albert Chan

Introduction

Our quarterly US Retail Inventory Tracker reports review inventories held by US retailers in the Coresight 100, a global focus list of retailers, brands and non-retail companies. In this report, we assess inventory turnover ratio trends over the past eight quarters.

The inventory turnover ratio indicates how efficiently a retailer manages their inventory, showing how many times inventory turns over in a particular period, calculated as the cost of goods sold (i.e., the amount of goods sold at wholesale prices) divided by inventory held at the end of the period. A relatively high inventory turnover tends to be positive for a retailer, while low or slowing inventory turnover may indicate lower sales and challenges in inventory management.

As retailers have different fiscal year-ends, the quarters under review in this report may not be identical. Most companies in our coverage reported 1Q20 results, which ended April 30 and included impacts of the coronavirus.

The first quarter was a tough period for discretionary retailers; from February onwards, retailers began to see sales negatively impacted by the coronavirus outbreak. US retailers have witnessed supply chain disruptions, including order shifts and delays. With nonessential retail shut down for part of March and the full month of April due to the coronavirus, pandemic we saw sharp differences between the inventory turnover rates of discretionary retailers, such as apparel, and non-discretionary retailers such as food, drug and mass merchants. The arrival of Covid-19 in the US triggered consumers to stockpile food and cleaning products, thus boosting sales for food, drug and mass retailers; the closure of food-service businesses compounded the demand for groceries in retail. However, sales of most nongrocery categories was very badly impacted—slowing inventory turnover for many retailers.

With lockdowns having eased and stores beginning to reopen from May, most sectors are witnessing the easing of sales declines. Some retailers, such as American Eagle Outfitters, have noted that they are continually clearing their spring and summer inventories and expect to enter the back-to-school (BTS) season clean. Others are likely to implement substantial markdowns to clear inventory, leading to a period of heightened promotions, especially in the apparel and department-store sectors.

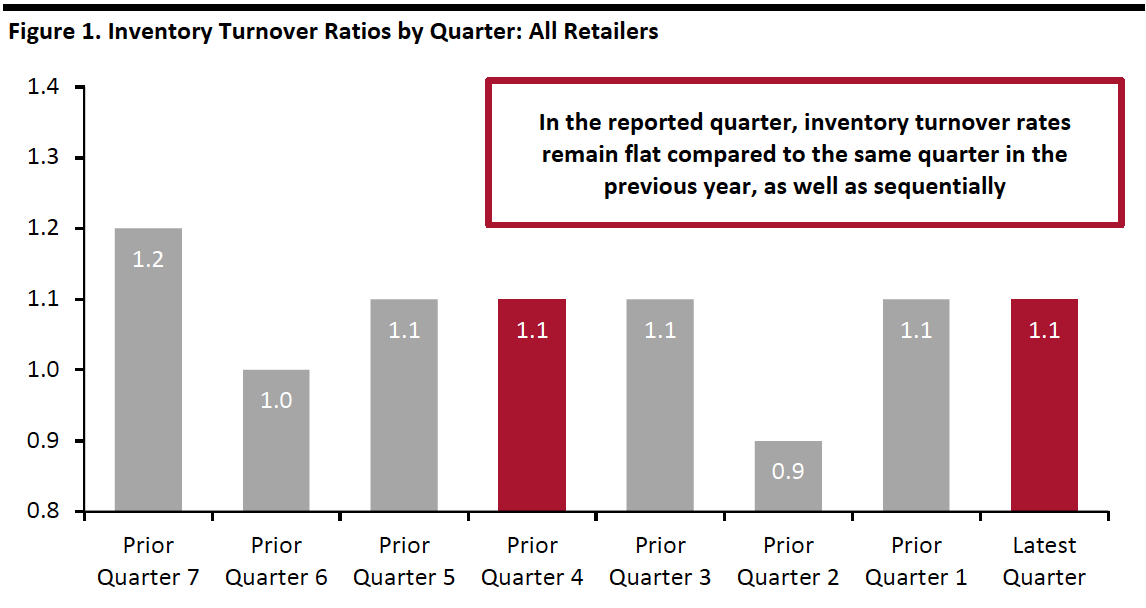

Overview: Inventory Turnover Rates Remain Flat Year over Year

Most retailers covered here saw their inventory turnover rates remain flat compared to the same quarter in the previous year, as well as sequentially (quarter over quarter). The same quarter last year saw many retailers accumulate inventory to offset the impact of potential tariffs and support their expansion plans.

[caption id="attachment_112313" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

How Various Retail Sectors Turned Over Inventories

1Q20 remained a mixed quarter from the point of inventory turnovers. With a long period of nonessential store closures, discretionary retailers such as apparel specialty retailers, department stores and our one covered beauty retailer (Ulta Beauty) faced the heat, with inventory turnover ratios declining 10–30% year over year. Essential retailers such as food, drug and mass retailers, on the other hand, saw a surge in sales that was supported by panic buying and stockpiling of food and household essentials—resulting in a 9% year-over-year increase in inventory turnover ratios. Home-improvement stores were deemed to be essential retailers, explaining the positive 12.5% year-over-year growth in their inventory turnover ratios.

In the first quarter, some retailers reduced their merchandise receipts substantially, while some recognized inventory reserve to account for a rise in inventory obsolescence or spoilage due to store closures; this reserve uses the money taken out of earnings for paying cash or non-cash future costs associated with inventory (in accounting terms, an inventory reserve is a contra asset account that writes down the value of the inventory in the balance sheet).

Our covered electronics retailer (Best Buy) saw a year-over-year improvement in its inventory turnover ratio as the company saw demand spike in certain categories (such as freezers, monitors and networking equipment) and also lowered its merchandise receipts—resulting in a double-digit decline in the ending inventory balance. Luxury retailers saw their inventory turnover ratios remain unchanged from the same quarter last year, mainly due to the recognition of incremental inventory obsolescence/write-down reserves in light of the current environment, which lowered the overall value of the inventory at quarter-end.

On a sequential (quarter-over-quarter) basis, apparel specialty retail, home-goods retail, luxury retail and beauty retail witnessed a decline, while food, drug and mass retailers and electronics saw a year-over-year increase in their inventory turnover ratios. Department stores saw their inventory turnover ratios remain unchanged as they reduced receipts by 30–80% and took inventory write-down charges, which lowered the overall value of the inventory.

Figure 2. Inventory Turnover Ratios by Quarter [wpdatatable id=290]Inventory turnover = Cost of sales for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic) *Excludes Wayfair, an outlier Source: Company reports/Coresight Research

Sector and Company Overview

We look at the inventory levels of various retailers and assess why inventory levels changed from the year-ago period.

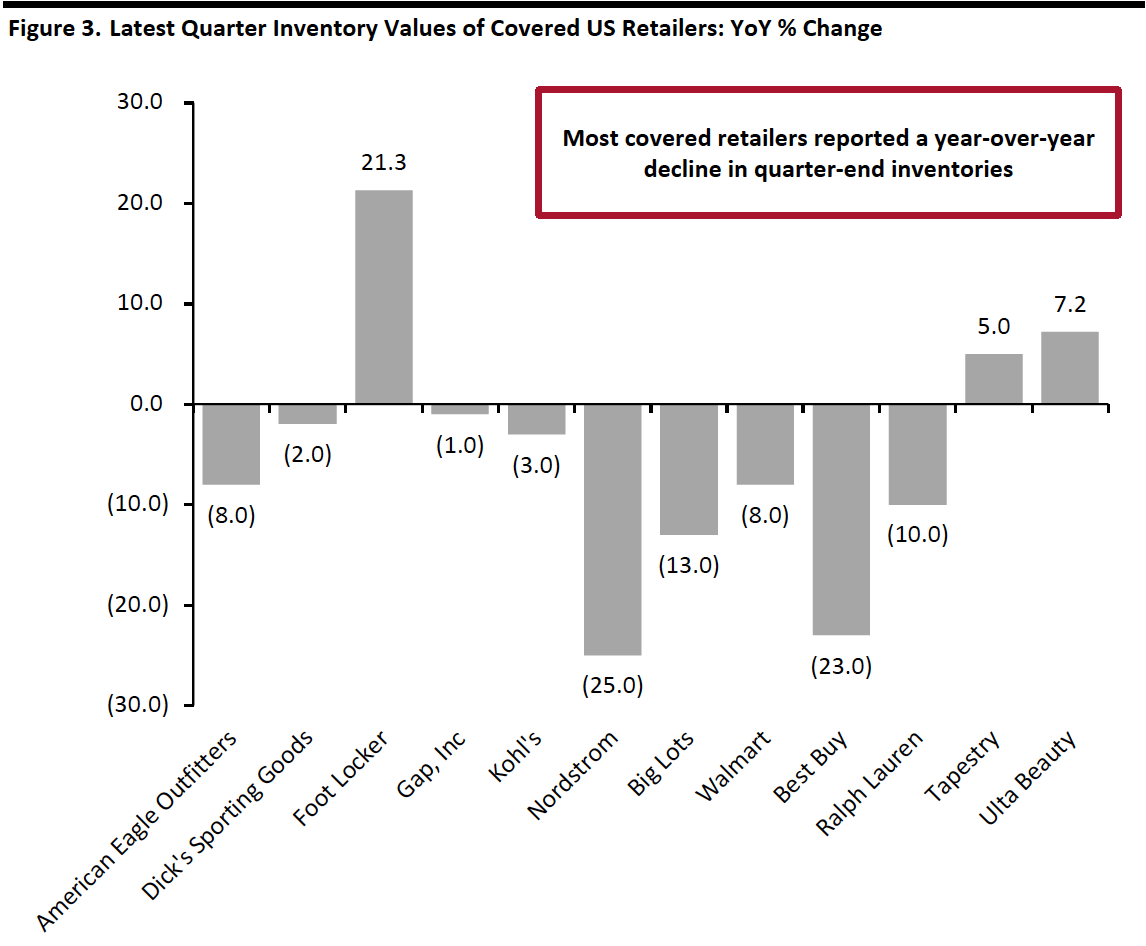

[caption id="attachment_112314" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Apparel Specialty Retailers

Inventory is a particular issue for apparel retailers: These companies are vulnerable to excess stock as a result of the weather (which is unpredictable), changing consumer tastes or simply making misjudgements about the selection and design of products.

Most apparel specialty retailers saw subdued consumer demand in the most recent quarter, which translated into poor sales and lower inventory turnover ratios, both compared to the year-ago period and sequentially.

American Eagle Outfitters

- The company ended the first quarter with inventory down 8% year over year, mainly driven by reductions in American Eagle (AE) stocks.

- Management noted that, on average, its 556 reopened stores (as of June 3, 2020) have achieved 95% of last year’s sales productivity. The higher-than-anticipated sales productivity is allowing the company to be less promotional than expected to move through store inventory. The company is continuing to clear through AE’s spring and summer inventories and expects to enter the BTS season in July clean across both AE and Aerie brands.

Burlington Stores

- In the first quarter, the company created a $272 million inventory markdowns reserve to account for a rise in inventory obsolescence due to store closures and in anticipation of a very promotional environment in the coming months. Its pack-and-hold inventory was 22% of total inventory as compared to 28% in the same quarter last year.

- CEO Michael B. O' Sullivan said, “We believe that the inventory charge that we have booked will pay for the markdowns that we expect to take in the second quarter to drive these inventory turns.” Sullivan expects the next few months to be extremely promotional as retailers attempt to rebuild traffic to their stores and to turn their inventory.

Dick’s Sporting Goods

- The company’s quarter-end inventory levels were down 2% year over year. Management said that the company is also buying off-price inventory for some categories from some of the brands.

Foot Locker

- The company ended the first quarter with inventory up 21.3% year over year on a constant-currency basis, versus a 42.9% decline in sales.

Ross Stores

- At quarter-end, net noncash inventory-valuation expenses (relating to the portion of the inventory that the company expects to sell below original cost) was down 3% year over year. The company’s packaway levels (opportunistic purchases created by manufacturer overruns and canceled orders both during and at the end of a season) stood at 42% of the total inventory, compared to last year’s 44%. The company’s average in-store inventories were up 1% year over year.

- Management noted that the vast majority of markdown activity will occur in the second quarter to sell through existing spring inventory.

Gap, Inc

- Inventory was down 1% year over year at quarter end. The company took a $235 million inventory-impairment charge.

- Management said that, depending on demand, pack-and-hold inventory will remain in the company’s reported inventory numbers until the same time next year.

The TJX Companies

- The company had an inventory write-down charge of about $500 million. Management reported that TJX has a lot less inventory in stores, and the company is in the process of shipping inventory from distribution centers to stores.

Urban Outfitters

- The company’s retail-segment inventory was down 18% and its wholesale segment was down 16% at quarter-end. The company filled over 2 million digital shipments from its stores during the quarter. The retailer is seeing average sales productivity of 50% for reopened stores versus last year. Urban Outfitters recorded a $43 million inventory obsolescence reserve.

- CFO Francis J. Conforti said, “We worked really hard to maintain pick, pack and ship in the quarter in order to try and get as much inventory out of stores as we could, which increased split shipments, but we think will prove to be a benefit to inventory and removing some of the markdowns necessary going forward as we do open up stores.”

Department Stores

All department stores that reported first-quarter results witnessed a year-over-year decline in inventory levels at the end of the quarter.

JCPenney

- The company has not yet reported first-quarter earnings results. At the end of the last fiscal year, inventory was $2.17 billion, representing a decrease of $271 million or 11.1% year over year. The company’s in-store inventory has reduced by almost 23% since 2017.

Kohl's

- The company’s inventory was down 3% year over year. By pulling back orders in March and April, the company reduced its first-quarter receipts by more than 30%. Kohl's expects to further reduce inventory in the second quarter as it has lowered its receipts by over 60% so far in the quarter.

Macy’s

- The company’s comparable inventory was down 7.2% year over year at the end of the first quarter. The company took a $300 million inventory write-down charge, mainly on fashion merchandise.

- On June 9, the company reported that it is seeing average sales productivity of 50% for reopened stores as compared to last year. The company expects second-quarter inventory to be down significantly and is looking to attain sales-to-stock parity.

Nordstrom

- The company ended the first quarter with inventory down 25%, with a 15% reduction in units. In mid-March, the company realigned its inventory, reducing receipts by about 80% in April and May.

- CFO Anne L. Bramman said, “Our favorable inventory position enables us to bring in newness beginning in June for full-price merchandise. We're also able to leverage our off-price business to clear excess full-price merchandise while being opportunistic in the marketplace for fall closeouts.”

Food, Drug and Mass Retailers

Most food, drug retailers and mass merchants exited the quarter with inventory in good shape.

Big Lots

- The company ended the quarter with inventory down 13%, driven by strong sales in most merchandise categories.

Dollar General

- At the end of the quarter, the company’s merchandise inventory was $4.1 billion, flat year over year and representing a 5.5% decline on a per-store basis.

Target

- CFO Michael J. Fiddelke said, “Regarding our inventory position, while the year-over-year decline looks good on the cashflow statement, it reflects the lack of availability and elevated out-of-stocks we are seeing in multiple categories [such as food and beverages, home and electronics]. As such, we have elected to invest more cash and ended the quarter with a higher level of inventory in those categories if it had been available.”

Walmart

- The company’s inventory level declined 8% year over year, but it has higher levels of inventory in discretionary areas (such as apparel) and lower-than-desired levels in essentials, such as food and general merchandise.

Home and Home-Improvement Retailers

Most of the home and home-improvement retailers reported an improvement in their inventory turnover ratio compared to the year-ago period. Recently, we presented an outlook for US home and home-improvement retail for the remainder of 2020.

The Home Depot

- At quarter-end, the company’s inventory turns were 5x, up from 4.7x in the same quarter last year.

Lowe’s

- The company ended the quarter with inventory at $14.3 billion, slightly lower than the prior-year levels.

Electronics Retailers

Best Buy

- At quarter-end, inventory was down 23% as the company lowered merchandise receipts to match consumer demand. The company witnessed a demand spike in certain categories, such as freezer, monitors and network equipment.

Luxury Retailers

Most luxury retailers highlighted the need to make more-informed decisions about inventory. Ralph Lauren has set aside inventory reserves to align inventories with demand, while Tapestry aims to end the next fiscal year with inventories down year over year.

Ralph Lauren

- The company’s inventory was down 10% year over year, mainly due to a significant increase in inventory reserves of about $160 million to keep its inventories aligned with consumer demand and continue its brand elevation as the company moves forward.

Tapestry

- The company ended 3Q20 with inventory up 5%, mainly due to incremental inventory obsolescence reserves taken. For the fourth quarter, the company expects inventories to be up in the same mid-single-digit range. As it moves through its fiscal year 2021, management said that Tapestry will continue to have a strong focus on the inventory management and expects to end fiscal year 2021 with inventories down year over year.

Beauty Retailers

Ulta Beauty

- The company’s total inventory grew 7.2% year over year in the quarter, driven by the opening of 68 new stores. Ulta Beauty’s inventory per store rose 1.5%, mainly due to store closures for most of the quarter.

Looking Forward

In the first quarter of 2020, most retailers experienced negative impacts of the coronavirus outbreak in their inventory levels. In mid-March, we saw many retailers realigning inventory, before reducing receipts in April and May. To attain sales-to-stock parity, retailers are looking to significantly reduce their inventory levels by the end of second quarter.

As stores are reopening, we are seeing a significant return to in-store shopping, as reflected in the higher-than-anticipated sales productivity of reopened stores (especially for apparel and department stores) as compared to last year’s levels.

Some retailers, such as Burlington Stores and Ralph Lauren, have invested substantially in inventory reserves to keep their inventories aligned with consumer demand and protect against a future need to make additional markdowns. On the other hand, mass merchandisers such as Walmart and Target are investing to offset out-of-stocks in multiple categories, such as food and general merchandise.