Introduction

Our quarterly

US Retail Inventory Tracker reviews inventories held by US retailers in the

Coresight 100, our global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past nine quarters.

The inventory turnover ratio indicates how efficiently a retailer manages inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported results for the first quarter of fiscal 2021 (1Q21), ended April 30, 2021.

In February 2021, US retail sales saw strong growth of 7.2% year over year. In March, US retail sales growth accelerated to 19.4%. April 2021 maintained very strong sales growth momentum, with sales growing by 24.2% compared to 2019. The strong momentum continued in May 2021, with

US retail sales growing by 19.6% compared to pre-pandemic 2019 values.

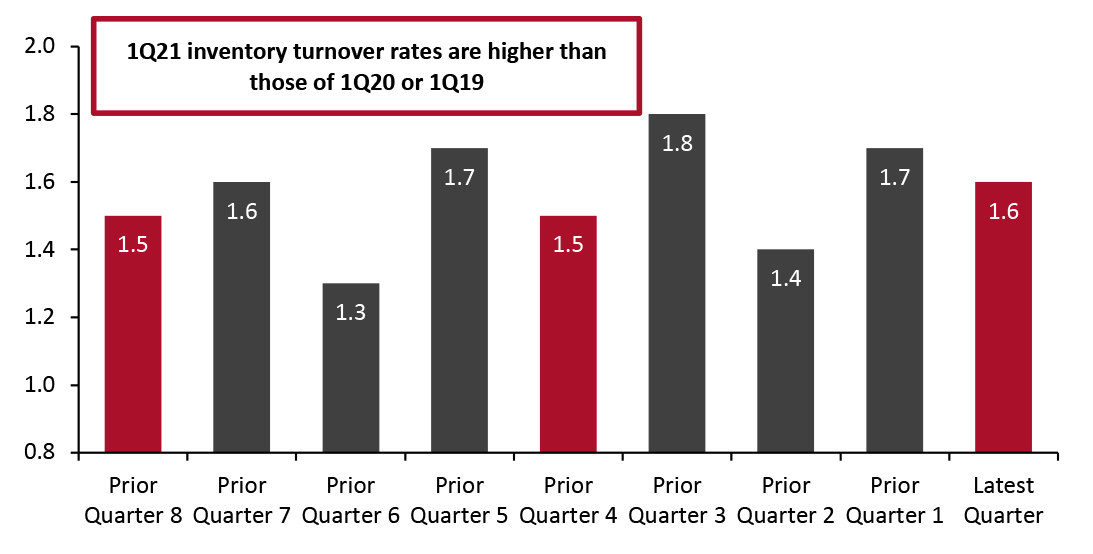

Overview: Inventory Turnover Rates Increase Year over Year and on a Two-Year Basis

Most retailers covered here saw their inventory turnover rates increase compared to the same quarter in the previous year (1Q20) as well as on a two-year basis (pre-pandemic 1Q19).

Figure 1. Inventory Turnover Ratios by Quarter: All Retailers

[caption id="attachment_128976" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

The latest quarter continued to see a strong rebound in inventory turnover, led mainly by soaring digital sales.

Apparel specialty retailers: Apparel specialists saw their inventory turnover ratios increase by 24% year over year but remain flat on a two-year basis. While athleisure, casualwear and intimates remained strong catalysts for these retailers, they are also witnessing a rebound in demand for dresswear as consumers are emerging from the crisis and looking to express their style in clothing and footwear.

Off-price retailers: Off-pricers maintained their growth momentum from the previous quarter, with inventory turnover ratios increasing by 77% year over year or by 14% on a two-year basis.

Beauty retailer: The single covered beauty retailer, Ulta Beauty, saw its inventory turnover ratio increase by 35% year over year, but growth remained flat on a two-year basis. The retailer saw increased demand for fragrance, haircare and skincare products, partially offset by weak demand in the overall makeup category.

Department stores: Department stores’ inventory turnover ratios increased by 22% year over year but declined 11% on a two-year basis. These retailers are witnessing strong trends in various apparel and footwear categories, such as activewear, denim, dresses and shorts, and see these categories as a key part of their strategy going forward.

Discount stores: Discount retailers reported an 8% year-over-year increase in inventory turnover ratios. On a two-year basis, these retailers saw inventory turnover ratios grow by 22%.

Drugstores: Drugstore retailers’ inventory turnover ratios increased by 9% year over year or by 4% on a two-year basis.

Electronics retailer: The one covered electronics retailer, Best Buy, saw a 6% year-over-year decline in its inventory turnover ratio. However, compared to 1Q19, Best Buy’s inventory turnover ratio grew by 23%. The company saw demand spike in computing, large appliances, gaming and televisions.

Food and grocery retailers: Food and grocery retailers’ inventory turnover ratios declined by 9% both year over year and on a two-year basis.

Home-improvement retailers: Although

consumers are increasingly returning to public places and social activities, the latest quarter saw household goods continue to perform extremely well: Home-improvement retailers witnessed 13% growth in inventory turnover ratios, both year over year and on a two-year basis.

Luxury retailers: The luxury category is seeing a substantial recovery, with luxury retailers reporting an inventory turnover ratio of 15% year over year and 20% on a two-year basis. We expect luxury retailers to maintain this momentum in the next quarter with the further easing of pandemic-related restrictions around the world.

Mass merchandisers: Mass merchandisers reported flat year-over-year growth in their inventory turnover ratios but an increase of 2.5% on a two-year basis.

Warehouse clubs: Warehouse clubs saw a 5% year-over-year decline in inventory turnover ratios. However, compared to 1Q19, these retailers saw inventory turnover ratios grow by 12%.

Figure 2. Inventory Turnover Ratios by Quarter

[wpdatatable id=1046 table_view=regular]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic)

*Excludes Wayfair, an outlier

Source: Company reports/Coresight Research

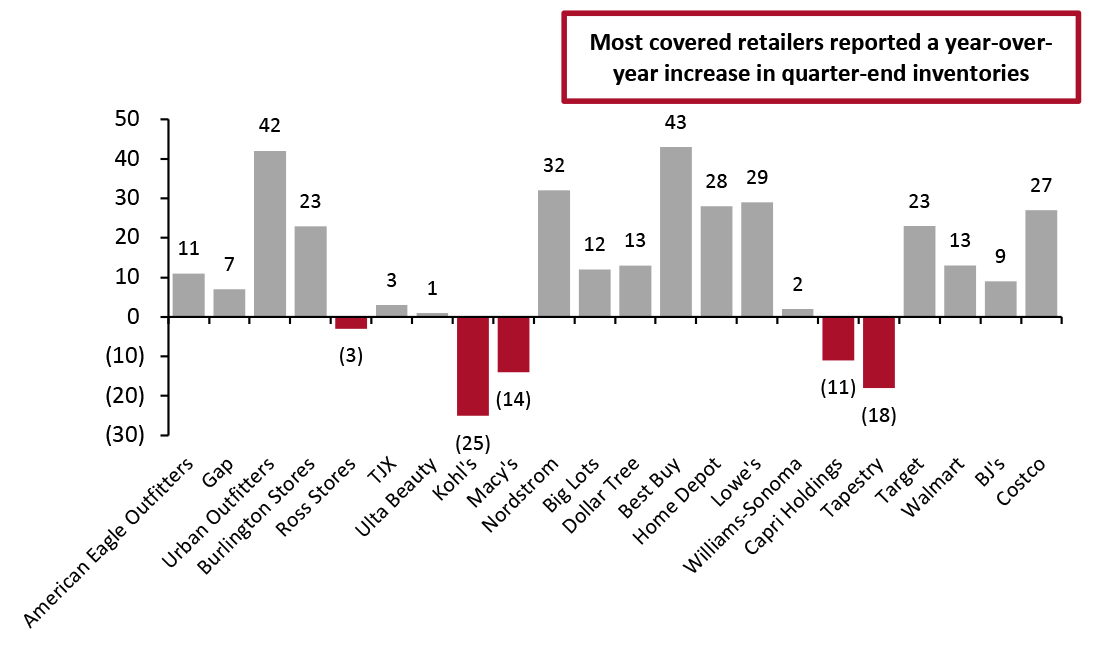

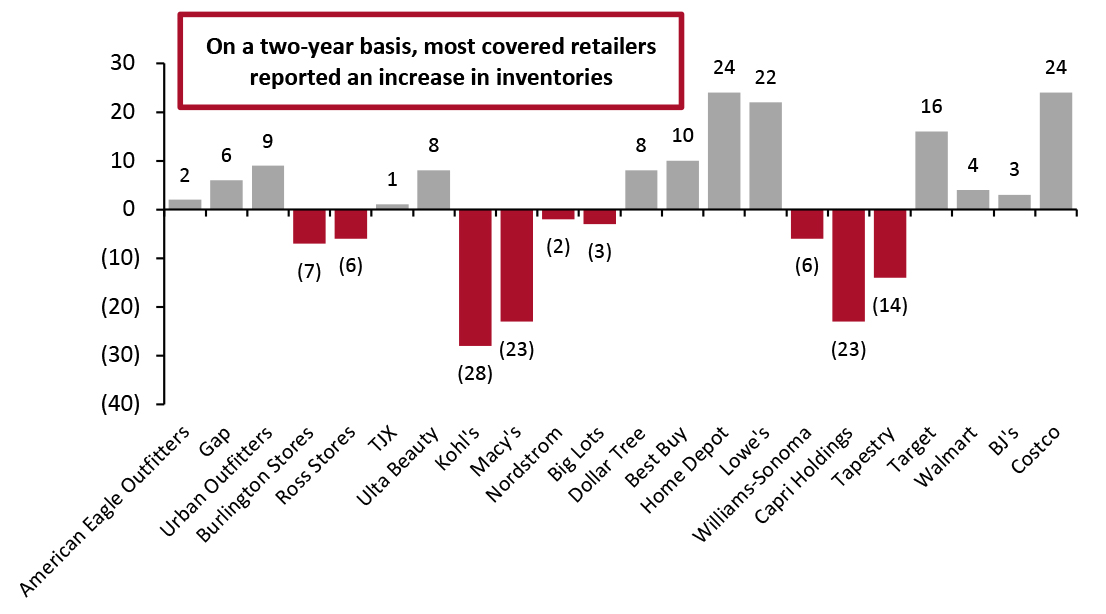

Sector and Company Overview

We look at the inventory levels of selected retailers across sectors and assess why inventory levels changed from the year-ago period and on a two-year basis.

Figure 3. Latest-Quarter Inventory Values of Covered US Retailers: YoY % Change

[caption id="attachment_128977" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Figure 4. Latest-Quarter Inventory Values of Covered US Retailers: % Change from Two Years Prior

[caption id="attachment_128978" align="aligncenter" width="725"]

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes, or simply making misjudgments about the selection and design of products.

All covered apparel specialists witnessed an increase in quarter-end inventories, both year over year and on a two-year basis.

|

Commentary |

| American Eagle Outfitters |

The company ended 1Q21 with inventory up 11% year over year or up 2% on a two-year basis. American Eagle (AE) inventory was down 15% versus 1Q19 as the company cut receipts due to its inventory-optimization initiatives, which focus on choice and SKU (stock-keeping unit) count reductions. Aerie’s inventory was up 50% versus 2019 as the company continued to invest in inventory to support growth momentum.

The company noted that its inventory is well positioned and below prevailing demand levels across brands. Management said that inventory-optimization initiatives are resulting in lower promotions and substantial growth in its merchandise margin. |

| Gap

|

At quarter-end, the company’s inventory was up 7% year over year or up 6% on a two-year basis. Management said that the pandemic-related US port congestion and impacts on shipping lanes have contributed to higher in-transit inventory levels. However, the company noted that markdown rates remain below 2020 and 2019 levels.

For the next quarter, Gap expects year-over-year inventory growth to be in the range of high-single-digits to mid-teens in percentage terms, reflecting the volatility related to pandemic-related supply chain disruptions impacting in-transit inventory levels. |

| Urban Outfitters

|

The company’s inventory was up 42% year over year or up 9% on a two-year basis.

Management said that the company is chasing inventory aggressively—ordering inventory several weeks earlier than it usually does due to significant challenges in its supply chain, which is increasing inventory in transit.

For the next quarter, the company expects high-single-digit or low-double-digit year-over-year inventory growth. |

Off-Price Retailers

All covered off-price retailers reported higher inventory turnover ratios than in the year-ago period. Most of these retailers used reserve or packaway inventory to chase high demand during the quarter.

| |

Commentary |

| Burlington Stores |

The company’s total inventory was up 23% year over year at the end of the quarter. However, on a two-year basis (compared to 1Q19), total inventory was down 7%.

On a comparable store basis, the company’s in-store inventory turnover increased by 59% compared to 1Q19. Reserve inventory, which includes stock that is being stored for later release (either later in the season or in a subsequent season), comprised 35% of total inventory versus 34% in the 2019 period.

Burlington Stores noted that it used reserve inventory to chase high demand during the quarter. For 2Q21, the company expects an increase in incoming receipts to replenish its reserves to planned levels. |

| Ross Stores

|

The company’s total inventories were down 3% year over year or down 6% on a two-year basis. Average store inventories declined by 1% relative to 2019.

Packaway inventory levels were 34% of total inventory versus 2019’s 44%, as the company used packaway inventory to replenish store inventory through the quarter. |

| The TJX Companies

|

The company ended the quarter with inventory up 3% year over year or up 1% on a two-year basis. Management said that the flexibility of the company’s procurement strategy, store format and distribution network allow it to take advantage of consumer trends and growing categories as consumer demand changes. |

Beauty Retailer

| |

Commentary |

| Ulta Beauty |

The company’s total inventory increased by 1% year over year or by 8% on a two-year basis, reflecting the impact of opening new stores as well as a fast-fulfillment center, partially offset by lower inventory levels owing to higher-than-expected sales.

For 2021, Ulta Beauty expects inventory levels to be higher than in 2020 but lower than the company’s comparable sales. |

Department Stores

Most covered department stores witnessed a year-over-year decline in inventory levels at the end of the quarter. These retailers plan to rebuild inventory for the back-to-school (BTS) and holiday shopping seasons.

| |

Commentary |

| Kohl’s

|

The company’s inventory level was down 25% year over year and down 28% on a two-year basis, reporting a 10-year high in inventory turnover for the second consecutive quarter due to tighter inventory management.

Management said that the company is well positioned for the BTS season, building inventory ahead of peak weeks. Kohl’s expects a more normal BTS season this year compared to pandemic-impacted 2020.

The company stated that it is navigating many supply chain challenges; its initiatives include adding more drivers and carriers, increasing store delivery frequency, moving containers on shorter transit times and prioritizing purchase orders. |

| Macy’s

|

The company ended the quarter with inventory down 14% year over year or down 23% on a two-year basis.

Management reported that the company has very good sales-to-stock parity, and the inventory turnover rate has improved 8% in the trailing 12-month period ended May 1, 2021, versus the same period in 2019.

Management said that the company will build inventory for the holiday season but will continue to manage its overall inventory conservatively for the second half of fiscal 2021, which will be helpful in managing markdowns and driving higher sell-throughs. |

| Nordstrom

|

The company’s inventory increased by 32% year over year but declined by 2% on a two-year basis. The company noted that sales growth at Nordstrom Rack outpaced inventory growth for the first time since the onset of the pandemic.

Heading into the second quarter, Nordstrom noted that it is progressing faster than expected in terms of inventory clearance. Management said that, across both Nordstrom and Nordstrom Rack, the company’s inventory is well positioned in key categories as it prepares for its Anniversary Sale, which will begin on July 28, 2021. |

Discount Stores

Overall, the discount store sector reported higher inventory turnover ratios than in the year-ago period. These retailers continued to attract a broad base of budget-conscious shoppers amid economic uncertainty.

| |

Commentary |

| Big Lots

|

The company’s total inventory was up 12% year over year but declined 3% on a two-year basis. Total inventory included significant growth in in-transit inventory as the company chased sales and worked to get stock back during the quarter.

In 2021, the company expects inventory to increase significantly versus 2020. CFO Jonathan Ramsden said, “Versus last year, we expect ending Q2 inventory to be up around 30%, equating to up around 5% versus 2019, which will reflect strong turn improvement. We expect similar two-year inventory increases in Q3 and Q4. To mitigate some supply chain pressures, we will accelerate some receipts into Q2 ahead of the peak inventory build period in Q3.” |

| Dollar Tree |

The company’s total inventory increased by 13.0% year over year or by 8.0% on a two-year basis.

At Dollar Tree, inventory increased by 13.5% year over year, while inventory per selling square foot grew by 9.0%. At Family Dollar, inventory increased by 11.9% year over year, while inventory per selling square foot grew by 9.8%. |

Electronics Retailer

| |

Commentary |

| Best Buy |

The company ended the quarter with inventory up 43% year over year and up 10% compared to the corresponding period in 2019. The increased inventory represents Best Buy’s plans to support current consumer demand for technology, along with the company’s tactics to counterbalance the actions it took in late 2020 to reduce inventory receipts based on its earlier lowered sales outlook.

Management said that the company experienced inventory constraints in a number of categories, such as computing, large appliances, gaming and televisions, which moderated sales growth during the quarter. The company expects some level of inventory constraints in key categories to continue throughout the rest of the year. |

Home and Home-Improvement Retailers

Most of the covered home and home-improvement retailers reported strong improvement in their inventory turnover ratios compared to the year-ago period.

| |

Commentary |

| Home Depot |

The company’s inventories increased by 28% year over year or by 24% on a two-year basis as it stocked up on products to meet elevated customer demand. Inventory turns were 5.5X, up from 5.0X in 1Q20. |

| Lowe’s

|

The company’s inventory was up 29% year over year and up 22% on a two-year basis. Management said that improved in-stocks allowed the company to capitalize on continued strong demand for various home-improvement products, particularly copper and lumber. |

| Williams-Sonoma |

The company’s inventories were up 2% year over year but down 6% on a two-year basis. Management said that the company’s inventory levels continue to be impacted by stronger-than-expected customer demand across all brands, along with supply chain disruptions, including the West Coast port congestion, Suez Canal blockage and the container shortage out of Asia. The company noted that these challenges will cause backorder levels to remain elevated until at least 3Q21. |

Luxury Retailers

All covered luxury retailers reported year-over-year declines in inventories, which they attributed to their actions to better align stocks with expected demand. However, these luxury retailers are rebuilding inventories to support expected strong sales growth over the remainder of the year.

| |

Commentary |

| Capri Holdings |

The company’s inventory declined by 11% year over year or by 23% on a two-year basis, reflecting the aggressive inventory-reduction program Capri Holdings implemented at the beginning of the pandemic. Management said that the company is building inventory to support expected strong sales growth over the year. |

| Tapestry |

Tapestry’s inventory decreased by 18% year over year or by 14% on a two-year basis, which the company attributed to its actions to lower SKU count and prioritize inventory turns.

Tapestry noted that the ongoing supply chain disruption due to West Coast port congestion and other constraints are increasing lead times, which in turn have delayed inventory receipts and likely limit the company’s ability to chase higher levels of customer demand going forward. |

Mass Merchandisers

While Walmart reported a higher inventory turnover ratio compared to the year-ago period, Target posted a slight decline. Both retailers reported an increase in inventory year over year as well as on a two-year basis. For the rest of 2021, these retailers are planning for full shelves and better in-store stocks to fulfill customer demand quickly.

| |

Commentary |

| Target

|

The company ended the quarter with inventory up 23% year over year or up 16% on a two-year basis.

By the end of 2022, Target plans to open four new regional distribution centers, with the first two centers slated to open in the second half of 2021. Management said that once these distribution centers are operational, they will substantially shorten lead times to nearby stores, enhancing in-stock levels while lowering the need for safety inventory in those stores.

Target expects a more normal BTS season this year compared to last year. The company noted that it is well positioned in terms of inventory to capitalize on opportunity during the BTS season. |

| Walmart

|

Total inventory increased by 13% year over year or by 4% on a two-year basis, reflecting higher purchases to support strong sales growth and the continued recovery of in-stock levels from the second half of 2020.

Management said that the company continued to face supply chain challenges including port congestion, and is taking steps to mitigate them, including using air freight.

Walmart is focusing on building automated systems that optimize inventory in real time—from how the retailer gets inventory from its suppliers to keep products in stock to fulfilling customer demand in the fastest and most economical way possible. |

Warehouse Clubs

Our covered retailers reported a slight decline in inventory turnover ratios compared to the year-ago period; however, on a two-year basis, they reported double-digit growth. These retailers continue to accumulate inventory aggressively to support the business going forward.

| |

Commentary |

| BJ’s Wholesale Club |

The company ended the quarter with inventory up 9% year over year or up 3% on a two-year basis.

The company noted that its gross margin was impacted by markdowns it took on its apparel inventory and substantial inflation in some commodities, including eggs. Management said that the availability of general merchandise inventory could potentially impact its margins for the remainder of 2021. |

| Costco

|

Total inventory increased by 27% year over year or by 24% on a two-year basis. Management said that the company had front-loaded some core and non-seasonal inventory items to mitigate some of the replenishment challenges due to port congestion and delays. |

Looking Forward

In 1Q21, most retailers reported an increase in their inventory turnover ratios, both year over year and compared to the corresponding quarter in 2019, pre-pandemic.

In May, we saw a significant improvement in-store traffic trends owing to the positive impact of stimulus check distribution and the continued rollout of Covid-19 vaccines, as several states lifted pandemic-related restrictions amid the decline in new cases. As more states eased their restrictions in June owing to a further decline in cases, we expect the month to have seen an improvement in traffic trends.

In the next quarter, despite strong comparatives, we expect to see continued growth momentum in inventory turnover ratios for most covered retailers, driven by an improvement in sales and in-store traffic trends. The e-commerce channel continues to help retailers reduce their in-store inventory. Some retailers, such as American Eagle Outfitters, Gap, Kohl’s, Macy’s and Walmart, are therefore looking to strengthen their digital models. This involves the expansion of ship-from-store capabilities and the implementation of automated fulfillment technology at stores and distribution centers. These measures will likely help retailers to adjust inventory levels in stores quickly and help distribution centers to meet changing consumer demand.

While a few retailers, such as Macy’s, continue to manage their inventory conservatively to reduce markdowns and drive higher sell-through, some retailers, such as BJ’s Wholesale Club, Costco and Urban Outfitters, are making a number of aggressive inventory purchases to plug holes in their in-stock position and support business going forward.

We expect a more normal BTS season this year as compared to last year, which was substantially impacted by the pandemic. Some retailers, such as Kohl’s and Target, noted that they are well-positioned for the BTS season with inventory building well ahead of peak weeks.

Given the fluctuations in consumer demand and with shoppers continuing to engage with retailers across a wider variety of channels, having real-time knowledge of where all inventory sits has become vital for most retailers. An efficient and flexible inventory management system could reroute in-store stock that has low demand in some areas to locations where demand is high.

The crisis-related US port congestion and impacts on shipping lanes continue to contribute to higher in-transit inventory levels. To reduce the risk of supply chain disruptions, retailers could strategically use air freight, diversify sourcing options, and work with a variety of suppliers and manufacturers. Some retailers, such as Kohl’s, seek to navigate the supply chain challenges by adding more carriers, moving containers on shorter transit times, increasing store delivery frequency and prioritizing purchase orders.