DIpil Das

Introduction

What’s the Story? Coresight Research’s US Department Store Insights quarterly series covers the recent performance of Kohl’s, Macy’s and Nordstrom, highlighting trends in comparable sales, revenue, digital sales, product categories and areas of note by management. Kohl’s, Macy’s and Nordstrom are the leading US department stores. We compare the three major department stores’ performance in the first quarter of fiscal 2022 (1Q22), ended April 30, 2022 on a year-over-year basis to 1Q21 as well as comparing to 1Q20 to build a picture of recent trends and growth or to 1Q19 to assess performance against pre-pandemic levels. As 66.7% of Americans are fully vaccinated as of June 10, 2022, according to the Centers for Disease Control and Prevention, consumers are shopping at department stores to resume pre-pandemic activities.We compare the three major department stores’ performance in the first quarter of fiscal 2022 (1Q22), ended April 30, 2022 on a year-over-year basis to 1Q21 as well as comparing to 1Q20 to build a picture of recent trends and growth or to 1Q19 to assess performance against pre-pandemic levels.

Why It Matters As the department store sector has become smaller, the dominant players including Kohl’s, Macy’s and Nordstrom are becoming more competitive in terms of total revenue, categories and customers they serve. Digital sales have become increasingly important for department stores, which have traditionally been more focused on physical store channels than other sectors, especially prior to Covid-19. Now, department stores are heavily investing in digital, and each is approaching digital integration differently. It will be instrumental to learn from all retailers, as increasing digital sales while maintaining physical sales is an industry-wide goal. Each department store has different growth strategies; tracking and monitoring these innovations is informative for the sector.1Q22 US Department Store Insights: Coresight Research Analysis

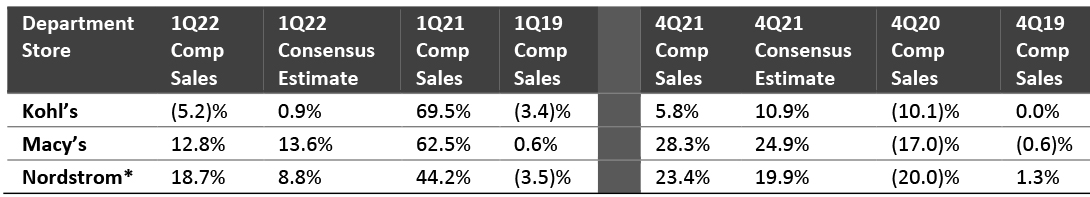

Comparable Sales: Growth at Macy’s and Nordstrom Comparable sales at Macy’s and Nordstrom were strong in the first quarter, with management reporting that consumers were shopping in stores for occasion apparel and apparel refreshes. Nordstrom’s store traffic was up 18.7%, beating the consensus estimate of 8.8%, but lower than 44.2% in the year-ago period. For 1Q22, Nordstrom reported the highest comp sales of the three retailers, as shown in Figure 1.Figure 1. Comparable Sales at Kohl’s, Macy’s and Nordstrom [caption id="attachment_150311" align="aligncenter" width="700"]

*Nordstrom reports only changes in net sales, which are represented in the table as approximate to comparable sales

*Nordstrom reports only changes in net sales, which are represented in the table as approximate to comparable sales Source: Company reports/S&P Capital IQ [/caption] Store Traffic Trends

- Kohl’s reported that its sales started strong in the quarter. It saw positive low-single-digit comps through late March, but sales weakened in April. The retailer attributes low comps in the quarter overall to an inflationary consumer environment and 1Q21 being buoyed by stimulus payments.

- Macy’s reported that it saw a notable shift in consumer shopping behavior between channels, with better-than-expected sales in stores and a shift toward occasion-based apparel. Management attributed the increase in in-store foot traffic to this category shift, as consumers are more likely to shop in person for occasion-based apparel. The total company average unit retail (AUR) was up 8.0% for the quarter.

- Nordstrom reported that consumers returned to its stores to shop for occasions/social events, travel, return-to-office clothing and wardrobe refreshes. Customer traffic and activity returned to its city centers; Nordstrom’s urban store sales collectively rebounded and reached pre-pandemic levels.

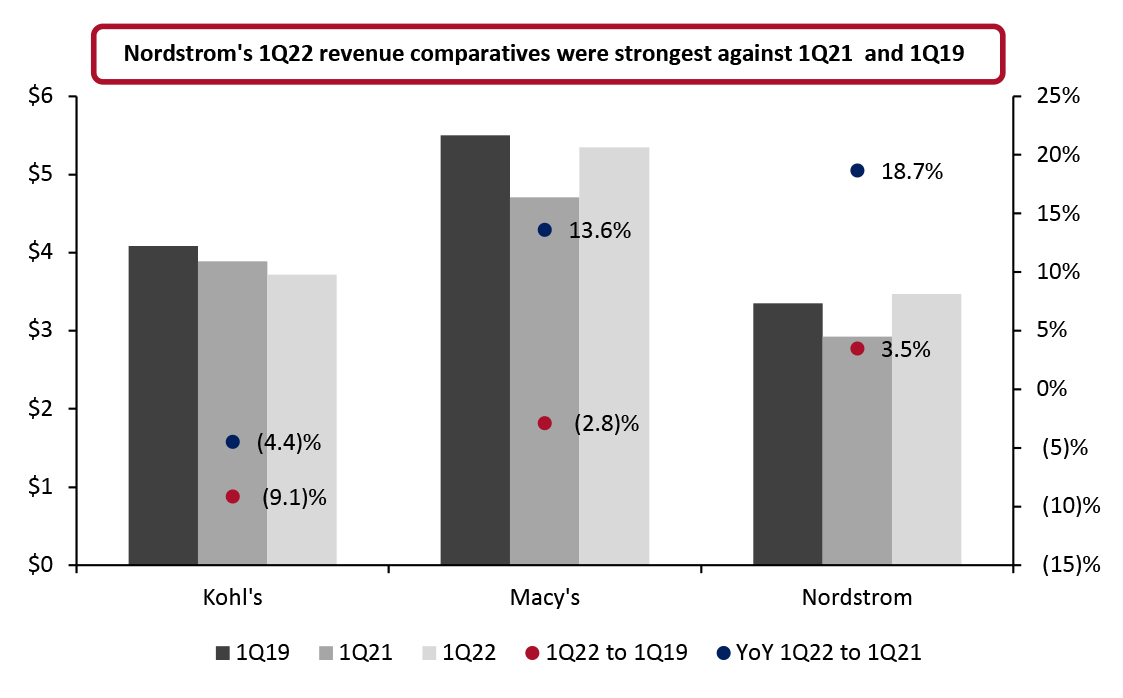

- Nordstrom showed the most resilience of the three department stores in the first quarter. Revenues were up 3.5% compared to 1Q19 and up 18.7% year over year.

- Macy’s revenues were 13.8% above 1Q21 but 2.9% below 1Q19.

- Kohl’s experienced the deepest revenue declines of the three department stores, with sales down 9.1% compared to 1Q19 and down 4.1% year over year.

Figure 2. First-Quarter Revenue Comparatives (USD Bil.; Left Axis) and Revenue Growth (%; Right Axis) [caption id="attachment_150301" align="aligncenter" width="700"]

Source: Company reports[/caption]

Digital Sales: Penetration Decline in 1Q22

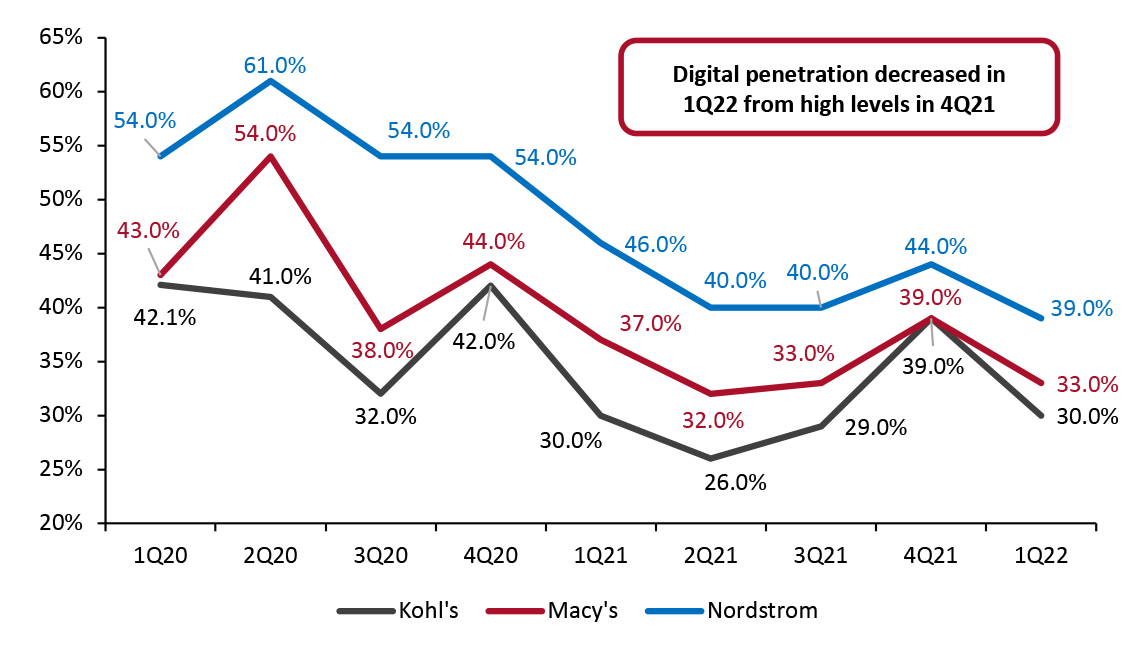

E-commerce penetration levels slowed across all three department stores in 1Q22. Total digital penetration across the three retailers decreased to 33.8% from 40.1% in 4Q21.

While Nordstrom experienced the softest dip in e-commerce penetration, its digital penetration is the lowest the retailer has seen in over two years—since 4Q19, when penetration was 35%.

Source: Company reports[/caption]

Digital Sales: Penetration Decline in 1Q22

E-commerce penetration levels slowed across all three department stores in 1Q22. Total digital penetration across the three retailers decreased to 33.8% from 40.1% in 4Q21.

While Nordstrom experienced the softest dip in e-commerce penetration, its digital penetration is the lowest the retailer has seen in over two years—since 4Q19, when penetration was 35%.

- At Kohl’s, digital sales comprised 30% of total sales, totaling $1.1 billion—down from 39% in 4Q21, which totaled $2.5 billion.

- Macy’s had 33% e-commerce sales in 1Q22, totaling $1.8 billion. This decreased from 39% in 4Q21, representing $3.4 billion.

- Nordstrom reported 39% of e-commerce sales totaling $1.4 billion in sales, down from 44% in 4Q21.

Figure 3. Digital Sales Penetration (Online Sales as a % of Total Revenue) [caption id="attachment_150302" align="aligncenter" width="700"]

Source: Company reports[/caption]

Inflation Impacts from 1Q22: Customer Habits, Costs and Prices

Kohl’s reported that its customer has been affected by inflation, with its average spend per customer going down during the quarter. Management said that its units per transaction have come under more pressure as consumers are being more mindful about what they are buying.

The company has built an price elasticity model and is offering consumers more value on highly elastic categories (such as children’s and private labels) and is increasing prices in other categories, such as dress apparel and dresses. The national brands set their pricing. Kohl’s said that it has agility to change prices quickly in response to consumers.

The company highlighted increased freight expense and heightened wage costs as major cost drivers.

Macy’s reported that all income tiers continue to shop at its banners, led by the high-income and middle-income consumer; management said that its luxury sales were a standout during the quarter as shopping behavior among high-income consumers has so far remained less affected by inflation.

The company is using predictive analytics to increase prices in selective categories; for example, management said it has been able to increase prices on some of its larger-ticket items and premium products, while it has not been able to increase prices on categories including soft home (textiles) and casual active, which are trending down.

Source: Company reports[/caption]

Inflation Impacts from 1Q22: Customer Habits, Costs and Prices

Kohl’s reported that its customer has been affected by inflation, with its average spend per customer going down during the quarter. Management said that its units per transaction have come under more pressure as consumers are being more mindful about what they are buying.

The company has built an price elasticity model and is offering consumers more value on highly elastic categories (such as children’s and private labels) and is increasing prices in other categories, such as dress apparel and dresses. The national brands set their pricing. Kohl’s said that it has agility to change prices quickly in response to consumers.

The company highlighted increased freight expense and heightened wage costs as major cost drivers.

Macy’s reported that all income tiers continue to shop at its banners, led by the high-income and middle-income consumer; management said that its luxury sales were a standout during the quarter as shopping behavior among high-income consumers has so far remained less affected by inflation.

The company is using predictive analytics to increase prices in selective categories; for example, management said it has been able to increase prices on some of its larger-ticket items and premium products, while it has not been able to increase prices on categories including soft home (textiles) and casual active, which are trending down.

Macy’s anticipates two major costs impacting its gross margin: higher fuel costs within its supply chain network (for package delivery) and markdowns needed to correct inventory levels within overstock categories.

Nordstrom reported that inflationary cost pressures have not adversely impacted customer spending, which it attributes to the higher-income profile of its customer base. In the first quarter, the number of customers and average spend per customer both increased versus the prior year. Through its strategic pricing initiatives using data analytics, Nordstrom reported that it increased AUR without seeing a negative impact on transaction volumes—and, specifically, at Nordstrom Rack, it raised prices on items with the lowest elasticities. Nordstrom highlighted three major cost drivers putting pressure on the gross margin: clearing through inventory markdowns, labor and inbound freight costs. Product Categories: Dress Apparel Trends Up; Pandemic Categories Weaken In 1Q22, the department stores noted that categories that were impacted by the pandemic (including dressier apparel) are continuing to trend upward, and categories that were strong during the pandemic (such as home and active) are weakening.Figure 4. Category Highlights

| Department Store | 1Q22 Category Highlights |

| Kohl’s | The men’s business increased by 3% during the quarter compared to last year, driven by the introduction of new brands over the past six months, including Tommy Hilfiger, Calvin Klein and Hurley. The company also saw significant growth in its tailored business. The women’s business saw strength in areas including outerwear, denim, inclusive sizing and dresses. Areas of weakness included underperformance in spring seasonal categories such as swim, tanks, shorts and tees, which were down by double digits but showed a strong positive trend in May due to warmer weather. There was growth in men’s and women’s active apparel, offset by softness in active footwear and children’s apparel. Home sales declined by 17% in the quarter. Management expects category demand to remain weak. Outdoor apparel continued to drive outsized sales growth. |

| Macy’s | Management reported that it saw an accelerated category shift, away from popular pandemic categories, such as casual and activewear as well as soft home, and into more occasion-based apparel, such as dresses, women’s shoes, men’s clothing and furnishings. The top categories for the quarter were fragrances, dresses, men’s clothing, women’s shoes and furnishings. |

| Nordstrom | Management reported double-digit growth in its core categories, with strength in men’s and women’s apparel driven by suiting and dresses. Men’s was its strongest category. The company said that the apparel demand included occasion wear and robust demand for wardrobe refreshes, especially for the spring and summer seasons. The store saw growth in shoes across formal, casual and athletic styles. Nordstrom saw continued strong growth in designers across all categories. |

Source: Company reports[/caption]

Macy’s and Nordstrom: Using Advanced Analytics Across the Business

Both Macy’s and Nordstrom reported that they are using advanced analytics to improve decision-making across their businesses and so improve margins.

Macy’s reported that its ability to maintain its gross margin depends on its understanding of customer demand within and across categories. The retailer is applying predictive analytics and data science in three ways to improve its understanding of the customer:

Source: Company reports[/caption]

Macy’s and Nordstrom: Using Advanced Analytics Across the Business

Both Macy’s and Nordstrom reported that they are using advanced analytics to improve decision-making across their businesses and so improve margins.

Macy’s reported that its ability to maintain its gross margin depends on its understanding of customer demand within and across categories. The retailer is applying predictive analytics and data science in three ways to improve its understanding of the customer:

- Macy’s is shifting its promotional profile to be more personalized.

- It is predicting demand to improve the accuracy of its upfront buys for allocating inventory within and across markets, which will help to drive better sell-throughs and higher inventory productivity.

- The retailer is using dynamic pricing to change the timing, cadence and size of markdowns based on factors such as inventory availability, sell-throughs and demand patterns.

Source: Company reports[/caption]

Source: Company reports[/caption]