DIpil Das

What’s the Story?

We present 10 trends impacting the US grocery market and identify strategies for grocery retailers to best capitalize on momentum in each area. Our trend coverage ranges from pre-eminent multiyear trends, such as sustainability, to more nascent trends in areas including checkout-free stores.Why It Matters

The grocery sector showed exceptional strength in 2020 and has remained one of the strongest performing retail segments throughout the pandemic. As we approach the end of 2021, grocers should be aware of the key trends that have emerged from or become more prevalent due to the pandemic, which may guide their future business strategies.10 Trends in US Grocery: Coresight Research Analysis

Coresight Research’s 10 key trends for US grocery retail are shown in Figure 1.Figure 1. 10 Trends in US Grocery [caption id="attachment_137904" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Online Channel Resilience

Grocery e-commerce has demonstrated continued strength and impressive staying power throughout the Covid-19 pandemic: Despite consumers’ gradual return to in-store shopping, many shoppers are still choosing to fill their carts virtually.

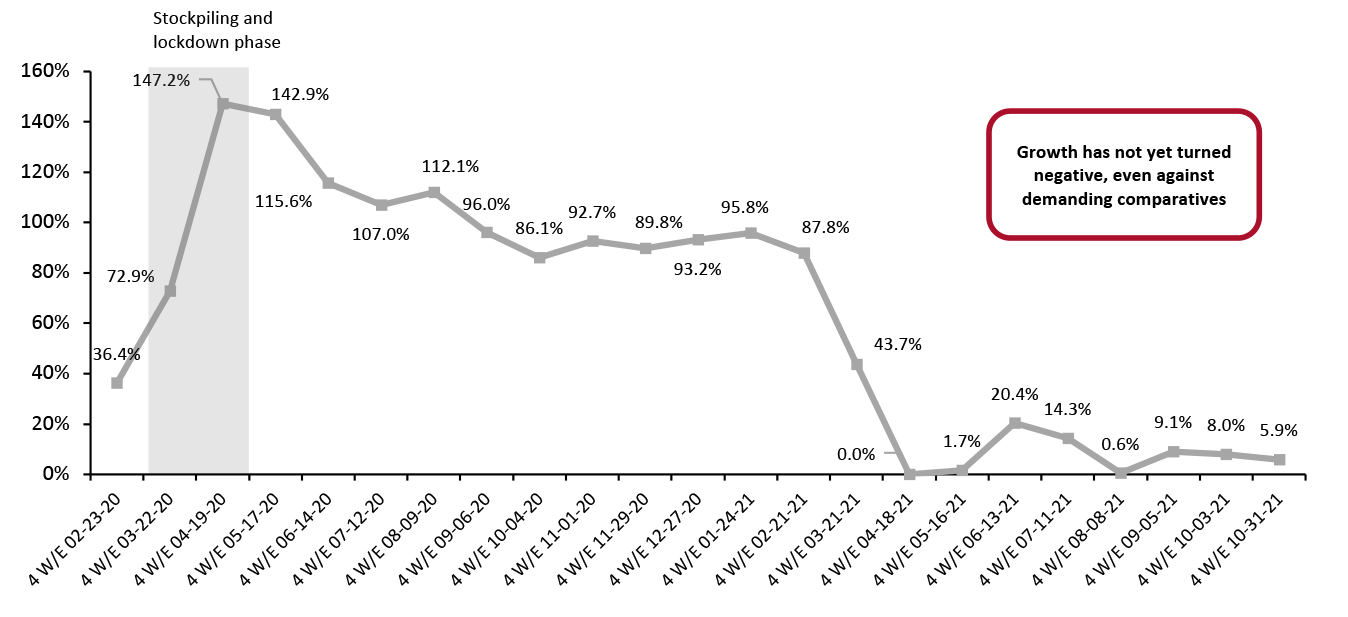

Even against tough comparatives, year-over-year growth of food and beverage e-commerce has not yet turned negative, reflecting shoppers’ retention of their newly acquired online shopping habits. Even at the weakest growth point year to date in 2021, in the four weeks ended April 18, revised online food and beverage sales growth was flat—against peak growth of 147.2% year over year in the same period last year.

The US grocery market is highly fragmented and includes many smaller, regional players, for whom the shift to e-commerce is a challenge. Smaller players face a painful choice: Digitalizing their businesses requires elevated capital expenditure, but is necessary in order to compete. The pandemic-induced shift to online shopping could thus prove a catalyst for consolidation, with smaller players dropping out of the market or being acquired by larger competitors.

Source: Coresight Research[/caption]

1. Online Channel Resilience

Grocery e-commerce has demonstrated continued strength and impressive staying power throughout the Covid-19 pandemic: Despite consumers’ gradual return to in-store shopping, many shoppers are still choosing to fill their carts virtually.

Even against tough comparatives, year-over-year growth of food and beverage e-commerce has not yet turned negative, reflecting shoppers’ retention of their newly acquired online shopping habits. Even at the weakest growth point year to date in 2021, in the four weeks ended April 18, revised online food and beverage sales growth was flat—against peak growth of 147.2% year over year in the same period last year.

The US grocery market is highly fragmented and includes many smaller, regional players, for whom the shift to e-commerce is a challenge. Smaller players face a painful choice: Digitalizing their businesses requires elevated capital expenditure, but is necessary in order to compete. The pandemic-induced shift to online shopping could thus prove a catalyst for consolidation, with smaller players dropping out of the market or being acquired by larger competitors.

Figure 2. US Food and Beverage E-Commerce Sales Growth (YoY % Change) [caption id="attachment_137905" align="aligncenter" width="700"]

Source: IRI E-Market Insights™/Coresight Research[/caption]

2. Booming Grocery Subscriptions

Cultivating the loyalty of a more digitally engaged consumer base has become more critical than ever. Online shopping gives consumers a much wider choice of retailers, making loyalty difficult to secure: Our annual US online grocery survey, undertaken on April 1, 2021, found that respondents had purchased from an average of 2.5 retailers online in the prior 12 months, up from 2.3 in 2020, indicating declining shopper loyalty.

In response, many retailers have launched launch new e-commerce subscription programs or expanded their existing ones with new benefits, and we expect this focus on subscription models to continue.

Walmart launched its Walmart+ membership program in September 2020, priced at $98 per year or $12.95 per month, which offers members unlimited free delivery—consumers’ favorite perk, as we discuss below. The program also offers Scan & Go checkout, fuel discounts, free curbside pickup and other benefits.

Other retailers have followed suit: Hy-Vee launched Hy-Vee Plus in December 2020, Ahold Delhaize-owned The Giant Company launched Choice Pass in January 2021 and Albertsons rebranded its Unlimited Delivery Club subscription as FreshPass, with added benefits, in August 2021. Retailers also have to compete with e-commerce subscriptions offered by third-party delivery providers such as DoorDash, Instacart, Shipt and Uber Eats, which have soared in popularity during the pandemic.

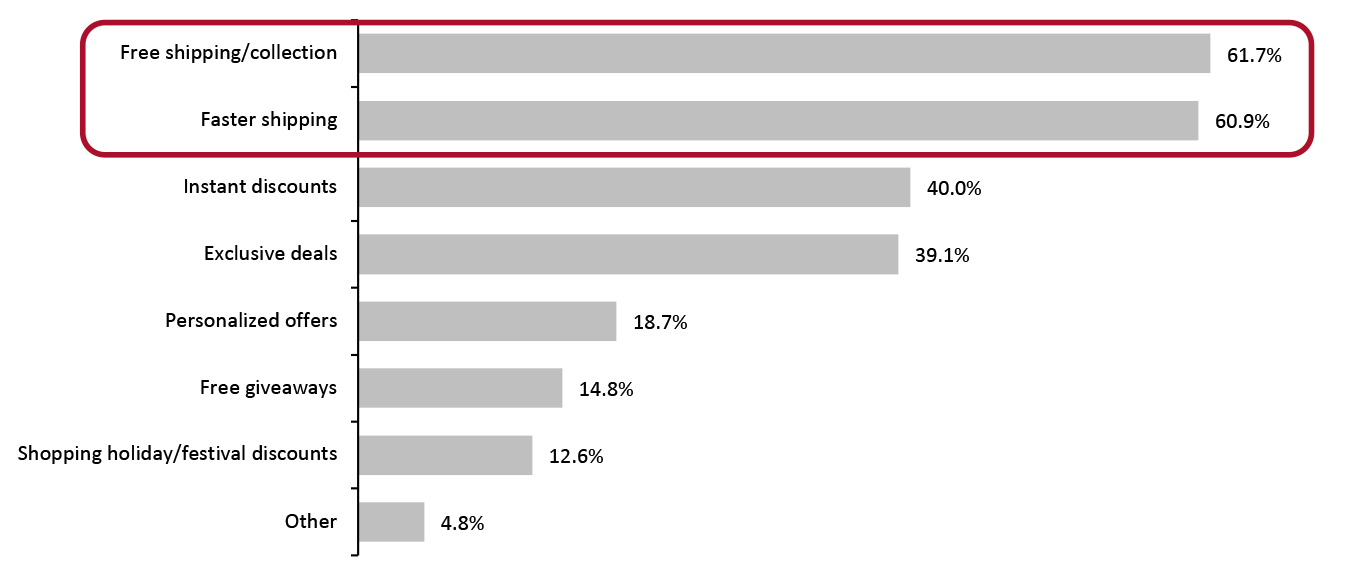

Free delivery or pickup and expedited shipping are the perks customers most want from a subscription service. According to Coresight Research survey data, almost 62% of respondents said free delivery and pickup would motivate them to invest in or renew a subscription, while 60.9% said that faster shipping would attract them to do so. Other benefits are also attractive, including instant discounts that shoppers can use whenever they shop (40.0%) and exclusive deals (39.1%).

Source: IRI E-Market Insights™/Coresight Research[/caption]

2. Booming Grocery Subscriptions

Cultivating the loyalty of a more digitally engaged consumer base has become more critical than ever. Online shopping gives consumers a much wider choice of retailers, making loyalty difficult to secure: Our annual US online grocery survey, undertaken on April 1, 2021, found that respondents had purchased from an average of 2.5 retailers online in the prior 12 months, up from 2.3 in 2020, indicating declining shopper loyalty.

In response, many retailers have launched launch new e-commerce subscription programs or expanded their existing ones with new benefits, and we expect this focus on subscription models to continue.

Walmart launched its Walmart+ membership program in September 2020, priced at $98 per year or $12.95 per month, which offers members unlimited free delivery—consumers’ favorite perk, as we discuss below. The program also offers Scan & Go checkout, fuel discounts, free curbside pickup and other benefits.

Other retailers have followed suit: Hy-Vee launched Hy-Vee Plus in December 2020, Ahold Delhaize-owned The Giant Company launched Choice Pass in January 2021 and Albertsons rebranded its Unlimited Delivery Club subscription as FreshPass, with added benefits, in August 2021. Retailers also have to compete with e-commerce subscriptions offered by third-party delivery providers such as DoorDash, Instacart, Shipt and Uber Eats, which have soared in popularity during the pandemic.

Free delivery or pickup and expedited shipping are the perks customers most want from a subscription service. According to Coresight Research survey data, almost 62% of respondents said free delivery and pickup would motivate them to invest in or renew a subscription, while 60.9% said that faster shipping would attract them to do so. Other benefits are also attractive, including instant discounts that shoppers can use whenever they shop (40.0%) and exclusive deals (39.1%).

Figure 3. Respondents with Any Paid-For Online Grocery Subscription from Grocery Retailers or Services Such as Amazon Prime or Instacart Express: Top Benefits that Motivate Them To Join or Renew (% Respondents) [caption id="attachment_137906" align="aligncenter" width="700"]

Base: 230 US respondents aged 18+ who are members of an online grocery subscription program

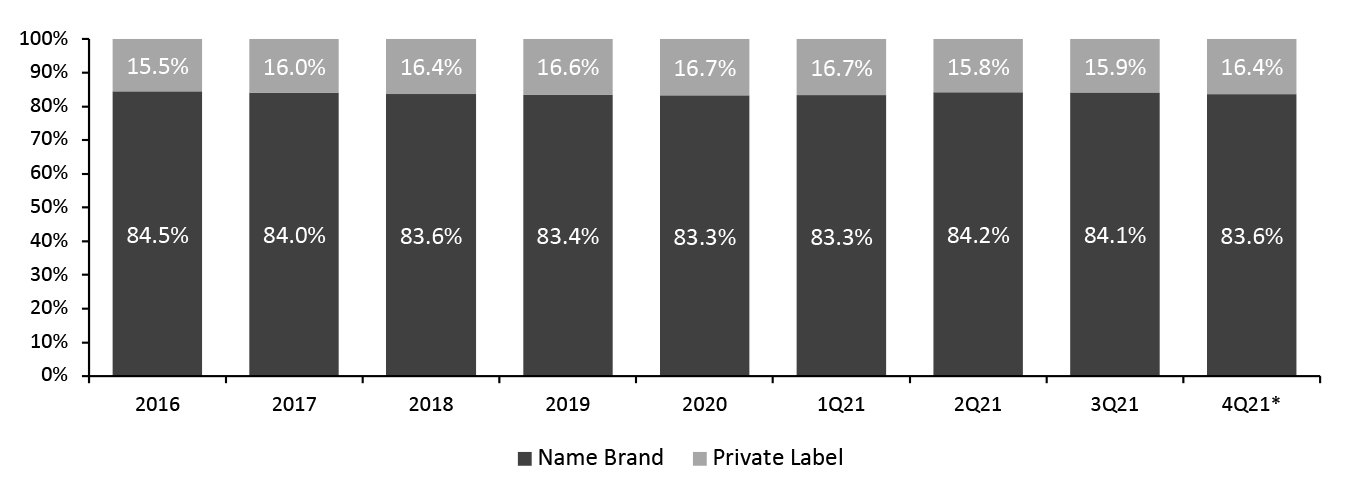

Base: 230 US respondents aged 18+ who are members of an online grocery subscription program Source: Coresight Research [/caption] 3. Growing Momentum in Private-Label Products Private-label products were historically associated with generic items and copycat branding, but now demand serious attention. Consumer interest in private-label products has grown due to continuous innovations in quality, packaging and product concepts. Retailers also increasingly view private labels as a way to drive consumer loyalty, to increase their profitability and as a point of difference in a crowded retail market. While grocers have stepped up their private-label efforts over the past few years, many fast-tracked new private-label products and scaled up distribution of existing portfolios with the onset of the pandemic. Encouraged by customer responses, retailers are continuing to extend their private-label offerings and move into new categories. Private-label products lost ground to name brands in the second and third quarters of 2021 but regained share in the fourth quarter. With the growing inflationary environment, where leading CPG companies have announced plans to pass on price increases to consumers, and the expiration of government stimulus payments, we anticipate a resurgence in sales of private-label products, particularly in high-inflation categories such as frozen foods, poultry and meat products.

Figure 4. US: Market Breakdown, by Food and Beverage Name Brand and Private-Label Sales Value (% of Total Sales) [caption id="attachment_137907" align="aligncenter" width="700"]

*9 weeks ended November 28, 2021

*9 weeks ended November 28, 2021 Online sales are not included

Source: IRI POS Data/Coresight Research [/caption] Relentless store expansion by discounters such as Aldi will give US shoppers more access to private-label products, increasing private-label products’ share of the market. It will also likely spur established retailers to strengthen their own private-label offerings. The growing popularity of private-label products implies that many grocers will compete on the strength of their private-label brand identity in 2021 and beyond. 4. Proliferation of Ultrafast Grocery Delivery Startups The grocery delivery landscape is changing, with consumer demand for faster delivery growing. In the last 12 months, many grocery retailers have established partnerships with takeaway food delivery operators (such as DoorDash and Uber Eats) and hyperlocal providers (such as Instacart and Shipt) in order to offer delivery within one to two hours. Over the same period, the market also saw the emergence of a new breed of ultrafast grocery delivery startups, including GoPuff, Fridge No More and JOKR—each have aggressively launched operations in the US with the promise of delivering grocery items within 10–30 minutes. Typically, these ultrafast delivery players are vertically integrated, meaning they build out their own, hyper-local, delivery-only fulfillment centers (also known as dark stores). They deliver through fully employed riders, in contrast to the gig model employed by other on-demand delivery operators. They typically carry a product assortment of 1,000–3,000 SKUs—much smaller than the 15,000–20,000 found in a typical grocery store. Their streamlined inventory and hyperlocal business model enables them to pick products and reach customers quickly—often quicker than the shopper going to a store themselves. Nearly all these ultrafast grocery delivery services have raised significant seed or sequential financing rounds since the beginning of 2021. GoPuff raised $1.15 billion in March and another $1 billion in July, pushing its valuation to $15 billion. In March 2021, Fridge No More closed a $15.4 million Series A funding round, while Jokr raised $170 million in Series A round in July and $260 million in a Series B round in November. These developments indicate a change in investment: Venture capitalists are increasingly seeking to invest in capital-intensive businesses rather than gig-based models. This crowded new market has already seen its first casualty: Ultrafast grocery delivery startup 1520, which launched in New York City in January, is reported to have ceased operations after it exhausted its funding and an acquisition deal with its larger competitor Jokr collapsed, according to Business Insider. This underscores the reality that many ultrafast delivery services are still loss-making, due to heavy discounting to attract customers— and the high investments required in technology and marketing. However, we believe their unit economics will improve once consumers come to trust—and order more frequently from—a service that is still new for many. We also see substantial cost advantages in dark stores optimized for speedy product picking and local delivery. Since this business model targets customers’ immediate grocery needs, it threatens grocery retailers’ buy online, pick up instore (BOPIS) and curbside offerings and the convenience store sector, which had so far been shielded from shoppers’ shift online.

Figure 5. Comparison of Ultrafast Grocery Delivery Services in the US [wpdatatable id=1536 table_view=regular]

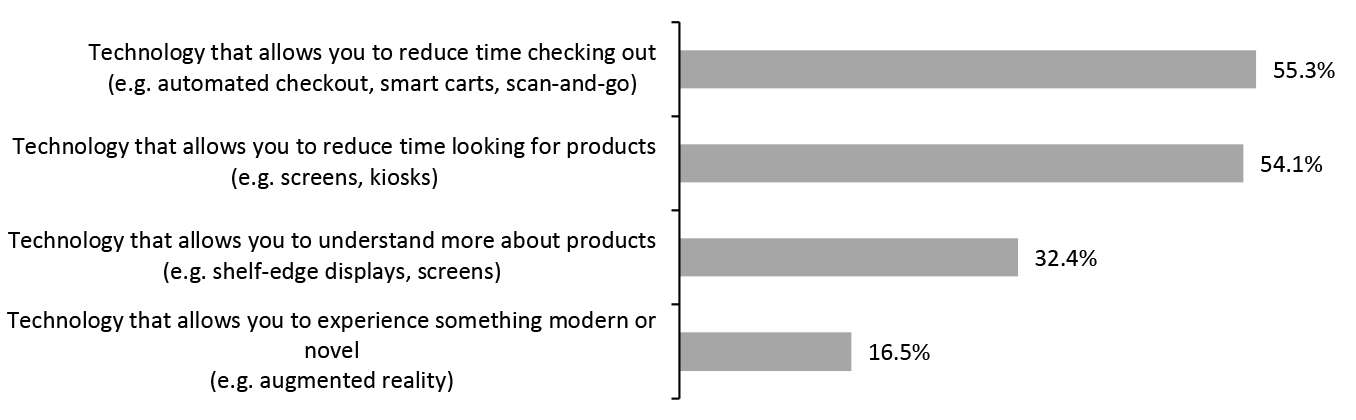

Source: Company reports/Coresight Research 5. Growing Focus on Retail Media Due to the pandemic-driven e-commerce boom, retail media has become an important category within digital advertising. It allows retailers to monetize the traffic already coming to their e-commerce website or app and offset the operating expenses associated with online fulfillment. Brands seeking to increase their visibility throughout consumers’ purchasing journeys are also directing more of their advertising spending toward retail media to influence shoppers at the digital point of sale. Retail media allows advertisers to use closed-loop attribution, meaning transaction data is tied to advertising data. This is possible because the same company is running the advertisement and selling the product advertised. This allows marketers to prove return on advertising spend (RoAS) and connect media exposure with product purchase decisions. It is harder for advertising platforms such as Facebook and Google to do this because users typically click away to retail sites or apps to complete their purchases. As the digital privacy landscape evolves, retail media is well positioned to benefit. Over the past two years, many grocery retailers have launched retail media offerings, in some cases listing them as separate entities from their core retail segment. These include the largest players, such as Walmart, Kroger, Albertsons and Ahold Delhaize, as well as regional grocers including Wakefern, Hy-Vee and Southeastern Grocers. However, the pandemic-induced surge in online grocery shopping—with much of it taking place on traditional grocers’ websites—has increased the scale of the overall retail media opportunity, making grocers’ websites more valuable as advertising properties and establishing their growing online audiences as key assets. We believe that retail media will become a permanent and integral part of how grocery retailers generate revenue. Structural shifts in the advertising marketplace have created the opportunity for retailers to become highly effective channels for marketing investment. Since building out e-commerce capabilities consumes much of retailers’ time and resources, monetizing their sites will be a priority—particularly as they look for a source of steady profits to offset their lower-margin e-commerce business. 6. Rollout of Competing Smart Checkout Technologies Besides building out their e-commerce infrastructure, grocery retailers are also investing in technology to improve experiences in brick-and-mortar stores, where the bulk of consumers still shop. Retailers are seeing the greatest potential in smart checkout systems including automated checkouts, smart carts and scan-and-go systems. These technologies gained prominence during the pandemic as customers sought ways to avoid queues and interactions with cashiers. Smart checkout technologies promise a simpler, faster and more convenient in-store shopping experience for shoppers—and reduced labor costs, greater access to customer data and enhanced advertising opportunities for retailers. Coresight Research survey data from October 4, 2021, found that technology that saved time spent during checkout was ranked the most desirable by consumers while shopping at physical stores. Some 55.3% of respondents selected technology that allows them to reduce time spent checking out as a preferred technology.

Figure 6. Technologies Consumers Prefer To Use While Shopping Inside a Grocery Store (% of Respondents) [caption id="attachment_137908" align="aligncenter" width="700"]

Base: 407 US Internet users aged 18+

Base: 407 US Internet users aged 18+ Source: Coresight Research [/caption] Amazon is certainly ahead of the curve with regard to cashierless stores, but it is not the only one looking into the space. Several technology vendors—including AiFi, Caper, Grabango, Standard Cognition, Trigo Vision, and Zippin—have partnered with traditional grocery retailers to gain a more significant share of the nascent smart checkout market. Technology providers are also seeing a deluge of funding from investors to help them expand their deployments into leading grocery retailers in the US and Europe. Penetration of cashierless smart checkout technology is still low, as its rollout requires a significant capital investment. However, as wages rise and the cost of technology deflates, we believe smart checkouts can confer an enduring competitive advantage. 7. Competition Between Fulfillment Models Against the backdrop of upward e-commerce trends, many retailers are stepping up investments in warehouse automation infrastructure to streamline their order fulfillment. Grocers are deploying two prominent models to increase the picking efficiencies of online orders: customer fulfillment centers (CFCs) and micro-fulfilment centers (MFCs). Many international retailers showed interest in the CFC model before the pandemic, as reflected in partnerships with UK-based fulfillment technology provider Ocado. As of May 2021, Ocado has signed deals to build 56 CFCs with international partners; so far it has announced that it expected to open five in 2021 and will open nine in 2022. Ocado has agreed to build 20 CFCs with Kroger, two of which, in Groveland, Florida, and Monroe, Ohio, became operational in the first half of 2021. On its April 2021 Investor Day, Kroger said that it expects new CFCs to reach the unit-level break-even point in their third year of operation—2024 for the Groveland and Monroe sites—and by the fourth year, it expects the centers to reach parity with its store operating profit rates. Over the long term, Kroger expects the unit economics of these facilities to be lower than its stores. However, MFCs are capturing the bulk of automation projects in the US and are emerging as a strong alternative to manual in-store fulfillment and CFCs. Many retailers increasingly see the MFC model as a more attractive strategy, due to its faster implementation potential, smaller footprint and lower initial investment. Many well-known companies, including Walmart, Albertsons and Ahold Delhaize, had experimented with MFCs by launching pilots even before the Covid-19 pandemic, and have now accelerated their implementation.

Figure 7. Timeline of MFC Deployment Announcements by US Grocery Retailers [wpdatatable id=1537 table_view=regular]

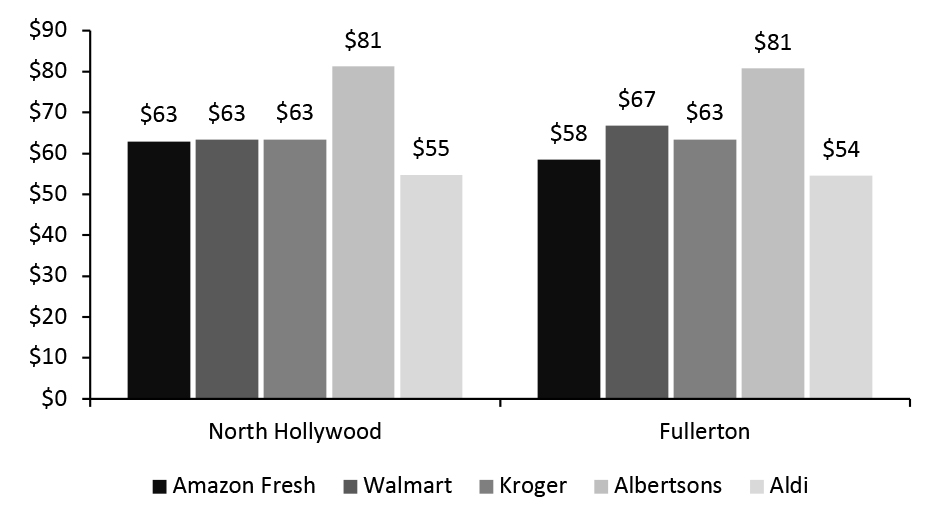

Source: Company reports/Coresight Research 8. The Brick-and-Mortar Threat from Amazon Amazon opened its first Amazon Fresh store in California in September 2020 and has quickly ramped up to 18 as of September 2021. The company is able to use its valuable customer data—particularly that from Prime members—to best determine the location and inventory of its stores. Amazon Fresh claims to offer “lower prices consistently” and stocks a wide assortment of mainstream brands. It is targeted at low- and middle-income shoppers who don’t frequent Whole Foods Market, as well as high-income customers looking for a bargain. In May 2021, Coresight Research conducted online price checks for a basket of 10 comparable items at nearby Amazon Fresh competitors (within the same zip code) at two locations—one in North Hollywood and one in Fullerton, California. The results indicate that Amazon Fresh is priced competitively with nearby Kroger and Walmart stores in the North Hollywood area but is priced lower than both in Fullerton. At both locations, Amazon Fresh is priced higher than Aldi, while undercutting Albertsons by over 30%.

Figure 8. Absolute Price Comparisons: Amazon Fresh Basket Versus Competitors (May 2021) [caption id="attachment_137909" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Amazon Fresh’s focus on mid-market positioning will allow it to go head-to-head with traditional grocers, intensifying price competition in the near future. Given Amazon’s historical willingness to accept low profit margins for long-term gains, the company may seek to gain significant market share by undercutting established players on price.

Amazon intends to differentiate itself through the technology it embeds into its stores. Amazon Fresh has a particular focus on checkout-free shopping—offering smart shopping carts, referred to as Dash Carts, that scan and weigh items while keeping a running total of purchases. Amazon has integrated its voice recognition technology into the store, enabling customers to navigate the store based on the location of items on their Alexa shopping lists. Stores use electronic shelf labels that can easily be updated to reflect price changes, and larger graphic displays offer product promotions, product reviews and shopper advice. Amazon has also opened two new stores featuring its fully autonomous “Just Walk Out” technology instead of Dash Carts, in Bellevue, Washington (in June 2021) and Logan Circle, Washington, D.C. (in July 2021).

9. Discounters’ Store Fleet Expansion

Discount retailers have seen strong growth in recent years and maintained that momentum during the pandemic, with sales growth of 8.6% in the US in 2020, according to Euromonitor. We expect growth among discounters and their relentless real estate expansion to intensify competition with traditional grocers and accelerate consolidation in the fragmented US grocery market—small and less differentiated players will likely struggle to cope with further margin pressure.

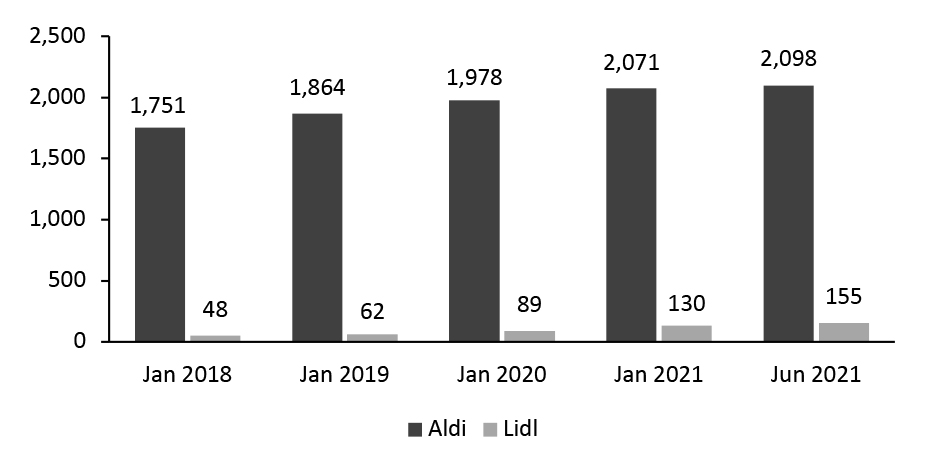

Aldi has established a strong presence in the US, with a total of 2,133 stores as of November 30, 2021. Aldi opened 46 new US locations in 2021, despite announcing in February plans to open approximately 100 by the end of the year. In 2022, Aldi’s plans center on expansion in the Gulf Coast region.

By comparison, Lidl’s US expansion plan has been modest, and it has so far been a relatively small player in the US grocery sector. However, the retailer made its intentions clear by announcing in April 2020 that it is building a network of distribution centers along the eastern coast that will service supply chain needs for around 1,500 stores.

We believe that retailers with significant store overlap with Aldi or Lidl could be at serious risk of profitability pressure in the coming years.

Source: Coresight Research[/caption]

Amazon Fresh’s focus on mid-market positioning will allow it to go head-to-head with traditional grocers, intensifying price competition in the near future. Given Amazon’s historical willingness to accept low profit margins for long-term gains, the company may seek to gain significant market share by undercutting established players on price.

Amazon intends to differentiate itself through the technology it embeds into its stores. Amazon Fresh has a particular focus on checkout-free shopping—offering smart shopping carts, referred to as Dash Carts, that scan and weigh items while keeping a running total of purchases. Amazon has integrated its voice recognition technology into the store, enabling customers to navigate the store based on the location of items on their Alexa shopping lists. Stores use electronic shelf labels that can easily be updated to reflect price changes, and larger graphic displays offer product promotions, product reviews and shopper advice. Amazon has also opened two new stores featuring its fully autonomous “Just Walk Out” technology instead of Dash Carts, in Bellevue, Washington (in June 2021) and Logan Circle, Washington, D.C. (in July 2021).

9. Discounters’ Store Fleet Expansion

Discount retailers have seen strong growth in recent years and maintained that momentum during the pandemic, with sales growth of 8.6% in the US in 2020, according to Euromonitor. We expect growth among discounters and their relentless real estate expansion to intensify competition with traditional grocers and accelerate consolidation in the fragmented US grocery market—small and less differentiated players will likely struggle to cope with further margin pressure.

Aldi has established a strong presence in the US, with a total of 2,133 stores as of November 30, 2021. Aldi opened 46 new US locations in 2021, despite announcing in February plans to open approximately 100 by the end of the year. In 2022, Aldi’s plans center on expansion in the Gulf Coast region.

By comparison, Lidl’s US expansion plan has been modest, and it has so far been a relatively small player in the US grocery sector. However, the retailer made its intentions clear by announcing in April 2020 that it is building a network of distribution centers along the eastern coast that will service supply chain needs for around 1,500 stores.

We believe that retailers with significant store overlap with Aldi or Lidl could be at serious risk of profitability pressure in the coming years.

Figure 9. Total US Store Count of Aldi and Lidl [caption id="attachment_137910" align="aligncenter" width="701"]

Source: Company reports/Coresight Research[/caption]

Aldi and Lidl’s US-based US rival Save A Lot, which operates approximately 1,000 stores in 32 states, has struggled in recent years with large debts and shrinking sales. Its share of the US discounter market dropped from 28.1% in 2016 to 15.2% in 2020, according to Euromonitor. The company is in the process of transitioning to a wholesale model and plans to sell off 94% of corporate-owned stores to its independent retail partners as part of that shift.

10. Increasing Emphasis on Sustainability

Awareness of sustainability is on the rise, and consumers are increasingly focusing on the environmental impacts of their shopping decisions and seeking to shop with brands that align with their values.

Coresight Research’s August 26, 2020 consumer survey found a substantial 29% of the respondents saying that the pandemic has made sustainability more of a factor in their shopping choices. Additionally, in another consumer survey conducted by Coresight Research on September 27, 2021, around 27% of the respondents said they try to buy from retailers they think have a good record on environmental issues.

Sustainability in grocery was mentioned across many sessions and keynotes as a theme in Groceryshop 2021, with executives from retailers and CPG brands sharing their experiences of consumers seeking sustainable products and prioritizing purchases that had a positive impact on the planet.

With sustainability becoming a key theme in consumers’ decision-making, we expect to see more grocery retailers heightening their efforts to address sustainability issues and increasing transparency to highlight their sustainability credentials.

Two major initiatives stand out among grocery retailers’ sustainability efforts:

Eliminating Plastic Packaging

Plastic packaging is a key environmental issue in the food retail space; the environmental damage that plastic packaging causes is widely acknowledged. In terms of types of sustainability practices that consumers consider the most important for retailers, reducing plastics takes the lead, according to Coresight Research survey findings.

Grocers across the industry are moving away from plastics that are difficult to recycle and toward recyclable packaging, and are cutting down on single-use plastic bags. Aldi, for example, aims to cut plastic packaging in both branded and non-branded products by 50% by 2025.

Retailers are enlisting the help of technology to enable and encourage consumers to re-use containers. Kroger partnered with Terracycle’s Loop to pilot a reusable packaging program at its Fred Meyer stores from October 2021. The company’s Loop initiative offers durable, innovative packaging that it hygienically cleans and sanitizes after each use, allowing boxes to be reused.

Reducing Food Waste

Food waste is a significant issue in the grocery supply chain. The grocery sector accounted for more than $232 billion of food waste in 2020, or more than $1,660 per household, Coresight Research estimates from US government data.

Many grocery retailers are setting up targets to reduce food waste within their operations and supply chain. Reducing food waste typically involves a range of community-based initiatives, such as working with charities, alongside technology-driven approaches.

Source: Company reports/Coresight Research[/caption]

Aldi and Lidl’s US-based US rival Save A Lot, which operates approximately 1,000 stores in 32 states, has struggled in recent years with large debts and shrinking sales. Its share of the US discounter market dropped from 28.1% in 2016 to 15.2% in 2020, according to Euromonitor. The company is in the process of transitioning to a wholesale model and plans to sell off 94% of corporate-owned stores to its independent retail partners as part of that shift.

10. Increasing Emphasis on Sustainability

Awareness of sustainability is on the rise, and consumers are increasingly focusing on the environmental impacts of their shopping decisions and seeking to shop with brands that align with their values.

Coresight Research’s August 26, 2020 consumer survey found a substantial 29% of the respondents saying that the pandemic has made sustainability more of a factor in their shopping choices. Additionally, in another consumer survey conducted by Coresight Research on September 27, 2021, around 27% of the respondents said they try to buy from retailers they think have a good record on environmental issues.

Sustainability in grocery was mentioned across many sessions and keynotes as a theme in Groceryshop 2021, with executives from retailers and CPG brands sharing their experiences of consumers seeking sustainable products and prioritizing purchases that had a positive impact on the planet.

With sustainability becoming a key theme in consumers’ decision-making, we expect to see more grocery retailers heightening their efforts to address sustainability issues and increasing transparency to highlight their sustainability credentials.

Two major initiatives stand out among grocery retailers’ sustainability efforts:

Eliminating Plastic Packaging

Plastic packaging is a key environmental issue in the food retail space; the environmental damage that plastic packaging causes is widely acknowledged. In terms of types of sustainability practices that consumers consider the most important for retailers, reducing plastics takes the lead, according to Coresight Research survey findings.

Grocers across the industry are moving away from plastics that are difficult to recycle and toward recyclable packaging, and are cutting down on single-use plastic bags. Aldi, for example, aims to cut plastic packaging in both branded and non-branded products by 50% by 2025.

Retailers are enlisting the help of technology to enable and encourage consumers to re-use containers. Kroger partnered with Terracycle’s Loop to pilot a reusable packaging program at its Fred Meyer stores from October 2021. The company’s Loop initiative offers durable, innovative packaging that it hygienically cleans and sanitizes after each use, allowing boxes to be reused.

Reducing Food Waste

Food waste is a significant issue in the grocery supply chain. The grocery sector accounted for more than $232 billion of food waste in 2020, or more than $1,660 per household, Coresight Research estimates from US government data.

Many grocery retailers are setting up targets to reduce food waste within their operations and supply chain. Reducing food waste typically involves a range of community-based initiatives, such as working with charities, alongside technology-driven approaches.

- Walmart plans to achieve zero waste, including food waste, in its operations by the year 2025. In addition to its sustainability commitments, Walmart engages with its suppliers to address food, product and material waste from factories, warehouses, distribution centers and farms, and to minimize the amount of waste going to landfill.

- Like Walmart, Kroger aims to achieve zero food waste in its operations by 2025. As part of its Zero Hunger, Zero Waste program, Kroger has partnered with Feeding America, which has a nationwide network of 200 local food banks, to donate surplus food and prevent resources from going to waste.

- In an effort to reduce potential waste caused by over-ordering, Aldi uses a computerized ordering system to optimize inventories at its stores and avoid overstocking perishable goods.

What We Think

The pandemic delivered a sales windfall for grocery retailers in 2020. However, as consumers return to more normal ways of living, we expect part of the share of food-away-from-home spending captured by grocery retailers to be directed back to foodservice. Grocery retailers should invest in measures to retain consumers by capitalizing on pandemic-accelerated trends and embrace technologies to increase the efficiency, agility and resiliency of their operations to retain a larger share of the food-at-home market. Implications for Retailers- Grocery e-commerce will continue to grow, driven by consumers’ retention of online shopping habits. Retailers should continue investment in developing grocery infrastructure, including improving supply chain efficiencies and providing friction-free last-mile services, since fast and efficient delivery is a priority for shoppers.

- Retailers must focus on introducing or expanding sustainable and natural private-label options to capitalize on shifting consumer trends. Natural and organic products, including those without artificial preservatives or those that meet certain criteria (such as non-GMO), represent a significant growth opportunity for retailers in the private-label market.

- As more retailers join the retail media bandwagon, competition for advertising budgets will increase, underscoring the need to provide brands and advertisers with a good experience and greater return on their spending. Retailers should provide efficient workflows, greater access to data and more accurate measurement within their retail media solutions.

- Although the penetration of smart checkout technology is still low, we believe it will become more mainstream once the technology investment generates an appealing return on investment.

- We believe that grocery discounters will remain a disruptive force and an increasingly competitive threat to traditional retailers in the coming years. Their growth will impact customer satisfaction among conventional retailers, likely pushing down the reference price of products for many shoppers.

- The developments of 2020 have placed renewed emphasis on supply chain technology, which vendors can leverage to promote the importance of their solutions moving forward: retailers are ready to listen. Technology companies must be able to provide flexible automated fulfillment systems that can fit different types of retail locations and systems.

- We believe larger, scaled grocery retailers will ultimately have the advantage in the retail media space as e-commerce grows. However, regional grocers will also seek access to tools to help them to narrow the digital capabilities gap and prevent the loss of brands’ advertising spend to third-party providers such as Instacart. Technology vendors should help such grocers to establish viable e-commerce apps and websites, as well as the infrastructure and analytics platforms to better understand and serve their customers, which can then support the construction of a profitable media platform.