Web Developers

Over the following pages, in partnership with Celect, we share our predictions for how these demands will manifest themselves in 18 trends across 2018.

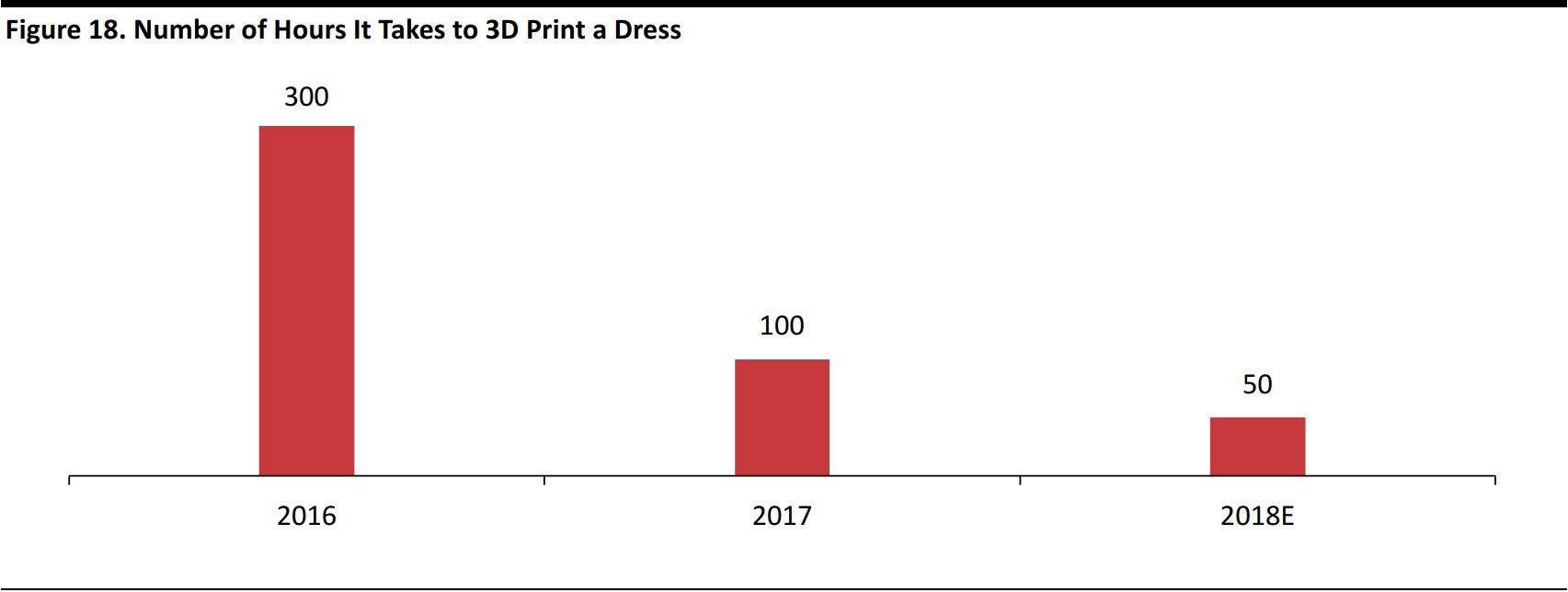

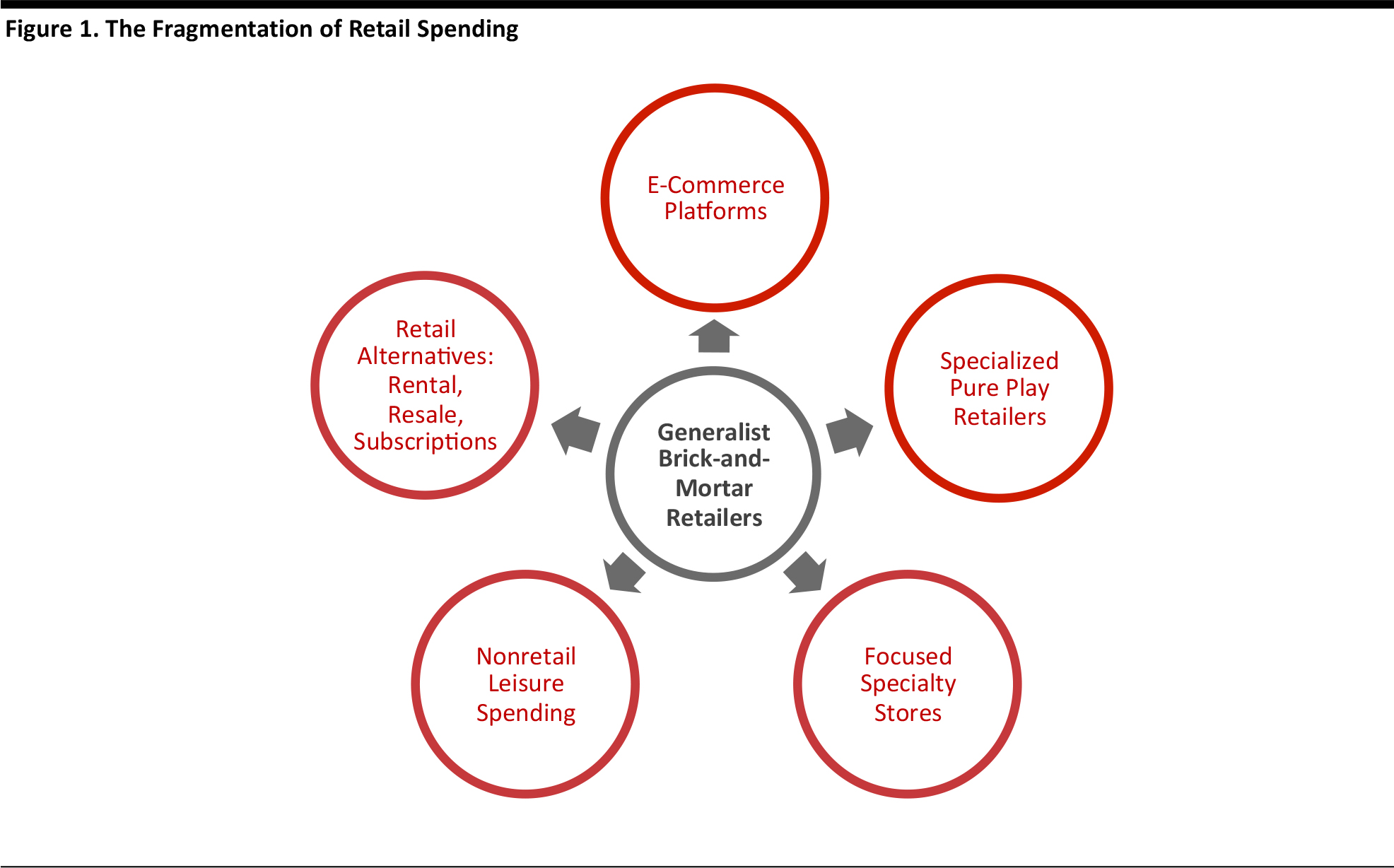

1. Enhanced Choice Sustains a Splintering of Spending

Spoiled by choice, shoppers will continue to splinter their spending away from middle-ground generalist retailers and toward more specialized retailers and channels. Today, everybody is unique and difference is celebrated, whereas homogeneity was valued more highly in the past. We see this cultural shift as the principal threat to long-standing generalist retailers that built scale by occupying the middle ground. We see no letup in the splintering of consumer spending in 2018, as specialist retailers offering ever-more choice will continue to peel dollars away from midmarket behemoths. We think that more consumer spending will flow to the following this year:- Focused brick-and-mortar specialists that have established strong identities, from specialist beauty stores to convincing fast-fashion retailers.

- Niche Internet pure plays that target specific customer segments and resonate with specific demographics.

- Nontraditional channels, such as rental, resale, subscriptions and digital-media alternatives.

- Nonretail categories, as lifestyle shifts will continue to benefit leisure services.

Source: FGRT

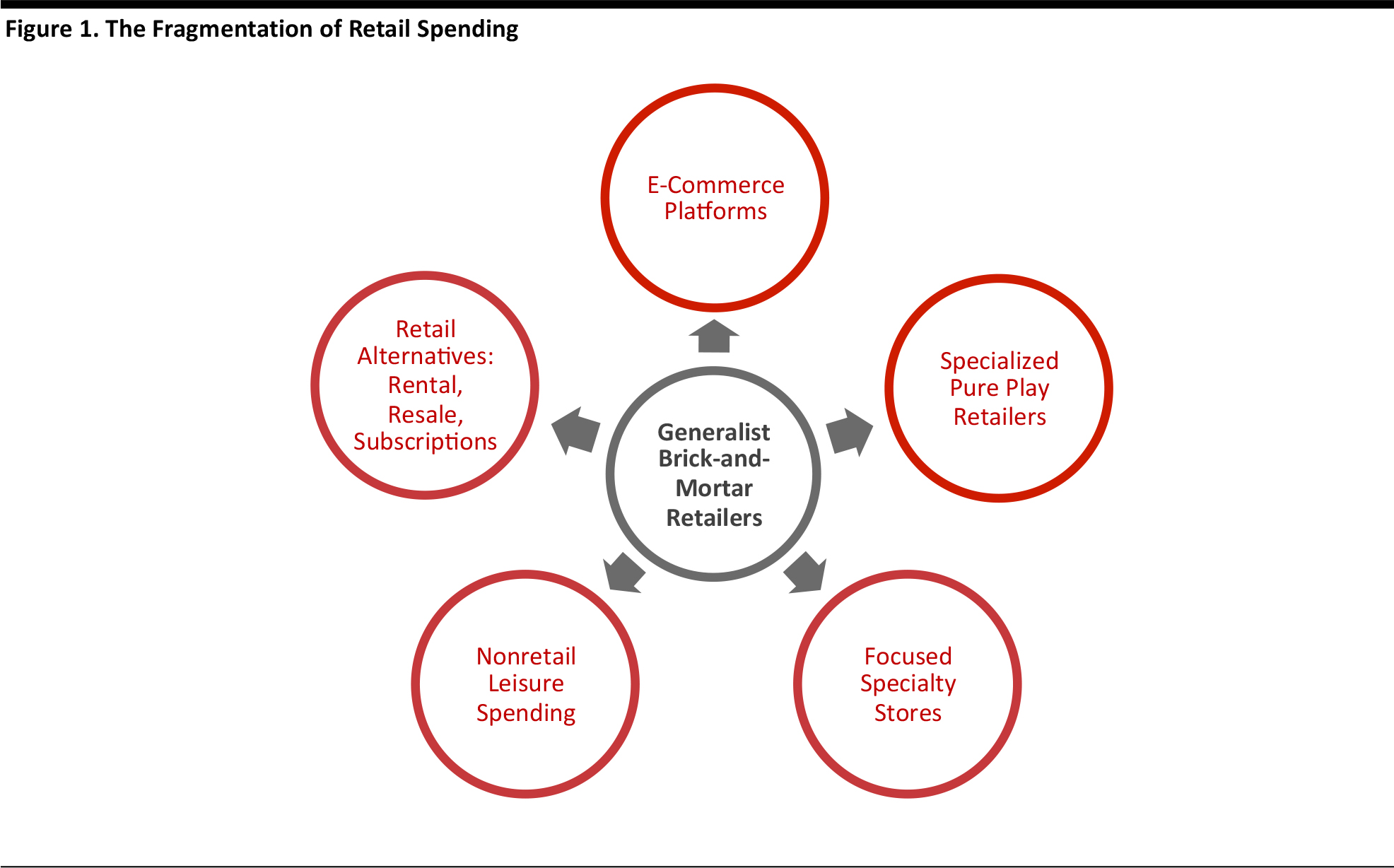

2. Demand for Convenience Prompts Vending to Supersize

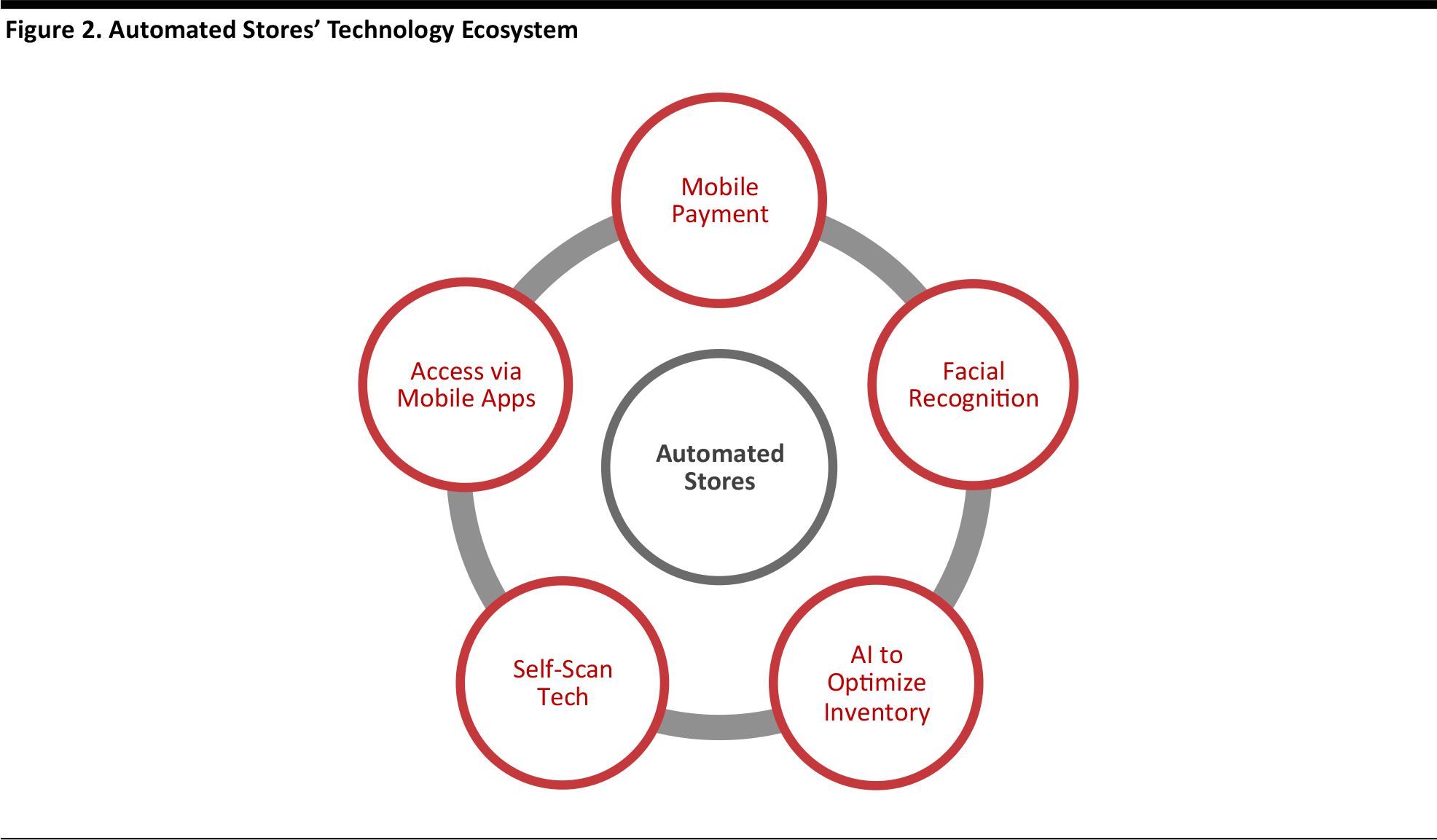

Many more consumers will be buying their groceries from unstaffed, high-tech and small-scale grocery stores in 2018 as vending goes supersize. Compact, high-tech convenience stores became a feature of many Chinese cities in 2017. In 2018, we expect droves of consumers elsewhere in the world to start buying groceries from such stores. BingoBox, which operates 200 unstaffed convenience stores in China, announced in late 2017 that it plans to move into Hong Kong, South Korea and Malaysia, and ultimately extend its network to Europe. In November, Auchan Retail China, part of France’s Auchan Group, announced the rollout of its unstaffed, 18-square-meter Auchan Minute stores in China. And in December, JD.com announced plans to open hundreds of stores similar to these. In the US, artificial-intelligence (AI) vending concept Bodega is set to grow its presence and Amazon’s full-scale launch of Amazon Go—its ultrahigh-tech, cashierless grocery store—is on the horizon. Many other retailers will retrofit their existing stores with new, automated checkout services that enable self-scanning and payment by mobile app or facial recognition. These innovations will cultivate an ecosystem of technologies as retailers seek out tech firms to partner with. That ecosystem will include:- Major payment apps such as WeChat Pay and Apple Pay to automate checkout.

- Technology vendors that leverage innovations such as facial recognition for payment and AI for inventory management.

- Emerging self-checkout offerings such as MishiPay, SkipQ and QueueHop that enable shoppers to scan and go rather than waiting in line.

Source: FGRT

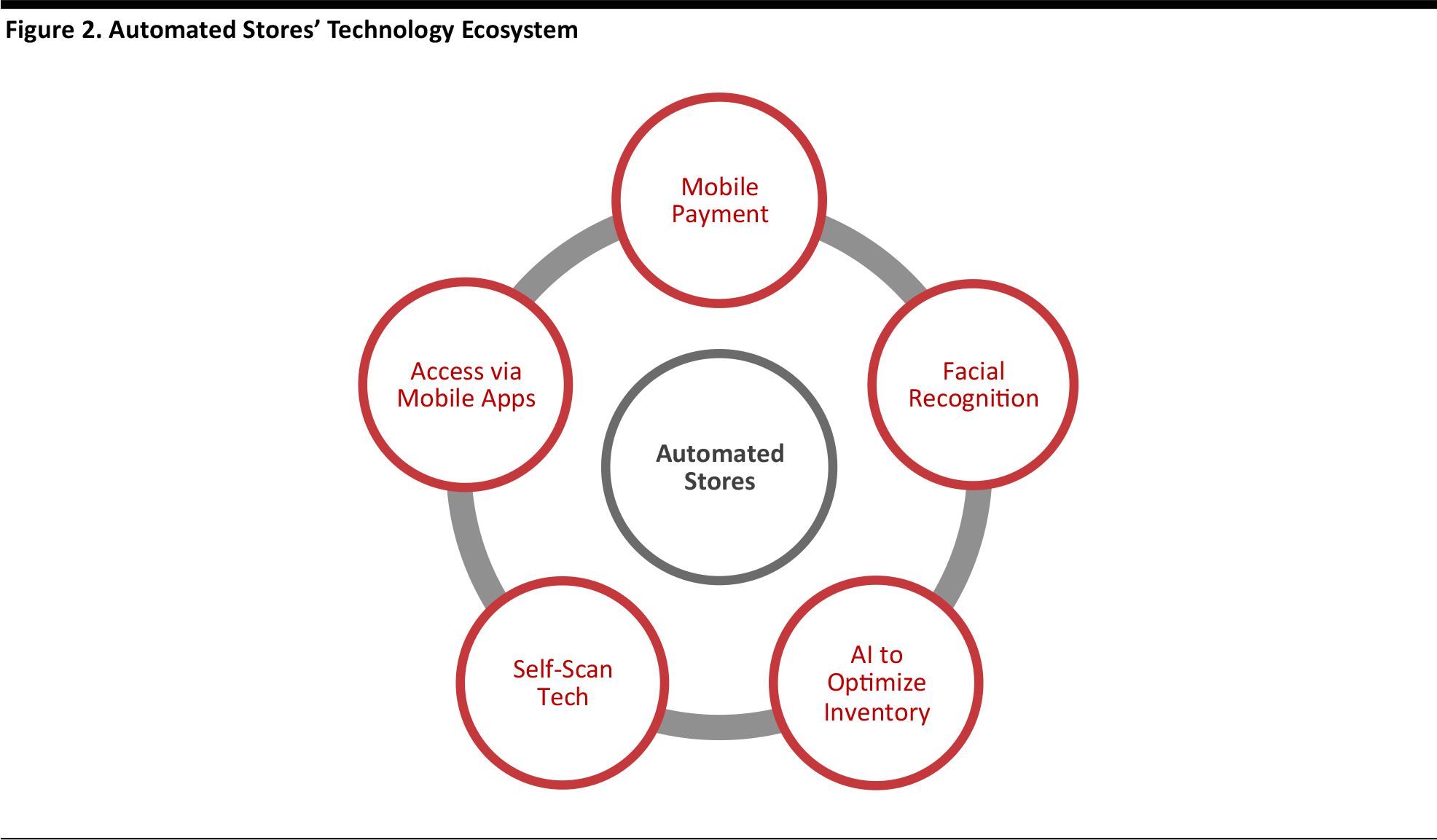

3. Grocery Giants Take Another Crack at Direct-to-Consumer Models

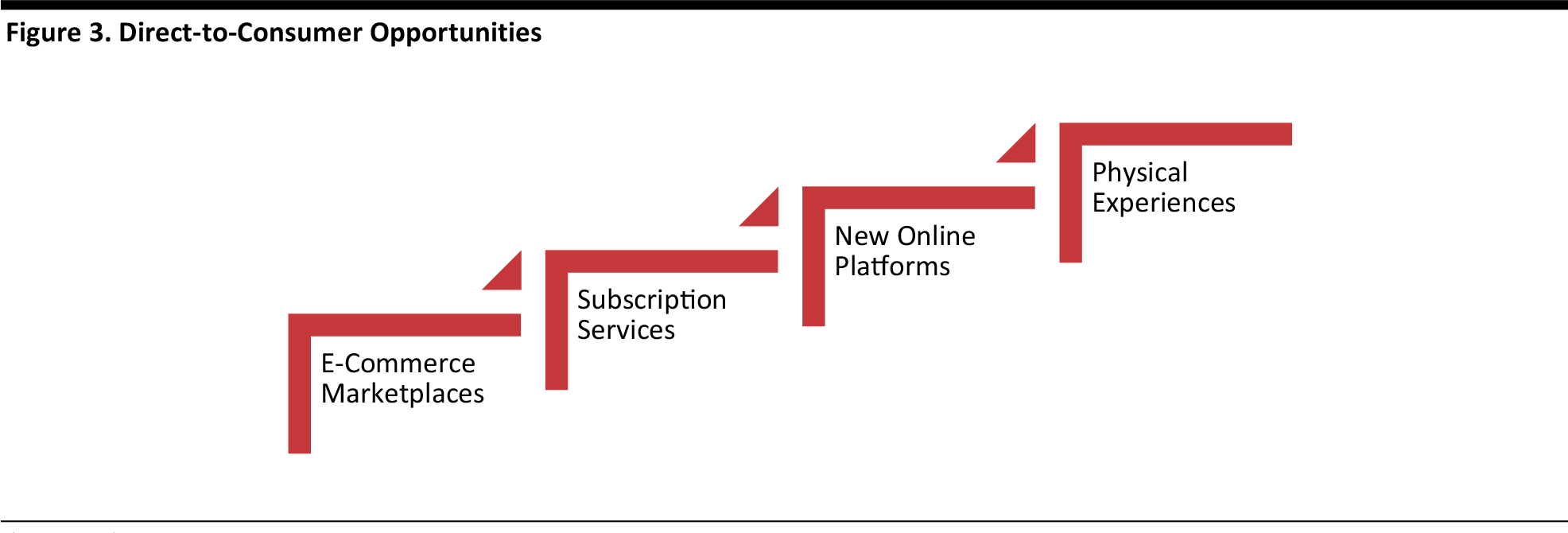

Blockchain technology will provide a springboard for more of the world’s biggest fast-moving consumer goods (FMCG) and grocery brand owners to bypass retailers and sell directly to consumers. FMCG firms such as Nestlé continue to experiment with direct-to-consumer sales, trying to square low-value items with the economics of fulfillment and home delivery. So far, most of the big moves in direct-to-consumer selling have been in nonfood categories such as apparel and electronics. We expect major FMCG and grocery brands to more fully adopt the direct-to-consumer model in 2018, following some false starts that focused on conventional e-commerce or big-name acquisitions. Online, the blockchain will be one springboard for this expansion. In 2018, INS Ecosystem, a company that wants to cut retailers out of the grocery supply chain, will launch its blockchain-enabled direct-to-consumer platform. It has already signed up Mars (in Russia), Reckitt Benckiser (in Russia) and Unilever Food Solutions (in the UK). Offline, we expect more brands to follow the likes of Kellogg’s and Hershey’s, which both launched experiential New York outlets in December 2017. This move toward direct-to-consumer models is not just about tapping the high-growth e-commerce channel:- Direct channels, including brick-and-mortar flagships and marketplace subsites, support brand building by allowing brand owners to shape the experience.

- Established brands are adopting these models in order to compete with a new wave of direct-to-consumer brands, such as Glossier in beauty, Harry’s in personal care and Bonobos in apparel.

- New technologies, including voice-enabled applications, are growing the demand side, while others such as blockchain are bolstering the supply side.

- More grocery brands selling selectively via major online marketplaces, their own sites and new intermediary platforms.

- Brand owners undertake more ambitious trials of direct-to-consumer formats, including alternative models such as subscription services and meal kits that support the economics of a direct-to-consumer proposition.

- Legacy brands open experiential physical formats ranging from pop-up stores to food service experiences to destination attractions.

- Brands and platforms experiment further with blockchain technology to facilitate direct sales.

Source: FGRT

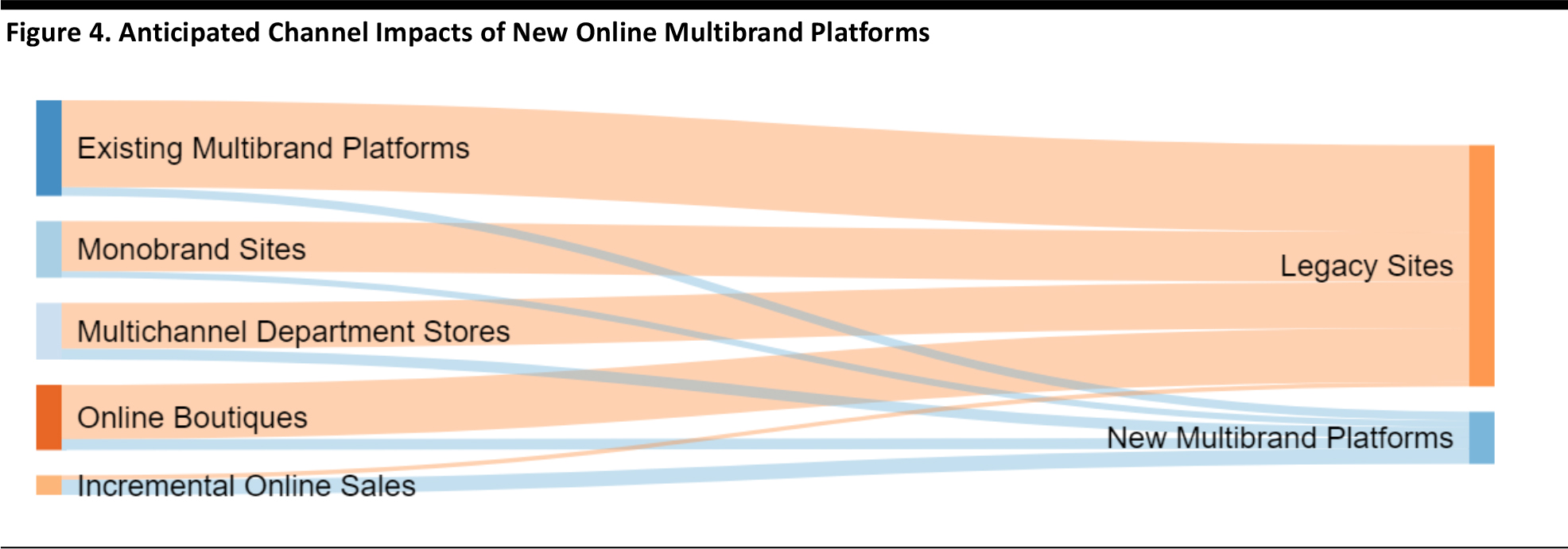

4. Online Platforms to Accelerate Luxury E-Commerce Penetration and Steal Market Share

A surge of activity in online multibrand platforms in 2017 will support a jump in luxury e-commerce and heap pressure on incumbents such as online department stores and monobrand websites in 2018. The online luxury market is set to become substantially larger and more competitive in 2018 as the effects of a flurry of activity in 2017 feed into the market. In 2017, we saw a suite of investments in multibrand platforms, with LVMH unveiling its 24 Sèvres site, Alibaba Group launching its Luxury Pavilion on Tmall and JD.com investing $397 million in Farfetch, a London-based online platform. Management consultancy Bain & Company estimates that online sales jumped by 24% in 2017, and we see these multibrand platforms underpinning further strong e-commerce growth in 2018. But platforms are not just driving up online sales; they are driving up the quality of multichannel services, too, with offerings such as “white glove” and same-day delivery services, online and in-home personal stylist services, and chatbots for more basic advice. We foresee the following impacts in 2018:- New and expanding platforms will add incremental sales to the online channel and steal sales from existing players, potentially dealing a further blow to those at the upper end of the department store sector.

- Platforms will drive up shoppers’ expectations of online service offerings. Existing Internet-only retailers such as Net-a-Porter and Farfetch already look well positioned on service; we think the impact will principally be felt by more transactional online department stores and monobrand sites.

- Generalist platforms looking to carve out share in the online luxury goods market will not see a smooth ride—at least in Europe. In December 2017, the European Union’s Court of Justice ruled that luxury brand owners can prohibit their distributors from selling on third-party platforms such as Amazon, in order to protect the equity in their brands.

Scales are indicative only.

Source: FGRT

Scales are indicative only.

Source: FGRT

5. “New Retail” Introducing Cross-Channel Formats and Services

More retailers will integrate their online and offline propositions with cross-channel formats and services in 2018. This will include Alibaba Group moving into department stores and opening hundreds of grocery stores. “New Retail” is what Alibaba founder Jack Ma calls the integration of online and offline commerce, data and logistics. Alibaba’s mix of online-to-offline offerings, digitalized physical stores and new fulfillment models is not unique to the group. Indeed, many retailers worldwide may think they have long been pursuing New Retail models without labeling them as such. One US example is Amazon, which moved into offline retail by opening bookstores, pop-ups and its high-tech Amazon Go format and through its acquisition of Whole Foods Market in the grocery space.

Source: iStockphoto

This year, we expect to see further investment in cross-channel formats and services:- Target’s recent acquisition of delivery firm Shipt will enable the retailer to offer same-day delivery from around half of its stores by early 2018 and from most of its stores before the 2018 holiday shopping season.

- Walmart plans to expand its coverage for one-hour delivery in China by introducing freestanding “dark stores” for quick fulfillment.

- JD.com plans to open more than 1 million JD convenience stores across China in the next five years. The company will also open hundreds of “unstaffed” convenience stores, as we discuss in more detail later in this report.

- Alibaba will open its first shopping mall, in Hangzhou, China, in 2018. In addition, Alibaba announced in December 2017 that it will open 2,000 of its Hema omnichannel grocery stores in China in the next three to five years.

- Across the grocery sector, we will see many retailers in the US, Europe and Asia continue to expand their omnichannel services, including their in-store fulfillment and pickup services as well as their rapid, crowdsourced delivery services.

Source: Company reports

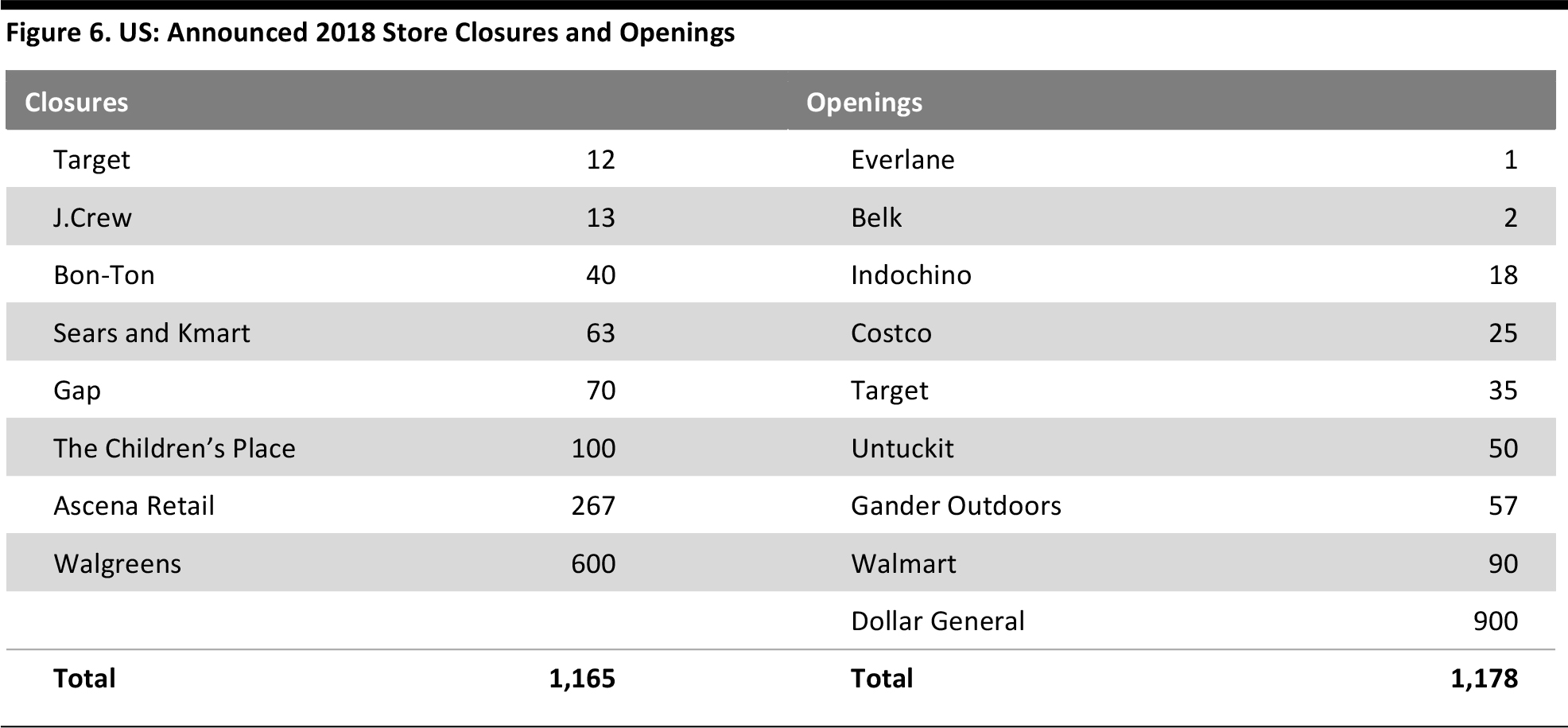

6. The US Mall Landscape Is Evolving to Include More Food, More Flexibility and More Diverse Anchors

As thousands of US stores close—including around 600 department stores—the shopping mall will evolve to incorporate traffic drivers such as food halls, flexible spaces and more diverse, mixed-use anchors. The US mall landscape will continue to evolve amid further store closures in 2018. Our analysis found that 2017 was a watershed year for US retail, with a nearly unprecedented 6,985 store closures and more than 15 major retail bankruptcies. The largest US department store chains announced 596 store closures in 2017—and most these serve as mall anchors. We see the following opportunities for US malls in 2018:- Food halls: Food halls are not just upgraded food courts, but spaces that offer products made by local artisans, food-oriented boutiques, butcher shops and, usually, interactive elements such as entertainment offerings and classes. Examples of successful food halls include Eataly, Le District and China Live. Garrick Brown, VP of Retail Research for the Americas at Cushman & Wakefield, predicted at the 2017 ICSC RECon event that the square footage of food halls will double in the next five to 10 years, from 3 billion to 6 billion square feet.

- Flexible spaces and leasing structures: Appear Here, one of the largest online marketplaces for short-term retail space, has partnered with Simon Property Group to create a new shopping experience called The Edit inside one of the country’s largest malls, Roosevelt Field on New York’s Long Island. The Edit features a rotating selection of 12 independent brands. This short-term, modular build out and leasing structure is one that other malls may begin to consider.

- More diverse anchors: In place of department stores, new mall anchors include discount stores, fast-fashion stores, small-format boutiques, apartment spaces, hotels, classrooms and fitness areas. GGP (formerly General Growth Properties) has invested more than $2 billion to redevelop more than 115 of its properties, and it is bringing in new types of stores that offer more experiential shopping, such as Indochino, Untuckit and Forever 21’s Riley Rose. In Seattle, GGP is also adding living spaces to its malls in partnership with residential REIT AvalonBay. Another major REIT, Seritage Growth Properties, recently announced that it would convert part of its Sears store in Orland Park, Illinois, into a 10-screen AMC movie theatre.

As of December 15, 2017

Source: Company reports/FGRT

As of December 15, 2017

Source: Company reports/FGRT

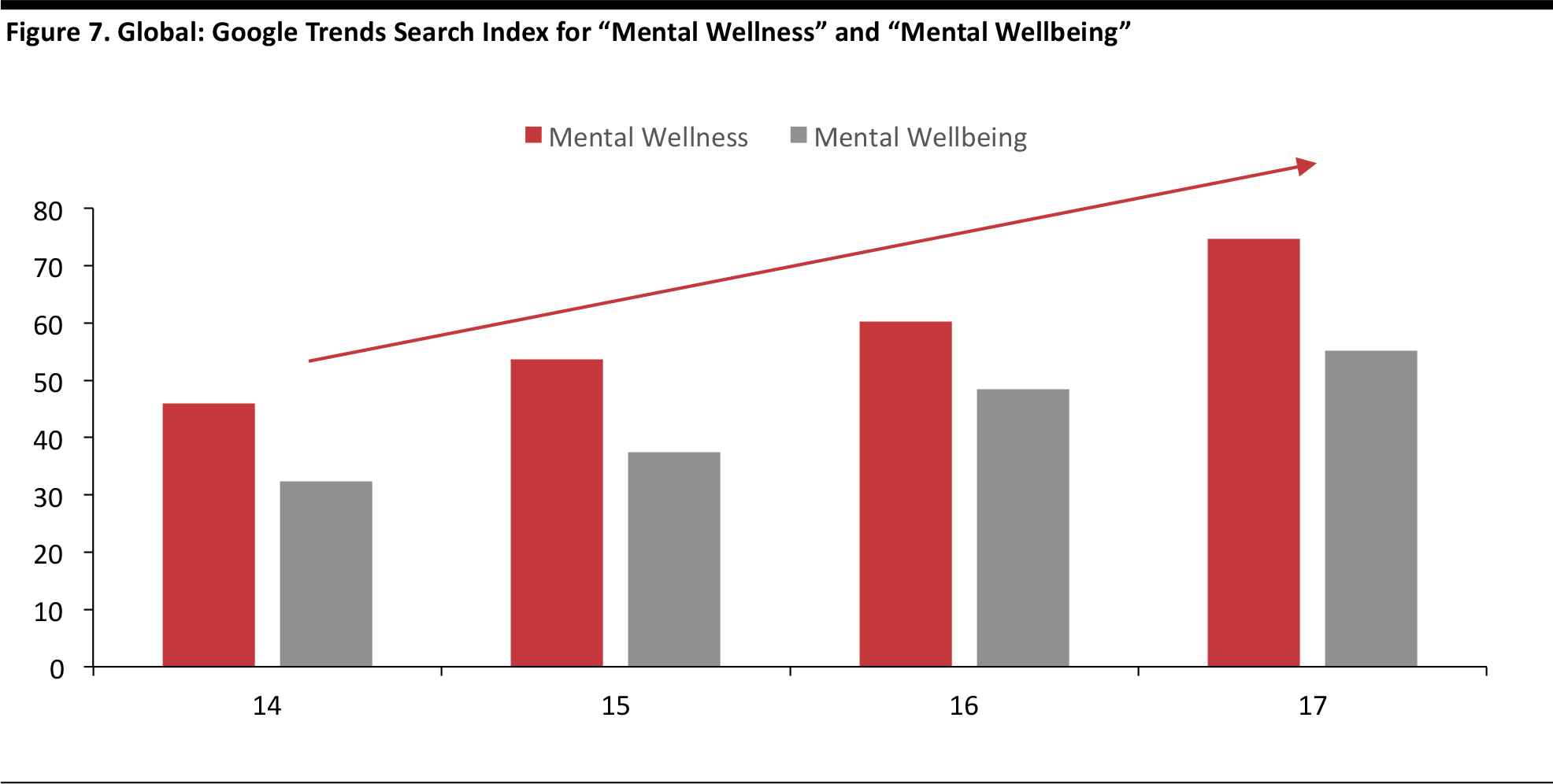

7. Wellness Is Cemented as a Preeminent Trend as Consumers Focus More on Mental Well-Being

Wellness-focused lifestyles will support demand for digital tools that function as “Fitbits for the mind” and promote mental well-being. For many consumers, wellness is the new luxury, and one to be enjoyed, indulged in and showcased, particularly on social media. This is a trend we covered in detail in 2017, and we expect consumer demand for wellness-related offerings to remain strong through 2018 and beyond. However, we expect the trend to expand further, especially with regard to mental well-being. High-profile figures such as the UK’s Princes William and Harry have attempted to end the stigma associated with discussing mental well-being and health and we have seen the emergence of trends such as companies offering mental health days to employees. A surfeit of new digital services, including Unmind and Headspace, have also emerged, offering businesses and consumers affordable, accessible means of promoting mental well-being. At the same time, the pressures imposed by social media, especially on young people, have moved into the spotlight. “God only knows what it’s doing to our children’s brains,” Facebook’s founding president Sean Parker said at an Axios event in November. His remark was part of a slew of criticism in late 2017 that served to drive consumer awareness of the negative impact of social media sites such as Facebook on users’ mental well-being. As more and more health-conscious consumers widen their focus to include concepts such as mindfulness, they will look for products that serve as “Fitbits for the mind.” Accordingly, we expect more companies and individuals to integrate digital tools that promote mental wellness into their health programs and routines. This prediction comes with a warning, though: the market for digital wellness tools will not be a free-for-all, and we anticipate a shakeout among well-being apps at some point as insurers, regulators and consumers demand greater evidence of efficacy. Annual averages of a monthly index, where 100 indicates the month with the highest number of searches for that phrase and zero the lowest. 2017 data are through December 10.

Source: Google Trends

Annual averages of a monthly index, where 100 indicates the month with the highest number of searches for that phrase and zero the lowest. 2017 data are through December 10.

Source: Google Trends

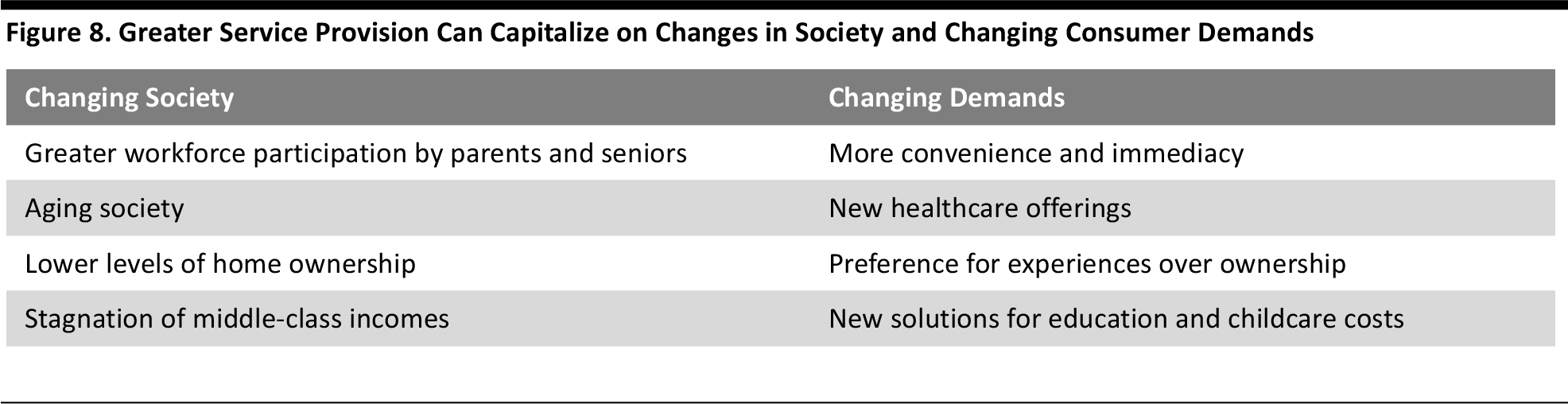

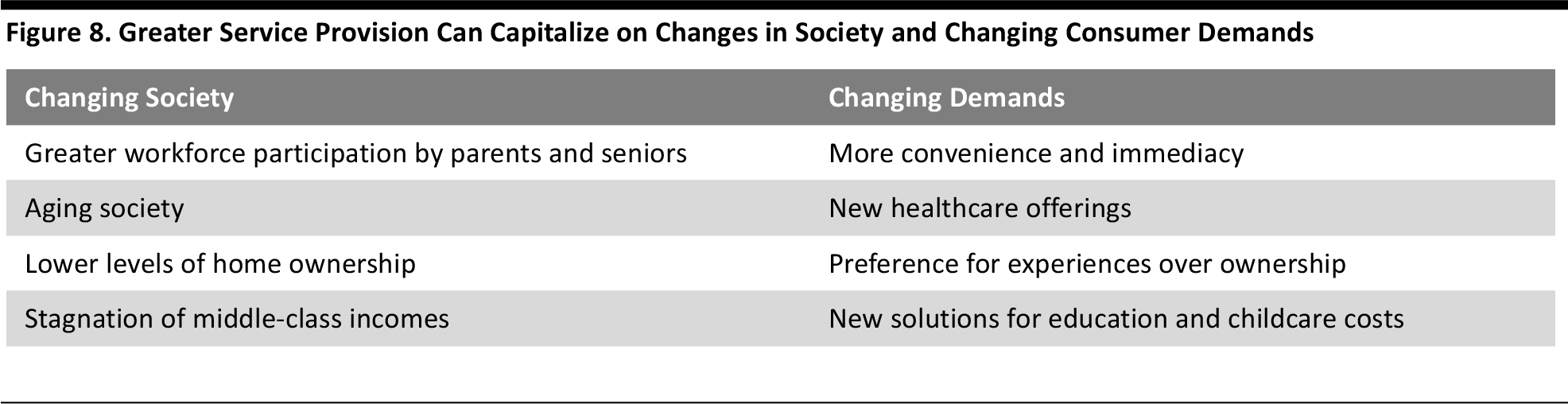

8. Shoppers Will Turn to Services that Make Their Lives Easier

More retailers will build service offerings that capitalize on changing consumer lifestyles and demands in 2018. This is about much more than just adding restaurants and beauty services to stores. In acquiring health-services provider Aetna, CVS Health is the flag bearer for the integration of retail and services. Target’s acquisition of delivery provider Shipt is a further example of retailers’ wholehearted move into services. In 2018, the blending of retail and services will go beyond previous, limited efforts, which tended to focus on enhanced in-store experiences such as integrated food service operations or beauty service counters in department stores. We expect retailers to enter more service markets and make acquisitions of existing service providers as they seek to offer services that respond to underlying shifts in how consumers live and what they expect.

Source: iStockphoto

Retailers that blend conventional selling with services could see several benefits:- Offering quality services can build brand connections with consumers more effectively than basic retailing can.

- In-store services can leverage any excess capacity that large-store retailers may be confronting, and they can drive traffic to retailers’ core operations.

- Services typically yield higher margins than retailing.

- Service offerings can tap trends such as an aging society and greater workforce participation as well as consumer demand for experiences, leisure and greater convenience.

Source: FGRT

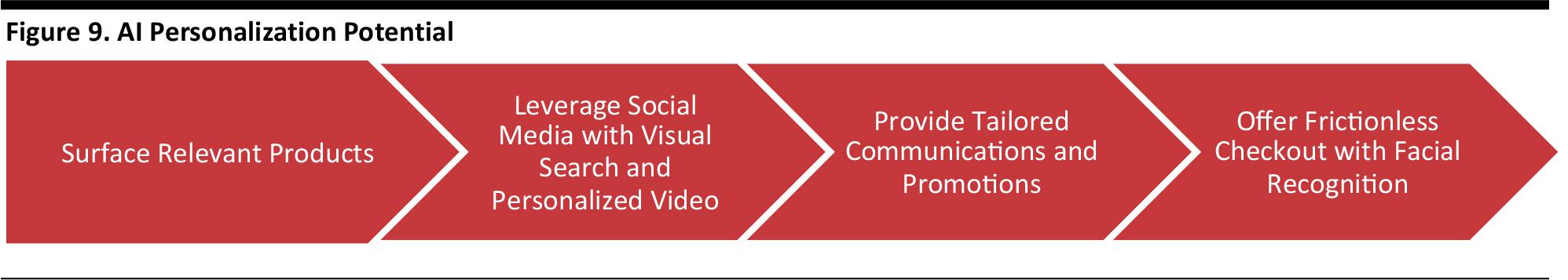

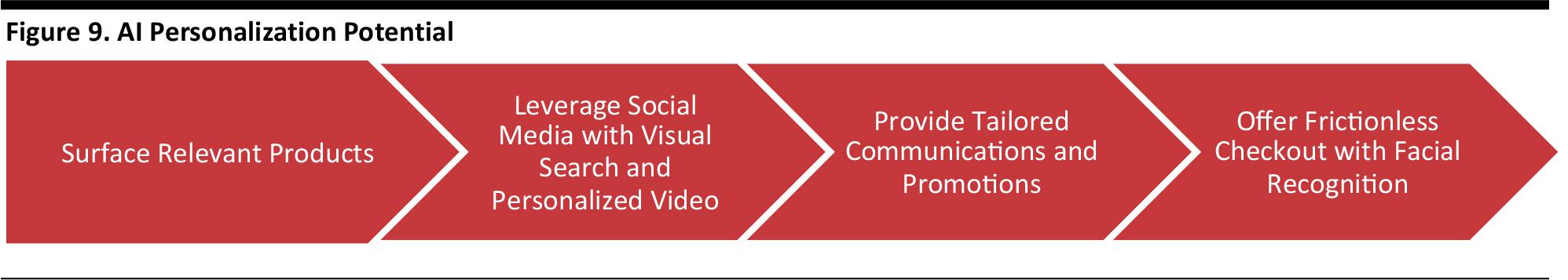

9. Using AI to Create Tailored Retail Interactions

More retailers will use AI to offer customers tailored, personalized interactions in 2018. Hard-hit legacy retailers such as department stores will need to use AI to surface relevant products and services in order to compete head-on with specialist rivals. This year, AI is set to gift early adopters competitive advantages in their customer offering, and it will provide opportunities for large-store retailers to sidestep their generalist positioning and communicate to a consumer segment of one. More retailers will leverage AI to interact with customers in a personalized, customized and localized way through tailored shopping recommendations, email, e-commerce and m-commerce portal layouts, marketing messages (including video), and promotions. We see the following developments amplifying AI’s impact on personalization in the coming months:- More mobile browsing and shopping will yield an abundance of geolocation data that can be used to target shoppers based on where they are.

- Facial recognition, a technology that is embedded in the new iPhone X, will provide retailers with new means of authenticating, understanding, identifying and communicating with shoppers.

- Voice-activated devices such as the Amazon Echo will become even more commonplace, providing retailers with a more intimate means of communication with shoppers. Moreover, in November, Amazon announced that developers of Alexa Skills (voice apps) will soon be able to build personalized responses based on recognizing individual users’ voices.

- The small screens of smartphones will make personalization of home pages imperative, driving retailers to optimize the shopping experience with AI.

- More retailers will trial or adopt personalized video marketing that incorporates content generated by customers on their social media channels.

- Visual search will provide new means for shoppers to find what they are looking for and serve as a springboard to shopping via social media.

- Recommendations and marketing communications will not just change from shopper to shopper; they will flex based on consumers’ locations and by daypart, delivering messages that are designed to resonate with consumers at specific moments.

- Retailers leading this charge will no longer be thinking about addressing consumer segments or demographics, but about communicating with a segment of one.

Source: FGRT

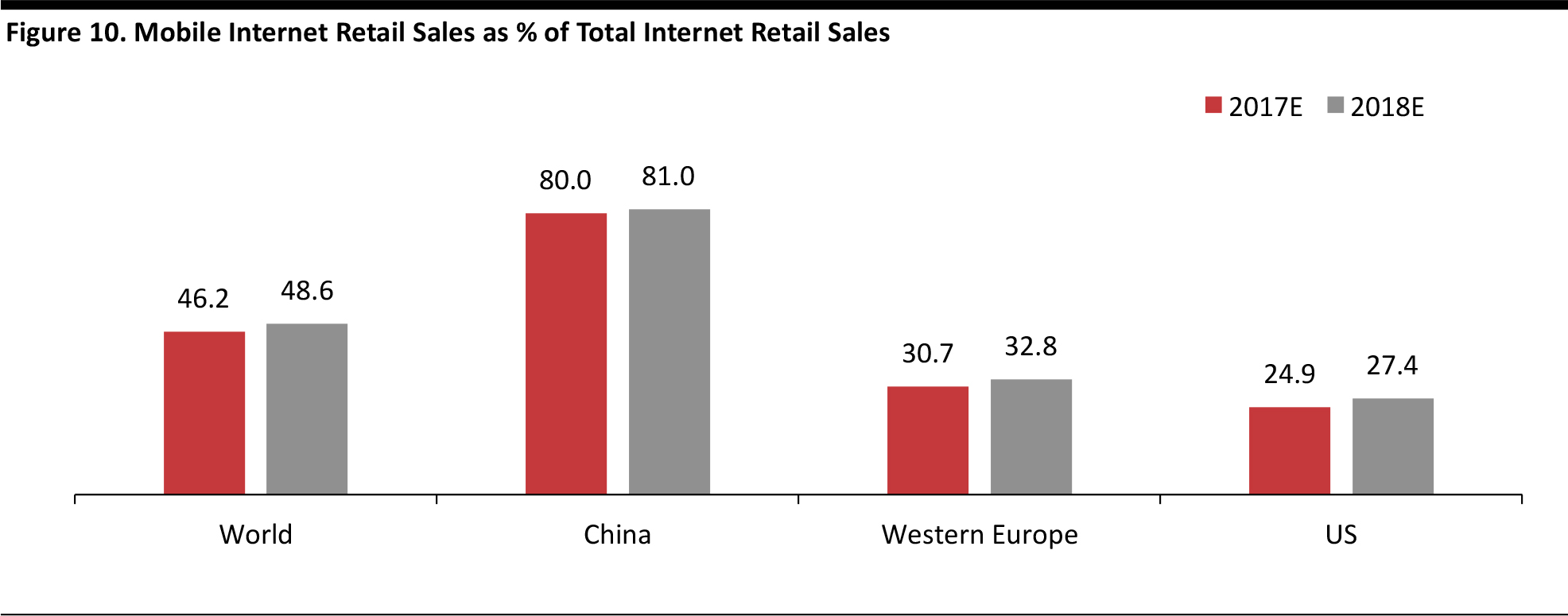

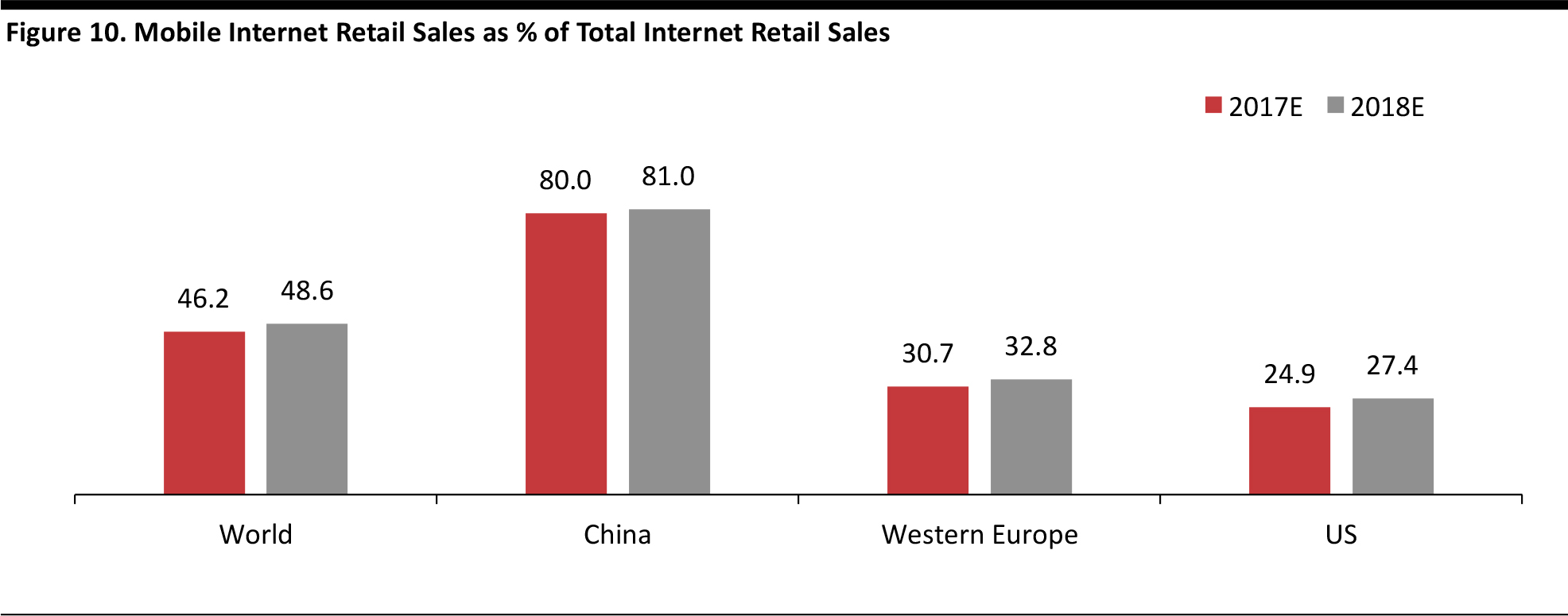

10. Mobile Consolidates Its Position as a Principal Customer-Engagement Channel

Mobile will become increasingly central to shoppers’ engagement with retailers at all points, from browsing to paying to getting customer service. Retailers must be ready with mobile-first loyalty programs, payment methods and personalized home pages. Sergio Bucher, the new CEO of UK department store retailer Debenhams, said on a recent earnings call, “I believe that mobile is the new blood of retail. Mobile will not only unite the channels, it will also become the way we build the relationship with our customers.” We, too, see mobile moving to a more central position in retailers’ relationships with their customers in 2018. This is not just about shoppers moving from desktop to mobile browsing and buying. We see retailers engaging more heavily with mobile shoppers through a number of services:- AI-enabled personalized home pages: Small mobile screens make it even more important for retailers to surface relevant products on personalized home pages, and they will use AI to achieve this.

- Mobile-first loyalty programs: As Macy’s and other retailers roll out new loyalty programs, we expect them to take a mobile-centered approach. Those retailers that still offer only physical loyalty cards and coupons will need to follow shoppers to mobile.

- Mobile payments: Mobile payments have proved most popular in China, but we are likely to see greater adoption of them in Europe and the US this year. In November, WeChat Pay went live in Europe through a partnership with German payments firm Wirecard. In the US, Walmart says that its Walmart Pay system is gaining serious traction: Daniel Eckert, SVP of Walmart Services and Digital Acceleration, predicted in November that Walmart Pay would outpace Apple Pay by number of transactions over the holiday season.

- Messaging and social media: More retailers will follow consumers to the channels where they are having conversations, offering service through communication and social media apps such as WeChat, WhatsApp and Facebook Messenger. In China, sales associates are engaging with luxury shoppers on a one-to-one basis via WeChat conversations, and we are likely to see conversational commerce become more prominent elsewhere, too, including in services that incorporate chatbots.

Source: Euromonitor International/FGRT

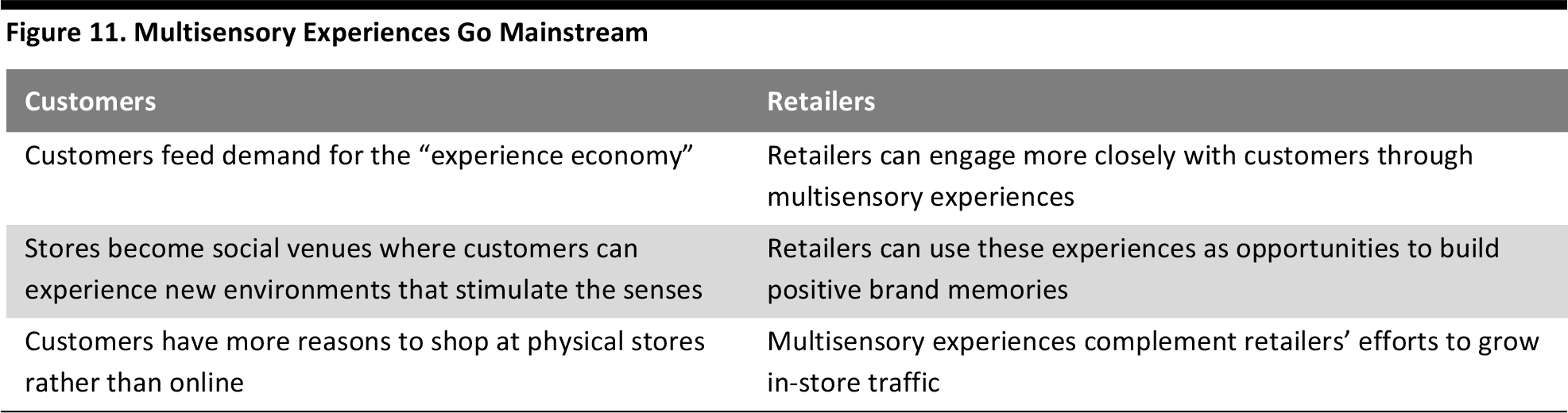

11. Retailers Will Offer New Multisensory Experiences

Multisensory experiences will move into mainstream retail and become part of immersive brand storytelling. In 2018, we anticipate that retailers will create multisensory events as a form of immersive brand storytelling. These experiences will variously incorporate virtual reality (VR), sound, taste, scents and temperatures. A number of initiatives and innovations suggest possibilities:- “4D” virtual tour of Anheuser-Busch’s brewery: At the annual SXSW (South by Southwest) cultural festival in Texas last March, Anheuser-Busch gave attendees a virtual tour of its Missouri brewery. Participants were given a VR headset that enabled them to virtually walk through the brewery. Changes in sound, temperature and scent in the experience space simulated the ambience inside the brewery, creating a 4D experience.

- Sonic and sensory installations: Manifest 1.0 was a project that involved exploring sonic and visual art through a series of installations in New York in October 2017. Each participant was asked to narrate a story about being alone, which was then analyzed by IBM’s Watson AI engine to create an information card that uniquely identified the participant. The person then received music and a color tailored to his or her personality, based on the card.

- Virtual fun: In the summer of 2017, Topshop’s flagship store in London offered a 10-day campaign during which customers donned a VR headset in order to experience a computer-generated waterslide journey through Oxford Street. Users slid down an actual slide in the store during the experience to enjoy the physical experience of momentum as they took their virtual journey.

- 4D pods: Dutch tech company Sensiks has created a “sensory reality” pod that combines visuals with variations in scent, temperature and airflow to simulate different environments. The company wants to develop its products for several applications, including retail, travel and healthcare.

Source: FGRT

Source: FGRT

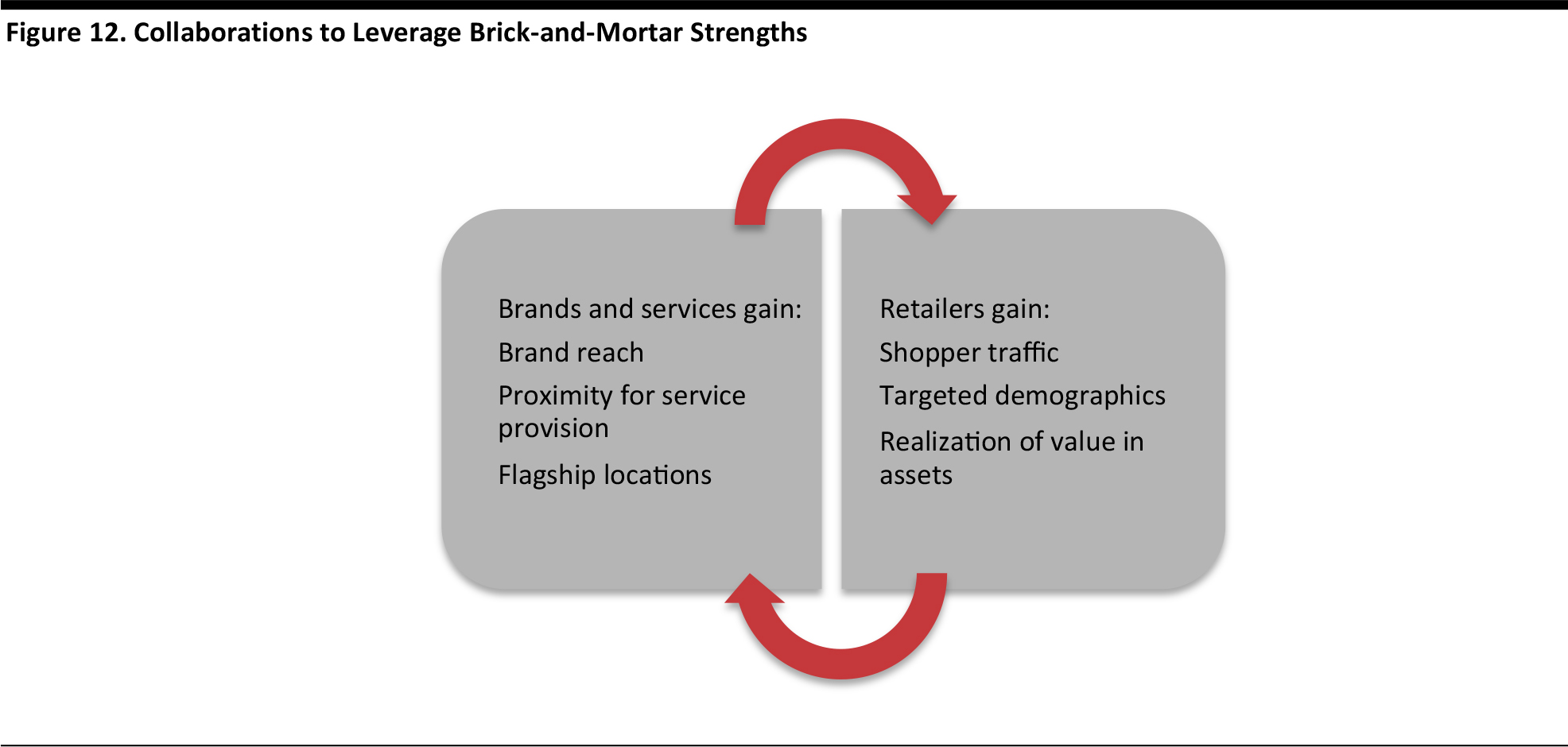

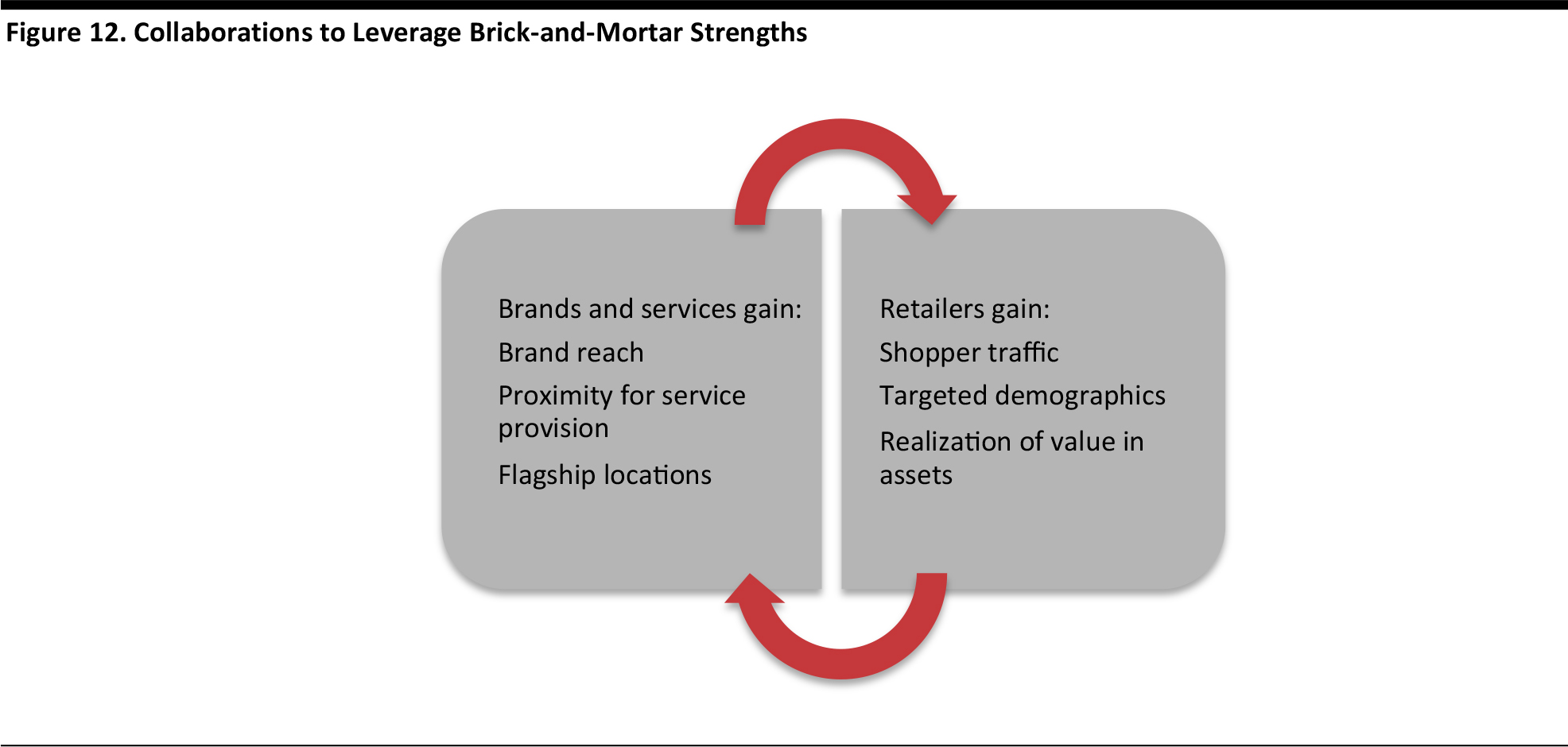

12. Brick-and-Mortar Retailers Thinking the Unthinkable in Terms of Collaboration

Legacy retailers will continue to surprise us in 2018 with their choice of partners for collaboration. Established retailers will seek to leverage their store estates in defensive collaborations spanning retailer-brand, retailer-retailer and retailer-service partnerships in 2018:- Retailer-brand: More online-only brands will look to establish retailer partnerships in order to scale up. Legacy retailers will seek out brands that resonate with desired demographics and that drive footfall. Firms will follow in the footsteps of Target, which first partnered with the Harry’s brand of shaving products to bring the brand to its stores in 2016 and then partnered with Casper to bring Casper mattresses to its stores in 2017. Germany’s KaDeWe Group also introduced the Casper brand to its store network last year.

- Retailer-retailer: More brick-and-mortar names could follow the lead of Kohl’s and collaborate with Amazon or other Internet-only retailers. Kohl’s is now selling Amazon’s smart-home products and allowing shoppers to return Amazon orders to Kohl’s stores. Another notable retailer partnership involves Lord & Taylor opening a store on Walmart’s marketplace site in early 2018. We expect more unexpected collaborations to drive store and online traffic this year.

- Retailer-service: More retailers will look for partners in expanding service industries in 2018, following the lead of Hudson’s Bay Company, which sold its Lord & Taylor New York flagship to office-space provider WeWork and will also lease space in other stores to WeWork.

Source: FGRT

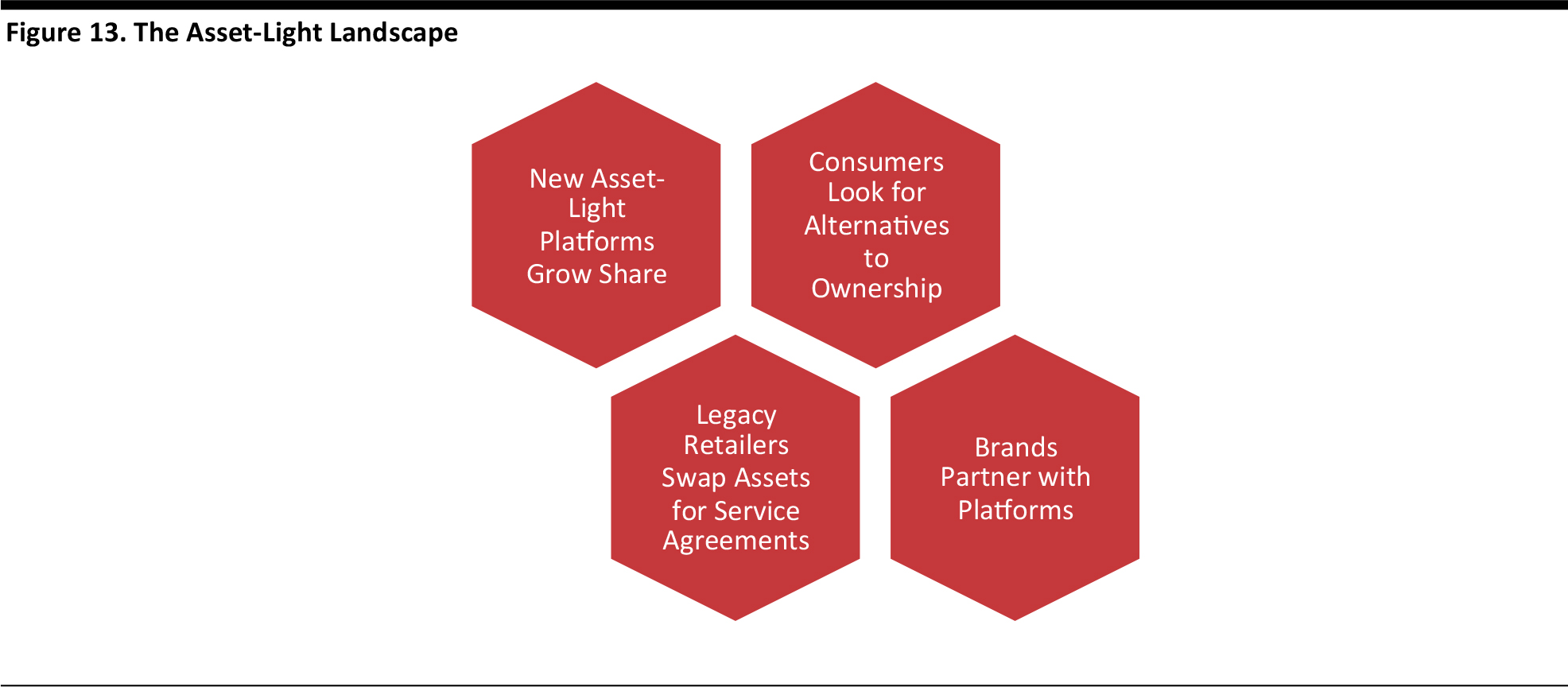

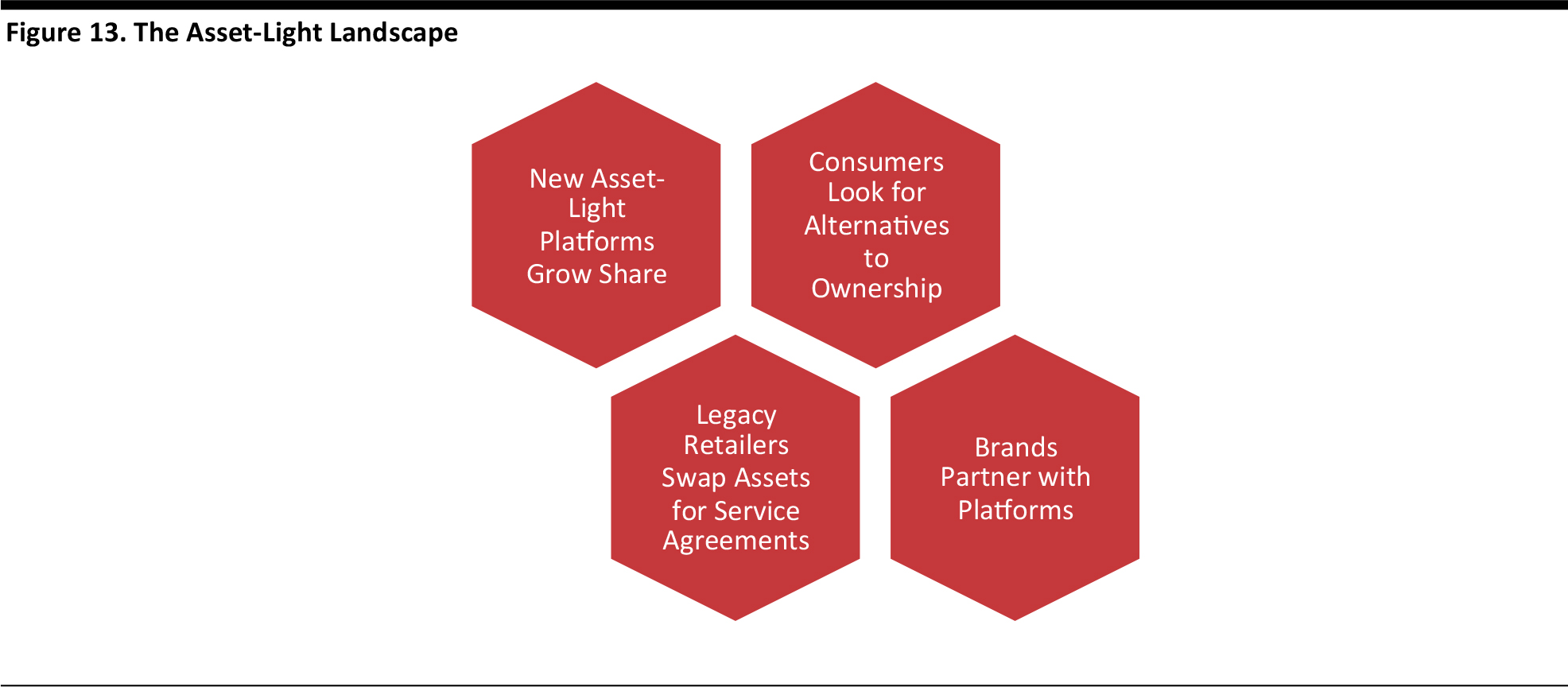

13. Accelerating the Move to an Asset-Light World

Services will continue to replace ownership of things in 2018 as more companies and consumers migrate to “as-a-service” models. We expect to see an accelerated move toward an asset-light world in 2018 as companies and consumers alike look to shed assets and switch to “as-a-service” models. In retail, this will be reflected in the continued ramping up of marketplace sites, where operators do not hold the inventory, at the expense of traditional retail sites, where they do. This trend spans major retail names such as Amazon and Walmart in the US and Karstadt and Zalando in Germany. Brands seeking to grow their e-commerce sales will continue to flock to marketplaces to tap large consumer bases while minimizing investment in front-end e-commerce capabilities.

Source: karstadt.de

In business more broadly, the asset-light world will see more companies swapping ownership of physical assets such as real estate and mainframe computers for leased property and cloud-based services. This will drive a switch of business costs from capital expenditures to operating expenses. For consumers, the move toward an asset-light world will mean switching more spending from conventional purchases of physical products to alternatives such as rental, resale and digital options. We expect more consumers to rent products ranging from cars to clothing in 2018 and to give greater consideration to reselling products rather than retaining them. In addition, we anticipate that shoppers will continue to switch to digital alternatives to physical products such as movies, games and music.

Source: FGRT

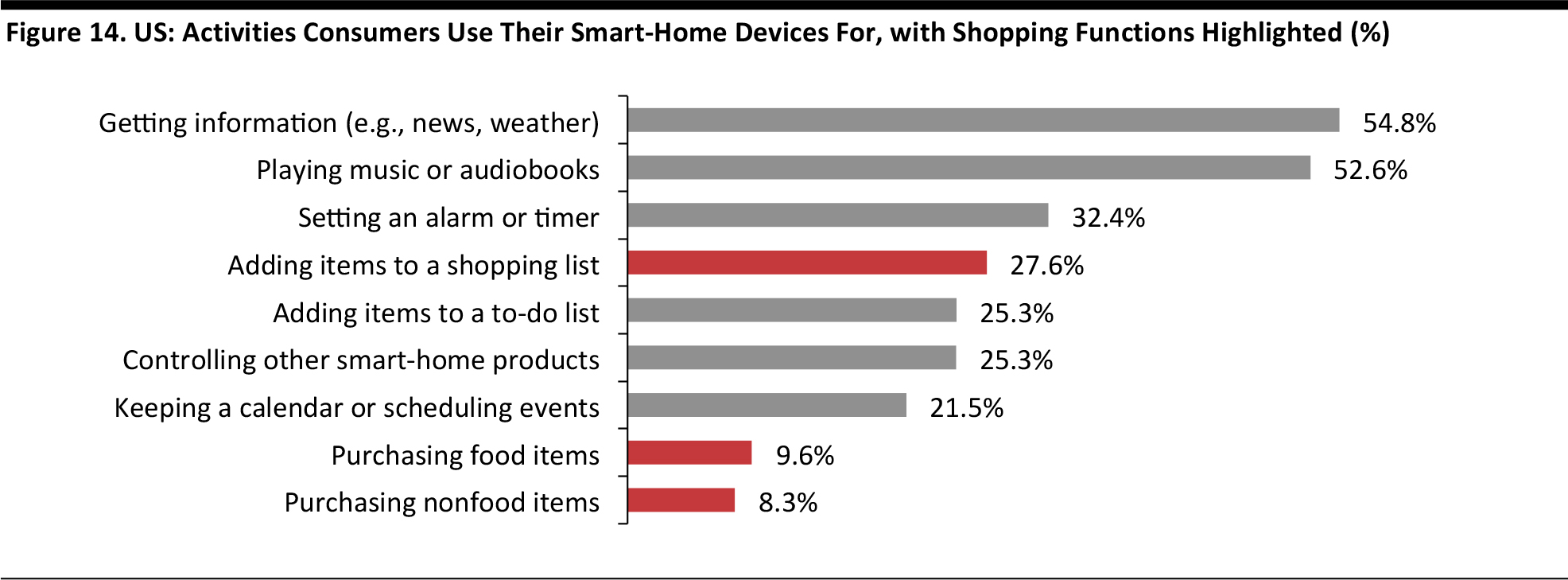

14. Voice Is the Lever that Will Prompt Retailers to Partner with Tech Giants

Brick-and-mortar retailers that are playing catchup in e-commerce will not want to miss out on voice commerce—and they will be forced to partner with potential rivals such as Amazon. Voice commerce is still a niche, and we do not expect that to change in 2018. However, shopping via voice-enabled devices such as the Amazon Echo and the Google Home will grow fast from a small base. And the integration of video with voice in second-generation devices such as the Amazon Echo Show will help support both ownership of voice devices and their use for shopping.

Source: Google Home, https://store.google.com/ca/product/google_home

The voice platform’s still-peripheral status will not stop retailers from jumping on it to avoid missing out on early-mover advantages. In particular, we think a substantial number of brick-and-mortar retailers will seek to avoid repeating the mistake they made by lagging in e-commerce so as not to miss a growth channel a second time. That incentive will push these legacy retailers into the arms of the tech giants, which are, in many respects, their rivals. In the US, Target has already partnered with Google Home and in the UK, grocery retailers Morrisons and Ocado allow shoppers to buy via the Amazon Echo. As voice commerce becomes more prominent, more retailers will be forced to put aside concerns about collaborating with potential rivals such as Amazon. Base: 966 US Internet users who own a smart-home assistant such as the Amazon Echo or Google Home; October 2017

Source: Prosper Insights & Analytics

Base: 966 US Internet users who own a smart-home assistant such as the Amazon Echo or Google Home; October 2017

Source: Prosper Insights & Analytics

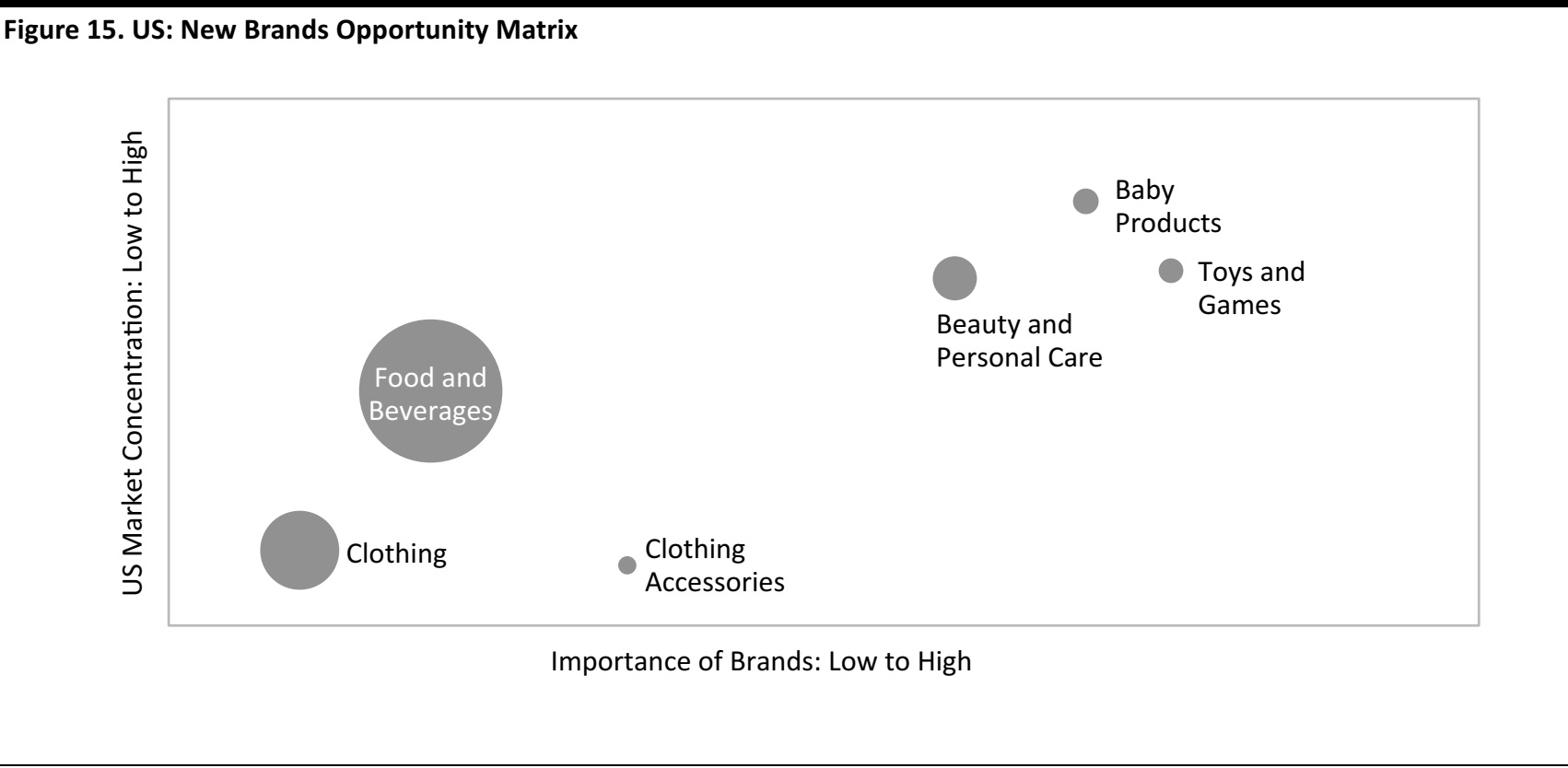

15. Searching for White Space for New Influencer Brands

Brand owners and retailers will seek closer collaboration with social media influencers, particularly for selective product launches in categories where shoppers look for trusted, endorsed brands. Social media influencers are big business, and they drive meaningful traffic to retailers. According to digital market intelligence firm SimilarWeb, approximately 13%–18% of all US desktop traffic to Nordstrom.com, Revolve.com, Net-a-Porter.com, Shopbop.com and Sephora.com is derived from influencer referrals, and the figures are higher for mobile traffic. As a result, brands are flocking to partner with influencers. Fully 70% of consumer goods brands are partnering with influencers on Instagram, according to web data firm L2. Such partnership rates reaches as high as 91% in luxury goods, 84% in activewear and 83% in beauty. Brands will spend $1.5 billion on the Instagram influencer market in 2018, according to marketing agency Mediakix. This year, we expect more partnerships to extend beyond endorsements or product placement to include closer collaboration on new product launches. Brands that expand their partnerships with influencers will be following major retail names such as Amazon, which partnered with Drew Barrymore to launch the Dear Drew clothing and lifestyle brand in October 2017. The opportunities are greatest in categories where brands are more important. We include that factor in our New Brands Opportunity Matrix, shown below, which also factors in total market size and concentration at a company level. High concentration suggests that brand creators will need to collaborate with major brand owners. Toys and games, baby products, and beauty and personal care products are three markets in which brands are highly important, but where a limited number of major brand owners currently dominate. Bubble size indicates relative 2017 US market sizes. Market concentration reflects concentration of companies/brand owners, not brands.

Source: FGRT

Bubble size indicates relative 2017 US market sizes. Market concentration reflects concentration of companies/brand owners, not brands.

Source: FGRT

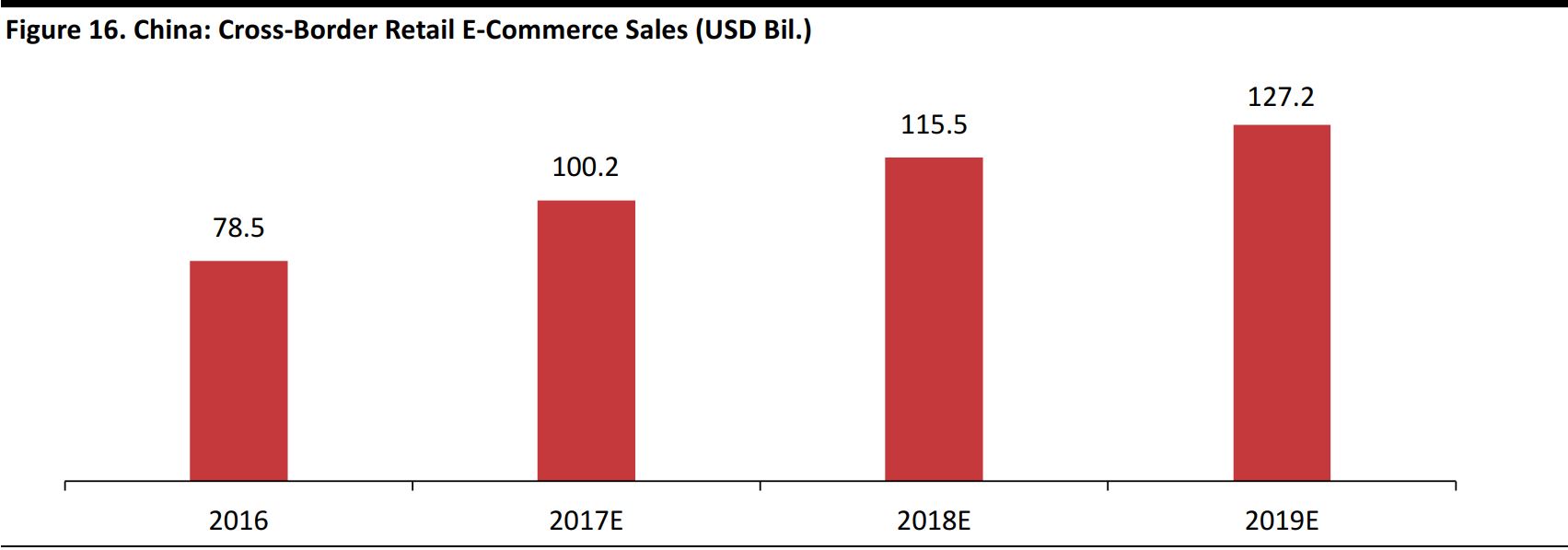

16. Making Cross-Border E-Commerce More Cost-Effective Through Partnerships

Cross-border e-commerce will gain further share of total online sales, prompting more brands and retailers to look to vendors that can help them sell across borders more efficiently. Cross-border e-commerce is already booming, and is likely to grow even bigger in 2018—not just in absolute terms, but also as a share of total e-commerce. Among the drivers of cross-border e-commerce are the growth of marketplaces hosting third-party sellers; the expansion of brands selling direct to consumers (these brands often dispatch from centralized warehouses); the continued growth of e-commerce in China, where many consumers seek international brands; and the growth of e-commerce shopping events and festivals such as Amazon’s Prime Day, Alibaba’s 11.11 Global Shopping Festival and JD.com’s 8.8 event. Our predictions are supported by the following:- The European Union is working to boost cross-border sales by making costs charged by delivery firms more transparent and increasing regulatory oversight of cross-border delivery charges.

- Market research firm eMarketer forecasts that cross-border retail e-commerce sales into China will grow by 15% in 2018, to $115.5 billion.

- FedEx forecasts that cross-border shopping will grow to make up 20% of global e-commerce sales by 2022, led by imports to and exports from the Asia-Pacific region.

- Retailers will turn to in-country service providers to manage their operations in markets such as China. There, beauty retailer Feelunique already uses service provider Azoya to manage every aspect of its Chinese e-commerce operation, including marketing and customer acquisition, customer service, payment support and last-mile delivery.

- More retailers and brands are likely to turn to third-party providers of reverse logistics services to assist with product returns. Companies such as ZigZag Global provide consolidation, inspection, and liquidation or resale services to make returns more efficient and cost-effective.

- Retailers also may adopt particular technologies and services that help minimize returns—and nudge their customers to use them before they buy. Examples include apparel-fitting services such as True Fit, which helps shoppers pick the right size when buying fashion online.

Source: eMarketer

Source: eMarketer

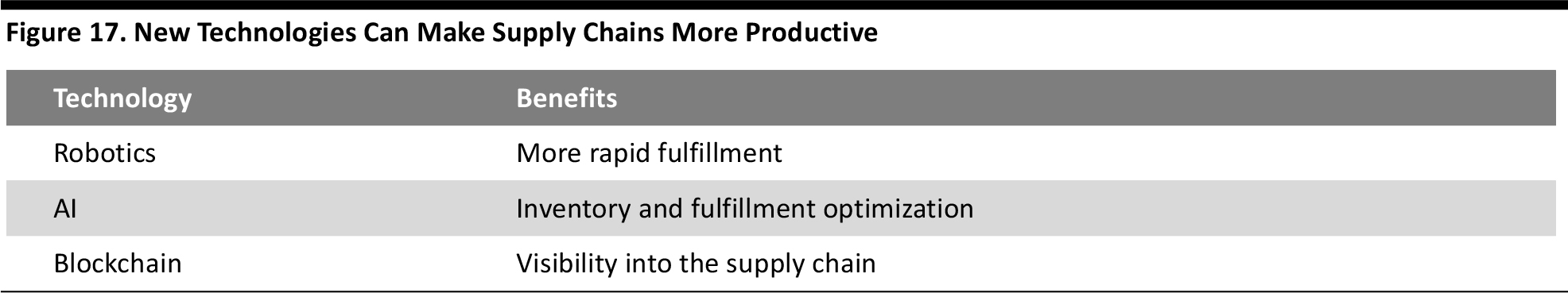

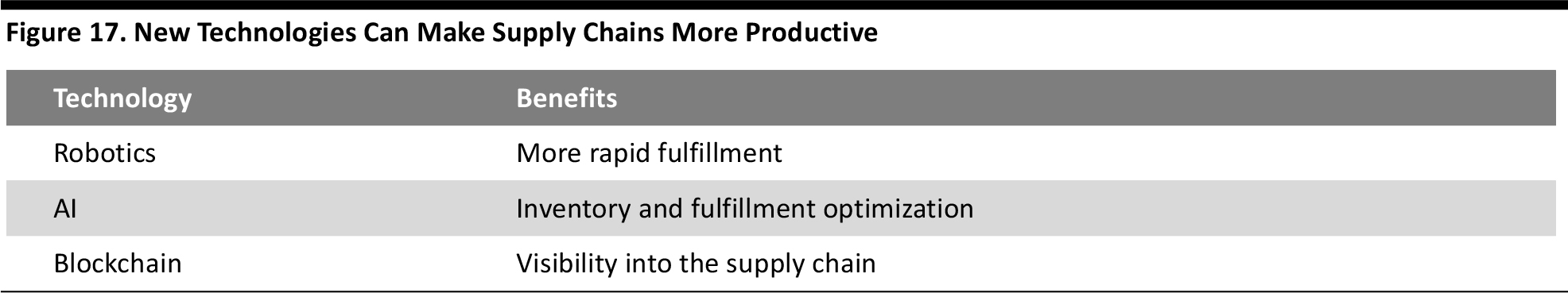

17. Heightened Adoption of Technology Set to Drive Up Supply Chain Productivity

For retailers, AI will yield big benefits this year in terms of inventory management. Coupled with greater use of robotics and blockchain-based services, AI applications will boost supply chain productivity. The use of robotics in fulfillment centers is nothing new and the use of AI in retail is becoming commonplace, especially in customer service applications. In 2018, we expect the sum of robotics plus AI plus blockchain to equal accelerated productivity gains in the supply chain, and we expect to see greater buy-in of these technologies among legacy retailers. Internet pure plays have so far led in the development and rollout of robotics in fulfillment centers. Grocery retailer and technology firm Ocado can now pick a grocery order in five minutes versus two hours previously, thanks to its highly automated operations. And news site Quartz estimated in December that robots could represent 20% of Amazon’s total “employee” base by the end of 2017. On the AI front, Internet platforms such as Deliveroo have led in the use of AI to optimize delivery routes based on historical data and inputs on traffic and weather conditions.

Source: iStockphoto

In 2018, we expect to see long-standing retailers that are less tech-focused try to compete by turning to third-party vendors of AI, robotics and blockchain services. They will be following the example of recent partnerships between retailers and vendors:- AI firms are already providing services such as demand-based predictive merchandising, automated replenishment and price optimization to conventional, long-standing retailers including grocery chains and catalog retailers.

- France’s Groupe Casino recently became the first non-UK retailer to license Ocado’s fulfillment center software and robotics.

Source: FGRT

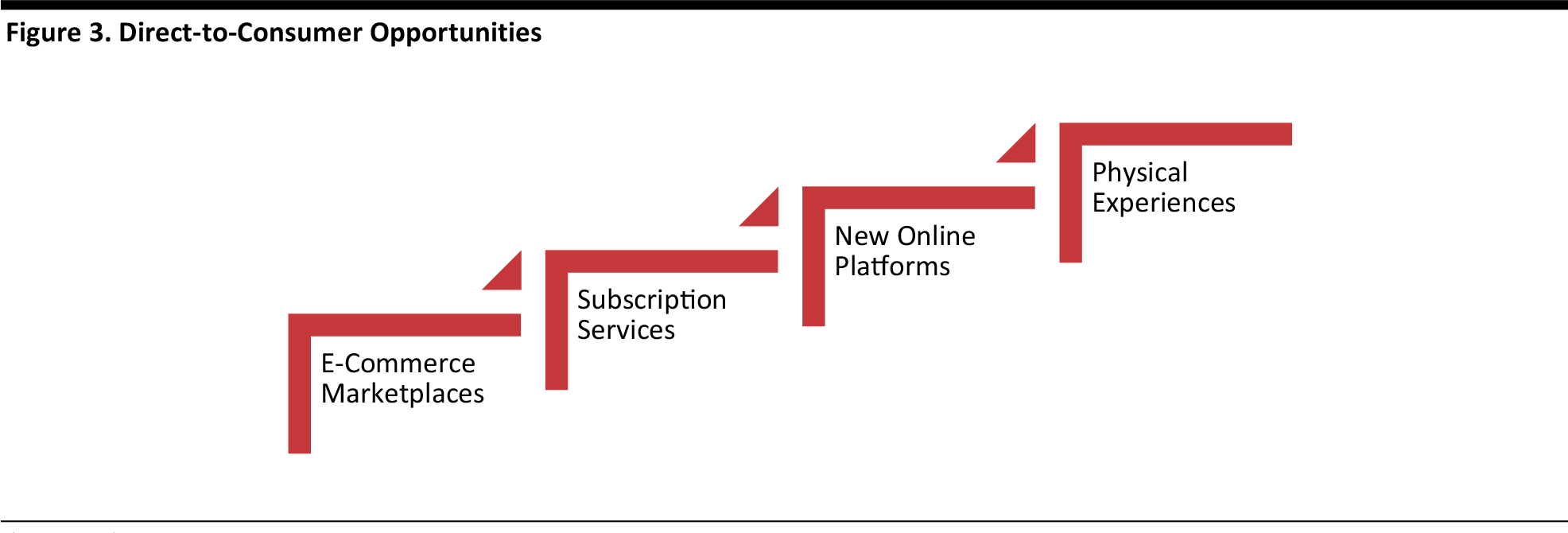

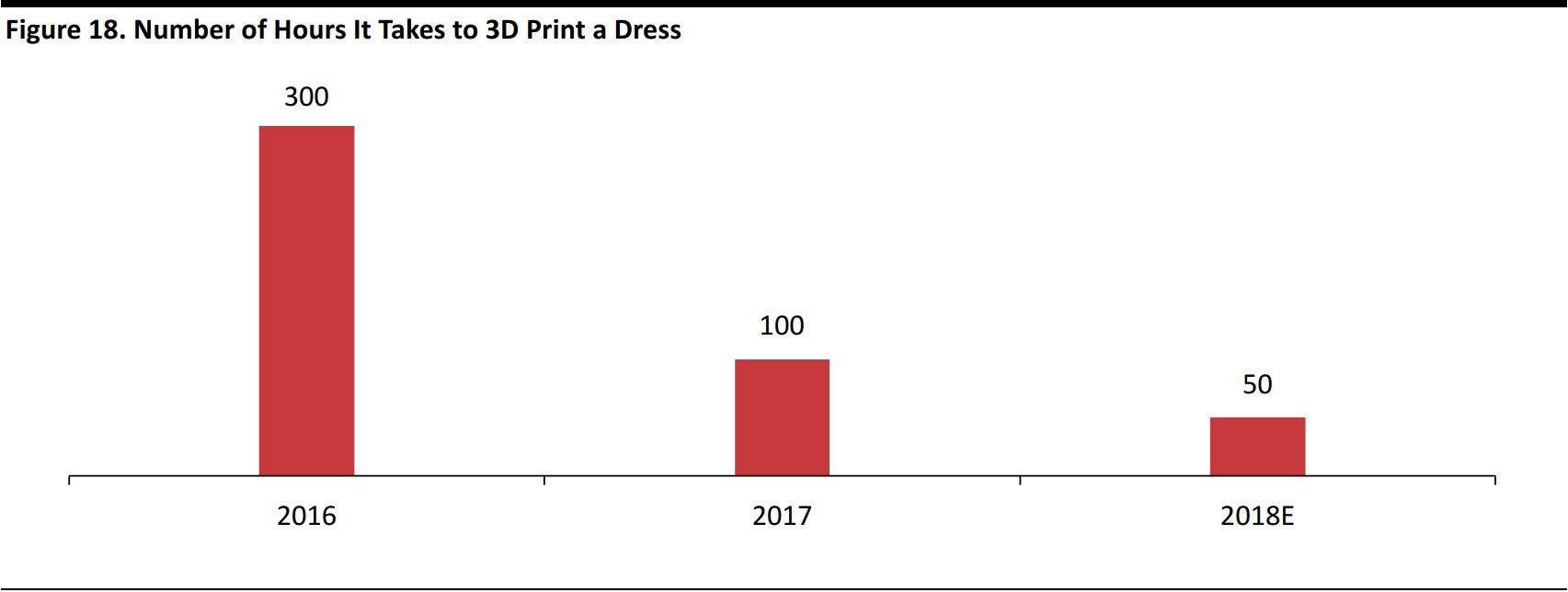

18. Footwear Brands Bring On-Demand Fashion a Step Closer to Consumers

3D printing of apparel is set to become more feasible as designers and developers make more fabric-like materials and shorten the time it takes to print garments. 3D printing of clothing and footwear is becoming a more feasible option for mass-market brands and retailers as printing speeds improve. Longer term, 3D printing may revolutionize the established infrastructure in the fashion industry. Time is a big factor in 3D printing. In December 2017, fashion designer Danit Peleg told news website Motherboard that she can 3D print a dress in 100 hours, down from 300 hours in 2016. Peleg expects that time frame to fall to 50 hours in 2018. The materials used for 3D-printed apparel are improving, too, although they do not yet have the feel of conventional fabrics such as cotton or wool, which remains a medium-term barrier to widespread adoption. That lack of fabric-like quality in materials is partially why footwear—which tends to be more rigid than clothing—looks set to lead the charge of 3D printing into mass-market fashion:- Nike has begun using 3D-printing technology to develop shoe prototypes, partnering with French 3D-printing company Prodways, which uses thermoplastic polyurethane material to produce the 3D-printed outsoles, midsoles and insoles of the shoes. Once fully developed, this process would help reduce manufacturing time for Nike and increase its speed to market.

- In 2017, Adidas introduced the first-ever 3D-printed shoe to be mass-produced, the Futurecraft 4D, aiming to produce 100,000 pairs by the end of 2018. The company has partnered with Carbon, a Silicon Valley startup, to 3D print the midsole of the shoe. According to Adidas, the company will use this technology to create customized shoes on demand according to customers’ individual physiological data.

- Under Armour has launched two limited-edition footwear ranges with 3D-printed soles under the Futurist and ArchiTech lines.