Nitheesh NH

What’s the Story?

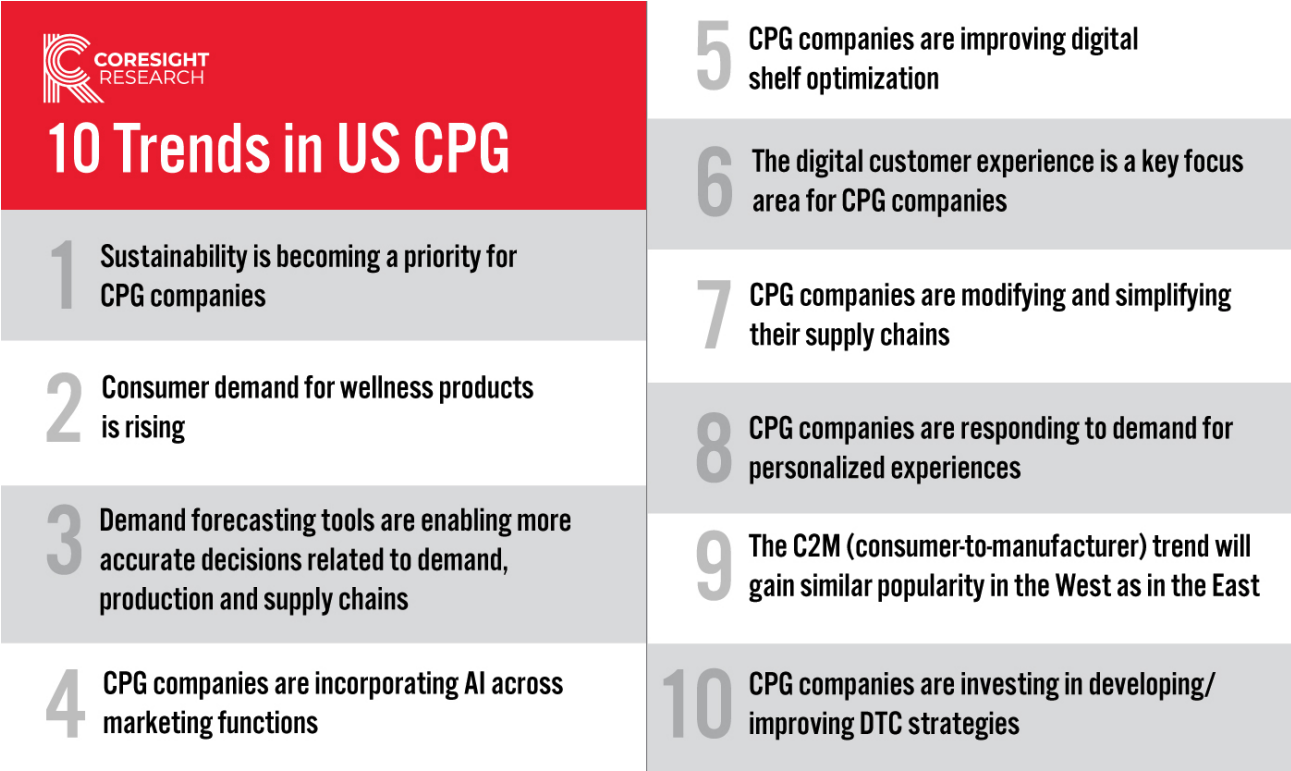

Over the past year, consumer packaged goods (CPG) companies have witnessed myriad challenges related to the Covid-19 pandemic, including volatility in demand, rapid e-commerce expansion, changing consumer preferences, decreased brand loyalty and supply chain disruption. In this report, we present 10 key trends in the US CPG industry that have emerged from, or become more prevalent due to, the global pandemic. We expect these trends to continue to reshape the CPG industry through the remainder of 2021 and beyond. This report is sponsored by Prevedere, a company that provides data and technology for Intelligent Forecasting and predictive analytics solutions.10 Trends in US CPG: A Deep Dive

Figure 1. 10 Trends in US CPG [caption id="attachment_128311" align="aligncenter" width="720"] Source: Coresight Research[/caption]

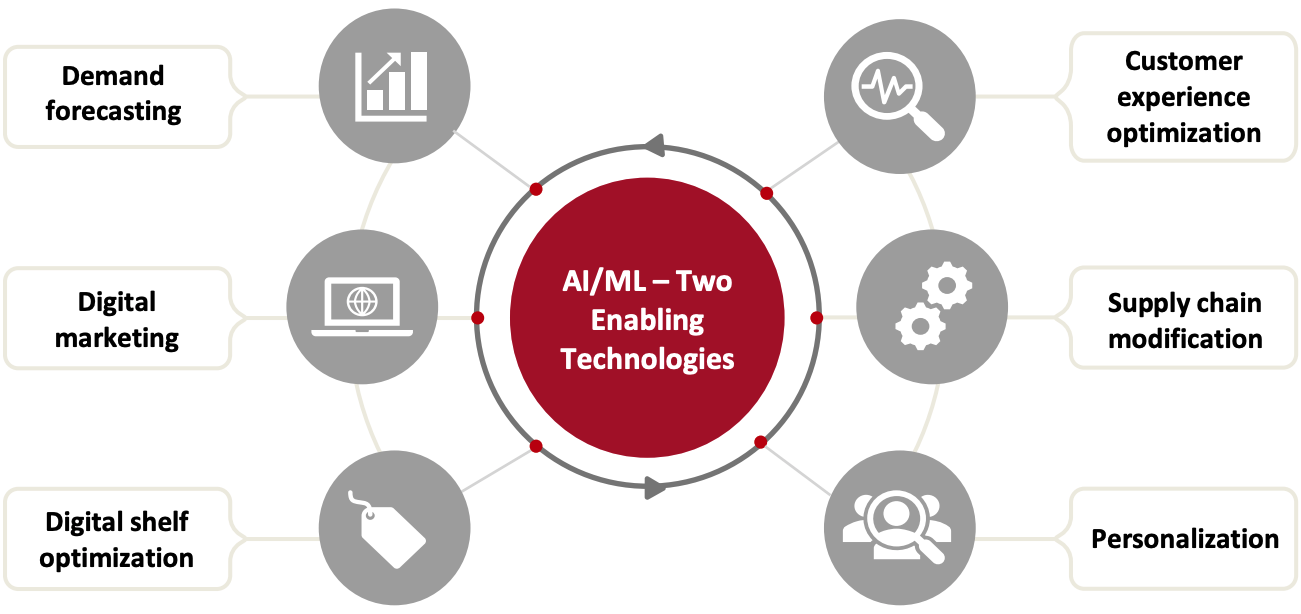

In responding to and overcoming pandemic-related challenges, CPG companies are increasingly adopting advanced technologies such as artificial Intelligence (AI) and machine learning (ML) to support multiple business functions. These enabling technologies are relevant across many of the trends that we explore in this report; we expect AI and ML to become integral to companies’ growth strategies and in gaining a competitive edge through Covid-19 recovery and in the long term.

AI is gaining traction in other industries too, and the global AI market is set to grow at a CAGR of 15.2% between 2021 and 2024, reaching annual revenue of $500 billion, according to market research firm IDC.

Figure 2. AI and ML: Two Enabling Technologies in the CPG Industry

[caption id="attachment_128312" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

In responding to and overcoming pandemic-related challenges, CPG companies are increasingly adopting advanced technologies such as artificial Intelligence (AI) and machine learning (ML) to support multiple business functions. These enabling technologies are relevant across many of the trends that we explore in this report; we expect AI and ML to become integral to companies’ growth strategies and in gaining a competitive edge through Covid-19 recovery and in the long term.

AI is gaining traction in other industries too, and the global AI market is set to grow at a CAGR of 15.2% between 2021 and 2024, reaching annual revenue of $500 billion, according to market research firm IDC.

Figure 2. AI and ML: Two Enabling Technologies in the CPG Industry

[caption id="attachment_128312" align="aligncenter" width="720"] Source: Coresight Research[/caption]

1. Sustainability Is a Key Focus Area for CPG Companies

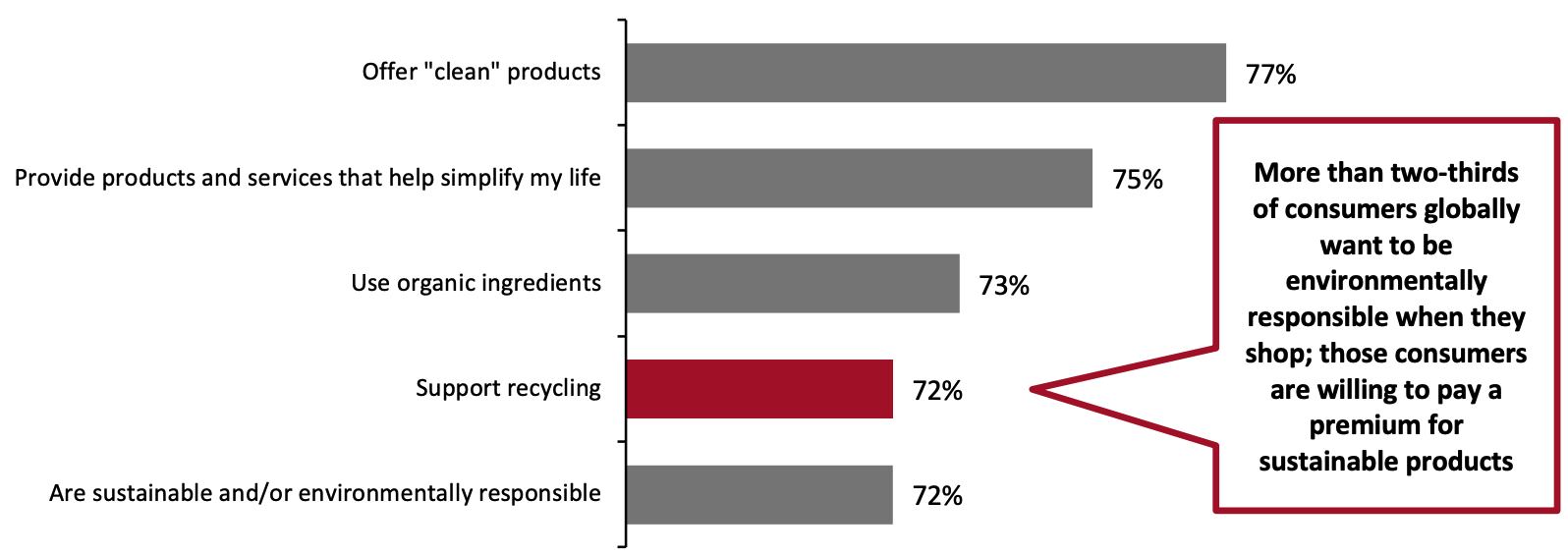

Awareness of sustainability is on the rise, and consumers are increasingly understanding the environmental impacts of their shopping decisions. At the same time, they are seeking to shop with brands that align with their values. According to a global survey conducted by the National Retail Federation (NRF) and IBM in 2020, nearly six in 10 consumers are willing to alter their shopping habits to reduce their environmental impact, and eight in 10 respondents said that sustainability is “essential” for them. Furthermore, the study revealed that 72% of consumers are willing to pay a premium for sustainable products, making environmental responsibility among the top five attributes for which consumers are willing to pay a premium (see Figure 3).

Figure 3. Top Five Attributes for Which Consumers Are Willing To Pay a Premium (% of Respondents)

[caption id="attachment_128313" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

1. Sustainability Is a Key Focus Area for CPG Companies

Awareness of sustainability is on the rise, and consumers are increasingly understanding the environmental impacts of their shopping decisions. At the same time, they are seeking to shop with brands that align with their values. According to a global survey conducted by the National Retail Federation (NRF) and IBM in 2020, nearly six in 10 consumers are willing to alter their shopping habits to reduce their environmental impact, and eight in 10 respondents said that sustainability is “essential” for them. Furthermore, the study revealed that 72% of consumers are willing to pay a premium for sustainable products, making environmental responsibility among the top five attributes for which consumers are willing to pay a premium (see Figure 3).

Figure 3. Top Five Attributes for Which Consumers Are Willing To Pay a Premium (% of Respondents)

[caption id="attachment_128313" align="aligncenter" width="720"] Base: 18,980 consumers in 28 countries, surveyed in 2020

Base: 18,980 consumers in 28 countries, surveyed in 2020Source: IBM/NRF[/caption] Given that sustainability has become a key part of consumers’ decision-making process, CPG companies must set up sustainability goals to remain competitive by aligning with shoppers’ values—and some players have begun to do this. Many have goals that revolve around improving their recycling systems and reducing wastage:

- Coca-Cola, PepsiCo and P&G (Procter & Gamble), among others, have partnered with recycling company TerraCycle to pilot a new sustainable packaging model that delivers products in reusable containers to consumers.

- L’Oréal signed a three-year partnership deal with Loop Industries in March 2020 to purchase PET resin made of 100% recycled materials, helping to improve the environmental profile of its packaging.

- In February 2021, Canadian upcycling company Outcast Foods secured $7.9 million funding from venture capital fund District Capital Ventures and the investment arm of the Business Development Bank of Canada.

- Read more Coresight Research coverage of sustainability in retail.

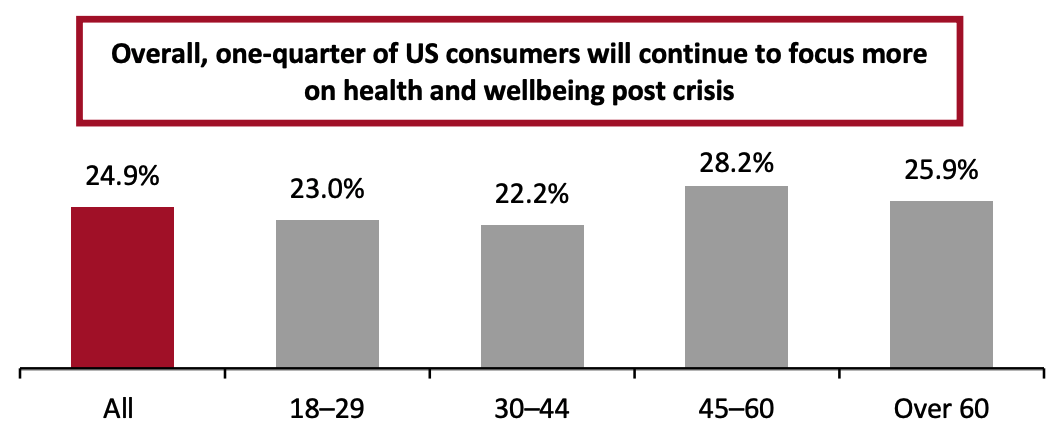

Source: Company reports 2. Consumer Demand for Wellness Products Is Rising Since the outbreak of the Covid-19 pandemic, consumer attention and desire for health and wellness products has increased significantly. In its latest estimate, the Global Wellness Institute reported that the global wellness market reached $4.5 trillion in 2018 and estimated that the market surpassed $5 trillion in 2020, driven by heightened consumer focus on good health and wellness amid the pandemic. We expect this trend to continue: Coresight Research’s US Consumer Tracker (our weekly surveys) found in December 2020 that one-quarter of US consumers expect to retain the changed behavior of focusing more on health and wellbeing in the long term. Health and wellness products are popular among all demographics, but particularly among Gen X consumers and Baby Boomers, who are taking an increased interest in healthy living as they move toward their senior years. Figure 5. US Consumers That Expect To Retain the Changed Behavior of Focusing More on Health and Wellbeing Post Crisis, by Age (% of Respondents) [caption id="attachment_128314" align="aligncenter" width="580"]

Base: 438 US respondents aged 18+ surveyed on December 15, 2020

Base: 438 US respondents aged 18+ surveyed on December 15, 2020Source: Coresight Research[/caption] Due to rising demand for health and wellness products, legacy CPG companies have started entering this space by acquiring health and wellness companies:

- In April 2021, Unilever signed a contract to acquire Onnit, a US-based a manufacturer and marketer of functional and nutrition supplements. In November 2020, Unilever acquired a US‐based vitamin, mineral and supplement company SmartyPants Vitamins as part of the company’s initiative to improve its health and wellbeing product category.

- Another legacy CPG company to join this trend is Nestlé. The company entered into an agreement in April 2021 to acquire core brands of The Bountiful Co., a US-based manufacturer of vitamins, minerals, supplements and nutrition products, for $5.75 billion.

- In March 2021, Mondelez International announced an agreement to acquire a significant share in Grenade, a UK-based performance nutrition company in the protein bar segment, for an undisclosed amount. The acquisition is a part of Mondelez International’s strategy to expand its footprint in the health and wellness industry. In 2020, the company acquired US-based Perfect Snacks, a manufacturer of protein bars, peanut butter cups and other healthy snacks, for $284 million.

- In April 2021, US capital investment group Carlyle acquired a majority stake of Beautycounter, a US-based skin and beauty company specializing in clean beauty, for $1 billion—showing the growing attractiveness of clean beauty in the eyes of investors.

- In February 2021, Estée Lauder announced its plans to increase its investment in Canada-based clean skincare company Deciem Beauty Group from 29% to 76%. The transaction is expected to close in the current quarter, ending June 30, 2021.

- Read our separate report on this topic, with a focus on the US: Six US Industries Benefiting from the Wellness Trend

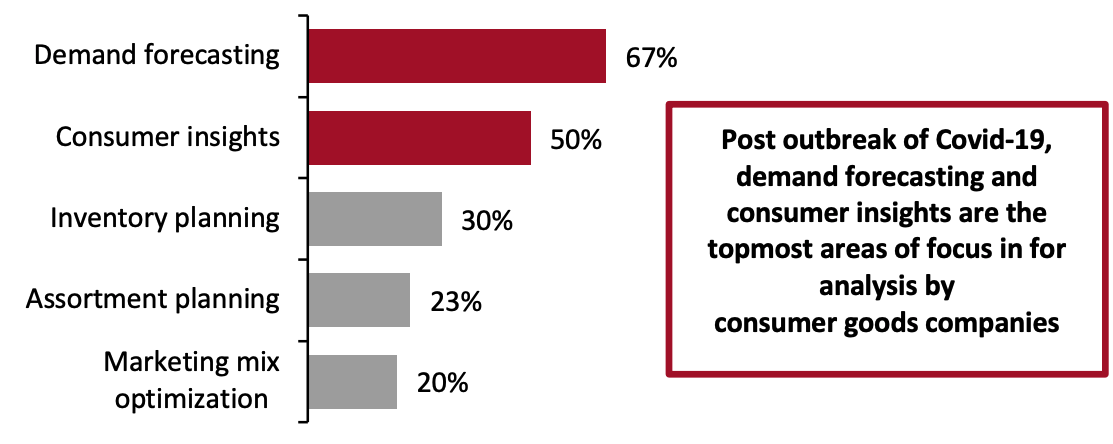

Base: Global consumer goods executives, surveyed in 2020

Base: Global consumer goods executives, surveyed in 2020Source: RIS News[/caption] Companies can use multiple statistical tools to analyze data collected from across the supply chain and predict future trends. Demand forecasting ensures that shelves are stocked and minimizes the risk of inventory shortages or surpluses. Daily and weekly sales data with local and regional details, along with AI-powered analytics, can help companies to forecast demand in both the short and long term, and assess supply chain risks. AI and ML also help companies to integrate data from multiple sources into one cohesive data source and eliminate errors that can be induced at multiple source points in the supply chain.

- Predictive analytics firm Prevedere partnered with a global alcohol brand to improve the brand’s demand-forecasting capabilities. Prior to this partnership, the company leveraged historical data to predict sales, which mostly led to over-production. Using Prevedere’s smart demand-forecasting tools, the brand was able to build its own models on a weekly basis, enabling it to make better decisions related to staffing and the procurement of raw materials, according to Prevedere. CPG companies are also increasingly using demand-sensing technologies for short-term inventory planning. Short-term forecasting has proven critical to understanding and effectively adapting to unexpected shifts in consumer demand amid the global pandemic.

- PepsiCo uses demand sensing to generate accurate near-term forecasts that enable the company to quickly respond to any events impacting consumers’ buying behaviors. According to the company, PepsiCo has reduced its forecast error for the near term (zero to six weeks) by deploying the demand-sensing solution. We expect more CPG companies to employ AI/ML solutions, including demand-sensing technologies, to generate accurate demand forecasting moving forward, with the pandemic having highlighted the importance of effective forecasting due to rapid shifts in consumer behavior.

- Read our Reshaping Supply Chains for the 2020s and RetailTech reports on demand forecasting.

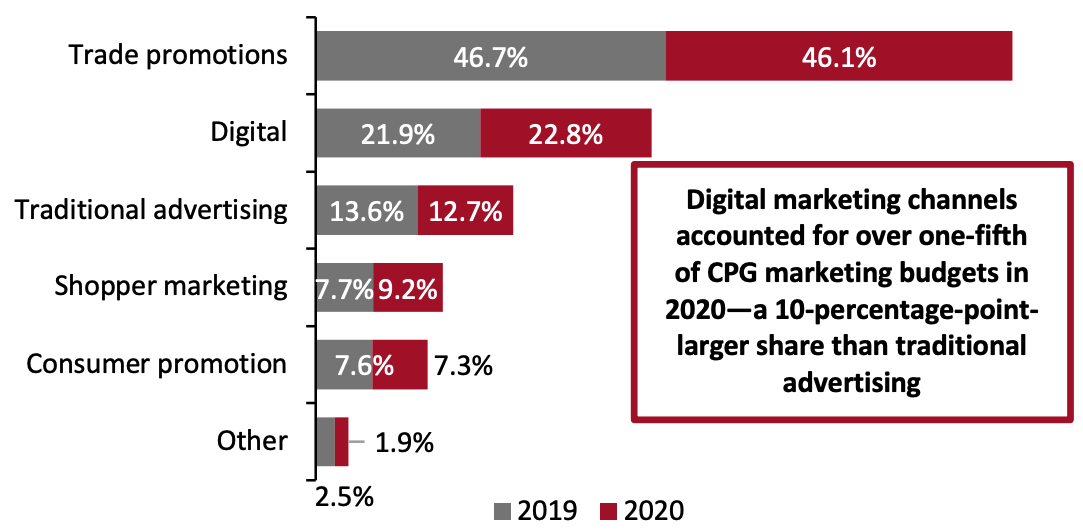

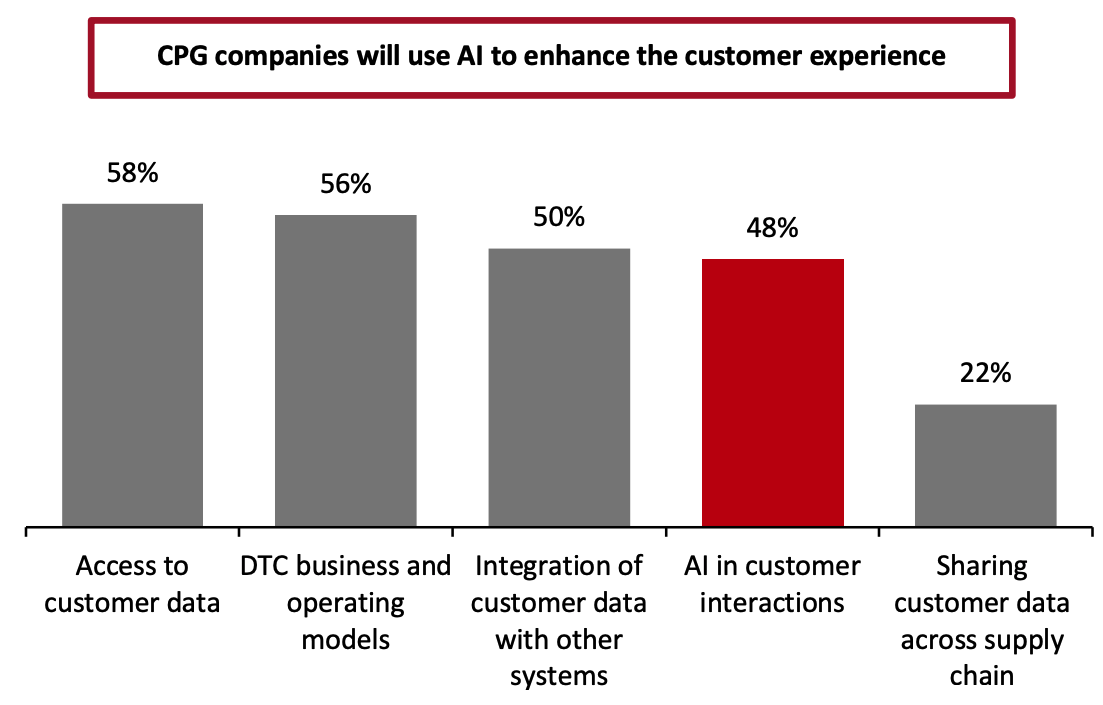

Base: US CPG companies

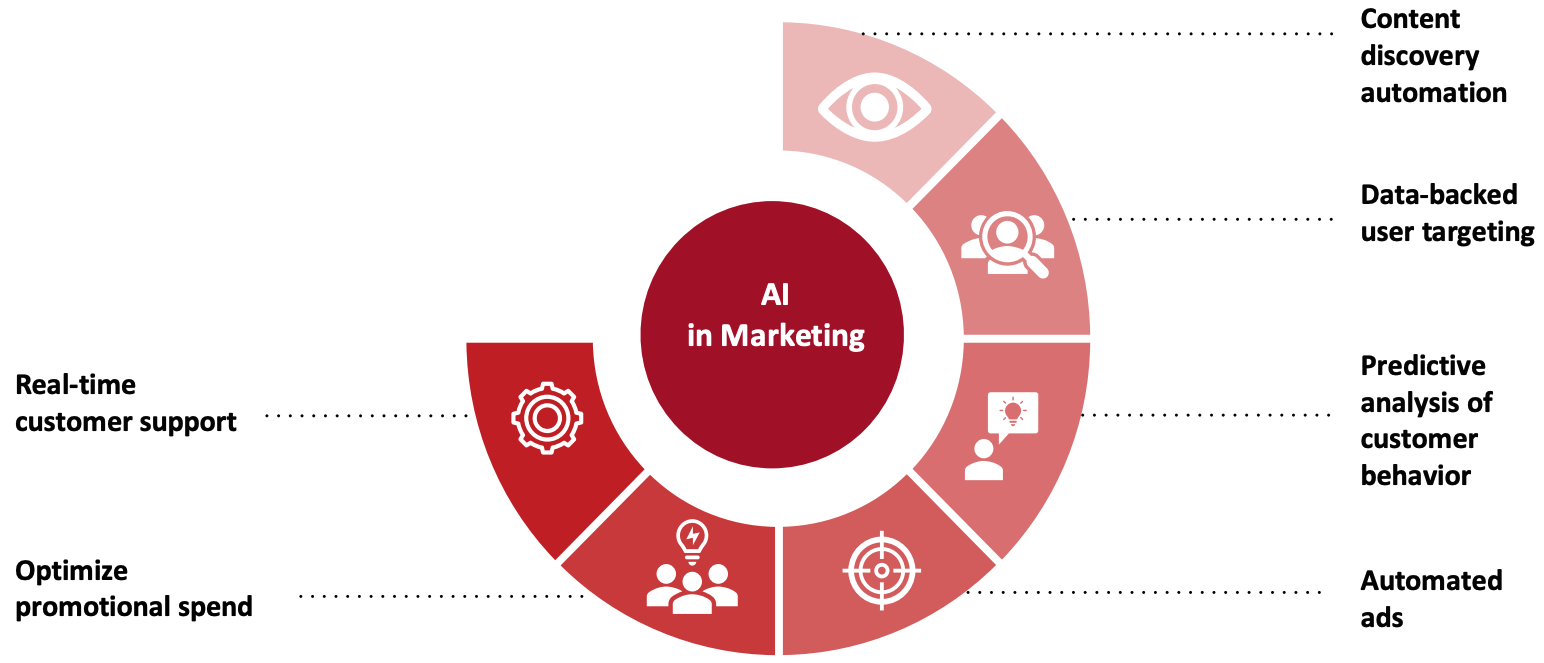

Base: US CPG companiesSource: Cadent Consulting[/caption] Marketers across different industries, including CPG, are extensively using AI to enhance their digital marketing initiatives. According to Jodie Sangster, Chief Marketing Officer at IBM, AI can help companies bring down digital marketing expenses by 50%.

- In December 2020, Clorox started using the IBM Watson Advertising Conversations, ML and Natural Language Processing tools to understand its consumers better. The company used IBM Watson to decode what consumers wanted to know about Covid-19 and developed specialized editorial content based on the information collected.

- In September 2020, UK-based CPG company Reckitt (formerly Reckitt Benckiser) partnered with Google Cloud to optimize its media spend with the aim of creating a “more natural” digital experience for its consumers. The company will use ML to generate consumer insights and optimize overall media spend.

Source: Coresight Research[/caption]

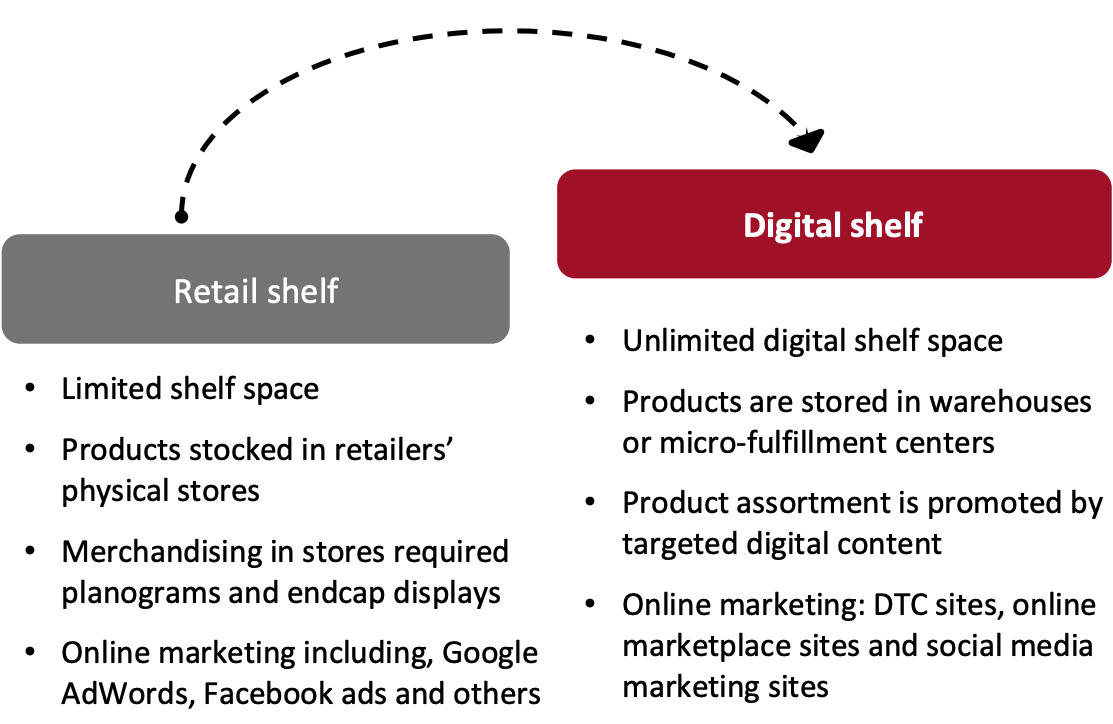

5. CPG Companies Are Improving Digital Shelf Optimization

In line with the acceleration of e-commerce, we expect CPG companies to further invest in digital shelf analytics and optimization to help consumers find, explore, compare and purchase products online. Consumers are drawn toward products that are easily available: Convenience is the key to win customers in the post-crisis era.

Figure 9. Difference Between Retail Shelf and Digital Shelf

[caption id="attachment_128318" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

5. CPG Companies Are Improving Digital Shelf Optimization

In line with the acceleration of e-commerce, we expect CPG companies to further invest in digital shelf analytics and optimization to help consumers find, explore, compare and purchase products online. Consumers are drawn toward products that are easily available: Convenience is the key to win customers in the post-crisis era.

Figure 9. Difference Between Retail Shelf and Digital Shelf

[caption id="attachment_128318" align="aligncenter" width="580"] Source: Coresight Research[/caption]

CPG companies are investing in advanced technologies, such as digital shelf analytics, which offer consistent, real-time data about how their products are performing on e-commerce websites and online marketplaces, as well as enabling companies to optimize product visibility. Digital shelf analytics uses external data—including ratings and reviews, pricing and promotions, product information, sales and searches data—to develop detailed, actionable insights for brands.

Source: Coresight Research[/caption]

CPG companies are investing in advanced technologies, such as digital shelf analytics, which offer consistent, real-time data about how their products are performing on e-commerce websites and online marketplaces, as well as enabling companies to optimize product visibility. Digital shelf analytics uses external data—including ratings and reviews, pricing and promotions, product information, sales and searches data—to develop detailed, actionable insights for brands.

- In February 2021, PepsiCo entered into a technology deal with e.fundamentals, a UK-based digital shelf analytics provider. Under this deal, e.fundamentals will help PepsiCo analyze, measure and optimize its online sales primarily in Europe. PepsiCo will be able to access retailer category e-commerce data to enhance search positioning and product visibility on the websites of major e-commerce retailers, including Amazon, Carrefour and Tesco.

- In July 2020, P&G announced plans to leverage data analytics and AI technology from Google Cloud. As part of the new collaboration, P&G merges all consumer, brand and media data to generate real-time insights using Google Cloud’s BigQuery.

Base: 64 CPG executives, surveyed in December 2020

Base: 64 CPG executives, surveyed in December 2020Source: Harvard Business Review/Salesforce[/caption] Below, we note two examples of AI being used to enhance customer interactions. This trends closely relates to trend #8, which discusses personalization in the customer experience—we offer further examples of AI in personalization in that section. In March 2021, Nestlé launched its own “cookie coach,” called Ruth, an AI-driven virtual assistant tool that responds to customer queries using natural-language AI and autonomous animation. As part of Estée Lauder’s partnership with Perfect Corp., a global beauty tech solutions provider, Perfect Corp. developed the iMatch Virtual Skin Analysis, a self-guided digital skincare diagnostic tool. The tool uses YouCam AI technology to design a personalized skincare regimen. It also enhances the customer experience by offering personalized messages and engaging content to customers. 7. CPG Companies Are Modifying and Simplifying Their Supply Chains As the world emerges from the global pandemic, CPG companies have been able to release and contemplate the lessons learned and restrategize their supply chain goals. According to a survey published by Microsoft in 2020, 90% of CPG and retail companies are modifying their supply chains, and around 40% expect to increase their total supply chain investment to achieve speed, agility and resilience goals. CPG companies have realized the importance of agility and resilience over cost reduction in the supply chain. According to Shelley Bransten, Corporate Vice President of Consumer Goods and Retail Industries at Microsoft, there has been “a significant shift in supply chain strategies as [Microsoft’s] customers adapt to meet the demands caused by Covid-19. While cost reduction and efficiency remain a critical priority, we are seeing supply chain agility rise to the top of the list for executives.” Leading CPG companies are deploying advanced technologies such as AI and ML across three key areas to improve supply chain speed and agility:

- Omnichannel fulfillment. A Coresight Research survey conducted in December 2020 found that omnichannel complexity was rated as “very challenging” (32%) by CPG suppliers and grocery retailers. AI/ML tools can support companies in managing multiple sales channels efficiently. ML tools can help companies identify the root cause of issues related to order fulfillment and recommend corrective actions.

- Predictive demand planning. As we discussed earlier in this report, CPG companies are turning to AI/ML tools for demand forecasting and predictive planning.

- Flexible operations. CPG companies are planning to increase supply chain flexibility to meet any future supply and demand shocks. According to recent survey by Microsoft, 53% of the CPG and retail companies are planning to upsurge their investments in flexible operations.

- Read our Reshaping Supply Chains for the 2020s ebook.

- Glossier, a US-based beauty and skincare provider, employed AI chatbot called “Glossy” that offers personalized recommendations to users. It helps users to select the skincare products that would suit them best based on their unique skin types.

- Kimberly-Clark uses ML to improve its digital promotions. The company analyzes real-time consumer behavior to deliver relevant, personalized content to each customer.

- In March 2020, Chinese e-commerce giant Alibaba launched a new app on Taobao Special Offers that connects directly with factories to create C2M products. Over the next three years, 2020–2023, the company aims to establish at least 1,000 factories that work on the C2M principle and connect directly with consumers.

- Read our separate report on key trends in China’s e-commerce market.

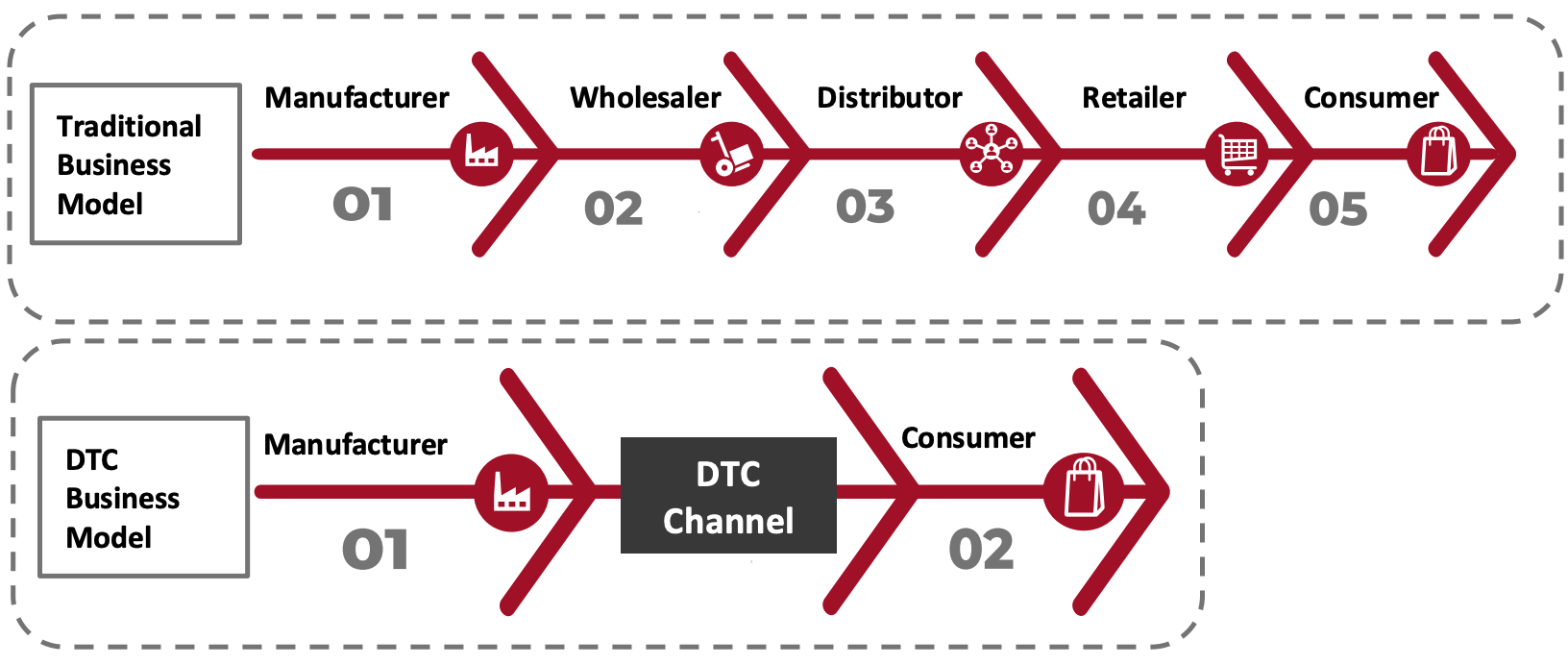

- It allows businesses to maintain a higher revenue margin for themselves, which in turn permits companies to lower prices and gain a competitive advantage.

- CPG companies own the relationship with the customer, along with all associated data. This allows companies to monitor user behavior on their websites, send targeted offers and continuously receive feedback to improve their product offering.

Source: Coresight Research[/caption]

The capability to quickly launch an online store and gain access to millions of potential customers is one of the biggest drivers of DTC growth over the past decade. Platforms such as Magento and Shopify empower new CPG brands to quickly open online shops, and they offer technological assistance for operations such as inventory management, payments, shipping, web hosting, marketing, SEO and analytics.

Legacy CPG companies also partner with these providers to gain expertise. In April 2020, Kraft Heinz launched its direct sales channel, Heinz to Home, in the UK. Heinz partnered with Shopify Plus to set up the new sales channel.

One of the emerging trends within the DTC space is the growing popularity of subscription services. According to the Subscription Trade Association, the global subscription business grew about 12% in 2020. In 2019, there were more than 7,000 subscription box companies globally, and around 70% were based in the US. These businesses are generally concentrated across categories such as food, beauty, and health and wellness, where products are purchased at regular intervals.

Source: Coresight Research[/caption]

The capability to quickly launch an online store and gain access to millions of potential customers is one of the biggest drivers of DTC growth over the past decade. Platforms such as Magento and Shopify empower new CPG brands to quickly open online shops, and they offer technological assistance for operations such as inventory management, payments, shipping, web hosting, marketing, SEO and analytics.

Legacy CPG companies also partner with these providers to gain expertise. In April 2020, Kraft Heinz launched its direct sales channel, Heinz to Home, in the UK. Heinz partnered with Shopify Plus to set up the new sales channel.

One of the emerging trends within the DTC space is the growing popularity of subscription services. According to the Subscription Trade Association, the global subscription business grew about 12% in 2020. In 2019, there were more than 7,000 subscription box companies globally, and around 70% were based in the US. These businesses are generally concentrated across categories such as food, beauty, and health and wellness, where products are purchased at regular intervals.

- Birchbox sends sample beauty products, personalized based on skin tone and hair type, to its subscribers for $15 per month. The subscription box is curated to serve as a channel for customers to purchase products from the Birchbox Shop, which offers more than 500 different beauty brands ranging from mainstream companies such as MAC to lesser-known favorites like Sunday Riley and even two in-house brands.

- Coca-Cola launched its Insiders Club subscription box in 2020, where subscribers receive monthly subscription boxes of goodies for a membership fee of $45 per month.