- E-commerce and home and home improvement were the two sectors in which 100% of the companies (five and six, respectively) beat consensus revenue estimates. Rounding out the top three in terms of revenue beats was the CPG sector, in which three out of four companies beat consensus revenues.

- Luxury brands/retailers led the group in earnings beats, with 100% (five companies) beating consensus EPS estimates. Apparel and footwear companies came in second place, with 88% (seven companies) and specialty apparel retailers came in third with 82% (nine companies) beating consensus EPS estimates.

- The worst performing retail channel was department stores, in which 80% (four companies) missed consensus revenue estimates and 60% (three companies) missed EPS estimates.

- A strong US dollar is impacting companies across sectors, abroad as well as domestically with international travelers.

- The e-commerce sector continues to see a consolidation of market share to Alibaba and JD.com as a duopoly in China and to Amazon in the US.

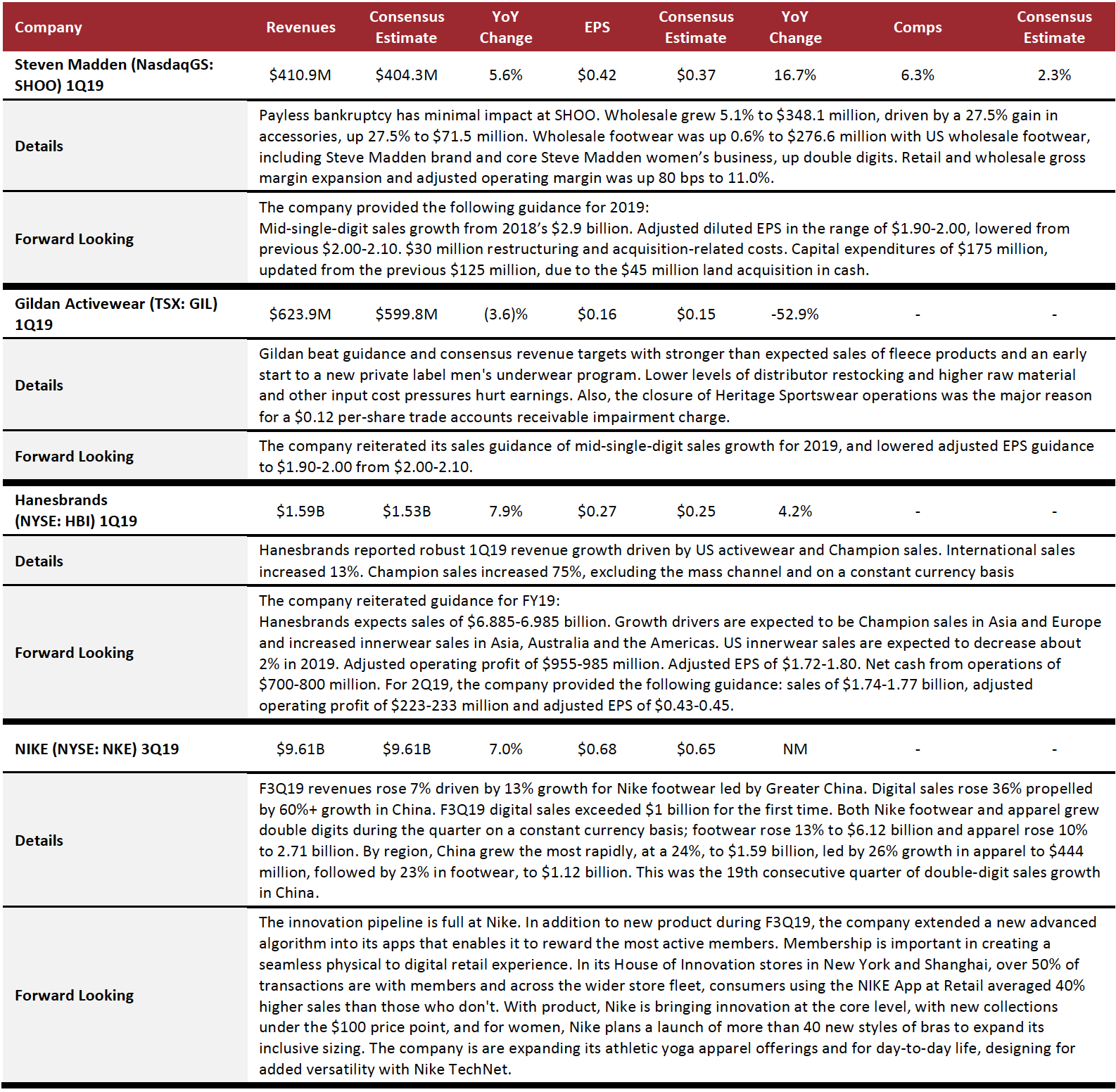

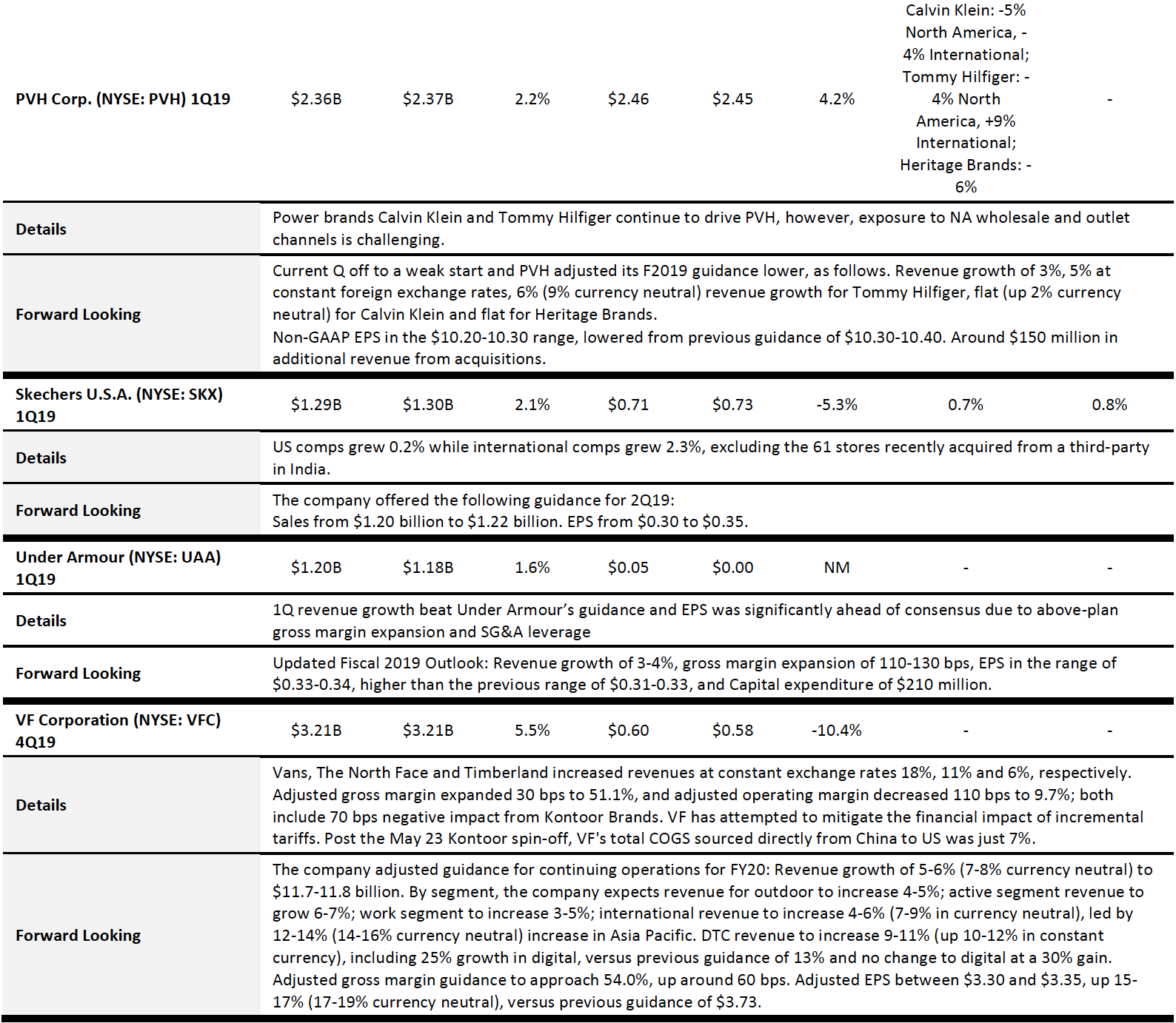

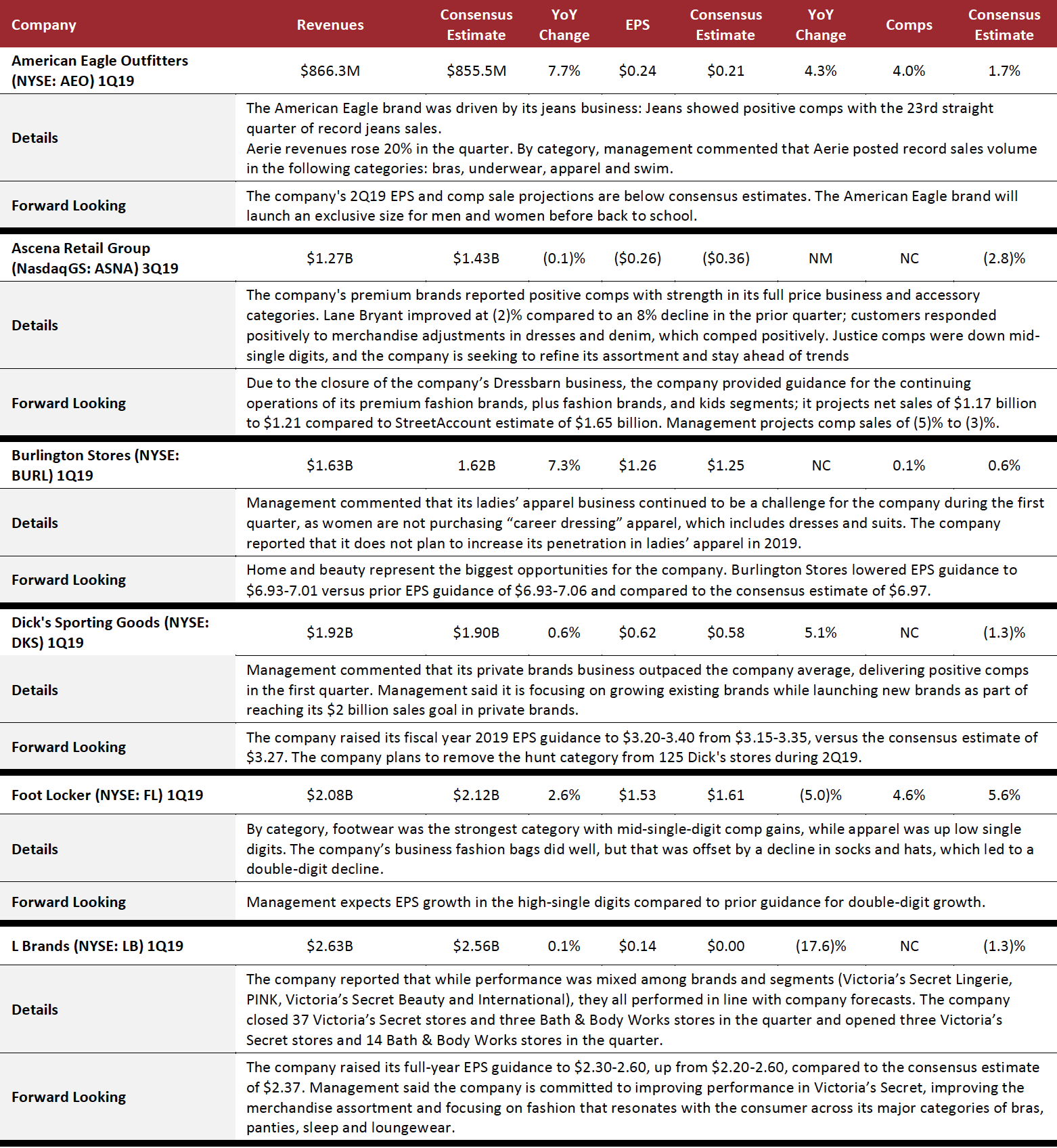

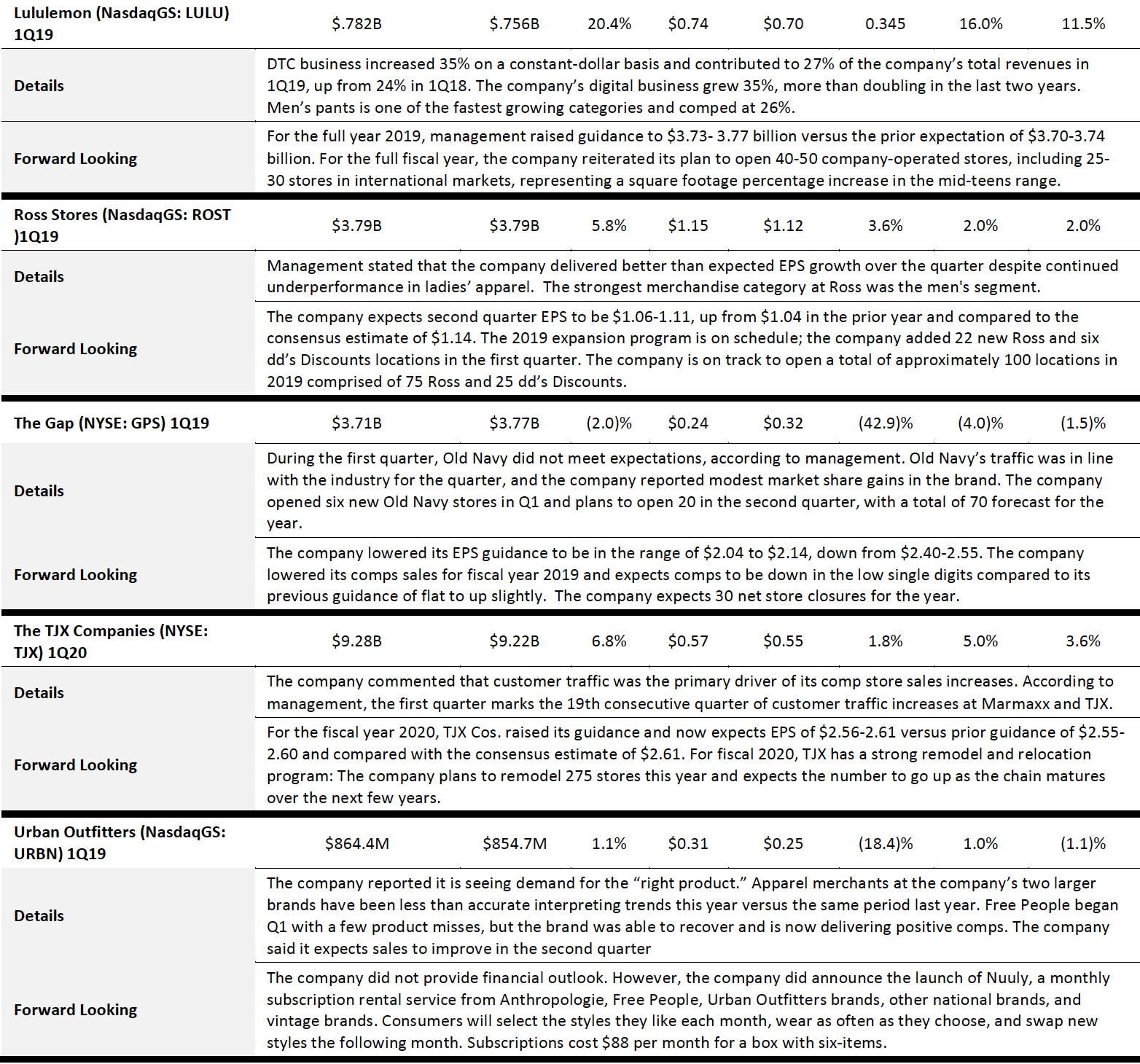

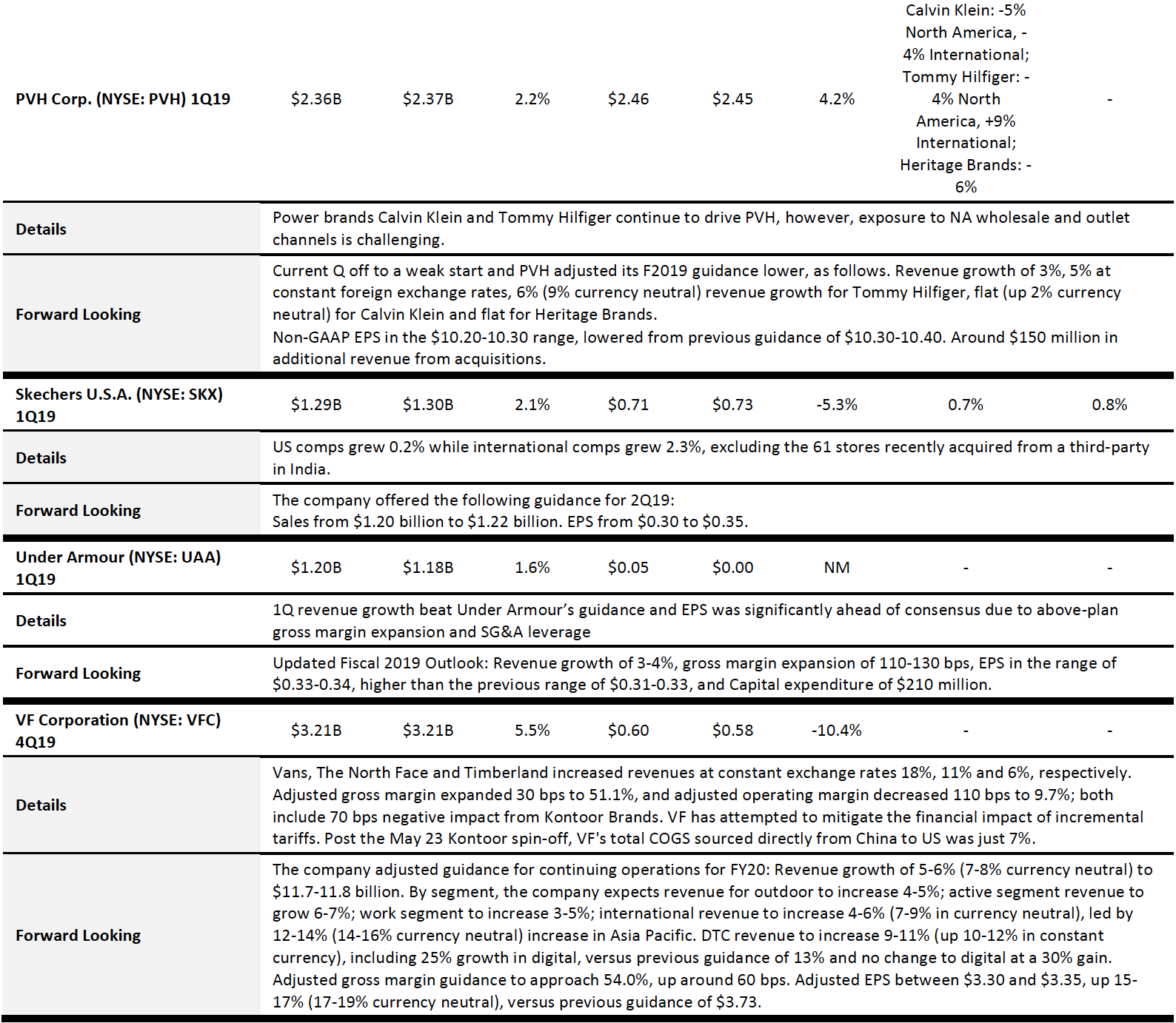

Apparel and Footwear

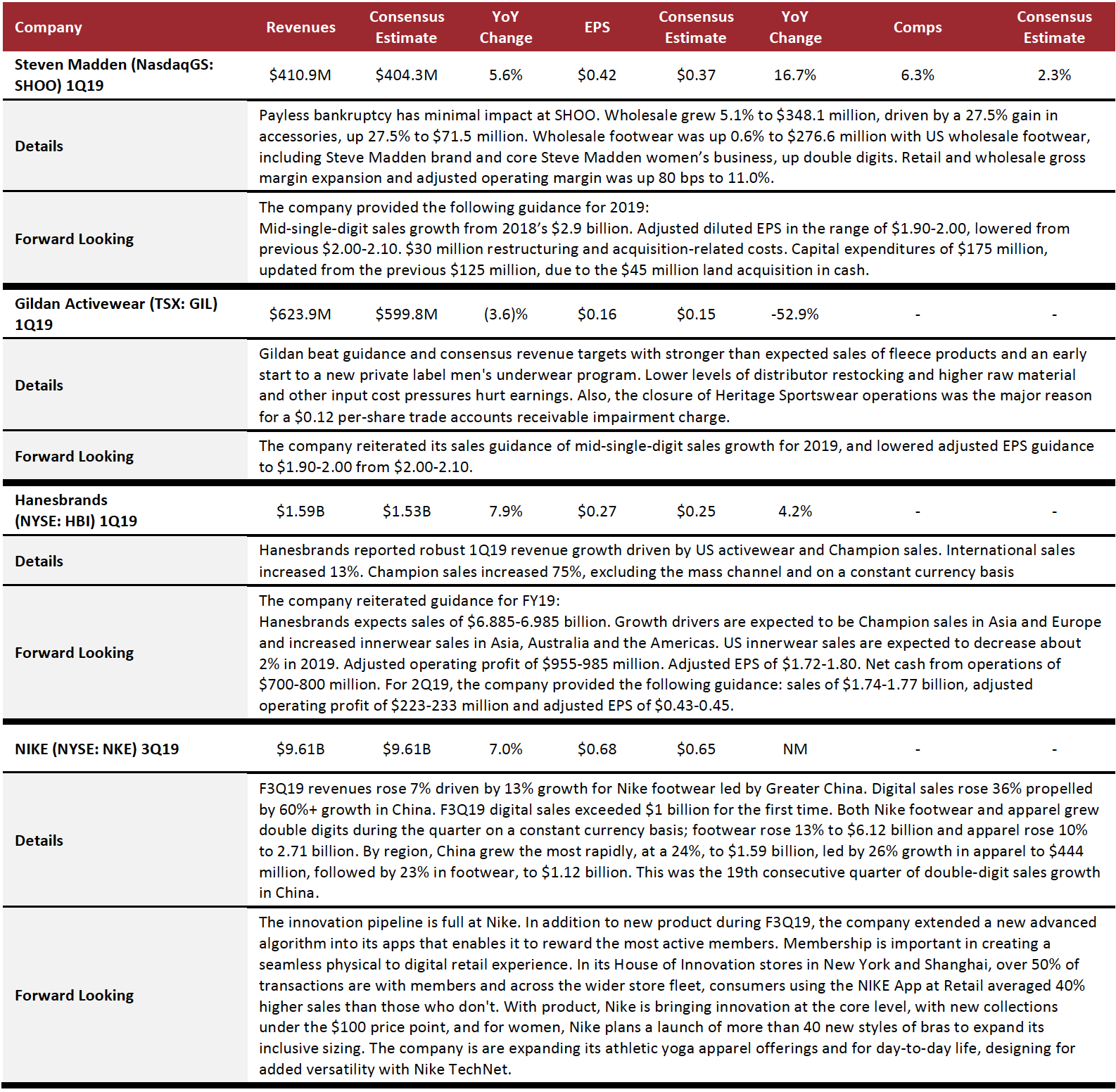

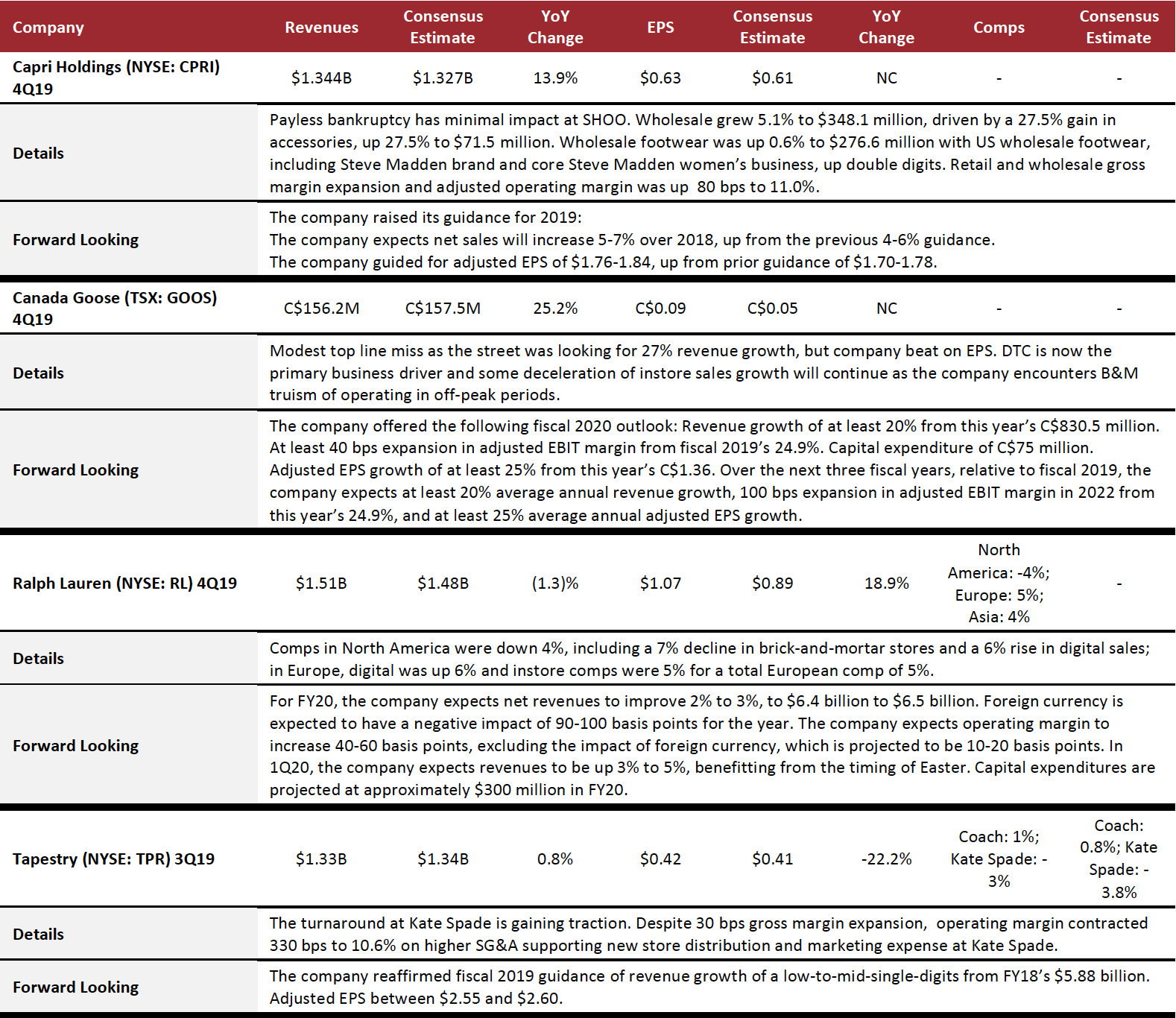

70% of US apparel and footwear Coresight 100 companies beat consensus revenue estimates and all but one beat on EPS, reflecting strong brand equity and successful direct-to-consumer (DTC) and growth strategies (new geographies/new categories and product adjacencies). Looking forward, the uncertainty regarding China/US tariffs and the strength of the US dollar caused a number of brands to reduce guidance or maintain guidance despite a strong calendar Q1.

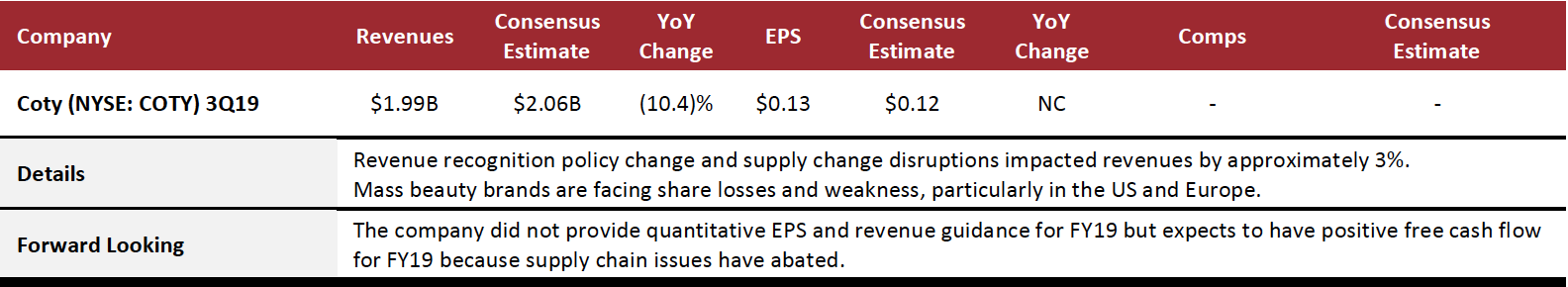

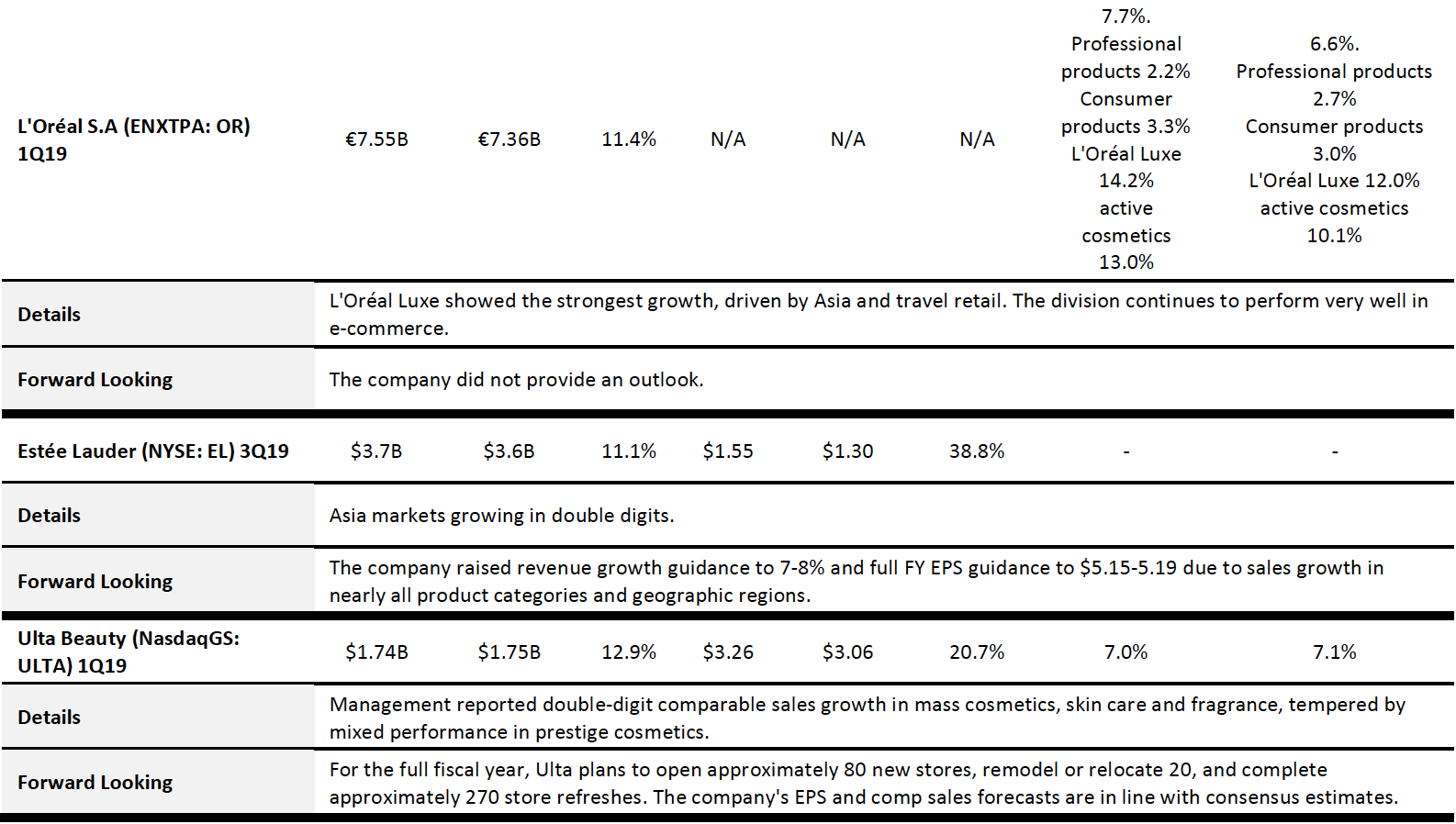

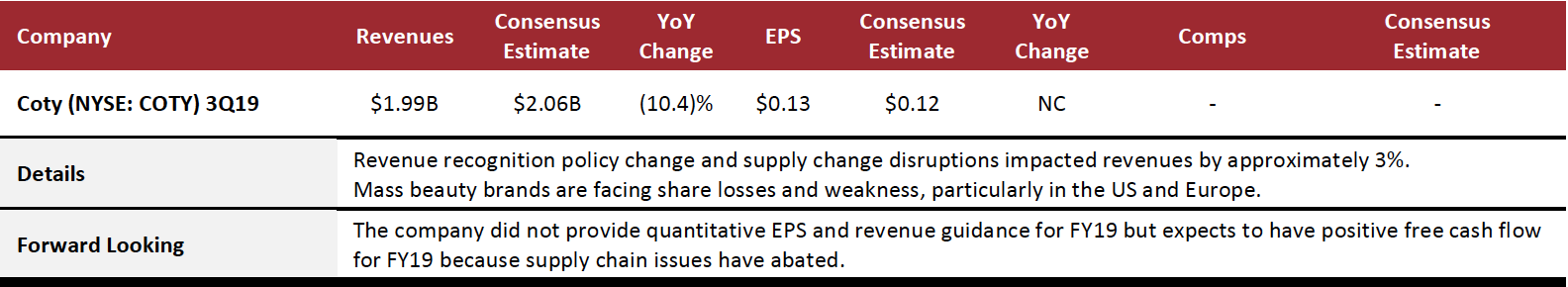

Beauty Brands and Retailers

Overall, the beauty brands and retailers sector saw growth geographically in the Asian market and in the luxury cosmetics category. For example, Estée Lauder reported that two-thirds of the markets in the region showed grew by double digits. L'Oréal reported that its Asia market grew by 23.2%, with all divisions reporting strong growth. Coty reported strong growth in luxury in China and the Middle East. Ulta reported double-digit comparable sales growth in mass cosmetics, whereas prestige/luxury cosmetics were stronger at L'Oréal and Estée Lauder.

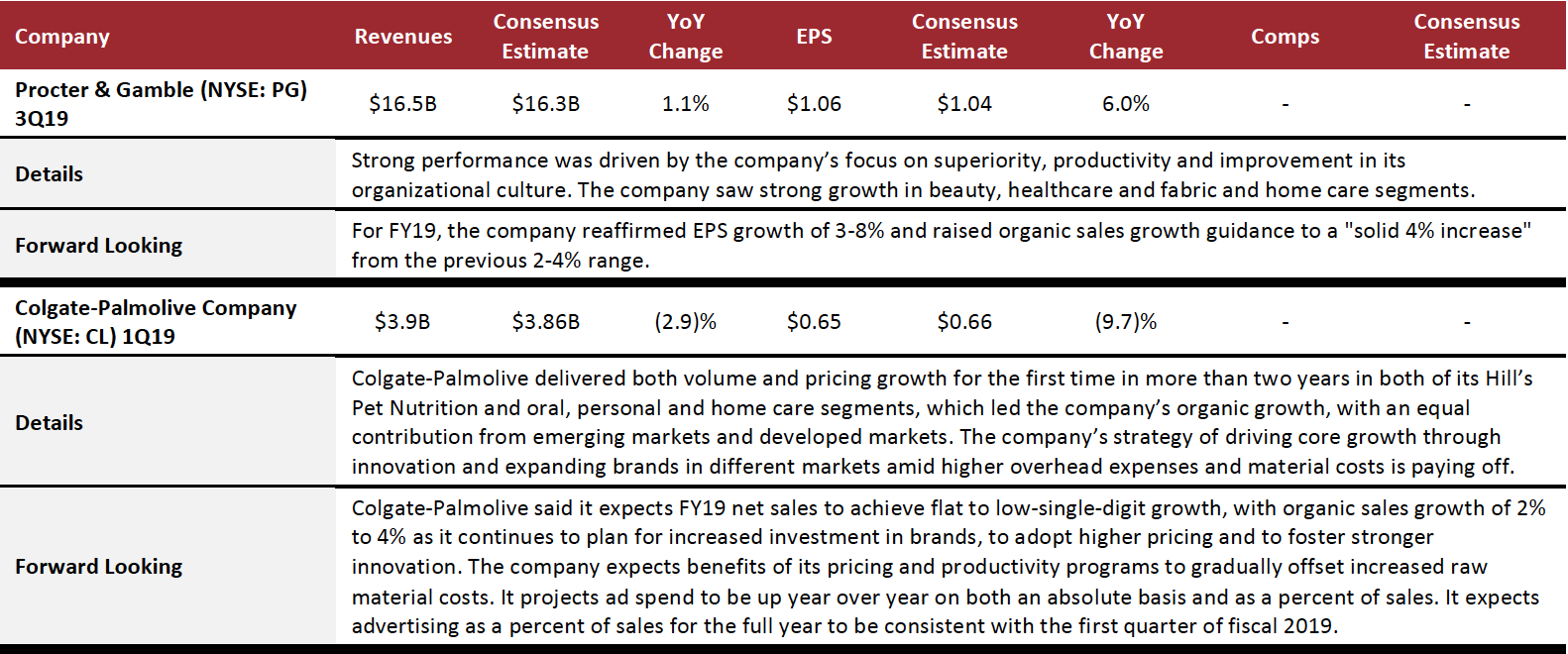

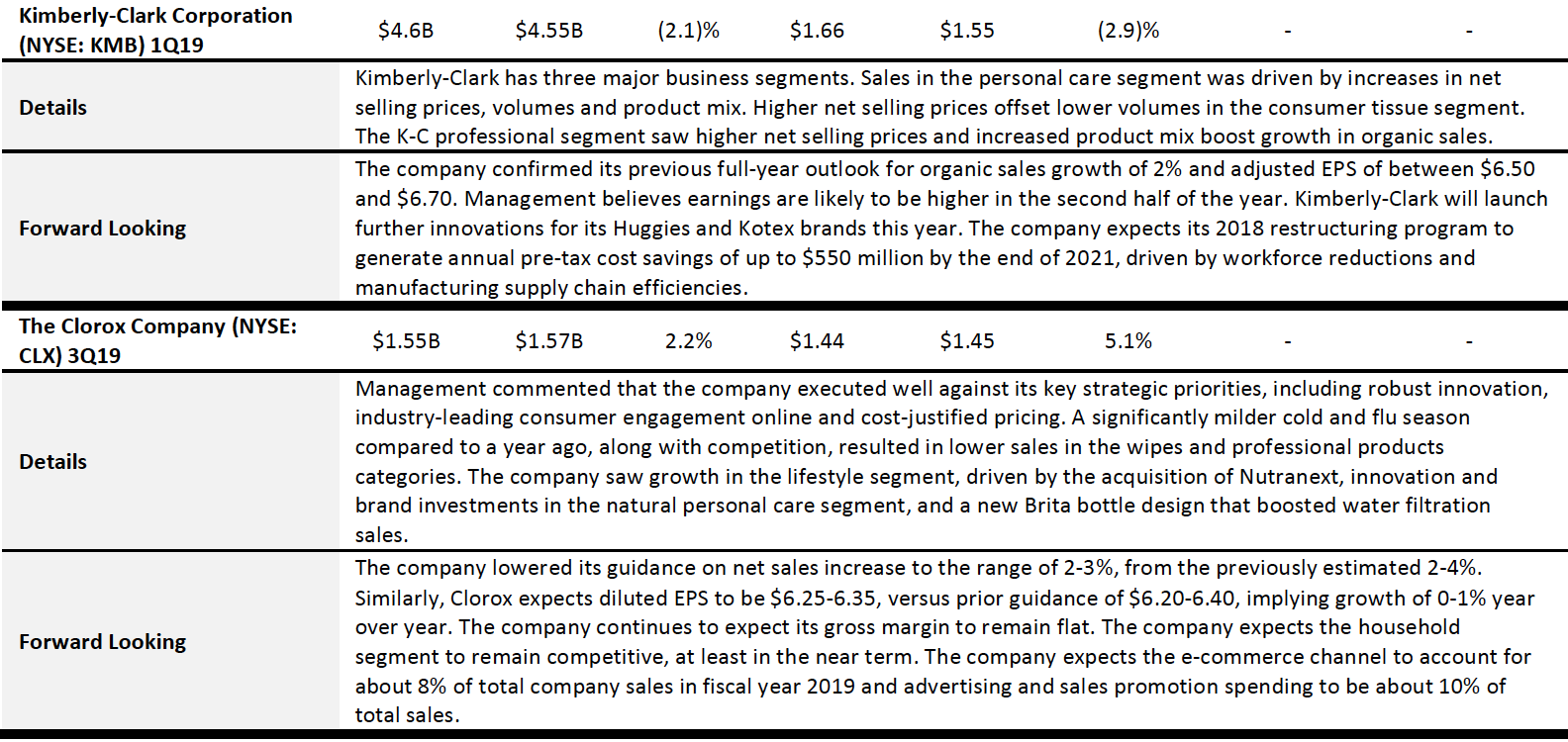

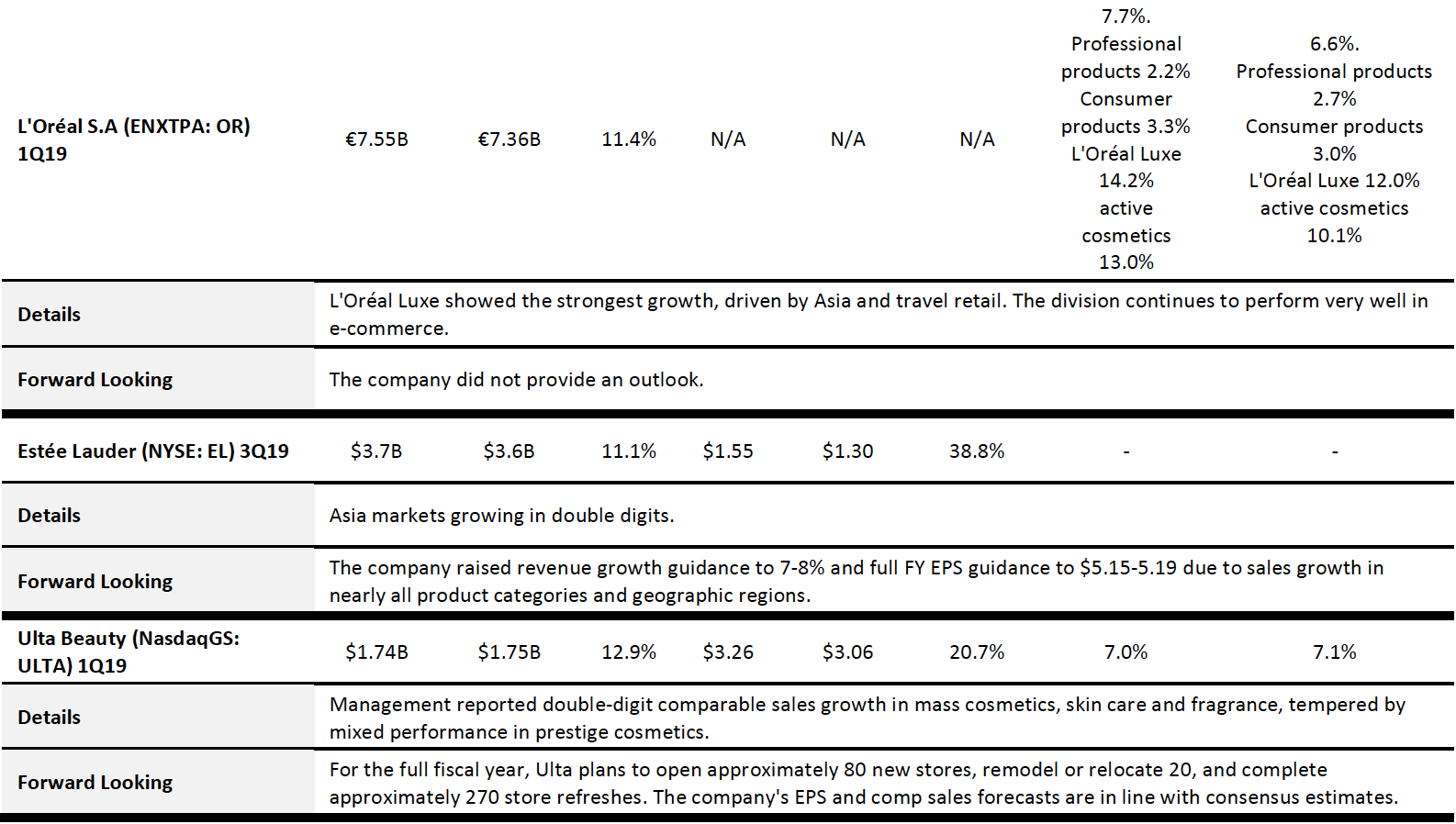

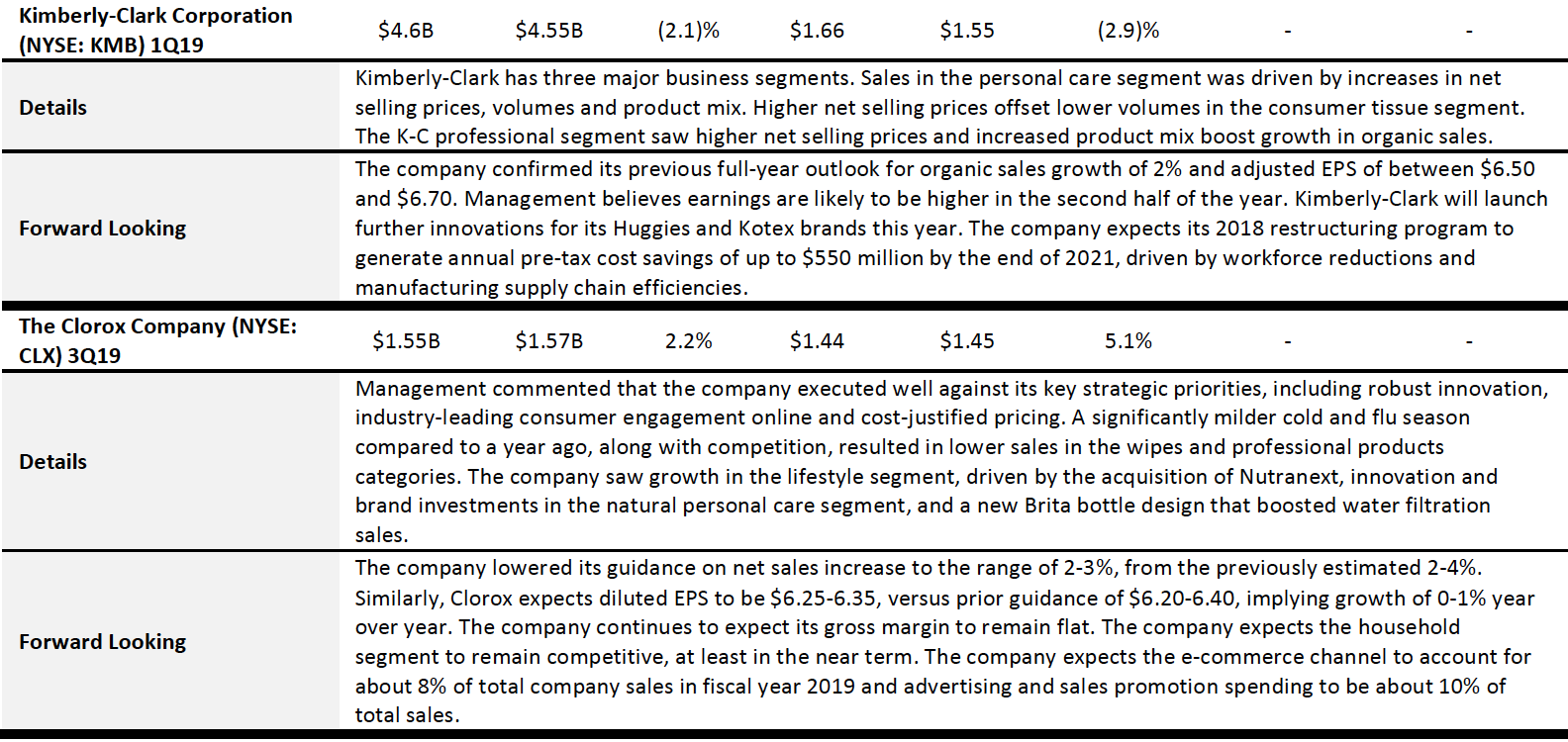

Consumer Packaged Goods (CPG)

The sector saw strong growth across every company. Despite slowing global economic growth due to ongoing trade disputes, CPG products are mostly necessities with inelastic demand, and consumers are reluctant to shift to lower-end brands. The sector is poised to be less impacted by economic and political instability. The negative impact by a shift to DTC and digital disruption are being offset by strong organic growth in product prices and volume. A shift to superior products and a growing emerging market are the duo-tailwinds to the sector, while an escalation of economic tension could still shake the revenues and earnings of the sector.

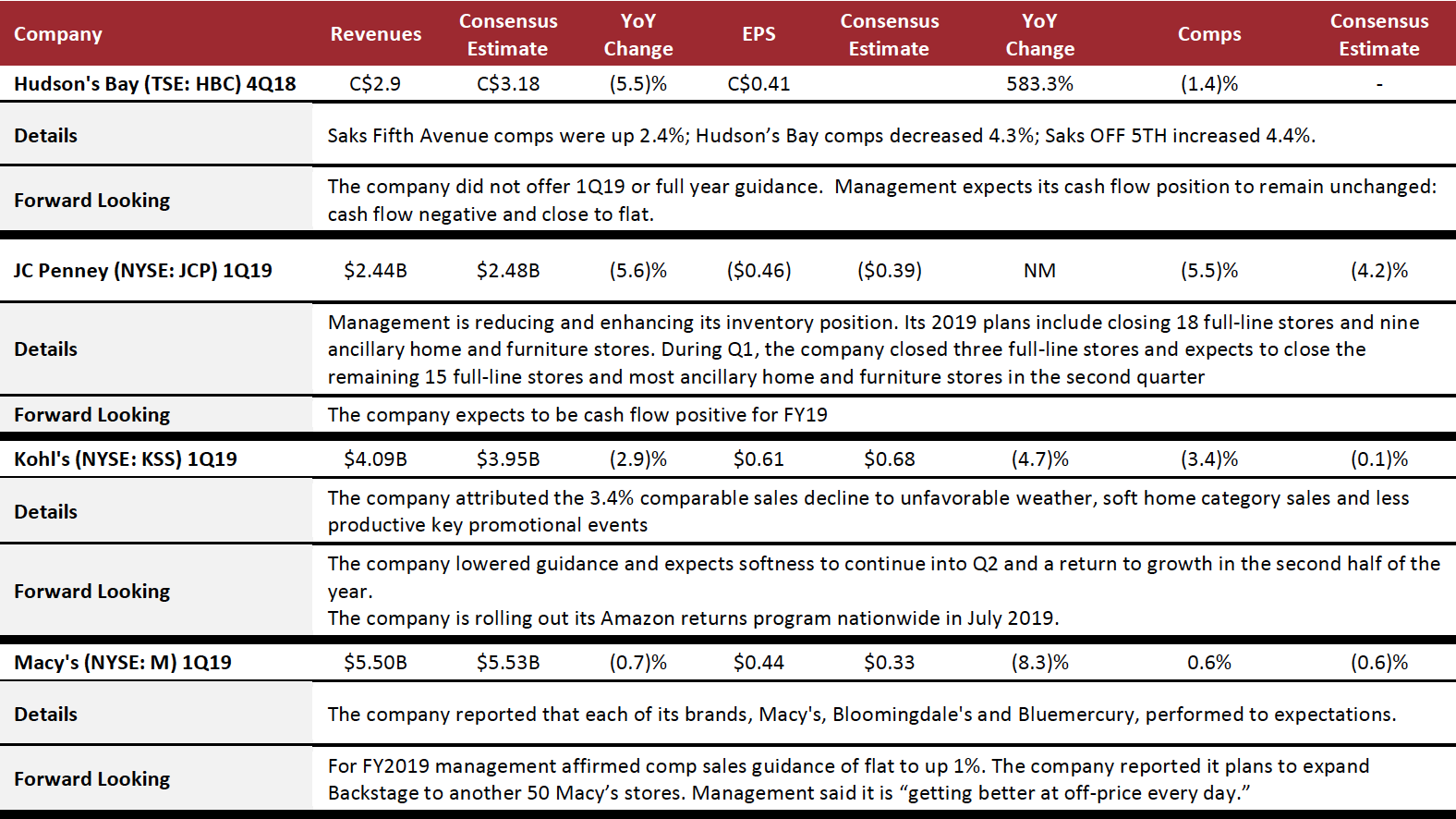

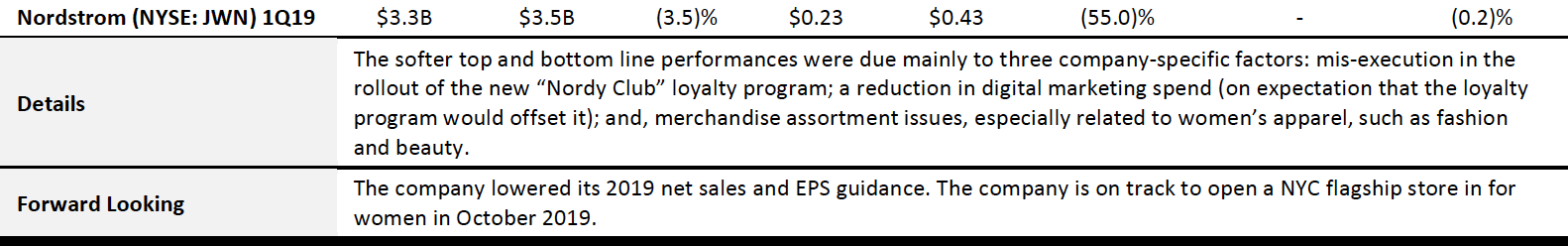

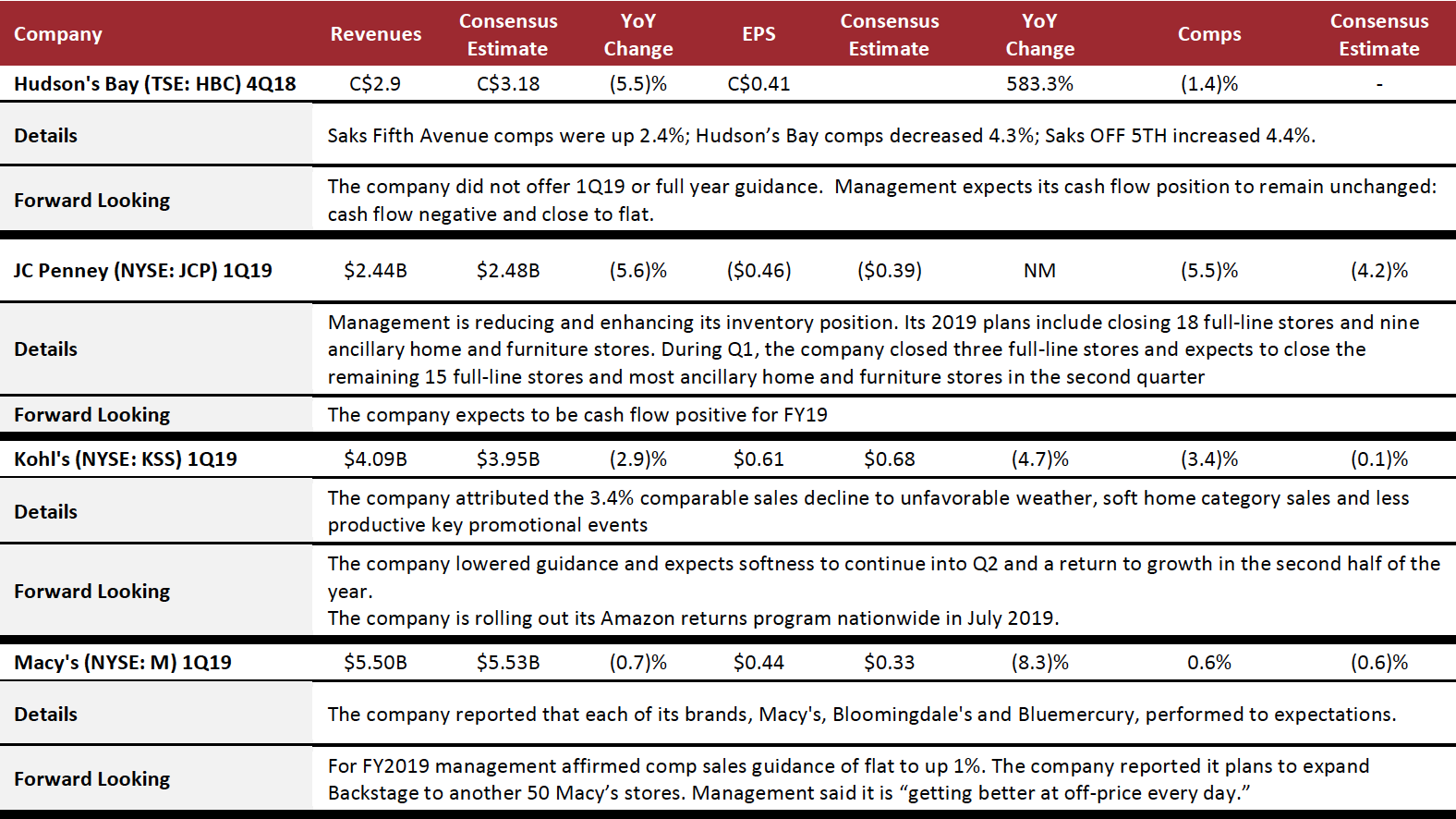

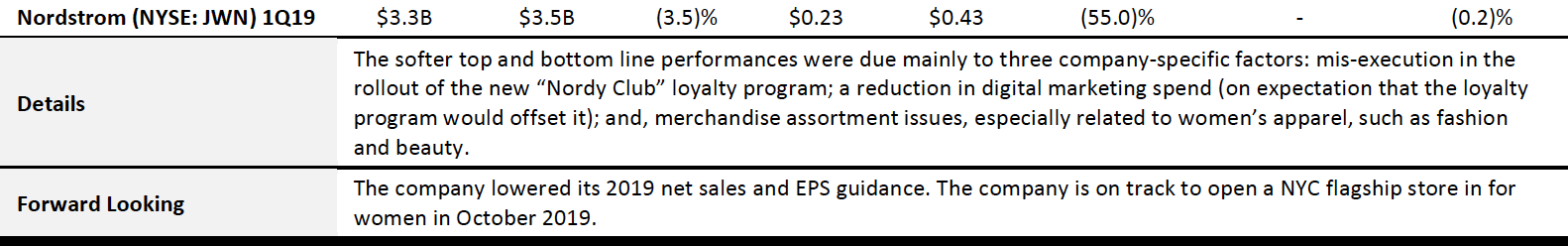

Department Stores

The off-price model is working for Macy's: The company announced it would expand Backstage to 50 more stores in FY19. However, the full price department store sector continues to reduce inventory. During the first quarter, JCPenney closed 3 stores and expects to close 15 more in 2Q, and HBC entered a real estate deal to exit its stores in Germany. In terms of categories, beauty and home were cited as white space for Kohl's, and men's performed better than women's overall.

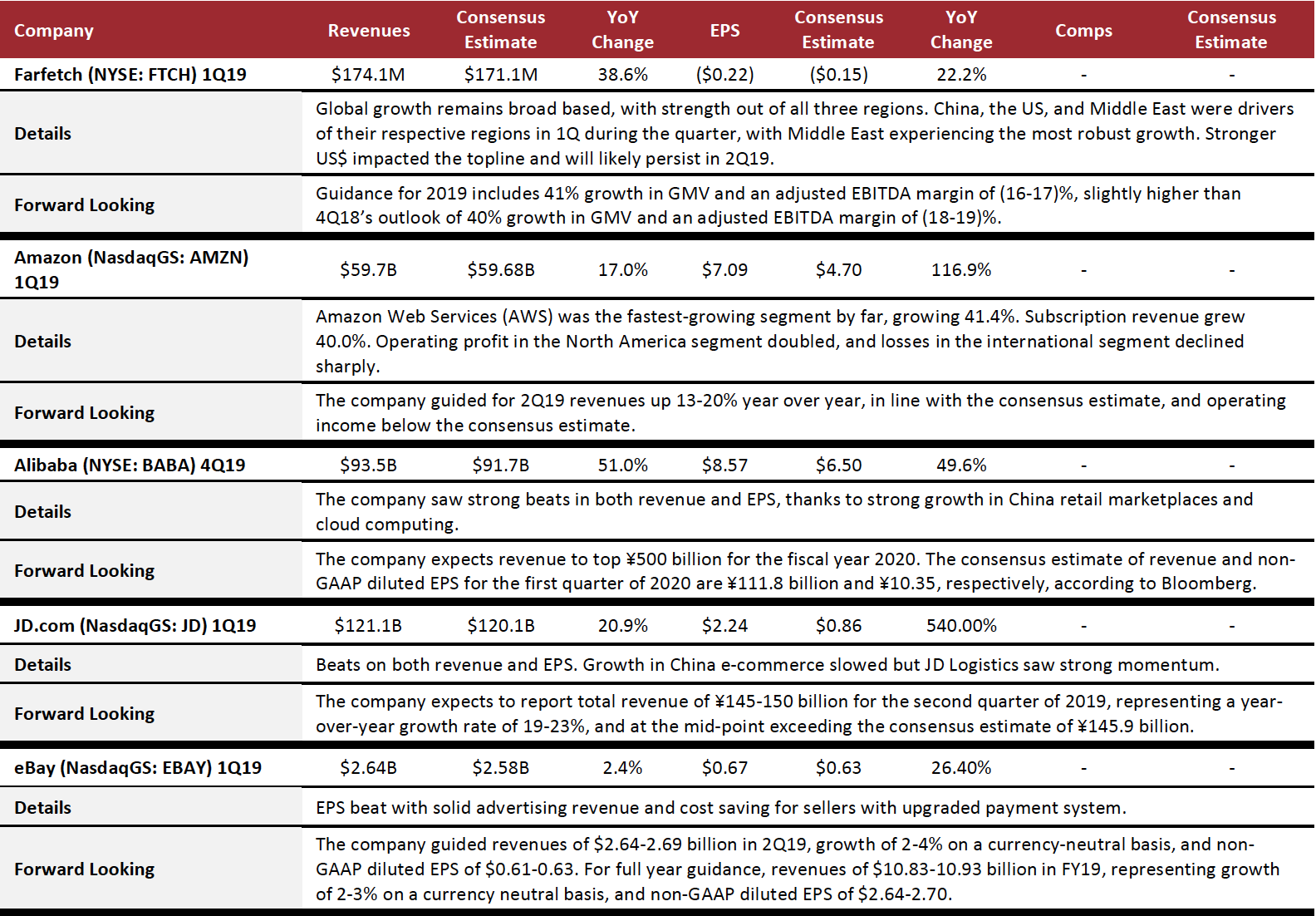

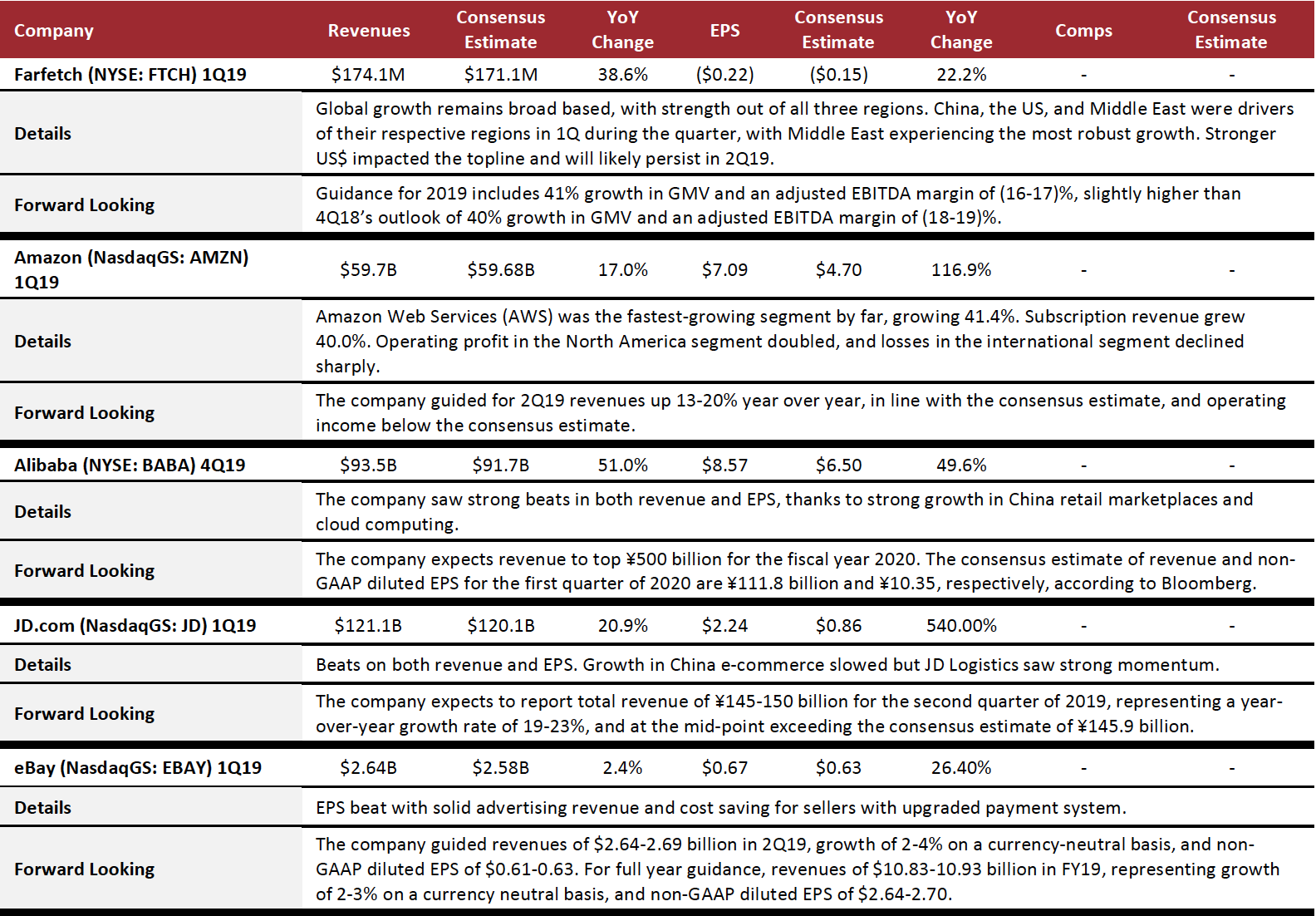

E-Commerce

The sector continues to see consolidation to Alibaba and JD.com as a duopoly in China and to Amazon in the US. Market leaders posted strong growth at the top and bottom lines. The sector looks poised to see continuing consolidation with further market share captured by market leaders. Amazon reported solid Q2 results and Q3 guidance; however, it is notable that revenue growth for its online stores decelerated to 9.5%, below the overall growth rate of US e-commerce in Q1.

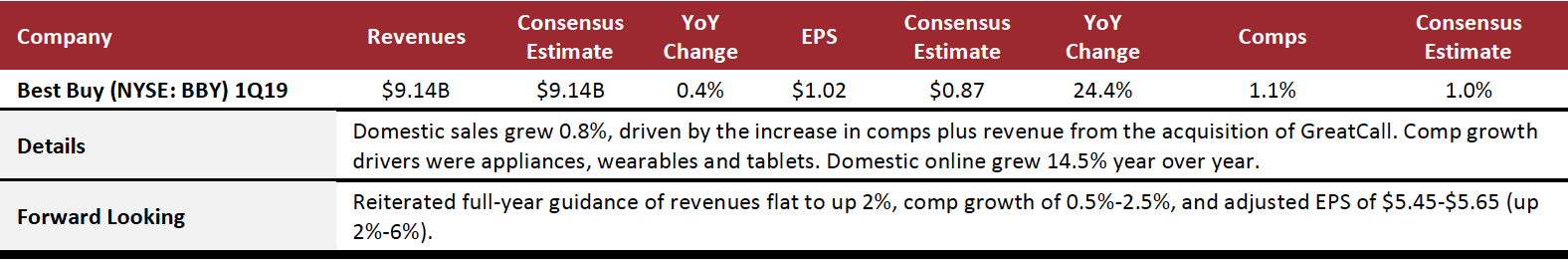

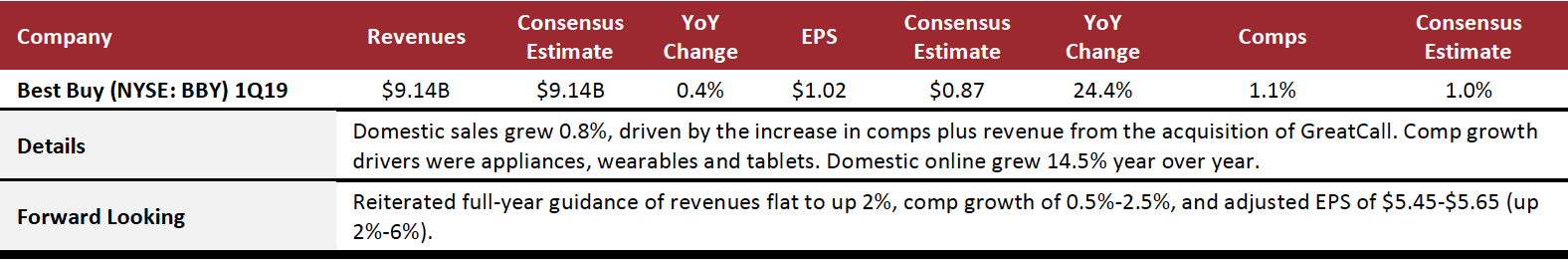

Electronics Retail

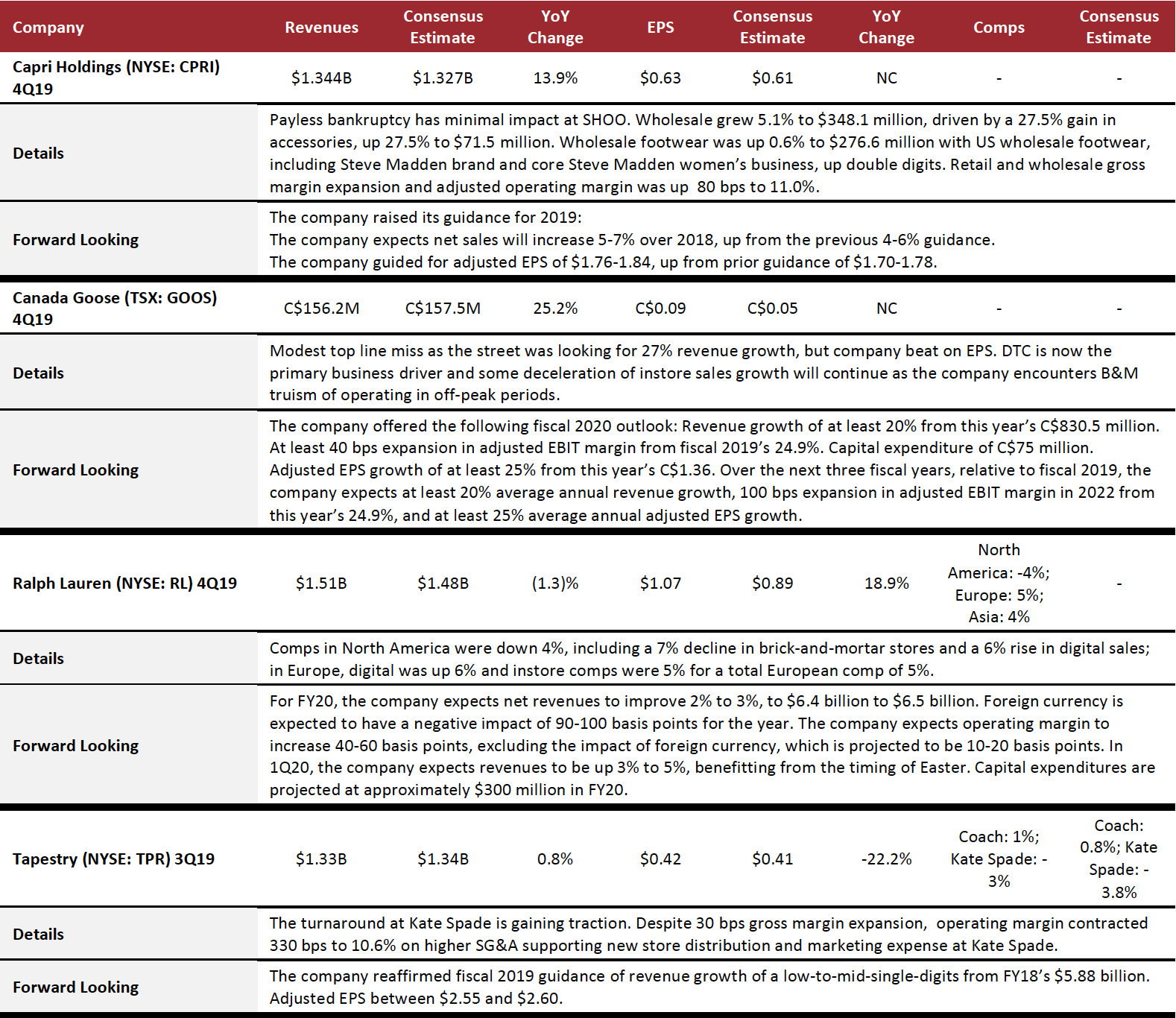

Luxury

All US based luxury Coresight 100 companies beat consensus EPS estimates, but only two, Capri and Ralph Lauren, beat consensus revenue estimates. A strong US dollar is impacting luxury abroad as well as domestically with international travelers.

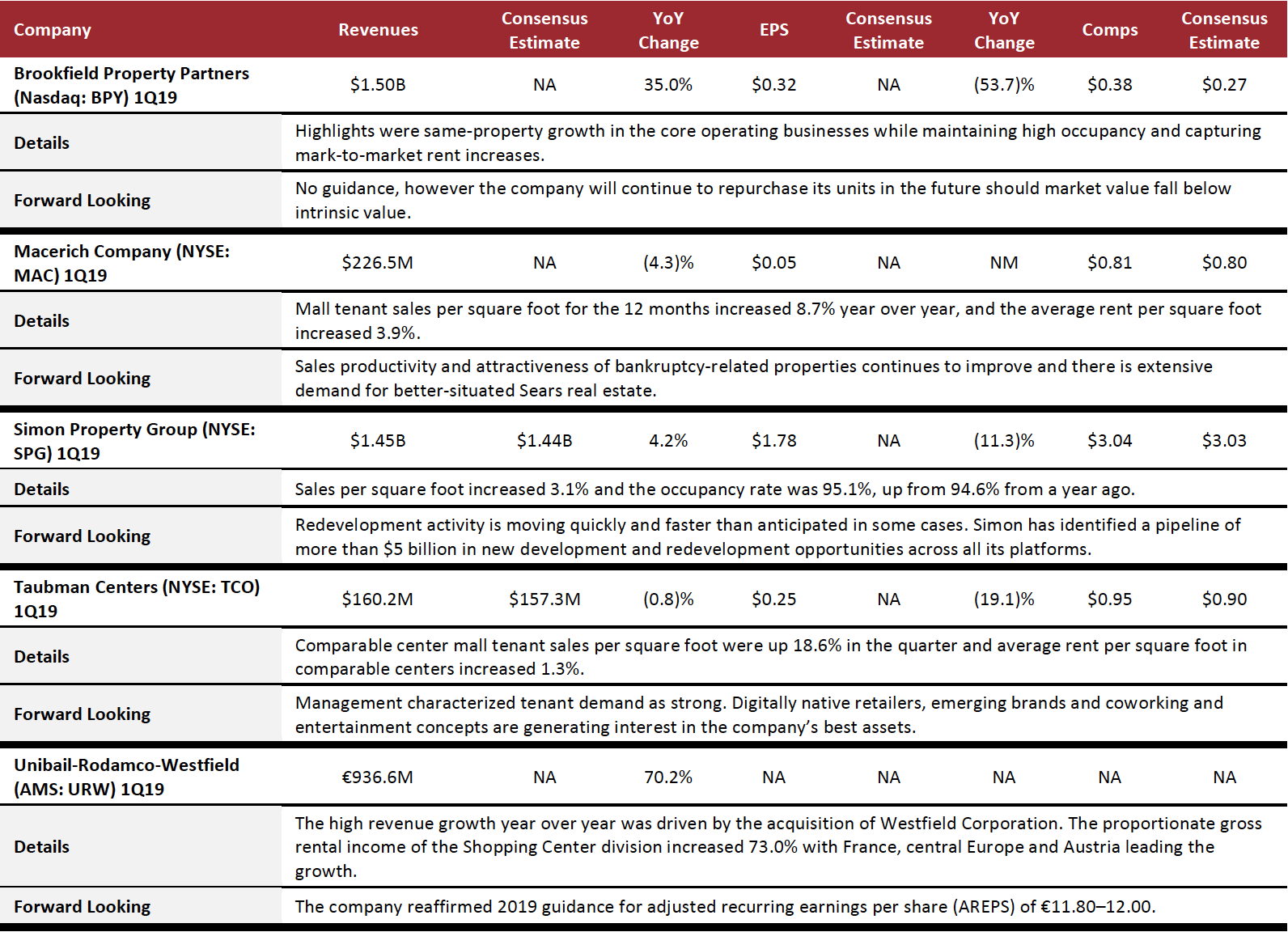

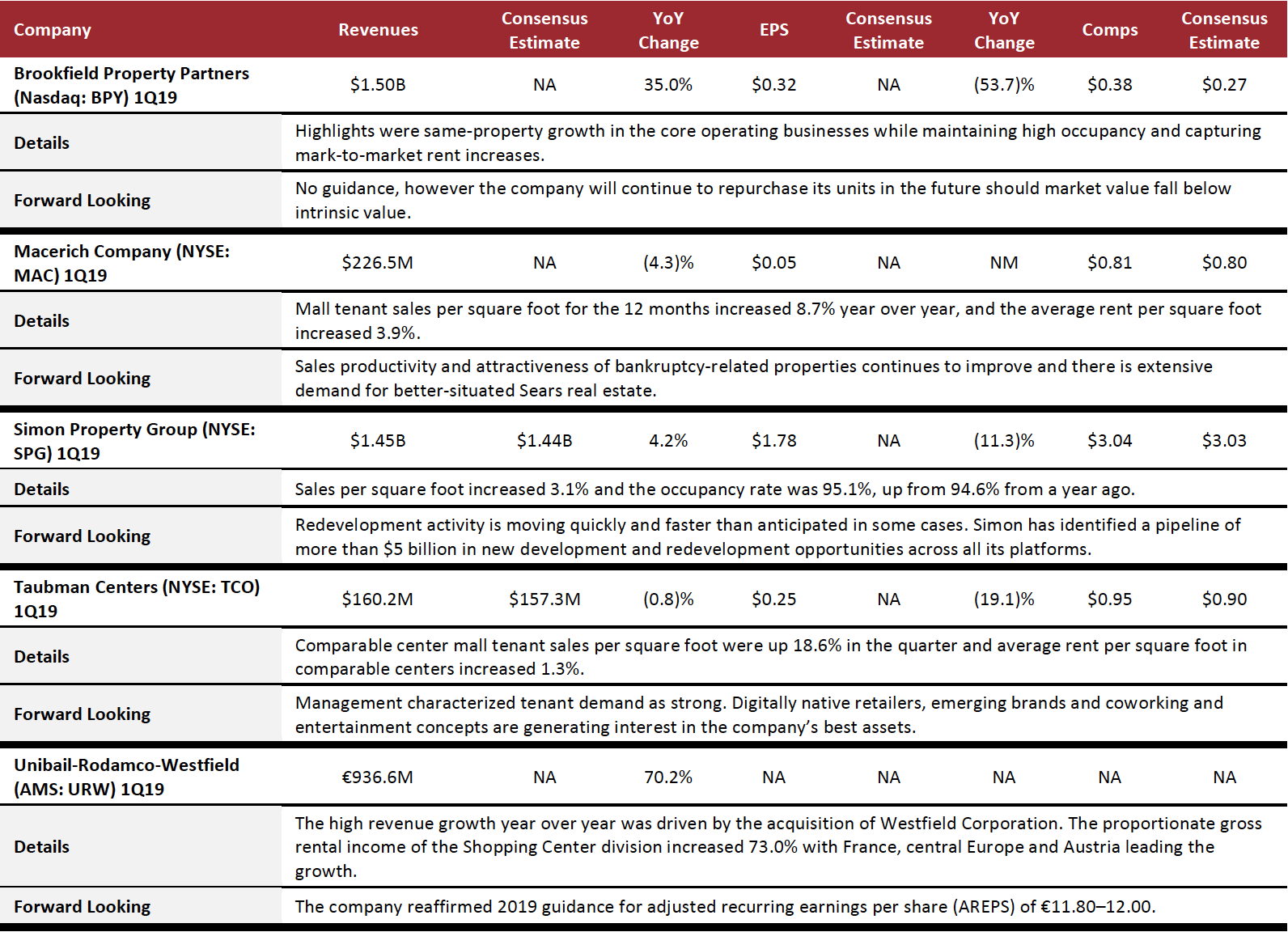

REITs

US REITs generally saw increases in sales per square foot, average rents per square foot and occupancy rates in the quarter, though earnings varied due to company-specific factors. Macerich reported significant interest in properties available due to bankruptcies, including well-situated Sears locations.

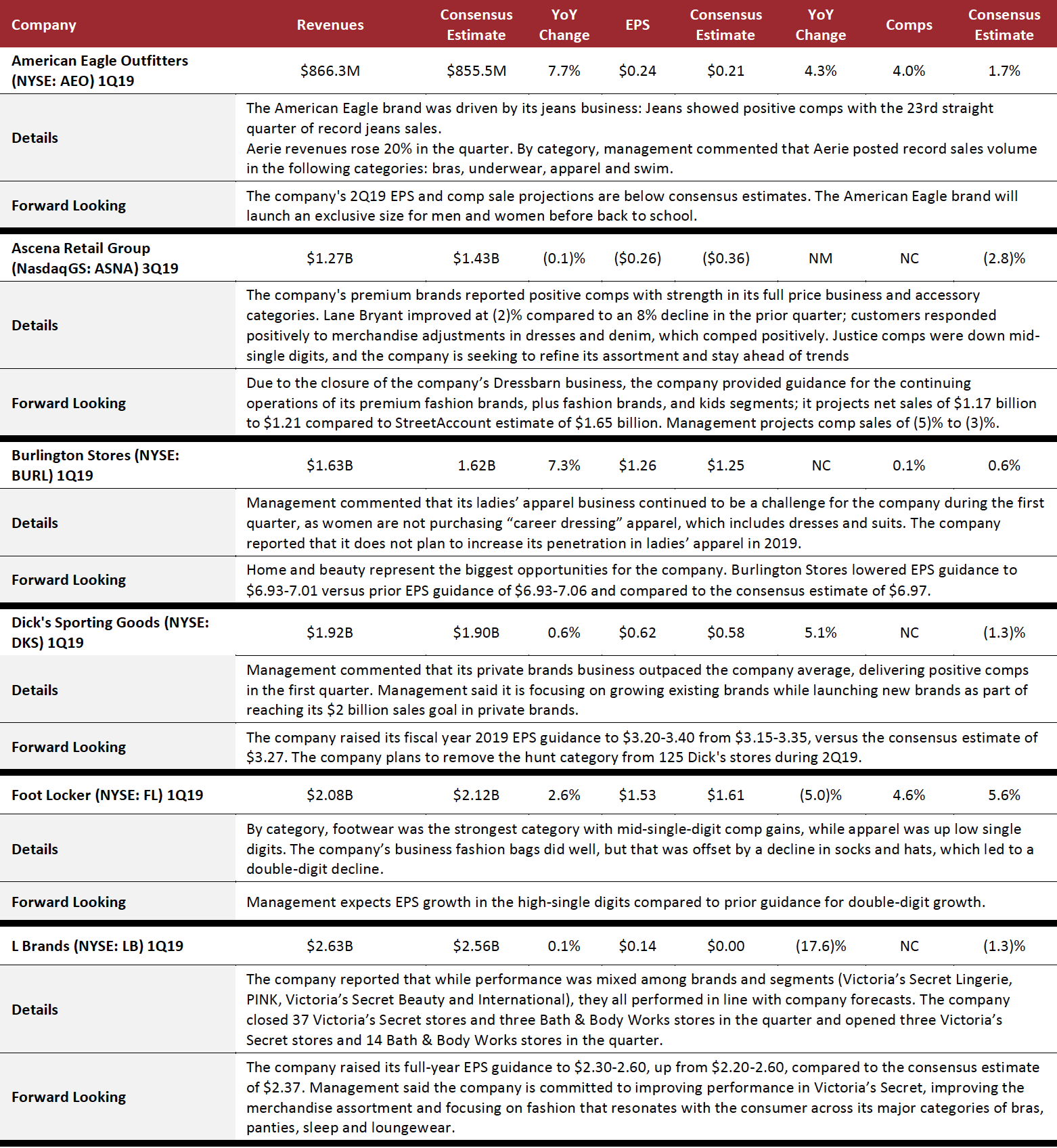

Specialty Retail

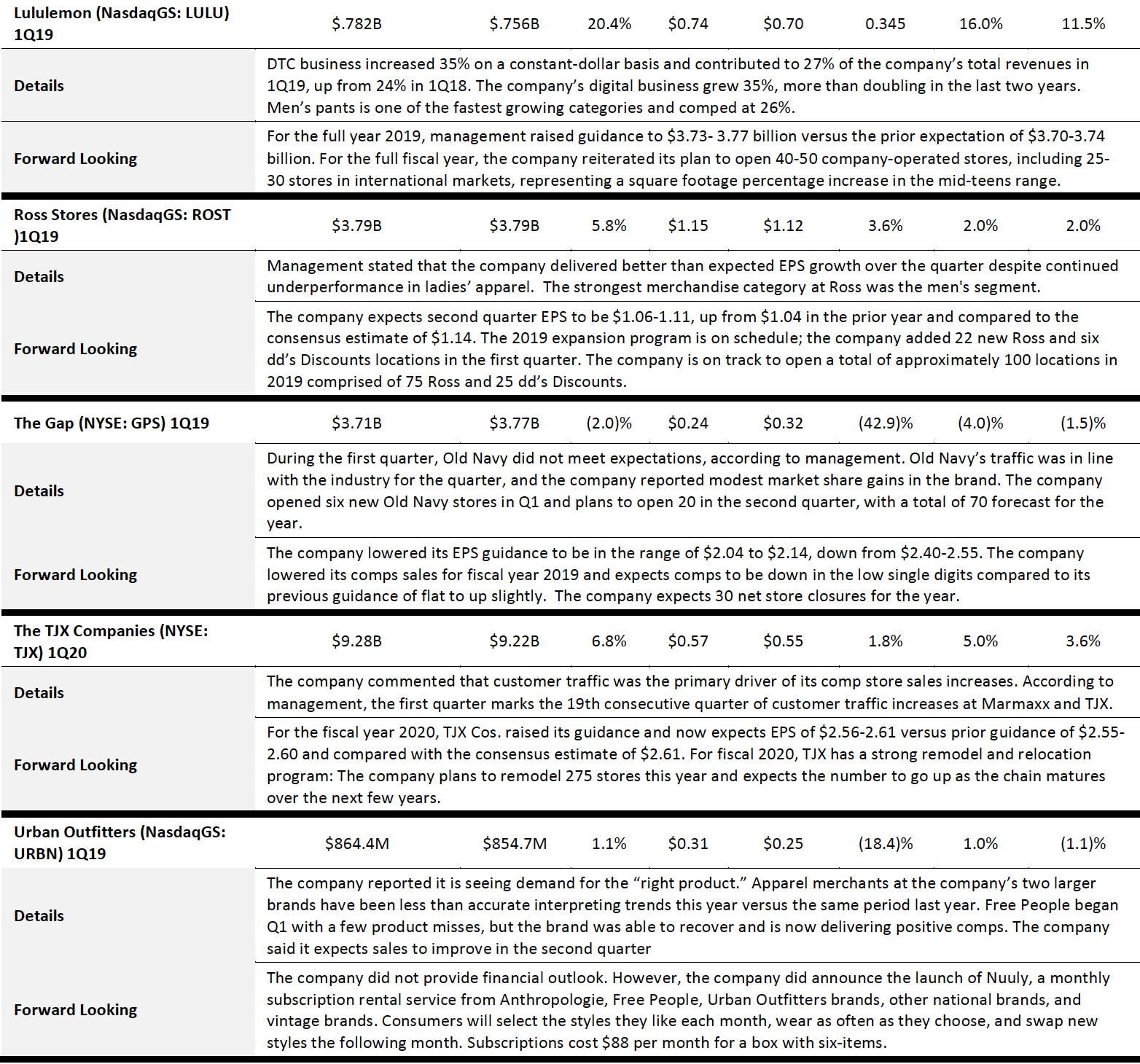

US specialty apparel did not meet expectations for the following main reasons: weather impacts, inaccurately predicting trends, merchandise assortment, and, according to Burlington, "career dressing no longer in fashion." The major traffic drivers over the quarter include: men's fashion, denim and comfortable lingerie. The men's segment is growing at Lululemon and Ross Stores.

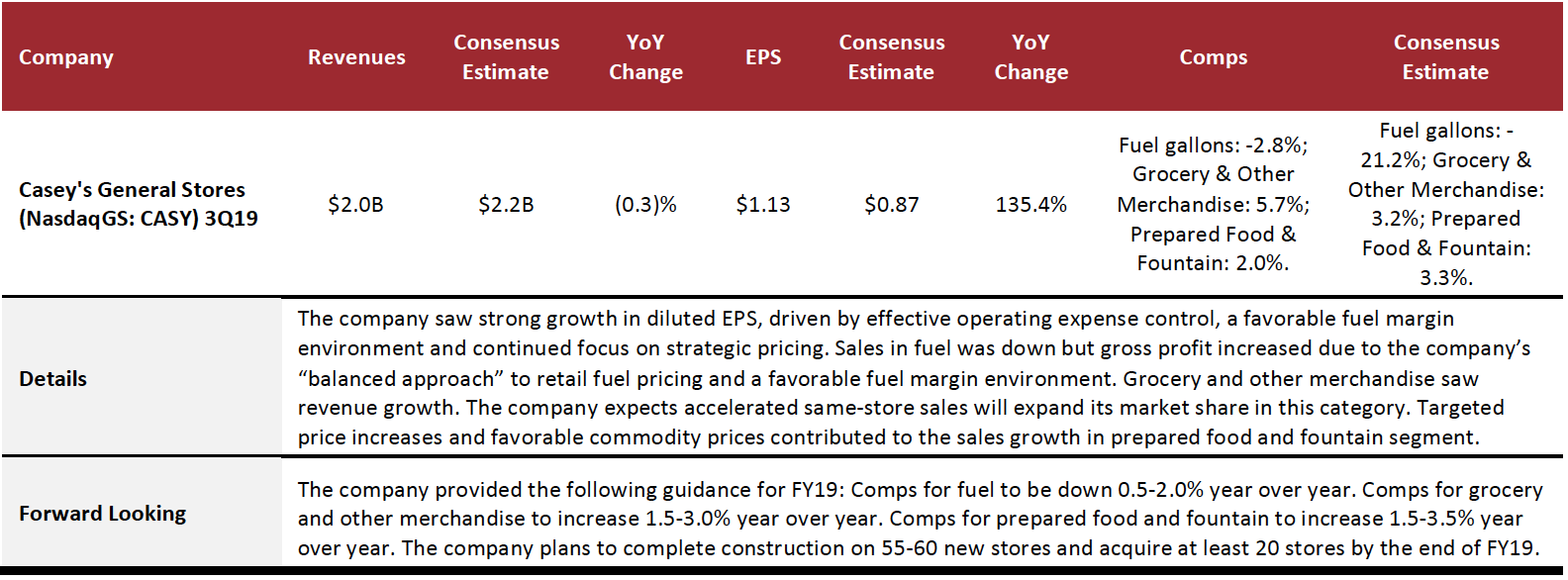

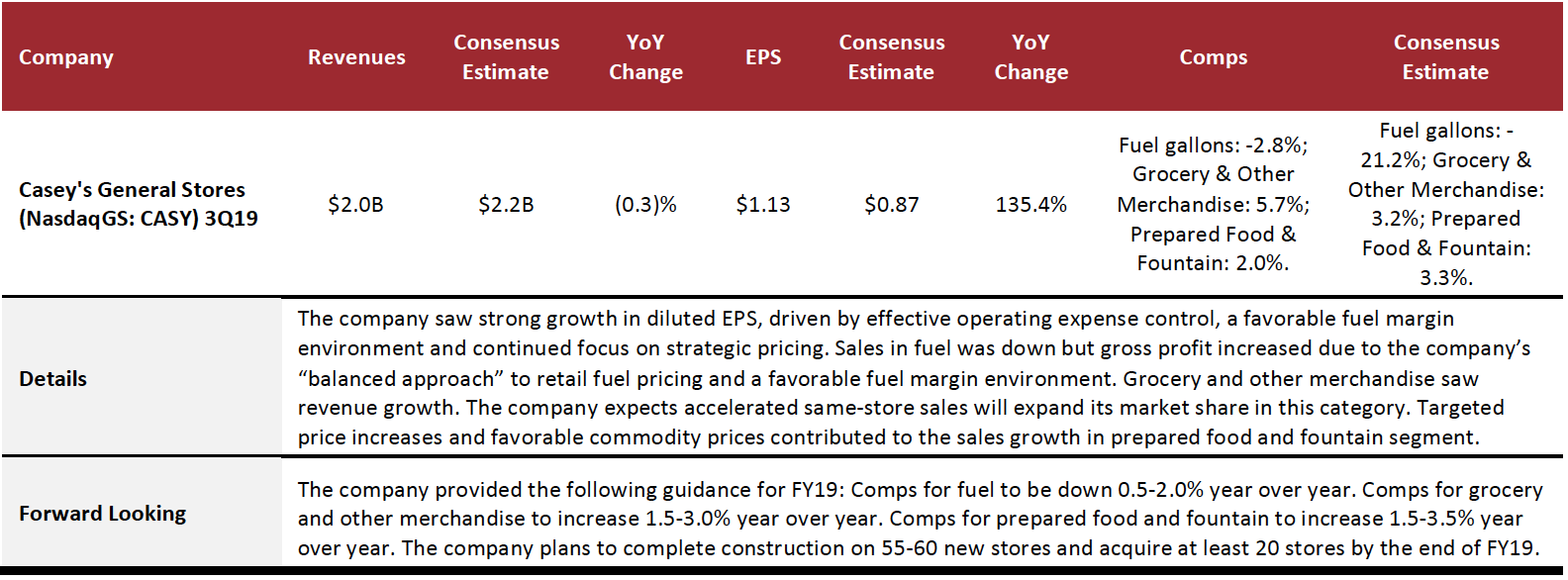

Food, Drug and Mass: Convenience Stores

Favorable commodity prices have contributed to the food segment. A favorable fuel margin environment is another tailwind to the sector in the US. Convenience stores provide convenience to local communities, meaning demand should be relatively inelastic, though changes in commodity prices could hurt or benefit a store.

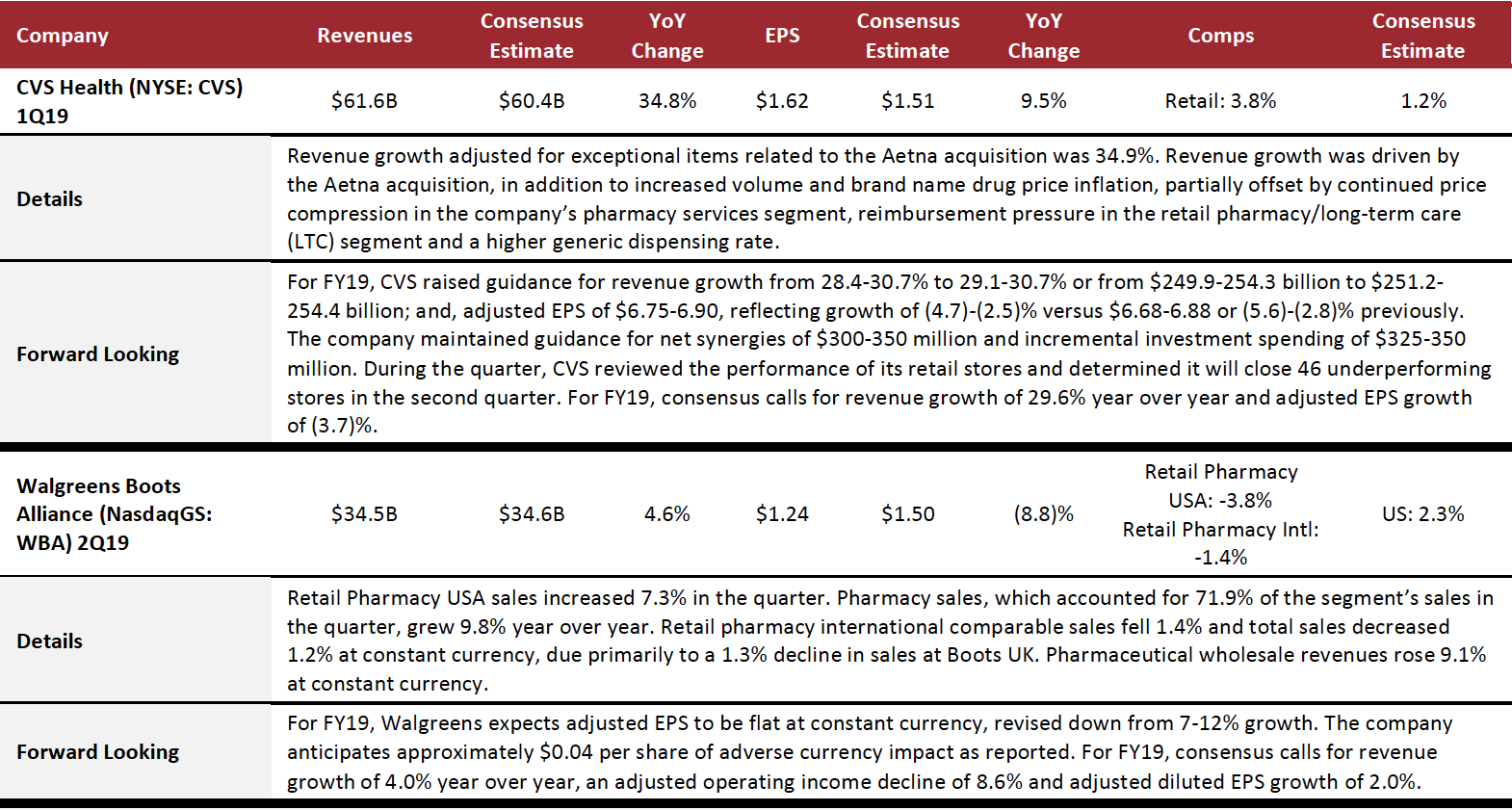

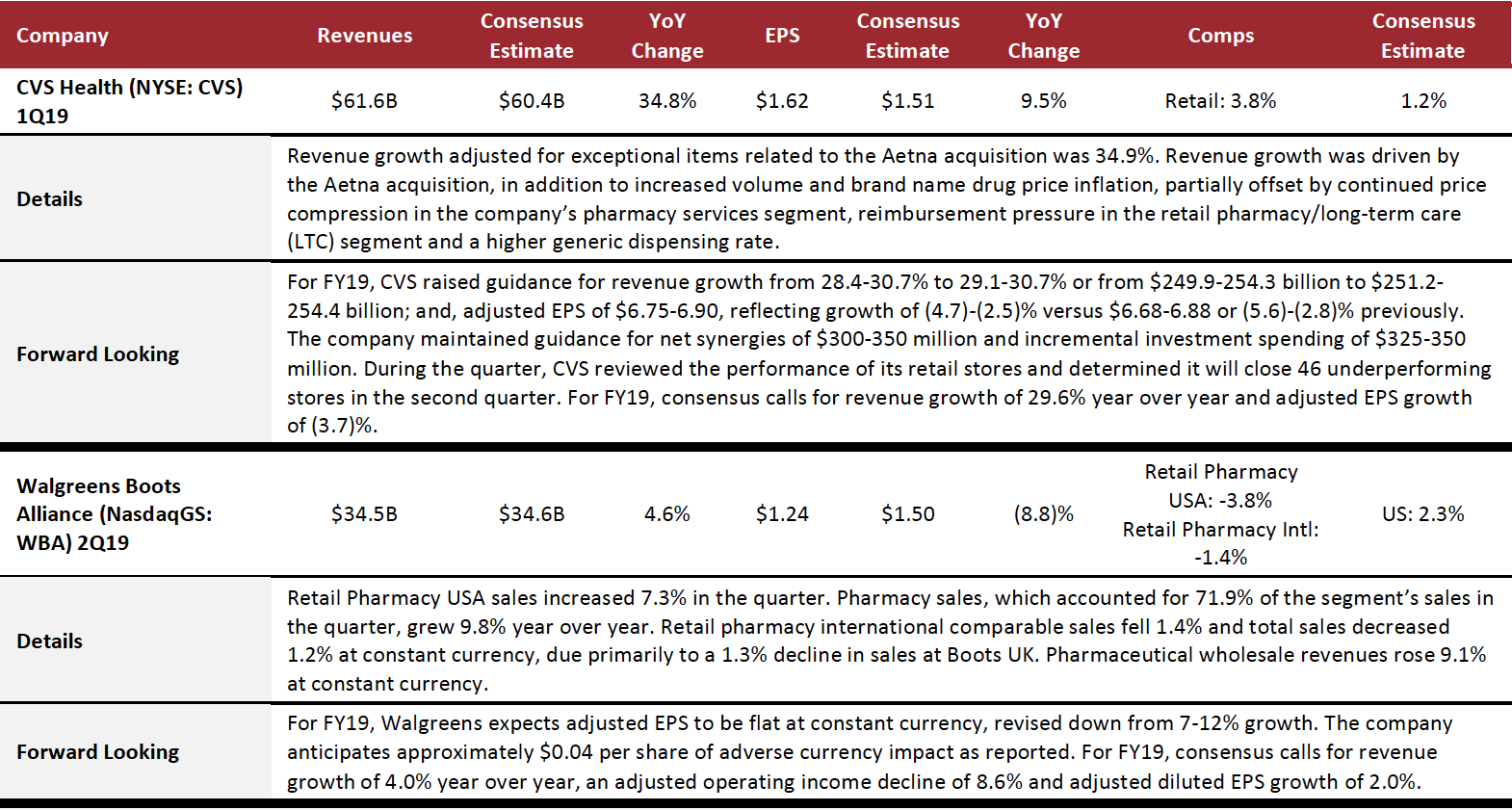

Food, Drug and Mass: Drug Stores

While CVS raised guidance, Walgreens Boots Alliance (WBA) revised down EPS guidance. Both retailers acknowledge the lower-than-expected returns from store investments and retail offerings and are working to revamp store estates. CVS and WBA have both introduced new health and beauty offerings and are repurposing spaces to create more experience-led shopping journeys.

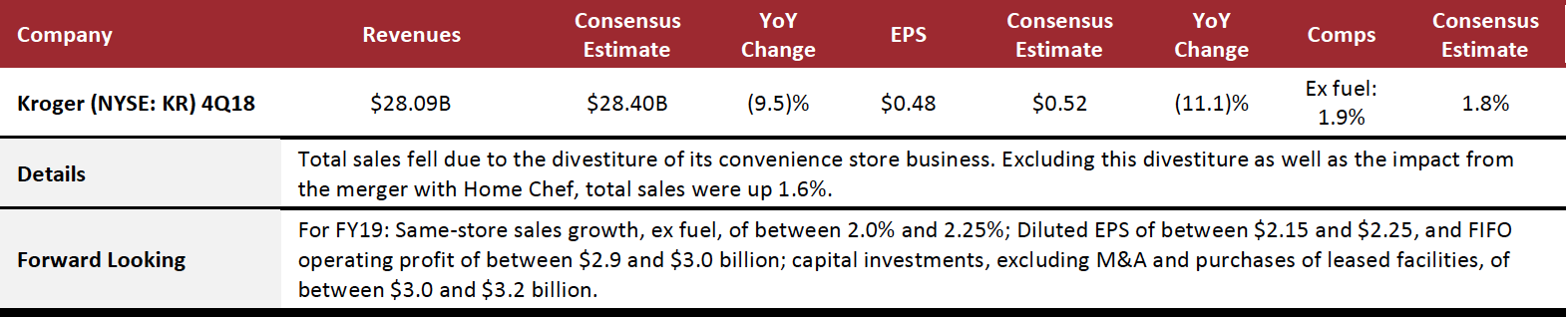

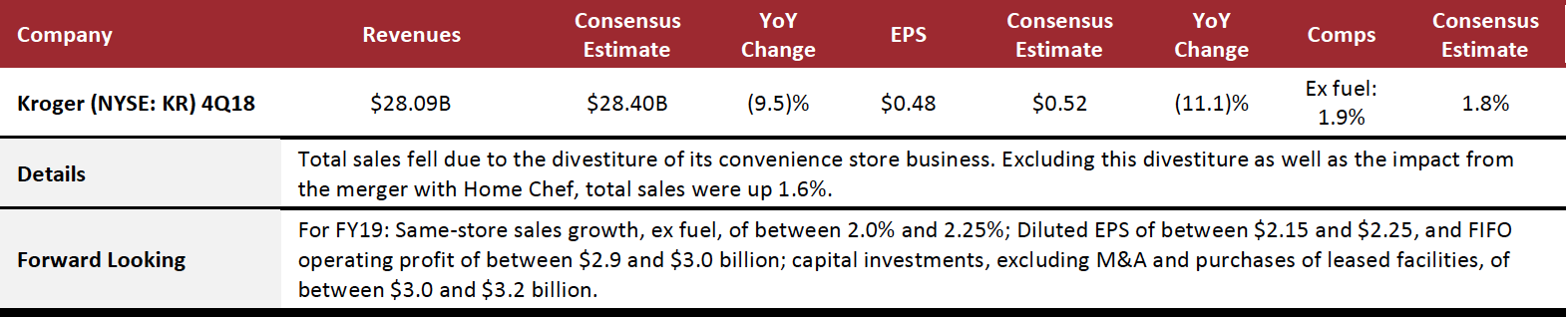

Food, Drug and Mass: Food Retailers

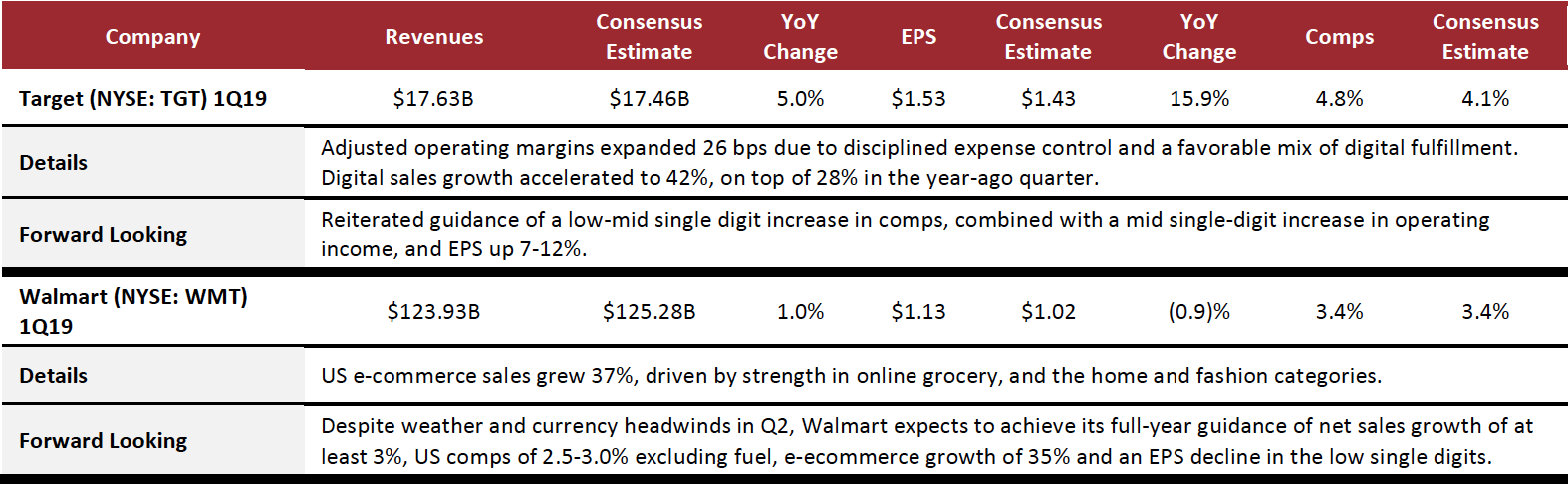

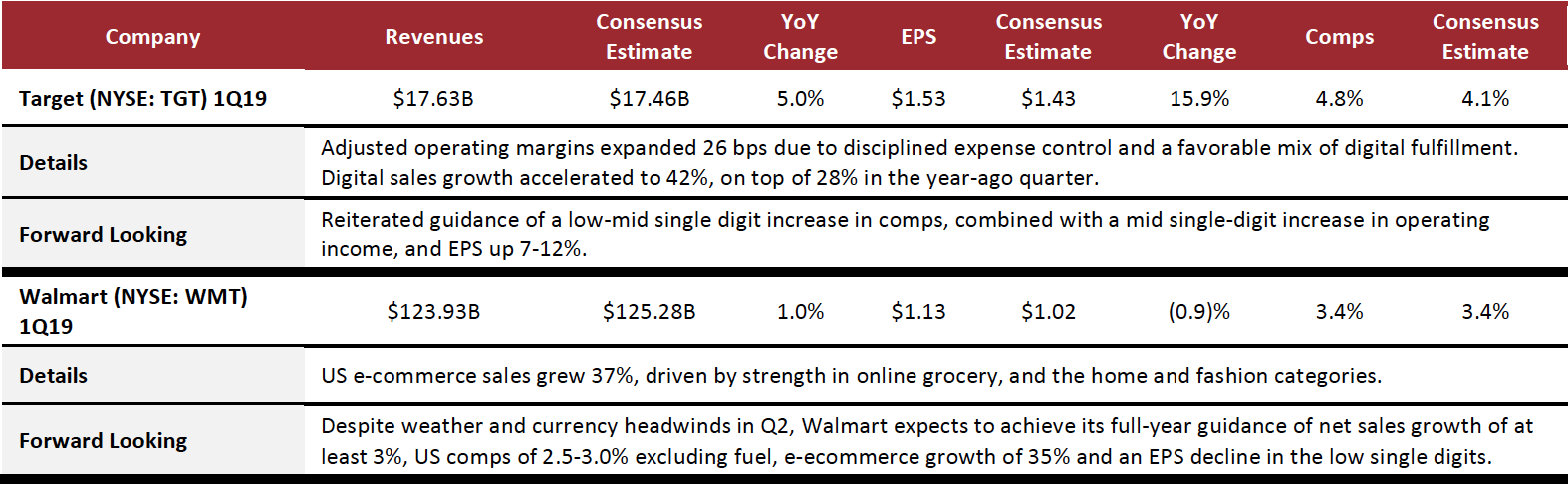

Food, Drug and Mass: Mass Merchandisers

Mass-merchandisers Target and Walmart posted solid comps, driven by circa-40% increases in online sales, combined with gains in traffic and average transaction value. Both retailers remain on track to achieve their annual targets, each with low-mid single digit sales growth, though Walmart expects some currency and weather headwinds in Q2.

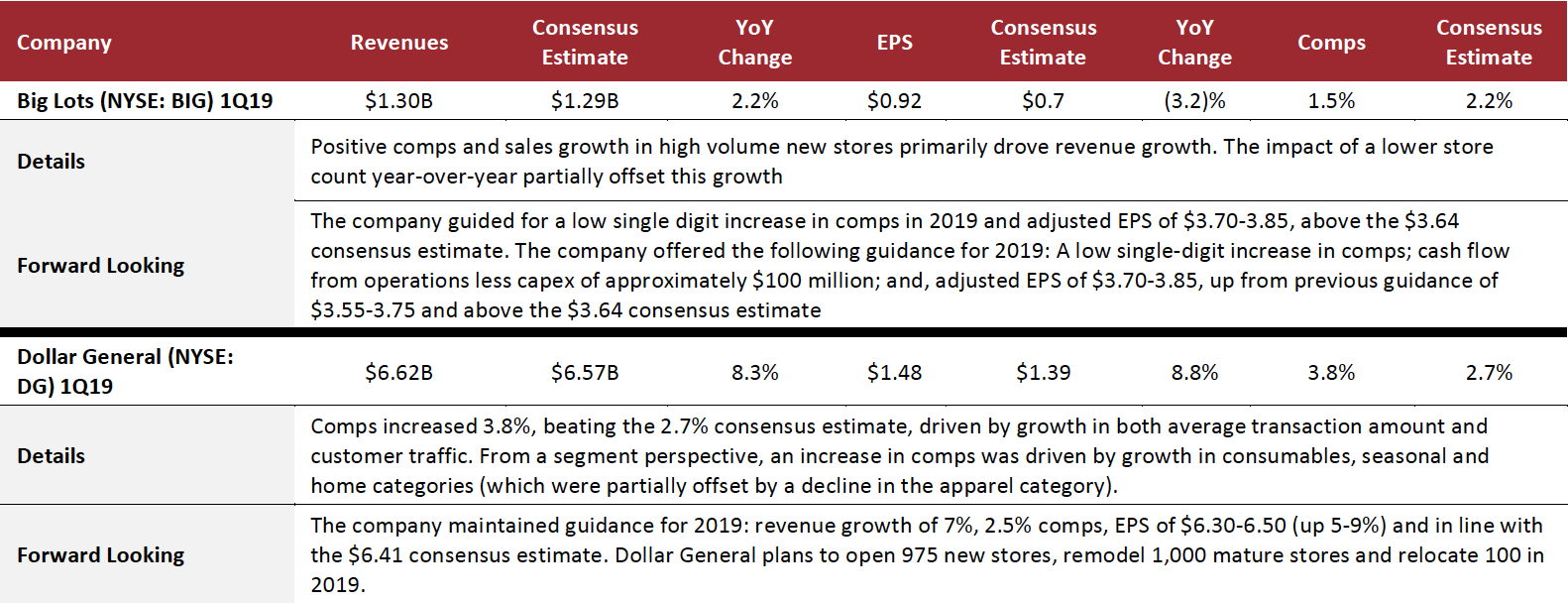

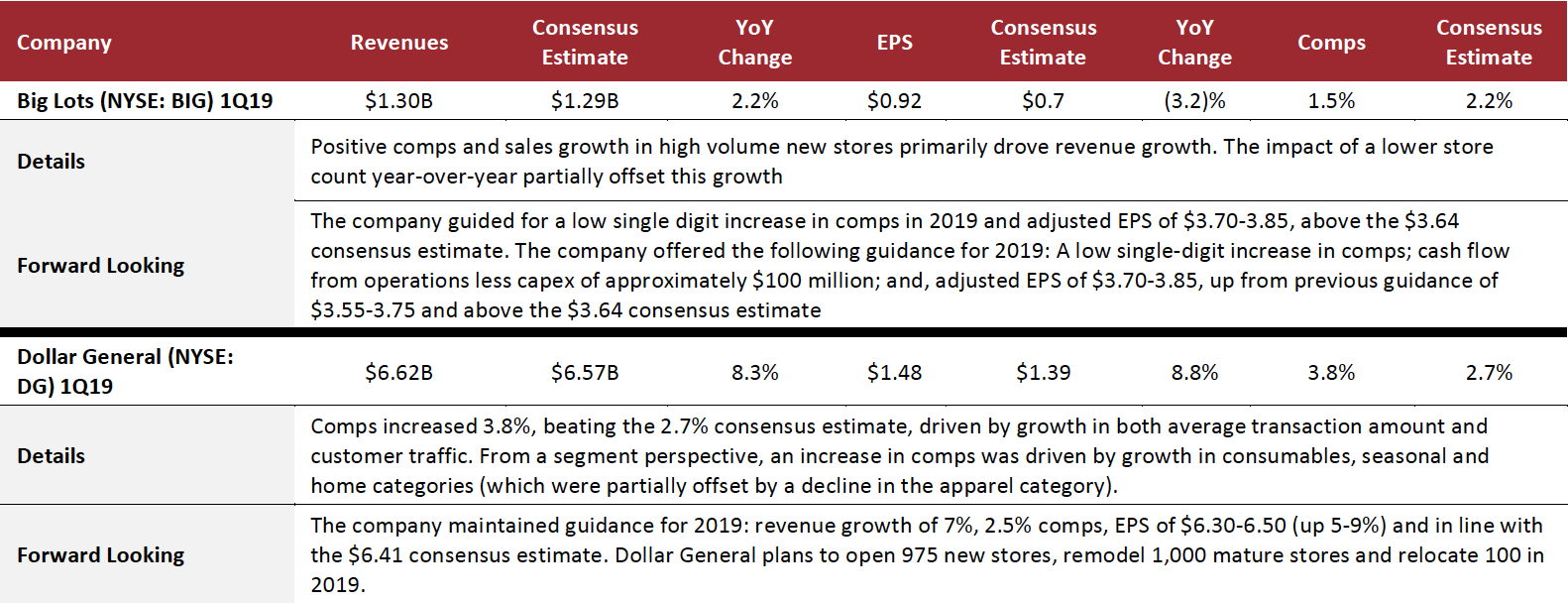

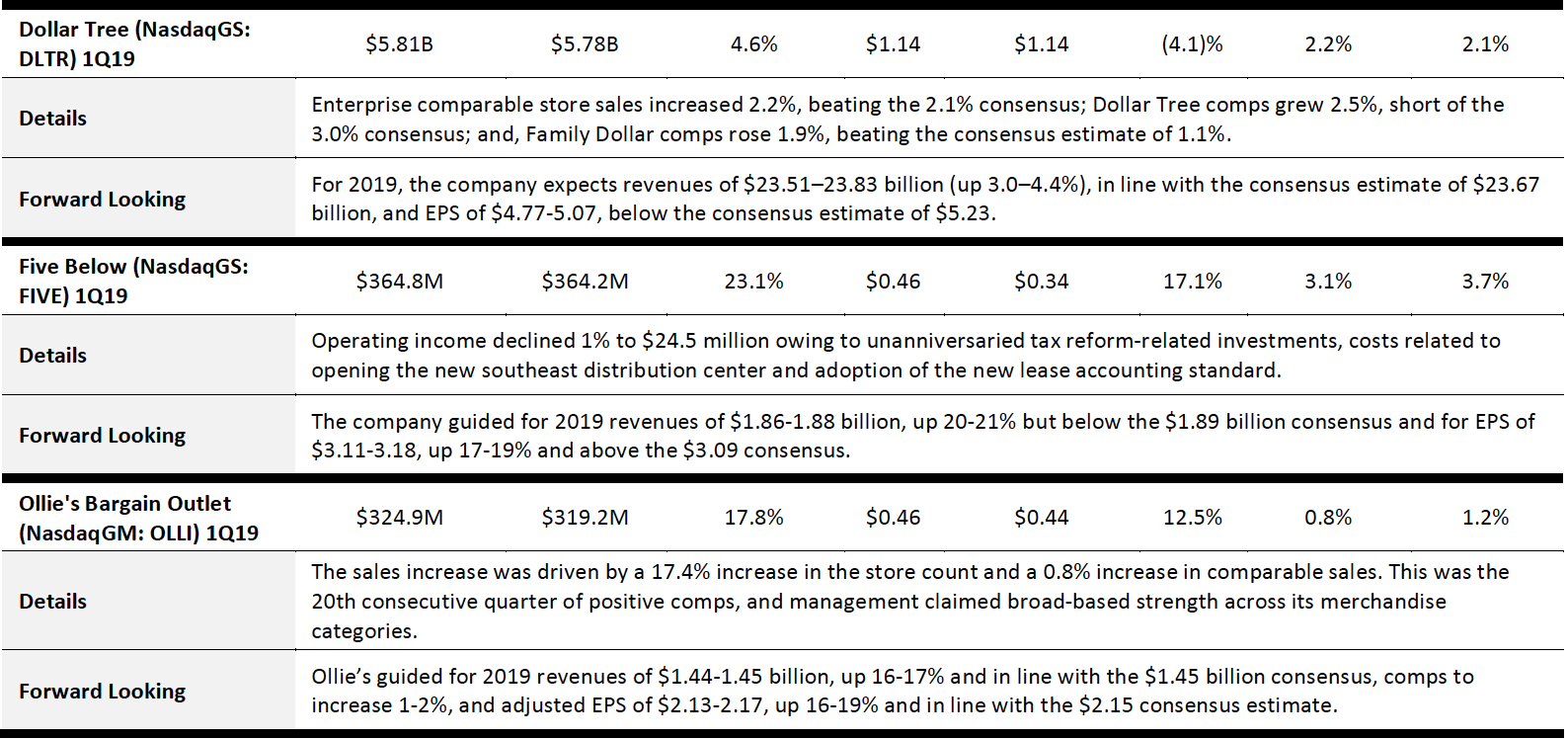

Food, Drug and Mass: Discount Stores

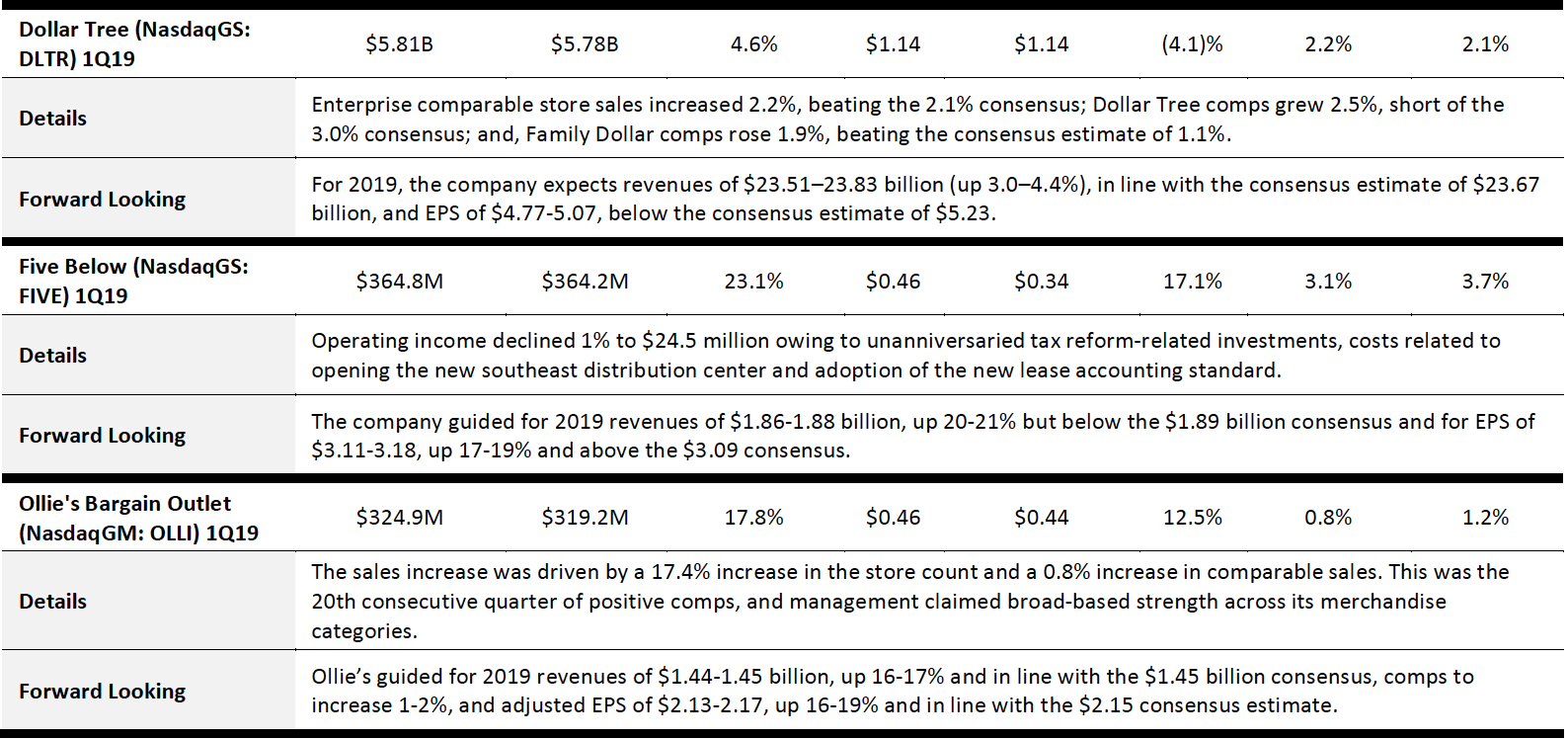

All five discount stores in the Coresight 100 reported 1Q19 revenues that beat consensus estimates, highlighting solid performance. In a retail climate of widespread store closures, discount stores continue to buck the trend as they proliferate across the country. Margins, however, continue to be under pressure. Discount stores are expected to continue driving growth by expanding their store base and enhancing e-commerce capabilities.

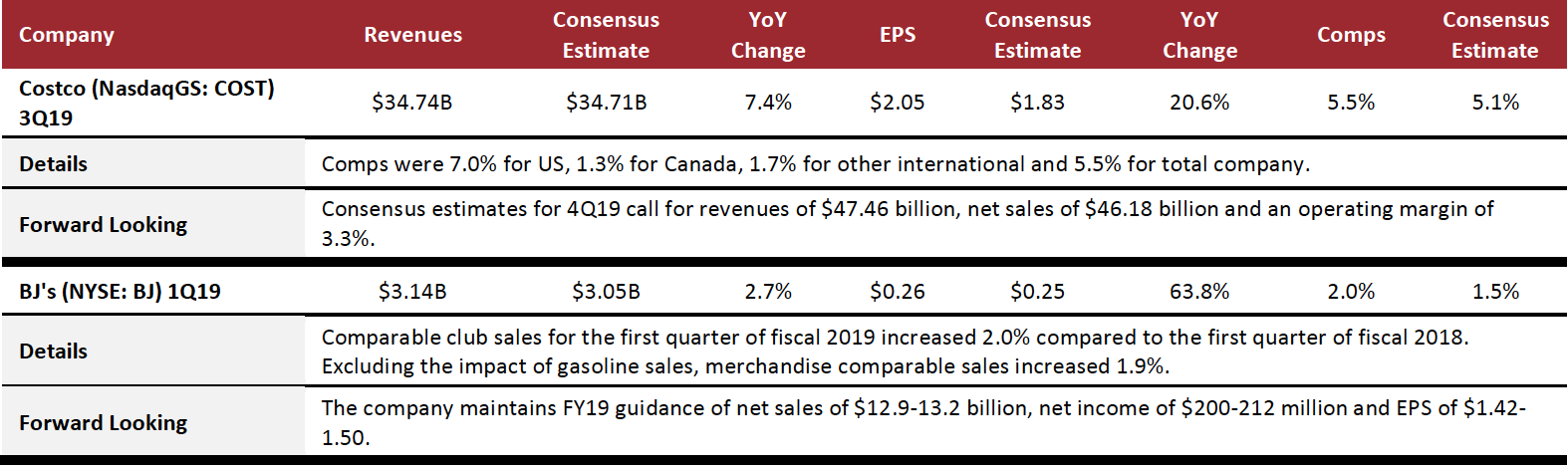

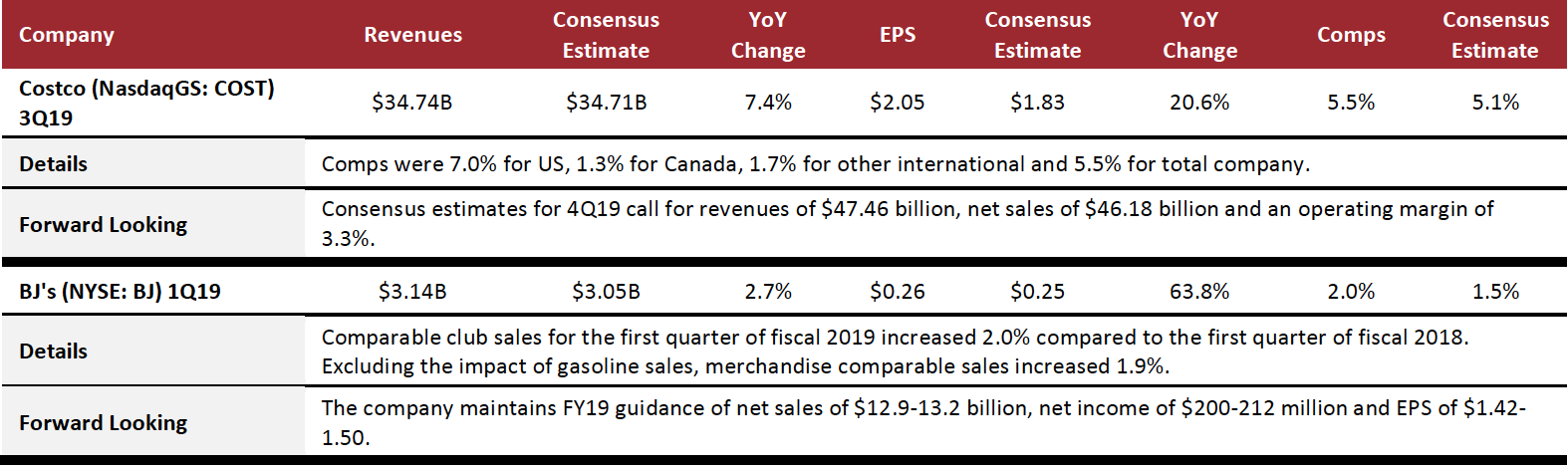

Food, Drug and Mass: Warehouse Clubs

Both warehouse clubs in the Coresight 100 beat consensus estimates on revenue. Margins continue to be under pressure in the face of a tough competitive landscape. E-commerce is growing rapidly compared to total sales growth. Warehouse clubs are continuing to invest in e-commerce and omnichannel capabilities and are better positioned to compete with rivals in the industry including mass merchandisers and discount stores.

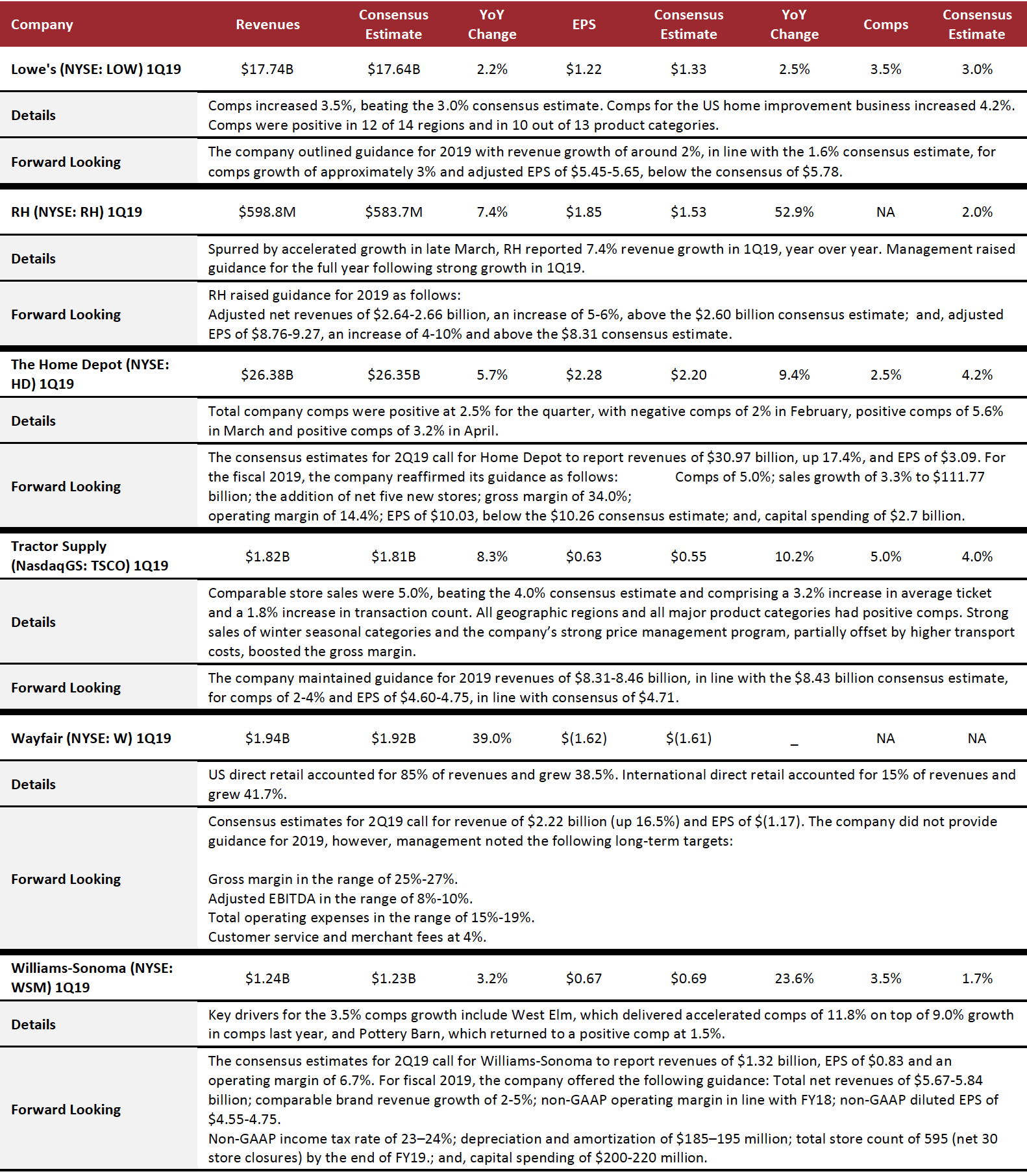

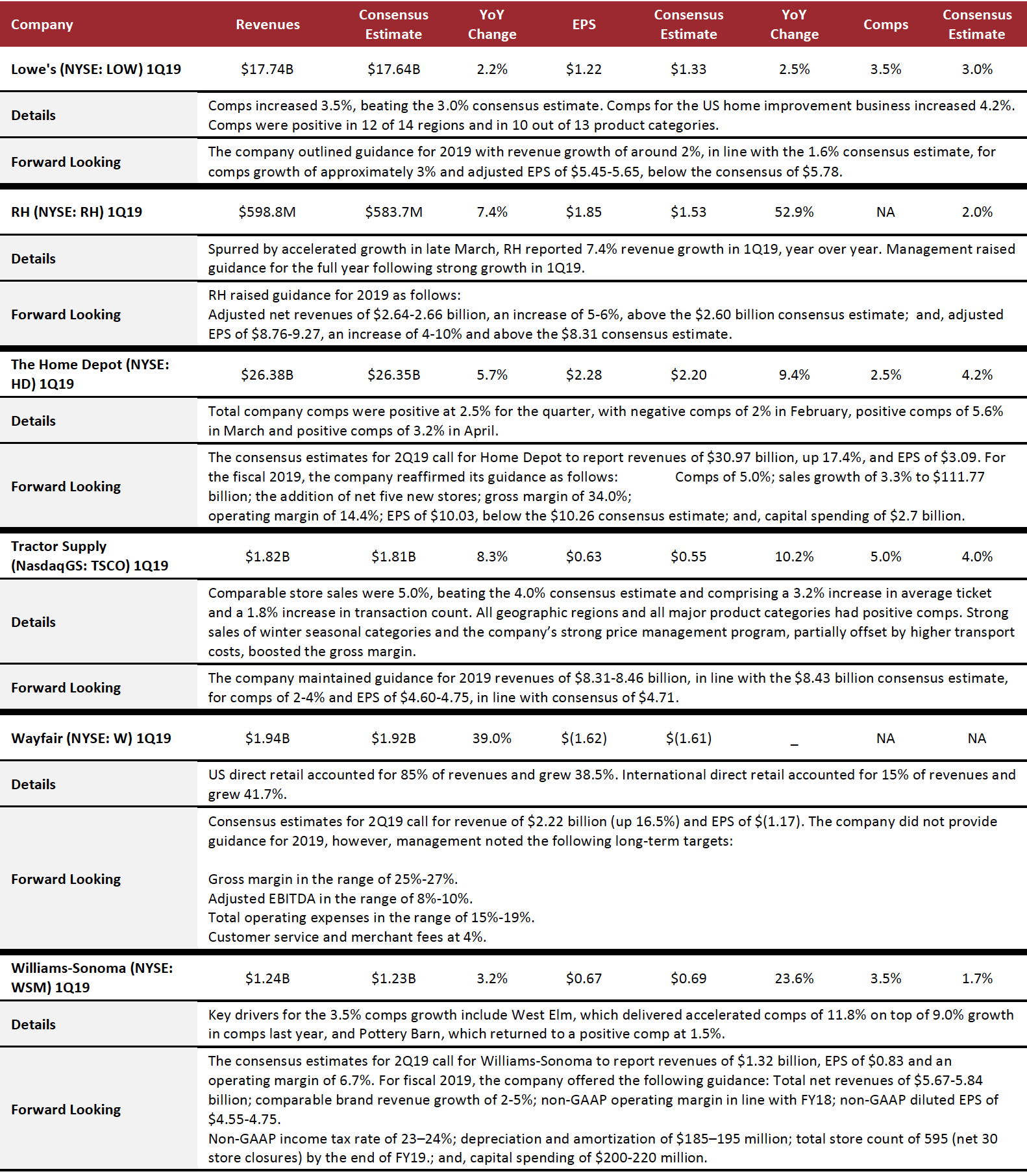

Home and Home-Improvement

All six US home and home-improvement companies in the Coresight 100 beat consensus estimates in revenue, reflecting strong performance in the industry. The outlook for the sector is mixed. On the one hand, the US economy remains strong despite the first quarter consumer spending sowdown.

While there are negative signs in the housing market, such as a decline in permits and starts, as well as a slowdown in existing home sales, the Federal Reserve’s announcement in March that it does not expect to increase interest rates for the rest of 2019 provides a source of respite for the home and home improvement sector. Home improvement (along with experiences) continues to be a favorite category for consumer spending and 1Q19 results of the six companies in this category in the Coresight 100 confirm this.