Nitheesh NH

Introduction

Long-established truisms in CPG and retail are gradually being demolished. The beauty industry used to be centered around the female consumer; CPG brands depended on retailers to reach the consumer; and Amazon was a seller of electronics and books rather than an owner of CPG private labels—but these and other longstanding assumptions are changing. As we outline in this report, we anticipate that CPG will undergo an array of changes, including the rise of male beauty, the use of direct-to-consumer sales channels, the potential disruption of Amazon, and the introduction of lifestyle apparel and accessories brands. Over the following pages, we detail our 10 top trends in the US CPG market. In this report, “CPG” encompasses beauty and personal care goods, and packaged grocery products.1. CPG Brands Are Tapping into Health and Wellness

Particularly for younger consumers, wellness is the new luxury, replacing more traditional signifiers of affluence as an indulgence and a spending priority. Modern-day wellness refers to holistic healthy living characterized by physical, mental, social and spiritual well-being—and this concept is gaining traction across the CPG sector. Consumers are increasingly taking ownership of their health and wellness. According to a 2019 Coresight Research survey, 46% of US consumers believe wellness to be very important, and 28% now consider wellbeing and fitness to be more of a spending priority compared with three years ago. We are seeing CPG brands catering to this trend. CPG companies are expanding into health and wellness products, acquiring wellness companies and also cooperating with communities to deliver wellness initiatives to raise public awareness of health issues:- Procter & Gamble (P&G) teamed up with Thrive Global, the wellness and behavioral health firm led by Arianna Huffington, in a bid to turn some of P&G’s most commonly used products into wellness boosters.

- Clorox expanded its health and wellness portfolio by dietary supplements leader Nutranext in March 2018, which manufactures and markets leading dietary supplement brands in retail and e-commerce channels.

- In April 2019, Unilever announced plans to acquire San Francisco-based supplement brand Olly.

- Colgate-Palmolive’s worldwide community health initiative, “Bright Smiles, Bright Futures,” provides children across the globe with free dental screenings and helps to educate people about oral health.

- E-commerce startup Brandless announced in March 2019 that it is launching a new collection of wellness items including organic matcha green tea powder and essential oils.

- US skincare brand Drunk Elephant does not use all-natural fragrance ingredients when producing essential oils, as these are believed to cause skin allergy issues.

2. CBD Is Gaining Traction in CPG

Tying in with increased demand for wellness products, more US consumers are exploring the benefits offered by CBD, which stands for cannabidiol, the second-most prevalent of the active ingredients of cannabis (marijuana). In the US, CBD extracted from hemp is federally legal as of December 2018, and is becoming more openly integrated in consumer products—ranging from beauty to food and beverages to active nutrition. According to Hemp Business Journal, a division of New Frontier Data, total sales of hemp-derived CBD products are expected to reach $646 million by 2022 from $49 million in 2014—growing at a CAGR of 38% over this period, representing a huge market opportunity for CBD products in future. Consumers are showing interest in the use of CBD for wellness, health and beauty applications as well as for pets. From different data points, we observe that US consumers are using, or are willing to try, products infused with CBD:- According to a research survey conducted by The Benchmarking Company in February 2019, US Gen Xers (those born between 1965 and 1979) are the most willing to try beauty and personal care products that are made with hemp or contain CBD at 77%, followed by millennials (those born between 1980 and 1993) at 74%, Gen Zers (those born between 1994 and 2000) at 68% and baby boomers (those born 1964 or earlier) at 67%.

- According to another survey conducted by the company in February 2019, 56% of respondents cited medicinal value as a selling point for cannabis, up from 38% in May 2018.

- Currently, 18% of US consumers currently use or have used beauty and personal care products that are cannabis-derived or contain hemp seed, hemp oil or CBD.

- Unilever announced in April 2019 that its subsidiary Schmidt’s Naturals would be launching a line of hemp-oil deodorants in September, followed by a CBD product range through selected retailers. As of October 10, it is still in planning stage as Unilever has not yet officially announced launch of the new product ranges.

- Kroger announced in September that it has decided to add CBD products—including lotions, balms, oils and creams—to all of its stores in Texas, after lawmakers authorized and regulated a bill for the sale of hemp and hemp-derived products earlier in June.

- Whole Foods also announced in September that it will expand distribution of topical CBD products to stores in 13 new US states.

3. CPG Brands Are Getting More Agile and Leaner

Customer needs are changing at a quicker pace than ever before, and it becomes increasingly important for companies to be able to adapt quickly. This is where agility and leanness come into play, emphasizing the need to optimize efficiency, minimize waste and continuously improve to meet customer requirements. An organization that is agile and lean enough has clear structure, lean governance and efficient core processes. McKinsey’s latest research on agility shows that agile business units are 1.5 times more likely to outdo competitors on both financial and nonfinancial performance metrics, with frontline sales staff demonstrating 30% higher productivity. We observe that different CPG brands are going lean to maintain a competitive edge against their industry peers, to keep up with consumer demand and to become more agile:- In July 1, P&G moved to a new organization structure by moving 60% of its corporate roles into six industry sector-based business units. The aim was to de-matrix the company and provide greater clarity on responsibilities and reporting lines in order to focus and strengthen leadership accountability. The new structure is intended to enable P&G to become a more focused, agile and accountable organization, operating at a lower cost.

- Colgate-Palmolive is upgrading its software systems—which were deployed in 1994 by SAP, an enterprise resource planning software provider—to one called SAP S/4HANA. This will allow the company to consolidate its different regional SAP systems into a global one, driving simplification, efficiency and standardization. Colgate-Palmolive is also becoming more agile, operating consumer innovation centers around the world to bring new products to market more quickly.

- Kimberly-Clark is implementing its Global Restructuring Program to make it a simpler, leaner and faster organization. The aim of the program is to help the company standardize manufacturing platforms to speed up the rollout of innovation.

- Clorox is continuing to drive its “Go Lean” strategy, which emphasizes the long-term profitability of the company’s international business by driving speed and efficiency in decision-making.

4. From Male Grooming to Male Beauty

Male grooming has become an established part of the personal care market, seeing steady growth on a global scale due to an increase in attention by male consumers to their own skincare needs. Now, we are on the cusp of male grooming morphing into male beauty among mainstream consumers. One driver of this trend is the growing impact that male beauty influencers have on younger consumers, developing interest in makeup products and challenging gender stereotypes. We are seeing male makeup slowing gaining traction in the US, riding on the growth of the male grooming market. David Yi, founder of men’s beauty website Very Good Light, believes that the ascendance of Gen Z is ushering in a more accepting attitude toward men’s makeup in American society. Male consumers are no longer only using shaving kits and fragrances to look and smell good, but are also expanding their horizons by embracing beauty products. Data points on male makeup indicate that US male consumers are open to trying such beauty products:- 33% of US men like or use natural-looking makeup, according to a 2017 Statista survey.

- According to US survey data from Prosper Insights & Analytics, approximately 50% of American men regularly purchase moisturizers and facial cleansers, and approximately 5% of men in the US purchase these products as frequently as once a week.

Boy de Chanel’s product range

Boy de Chanel’s product rangeSource: Chanel[/caption] With the needs of US male consumers evolving toward skin care as more emphasis is placed on looking good, there is a positive outlook for male beauty brands in the CPG space in the future.

5. CPG Brands Are Adopting a Direct-to-Consumer Approach

Among the pressures facing established CPG companies is heightened competition from direct-to-consumer (DTC) startups, which are starting to capture meaningful market share. To offset this, traditional CPG companies are starting to invest in DTC e-commerce. DTC allows manufacturers and CPG brands to take out the intermediation of retailers, gain more control over the presentation of their products and gather their own customer data. Companies including Unilever, P&G and Colgate have launched their own DTC businesses to withstand competition from CPG startups:- Unilever’s Chief Marketing and Communications Officer Keith Weed discussed the learnings of the company’s 2016 acquisition of Dollar Shave Club in April 2019 in the World Federation of Advertisers annual conference, including the development of a DTC approach to selling mustard.

- P&G’s US Gillette DTC, while still small, doubled in the US in 12 months ending July 2019. P&G recently expanded Gillette DTC in Australia and Germany, and launched Venus DTC in the US.

- Colgate is introducing its “Magik” toothbrush through a DTC marketing approach. It is the company’s first manual toothbrush with augmented reality, which aims to teach children in a creative and novel way how to properly brush their teeth. DTC selling enables Colgate to directly target the product at mothers of the intended user age group.

Colgate’s Magik toothbrush

Colgate’s Magik toothbrushSource: Colgate-Palmolive[/caption] According to a 2018 survey of 150 consumer goods companies conducted by research firm PA Consulting, 84% reported increased DTC sales in the last 18–36 months, and 88% expected their direct sales to increase further by 2020. The importance of understanding customers through data is growing, and with the added benefit of saving intermediary costs, there is potential for more CPG brands to have their own DTC offerings in the future.

6. CPG Brands Are Becoming Digitalized and Technology-Enabled Businesses

Digital capabilities allow companies to interact with consumers in new and innovative ways, and can yield a variety of benefits for both businesses and consumers. We have previously discussed how, for CPG companies, digitalization can drastically improve operational efficiency and also have a significant impact on marketing, product design, supply chain and decision-making. We observe that CPG companies are implementing, or planning to implement, strategies that help them undergo digital transformation to become competitive in the CPG space. These include a mix of consumer-facing digital tools as well as tools to facilitate the company’s own business operations:- P&G’s SK-II Future X Smart Store offers an AI-supported shopping experience that offers personalized recommendations to customers based on scans of their skin, product browsing on virtual shelves and shopping through the wave of a hand. The AR-enabled retail environment provides shoppers with a skincare regimen that features a companion app for personalized skin care information every day.

- On the business operations side, P&G also built a data and analytics learning lab in the US, based on anonymous media audience data and retail purchase information.

- In its company presentation in July 2019, Colgate-Palmolive shared that it has been investing in robotics and partnering with Google to leverage Google Suite tools, advanced analytics and digital marketing.

- Kimberly-Clark announced in March 2019 that it is opening a global digital technology center in Bengaluru, India. The technology center will digitalize the company’s global supply chain, create AI-enabled sales tools and leverage robotic process automation for its customer service operations.

Kimberly Clark’s digital technology center in India

Kimberly Clark’s digital technology center in IndiaSource: Kimberly Clark[/caption]

7. Premiumization Is On the Rise, and CPG Brands Are Premiumizing To Remain Relevant

With rising consumer interest in wellbeing, and in a solid macroeconomic context that includes strong wage growth, US shoppers are becoming more willing to spend on premium CPG products. According to a 2018 survey conducted by research firm YouGov, 87% of US consumers do not mind paying extra for quality, and 55% of US consumers tend to choose premium products and services. There are many reasons why consumers might prefer to purchase higher-priced or premium CPG products, including the perception of higher quality compared to lower-priced products and the tendency to use such products for special occasions. To capitalize on the premiumization trend, CPG companies are starting to offer premium products to meet the evolving needs of consumers:- In the US, P&G's Tide value-add laundry pods sell for 25% more than basic pods, which in turn sell for 25% more than liquid detergent, and even the Tide liquid sells for double the market average.

- Colgate-Palmolive is expanding into premium skin care through its acquisition of premium skincare company Filorga, in line with the company’s strategy to focus on higher-margin personal care products. Filorga has become a highly profitable business for Colgate-Palmolive, according to the company’s latest earnings report.

- Kimberly-Clark launched Huggies Special Delivery diapers in the US in July, which are made from plant-based materials and are the company’s softest diaper, providing “ultimate skin comfort.” The Special Delivery product is also premium-priced—at 40% higher than the company’s current premium Huggies product.

- Kimberly-Clark also has an initiative called “Elevate the Washroom” that delivers premium bath products and introduces Internet-connected technology to help facility managers deliver a better washroom experience while reducing cost in use.

- Unilever announced in June that it signed an agreement with leading North American prestige skincare brand Tatcha for its unique combination of natural ingredients and high product efficacy.

- P&G aims to leverage premiumization as a means to achieve its superiority strategy for products and packages, and to provide innovations that can grow its product categories.

- Elevating its core offerings through premiumization is one of Kimberly-Clark’s corporate strategies.

- Colgate-Palmolive aims to leverage premiumization to grow organically through brand-focused innovation and geographic diversification.

8. Consumers Are Looking for Sustainability, and Industry Is Responding

Sustainability has been a discussion point in the CPG industry for a number of years but the recent past has seen issues such as plastic waste and carbon dioxide emissions shift further into the mainstream and move up the agendas of CPG shoppers and brand owners. According to a 2019 Coresight Research survey, 23% of US consumers try to buy from brands or retailers that they think have a good record on environmental issues. In an earlier survey conducted in November 2018 by global business applications provider CGS, 68% of US Internet users deemed product sustainability an important factor in making a purchase. In response to consumer demand, companies are spearheading initiatives to increase the use of recycled packaging materials and reduce or outright eliminate “single-use” packaging:- Colgate-Palmolive announced its 2025 commitments, which it will meet by getting involved with the Ellen MacArthur Foundation’s new global plastic initiative. Colgate is committing to use 100% recyclable plastic (either reusable or compostable) in all product categories by 2025. The company is also committing to use 25% recycled content from all plastic packaging that it puts into the market moving forward.

- P&G announced in January 2019 that it is partnering with Loop, a circular e-commerce platform developed by TerraCycle in Trenton, New Jersey, to introduce “collect and recycle” circular solutions that are designed to eliminate packaging waste.

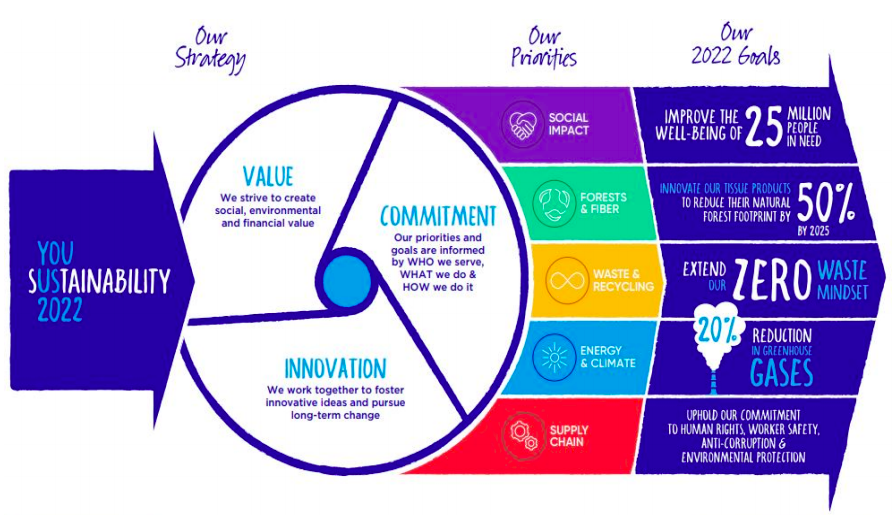

- Kimberly-Clark is in the third year of its Sustainability 2022 program, which has five strategic sustainability pillars: Social Impact, Forests & Fiber, Waste & Recycling, Energy & Climate and Supply Chain.

Kimberly Clark’s Sustainability 2022 program

Kimberly Clark’s Sustainability 2022 programSource: Kimberly Clark[/caption]

9. Amazon Is Becoming a CPG Disruptor

Amazon has disrupted numerous retail sectors, from electronics to apparel. While it may not always be front of mind as a retailer of CPGs such as beauty and grocery products, the e-commerce giant has quietly penetrated these markets.- A number of Coresight Research data points suggest that Amazon is already a top retailer in beauty and personal care in the US:

- Our survey data show that Amazon is the second most-shopped retailer for beauty, grooming and personal care products, based on the number of shoppers buying from the e-commerce platform in the past 12 months; some 42.5% of US beauty, grooming or personal care shoppers had bought on Amazon in the past year. Only Walmart garners more shoppers.

- Skin care and hair care are the most popular beauty, grooming and personal care categories on Amazon, by number of shoppers.

- Few retailers can compete with Amazon on range—though they can compete in areas such as curation and quality. Amazon.com sells 212,818 beauty and personal care products across 2,499 brands, spanning eight major beauty categories, according to our analysis.

- Amazon is the most-shopped retailer for groceries online: 62.5% of those who bought groceries online bought on Amazon.com in the past year.

- Amazon grocery shoppers appear to be occasional or small-basket online grocery shoppers. The company may underindex in grocery because the most popular Amazon service is its regular website; this site is limited to ambient grocery products that can be sent by mail, which makes it all but impossible to shop for a basket of conventional groceries.

10. Lifestyle Apparel and Accessories Brands Are Tapping into Beauty

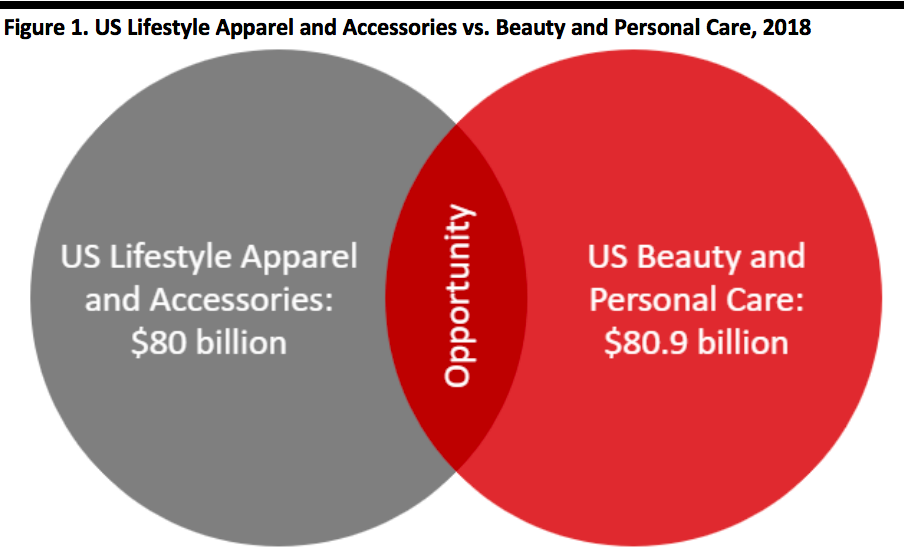

In the US, apparel and accessories brands are intersecting with the wellness movement and the beauty industry. We see sustained opportunities in beauty for lifestyle brands—aspirational, premium-positioned and desirable brands that sit below the luxury segment, epitomized by names such as Calvin Klein, Kate Spade, Lululemon and Nike. This trend is being driven by companies recognizing an opportunity to tap into the beauty market and realizing that US consumers are increasingly spending on wellness products. The beauty sector offers retailers a platform to provide more comprehensive solutions to their target customers as well as upselling and repurchasing potential. We estimate that the US lifestyle apparel and accessories market was worth $80 billion in 2018. The US beauty and personal care market was worth just under $81 billion in the same year, according to Statista. We therefore see a multibillion-dollar opportunity for lifestyle brands in the overlap of these two categories. [caption id="attachment_98673" align="aligncenter" width="700"] Source: Statista/Coresight Research[/caption]

Different lifestyle apparel and accessories brands have begun to tap into the beauty space recently to take advantage of this multibillion-dollar opportunity:

Source: Statista/Coresight Research[/caption]

Different lifestyle apparel and accessories brands have begun to tap into the beauty space recently to take advantage of this multibillion-dollar opportunity:

- In June 2019, Lululemon launched Lululemon Selfcare, a gender-neutral beauty line consisting of four products: facial moisturizer, two spray-on deodorants in different scent offerings, a dry shampoo and a lip balm. The company hopes to use its experience in athletic wear and expertise in sweat to build consumer trust in the Selfcare line, which is focused around sweat-related skin and hair problems.

Lululemon’s Selfcare range

Lululemon’s Selfcare rangeSource: Lululemon[/caption]

- New York-based fashion brand Alice + Olivia announced in July that it is taking another step into the beauty and wellness industry in a new partnership with luxury cannabis brand Kush Queen.

- Gap-owned fitness fashion company Athleta decided in May that it would move to an experiential wellness focus, with a 13-store event series called the Wellness Collective. According to Nancy Green, President and CEO of Athleta, the company is considering how self-care, meditation and beauty can be incorporated into fitness and apparel.

- Equinox partnered with Glossier in early 2018 after the launch of a new group fitness class, allowing Equinox members to try on Glossier products.

- Anthropologie, the apparel and lifestyle company, has created a “Wellness Shop” in its stores, which includes products ranging from fitness apparel to superfood supplements and room mists to help consumers to “lead a balanced lifestyle.”