1. ROBOTICS—ROBOTS ARE COMING TO YOUR STORE AND HOME

Robotics has brought great benefits to the electronics and automotive industries in terms of improving quality and reducing labor costs, and they could offer similar benefits to retailers. Retailing is currently not a heavy user of robots, but that could soon change, with Amazon leading the way. The e-commerce giant deployed robots, robotic arms and a slew of other leading-edge technologies in its fulfillment centers just in time for the 2014 holiday season. And it is testing another kind of robot—flying drones—for aerial package delivery. In addition to Amazon, several other companies are developing robotics technology for use in warehouses, and continuous price and performance improvements in robotics have reached an inflection point, leading to adoption by many other industries.

Robots in Retail

In advance of the 2014 holiday rush, Amazon deployed more than 15,000 robots in 10 fulfillment centers, a move that it estimated could cut operating costs by 20%. Instrumental to this was its acquisition of Kiva Systems for $775 million in May 2012. Kiva’s robots zip along the floor of a warehouse, pick up items from shelves and pallets, and transfer them to cartons and totes. Kiva reportedly had more than $100 million of revenue in 2010, and a Kiva start-up kit costs between $1 million and $2 million. Setting up and programming a Kiva system requires six months of planning and testing, as well as logistics training for employees. In addition to Kiva’s robots, Amazon uses Robo-Stow, a robotic arm it developed, as well as machine-vision systems that can unload and register a trailer full of goods in half an hour (this previously took hours) and a graphically oriented software package for use in order fulfillment. Prior to the acquisition, Kiva’s customer list prior to its acquisition included other retailers such as Crate and Barrel, Gap, Office Depot, Staples and Walgreens.

Walmart uses an undisclosed number of robots in its US distribution centers to pick, pack and sort items for its e-commerce business. The company uses robots to tape packages for shipping and stamp shipping labels on packages. Using an algorithm developed at its Silicon Valley–located Walmart Labs, the company has been able to locate and sort items more efficiently, which has reduced delivery time by 15%. Still, robots cannot perform all of the tasks needed, such operating forklifts, so Walmart’s distribution centers also employ human labor.

Robotics Startups for Warehousing

In addition to Kiva, there are many other start-ups that are developing automated warehousing technology, including Adept Technology, Bastian Robotics, Cimcorp, Dematic, Fetch Robotics, Gray Orange, Grenzebach, Hi-Tech Robotic Systemz, KUKA, Swisslog and Vanderlande, according to the website TheRobotReport.com. Hardware represents just one part of the solution, though—eBay has developed software for optimizing shipments without the need for distribution centers, and newly launched Jet.com is also using software to minimize pricing and shipping costs.

Symbotic (formerly known as CasePick Systems), located in Wilmington, MA, is a private company developing warehouse robots that can optimize fulfillment, transportation and logistics. The company claims its system is easy to configure and can be configured using existing warehouse assets, which minimizes logistics costs. The company serves two industries: general merchandise and retail and grocery and food service. The platform’s two main offerings are its storage solution and its internal software. In terms of storage, its robot—the Matrix Rover—can access any pick location (based on SKU) and sort items without requiring any additional hardware, offering increased storage density, modularity, extensibility, and high speed and throughput. The software in Symbotic’s robots employs a massively parallel, distributed approach toward handling items, and promises world-class accuracy combined with optimized storage and robust supply chain integration.

Other Applications

Robots have already entered our homes in the form of robotic vacuum cleaners, and auto maker Tesla just demonstrated an autonomous robotic charger for its electric cars, which performs the function of the filling station attendant of yesteryear. In Japan, gadgets—including robots—have long been popular. Sony announced a prototype of a robot dog named Aibo in the late 1990s, and this year retailer Mitsukoshi installed a robotic greeter made by Toshiba in its Tokyo store. Bank of Tokyo-Mitsubishi UFJ is testing Nao, a customer service robot that can answer questions in 19 languages. One startup, SoftWear, has developed a robotic sewing machine which can operate completely without the need for a human operator.

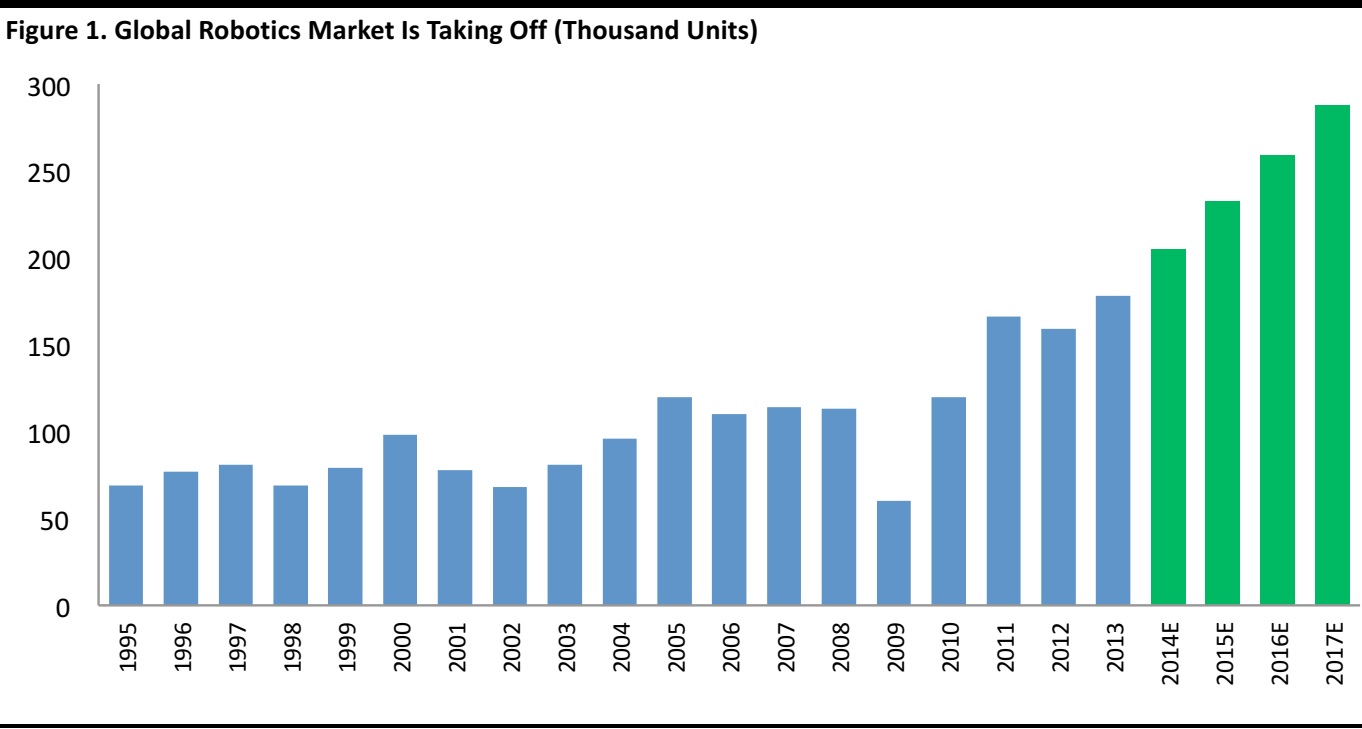

Global Robot Market: More than $9.5 Billion

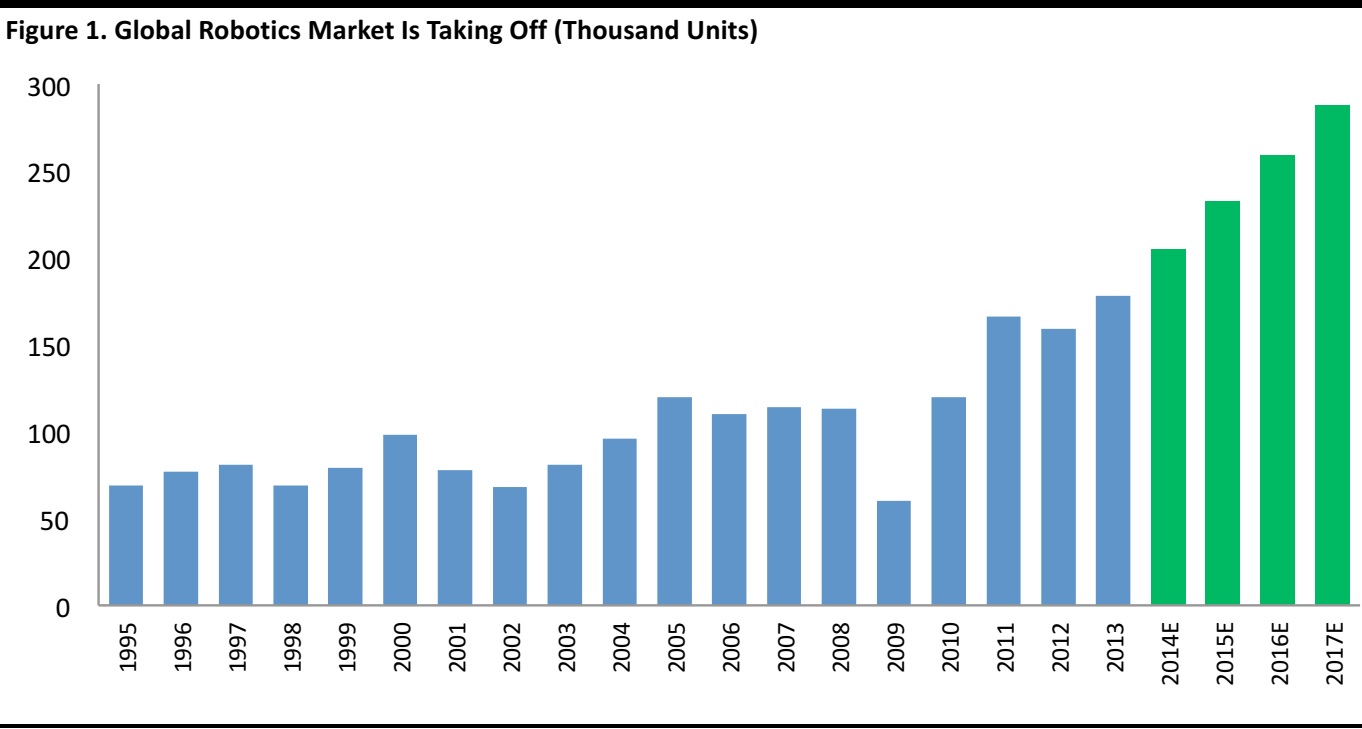

In 2013, global robot sales totaled 178,132 units, a 12% increase over the prior year. Sales were driven by purchases from the automotive, chemical, rubber and plastics, and food industries. In US-dollar terms, the global robot market was worth $9.5 billion in 2013. However, the market for robotic systems was worth approximately $29 billion, roughly three times the market for the robots themselves. In the graph below, we see that robot shipments have generally followed economic cycles, with a 5% average growth rate from 1995 through 2013.

Source: International Federation of Robotics

The International Federation of Robotics (IFR) forecasts that robot shipments will grow at a 12.8% CAGR from 2013 through 2017. The Boston Consulting Group concluded in a study that robotics is quickly approaching an inflection point in usage that will spark adoption in new industries. The consultancy predicts that prices will drop by about 20% and that performance will increase by about 5% over the next decade.

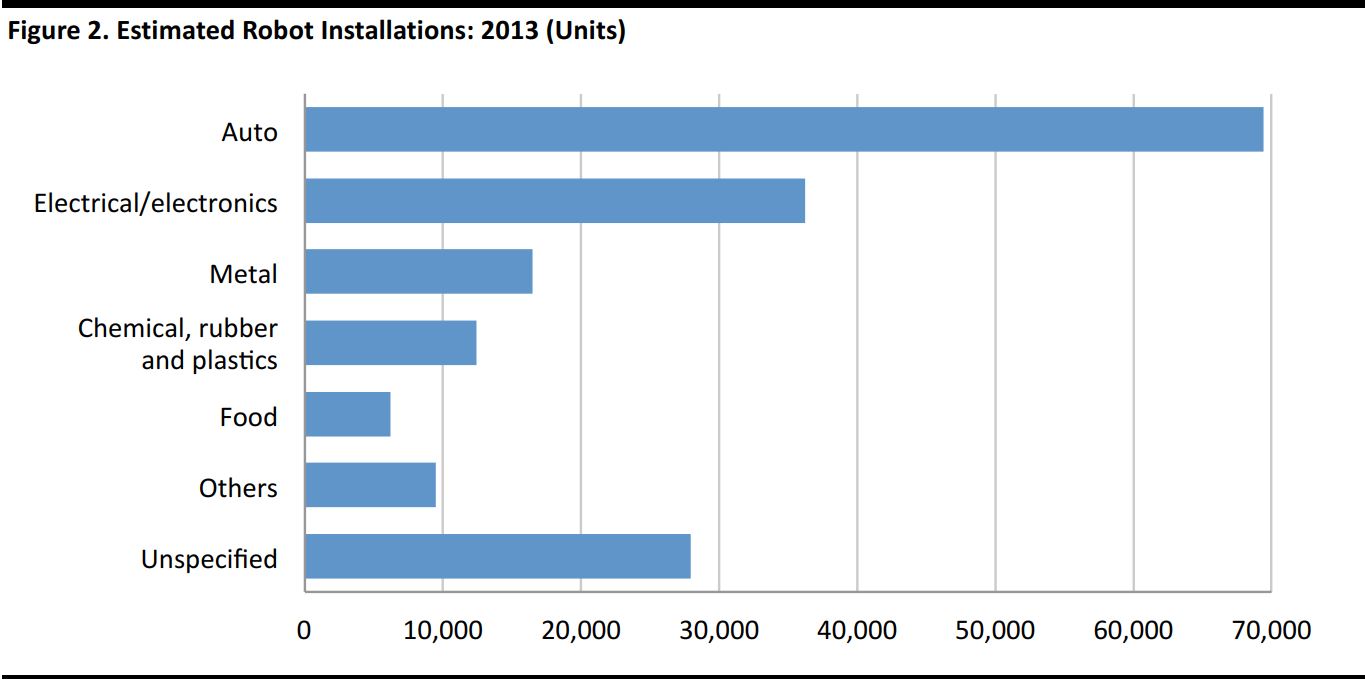

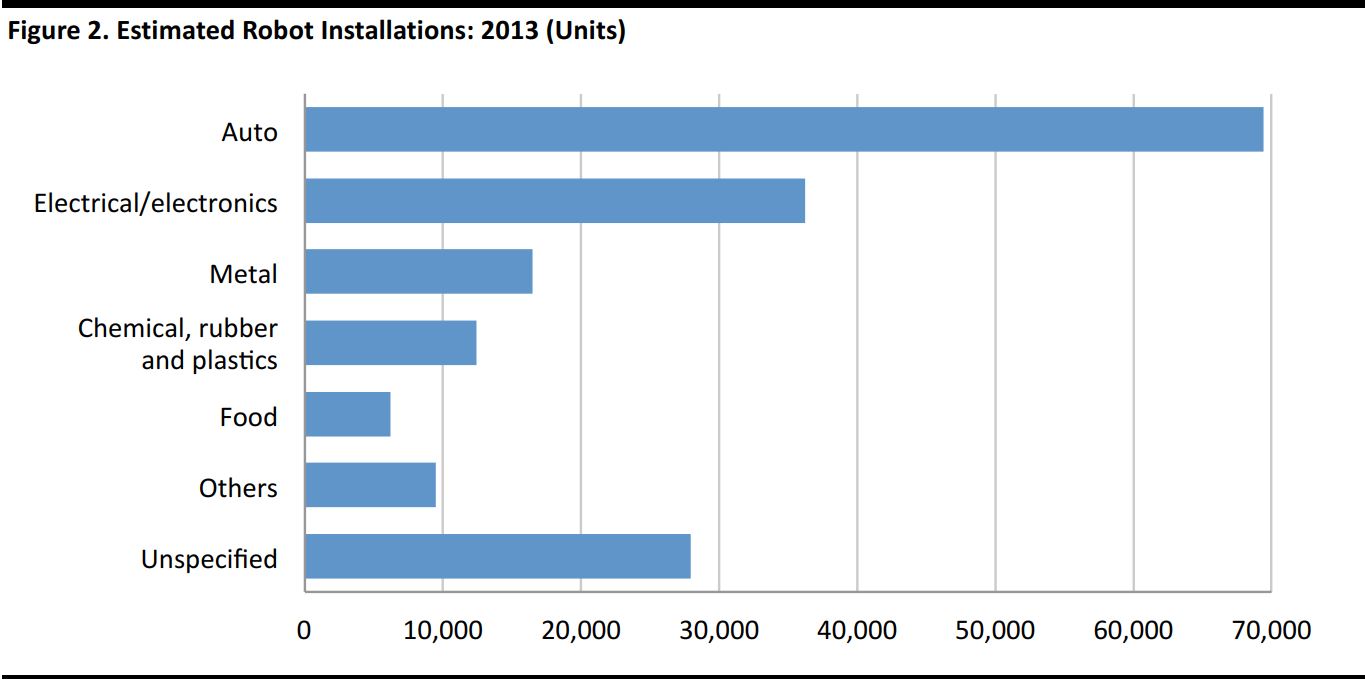

In terms of deployment, the automotive industry is the largest deployer of robots, followed by the electrical and electronics, metal and machinery, chemical, rubber and plastics, and food industries. The graph below shows robot deployment by industry in 2013.

Source: IFR

Asia and Australia Are Largest Users of Industrial Robots

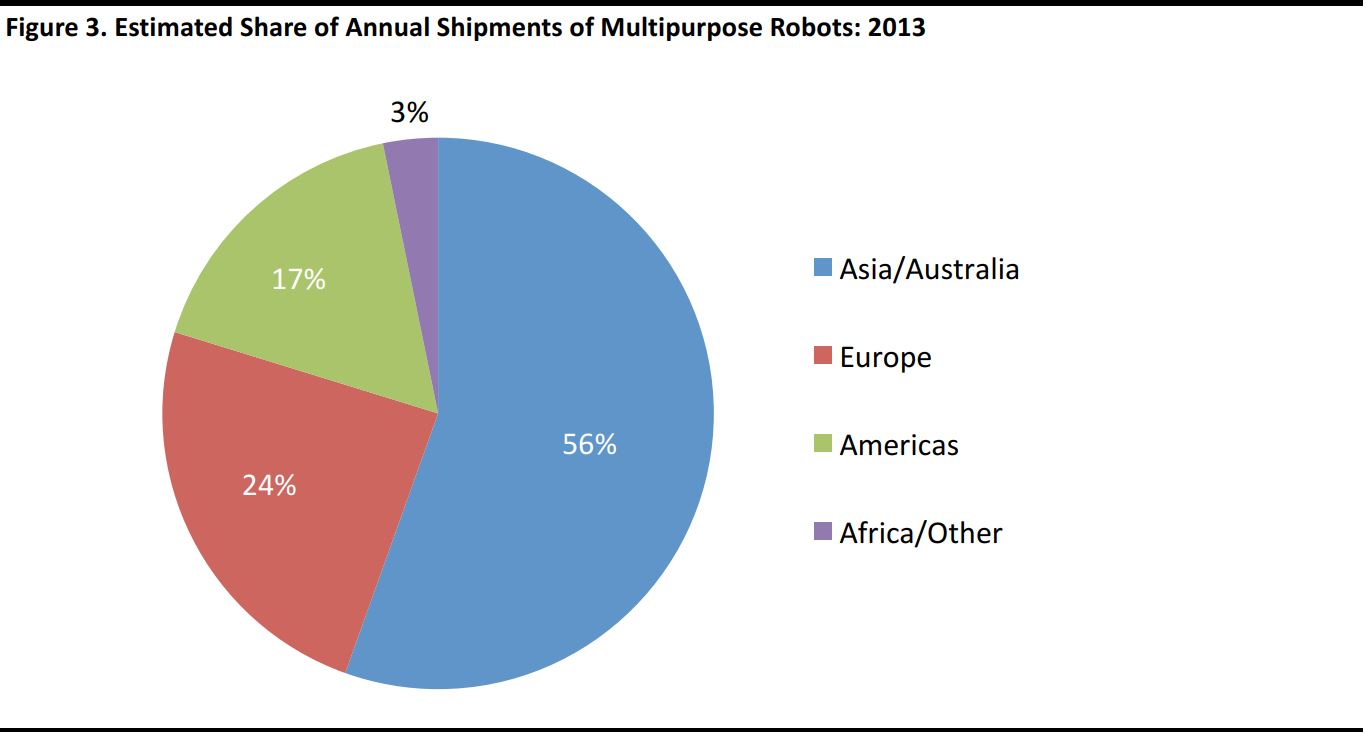

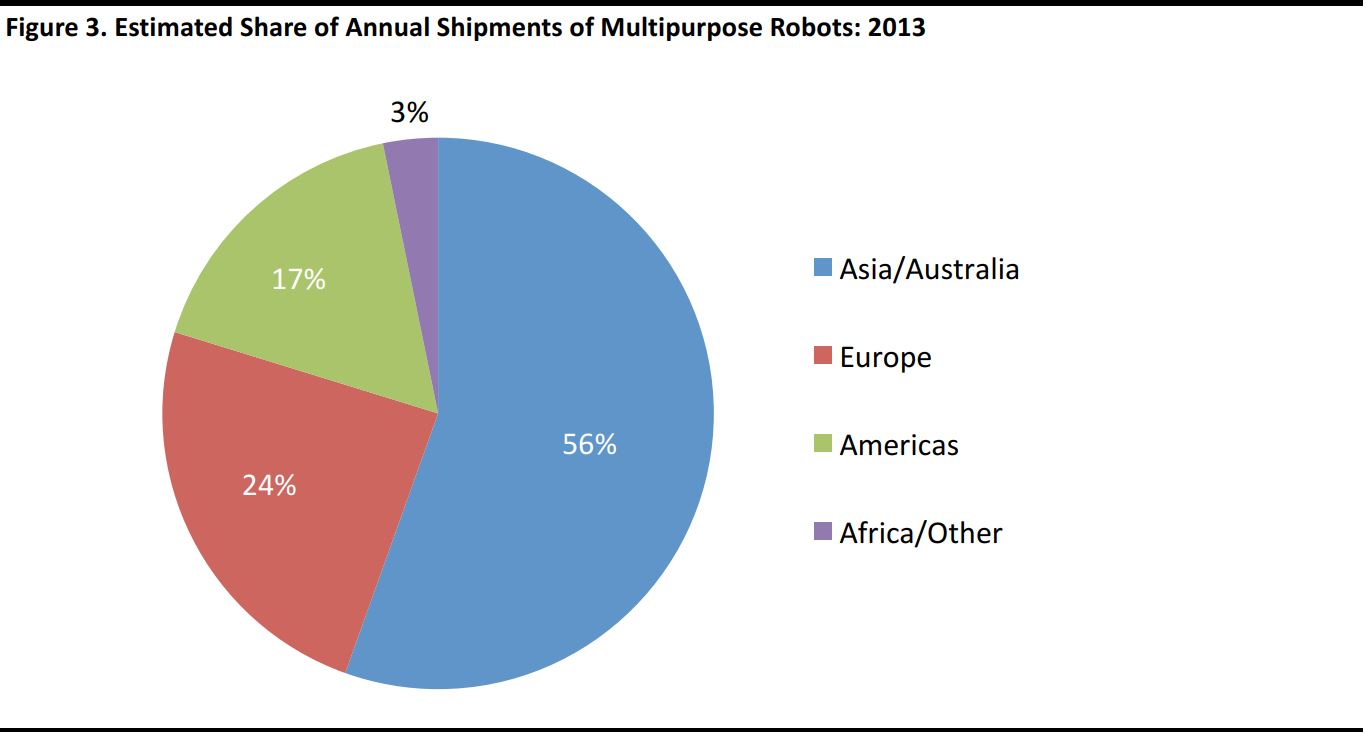

In terms of geography, Asia (particularly China, Japan and South Korea) and Australia are the largest users of industrial robots, followed by Europe (led by Germany) and then the Americas (North America), as seen below.

Source: IFR and FBIC

2. MOBILE COMMERCE—STEADILY BECOMING THE DOMINANT PLATFORM

Across the globe, smartphones are rapidly becoming the dominant tool of e-commerce, and mobile usage predominantly primarily relies on applications rather than browsers. Mobile devices have become the essential technology hub for managing our lives, including coordinating our shopping. Although apps represent a small fraction of commerce and mobile commerce today, their importance continues to increase. Therefore, retailers need to be aware of the technology trends so as not to miss out on this channel’s growing share of sales. Consumers are increasingly indifferent to the exact method of shopping, and expect a seamless experience from store to desktop to mobile device.

A recent eMarketer survey found that only 40% of US respondents had downloaded a shopping app (as of October 2014), and only 39% of that group had used it for purchases (i.e., about 16% of the total group). Yet

Internet Retailer says that 42% of mobile revenue comes from apps. And, according to eMarketer, apps are expected to increase in importance for the following reasons: they are faster than the mobile web; they are necessary for complex functions, such as effecting electronic payments; the majority of mobile users’ time is spent on them; and they are the primary software platform for distributing notifications.

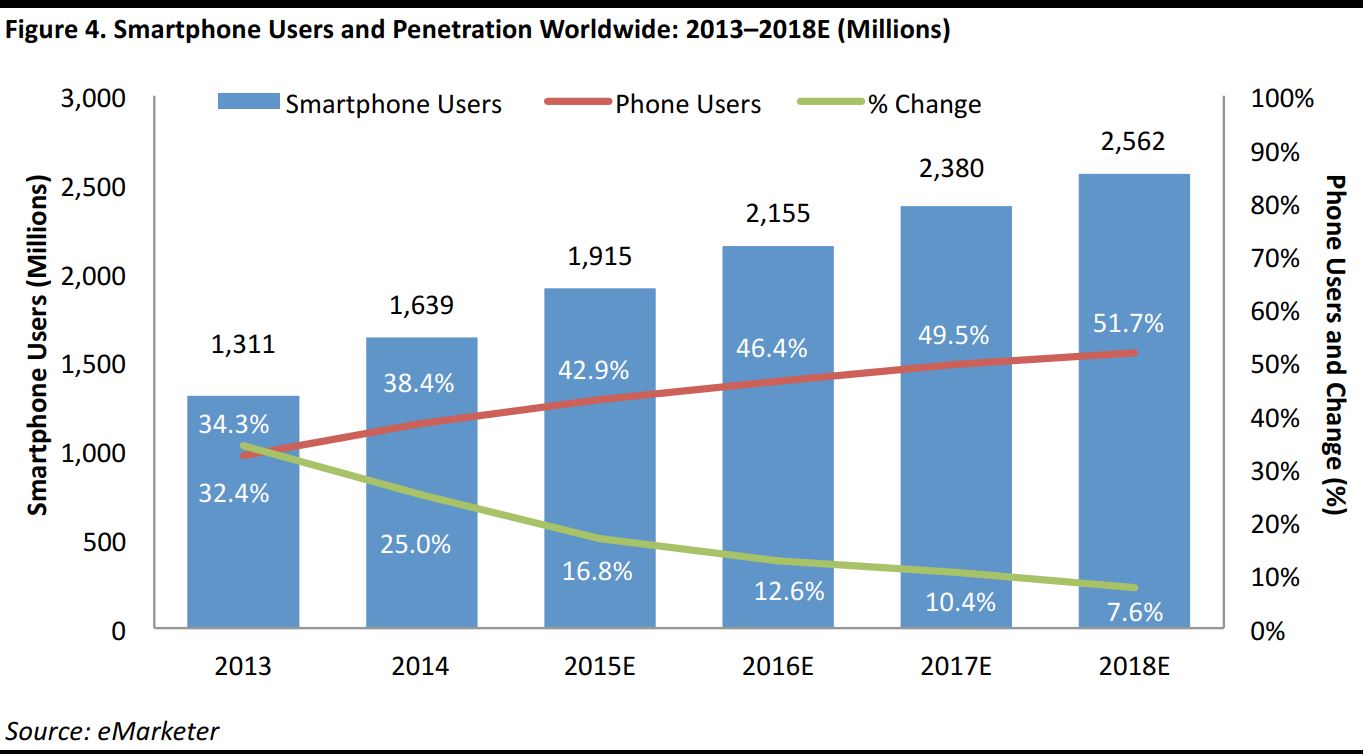

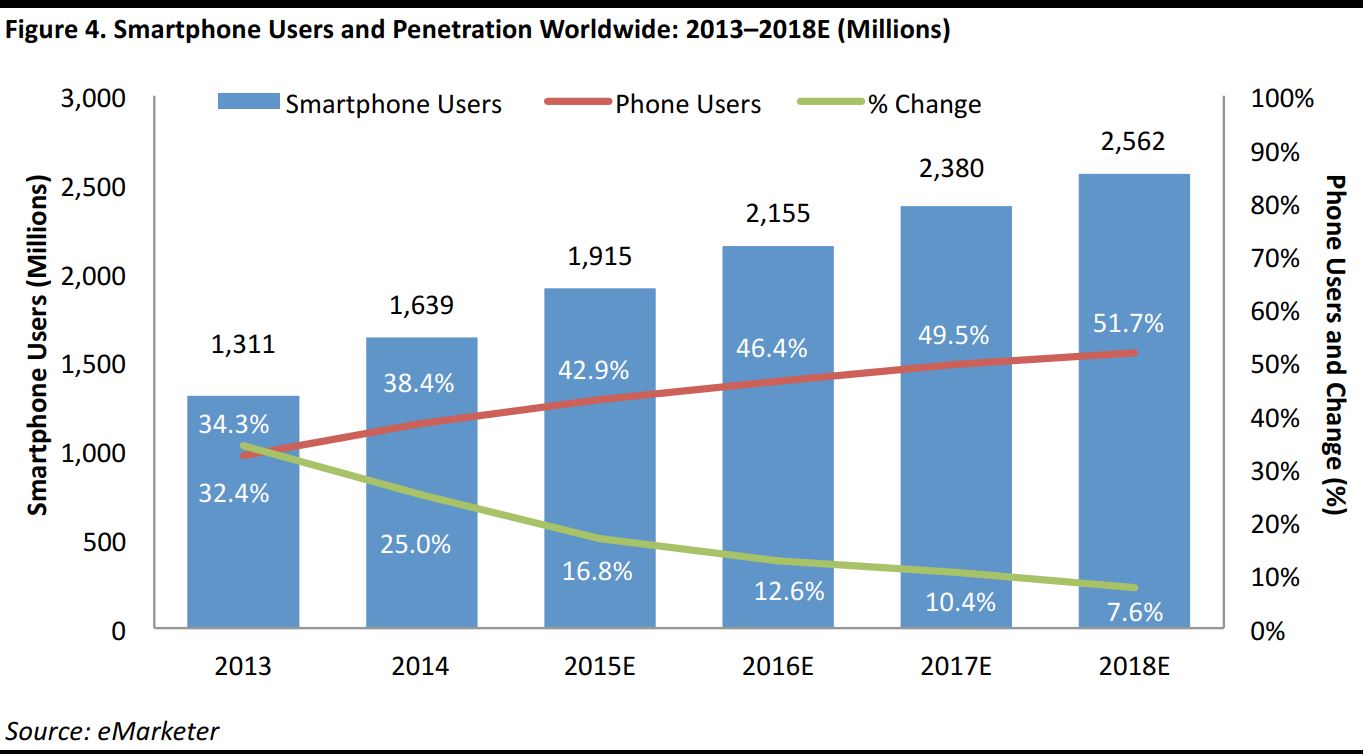

Looking at the potential of mobile apps and m-commerce, we see that both the number of smartphone users and the share of smartphones is increasing, and are forecasted to increase through 2018, as depicted in the figure below.

Source: eMarketer

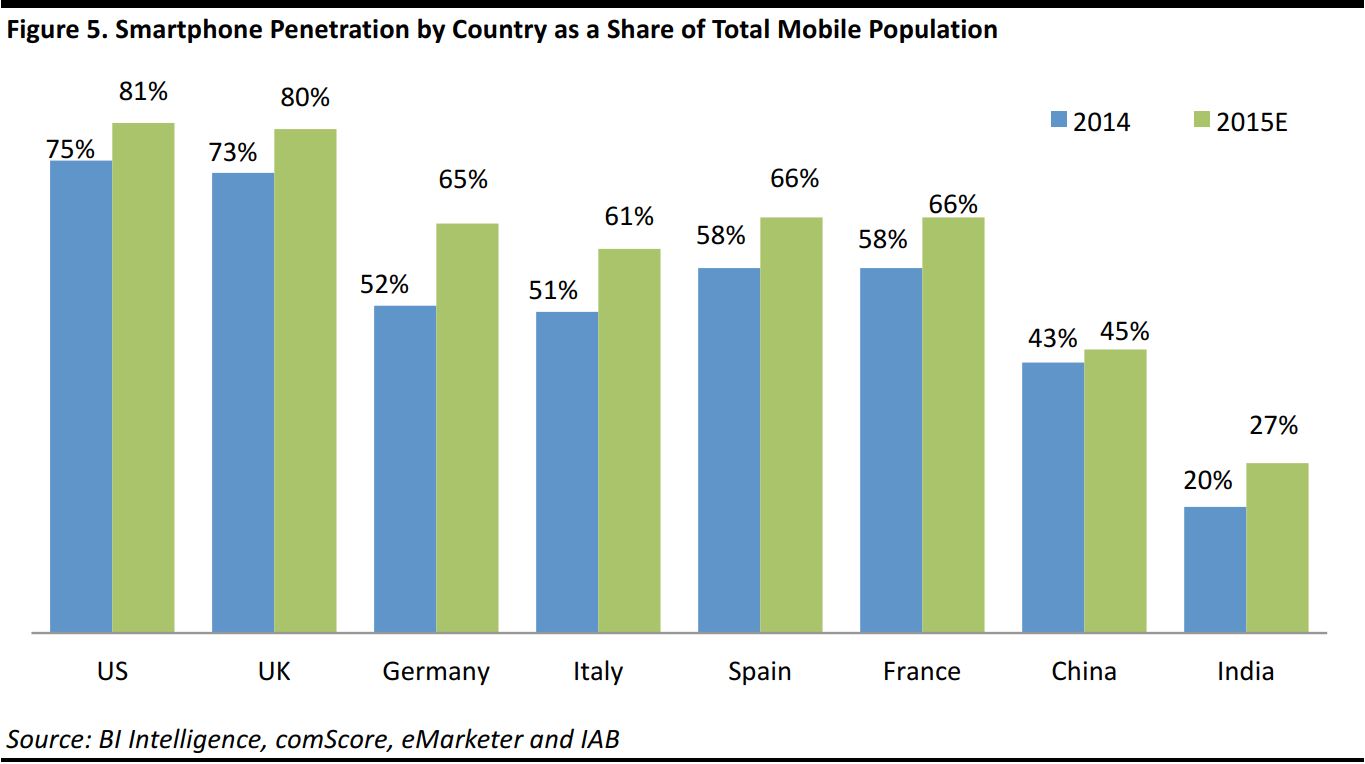

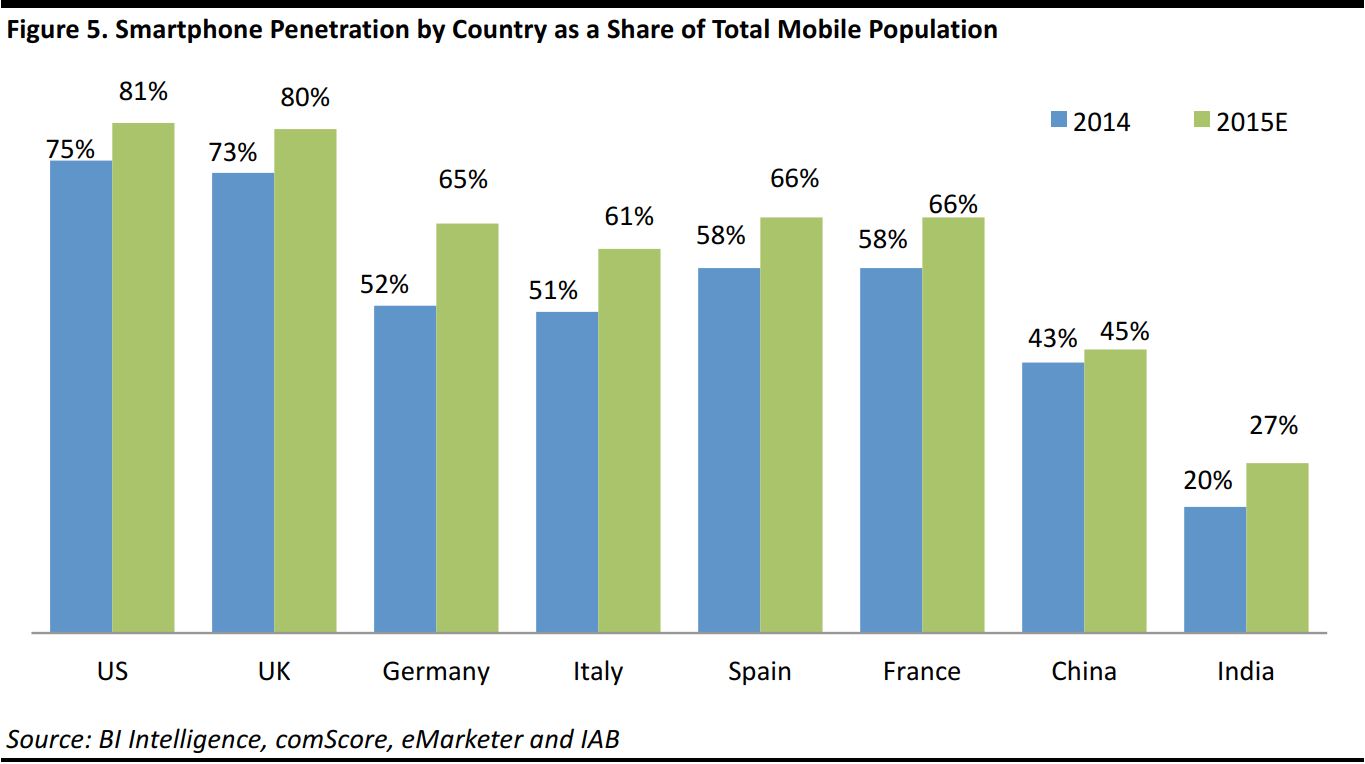

The transition to mobile devices has not been limited to developed countries, as many developing countries have leapfrogged the PC generation, transitioning directly to using mobile devices to do personal business, in particular, shopping. In the graph below, we see smartphone adoption rates for India and China that are not so far off from those of developed countries.

Source: BI Intelligence, comScore, eMarketer and IAB

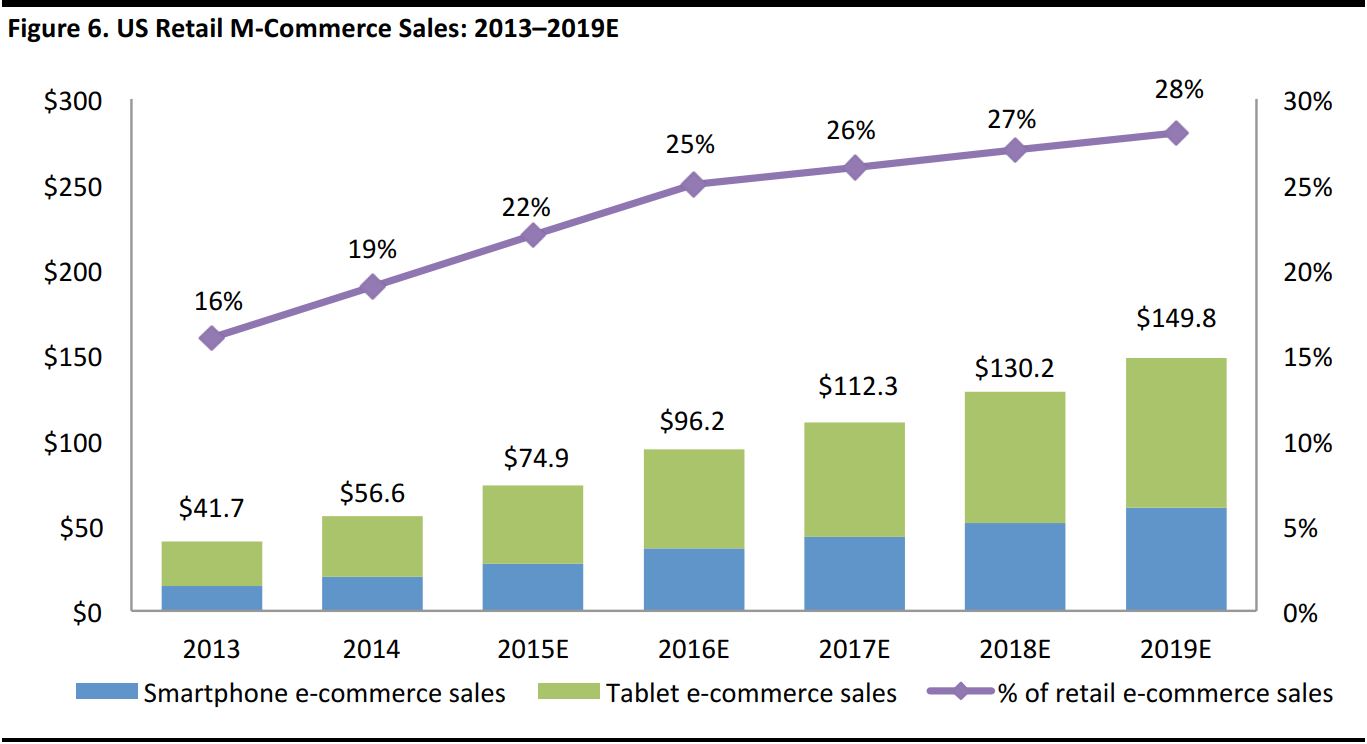

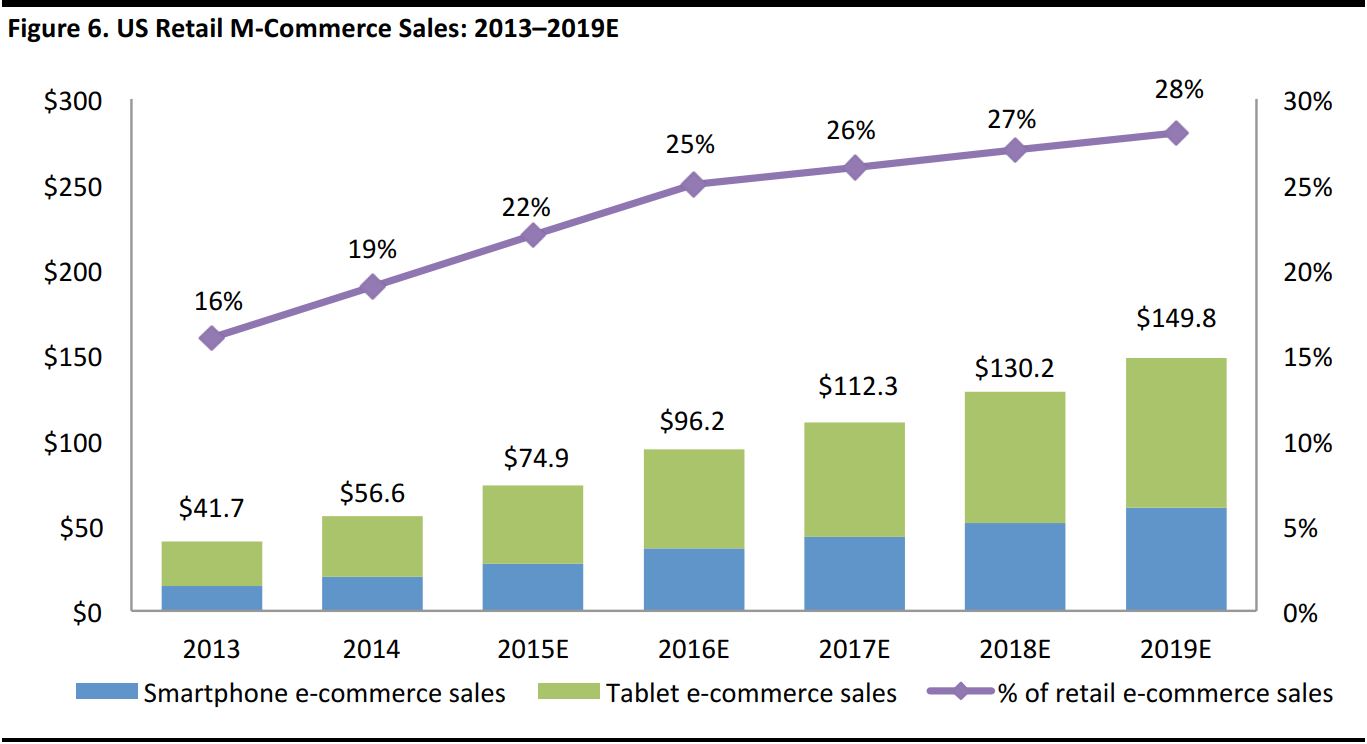

Although the amount of purchases made on mobile devices is quite small today—representing just 1.6% of total US retail sales in 2015—m-commerce sales are expected to grow rapidly. eMarketer forecasts that they will grow by more than 32% this year alone and will represent 22% of retail e-commerce sales. The $75 billion in estimated m-commerce sales this year is expected to double in 2019, when it will contribute 28% of e-commerce sales. This year, nearly two-thirds of US digital buyers (63.7%) are expected to make a purchase with a digital device. Interestingly, shoppers who use tablets are far more likely to complete a purchase than shoppers who use smartphones are.

Source: eMarketer

M-Commerce in China

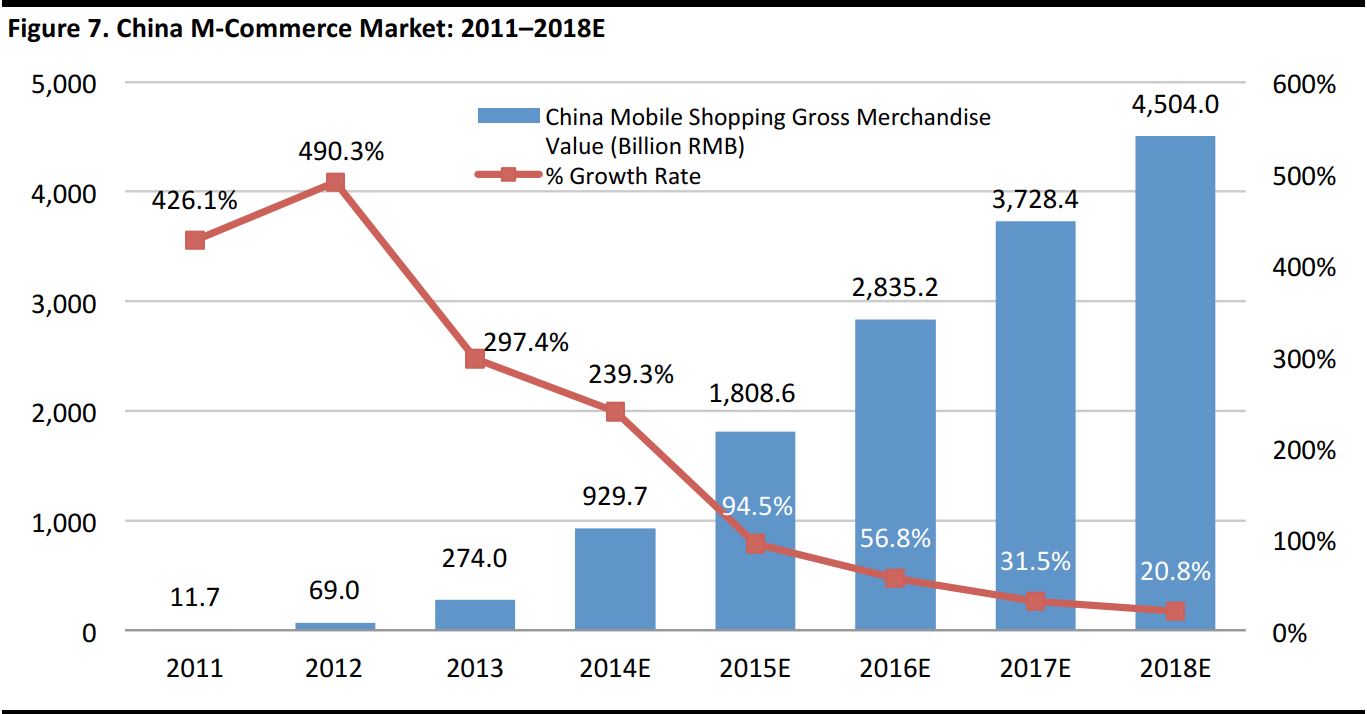

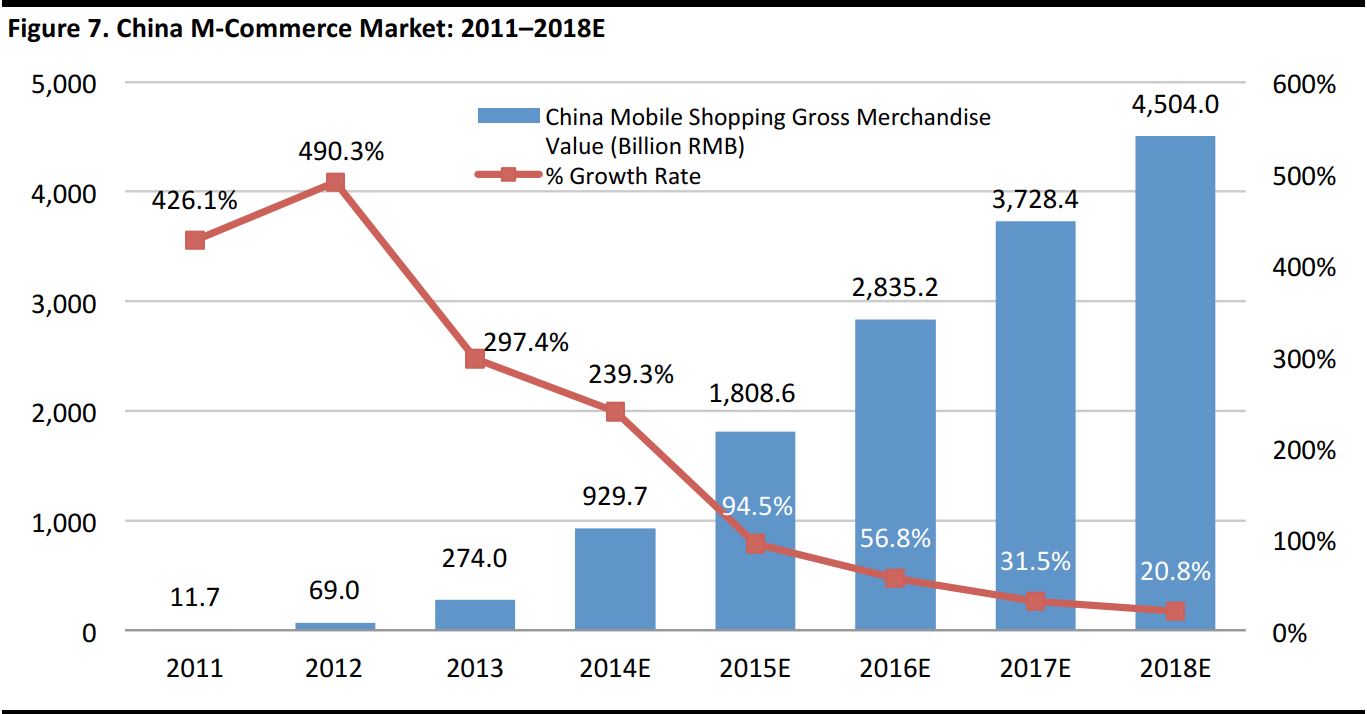

Looking at China, we see that m-commerce presents a significant opportunity for retailers in the country. The China mobile market is expected to grow by 94.5% in 2015 and by another 56.8% in 2016, and to maintain a strong growth pattern over the next three years, which will create an ample foundation for m-commerce applications.

Source: iResearch

Dramatic Growth of WeChat, Enabling Micro-Commerce

Over the past two years, the growth in m-commerce activity in China has been manifested by the increasing popularity of micro-commerce accounts on WeChat, the Chinese messaging platform. Micro-commerce accounts have become a “social selling” tool that allows account owners to promote or sell products and services to their circle of friends. One particulary interesting strategy that has emerged and that is applicable to retail is employee social selling.

In 2014, gaming and social media giant Tencent started allowing verified official users (typically brands) of its popular WeChat messaging app to create in-app stores. These

Weixin Xiaodian, or little WeChat shops, are linked to the WeChat TenPay payment system. Tencent initially used Weixin’s payments facility for in-game purchases, flash sales, online-to-offline purchases and its own shopping platforms. According to qz.com, the platform was expected to bring in more than US$ 1 billion in revenue in 2014, which was to increase by 40% in 2015. Tencent’s move into e-commerce appears to be a challenge to Alibaba’s Taobao marketplace, and Alibaba paid US$215 million for a 15% stake in JD.com in March 2014.

Emergence of Social Shopping

Social shopping means getting friends involved in the shopping experience through social media, and it appears in many forms. Major social media sites such as Google, Twitter and Pinterest have recently started to include “Buy Now” buttons. Social-shopping experiences can also include group shopping through sites such as Groupon and LivingSocial. Shopping communities can be formed where enthusiasts can shop, share and discuss their purchases. Many e-commerce sites provide feedback and recommendation pages where shoppers can rate products and offer advice to fellow shoppers. Fancy.com lets users “fancy” products from across the Internet; those products can be featured, commented on or added to custom lists. Similarly, Luvocracy enables shopping based on others’ recommendations.

There are also several social-shopping marketplaces, or bazaars, where independent sellers can display their products to buyers, and buyers and sellers can communicate within the forum. Examples of online bazaars include Etsy, Polyvore (recently acquired by Yahoo), Shopcade and Storenvy. In addition, there are shared-shopping methods for e-commerce sites that use catalogs, enabling real-time communication between consumers and retailers. Fab works like a discount department store for social shopping, with products classified in several categories and with flash sales, and Faveable is organized like a digital magazine, with searchable categories.

Many social-shopping sites feature curation. For example, Wanelo stands for “want, need, love” and the site works like Pinterest, bringing together products from many stores on a single platform. OpenSky uses gamification: users can receive points from friends who join the site or make purchases, and the points can be exchanged for rewards such as free shipping or credits toward future purchases.

Opportunities for Smartphones in Warehouse Clubs

Beyond m-commerce, there are additional uses of smartphones in warehouse club stores. Smartphones can provide an enormous amount of useful information to shoppers. For example, smartphone apps can include store maps that show the location of goods, which is particularly useful in large stores or in stores where the location of goods is changed frequently. Many retailers in the apparel world are testing beacons, which are Bluetooth transmitters. When a user has the company’s app on a smartphone and turns on Bluetooth, the store can store this information, as well as provide personalized offers, in particular, coupons, to the shopper. For instance, a retailer could draw a shopper’s attention to time-limited sales or onetime quantities of merchandise via the shopper’s smartphone. Finally, shoppers are increasingly using smartphones for “webrooming,” i.e., obtaining additional product information or making comparisons in order to make a more informed purchase in a physical store.

3. THREE NAMES TO KNOW IN CHINA E-COMMERCE—HAITAO, TMALL, AND JD.COM

Haitao.Com—China’s Most Popular B2C Cross-Border E-Commerce Site

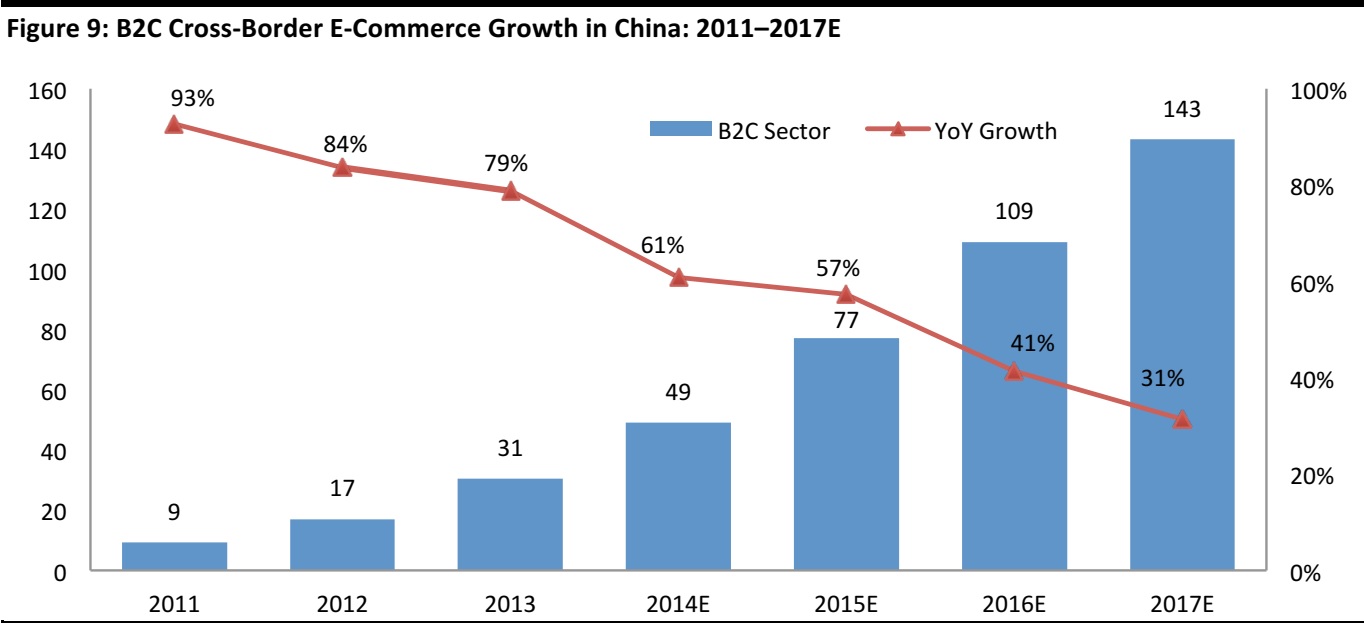

Cross-border shopping has been gaining in popularity in China since 2011. Driven by a desire for authenticity, quality and low prices, Chinese consumers are increasingly buying products directly from overseas online shopping platforms, a process called

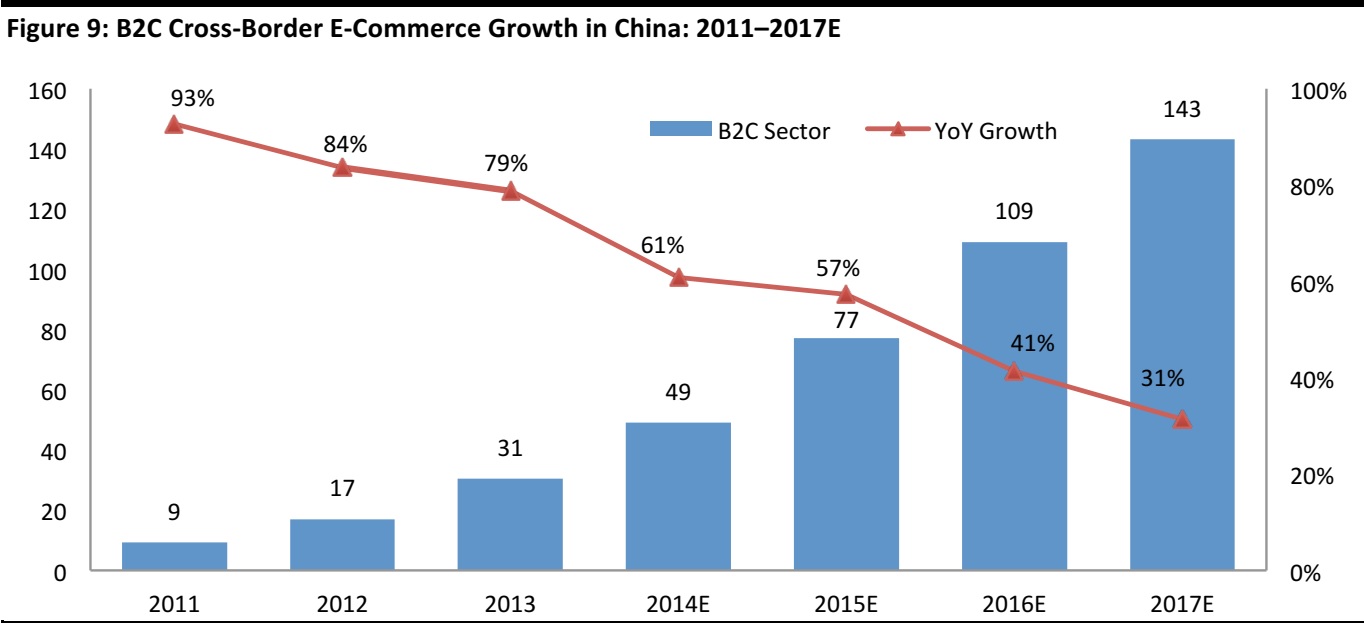

haitao. According to iResearch, the size of the B2C cross-border e-commerce market in China is estimated to hit US$143 billion in 2017, more than three times its size in 2014. Cross-border e-commerce offers significant market opportunities for both domestic and international players in China.

Haitao.com is the most popular B2C cross-border e-commerce site in China. The website’s distinguishing factors are its guarantee of direct shipping from overseas and its guarantee of the authenticity of its goods. The site also offers services that help Chinese customers shop on international e-commerce websites. In addition to translating product pages and providing links to international e-commerce sites, the site offers options for Chinese shoppers to have products shipped to a Haitao warehouse in the country of origin. Haitao.com then coordinates shipping from that warehouse directly to the Chinese consumers. This shipping service enables Chinese consumers to shop on websites that do not offer international shipping options. Haitao.com currently operates four local warehouses in three countries: the US, Germany and Japan.

Amazon

Haiwaigou (“shopping overseas”) has introduced millions of products from Amazon’s US website to Chinese consumers via the Amazon.cn website. Its cross-border e-commerce platform sells 100% of its products from Amazon.com, shipping directly from the US with a two-week delivery window.

FBIC Research on Private-Label Brands in China

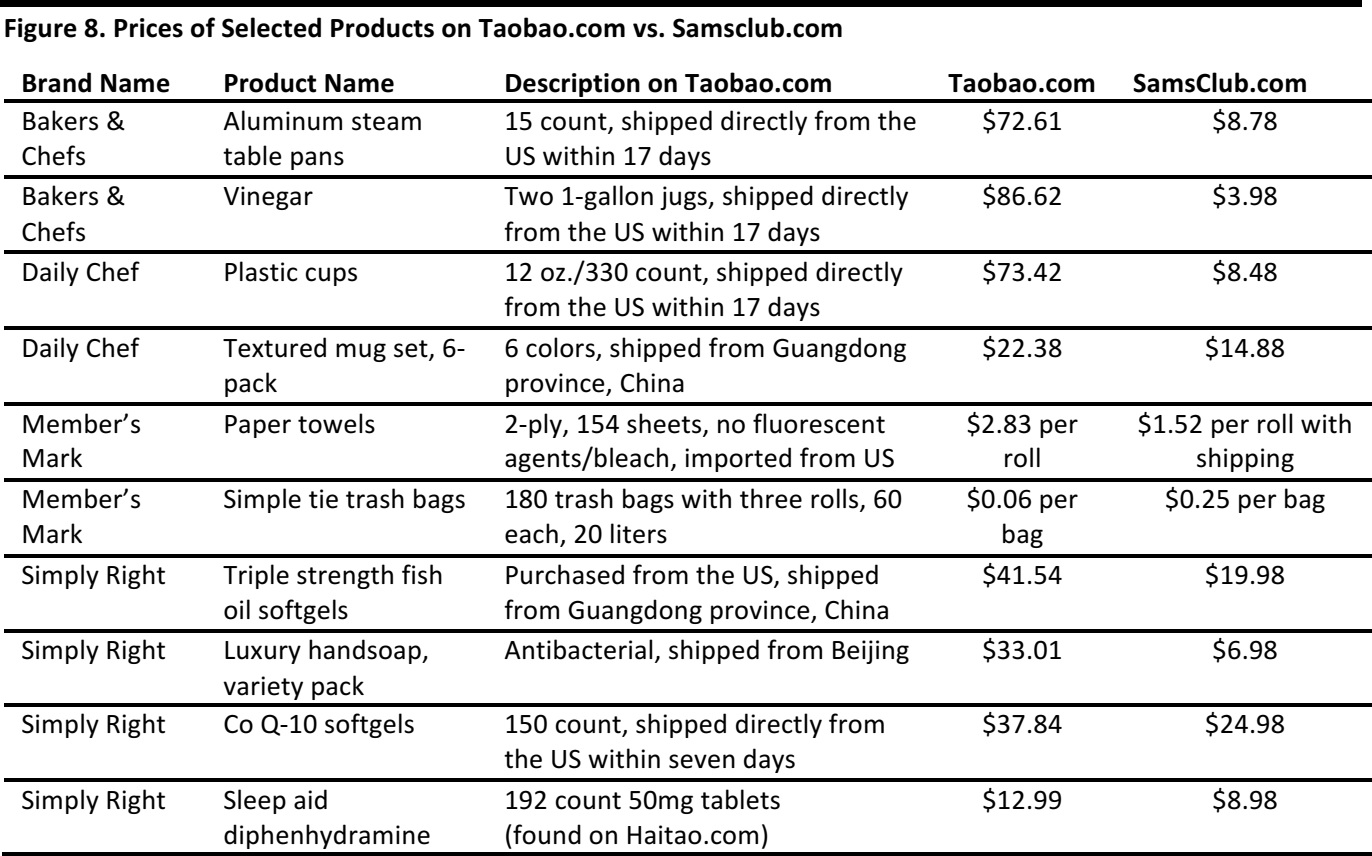

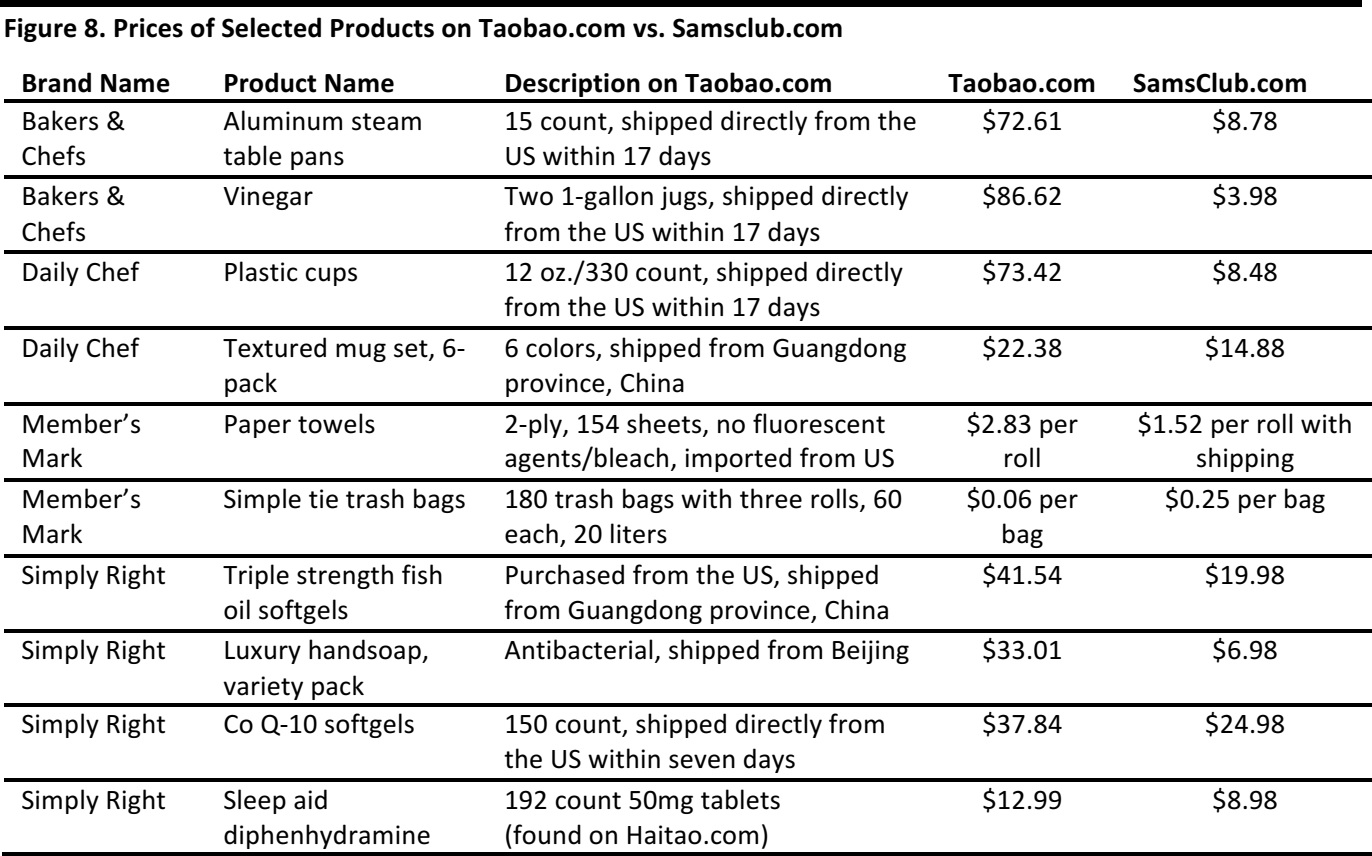

Given the recent explosive growth in Chinese cross-border e-commerce, FBIC conducted an extensive search to examine the offering of Sam’s Club top-10 private label brands and the unauthorized reselling of Sam’s Club products on four major Chinese e-commerce marketplaces: Taobao.com (Alibaba’s B2C platform and China’s largest e-commerce site), JD.com (China’s second-largest B2C site), Haitao.com (China’s most popular cross-border e-commerce site) and Yihaodian (an online supermarket owned by Walmart). Our key findings follow.

Taobao.com hosted the most offers for resale of Sam’s Club private brand products. Haitao.com provides direct links to US e-commerce sites, including Amazon.com, for Chinese consumers to purchase Sam’s Club branded goods. JD.com and Yihaodian returned no search results for Sam’s Club products.

On Taobao.com

- A search for “Member’s Mark” on Taobao.com returned over 800 products.

- Nearly all Taobao.com merchants claim their products are authentic and introduce them as “internationally renowned brands.”

Sam’s Club’s products are mostly food and kitchen products rather than apparel items. Most merchants are based in the US or claim that they purchase products from Sam’s Club and then ship them to China. Hence, the prices they offer are significantly higher than US regular retail prices: some prices are eight times higher than US prices.

- Compared to SamsClub.com, product selection is limited on Taobao.com. Sellers tend to overstate the quality of their products.

On Haitao.com

- All transactions are either directly linked to the original US sellers’ websites or completed via the Haitao platform.

- A search for “Simply Right” returned only a few search results, and the results page was linked to Amazon.com.

The table below lists the relative prices of selected products on Taobao.com versus SamsClub.com.

Source: Haitao.com, SamsClub.com, Taobao.com and FBIC

Other Popular Haitao Websites

Kuajingtong

Kuajingtong (which means, “cross-border flow”) is an e-commerce platform maintained by government-backed Orient Electronic Payment Co. for the online purchase of imported goods from China. Based in the Shanghai Free Trade Zone, the site allows buyers to avoid the import duties that would otherwise apply to their purchases. Products can be listed on the site only after the vendor has been cleared by the General Administration of Customs, resulting in a safer, more reliable channel for the purchase of imported goods.

Products offered on Kuajingtong are imported through bonded warehouses, which significantly reduces the associated logistical costs. Kuajingtong targets the middle-to-high end of the market and products are divided into categories of shoes, luggage and handbags; health products; baby products; skincare and cosmetics; apparel; accessories; household goods; and food products.

Smzdm.com

Smzdm.com (which is an abbreviation of “something worth buying”) is one of the leading online rebate sites in China. The website resembles a blog and is filled with real-time online shopping promotional information. The site helps online shoppers find the best-priced products online and directs consumers to external shopping sites.

Smzdm.com was a pioneer in offering cross-border e-commerce promotional information to Mainland consumers. The website hosts a channel dedicated to overseas e-commerce promotional information. FBIC has observed that large international online retailers, including Amazon, Gilt, 6PM, Macy’s and several other specialty stores, list their latest product promotion details on Smzdm.com.

During the Black Friday shopping promotion in 2014, Smzdm.com aggregated a significant amount of promotional information and educated users on how to conduct cross-border shopping. The company temporarily had to suspend several functions on its web page due to a spike in traffic on that day.

Tmall Global & JD.com—The Fast Track to Unlocking China for Foreign Retailers

In order to tap Chinese consumers’ growing appetite for imported products, Chinese online shopping marketplaces began launching individual cross-border e-commerce platforms in 2014. E-commerce giant Alibaba, which dominates the Chinese online B2C market, launched Tmall Global in 2014 as an online channel where foreign retailers without Chinese business licenses could sell directly to Chinese customers. Since its launch, Tmall Global has attracted multinational supermarkets and hypermarkets, including Costco from the US, Inferno from Germany and King Power from Thailand. The graph below shows the dramatic and rapid growth in B2C cross-border e-commerce in China.

Source: iResearch

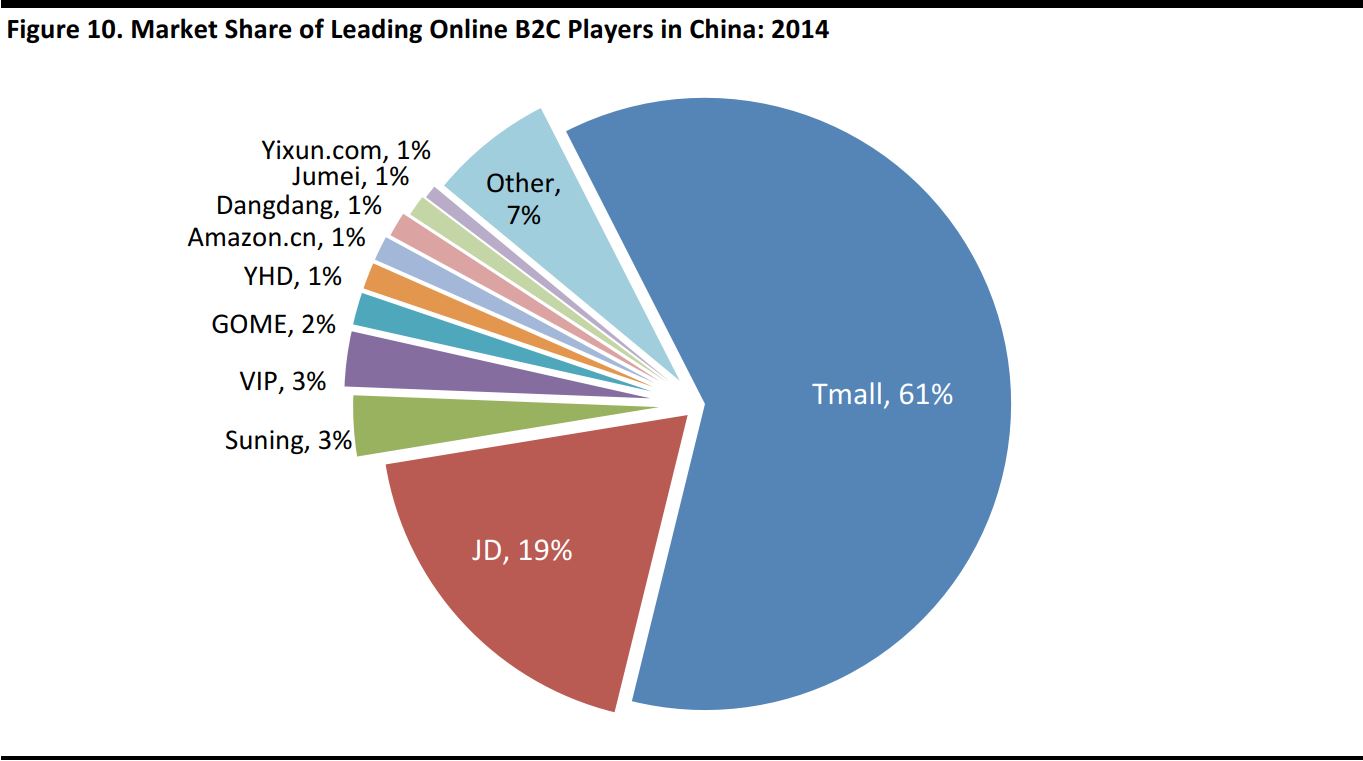

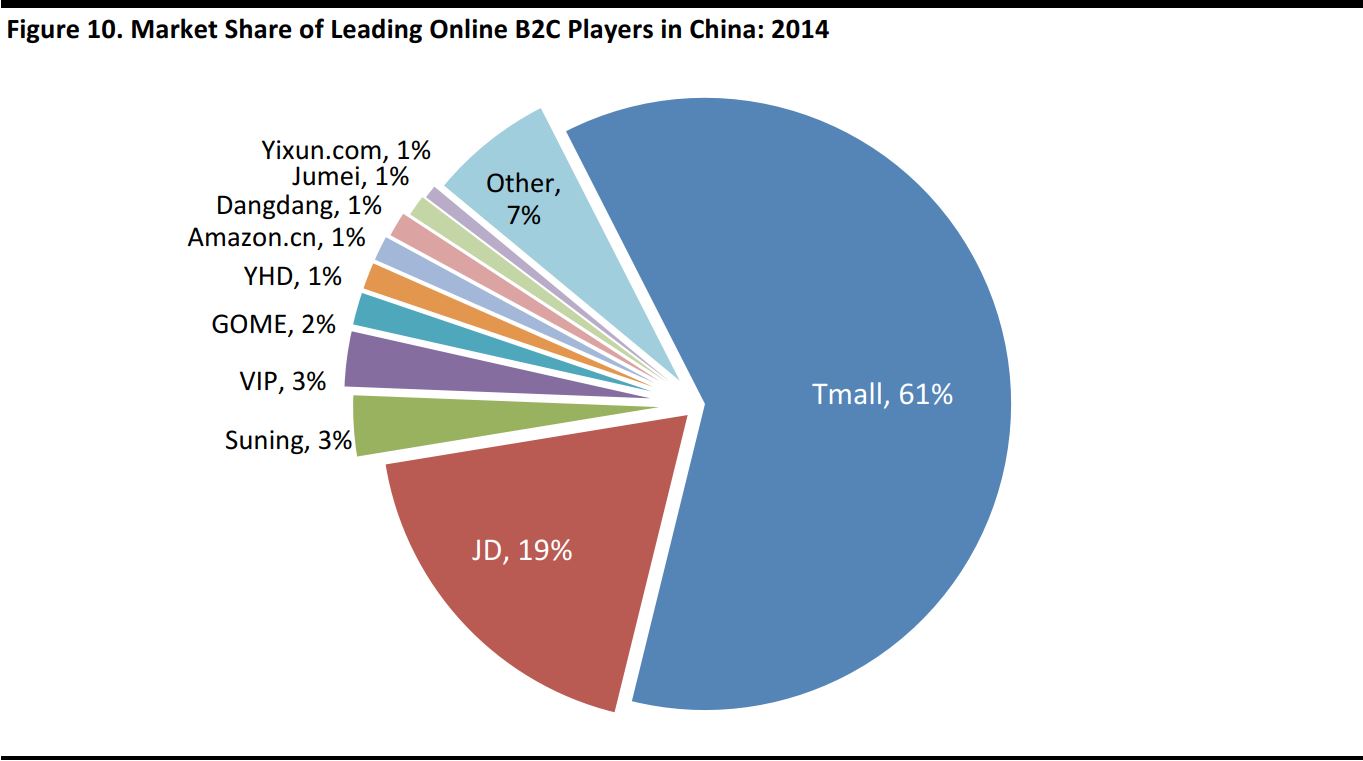

The pie chart below shows that Tmall owns the majority share of the B2C market in China, and that Tmall and JD.com together comprise 80% of the market.

Figure 10. Market Share of Leading Online B2C Players in China: 2014

Source: iResearch

The second-largest e-commerce player in China is JD.com, with a 19% market share of online B2C transactions. It launched its cross-border platform, JD Worldwide, in April 2015, with imported goods from Japan, South Korea, the US, Australia, the UK and other countries. In addition, eBay’s Overseas featured channel has launched on the JD Worldwide website. eBay’s offerings include proprietary business and platform segments. The proprietary segment centers on independent procurement by JD.com and is supported by service agencies in a bonded customs area; the platform segment operates via a cross-border e-commerce model that foreign brands can join to sell to Chinese consumers directly.

These marketplaces provide cost-effective options for foreign retailers seeking entry to China’s competitive e-commerce market. Orders can be fulfilled inside or outside China and settled in the retailer’s preferred currency. In addition, foreign retailers can enjoy lower customs tariffs and shorter delivery times if their products are stocked in a bonded warehouse in any of the pilot Free Trade Zones.

The Sweeping Success of Costco’s Flagship Store on Tmall Global

Many foreign brands and retailers are already gearing up to launch their online presence in China. Last year, Costco teamed up with Alibaba to make its online debut in China. The launch of Costco’s flagship store on Tmall Global in November 2014 has been a sweeping success. On November 11, the date of China’s big online Singles’ Day shopping festival, Costco reported single-day sales of US$3.6 million.

Costco’s store on Tmall Global allows consumers to buy Costco’s products without being a Costco member. Meanwhile, Costco stocks some products in bonded warehouses in the Free Trade Zones, which enables it to ship those products in China immediately after receiving an order.

AliExpress: An Emerging Competitive Threat

AliExpress is Alibaba’s cross-border online marketplace. It is positioned to market Chinese goods to consumers all over the world. Launched in 2010, AliExpress offers consumers competitive prices on a wide variety of products, including apparel and accessories, electronics, health and beauty products, watches, jewelry, and many others. AliExpress can also help in sourcing hard-to-find products at wholesale prices.

At present, relatively few consumers in the US are aware of AliExpress, and the quality of the products offered is lower than at leading retailers. Still, the site offers some items at huge discounts to listed prices on both Amazon and Walmart.com. Price-conscious American shoppers and bargain hunters will be attracted to the site. In early 2014, a William Blair analyst surveyed hundreds of items in stores and online across the retailers and found some attractive deals offered by AliExpress:

- A KitchenAid Classic 4.5-Qt Stand Mixer was $299.00 at both Walmart and Amazon, but was only $199.18 at AliExpress.

- A Keurig K10 coffee maker was $99.00 at Walmart and $95.44 at Amazon, but was only $48.58 at AliExpress.

FBIC believes that AliExpress’s lower-priced merchandise could pose strong competition to warehouse clubs. Meanwhile, AliExpress is actively expanding its global presence, and is now one of the leading online marketplaces in Russia and Brazil. Earlier this year, AliExpress teamed up with Indian e-commerce shopping platform Paytm to sell low-priced Chinese goods in India. Although it is still too early to predict the ultimate size of AliExpress’ international expansion, it could pose a serious threat to the international business of the warehouse clubs, which serve more price-conscious consumers.

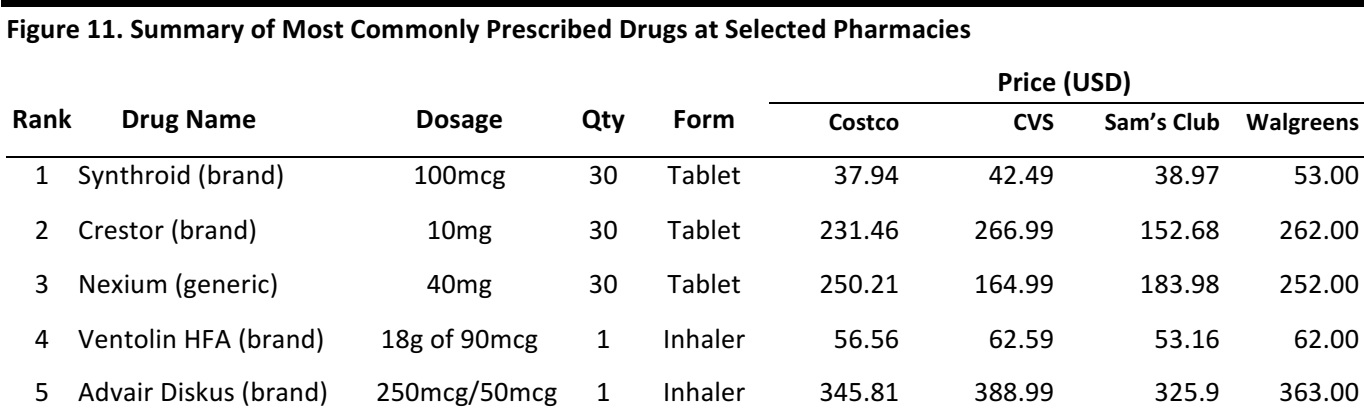

4. PHARMACIES—BENEFITING FROM AGING POPULATION WITH A STRONG PIPELINE

The retail drug industry should benefit from favorable long-term trends that include an aging population, a strong drug pipeline and expanded healthcare coverage for Medicare participants. According to the Centers for Medicare & Medicaid Services (CMS), the US federal agency that administers Medicare, Medicaid and the Children’s Health Insurance Program, US retail prescription drug spending grew by 2.5% in 2013, reaching $271.1 billion. CMS estimates that prescription drug spending in 2020–2023 will grow at a compound annual growth rate (CAGR) of 6.0%. And pharmaceutical companies are using strategies such as hiring pharmacy benefit managers (PBMs) to differentiate themselves from the competition.

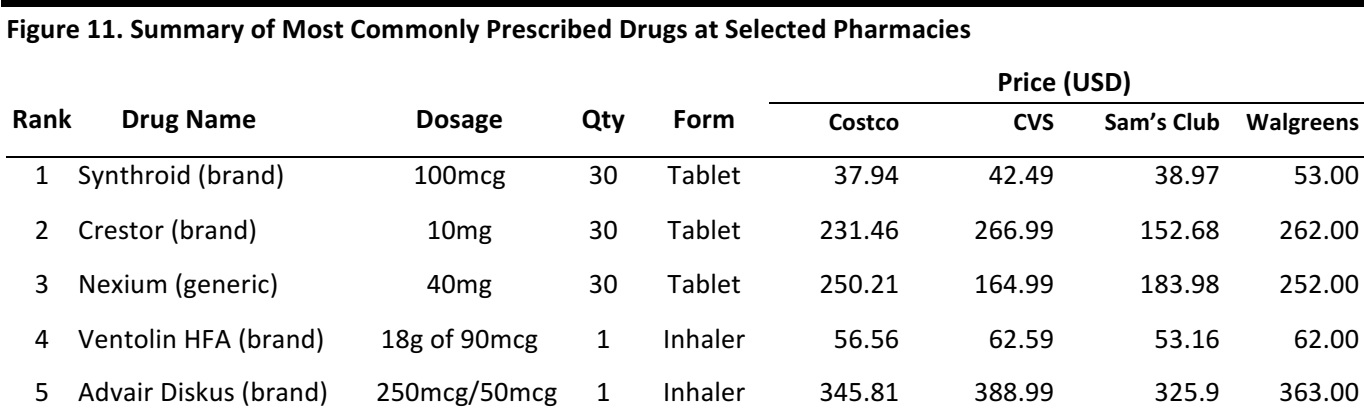

The table below shows the top five most commonly prescribed drugs from July 2013 through June 2014, according to a study by IMS Health. The prices shown are the cash price at each pharmacy, before insurance or discount. The data were collected either in person at the pharmacy, by telephoning the pharmacy or by using GoodPx.com, a drug prescription search engine that compares prices in pharmacies in selected regions. The prices were collected in New Jersey, specifically in the Secaucus region, because it is home to Costco, CVS, Sam’s Club and Walgreens outlets. We indicate below whether the drug is the name brand or generic version.

Source: Drugstores and Goodpx.com

Costco

In January 2013, Costco introduced a PBM, Costco Health Solutions (CHS). The warehouse giant is looking to drive demand and increase revenues from its pharmacies and prescription drug sales by growing store traffic.

- Costco’s PBM targets existing wholesale business members and businesses located near its stores, which means it is focusing on midmarket businesses with fewer than 20,000 employees under medical coverage.

- CHS encourages plan sponsors to set up a preferred network model in which consumers have a financial incentive to choose a Costco pharmacy in order to reduce costs.

- Participants in the Costco membership club receive exclusive services from in-warehouse pharmacies, including clinical and walk-up immunization services and free health screenings.

- Costco also offers transparent pricing by taking manufacturer rebates and discounts off the point-of-sale price.

- CHS has partnered with a large, undisclosed specialty pharmacy that can provide back-end clinical services and care management such as adherence calls, injection training and pharmacist consultations.

- CHS provides all discounts and rebates. There is no spread on the amount paid by Costco to the retail network pharmacy that dispenses the drug to a consumer.

- Retail pharmacy is becoming dominated by low-cost generic prescriptions because consumers are increasingly cost-averse. Costco’s low prices and small margins fit this new model, so it can build a PBM business with generics.

CVS

CVS is the retail pharmacy division of PBM CVS Health. CVS Health has pursued a two-pronged strategy to capture as much market share as possible from the retail pharmacy industry. CVS is unique because it has integrated its operations vertically; it processes claims as an independent PBM and also runs one of the largest retail pharmacy chains. The firm has established itself as one of the largest US pharmacy retailers and also as a top-tier PBM.

- In January 2014, CVS Health acquired Coram, a specialty infusion services and enteral nutrition business, for approximately $2.1 billion. The deal strengthened the company’s capabilities in specialty pharmacy.

- In June 2015, CVS Health announced that it would purchase Target’s pharmacy and clinical businesses for $1.7 billion and rebrand the in-store pharmacy operations.

- In May 2015, CVS Health announced it would acquire pharmacy services provider Omnicare for roughly $10 billion. The company expects to achieve significant purchasing and revenue synergies, as well as operating efficiencies, from the acquisition.

- CVS Health’s substantial claim volume allows it to take advantage of two key industry drivers: supplier pricing leverage and centralized cost scale.

- CVS’s core PBM service assists pharmaceutical benefit payers with the fulfillment of member prescriptions. This entails processing prescription claims made by a client’s members and ensuring the claims comply with benefit plan parameters.

- Larger PBMs can usually negotiate large enough discounts to keep a portion of the discount and still provide clients with highly advantageous drug pricing.

- In 2015, CVS Health has shifted toward lower-margin specialty prescription claims in order to bring on new clients.

Sam’s Club

Sam’s Club wants to offer customers something that motivates them to continue renewing their memberships. Therefore, Sam’s Club Plus members accrue Cash Rewards on qualifying purchases at the store. Cash rewards are loaded on to the membership account after a 12-month period and are then available for redemption as cash or credit towards purchases at Sam’s Club.

- Sam’s Club is the second-largest US warehouse club, after Costco, and charges a $40 membership fee.

- Sam’s Club provides a resilient cost-saving business model.

- Compared to Costco, Sam’s Club is more evenly spread across the US, with 647 stores in 47 states and Puerto Rico, according to its website.

- Sam’s Club offers a Plus Membership for $100 per year that gives members access to selected pharmaceuticals at a discount. According to GoodPx.com, these products are as good as or better than the offerings of most pharmacy discount programs.

- Plus members save up to 8% every day on name-brand prescription medications.

- In April 2015, Sam’s Club announced new savings on generic prescriptions. Some are available free of charge and some are discounted to $4 or $10 in specified quantities. This new benefit is part of the Sam’s Club Extra Value Drug List, through which Sam’s Club Plus and Business Plus members receive 10%–30% savings on select brand name medications. These deals specifically benefit those who are under- or uninsured, according to Sam’s Club management.

Walgreens

Several years ago, Walgreens—the nation’s largest drugstore chain—was faced with a strategic decision about whether to go to market as a PBM or divest that portion of its business. The goal was to go to market as a healthcare provider. Instead of going the PBM route, the company chose a “bolder, patient-centric, outcomes-focused strategy,” according to Walgreens executives. The drugstore chain decided to extend its business model deeply into the provider space.

- In December 2014, Walgreens acquired Alliance Boots, a leading international pharmacy store and wholesale drug operator, to form Walgreens Boots Alliance. The transaction gave the company improved purchasing power (for prescription drugs, over-the-counter drugs and non-pharmacy products) and allowed it to expand its product pipeline through the addition of Alliance Boots’ beauty product brands.

- Walgreens enhanced its distribution capabilities when it took a minority stake with Alliance Boots in AmerisourceBergen, a US drug distributor, in March 2013. Walgreens Boots Alliance has improved purchasing power to lower drug prices, according to S&P Capital IQ’s analysis.

- Walgreens also introduced a Balance Rewards card for consumers to earn points from purchases, including prescriptions, that can be used later for discount deals.

- Walgreens and WebMD formed a partnership that brings WebMD tools (namely an online goal-setting/care-coaching program) to the Walgreens website, and introduces Balance Rewards–based incentives for users of the WebMD app who are tracking fitness, nutrition or other health data. It also introduces a refill feature to the WebMD app, so that users can order a refill or change their pickup location after scanning the barcode on their empty prescription package.

- Walgreens announced that it will partner with MDLIVE, a leading virtual-visit supplier, to give patients round-the-clock access to doctors via a smartphone, desktop or tablet. This represents an expansion of a “pharmacist chat” feature that was offered via the Walgreens app in 2014.

- Walgreens is working with semiconductor-maker Qualcomm to link the usage of specific devices (for example, blood pressure cuffs and blood glucose monitors) to members’ Balance Rewards accounts. The initiative was unveiled at the Health 2.0 conference last fall.

- According to Merchant Medicine, a consulting firm, Walgreens has 388 clinics in 19 states.

5. PRIVATE LABEL—CLUB EXCLUSIVES DRIVE TRAFFIC AND PROFIT GROWTH

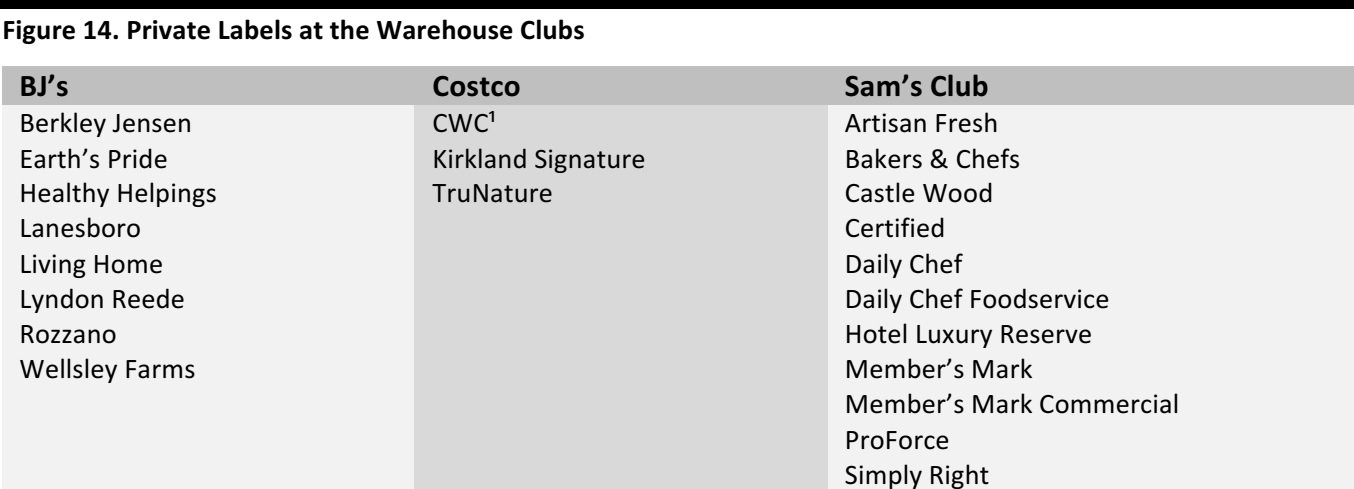

The warehouse club retail channel’s value proposition relies on offering national brands at extremely low prices. Shoppers love the treasure hunt aspect of finding national brands, which are usually carried only at department stores and specialty shops, at the clubs. However, a growing proportion of warehouse merchandise offerings is from private label. This strategy of offering private label goods is gaining traction with industry leaders and private label may soon account for more than 25% of merchandise sales. These labels provide each club with exclusivity and differentiation, while offering the opportunity for higher gross margins.

Private label apparel has a low (1% to 3%) penetration rate versus total apparel sold in the clubs, which means it represents a substantial growth opportunity—even though deflationary trends in the apparel category as a whole could make the value proposition less appealing. Furniture is another potential private label category play; it has a low private label penetration in a highly fragmented industry.

Warehouse Clubs: National Brands and Private Labels = a Winning Formula

National brands at extremely low prices; this a key ingredient to the value proposition of the warehouse club retail channel. On a recent visit to Connecticut, we visited Sam’s Club in Newington and Costco in Waterbury. We saw Bose sound systems, Apple iPads and iPhones, Charisma sheets, Dockers khakis, Speedo swimsuits and Fitbits. While Costco had truly luxurious diamond rings for sale at $16,999, Sam’s Club offered an aspirational handbag collection that included items from Coach, Kate Spade, Michael Kors and Tory Burch.

These clubs in Connecticut and others offer shoppers a unique treasure hunt experience. While vendors may advertise in a club’s circular (at their own cost), club members generally do not know what they will find when they visit a club, and are surprised and delighted by the unexpected. Experience has taught longtime warehouse club members to buy now; merchandise moves quickly at the clubs and any item a member likes could be sold out by the next time he or she visits, which, on average, is about 3½ weeks later.

Source: WCF Research

Members Like Private Label Offerings at Warehouse Clubs

Despite lower prices, sales volumes are considerably higher for private label products versus branded goods at warehouse clubs generating higher average sales per SKU. According to WCF Research estimates,

- The average private label SKU at Costco produces $1,043 in average weekly sales per club, 62% higher than the average weekly sales volume of a branded SKU

- The average private label SKU at Sam’s Club produces $363 in average weekly sales per club, 35% higher than the average weekly sales volume of a branded SKU

- The average private label SKU at BJ’s produces $238 in average weekly sales per club, 48% higher than the average weekly sales volume of a branded SKU

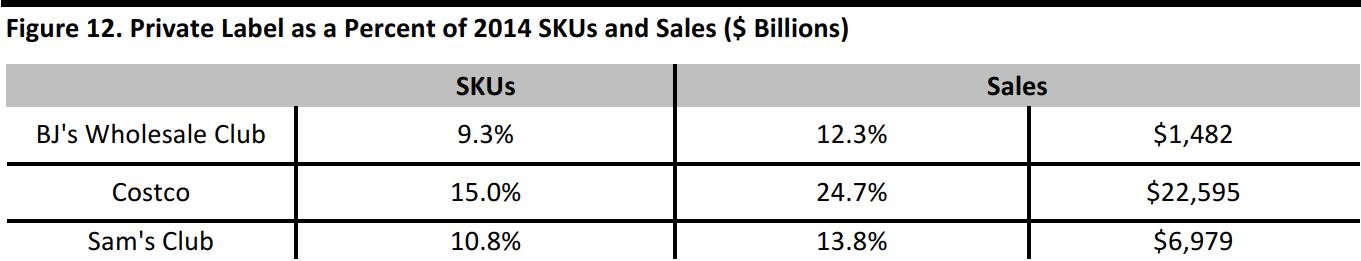

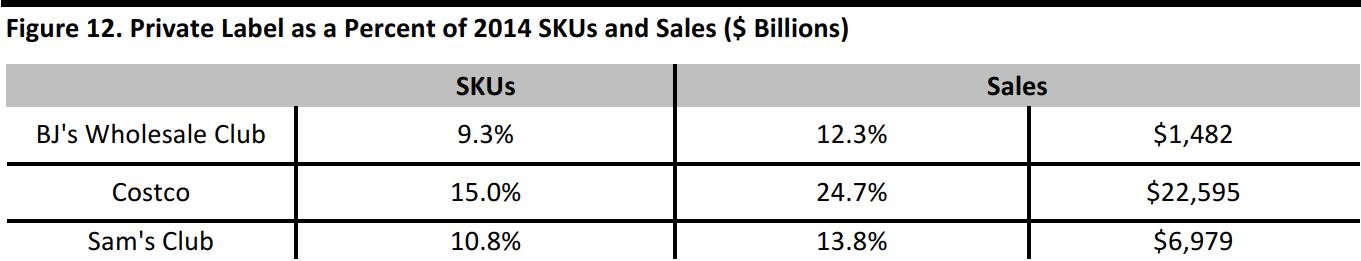

In the warehouse club industry, private label merchandise generates greater sales volume per SKU than branded merchandise does. Private label accounted for 24.7% of Costco’s 2014 product sales (excluding sales of ancillary products and services). At Sam’s Club, the figure was 13.8% and at BJ’s, it was 12.3%. Despite its higher penetration of private label products, Costco’s operating margin has trailed Sam’s Club’s for the past 10 years and, in the most recent fiscal year, it was 52 basis points lower than the 3.38% reported at Sam’s Club.

Costco offers far fewer SKUs in its warehouses than either BJ’s (43% fewer) or Sam’s Club (29% fewer), but offers more private label SKUs than either: 10% more than BJ’s and 13% more than Sam’s Club.

Source: WCF Research

Private Label Rounds Out Assortments

Private label programs are an important and growing feature of merchandising strategies in the warehouse club industry; they allow the clubs to differentiate themselves, while offering the opportunity for higher gross margins. The goal is for private label goods to meet or exceed quality standards set by competing national brands.

Our conversations with industry participants suggest that clubs seek to create private labels that exceed national brands in terms of design and quality, and offer them at prices that are as much as 70% lower than prices at alternative retail venues. This strategy is a strong building block in attracting and retaining members and creating customer loyalty.

Gross margins at warehouse clubs are typically in the 8% to 12% range. However, Costco allows a gross margin of 15% for a private label offering whose quality exceeds the national brands’, an exception to its corporate 12% gross margin rule.

The following is an excerpt from the Costco 2014 10-K annual report:

We believe that Kirkland Signature products are premium products offered to our members at prices that are generally lower than those for national brand products and that they help lower costs, differentiate our merchandise offerings from other retailers, and generally earn higher margins. We expect to continue to increase the sales penetration of our private label items in the future.

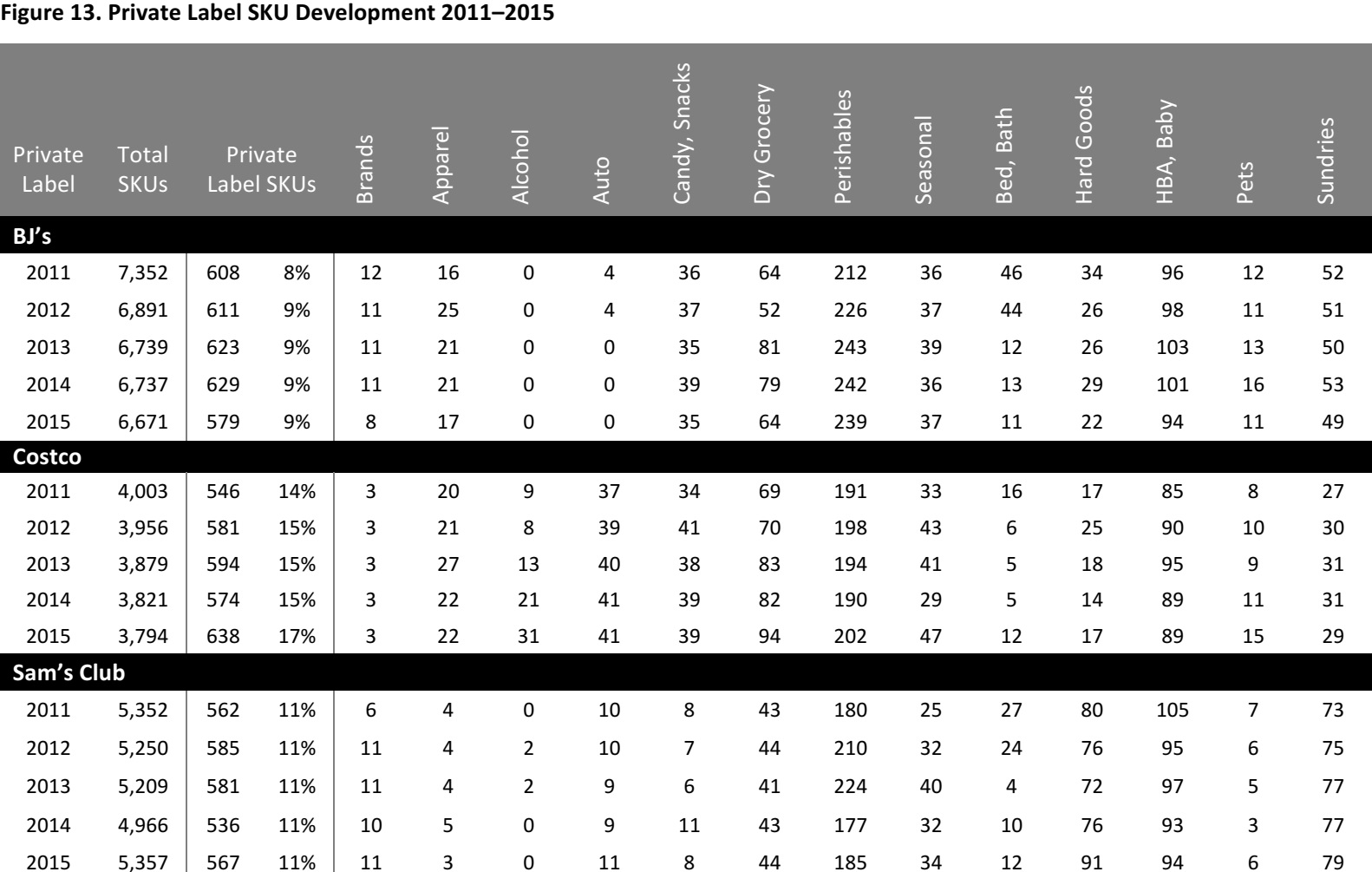

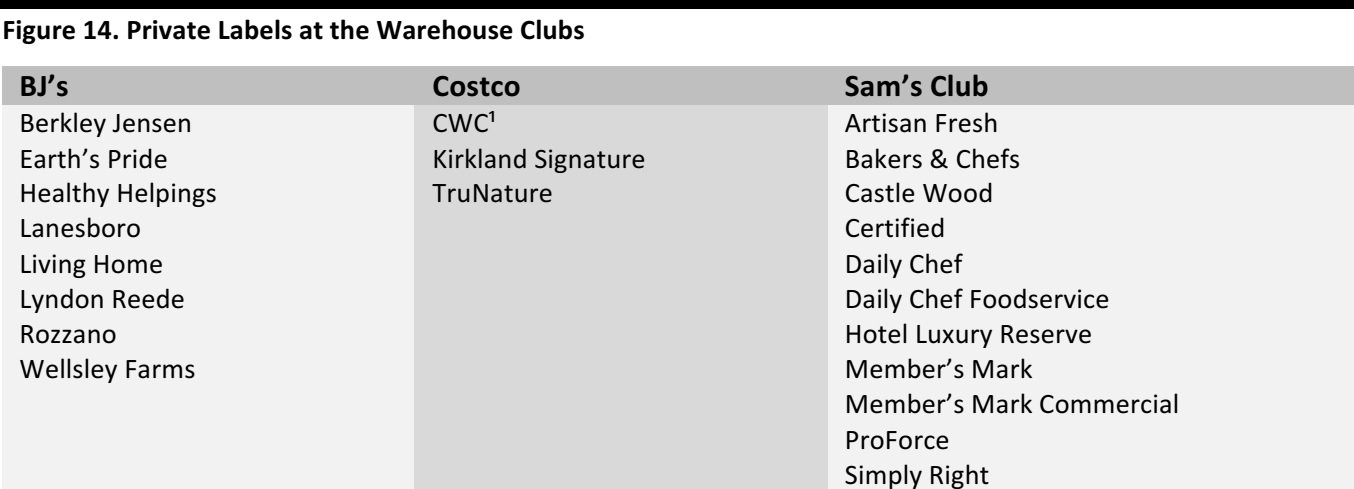

BJ’s Wholesale Club, Costco and Sam’s Club all have an extensive private label offering to round out their assortment and provide members with alternative products, and a number of these brands have achieved strong brand recognition and a loyal following. The table below lists the private labels available at BJ’s, Costco and Sam’s Club.

Source: WCF Research and company reports. ¹ non-branded merchandise distributed by Costco

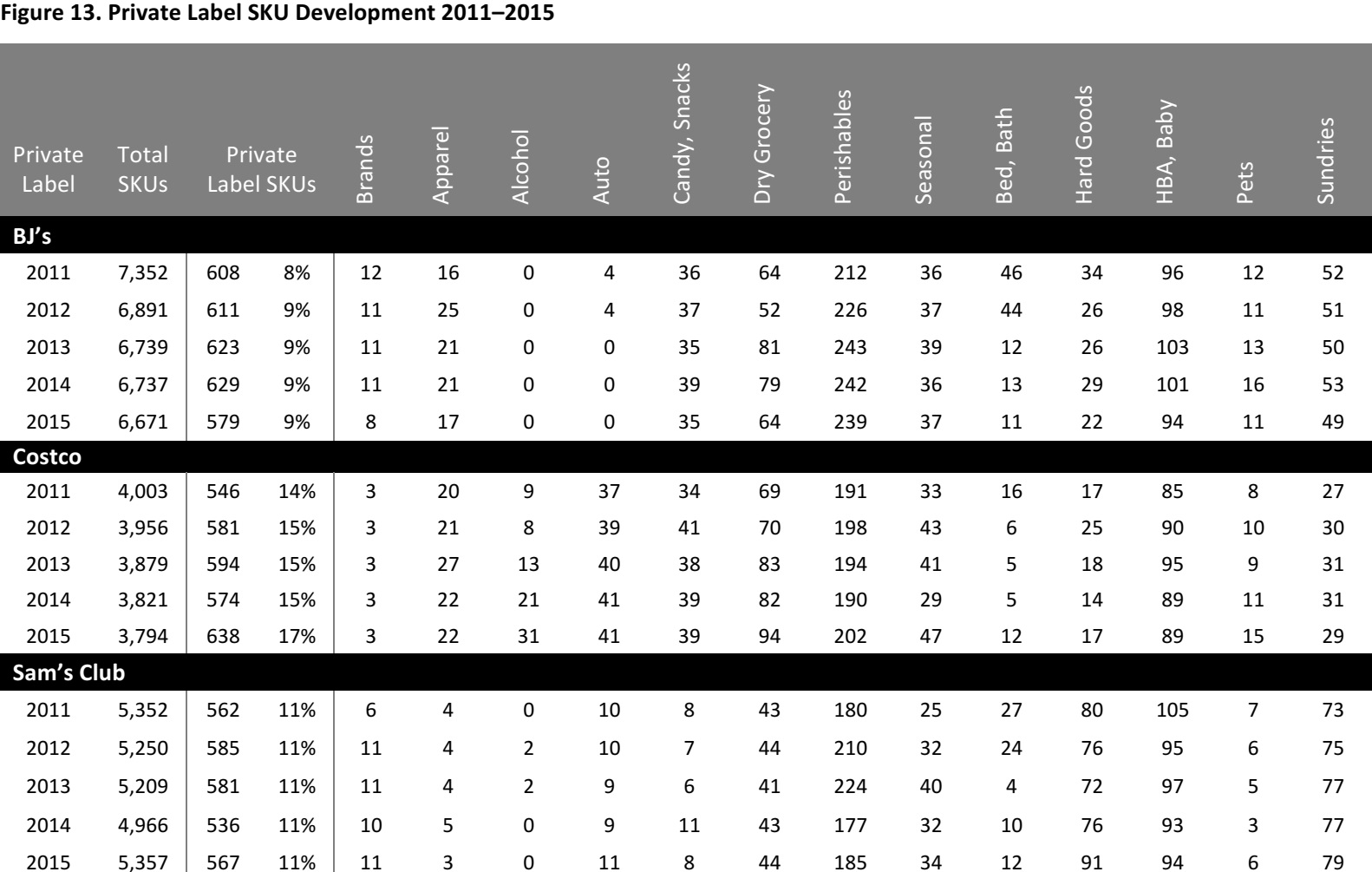

According to data collected by WCF Research in March 2015, private label has the highest concentration at Costco, where it represents 17% of sales. That figure was up 200 basis points year over year, reflecting an additional 64 SKUs.

The bulk of private label merchandise is perishables, which represents:

- 41% of BJ’s private label offering

- 32% of Costco’s private label offering

- 33% of Sam’s Club private label offering

Health and beauty follows, accounting for:

- 16% of BJ’s private label offerings

- 14% of Costco’s private label offering

- 17% of Sam’s Club private label offering

Private label offerings in the apparel and bed and bath categories are relatively small. Apparel accounts for 3% of the private label offerings at BJ’s and Costco and less than 1% at Sam’s Club, while bed and bath accounts for 2% of the private label offerings at all three clubs.

Costco also co-brands its private labels with well-recognized and highly regarded national brands, such as Campbell’s, Keurig, Ocean Spray and Starbucks, for selected product offerings. These strong brand partners provide a halo effect for the private label offerings, extending quality and premium perceptions along with individual brand associations to the co-branded product.

Club Membership Provides Access to Significantly Lower Prices

Using pricing data collected by WCF Research, we calculated average private label savings:

- Sam’s Club leads, offering an average of 110% savings

- Costco follows at 81%

- BJ’s offers average savings of 48%

These savings are for products offered within the clubs, so the differential with grocers and mass merchants is likely much higher.

A WCF Research study conducted in Raleigh, NC, over September 14 and 15, 2014, revealed that Sam’s Club had the lowest prices for a basket of 59 food and 35 general merchandise SKUs. At Costco, the same basket cost 1% more, and at BJ’s, it cost 4% more. Walmart came in fourth; a basket of same/like goods cost 27% more at Walmart. And local grocer Food Lion came in last, with a price more than two-thirds (69%) higher.

Generic Healthcare Products Provide the Greatest Savings

The greatest savings are found in generic healthcare products: Sam’s Club offers savings as high as 722% for allergy medication that is comparable to Zyrtec. Costco’s private label equivalent to Zantac costs 365% less. And for over-the-counter health products and pet care, private label offerings are as much as 200% cheaper.

In order to pass along these significant savings, the warehouse clubs may increase quantities and attempt to maintain and/or exceed gross margin dollars. For instance, the private label Daily Chef extra virgin olive oil at Sam’s Club is $17.98 for three liters, a 17% savings versus the brand name Bertolli offering of two liters for $13.98.

In sum, both private label merchandise and national brands are priced incredibly competitively at warehouse clubs. Prices at the clubs are so low that members often brag to colleagues, friends and neighbors about the incredible savings they achieve; they are club advocates. These recommendations attract new members, and the cycle begins again. Granted, warehouse shopping often involves buying large quantities that can require a sizable pantry, but most members are satisfied, as high renewal rates (of about 90%) prove.

Opportunities in Private Label

Private label merchandise at the warehouse clubs is a growing source of member satisfaction and warehouse profits. Retail is continually disrupted by new forms of delivery and new pricing models, but warehouse clubs have a greater degree of stickiness than alternative commerce models, given the clubs’ membership base. And consumers remain value-focused six years into an economic recovery, which aligns well with the clubs’ value proposition.

There is plenty of category opportunity. Private label penetration is very shallow in apparel, at about 3%. And while apparel price deflation mitigates the sharp value/price equation offered by warehouse clubs, apparel remains a large industry. So, warehouse clubs would do well to provide apparel staples such as khakis and leggings, denim jackets, and hoodies under their trusted private label brands. Hard goods or furniture is another category that currently has minimal private label representation in the clubs. Costco brings in furniture twice a year during seasonal transitions (spring to fall and winter to spring) for about four to five weeks and the category receives modest attention at Sam’s and BJ’s through the year. This fragmented $85 billion market represents another opportunity.

6. AMAZON—CHALLENGING THE RETAIL INDUSTRY ON MULTIPLE FRONTS

Amazon continues to gain e-commerce market share. On July 15, millions of Amazon Prime members shopped for discounts as the world watched the launch of Amazon Prime Day. The event was ultimately a success, and the company said 398 items were ordered per second. Amazon’s second-quarter earnings report showed a 93% increase in US sales year over year. The company has continued to innovate, introducing the Dash Button, which is a simplified, one-button, electronic device used to reorder supplies. It also introduced Prime Now, a speedy, one- to two-hour delivery service. Amazon’s warehouse club competitors are looking for ways to keep up with its innovative tactics.

Rising Number of Prime Members

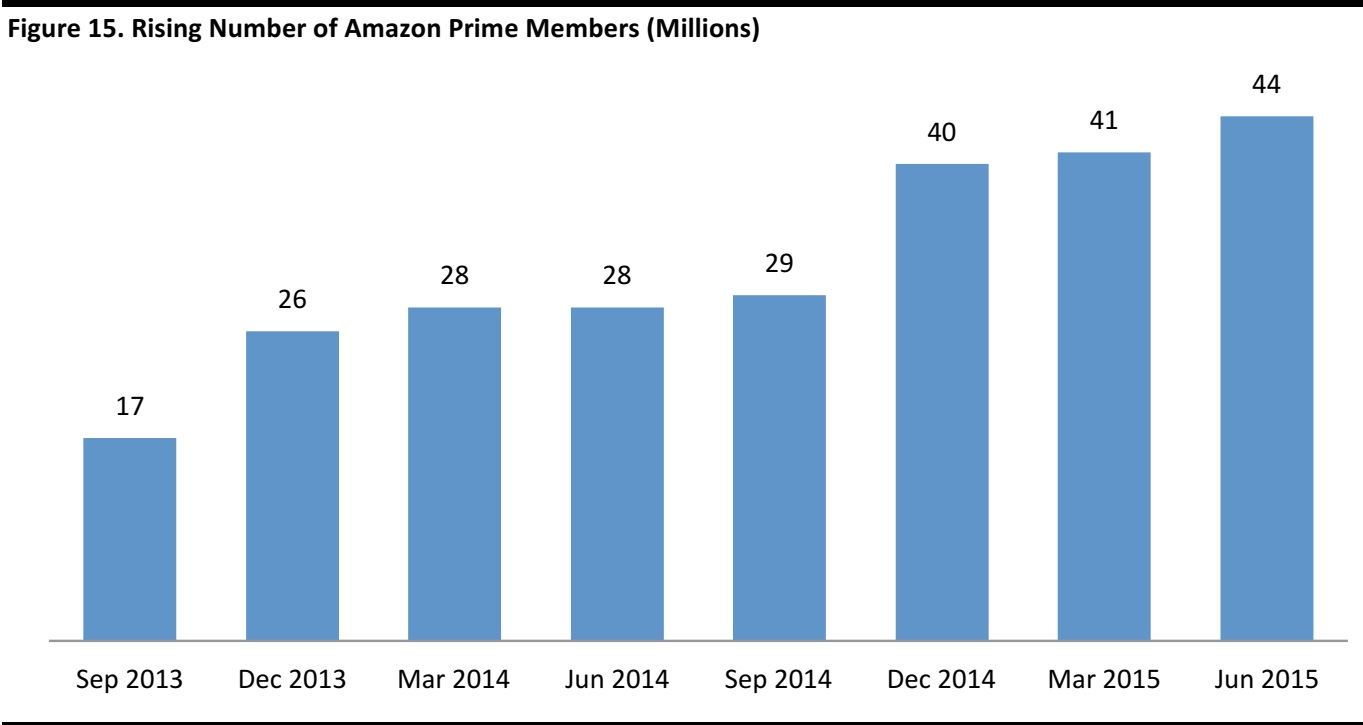

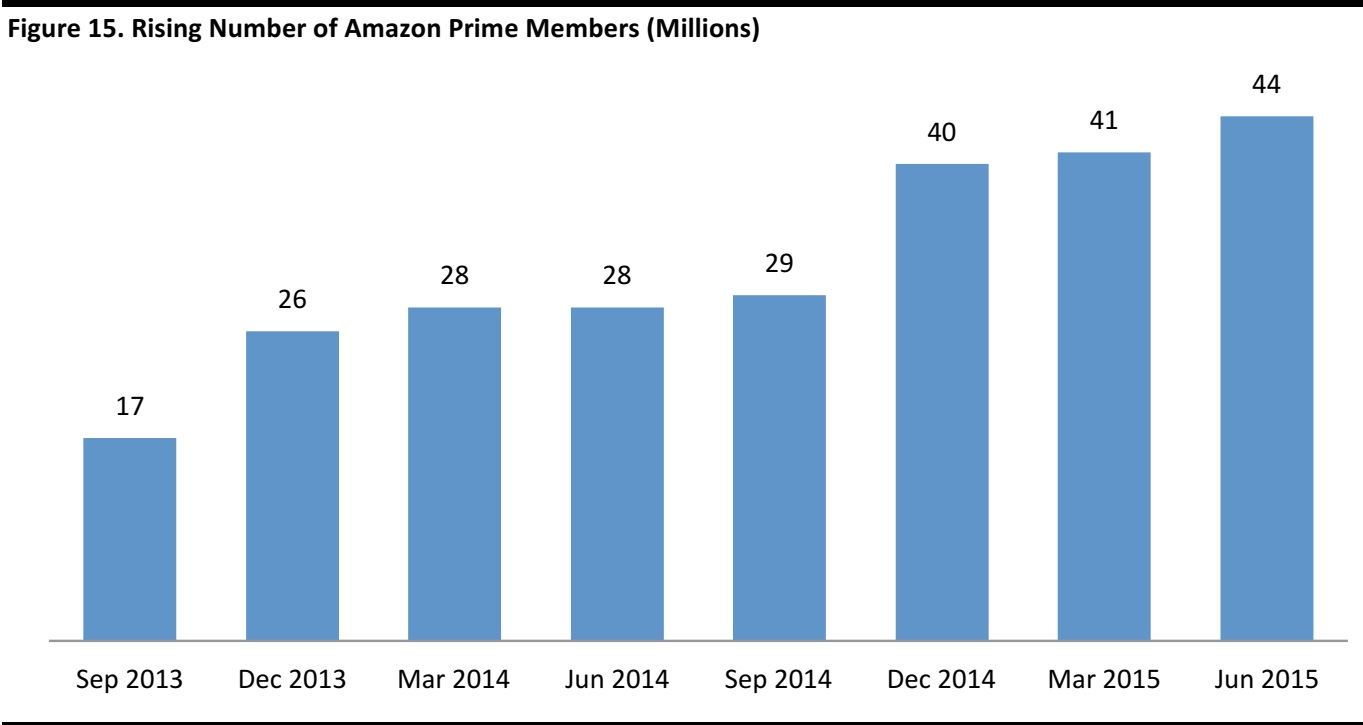

The number of Amazon Prime members has continued to rise rapidly in recent years. Consumer Intelligence Research Partners estimated that Amazon had approximately 44 million Prime members in the US as of June 30, 2015. According to the US Census Bureau, 35% of US households are members (out of 123 million total households). But there is a strong overlap between warehouse club shoppers and Amazon Prime members. Kantar Retail found that 49% of warehouse club members have a Prime membership, while 24% of Prime members have a club membership. This indicates that warehouse clubs and Amazon Prime appeal to a similar group of shoppers.

Amazon continues to add new benefits for Prime members. In 2014 alone, it added a dozen new benefits, including Prime Music, Prime Photos and Prime Pantry. Compared with warehouse clubs, Amazon Prime now has a far more extensive offering that goes beyond free shipping to include free streaming video and music, e-books via the Kindle Lending Library, unlimited photo storage, and so on. Therefore, warehouse clubs may be losing customers to Amazon. The benefits offered to Prime members justify the higher membership fee, in our view.

Source: Consumer Intelligence Research Partners

Following Amazon’s second-quarter earnings report and Prime Day results, Consumer Intelligence Research Partners estimated that 47% of Amazon users in the US had signed up for Prime, a net 3 million new Prime members. Due to the cost of Prime membership, it will be interesting to see how sticky it is once Jet comes to town in a meaningful way. There were an estimated 27 million Prime members in June 2014, and membership has more than doubled over the past two years. Efforts to make Amazon Prime more valuable and more integral to customers’ lives (through video streaming, music and additional shipping benefits) appear to have paid off. These efforts may also have contributed to Amazon Prime subscribers spending significantly more than standard Amazon users in the US. Consumer Intelligence Research Partners reported that the average Prime member spends $1,200 per year, while the average standard customer spends $700.

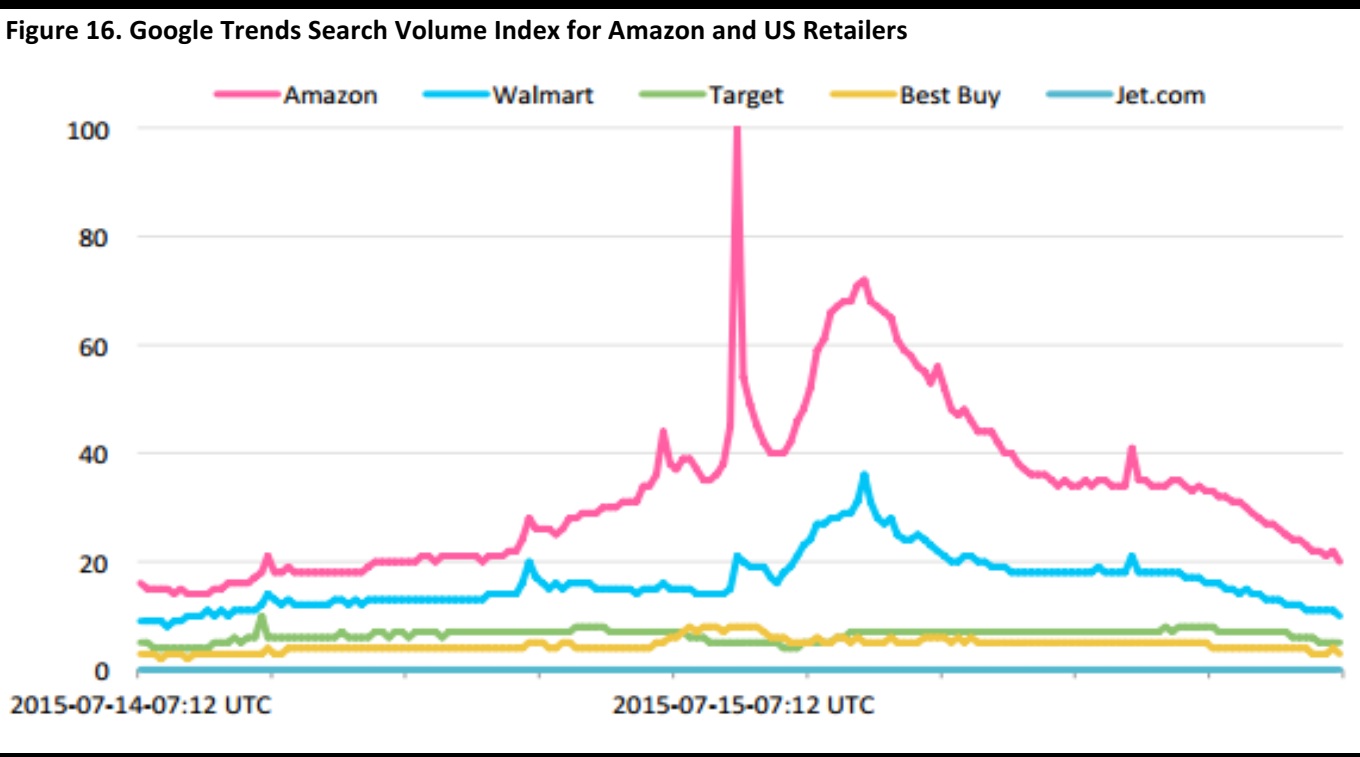

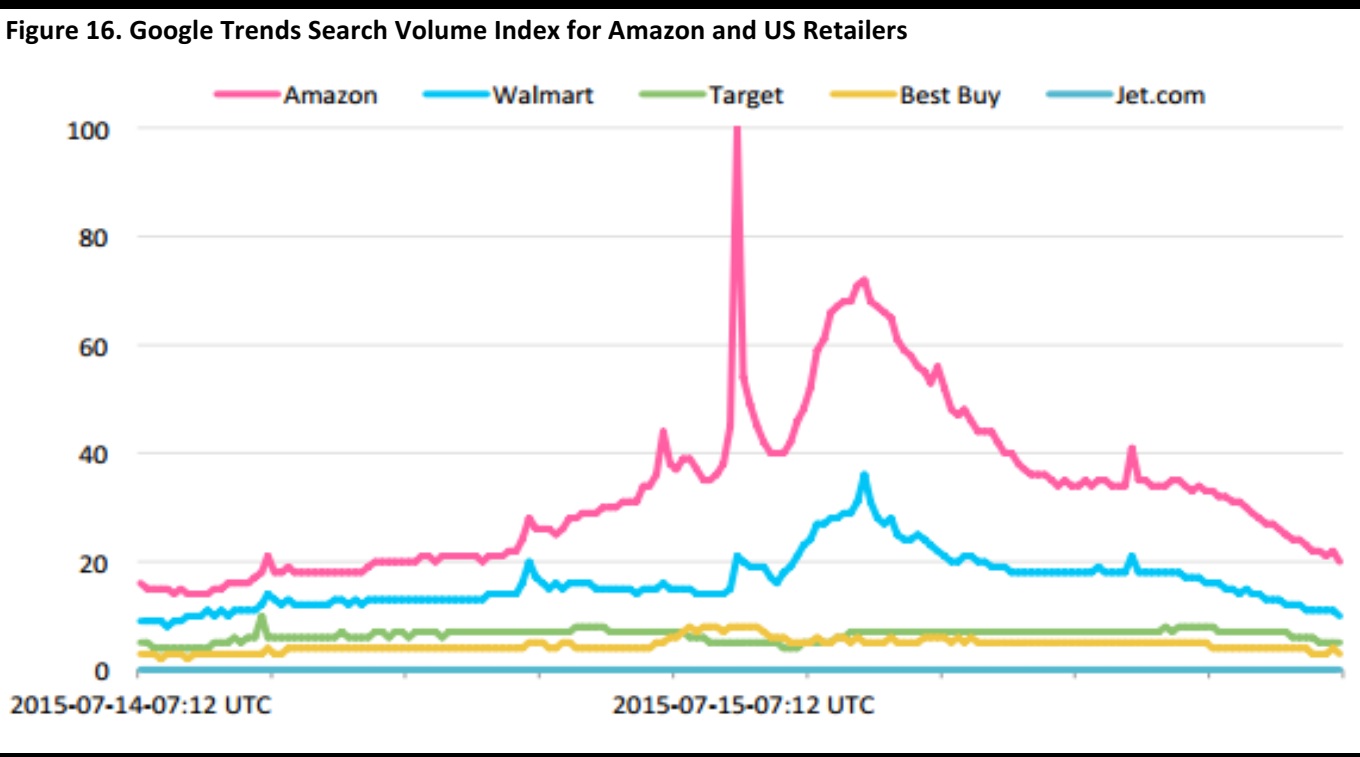

Amazon Prime Day generated tremendous media publicity. Google Trends’ search volume index showed that Prime Day generated over 50,000 tweets and hashtags. Customers ordered 34.4 million items across Prime-eligible countries, while third-party merchants enjoyed sales growth of nearly 300%. Amazon reported that Prime Day orders had exceeded those of Black Friday and that it had signed up hundreds of thousands of new Prime members.

Following Prime Day, Walmart lowered its free shipping requirement to $35 from $50 and, on that same day, Target extended its “Black Friday in July” sale through July 18. Greg Greeley, Vice President of Amazon Prime, intends to make Amazon Prime Day an annual event. Amazon reported that second-quarter US sales grew by 93% year over year (not accounting for vendors that joined or left Amazon’s Marketplace within the past year).

Source: Google Trends

The conversion rate from 30-day free-trial members remained steady at roughly 70% through the second quarter. In the same quarter, 95% of Amazon Prime members renewed a paid membership after one year, up from under 90% in the previous two quarters, according to The Huffington Post. (By way of comparison, the retention rate for the 67 million Costco warehouse members was in excess of 85% in April 2015.) Once a consumer becomes a Prime member, he or she is a lot less likely to consider purchasing from any other e-retailer. For example, if someone who is not a Prime member begins an Amazon shopping session, 12% of the time that consumer will also browse Walmart.com. But a Prime member will only browse Walmart.com 0.9% of the time, according to Millward Brown Digital, a firm that measures online shopping behavior. Amazon’s conversion rate among Prime members is 74% as of June 25, up nearly 10% since the month April. When Prime members shop with other online retailers such as Walmart, they convert on sales an average of 6% of the time.

Subscribe & Save and the Dash Button

The online subscription industry has grown to more than $3 billion in sales, and venture capitalists have invested more than $500 million in the emerging sector. In response, several e-commerce websites have introduced a subscription business. For a $45 annual fee, Sam’s Club members can join its My Subscription program. This enables online shoppers to receive free shipping on some 700 items. Amazon’s Subscribe & Save program offers free shipping and a 15% discount to customers who order five or more products for regular monthly delivery. The service does not require a Prime membership and is tailored to those who are going to use Amazon long term for their home shopping needs. Subscribe & Save lets customers pick the type, quantity and frequency of shipments.

In 2015, Amazon released its Dash Button, a one-button, branded electronic device that connects to a home Wi-Fi network to enable Amazon Prime members to reorder supplies. A specific product is assigned to the button and when a customer needs it, he or she just clicks. The $5 button is available only to Prime members.

With Subscribe & Save, customers do not have to be near an electronic device when they remember they need to order something, and they are free to change their brand preference. The Dash Button limits them to an assigned brand. Subscribe & Save allows customers to cancel a subscription whenever they would like, too. However, customers must plan ahead, as the items ship in the month following the month in which they are ordered.

Amazon Prime Now

In May this year, Amazon introduced to its Prime members in 14 major metropolitan areas same-day, free delivery on orders over $35. It also introduced its Prime Now feature, which is a one- to two-hour delivery service that costs $7.99 for one-hour deliveries and is free for two-hour deliveries. We have personally tried the two hour delivery for everything from Red Bull to Oster bread makers, and Amazon Prime has greatly exceeded expectations every time. Prime Now is available in select cities and Amazon is rapidly expanding the service. The speedy deliveries began in

Manhattan in December 2014, and are now also available in Atlanta, Baltimore, Brooklyn, Dallas and Miami. One-hour grocery delivery from local stores is also available in Manhattan. The same-day and Prime Now delivery options allow online shoppers to get their purchases nearly immediately, which is a compelling reason for many households still loyal to brick-and-mortar stores to shift their purchases to Amazon.

What’s New?

On August 4, Amazon announced that it is limiting the way Prime customers can share their benefits. Under a new program called Amazon Households, Prime members can share their subscription with one adult family member or friend, and with up to four children. Households can create a shared library of e-books, audiobooks, apps and games across all Amazon devices and media apps. Previously, Prime members could share benefits with up to five people. Current accounts with more than two members will not be affected by the change in policy until the account is renewed.

7. JET.COM—WAREHOUSE CLUB OR E-COMMERCE COMPANY?

The third week of July 2015 was an exciting one for retail. We saw both hype and grumbling over Amazon’s Prime Day launch on July 15 and, ultimately, solid results from the company. Jet.com completed its public launch on July 21, backed by a $100 million marketing budget. Now that Jet has launched, the discussion has shifted to its economic viability, in the face of its seemingly unreasonably low prices. The company is currently getting flak in the press for linking to other retailers’ websites without their consent, as part of its “Jet Anywhere” rewards program.

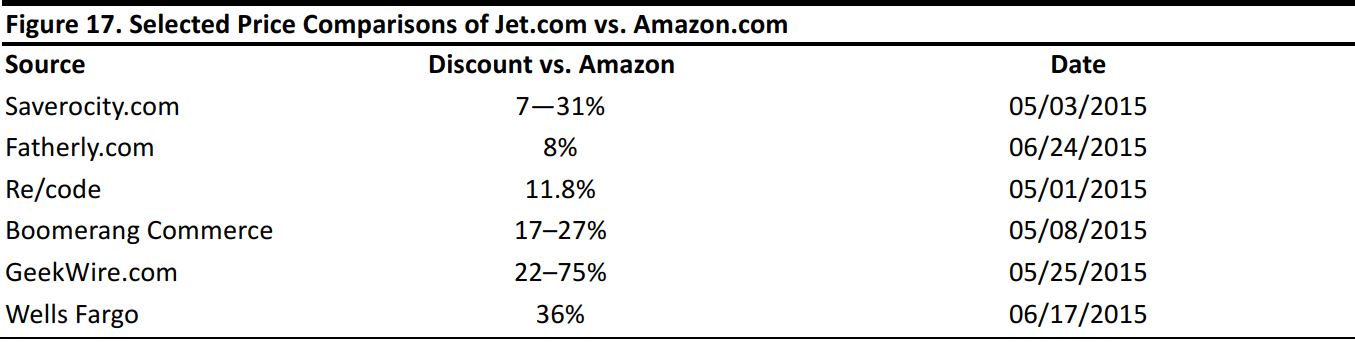

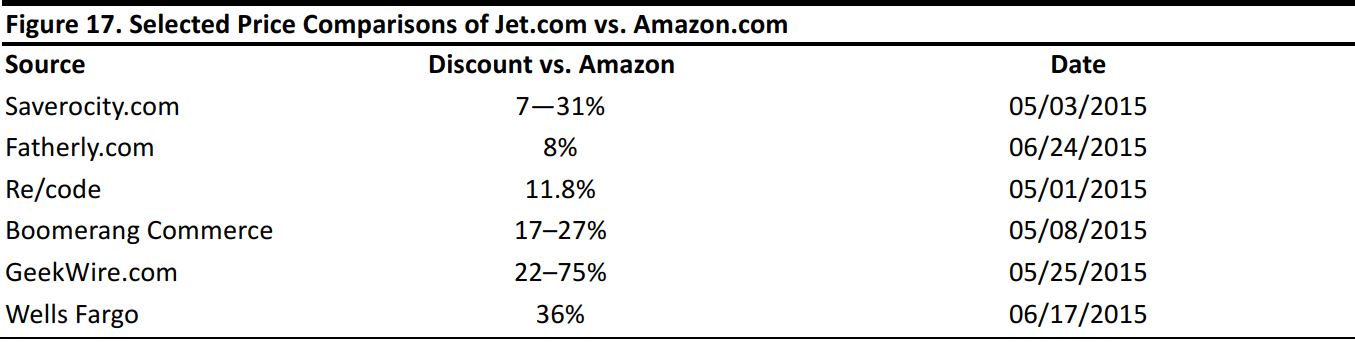

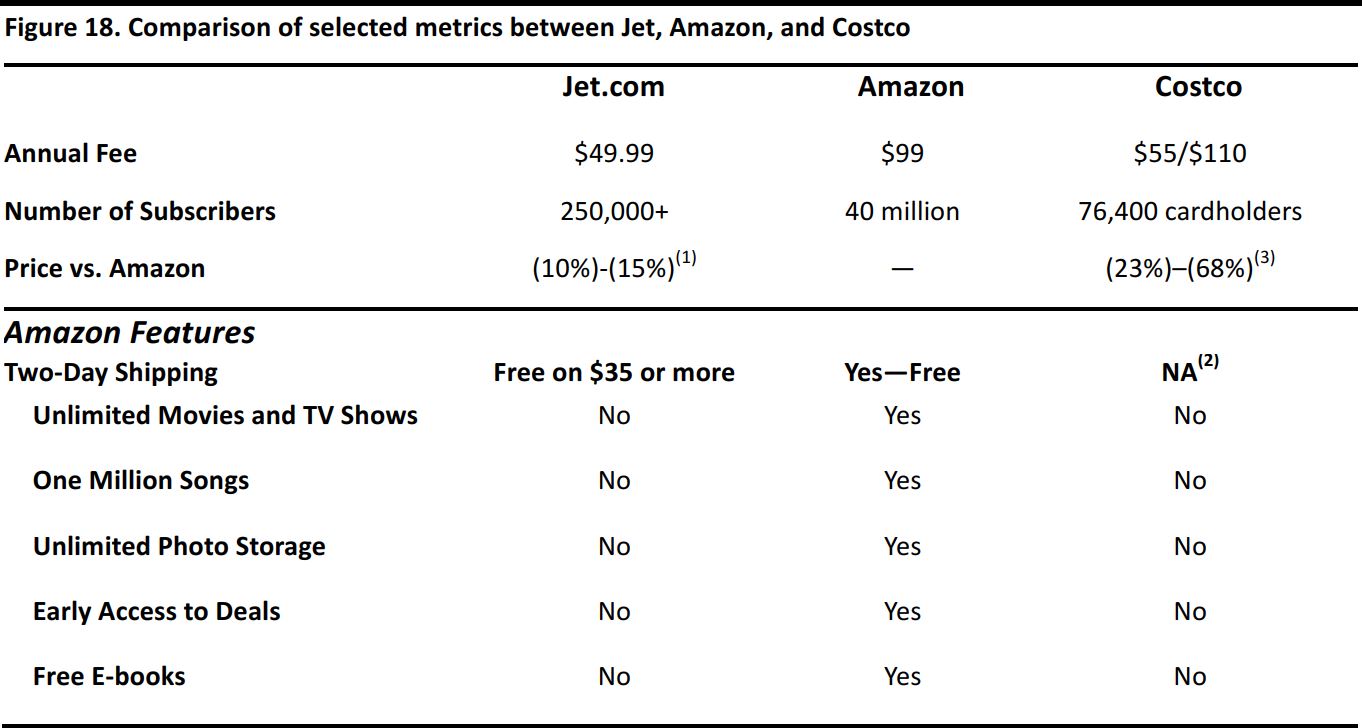

Jet is taking a page (or two) right out of Amazon’s playbook by offering a friendly user interface and low prices. That is no surprise, since Jet’s CEO, Marc Lore, spent two years at Amazon after it acquired his company (the parent company of Diapers.com). What’s different is that Jet seeks no profit on the goods it sells; rather, it aims to generate profits only from membership fees. To entice new customers, Jet is offering a free trial membership for the first six months. Jet claims to offer prices that are 10%–15% lower than those of other e-commerce retailers, and several analyses have calculated that its prices are 7%–36% lower than Amazon’s.

The company aims to offer a premium browsing experience through a clean, easy-to-use website. Its unique business model relies on deriving profits solely from membership subscriptions. Wholesale prices are passed along to subscribers, resulting in extremely discounted prices versus MSRPs and prices for like products at competing retailers.

The company offers the following membership benefits:

- Big savings

- Savings at an additional 700+ sites using Jet Anywhere (“From Gap.com to Apple.com”)

- Free shipping with purchase of over $35 and free returns within 30 days

- Two-day shipping on “essentials”; two- to five-day shipping on everything else

- Customer support (from its team, called the “Jet Heads”)

Jet.com was founded by Marc Lore, who previously founded Quidsi (the operator of Diapers.com). Quidsi was acquired by Amazon for $545 million in 2010, and Lore stayed on at Amazon for two years after the acquisition. He founded Jet.com in 2014. The company is located in Montclair, New Jersey (but will soon to move to Hoboken, NJ), has about 233 employees and has raised more than $225 million in venture capital.

Since Jet is a privately held company, it does not have to disclose its financials or business metrics, and thus, very little information has been available. On July 31, Jet released the following statistics on its Facebook page:

- Total member savings: $815,642

- Most popular product sold: protein bars (enough daily recommended protein for 212 years)

- Second-most popular product sold: toilet paper (enough to cover the Empire State Building twice)

- Biggest pantry cart: 39 items

From our discussions with the company, the company’s goal is to reach $20 billion in sales by 2020 and in order to succeed, it is operating they are operating like it is already that size.

While overall retail is not growing, this market is and Jet believes the opportunity is significant to not only disrupt, but also grab significant share. Consumers will change the way that they think about buying warehouse goods. They will not get into their cars and drive long distances and haul items home which often defrost before they put them away. Instead, they will be delivered directly to their door, and Jet will only be US focused. We believe that all retailers should pay attention as this might just be the first model of this kind.

Amazon has not taken the new competitive threat lying down. While Amazon’s Prime Day was scheduled a day before its 20th birthday, that day also happened to fall a week before Jet’s launch. Despite some consumer grumbling about the quality of deals offered on Prime Day, Amazon signed up hundreds of thousands of new Prime members, and those shoppers will likely be reluctant to pay for two club memberships at the same time. Other retailers offered promotions of their own, some recurring and some in response to Amazon, making July a sweet shopping month for consumers.

Jet is doing a couple other things that promise to reduce prices even further. It hired engineers with experience building financial-trading systems to develop a “smart cart.” This cart uses dynamic pricing that readjusts prices and shipping methods depending on what’s in the cart and where the goods are going. If consumers waive their return privileges, they can receive even lower prices. In addition to low prices, Jet plans to offer discounts at other retailers such as Gap.com and Apple.com, two-day shipping on essential items, and a dedicated customer-support team. Members will also receive bonus savings alerts about special deals.

During its stealth period, Jet effectively used social media and viral marketing to create a huge buzz. Memberships were offered to a select few who responded to limited-time promotions on Jet’s Facebook page, creating a feeling of exclusivity and mystery surrounding membership. Jet also uses gamification, such as prize giveaways, to entice members.

Comparisons with Amazon and Costco

Amazon is Jet.com’s most-often mentioned competitor, and Jet.com’s website promises prices that are 10%–15% lower than Amazon’s. A Boomerang Commerce survey found that Jet.com’s household product prices were 39% cheaper than Amazon’s, that its appliance prices were 27% cheaper, and that its electronics and cellphone prices were 16% cheaper, for an average product price that is 27% cheaper. Below is a list of price comparisons generated by selected sources:

Source: Wall Street Journal, TheStreet.com, and respective websites

Costco offers two main memberships for individuals: a Gold Star Membership for $55 per year and a $110 per year Executive Membership that offers an annual reward equal to 2% of purchases. According to a recent article on

Investopedia, Costco charges membership fees for three reasons: they increase loyalty (being a member of a private club and shopping to get a return on the membership fee), they reduce shrinkage (i.e., shoplifting), and of course, provide a revenue stream for the retailer. (Costco received $2.4 billion in of its revenue from membership fees in 2014, which contributed more than 75% of its operating income.)

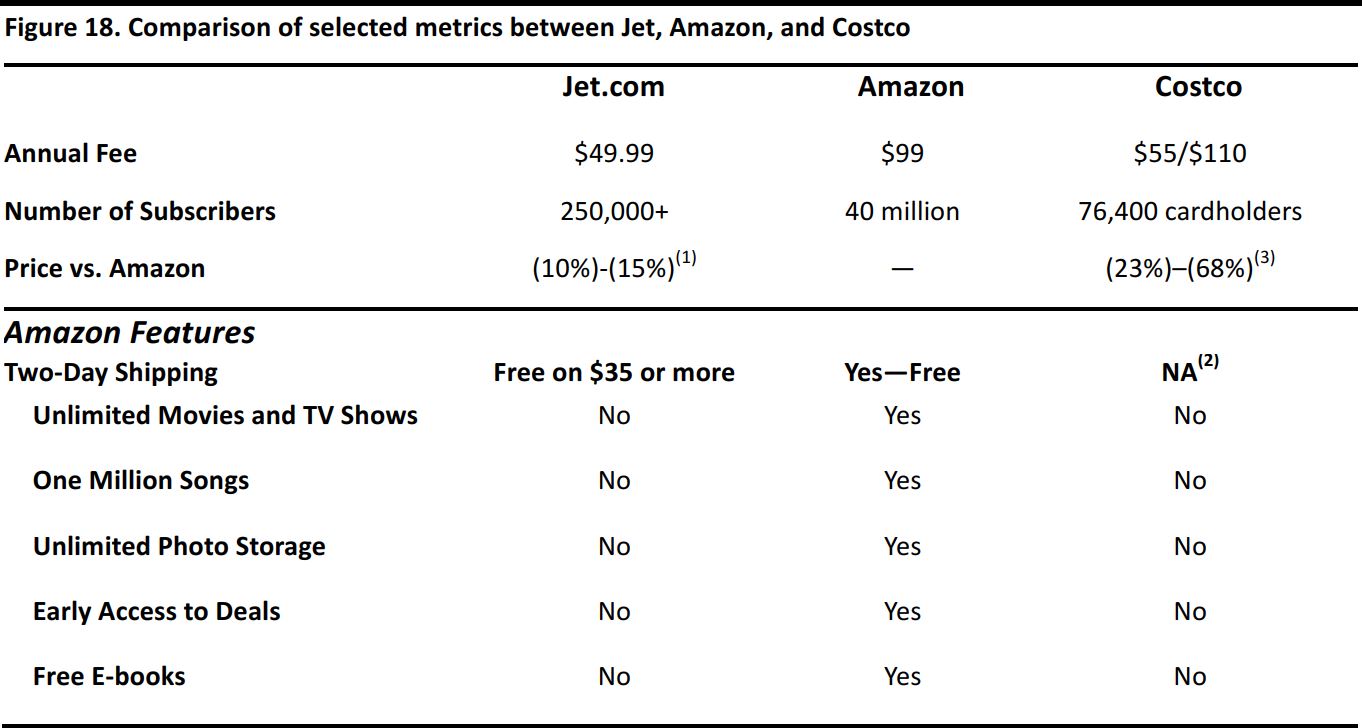

The table below outlines selected service offerings for, Jet, Amazon, and Costco.

Source: Business Insider, The Washington Post, and company websites

1. The Washington Post, 5/1/2015 2. Jet.com 3. Business Insider, 12/17/2014 4. Costco offers next-business-day delivery of certain items for free for orders over $250 and standard delivery of pharmacy products

Amazon and Jet both pose serious competition for warehouse club stores, which also hold the line on prices and use a membership model. Whereas previously a shopper had to drive to the store, park, shop and then load up the car with bargains, customers can now receive similar pricing with greater convenience through Jet. With Jet, goods can be purchased online or via a smartphone app and delivered to the shopper’s doorstep (with free shipping for orders over $35). It is unclear at this time how the warehouse clubs plan to respond to the new competition.

Jet’s detractors say that its product offerings are much narrower than Amazon’s, which is likely the case. For example, one analysis found that Jet offers only 38 varieties of dishwasher detergent versus Amazon’s 2,416. Most of us do not really need that level of variety, though, and Jet said it planned to offer 10 million items at launch. Moreover, there are questions about exactly how many memberships the company needs to sell in order to become viable, as well as how it will handle breakage and returns.

Although Jet.com is not yet a household name, it could well become one soon. Jet’s CEO maintains that “[p]rice is still king,” and if the company can deliver lower-priced goods with great customer service, consumers are likely to sign up in droves. It is fairly easy for consumers to justify purchasing a $50 membership (half the price of an Amazon Prime membership) in exchange for 10%–15% savings on a wide variety of products. So, the real winner here is definitely consumers, who are now able to receive warehouse club prices with e-commerce-style convenience.

8. UNCLE SAM PROFILE—UNCLE SAM WANTS YOU!

The Approach

Uncle Sam is a German brand that specializes in athletic and outdoor clothing. The brand designs are based around two key principles: comfortable style at an unbeatable price. Uncle Sam is a national symbol of the US and typically stands for liberty, independence and individualism. The German apparel company uses this image in marketing its brand. The apparel is meant to be dynamic—combining leisure time and sports. The company slogan is, “WEARever you go.” Its mission statement reflects this attitude as well: “With Uncle Sam we like to procure an attitude of life, which does not know any boundaries, but matches individual needs.”

Uncle Sam also offers accessories like watches, bags, belts as well gym equipment. The active sports collection is one of the main focuses of Uncle Sam. According to its website, unclesam.de, “Our Active sports collection is distinguished by a high comfort-to-wear, breathable and moisture regulative material and a perfect fit.”

Uncle Sam also publishes monthly issues of Uncle Sam Magazine that discusses sport topics, healthy foods, and workout trends and tips.

Price Range and Product Categories

All of the products are designed in-house with the mission to keep prices low, without sacrificing quality. The design team mixes classic styles with new trends. Men’s apparel is labeled Uncle Sam, while Woman’s are just Sam. Each division produces both sportswear and streetwear—however we feel sportswear is the brand’s primary focus based on the number of products shown on its website.

Uncle Sam produces several product categories for men to choose from. For activewear, Uncle Sam offers: dry-fit T-shirts, tanks, sweatpants, underwear, socks and jackets. For streetwear, they offer products like graphic t-shirts, sweaters, polos, sweatpants, socks, and jackets. Below are the price ranges for each product according to the website.

Men’s Sportswear

- Sweatpants: $21.85

- T-shirts and tank tops: $7.61-$14.19

- Training jackets: $27.33

Men’s Streetwear

- Sweatpants: $21.85-$32.81

- T-shirts and tank tops: $10.90-$17.47

- Style jackets: $21.85-$43.76

Sam, the women’s product division, offers workout and casual clothing as well, however the options seem more limited for the ladder. The active wear offerings are: shorts, pants, tanks, leggings, sweatshirts, and jackets. For the casual wear, Sam’s offers: shirts, blouses, sweaters and tanks.

Women’s Sportswear

- Leggings: $10.90

- Shorts: $10.90

- T-shirt and tank top: $6.52-$14.19

Women’s Streetwear

- Sweatpants: $21.85-$32.81

- Shorts: $10.90-$16.38

- T-shirt and tank top: $10.90-$21.85

9. SUPPLIER IDENTIFICATION—RFID AND HOLOGRAMS

Retailers and consumers usually want to know that their goods are genuine, with a clear audit trail back to the brand and the factory.

When authentic goods are preferred, there are several processes and technologies that can be used to certify that a product is genuine. In terms of process, retailers can elect to work only with trusted suppliers and conduct unannounced, thorough inspections to ensure compliance.

Common materials and technologies used for demonstrating product authenticity include tags or logos or serial numbers (as on designer handbags) or holographic labels on driver’s licenses, liquor bottles, or copies of Microsoft Windows software, though even holograms can also be copied. Manufacturers and suppliers also use identifiers such as barcodes or RFID tags to identify products.

Higher-tech solutions include embedding chemicals or specific chemical markers in materials for identification. One company, Lumentum (which was spun off from JDS Uniphase) has developed a line of color-shifting pigments, which are used in applications ranging from automobile paint to use in many of the world’s currencies. The unauthorized marketing of drugs is a worldwide problem with potentially deadly results, and technologies have been developed to identify genuine and fake drugs. One startup, now a division of Thermo Scientific, developed a handheld scanner that uses optical technologies formerly used in telecommunications to identify many kinds of chemicals and substances.

Initial great enthusiasm for RFID tags in retailing turned into great disappointment, pinning the technology with an undeserved bad reputation for expense and difficulty of use, in FBIC’s view. At present, the technology is primarily used for pallet identification, however it still has enormous promise in terms of inventory control and management, especially in an omnichannel world where retailers needs to have an accurate view of inventory for the fulfillment of online orders.

RFID technology could also be used for product identification, through there are privacy issues that need to be overcome. If the apparel or footwear of a certain brand had a tag, then a frequent customer could be identified upon walking into a store and provided better service. The lack of hidden RFID tags could also be used to help identify non-authentic goods. Further to the topic of privacy, since RFID tags can only be interpreted by their writer, they are therefore unintelligible to others, though privacy concerns still remain.

The warehouse club industry and its customers receive great benefits from diverted goods, since there are brands who wish to control their distribution channel, and these goods are also often new, seasonal merchandise. These one-time shipments offer the surprise element to treasure hunting in warehouse stores, when the shopper comes across an unexpected great deal on brand-name products not ordinarily stocked. It is one of the key traffic drivers, in addition to fresh food items, in our opinion.

There are many websites that specialize in disposing of excess retail merchandise, and a recent article on retlailmenot.com lists flash-sale sites, such as Beyond the Rack, the Clymb, Doggyloot, Fab, HauteLook, Ideel, Jetsetter (for travel), Joss & Main, Gilt, Lot 18, MyHabit, One Kings Lane, Rue La La, Shop it to Me and Zulily.

One startup, INTURN, promises to add clarity to the market for moving excess inventory, and the company estimates that there is a global $250 billion market for off-price inventory. The company offers a global b-to-b marketplace to efficiently and easily sell end-of-season/excess inventory to retailers in private online showrooms, with its first vertical focus on fashion and apparel brands. It provides automated tools to replace what is a manual, painstaking, error-prone process, which provides a powerful opportunity to increase profitability. In effect, the platform creates “private, curated showrooms for retailers,” according to a WWD article. INTURN is designed and led by retail industry veterans and technology experts, such as Ken Seiff, founder of Bluefly, and Silas Chou, who invested in the Michael Kors and Tommy Hilfiger businesses. INTURN has received $3.6 million in financing to-date, including from Seiff’s Beanstalk Ventures and Chou’s family investment group, Novel TMT.

10. DOMESTIC VS. DIRECT IMPORTING—COST VS. VISIBILITY

In this section we take a look at the trends in direct vs. indirect importing. In our discussion, we analyze the two by leveraging Walmart’s definitions for Domestic Supplier and Direct Import Supplier as featured in its ethical sourcing guide for suppliers, namely: a domestic supplier is an entity or individual “that sells domestic and/or imported merchandise (where the supplier is the importer of record) to Walmart in the local market (retail country)”; and direct import supplier is an entity or individual “that sells imported merchandise (where Walmart is the importer of record) to Walmart in any retail market (retail country),” according to Walmart’s Standards for Suppliers Manual.

There are certain benefits and risks related to choosing to work with a direct-import supplier vs a domestic supplier, which are idiosyncratic dependent on the supplying company and product being sourced. Most notably, in apparel our operating teams have observed that some domestic suppliers offer slightly lower prices versus the equivalent cost for sourcing directly from the vendor. This can be due to efficiencies gained at the supplier level; however, it can also be the result of less stringent processes around factory compliance and following import regulations. In other words, domestic suppliers could potentially offer better value at the cost of higher supply chain obscurity.

Sourcing directly from the supplier offers the benefit of supply-chain visibility. The sourcing process is monitored from its starting point and necessary factory and compliance audits are executed and verified.

Our observations point to an increasing interest for companies to achieve this level of visibility in their supply chains. This means either sourcing direct or implementing a more thorough monitoring process during the production of goods sourced by domestic importers; for example, performing final quality control inspections for branded goods in addition to compliance and factory audits.

11. SOURCING—ONSHORING AND NEARSHORING

Wholesale clubs offer a wide assortment of products. Consequently, the supply chains that clubs use to source and deliver products to their stores tend to be complex. Wholesale clubs need to deal with local and international suppliers for items ranging from fresh produce to apparel and home appliances.

Traditionally, because of the sheer volume of product that gets sold through the doors of clubs, the hardline (major appliances, hardware, office supplies) and softline (apparel, small appliances, home furnishings) categories sell products mostly manufactured “offshore”. Low labor costs have been a competitive advantage for Chinese and Asian manufactures that has overwhelmed their US and European counterparts for decades. However, with rising labor costs in Asia and improving productivity due to automation at home, the debate about re-shoring production to the US has been spurred anew.

Harold Sirkin, a managing director at Boston Consulting Group, was quoted in a recent Business of Fashion article by saying that Chinese labor costs have reached 61% of U.S. levels, compared to 17% of U.S. levels 15 years ago. According to Sirkin in an article published on businessoffashion.com, the labor cost appreciation overseas makes American manufactures competitive after adding the higher supply chain and transportation costs associated with offshore production.

Back in 2013, BCG published a survey in the Economist which suggests that 37% of companies with annual sales above $1 billion and 48% of those with sales over $10 billion were planning or actively considering shifting production facilities from China to USA, which supports Sirkin’s suggestion.

Walmart has committed to buying $250 billion more in products from U.S. factories by 2023, which makes the onshoring movement particularly relevant for the company. According to a recent article in the Washington Post, Walmart is making significant efforts to deliver on its commitment. Darrell Rosen, who heads a consultancy for Walmart suppliers, is quoted in the article by saying he believes Walmart’s commitment is a strategy to save money for the retailer. This suggests that buying product manufactured onshore can actually be more cost-efficient.

Even though the onshoring movement seems to have gathered impetus and publicity over the last few years, we believe there are major considerations that would delay a more pronounced trend past the next five years:

- When it comes to apparel, between 2011 and 2014, wholesale prices of U.S. apparel grew four percent, according to the US Bureau of Labor Statistics, while the price per square foot of apparel imported from China fell 11% over the same period. The trend shows that the price gap between U.S.-made garments and China-made garments has actually widened, according to an article on sourcingjournalonline.com.

- According to the 2015 U.S. Fashion Industry Benchmarking Study nearly 39% of the 30 companies participating in the survey expect to increase sourcing value or volume from the United States in the next two years; however, companies expecting to increase sourcing in the United States do not expect to cut back on imports. This means sourcing for US made product is perceived as a diversification option rather than a relocation option, which leads us to believe that the reshoring movement does not have the fundamentals to grow into a pronounced trend.

- Automation technology that enables cost-efficient reshoring for some product categories is still in its infancy. For example, garment manufacturing still very much relies on human labor and emerging technologies such as machine vision systems to track stitching and maneuver materials are still a long way out before becoming commercial viable on a large scale.

- The decision to onshore vs offshore production depends on more factors than just labor cost. Mostly, evidence suggests that the US still needs to rebuild the infrastructure that can support large-scale onshore manufacturing. For example, the manufacturing labor pool has shrunk dramatically in the US with roughly 5 million fewer Americans working in factories today compared to 1990, according to an article on businessoffashion.com.

We remain similarly skeptical when it comes to the potential of nearshoring production from a warehouse club point of view. For example in apparel, nearshoring production is mostly about speed to market and we have seen a small incremental increase in nearshoring to Central America, including Guatemala and Nicaragua, where US brands and retailers source in order to achieve shorter lead times and improve inventory management. For a warehouse club, however, these factors are less important compared to the value and quality of the products being sourced. With established sourcing relationships in Asia, we see limited upside in nearshoring production in the mid-term.

12. MARGINS—HOLDING STEADY

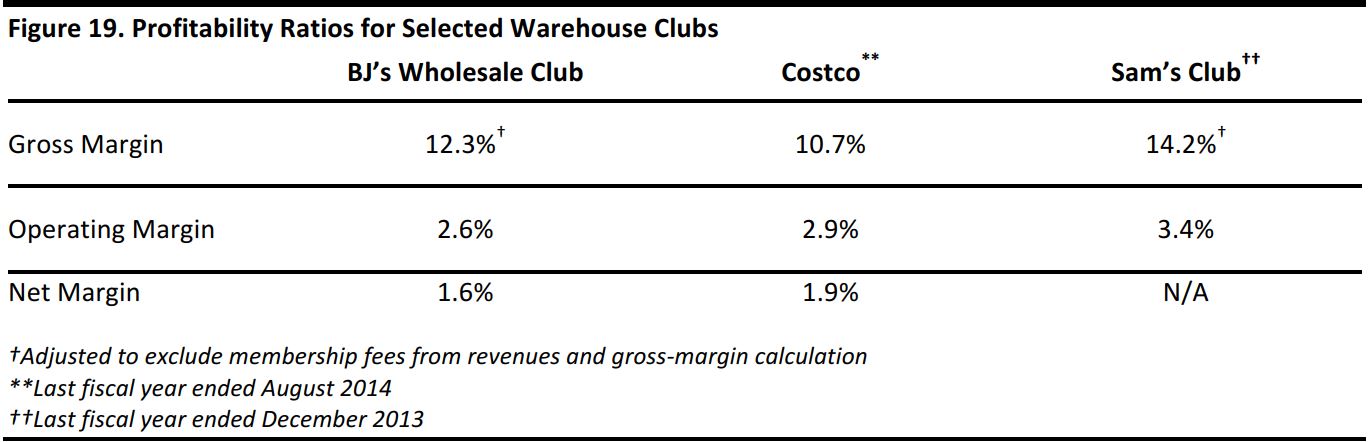

Since warehouse clubs aim to offer the lowest possible retail prices to their members, it is understandable that they will do so at lower margins than other retailers. For example, Amazon reported gross margins of 29.5% in 2014 and Walmart reported 24.3% gross margins in 2015, whereas the companies listed below reported gross margins in the teens. Warehouse clubs offer lower prices by deliberately capping their gross margins as well as by limiting the number of SKUs offered and achieving efficiencies in shipping and logistics.

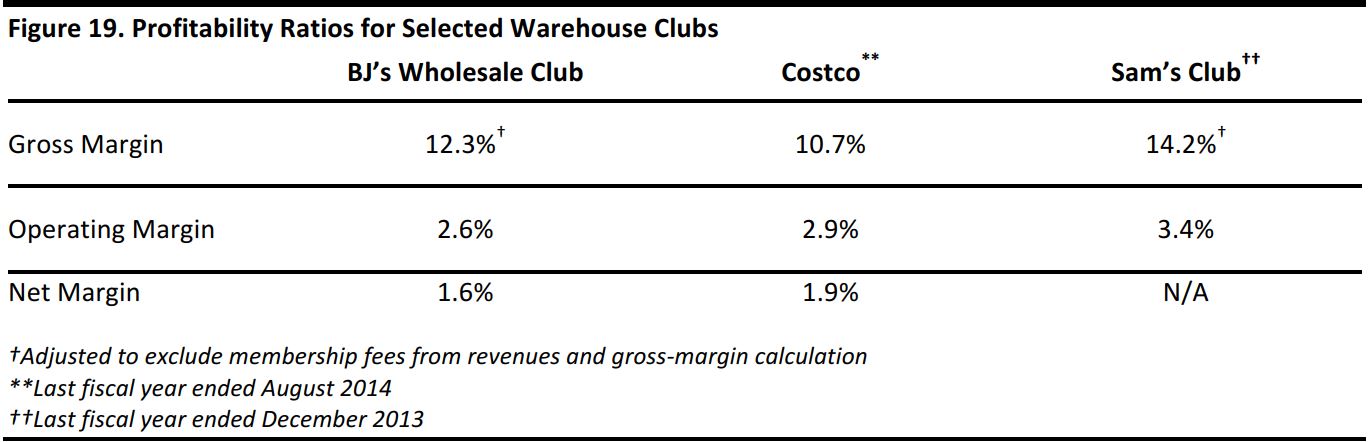

The table below summarizes the gross operating margins for three warehouse clubs, using data that admittedly spans several sources and time periods and relies on certain assumptions. As the table indicates, most gross margins fall within the range of 9%–11%. Operating margins are generally lower and net margins are generally in the 1%–2% range.

Source: WCF Research, company reports and FBIC

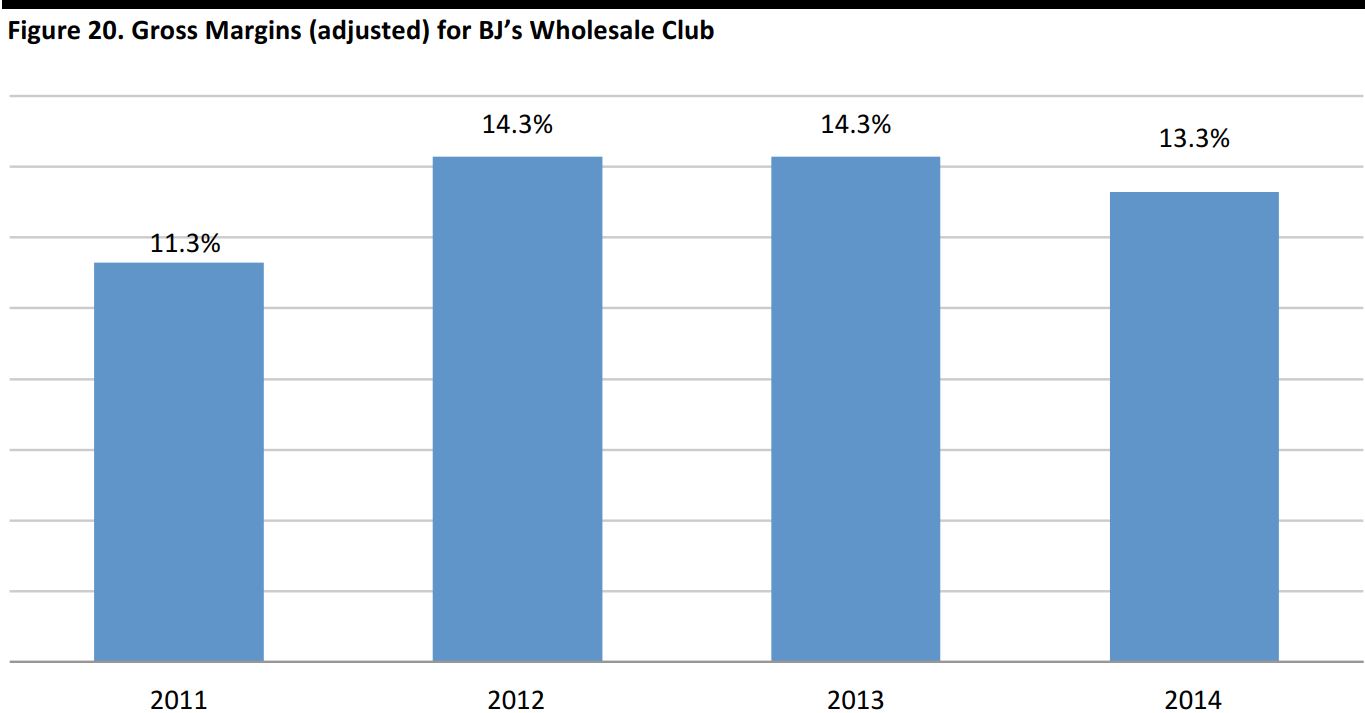

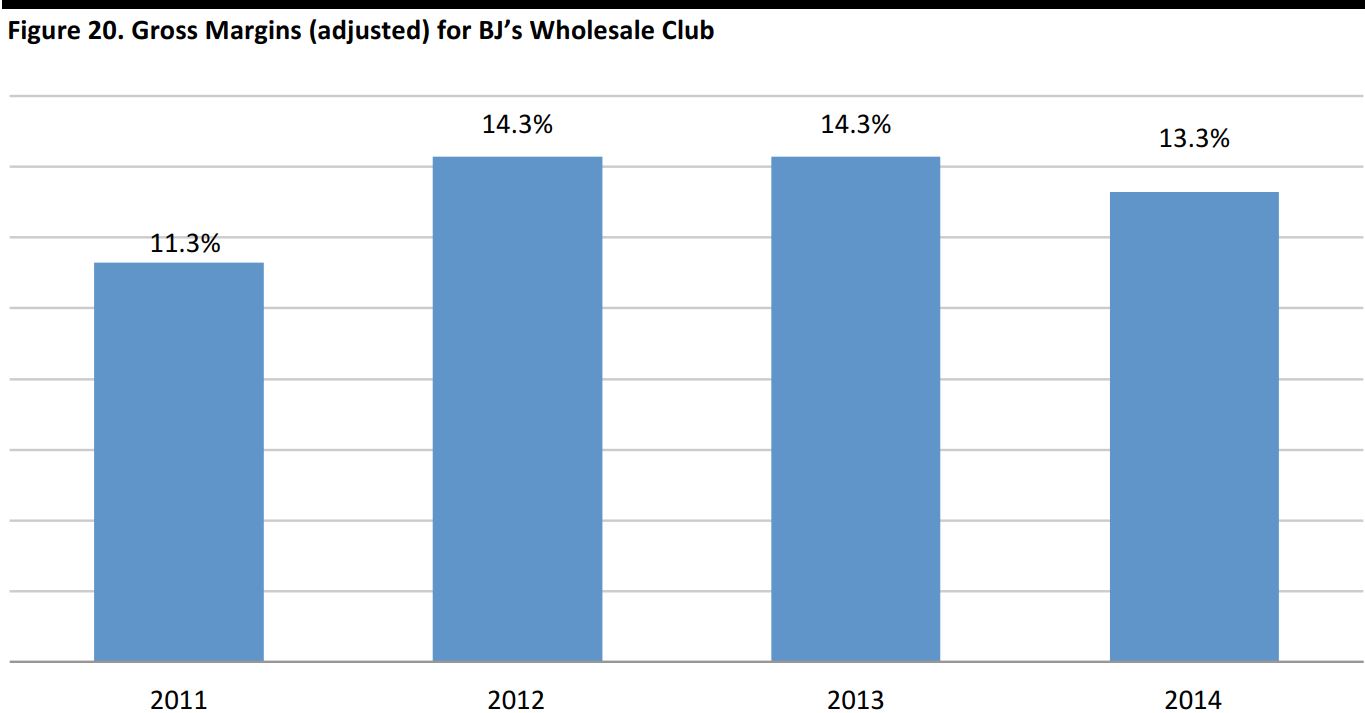

BJ’s Wholesale Club: During BJ’s last five years as a public company (FY07–FY11), adjusted gross margins (which exclude membership fees from revenue) fell within the range of 8.9–9.3%, and FBIC estimates that gross margins have since risen to 13.3%. Before going private, adjusted operating margins fell within the range of 1.8–2.3%, and FBIC estimates that operating margins have risen to 2.7%. Finally, adjusted net margins were 0.9–1.3% while BJ’s were public, and FBIC estimates that net margins have risen to 1.6%.

Source: FBIC analysis and WCF Research

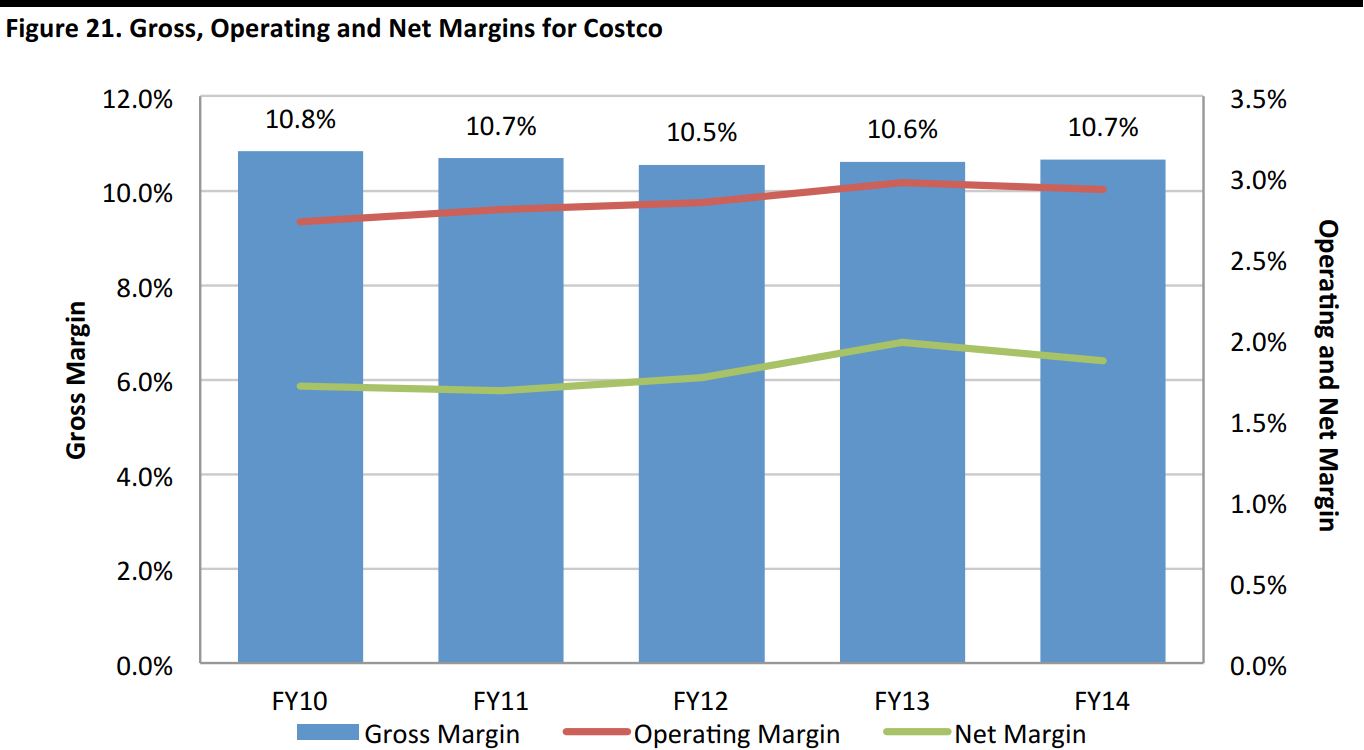

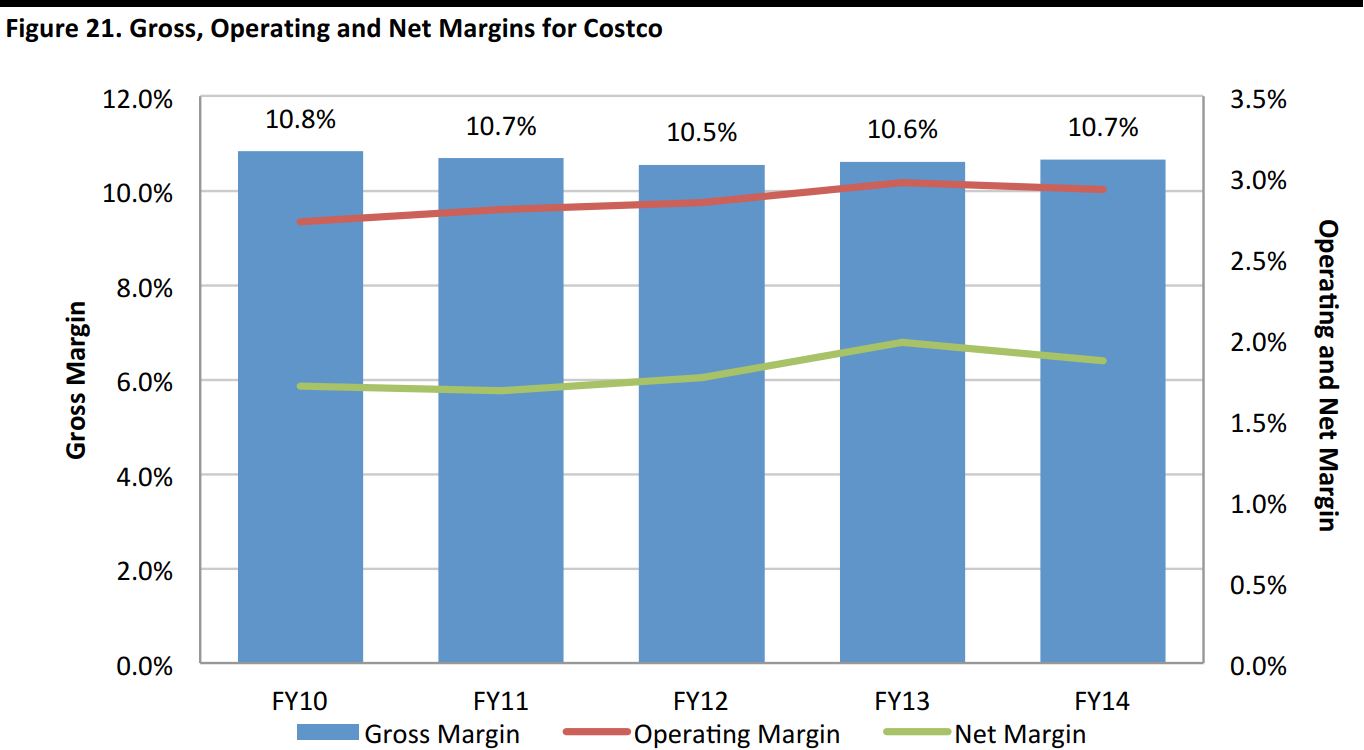

Costco: As the only public pure-play warehouse club operator, Costco offers the clearest and highest-quality data of the three warehouse club operators. Costco falls solidly in the middle, with gross margins similar to, but higher than, BJ’s. Costco’s operating and net margins are one percent higher than BJ’s. Costco’s gross margins are quite flat, yet operating and net margins generally improved from 2010 to 2014.

Source: Company reports and FBIC

Sam’s Club: As a wholly owned subsidiary of Walmart, Sam’s Club provides only selected financial information, including revenues and operating margins. Sam’s Club’s gross margins lead the group (although they are based on adjusting an estimate), and the company’s reported operating margins lead the group as well. We speculate that Sam’s Club receives some benefits from its parent company in terms of purchasing power or other advantages, which result in its higher profit margins.

Although it is premature to consider Jet.com (see next section) a serious threat to established warehouse club stores, the company has received more than $225 million in venture capital funding and earmarked a $100 million marketing budget for its public launch. While many questions surround Jet’s viability due to its zero-profit-on-products business model, the company could put downward pressure on margins across retail until its future becomes clear, i.e., whether Jet’s business model is viable, it gets acquired, as well as the response from established retailers.