, at a sales CAGR of 20% between 2022 and 2024, supported by accelerated store openings and strong same-store sales growth. Foot Locker also reiterated its plan to expand Atmos’s sales by about 50% annually to nearly $300 million by 2024 by expanding internationally and scaling up in the company’s existing markets. |

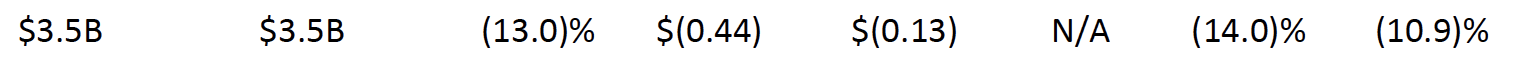

| Gap Inc. (NYSE: GPS) 1Q22 |  |

| Details |

Gap’s total revenues declined by 13.0% year over year, compared to a 2.0% increase in the prior quarter. Comparable sales were down 14.0% versus a 3.0% increase in the previous quarter, while digital sales were down 17.0% year over year, representing 39% of the total business. By brand, Athleta’s sales increased by 4.0% year over year, Banana Republic’s sales increased by 24.0%, Gap’s sales decreased by 11.0% and Old Navy’s sales declined by 19%. In terms of comps, Athleta reported a 7.0% decline year over year, Banana Republic reported a 27.0% increase, Gap saw a decline of 11.0% and Old Navy reported a 22.0% decline. The company’s gross margin stood at 31.5%, down 930 bps year over year due to incremental transitory air freight costs, higher discounting at Old Navy and inflationary commodity price increases; however, the company partially offset these issues with lower discounting at Banana Republic banner. CEO Sonia Syngal stated, “We expected tough first half compares driven by moderate product delays due to supply chain disruptions last year as well as lapping the brand’s disproportionate benefit from last year’s stimulus. In addition, we also expected continued assortment imbalances given the numerous pivots to fashion, such as dresses, pants and tops, which were underrepresented in Old Navy’s women’s product mix. Old Navy was especially disadvantaged given their leadership in fleece, active and kids and baby, categories that grew significantly during the height of the pandemic and experienced lower-than-expected demand during the first quarter.” |

| Looking Forward |

Gap lowered its financial guidance for fiscal 2022. The company now expects sales to decline low- to mid-single-digit year over year versus its prior guidance of low-single-digit sales growth. The company issued a new adjusted operating margin guidance of 1.5%–2.5%, versus its previous guidance of 6.0%–6.5%, and now forecasts adjusted EPS to be $0.30–$0.60 versus the prior guidance of $1.85–$2.05. Syngal said, “The majority of the sales and earnings reduction from our prior guidance stems from Old Navy, primarily assortment imbalances and lower-than-anticipated demand in key categories like active, fleece and kids and baby. While the primary impact of soft demand in active, fleece and kids and baby is being felt at Old Navy, our Gap and Athleta brands are not immune to this customer shift.” For fiscal 2022, Gap reiterated its capital expenditure guidance of about $700 million, primarily to support growth investments, including digital and supply chain capacity projects and store growth for its Athleta and Old Navy banners. In fiscal 2022, Gap plans to open 30–40 stores each for Old Navy and Athleta, and close about 50 Gap and Banana Republic stores in North America. |

| Lululemon Athletica, Inc. (NasdaqGS: LULU) 1Q22 |  |

| Details |

Lululemon Athletica’s total revenues increased by 32.0% year over year, accelerating from 23.1% growth in the prior quarter. Its total comparable sales increased by 29.0% year over year versus 22.0% comp growth in the previous quarter. The company’s DTC sales increased by 33.0% year over year, accounting for 45.0% of the company’s total revenues versus 44.0% in the year-ago quarter. Management stated that the company saw broad-based growth across its product categories and regions. Its women’s apparel business grew by 24.0% on a three-year CAGR basis, while its men’s apparel business also remained strong, with sales increasing by 30% on a three-year CAGR basis. During the quarter, the company launched Blissfeel—Lululemon Athletica’s first sneakers for women—in select stores in China, the UK and the US. It also plans to launch a men’s version of the Blissfeel shoes in 2023. By geography, North American revenues increased by 32.0% year over year and international revenues increased by 29.0% year over year. The company’s gross margin declined by 320 bps to 53.9%, driven by a 370-bps decrease in product margin—which included a 340 bps increase in air freight. Its operating margin decreased by 30 bps to 16.1%, while its diluted EPS increased by 33.3% year over year. The company opened five net new stores and completed four co-located optimizations. |

| Looking Forward |

For 2Q22, the company expects its revenues to increase by 21%–22% year over year, but its gross margin to be down 200 bps due to increased air freight costs led by port congestion and capacity constraints. The company expects its adjusted EPS to increase by 10.3%–13.3% year over year in the second quarter. At the same time, Lululemon plans to open 20 net new company-operated stores. For the full-year 2022, Lululemon Athletica expects its revenues to increase by 20.6%–22.4% year over year, based on the assumption that its e-commerce business will grow by a high-teens-to-low-20s percentage. The company forecasts its gross margin will decrease by 100–150 bps year over year due to increased investment in its distribution center network and a strategic rise in content development costs for its home gym technology, MIRROR; this will be slightly offset by a reduction in digital marketing. Lululemon Athletica now expects air freight to have a modest negative impact of nearly 30 bps on its gross margins in 2022 versus its prior expectation of flat change. The company expects its adjusted EPS to increase by 20.0%–22.0% and continues to expect capital expenditures of $600–625 million for fiscal 2022, reflecting increased investment in its digital capabilities, stores and supply chain, along with other corporate infrastructure projects. For 2022, Lululemon Athletica continues to expect to open nearly 70 net new company-operated stores, with about 40 stores in its international markets—the majority of these 40 store openings are planned for Mainland China. |

| Urban Outfitters (NasdaqGS: URBN) 1Q23 |  |

| Details |

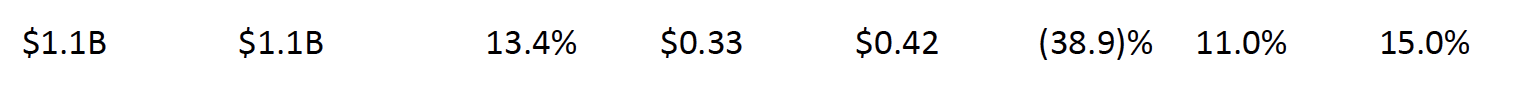

Urban Outfitters reported a revenue increase of 13.4% year over year, versus 22.4% growth in the prior quarter. At the same time, comparable sales increased by 11.0% year over year, decelerating from 14.0% in the previous quarter. By brand, Anthropologie led the way, with comps of 18% year over year—followed by Free People and Urban Outfitters, which posted comp growth of 15.0% and 1.0%, respectively. By segment, retail saw total sales growth of 12.0% year over year, while wholesale’s net sales increased by 6.0%. The company’s gross margin declined by 168 bps year over year to 30.7% due to supply chain disruptions and continued elevated inbound freight costs. The company witnessed strong demand across all categories during the first quarter, with women’s apparel and home furniture performing the strongest. Urban Outfitters stated that demand for dresses and occasion wear is growing substantially as weddings and events are once again occurring. |

| Looking Forward |

Urban Outfitters did not provide financial guidance, but management anticipates sales growth to decelerate sequentially in the second quarter. CFO Melanie Marein-Efron said, “We believe our Retail segment comp sales growth could land in the low single-digit range and Wholesale segment sales could grow in the mid-single digits. Together, this would result in total company sales growth in the low single-digit range.” Furthermore, the company forecasts that its gross margins for 2Q22 will be down by about 500 bps year over year due to ongoing supply chain challenges and increased inbound product transportation costs. |

Off-Price Retailers

Off-price retailers witnessed weak demand as customers pulled back on spending due to high inflation. Both Burlington Stores and Ross Stores underperformed versus sales and margin expectations, with both companies reporting year-over-year sales declines. However, The TJX Companies posted double-digit sales growth year over year, but management still revised down full-year sales guidance due to cost pressures in the market. |

|

| Burlington Stores (NYSE: BURL) 1Q22 |  |

| Details |

Burlington Stores’ total revenue decreased by 12.0% year over year, versus 14.3% growth in the prior quarter. Adjusted EPS declined by 79.2% year over year, while comp sales declined by 18.0% on a two-year basis. The company achieved 20.0% comp store sales growth last year and, as a result, it planned for a mid-teens comp decline in its first quarter. However, it missed this plan due to low and unbalanced inventories in February and March. The company deliberately planned inventories down in the first quarter, but this backfired, as late deliveries created significant gaps in its assortment, impacting its sales. Burlington’s gross margin rate declined by 230 basis points (bps) year over year to 41.0% due to higher freight expenses and low merchandise margins. The company stated that it feels disappointed with its first-quarter results and that it also expects the economic environment to worsen this year. Should this happen, the company said it would likely face more challenges in the short term. However, it believes that the economic slowdown could provide long-term benefits, as it could cause new shoppers to begin shopping at off-price retailers as they look for value. CEO Michael O'Sullivan told analysts: The low-to-moderate income customer is under a lot of pressure right now. In 2021, certainly, in proportion to their income, these shoppers were big beneficiaries of government support programs, stimulus checks, child benefit, extended unemployment, and those programs have now gone. That alone would have made 2022 a difficult year. But if you layer on top of that, retail price inflation for essential items like food and gas is now running at extraordinarily high levels. And again, those items represent a disproportionate share of household budgets for those shoppers. So, it's not difficult to see why the customer is under significant economic stress. At the end of the quarter, merchandise inventories had increased by 64.0%, while in-store inventories increased by 2.0% on a comp store basis. Reserve inventory, which the company holds back in anticipation that it will not be able to be sold, was 50.0% of the total inventory. Burlington opened 26 net new stores during the quarter, bringing its store count to 866. |

| Looking Forward |

For fiscal 2022, Burlington Stores expects a comp sales decline of 6.0%–9.0% year over year and its adjusted EBIT margin to be down by 130-200 bps. It expects its adjusted EPS to be in the range of $6.00–$7.00, representing a decline of 16.7%–28.6% year over year. For the second quarter of fiscal 2022 (2Q22), the company expects a comp sales decline of 13.0%–15.0% year over year and its adjusted EBIT margin to be down 610-670 bps. It expects its adjusted EPS in the range of $0.20–$0.30, representing a decline of 84.0%–90.7% year over year. The company remains cautious about second-quarter planning, as it is concerned about the economic environment, primarily the impact of inflation on retail spending. Lower-income customers are under significant financial stress, and it is not clear that this will change in the next few months, the company stated. Burlington plans to open 120 new stores during 2022 while relocating or closing 30 stores, adding 90 net new stores to its fleet. |

| Ross Stores (NasdaqGS: ROST) 1Q22 |  |

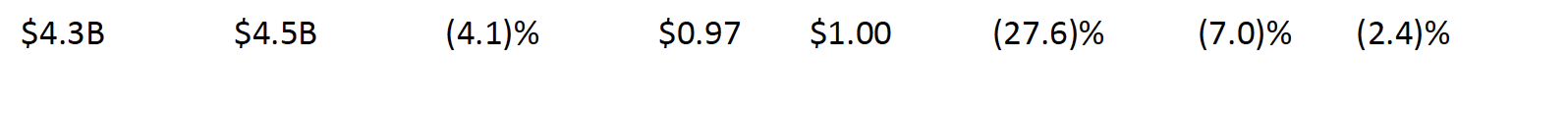

| Details |

Ross Stores’ total sales declined by 4.1% year over year, versus 18.1% growth in the prior quarter. The company’s comparable store sales declined by 7.0% year over year, and its EPS decreased by 27.6% year over year. According to the company, the results came in below expectations due to high inflationary pressures and very strong comparatives from last year’s government stimulus quarter. Management also reported that it saw customers pull back on spending at both its Ross and dd’s DISCOUNTS stores. The company’s operating margin was down 340 bps year over year to 10.8% due to same-store sales decline and cost pressures from higher freight and wages. Men’s clothing was its best-performing category this quarter, while Florida was the top-performing region in terms of sales. Michael Hartshorn, Group President, COO told analysts: Obviously, with higher fuel and food prices, discretionary spending for the lower-end customer is being squeezed. We saw customers at both chains [Ross and dd’s DISCOUNTS] pull back on spending in the first quarter. …Food and fuel prices with inflation there means they have less to spend on discretionary items. At the quarter’s end, Ross’s inventories were up 57.0% year over year, mainly due to higher packaway inventory (which includes apparel), which represented 43.0% of total inventories versus 34.0% in the first quarter of 2021 (1Q21), when the company used a substantial amount of packaway inventory to meet robust consumer demand. The company opened 22 new Ross stores and eight dd’s DISCOUNT stores during the quarter. |

| Looking Forward |

Ross Stores updated its guidance with a more conservative outlook for the rest of the year, given its first-quarter results and the uncertain macro-economic and geopolitical environment. For fiscal 2022, the company revised down its comp sales and EPS guidance. It now expects its comp sales to decline by 2.0%–4.0% year over year, compared to its prior guidance of flat to 3.0% growth. Meanwhile, it expects its EPS in the range of $4.34–$4.58, compared to its prior guidance of $4.71–$5.12, representing a decline of 5.6%–10.9% year over year. For 2Q22, Ross forecasts total sales to decline by 1.0%–4.0% year over year and comp sales to decline by 4.0%–6.0%. It expects its operating margin to be 10.4%–10.8%, down from 2021 due to deleveraging on lower comp sales and ongoing expense headwinds that are expected to continue through the first half of fiscal 2022. Ross expects its EPS in the range of $0.90–$1.10, representing a decline of 23.0%–28.8% year over year. Ross plans to return to its regular store opening plan of 100 new store openings in 2022, comprising 75 Ross and 25 dd’s DISCOUNTS locations. It plans to open 29 stores in the second quarter, including 21 Ross and eight dd’s DISCOUNTS stores. |

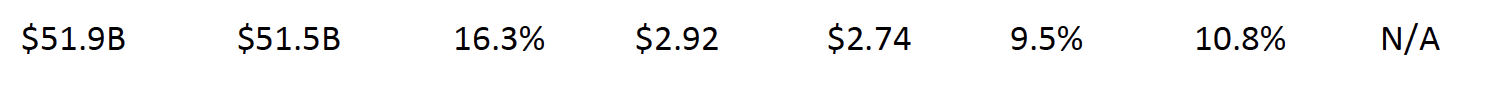

| The TJX Companies (NYSE: TJX) 1Q23 |  |

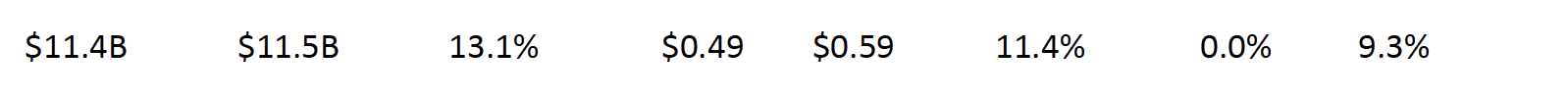

| Details |

TJX Companies’ total sales increased by 13.1% year over year, versus 28.6% growth in the prior quarter. The company’s EPS increased by 11.4% year over year, while its overall open-only comp sales were flat year over year. The operating margin was up 30 bps year over year to 7.5%, driven by a reduction in Covid-19 related expenses and the annualization of temporary store closures internationally last year. By banner, Marmaxx (US Marshalls and US T.J. Maxx) comps increased by 3.0% year over year, driven by Marmaxx’s overall apparel business, which was up 6.0%. HomeGoods comps declined by 7.0% versus a 40.0% open-only comp increase in the 1Q22. TJX Canada’s sales increased by 41.0% year over year, and TJX International sales increased by 163.0% due to stores being open during the quarter, compared to 1Q22 when many stores closed due to Covid-19 restrictions. Total inventories were up 37.0% year over year, and TJX management stated that the overall availability of branded merchandise remains strong. During the quarter, the company increased its store count by 26 for a total of 4,715 stores. |

| Looking Forward |

For 2Q23, it expects US comp store sales to be down 1.0%–3.0% versus a 21.0% US open-only comp store sales increase in 2Q22. The company expects second-quarter sales in the range of $12.0–12.2 billion, representing growth of flat to 1.2% year over year. It expects EPS of $0.65–$0.69, representing growth of 1.2%–7.8% year over year. For fiscal 2023, TJX revised down its sales and US comp guidance and now expects US comp store sales to be up 1.0%–2.0% year over year, compared to the prior guidance of 3.0%–4.0% growth. The company expects total sales in the range of $51.3–51.8 billion, compared to the previous guidance of $52.6–53.1 billion, representing growth of 5.8%–6.8% year over year. TJX management stated that store visits have become very appealing to many customers, which will positively affect the company’s sales growth. The lower sales guidance is primarily a result of a change in foreign exchange rates, which reduced its full-year sales forecast by around $700 million. The company expects adjusted EPS of $3.10–$3.20, representing growth of 10.0%–12.0% year over year. |

Beauty Brands and Retailers

The beauty category saw a robust sales growth, with all the covered beauty brands and retailers posting positive year-over-year sales growth. By category, bath, fragrance, haircare and skincare continued to perform strongly, while consumer demand bounced back in the makeup category as consumers resumed their beauty routines with more in-person activities.

|

|

| Bath & Body Works (NYSE: BBWI) 1Q22 |  |

| Details | Bath & Body Works (formerly L Brands) reported a sales increase of 2.0%—excluding the estimated the first quarter 2021 (1Q21) sales benefit of $50 million related to government stimulus payments—while its prior quarter sales growth was 11.4%. The company’s adjusted EPS increased by 7.0% year over year, and its operating income declined by 16.9%.

The company launched a women’s fragrance brand, Butterfly, which saw strong demand in the first quarter, becoming the largest spring season cross-category launch across body and home.

CFO Wendy Arlin stated:

We ended the first quarter with FOCUS availability in over 700 stores. We plan to fully roll out BOPIS availability during the course of the year with the goal to be in approximately 75.0% of our store fleet by fall. We are excited about the role of BOPIS as it drives customer engagement and traffic to our stores. The company continued to experience increased raw material costs, transportation and wage rates during the quarter and expects incremental inflation pressure for full-year 2022, which could range from $225–250 million—about $75 million higher than its initial estimates. |

| Looking Forward | For the second quarter of fiscal 2022, Bath & Body Works expects its sales to be up, in the low single-digit range year over year. It expects EPS to be $0.60–$0.70, representing a decline of 9.1%–22.7% year over year. For full-year 2022, the company raised its sales guidance and now expects it to be up low-single-digit year over year, compared to prior guidance of flat to 4.0% growth. However, the company revised down its EPS guidance and now expects it to be $3.80–$4.20, compared to prior guidance of $4.30–$4.70, representing a 6.9%–15.7% decline year over year. |

| Coty (NYSE: COTY) 3Q22 |  |

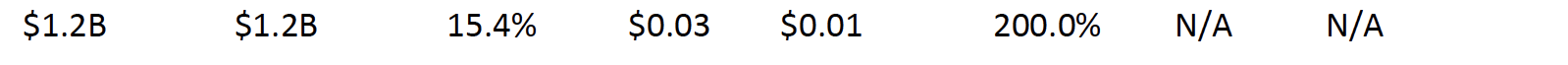

| Details |

Coty reported a 15.4% year-over-year sales increase versus 12.0% growth in the prior quarter, while comparable-store sales increased by 13.0% year over year. Adjusted EPS increased by 200.0% year over year. Adjusted gross margin increased by 240 bps year over year to 64.6%, driven by a favorable product and category mix and pricing. By segment, prestige reported 21.0% year-over-year sales growth, driven by strength across all regions, including continued recovery in most EMEA markets, travel retail and the US. Prestige fragrance sales continued to grow at a double-digit pace in the third quarter, with nearly all brands—particularly Burberry, Chloe, Gucci and Hugo Boss—showing strong sales results. Prestige cosmetics sales nearly doubled during the quarter, driven by strong performances of Gucci Makeup, Kylie Cosmetics and Burberry Makeup. The consumer beauty segment saw 8.0% year-over-year sales growth, with strong performance across color cosmetics, mass fragrances and body care. By geography, the company saw sales growth across all regions and travel retail. The Americas’ sales grew 17.0% year over year, driven by strong growth in the prestige and consumer beauty segments. EMEA sales increased by 16.0% year over year, driven by a double-digit sales increase in the prestige and consumer beauty segments after Covid-19-related restrictions from the prior year were relaxed. APAC sales increased by 9.0% year over year, surpassing pre-Covid-19 levels, fueled by substantial expansion in regional travel retail. The company also released a new virtual try-on tool for its Sally Hansen nail polish line, allowing customers to easily experiment with a wide shade variety before purchasing, without making a mess. This creates an entirely new shopping experience, whether buying online or in-person, that makes testing nail polish accessible, hygienic and easy. |

| Looking Forward |

For fiscal 2022, Coty reiterated its comparable sales guidance, expecting growth at the upper end of the previously guided range of low-to-mid-teens percentage growth year over year. Based on current foreign exchange rates, Coty expects a 4.0%–5.0% headwind to its reported sales in the fourth quarter of 2022. Coty raised fiscal 2022 adjusted EPS guidance and now expects it between $0.23 and $0.27, up from the previously guided range of $0.22–$0.26. The company continues to expect adjusted EBITDA of $900 million for fiscal 2022 as it navigates the inflationary environment while intentionally reinvesting gross margin gains and cost savings in its brands to maximize value. |

| Estée Lauder (NYSE: EL) 3Q22 |  |

| Details |

Estée Lauder reported a 10.0% year-over-year increase in sales versus 14.2% growth in the prior quarter. Meanwhile, organic sales increased by 9.0% year over year and adjusted EPS increased by 17.0% year over year. The company’s operating income increased by 15.0% year over year, and its operating margin expanded by 110 bps to 21.6%, reflecting higher net sales and a favorable impact from a stronger US dollar. By geography, organic net sales in the Americas increased by 11.0% year over year, with all markets and product categories contributing to growth. In Europe, the Middle East and Africa (EMEA), organic net sales increased by 18.0% as growth was realized across most markets, channels and brands. Organic net sales declined by 4.0% in the Asia-Pacific region due to Covid-19 lockdowns in Mainland China. By category, fragrance’s organic net sales grew 31.0% year over year, with sales growth in every region and across all brands. Hair care’s organic net sales increased by 17.0%, reflecting increases from both Aveda and Bumble and bumble as brick-and-mortar salons and retail stores recover. Makeup’s organic net sales increased by 12.0%, reflecting continued progression toward recovery in western markets and increased usage occasions. Skincare organic net sales increased by only 3.0% year over year due to sales decline in the Asia-Pacific region, which was affected by transitory logistics constraints in China. The CEO, Fabrizio Freda, said: Estée Lauder brand entered the metaverse as connecting with our consumer wherever they are is paramount, and we are excited to be testing and learning in this new ecosystem. Estée Lauder was the exclusive beauty brand partner of Decentraland Metaverse Fashion Week, the first ever large virtual fashion week in an unchanged metaverse. |

| Looking Forward |

Due to Covid-19 restrictions in Mainland China and the impact of the Russia-Ukraine war, Estée Lauder revised its fiscal 2022 revenue growth guidance and now expects high-single-digit growth year over year, compared to its prior guidance of double-digit growth. The company expects adjusted EPS growth to be 8.0%–10.0% on a constant currency basis. According to the company, eliminating sales in Russia and Ukraine has reduced expected fourth-quarter sales growth by 120 bps. |

| L'Oréal S.A (ENXTPA: OR) 1Q22 |  |

| Details |

L’Oréal reported a 19.0% year-over-year increase in revenues versus 15.4% growth in the prior quarter. Comp sales increased by 13.5% year over year. All divisions grew at a double-digit pace year over year: the professional products division recorded 22.7% year-over-year sales growth; consumer products sales increased by 11.1%; L’Oréal Luxe’s sales were up 25.1%; and active cosmetics sales grew by 22.4%. By channel, there was a clear revival in offline sales, which showed a comp sales growth of 15.0%. Meanwhile, e-commerce sales grew by 8.0% and represented 25.8% of quarterly sales. Travel retail sales increased by 19.0%, boosted by a sharp sales rebound in Europe and continued double-digit sales growth in Asia. By geography, Latin America achieved the fastest sales growth at 33.9% year over year, North America’s sales increased by 21.5% and Europe’s sales increased by 15.8% year over year. North Asia reported 18.0% year-over-year sales growth, led by double-digit sales growth in Mainland China. Sales in the South Asia Pacific, the Middle East, North Africa and Sub-Saharan Africa region were up 18.7%, with strong performances in India and the Gulf countries. At 40.0%, L’Oréal’s fragrance business doubled global fragrance growth (20.0%), as the company is benefitting from the beauty products premiumization trend. Cosmetics are rebounding in Europe and the US—where mass and luxe provide the strongest benefits. |

| Looking Forward |

The company did not provide the financial guidance for fiscal 2022; however, it remains optimistic about the beauty market’s outlook in the coming months. |

| Ulta Beauty (NasdaqGS: ULTA) 1Q22 |  |

| Details |

Ulta Beauty’s total revenues increased by 21.0% year over year versus 24.1% in the prior quarter, while its comp sales increased by 18.0% year over year and its EPS increased by 53.7% year over year. The sales growth was driven by the favorable impact of fewer Covid-19 restrictions compared to 1Q21. The company’s gross margin increased by 120 bps year over year to 40.1%, driven by leveraging fixed costs and favorable channel mix shifts, but partially offset by lower merchandise margin. By category, bath and fragrance, haircare, makeup and skincare all delivered double-digit comp growth year over year. Sales of makeup exceeded pre-pandemic levels in both mass and prestige cosmetics. Compared to 1Q21, prestige cosmetics outperformed mass cosmetics, driven by new and expanding brands and the strong 21 Days of Beauty event. According to the company, store traffic trends were strong in the quarter as guests capitalized on their preference for in-store shopping, with store capacity returning to normal levels. In April 2022, as guests started returning to stores, the company relaunched makeup services in all stores, just in time to support special events such as proms, graduations and weddings. The company also expanded and enhanced its digital experiences by launching two virtual try-on tools, each powered by technology developed by companies Ulta Beauty invested in via its digital innovation fund. First, it launched GLAMlab Skin Advisor 2.0, powered by global artificial intelligence startup pot.ai., a skin analysis technology that provides guests with a more accurate skin diagnosis. Secondly, it launched GLAMlab Hairstyle Try-On powered by Restyle, a beauty tech startup that uses artificial intelligence and machine learning to enable virtual try-on of more than 50 different hairstyles. The company continued to enhance and expand its partnership with Target, opening 26 Ulta Beauty locations in Target shops, ending the quarter with 127 locations. The company opened 10 and relocated six standalone stores during the quarter. |

| Looking Forward |

For fiscal 2022, Ulta Beauty raised its sales, comp sales, operating margin and EPS guidance. It now expects sales of $9.4–9.6 billion, compared to its prior guidance of $9.1–9.2 billion, representing growth of 9.3%– 11.6% year over year. It expects year-over-year comp sales growth of 6.0%–8.0%, compared to its previous guidance of 3.0%–4.0%, and an operating margin of 14.1%–14.4%, compared to its prior guidance of 13.7%–14.0%. The company expects EPS of $19.20–$20.10, compared to the previous guidance of $18.20–$18.70, representing 6.8%-11.8% year-over-year growth. This updated outlook reflects year-to-date trends while considering uncertainties that could impact the second half of the year, including inflation and the impact of increased points of distribution for prestige beauty. Ulta Beauty expects a stronger first half and weaker second half, when comps growth is projected to be at a low-single-digit rate. In fiscal 2022, Ulta Beauty plans to open 50 new stores and remodel or relocate 35. |

CPG

Most CPG companies witnessed a strong recovery, with all the covered companies, except Herbalife Nutrition, posting positive sales growth year over year.

|

|

| Clorox Company (NYSE: CLX) 3Q22 |  |

| Details |

The Clorox Company reported a net sales increase of 2.0% year over year versus a sales decline of 8.0% in the previous quarter. Net sales growth reflects higher shipments across all reportable segments. Adjusted EPS declined by 19.0% year over year due to lower gross margin, partially offset by lower advertising spending and higher net sales. Gross margin decreased by 760 bps to 35.9% due to higher manufacturing and logistics costs and commodity costs. The company’s CEO, Linda Rendle, said, “We saw continued strong demand for our products this quarter and delivered sequential gross margin improvement against the backdrop of a volatile and challenging environment. While cost inflation continues to increase and uncertainty remains, we’re seeing the strength and resiliency of our brands driving benefits across the business.” By segment, health and wellness’s net sales decreased by 3.0%, with three percentage points of benefit from pricing offset by three percentage points of unfavorable mix and another three percentage points of higher trade spending. Household net sales increased by 6.0%, driven primarily by four percentage points from pricing benefits and a two-percentage-point increase in volume. Lifestyle net sales increased by 4.0%, driven by six percentage points of volume growth, which was partially offset by two percentage points of unfavorable price mix. International sales increased by 1.0%, driven by four percentage points of price mix and two percentage points of higher volume. |

| Looking Forward |

For fiscal 2022, Clorox reiterated its sales guidance and revised its EPS guidance. It expects 1.0%–4.0% year-over-year sales decline due to the rising cost inflation and it now expects adjusted EPS in the range of $4.10–$4.30, compared to prior guidance of $4.30–$4.50, representing 41.0%–44.0% year over year decline. The company expects its gross margin to decline by 800 bps, primarily due to higherthan-anticipated commodity, manufacturing and logistics costs. |

| Colgate-Palmolive Company (NYSE: CL) 1Q22 |  |

| Details |

In the fourth quarter, Colgate-Palmolive reported organic sales growth of 4.0% year over year, versus 3.0% growth in the previous quarter, driven by higher pricing in nearly every region. Diluted EPS declined by 18.0% year over year. The company’s gross profit margin was down 220 bps year over year to 58.5% due to significant increases in raw material and logistics costs worldwide. By geography, North America’s organic sales were flat year over year as declines in-home care’s organic sales partially offset oral care and personal care organic sales. Specifically, Latin America’s organic sales increased by 6.5%, with Mexico, Argentina, Colombia and Brazil leading growth. Europe’s organic net sales declined by 3.0%, as organic sales declined in the Filorga duty-free business, France and Spain, despite being partially offset by organic sales growth in Germany. The Asia-Pacific region’s organic net sales grew 1.0%, where organic sales growth in Australia, the Philippines and Indonesia was partially offset by organic sales declines in China and Thailand. CEO Noel Wallace said: Our entire cost factor has risen over the past few months, but the biggest impact has come in the area that we call fats and oils. That's palm oil, palm kernel oil, soybean oil, tallow and others. These ingredients are used in every category we compete in, and we expect a more than 60% increase across fats and oils this year. |

| Looking Forward | Colgate-Palmolive raised its organic sales guidance for fiscal 2022 and now expects it in the 4.0%–6.0% range year over year, compared to prior guidance of 3.0%–5.0%. It expects net sales growth to be at the higher end of 1.0%–4.0%, including a low-single-digit negative impact from foreign exchange. The company expects a year-over-year decline in adjusted gross profit margin and mid-single-digit EPS decline. |

| Herbalife Nutrition Ltd. (NYSE: HLF) 4Q21 |  |

| Details |

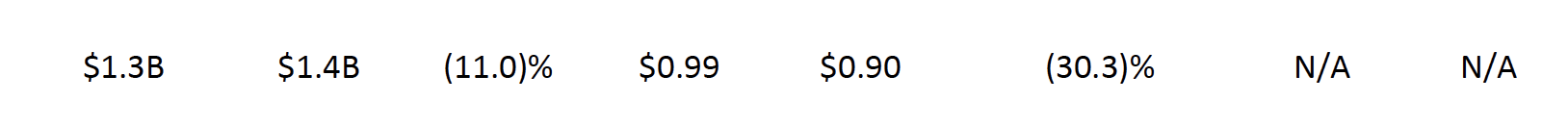

Herbalife’s total sales decreased by 11.0% year over year, compared to a 6.6% decline in the previous quarter. The sales decline was due to the inflationary environment, widespread geopolitical uncertainty driven by the Russia-Ukraine war and the current Covid-19 crisis in the Asia-Pacific region and South and Central America. Adjusted EPS declined by 30.3% year over year. The gross margin was down 201 bps year over year to 77.0% due to increased supply chain costs and lower production volume at the company’s facilities. By geography, North America’s sales decreased by 9.5% year over year, EMEA’s sales decreased by 16.7% year over year, and South and Central America’s sales decreased by 13.6% year over year. Meanwhile, however, Asia Pacific’s sales increased by 1.1% year over year, led by continued strength in India. The company is taking meaningful steps to improve margins through pricing actions and cost controls. The company implemented price increases in most markets in the first quarter and will take incremental pricing actions during the second quarter in response to the dramatic increase in input and freight costs. |

| Looking Forward |

For the second quarter of 2022, Herbalife expects sales growth to decline by 11.5%–17.5% year over year, including an approximately 270 bps currency headwind versus the prior year. It expects adjusted EPS to be in the range of $0.60–$0.80, representing a decline of 47.4%–60.5% year over year. For fiscal 2022, the company revised its net sales and EPS guidance and now expects sales to be in the range of (4.0)%–(10.0)% year over year, compared to prior guidance of flat-to-6.0% growth. However, the company expects net sales will be flat in the second half of 2022 and will return to year-over-year net sales growth in the fourth quarter. Herbalife expects adjusted EPS in the range of $3.50–$4.00, compared to prior guidance of $4.30–$4.80, representing a decline of 16.5%–26.9% year over year. For fiscal 2022, the company expects to spend $175.0–225.0 million in capital expenditure. |

| Kimberly-Clark Corporation (NYSE: KMB) 1Q22 |  |

| Details |