albert Chan

Introduction

Chinese consumers have become a strong force in global spending – but tapping into this market requires brands and retailers to understand Chinese consumers. In this report, we discuss ten trends that are shaping the future Chinese consumer.1. A Young and Affluent Population will Fuel Future Consumption in China

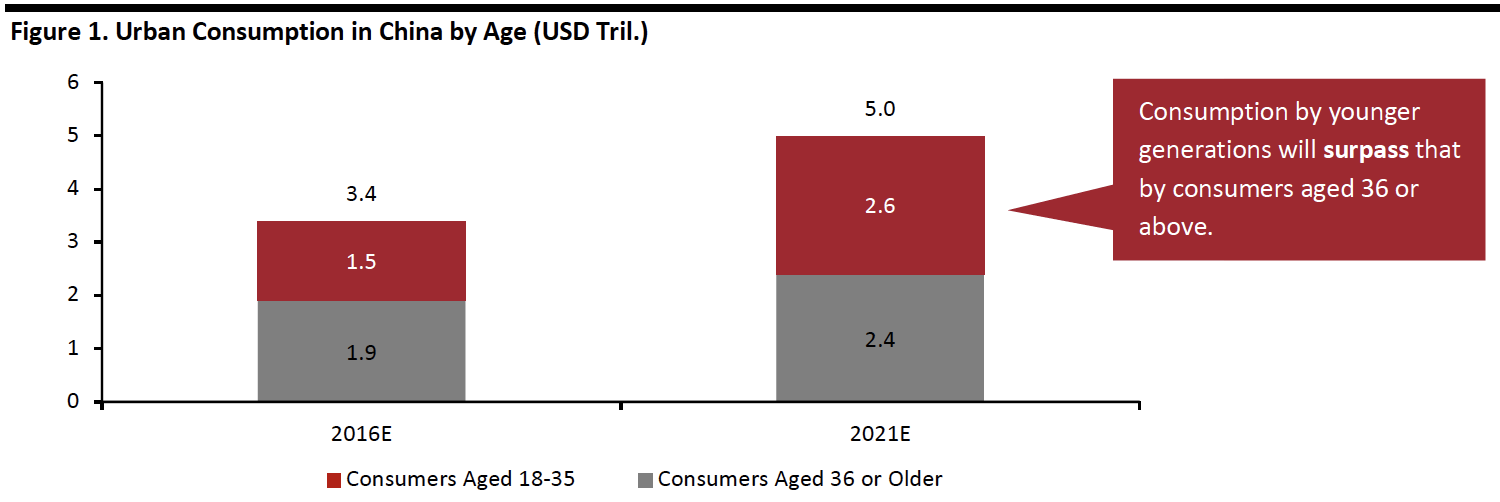

The demographics of the Chinese consumer are changing. Future consumption will be driven by a young and affluent population — millennials born between 1980 and 2000 and Generation Z born after 2000 – both groups having higher disposable incomes than any prior generation. By 2021, urban consumption by Chinese consumers aged 18-35 will reach $2.6 trillion, a CAGR rate of 11% from 2016 to 2021, according to the Boston Consulting Group. In contrast, urban consumption for consumers aged 36 or older will grow at a much lower CAGR of 5% to $2.4 trillion over the same period. At the same time, the younger generation (aged 18-35) will account for 52% of total domestic consumption, surpassing the 48% consumed by older generations. [caption id="attachment_90108" align="aligncenter" width="700"] Source: Boston Consulting Group/Coresight Research[/caption]

What’s driving the shift?

Chinese consumers are earning more and now have more disposable income. According to China’s National Bureau of Statistics, annual disposable income increased 8.7% year over year to ¥28,228 in 2018. China’s affluent population (urban households earning an annual household income of more than $34,000) are expected to account for 25% of total urban private consumption by 2022, a 14-percentage-point increase over 2012, according to McKinsey Insights China.

What Does it Mean for Brands?

Brands and retailers need to recognize the changing demographics of Chinese consumers and dramatically up their games to satisfy the changing tastes of China’s growing young and increasingly affluent population.

Source: Boston Consulting Group/Coresight Research[/caption]

What’s driving the shift?

Chinese consumers are earning more and now have more disposable income. According to China’s National Bureau of Statistics, annual disposable income increased 8.7% year over year to ¥28,228 in 2018. China’s affluent population (urban households earning an annual household income of more than $34,000) are expected to account for 25% of total urban private consumption by 2022, a 14-percentage-point increase over 2012, according to McKinsey Insights China.

What Does it Mean for Brands?

Brands and retailers need to recognize the changing demographics of Chinese consumers and dramatically up their games to satisfy the changing tastes of China’s growing young and increasingly affluent population.

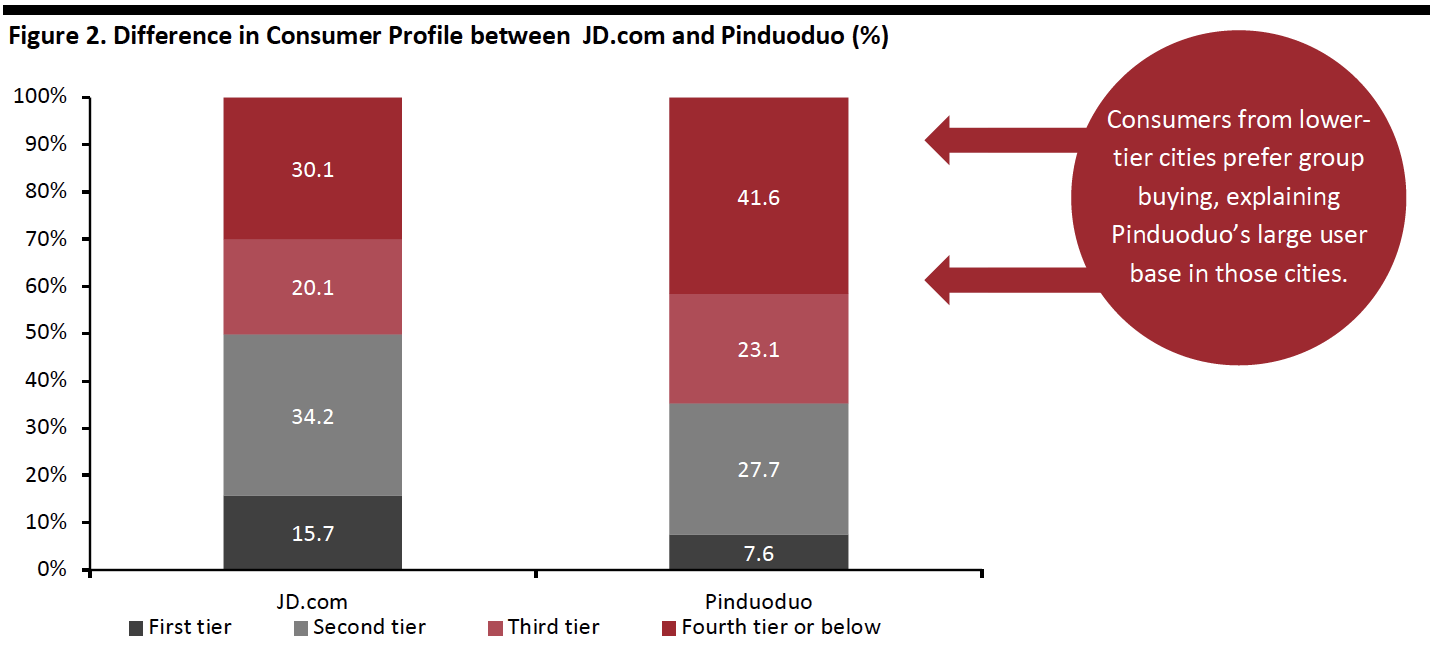

2. Lower-Tier Cities will Drive Future Demand, and Shoppers There Increasingly Buy in Groups

Lower-tier cities in China are fueling consumption growth. Urban consumption in tier 3 cities and below is expected to increase to $6.9 trillion in 2030 from just $2.3 trillion in 2017, according to Robin Xing, Chief China Economist at Morgan Stanley Hong Kong. Spending in tier 1 and 2 cities is expected to grow at roughly the same rate, from $1.4 trillion to $3.5 trillion in the same period. Compared to first- and second-tier cities, consumers from third- and fourth-tier cities tend to be more budget-savvy and are less likely to buy through traditional e-commerce platforms. They prefer group buying – and the lower prices it offers. As of November 2017, Pinduoduo, a social commerce platform where consumers buy in groups, had 64.7% of its consumers in third-tier or lower-tier cities. In comparison, JD.com has half of its consumers in first- and second-tier cities, according to Jiguang Research Institute. [caption id="attachment_90109" align="aligncenter" width="700"] Source: Jiguang Research Institute/Coresight Research[/caption]

What Does it Mean for Brands?

Lower-tier cities offer real opportunities for long-term growth in China, but brands need to understand the differences in consumer tastes in those cities, which may be very different from top-tier cities. Consumers in these cities are more budget-conscious, want more discounts and are more attracted to group buying.

Source: Jiguang Research Institute/Coresight Research[/caption]

What Does it Mean for Brands?

Lower-tier cities offer real opportunities for long-term growth in China, but brands need to understand the differences in consumer tastes in those cities, which may be very different from top-tier cities. Consumers in these cities are more budget-conscious, want more discounts and are more attracted to group buying.

3. The Increasing Obese Population will Boost the Plus-Size Market

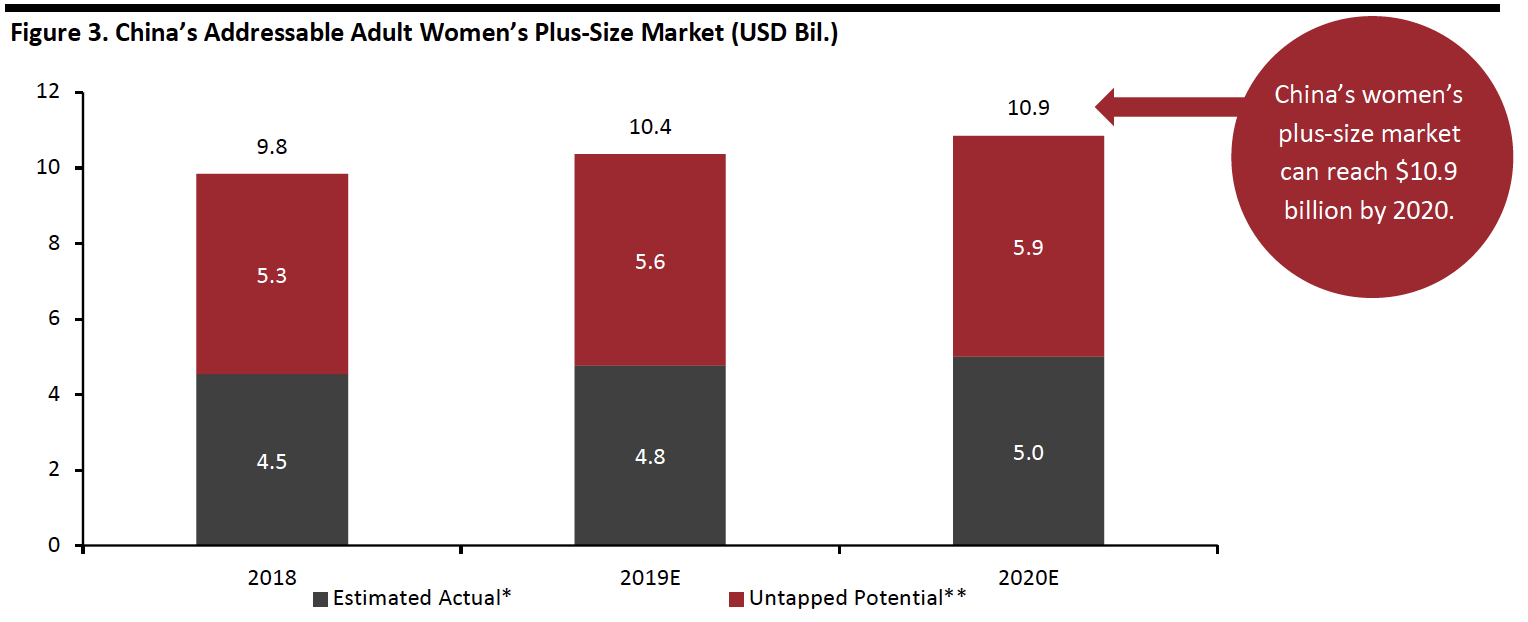

In our report The Women’s Plus-Size Apparel Market in China, we outlined how 6.5% of China’s adult female population was obese in 2016, according to the World Health Organization. A person is considered obese if his or her body mass index, defined as weight divided by height squared, reaches 30 or above. According to Euromonitor International, the women’s clothing market in China is estimated to grow from $151.4 billion in 2018 to $167.1 billion in 2020. As such, we estimate that the Chinese adult plus-size market will grow from $4.5 billion in 2018 to $5 billion by 2020, with an addressable market size growing from $9.8 billion to almost $11 billion in the same period. [caption id="attachment_90110" align="aligncenter" width="700"] Total potential market value is based on the plus-size market capturing a share of the women’s clothing market that is equal to the proportion of women that are classified as obese (6.5%).

Total potential market value is based on the plus-size market capturing a share of the women’s clothing market that is equal to the proportion of women that are classified as obese (6.5%).*”Estimated Actual” is based on the relative underindexing of the plus-size market versus obesity rates we’ve seen in the US.

**“Untapped Potential” is the difference between the total potential market value and “Estimated Actual.”

Source: Coresight Research[/caption] In China, local plus-size retailers are emerging to tap the potential:

- MsShe is a plus-size clothing retailer and was the best-selling plus-size clothing retailer on Tmall from 2011 to 2018. The brand targets female customers aged 30-40 and sells clothes size XL to 6XL. The retailer employs plus-size women to write about product experiences.

- Garden Lis Fashion designs and manufactures clothing for plus-size women. The brand targets female customers aged 25-35 and sells size L to 6XL clothing. The retailer is creating an online community on WeChat to share information on food, fashion and daily activities.

4. More Chinese Consumers Will Embrace “Buy Now, Pay Later”

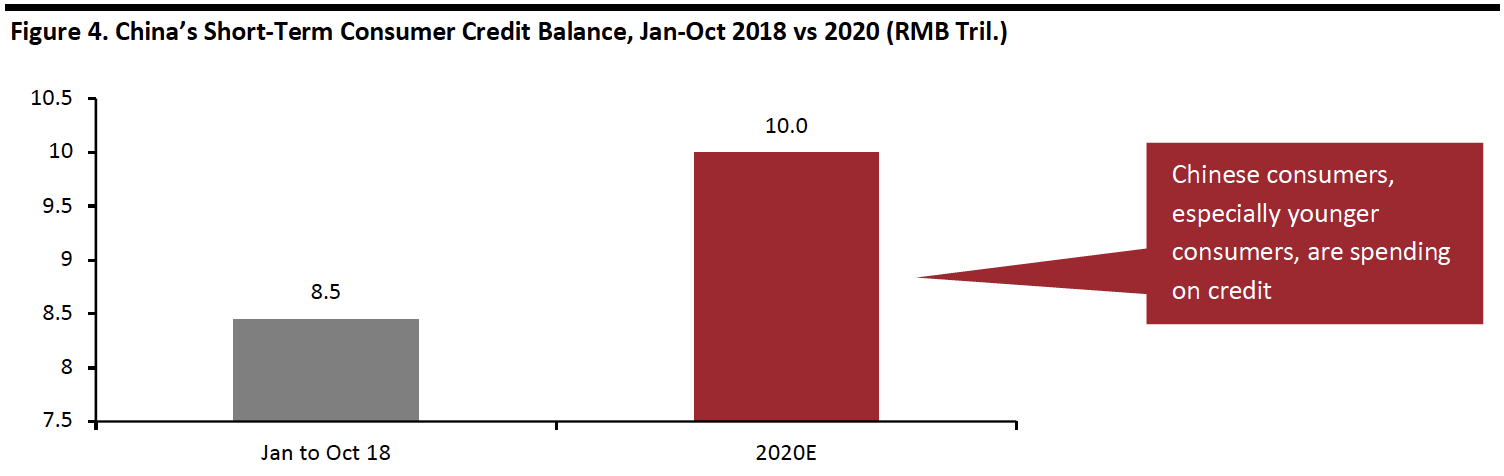

Chinese people are known for being avid savers, but that is changing as the younger generation embraces buying on credit. China’s total outstanding short-term consumption loan credit balance reached RMB8.5 trillion ($1.2 trillion) in October 2018, and is expected to hit RMB10 trillion ($1.5 trillion) by 2020, according to Tsinghua University’s Institute for Chinese Economic Practice and Thinking. [caption id="attachment_90111" align="aligncenter" width="700"] Source: Tsinghua University/Coresight Research[/caption]

Younger consumers are driving growth in installment consumption. According to a Southern Metropolis Daily survey, roughly 56% of surveyed respondents aged 22-25 said they would buy products using an installment plan.

While the younger generation is more inclined to spend than their older counterparts, there are other reasons they opt for installments. The same survey found that “enhancing my quality of life” was the top reason for buying on credit. Furthermore, two-thirds of respondents reported improved life satisfaction, either slightly or significantly, after buying using an installment plan, as it allowed them to acquire things they otherwise could not afford with eased financial pressure.

Consumer finance companies have evolved in tandem with these changing attitudes towards consumer debt. Ant Check Later, a loan service affiliate of the Alibaba Group, offers credit ranging from ¥500 to ¥50,000, based on the applicant’s Alipay account history. According to Ant Financial, as of April 2017, people born in the 1990s constituted 47.3% of Ant Check Later’s registered users.

[caption id="attachment_90112" align="aligncenter" width="700"]

Source: Tsinghua University/Coresight Research[/caption]

Younger consumers are driving growth in installment consumption. According to a Southern Metropolis Daily survey, roughly 56% of surveyed respondents aged 22-25 said they would buy products using an installment plan.

While the younger generation is more inclined to spend than their older counterparts, there are other reasons they opt for installments. The same survey found that “enhancing my quality of life” was the top reason for buying on credit. Furthermore, two-thirds of respondents reported improved life satisfaction, either slightly or significantly, after buying using an installment plan, as it allowed them to acquire things they otherwise could not afford with eased financial pressure.

Consumer finance companies have evolved in tandem with these changing attitudes towards consumer debt. Ant Check Later, a loan service affiliate of the Alibaba Group, offers credit ranging from ¥500 to ¥50,000, based on the applicant’s Alipay account history. According to Ant Financial, as of April 2017, people born in the 1990s constituted 47.3% of Ant Check Later’s registered users.

[caption id="attachment_90112" align="aligncenter" width="700"] Ant Check Later

Ant Check LaterSource: Alipay[/caption] What Does it Mean for Brands? China’s younger generation is creating new opportunities for consumer credit and for brands and retailers to offer financing for big-ticket items. Retailers should work with consumer loan companies to create credit capabilities – especially online and mobile transactions. In China, these services are offered mostly by mobile payment leaders, notably Alipay and WeChat Pay – the mobile revolution in China has leapfrogged the credit card phase (popular in the US) and gone directly online.

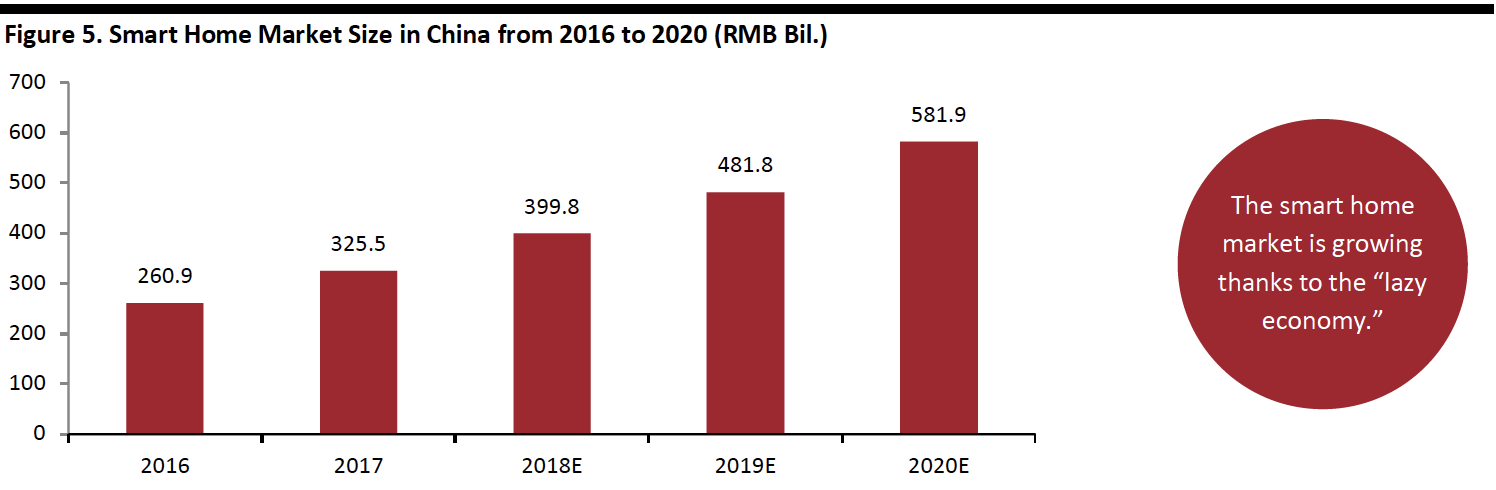

5. The “Lazy Economy” is Gaining Traction

The “Lazy Economy” in China represents a new form of consumption demand, referring to services that save time, save labor or increase convenience. As people embrace more hectic, urban lifestyles, they spend more time at work and on social activities – and spending less time on chores such as grocery shopping, cooking and house cleaning. Products and services that increase convenience are becoming increasingly popular, such as online offerings, home delivery, meal preparation and delivery – even a cup of coffee can be ordered via mobile device and delivered to your door. According to Ali Data, a business intelligence company in the Alibaba Group, consumption of different “lazy devices” has been increasing in China:- Spending on smart kitchen appliances, including automatic vegetable frying machines, rose 81% year over year from 2017 to 2018.

- Spending on smart home cleaning devices rose 50% during the same period.

- Spending on lazy home devices, including smartphone desk support devices, increased 28% year over year in 2018.

Source: iResearch/Coresight Research[/caption]

What Does it Mean for Brands?

Retailers should consider offerings that increase convenience for China’s increasingly time-pressed young urban affluent.

Source: iResearch/Coresight Research[/caption]

What Does it Mean for Brands?

Retailers should consider offerings that increase convenience for China’s increasingly time-pressed young urban affluent.

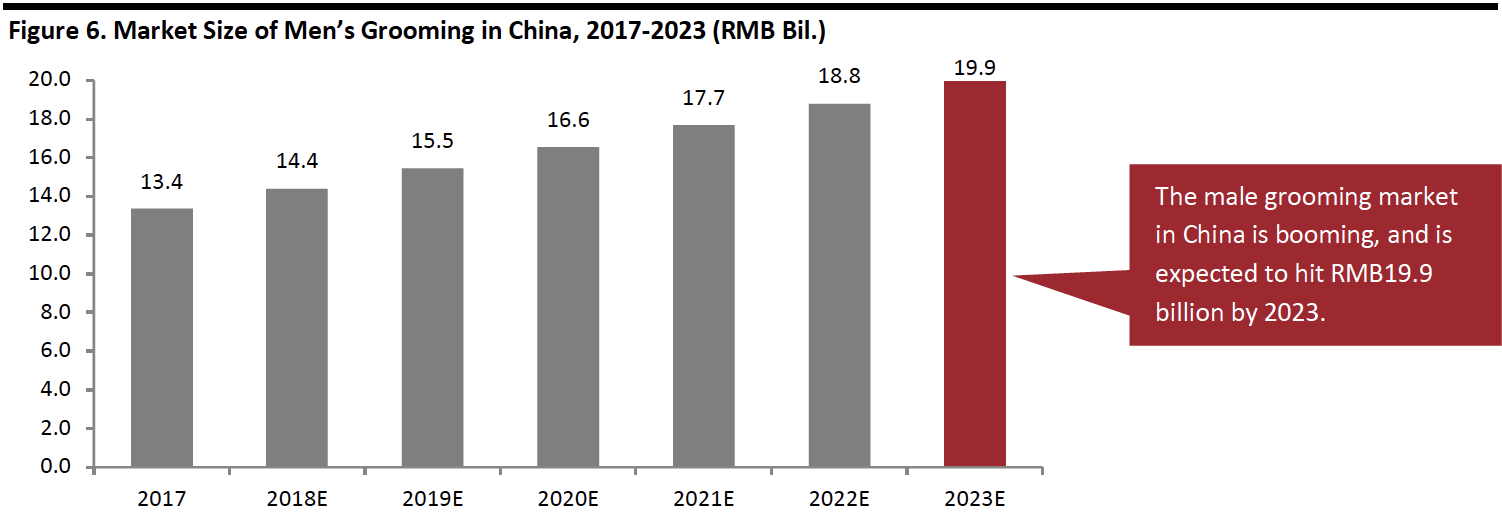

6. Men Will be the New Beauty Consumer

While beauty has traditionally been a female business, urban Chinese men have become more conscious of their appearance, and are willing to spend more on grooming. According to Euromonitor International, the male grooming market in China hit RMB13.4 billion ($1.9 billion) in 2017, and is expected to grow to RMB19.9 billion ($2.9 billion) by 2023. See our report Male Makeup in Asia and the US for more detail. [caption id="attachment_90114" align="aligncenter" width="700"] Source: Euromonitor International[/caption]

This is supported by observations on Tmall in China, where male consumers are spending more on products specifically targeted at men, compared to unisex beauty products: Men are interesting in grooming and beauty products designed for men, not using women’s or even unisex products. In a March 2019 interview, Jason Chen, General Manager of Tmall Beauty, commented that the male beauty market is growing faster than the female beauty market on Tmall in China.

Beiersdorf China, part of Beiersdorf AG of Germany, commented the company sees huge potential for its Nivea Men brand’s online sales in China. The Nivea Men segment has become the firm’s largest business in China, said Simon Cao, Marketing Director of Beiersdorf China.

[caption id="attachment_90115" align="aligncenter" width="500"]

Source: Euromonitor International[/caption]

This is supported by observations on Tmall in China, where male consumers are spending more on products specifically targeted at men, compared to unisex beauty products: Men are interesting in grooming and beauty products designed for men, not using women’s or even unisex products. In a March 2019 interview, Jason Chen, General Manager of Tmall Beauty, commented that the male beauty market is growing faster than the female beauty market on Tmall in China.

Beiersdorf China, part of Beiersdorf AG of Germany, commented the company sees huge potential for its Nivea Men brand’s online sales in China. The Nivea Men segment has become the firm’s largest business in China, said Simon Cao, Marketing Director of Beiersdorf China.

[caption id="attachment_90115" align="aligncenter" width="500"] Nivea Men’s Hydrating and Oil Control Products

Nivea Men’s Hydrating and Oil Control ProductsSource: Lefeng.com[/caption] What Does it Mean for Brands? To capitalize on the growing male grooming segment, beauty brands and retailers should seek to understand male consumers’ needs and preferences in China and offer innovative products tailored to those local demands.

7. Consumers are Becoming More Health Conscious

To combat increasingly stressful work and living conditions in China, Chinese consumers welcome products that offer better health: Consumers are embracing healthy lifestyles, spending on health supplements, frequenting yoga studios and using devices to track health. According to a recent consumer survey on Chinese and North Asian consumers conducted by Mintel:- 45% of Chinese consumers said they consider a healthy lifestyle to be the most important thing for them.

- 32% of Chinese consumers said they spend more on fitness-enhancing health supplements compared to six months ago.

- 24% of Chinese consumers have examined and diagnosed health conditions using real-time monitoring and tracking devices.

Yakult drink with low sugar content for the China market

Yakult drink with low sugar content for the China marketSource: China.com.cn[/caption] What Does it Mean for Brands? Brands and retailers should consider extending ranges to include products that support the increasing focus on healthy lifestyles.

8. Chinese Consumers are Traveling More for the Experience than for Shopping

In our previous report Chinese Millennials Travel Overseas for Experiences, we discussed how Chinese tourists are spending less per overseas trip, but traveling overseas more often:- Chinese outbound tourists’ average spend per trip dropped from ¥15,115 ($2,257) in 2017 to ¥12,416 ($1,854) in 2018, an 18% decline.

- Similarly, average expenditure on shopping in their most recent overseas trip totaled ¥6,938 ($1,036) in 2018, down 24% from ¥9,088 ($1,357) in 2017.

- However, Chinese outbound tourists made 2.1 trips on average in 2018, compared with only 2.0 trips in 2017.

- In particular, younger Chinese outbound tourists aged 18-39 took an average of 2.3 trips in 2018, compared with the 2.1 average across all surveyed Chinese outbound tourists.

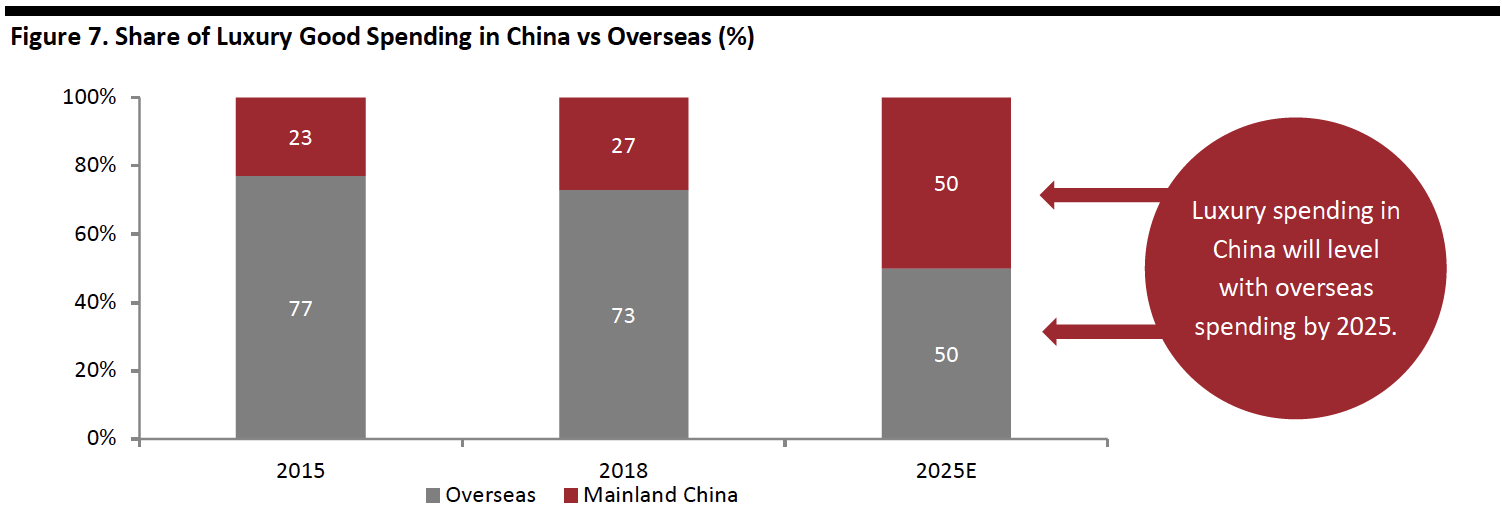

9. Chinese Consumers are Spending on Luxury Domestically

More Chinese consumers are buying luxury goods at home thanks to government efforts to encourage more domestic consumption, lower import duties, stricter control over grey markets that increases consumer confidence that products are genuine and efforts by luxury brands to narrow price gaps with overseas markets. Chinese consumers made 27% of their luxury purchases in China in 2018, up from 23% in 2015, and this is expected to rise to 50% by 2025, according to Bain’s Luxury Goods Worldwide Market Study 2018. [caption id="attachment_90117" align="aligncenter" width="700"] Source: Bain[/caption]

Tiffany & Co. said it enjoyed double-digit sales growth in China in the final two months of 2018. Hermes experienced sales growth in the first quarter of 2019 in China, driven by store extensions in China, particularly its retail outlet in Shanghai’s IFC luxury shopping mall. Both brands also conducted marketing campaigns on WeChat.

[caption id="attachment_90118" align="aligncenter" width="500"]

Source: Bain[/caption]

Tiffany & Co. said it enjoyed double-digit sales growth in China in the final two months of 2018. Hermes experienced sales growth in the first quarter of 2019 in China, driven by store extensions in China, particularly its retail outlet in Shanghai’s IFC luxury shopping mall. Both brands also conducted marketing campaigns on WeChat.

[caption id="attachment_90118" align="aligncenter" width="500"] Hermes’ retail outlet in Shanghai’s IFC shopping mall

Hermes’ retail outlet in Shanghai’s IFC shopping mallSource: Company website[/caption] What Does it Mean for Brands? China represents a promising market for luxury retailers, thanks to rising incomes, government policy that encourages domestic consumption, cuts in import duties and other changes that make it easier for consumers to buy imported luxury goods for similar prices at home.

10. Chinese Consumers are Increasingly Watching Videos and Following KOLs

Digital technologies such as smartphones, social media platforms and short video apps such as TikTok have transformed the way Chinese consume content. Chinese consume way more video content than the global average, according to Deloitte’s China Mobile Consumer Survey 2018:- 59% of Chinese consumers watch videos on instant messages at least once a day, compared with 28% of global consumers.

- 54% of Chinese consumers watch news on video at least once a day, compared with 21% of global consumers.

- 35% of Chinese consumers use video chat at least once a day for daily communication, compared with 10% of global consumers.

- 56% of Chinese consumers follow influencers on WeChat.

- 53% of Chinese consumers follow influencers on Sina Weibo.

- 16% of Chinese consumers learn about financial services on Zhihu.

- 16% of Chinese consumers learn about financial services on Yizhibo.

Key Insights

The consumption power of the Chinese market cannot be overstated – but it is changing quickly and generational differences are pronounced. Brands and retailers need to closely follow the trends that are reshaping Chinese consumers to meet the “new” consumers where they are.- Brands and retailers need to cater to the preferences of the growing young and affluent population in China.

- Lower-tier cities are growing in spending power: Brands and retailers have great opportunity in these cities, but consumer preferences are different.

- With an increasing plus-size population, China offers opportunities for retailers with designs and sizes catered to the segment.

- More Chinese consumers, especially the younger generation, are embracing “Buy Now, Pay Later.”

- The trend for convenience, which has been dubbed the “lazy economy,” is driving demand for products and services that make life easier for young affluent living increasingly hectic lifestyles.

- Male grooming is a growing segment in China: Beauty brands and retailers can tap into this demand with products designed for men.

- Chinese consumers are becoming health conscious and products and services that improve health and well-being will be in increasing demand.

- Chinese tourists are becoming more interested in experiences than shopping, and use social media to guide their trips.

- China represents a promising market to luxury retailers thanks to government efforts to encourage domestic consumption, relaxed import rules, lower tariffs and rising affluence.

- Retailers can leverage social influencers and videos through various social media platforms to reach Chinese consumers.