Introduction

Our first-quarter 2020 (1Q20) wrap-up covers the quarterly earnings of 64 (mostly) US-based retailers, brands, e-commerce platforms and REITs in the Coresight 100.

- Over half (51% or 33 companies) beat revenue consensus estimates, 41% (26 companies) missed revenue consensus estimates, and 8% (five companies) reported revenues in line with the consensus.

- Home and home-improvement retailers and e-commerce companies saw the most companies (over 80%) beat consensus revenue estimates. In terms of earnings, home and home-improvement retail and CPG led.

- Apparel specialty retail was the worst-performing sector (versus expectations) in the quarter, with over 90% (10 companies) missing the consensus revenue estimates.

However, in the context of store closures and reduced consumer demand for discretionary goods, beating or meeting consensus does not mean results were “good.” Sales productivity rates and the pace of recovery are much more useful metrics than benchmarking versus consensus as we head into the post-crisis period.

Company results in 1Q20, which ended April 30 for most companies in our coverage, will include the impact from the

coronavirus. From February onwards, brands and retailers began to see negative impacts on sales due to the coronavirus outbreak. US retailers initially saw supply-chain disruptions, such as orders shifting and being delayed. The problems then became much more fundamental as nonessential retail shut down in March and for the full month of April, and demand for many discretionary categories slumped. However, US consumers initially stockpiled food and cleaning products, and demand for food continued to be supported by the reduction in the use of food-service businesses. In May, most sectors witnessed an easing of sales declines, as nonessential stores began to reopen.

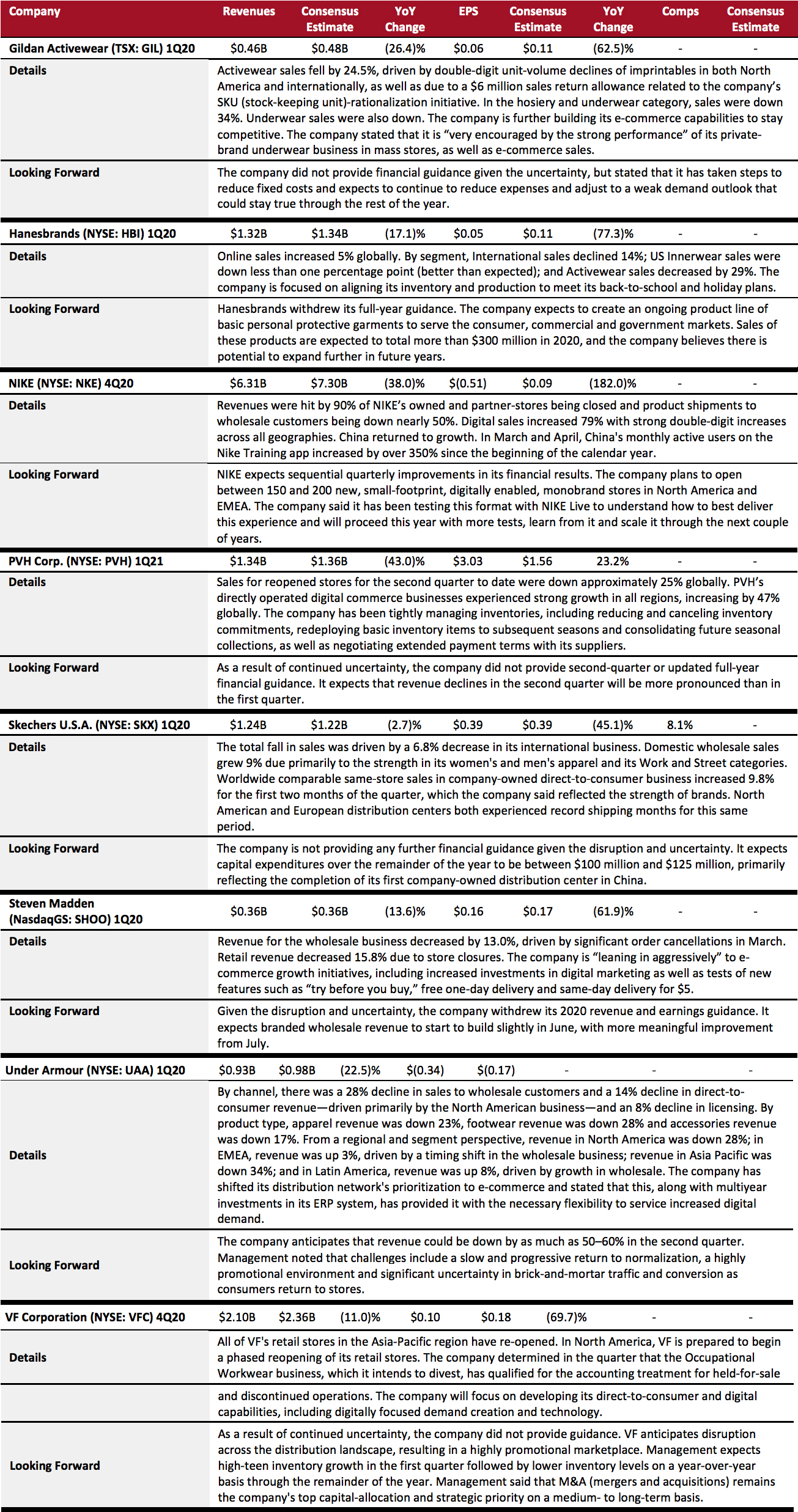

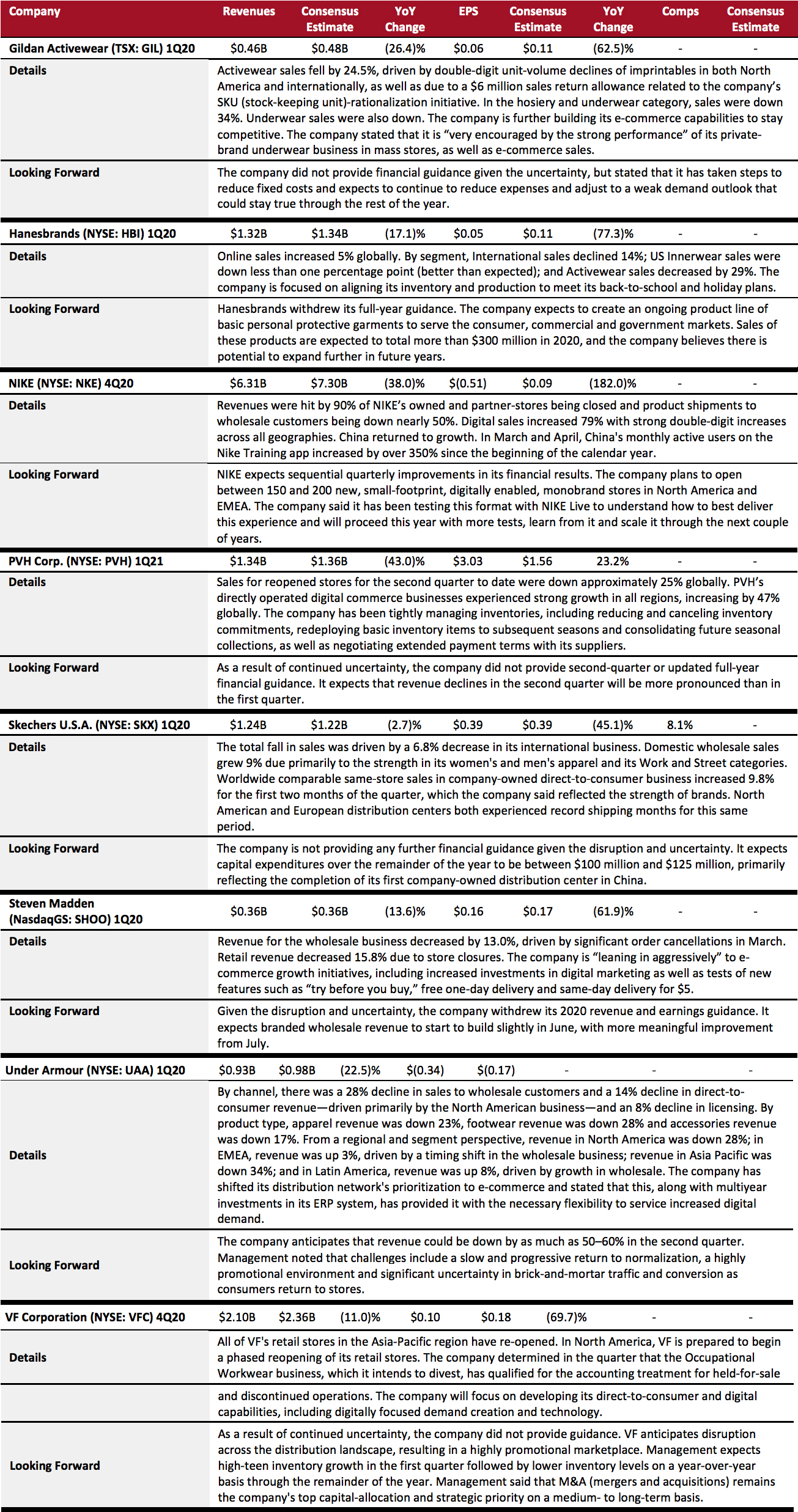

Apparel and Footwear Brand Owners

Unsurprisingly, amid store closures and demand factors such as lockdowns and more working at home, most US apparel and footwear firms had a weak quarter. Most of the retailers and brands under our coverage reported revenues down from the year-ago period and withdrew financial guidance without offering further financial expectations due to the looming uncertainties.

Companies including PVH and Under Armour expect to see further disruptions and losses in the next quarter. Companies are betting on e-commerce to generate sales and stay competitive. Inventory-wise, we have seen retailers adjust inventory levels by negotiating with suppliers.

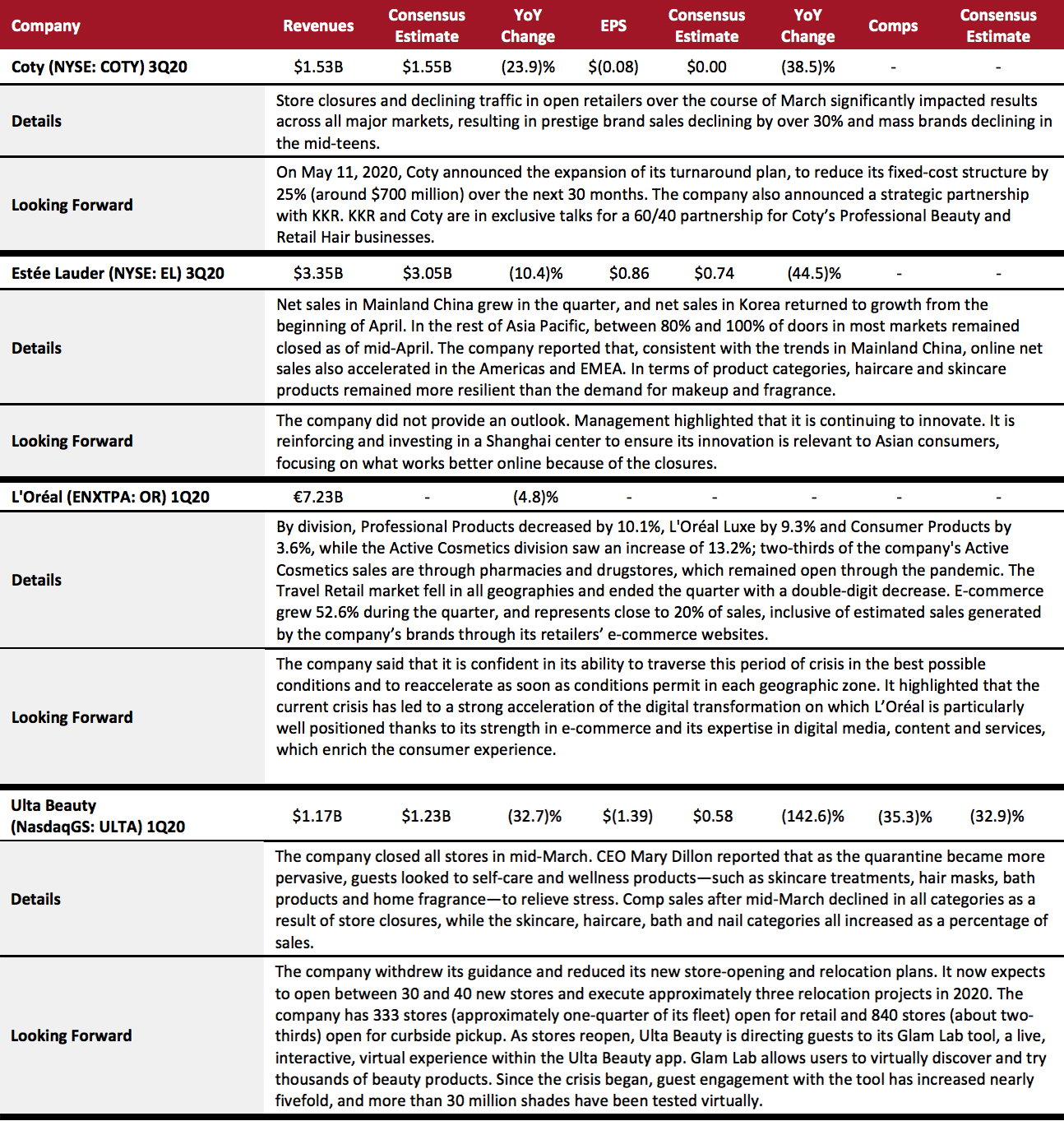

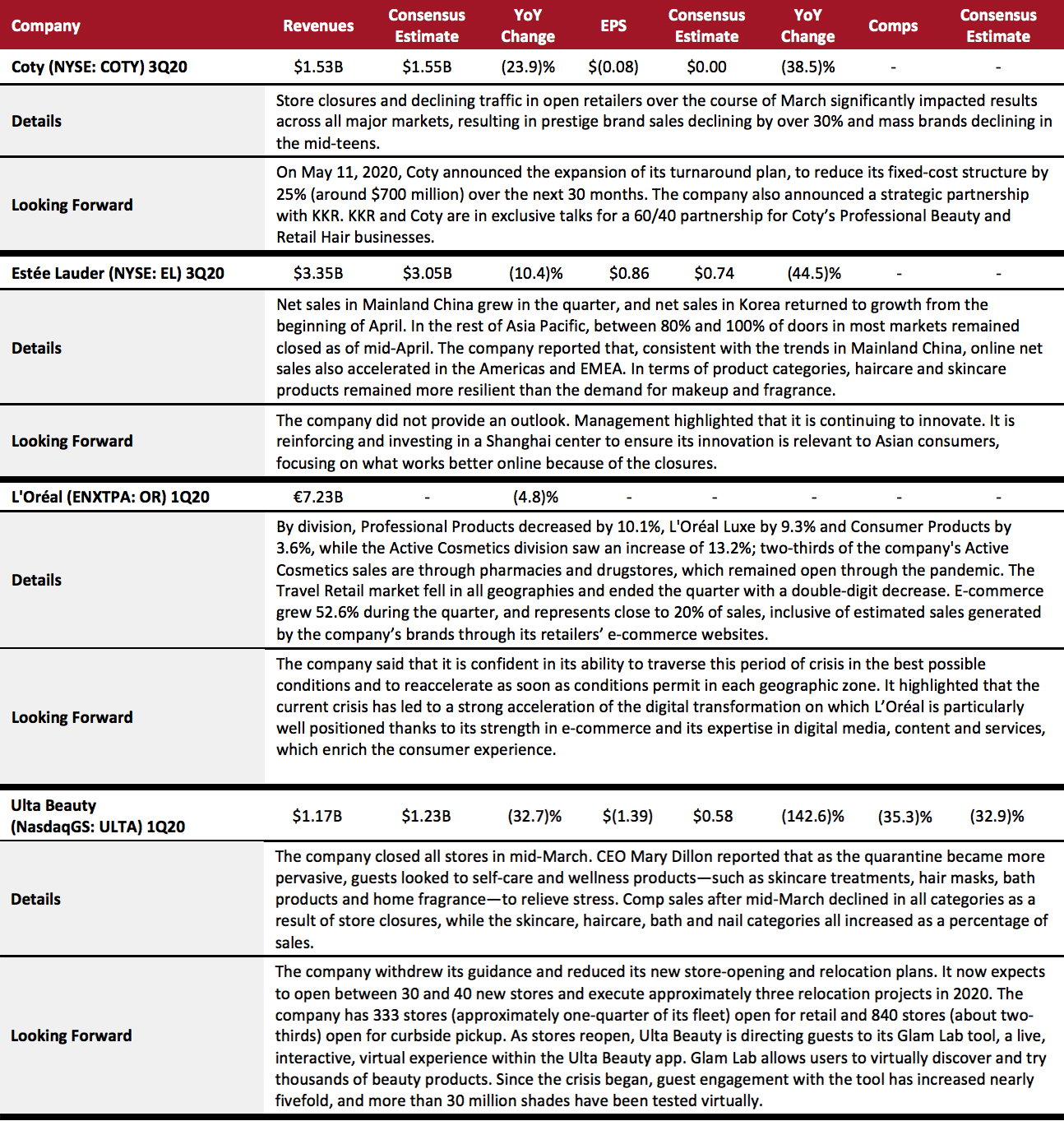

Beauty Brands and Retailers

Our beauty sector coverage is a combination of brand owners and one retailer (Ulta Beauty). The brand owners outperformed, given that they supply to a range of retailers across different channels in multiple countries, while Ulta Beauty is skewed toward physical store sales in just one country. However, beauty brands could be impacted by destocking in the current quarter, in the face of economic headwinds and reduced high-end demand due to lower traveler numbers.

Revenue changes ranged from (4.8)% at L’Oréal to (32.7)% at Ulta Beauty. L’Oréal’s growth was driven by its Active Cosmetics division (products sold in healthcare outlets and pharmacies designed to solve problems), whose brick-and-mortar sales remained unaffected during the lockdown. Estée Lauder reported that demand for its haircare and skincare products remained more resilient than for makeup and fragrance. Coty was impacted by prestige brand sales declining by over 30% and mass brands declining in the mid-teens.

In retail, Ulta Beauty's comps were down 35% after stores closed in mid-March, while the skincare, haircare, bath and nail categories all increased as a percentage of sales.

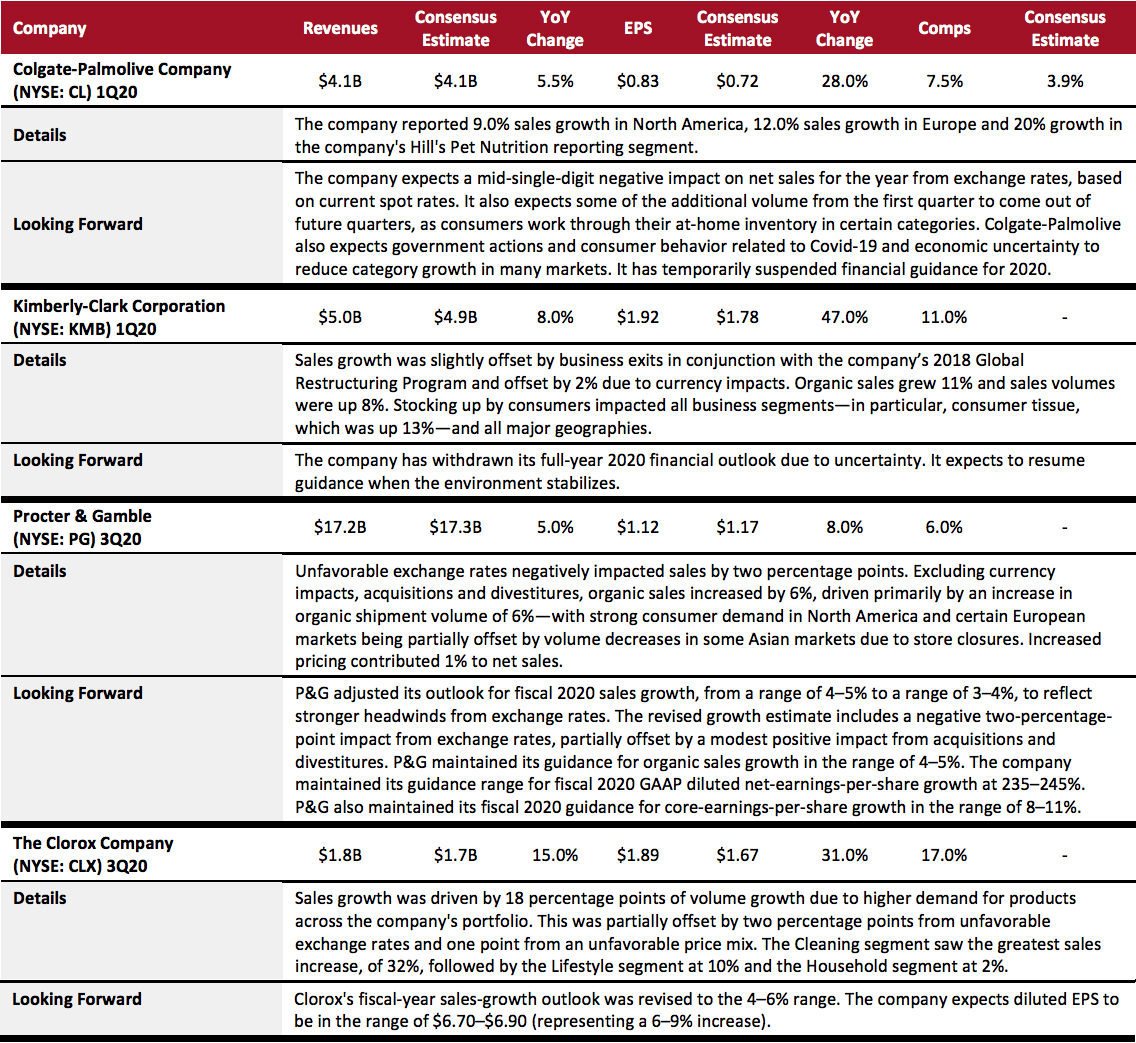

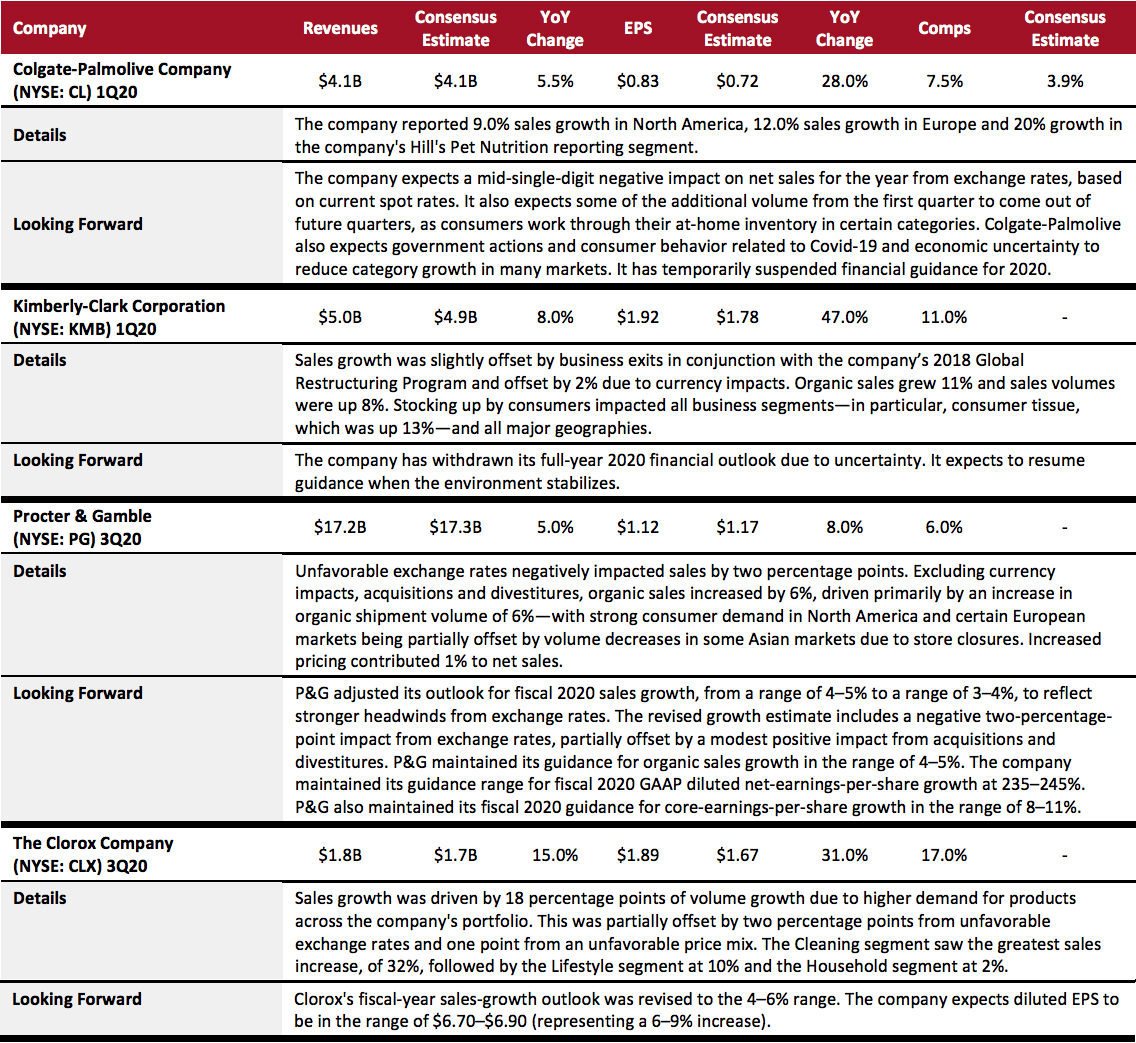

Consumer Packaged Goods (CPG)

As consumers flocked to buy food and essentials in personal and household care, this was a strong quarter for CPG firms, with all covered firms posting between 5% and 15% sales growth, and all in line with, or beating, consensus estimates.

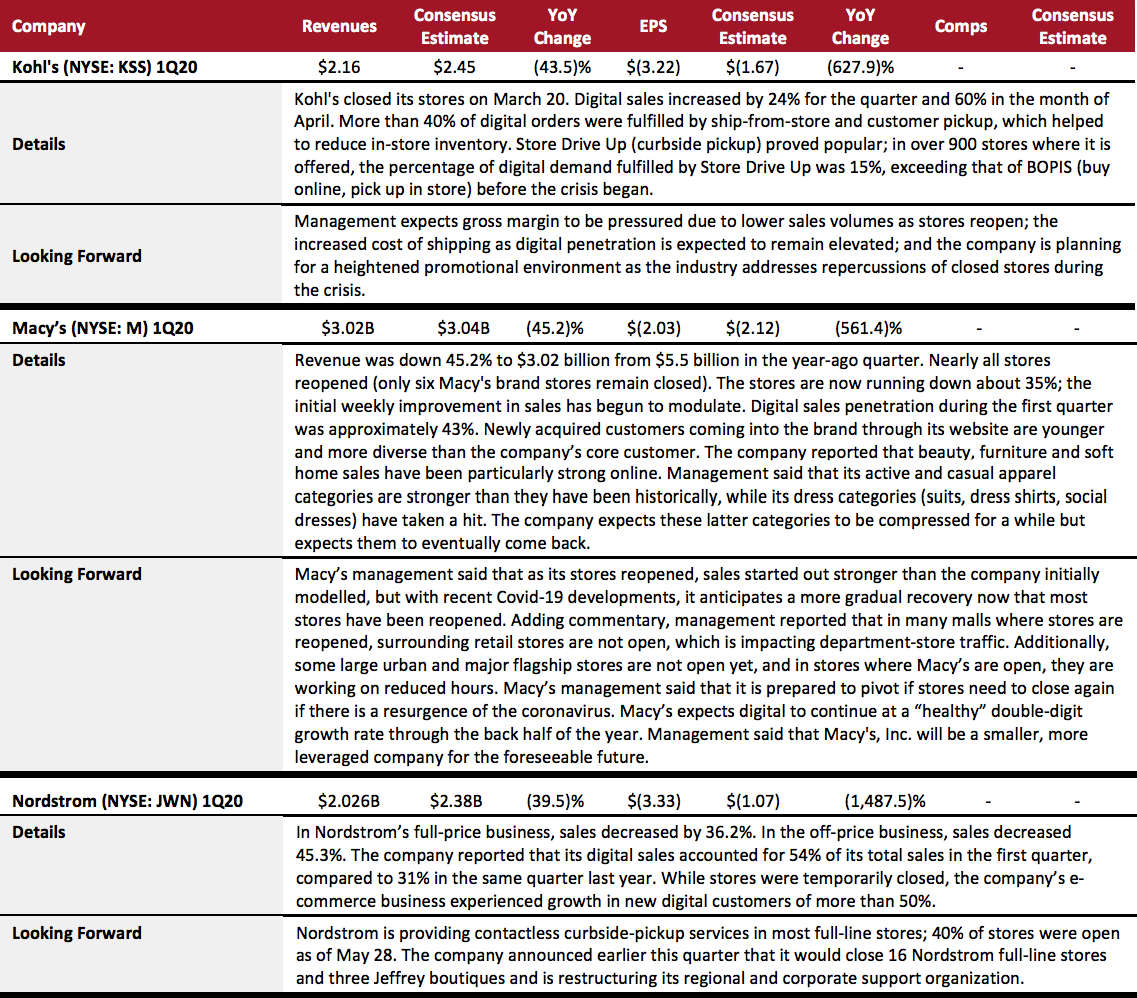

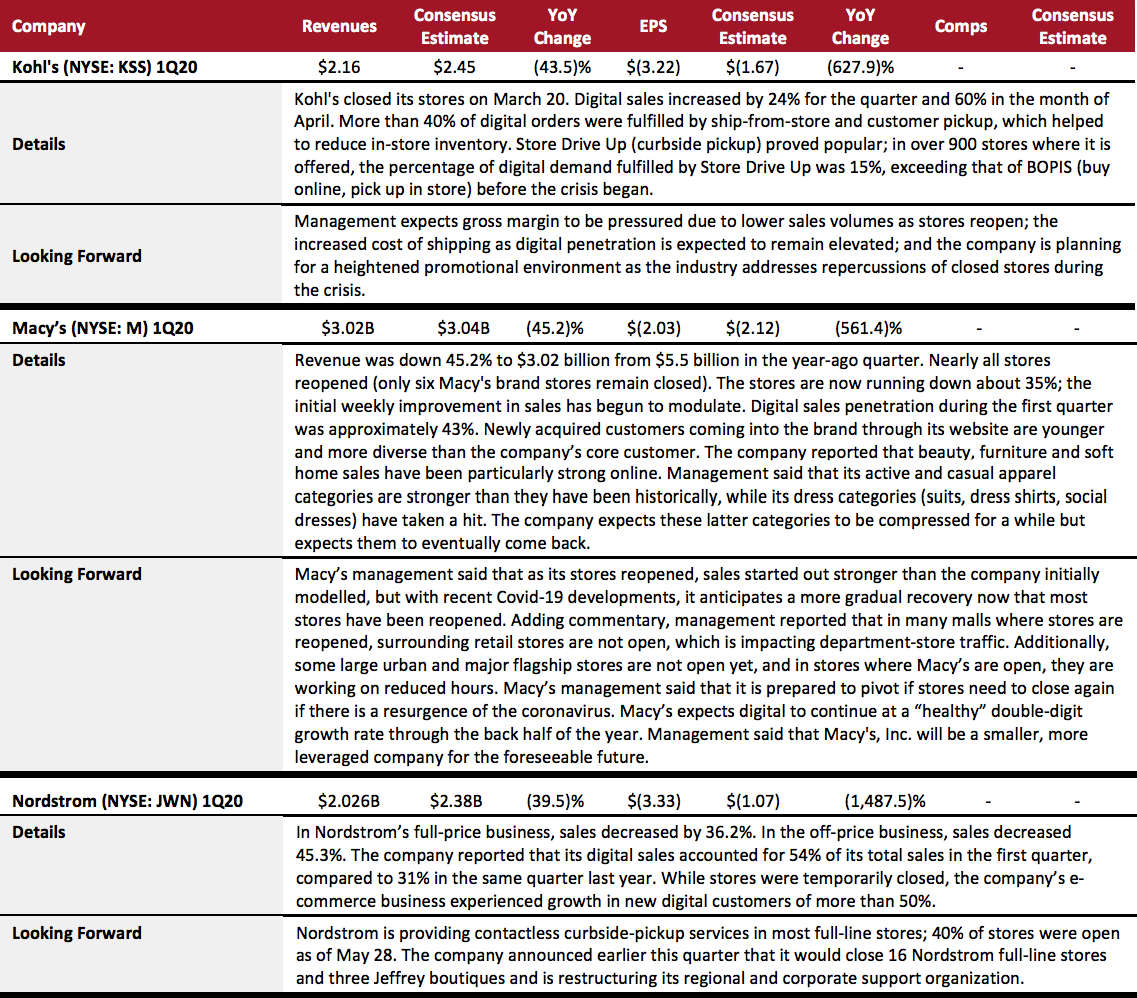

Department Stores

In the context of closed stores compounding structural challenges, it is little surprise that the US department-store sector had a difficult quarter. Sales were down 39.5% for Nordstrom and 43.5% for Kohl's. However, two bright spots for both were the acceleration of digital sales and the acquisition of new customers. Kohl's said that its new customers were younger, and Nordstrom's digital customers increased by 50% during the quarter. Consumers responded positively to Kohl's contactless curbside-pickup offering, which helped the retailer to fulfill digital orders in over 900 stores.

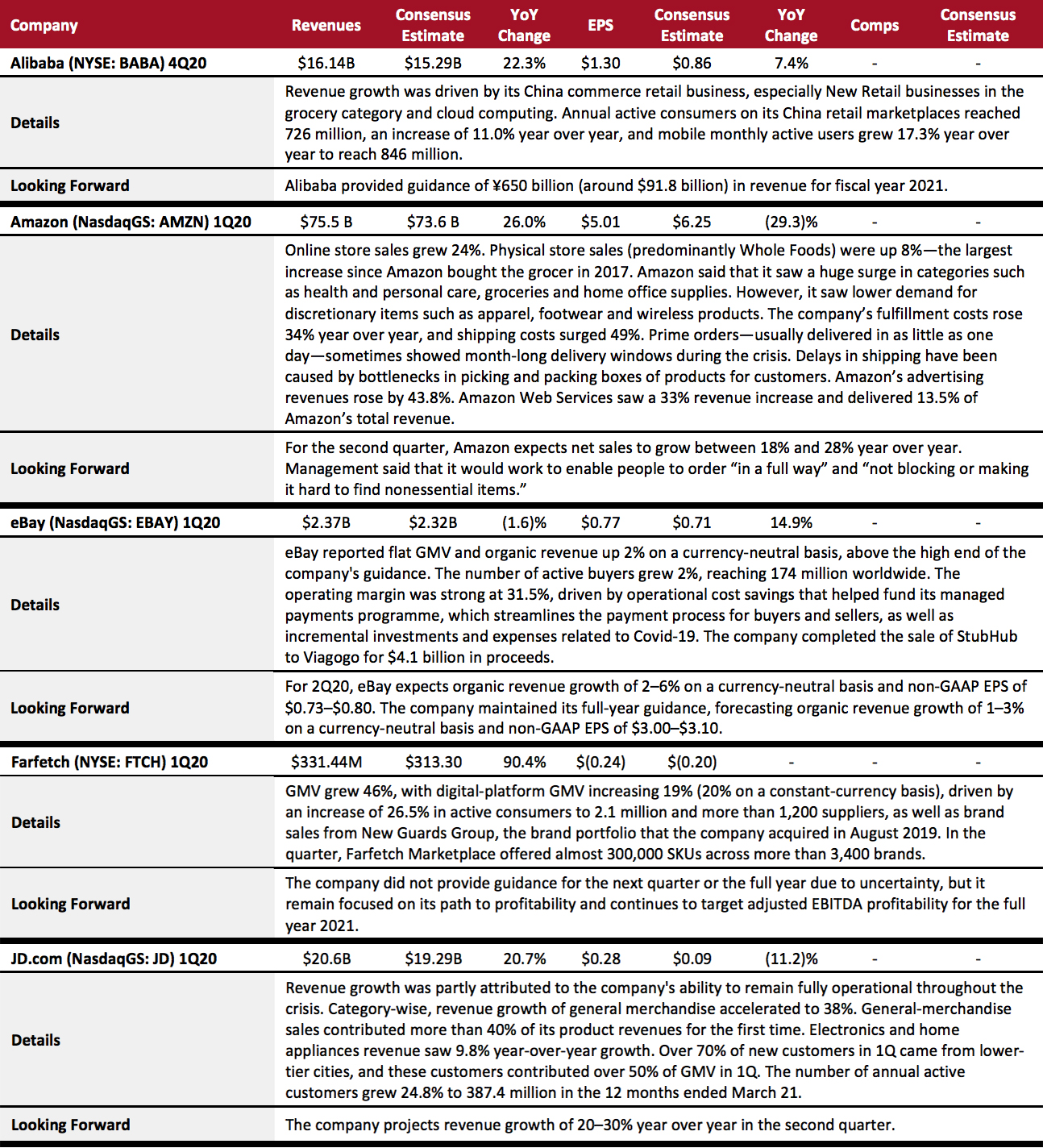

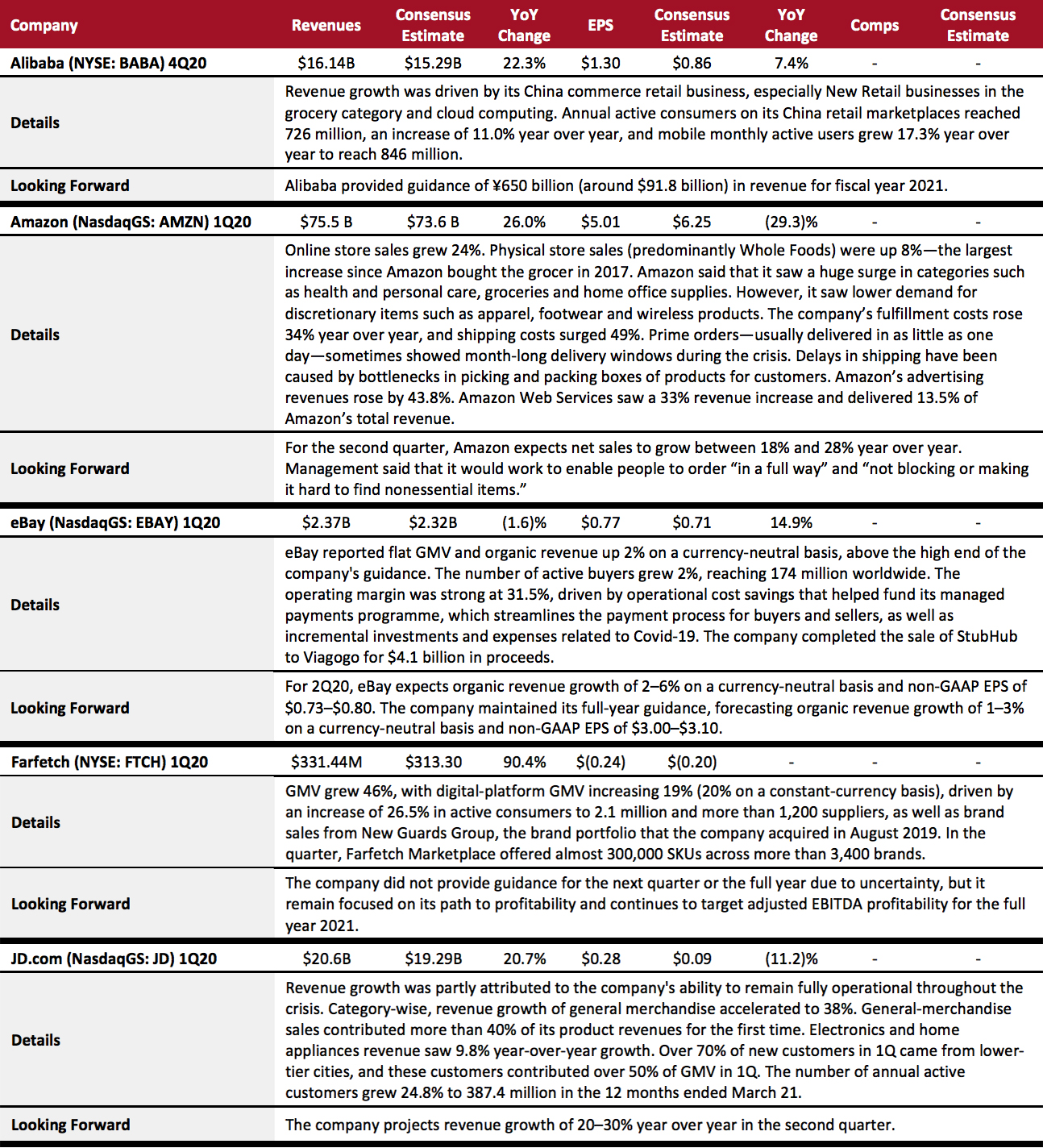

E-Commerce

In a context of closed stores, e-commerce naturally benefited. Amazon reported strong revenue growth online and in Whole Foods. Gross merchandise volume (GMV) on eBay’s Marketplace platform remained flat year over year and was impacted by an Internet sales tax across more US states, as well as lower marketing spend. Farfetch delivered better-than-expected revenue in the quarter, partly driven by a growing number of customers and direct-to-consumer sales from its subsidiary New Guards Group, a fashion conglomerate.

Chinese e-commerce giants continued to see solid sales growth thanks to huge demand for online grocery and the number of users gained from lower-tier markets. While Alibaba noted a negative impact of the coronavirus on some of its business in February and March, JD.com reported more daily active users and fulfilled orders in February.

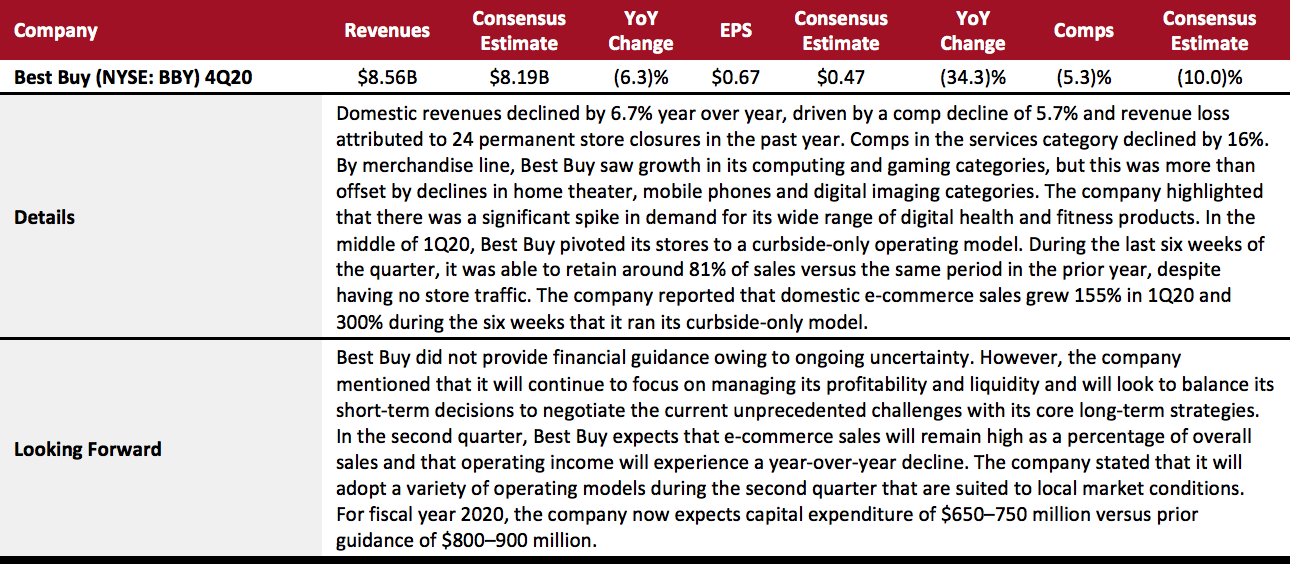

Electronics Retail

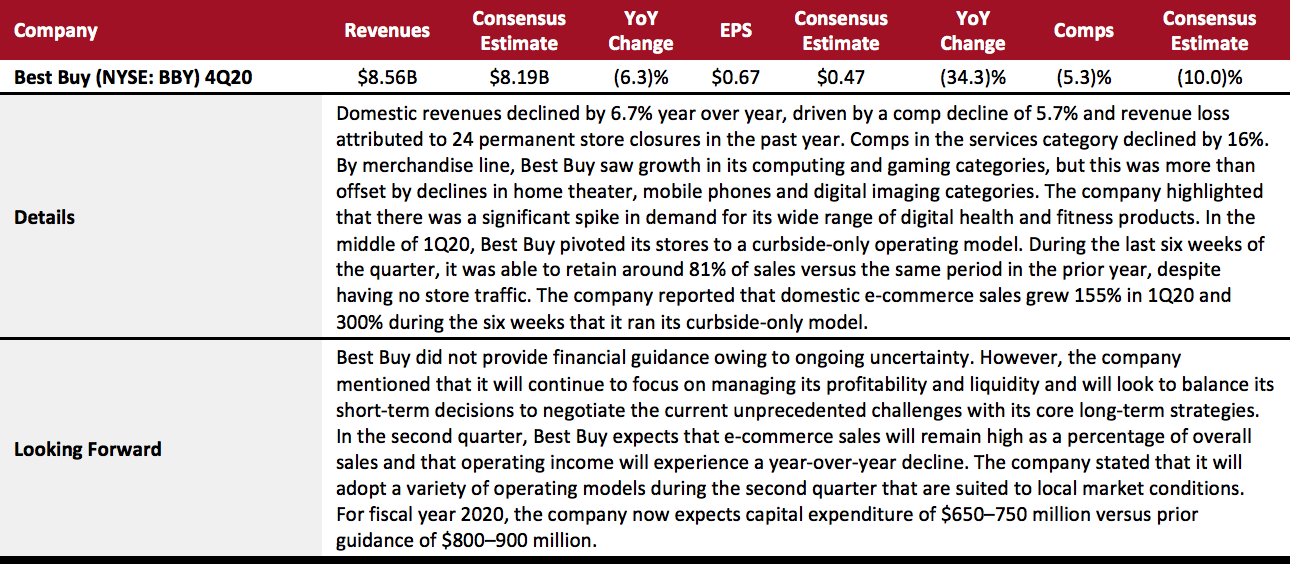

Despite experiencing a decline in revenues as a result of the lockdown, Best Buy managed to beat consensus estimates on revenues, comps and EPS in 1Q20. The company's shift to a curbside-only model midway through the quarter helped it to register a dramatic increase in online sales. In the challenging environment posed by the coronavirus pandemic, the company still managed to retain a considerable portion of last year's sales, which it attributed to the strength of its multichannel capabilities and the strategic investments that it has been making over several years.

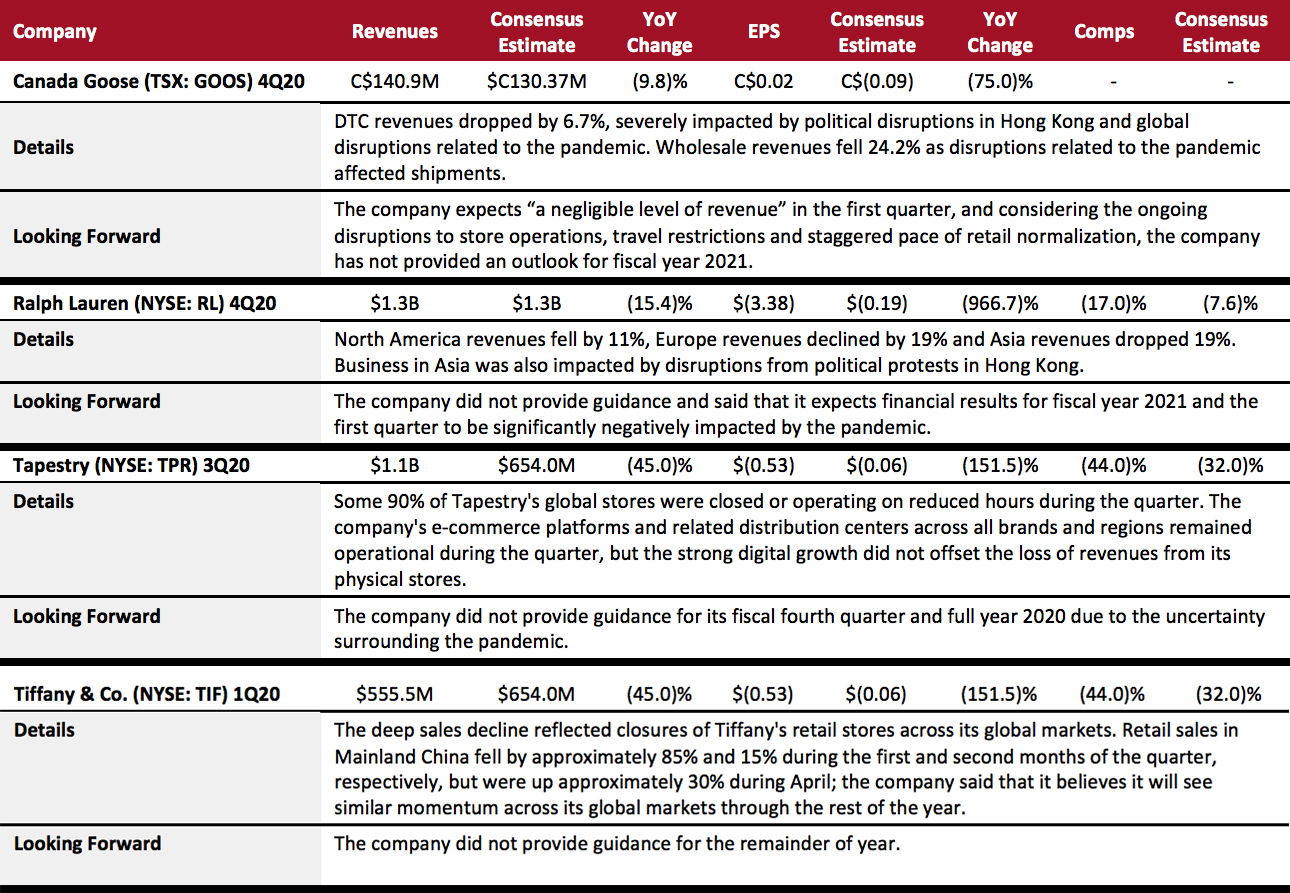

Luxury

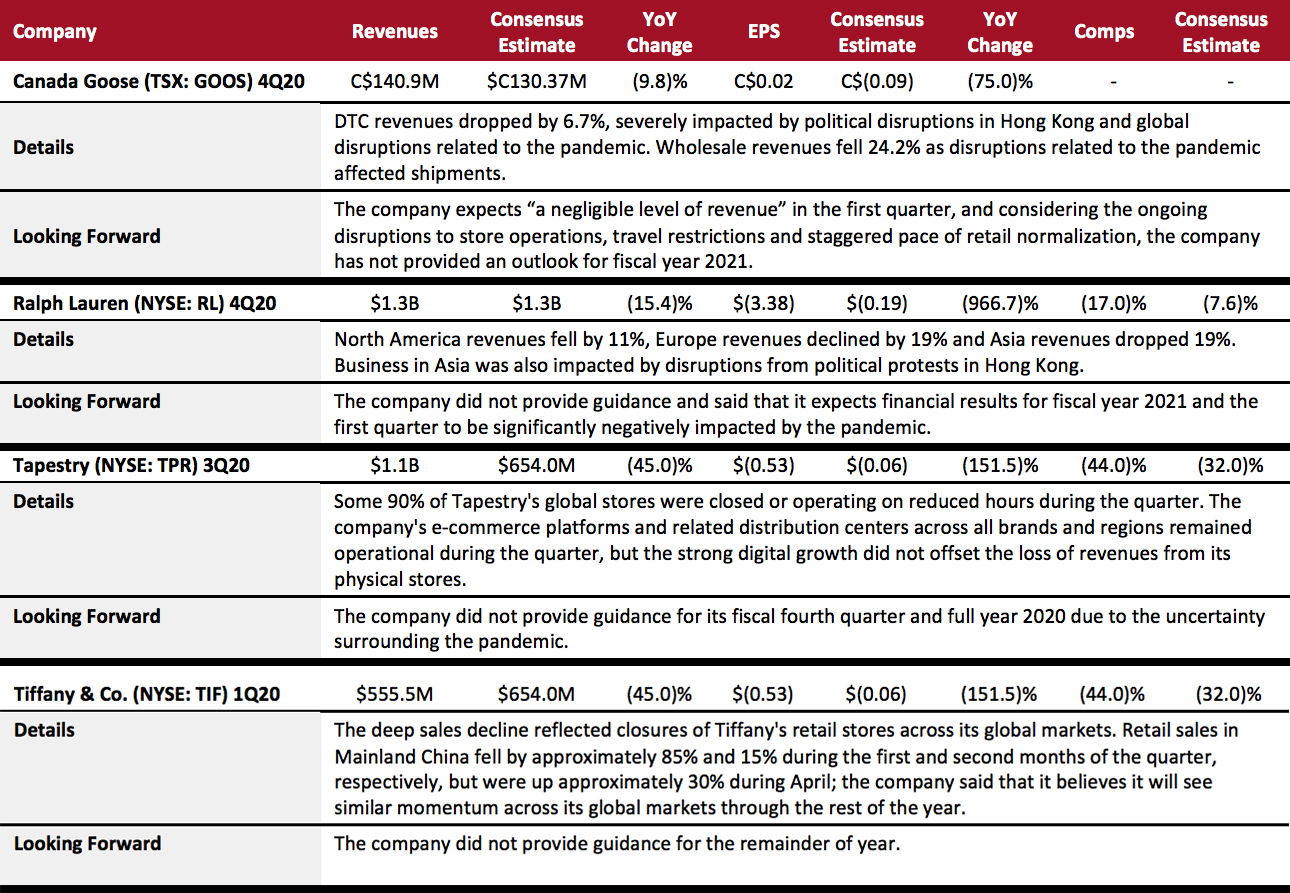

The last quarter was a difficult one for the global luxury sector as the coronavirus pandemic forced nonessential retailers to close stores, and international travel, which fuels many luxury sales, ground to a halt. While stores in China, where the earliest closures were reported, have seen some recovery, it has not been adequate to offset the loss in revenues observed in other markets. Four of the five companies in our coverage reported a significant fall in revenues and profits during the quarter.

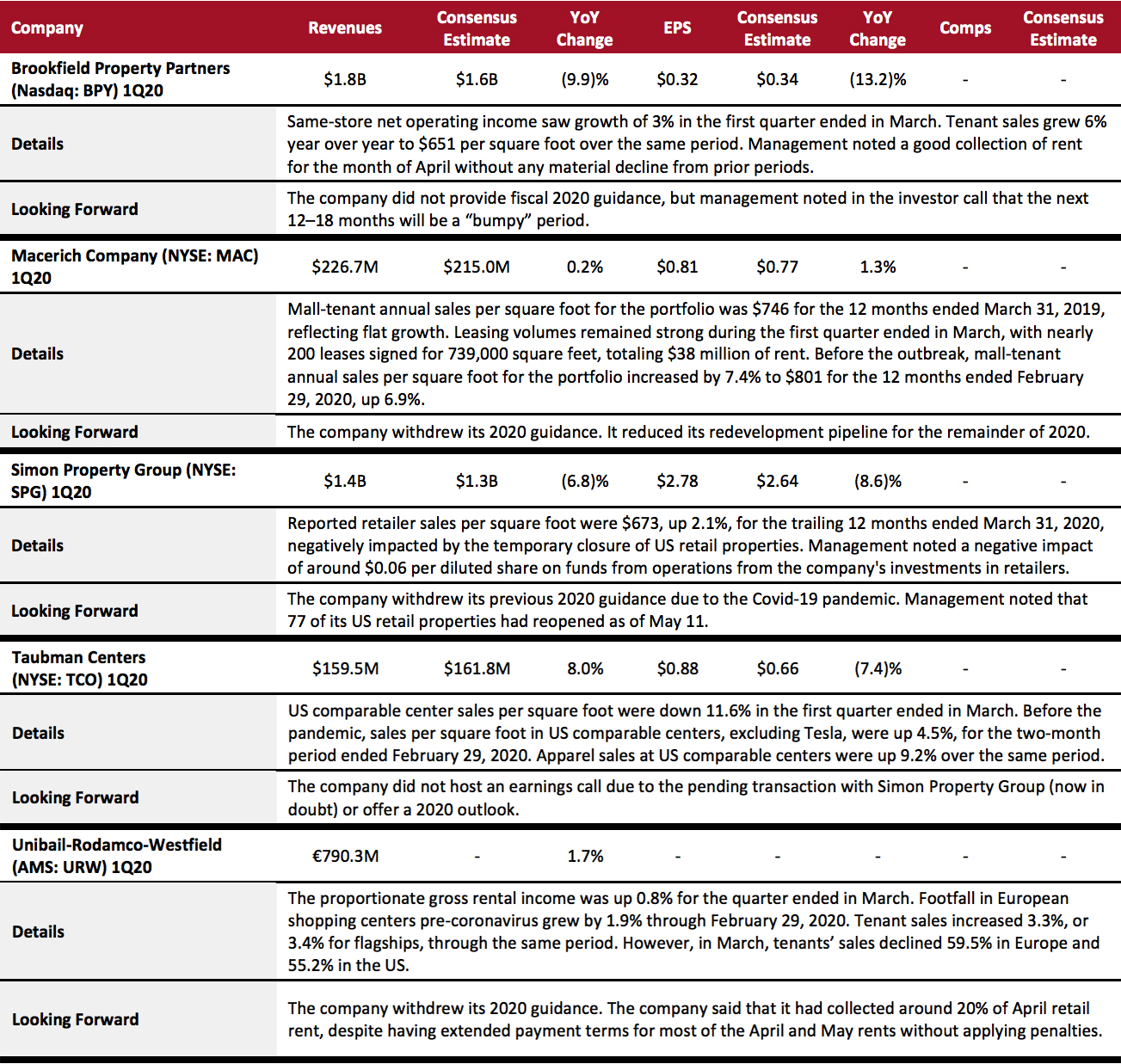

REITs

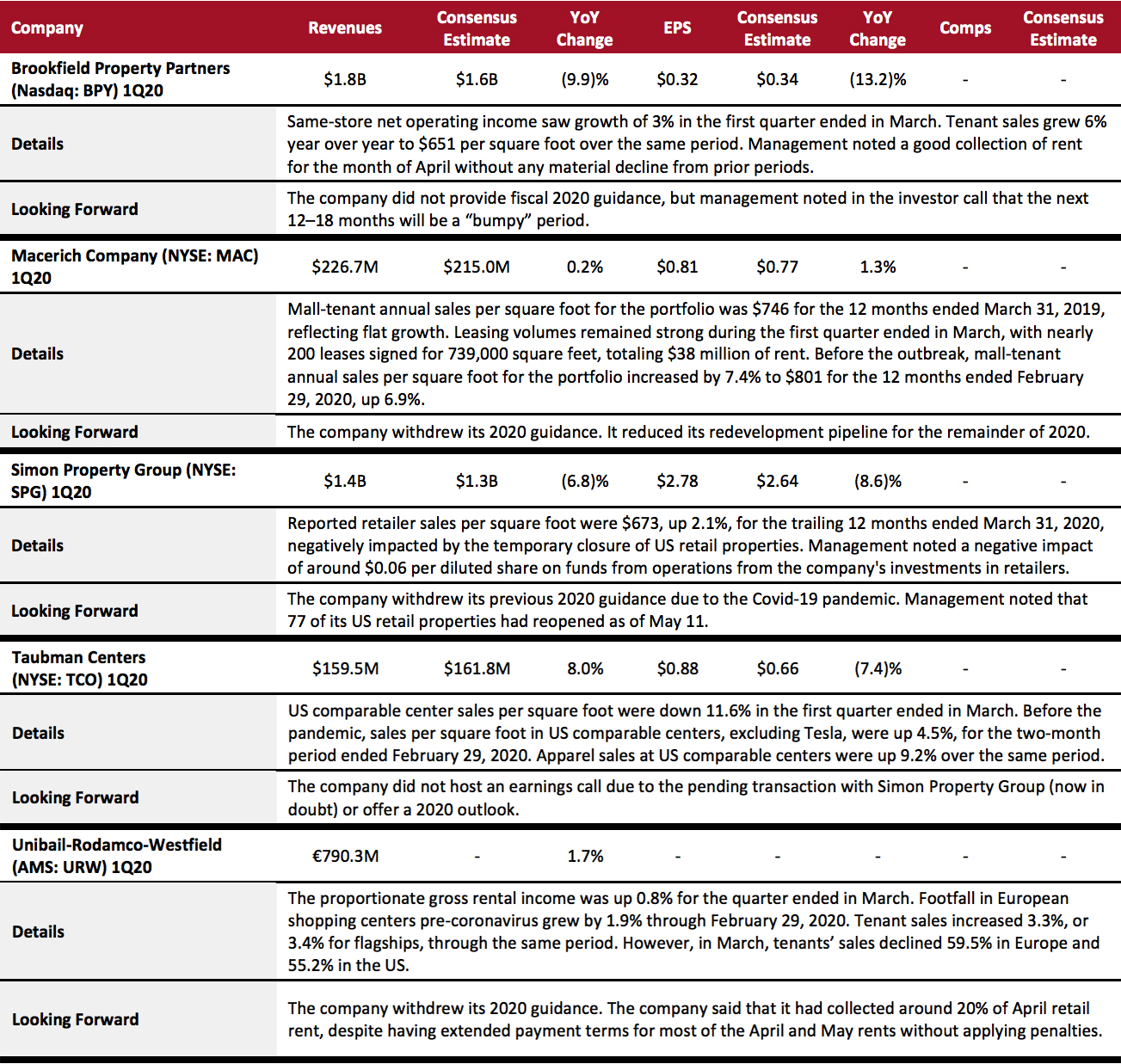

Fiscal quarters for the covered REITs all ended in March. The sector was heading toward a strong quarter until the outbreak of the coronavirus. With uncertainty ahead, none of the covered companies provided an updated outlook for fiscal year 2020. Since the lockdown began in March, first-quarter results did not reflect a significant decline. However, going forward, rent collection faces significant headwinds, possibly for the remainder of 2020. A stronger negative impact is likely to show in the next quarter.

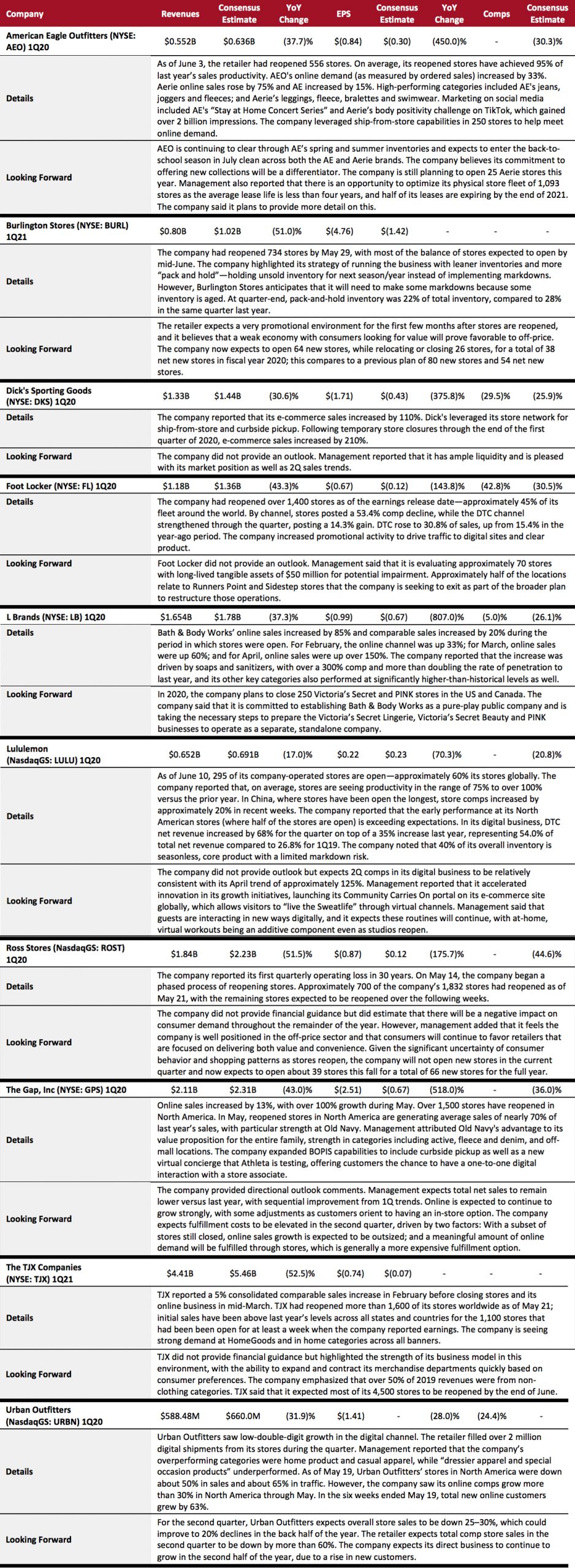

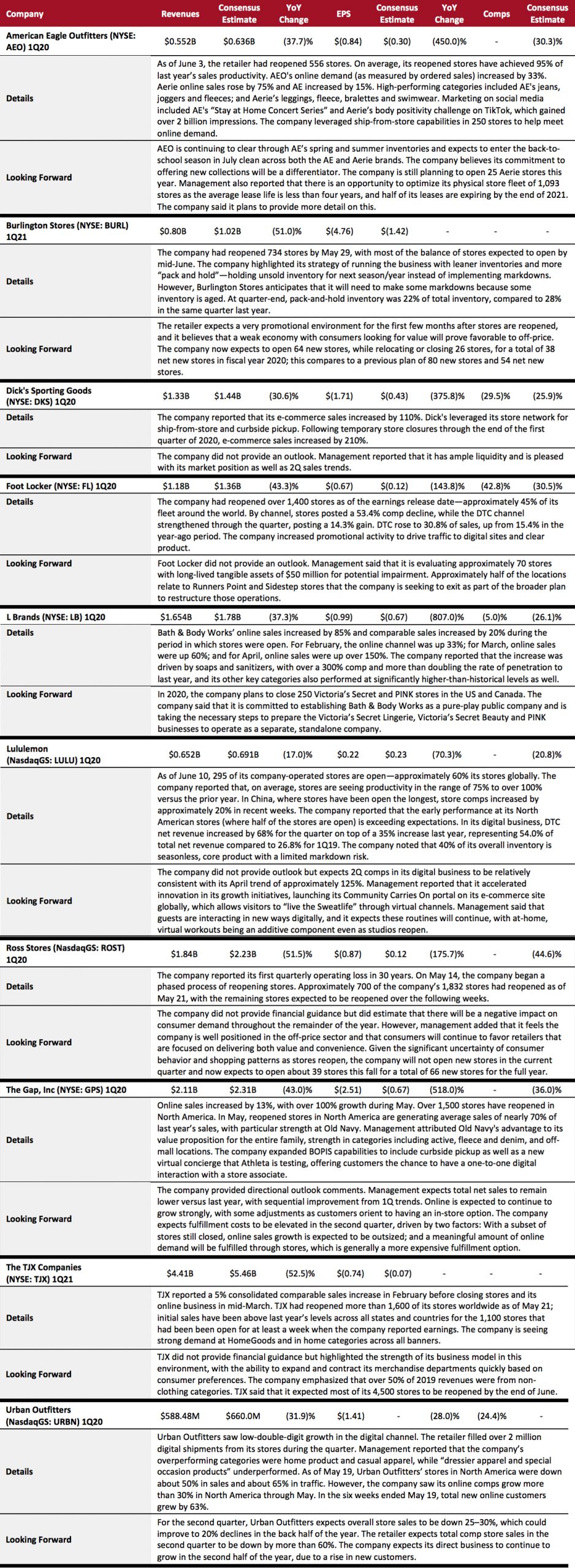

Specialty Retail

Apparel specialty retail took the biggest hit in the first quarter, with year-over-year changes in retailers’ revenues varying from (17.0)% to (52.5)%. Over 90% of the covered companies missed revenue consensus estimates. However, as stores have reopened, retailers are witnessing a significant return to in-store shopping, apparently supported by pent-up demand, and this is reflected in higher-than-anticipated sales productivity at reopened stores.

Some retailers, such as American Eagle Outfitters, have noted that they are clearing their spring and summer inventories and expect to enter the back-to-school season clean, while others are likely to implement substantial markdowns to clear inventory—leading to a period of heightened promotions.

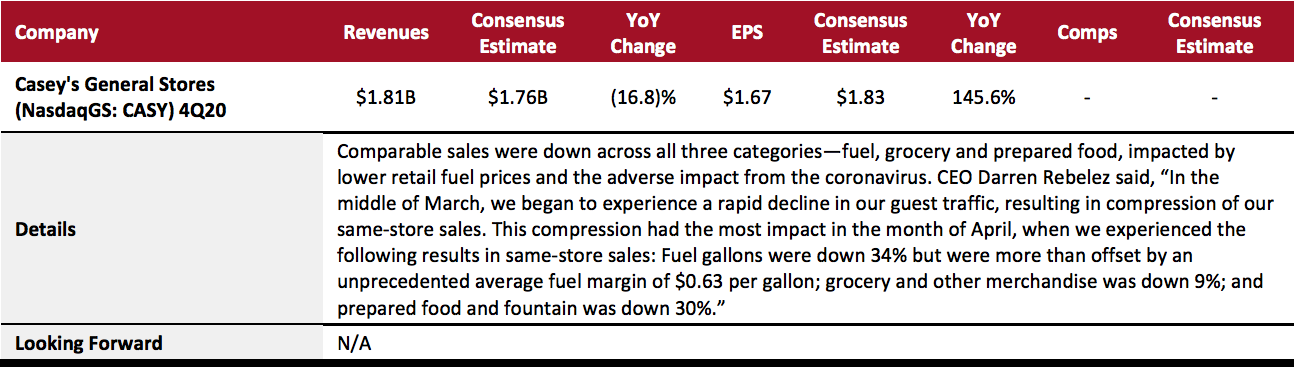

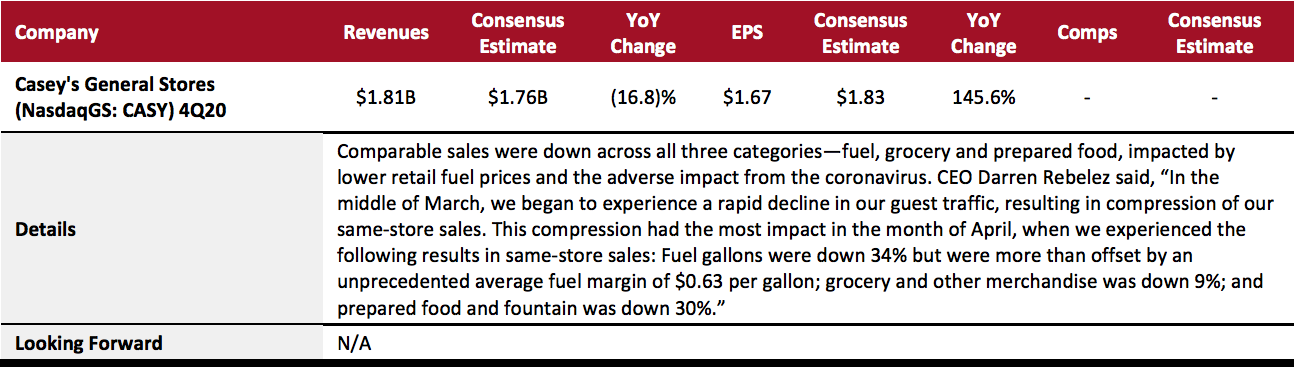

Food, Drug and Mass Retailers: Convenience Stores

Casey's saw its comparable sales decrease among all three categories—fuel, grocery and prepared food. In fiscal year 2020, the company completed 60 new store constructions, acquired 18 stores and entered into two additional store purchase agreements. So far in the first quarter of fiscal year 2021, Casey’s has opened six new stores and has eight stores under construction. As of April 30, the company had a new store pipeline of 93 sites, including 24 under construction.

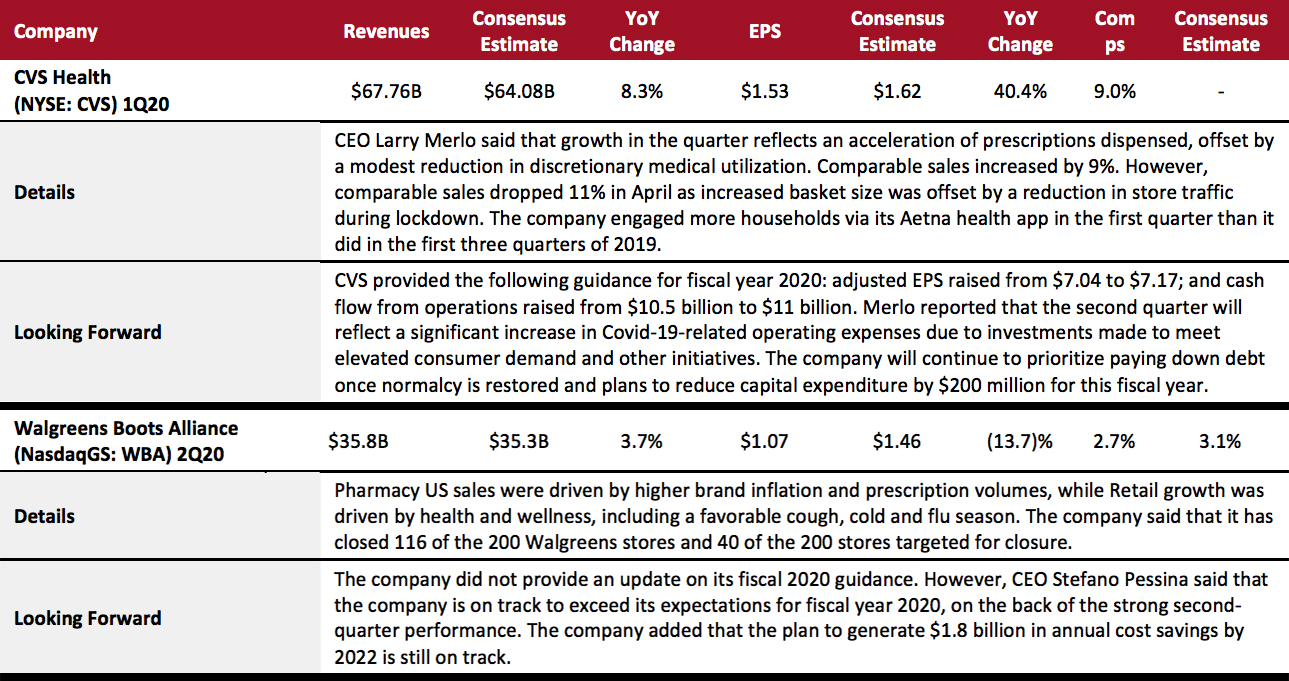

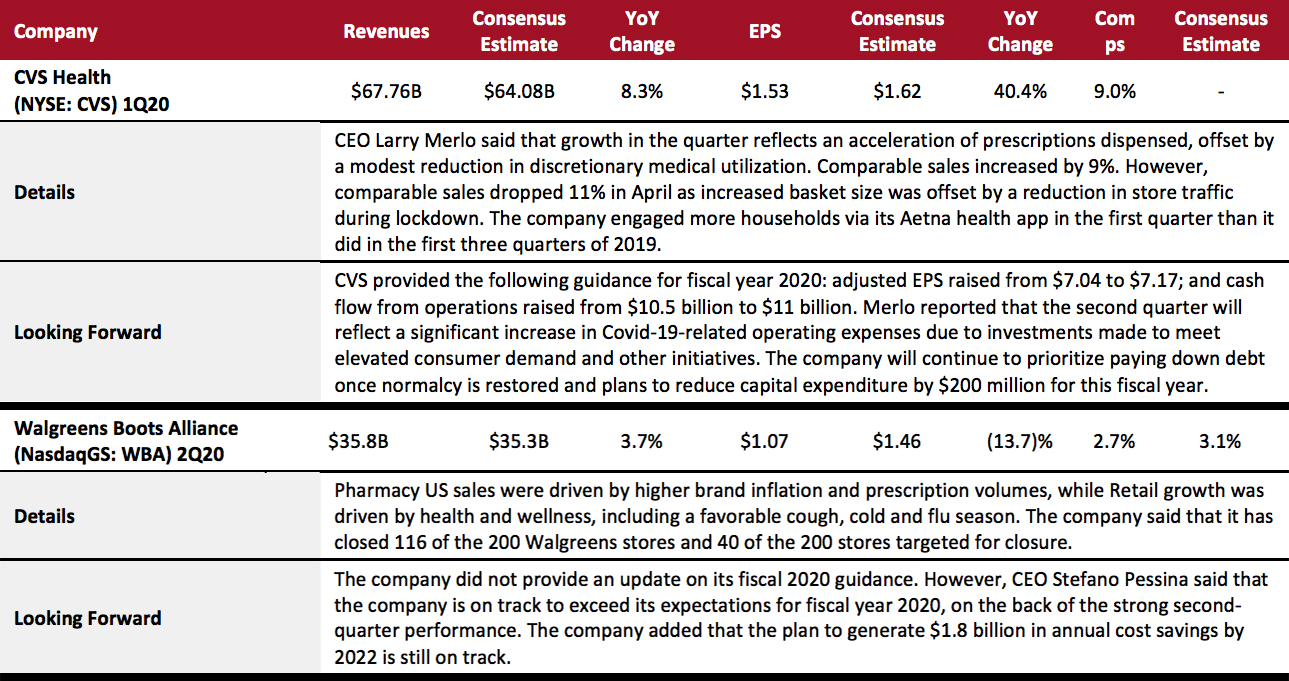

Food, Drug and Mass Retailers: Drugstores

Drugstore chains experienced a mixed quarter, with CVS and Walgreens beating consensus on revenues but falling short on comps and EPS. CVS kept fiscal 2020 guidance almost unchanged, while Walgreens withdrew its guidance but assured that the company is on track to exceed expectations for the financial year.

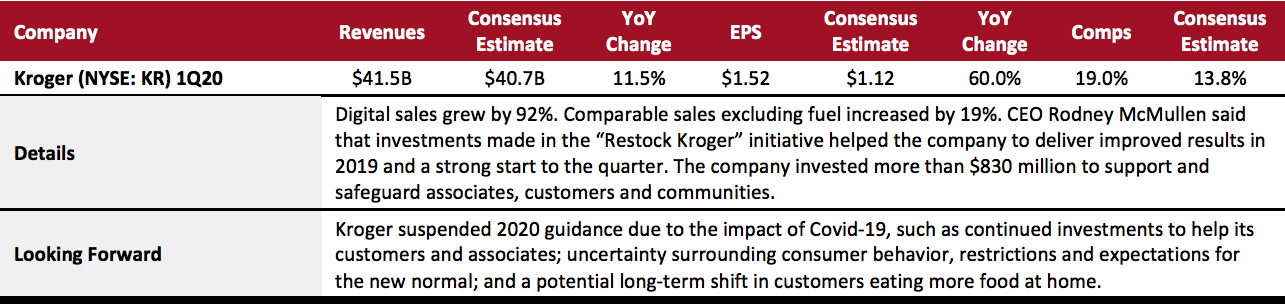

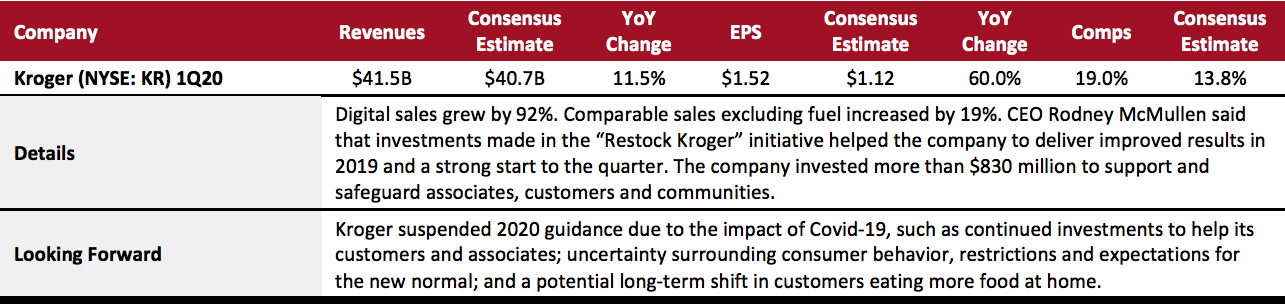

Food, Drug and Mass Retailers: Food Retailers

Kroger saw an 11.5% rise in total revenues, with comp growth accelerating to 19%. Digital sales were up 92%. The company’s CEO Rodney McMullen said that its strategic framework program “Restock Kroger” has given a strong start to the quarter and will continue to enhance the core business and achieve sustainable growth in the future.

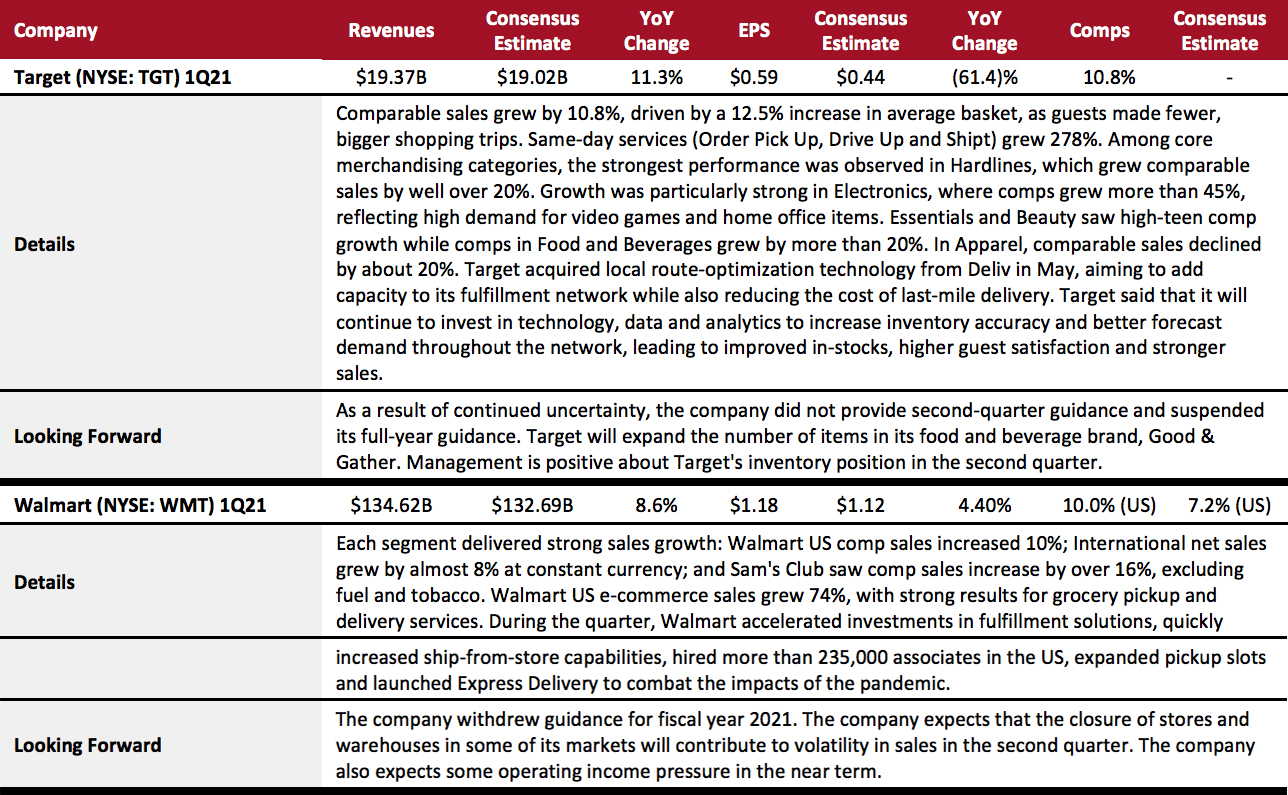

Food, Drug and Mass Retailers: Mass Merchandisers

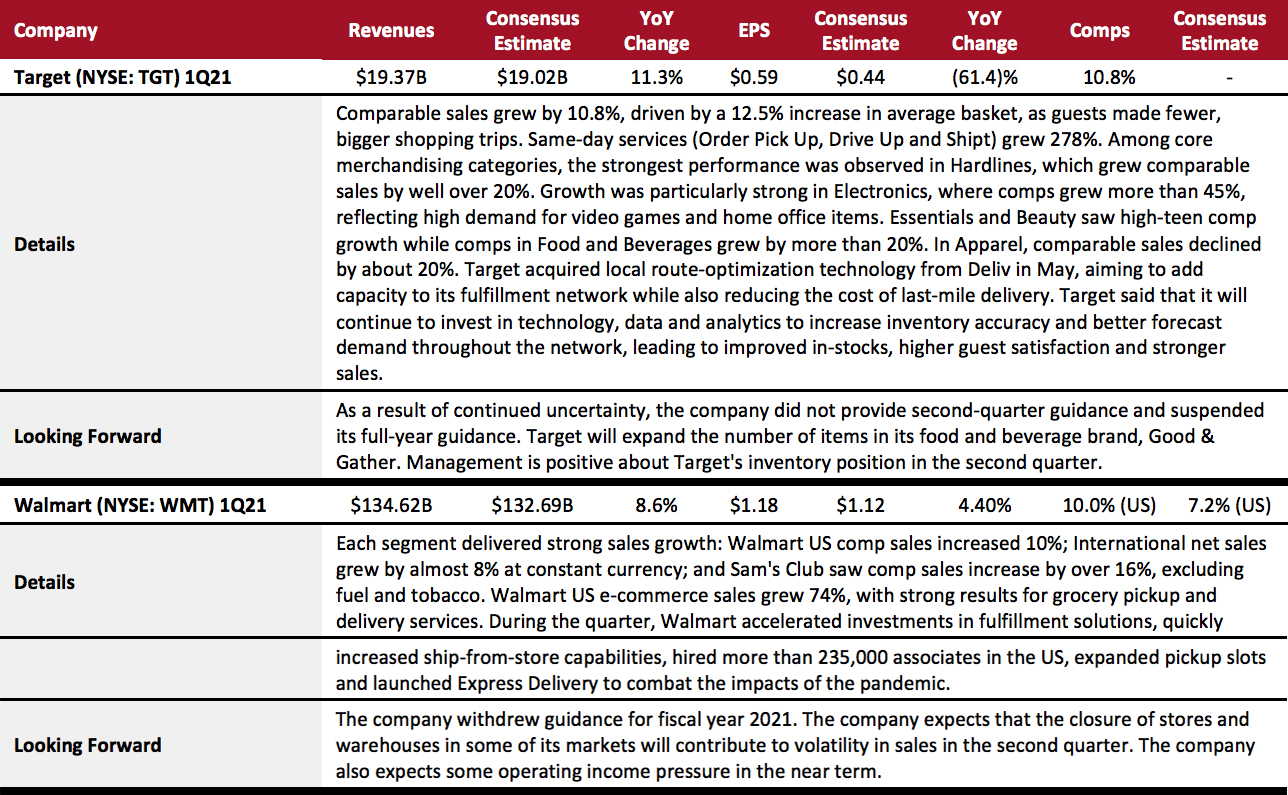

Target and Walmart both saw significant sales growth, driven by consumers’ needs for staples during the pandemic. We have seen these two retailers continue to invest in fast delivery and omnichannel capabilities. During the quarter, Walmart quickly increased its ship-from-store capabilities, expanded pickup slots and launched Express Delivery. Target acquired local route-optimization technology from Deliv in May, aiming to add capacity to its fulfillment network while also reducing the cost of last-mile delivery. Target and Walmart are also investing in technology and data analytics tools for better inventory management and demand forecasting. The two companies also hired more employees in the US and elevated in-store social-distancing measures.

Food, Drug and Mass Retailers: Discount Stores

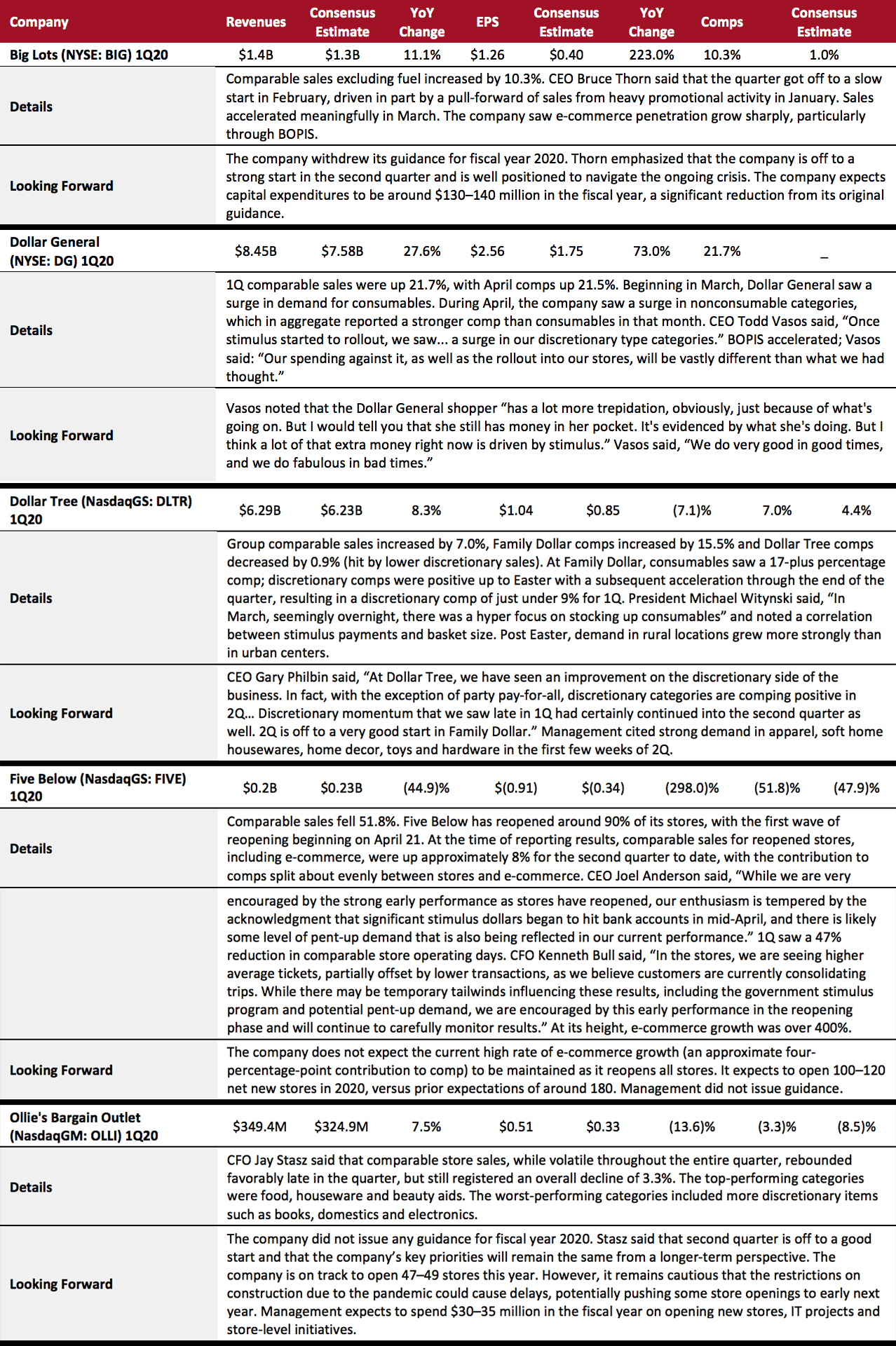

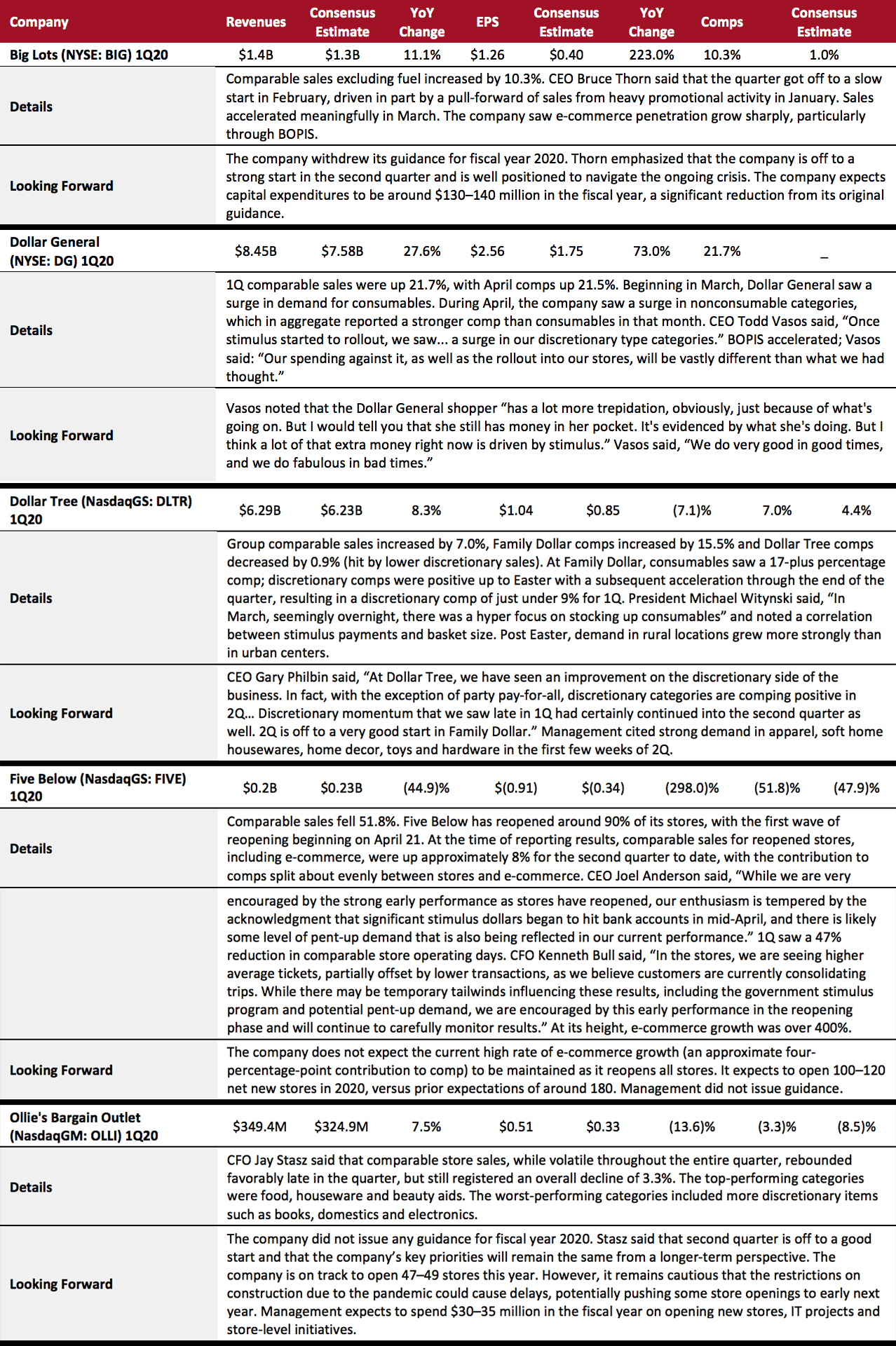

Discounters had a strong quarter, with four out of five companies beating consensus on revenues, comps and EPS. However, Five Below missed consensus on all the three metrics. Although none of the companies issued guidance for fiscal year 2020, management at all companies noted a strong start to the current quarter and emphasized that they are well positioned to navigate the crisis. Dollar Tree experienced strong discretionary momentum into the second quarter with strong demand for apparel, soft home housewares, home decor, toys and hardware.

Food, Drug and Mass Retailers: Warehouse Clubs

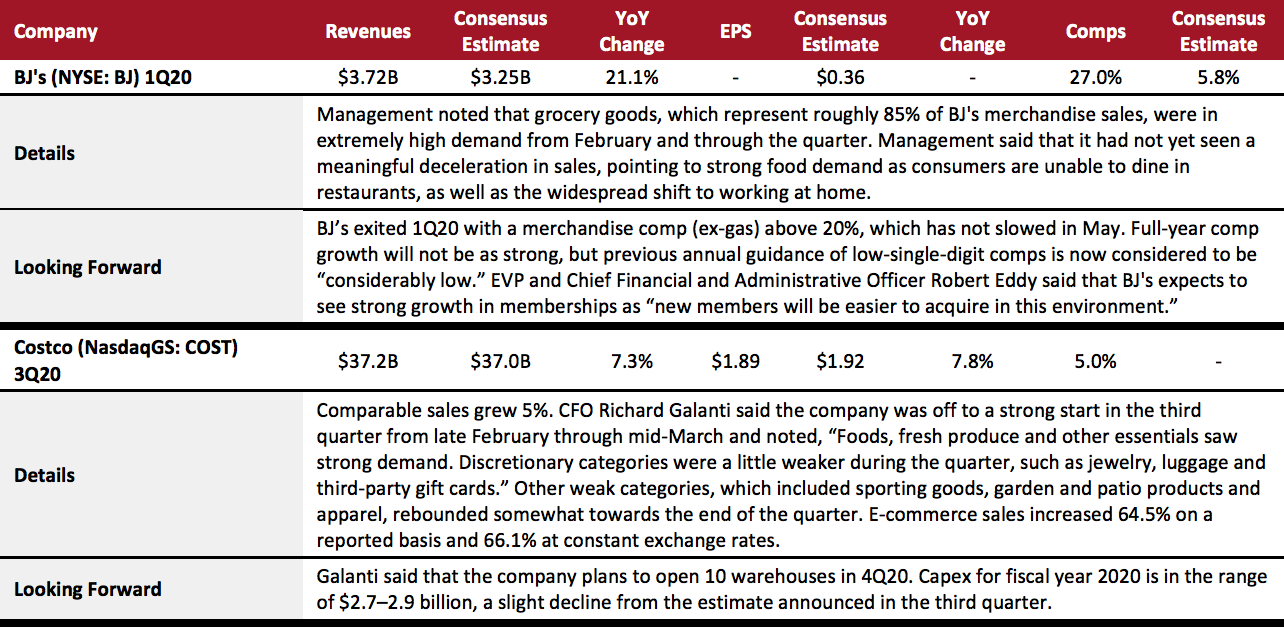

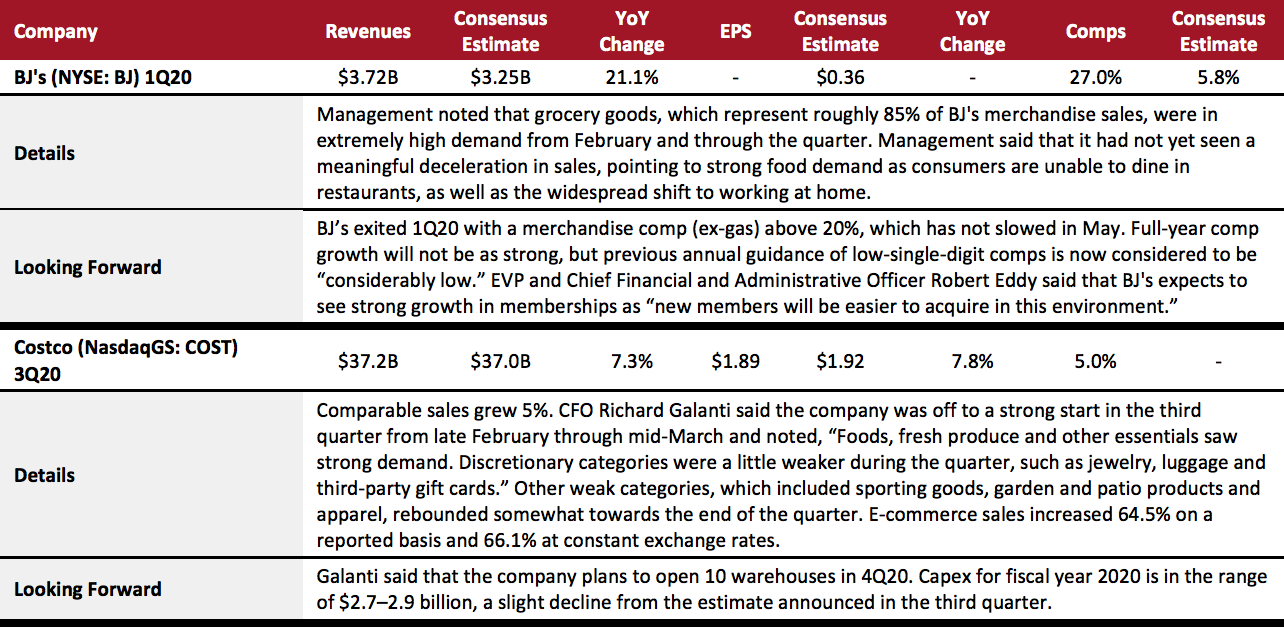

Warehouse clubs experienced a mixed quarter. Costco and BJ's beat consensus on revenues, with BJ's comp growth of 21.8% exceeding expectations. Costco, however, missed consensus estimates on EPS.

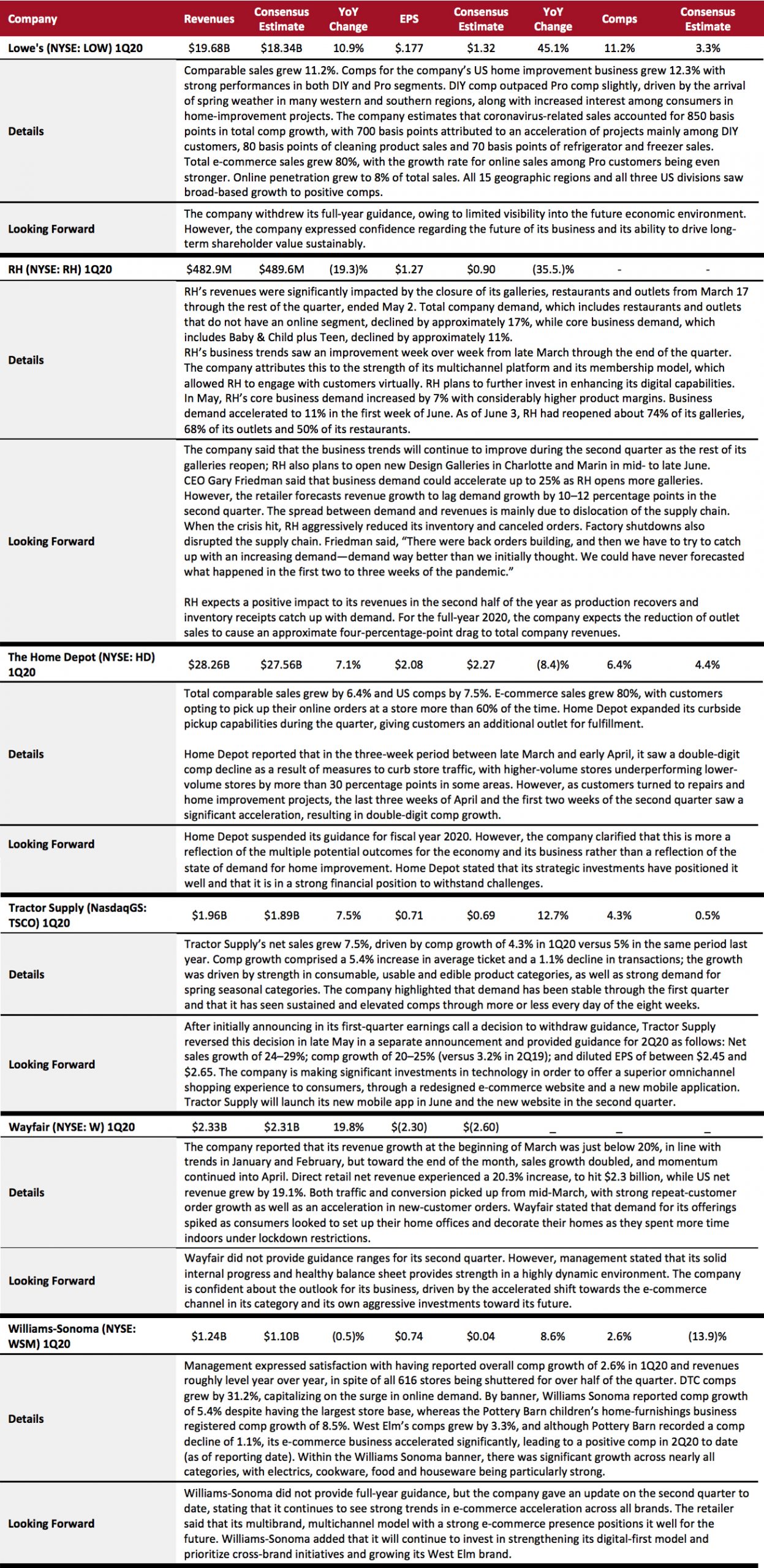

Home and Home-Improvement Retailers

The home and home-improvement sector is divided into home-improvement stores and furniture retailers.

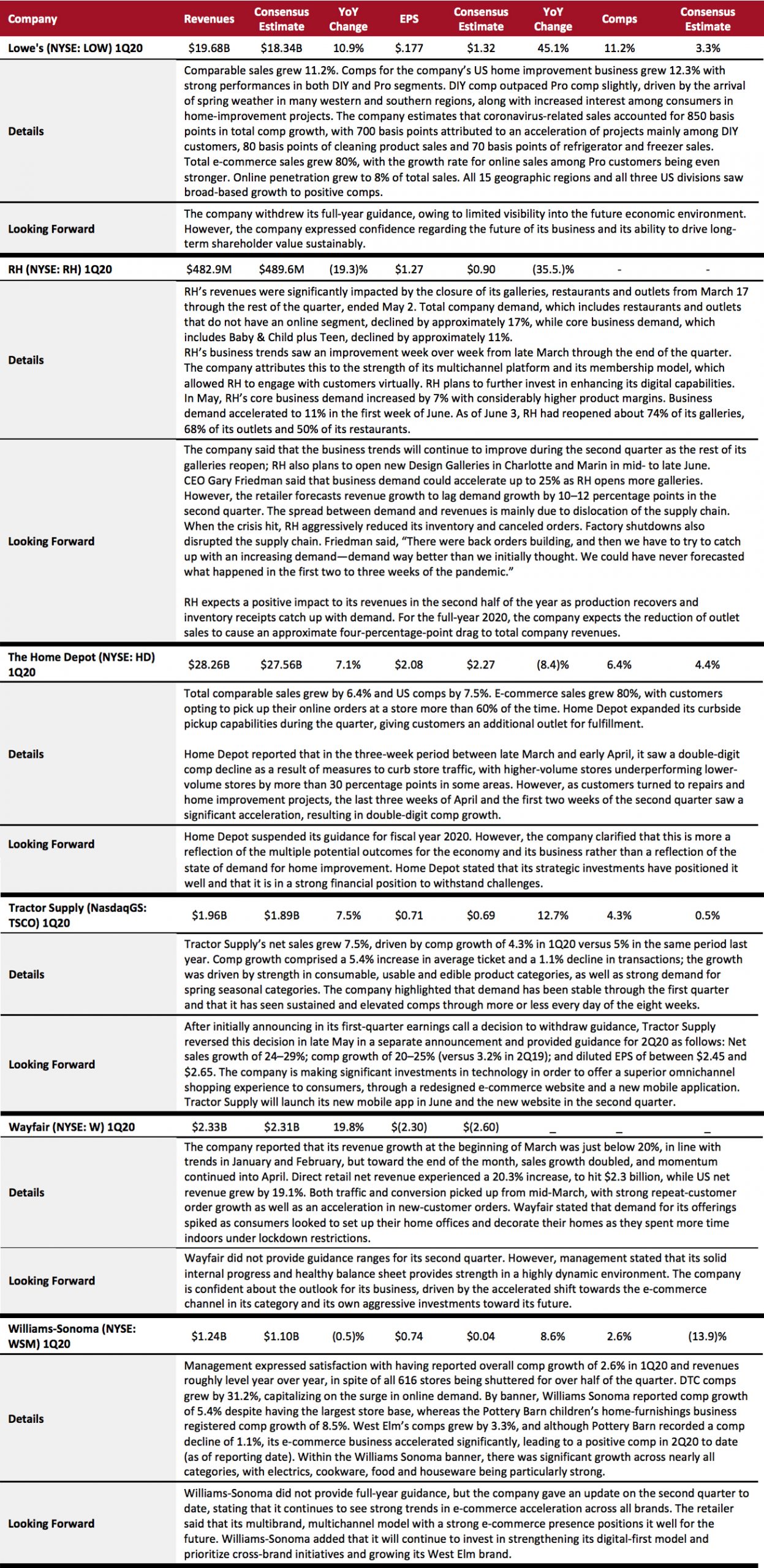

In home-improvement retail, the businesses of Tractor Supply, Lowe's and Home Depot are considered essential and so could remain open during lockdown; these companies saw an increase in demand, supported by consumers spending more time indoors.

In furniture, digitally dominant retailers Wayfair and Williams-Sonoma also flourished under the changed environment as there was an acceleration in e-commerce channel adoption among consumers. Brick-and-mortar store-dependent RH suffered during the quarter on account of the shutdown but said that it expects a positive impact to its revenues in the second half of the year as production recovers and inventory receipts catch up to demand.

Five of the six Coresight 100 companies beat consensus on EPS, with only Home Depot missing out, and all four companies that reported comps beat consensus.

Looking Forward

With the e-commerce channel helping retailers to offset some of the lost sales from brick-and-mortar store closures and reduced in-store inventory, some retailers are looking to strengthen their digital models, including through the expansion of ship-from-store capabilities or the implementation of several omnichannel options, such as BOPIS and curbside pickup. However, rising digital penetration will pressurize gross margins.

Many retailers did not provide, or withdrew, their full-year financial guidance, reflecting uncertainty around several key factors, including the duration and intensity of the coronavirus crisis, consumer confidence, employment trends, the scale and duration of economic stimulus and the length and impact of stay-at-home orders. Readers seeking a view for the rest of 2020 and into 2021 may be interested in our Post-Crisis Outlook series of reports, which include

US Apparel Retail: Post-Crisis Outlook and

US Home and Home-Improvement Retail: Post-Crisis Outlook.

As stores have reopened, we are seeing a significant return to in-store shopping, apparently supported by pent-up demand, and this is reflected in the higher-than-anticipated sales productivity of reopened stores (especially for apparel). Some retailers, such as American Eagle Outfitters, have noted that they are continually clearing their spring and summer inventories and expect to enter the back-to-school season clean, but others are likely to implement substantial markdowns to clear inventory—leading to a period of heightened promotions, especially in the apparel and department-store sectors.