Nitheesh NH

Introduction

What’s the Story? In this report, we look at 10 trends impacting the US consumer packaged goods (CPG) market and discuss how brands and retailers targeting the market can capitalize on the changes we expect to see in 2022 and beyond. Our trend coverage includes multiyear trends, such as sustainability and heightened demand for health and wellness products, as well as burgeoning trends such as increases in brand collaborations, innovation and private-label offerings. Why It Matters 2021 was an overall strong year for the US CPG market, with many top companies experiencing year-over-year growth beyond their 2007–2021 CAGR rates. The overall market grew 6.0% year over year, reaching $998.3 billion, according to data from IRI. We expect CPG growth to be mainly driven by inflation and price in 2022, as increasing mobility and inflation impact consumers’ at-home consumption volume. Multiyear trends such as growing demand for sustainable products and health and wellness offerings will also drive growth in 2022, albeit to a lesser extent. Meanwhile, we believe that CPG companies will continue to invest in ultra-fast delivery and improved digital experiences for the foreseeable future.10 Trends in US CPG: Coresight Research Analysis

We have identified 10 key trends for US CPG, as shown in Figure 1 below.Figure 1. 10 Trends in US CPG [caption id="attachment_151446" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Focus on Sustainability

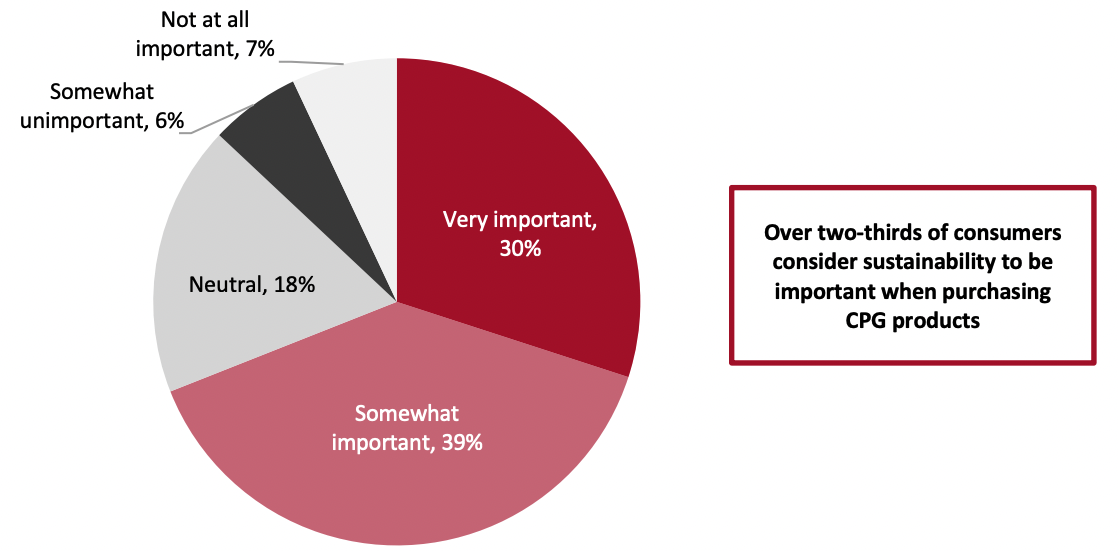

More and more consumers are demanding sustainable products as they grow increasingly aware of the environmental impacts of the products they use. In an October 2021 survey by Acosta, a global sales and marketing services provider for CPG companies, 69% of online shoppers in the US stated that sustainability is somewhat or very important when buying consumer packaged goods (see Figure 2).

Source: Coresight Research[/caption]

1. Focus on Sustainability

More and more consumers are demanding sustainable products as they grow increasingly aware of the environmental impacts of the products they use. In an October 2021 survey by Acosta, a global sales and marketing services provider for CPG companies, 69% of online shoppers in the US stated that sustainability is somewhat or very important when buying consumer packaged goods (see Figure 2).

Figure 2. US Online Shoppers: Importance of Sustainability When Purchasing CPG Products (% of Respondents) [caption id="attachment_151447" align="aligncenter" width="700"]

Base: Online survey using Acosta’s proprietary shopper community in the US, conducted in October 2021

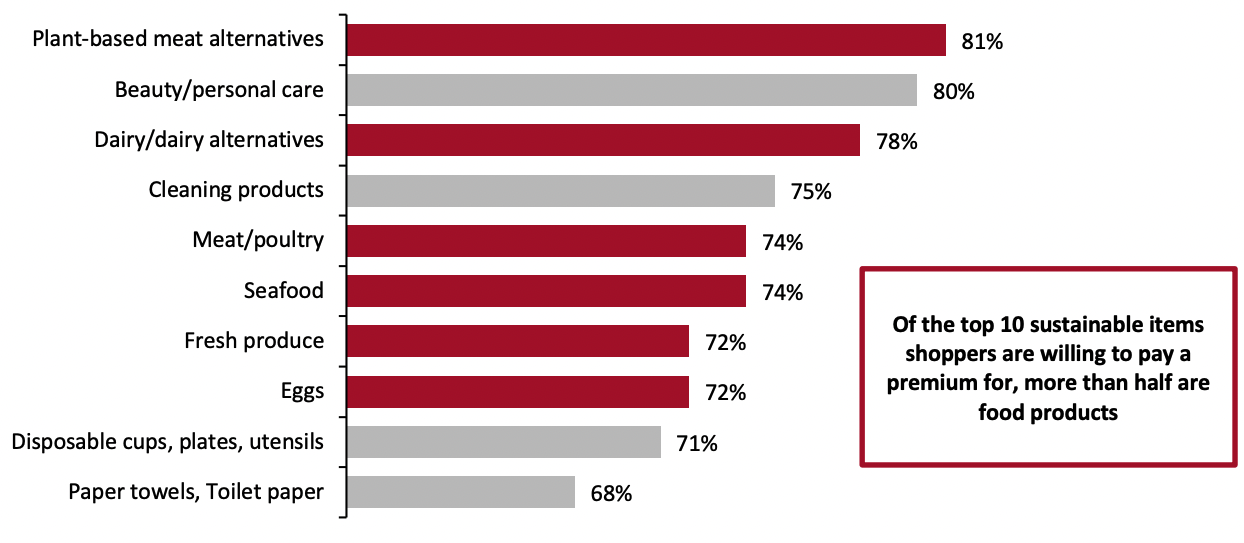

Base: Online survey using Acosta’s proprietary shopper community in the US, conducted in October 2021Source: Acosta[/caption] Acosta’s study also revealed that consumers are willing to pay a premium for sustainable alternatives to the products they already use (see Figure 3). Specifically, at least three-quarters of all respondents said they would pay a premium for sustainable plant-based meats, beauty and personal care products, dairy and dairy alternatives, or cleaning products.

Figure 3. Sustainable Products for Which Consumers Are Willing To Pay a Premium (% of Respondents) [caption id="attachment_151448" align="aligncenter" width="700"]

Respondents could select multiple options; categories as published in the survey

Respondents could select multiple options; categories as published in the surveyBase: Online survey using Acosta’s proprietary shopper community in the US, conducted in October 2021

Source: Acosta[/caption] As consumer demand for sustainable products has grown, various CPG companies have responded by announcing sustainability goals and initiatives.

- Nestlé has announced its commitment to creating “a future where no Nestlé plastic packaging ends up in a landfill or ocean.” As part of the initiative, the company eliminated 4.5 billion plastic straws in 2021 and switched its Smarties candy to recyclable paper packaging. It is currently aiming to use 50% recycled plastic in its water bottles by 2025 and reduce its total carbon emissions by 50% by 2030.

- Procter & Gamble (P&G) said that, as of 2021, 73% of its consumer packaging is recyclable. It is now working towards 100% recyclable consumer packaging and a 50% reduction in virgin petroleum plastic resin in its packaging by 2030. In September 2021, P&G announced its plans to achieve net-zero supply chain and operations emissions by 2040.

- Reckitt Benckiser aims to make 100% of its plastic packaging recyclable by 2025. By 2030, Reckitt plans to reduce its greenhouse gas emissions by 65%, use 100% renewable electricity and reduce its carbon footprint by 50%. Finally, by 2040, it aims to reduce its energy consumption by 25% and its water consumption by 30%, as well as become carbon neutral.

- Safe Catch, a seafood company founded in 2015, embraces sustainability through plastic neutrality. To offset any plastic in its packaging, Safe Catch invests in projects that recycle an equivalent amount of ocean-bound plastic.

- Waterdrop created the “world’s first microdrink,” a dissolvable cube containing vitamins, minerals and natural fruit extract that offers a sustainable alternative to other dry mix drinks with minimal packaging. The company also sells reusable water bottles of bamboo, steel and glass.

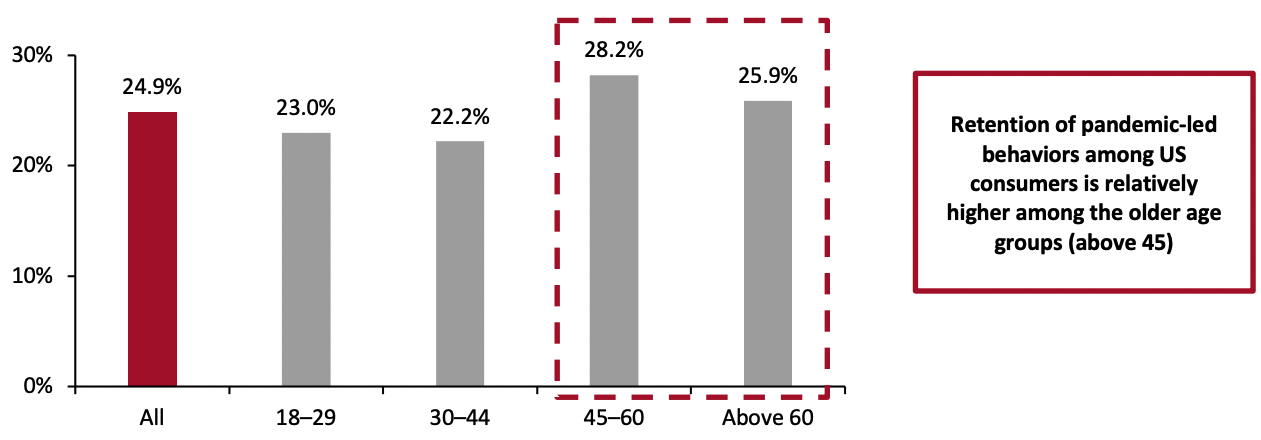

Figure 4. US Consumers That Expect To Retain the Changed Behavior of Focusing More on Health and Wellbeing Post Crisis, by Age (% of Respondents) [caption id="attachment_151449" align="aligncenter" width="700"]

Base: 438 US respondents aged 18+ surveyed on December 15, 2020

Base: 438 US respondents aged 18+ surveyed on December 15, 2020Source: Coresight Research[/caption] Various CPG companies are branching into the health and wellness sector by acquiring startup brands. Rather than building the brand themselves, the companies use acquisitions to take a ready-made wellness brand with a compelling story to the next level. Furthermore, these startups often succeed in niche categories that large companies typically don’t perform well in, providing them with new customers.

- In February 2022, Nestlé purchased a majority stake in Orgain (a plant-based nutrition company that makes protein powders, shakes and bars) for an undisclosed amount. The investment is part of Nestlé’s recent efforts to grow its health and wellness business. Through this acquisition, Nestlé is also deepening its presence in the all-natural category, which consumers value. According to the agreement, the company will completely acquire Orgain by 2024.

- The Coca-Cola Company acquired New York-based sports drinks maker BodyArmor in November 2021. Coca-Cola previously acquired a 15% stake in the company in 2018, acquiring the remaining 85% stake for $5.6 billion. BodyArmor will be a key addition to Coca-Cola’s ongoing innovation in the sports drinks and health and wellness categories.

- Unilever purchased Onnit, a US-based manufacturer and marketer of functional and nutrition supplements, for an undisclosed sum in April 2021.

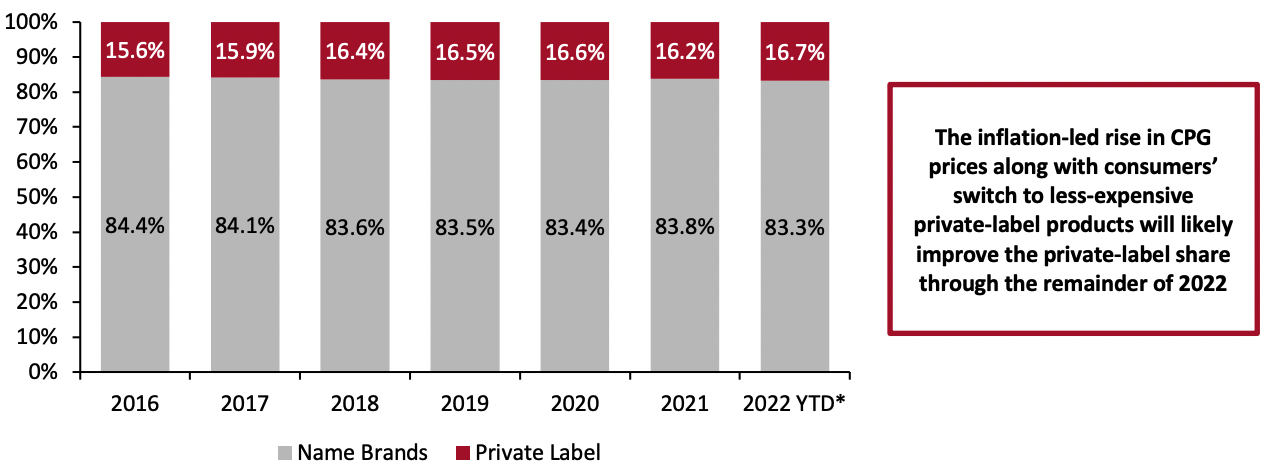

Figure 5. US: Market Breakdown, by Food and Beverage Name Brand and Private-Label Sales Value (% of Total Sales) [caption id="attachment_151450" align="aligncenter" width="700"]

Excludes online sales

Excludes online sales*As of June 5, 2022

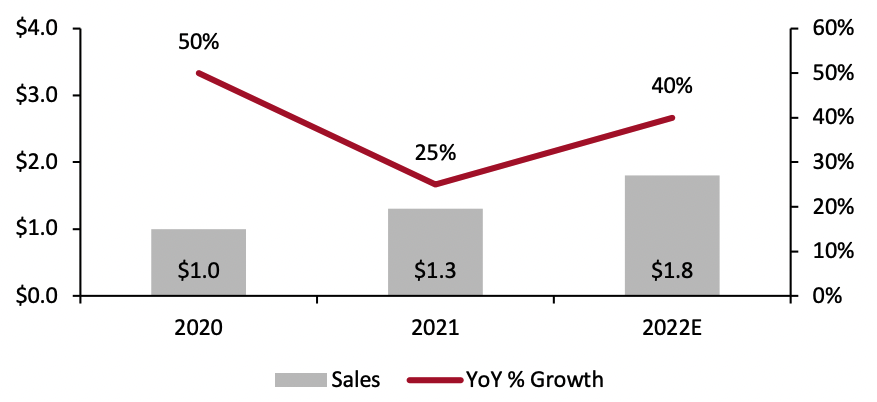

Source: IRI POS data/Coresight Research[/caption] Amid economic uncertainty and high inflation, we expect private-label products to continue to claim a greater market share, because as CPG companies increase prices, value-conscious consumers will likely switch to less-expensive private-label products. As such, CPG retailers plan to expand and revamp their private-label offerings. According to the Food Industry Association’s 2021 Power of Private Brands report, 91% of retailers and manufacturers plan to increase overall investments in private brands in the next two years, 77% are changing or rethinking private brand assortments and supplier strategies, and 58% are working on adding new private brands. CPG retailers offering private-label products should focus on improving their product assortment, pricing, marketing and communication, clearly defining each private-label brand’s story and value proposition. CPG retailers should compare private-label stock-keeping units’ (SKUs) prices against competitors and employ price-gapping measures to attract the increasing number of value-conscious shoppers. Furthermore, they should communicate sourcing and innovation details to challenge preconceived notions of private label as simply lower priced, leading to both improved sales and consumer perception. 4. Improved E-Commerce Presence Through DNVBs To stay competitive and meet consumer demand for digital options, CPG companies are looking at digitally native vertical brands (DNVBs) to improve their online presence, gain greater inventory control and flexibility, leverage data and offer personalized experiences to customers. We expect that sales by DNVBs in the US food, beverage and food supplement market will grow by 40% to $1.8 billion in 2022 (see Figure 6), driven by consumers’ online shopping stickiness, the expansion of DNVBs offline and their partnerships with large retailers.

Figure 6. Total Sales by DNVBs in the US Food, Beverage and Food Supplement Market (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_151451" align="aligncenter" width="520"]

Source: Coresight Research[/caption]

Established CPG companies are also adopting this business model to their existing brands or purchasing smaller brands that are already in this market.

Source: Coresight Research[/caption]

Established CPG companies are also adopting this business model to their existing brands or purchasing smaller brands that are already in this market.

- In 2019, P&G established its eco-oriented brand, EC30, as a DNVB.

- Unilever acquired DNVB skincare brand Paula’s Choice in August 2021.

- Nestlé acquired The Bountiful Co., a US-based manufacturer of vitamins, minerals, supplements and nutrition products, for $5.7 billion in August 2021, marking Nestlé Health Science’s entry into the US DNVB market.

- Founded in 2014, SnackNation is a healthy snacks subscription box that curates customized snacks and beverages, aiming to inspire customers to make healthier food choices. It also partners with emerging CPG brands to help them scale using consumer insights.

- Universal Yums, founded in 2014, is a subscription service for snacks and candy. Its monthly subscription box features a variety of products from a different country each month. The company claims to have shipped over 5 million boxes since its inception.

- Founded in 2018, Munch Addict is an international snack-box company that curates snacks from different parts of the world and delivers them to customers. It operates using a subscription-based service along with add-on snack options.

- Huel, a maker of nutritional powdered foods, uses Instagram to showcase both their products and existing Huel customers—often using recipes submitted by those who use Huel powders—communicating product benefits to new consumers.

- RunGum, a company that sells energy, probiotic and calming gums and offers gum subscription services, builds brand awareness via TikTok videos with its CEO, Olympian Nick Symmonds. The videos feature Symmonds discussing the benefits of RunGum’s line while engaging in athletic challenges with strangers, such as jumping rope or foot races.

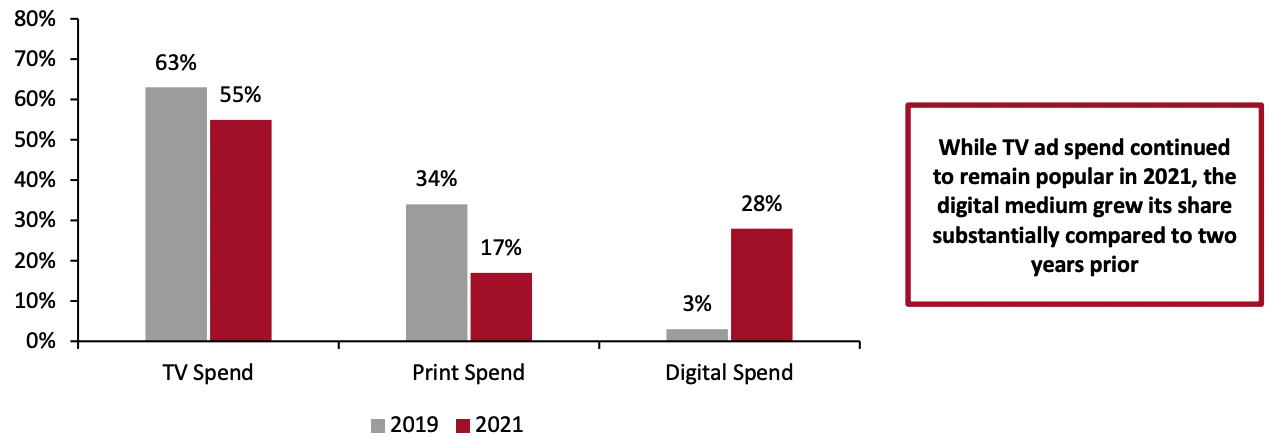

Figure 7. CPG Companies’ US Media Spend: Breakdown by Advertising Medium (% of Total Media Spend, on Average) [caption id="attachment_151452" align="aligncenter" width="700"]

Data considered for the period January 1 to November 30

Data considered for the period January 1 to November 30Source: MediaRadar[/caption] Digital ad spending by CPG companies in the US has grown by 747% in the last two years, from $189 million in 2019 to nearly $1.6 billion in 2021, according to MediaRadar. Specifically, year-over-year digital ad spending of CPG companies The Hershey Company, Unilever and P&G was up by 225%, 201% and 93%, respectively, in 2021 (between January 1 and October 31, 2021). While television and print advertisements’ year-over-year growth was down for most of these players, online video, social media and over-the-top ad spend—all digital media—saw growth. CPG brands are also leveraging livestreaming and in-person events in the US to improve their social activations and build direct consumer relationships.

- In July 2021, Clorox announced a multi-year agreement with Live Nation Entertainment, a leading global live events company, making Clorox the official cleaning and disinfecting partner of over 90 amphitheaters, clubs and theaters in the US. The collaboration saw the integration of several Clorox disinfectant products throughout the Live Nation’s venues as it welcomed fans back to in-person concerts after the pandemic.

- According to the company’s annual report, P&G’s hair care products witnessed 25% growth in China in fiscal 2021, driven by its brand Pantene. Pantene used social engagements such as livestreams with influencers to engage consumers that use social media for product discovery. In total, 90% of P&G’s media spending in China is digital.

- In March 2021, Nestlé and Dada Group, China’s local on-demand delivery and retail platform, launched a series of livestreamed e-commerce events titled “Morning! #Nes-trition Day!” The events featured delegates from Nestlé and Dada Group, as well as a Chinese cuisine master from International Cuisine Master Association, who introduced Nestlé products to viewers and discussed nutrition, specifically how viewers could prepare a breakfast that would start their day off right. Consumers could also place online orders during the event, and Dada Group’s partner stores delivered the products within one hour of order submission.

"Morning! #Nes-trition Day!" event promo

"Morning! #Nes-trition Day!" event promoSource: Prnewswire.com[/caption] 7. Personalized Experiences To Win Consumers CPG companies are increasingly offering personalized experiences on their websites to deepen consumer engagement and increase traffic. For instance, a CPG company could leverage real-time data—including location, consumption and demographic information, purchase history and browsing and social media data—to understand the consumer. Afterward, they could use artificial intelligence (AI) and machine learning (ML) to analyze the data and generate personalized product and store recommendations for them.

- In April 2022, P&G’s skincare brand Olay and haircare brand Pantene launched a new Booster collection, offering personalized solutions for shoppers’ unique skin and hair needs. Olay and Pantene’s research and development teams leveraged consumer data insights, revealing that consumers believed stores did not have products specific to their skin and hair. The company created the Booster collection as a response, delivering both personalization and value. Consumers can take an online quiz to help them find the right Booster product and direct them to either the nearest store that stocks the item or an online channel where they can purchase it.

- In March 2021, Unilever announced a partnership with Onegevity, a health intelligence company, to offer personalized acne solutions. The companies will collect, curate, and synthesize biological data on acne from proprietary and external research databases. Onegevity will then leverage its AI and ML capabilities to assess biological features and develop specific acne management regimens, evolving Unilever’s acne treatments.

- The Kraft Heinz Company is both investing in its in-house supply chain capabilities and working with Microsoft to build resiliency. “Our collaboration with Microsoft is a critical piece of our transformation strategy, providing us with the machine learning and advanced analytics to drive innovation and efficiencies across the supply chain so we can get products into the market faster, better serve our customers and, ultimately, deliver on the sustained and growing consumer demand our iconic brands continue to experience,” explained Carlos Abrams-Rivera, Executive VP and President, North America, at Kraft Heinz Company.

- Strengthen tech investments—CPG companies are using digital enablers, such as cognitive planning and AI-driven predictive analytics, to augment their supply chain planning capabilities. 64% and 63% of CPG companies are planning to make extensive use of AI and ML across transportation and pricing optimization, respectively, according to the Capgemini survey.

- Diversify trading partnerships—CPG brands have started looking at a broader list of suppliers, markets and logistics providers to diversify and strengthen their supply chains, mitigating the risks of having only one or a few trading partners. They are also embracing digital business networks that unify all points of interaction and integrate with suppliers and trading partners, enabling greater agility and speed-to-market.

- Shift to micro-supply chains—CPG businesses are shifting to close-to-market partners and micro-supply chains to help save on logistics and gain flexibility. Sourcing quality products locally will help companies meet consumer demand for local goods and improve private label offerings. As such, 72% of CPG companies and 58% of retailers are actively investing in regionalizing or localizing their manufacturing base or nearshoring production, according to the Capgemini survey.

- Doritos, a corn chip brand owned by PepsiCo, partnered with Netflix to promote the fourth season of the show Stranger Things with a virtual concert, “Live From The Upside Down,” on June 23, 2022. The concert featured a story, tied into Stranger Things, about a fictional 1980s concert where all the headline acts vanished. Fans earned free tickets for the virtual shows by purchasing marked, limited-edition bags of Doritos chips.

Doritos Netflix Collaboration for Doritos Product Launch

Doritos Netflix Collaboration for Doritos Product LaunchSource: Company website[/caption]

- Kellogg’s Cheez-It partnered with music-streaming service Pandora to launch a limited-edition Cheez-It variety, “Aged by Audio.” The cheese used in the crackers was “sonically-aged” with hip-hop music for six months. The release comes after a study conducted in Bern, Switzerland, revealed that cheese aged in the presence of music, especially hip-hop, develops a strong smell and flavor. To celebrate the launch of the Cheez-It x Pandora Aged by Audio crackers, Cheez-It collaborated with hip-hop radio personality Sway Calloway to release the “Living Legendz” series on YouTube.

Cheez-It x Pandora Aged by Audio Crackers

Cheez-It x Pandora Aged by Audio CrackersSource: Company website[/caption]

- Mondelez International launched its Oreo x Pokémon collaboration in September 2021, which became the brand’s fastest-selling Oreo edition of all time in the US, according to Dirk Van de Put, Mondelez International’s Chief Executive, and sparked a massive resale market for the limited-edition cookies.

- Unilever has partnered with store-hailing platform Robomart to roll out driverless mobile ice cream trucks for its DTC ice cream storefront, The Ice Cream Shop, in Los Angeles this summer. Consumers use the Robomart app to both hail the driverless truck and open the vehicle’s door. Robomart’s checkout-free system enables customers to select their ice cream products—including selections from Ben & Jerry’s, Breyers, Good Humor, Magnum and Talenti—and walk away without using a credit card.

- Simulate, a CPG company that creates plant-based meats under various brands, including NUGGS and DISCS, started using ghost kitchens for both quick research and increased brand awareness. “With retail and food service, the necessary evil is having these large distributors that aren’t agile at all, which doesn’t allow you to iterate quickly within their systems,” Founder and CEO of Simulate, Ben Pasternak, explained to the magazine Fast Company. “(Ghost) kitchens allow us to experiment with anything really quickly.”

What We Think

As CPG brands embrace sustainability and wellness as long-term business goals, they will turn to digital initiatives and micro-supply chains in the short term to navigate continued production and distribution disruptions through 2022. Meanwhile, given the current inflationary environment and reports of an oncoming recession—both leading to a hike in CPG product prices—consumers are likely to cap their spending on name-brand CPG products, helping grow private-label offerings and sales. In 2023 and beyond, CPG brands will continue collaborating with other brands and innovating their products to better communicate with their customers and expand their brand reach. Implications for Brands/Retailers- CPG brands and retailers should move away from the current business models, adopt circular and sustainable models and use eco-friendly technologies to meet consumers’ growing demands for sustainable products.

- CPG brands should develop, evolve and expand their health and wellness portfolio for better revenue prospects.

- CPG brands offering quality private-label products will likely gain market share in 2022.

- DNVBs can help CPG brands gain access to first-party data, allowing them to offer personalized recommendations.

- Increased focus on social media, digital ads, innovation and collaborations will improve CPG companies’ reach and sales, as consumers respond well to these strategies.

- CPG companies should reevaluate their operating models and adopt digital strategies to deliver an end-to-end experience.

- CPG brands and retailers should look at various sourcing strategies to keep a check on their input costs. They should cap rising product prices either by absorbing costs (if they don’t find alternative sourcing) or by offering cheaper alternatives (if they find alternative sourcing).

- Technology providers can develop applications that help increase visibility and promote coordination between CPG supply chain stakeholders.

- Companies specializing in AI and predictive analytics can partner with CPG businesses to help them with a range of applications, including supply chain planning to help avoid disruptions and leveraging consumer data to offer personalized recommendations.

- AI/ML technology vendors can partner with CPG brands and retailers to help them estimate future demand for various categories.

- Technology platforms can partner with CPG brands to help them leverage advanced technologies for brand collaborations, offer digital experiences and marketing options and develop innovation in products, packaging and services.