Nitheesh NH

Introduction

What’s the Story? Dollar and discount stores, mass merchandisers and warehouse clubs dominate rankings of America’s biggest and most-shopped retailers. We aggregate these sectors under the “mass” umbrella”—in each of these sectors, companies sell large volumes of a wide variety of goods to consumers at affordable prices that reflect bulk purchasing power. Mass retailers in our Coresight 100 focus list include Costco, Dollar General, Dollar Tree, Target and Walmart (including Sam’s Club). As US mass retail moves beyond the pandemic and toward a new set of challengeswe present 10 trends in the industry to explore how retail players can best navigate the path ahead. Why It Matters US mass retailers now find themselves in unprecedented waters—with inflation at a four-decade high, widespread supply chain disruptions, and well-informed and sustainability-minded shoppers growing increasingly wary of economic uncertainty. The mass retail sector must act on key trends to address this complex set of challenges.10 Trends in US Mass Retail: Coresight Research Analysis

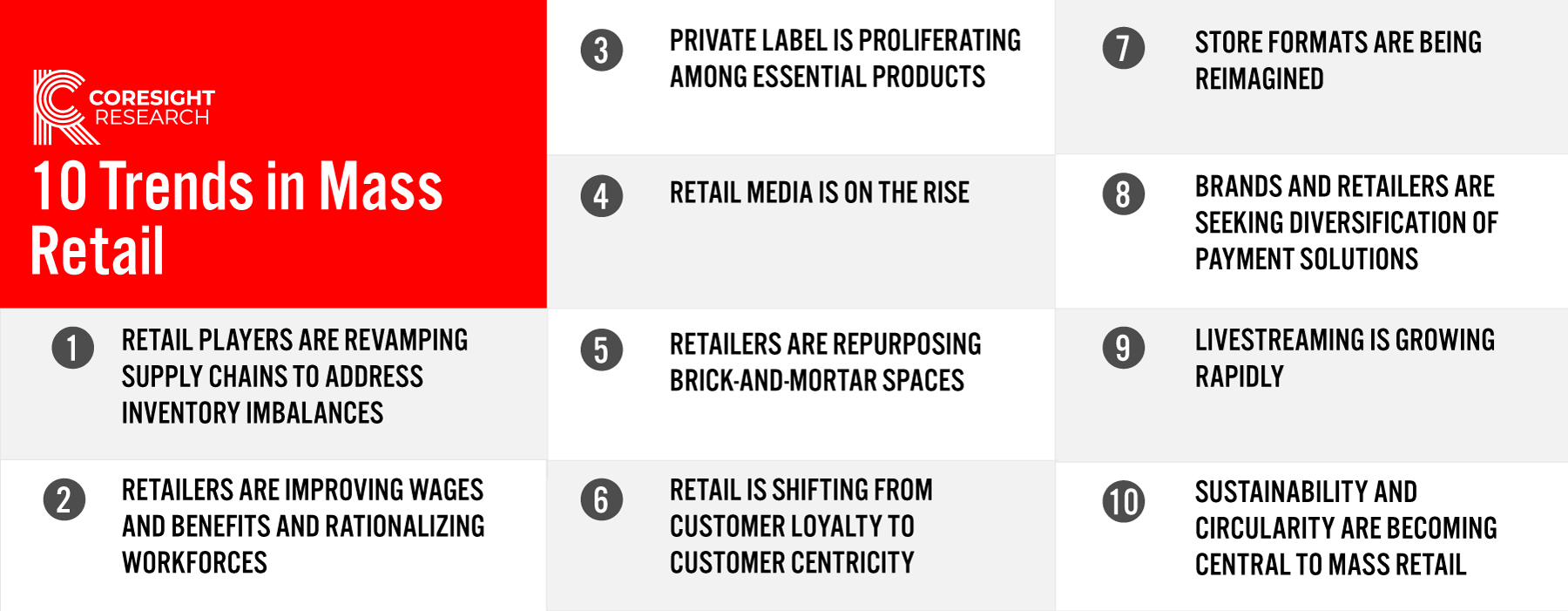

Coresight Research has identified 10 key trends in US mass retail in Figure 1.Figure 1. 10 Trends in US Mass Retail [caption id="attachment_153490" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Revamping Supply Chains To Address Inventory Imbalances

Pandemic-prompted supply chain disruptions have persisted into 2022, impacted by the war in Ukraine, Chinese lockdown restrictions and 40-year highs in inflationary pressures.

Snared supply chains have led to increased schedule-related costs at Walmart and Target, the two leading mass retailers in the US—previously touted for their near-impeccable supply chains. Inflation-weary shoppers are passing up high-margin, big-ticket items, such as home furnishings and apparel, to prioritize spending on essentials and groceries.

This shift in shopping patterns has resulted in inventory imbalances, with a glut in high-margin segments, particularly in home furnishings and electronics, and often unprecedented shortages of low-margin essentials including eggs and sanitary products. As shown in Figure 2, inventory turnover ratios fell almost across the board for the first quarter of 2022, pointing to weak sales.

Source: Coresight Research[/caption]

1. Revamping Supply Chains To Address Inventory Imbalances

Pandemic-prompted supply chain disruptions have persisted into 2022, impacted by the war in Ukraine, Chinese lockdown restrictions and 40-year highs in inflationary pressures.

Snared supply chains have led to increased schedule-related costs at Walmart and Target, the two leading mass retailers in the US—previously touted for their near-impeccable supply chains. Inflation-weary shoppers are passing up high-margin, big-ticket items, such as home furnishings and apparel, to prioritize spending on essentials and groceries.

This shift in shopping patterns has resulted in inventory imbalances, with a glut in high-margin segments, particularly in home furnishings and electronics, and often unprecedented shortages of low-margin essentials including eggs and sanitary products. As shown in Figure 2, inventory turnover ratios fell almost across the board for the first quarter of 2022, pointing to weak sales.

Figure 2. Inventory Turnover Ratios by Quarter [wpdatatable id=2183]

Inventory turnover = Cost of goods sold for the quarter/ending inventory for the quarter; averages are non-weighted (arithmetic). The absolute inventory turnover ratios have been rounded off to one decimal place. Source: Company reports/Coresight Research

The imbalances, which have caught mass retailers off guard, have led to markdowns and undermined profitability.- In Walmart’s first quarter of fiscal 2022, merchandising issues drove 3% of a 27.5% decline in gross margin. Backed-up supply chains and inflationary pressures also led to increased schedule and storage costs in the period as consumers focused spending on essentials. This shift from high-margin big-ticket items impacted Walmart’s US gross profit by approximately $100 million. CEO Doug McMillon stated that “the rate of inflation in food pulled more dollars away from general merchandise than we expected as customers needed to pay for the inflation in food.”

- Target saw a 43% increase in inventory in its first quarter of fiscal 2022. In June this year, Target slashed its operating margin guidance for its second quarter to 2% from 5.3%.

- For its fiscal 2022 first quarter, Dollar General’s merchandise inventories rose by 7% to $5.6 billion. At Family Dollar and its unit Dollar Tree, inventory levels rose by 39% and 17%, respectively.

- Both Costco and BJ’s have evaded inventory imbalances, which can be attributed, in part, to their strengths in supply chains and private labels. At Costco, total inventory increased by 26% for its third quarter of fiscal 2022, ended May 8, 2022, compared with 19% in the prior quarter. This inventory will be partially redistributed among the 20 new stores Costco is set to open by May 2023. With its recent acquisition of cold-chain networks, BJ’s now has full control of its perishable supply chains and is thus better shielding itself from cost fluctuations in grocery (71% of its revenue as of fiscal 2021). The company has statistically maintained a high level of grocery inventory and reduced markdown risks.

- In Walmart’s first quarter of fiscal 2022, wage costs increased operational expenses by 39 percentage points.

- In February 2022, Target unveiled a $300 million plan to raise hourly pay to $24 from $15 and expand healthcare benefits to include hourly employees by the end of the year. Ongoing inflation, coupled with labor shortages, will likely increase upward pressure on wages in the sector.

- Due to wage increases, BJ’s operational expenses increased by 6% year over year for its quarter ended April 30, 2022.

- Costco incurred a one-off charge of $77 million for its quarter ended May 8, 2022, related to expanded benefits under its new employment agreement.

- At Dollar Tree, payroll expenses increased by 90 basis points in its latest quarter as both wages at distribution centers and in-store went up. Dollar General does not see any material wage cost pressure as much of its workforce earns a minimum wage.

- In January this year, Sam’s Club rolled out inventory scanning robots chainwide.

- In May 2022, Walmart unveiled plans to roll out robotics and software automation platforms in collaboration with supply chain provider Symbotic LLC, a warehousing solutions provider, to all 42 of its regional distribution centers.

- In June 2022, Dollar General began piloting self-checkout technology at 200 stores.

- At BJ’s, sales penetration of its Wellsley Farms and Berkeley Jensen private-label brands reached 24% of sales in the quarter, an all-time high.

- For the quarter ended May 8, 2022, penetration by Costco’s private brand, Kirkland, increased by 30–40 basis points.

- Without disclosing statistics, Walmart stated that inflation pressures increased private-label grocery brand penetration in its latest quarter.

- Target’s own grocery brand, Good & Gather, which was established two years ago, reached more than $2 billion in sales in the company’s latest quarter, ended April 30, 2022.

- Dollar General saw improvements in private-label sales in its latest quarter and plans to expand its grocery line, Clover Valley, and its healthcare private label, Rexall.

Figure 3. Private-Label Sales by Selected Mass Retailers, Fiscal 2021 (USD Bil.)*

| Costco | Target | BJ’s |

| $58 | $30 | $3 |

Fiscal 2021 ended on August 29, 2021, for Costco and on January 29, 2022, for Target and BJ’s Source: Company reports/Coresight Research

4. The Rise of Retail Media We are seeing a rise in retail media among mass retailers, fueled by demand for new revenue streams and first-party customer data to target consumers more effectively.- Target’s retail media unit, Roundel, has grown into a 500-strong team from a five-person group within just five years. Roundel generates more than $1 billion in value as measured in guest retention, according to the company. The company expects it to grow to $2 billion in the next several years as primary data collected and deployed by Roundel helped to reduce the cost of sales and benefit margins.

- In its battle with inflationary pressures, we expect Walmart’s in-house media strategy to be instrumental in its capacity to offer shoppers personalized, manufacturer-funded discounts. For the second quarter of fiscal 2022, the retailer’s media unit, Walmart Connect, has expanded its self-serve capabilities and offerings. Walmart Luminate, the retailer’s data unit, posted 75% growth quarter over quarter as more Walmart suppliers use primary data collected by the Walmart platform.

- Dollar General’s DG Media Network (DGMN), launched in 2018, has 75 million “data profiles,” enabling vendors to reach more than 90% of Dollar General customers through the network, according to the company. DGMN has a number of insourcing capabilities such as sales, client engagement and decision science and analytics. While warehouse clubs have not traditionally been strong advertising and marketing spenders, are now being e drawn to retail media on the back of its primary data collection advantages.

- Costco does not have a media unit in-house but has deployed tools developed by advertising platform Criteo to collect primary data.

- In October 2021, BJ’s named executive vice president Rachael Vegas to Chief Merchandising Officer, the first C-level promotion for an executive with expertise in retail media. The appointment underscores BJ’s data-driven efforts to bring merchandise upmarket and drive its own brand penetration to expand into high-demand categories such as fitness, recreation and seasonal products.

- In fiscal 2021, the number of orders fulfilled at Walmart stores rose by 170%, compared with the peak of the pandemic in fiscal 2020.

- For fiscal 2021, Target’s digital sales were up $900 million year over year and up sixfold compared with 2019. Digital sales comprised around 19% of the company’s total revenue, which Target said it would increase significantly in the five years from 2022.

- While BJ’s did not even disclose digital sales as late as 2018, the company reported more than $1 billion in digitally enables sales for 2021 and a 22% increase year over year for the first quarter of 2022. BJ’s uses DoorDash for same-day delivery of grocery orders.

- In January 2021, Costco began piloting a roadside pickup service for groceries in three warehouses in New Mexico.

- In April 2022, BJ’s unveiled BJ’s Market, a new smaller market format in Warwick, R.L. Spanning 43,000 square feet, the format is approximately 37% the average size of BJ’s standard stores, according to Coresight Research’s estimates. This represents a departure from BJ’s usual suburban territory and long in-store trips toward urban centers and business districts, where shoppers move in and out of stores quickly during busy work days.

- BJ’s is not alone in testing waters in urban areas. In 2022, Target’s small-format store openings are concentrated in city centers and dense suburban streets, as well as near college campuses.

- Amazon Go and Amazon Fresh store openings are clustered in wealthy suburbs of New York, California and Virginia in direct competition with Target’s and BJ’s new smaller format.

- In January 2022, Walmart unveiled the second phase of its store redesign, two years after the first phase. The concept store, incubated in Springdale, Arkansas, features big corner displays and QR codes. It is designed to amplify personal shopping experiences with touch and feel, according to the company. The new store format represents an attempt to strengthen its presence in higher-margin apparel and general merchandise versus a low-margin mix of grocery and essentials—the formula that has helped it not only withstand but also thrive through the pandemic.

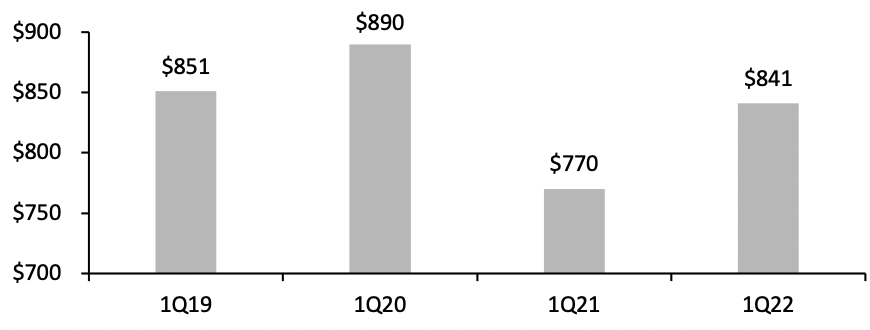

Figure 4. US Credit Card Balances (USD Bil.) [caption id="attachment_153491" align="aligncenter" width="480"]

The first fiscal quarter ends on March 31 of each calendar year

The first fiscal quarter ends on March 31 of each calendar yearSource: Federal Reserve Bank of New York[/caption] Among mass retailers, focus is shifting to the enhancement of credit access and speed.

- In March 2022, Dollar General introduced spendwell, a debit card service run in partnership with MetaBank and inComm Payments, and began piloting a buy now, pay later option in partnership with Sezzle at more than 1,700 stores in Texas.This comes as an unprecedented move to facilitate credit almost exclusively for low-income rural consumers. The pilot program allows users to pay for their purchases in four installments.

- Walmart and Target offer buy now and pay later for digitally initiated sales, highlighting the trend of payments as a service (PaaS). In March 2022, in partnership with investment firm River Capital, Walmart acquired two fintech startups designed to provide further innovative payment infrastructure to shoppers.

Figure 5. Mass Retailers That Use Buy Now, Pay Later Services

| Retailer | Buy Now Pay Later Platform |

| Walmart | Zip and Affirm (Walmart.com) |

| BJ’s | Citizen’s Pay |

| Costco | Zip |

| Target | Affirm, Sezzle |

| Dollar General | Sezzle |

| Family Dollar/Dollar Tree | Zip |

Source: Company reports

9. Growth of Livestreaming Livestream shopping is steadily gaining ground in the US, following in the footsteps of many Asian markets where it is a prolific sales channel. Coresight Research estimates that the US livestreaming e-commerce market will grow from $20 billion in 2022 to $68 billion in 2026—at which point, it will account for over 5% of total e-commerce sales. US mass retailers are recognizing this growing opportunity and expanding their livestreaming capacities.- Walmart is expanding its livestreaming presence as growing numbers of consumers turn to social commerce and livestream shopping. “We think about it as a way to engage with customers in a much more meaningful fashion,” said Kim Tunick, Senior Director and Head of Brand experiences and Partnerships at Walmart at Coresight Research’s 2021 livestreaming conference. In March this year, Walmart partnered with TikTok to host regular shoppable livestream events in the US for its 1.2 million subscribers (as of June 2022). Target also uses YouTube’s livestream feature to run a live style haul.

- In April 2022, Walmart launched Circular Connector, a tool aimed at connecting parties seeking sustainable packaging with suppliers. Walmart US aims to use 100% recyclable, reusable or industrially compostable packaging for private brands by 2025.

- Target plans to launch at least two circular private brands in the near term, with a long-term goal of making all house brands circular by 2040.

- Both Dollar Tree and Dollar General have strengthened their sustainability initiatives. Dollar Tree has formed a sustainability committee on its board and Dollar General has joined the Beyond the Bag Initiative, an international consortium aimed at developing sustainable alternatives to retail’s plastic bags. However, neither has come up with a sustainability action plan.

- BJ’s is currently setting sustainability goals with the support of an outside expert, according to the company. This move aims to bring its once-negligible sustainability program in line with current consumer demands.

What We Think

Retailers across the dollar and discount stores, mass merchandisers and warehouse clubs sectors have persisted with their strategies for adaptability and agility implemented during the pandemic as they shift to catering to inflation-weary and well-informed consumers in a complex economic climate. Implications for Brands/Retailers- The growth of private labels will intensify rivalries with national brands in essential areas, such as grocery and household goods.

- The need for markdown will further fuel such rivalry in some big-ticket segments where mass retailers’ own brands have a meaningful presence.

- New small store formats by mass retailers will boost real estate markets in business districts and urban locations.

- Mass retailers will rationalize supply chains, in lieu of expanding them, curbing years of commercial real estate booms.

- Automation will create a new niche for robotics solution providers.

- The wider adaptation of buy now pay later will create a variety of partnership opportunities for fintech firms.